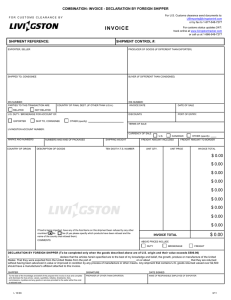

CHAPTER 2 EX-IM DOCUMENTS AND STEPS AZRIN ARIFFIN Importance of import-export documents • Global flows of goods are not possible without a global flow of information. This must be exchanged between various stakeholders, including government authorities and transport intermediaries. The information is provided and exchanged in paper or electronic form, the so-called trade documents. • This provides information for the customs authorities, which helps them asses if the goods can move in or out of a country and what, if any, controls are needed. It also helps them determine duties and taxes. Importance of import-export documents (cont’d) • Documentation in foreign trade is designed in such a way to ensure that the exporter will receive payment and the importer will receive the merchandise. • Export documentation facilitates the smooth flow of goods and payments thereof across national borders. It is widely considered as the heart and soul of international business as no form of international business can be done without the presence of proper documentation. • Missing or incorrect documents can result in delays, demurrage, storage fees, or non-delivery of the goods. • Failure to include the proper documentation with your imports and exports can result in fines and even seizure of your goods by customs. Steps for successful exporting Steps for successful exporting Step 1: get IM-EX code number (not mandatory for import for personal use) Step 2: register with export promo council – to obtain benefits from government Step 3: Procuring order – IM sends purchase order Step 4: EX starts manufacture/buy from O manufacturers Step 5: quality control by EX – obtain cert from inspector Step 6: send export items to ports/airports for transit Step 7: EX has to apply insurance - marine/air insurance Steps for successful exporting (cont’d) Step 8: EX contacts C&F agent (Clearing and forwarding agent is the expert when it comes to getting the goods cleared through customs formalities, coordinating with the carrier and taking care of all shipping and delivery related activities) to store goods in warehouse – agent present Shipping Bill Step 9: load goods on the ship and captain will issue Mate’s Receipt to ship superintendent – SUP calculate port charges and give to EX/C&F agent Step 10: after payment EX/C&F agent gets Bill of Lading/Airway Bill Step 11: EX applies to Chamber of Commerce to obtain Cert of Origin – not mandatory in all cases Step 12: EX sends DOCX (the details) to IM Step 13: EX present ALL DOCX at his bank (bank will scrutinize documents against original LC) Step 14: EX’s Bank sends documents to IM’s Bank. IM’s bank make payment EX-IM DOCUMENTATION EX-IM DOCUMENTATION • 1. Pro forma invoice • It is an important document used as a negotiating tool between the seller and the buyer prior to an export shipment. • First important document – an idea about the prices, description, quantity and quality for sale of goods to importer. • This document should be used by the seller to quote at the beginning of an export transaction and it will eventually become the final commercial invoice used when goods are cleared through customs in the importing country. • The document contains a description of goods (e.g., quantity, price, weight, kind and other specifications) and is a declaration by the seller to provide the products and services to the buyer at the specified date and price. EX-IM DOCUMENTATION • 2. Packing List • A packing list may serve as conforming document. It is not a substitute for a commercial invoice. It shows the details of goods contained in each parcel / shipment. • In addition, U.S. and foreign customs officials may use the packing list to check the cargo so the commercial invoice should reflect the information shown on the packing list. • An export packing list lists seller, buyer, shipper, invoice number, date of shipment, mode of transport, carrier, and itemizes quantity, description, the type of package, such as a box, crate, drum, or carton, the quantity of packages, total net and gross weight (in kilograms), package marks and dimensions, if appropriate. EX-IM DOCUMENTATION • 3. Commercial Invoice • A commercial invoice is a contract and proof of sale issued by the seller to the buyer. It is a legal document between the exporter and the buyer (in this case, the foreign buyer) that clearly states the goods being sold and the amount the customer is to pay. • A Commercial Invoice document is issued to the buyer after the goods have been delivered or shipped. • The commercial invoice is one of the main documents used by customs in determining customs duties. These documents are often used by governments to determine the true value of goods when assessing customs duties. It helps customs authorities quickly decide which taxes and import duties apply to the package. EX-IM DOCUMENTATION • 4. Certificate of Origin • A certificate of origin is required by the customs department of the country importing the goods to decide upon import duty. • It is issued and must be authenticated by the Chamber of Commerce of the origin country and primarily consists of the name and address of the exporter, number and description of the goods, seal of the chamber etc. • Certain countries require these documents to prove the origin of the goods being imported. Preferential tariffs may be offered for products imported from certain countries, while countries which boycott goods from certain other countries will require an undertaking that the goods being imported conform to their import restrictions. • E.g.: Certain countries will require certain certificates such as some Arab countries will only accept an Arab-British Chamber of Commerce Certificate of Origin EX-IM DOCUMENTATION • 5. Shipping Bill/ Bill of Entry • Exporter prepares the shipping bill and it is required for the customs clearance. Shipping bill is the main document on the basis of which the customs office gives the permission for export. A shipping bill can be filed after the particular vessel/ship, etc., is granted with entry outwards that allows it to move out of the country. • Shipping bill contains particulars of the goods being exported, the name of the vessel, the port at which goods are to be discharged, country of final destination, exporter's name and address, and so on. • A bill of entry is a legal document that is filed by importers or customs clearance agents on or before the arrival of imported goods. It is important part of the customs clearance procedure and it is submitted to the Customs department as a part of the customs clearance procedure. • Final bill of entry is printed after 'out of charge' is given by the Custom Officer. In EDI system, in certain cases, the facility of system appraisal is available and the system itself calculates duty which is paid by the importer. Manual Bill of Entry is filed at customs station where electronic filing is not available. • https://enquiry.icegate.gov.in/enquiryatices/ EX-IM DOCUMENTATION • 6. ARE-I form • It is the application for removal of excisable goods for export by (Air/Sea/Post/Land). • Goods subject to excise taxes could be fuel, tobacco, and alcohol • This form is issued by a manufacturer or merchant when excisable (a tax levied/imposed on certain goods and commodities produced or sold within a country and on licenses granted for certain activities) goods are exported. • ARE-1 is a document which is used in case of direct exports. Direct exporting means that the manufacturer takes care of exporting itself. • This export document shall be prepared in quintuplicate (5 copies). ARE-1 form is to seek for permission for export from the Central Excise Department. EX-IM DOCUMENTATION • 7. Mate’s Receipt • It is a receipt issued and signed by the chief mate of the ship for goods received on board and is issued when goods are placed on board ship after verification of quantity and condition. • Once the port dues are received, the port superintendent gives the mate's receipt to the C&F agent concerned. It is only after the mate's receipt has been obtained that the shipping company will issue the bill of lading. • MR is currently replaced by the Standard Shipping Note (SSN), but can still be seen in conventional trade like general cargo, dry bulk or tanker. SSN replaces MR in trades where it is used. SSN should not be used where the consignment is classified as hazardous. • SSN is widely used in the UK liner trades to accompany a consignment of goods from their place of origin (e.g. a factory) to the place of loading (e.g. an inland container depot) or the port of shipment. EX-IM DOCUMENTATION • 8. Exchange Declaration form • Exports directly related to the country’s FOREX earning and Central Bank is to control and monitor. Most offices in custom department are now computerized therefore GR form has been replaced with Statutory Declaration Form (SDF). • https://www.sc.com/global/av/my-declarationappendix-a.pdf) • https://www.rhbgroup.com/~/media/files/malaysia/p roduct-and-services/bussiness/reflex-online-cashmanagement/fea-declaration-form.ashx?la=en • https://www.sc.com.my/api/documentms/download. ashx?id=9f8bf83e-9e48-4ec4-8752-1d90a83db60d • EX-IM DOCUMENTATION • 9. Post Parcel Form • It is used when goods are exported by post. This post parcel need to be signed in original by the banker. Exporter first submit to banker and the banker will return the original form to exporter to submit to post office, along with the parcel. • 10. SOFTEX forms • SOFTEX form are related to specifically export of software means any entity making export of software and software related service required to follow this procedure. The declaration in SOFTEX form, in respect of export of computer software and audio/video/television software to be submitted to department of electronics or free trade zones. EX-IM DOCUMENTATION • 11. Bill of exchange – Sight/Usance • A bill of exchange is a unique handwritten document raised by the exporter to the importer asking for a certain amount of money to be paid in the future and the importer also agrees. • This kind of document is generally used in wholesale trading where a huge amount of money is involved. • It is also known as draft. • Sight draft • Usance/time draft • BOE is an unconditional order in writing form the exporter (the drawer) requiring the person to whom it is addressed (the drawee) to pay on demand (immediately), or at a fixed or determinable future time, a specified sum of money to a named payee (exporter). • This demand of payment is recognized by banks, traders, and courts worldwide. EX-IM DOCUMENTATION • 12. Inspection Cert • A Certificate of Inspection is a trade document issued by an agency after inspecting the products that are to be exported. • Some of the details in an inspection certificate include the date of issue, contact details of the applicant, number of packages, place of issue, port of discharge, the country of origin, and the description of the goods. • An inspection certificate is essential to ensure adherence to the sales agreement. • It helps the authorities to check and confirm whether the goods in the shipment meet the various specifications mentioned in the sales contract. These include adhering to specifications related to quality, quantity, tariff classification, import eligibility, and price of the goods. EX-IM DOCUMENTATION • 13. Bill of Lading • It is a legal document issued by a carrier (transportation company) to a shipper that details the type, quantity, and destination of the goods being carried. A bill of lading also serves as a shipment receipt when the carrier delivers the goods at a predetermined destination. This document used in import and export business, where the shipping company gives the document and is signed by the carrier of the vessel. The Bill of Lading is handled very carefully and ensured it does not fall in the hands of any unauthorized persons. • 14. Airway Bill • An Air Waybill is typically a document in international trade that proves the goods have arrived and are ready to be shipped by air. There are 3 originals and 9 copies of the document which are signed by export agents and the air carrier. It is considered as a receipt for the goods being transported. The Air Waybill ideally serves as multiple things - a receipt for the consignment being shipped, an insurance certificate, an invoice for the freight and manual for the airlines staff on how to board, unload and dispatch the items. Bill of lading process flow EX-IM DOCUMENTATION • 15. Insurance Cert • A document used so that coverage is provided to cover loss or damage to cargo while in transit when insurance is placed. • Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. • Air cargo insurance is a type of policy that protects a buyer or seller of goods that are being transported through the air. It reimburses the insured for items that are damaged, destroyed, or lost and, in some cases, may even offer compensation for shipment delays. • Example : AIG Malaysia offers a wide range of products to provide solutions especially suited for the import & export industry. EX-IM DOCUMENTATION • 16. Consular Invoice • A consular invoice is a document signed by the consul of the importing country and consul of the exporting country that certifies the shipment of goods. Describes the shipment of goods and shows information such as the consignor, consignee, and value of the shipment. • Certified by the consular official of the foreign country, it is used by the country's customs officials to verify the value, quantity, and nature of the shipment. • It is certified by the Consulate of the destination country for shipment of goods. Helps determine if the contents of the shipment are allowed to enter the destination country. • This document assist in calculating customs duty and contains details such as the quantity, rate and value of the shipment. Mainly needed for the countries like Kenya, Uganda, Tanzania, Mauritius, New Zealand, Burma, Iraq, Australia, Fiji, Cyprus, Nigeria, Ghana, Zanzibar etc. It is prepared in the prescribed format and is signed/ certified by the counsel of the importing country located in the country of export. Tutorial 2 • Ali received an order from a buyer in Seoul, South Korea who ordered 100 cartons of local fruit milk from him. However due to lack of knowledge regarding exporting for the first time, Ali sought for your help since you are the expert. The buyer wishes to receive the goods in less than two weeks and has requested a specific type of packaging from Ali. Advice him to ensure he is doing the exporting right and the documents he needed for this trade activity. END