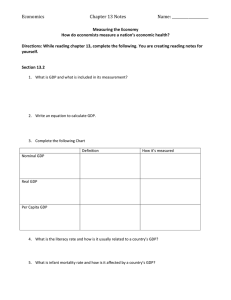

Y12 Macroeconomics Introduction Macroeconomics What is it? Macroeconomics (from the Greek prefix makro- meaning "large" and economics) is a branch of economics dealing with the performance, structure, behaviour, and decision-making of an economy as a whole. This includes regional, national, and global economies. It looks at government actions to control their economies as well as the relationships and connections between one country and another. Aggregated analysis Microeconomics Decisions of individuals and firms to form markets. Macroeconomics The aggregated analysis of many markets brought together into one economy. A lot of emphasis is placed on government control of their economy. Macroeconomics What does the government do? What are they looking to control? Macroeconomics Are they successful? How do you judge their success? Macroeconomics How would you rank these countries? USA China Norway What were you basing your decisions on? Costa Rica The UK is an example of a mixed economy. In a mixed economy, the government intervenes to a degree. THE FOUR MAIN MACROECONOMIC POLICY OBJECTIVES The governments of most mixed economies have four main objectives in relation to the economy: • • • • to achieve economic growth to work towards full employment to limit inflation to ensure a ‘satisfactory’ balance of payments policy objective = a goal/desired outcome that a government (for instance) wants to achieve. Economic growth Economic growth is an increase in the capacity of an economy to produce goods and services, compared from one period of time to another. Economic growth is an objective because ceteris paribus it means improving living standards and greater economic welfare for citizens. Measured using GDP and when talking about growth it is usually recorded as a percentage Unemployment The percentage of people who are unable to find work, but are able and willing to work (Seeking work). ● Calculated using a few different measures, either claimant count or ILO measure often used in UK ● Recorded as % unemployed Inflation The general and persistent rise in prices over a period of time ● Calculated using RPI or CPI (basket of goods) ● Recorded as a percentage change ● Below 0% is deflation Balance of Payments The balance of payments (BOP) records all financial transactions made between consumers, businesses and the government in one country with others ● Inflows of foreign currency are counted as a positive entry (e.g. exports sold overseas) ● Outflows of foreign currency are counted as a negative entry (e.g. imported goods and services) Other objectives Environment Equality Innovation Public services Trade agreements Government budget... debt Which do you think is the most important out of these. Why do you think they’re seen as less important than the 4 main macroeconomic objectives? So how do we measure an economy? How do we measure whether the government is meeting its economic objectives? MACROECONOMIC INDICATORS WHAT ARE THE KEY MACROECONOMIC INDICATORS? • Measuring the macroeconomic performance of a country over time involves assessing various economic indicators that provide insights into the overall health and growth of the economy. • These indicators help policymakers, economists, and investors understand trends, identify potential issues, and formulate appropriate policies • The relative importance attached to each indicator can and does change over time. SELECTION OF KEY MACROECONOMIC INDICATORS Some key macroeconomic indicators include the following: • Growth of real GDP (national output) • Real GDP per capita • Annual rate of consumer price inflation • Unemployment rate (% of the labour force) • Balance of trade in goods and services • Government borrowing and national debt • Monetary policy interest rates • Labour productivity (GDP per person employed) MEASURING THE FOUR MAIN MACROECONOMIC POLICY OBJECTIVES Measuring Economic Growth GDP Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a period (quarterly or yearly) of time. The letter ‘Y’ can be used to represent GDP in economics GDP maps Look at the maps you have been given, they are all GDP but in slightly different forms, can you work out… 1. What each map is showing 2. Why it is important we understand which measurement of GDP we are looking at...use examples. 3. Which country has the most successful economy? Explain using reference to the data on the maps and highlight why you have prioritised certain points. Subtle differences... Being precise with your use of key terms is essential. It can also highlight great evaluation opportunities. Nominal GDP GDP evaluated at current market prices. It will include all of the changes in market prices that have occurred during the current year due to inflation or deflation Real GDP An inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given year. We usually use this measure as it shows the change in physical output. GDP Growth The percent rate of increase in real gross domestic product, or real GDP GDP per capita a measure of a country's economic output that accounts for its number of people. It divides the country's gross domestic product by its total population. 1949 1952 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 2015 2018 2021 Annual growth GROWTH OF REAL GDP FOR THE UK (1949-2022) 10% 5% 0% -5% -10% -15% 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 2015 2018 2021 Real GDP per capita in £s REAL GDP PER CAPITA FOR THE UK 35 000 30 000 25 000 20 000 15 000 10 000 5 000 Measuring Inflation Inflation How would you measure inflation? https://www.youtube.com/watch?v=rYf9TZp99Xw Inflation Inflation is measured using the Consumer Price Index (CPI) and the Retail Price Index (RPI). Both measure using a ‘basket’ of goods and services regularly used by consumers. The data is found using a family expenditure survey – the survey covers over 40,000 households in the UK The UK and Europe use CPI rather than RPI CPI/RPI A representative basket of goods and services used is compared over time. Weights are attached to each item - based on these items’ importance in people’s expenditure as measured by the family spending survey Each month government officials collect 120,000 separate price quotations in 141 locations of around 700 products Weights are multiplied by price changes - the weighted price changes are then totalled to calculate the inflation rate CPI/RPI The “shopping baskets‟ of items used in the Consumer Prices Index (CPI) are reviewed each year. Some items are taken out and some are added to make sure the CPI is up to date and representative of consumer spending patterns TASK: Read the article and write an explanation of why it is important that the ‘basket’ is regularly updated. CPI vs RPI Both RPI and CPI measure inflation. Both of them take a basket of goods – food, clothes, petrol etc. - comparing what they cost last year to what they cost now, and finding the proportional difference. But the CPI leaves the costs of your home out of the basket – so rises in mortgage payments, rents, and council tax, which in real life you pay, don’t get reflected in it. The RPI does take account of those costs. CPI vs RPI https://www.theweek.co.uk/87811/rpi-vs-cpi-inflationare-commuters-paying-the-price “RPI uses a formula known as "Carli" that doesn't account for changes in shopping behaviour if prices rise. It tracks inflation as having risen if a price drops and returns to its previous level, says the Financial Times. No other advanced economy uses a Carli-based measure of inflation. RPI is believed to overstate inflation by an average of 0.8%. It lost its National Statistics kitemark six years ago. CPI uses the more robust “Jevons” formula that is used in most developed economies. It has been used as the main benchmark for UK inflation since 2003. RPI generally runs at about 1% higher than CPI” The government still uses RPI for some things… read and explain why this matters! Limitations of CPI Few households are average – the published figure for inflation is rarely the actual rate of inflation experienced by different people ● The CPI is not fully representative - it will be inaccurate for the ‘non-typical’ household, e.g. 14% of the CPI index is devoted to motoring costs - inapplicable for non-car owners. ● Spending patterns: e.g. Single people have different spending patterns from households that have one or more children ● Changing quality of goods and services: Although the price of a good or service may rise, this may also be accompanied by improvements in quality / performance of the product ● New products: The CPI is slow to respond to new products and services – the CPI basket is changed each year but only a few items fall out / come in ANNUAL RATE OF UK CONSUMER PRICE INFLATION Inflation rate forecast 10% 8% 6% 4% 2% 0% MACROECONOMIC INDICATORS 2023 is a forecast published in April 2023. Source: OBR TUTOR2U.NET/ECONOMICS INFLATION RATES OF THE G7 COUNTRIES France Germany Italy United Kingdom United States Japan 10,0% 8,0% 6,0% 4,0% 2,0% 0,0% MACROECONOMIC INDICATORS 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 -2,0% 2000 CPI change compared to last year Canada TUTOR2U.NET/ECONOMICS Measuring Unemployment Unemployment Definition? The percentage of people who are unable to find work, but are able and willing to work (Seeking work). Why do we talk about unemployment rather than employment? Unemployment Why do we talk about unemployment rather than employment? 2 Measures... Labour force survey Counts those who are without any kind of job including part time work but who have looked for work in the past month and are able to start work immediately. The figure includes those people who have found a job and are waiting to start in the next two weeks. Claimant count Includes people who are eligible to claim the Job Seeker's Allowance (JSA). The data is seasonally adjusted to take into account predictable seasonal changes in the demand for labour. Comparisons Read through the information table on LFS and CC. Make a list of the positives and negatives of each measures ● This might be about recording unemployment… What does one include that the other doesn’t? ● Which is the most accurate measure? ● Which is the most useful for the government? Comparisons like this often come up in exams Differences LFS unemployed but not claimant count unemployed The following groups would not be entitled to claim unemployment related benefits but could be looking for and available to start work: ● people whose partner works more than 24 hours a week ● young people under 18 who are looking for work but do not take up the offer of a Youth Training place ● students looking for part‐time work or vacation work ● people who have left their job voluntarily ● people with savings of over £16,000. Differences Claimant count unemployed but not LFS unemployed Similarly, those out of work, capable of, available for and actively seeking work may be eligible to claim JSA but not appear in the LFS measure of unemployment if that person: ● when interviewed for the survey, states that they are not seeking, or are not available to start work ● has done at least one hour’s paid work in the week (but less than the 16 hour average as required to be eligible for JSA, depending on income) prior to interview or has a job they are temporarily away from e.g. on holiday ● is on a Government training scheme e.g. Steps 2 Success. Knowledge test Use your first sheet to help work it out Knowledge test Mar 71 Mar 73 Mar 75 Mar 77 Mar 79 Mar 81 Mar 83 Mar 85 Mar 87 Mar 89 Mar 91 Mar 93 Mar 95 Mar 97 Mar 99 Mar 01 Mar 03 Mar 05 Mar 07 Mar 09 Mar 11 Mar 13 Mar 15 Mar 17 Mar 19 Mar 21 Mar 23 Unemployment rate UK UNEMPLOYMENT RATE (% OF LABOUR FORCE) 12,5% 11,5% 10,5% 9,5% 8,5% 7,5% 6,5% 5,5% 4,5% 3,5% 2,5% MACROECONOMIC INDICATORS TUTOR2U.NET/ECONOMICS UNEMPLOYMENT RATE OF THE G7 COUNTRIES Canada France Germany Italy Japan United Kingdom United States 14% Unemployment rate 12% 10% 8% 6% 4% 2% MACROECONOMIC INDICATORS 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0% TUTOR2U.NET/ECONOMICS Measuring Balance of Payments Global trade Describe the trends... Interactive map Balance of Payments Definition? The balance of payments measures all of the currency flows into and out of an economy in a particular time period (usually a month, quarter or year). Balance of Payments The balance of payments (BOP) records all financial transactions made between consumers, businesses and the government in one country with other nations Inflows of foreign currency are counted as a positive entry (e.g. exports sold overseas) Outflows of foreign currency are counted as a negative entry (e.g. imported goods and services) Surplus or Deficit? Imports > Exports = Current account deficit (there’s more money leaving the country than coming in) Exports > Imports = Current account surplus (the money coming into the country exceeds that leaving) Research to find what each includes 4 Elements There are 4 elements of the Balance of Payments on the current account (there are other accounts on the balance of payments, but at this stage we just focus on the current account) Trade Balance in Goods (visibles) Trade Balance in Services (invisibles) Primary income Secondary income ➔ ➔ Finished manufactured goods, components, raw materials Energy products, Capital technology ➔ Banking, Insurance, Consultancy ➔ Tourism, Transport, Logistics ➔ Shipping, Education, Health ➔ ➔ Incomes from interest, profits and dividends generated from foreign investment Migrant remittances ➔ ➔ Spending on military aid Overseas development aid 4 Elements - Example If a country is running a current account deficit, there is a net outflow of demand and income from the circular flow. Item of the Balance of Payments Net balance $ Billion Current Account (1 ) Balance of trade in goods -25 (2) Balance of trade in services +10 (3) Net primary income +8 (4) Net secondary income -12 Sum of 1+2+3+4 = Current account balance -19 Discuss - Application Decide whether the following countries operate at a surplus or a deficit on the current account of the balance of payments ...and how much? (% of GDP) What is guiding your decisions? Saudi Arabia Afghanistan Norway Find the current figures online to see if you were right... Breaking it down The UK’s current account deficit has widened in recent years. The UK recorded the largest deficit in 2018 among other G7 economies at 4.3% of GDP. The UK, Canada and United States are the largest current account deficit holders amongst other advanced economies. In contrast, Germany holds the largest current account surplus at 7.3% of GDP, which is followed by Japan at 3.5%. Breaking down the BOP can be a helpful way to build on your analysis Inconsistency? Trade is not always as simple as it first appears... Read through the article and list the possible reasons for problems with the recorded trade statistics UK TRADE BALANCE IN GOODS AND SERVICES Services trade balance Overall trade balance 15 000 10 000 5 000 0 -5 000 -10 000 -15 000 -20 000 -25 000 -30 000 Jan 97 Feb 98 Mar 99 Apr 00 May 01 Jun 02 Jul 03 Aug 04 Sep 05 Oct 06 Nov 07 Dec 08 Jan 10 Feb 11 Mar 12 Apr 13 May 14 Jun 15 Jul 16 Aug 17 Sep 18 Oct 19 Nov 20 Dec 21 Jan 23 Balance of trade £ million Goods trade balance MACROECONOMIC INDICATORS TUTOR2U.NET/ECONOMICS UK GOVERNMENT SPENDING AND TAX REVENUES Revenue / Spending in billion pounds Revenue Spending 1 300 1 200 1 100 1 000 900 800 700 2018 2019 2020 2021 2022 2023* 2024* 2025* 2026* 2027* 2028* MACROECONOMIC INDICATORS TUTOR2U.NET/ECONOMICS Measuring Economic Growth - Change in national output (goods and services produced) over a period of time. Measured in two ways: Volume (quantity) of goods/services in one year or Value (£billions) of goods/services in one year. Usually measured by value – known as GDP. Measuring Economic Growth Measured as a percentage – the rate is the speed at which national output grows over time. • Long periods of growth = “Boom” • Negative growth in two consecutive quarters = “Recession”. A long recession = “Slump” • “Economic depression” = sustained economic downturn, usually lasting several years. Measuring Economic Growth To measure the rate of economic growth: 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐺𝐷𝑃 (£𝑏𝑖𝑙𝑙𝑖𝑜𝑛𝑠) × 100 𝑂𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝐺𝐷𝑃 (£𝑏𝑖𝑙𝑙𝑖𝑜𝑛𝑠) Measuring Economic Growth Some GDP growth maybe due to inflation – Nominal GDP is GDP not adjusted for inflation. This can be misleading, implies GDP is higher than it actually is. So Real GDP is where the effect of inflation is removed. E.g. 4% increase in nominal GDP when inflation is 3% means real GDP rose by 1%. Measuring Economic Growth GDP gives an indication on the country’s standard of living by finding GDP per capita (person) 𝑇𝑜𝑡𝑎𝑙 𝐺𝐷𝑃 = 𝐺𝐷𝑃 𝑝𝑒𝑟 𝑐𝑎𝑝𝑖𝑡𝑎 𝑃𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛 𝑆𝑖𝑧𝑒 Higher the GDP per capita, higher the standard of living Measuring Economic Growth GNI and GNP (Gross National Income, Product) compare living standards across countries. GNI = GDP plus net income from abroad GNP = Total output of citizens of a country, whether or not they are resident. Measuring Economic Growth Purchasing Power Parities (PPP): Used in comparison of living standards. Exchange rates may not reflect the true worth of currencies so can affect GDP comparisons. Purchasing Power is the real value of money (what you can actually buy). E.g. In a less developed country (Malawi, for example) $1 will buy you more goods than in a developed country (e.g. Canada). Measuring Economic Growth Purchasing Power Parities (PPP): Using PPP involves adjusting GDP per capita to account for differences in purchasing power, expressed in US Dollars. Paints a more accurate and easier comparison. Measuring Economic Growth GDP/GDP per capita used to compere economic performance such that: High GDP = suggests economic performance if strong High GDP per capita = suggests high standard of living Measuring Economic Growth Limitations of GDP comparisons: • • Extent of hidden economy – activity not appearing in official figures Public spending – some govt. provide more benefits (unemployment, health care etc.) – countries may have comparable GDP per capita but one country may spend more per person on benefits to improve their standard of living. Measuring Economic Growth Limitations of GDP comparisons: • • Extent of income inequality - distribution of income between rich and poor may vary massively country to country. Other differences – number of hours worked per week, working conditions, damage to the environment, spending needs (heating cold climate country to achieve same comfort in warmer countries) Index Numbers Changes in real GDP are usually expressed using index numbers. They make comparisons over a period of time. First year is the ‘base year’, index = 100. Later years, an increase causes the number to go above 100 (e.g. 3% rise over one year means index rose to ‘103’). Whereas a 2% fall means it would be 98 in Year 2. An index number of 108 in year 4 means an 8% rise from the base year. Measuring Economic Growth Quick homework task: Search up/research about the ‘Big Mac Index’ and why it could be a (albeit light-hearted) method for measuring a PPP exchange rate. Measuring Inflation Inflation = sustained rise in average price of goods and services over time. It also can be seen as a fall in the value of money (£10 buys you less today than it did a year ago), the purchasing power of money has fallen Measuring Inflation Inflation is positive, negative or 0. 1) 2) 3) 4) Inflation is positive when average price of goods/services is rising Deflation (or negative inflation) is when average price is falling Hyperinflation is when prices rise extremely quickly and money loses value Disinflation is when the rate is slowing down but still rising (i.e. 6% in June, 4% in July) Measuring Inflation Two main measures: Retail Price Index (RPI) – two surveys Living Costs and Food survey (to find out what people spend money on) and proportion of income (20% on transport = 20% weighting is given) ‘Basket of goods’ measures price of 700ish goods/services. Price changes in the basket are multiplied by the weighting, then converted to index number Measuring Inflation Two main measures: Consumer Price Index Similar to RPI but: 1) Mortgage interest payments + council tax excluded 2) Slightly different formula 3) Larger population sample than RPI Measuring Inflation CPI tends to be lower than RPI – exception is when interest rates are very low. Other countries use similar methods to CPI, so useful for international comparison Measuring Inflation Limitations 1) RPI excludes households in the top 4%, CPI covers a broader range but excludes the things mentioned previously 2) Information given by the Living Costs and Food Survey can be inaccurate 3) Basket only changes once per year, so can miss short-term changes in spending patterns. Measuring Inflation RPI/CPI used to help determine wages and state benefits 1) 2) 3) Employes + trade unions use them in wage negotiations Government uses to decide on state pension increases and welfare benefits Some benefits are index linked – rise automatically by the same percentage as the chosen index Measuring Inflation International competitiveness If CPI is higher in the UK than countries we trade with, then UK goods become less price competitive as they cost more! Exports therefore fall. Imports are now relatively cheaper by domestic inflation, and hence increase Measuring Unemployment Defining: 1) 2) Number of people looking for a job but cannot find one Rate of unemployment is number as a percentage of the labour force Rate of unemployment is used to compare across countries (due to population difference) Measuring Unemployment The Claimant Count Number of people claiming unemployment benefits from government. Includes : Job Seeker’s Allowance (JSA), Universal Credit and other smaller groups Measuring Unemployment Advantages include: - Data easy to obtain, count people claiming benefits - Little/no cost in collecting data is recorded when applied for. Disadvantages include: - Data can be manipulated by governments to make it seem smaller (e.g. raise school leaving age to 19) to reduce those able to claim. - Excludes people looking for work but not able to claim (or choose not to claim) benefits. Measuring Unemployment The Labour Force Survey International Labour Organistation (ILO) uses a population sample. Asks a representation of the population and added up to produce the ILO unemployment count. Measuring Unemployment Advantages include: - Thought to be more accurate than Claimant Count - Internationally agreed measure and therefore easy to compare across countries Disadvantages include: - Expensive to collect and time-consuming - Sample may be unrepresentative of the whole population and therefore inaccurate Measuring Unemployment The Labour Force Survey tends to be higher than the claimant count as groups of people are excluded from the latter. For example, you may not be able to claim if you have a high earning spouse, or have too much money in savings. Measuring Unemployment Unemployment is a cost to the whole economy. Governments wish to keep track because: 1) High unemployment = suggests economy is performing badly 2) Unemployment leads to lower income and less spending. Companies sell fewer goods, or cut prices = less profit. 3) Means unused labour in economy, so fewer goods/services are produced. 4) Government has extra costs, such as benefits, and less revenue as less tax is paid. Measuring Balance of Payments BoP refers to International Flows of money Records the flow of money out (pay for imports) and the flow of money into a country (payments from exports) Value of exports/imports, not the volume. So if prices change but volume remains the same, then the value will change. Measuring Balance of Payments Four sections in the Current Account Records the international exchange of goods and services: 1) Trade in goods (visible trade) – goods are either visible imports or visible exports (cars, computers, food) 2) Trade in services (invisible trade) – such as tourism, insurance, transport 3) International flows of income earned as salaries, interest, profit and dividends. (interest on account held in foreign country) 4) Transfers of money from one person/government to another (foreign aid, family member in another country) Measuring Balance of Payments The Balance of Payments is not always balance. If money in exceeds money flowing out, there is a surplus. If money out exceeds money flowing in, there is a deficit. Recently the UK has had a deficit in the BoP. - Usually has a surplus in invisible trade - But a large deficit in visible trade Measuring Balance of Payments A deficit isn’t necessarily a bad thing – but it does imply that the country is uncompetitive Governments want to avoid a large, long term deficit. Can cause bigger problems, such as job losses. Measuring Balance of Payments For each of the items below, identify where it would appear in the current account of the balance of payments and whether it is a flow into or out of the UK: Item 1 : A British car company increases its sales in the Far East Item 2 : Dividends from shares in an American company paid to a British shareholder Item 3 : A British family holidaying in Spain who pay for a taxi in Madrid. 1) What are the four main macroeconomic indicators? 2) What is the difference between nominal and real GDP output and why is it important? 3) What is meant by purchasing power parity? When is it used and why is it important? 4) What can index numbers be used to show? 5) In what two ways can inflation be defined? 6) Describe what happens to prices in: a) Negative inflation b) Hyperinflation c) Disinflation 7) In what ways is RPI different from CPI? 8) Give two negative effects unemployment has on an economy. Y12 Macroeconomics Short run policy objectives Review starter Write a definition for the following without looking at your notes 1. Balance of Payments 2. Inflation 3. Economic growth 4. Unemployment Ext: Can you remember the real or target figures for these objectives? Forgetting curve for newly learned information Key terms Policy Conflict When two policy objectives cannot both be achieved at the same time: the better the performance in achieving one objective, the worse the performance in achieving another. You won’t need to define these terms but using them is a very good way to construct arguments in essays. Trade-offs Although it may be impossible to achieve two desirable objectives at the same time, e.g. zero inflation and full employment, policy makers may be able to choose an acceptable combination lying between the extremes, e.g. 2% inflation and 4% unemployment Seeking balance Because of conflicts between actions to change the objectives trade-offs must be made to seek a desirable overall balance. The importance attached to each objective is not static. It changes over time due to a number of reasons… ● Stage of development of that country ● Global economic conditions ● Sentiment about the economy at that time ● ‘Hot topics’ in the media ● Experience of other countries ● Political stability / Different political parties Policy Conflicts Four significant conflicts between policy objectives: 1) Full employment and economic growth vs satisfactory balance of payments or exchange rate 2) Full employment and economic growth vs control of inflation 3) Economic growth vs greater income equality 4) Current living standards vs future living standards Finding the conflict Good reasoning/justification is often the difference between top grades and lower grades Create a table like the one below. Explain why there is a conflict in as much detail as possible. Objective 1 ← Justification of conflict → Objective 2 Full employment and economic growth Satisfactory balance of payments or exchange rate Full employment and economics growth Control of inflation Economic growth Income equality Objective 1 ← Justification of conflict → Objective 2 Full employment and economic growth Satisfactory balance of payments or exchange rate Full employment and economic growth Control of inflation Economic growth Income equality Current living standards Future living standards Economic growth Environment Economic growth Government budget deficit Harmony? It’s important to remember that there is not always a conflict or trade off... Some economists would suggest that there are not as many trade-offs when thinking about the long run, it is often our short sightedness that makes them into more significant conflicts. ‘Right’ policies Not all objectives conflict. Some economists believe that with the right policies, conflicts do not occur in the long run; they are compatible. Most agree however that conflicts and trade-offs occur in the economic short run. Pro-free-market economists (those who dislike government intervention) argue that, if appropriate supply-side policies are implemented, the main objectives of macroeconomic policy are compatible in the long run and do not conflict. Exam skills today AO1: Demonstrate knowledge of terms/concepts and theories/models to show an understanding of the behaviour of economic agents and how they are affected by and respond to economic issues. AO2: Apply knowledge and understanding to various economic contexts to show how economic agents are affected by and respond to economic issues. AO3: Analyse issues within economics, showing an understanding of their impact on economic agents. AO4: Evaluate economic arguments and use qualitative and quantitative evidence to support informed judgements relating to economic issues.