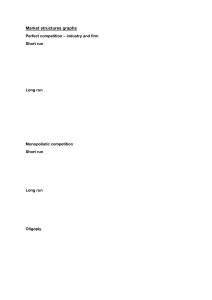

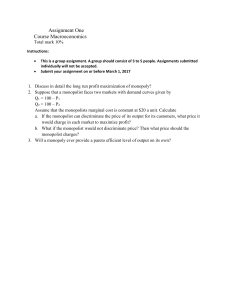

MONOPOLY • Single seller that produces a product with no close substitutes Market Structure: Monopoly • Market and firm demand curve slopes downward. • Is at the opposite extreme of perfect competition. Monopolist is a price maker as against perfect competitor who is price taker • Entry prohibited or difficult • Opportunity for economic profit in LR. • The ability of a monopolist to raise its price above the competitive level by reducing output is known as market power. Under perfect competition, the price and quantity are determined by supply and demand. Here, the equilibrium is at C, where the price is PC and the quantity is QC. A monopolist reduces the quantity supplied to QM, and moves up the demand curve from C to M, raising the price to PM. Why Do Monopolies Exist? • A monopolist has market power and as a result will charge higher prices and produce less output than a competitive industry •This generates profit for the monopolist in the short run and long run • Profits will not persist in the long run unless there is a barrier to entry. •This can take the form of control of natural resources or inputs economies of scale technological superiority (https://www.youtube.com/watch?v=2kJDTzFtUr4) legal restrictions imposed by governments, including patents and copyrights 1 China’ Dominance (%) on Strategic Metals and Technologies for Clean Energy Transition Economies of Scale and Natural Monopoly • A monopoly created and sustained by economies of scale is called a natural monopoly. • It arises when economies of scale provide a large cost advantage to having all of an industry’s output produced by a single firm. • Under such circumstances, average total cost is declining over the output range relevant for the industry. • This creates a barrier to entry because an established monopolist has lower average total cost than any smaller firm. Economies of Scale Create Natural Monopoly Monopoly Short-Run Equilibrium • Demand curve for the firm is the market demand curve • Firm produces a quantity (Q*) where marginal revenue (MR) is equal to marginal cost (MC) Firm’s AC curve declines over the range of output at which price is greater than or equal to average total cost. This gives the firm economies of scale over the entire range of output at which the firm would at least break even in the long run. As a result, a given quantity of output is produced more cheaply by one large firm than by two or more smaller firms. 7 • When D is linear, slope of MR is twice the slope of D [P=a-bQ, TR = PQ = (a-bQ)Q, MR = d(TR)/dQ=a – 2bQ] 2 Profit maximising under monopoly Rs Profit maximising under monopoly Rs MC MC AC Pm a a PM Profit AC b c D D MR O Qm MR O Q Lessens Learnt • As the only seller, a monopolist faces the market demand curve • Profit maximizing output is determined by equating marginal revenue with marginal cost • A monopolist could also incur losses in the SR, depending on the height of the AC curve at the best level of output. If AC > P, monopolist incurs a loss and may remain in business in SR as long as P>AVC • If entry by other firms is difficult, the monopolist can earn economic profit even in the long run • Production is not likely to take place at the lowest point in LAC curve, unlike perfect competition in LR Qm Q Computing Profit Maximizing Price & Output • • • • Cost equation of monopolist; TC = 500+20Q2 Demand equation is P=400 – 20Q Total revenue is TR = 400Q – 20Q2 What are profit maximizing price & output? • • • • Soln: MR = d(TR)/dQ = 400 - 40Q MC = d(TC)/dQ = 40Q MR = MC; Q = 5 & P = Rs. 300 3 Monopoly and Public Policy • By reducing output and raising price above marginal cost, a monopolist captures some of the consumer surplus as profit and causes deadweight loss • To avoid deadweight loss, government policy attempts to prevent monopoly behavior. • When monopolies are “created” rather than natural, governments should act to prevent them from forming and break up existing ones. Monopoly Causes Inefficiency Panel (a) depicts a perfectly competitive industry: output is QC and market price, PC , is equal is to MC Since price is exactly equal to each producer’s cost of production per unit, there is no producer surplus. Total surplus is therefore equal to consumer surplus, the entire shaded area. Panel (b) depicts the industry under monopoly: the monopolist decreases output to QM and charges PM. Consumer surplus (blue area) has shrunk because a portion of it is has been captured as profit (green area). Total surplus falls: the deadweight loss (orange area) represents the value of mutually beneficial transactions that do not occur because of monopoly behavior. 14 Here, we assume AC and MC are constant for all output level Dealing with Natural Monopoly Dealing with Natural Monopoly • Breaking up a monopoly that isn’t natural can be a good idea • But it’s not so clear whether a natural monopoly, one in which large producers have lower average total costs than small producers, should be broken up, because this would raise average total cost • Yet even in the case of a natural monopoly, a profit-maximizing monopolist acts in a way that causes inefficiency—it charges consumers a price that is higher than marginal cost, and therefore prevents some potentially beneficial transactions. • What can public policy do about this? • A common response is price regulation • A price ceiling imposed on a monopolist • Price deregulation and impose competition wherever possible •Wire & energy business • There always remains the option of doing nothing !!! 4 • Income redistribution from consumer to monopolist in the form of profit does not necessarily represent a loss in society • Monopolist could use this for R & D Regulated and Unregulated Natural Monopoly In panel (a), if the monopolist is allowed to charge PM, it makes a profit, shown by the green area; consumer surplus is shown by the blue area. If it is regulated and must charge the lower price PR, output increases from QM to QR, and consumer surplus increases. Panel (b) shows what happens when the monopolist must charge a price equal to average total cost, the price PR*. Output expands to QR*, and consumer surplus is now the entire blue area. The monopolist makes zero profit. This is the greatest consumer surplus possible when the monopolist is allowed to at least break even, making PR* the best regulated price. Technical Inefficiency & Rent Seeking Price, cost Per unit Pm Economic Profit Rent Seeking Pc – Employment for players and artists • Two major negative consequences of monopoly are – Technical Inefficiency – Rent Seeking Technical Inefficiency • Objective of a firm’s manager is to maximize profit • A necessary condition for profit maximization is cost minimization • A monopoly, earning supernormal profit and insulated from competition, may not keen on cost minimization because A Tech Inefficiency • Some resources will be transferred to the production of other products, which are valued less by the society A D MR Qm Qc Quantity per period – Manager, who is salaried and not a stockholder, may not give significant effort – Faulty labour contract, which consider number of hours work, not efficiency – Everybody wants leisure 5 Rent Seeking Case Study: Price of Caviar • Rent-seeking is an attempt to obtain economic rent by manipulating the social or political environment in which economic activities occur, rather than by creating new wealth • In Soviet era, Bureau of Fisheries made decisions about sales of caviar • In a typical year, out of 2000 tons of cavier, only 150 tons were allowed to export • The caviar which was available in $5 in Russia could easily have been sold in $500 - $1000 in US • Monopoly arrangement caused substantial redistribution of income from US to USSR • After breaking up of USSR in 1991, increase competition in caviar mkt as fisheries are now under the control of Russia and Kazakhstan. • Fisherman in Caspian sea bypass government and establish their own export business – For example, spending money on political lobbying in order to be given a share of wealth that has already been created – Monopoly producer often pays a pert of its profit to maintain its monopoly status • Rent seeking behavior does not increase the amount of goods and services produced and also results in deadweight loss • The Organization of the Petroleum Exporting Countries (OPEC) was formed on September 14, 1960 in Baghdad, Iraq. The current membership is comprised of five founding members plus six others: Algeria, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela. OPEC’s stated mission is Ato bring stability and harmony to the oil market by adjusting their oil output to help ensure a balance between supply and demand.@ At least twice a year, OPEC members meet to adjust OPEC’s output level in light of anticipated oil market developments. OPEC's eleven members collectively supply about 40 per cent of the world's oil output and possess more than three-quarters of the world's total proven crude oil reserves. To demonstrate the deadweight loss from monopoly problem, imagine that market supply and demand conditions for crude oil are: • QS = 2P (Market Supply) • QD = 180 - 4P (Market Demand) where Q is barrels of oil per day (in millions) and P is the market price of oil. • Graph and calculate the equilibrium price/output solution. How much consumer surplus, producer surplus, and social welfare is produced at this activity level? • Use the graph to help you ascertain the amount of consumer surplus transferred to the monopoly producer following a change from a competitive market to a monopoly market. • Price of caviar dropped by 20% in one year • The competitive market equilibrium price-output combination is a market price of $30 with an equilibrium output of 60 (million) barrels per day. • Consumer Surplus = 2 [60 *($45 - $30)] = $450 (million) per day • Producer Surplus = 2 [60 *($30 - $0)] = $900 (million) per day • Social Welfare = Consumer Surplus + Producer Surplus $450 (million) + $900 (million) = $1,350 (million) per day 6 • The amount of deadweight loss from monopoly suffered by the monopoly producer is given by the triangle bounded by BCD. • Producer Deadweight Loss = 2 [(60 - 45) * ($30 - $22.50)] = $56.25 (million) per day • The creation of a monopoly also results in a significant transfer from consumer surplus to producer surplus. • In the figure, this amount is shown as the area in the rectangle bordered by PCMPMAB: • Transfer to Producer Surplus = 45 * ($33.75 - $30) = $168.75 (million) per day Example: SEBs Monopoly Example: SEBs Monopoly OPERATIONAL REASONS FOR PRODUCTIVITY GAP – GENERATION Index :US = 100 • Higher • Poor quality coal • Shortage of coal • Low capacity utilisation • Inefficient deployment of manpower • Overengineering • Construction overruns 3 India India average average == 34% 34% 80 3 • High ash content coal 1 2 capital work-in progress OPERATIONAL REASONS FOR PRODUCTION GAP – T&D • Less availability of gas Index :US = 100 100 100 86 4 5 5 • Thefts • Inefficient • Under- reading technology 58 hierarchy 13 33 India India average average == 4% 4% 4 30 27 SEBs SEBs • Theft • Excessive investment in substations, capacitors etc. deployments of manpower 7 • Outdated meter Excess Poor manOFT* power Lack of Lack of Best Supply Lack of Lack of India viable scale practice relaviable infrast- poteninvestIndia tions invest- ructure tial ments ments * Organisation of functions and tasks Source: Planning Commission; CEA; EIA; ASI; Interviews; McKinsey analysis Supplier relations High growth rates Plant mix US average 6 2 5 2 42 22 1 Excess manpower Poor OFT* Lack of viable investments Best practice India Excess manpower Poor OFT* Lack of viable investments India potential Low per capita consumption US average * Organisation of functions and tasks Source: CEA; CMIE; ASI; Planning Commission; EIA; Interviews; McKinsey analysis 7 Rise of Private Monopolists • Google, Facebook, Amazon - The rise of the mega-corporations | DW Documentary https://www.youtube.com/watch?v=Dy8ogOaKk4Y&t=258s MONOPOLY • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate • India’s New Economy Can’t Be a Monopoly Board https://www.bloombergquint.com/opinion/adani-joins-ambani-in-carvingup-india-s-post-covid-monopoly-board – “Airports are natural monopolies. To have one private owner controlling eight or more — a fresh batch of six will soon go under the hammer — can’t possibly be great news for airlines, fliers, or businesses operating from the premises” Bloomberg – X-inefficiency • Advantages of monopoly – economies of scale – profits can be used for investment Economic & Normal Profit • In economics, the term profit has two related but distinct meanings. – Normal profit represents the total opportunity costs (both explicit and implicit) of a venture to an entrepreneur or investor. Normal profits are basically earning what is required to keep you in the business. Any less than that, and you would go do something else – Economic profit (also abnormal, pure, supernormal or excess profit, as the case may be monopoly or oligopoly profit, or simply profit) is the difference between a firm's total revenue and all costs, including normal profit. 8