Enron & WorldCom Scandals: Auditing Ethics Case Analysis

advertisement

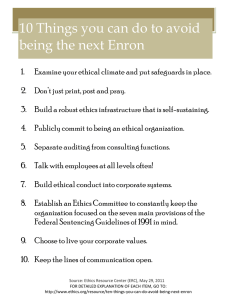

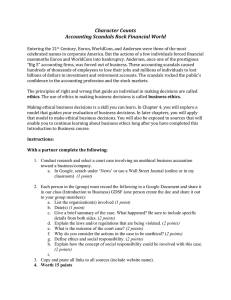

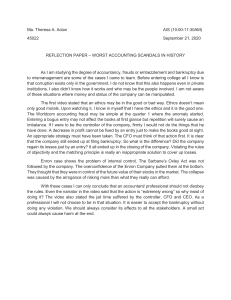

Name Subject : Nornanifa A. Cosign Date : Auditing and Assurance Principle Section : 08/31/2023 : Accy3 The Enron and WorldCom Scandal and Its Impact on Auditing, Ethics, and Our Role as Auditors: A Case Analysis ENRON CORPORATION The Enron Corporation, once a prominent player in the energy sector, faced a catastrophic collapse in December 2001, unveiling a complex network of financial fraud, deceptive accounting practices, and ethical misconduct. Founded in 1985, Enron quickly soared to become a global energy giant, renowned for innovative financial structures such as Special Purpose Entities (SPEs) that were used to obscure debt and losses, creating a deceptive façade of financial stability. Several contributing factors led to Enron's downfall. The company engaged in aggressive accounting practices that distorted profits through the misuse of mark-to-market accounting. This approach projected future earnings based on estimated values of long-term contracts, allowing Enron to artificially inflate reported revenues. Ethical concerns came to the forefront as senior executives, including CEO Jeffrey Skilling and CFO Andrew Fastow, engaged in unethical practices like conflicts of interest and self-serving transactions. This revealed a corporate culture driven by short-term financial gains that paid little heed to ethical considerations. The impact of the Enron scandal reverberated through the auditing profession and ethical standards in the corporate realm. The external auditing firm, Arthur Andersen, failed to exhibit the necessary professional skepticism, enabling the fraudulent activities to go unnoticed. Consequently, trust in auditors' capacity to offer unbiased evaluations of a company's financial health was severely compromised. The aftermath prompted regulatory changes, culminating in the Sarbanes-Oxley Act, which aimed to enhance financial reporting accuracy and reinforce corporate accountability. Personally, the Enron scandal has reinforced my commitment to upholding the highest standards of ethics and professional conduct. It underscores the critical importance of maintaining independence, exercising professional skepticism, and thoroughly investigating any red flags or inconsistencies. The Enron case has also sharpened my focus on the need for clear communication between auditors, company management, and stakeholders. By fostering an environment of open dialogue, we can better identify potential issues and address them proactively. As future accountant or auditors, the Enron case serves as a powerful reminder of our responsibilities and the potential consequences of negligence that must be instilled in our mind and heart. WORLDCOM The WorldCom scandal, another immense corporate disaster as well, unfolded in the early 2000s, revealing a complex web of financial deceit, unethical actions, and a profound erosion of trust. WorldCom, previously a giant in telecommunications, was established in 1983 and expanded rapidly through acquisitions. Yet, beneath its outward success, lay an intricate network of deception. WorldCom orchestrated a massive accounting fraud, artificially inflating earnings by categorizing regular expenses as profits. This violated Generally Accepted Accounting Principles (GAAP), distorting its financial state. CEO Bernard Ebbers and senior executives led these fraudulent activities, disregarding ethics and laws. The organization's leadership turned a blind eye to pervasive unethical behavior. The absence of effective corporate governance also facilitated the ongoing fraud. The board of directors failed to oversee properly, enabling continued manipulation of financial data. This negligence underscores how unethical practices can thrive when oversight is lacking. On a personal level, the WorldCom scandal has reinforced my commitment to ethical conduct and the unwavering pursuit of truth. It reminds me again that our work as auditors extends beyond numbers; we are the gatekeepers of financial integrity, entrusted with safeguarding the interests of stakeholders and the public. This case just like in the previous one highlights the need for auditors to possess a deep sense of professional skepticism. It prompts us to question assumptions, delve into the details, and challenge financial information that may appear too good to be true. In conclusion, the Enron and WorldCom scandals stand as a cautionary tale that continues to shape the way auditors approach their work. By learning from the mistakes of the past and emphasizing ethics, transparency, and diligent auditing practices, we can contribute to a more trustworthy and resilient financial landscape. Lastly, embracing our inherent imperfections as humans, we wholeheartedly recognize our missteps and have earnestly sought to comprehend the nuances within our vocation. Thus, it becomes not only imperative to exhibit professionalism, but to also exude the compassion and conscientiousness inherent in our shared human experience.