Time Series Analysis of Aegean Migration: Master Thesis

advertisement

UNIVERSITY OF THE AEGEAN

SCHOOL OF SCIENCES

DEPARTMENT OF STATISTICS and

ACTUARIAL - FINANCIAL MATHEMATICS

MSc in STATISTICS AND DATA ANALYSIS

MASTER THESIS

A TIME SERIES ANALYSIS APPROACH TO THE MIGRATION

ISSUE – THE AEGEAN ROUTE

EVANGELIDIS KONSTANTINOS

2022

SAMOS

ΠΑΝΕΠΙΣΤΗΜΙΟ ΑΙΓΑΙΟΥ

ΤΜΗΜΑ ΣΤΑΤΙΣΤΙΚΗΣ ΚΑΙ ΑΝΑΛΟΓΙΣΤΙΚΩΝ –ΧΡΗΜΑΤΟΟΙΚΟΝΟΜΙΚΩΝ

ΜΑΘΗΜΑΤΙΚΩΝ

Π.Μ.Σ. ΣΤΑΤΙΣΤΙΚΗ ΑΝΑΛΟΓΙΣΤΙΚΑ –ΧΡΗΜΑΤΟΟΙΚΟΝΟΜΙΚΑ

ΜΑΘΗΜΑΤΙΚΑ

ΚΑΤΕΥΘΥΝΣΗ : ΣΤΑΤΙΣΤΙΚΗ & ΑΝΑΛΥΣΗ ΔΕΔΟΜΕΝΩΝ

ΔΙΠΛΩΜΑΤΙΚΗ ΕΡΓΑΣΙΑ

MΕΤΑΝΑΣΤΕΥΤΙΚΕΣ ΚΑΙ ΠΡΟΣΦΥΓΙΚΕΣ ΡΟΕΣ ΣΤΟ

ΒΟΡΕΙΟΑΝΑΤΟΛΙΚΟ ΑΙΓΑΙΟ – ΜΙΑ ΣΤΑΤΙΣΤΙΚΗ ΧΡΟΝΟΛΟΓΙΚΗ

ΠΡΟΣΕΓΓΙΣΗ

ΕΥΑΓΓΕΛΙΔΗΣ ΚΩΝΣΤΑΝΤΙΝΟΣ

2022

ΣΑΜΟΣ

Μέλη Τριμελούς Επιτροπής

Αλέξανδρος Καραγρηγορίου (Επιβλέπων)

Χρήστος Κουτζάκης

Αθανάσιος Ρακιτζής

To Narges, Sheila, Mohammad,

and all the dear students I have met during this journey.

If it wasn’t for you, I would never be where I stand today.

ACKNOWLEDGEMENTS

First and foremost, I would like to express my deepest gratitude to my supervisor Prof.

Alexandros Karagrigoriou of the Department of Statistics and Actuarial-Financial

Mathematics of the University of Aegean for his support, thorough guidance, patience

and of course for being an excellent teacher for me throughout my studies in the

Department of Statistics. I am also grateful to Ph.D. Emmanouil-Nektarios Kalligeris for

the communication between us throughout the writing as it was particularly

constructive and helpful for me. Furthermore, words cannot express my appreciation

to everyone who stood by me offering moral support and encouragement in the daily

difficulties during my studies, as well as seemingly small help from dear friends is what

often determines success or failure in anything we undertake that requires personal

sacrifice and effort. Last but not the least, it would be remiss not to mention my

mother. She was always by my side since my childhood, no matter how much I made it

difficult for her along the way.

ABSTRACT

Prediction issues are one of the most exciting fields in the sciences. Modeling through

stochastic processes is also often used for forecasting purposes, particularly in the field

of finance. The fact that stochastic processes produce time series of data makes the

study of time series particularly useful on our quest of predicting quantities that

change with time when randomness is included. So, since we are able to make

quantitative measurements of a phenomenon during its evolution over time, we can

apply time series analysis methods to a range of scientific applications that is truly

unlimited. In this thesis, we are going to follow the Box - Jenkins approach to time

series analysis and forecasting on an attempt to forecast a social phenomenon, the

refugee and migrants flows through the islands of the East Aegean Sea. We use a

series of time indexed data recorded from 01/2014 to 01/2022 from the United Nation

High Commissioner for Refugees (UNHCR) database. This is a time period in which the

refugee issue became major from a social and political point of view. First, the

theoretical framework is set, then the Box - Jenkins method is presented and finally we

proceed with the analysis of the data. The goal is to see whether the method we have

chosen is suitable to make forecasts on the specific phenomenon.

ΠΕΡΙΛΗΨΗ

Τα προβλήματα πρόβλεψης αποτελούν ένα από τα πιο συναρπαστικά πεδία στις

επιστήμες. Η μοντελοποίηση φαινομένων μέσω στοχαστικών διαδικασιών

χρησιμοποιείται συχνά για σκοπούς πρόβλεψης, ειδικά στο πεδίο των

χρηματοοικονομικών . Το γεγονός ότι οι στοχαστικές διαδικασίες παράγουν χρονικές

σειρές δεδομένων κάνει την μελέτη των χρονοσειρών ιδιαίτερα χρήσιμη όταν

θέλουμε να προβλέψουμε μεγέθη που αλλάζουν με το χρόνο όταν αυτή η διαδικασία

περιλαμβάνει και τυχαιότητα. Εφόσον λοιπόν είμαστε σε θέση να κάνουμε ποσοτικές

μετρήσεις ενός φαινομένου κατά την χρονική του εξέλιξη, μπορούμε να

εφαρμόσουμε μεθόδους ανάλυσης χρονοσειρών σε ένα φάσμα επιστημονικών

εφαρμογών που είναι πραγματικά απεριόριστο. Σε αυτή την εργασία, θα

ακολουθήσουμε την προσέγγιση Box - Jenkins στην ανάλυση και πρόβλεψη

χρονοσειρών σε μια προσπάθεια να προβλέψουμε ένα κοινωνικό φαινόμενο, τις ροές

προσφύγων και μεταναστών μέσω των νησιών του Βορειοανατολικού Αιγαίου.

Χρησιμοποιούμε ένα σύνολο χρονικά καταχωρημένων δεδομένων για την περίοδο

01/2014-01/2022 από την βάση δεδομένων της ‘Υπατης Αρμοστείας του Οργανισμού

Ηνωμένων Εθνών (UNHCR), μια περίοδο κατά την οποία το προσφυγικό ζήτημα έγινε

καίριο από κοινωνική και πολιτική άποψη. Πρώτα εισάγεται το θεωρητικό πλαίσιο,

μετά παρουσιάζεται η μέθοδος ανάλυσης Box - Jenkins και κατόπιν εφαρμόζουμε τη

μέθοδο αυτή στα δεδομένα. O σκοπός είναι να διαπιστώσουμε σε ποιο βαθμό η

μέθοδος αυτή είναι κατάλληλη για να κάνουμε προβλέψεις για το συγκεκριμένο

φαινόμενο.

CONTENTS

1

2

Introduction

The refugee issue and its socio-economic dimension

2.1 Global overview

2.2 The situation in the European Union (EU)

2.3 The eastern passage through the Aegean Sea

1

2

2

8

11

3

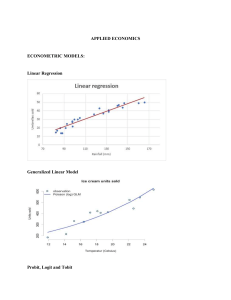

The Box – Jenkins methodology

3.1 Introduction to time series analysis

3.2 Stationarity

3.3 Components of a non-stationary time series

3.4 Stochastic processes

3.5 The Box – Jenkins approach

15

15

17

19

20

25

4

Application of the Box – Jenkins Method

4.1 Pre Growth season (01/2014 - 02/2015) _

4.1.1 Data plots

4.1.2 Fitting polynomials to the Pre growth season data

4.1.3 Box-Jenkins method for fitting (S)ARIMA models

4.1.4 The Auto ARIMA

29

29

29

31

37

46

4.2 Growth season (03/2015 – 04/2016) _

4.2.1 Data plots

4.2.2 Fitting polynomials to the Growth season data

4.2.3 Box – Jenkins method for fitting (S)ARIMA models

4.2.4 The Auto ARIMA

49

49

51

56

61

4.3 Post growth season (05/2016 – 01/2022)_

4.3.1 Data plots

4.3.2 Fitting polynomials to the Post growth season data

4.3.3 Box – Jenkins method for fitting (S)ARIMA models

4.3.4 The Auto ARIMA

4.3.5 Conclusion

65

65

68

73

81

86

Bibliography

88

Web References

89

Appendix

91

LIST OF FIGURES

2.1

2.2

2.3

2.4

2.5

2.6

Number of refugees globally per year ,2016-2021

People forced to flee worldwide per year (2012-2022)

The number of international migrants. 1990 – 2020

Top five countries of origin, 2005-2020

Migrant workers by destination country income level

Percentage of refugee population as to

the average income of country host

2.7 Territorial attractiveness

2.8 Unemployment rate

2.9 The sea routes

2.10 The Aegean Sea arrivals per island, Jan.2015-Sept.2015

2.11 The total time series for the recorded arrivals in the Greek islands

of East Aegean Sea 01/2014 – 01/2022

3.1 Strikes in the USA, 1951 – 1980

3.2 Population of USA at 10-year intervals, 1970-1990

3.3 The monthly accidental deaths data, 1973-1978

4.1 The time series of Pre growth season, 01/2014-02/2015

4.2 The sample ACF plot of the Pre growth time series

4.3 The sample ACF values

4.4 The sample PACF plot for the Pre growth time series

4.5 The sample PACF values

4.6 Fitted 3rd degree polynomial summary

4.7 3rd degree polynomial fit on the Pre growth data plot

4.8 Fitted 4th degree polynomial summary

4.9 4th degree polynomial fit on the Pre growth data plot

4.10 Fitted 5th degree polynomial summary

4.11 5th degree polynomial fit on the Pre growth data plot

4.12 The first difference of the Pre growth series

4.13 The second difference of the Pre growth series

4.14 The third difference of the Pre growth series

3

3

5

6

7

8

9

10

11

13

14

16

16

17

29

30

30

31

31

32

33

34

34

35

36

38

39

39

4.15

4.16

4.17

4.18

4.19

4.20

4.21

4.22

4.23

4.24

4.25

4.26

4.27

4.28

4.29

4.30

4.31

4.32

4.33

4.34

4.35

4.36

4.37

4.38

4.39

4.40

4.41

4.42

4.43

4.44

4.45

4.46

4.47

4.48

4.49

4.50

4.51

The ACF of the first difference of the Pre growth series

The PACF of the first difference of the Pre growth series

ARIMA(0,1,0) fit summary on Pre growth

ARIMA(0,1,1) fit summary on Pre growth

ARIMA(1,1,1) fit summary on Pre growth

Forecast summary of ARIMA(0,1,0) for the Pre growth season

Forecast graph of ARIMA(0,1,0) for the Pre growth season

Forecast summary of ARIMA(0,1,1) for the Pre growth season

Forecast graph of ARIMA(0,1,1) for the Pre growth season

Auto ARIMA fit summary on Pre growth

The common plot of the two optimal ARIMA models with the data

of Pre growth season

The time series plot for the Growth season, 03/2015-04/2016

The sample ACF plot for the Growth season time series

The sample ACF values

The sample PACF plot for the Growth season

The sample PACF values

2nd degree polynomial fitted on Growth season

2nd degree polynomial fit on Growth season data plot

3rd degree polynomial fitted on Growth season

3rd degree polynomial fit on Growth season data plot

4th degree polynomial fitted on Growth season

4th degree polynomial fit on Growth season data plot

The first difference of the Growth season data

The ACF plot for the differenced Growth season data

The PACF plot for the differenced Growth season data

ARIMA(0,1,0) fit summary on Growth season

ARIMA(0,1,1) fit summary on Growth season

ARIMA(1,1,1) fit summary on Growth season

ARIMA(1,1,0) fit summary on Growth season

ARIMA(1,1,0) forecast summary on Growth season

ARIMA(1,1,0) forecast plot on Growth season

The Auto ARIMA fit summary on Growth season

The Auto ARIMA forecast summary on Growth season

The Auto ARIMA forecast plot on Growth season

The common plot of the two optimal ARIMA models with the data line on

Growth season

The Post growth time series plot

The sample ACF plot of the Post growth data

40

41

41

42

42

44

45

45

46

46

47

49

50

50

50

51

52

52

53

53

54

55

56

57

57

58

58

59

59

61

61

62

62

63

63

66

66

4.52

4.53

4.54

4.55

4.56

4.57

4.58

4.59

4.60

4.61

4.62

4.63

4.64

4.65

4.66

4.67

4.68

4.69

4.70

4.71

4.72

4.73

4.74

4.75

4.76

The Post growth sample ACF values

The Post growth sample PACF plot

The sample PACF values

2nd degree polynomial fitted on the Post growth data

2nd degree polynomial fit on the Post growth data plot

3rd degree polynomial fitted on Post growth data

3rd degree polynomial fit on the Post growth plot

4th degree polynomial fitted on the Post growth data

4th degree polynomial fit on the Post growth plot

The first difference of the Post growth data

The ACF plot for the differenced data of Post growth season

The PACF plot for the differenced data of Post growth season

ARIMA(1,1,1) fit summary on Post growth

ARIMA(1,1,2) fit summary on Post growth

ARIMA(2,1,1) fit summary on Post growth

ARIMA(2,1,2) fit summary on Post growth

ARIMA(1,1,0) fit summary on Post growth

ARIMA(1,1,0) forecast summary for the Post growth

ARIMA(1,1,0) forecast plot on Post growth season

ARIMA(2,1,1) forecast summary for the Post growth

ARIMA(2,1,1) forecast plot for the Post growth season

Auto ARIMA fit summary on Post growth

Auto ARIMA forecast summary for the Post growth season

Auto ARIMA forecast plot for the Post growth season

Common plot of the three optimal ARIMA models with the data line

67

67

68

69

69

70

71

72

72

74

74

75

75

76

76

77

77

79

80

80

80

81

82

83

83

LIST OF TABLES

Table 1

Summary of polynomials fitted on Pre growth

37

Table 2

Summary of the ARIMA models fitted on Pre growth

43

Table 3

Summary of all models fitted on Pre growth

48

Table 4 Summary of forecasting errors for the ARIMA models on Pre growth

48

Table 5

Summary of polynomials fitted on Growth

55

Table 6

Summary of the ARIMA models fitted on Growth

60

Table 7

Summary of all models fitted on Growth

64

Table 8

Summary of forecasting errors for the ARIMA models on Growth

65

Table 9

Summary of polynomials fitted on Post growth

73

Table 10

Summary of the ARIMA models fitted on Post growth

78

Table 11

Summary of all models fitted on Post growth

85

Table 12

Summary of forecasting errors for the ARIMA models on Post growth

85

Appendix

91

Chapter 1

Introduction

Time series analysis is a way of understanding the mechanism that generates a set of

time indexed data, finding an appropriate model to represent this mechanism, and to

use this model for future predictions. A question arises when it comes to forecasting,

can we forecast a quantity in a sufficient way, or this specific quantity cannot be

predicted? Is the selected approach suitable for this forecasting? Do we have enough

data to produce an accurate prediction for the future values? Is every observed

phenomenon suitable for applying the usual methods of analysis and forecast? With

time series analysis, it is assumed that the way in which a system changes, will be the

same to the future. On the context of this work, the question is if we can forecast the

social activity of large groups of human beings, where the complexity of the

phenomenon is determined by countless many factors, political, economy, personal,

global or local?

This thesis is focused on a method of time series analysis and forecasting based on the

Box- Jenkins (B-J) approach. This approach consists of three stages: identification,

estimation and diagnostic checking. To apply the method, we divide the time series of

arrivals in the islands in three seasons, based on the initial plot of the total series. The

seasons are named Pre Growth, Growth and Post Growth respectively. The reason for

this splitting was the observed increased values that indicate a rapid growth that is

initiated at 03/2015. The values appear to return to the previous level (post growth

level) on 05/2016. The purpose was to have a lower degree of variation in the analyzed

time series, supposing that this would result in finding more appropriate models for

each season.

The outline of this thesis is the following: In Chapter 2, a history of the refugee crisis

for the period which we will analyze next, is presented, based mainly on statistical

figures. In Chapter 3, we present fundamental theoretical terms that are commonly

used on time series analysis and make a brief description of the Box - Jenkins

methodology. Finally, in Chapter 4, we proceed to the analysis of the time series of

arrivals to the Greek islands.

1|P a ge

Chapter 2 The refugee issue and its socio-economic dimension

2.1

Global overview

The United Nations High Commissioner for Refugees (UNHCR) announced on May 23,

2022 that the number of people forced to flee due to persecution, conflicts, violence,

human rights violations, had reached more than 100 millions for the first time in

history, a negative record that would have been totally unreal a few decades ago [1].

This number represents 1 in every 78 people of the global population and includes

refugees, asylum seekers and the 53,2 million people that have been forced to move

within their country’s borders because of conflicts. These numbers are the result of

new or protracted conflicts in countries including among others Ethiopia, Burkina Faso,

Myanmar, Nigeria, Afghanistan and the Democratic Republic of the Congo. More

recently, the war in Ukraine has forced more than 6 million people to leave the country

and 8 million people to be internally displaced, that is within the country’s borders,

according to data that UNHCR has recorded [1]. Figure 2.1 exhibits the numbers

recorded by UNHCR during the years of the period 2016 -2021. We can track an

increasing trend to the numbers of every column suggesting that since 2016, a year in

which the refugees’ flows to Europe reached overwhelming figures, until 2021 the

global situation in terms of peace, safety, human rights and living condition, gets worse

by each year. In figure 2.2, a visualization of the data for the decade 2012-2022 in

which there is a noticeable upward trend. Also, according to the International

Organization for Migration (IOM), the United Nations migration agency, the total

number of international migrants in the world is estimated 281 millions, or 3.6% of the

global population [4]. This means that the total people living in countries other than

their birth country is 128 millions more than in 1990 and over three times the

estimated numbers in 1970, as it is stated on the organization 2022 World Migration

report [4].

2|P a ge

Figure 2.1: Number of refugees globally per year, 2016-2021 (UNHCR data finder, [2])

Figure 2.2: People forced to flee worldwide per year ,2012-2022. (UNHCR Global trends, [3])

Furthermore, a greater rate of increase to the numbers of international migrants is

observed in Asia and Europe in comparison with other regions as depicted in figure

2.3. IOM notes the existence of a wide variation between countries as for the number

of international migrants that live in those. In United Arab Emirates for example, the

88% of the population are migrants from other countries. An interesting fact is that

although mobility between countries was reduced in 2020 due to Covid-19 pandemic

restrictions, the number of internally displaced people had an increase during 2020,

reaching 55 million globally whereas the same figure was 51 million for 2019 [5].

During the presentation of IOM’s World Migration Report 2022, the organization’s

general director Antonio Vitorino said: « We are witnessing a paradox not seen before

3|P a ge

in human history. While billions of people have been effectively grounded by COVID19, tens of millions of others have been displaced within their own countries.».

The causes of this impressive increase on the number of refugees, migrants, asylum

seekers and internally displaced people during the last decades and especially after

1990, can be found in a complex of economical, geopolitical and environmental facts

that affect the lives of literally every single person in today’s globalized world. In IOM

World Migration Report 2022 is stated that: «Increased competition between States is

resulting in heightened geopolitical tension and risking the erosion of multilateral

cooperation. Economic, political and military power has radically shifted in the last two

decades, with power now more evenly distributed in the international system. As a

result, there is rising geopolitical competition, especially among global powers, often

played out via proxies. The environment of intensifying competition between key

States– and involving a larger number of States– is undermining international

cooperation through multilateral mechanisms, such as those of the United Nations»

[4].

This is an interesting statement, if one considers that it comes from the United Nations

(UN) agency for migration and at the same time, the five permanent members of UN

Security Council are countries who participate in a major role in the international field

of economical and geopolitical competition, while they have a continuous presence in

conflicts around the globe since the establishment of UN in 1945, either by means of

political influence and diplomacy , or by military means through the intergovernmental

alliance of the North Atlantic Treaty Organization (NATO).

4|P a ge

Figure 2.3 The number of international migrants , 1990-2020 . ( IOM World Migration

Report 2020 , [4] )

The rapidly changing environmental conditions , related to human activity through

the absence of a planned development of the material production and consumption

system that leads to industrial overproduction , toxic waste pollution , uncontrolled

energy consumption , is another factor that can lead people to flee in other countries

seeking better living conditions . As stated in IOM’s 2022 report: «The intensification of

ecologically negative human activity is resulting in overconsumption and

overproduction linked to unsustainable economic growth, resource depletion and

biodiversity collapse, as well as ongoing climate change. Broadly grouped under the

heading of “human supremacy”, there is growing recognition of the extremely

negative consequences of human activities that are not preserving the planet’s

ecological systems. (…) The implications for migration and displacement are significant,

as people increasingly turn to internal and international migration as a means of

adaptation to environmental impacts, or face displacement from their homes and

communities due to slow-onset impacts of climate change.»[4]

5|P a ge

Figure 2.4 Top five countries of origin , 2005-2020 . (IOM World Migrant Report,2022,[6])

In figure 2.4 is depicted the number of refugees by top five countries of origin during

the years 2005-2020. A rapid upward trend initiated in 2011 for the number of Syrian

refugees brings this country to the top of the list, whereas we note an almost

constant number of refugees from Afghanistan each year, placing this central Asia

country to the second position. It is obvious by the political facts that the war in Syria

and the conflicts in Afghanistan that are ongoing for decades, generated these flows.

Also it is estimated by IOM [7] that there were nearly 169 million migrant workers

around the world in 2019, which is the 62% of the total number of immigrants in 2019

(272 millions). From these people, 67% of workers were living in high-income

countries, 29% were living in middle-income countries and 3.6% were in low-income

countries. ( figure 2.5) . The numbers indicate the much expected fact that regardless

the reason of displacement, refugees and immigrants prefer countries with better

income, hoping that this will provide them with higher standards of living.

6|P a ge

Figure 2.5 Migrant workers by destination country income level. (IOM World Migrant Report

2022 , [7])

On the same time , as UNHCR states in data figures , 83% of the refugees are hosted in

low and middle-income countries (figure 2.6) . This indicates the distinction between a

person who is a refugee or an asylum seeker , and a migrant . According to UNHCR :

«Migrants choose to move not because of a direct threat of persecution or death, but

mainly to improve their lives by finding work, or in some cases for education, family

reunion, or other reasons. Unlike refugees who cannot safely return home, migrants

face no such impediment to return. If they choose to return home, they will continue

to receive the protection of their government.» . This is a point that is often neglected

or misunderstood by many when they refer to the issue .

7|P a ge

Figure 2.6: Percentage of refugee

population as to the average income of

country host. (UNHCR Figures at a glance,

[8])

2.2

As a conclusion , migration and the

refugee issue is a phenomenon generated

by a complex of multi-causes , including

political , economical and environmental

factors . It is an international issue with

multiple

social

and

economical

dimensions that affects the local

economies of the destination countries by

raising the available working power and it

should be confronted by means of

distinction between a person who is a

refugee or a seeker of international

protection , and a migrant .

The situation in the European Union (EU)

In recent years, Europe has seen the largest flow of migrants and refugees from

countries outside of EU , since the end of World War 2 . These flows had their peaks in

2015 and 2016 , with a significant reduction after 2017. A relative stability in

economical and political situation in compare to African, Asian or Middle East

countries, even though this contrast is highly related with more than a century of

historical interaction between these territories and European countries through

colonialism and its consequences, makes the countries of European Union an

attractive destination for people who want to find better living conditions or they seek

international protection.

The most attractive regions, as we might expect , are in destination countries like

Germany or Austria . Greece and Italy are in the middle of the scale and the less

attractive are found to be in Romania, Serbia and Montenegro [9] as it is also seen in

figure 2.7. This enhances the general assumptions about the factors that attract

refugees and migrants to specific areas.

We have to note that regardless of the expectations a person may have, the

unemployment rates are significantly higher for asylum seekers residing in EU

countries, than it is for native population or migrants that have moved in the same

country having a university degree. The unemployment rates for refugees [9] differ

8|P a ge

between different states , with Great Britain to have a rate of 15 % and Spain to have

over 50% rate . (figure 2.8 )

The routes through which the refugees attempt to reach the destination country of EU

is highly dangerous . Crossing into Europe can be done by land border or by sea. The

main border crossing routes with direction the EU territory are : the Eastern

Mediterranean Route, the Western Balkan Route and the Central Mediterranean

Route. The central crossing of the Mediterranean sea (figure 2.9) has proven to be

extremely dangerous, while there are many times when the boat capsized and the

passengers didn’t survive . In October 2013, a boat carrying hundreds of refugees from

Libya to Italy sank near the island of Lampedusa, killing 368 refugees. Italy launched a

large scale sea rescue operation named Mare Nostrum . UNHCR reports (2015) that :

«During the first four months of 2015, the numbers of those dying at sea reached

horrifying new heights. Between January and March, 479 refugees and migrants

drowned or went missing, as opposed to 15 during the first three months of the year

before. In April the situation took an even more terrible turn.

Figure 2.7 . Territorial attractiveness . ( ESPON 2018, [10])

9|P a ge

Figure 2.8 . Unemployment rate (U) , Long Term (LTU) , Very Long Term (VLTU) . (ESPON

2018 , [9] )

In a number of concurrent wrecks, an unprecedented 1,308 refugees and migrants

drowned or went missing in a single month (compared to 42 in April 2014), sparking a

global outcry.» [12] . European states held meetings shortly after that incident and

decided to raise the funding of Frontex , a private company which is one of the main

EU border surveillance agency , member states offered to deploy naval vessels for

patrols and a better coverage of the sea routes . During the months May and June of

2015 , the number of people drowned or missing in the sea fell to 68 and 12 persons

respectively as a result of the applied operations [12] .

10 | P a g e

Figure 2.9 The sea routes . ( UNHCR 2015 , [11] )

2.3

The Eastern passage through the Aegean Sea

Greece is one of the main gateways to Europe, along with Italy and Spain in the

Mediterranean region. Refugees and immigrants arrive in Greece both through of its

land border with Turkey in the North (Evros) as well as through the Greek-Turkish

maritime borders in the Aegean , which is the route that is mainly used . During the

years 2015-2016 which was the peak arrivals years for Greece as well as for Europe ,

there were more than 1 million refugees that arrived through the sea in the islands

and more than 6000 arrivals through the land borders . For the period 01.01.201621.11.2016 there were 49792 sea rescues , 765 arrests of smugglers transporting

refugees by boats and 108 people lost their lives in the sea , when for 2015 the

number of people that got drowned was 272 [13] . According to UNHCR reports ,

during the first six months of 2015 , 68000 refugees arrived in the island of Lesvos ,

Chios , Samos and Kos , and Greece overtook Italy which had the first place in arrivals

during 2014 while for the same period of 2015 , had 67,500 . A change in the profile of

11 | P a g e

people arriving as refugees also was noted . The main countries of origin arriving in

Italy were Eritrea (25 %), Nigeria (10 %) and Somalia (10 %), followed by Syria (7 %) and

Gambia (6 %). The main countries of origin of refugees and migrants arriving in Greece

were Syria (57 %), followed by Afghanistan (22 %) and Iraq (5 %) . [14]

The 2016 agreement between EU and Turkey had significant consequences for the

management of this unprecedented refugee crisis by the Greek state , and

consequently to the people who had arrived in the Greek islands . Since March of 2016

when it first took effect , the agreement held the vast majority of the refugees to the

Greek islands , where the Greek state didn’t have the infrastructure and services to

address the basic needs of the population . As it was reported on UNHCR’s factsheet of

May 2017 : «The Aegean islands have been at the forefront of the 2015/2016

European Refugee Emergency with over 1 million people arriving in total, the vast

majority from refugee producing countries. Before 20 March 2016, the population was

transient, with arrivals remaining on the islands for a limited time, sometimes hours or

a few days, before continuing their journey. The situation changed after the closure of

the so-called ‘Balkans route’ and the implementation of the Joint EU-Turkey Statement

of 18 March 2016. Arrivals decreased significantly, the length of stay on the island

increased, and the needs of the refugee and migrant populations on the islands

changed, especially for people and families with specific needs.» [15]

These facts generated tremendous strain on the island local communities . The

reception conditions in the so called Hot-spots were insufficient , and the situation was

getting worse while thousands of people were accumulating in small towns , and being

unable to move to the inland or elsewhere . In the same UNHCR factsheet of 2017 , is

reported that : «…. challenges with overcrowding and insecurity remain, and substandard conditions must still be improved in some locations, notably on Chios due to

recent overcrowding. Protection risks for people staying on the islands continue,

particularly the risk of sexual and gender-based violence. Children, including

unaccompanied children, remain in inadequate shelter with insufficient access to

formal or non-formal education, which also severely impacts their psychosocial wellbeing.» [15]

Τhe situation gradually de-escalated, partially because specific measures of relocation

of the population were taken by the Greek Government and other EU Governments

and partially because of the fact that in countries like Afghanistan and Syria , the war

conflicts stopped or decreased , although the Aegean islands had 29718 arrivals in

2017 , 32494 in 2018 , a flare up on 2019 with 59726 arrivals [16], followed by a rapid

decline in 2020 and 2021 , when the number of arrivals was 9714 and 4331

respectively . [17]

12 | P a g e

Among the islands of east Aegean , Lesvos got the highest numbers of arrivals . In

December 2015 , a factsheet from UNHCR reported that up to that time , 59 % of total

arrivals by sea in Greece , passed through Lesvos . The total arrivals from January to 24

of December 2015 was 487964 people . The average daily arrivals during the last 7

days was estimated to be 1968 per day . The total arrivals during December was

47243 people [18] . From January to November 2017 Lesvos had the 42 % of total

arrivals in Greece by sea . 11570 asylum –seekers and migrants were recorded to

reach the island and the total number of sea arrivals in Greece during that season was

27354 [19] . Between January and November 2018 the 47% of the total arrivals in

Greece by sea , was in Lesvos (13945 people) and the total number of sea arrivals in

Greece was 29.567 [20] . For 2019 , until December the percentage of people arriving

to Lesvos was 40 % of the total arrivals and 23861 arrivals in total number [21]. The

majority of the asylum-seekers and migrants arriving in the Greek islands of East

Aegean sea for the whole period of 2015 -2021 was from Syria, Afghanistan , Iraq and

the Democratic Republique of Kongo. Typically these nationalities arrive in family

groups , although a large number of unaccompanied minors , mainly from Afghanistan

was recorded in the Reception and Identification Centres of the Greek State . [UNHCR,

factsheets 2017,2018]

Figure 2.10 The Aegean Sea arrivals per island , Jan.2015-Sept.2015 [22]

13 | P a g e

In this work we attempt a time series analysis for the modeling of the number of

migrants arriving to Greece ( through all the islands and Evros borders) for the period

01/2014 – 01/2022 .The entire time series which will be analyzed in Chapter 4 with the

Box-Jenkins methodology to be presented in Chapter 3 is depicted in figure 2.11.

(Data collected from the Operational Data Portal of UNHCR for the Mediterranean

Situation https://data.unhcr.org/en/situations/mediterranean/location/5179).

Figure 2.11: The time series for the recorded arrivals in the Greek islands of East Aegean Sea,

01/2014 – 01/2022.

14 | P a g e

Chapter 3 The Box- Jenkins methodology

3.1.

Introduction to time series analysis

A time series is a set of observations {𝑥1 , 𝑥2 , 𝑥3 , … , 𝑥𝑛 } recorded sequentially over

time. We suppose that each observation is a realized value of a specific random

variable 𝑋𝑡 . Therefore , we may consider the time series to be the realized values of a

sequence {𝑋𝑡 } of random variables indexed by time t ,where 𝑥1 is the observed value

at time point 1 , 𝑥2 is the observed value at time point 2 , and so on. In general, we

refer to a collection {𝑋𝑡 } of random variables indexed by time t, as a stochastic

process. Hence the observed time series can be considered as a realization of a specific

stochastic process. In this study , we will use the term time series whether we are

referring to the stochastic process or to a particular realization of it and t will have

discrete integer values ±1, ±2, ±3, … and so on .However , in other cases the set T of

time in which we record the observations can be a continuous interval , i.e. T = [0,1] .

In that case we denote that we have a continuous time time series.

Time series occur in the field of economics, where we can have monthly national

unemployment figures, inflation rates registered over equal time periods, annually

GDP registration etc. In epidemiology, an example of time series is the daily

registration of covid-19 deaths observed in a specific geographical area. In medicine, a

patient’s blood sugar measurements traced over time could be useful for evaluating

the influence of a specific drug on treating diabetes. In environmental sciences, time

series can occur by registration of average monthly temperature or yearly rainfall. In

the stock market, daily stock prices produce a time series. Time series analysis applies

to a diverse list of scientific fields, practically anything that we observe sequentially

over time is a time series and can be analyzed as such.

Graphically, we display a sample time series by plotting the values of the random

variables on the vertical axis, or ordinate, and having the time scale as the abscissa.

Typically, we connect the values at adjacent time points producing visually a

hypothetical continuous time series that could have produced these values as a

discrete sample. Examples of time series plots can be seen in figures 3.1- 3.3.

15 | P a g e

Figure 3.1 Strikes in the USA , 1951 – 1980 . [Brockwell – Davis , 2016]

Figure 3.2 Population of USA at 10-year intervals , 1790-1990 .[Brockwell – Davis , 2016]

16 | P a g e

Figure 3.3 The monthly accidental deaths data , 1973-1978 . [Brockwell – Davis , 2016]

The purpose of time series analysis is primarily to find a satisfactory probability model

to represent the data. This will help to understand the stochastic process that

produces the observed time series. Once the model is developed, it could be used for

prediction purposes.

3.2 Stationarity

Definition 1. A time series 𝑋𝑡 , 𝑡 ∈ 𝑇 is said to be strictly stationary if the joint

distribution F of 𝑋𝑡1 , 𝑋𝑡2 , … . , 𝑋𝑡𝑛 is independent from the system of coordinates:

F(𝑋𝑡1 , 𝑋𝑡2 , … . , 𝑋𝑡𝑛 ) =F(𝑋𝑡1+𝑘 , 𝑋𝑡2+𝑘 , … . , 𝑋𝑡𝑛+𝑘 ) ,

where 𝑘, 𝑛 ∈ ℕ

𝑎𝑛𝑑 𝑡1 , 𝑡2 , … , 𝑡𝑛 ∈ 𝑇

According to Definition 1 we have:

𝐹(𝑋𝑡 ) = 𝐹 (𝑋𝑡+𝑘 ) = 𝐹(𝑋0 )

17 | P a g e

which means that the cumulative distribution function is independent of t , and so

the mean 𝐸𝑋𝑡 = 𝜇 is independent of t . Also we have :

𝐹 (𝑋𝑡 , 𝑋𝑠 ) = 𝐹(𝑋𝑡+𝑘 , 𝑋𝑠+𝑘 ) = 𝐹(𝑋0 , 𝑋𝑠−𝑡 )

which means that the common distribution of d 𝑋𝑡 , 𝑋𝑡+𝑘 𝑑oes not depend on t , in

other words , observations that have the same distance between them will have the

same common distribution .

Definition 2 . A time series 𝑋𝑡 , 𝑡 ∈ 𝑇 is said to be weakly stationary ( stationarity of

2nd order ) if the mean and the covariance are independent of time t , which means :

𝐸𝑋𝑡 = 𝜇 ,

𝑡 ∈𝑇

𝐶𝑜𝑣( 𝑋𝑡 , 𝑋𝑠 ) = 𝐸 (𝑋𝑡 − 𝜇)(𝑋𝑠 − 𝜇) = 𝛾|𝑡−𝑠|

and

, 𝑡 ∈𝑇

Because strict stationarity is a very difficult condition to have and it is highly restricting

,. whenever we use the term ” stationary time series “ we will mean weakly stationary

.

From all the above , we get the following assumptions for every time we start to

define an appropriate model :

1) 𝐸𝑋𝑡 = 𝜇

𝑎𝑛𝑑

𝑉𝑎𝑟(𝛸𝑡 ) = 𝜎𝜒 2

, 𝑡 ∈𝑇

meaning that the mean and the variance are constant in time t .

2) 𝐶𝑜𝑣(𝑋𝑡 , 𝑋𝑡+𝑘 ) = 𝛾𝜅

,𝑡 ∈ 𝑇

meaning that covariance between two observations of the time series depends only

on lag κ between their time moments .

Definition 3 . Let {𝑋𝑡 } be a stationary time series . The autocovariance function

(ACVF) of {𝑋𝑡 } at lag k is :

𝛾𝑘 = 𝐶𝑜𝑣( 𝑋𝑡 , 𝑋𝑡+𝑘 ) = 𝐸 (𝑋𝑡 − 𝜇)(𝑋𝑡+𝑘 − 𝜇)

By this definition , we find :

𝛾𝑘 = 𝐶𝑜𝑣( 𝑋𝑡 , 𝑋𝑡+𝑘 ) = 𝐶𝑜𝑣( 𝑋𝑡−𝑘 , 𝑋𝑡 ) = 𝐶𝑜𝑣 (𝑋𝑡 , 𝑋𝑡−𝑘 ) = 𝛾−𝑘

αnd

𝛾0 = 𝜎𝜒 2

18 | P a g e

We also define the autocorrelation function (𝑨𝑪𝑭)

𝜌𝑘 =

from which , we get 𝜌0 = 1

𝛾𝑘

𝛾0

:

, 𝑘 = 0, ±1, ±2, … ..

𝑎𝑛𝑑 𝜌𝑘 = 𝜌−𝑘

Practically , we don’t calculate the ACF starting from a model , we use a finite set of

observed data {𝑥1 , 𝑥2 , … . . , 𝑥𝑛 } and calculate the sample autocorrelation function

(sample ACF ) .The sample equivalents of the above quantities are used as estimators

for inferential purposes . Thus , we are provided with an estimate of the extend of the

dependence in the data which is one of the most important tools we have for

modeling purposes .

3.3

Components of a non-stationary time series

The first step in the analysis of a time series should always be to plot the data . If we

find any apparent outlying observations , we need to examine them carefully to

understand if they were caused by mistakes during the data recording and decide

whether or not we need to discard them . We also check the magnitude of the

fluctuations and try to see whether the variance changes with the level of the time

series . If so, we need to apply a transformation to the data , i.e. we get the

{𝑙𝑛𝑥1 , 𝑙𝑛𝑥2 , … , 𝑙𝑛𝑥𝑛 } in which we have more limited

transformed time series

magnitudes , or we can use of the Box-Cox transformation .By observing the plot we

can also see if there is a trend and a seasonal component . A trend exists if we notice a

long term increase or decrease in the observed values . A repeated pattern in the plot

implies the presence of a seasonal component . If both components exist in the plot

(which means that the time series is not stationary) , to represent our data we will

use the classical decomposition model

𝑋𝑡 = 𝑚𝑡 + 𝑠𝑡 + 𝑌𝑡

(1)

where

•

•

•

𝑚𝑡 is a slowly changing function of time t which can be of deterministic or

stochastic nature and is known as the trend component

𝑠𝑡 is a periodical function with period d , the seasonal component . We note

that 𝑠𝑡 = 𝑠𝑡−𝑑

𝑌𝑡 is the random noise component that is stationary

19 | P a g e

The goal of the researcher is to estimate the trend and seasonal components and to

eliminate them from the original series . If the noise component 𝑌𝑡 that remains after

this elimination is a stationary time series , we can find a satisfactory model to describe

the process and its properties and by following the reverse route , we can combine it

with the estimated 𝑚𝑡 and 𝑠𝑡 components to compose a model that fits our original

data . Then we can use this model to forecast future values of 𝑋𝑡 . For methods of

estimation the interested reader could refer to the book by Cryer & Chan (2008) .

3.4

Stochastic processes

We have already define a time series to be the realization of a specific stochastic

process . Therefore , we need to define the basic stochastic models that are commonly

used to describe the process which generated the data . Finding a model that is a

satisfactory fit to our data , gives us the ability to move with forecasting future values

of the time series . We have to note again that by the term time series , we refer to

both the data set , and the stochastic process that we consider to have generated

these data .

a) The time series {𝑋𝑡 } , 𝑡 ∈ ℤ is named time series of independent and

identically distributed random variables (iid) if it consists of independent

random variables that have the same distribution. An iid time series is

completely random and doesn’t contain any correlations (linear or not)

between its observations . The independence of the random variables indicates

that we can’t get any information out of the series analysis .

b) A time series that consists of random variables that don’t have correlations but

they might not be independent , is not an iid time series . We will refer to a

time series of this case as white noise with mean 0 and variance 𝜎𝑥 2 and we

will use the notation

{𝑋𝑡 } ~ 𝑊𝑁(0, 𝜎𝑥 2 )

Additionally , if the random variables of the white noise have a normal

distribution , the time series is named Gaussian white noise .

20 | P a g e

c) The random walk is a non-stationary time series model {𝑋𝑡 } in which , every

random variable 𝑋𝑡 comes from the previous 𝑋𝑡−1 by adding a random

number 𝑌𝑡 , in other words by adding an iid random variable . This process is

denoted as

𝑋𝑡 = 𝑋𝑡−1 + 𝑌𝑡

If we start with t=0 and replace the random variables 𝑋𝑡−1 , 𝑋𝑡−2 , …. using the

definition of the random walk , we get the notation

𝑡

𝑋𝑡 = ∑ 𝑌𝑘

𝑌𝑘

,

∶ 𝑖𝑖𝑑 𝑛𝑜𝑖𝑠𝑒

𝑘=0

It’s easy to see that random walk has a mean 𝐸 (𝑋𝑡 ) = 0 and a variance 𝜎𝑥 2 =

𝐸(𝑌𝑡 2 ) = 𝑡𝜎𝑥 2 . The variance is increasing with time t , indicating that random

walk is not a stationary time series . We note that if we apply first differencing

to a random walk , we get the stationary iid time series {𝑌𝑡 } .

d) An autoregressive process of order p , denoted as AR(p) , is of the form

𝑋𝑡 = 𝜑1 𝑋𝑡−1 + 𝜑2 𝑋𝑡−2 + ⋯ + 𝜑𝑝 𝑋𝑡−𝑝 + 𝑍𝑡

, 𝑍𝑡 ~𝑊𝑁(0, 𝜎𝑧 2 )

where 𝑋𝑡 is stationary and 𝜑1 , 𝜑2 , … . , 𝜑𝑝 are constants ( 𝜑𝑝 ≠ 0 ) and

we have considered the mean of 𝑋𝑡 to be zero . If the mean is not zero we

write 𝑋𝑡 − 𝜇 instead of 𝑋𝑡 in the formula above .

By using the backshift operator , we can write the AR(p) model as follows

(1 − 𝜑1 𝛣 − 𝜑2 𝛣2 − … … … . . − 𝜑𝑝 𝐵𝑝 )𝑋𝑡 = 𝑍𝑡

or more concisely as

𝛷 (𝐵)𝑋𝑡 = 𝑍𝑡 ,

where

𝑝

𝛷 (𝐵) = 1 − ∑𝑖=1 𝜑𝑖 𝐵𝑖

is the AR(p) operator .

We also define as the AR(p) characteristic polynomial , the polynomial 𝛷 (𝑧) = 1 −

∑𝑝𝑖=1 𝜑𝑖 𝑧 𝑖 , where z is a complex number .

It can be proved that AR(p) is stationary , when the roots of the AR(p) polynomial are

outside the unit circle . The idea behind Autoregressive models is that the current

21 | P a g e

value of the series, 𝑥𝑡

, can be explained as a function of p past values

𝑥𝑡−1 , 𝑥𝑡−2 , … , 𝑥𝑡−𝑝 with the addition of white noise . The linear combination of 𝑥𝑖 for

i=t-1 ,….,t-p can be nonsidered as the deterministic part of this model and 𝑍𝑡 the

stochastic part .

e) A moving average model of order q , denoted as MA(q) , is defined to be

𝑋𝑡 = 𝑍𝑡 − 𝜃1 𝑍𝑡−1 − 𝜃2 𝑍𝑡−2 − … … − 𝜃𝑞 𝑍𝑡−𝑞

, 𝑍𝑡 ~𝑊𝑁(0, 𝜎𝑧 2 )

where 𝜃1 , 𝜃2 , … . 𝜃𝑞 are parameters . By using the backshift operator , we can write the

MA(q) model as

𝑋𝑡 = (1 − 𝜃1 𝛣 − 𝜃2 𝛣2 − … … … . . − 𝜃𝑞 𝐵𝑞 )𝑍𝑡

or more concisely as

𝑋𝑡 = 𝛩(𝐵)𝑍𝑡 ,

where

𝑞

𝛩(𝐵) = 1 − ∑𝑖=1 𝜃𝑖 𝐵𝑖

is the MA(q) operator .

We also define as the MA(q) characteristic polynomial , the polynomial

𝑞

𝛩 (𝑧) = 1 − ∑𝑖=1 𝜃𝑖 𝑧 𝑖 where z is a complex number .

The moving average process is stationary for any values of the parameters, since it is a

finite sum of white noise terms .

f) A process {𝑋𝑡 } is an autoregressive moving average series (ARMA) if it is

stationary and

𝑋𝑡 = 𝜑1 𝑋𝑡−1 + 𝜑2 𝑋𝑡−2 + ⋯ + 𝜑𝑝 𝑋𝑡−𝑝 + 𝑍𝑡 − 𝜃1 𝑍𝑡−1 − 𝜃2 𝑍𝑡−2 − ⋯ 𝜃𝑞 𝑍𝑡−𝑞

where 𝜑𝑝 ≠ 0 , 𝜃𝑞 ≠ 0 . The parameters p and q are the autoregressive and the

moving average orders respectively . We have assumed that 𝑋𝑡 has a zero mean . If

𝑋𝑡 has a nonzero mean , we write 𝑋𝑡 − 𝜇 instead of 𝑋𝑡 in the formula above .

Since the process consists of an AR(p) part and an MA(q) part , we refer to this model

as ARMA(p,q) model . The AR part defines if the series is stationary , so if the roots of

the AR polynomial are outside of the unit circle , the ARMA(p,q) is stationary . We have

to note that an ARMA(p,0) model is in fact an AR(p) model , while an ARMA(0,q) is an

MA(q) model .

22 | P a g e

ARMA models are very important for representing time series data , but they can be

applied only if we have a stationary time series . If the time series becomes stationary

after what is called differencing , we have the class of autoregressive integrated

moving average models ( ARIMA ) described below .

g) A process {𝑋𝑡 } is an ARIMA(p, d, q) if

∇𝑑 𝑋𝑡 = (1 − 𝐵)𝑑 𝑋𝑡

is ARMA (p, q) with d being the order of differencing. Observe that all the previous

models are specific cases of ARIMA(p,d,q) . For obtaining based on a data set

appropriate values for p,d,q we will proceed in the next section in the Box –Jenkins

approach .

h) If 𝑑 𝑎𝑛𝑑 𝐷 are nonnegative integers , then {𝑋𝑡 } is a seasonal

𝑨𝑹𝑰𝑴𝑨(𝒑, 𝒅, 𝒒) × (𝑷, 𝑫, 𝑸)𝒔 process with period s if the differenced series

𝑌𝑡 = (1 − 𝐵)𝑑 (1 − 𝐵 𝑠 )𝐷 𝑋𝑡 is a casual ARMA process defined by

𝜑(𝛣)𝛷 (𝛣 𝑠 )𝑌𝑡 = 𝜃 (𝛣)𝛩(𝐵 𝑠 )𝑍𝑡

,

𝑍𝑡 ~𝑊𝑁(0, 𝜎𝑧 2 )

where 𝜑(𝑧) = 1 − 𝜑1 𝑧 − ⋯ − 𝜑𝑝 𝑧 𝑝 , 𝛷(𝑧) = 1 − 𝛷1 𝑧 − ⋯ − 𝛷𝑃 𝑧 𝑃

𝜃(𝑧) = 1 + 𝜃1 𝑧 + ⋯ + 𝜃𝑞 𝑧 𝑞 , 𝛩 (𝑧) = 1 + 𝛩1 𝑧 + ⋯ + 𝛩𝑄 𝑧 𝑄

Before we move to the final part of this chapter , we will give the definition of a

function that plays an important role in finding candidate ARMA models to fit our

data . In an autoregressive process AR(p) , the partial autocorrelation of 𝑋𝑡 and 𝑋𝑡−ℎ ,

for ℎ > 𝑝 is nonzero since they are correlated through the random variables that are

between them , 𝑋𝑡−1 , … , 𝑋𝑡−ℎ−1 . We want to find the straight correlation between

them , by neutralizing all the other autocorrelations they might have with

𝑋𝑡−1 , … , 𝑋𝑡−ℎ−1 . This correlation is defined as

𝐶𝑜𝑟𝑟(𝑋𝑡 , 𝑋𝑡−ℎ ⁄ 𝑋𝑡−1 , … , 𝑋𝑡−ℎ−1 )

and it is noted as partial autocorrelation .

23 | P a g e

The partial autocorrelation function (PACF ) of an ARMA process {𝑋𝑡 } is the function

a(.) defined by

𝑎 (0) = 1

and

𝑎(ℎ) = 𝜑ℎℎ , ℎ ≥ 1

where 𝜑ℎℎ is the last component of

𝜱𝒉 = 𝜞𝒉 −𝟏 𝜸𝒉

𝜞𝒉 = [𝛾(𝑖 − 𝑗)]

and

, 𝑖, 𝑗 = 1, … . , ℎ

𝛾(𝑘) = 𝑐𝑜𝑣(𝑥𝑡+𝑘 , 𝑥𝑡 )

and 𝜸𝒉 = [𝛾(1), 𝛾 (2), … , 𝛾(ℎ)]′ ,

the autocovariance function .

For a set of observations {𝑥1 , … . , 𝑥𝑛 } with 𝑥𝑖 ≠ 𝑥𝑗 for some 𝑖 𝑎𝑛𝑑 𝑗 , the sample

PACF 𝑎̂(ℎ) is given by

𝑎̂(0) = 1

𝑎̂(ℎ) = 𝜑̂ℎℎ , ℎ ≥ 1

where 𝜑̂ℎℎ is the last component of

̂𝒉 = 𝜞

̂ 𝒉 −𝟏 𝜸

̂𝒉

𝜱

Statistical packages can do the computations for the sample PACF and provide us with

a plot in similar fashion as for ACF .

24 | P a g e

3.5

The Box – Jenkins approach

Box and Jenkins approach is a method of time series analysis and forecasting that

aims to define a proper statistical model 𝐴𝑅𝐼𝑀𝐴(𝑝, 𝑑, 𝑞 ) to represent in a sufficient

way the stochastic process that produced our data . There are three stages in the Box

– Jenkins approach : identification, estimation and diagnostic checking .

a) Identification

In this stage we choose an initial set of values for the parameters p,d,q . The basic

tools in this procedure are the sample ACF and PACF . If the sample ACF plot exhibits a

rapid decay under the limits of significance , the time series is most probably stationary

in which case , we choose d = 0 . On the other hand , if the ACF plot decays slowly with

lag , the series is not stationary and thus it is necessary to apply differencing in order

to obtain series stationarity . If we apply first order difference , d = 1 etc . Next , we

define the parameters p and q by using the plots of the sample ACF and PACF .

b) Estimation

By using a non-linear technique and through the minimization of the sum of squares

of the errors we get estimates of the coefficients 𝜑1 , … , 𝜑𝑝 𝑎𝑛𝑑 𝜃1 , … , 𝜃𝑞 for our

ARIMA(p,d,q) model . If the model does not contain an MA part , we can use the least

squares method .

c) Diagnostic checking

In this stage , we conduct a number of checks for the goodness of fit for the selected

model . If the fit is poor , we apply modifications . We check the statistical significance

for the model’s coefficients , standard errors for the estimates , and confidence

intervals . Also Box and Jenkins suggest to check for the goodness of fit by applying

tests on the residuals of the fitted model . If the fitted model is satisfactory , the

residuals should behave like white noise and this is what we want to see by applying

the diagnostic tests . The information criteria AIC , BIC and AICC are commonly used as

we repeat the procedure for a variety of competing p and q values . The model with

the smallest value for a certain criterion , is better .

25 | P a g e

After the selection of the optimal model to fit our data , we proceed with forecasts .

Suppose we have the time series {𝑥1 , 𝑥2 , … , 𝑥𝑛 } generated from the stochastic

process {𝑋𝑡 } and we want to explore the forecast 𝑥𝑛 (𝑘) of the time series for the

future time moment 𝑡 = 𝑛 + 𝑘 . The true value at that time which is unknown to us

is 𝑥𝑛+𝑘 . The prediction error is 𝑒𝑛 (𝑘) = 𝑥𝑛+𝑘 − 𝑥𝑛 (𝑘)

In fact , the forecast value 𝑥𝑛 (𝑘) is the estimation of 𝑋𝑛+𝑘 of the process {𝑋𝑡 } .

Since this is a stochastic process , the optimal forecast is

𝑋𝑛 (𝑘) = 𝐸[𝑋𝑛+𝑘 ⁄𝑋𝑛 , 𝑋𝑛−1 , … ]

We want to have

•

unbiasedness of the forecast

𝐸 [𝑋𝑛 (𝑘)] = 𝑋𝑛+𝑘

•

efficiency , meaning a small variance for the prediction error .

𝑉𝑎𝑟[𝑒𝑛 (𝑘)] = 𝑉𝑎𝑟[𝑋𝑛+𝑘 − 𝑋𝑛 (𝑘)]

Our goal is to have a forecast that minimizes mean squared prediction error

2

𝐸[(𝑋𝑛+𝑘 − 𝑋𝑛 (𝑘)) ]

for any k .

If we believe that the time series {𝑥1 , 𝑥2 , … , 𝑥𝑛 } is the realization of an AR(p) process

, then 𝑥𝑛+1 = 𝜑1 𝑥𝑛 + ⋯ + 𝜑𝑝 𝑥𝑛−𝑝+1 + 𝑧𝑛+1 .

The optimal forecast for 1 time step will be

𝑥𝑛 (1) = 𝜑1 𝑥𝑛 + ⋯ + 𝜑𝑝 𝑥𝑛−𝑝+1

and the corresponding prediction error

𝑒𝑛 (1) = 𝑧𝑛+1

The optimal forecast for 𝑘 time steps will be

𝑥𝑛 (𝑘 ) = 𝜑1 𝑥𝑛 (𝑘 − 1) + ⋯ + 𝜑𝑝 𝑥𝑛 (𝑘 − 𝑝)

26 | P a g e

where each value 𝑥𝑛 (𝑗) is known eather by previous forecast or from the time series

data .

The prediction error will be 𝑒𝑛 (𝑘) = ∑𝑘−1

𝑗=0 𝑏𝑗 𝑧𝑛+𝑘−𝑗

2

Var[𝑒𝑛 (𝑘)] = 𝜎𝑧 2 ∑𝑘−1

𝑗=0 𝑏𝑗

and also

If we believe that {𝑥1 , 𝑥2 , … , 𝑥𝑛 } is the realization of an 𝑴𝑨(𝒒) process , then the

next observation will be

𝑥𝑛+1 = 𝑧𝑛+1 + 𝜃1 𝑧𝑛 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+1

The optimal forecast for 1 time step will be

𝑥𝑛 (1) = 𝜃1 𝑧𝑛 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+1

and the corresponding prediction error

𝑒𝑛 (1) = 𝑧𝑛+1

For k time steps , the forecast will be

𝜃𝑘 𝑧𝑛 + 𝜃𝑘+1 𝑧𝑛−1 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+𝑘 ,

𝑥 𝑛 (𝑘 ) = {

0

𝑖𝑓 𝑘 ≤ 𝑞

𝑖𝑓 𝑘 > 𝑞

If we consider the {𝑥1 , 𝑥2 , … , 𝑥𝑛 } to be the realization of an 𝑨𝑹𝑴𝑨(𝒑, 𝒒) process ,

then

𝑥𝑛+1 = 𝜑1 𝑥𝑛 + ⋯ + 𝜑𝑝 𝑥𝑛−𝑝+1 + 𝑧𝑛+1 + 𝜃1 𝑧𝑛 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+1

When {𝑥1 , 𝑥2 , … , 𝑥𝑛 } is given , the optimal prediction for 1 time step is

𝑥𝑛 (1) = 𝜑1 𝑥𝑛 + ⋯ + 𝜑𝑝 𝑥𝑛−𝑝+1 + 𝜃1 𝑧𝑛 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+1

and the prediction error

𝑒𝑛 (1) = 𝑧𝑛+1

For k time steps the optimal forecast will be

27 | P a g e

𝑥 𝑛 (𝑘 ) = {

𝜑1 𝑥𝑛 (𝑘 − 1) + ⋯ + 𝜑𝑝 𝑥𝑛 (𝑘 − 𝑝) + 𝜃𝑘 𝑧𝑛 + ⋯ + 𝜃𝑞 𝑧𝑛−𝑞+𝑘 , 𝑘 ≤ 𝑞

𝜑1 𝜒𝑛 (𝑘 − 1) + ⋯ + 𝜑𝑝 𝑥𝑛 (𝑘 − 𝑝)

,

𝑘>𝑞

To measure the accuracy of the forecasts we use a number of statistical measures

based on the prediction errors 𝑒𝑡 , the original series 𝑥𝑡 and the number of

observations n. These are:

•

Mean Squared Error (MSE)

𝒏

𝟏

𝑴𝑺𝑬 =

∑ 𝒆𝒕 𝟐

𝒏

𝒕=𝟏

•

Root Mean Squared Error (RMSE)

𝟏

𝑹𝑴𝑺𝑬 = √𝒏 ∑𝒏𝒕=𝟏 𝒆𝒕 𝟐

•

Mean Absolute Error (MAE)

𝒏

𝟏

𝑴𝑨𝑬 = ∑|𝒆𝒕 |

𝒏

𝒕=𝟏

•

Mean Absolute Percentage Error (MAPE)

𝒏

𝟏𝟎𝟎

𝒆𝒕

𝑴𝑨𝑷𝑬 =

∑| |

𝒏

𝒙𝒕

𝒕=𝟏

28 | P a g e

Chapter 4

Application of the Box-Jenkins method

The time series in figure 2.11 has been divided into three seasons (periods), namely:

•

•

•

The Pre Growth Season (01/2014 – 02/2015)

The Growth Season (03/2015 – 04/2016)

The Post Growth Season (05/2016 – 01/2022)

which are analyzed in this Chapter.

The break points for the three periods have been chosen by combining the visual

inspection of the data and the Change Point Analysis [12]. For the latter, using the

(approximate) Binary Segmentation method [11] we identified the end of the Pre

Growth Season as being at 02/2015.

The same method identified a short period with 10 observations, from 5/2019 –

2/2020 as another (short) outbreak period. We have chosen, mainly due to a very

limited number of observations, to ignore this recommendation and retain this period

within the Post Growth Season. For the latter, the method proposed the end of the

Growth Season to be at 2/2016. Since though the value associated with this time point

was extremely high (as compared to all future values) we have chosen to delay the end

of the Growth Period for two more months until 4/2016 believing that by that time the

degree of influence of the outbreak will have been fully extinct. Hence, the Growth

period has been chosen as above, namely from 3/2015 – 4/2016 with the Post Growth

Season lasting for 69 months starting at 5/2016. For this analysis we have used the

changepoint package of R.

(https://cran.r-project.org/web/packages/changepoint/index.html)

4.1

Pre growth season (01 /2014 – 02/2015)

4.1.1 Data plots

The first step is to plot the data of the Pre growth time series (fig.4.1) , the sample

auto correlation function (ACF) and partial auto correlation function (PACF ) (fig.4.2 4.5 ) . We notice that the plot shows an upward trend followed by a downward trend

and a peak on September of 2014 and doesn’t contain any apparent periodic

component. The sample ACF graph demonstrates only one significant spike at lag 1

.It is critical to use a more objective measure to determine whether there is a trend or

not . We apply the augmented Dickey - Fuller test (ADF ) of unit root for which we find

29 | P a g e

a p-value of 0.1514 ,so we accept that the time series is not stationary on the usual

significance levels.

Figure 4.1 : The time series of Pre growth season , 01/2014 -02/2015

Figure 4.2 : The sample ACF plot of the Pre growth time series .

30 | P a g e

Figure 4.3 : The sample ACF values .

Figure 4 .4 : The sample PACF plot for the Pre growth time series .

Figure 4. 5

The sample PACF values .

4.1.2 Fitting polynomials to the Pre growth season data

When a time series is not stationary , one of the first steps to proceed with exploratory

analysis is to remove the trend component . One way to do this is by differencing.

Differencing allows to remove but doesn’t allow to estimate the deterministic trend

31 | P a g e

component . An estimation of the trend can be done by fitting polynomials with

respect to time t to the data . The coefficients can be calculated with ordinary least

squares method and the detrending is done by subtracting the estimated trend values

from the original data for every t . In the following examples , in every polynomial

equation , t represents the month order since season start and has values 1,2,3,… and

X(t) represents the monthly number of arrivals .

Using R , we fit a 3rd degree polynomial with respect to time t on the data of Post

growth season . This can provide us with an estimation of the trend component of the

time series .The fitted polynomial as we see on figure 4.6 is :

𝑋(𝑡) = 𝑋𝑡 = −15.462𝑡 3 + 251.741𝑡 2 − 498.774𝑡 + 923.062

The p-values for the coeficients lead to accept the null hypothesis of non-significance .

The 𝑅2 and adjusted 𝑅2 are 0.6428 and 0.5357 respectively . Residuals’ Standard

Error is 1602 . Mean Square Error (MSE) is 15400613 . The information criteria values

are found to be 251.6347 and 254.83 for AIC and BIC respectively . We also apply the

Box –Ljung test on the residuals to check for correlation between them and

determine if they are white noise . The p-value of the test is 0.1685 hence in all the

usual levels of significance , we can accept the hypothesis that the residuals are white

noise. Finally for a visual presentation of the goodness of fit , we plot the fitted

polynomial and the original data on the same graph ( fig.4.7 ) .

Figure 4.6 Fitted 3rd degree polynomial summary .

32 | P a g e

Figure 4.7 3rd degree polynomial fit on the Pre growth data .

The next candidate polynomial for fitting our data is a 4th degree polynomial . The R

output for the fitted model can be seen in figure 4.8 . The fitted polynomial is :

𝑋(𝑡) = 𝑋𝑡 = 4.75𝑡 4 − 157.97𝑡 3 + 1659.85𝑡 2 − 5588.31𝑡 + 5906.73

The p-values for the coefficients’ significance show an improved fitness of the 4 th

degree polynomial compared to the previous model . The MSE is 13807342 and

residuals’ Standard Error is 1360 . The values of the information criteria AIC ( =

247.5674) and BIC ( = 251.4017) , are better in comparison with the previous model

and the Box –Ljung test has a p-value of 0.1938 , so we accept the null hypothesis : the

time series of the residuals is a white noise . A common plot of the Pre growth data

and the fitted polynomial of 4th degree is shown in figure 4.9.

33 | P a g e

Figure 4.8 : fitted 4th degree polynomial summary .

Figure 4.9 : 4th degree polynomial fit on the Pre growth data .

34 | P a g e

The fitting of a 5th degree polynomial is our next and last attempt . The fitted

polynomial is :

𝑋 (𝑡) = 𝑋𝑡 = 1.712𝑡 5 − 59.4508𝑡 4 + 715.1661𝑡 3 − 3540.4416𝑡 2 + 7232.8518 − 3573.014

The output of the model summary is presented in figure 4.10 . The T statistics and pvalues for the coefficients show that they are statistically significant for any of the

usual levels of significance, the residuals standard error is 705.6 which is a great

improvement from the previous models , MSE is decreased and equals to 13577691 ,

the multiple and the adjusted 𝑅2 statistics have been improved as well , the F statistic

and the p-value for the model’s significance indicate a good fitness . The AIC and BIC

values have been found to be 229.5478 and 234.0212 respectively , much better than

the other two polynomials . The p-value of the portmandeau test is 0.2708 so we can

accept the null hypothesis , the residuals are not correlated and the model doesn’t

show a lack of fit .

Figure 4.10 : fitted 5th degree polynomial summary .

35 | P a g e

Figure 4.11 : 5th degree polynomial fit on the Pre growth data .

The summary of the AIC , BIC , 𝑅2 and 𝑅2 − adjusted values for all three

polynomials fitted in the Pre growth time series ( Table 1) indicates that the 5th degree

polynomial has a much better fit than the other two since it has the minimum score in

both AIC and BIC and has significantly better 𝑅2 and adjusted 𝑅2 values . The 5th

degree polynomial seems a better choice if we want to estimate the trend component

in the time series . It can also provide a prediction of future values of arrivals 𝑋𝑡 . For

example , if we consider the noise of t = 15 to be zero ( it’s mean value ) , then we get

an estimation of the arrivals for the month March of 2015 equal to :

𝑋15 =

1.712 ∙ 155 − 59.4508 ∙ 154 + 715.1661 ∙ 153 − 3540.4416 ∙ 152 + 7232.8518 ∙ 15 −

3573.014 = 12359.24

We have to state that this polynomial by having a higher degree than the other two

models , loses in terms of simplicity and this is something we should consider along

with the rest of criteria when it comes to choose the estimator function of the trend .

At the same time the complexity is not severe and it has the best values of AIC and BIC

as shown in Table 1

36 | P a g e

AIC

BIC

𝑅2

Adjusted

𝑅2

3rd degree

251.6347

254.83

0.6428

0.5357

4th degree

247.5674

251.4017

0.7685

0.6655

5th degree

229.5478

234.0212

0.9446

0.91

Criterion

Polynomial

fitted

Table 1. Summary of polynomials fitted on Pre growth.

4.1.3

Box - Jenkins method for fitting (S)ARIMA models to the data

We have already plotted the Pre growth time series and the sample ACF and PACF .

The ADF test p-value for the original Pre growth data is 0.1514 , which shows that

there is a trend in the time series . To eliminate that trend , we apply 1 st order

differences (fig.4.12) and we repeat the ADF test for the differenced series . By having

a p-value of 0.1279 , on all the usual levels of significance we fail to reject the null

hypothesis of non-stationarity .

37 | P a g e

Figure 4.12 : The first difference of Pre growth series .

We apply 2nd order differences in the Post growth time series (fig.4.13) . We find the

p- value for the ADF test to be 0.4403 , higher than the p-value of the 1st differences

so we proceed by applying 3rd order differences on the original time series . The plot

of the differenced data (fig.4.14) is getting more fluctuations and even shows some

upward trend . The ADF p-value is 0.7118 , even higher than before .

38 | P a g e

Figure 4.13 : The second difference of the Pre growth series .

Figure 4.14 : The third difference of the Pre growth series .

39 | P a g e

Not wishing to proceed further with the differencing ( due to small number of

observations) we consider a significance level of 12.79% and continue with the first

differenced data . We have succeed partial trend elimination . From figure 4.12 of the

1st order differences , we do not recognize any obvious patterns or any trends and

there is only one point getting some more distance from a central line where all the

others are gathered . We don’t see any cycles in the series . We plot the sample ACF

and PACF (figures 4.15 and 4.16 ) and we see no significant values at any lag on both

graphs . We don’t see any pattern in the ACF and PACF plots to indicate the presence

of a seasonal component in the series .

Figure 4.15 : The ACF of the first difference of the Pre growth series .

40 | P a g e

Figure 4.16 : The PACF of the first difference of the Pre growth series .

Based on the sample ACF and PACF plots of the 1st order differences , we can decide

the order of our ARIMA model . For our model, d=1, since we performed the 1st

differences to transform the original time series into stationary . We choose our

parameters to be p = 0 and q = 0 , so we fit an ARIMA (0,1,0 ) model . Additionally ,

several alternative models will be considered . We will try models that have p and q

values close to our primary selection .

1) ARIMA (0,1,0)

Figure 4.17 : ARIMA(0,1,0) fit summary on Pre growth .

Model :

𝑋𝑡 = 𝑍𝑡

41 | P a g e

2) ARIMA (0,1,1)

Figure 4.18 : ARIMA(0,1,1) fit summary on Pre growth.

Model :

𝑋𝑡 = 𝑍𝑡 + 0.3198𝑍𝑡−1

3) ARIMA (1,1,1)

Figure 4.19: ARIMA(1,1,1) fit summary on Pre growth .

Model :

𝑋𝑡 = 0.3232𝑋𝑡−1 + 𝑍𝑡 + 0.1076𝑍𝑡−1

42 | P a g e

Criterion

AIC

BIC

ARIMA (0,1,0)

229.11

229.6754

ARIMA (0,1,1)

229.11

230.2421

ARIMA (1,1,1)

230.61

232.3002

Fitted model

Table 2. Summary of the ARIMA models fitted on Pre growth.

Table 2 contains a summary of all the candidate models’ scores for the AIC and BIC

criteria . ARIMA (0,1,0) gets the best BIC score and has the same AIC score with the

ARIMA (0,1,1) , better than ARIMA (1,1,1) which seems to be the worst . The

difference between the scores though , is minor and both models with the best score

have a simple structure . We plot each one of the two models along with the data and

we can check visually the goodness of fit for both models (figure 4.25) .

We proceed with goodness of fit diagnostic tests. The tests are applied to the

residuals of the ARIMA (0,1,0) fitting . First we plot the residuals’ series and we look

for any trends, skewness, or other patterns that the model didn’t capture . (App.) .

The plot shows the residuals moving randomly around zero value , the variance

doesn’t appear to increase over time and their sequence looks like white noise . This

is supported by the ACF plot of the residuals which shows no significant spikes at any

lag (App.) . The p value for the Box – Ljung test is found to be 0.08455 and indicates

the lack of correlation between the residuals for the usual 1% and 5% levels of

significance. The same conditions apply to the ARIMA (0,1,1) fitting . The Box – Ljung

p-value is 0.611 . The relevant graphs are given in the Appendix .

43 | P a g e

Both models have a fairly good fit in our data. Now we can use the chosen models for

forecasting future values of arrivals for the Pre growth season for the best two models

of Table 2, namely ARIMA(0,1,0) and ARIMA(0,1,1). Our forecasts will be for the

months February to March of year 2022, a period of h=3 months. The forecasting

output for the model ARIMA (0,1,0) is shown in figure 4.20. In figure 4.21 we have the

corresponded plot in which, we can see the forecasting line and also the 80% and 95%

confidence intervals for the forecasts, highlighted with light blue and dark blue colours

respectively.

It should be noted that the forecasts for the Post Growth Season are presented only

for illustrative purposes since as we already now, this season is followed by an

outbreak, which due to its unnatural behavior, cannot be predicted by the model of

the Post Growth Season.

Figure 4.20: Forecast summary of ARIMA(0,1,0) for the Pre growth season .

44 | P a g e

Figure 4.21 .Forecast graph of ARIMA(0,1,0) for the Pre growth season .

The forecasting output for the model ARIMA(0,1,1) and the corresponded plot are

shown in figures 4.22 and 4.23 .

Figure 4.22 : Forecast summary of ARIMA(0,1,1) for the Pre growth season.

45 | P a g e

Figure 4.23: Forecast graph of ARIMA(0,1,1) for the Pre growth season .

4.1.4 The Auto ARIMA

In this section we are going to see the output of the automated method by using the

“auto.arima(.)” command in R . The optimal ARIMA model according to all the

standard criteria is fitted by R without us having to choose the parameters p and q .We

can compare with the previous models and use it for forecasting. The output is

exhibited in figure 4.24 and the model is the ARIMA(0,1,0) :

𝑌𝑡 = 𝑍𝑡 .

This is a model that we have already applied on our data . For a straight comparison of

the two models with the best fit , we plot them together on the Pre growth data plot

( fig.4.25) .

Figure 4.24 : Auto ARIMA fit summary on Pre growth .

46 | P a g e

Figure 4.25: The common plot of the two optimal ARIMA models with the data of Pre

growth season .

Pre growth overview

In summary , we form Table 3 which contains all the models fitted in our Pre growth

data . We can see right away that ARIMA(0,1,0) and ARIMA(0,1,1) have the same AIC

value but ARIMA(0,1,0) has a slightly better BIC value . The 5th degree polynomial has

much better 𝑅2 and adjusted 𝑅2 scores compared to the other two polynomials and

better AIC and BIC . 3rd and 4th degree polynomials have worst scores in AIC and BIC

than any of the ARIMA models that we have applied , but the 5 th degree polynomial

has an AIC value very close to the best fitted ARIMA model . As for the ARIMA models ,

since we have two models with the same AIC value ,we could say that any of these

models is as good as the other . On Table 4 we see that the Root mean square error for

the ARIMA (0,1,0) is higher than the corresponding error for the ARIMA (0,1,1,) . We

must note that ARIMA (0,1,0) as a model that shows no significant sample ACF and

PACF values in any lag , is equal to an ARMA (0,0) which is random iid noise and so ,

the original time series is a random walk . ARIMA (0,1,1) on the other hand , having a

lack of an AR component , is being in fact an MA(1) process , will give a constant

forecast for each one of the forecasting months .

47 | P a g e

Criterion

AIC

BIC

𝑅2

Adjusted

𝑅2

Fitted model

3rd degree

polynomial

251.6347

254.83

0.6428

0.5357

4th degree

polynomial

247.5674

251.4017

0.7685

0.6655

5th degree

polynomial

229.5478

234.0212

0.9446

0.91

ARIMA (0,1,1)

229.11

230.2421

ARIMA (1,1,1)

230.61

232.3002

ARIMA (0,1,0) =

AUTO

229.11

229.6754

Table 3. Summary of all models fitted on Pre growth.

ME

ARIMA 125.0664

(0,1,1)

ARIMA 116.91

(1,1,1)

ARIMA 137.0682

(0,1,0)

RMSE

MAE

MPE

1336.781 832.2897 2.490061

MAPE

MASE

26.49729 0.7769472

ACF1

0.12253

1306.821 820.2339 4.245509

25.58179 0.765693

0.05033

1449.574 994.7825 0.0286448

31.66417 0.9286351

0.41553

Table 4. Summary of forecasting errors for the ARIMA models on Pre growth.

48 | P a g e

4.2

Growth season (03/2015 -04/2016)

4.2.1 Data plots

We plot the data and observe the features of the graph (fig.4.32) . We distinct two

obvious trends , an upward trend with an increasing slope until the line reaches the

peak point , and a downward trend after the peak leading the series to a continuous

decrease until the end of this period . Both trends seem to follow an exponential or

quadratic function line so we assume that 1st or 2nd order differences bay be needed .

Since our season lasts 13 months , by definition there is no seasonality and we don’t

see any cycles also . There are no obvious outliers . The data don’t exhibit increasing

fluctuations as the level of the series increases . In the ACF plot , we see a sinusoidal

pattern declining to zero , with significant spikes on lags 1 ,5 and 6 . In the PACF plot

we see one significant spike at lag 1 suggesting that the series can be stationary after

performing the 1st order difference on the original series. We apply the ADF test and

by getting a p-value of 0.7845 , higher than all the usual significance levels ,we accept

the null hypothesis of non-stationarity .

Figure 4.26: The time series plot for the Growth season , 03/2015-04/2016 .

49 | P a g e

Figure 4.27 : The sample ACF plot for the Growth season time series .

Figure 4.28: The sample ACF values

Figure 4.29 : Sample PACF plot for the Growth season time series .

50 | P a g e

Figure 4.30 : The sample PACF values

4.2.2 Fitting polynomials to the Growth season data .

We start by fitting on the data a 2nd degree polynomial with respect to time t. The R

output for the model is shown in figure 4.31 . The fitted polynomial is :

𝑋 (𝑡) = 𝑋𝑡 = −3513.9𝑡 2 + 55261.6𝑡 − 87759.9

The p-values for the coefficients’ significance are lower than the significance level of

5% hence they are significant . 𝑅2 and adjusted 𝑅2 are 0.7 and 0.646 respectively .

Residuals’ standard error is 38110 and MSE is 1.45 ∙ 109 .

The values for the AIC and BIC information criteria are found to be 339.7011 and

342.2573 respectively . The Box– Ljung test for the residuals gives a p-value of 0.039

which means we can accept the null hypothesis of non-correlation on the significance

level of 1% but we reject the null hypothesis on the 5% level. The fitted polynomial

together with the data line is shown in figure 4.32

51 | P a g e

Figure 4.31 : 2nd degree polynomial fitted on Growth season .

Figure 4.32: 2nd degree polynomial fit on Growth season data plot .

Next , we fit a 3rd degree polynomial to the data . The results of the R output appear in

figure 4.33 . The fitted polynomial is :

𝑋(𝑡) = 𝑋𝑡 = −276.8𝑡 3 + 2715𝑡 2 + 16587.2𝑡 − 31284.7

We see the p-values for the coefficients’ significance to be higher than any usual

significance level , a sign that this model is not fitting well . Residuals’ standard error is