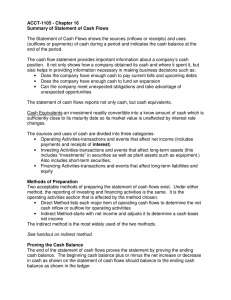

The sections of the cash flow statement include each of the following except direct activities True or false: The majority of public companies use the direct method of preparing cash flows from operating activities FALSE 00:04 03:56 Solar Corporation reported net income for the current year of $75,000. They reported depreciation expense of $12,575. Cash flow from operating activities is $87,575 Gratiot Corporation reported income tax expense of $13,500 on its income statement. It had income taxes payable of $4,000 at the beginning of the year and $3,475 at the end of the year. How does this affect cash provided by operating activities in a cash flow statement? The decrease in income taxes payable $525 is subtracted from net income using the indirect method. Solar Corporation reported net income for the current year of $75,000. The company also reported a loss on the sale of equipment of $1,000 after receiving $5,000 in proceeds. They purchased equipment for $25,400. How does this affect the cash flow statement using the indirect method? The loss on the sale of equipment of $1,000 is added back to net income to determine cash flows from operating activities Solar Corporation reported net income for the current year of $75,000. The company also reported a gain on the sale of equipment of $1,275 after receiving $5,000 in proceeds. They purchased equipment for $25,400. How does this affect the cash flow statement using the indirect method? The gain on the sale of equipment of $1,275 is subtracted from net income to determine cash flows from operating activities. Forester Company has provided you the following information for the current year. The beginning and ending balances for Buildings and equipment were $275,000 and $300,000, Accumulated depreciation was $40,000 at the beginning of the year and $50,000 at the end of the year. A storage shed with an original cost of $60,000 and a book value of $40,000 was sold for $45,000. Which of the following statements is true? The company purchased $85,000 in buildings and equipment during the year. An example of an item that was included in accrual-basis income but that did not affect operating cash flows includes all of the following except rent received in advance. An example of an item that was excluded from accrual-basis income that affected operating cash flows includes all of the following except depreciation expense. If accounts receivable is factored and it fails to qualify as a sale under GAAP, the proceeds are shown as a(n)__________ cash inflow. Financing An increase in prepaid expenses is deducted from accrual earnings to obtain operating cash flows using the indirect method. A decrease in prepaid expenses is added to accrual earnings to obtain operating cash flows using the indirect method. 00:02 03:56 Which of the following are reasons that the overwhelming majority of public companies use the indirect method of preparing cash flow statements? -The indirect method characterizes cash flow in a way that many analysts find useful. -The indirect method relies exclusively on data already available in accrual accounts. Identify the correct statement regarding how depreciation expense affects the statement of cash flows Depreciation expense must be added back to accrual-basis net income using the indirect method. Under the indirect method, the gain on sale of equipment is subtracted from net income to arrive at cash flow from operating activities. Which of the following is not generally helpful in reconciling differences that result from year-to-year changes in comparative balance sheet accounts not coinciding with the changes implied from amounts reported on the cash flow statements? IRS tax code Holt Company's uses the indirect method to prepare a cash flow statement. Adjustments to reconcile net income to cash provided by operations include a $15,000 addition for change in inventory. Holt's comparative balance sheet, however, shows a $20,000 decrease. What could explain the $5,000 discrepancy? The write-down of inventory The ______ method of translating financial statements generates a potential discrepancy between the change in the inventory amount presented in the balance sheet and the cash flow statement inventory change figure. current rate Cash flows that result when a company sells its own stock or bonds, pays dividends, or issues or repays debt are financing activities. The section on the cash flow statement that arises from transactions related to the production and delivery of goods and services to customers is called the _________activities section. operating Debt prepayments and extinguishment costs should be classified as _______ cash flows. financing If accounts receivable are factored and the transfer qualifies as a sale, the proceeds are shown as a(n) operating cash inflow Which of the following would result in changes in asset balances unrelated to cash? -Impairment of assets -Write-down of assets Identify the correct statement regarding preparing cash flow from operations using the indirect method. It adjusts for items included in accrual-basis net income that did not affect operating cash flows. Which of the following are true of deferred income taxes with regards to an indirect method cash flow statement? -A decrease in net deferred tax liabilities must be subtracted from accrual-basis net income. -An increase in net deferred tax liabilities must be added to accrualbasis net income in the cash flow statement. Use of the temporal method of translating financial statements will not generate a discrepancy between the change in the inventory amount presented in the balance sheet and the cash flow statement because -the U.S. dollar value of inventories is not adjusted for changes in the exchange rate. -inventory is always translated at the exchange rate in effect when it was purchased. Zero-coupon bond settlement should be allocated between operating and financing cash flows. Amounts on the balance sheet that do not map directly to corresponding account changes in the statement of cash flows include all of the following except acquisition of treasury stock. Cash flows that result when a company sells its own stock or bonds, pays dividends, or issues or repays debt are financing activities. A fourth section of the cash flow statements of companies having foreign operations consists of a single line item that represents the change in the U.S. dollar equivalent of foreign currency holdings due to exchange rate fluctuations. 00:02 03:56 The operating section on the cash flow statement starts with net income using the indirect method. Categories of cash inflows and outflows of operating activities that are required to be reported under the direct method include interest and dividends received. cash collected from customers. True or false: Both the direct method and indirect method will arrive at the same amount for cash flow from operating activities. True Cash flows that result from the purchase or sale of productive assets are investing activities. An additional section on the cash flow statement having to do with foreign operations includes the change in the U.S. dollar equivalent of foreign currency holdings that occur when exchange rates change. The direct method and the indirect method are alternative presentations for presenting cash flows from operating activities. Categories of cash inflows and outflows of operating activities that are required to be reported under the direct method include interest paid. interest received. income taxes paid. Firms using the direct method of reporting operating activities must present major classes of gross receipts and disbursements. Dillon Company reported cost of goods sold of $325,000 for the current year. The beginning and ending balances in inventory were $45,500 and $55,000, respectively while the amounts for Accounts payable were $37,000 and $25,800. How much cash was paid to suppliers during the year? $345,700 Under the direct method, the reconciliation of net income to net cash provided by operating activities would be found in required supplemental disclosures. 00:02 03:56 A fourth section of the cash flow statements of companies having foreign operations consists of a single line item that represents the change in the U.S. dollar equivalent of foreign currency holdings due to exchange rate fluctuations. The operating section on the cash flow statement starts with net income using the indirect method. Makalan Company reported net sales of $500,000 for the current year. The beginning and ending balances in accounts receivable were $62,500 and $75,000, respectively. How much cash was received from customers during the year? $487,500 True or false: The reconciliation of net income to net operating cash flow is a required supplemental disclosure for companies using the indirect method. False An example of an item that was included in accrual-basis income but that did not affect operating cash flows includes all of the following except rent received in advance. Which of the following are reasons that the overwhelming majority of public companies use the indirect method of preparing cash flow statements? The indirect method characterizes cash flow in a way that many analysts find useful. The indirect method relies exclusively on data already available in accrual accounts. Identify the correct statement regarding how depreciation expense affects the statement of cash flows. Depreciation expense must be added back to accrual-basis net income using the indirect method. Which of the following are true of deferred income taxes with regards to an indirect method cash flow statement? A decrease in net deferred tax liabilities must be subtracted from accrual-basis net income. An increase in net deferred tax liabilities must be added to accrual-basis net income in the cash flow statement. Identify the correct statement regarding preparing cash flow from operations using the indirect method. It adjusts for items included in accrual-basis net income that did not affect operating cash flows. True or false: The majority of public companies use the direct method of preparing cash flows from operating activities. False Solar Corporation reported net income for the current year of $75,000. The company also reported a gain on the sale of equipment of $1,275 after receiving $5,000 in proceeds. They purchased equipment for $25,400. How does this affect the cash flow statement using the indirect method? The gain on the sale of equipment of $1,275 is subtracted from net income to determine cash flows from operating activities. Solar Corporation reported net income for the current year of $75,000. They reported depreciation expense of $12,575. Cash flow from operating activities is $87,575. Gratiot Corporation reported income tax expense of $13,500 on its income statement. It had income taxes payable of $4,000 at the beginning of the year and $3,475 at the end of the year. How does this affect cash provided by operating activities in a cash flow statement? The decrease in income taxes payable $525 is subtracted from net income using the indirect method. An example of an item that was excluded from accrual-basis income that affected operating cash flows includes all of the following except depreciation expense. Forester Company has provided you the following information for the current year. The beginning and ending balances for Buildings and equipment were $275,000 and $300,000, Accumulated depreciation was $40,000 at the beginning of the year and $50,000 at the end of the year. A storage shed with an original cost of $60,000 and a book value of $40,000 was sold for $45,000. Which of the following statements is true? The company purchased $85,000 in buildings and equipment during the year. Solar Corporation reported net income for the current year of $75,000. The company also reported a loss on the sale of equipment of $1,000 after receiving $5,000 in proceeds. They purchased equipment for $25,400. How does this affect the cash flow statement using the indirect method? The loss on the sale of equipment of $1,000 is added back to net income to determine cash flows from operating activities. Which of the following items would be subtracted from accrual-basis net income in determining cash flows from operating activities using the indirect method? an increase in inventory A decrease in prepaid rent is added to net income to arrive at operating cash outflow. An example of an item that was included in accrual-basis income but that did not affect operating cash flows includes all of the following except rent received in advance. Under the indirect method, the gain on sale of equipment is subtracted from net income to arrive at cash flow from operating activities. A decrease in prepaid expenses is added to accrual earnings to obtain operating cash flows using the indirect method. Dexter Corporation reported net income for the current year of $85,000. An examination of their balance sheet showed the following: Accounts receivable increased by $7,500, inventory decreased by $3,250 and Accounts payable increased by $1,200. Using only this information, what is their cash flows from operating activities using the indirect method? $81,950 An increase in inventory decreases operating cash flows using the indirect method. Candlewax Company has net income of $175,000 in the current year. It also reported the following: increase in Accounts receivable of $5,000, decrease in Accounts payable of $2,500 and an increase in Accrued expenses of $1,300. Cash flow from operating activities is $168,800. A decrease in accrued expenses is shown as a deduction from accrual earnings to arrive at operating cash flows using the indirect method. An increase in prepaid expenses is deducted from accrual earnings to obtain operating cash flows using the indirect method. Which of the following is true regarding a change in Accounts payable as it relates to the indirect method of a cash flow statement? A decrease in Accounts payable must be subtracted from accrual-basis earnings to arrive at cash flows from operations. An increase in accrued expenses is shown as an addition to accrual earnings to arrive at operating cash flows using the indirect method. Which of the following items would be added to accrual-basis net income in determining cash flows from operating activities using the indirect method? an increase in accounts payable An increase in income tax payable is added to net income in calculating operating cash flows using the indirect method. A cash flow statement prepared under the direct method results in the same amounts for cash provided by operating, investing, and financing activities as the indirect method. Firms using the method of preparing cash flow statements must separately disclose the amount of interest paid. indirect Which of the following is not generally helpful in reconciling differences that result from year-to-year changes in comparative balance sheet accounts not coinciding with the changes implied from amounts reported on the cash flow statements? IRS tax code. Holt Company's uses the indirect method to prepare a cash flow statement. Adjustments to reconcile net income to cash provided by operations include a $15,000 addition for change in inventory. Holt's comparative balance sheet, however, shows a $20,000 decrease. What could explain the $5,000 discrepancy? The write-down of inventory A decrease in income tax receivable is added to net income in calculating operating cash flows using the indirect method. Which of the following is a reason that some claim to justify their preference of the direct method over the indirect method for computing net cash provided by operating activities? The direct method discloses operating cash flows by category which facilitates cash flow predictions. Firms using the indirect method are required to separately disclose the amount of interest paid. Use of the temporal method of translating financial statements will not generate a discrepancy between the change in the inventory amount presented in the balance sheet and the cash flow statement because inventory is always translated at the exchange rate in effect when it was purchased. the U.S. dollar value of inventories is not adjusted for changes in the exchange rate. Amounts on the balance sheet that do not map directly to corresponding account changes in the statement of cash flows include all of the following except acquisition of treasury stock. Which of the following would result in changes in asset balances unrelated to cash? Write-down of assets Impairment of assets Cash flows arising from the acquisitions and divestitures of other companies are cash flows from investing activities. A cash flow statement prepared under the direct method results in the same amounts for cash provided by operating, investing, and financing activities as the indirect method. Examples of noncash financing and investing activities include each of the following except acquisition of treasury stock. The ______ method of translating financial statements generates a potential discrepancy between the change in the inventory amount presented in the balance sheet and the cash flow statement inventory change figure. current rate Why are changes in inventory due to acquisitions not included as part of the adjustments to accrual-basis income to arrive at operating cash flows? Changes due to acquisitions do not create a corresponding accrual adjustment to cost of goods sold on the income statement. Identify the correct statement regarding noncash financing and investing activities. They are not included in the investing and financing activities sections of the cash flow statement. Which of the following is true regarding restricted cash? It is required to be included in the cash amounts used to determine the change in cash to which cash flow statement reconciles. Debt prepayments and extinguishment costs should be classified as _______ cash flows. financing True or false: Changes in working capital accounts provide major sources and uses of investing cash flows. False If accounts receivable are factored and the transfer qualifies as a sale, the proceeds are shown as a(n) operating cash inflow. ASU 2016-18 requires that ______ be included in the cash amounts used to determine the change in cash to which the cash flow statement reconciles. restricted cash Zero-coupon bond settlement should be allocated between operating and financing cash flows. Collections on accounts receivable ______ operating cash flows while payments on accounts payable decrease _______ cash flows. increase, operating If accounts receivable is factored and it fails to qualify as a sale under GAAP, the proceeds are shown as a(n) cash inflow. financing Improper capitalization of operating costs causes these items to be reported in the investing activities section rather than the operating activities section. depreciation expenses in later years that do not reduce cash flow from operations. Technological feasibility is established when the company has completed a detailed program design or a working model. At the inception of a finance lease, there is no immediate cash flow effect. True or false: Changes in working capital accounts provide major sources and uses of investing cash flows. False Improper capitalization ______ boosts operating cash flow because amounts capitalized are later expensed as depreciation or amortization. permanently Identify the correct statement regarding software development costs for computer software companies. Once they reach technological feasibility, they are treated as investing cash outflows. Each lease payment for an operating lease is an operating cash flow. Improper capitalization of operating costs causes depreciation expenses in later years that do not reduce cash flow from operations. these items to be reported in the investing activities section rather than the operating activities section