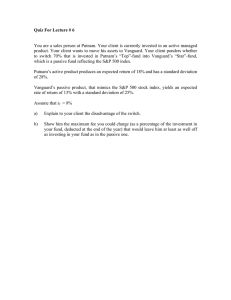

MHE-FTR-059 1 2 60 26 1 28 X R E VI S E D: F E B R UAR Y 3, 20 1 9 FR ANK T. ROT H A E R ME L MH0059 The Vanguard Group As Mortimer “Tim” Buckley, CEO of Vanguard, left the main galley at Vanguard’s campus in Valley Forge, Pennsylvania on a sunny fall day, he began to take stock of everything that had happened since he took the helm in late 2017. Vanguard had experienced record growths in recent years, even amid vast changes in the investing world. Assets Under Management (AUM) had grown at a record pace in 2017, bringing in an average of over $1 billion a day. Vanguard’s reputation for smart investing was as strong as ever, and their average expense ratio had reached 0.11 percent, well below the target they had set for themselves. Yet, Tim Buckley also had some worries. The role of artificial intelligence (AI) and other advances in computing were quickly becoming one of the most important aspects for investors. This was an area Vanguard needed to make up ground in, however, as they had troubles in recent years with some of their customer-facing systems. To compound this, their competitors were working to undercut their expense ratios on the most popular funds, creating parity concerning an advantage Vanguard had relied on since their founding. Keeping in mind how these changes were affecting the company, he wondered how Vanguard could position itself moving forward to continue its market leading position and keep growing. Brief History of The Vanguard Group In 2019, The Vanguard Group with $5.1 trillion in assets under management (Exhibit 1) was the largest global provider of mutual funds, and the second largest provider of exchange traded funds after BlackRock, which had $6.3 trillion in assets under management (Exhibit 2). Vanguard continues to achieve record growth. During 2017, for example, average AUM inf lows were over $1 billion a day. The Vanguard Group serves individual investors, financial professionals, and institutional investors such as state retirement funds. Vanguard’s mission is to help clients reach their financial goals by being their highest-value provider of investment products and services. Vanguard was created in 1974, by offering a client-owned mutual fund to provide a low-cost investment option for anyone interested in participating in the stock market. Since its inception, Vanguard has emphasized low-cost investing and quality service for its clients. Vanguard’s average expense ratio (fees as a percentage of total net assets paid by investors) is generally the lowest in the industry (Exhibit 3). Professor Frank T. Rothaermel prepared this case with Michael Buckenmeyer, who provided excellent research assistance. This case is based on public sources; it is not intended to be used for any kind of endorsement, source of data, or depiction of efficient or inefficient management. All opinions expressed, and all errors and omissions, are entirely the author’s. © by Rothaermel 2019. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group The Vanguard Group also is a pioneer in passive index-fund investing. Rather than picking individual stocks and trading frequently as done in traditional money management, a mutual fund tracks the performance of an index (such as the Standard & Poor’s 500 or the Dow Jones 30) and discourages active trading while encouraging long-term investing. The major advantage of this method is that over a long enough time horizon, the returns from two comparable funds will be vastly different based on the expense ratios charged for those funds. Exhibit 4 shows the hypothetical growth of two portfolios with different expense ratios over 30 years. Explains Vanguard’s previous CEO Bill McNabb: 1 “These days, it’s not hard to find an index fund that charges maybe 0.05 percent or 0.10 percent. So even if you have identified active managers who are skilled at selecting stocks and bonds, to match the return of a comparable (much cheaper) index fund would require significant outperformance. Think about it. Any fund that charges 1.00 percent in expenses—not even the high end of the range—will likely find it extraordinarily difficult to overcome the index fund’s head start.” From its inception, founder and long-time CEO John Bogle has been a strong proponent of passive investing. In fact, his interest in mutual funds dates back to his days as an undergraduate at Princeton University in the late 1940s. Bogle wrote his thesis, titled “The Economic Role of the Investment Company,” which explored the at-the-time f ledgling mutual fund industry. 2 In the quarter century between his Princeton days and the start of Vanguard, Bogle worked at the Wellington Fund, and his experiences there along with the company itself, would prove to be the birthplace of Vanguard. Bogle took over as Wellington’s CEO by 1970 but was fired in 1974 after a failed merger and the loss of roughly one-third of Wellington’s assets under management. 3 He did, however, retain his position as the head of fund management, which ultimately led to the idea for Vanguard. Returning to Wellington’s board of directors, Bogle pitched his idea for an independent fund able to operate with its own fund directors. While seemingly obvious now, the unique fund structure Bogle proposed was radical at the time. His idea was to create a company which was wholly owned by the investors who bought into the funds that were controlled by the company. In line with the thinking of that time, the Wellington board roundly dismissed Bogle’s idea; he left the company in 1975. While deciding on what to do next, Bogle read a column by the famous economics Nobel Laureate Paul Samuelson in the summer of 1976, in which the academic laid out the reasons why index-fund investing should be superior to stock picking. Samuelson concluded that “there exists no convenient [retail] fund that apes the whole market, requires no load, and that keeps commissions, turnover and management fees to the feasible minimum. I suspect the future will bring such new and convenient instrumentalities.” 4 Samuelson’s piece inspired and motivated Bogle to make this type of low-cost index fund become a reality. Accordingly, the first index-tracking fund offered by Vanguard would simply track the S&P 500, which is a broad stock market index based on the market capitalization (= number shares outstanding x share price) of the largest 500 companies traded on U.S. stock exchanges such as the New York Stock Exchange (NYSE) or the NASDAQ stock exchange, an electronic stock exchange. In 1977, Vanguard introduced the “no-load” requirement, thus eliminating the all sales commissions on its funds. This fund is now called Vanguard 500 Index Fund and is still one of the most popular among all its funds (with over $400 billion in net assets as of 12/31/18). 2 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group When first launched, however, Vanguard’s first fund fell f lat with only $11.3 million in assets. 5 Despite the lackluster start, Vanguard forged ahead, determined that its mutual structure would pay dividends to its customers, and indeed it did. Over time, as Vanguard made money, it was able to reinvest it in the company, either in the form of lower expense ratios on the funds (which, in Vanguard’s case is effectively the same as paying a dividend to the shareholders), or in the business itself to facilitate the creation of new funds. Vanguard’s expense ratios have continued to drop over time while their AUM has been on the rise (Exhibits 1 and 3). Vanguard’s CEOs The Vanguard Group has had four CEOs since its inception. Jack Bogle was Vanguard’s founder and first CEO. He conceived and implemented the idea of mutual fund investment and made the stock market accessible to the average American. Bogle was also known for his no-nonsense approach to business and strong insistence on integrity. In regard to corporate governance, Bogle was a strong proponent of index funds as they allowed to harness and focus shareholder votes and thus to exert more pressure on companies that were included in the fund. In 2009, Warren Buffet, one of the world’s most famous investors, lauded Jack Bogle by stating, “If all investors had heeded his ideas, they would be hundreds of billions of dollars better off than they are now.” 6 When “Jack” Bogle passed away in early 2019, The Wall Street Journal heralded him as one of the great entrepreneurs and innovators: “His campaign to cut fees put Mr. Bogle squarely into an American tradition of iconoclastic discounters like Henry Ford of Ford Motor, Sam Walton of Walmart and Michael Dell of Dell Inc.—men who built giant companies by selling directly to the consumer at rock-bottom prices.” 7 In 1997, John “Jack” Brennan, Vanguard’s long-time president, was appointed CEO. Brennan brought with him a number of changes, most notably in the creation of new products and services, such as Vanguard’s first Exchange Traded Fund (ETF, an investment fund traded on stock exchanges much like individual stocks) in 2001. 8 This was seen as a late entry to the space considering the fact that ETFs had launched nearly a decade earlier in 1993. 9 Another late product launch during this time was the target date retirement fund that allowed clients to customize their retirement savings for their particular retirement year. The decade in which Brennan was at the helm proved to be pivotal in terms of growth, as this was the time when Vanguard really started to become a household name. The introduction of ETFs, as well as numerous other new services, set Vanguard up for the explosive growth it experienced in the wake of the 2008 global financial crisis. In 2008, Brennan made way for Bill McNabb who came in during the midst of the financial crisis. He was responsible for navigating Vanguard out of the depths of the financial crisis into the current market. Under his leadership, Vanguard rose to the heights it is currently experiencing, taking the company through multiple years of record AUM inf lows. Most recently, Mortimer “Tim” Buckley was appointed CEO at the end of 2017. Although Vanguard’s core focus on cost and expense control remains the same, there are several challenges facing Buckley that he must address. Tim Buckley must address the challenges posed by advances in AI and other areas of computing at Vanguard. Also, Vanguard is no longer the scrappy underdog in the investment management industry, but it is now one of the biggest players, bringing it other challenges and responsibilities. Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 3 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Financial Services Industry Financial Services in the United States The first publicly traded stocks emerged as an investment vehicle early in the 17th century as a way for companies to finance riskier operations that could yield potentially larger returns. 10 At the time, many of the companies using this new method of financing were engaged in commodities trading. Although there was not much resemblance to modern markets, the evolution of these merchant banks was key to shaping the financial world of today. As companies grew and took on larger projects, so too did the financial activities required to support these activities. The history of the stock market in the United States dates to 1792 with the inception of the New York Stock Exchange (NYSE). Initially there were only five securities being traded, three government bonds, and two bank stocks. 9 During the same year, the first Bank of the United States was also created; it was the earliest stocks to be sold on the NYSE (called the New York Stock and Exchange Board at the time). 11,12 Without a federal reserve banking system at the time, private banking and financial services in the United States dominated the public markets, including some of the largest investment banks active today. For instance, Lehman Brothers (filing for bankruptcy during the global financial crisis in 2009) was founded in 1844 as a dry-goods trader. JP Morgan, today the largest investment bank in the United States, was originally formed in 1871 to finance U.S. railroads. Goldman Sachs, one of the best-known worldwide investment banks, commenced in 1869 to fund small businesses in the United States. 13,14 Without a central bank to guide financial markets, the United States felt the direct effects of any market downturns, especially compared to other similarly developed countries in the world. In fact, private banks became so big and powerful that during the market crash of 1907, it was J.P. Morgan that bailed out the government and supplied the liquidity needed to stabilize the economy. 15 This finally led to the creation of the Federal Reserve Bank in 1913 to afford the United States a more secure, and at the same f lexible and stable, monetary and financial system. 16 The U.S. Securities and Exchange Commission (SEC), overseeing and regulating the securities markets, was created in 1929 after the markets collapsed at the start of the Great Depression (1929–1939). 17 At the same time, the Federal Reserve was restructured, giving it significantly more power and ability to intervene in the markets. Over the ensuing 60 years, several regulations passed in the 1930s as a response to the Great Depression were weakened or repealed. This wave of deregulation, for example, removing the separation of investment and commercial banking, paved the way for various financial institutions to expand into many different areas of the markets, both domestically and internationally. This regulation, however, was re-introduced in the wake of the global financial crisis in 2010 as part of the Dodd-Frank Wall Street Reform Act. Modern Investment Vehicles Even though stocks and bonds have existed for hundreds of years, many of the more popular investment vehicles today did not come about until the 1900s. One such type of investment is the mutual fund. Although the first mutual fund did appear in the 1800s, it did not resemble the mutual funds around today, which were first created in 1924. 18 A mutual fund is a type of investment that allows 4 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group an investor to diversify their holdings without needing to buy a large amount of individual stocks and bonds. Essentially, a fund manager will accept investor’s money for a specific type of mutual fund, such as one that tracks a major index. Once enough cash is generated, the fund manager will invest it in the underlying securities of the index, doing their best to capture the same overall return of the index being tracked. Each investor will then own a small percentage of all the stocks or bonds that were invested in, without needing to individually purchase each one. Although mutual funds allow investors to more easily mitigate risk, they were mismanaged in the early 1920s. Following the stock market collapse in 1929, and the general attitude of Wall Street investors, they did not become popular until the 1990s. Exchange Traded Funds (ETFs) are a more recent financial innovation. While they are set up like mutual funds, in that they invest in a wide range of stocks and bonds, they are a distinct category. For one, they are dynamically priced, meaning their price can be set at any moment while the markets are open, contrary to mutual funds that are only priced after the markets have closed for the day. This allows them to be traded during the day, allowing investors a more accurate picture of the return they can expect when selling their ETFs. Second, and more important to most investors, is that they are tax advantaged compared to mutual funds. When any asset in a mutual fund is sold, capital gains are assessed on any investor taking part in that fund, regardless of when they bought in. With an ETF, however, only the investor selling the security is assessed capital gains or loss taxes, making the fund much more efficient for investors. 19 The first ETF was launched in 1993 by State Street Investors but saw relatively slow growth for the first 15 years or so. Since reaching $1 trillion invested in ETFs in 2010, however, the total investments in ETFs have ballooned, rising to $3.4 trillion. 20 Although they have become quite popular, even at Vanguard, founder Jack Bogle is not entirely convinced. In his own words: “The index investor doesn’t need to be touched by any of the lunacy that is going on in the ETF market. The ETF industry, which has got to be the greatest marketing idea of this age, is not the greatest investment idea of this age, I can assure you.” 21 Given this, it may come as no surprise that Vanguard was a late-mover on ETFs. 22 Still, ETFs continue to draw in millions of investors worldwide and continue to be an attractive investment option. Competition BlackRock BlackRock is a multinational firm serving a wide variety of customers, including governments, companies, and individual investors. BlackRock began in 1988 as a small fixed-income group under The Blackstone Group; renaming itself BlackRock in 1992. 23 In the mid-90s, it saw rapid growth from $17 billion in AUM in 1992 up to $53 billion at the end of 1994 (compound annual growth rate or CAGR of close to 47 percent). In 1995, BlackRock was acquired by PNC Financial Services Group Inc for $240 million. 24 Pairing PNCs resources with BlackRock’s people helped PNC realize a 20 percent increase to their trust and Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 5 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group mutual fund revenues. 25 In the intervening years, BlackRock continued to grow under PNC’s leadership, and in 1999, PNC took BlackRock public (ticker: BLK) with an IPO price of $14 per share, or roughly $1 billion in market cap. 26 While PNC’s ownership of BlackRock has changed over the years, they still hold roughly 25 percent of the company as of 2018. 27 In recent years, BlackRock has turned to acquisitions in order to build its brand, both in the United States and overseas. Beginning in 2004, BlackRock began acquiring stakes in companies such as State Street Research and Management, Merrill Lynch Investment Managers (in 2006), Barclays Global Investors (in 2009) and Citibanamex (in 2018). 28,29 Each of these acquisitions has broadened BlackRock’s reach, either into foreign markets, or new product offerings such as institutional 401(k) retirement savings accounts. By the end of 2018, BlackRock’s AUM is with $6.3 trillion the largest in the industry. Since inception, BlackRock’s AUM have more than quintupled since 2008 (Exhibit 2). 30 BlackRock offers some 800 ETFs globally, making up some $1.5 trillion in AUM. 31 This amount equates to little under half of the global ETF market, making BlackRock the largest provider of this popular investment vehicle. 32 Investing in ETFs, which often track major indices, requires BlackRock to keep large holdings in many major companies around the world. In fact, BlackRock and Vanguard have comparable holdings in the 15 largest companies globally by investment stake in the company (Exhibit 5). 33 Perhaps the only thing BlackRock is more well known for than ETFs, however, is their so-called Aladdin risk management platform. Originally developed when the company was founded in 1988, Aladdin (Asset Liability and Debt and Derivatives Investment Network) started as an internal tool for BlackRock investors to keep track of the riskiness of their portfolios. 34 Over time BlackRock began marketing this tool to other rival asset managers, including companies such as Vanguard and Deutsche Bank. Aladdin is now one of the most widely used risk management platforms in the world. As more and more investment management as well as companies are relying on Aladdin, exposure to risk might be compounded. As market leader by size, BlackRock is uniquely situated as one of Vanguard’s main rivals. BlackRock is one of the few competitors in virtually any market Vanguard is active in, and they are the only company that offers more ETFs to investors. In early 2019, BlackRock’s market cap stands at some $67 billion. Fidelity By end of 2018, Fidelity has just under $2.5 trillion in AUM. 35 Started in 1946 by Edward C. Johnson, Fidelity has become known for retirement investing by helping to pioneer new methods for investing, for instance, introducing target date retirement funds in the 1990s. 36 Fidelity’s Freedom Funds, a family of target date retirement funds, alone account for roughly 10 percent of Fidelity’s total AUM. In recent years, Fidelity Freedom Funds have been experiencing net withdrawals, mainly due to higher expense ratios. This is in stark contrast to Vanguard, the largest target date fund provider in the United States, which has seen a steady rise year after year as investors increasingly f lock to these types of retirement funds. 37 Despite these challenges, Fidelity remains a major player in the investment world, offering a wide range of services to their customers and competitive rates on a broad range of products. 6 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Whereas BlackRock’s coopetition with Vanguard centers around supplying them with their risk management tool, Aladdin, Fidelity offers Vanguard’s products, both to their retail investors as well as institutional investors. Even though Fidelity allows consumers to invest in competitor’s products, they are continually looking for ways to drive consumers back to their offerings. Early in 2018, Fidelity announced a new fee on their corporate customers who wish to offer Vanguard funds as part of their retirement accounts. 38 While it is a small fee, at only 0.05 percent, it adds up and could deter some companies from offering these funds to their plan participants. More recently, Fidelity has even taken a step further in the price competition with Vanguard by offering no (that is zero) expense ratios on a number of their mutual funds, and thus undercutting Vanguard’s expense ratios on a large number of its most popular index funds. 39 This strategic shift is aimed directly at Vanguard, with Fidelity singling them out over other competitors as a way to gain market. As such, Fidelity’s mutual fund overview website specifically targets Vanguard, not even bothering to mention other competitors such as BlackRock, Franklin Templeton, and T. Rowe Price (Exhibit 6). A household name in investing today, Fidelity grew as large as they did thanks in large part to their highly talented stock pickers over the years. 40 While this had served them well during the heyday of Wall Street in the 1980s and during the dot.com boom in the 1990s, more recent changes have caused them to shift their strategy. Given the large push of late towards passive investing, a side effect of both Vanguard’s prominence as well as the 2008–2009 financial crisis, active asset managers no longer carry the same clout they once did. As such, Fidelity has seen large outf lows on some of their most popular investment vehicles, their actively managed funds. 41 This is somewhat surprising because some of the Fidelity funds have outperformed some of their rivals. Seeing these changes take place, Fidelity is working to shift their strategic focus in order to renew customer confidence in the returns they can expect. In 2014, for example, they switched to a markettiming strategy, attempting to buy and sell fund assets that they deemed undervalued. While this strategy has been working well to date, it will likely take more time before any serious swings in investors’ money will be realized. Charles Schwab When Charles Schwab Corporation commenced business in 1971, founder Chuck Schwab was looking for a way to save money for investors while opening the markets to more of them. 42 In the earlier days of investing, brokerage services would charge high commissions that would significantly reduce the returns to investors and presented a barrier for many wishing to put their money into the markets. The reason for such high costs is that commissions were regulated by the Securities and Exchange Commission (SEC) at set prices. This means that regardless of the number of shares being bought or sold, the price per transaction remained the same. 43 This type of regulations essentially created entry barriers for average-day retail investors, something both Charles Schwab and Vanguard were attempting to overcome in order to make stock market investing accessible to all Americans. On May 1, 1975, however, the SEC finally changed this regulation, allowing brokerage firms to set their own fees. While many brokers used this opportunity as a way to raise prices and up their margins, Charles Schwab was one of the few firms that went in the opposite direction, becoming one of Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 7 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group the first discount brokers in the United States. 44 Along with a few other firms that followed the same low-cost strategy, Schwab lowered its prices for brokerage fees and thus was able to open the markets to the masses, bringing in a vast amount of new money and a large number of small retail investors. Much has changed for Charles Schwab since those days. Initially known for their discount services, Schwab has grown to offer a wide range of investment services, always with an eye for their customers. In the late 1980s they launched a financial advisor service for independent retail advisors, and in the early 2000s worked to expand their advisor services directly to investors. In the 2000s, they also went on an acquisition spree that helped them penetrate the retirement services and investment banking industries. 45 In 2003, Schwab Bank was introduced, a place for investors to store their cash when it wasn’t being actively invested. Introducing its first ETF not until 2009, and thus coming quite late to the market, Charles Schwab has made significant strides in catching up to the competition. 46 They are currently the fifth largest provider of ETFs in the United States, and, at least according to some measures, deliver better value for their ETFs than either Vanguard or BlackRock, providers number 1 and 2 by assets invested. 47 A major factor in Schwab’s value creation is their low expense ratios on most of their ETFs, due in large part to their ability to earn money on their customers uninvested cash. In early 2018, Schwab updated its bank sweep feature to essentially allow the corporation to move a clients uninvested cash into the Charles Schwab Bank. 48 Once in Schwab Bank, it can invest this money in safe vehicles, such as money market funds, and earn a return several times higher than the interest rate paid out by their bank. 49 Not only will this help Schwab generate extra cash, and therefore offset any potential losses from its low-cost ETFs, but it will also generate additional returns any time the Fed raises the interest rates, as the spread between money market returns and their bank interest rates widens. Competitive Strategy Cost Advantage From the outset, Vanguard has focused on low-cost investing. Founder Jack Bogle has long spouted the impact expense ratios can have on an investor’s returns, and designed Vanguard in such a way to minimize this type of compounding loss to investors. To this day Vanguard’s website includes a section explaining the way expense ratios lower returns over time. 50 As a result, Vanguard continually pushes to lower its ratios over time, and still boasts the lowest average expense ratios in the industry. Therefore, Vanguard’s expense ratios have declined steadily over time and since the early 1980s have differed greatly from the rest of the industry (Exhibit 3). In another move designed to reduce the tax burdens on their customers, Vanguard patented its ability to make ETFs a share-class of the mutual funds. This effectively lowers the tax burden on its mutual funds by allowing it to tap into the efficiencies of its ETFs. Many competitors such as Fidelity and Charles Schwab work to undercut Vanguard expense ratios in specific product categories in order to gain market share, even if this entails a loss. While Vanguard is the cost leader in terms of average expense ratios for all its products, there are certain areas where it does not compete on price and fees are in fact much higher than other 8 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group competitor’s in the industry. For example, given their focus on passive investing, although the company offers stock brokerage services, its fees are comparably steep compared to the likes of Fidelity. While Fidelity (and most brokerage firms) offers a f lat fee of $4.95 for all trades, Vanguard will charge up to $25 per trade depending on the circumstances surrounding it. 51,52 While Vanguard does offer stock trading as a way to match the service offerings of other investment firms, it does not place high value on it because equity trading does not fit into its strategic activity system. As a result, Vanguard actively attempts to discourage active trading, and other related investments by not price matching and discouraging its customers from using these types of investments. Vanguards’ goal is to cultivate the passive, long-term investor; yet, recent years have seen an uptick in more active trading including small retail investors. Although being a cost leader has its advantages, especially in a multi-trillion-dollar industry, there are certainly some drawbacks associated with this business strategy. Being set up only to charge fees in order to cover fund costs, Vanguard is essentially a company that is run “at-cost.” 53 Therefore, unlike other large financial services companies, Vanguard does not have a large stockpile of money it has earned over the years. This leaves it open to downturns in the market, as it would likely need to raise fees quicker than competitors in order to cover the same level of expenses. Looking at Vanguard’s expense ratios over time (Exhibit 3), while the general trend has been downward, there are a few examples of raises, most of which correspond to a downturn in the stock market, such as Black Monday in 1987 and the deep recession in 2008–2009. 54 Further complicating matters for Vanguard is its strong desire to keep expenses low. For the first quarter century of Vanguard’s existence, the company devalued spending aimed at enhancing the support infrastructure of the company. This primarily showed up as a low investment in its IT department. 55 This was not a problem during a time when Vanguard served relatively few investors, but as it started seeing large growth around the turn of the century, the antiquated systems Vanguard was relying on could no longer support the volume of business. To be sure, the effects of this are still being felt today, as Vanguard has consistently been one step behind their competition in terms of offering technology-related services for its customers. During 2018, for instance, Vanguard has run into several issues with its customer-facing solutions, including troubles logging into the system, incorrect balances shown in accounts, and issues with the required minimum distributions for retirees. 56 While Vanguard is obviously not the only company that is able to reap economies of scale with some $5 trillion in AUM, their lean organizational structure allows them to take advantage in a way that is unique. Whereas most companies are attempting to maximize profits to appease shareholders, Vanguard looks to minimize its expenses to the same end. Every time another investor puts money into a Vanguard fund, it allows Vanguard to reduce the expense ratio of that fund because essentially the same costs are now being spread out among more consumers. Innovation and New Product Development To compete in the investing world today, it is especially important to deliver new services to customers, increasingly offering more value while keeping incremental costs low. It is with this in mind that Vanguard launched its Personal Advisor Services (PAS) in 2015 as a way to provide advice to individual investors via its platform. 57 PAS follows a format similar to other advice offerings, such as Fidelity’s Digital Advisor or Schwab Intelligent Advisory™ in that a robo-advisor paired with a (human) Vanguard advisor, will walk through an investor’s portfolio and offer advice on where to invest his or her money to best meet his or her goals. This launch was mainly as a response to similar products offered by other competitors, as well as Vanguard’s desire to better meet the needs of its Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 9 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group clients, specifically investors who were getting close to retirement age. In addition, it is one example of Vanguard’s foray into the use of artificial intelligence, or AI. Like any of Vanguard’s products, PAS is focused on low expense ratios for customers. Investor’s with $50,000 to $5 million pay 0.30 percent annually for the service. This percentage drops to 0.20 percent if the assets are between $5 million and $10 million, 0.10 percent between $10 million and $25 million, and a mere 0.05 percent for an investor with over $25 million in assets. This is in stark contrast to many other wealth management firms with advice offerings, which can charge fees of up to 3 percent depending on the level and type of service requested (Exhibit 7). Outside of advisory services, Vanguard also looks to keep up with investment vehicles by continually delivering fresh products that investors will find attractive. For instance, early in 2018 Vanguard launched six new ETFs and a new mutual fund, all actively managed. 58 Even though ETFs have relatively low expense ratios compared to most other actively managed products, they represent a desire by Vanguard to serve more investors. Given these recent changes, there is still much Vanguard can be doing in terms of new product development. From Tim Buckley, Vanguard’s latest CEO, shortly before he took over: “I’ve been cautious. . . Vanguard has come of age with mutual funds (and now) exchangetraded funds. (The culture is now) taking hold outside mutual funds. Look at the advice world. Can the advice world be more efficient? Can we help advisers scale their business better? Can we help them offer more for their clients? And can we offer something for people who come to Vanguard directly? I think we’ll see a lot more offerings.” 59 Challenges A major area of concern for Vanguard is rooted in the industry trend to lower expense ratios. Vanguard was able to rest its laurels on the fact that in the past they consistently offered lower expenses ratios compared to the rest of the industry. This trend is changing, however, as many of its competitors have become aware of investors’ desires for low-cost investments. Referencing Fidelity’s recent campaign aimed at Vanguard, Charles Schwab is offering a range of no cost ETFs, and BlackRock’s bargain pricing, among others, Vanguard has found it can no longer rely on just a low-cost structure to attract customers. Artificial Intelligence As rock-bottom pricing becomes the norm, the cost differentiation to customers will evaporate, meaning the industry will need to find alternative ways to stand out from their competitors. No longer are investors willing to hand their cash to a broker and expect to see a modest return on investments. These days, consumers are increasingly looking for self-investment information, access to a di gital relationship with their wealth management provider, and a desire to invest in environmental, social, and governance (ESG) factors. In addition, investors now expect seamless and real-time trading capabilities online on any device. 60,61 As a response to this trend, the industry has started turning to IT-related enhancements to offer more for its customers. Robo-advisors have become increasingly popular, especially as improvements to AI have expanded a computer’s ability to analyze a portfolio and provide investment recommendations. This has provided a significant boost for investment companies as, beyond the initial investment, running a robo-advisor service is relatively cheap, but an excellent way to market a higher value for that firm’s products. A recent Deloitte study found that the cost of a robo-advisor was less than half of a wealth manager, giving firms a great low-cost alternative that is seen as highly desirable to investors. 62 10 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group The rise of the digital age has also given financial companies immense amounts of data on all customers, and these companies are just now figuring out the best ways to utilize this information. This can be as simple as determining which investments to make in the company to digging into which types of information investors are most interested in receiving. A recent study by TD Ameritrade has found that 88 percent of investors now use technology when managing their finances, with 30 percent saying it was critical to their finances. 63 These investors are increasingly interested in ways technology can work for them, including receiving recommendations based on past behaviors, portfolio analysis based on each investor’s unique situation, and a greater amount of control over one’s finances. Vanguard, and its competitors, are working hard to find the best ways to use these data to differentiate themselves. Two powerhouses in their respective industries, BlackRock and Microsoft have recently teamed up in order to build a technology platform aimed at providing retirement plan ning tools and advice. 64 While still in the early stages, this venture is designed to educate employees on their finances, with a special focus on delivering information tailored for each individual company’s workforce. Artificial intelligence is appearing in other aspects of investing as well. More recently, a company named EquBot has created an ETF called A.I. Powered Equity that utilizes AI to determine which stocks should be held by the ETF (Exhibit 8). It’s too early to tell how well this ETF will perform over the long run, but it has managed to attract over $170 million as of November 2018. 65 Vanguard’s largest competitor, BlackRock, also relies on AI for several of its back-office functions, including analyzing data for nonobvious patterns and searching for potential relationships between common market indicators and securities. 66 AI does have its drawbacks, however, as it is not well suited to handling longer-term investment opportunities. For things like high frequency trading, which generates large amounts of data for algorithms to ingest in real time, AI is more than up for the task. The irrationality of traders, often more based on psychological factors than economic fundamentals, makes it difficult for AI to accurately predict significant market movements, keeping them on the sidelines for at least a little bit longer. As time goes on advances are expected to increase its use in the investing world, giving companies like Vanguard and Fidelity a lot to think about in terms of how to best roll it out. To best capture this opportunity, Vanguard has recently opened an innovation center of their own in downtown Philadelphia. 67 This tech-heavy space provides them the ability to test innovations in customer interactions as well as provide a heavier presence in the technology sector and thus access to cutting-edge human capital. From then- CEO Bill McNabb, “The Innovation Center is a tangible commitment that will continue our strong track record of building capabilities that we believe give our clients the best chance for investment success, and we’re pleased to take this significant next step in Philadelphia.” 68 International Expansion Another significant challenge Vanguard has faced is how to increase their market share overseas. To date more than three quarters of Vanguard’s business comes from the domestic U.S. market. Since their first overseas office in 1996 in Australia, Vanguard has seen relatively low international growth. Some of this stems from its cautious attitude whenever entering new markets. The strategy in the past has never been to jump into any market where it may have a chance, rather to ensure its core philosophy matches up with those of the investors in the markets it is looking to enter. This has slowed the company compared to competitor’s like BlackRock, which have used international acquisitions in order to grow. Even so, Vanguard has 15 international offices located in 12 countries, serving investors in over 170 countries worldwide. 69 For a case in point, compare the total number of international Vanguard funds versus its international assets under management. As of April 30, 2018, Vanguard had 187 funds available to Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 11 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group U.S.-based investors compared to 209 for the rest of the world. Although more than half of Vanguard’s funds are overseas, it only comprises 22 percent of their AUM, accounting for less than a quarter of its global AUM. 70 Despite this, Vanguard has moved ahead with its international expansion, with offices spanning the globe in places such as London, Paris, Frankfurt, Shanghai, Tokyo, Melbourne, and Toronto, as well as a planned expansion into Germany. As a comparison, BlackRock has been able to realize 36 percent of its AUM in markets outside the United States, showing that its investment in overseas growth has been paying dividends. 71 Vanguard continues to be primarily a U.S brand, at least in the eyes of many. There has been a concerted push as of late to target international investors, primarily by selling funds directly to retail clients as opposed to pushing them out through institutional channels, but it has been slow moving. Vanguard’s head of international business, Jim Norris, describes Vanguard’s approach as “deliberate rather than slow,” ref lecting the attitude of many at the company. This has done nothing to help its brand awareness, however, especially in the eyes of international investors. A ranking of the top asset managers conducted by eVestment did not include Vanguard, even after breaking out companies by firm AUM (Exhibit 9). The Wellington Management Company, out of which Vanguard was born, was ranked number 1, over competitors such as BlackRock, T. Rowe Price, and J.P. Morgan Investments. 72 Clearly, this is still an area that requires attention moving forward, especially as Vanguard works to overtake BlackRock as the largest asset manager by AUM. Foreign markets each have their own intricacies that require changes to how a company interacts with the investors in these markets. For a company like Vanguard, a unique approach in each market is difficult to manage as it equates to higher costs as more crew, Vanguard’s term for employees, and infrastructure are needed to support each market. Being as it is always focused on keeping costs low, it is untenable for it to enter every market perfectly positioned. Instead, the company waits until the investors are ready for Vanguard’s philosophy before entering a new market. For example, the 2018 change in Europe banning asset managers from paying commissions to financial advisors paves the way for “new opportunities for Vanguard’s way of investing,” according to Jim Norris. 73 Moving Forward In early 2019, as CEO Tim Buckley was ref lecting upon the challenges ahead, he knew that Vanguard needed to take advantage of the changing landscape in investing. Vanguard, generally known for their methodical approach to change, was at a crossroads. It was clear to the CEO that they could no longer rely on their past successes but needed to steer their company in a new direction. With that in mind, he opened a can of Diet Coke and booted up his laptop to organize his thoughts. 12 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 1: The Vanguard Group’s Asset Under Management, 1980–2018 $6T [VALUE] trillion* $5T $4T $3T $2T $1T $0T 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 *AUM as of Q2 2018 Source: Author’s depiction of publicly available data from Vanguard Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 13 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 2: BlackRock’s Assets Under Management, 1998–2018 $7T $6.29 trillion* $6T $5T $4T $3T $2T $1T $0T 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 *AUM as of Q2 2018 *AUM as of Q2 2018 Source: Author’s depiction of publicly available data from BlackRock Annual Reports, 2001–2018 14 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 3: Vanguard Average Expense Ratio vs. Industry, 1990–2017 Vanguard Average Industry Average 1.00% 0.50% 0.00% 1975 1982 1989 1996 2003 2010 2017 Source: Author’s depiction of publicly available data in Vanguard and Morningstar reports, https://investor.vanguard.com/expense-ration/ vanguard-effect Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 15 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Expense Ratio Expense Ratio Yearv Year 10%Gain Gain 10% 0.10% 0.10% 0.60% 0.60% 0 $20,000 $20,000 $20,000 1 $22,000 $21,980.00 $21,880.00 2 $24,200 $24,156.02 $23,936.72 3 $26,620 $26,547.47 $26,186.77 4 $29,282 $29,175.67 $28,648.33 5 $32,210 $32,064.06 $31,341.27 6 $35,431 $35,238.40 $34,287.35 7 $38,974 $38,727.00 $37,510.36 8 $42,872 $42,560.97 $41,036.34 9 $47,159 $46,774.51 $44,893.75 10 $51,875 $51,405.18 $49,113.76 11 $57,062 $56,494.30 $53,730.46 12 $62,769 $62,087.23 $58,781.12 13 $69,045 $68,233.87 $64,306.55 14 $75,950 $74,989.02 $70,351.36 15 $83,545 $82,412.94 $76,964.39 16 $91,899 $90,571.82 $84,199.04 17 $101,089 $99,538.43 $92,113.75 18 $111,198 $109,392.73 $100,772.44 19 $122,318 $120,222.61 $110,245.05 20 $134,550 $132,124.65 $120,608.09 21 $148,005 $145,204.99 $131,945.25 22 $162,805 $159,580.28 $144,348.10 23 $179,086 $175,378.73 $157,916.82 24 $196,995 $192,741.22 $172,761.01 25 $216,694 $211,822.61 $189,000.54 26 $238,364 $232,793.04 $206,766.59 27 $262,200 $255,839.56 $226,202.65 28 $288,420 $281,167.67 $247,465.70 29 $317,262 $309,003.27 $270,727.48 30 $348,988 $339,594.59 $296,175.86 $ Less ($9,393.45) ($52,812.19) % Less -3% -15% Source: Author’s own tabulation 16 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 5: Vanguard and BlackRock’s Holdings in the Largest 15 Companies by Market Cap (as of June 30, 2018) Vanguard Holding BlackRock Holding Apple, Inc Amazon.com, Inc Microsoft Corporation Alphabet Inc Facebook, Inc Cisco Systems, Inc Intel Corporation Comcast Corporation Pepsico, Inc Netflix, Inc NVIDIA Corporation Amgen Inc Adobe Inc Costco Wholesale Corporation Texas Instruments Incorporated $0B $10B $20B $30B $40B $50B $60B $70B $80B Source: Author’s depiction of publicly available information from NASDAQ.com Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 17 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 6: Fidelity’s Mutual Fund Overview and Advertisement (as of late 2018) VANGUARD® FIDELITY® ZERO minimum investment mutual funds ZERO expense ratio index mutual funds Source: Adapted from Fidelity Mutual Funds Overview Website, https://www.fidelity.com/mutual-funds/investing-ideas/index-funds 18 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 7: Advisory Fee Range for Select Wealth Management Companies Company Advistory Fee Range Ameriprise 0.90%–3.00% UBS 2.50% Morgan Stanley 2.00%–2.50% Wells Fargo 1.00%–2.75% Merrill Lynch 0.75%–3.00% J.P. Morgan 0.30%–1.45% Edward Jones 0.50%–1.35% Charles Schwab 0.28% Vanguard 0.30% Fidelity 0.20%–1.50% Source: Author’s compilation of data from various publicly available company brochurest– Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 19 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 8: Growth of $10,000 in AIEQ ETF Over Time $13,000 $12,000 $11,000 $10,000 11/1/2022 10/1/2022 9/1/2022 8/1/2022 7/1/2022 6/1/2022 5/1/2022 4/1/2022 3/1/2022 2/1/2022 1/1/2022 12/1/2021 11/1/2021 $9,000 Source: Author’s depiction of price history data from Fidelity as of November 28, 2018 20 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Exhibit 9: Asset Manager’s Brand Awareness for $100+ billion AUM Firms (as of Q3 2018) Rank Firm 1 Wellington Management Company LLP AUM Brand Awareness Score $1,087,684 10 2 BlackRock $3,926,959 10 3 PIMCO $1,559,625 10 4 T. Rowe Price $481,073 10 5 Lazard Asset Management LLC $154,820 10 Morgan Investment Management, 6 J.P. Inc. $944,749 10 7 MFS Investment Management $202,924 9.5 8 Dimensional Fund Advisors LP $595,917 9.5 $223,096 9.5 $183,500 9 9 Baillie Gifford & Co 10 Loomis, Sayles & Company, L.P. Source: Author’s depiction of publicly available data from eVestment report, “The Importance of Brand Awareness: Quantifying the Impact on Asset Manager Growth and Perception,” https//www.evestment.com/project/ importance-brand-awareness-whitepaper/. Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 21 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group Endnotes 1 Senior Editor, FA Content. 2017. “Vanguard’s CEO—Not All Active Management Is Dead: Financial Advisors’ Daily Digest.” Seeking Alpha, May 20, 2017. https://seekingalpha.com/article/4056563-vanguards-ceo-active-management-deadfinancial-advisors-daily-digest. 2 “Vanguard: Child of Princeton. (Remarks by John C. Bogle to the Princeton Entrepreneurs’ Network 5th Annual Conference) 2004.” http://www.vanguard.com/bogle_site/sp20040528.htm. 3 Krouse, Sarah. 2017. “Vanguard Reaches $4 Trillion for First Time.” The Wall Street Journal, February 10. https://www. wsj.com/articles/vanguardreaches-4-trillion-for-first-time-1486745349. 4 Samuelson, Paul. 1976. “Index-Fund Investing.” Newsweek, Accessed January 21, 2019. Reproduced at: http:// johncbogle.com/wordpress/wp-content/uploads/2013/10/Samuelson-Newsweek-1976.pdf 5 Zweig, Jason. 2016. “Birth of the Index Mutual Fund: ‘Bogle’s Folly’ Turns 40.” The Wall Street Journal, August 31, 2016. https://blogs.wsj.com/moneybeat/2016/08/31/birth-of-the-index-mutual-fund-bogles-folly-turns-40/. 6 Zweig, Jason and Sarah Krouse. 2019. “John C. Bogle, Founder of Vanguard Group, Dies at 89.” The Wall Street Journal, January 17. https://www.wsj.com/articles/john-c-bogle-founder-of-vanguard-group-dies-11547677745. 7 Zweig, Jason and Sarah Krouse. 2019. “John C. Bogle, Founder of Vanguard Group, Dies at 89.” The Wall Street Journal, January 17. https://www.wsj.com/articles/john-c-bogle-founder-of-vanguard-group-dies-11547677745. 8 Sunderam, A. Viceira, and A. L. Ciechanover. 2017. “The Vanguard Group, Inc. in 2015: Celebrating 40.” Harvard Business Review. 9 Balchunas, Eric. 2016. “How the U.S. Government Inadvertently Created the $3 Trillion ETF Industry.” The ETF Files, www.bloomberg.com. March 7, 2016. https://www.bloomberg.com/features/2016-etf-files/. 10 Fohlin, Caroline. 2016. “A Brief History of Investment Banking from Medieval Times to the Present.” Oxford Handbook of Banking and Financial History, edited by Youssef Cassis, Catherine Schenk, and Richard Grossman https://papers.ssrn.com/ sol3/papers.cfm?abstract_id=2524636. 11 Waxman, Olivia. B. 2017. “How a Financial Panic Helped Launch the New York Stock Exchange.” Time, May 17. http:// time.com/4777959/buttonwood-agreement-stock-exchange/. 12 NYSE, New York Stock Exchange > About Us > History > Timeline > Timeline. Internet Archive: Wayback Machine. Accessed October 12, 2018. https://web.archive.org/web/20110319024118/http:/www.nyse.com/about/history/timeline_chronology_index.html. 13 “TIMELINE: A Brief History of Lehman Brothers.” 2008. Reuters, www.reuters.com. Accessed October 14, 2018. https:// www.reuters.com/article/us-lehman-timeline-idUSLC64449320080912. 14 Beattie, Andrew. “The Evolution of Goldman Sachs.” Forbes. Accessed October 14, 2018. https://www.forbes. com/2010/05/21/goldman-sachs-fraud-case-personal-finance-gs.html#3b44d37676b3. 15 “Easing the Financial Panic.” J.P. Morgan. Accessed October 14, 2018. https://www.jpmorgan.com/country/US/en/ jpmorgan/about/history/month/oct. 16 “Federal Reserve History.” Board of Governors of the Federal Reserve System. Accessed October 12, 2018. https://www. federalreserve.gov/aboutthefed/centennial/about.htm. 17 “What We Do.” U.S. Securities and Exchange Commission. Accessed October 15, 2018. https://www.sec.gov/Article/ whatwedo.html. 18 Fernando, Deepthi, et al. The Global Growth of Mutual Funds. The World Bank. 2003. Crossref, doi:10.1596/ 1813-9450-3055. 19 Moore, Simon. 2018. “Are ETFs or Mutual Funds More Tax-Efficient?” Forbes, August 6. https://www.forbes.com/sites/ simonmoore/2018/08/06/are-etfs-or-mutual-funds-more-tax-efficient/. 20 Vanguard. “What Is the History of ETFs?” Accessed October 17, 2018. https://advisors.vanguard.com/VGApp/iip/site/ advisor/etfcenter/article/ETF_HistoryOfETFs.. 22 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group 21 Johnston, Michael. “20 Must-Read Quotes about the ETF Industry.” 2013. ETF Database, March 5, 2013. https://etfdb. com/2013/20-must-read-quotes-abou-the-etf-industry/. 22 Flood, Chris. 2017. “New Vanguard Boss urged to Target Growth Overseas.” Financial Times, July 22. 23 BlackRock. “History.” Accessed October 6, 2018. https://www.blackrock.com/corporate/about-us/blackrock-history. 24 Markets Main. 2006. “Who Is BlackRock?” The Wall Street Journal. February 15, 2006. http://www.wsj.com/articles/ SB113984464648572495. 25 The Associated Press. 1994. “Company News; PNC Bank in Deal to Buy Blackrock Financial.” The New York Times, June 17. https://www.nytimes.com/1994/06/17/business/company-news-pnc-bank-in-deal-to-buy-blackrock-financial.html 26 “BLACKROCK HOLDCO 2, INC. (BLK) IPO.” NASDAQ.Com. Accessed October 6, 2018. http://www.nasdaq.com/ markets/ipos/company/blackrock-holdco-2-inc-8141-2743. 27 “BlackRock, Inc. (BLK) Ownership Summary.” NASDAQ.Com. Accessed October 6, 2018. https://www.nasdaq.com/symbol/blk/ownership-summary. 28 “BlackRock.” Crunchbase. Accessed October 6, 2018. https://www.crunchbase.com/organization/blackrock. 29 Press Release. 2018. “BlackRock Completes Acquisition of Asset Management Business of Citibanamex.” The Wall Street Journal, September 24. https://www.wsj.com/articles/PR-CO-20180924-905909. 30 BlackRock. “BlackRock Corporate.” Accessed October 6, 2018. https://www.blackrock.com/corporate/about-us. 31 BlackRock. “What Is an ETF?” BlackRock. Accessed October 6, 2018. https://www.blackrock.com/investing/products/ ishares-etfs. 32 Lisa Kealy, Kieran Daly, Andrew Melville, Pierre Kempeneer. 2017. “Reshaping Around the Investor: Global ETF Research 2017.” https://www.ey.com/Publication/vwLUAssets/ey-global-etf-survey-2017/%24FILE/ey-global-etf-survey-2017.pdf. 33 The Economist. 2013. “BlackRock: The Monolith and the Markets.” December 7. https://www.economist.com/ briefing/2013/12/07/the-monolith-and-the-markets. 34 Financial Times. 2017. “BlackRock bets on Aladdin as genie of growth.” May 17. 35 Fidelity. “Fidelity by the Numbers: Corporate Statistics.” Accessed October 8, 2018. https://www.fidelity.com/about-fidelity/fidelity-by-numbers/corporate-statistics. 36 McLaughlin, Tim and Renee Dudley. 2018. “Special Report: Fidelity Puts 6 Million Savers on Risky Path to Retirement.” Reuters, March 5. https://www.reuters.com/article/us-funds-fidelity-retirement-special-rep-idUSKBN1GH1SI. 37 “2018 Target-Date Fund Landscape.” Morningstar. Accessed October 8, 2018. https://www.morningstar.com/content/dam/ marketing/shared/pdfs/Research/TDF_Landscape_2018.pdf?cid=EMQ_. 38 Krouse, Sarah. 2018. “Wall Street to Vanguard: We’re Not Your Doormat.” The Wall Street Journal, January 28. https:// www.wsj.com/articles/wall-street-to-vanguard-were-not-your-doormat-anymore-1517157915. 39 Fidelity.“We’re Raising the Bar on Value.” Accessed October 8, 2018. https://www.fidelity.com/mutual-funds/ investing-ideas/index-funds. 40 Ritholtz, Barry. 2018. “The Next Financial Crisis Is Staring Us in the Face.” Bloomberg, October 8, 2018. https://www. bloomberg.com/opinion/articles/2018-10-08/the-next-financial-crisis-is-staring-us-in-the-face. 41 Stein, Charles and Sabrina Willmer. 2018. “Fidelity Active Funds See Outflows Despite Strong Performance.” Bloomberg, February 2. https://www.bloomberg.com/news/articles/2018-02-26/fidelity-active-funds-see-outflows-despite-strongperformance. 42 Schwab, Charles. Open Letter to Investors. Accessed October 18, 2018. https://www.schwab.com/public/file/P-6083252/ Chuck_Open_Letter.pdf. 43 Zweig, Jason. 2015. “Lessons of May Day 1975 Ring True Today: The Intelligent Investor.” The Wall Street Journal, May 1. https://www.wsj.com/articles/lessons-of-may-day-1975-ring-true-today-the-intelligent-investor-1430450405. 44 Charles Schwab.“Company History.” Accessed October 17, 2018. https://aboutschwab.com/about/history. 45 “Charles Schwab.” Crunchbase. Accessed October 17, 2018. https://www.crunchbase.com/organization/charles-schwab. 46 Charles Schwab. “Schwab ETFs.” Accessed October 17, 2018. https://www.schwabfunds.com/public/csim/home/products/vehicle/etfs. Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 23 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group 47 Baldwin, William. 2018. “Schwab Bests Vanguard in ETFs.” Forbes, July 9. https://www.forbes.com/sites/baldwin/2018/07/09/schwab-bests-vanguard-in-etfs/. 48 Charles Schwab. “Schwab’s Enhanced Bank Sweep Feature.” Accessed October 17, 2018. https://advisorservices.schwab. com/public/file/p-11019652. 49 Crudele, John. 2018. “Is Charles Schwab Taking Advantage of Sweep Account Customers?” New York Post, September 9. https://nypost.com/2018/09/09/is-charles-schwab-taking-advantage-of-sweep-account-customers/. 50 Vanguard. “The Impact of Investment Costs.” Accessed October 9, 2018. https://investor.vanguard.com/investing/ how-to-invest/impact-of-costs. 51 Fidelty. “Commissions. Margins Rates, and Fees.” Accessed October 9, 2018. www.fidelity.com/trading/ commissions-margin-rates. 52 Vanguard. “Vanguard Brokerage Services® Commission and Fee Schedules.” Accessed October 9, 2018. https://investor. vanguard.com/investing/transaction-fees-commissions/stocks. 53 Vanguard. “Why Ownership Matters.” Accessed October 19, 2018. https://about.vanguard.com/what-sets-vanguard-apart/ why-ownership-matters/. 54 Reuters. 2012. “Factbox: The 1987 Crash, by the Numbers.” www.reuters.com. October 19, 2012. https://www.reuters. com/article/us-usa-markets-blackmonday-idUSBRE89I0YA20121019. 55 Siggelkow, Nicolaj. “Evolution Toward Fit.” Administrative Science Quarterly. Vol 47. No 1. Mar 2002. pp. 125–159. 56 Krouse, Sarah. 2018. “Is Vanguard’s Success a Problem? Some Customers Think So.” The Wall Street Journal, March 29, 2018. https://www.wsj.com/articles/is-vanguards-success-a-problem-some-customers-think-so-1522324800. 57 Vanguard. 2015. “Vanguard Introduces Personal Advisor Services, Lowers Minimum to Investors with $50,000.” Accessed October 19, 2018. https://pressroom.vanguard.com/news/Vanguard_Introduces_Personal_Advisor_Services_Lowers_ Minimum.html. 58 Vanguard. 2018. “Vanguard Launches Suite of Factor-Based Products.” Accessed October 19, 2018. https://institutional. vanguard.com/VGApp/iip/site/institutional/researchcommentary/article/NewsInstInfo2152018. 59 DiStefano, Joseph N. 2017. “New CEO Tim Buckley: To Run Vanguard, ‘You Have to Be Willing Not to Be a Billionaire.’” The Philadelphia Inquirer, November 6. http://www.philly.com/philly/blogs/inq-phillydeals/new-ceo-tim-buckley-to-runvanguard-you-have-to-be-willing-not-to-be-a-billionaire-20171106.html. 60 Thompson, Kendra. 2016. “Meeting the Needs of the Modern Investor.” Accenture Capital Markets Blog, May 3. https:// capitalmarketsblog.accenture.com/meeting-the-needs-of-the-modern-investor. 61 EY. 2017. “Sustainable Investing: The Millennial Investor.” p. 4. https://www.ey.com/Publication/vwLUAssets/ey-sustainable-investing-the-millennial-investor-gl/$FILE/ey-sustainable-investing-the-millennial-investor.pdf 62 Deliotte. 2016. “Cost-Income Ratios and Robo-Advisory.” Accessed November 4, 2018. https://www2.deloitte.com/ content/dam/Deloitte/de/Documents/financial-services/Robo-Advisory-in-Wealth-Management.pdf. 63 Ameritrade. 2018. “The Tech Effect: How the Digital Age Is Changing Investing.” https://s1.q4cdn.com/959385532/files/ doc_downloads/research/2018/TDA_FinTech_ebook.pdf. 64 Lim, Dawn. 2018. “BlackRock, Microsoft to Build Retirement-Planning Platform.” The Wall Street Journal, December 13. https://www.wsj.com/articles/blackrock-microsoft-to-build-retirement-planning-platform-11544715121. 65 “Fund Summary.” The AI Powered Equity ETF. https://www.aieqetf.com/fund/#fund-summary. 66 Aenlle, Conrad De. 2018. “A.I. Has Arrived in Investing. Humans Are Still Dominating.” The New York Times, June 8. https://www.nytimes.com/2018/01/12/business/ai-investing-humans-dominating.html?searchResultPosition=1. 67 Vanguard. 2016. “Vanguard to Open Innovation Center.” Accessed November 30, 2016. https://pressroom.vanguard.com/ news/Vanguard-To-Open-Innovation-Center-11-02-16.html. 68 McCullough, Brian. 2016. “Vanguard Plans Philly Innovation Center.” Daily Local News, November 2, https://www. dailylocal.com/news/national/vanguard-plans-philly-innovation-center/article_461f0f09-244c-5a9c-af7a-3e9a30d13bf2.html. 69 Vanguard. “Fast Facts about Vanguard.” Accessed November 25, 2018. https://about.vanguard.com/who-we-are/fast-facts/. 70 Vanguard. “2018 Investment Stewardship Annual Report.” Vanguard, https://about.vanguard.com/investment-stewardship/ perspectives-and-commentary/2018_investment_stewardship_annual_report.pdf. 24 Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023. The Vanguard Group 71 BlackRock. “Q1 2018 Earnings: Earnings Release Supplement.” http://ir.blackrock.com/Cache/ 1500109536.PDF?O=PDF&T=&Y=&D=&FID=1500109536&iid=4048287. 72 Evestment. “The Importance of Brand Awareness: Quantifying the Impact on Asset Manager Growth & Perception. Updated Q4 2018.” https://www.evestment.com/wp-content/uploads/resources/whitepapers/eVestment-WP-importance-of-brandawareness.pdf. 73 Flood, Chris. 2017. “New Vanguard Boss Urged to Target Growth Overseas.” Financial Times, July 23. Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction, distribution, or posting online without the prior written consent of McGraw-Hill Education. 25 This document is authorized for use only in Prof. Shubha Patvardhan, Prof. Sandeep Yadav, Prof. Shailendra Kumar, Prof. Sai Yayavaram, Prof. Sai Chittaranjan Kalubandi, Prof. Srinivasan R, Prof. Nilam Kaushik's PGP- Competition & Strategy 2023 at Indian Institute of Management - Bangalore from Sep 2023 to Dec 2023.