Advances in Luxury Brand Management (Jean-Noël Kapferer, Joachim Kernstock etc.) (Z-Library)

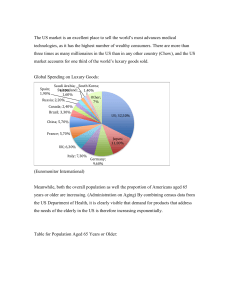

advertisement