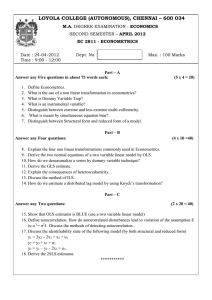

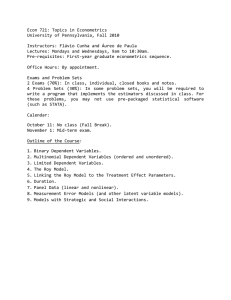

Time Series Econometrics In the following, we are going to proceed to the analysis given by case3_2023 on the respective data series realgdp.wf1 1) Given the result of the Unit Root Test of the Week 2, we have a Deterministic Trend hence we performed the following calculations Deterministic Trend 2) Testing for the presence of seasonality 3) Testing for the Null Hypothesis of no seasonality Because of no presence of seasonality, we added 2 lags 1 Week 1 - Time Series Econometrics 4) Why is that so? The overall F-statistic of a trend stationary model evaluates the overall significance of the entire model including the joint insignificance of your intercept in its null hypothesis while the Wald F-statistic test does not. 5) Given our LM Test = 0.21, we have the presence of autocorrelation hence we perform the F-test after having robustified the standard error and there’s no autocorrelation anymore because of the White Test, we accept the Null = 1.319 and hence there’s Homoskedasticity 2 Week 1 - Time Series Econometrics 6) Test for autocorrelation - Our best model is Log(RealGDP) with 2 lags 7) 3 Week 1 - Time Series Econometrics 8) Test for the presence of a break at some chosen date 9) Test for the presence of one endogenous break 10) Test for the presence of several endogenous break Germany(-1) 4 Week 1 - Time Series Econometrics 11) White and Q for New Model White Q 12) Reestimate your equation without the last 10 (because last 2 are within the break) observations and compute RMSE for dynamic and static forecast Static Dynamic 5 Week 1 - Time Series Econometrics 13) Diebold Mariano Test 14) No strong seasonal pattern 6