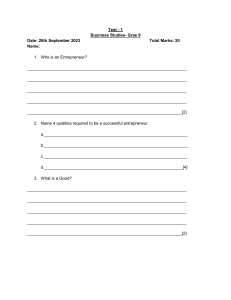

Entrepreneurship L1 – introduction to entrepreneurship The entrepreneurial process: 1. 2. 3. 4. Deciding to become an entrepreneur Developing successful business ideas Moving from an idea to an entrepreneurial firm Managing and growing the entrepreneurial firm Self-efficacy: the measure of one´s own belief in competence to complete tasks and reach goals. (You have to believe in yourself to be successful) 3 ways to achieve self-efficacy: 1- Mastery: direct experience. You have to participate and learn from your experiences. 2- Modelling: sometimes direct experience can be difficult. Learning from others can also be a good way. 3- Social persuasion: let others provide you with input and examples that you have the competence. Entrepreneurship is: - Creation of new economic activity Creation, evaluation, and exploitation of entrepreneurial opportunities The process by which individuals pursue opportunities without regard to resources they currently control Entrepreneurs create something out of nothing. If you start a business, you are an entrepreneur. The degree of being entrepreneurial changes whether you look at it from a personal or a bigger perspective. Entrepreneurial mindset: the ability to quickly sense, take action, and get organized under uncertain conditions. There are many different types of entrepreneurships. Immigrant entrepreneurship is a good way of integrating new cultures in a country. High growth entrepreneurship. Women entrepreneurship is talked about in a different way than “men entrepreneurship”. Proves that they have different opportunities. Small giants that choses to be great instead of big. “Oldpreneurship”, “mumpreneurship”. Everyday entrepreneurs who follow the entrepreneurial mindset. L2 – business opportunities Not all ideas are great business opportunities. An idea is a thought, impression, or notion. A business opportunity is a set of circumstances that creates a need for a new product, service or business. It has to be attractive, someone else has got to want to buy it. It has to be timely – the right time. It has to be durable – last over a longer period of time. You want to work with the product for long. Not something that is only relevant for a week each year for example. It has to create or add value to the potential customer – provide a benefit. All four criteria are key to a business. Fulfil all characteristics business opportunities. Maybe you have an idea, but does the opportunities exist to fulfil the idea? Do the opportunities exist, or do you have to create them? - Both. Not everyone wants to act on opportunities or have the resources to act on them. We have to figure out if there exists even one person who is interested in the idea or product. The opportunities might be there but we have to create them out of what we see or think is needed in society. – half full or half empty? Depends on the person. Different preferences for risks. Is it worth it? To become an entrepreneur, you have to be able to identify what the customer needs. Can you solve a problem to make their life better in any way? “Every unhappiness is a new business waiting to be born”. The first step to becoming an entrepreneur is to study your own, and others, unhappiness and then figure out what might possibly heal it. - - What are we offering, for whom, and how? If we can answer this in a positive way we have a business opportunity. The opportunities are not enough whether it’s there or if it needs to be created. Action has to be taken by the person who sees the opportunity - The one prepared to make the effort. The opportunity, idea and person ready to make the effort have to meet. Opportunities can be identified internally or externally. The initial stages differ but the process take the same shape towards the end. Externally stimulated: you take a decision to start. you need to recognize different ideas to see your business opportunity. (jeff bezos). Internally stimulated: you don’t want to be an entrepreneur, but you become one because you have solved a problem for yourself. The solution then becomes attractive to other people. The environment Trends in environment change over time. Changes that can generate entrepreneurial opportunities: - Political and regulatory changes Economic forces Social changes Technological changes = PEST Economic forces: sometimes we are up and sometimes down in economy. The change influences what opportunities and problems people have. - - Economic climate, business cycles Income levels, disposable income. Depending on how much money we have, after the tax, what type of business might be attractive? Low income, low disposable income – wont check for Rolex or omegas for example…. In a down going economic trend people won’t spend as much money. Spending patterns. Do some target customers tend to spend more/less money than others? Trends. Social forces: depending on how society evolves, different businesses will develop. - - Social and cultural trends (veganism) Demographic changes. Older people are today living longer while as many children are not brought to the world. We need more services for elderly than earlier when people didn’t live as long. Level of education. Depending on the level of education the society has. Income distribution. Before teenagers didn’t often have pocket money, but nowadays more teenagers work strong and vibrant group. A reason and source for many ideas in entrepreneurship. Technological advances: - New and emerging technologies New uses of established technologies Political and regulatory changes: Businesses will develop as the politics change. - Example communism market economy. taxes, war, government, regulation changes. Timing – the strategic window: window of opportunity. You have to be able to see when the best timing is for your idea to be developed. Its difficult to spot an open window – see, locate, measure, open and then close the window. Are the conditions right? The opportunity has to work in the context. - Challenging to be first: convincing people. Challenging to be last: many competitors. The individual How could people go about making a decision? How do they know what to do next? A problem generate alternatives evaluate alternatives select best option What to do next under uncertainty? Decision making shortcuts = heuristics. Fast and slow thinking. Nowadays were often pressured and can’t make decisions – we have to take shortcuts. We then have to deal with risky and uncertain situations. Risk vs uncertainty Frank knight: in business world there are situations where we can’t calculate risks. - - Known distribution, unknown draw risk. You have 2 different flavoured candys, but when mixing them you don’t know which one you will get. Unknown distribution, unknown draw uncertainty. You have an unknown amount of different flavoured candys, when mixing them up you have no idea which one you will get. Unknowable distribution true uncertainity (Knightian). You don’t know what candys you have and then you have no idea what you will get. You don’t know and cant calculate, it’s a risk some people wont act. Risk true uncertainty ------------------------------------------------------------------------------------------ Causation (managerial) planning– when you know what awaits you. Something planned. Begins with a pre-determined goal, then the entrepreneur seeks to identify the optimal alternative to achieve it. This, by planning. Effectuation (action oriented) doing - You start with what you have and are uncertain of the goal. Begins with a given set of means, goals will emerge over time. - Who am I? What do I know? Whom do I know? L3 – feasibility analysis Ideation and justification - Ideation: coming up with an idea Justification: proving that the idea has some merit and isn’t just a figment of your imagination. Feasibility analysis = justifying or evaluating your project. Type one errors you thought there was something valuable in your idea, but it wasn’t. Type two errors: you think it’s nothing there, but there is. - A feasibility analysis is an evaluation of your business idea based on perceived business opportunity. Done before taking any decision to commit more resources. Evaluation – somewhere between discovery and exploitation. Objective: avoid wasting resources a basis for revising your idea Feasibility analysis - An evaluation of a business idea that has not gone into exploitation. (value in exchange for money) Helps an entrepreneur with type 1 errors by providing a reality check. Feasibility analysis is done in four dimensions - Product/service feasibility – can it be produced at a reasonable cost? Industry and market feasibility – is there a market and can we have a piece? Organizational feasibility – can we build the organization we need? Financial feasibility – can we get cash needed for the project? The phases of your feasibility analysis: 1. Scanning phase: searching, looking, collecting. 2. Forecasting phase: developing projections. Look ahead and try to understand the factors that can affect your business. 3. Monitoring phase: keeping track of things that happen. Data. How are things developing? 4. Assessing phase: trying to understand what the data means. The data needs to be converted into information. Product/service feasibility Purpose – evaluate whether the product can be produced at a reasonable cost, and if it is wanted or needed on the market. Three basic parts: concept statement – a short written description of the project. One page. Used for getting feedback. Concept testing – reality check. A simple test to see if your solution is: - Desirable Acceptable Usability testing – how do people use and handle your product? Do people accept to use the product? Beta testing, user tests or field trials using: - Demo types – looks like a real thing but isn’t, looks like the product but doesn’t function. Virtual prototypes Prototypes – it has function but not the final form Industry and market feasibility Purpose – to assess the overall appeal of the industry and product market. Main considerations – industry attractiveness, window of opportunity, niche market identification. - Understanding the environment What is an industry? - A set of firms that are producing the same kind of products or services. A set of firms perceived to be competitors. What is a market? A structure where buyers and sellers can exchange goods and services. Buyers – sellers – product. Understanding an industry - Industry type and life cycle Five forces – understanding the level of competition Competitor analysis PESTEL analysis, understanding the macro environment Different types of industries: Emerging – just forming, no dominant designs or clear rules of competition. Rapid growth. Fragmented – many firms of similar size. Mature – slow growth, limited product innovation Declining – decline in demand Global vs. local markets. Different types of opportunities: Emerging – product innovation, first mover Fragmented – consolidation, franchising Mature – process innovation, forward and backward integration Declining – harvesting, divesting, niche Window of opportunity Is your venture timely? What about: - Business cycle Product-market cycle Competitor action Consumer preferences Industry analysis – five forces model potential entrants Barriers to entry: - Economies of scale Product differentiation Need for capital Cost advantage independent of size Access to distribution channels Legal barriers Substitutes Example of threats: - Product substitution – tea for coffee Generic substitution – flat screen for holiday Doing without – I’m not buying Threat increase if - Substitutes are close Switching costs are low Suppliers Determinants of threat: - Concentration – e.g. Try to negotiate with big companies. Switching costs – e.g. switching from windows to mac. One system to another. Threat of forward integration – suppliers becoming your competitor. Buyers Determinants of threats: - Concentration – try to negotiate with VW Switching costs – toilet paper vs home automation Share of buyer´s costs – food vs. jewellery Threat of backward integration – you customers becoming your competitors Rivalry Determinants of threat: - Number and balance of competitors Product differentiation – the more the better Growth rate – high=firms don’t have to compete for market shares Level of fixed costs – the higher, the higher the risk of price wars The level of competition is determined by these five forces The level of competition affects the overall profitability of an industry Research shows that 10-30% of a firm’s profit is determined by the industry Avoiding the five forces can make it possible to find profitable niches in an industry with high overall competition. Competitor analysis Mapping all existing competitors in scale and scope. Direct competitors – same industry Indirect competitors – substitute industries Potential competitors – potential entrants Market analysis (STP) 1. Segmentation 2. Targeting 3. Positioning Segmentation A segment is a limited group of buyers with certain attributes in common. A target market can be one or several segments. How to segmentate: 1. 2. 3. 4. 5. 6. Select segmentation attributes Analyse buyer similarities and differences Develop profiles (typical customers) Target segments Position the product for each target segment Develop the marketing mix (the 4 Ps), and tailor it for each target segment. Targeting - Choosing the appropriate segments Positioning - What you do to the mind of the receiver of the product. Focus on the receiver, not the sender. PESTEL analysis – environmental scan - A list of factors that may impact your firm and the industry it is in. Political – taxes, laws, policies, legislations, etc. Economical – business cycles, inflation, income, costs, interest rates, etc. Socio-cultural – income distribution, lifestyle changes, education, etc. Technological – discoveries, technological development, research, etc. Environmental – energy policies, environmental legislation, etc. Legal – product liability rules, competitive legislation, etc. You have to consider only the things that actually impacts your firm and focus on them, you cant focus on every little detail. This list of factors is a list of what COULD be important, and your task as an entrepreneur is to figure out what factors will matter in the future of your firm. Organizational feasibility - Can you manage your firm the right way? A reality check on the venture´s ability to match the environment (industry) You need the right skills and the necessary resources for the venture. Financial feasibility Profit is much less important than cash at any given point in time! - You pay with cash, not profits Profits are calculated and do not guarantee a lot of cash Without cash to pay suppliers etc. the business wont work out and there will be no future profits. SWOT-summary - A way to summarise your findings It’s a powerful tool to give a quick overview of positive and negative factors, its not analytical, but a useful tool. L4 – developing a business model Business model = the design of how we want the business to compete with other business. A plan for how the venture: - Competes Uses its resources Structures in relationships Interfaces with customers Creates value to sustain itself on the basis of the profits it generates How an organisation creates, delivers and captures value There are four elements of a business plan: - Core strategy - Strategic resources Core competencies – who are you and what can you do? Strategic assets - Partnership network Suppliers Partners Other key relationships - Customer interface Target customer Fulfilment and support Pricing structure The four elements were not enough Barringer/Ireland created a business model template Business model canvas Consists of 9 elements that represent the business at a whole. 1. The customer segments – defines the different groups of people or organizations an enterprise aims to reach and serve. Who’s the customer? 2. The value proposition – describes the bundle of products and services that create value for a specific customer segment. - Solves a customer problem or satisfies a customer need. - Not necessarily the product itself, more the functionality, the need that’s fulfilled. 3. The channels – describe how a company communicates with and reaches its customer segments or deliver a value proposition. - Communication, distribution and sales channels comprise a company´s interface with customers. 4. The customer relationships – describe the types of relationships a company establishes with specific customer segments - What type of relationships/interaction to the customers? - Will help later to decide on revenue streams 5. The revenue streams – represent the cash the company generates from each customer segment. - How are the customers paying? - For what are our customers paying? Usage, subscription fee, asset sale. Leasing…. - Each revenue stream can have different pricing mechanisms - Fixed/dynamic pricing - More revenue streams are better than one – money from different sources. 6. The key resources – describe the most important assets required to make a business model work. The resources allow a firm to create and offer a value proposition, reach markets, maintain relationships with customer segments and earn revenues. 7. The key activities – describe the most important things a company must do to make its business model work. Can include: - Production - Problem solving - Platform/network 8. The key partners/partnerships – describe the network of suppliers and partners that make the business model work. Companies can create alliances to optimise their business. There are four different types of partnerships: - Strategic alliances - Cooperation - Joint ventures - Buyer-supplier relationships 9. The cost structure – describes all costs incurred to operate a business model. - What are the most important costs? - Which key resources and key activities incur costs? The business model canvas: Business model innovation The ideas for business model innovation can come from anywhere. Companies work with their business model all the time, and tries to improve it. Most commonly the ideas come from: -resource driven -offer driven. The conditions around a product changes -Customer driven. Customers demand changes -finance driven -multiple-epicenter-driven. The changes comes from different sources. Business model vs. business plan. L5 L5 – finding and managing resources ” For the firm, resources and products are two sides of the same coin. Most products require the services of several resources and most resources can be used in several products. By specifying the size of the firm’s activity in different product markets, it is possible to infer the minimum necessary resource commitments. Conversely, by specifying a resource profile for a firm, it is possible to find the optimal product-market activities.” Point of departure - To be viable, a business needs bidirectional flows upstream and downstream. In a way, opportunity is the connection between resources and demand. Resources Cost The venture value revenue Definition of resources - Anything that the firm holds, and that can be used to produce value for the firm. Tangible – resources you can touch Intangible – resources you can’t touch Both tangible and intangible resources can be difficult to imitate by competitors, that is because it takes time to gain and retain resources. Resources for P R O F I T A firm must have a sufficient number of resources to enable its business model to work. Physical – Part of the tangible types of resources. Generally, not rare and hard to buy, but can be. Anyone can buy it – not a source for competitiveness. Premises, equipment, location, security systems. Reputational – Part of the intangible resources. Perceptions of the company held by people in the firm’s environment. Brand, personal reputation. - Available on product level: brand loyalty Or corporate level: global image Long lived, if maintained. Organizational – Part of the intangible resources. How the organization is built. Structure, routines, systems. - Structure: how we organize. Routines: how we do things Systems: for learning, reporting and decision-making. Financial – Storage of value that can be turned into other resources. Money assets and the ability to get them if needed. Intellectual (Human) capital – Owned by individuals, part of the intangible resources. Knowledge, training, experience, social relations. Can walk out the door – needs value. Technological – Broad term, part of the tangible and intangible resources. The techniques, skills, methods, and processes used in the production, or the knowledge about them. Process, equipment, software. The mother of invention A lack of cash will force you to get it from your customers in order to refine your idea. It will drive you to work harder, enter into partnerships, borrow resources, make profitable sales, etc. Competitive advantage – a firm has it when it’s implementing a value creating strategy which is not simultaneously being implemented by any current or potential competitors. Sustainable competitive advantage – a firm has it when it is implementing a value creating strategy not simultaneously being implemented by any current or potential customers, and when these firms are unable to duplicate the benefits of these strategies. Strategic resources - Resources used to provide competitive advantage. Factor market: superior location, supply chain, processes, culture Product market: better products or services, market position It’s not forever, but for a longer period of time. VRIN framework Valuable – help conceive of and implement efficient strategy, exploit opportunities, and minimize threats. Appropriate for the situation Rare – not widely available to competitors. Imperfectly imitable – hard to copy, can’t duplicate for a lower price, hard for others to understand how it works. Non-substitutable – shouldn’t be able to use something else. Summing up RBV – resource-based view - Resources are heterogeneous and have different characteristics Some resources are rare and hard to acquire Some resources can only be built, not bought, using time, cash, and other resources. Such resource can be the basis for sustained competitive advantage The RBV of a firm provides the foundations for understanding how resources can be related to entrepreneurial differences among companies. The essence of RBV logic rests on the emphasis on bundles of strategic resources at the firm’s disposal as the basis for creating competitive advantage, possibly sustained. Possessing resources does not automatically lead to superior outcomes. Rather, the firm´s resources must be managed appropriately to produce value. Owners and managers need to recombine their resources to realise any potential advantage. Entrepreneurial innovation is in fact the carrying out of new combinations of resources. Point of arrival Resources Cost - utility Resource combination revenue Entrepreneurship as creating new ventures through innovative resource combination Managing resources - Selecting resources and managing a portfolio of resources Combining resources to create new bundles Using new resource bundles for creating superior value for the customer L6 – what is marketing? “Marketing is the activity, set of institutions, and processes for creating, communicating, delivering and exchanging offerings that have value for customers, clients, partners, and society at large” Promotions techniques – types of marketing Viral marketing – facilitates and encourages people to pass along a marketing message about a particular product or service. Guerrilla marketing – a low budget approach to marketing that relies on ingenuity, cleverness, and surprise rather than traditional techniques. Influencer marketing – relying on a person with high influence to drive a brand message to the larger market. Green marketing – development and promotion of products that are presumed to be environmentally safe. Keyword marketing – involves placing a message in front of users based on specific keywords or phrases they are using to search. Outbound marketing – the marketer initiates contact with the customer, i.e., a TV ad. Inbound marketing – customers initiate contact with the marketer, example feedback on service or product. Selecting a market and establishing a position – STP - Who are our customers and how will we appeal to them? Market segmentation (S) Involves studying a firm’s industry and determining the different target markets (customer types) in that industry. Markets can be segmented in different ways: - Geography - Demographic variables (age, gender, family size) - Psychographic variables (personality, lifestyle, values) - Behavioural variables (benefits sought…) - Product type - Selecting a target market (T) - Once a firm has segmented the market, a target market must be chosen. Those customers must be defined and reached. The market must be sufficiently attractive, and the firm must have the capability to serve it. By focusing on a clearly defined market, a firm can become an expert within that market, and then be able to provide customers a high level of service. Establishing a unique position (P) - After selecting a target market, the firm´s next step is to establish a position within the market that differentiates it from its rivals. Position = the part of a market that the firm is claiming as its own A firm establishes a unique position in its customers´ minds by drawing attention to two or three of the product attributes. A Product attribute map is a helpful technique for illustrating the firm´s positioning strategy relative to its rivals. Branding Establishing a brand: - A brand is the set of attributes that people associate with a company. The attributes can be positive or negative. The customer loyalty a company creates through its brand is one of its most valuable assets. Brand management: - Some companies monitor the integrity of their brands through a program called “brand management”. On a philosophical level, a firm must have meaning in its customers lives, create value. Something that people are willing to pay for. On a practical level, brands are built through different techniques, including advertising, sponsorship, public relations…. A firm’s name, logo, website design, social media accounts etc. are a part of its brand. Power of a strong brand: - A strong brand can be a very powerful asset for a firm. Over 50% of customers say that known and trusted brands are reasons to buy a product. A brand allows a company to charge a price for it products that’s consistent with its image. A successful brand can increase the market value of a company by 50 – 75% The four Ps of marketing 1. Product - A good or a service a firm offers to its target market. - It has to add value to the customers The core product is the product itself and should be looked at separately from the actual product, which is the product plus all the attributes that come with it. A common challenge to a new venture is that they have to convince the first customer to buy their product. Some people use a reference account – an early user of their product that’s willing to give a review. Such as influencers. 2. Price - The amount of money consumers pay to buy a product. The price sends an important message to the target market, where an expensive product might be thought to have better quality, for example. There are two methods for setting the price of a product: Cost-based pricing: - The price is determined by adding a markup percentage to a product´s cost. Value-based pricing: - The price is determined by estimating what consumers are willing to pay for a product. 3. Promotion - The activities the firm takes to communicate merits of a product to their target market. Advertising - Makes people aware of a product and how it adds value to them. Pros of advertising: - Raise customer awareness of a product Explain a product´s comparative features and benefits Create associations between a product and a certain lifestyle Cons of advertising: - Low credibility, the customer can’t know if it is legit since they have not yet used the product. The possibility that many of the people who see the ad will not be interested. Costly, compared to other forms of promotions. Public relations - A cost-effective way to increase the awareness of the products of a company. Refer to efforts to establish and maintain a company´s image with the public. Examples: social media coverage, blogging, press release, newsletters, etc. 4. Place - Activities that move the product from the company to the buyer. The first choice a company has to make regarding distribution is whether to sell their products directly to consumers, or through intermediaries. Often depends on the target market. L7 – accounting for entrepreneurs Financial management Deals with achieving the best financial outcome and raising money. - How are we doing? Making/losing money How much cash do we have on hand? Do we have enough cash to meet our short-term obligations? How efficiently are we utilizing our assets? How do our growth and net profits compare to those of our industry peers? Where will the funds we need for capital improvements come from? Are there ways we can partner with other firms to share risk and reduce the amount of cash we need? Are we in good shape financially? Financial objectives of a firm Profitability – a firm’s ability to make a profit. - For the first years of a business (2-3) it’s very common not to go with profit. Breakeven is good in the beginning. In the long run, a business must be profitable, otherwise it’s not viable. Identify why you’re not making money! Control on a regular basis. Liquidity – a firm’s ability to cover its short-term liabilities - Even for a profitable firm, its hard to keep enough money in the bank to meet all costs. How do you manage your cash? Efficiency – how productively a firm utilizes its assets - All assets must be utilized, cant be inactive for a longer period. Stability – how healthy the financial structure of a firm is - A firm must be able to make profit – be stable. Financial management and accounting information - To assess whether its financial objectives are being met, firms rely heavily on analysis of financial statements. Accounting is: - A storyteller/language Definition: “the process of identifying, measuring and communicating economic information to permit informed judgements and decisions by users of the information” To be able to make goods/services for sale, you need personal effort/work, tools/assets, raw material. These things cost money – you have to know where to get the money. The sales must cover the costs. Users of accounting (stakeholders) can be external or internal External: owners/shareholders, prospectors, tax authorities, creditors, banks, government Internal: management, other employees. Stakeholder – has interest in the company Shareholder – has shares/stocks in the company Financial management and accounting information Some information has to stay within the company. Its illegal for a person to tell external parties about confidential information. The information is conveyed to different people through a wide range of channels: Externally – financial accounting - Financial statements are written reports that quantitatively describes a firm’s financial health. Pro forma financial statements are similar to historical financial statements, except that they look forward rather than track the past. (estimates) Internally – managerial accounting Forecasts/budgets – are estimates of a firm’s future income and expenses, based on past performance, its current circumstances, and its future plans Or Are itemized forecasts of a company’s income, expenses and capital needs and are also an important tool for financial planning and control. The process of financial management Financial information is interdependent on other financial information. You have to compare numbers to previous numbers in order to know whether they are good or not. Historical vs. pro forma financial statements Historical financial statements - Reflect past performance Are usually prepared on a quarterly and annual basis Are usually prepared under specific rules/principles Should be published for specific companies Provide external stakeholders with reassurance Pro forma financial statements - Are projections for future periods based on forecasts Are typically completed for two or three years in the future Are strictly planning tools and usually confidential Do not have to be published Useful when constructing a business plan and seeking financing. The annual report The basic components of the annual report: - Income statement – statement of profit or loss during a particular period of time. Balance sheet – statement of financial position on a particular day of time. Statements of cash flows – how much actual cash the company has. Important in order to be able to pay. Income statement: Revenue or sales: the amount of money that a company receives during a specific period, including discounts and deductions for returned merchandise. It is the top line or gross income figure from which costs are subtracted to determine net income. Expenses: the economic costs that a business incurs through its operations to earn value. Balance sheet: Asset: a resource with economic value that an individual or corporation owns or controls with the expectation that it will provide future benefit. Liability: A company’s legal debts or obligations that arise during the course of business operations. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. If someone asks you how much a company made from its sales last year, what are they talking about? Group of answer choices Revenues (sales) plus operating income (EBIT) Revenues (sales) minus costs of goods sold Net income Earnings before taxes Sweat : The amount of the funds contributed by the owners plus the retained earnings or losses. Also referred to as “shareholders equity” Statement of cash flows - Summarizes the changes in a firm´s cash position for a specified period of time. Shows how a firm receives and uses cash from operating, investing, and financing activities. Can only be prepared after the income statement and balance sheet. L8 – financing and funding Financing – you get money that you’ll have to repay, either with interest or equity. Funding – you get money that you don’t have to pay back. Important in financing start-up and growth Funding needs – how much money do we need to run our business? Funding sources – where and from whom to obtain the money? Evaluate risk and uncertainty. Timing – when to go for the money? Time is vital, you can’t be too early or too late. You have to time the opportunity precisely. Why especially start-ups need funding/financing - Cash-flow challenges Capital investment Lengthy product development cycles Why do cash-flow problems occur? And ways to overcome it External reasons - Suppliers introduce shorter payment terms Banks restrict short-term credits Customers delay payments Internal reasons - Private withdrawals too high Lack of pre-financing for tall orders Urgent investments Small profit margin together with stagnating turnover Cashflow management - Speeding cashflow – money in before money out Reducing costs Raising process – depends on consumer preferences and switching costs Financial problems in new and innovative firms New and small firms - Higher transaction costs Restricted access to capital market Limited internal possibilities to spread risks Lack of information Little bargaining power Innovative firms - High risk of liability of newness because of innovation Limited self-financing power in stages of preparing and creating the venture Higher sunk costs How entrepreneurs fund their ventures Personal savings – indicates that the entrepreneur has worked for a while since they have money to invest Your own money is a good start. Sources: The term bootstrapping means doing more with less. It is about finding ways of avoiding the need for money. It can be accomplished in many different ways: - Get the start-up operational quickly Keep costs to a minimum Generating sales early Look for opportunities to make money Using personal network to share resources Using personal network to get resources for free or cheaply Crowdfunding Funding from the public, a type of micro financing. Either reward-based or equity-based. - Requires fundraising platforms that allow entrepreneurs to create a profile, list their fund-raising goals and provide an explanation of how the funds will be used. The platform takes a small % of the funds raised. Problem: how do you protect your idea? Venture capitalists vs. business angel Business angel - Venture capitalist Informal capital Private investment Own money Early-stage funding What the venture capitalist looks for: - Experience and knowledge of management team Potential for exit Profitability of business Outlook for industry Competitiveness of product Barriers to entry Viable business model The negative aspects of venture capitalists: - They demand rapid growth Independence Reporting Intrusion - Formal capital Invests funds Portfolio Later stage funding - Who is in control? Lessons for entrepreneurs - Later stage investment = better deal Faster estimated process from VC investment to IPO = better deal Bigger opportunity, future growth, and market valuation = better deal Generally, - Few use/get equity funding Lack of information on ability to make profit limits the attraction to investors Mixed feelings about growth and shared ownership limits the attraction to entrepreneurs. Initial public offering (IPO) - The first sale of stock by a company to the public (stock market launch) Private company public company Used to raise expansion capital and become publicly traded Evaluation process/due diligence Advantages: - Raising new capital with the possibility of later, additional offerings Liquidity – ability to convert ownership to cash, potential of harvest for investors and founders Visibility – build brand and reputation Disadvantages: - Costs and effort for mounting the operation Financial disclosure requirements and scrutiny of operations Perceived pressures on achieving short-term results Possible loss of control to a majority shareholder Types and sources of financing Internally generated - Positive cash flow Retained earnings External Equity: - Debt: Business angels/private investors Venture Capital firms Initial Public Offering (IPO) (Private equity placement) - Single-purpose loans (longterm, short-term) Credit lines Vendor credit (trade credit) L9 – ethical and legal firm foundations Legal forms of businesses in Sweden Choosing a legal form of a business depends on many factors: - The cost of setting up and maintaining the legal form The extent to which personal assets can be shielded from the liabilities of the business. Tax considerations The number and type of investors involved. Sole proprietorship/sole trader: = Enskild firma - Can only be run by one person Income is declared on private declaration Partnership: = Handelsbolag - Founded by at least two people Every owner declares their part of the income/profit/loss privately. Limited partnership = Kommanditbolag - General owners (komplementär ägare) Limited owners (kommanditägare) A type of partnership Offers possibilities to limit responsibility for debts. Partnership agreement should be written Private limited company/ public limited company/ incorporated = Aktiebolag - Expertise knowledge is needed, initial investment of minimum 25 000 SEK. Annual report is required. Other common legal forms Co-operative society/economic association = Ekonomisk förening Non-profit organization/Voluntary organization = Ideell förening Foundation/Trust = Stiftelse Ethical foundations Ethics is moral principles that govern a person´s behavior or the conducting of an activity. All firms have different goals: - Profitability, profits to shareholders, market-shares. Growth Environmental responsibility Better society Personal goals, lifestyle Innovation To develop a strong ethical culture comes with potential benefits: Developing a strong ethical culture: - Lead by example Form a code of conduct Three levels of ethical standards: - Laws – societal Organizational policies and procedures – organizational Moral stance – individual All these levels are influenced by, as well as influence, the context and culture in which we live. For example: cultural norms and values. Reasons behind ethical misconduct: - Bad apple Bad barrel Moral blindness Competitive pressure Opportunity pressure - Globalization of business Forms of ethical misconduct: Reasons for employee misconduct: - Feeling pressure to do whatever it takes to hit business targets. Believing they will be rewarded for their results, regardless of the means. Believing the code of conduct is not taken seriously. Lack of resources to get the job done without cutting corners. Fear of loosing their job if they do not meet targets. Believing policies or procedures are easy to bypass or override. Seeking to bend the rules for personal gain. No one feels individually accountable. Managerial approaches to ethics: Immoral management – selfish, profitability at any cost, legal standards are barriers, etc. Amoral management – well-intentioned but selfish, profitability, what can be done legally, compliance with law, etc. Moral management – good profitability within ethical boundaries, law is minimal ethical behavior, etc. In order to be ethical in the startup process, a company should have informal programs, state core values, resist pressures to cut ethical corners, and hire employees that fit the ethical values. Intellectual property The first steps towards protecting a firm´s intellectual property, are to: - Make employees and potential financers sign a non-disclosure agreement. Get legal assistance to make written agreements to protect the IP. Intellectual property should be legally protected if it: - Is related to the firm´s competitive advantage Has value in the marketplace Trade secrets - Knowledge restricted to the firm. Developed at great costs, time, efforts. Can not be duplicated or discovered by a similar firm. Only shared on a need-to-know basis, kept confidential. Gives valuable and sustainable competitive advantage. Copyright - Autor of a copyrighted work (has to be tangible) has the legal right to determine use of it, and to obtain economic benefits. Copyright infringement is growing. Fair use: teaching, news, commenting, etc. Trademark - Word, symbol, name, etc. Registration is not required, but it is advantageous in case of infringements. Patents - Requirements: usefulness, novelty, not obvious. Utility patent: new inventions of processes. Machinery, product combinations. Design patents: new/original/ornamental designs for products. (Business methods and plant patents not available in Sweden) Patenting can take a long time and can be expensive.