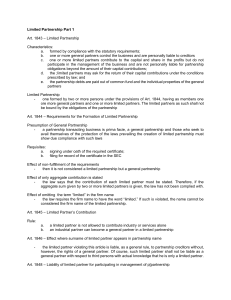

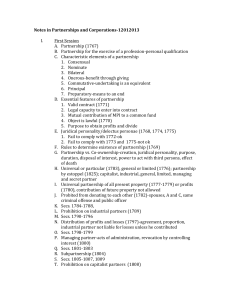

[Type text] [Type text] PAGE 297 [Type text] UP LAW BOC AGENCY AND PARTNERSHIP PARTNERSHIP Contract of Partnership DEFINITION By the contract of partnership: (1) Two or more persons; (2) Bind themselves to contribute money, property, or industry to a common fund; (3) With the intention of dividing the profits among themselves [Art. 1767] (1) Those who are prohibited from giving each other any donation or advantage cannot enter into a universal partnership [Art. 1782]; (2) A corporation cannot enter into a partnership in the absence of express authorization by statute or charter. Although a corporation cannot enter into a partnership contract, it may, however, engage in a joint venture with others [Auerbach vs. Sanitary Wares Manufacturing Corp (1989)]. On the other hand, there is no prohibition against a partnership being a partner in another partnership [De Leon (2010)] Article 1767 defines partnership from the viewpoint of a contract. From the contract arises the partnership relation [De Leon (2010)] OBJECT ESSENTIAL FEATURES OBJECT OF UNIVERSAL PARTNERSHIP (1) There must be a valid contract; (2) The parties must have legal capacity; (3) There must be a mutual contribution of money, property, or industry to a common fund; (4) The object must be lawful; (5) The primary purpose must be to obtain profits and to divide the same among the parties; (6) The partnership has a juridical personality separate from individual partners [Art. 1768]. CIVIL LAW A universal partnership may refer to: (1) All present property : (a) The partners contribute all the property which belongs to them to a common fund, with the intention of dividing the same among themselves, as well as the profits they may acquire therewith [Art. 1778]. (b) The property contributed includes all those belonging to the partners at the time of the constitution of the partnership. (c) A stipulation for the common enjoyment of any other profits may also be made. However, the property which the partners may acquire subsequently by inheritance, legacy or donation cannot be included in such stipulation, except the fruits thereof [Art. 1779]. (2) All the profits: (a) It comprises all that the partners may acquire by their industry or work during the existence of the partnership. As such, any immovable property or an interest therein may be acquired in the partnership name. Title so acquired can be conveyed only in the partnership name [Art. 1774]. PARTIES General rule: Any person capacitated to contract may enter into a contract of partnership. As such, the following persons cannot enter into a contract of partnership: (1) Those suffering from civil interdiction; (2) Minors; (3) Insane or demented persons; (4) Deaf-mutes who do not know how to write; (5) Incompetents who are under guardianship. (b) Only the usufruct over the property of the partners passes to the partnership [Art. 1780]. Exceptions : The capacity of the following persons to enter into a contract of partnership, though capacitated to contract generally, are limited: PAGE 298 Art. 1781. When the articles of universal partnership does not specify its nature (all present property or all the profits), the partnership will be considered as one only of all the profits. UP LAW BOC AGENCY AND PARTNERSHIP OBJECT OF PARTICULAR PARTNERSHIP CIVIL LAW DURATION COMMENCEMENT Art. 1783. A particular partnership has for its object determinate things, their use or fruits, or a specific undertaking, or the exercise of a profession or vocation. Art. 1784. A partnership begins from the moment of the execution of the contract, unless otherwise stipulated. EFFECT OF UNLAWFUL OBJECT TERM If the partnership has an unlawful object or purpose: (1) The contract is void ab initio [Art. 1409, par. 1]. (2) Once dissolved by judicial decree: (a) The profits shall be confiscated by favor of the State; (b) The instruments or tools and proceeds of the crime shall also be forfeited in favor of the State [Art. 1770]. (3) The contributions of partners shall not be confiscated unless they are instruments or tools of the crime [De Leon (2010)]. As to period, a partnership may either be: (1) For a fixed term or particular undertaking; or (2) At will, the formation and dissolution of which depend on the mutual desire and consent of the parties. Any one of the partners may, at his sole pleasure, dictate the dissolution of the partnership, even in bad faith, subject to liability for damages [Ortega v. CA (1995)]. EXTENSION A partnership term may be extended by: (1) Express renewal; or (2) Implied renewal, when these requisites concur: (a) The partnership is for a fixed term or particular undertaking; (b) It is continued after the termination of the fixed term or particular undertaking without any express agreement [Art. 1785]. FORM General rule: The contract may be constituted in any form [Art. 1771]. Exceptions: (1) Where immovable property or real rights are contributed: (a) The contract must appear in a public instrument; and (b) Attached to such instrument must be an inventory, signed by the parties, of the property contributed [Arts. 1771 and 1773]; (2) Where the capital is at least P3,000, in money or property: (a) The contract must appear in a public instrument; and (b) It must be recorded in the Office of the Securities and Exchange Commission (SEC). RULES TO DETERMINE EXISTENCE When the intent of the parties is clear, such intent shall govern. When it does not clearly appear, the following rules apply: (1) Persons who are not partners to each other are not partners as to third persons, subject to the provisions on partnership by estoppel. (2) Co-ownership or co-possession does not of itself establish a partnership, even when there is sharing of profits in the use of the property. (3) Sharing of gross returns does not of itself establish a partnership, even when the parties have joint or common interest in any property from which the returns are derived. As to the second, failure to comply with these requirements, however, does not affect the liability of the partnership and the partners to third persons [Arts. 1768 and 1772]. PAGE 299 UP LAW BOC AGENCY AND PARTNERSHIP (4) The receipt by a person of a share in the profits of a business is prima facie evidence that he is a partner. As to the fourth, no such inference is drawn if the profits are received in payment: (1) As a debt by installments or otherwise; (2) As wages of an employee of rent to a landlord; (3) As an annuity to a widow or representative of a deceased partner; (4) As interest on a loan, though the amount of payment vary with the profits of the business; (5) As the consideration for the sale of a goodwill of a business or other property by installments or otherwise [Art. 1769]. KINDS (1) As to the legality of its existence: (a) Partnership de jure is one which has complied with all the requisites for its lawful establishment; (b) Partnership de facto is one which failed to so comply. (2) As to its object: (a) Universal partnership: (i) Of all present property; (ii) Of profits; (b) Particular partnership. (3) As to its duration: (a) For a fixed term or particular undertaking; (b) At will. (4) As to the liability of the partners: (a) General partnership, consisting of general partners only, who are liable pro rata for partnership obligations with all their after exhaustion of partnership assets; (b) Limited partnership, includes, aside from general partner/s, limited partners, who are not personally liable for partnership obligations. (5) As to its publicity: (a) Secret partnership, where the existence of certain persons as partners is not made known by the partners; (b) Open or notorious partnership, the existence of which is made known to the public by the partners. PAGE 300 CIVIL LAW (6) As to its purpose: (a) Commercial or trading partnership, for transaction of business; (b) Professional or non-trading partnership, for the exercise of profession. A profession has been defined as “a group of men pursuing a learned art as a common calling in the spirit of public service – no less a public service because it may incidentally be a means of livelihood” [In the Matter of the Petition for Authority to Continue Use of Firm name “Sycip, Salazar, etc.”/“Ozaeta, Romulo, etc.” (1979)]. A professional partnership is a particular partnership [Art. 1783]. KINDS OF PARTNERS (1) Capitalist partner, whose contribution is money or property; (2) Industrial partner, contribution is only his industry; (3) General partner, whose liability to third persons extends to his separate property; (4) Limited partner, whose liability to third persons is limited to his capital contribution; (5) Managing partner, who was designated to manage the affairs or business of the partnership; (6) Liquidating partner, who takes charge of the winding up of partnership affairs; (7) Partner by estoppel, who is not really a partner but is liable as such for the protection of innocent third persons; (8) Continuing partner, who continues the business after dissolution of the partnership by admission of a new partner, or retirement, death or expulsion of existing partners; (9) Surviving partner, who remains a partner after dissolution by death of any partner; (10) Subpartner, who is not a member of the partnership but contracts with a partner with regard to the share of the latter in the partnership; (11) Ostensible partner, who takes active part in the business of the partnership and is known by the public; (12) Secret partner, who takes active part in the business, but is unknown to the third persons as a partner; UP LAW BOC AGENCY AND PARTNERSHIP (13) Silent partner, who does not take active part in the business, but may be known to be a partner by third persons; (14) Dormant partner, who does not take active part in the business and is not known or held out as a partner; (15) Original partner, who has been a partner since the constitution of the partnership; (16) Incoming partner, who is about to be taken as a member into an existing partnership; (17) Retiring partner, who is withdrawing from the partnership. Industrial partner CIVIL LAW PARTNERSHIP AND OTHER CONTRACTS DISTINGUISHED Partnership Operates with name and personality Capitalist partner Joint venture firm legal Operates without firm name and legal personality Generally relates to a continuing business of various transactions of a certain kind Usually limited to a single transaction Corporations may not enter into a partnership Corporations enter into ventures may joint Form of contribution Industry Money or property Under Philippine law, a joint venture is a form of partnership and should thus be governed by the laws of partnership [Auerbach vs. Sanitary Wares Manufacturing Corp. (1989)]. Share in profits Just and share equitable According to agreement; if none, in proportion to contribution Share in losses Exempted as to losses as between partners, but liable to third persons, without prejudice to reimbursement from capitalist partners According to agreement; if none, in the same proportion as the agreed share in profits; if none, in proportion to contribution Partnership Co-ownership Generally created by either express or implied contract Generally created by law and may exist even without a contract Has a separate juridical personality Has no separate juridical personality Generally, the purpose is to obtain profits The purpose is the common enjoyment of a thing or right Duration limitation no An agreement to keep a thing undivided for more than ten years is not allowed, but may be extended mutual between There is no mutual representation among co-owners Death or incapacity of a partner dissolves the partnership Death or incapacity of a co-owner does not dissolve the coownership A partner cannot dispose of his interest, so as to make the assignee a partner, without consent of others A co-owner can dispose of his share without consent of others Engagement in business Cannot engage in business for himself, unless the partnership expressly permits him to do so; should he do so without permission, the capitalist partners may: (1) exclude him from the firm; or (2) avail themselves of the benefits obtained in violation of the prohibition, with right to damages in either case [Art. 1789] Cannot engage, for his own account, in the same kind of business as that of the partnership, unless there is a stipulation to the contrary; should he do so, he shall bring to the common fund any profits accruing to him from his transactions and shall personally bear all the losses [Art. 1808] There is agency partners PAGE 301 has UP LAW BOC AGENCY AND PARTNERSHIP Partnership Corporation CIVIL LAW Partnership Conjugal Partnership of Gains Created by voluntary agreement of two or more partners of either sex Arises in case the spouses, of opposite sex, agree before marriage Distributes its profits to those who contributed capital to the business Governed agreement by Governed by law Can only be organized where there is a law authorizing its organization Has personality juridical Has juridical personality separate and distinct from its individual members Can only act through agents Composed of an aggregate of individuals Taxable as in a corporation Created by agreement Created by operation of law Involves at least two persons Except for corporation sole, requires at least five incorporators Personality commences from the moment of execution of the contract Personality commences from the issuance of certificate of incorporation Can exercise any power authorized by partners Can exercise only powers conferred by the Corporation Code or by its articles of incorporation, and such as are necessary or incidental to the exercise of such powers When management is not agreed upon, every partner may act for the partnership Management is vested in the board of directors or trustees Partners are generally liable for partnership debts Stockholders are liable only to the extent of their shares A partner cannot dispose of his interest, so as to make the assignee a partner, without consent of others A stockholder has the right to transfer his shares without consent of others Duration limitation The term limit is 50 years, but may be extended has no May be dissolved at any time by one or all of the partners PAGE 302 juridical Commencement date may be stipulated Commencement is on the date of the celebration of the marriage and any stipulation to the contrary is void Share in profits may be stipulated; otherwise, in proportion to contribution Share in profits is equal Management shared by all partners, unless otherwise agreed upon Administration belongs to the spouses jointly, but decision of husband prevails in case of disagreement Partner can dispose of interest even without consent of others Spouse cannot dispose of interest during marriage, even with consent Partnership Association Has personality May only be dissolved with the consent of the state Has no personality juridical Has no personality juridical Organized for profit Not always organized for profit Capital is contributed Capital is not contributed, although fees are collected from members The partnership is primarily liable; the partners are liable only subsidiarily The members are liable individually for debts which they authorized or ratified Share in profits may be stipulated; otherwise, in proportion to contribution Share in profits is equal UP LAW BOC AGENCY AND PARTNERSHIP (2) The majority of the capitalist partners are of the opinion that an additional contribution to the common fund would save the business; (3) The capitalist partner refuses deliberately (not because of financial inability) to contribute an additional share to the capital; and (4) There is no agreement that even in case of imminent loss of the business, the partners are not obliged to contribute. Rights and Obligations of the Partnership RIGHT TO CONTRIBUTION The partnership has a right to the contribution (or the partners are obliged to contribute). The money or property thus contributed, or their use or fruits, become the property of the partnership. CONTRIBUTION PROPERTY OF MONEY CIVIL LAW Any partner who refuses to contribute an additional share to the capital, except an industrial partner, to save the venture, shall be obliged to sell his interest to the other partners, unless there is an agreement to the contrary [Art. 1791]. OR With respect to contribution of property, a partner is obliged to: (1) To contribute, at the beginning of the partnership or at the stipulated time, the money, property or industry which he undertook to contribute; (2) In case a specific and determinate thing is to be contributed: (a) To warrant against eviction in the same manner as a vendor; and (b) To deliver to the partnership the fruits of the property promised to be contributed, from the time they should have been delivered, without need of demand [Art. 1786]; (3) In case a sum of money is to be contributed, or in case he took any amount from the partnership coffers, to indemnify the partnership for: (a) Interest; and (b) Damages, from the time he should have complied with his obligation, or from the time he converted the amount to his own use, respectively [Art. 1788]. CONTRIBUTION OF INDUSTRY An industrial partner is obliged to contribute his industry at the stipulated time. General rule: An industrial partner cannot engage in business for himself. Should he do so, the capitalist partners, as well as industrial partners [De Leon (2010)] may either: (1) Exclude him from the firm; or (2) Avail themselves of the benefit which he may have obtained. Exception: He may engage in business for himself when the partnership expressly permits him to do so [Art. 1789]. RIGHT TO APPLY PAYMENT RECEIVED TO PARTNERSHIP CREDIT AMOUNT OF CONTRIBUTION General rule: A partner authorized to manage, who collects a demandable sum owed to him in his own name from a person who also owes the partnership a demandable sum, is obliged to apply the sum collected to both credits pro rata, even if he issued a receipt for his own credit only. General rule: Partners are to contribute equal shares to the capital of the partnership. Exception: When there is an agreement to the contrary, the contribution shall follow such agreement [Art. 1790]. ADDITIONAL CAPITAL CONTRIBUTION Requisites: (1) There exist at least two debts, one where the collecting partner is creditor, and the other, where the partnership is the creditor; Requisites: (1) There is an imminent loss of the business of the partnership; PAGE 303 UP LAW BOC AGENCY AND PARTNERSHIP (2) Both debts are demandable; and (3) The partner who collects is authorized to manage and actually manages the partnership. Exceptions: (1) In case the receipt was issued for the account of the partnership credit only, however, the sum shall be applied to the partnership credit alone. (2) When the debtor declares, pursuant to Article 1252, at the time of making the payment, to which debt the sum must be applied, it shall be so applied [Art. 1792]. RIGHT TO RETURN OF CREDIT RECEIVED SUIT FOR DAMAGES Before a partner may sue another for alleged fraudulent management and resultant damages, liquidation must first be effected to determine the extent of the damage. Without liquidation of partnership affairs, a partner cannot claim damages [Soncuya v. De Luna (1939)]. In the absence of any stipulation to the contrary, every partner is an agent of the partnership for the purpose of its business. As such, it is responsible to every partner: (1) For amounts, and the corresponding interest from the time the expenses were made, which he may have disbursed on behalf of the partnership; (2) For obligations he may have contracted in good faith in the interest of the partnership business; and (3) For risks in consequence of the management of the partnership [Art. 1796]. This obligation exists even when he issued a receipt for his share only [Art. 1793]. Ratio: In this case, the debt becomes a bad debt. It would be unfair for the partner who already collected not to share in the loss of the other partners. INDEMNITY Exception : The court may equitably lessen the liability if, through his extraordinary efforts in other activities of the partnership, unusual profits were realized [Art. 1794]. Note, however, that there is still no compensation in this case. RESPONSIBILITY TO PARTNERS A partner, authorized to manage or not, who already received, in whole or in part, his share of a partnership credit, is obliged to bring to the partnership capital what he received when: (1) The other partners have not collected their shares; and (2) The partnership debtor has become insolvent. RIGHT TO DAMAGES CIVIL LAW Rights and Obligations of Partners Inter Se FOR RIGHT TO ASSOCIATE ANOTHER IN SHARE Every partner is responsible to the partnership for damages suffered by it through his fault. Every partner may associate another person with him in his share. The admission of the associate to the partnership, however, requires consent of all the other partners even if the partner having an associate is a managing partner [Art. 1804]. SET-OFF OF LIABILITY General rule: The liability for damages cannot be set-off or compensated by profits or benefits which the partner may have earned for the partnership by his industry. This arrangement refers to a contract of subpartnership, which is a partnership within a partnership, distinct and separate from the main partnership. It is considered a modification of the original contract [De Leon (2010)]. Ratio: The partner has the obligation to secure the benefits for the partnership. As such, the requirement for compensation, that the partner be both a creditor and a debtor of the partnership at the same time, is not complied with [Art. 1278; De Leon (2010)]. PAGE 304 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW PROPERTY AND CAPITAL DISTINGUISHED RIGHT TO INSPECT PARTNERSHIP BOOKS Partnership capital The partnership books shall be kept: (1) At a place agreed upon by the partners; (2) When there is no such agreement, at the principal place of business of the partnership. Every partner shall, at any reasonable hour, have access to and may inspect and copy any of them. Any reasonable hour means reasonable hours on business days throughout the year [Pardo v. Lumber Co. (1925)]. Partnership property With constant value Value varies with market conditions Includes only actually contributed and promised capital Includes the contributions and property acquired by the partnership OWNERSHIP PROPERTIES OF CERTAIN (1) The ownership of property used by the partnership depends on the intention of the parties, which may be drawn from an express agreement or their conduct. (a) A partner may allow the property to be used by the partnership without transfer of ownership, contributing only the use or enjoyment thereof. (b) He may also hold title to partnership property, without acquiring ownership thereof [Art. 1819]. (2) Property acquired by a partner with partnership funds is presumed to be partnership property. (3) The same presumption also arises when the property is indicated in the partnership books as partnership asset. (4) Other factors may be considered to determine ownership of the property. RIGHT TO FORMAL ACCOUNT General rule: The right to a formal account of partnership affairs accrues only when the partnership is dissolved. Exceptions: In the special and unusual cases mentioned in Article 1809, formal accounting may be demanded by any partner even before dissolution: (1) If he is wrongfully excluded from the partnership business or possession of its property by his co-partners; (2) If the right exists under the terms of any agreement; (3) If, without his consent, a partner has derived profits from any transaction connected with the formation, conduct, or liquidation of the partnership or from any use of partnership property; (4) Whenever other circumstances render it just and reasonable [Art. 1809]. RIGHTS IN SPECIFIC PROPERTY (1) The partners have equal rights to possess partnership property for partnership purposes. (2) For other purposes, the consent of his partners is necessary. (3) If the partner is excluded, he may ask for: (a) Formal accounting [Art. 1809]; or (b) Dissolution by judicial decree [Art. 1831]. (4) A partner’s right in such property is not assignable, except when all the partners assign their rights in the same property; (5) The right is not subject to attachment or execution, except on claim against the partnership. In case of such attachment, the partners, or any of them, or the representatives of a deceased partner, PROPERTY RIGHTS OF PARTNERS IN GENERAL The property rights of a partner are: (1) Rights in specific partnership property; (2) Interest in the partnership; and (3) Right to participate in the management [Art. 1810]. PAGE 305 UP LAW BOC AGENCY AND PARTNERSHIP cannot claim any right under the homestead or exemption laws. (6) The right is not subject to legal support under Article 291 [Art. 1811]. CIVIL LAW court, may be purchased without causing dissolution: (1) With separate property, by one or more of the partners; or (2) With partnership property, by one or more of the partners, will consent of all, except the debtor partner [Art. 1814]. INTEREST IN PARTNERSHIP A partner’s interest in the partnership is his share of the profits and surplus [Art. 1812]. RIGHT TO PARTICIPATE MANAGEMENT ASSIGNMENT OF INTEREST Assignment by a partner of his whole interest in the partnership, of itself: (1) Does not dissolve the partnership; or (2) Does not entitle the assignee to: (a) Interfere in the management or administration of the partnership business or affairs; (b) Require information or account of partnership; or (c) Inspect the partnership books. IN Management of the partnership is primarily governed by the agreement of the partners in the articles of partnership. It may be stipulated that the partnership will be managed by: (1) All the partners; or (2) A number of partners appointed as managers, which may be appointed: (a) In the articles of partnership; or (b) After constitution of the partnership. POWERS OF A MANAGING PARTNER It merely entitles the assignee to: (1) Receive the profits to which the assigning partner was entitled; (2) In case of fraud in management, avail himself of the usual remedies; (3) In case of dissolution: (a) Receive his assignor’s interest; and (b) Require an accounting from the date only of the last account agreed to by all the partners [Art. 1813]. General rule: The partner designated as manager in the articles may execute all acts of administration despite opposition by the other partners. Exception: He cannot do so when he acts in bad faith. REVOCATION OF POWER MANAGING PARTNER BY The powers of the managing partner may be revoked: (1) If appointed in the articles of partnership, when: (a) There is just or lawful cause for revocation; and (b) The partners representing the controlling interest revoke such power. (2) If appointed after the constitution of the partnership, at any time and for any cause [Art. 1800]. INTEREST BY PERSONAL CREDITORS General rule: Partnership creditors are preferred over the personal creditors of the partners as regards partnership property. Exception: On due application by any judgment creditor of a partner, a competent court may: (1) Charge the interest of the partner for the satisfaction of the judgment debt; (2) Appoint a receiver of the share of the profits and of any other money due or to fall due to the partner; and (3) Make all other orders, directions, accounts and inquiries, which the debtor partner might have made, or which the circumstances may require. MANAGING PARTNERS BY TWO OR MORE When there are two or more managing partners appointed, without specification of their duties or without a stipulation on how each one will act: The interest charged may be redeemed before foreclosure or, in case of sale directed by the PAGE 306 UP LAW BOC AGENCY AND PARTNERSHIP (1) Each one may separately execute all acts of administration. (2) If any of them opposes the acts of the others, the decision of the majority prevails. (3) In case of a tie, the partners owning the controlling interest will decide [Art. 1801]. CIVIL LAW MUTUAL AGENCY In addition to the Article 1801, there is effectively a mutual agency in the following cases: (1) Partners can dispose of partnership property even when in partnership name [Art. 1819]. (2) An admission or representation made by any partner concerning partnership affairs is evidence against the partnership [Art. 1820]. (3) Notice to any partner of any matter relating to partnership affairs is notice to the partnership [Art. 1821]. (4) Wrongful act or omission of any partner acting for partnership affairs makes the partnership liable [Art. 1822]. (5) Partnership is bound to make good losses for wrongful acts or misapplications of partners [Art. 1823]. Requisites: (1) Two or more partners have been appointed as managers; (2) There is no specification of their respective duties; and (3) There is no stipulation that one of them shall not act without the consent of all the others. STIPULATION OF UNANIMITY Art. 1802. In case there is a stipulation that none of the managing partners shall act without the consent of others, the concurrence of all is necessary for the validity of the acts, and the absence or disability of one cannot be alleged, unless there is imminent danger of grave or irreparable injury to the partnership. RIGHT TO PROFITS AND OBLIGATIONS FOR LOSSES RULES FOR DISTRIBUTION PROFITS AND LOSSES OF The distribution of profits and losses shall be in accordance with the following rules: (1) They shall be distributed in conformity with the agreement. (2) If only the share in profits has been stipulated, the share in the losses shall be in the same proportion. (3) In the absence of any stipulation: (a) The share in the profits of the capitalist partners shall be in proportion to their contributions. (b) The losses shall be borne by the capitalist partners, also in proportion to the contributions. (c) The share of the industrial partners in the profits is that share as may be just and equitable. If he also contributed capital, he will receive a share of the profits in proportion to his contribution; and (d) The industrial partner, who did not contribute capital, is not liable for losses [Art. 1797]. MANAGEMENT WHEN MANNER NOT AGREED UPON When there is no agreement as to the manner of management, the following rules apply: (1) All the partners are considered agents (mutual agency). Whatever any one does alone binds the partnership, unless there is a timely opposition to the act, under Article 1801. (2) Any important alteration in the immovable property of the partnership, even if useful to the partnership, requires unanimity. If the alteration is necessary for the preservation of the property, however, consent of the others is not required [De Leon (2010)]. If the refusal is manifestly prejudicial to the partnership, court intervention may be sought [Art. 1803]. PAGE 307 UP LAW BOC AGENCY AND PARTNERSHIP EXCLUSION OF PARTNER FROM SHARE Obligations of the Partnership/Partners to Third Persons General rule: A stipulation excluding one or more partners from any share in the profits or losses is void [Art. 1799]. Exception: A stipulation exempting an industrial partner from losses is valid, since, if the partnership fails to realize profits, he can no longer withdraw his work or labor [De Leon (2010)]. OBLIGATION TO INFORMATION CIVIL LAW OBLIGATION TO OPERATE UNDER A FIRM NAME Art. 1815. Every partnership shall operate under a firm name, which may or may not include the name of one or more of the partners. RENDER Those who, not being members of the partnership, include their names in the firm name, shall be subject to the liability of a partner. Partners shall render on demand true and full information of all things affecting the partnership to: (1) Any partner; (2) The legal representative of any deceased partner; or (3) The legal representative of any partner under legal disability [Art. 1806]. General rule: The partners may adopt any firm name desired. Exceptions: (1) They cannot use a name which is “identical or deceptively or confusingly similar to an existing or corporation [or partnership] or to any other name already protected by law or is patently deceptive, confusing or contrary to existing laws” [Sec. 18, Corporation Code]. (2) Use of names of deceased partner in law firms is “permissible provided that the firm indicates in all its communications that said partner is deceased” [Rule 3.02, Code of Professional Responsibility]. OBLIGATION TO ACCOUNT AND ACT AS TRUSTEE Every partner must (1) account to the partnership for any benefit and (2) hold as trustee for it any profits derived by him without the consent of the other partners: (1) From any transaction connected with the formation, conduct, or liquidation of the partnership; or (2) From any use by him of its property [Art. 1807]. LIABILITY OF PARTNERS FOR PARTNERSHIP CONTRACTS The partnership is primarily liable for contracts entered into: (1) In its name and for its account; (2) Under its signature; and (3) By a person authorized to act for it. Upon exhaustion of its assets, all partners are liable pro rata with all their property. Any partner may enter into a separate obligation to perform a partnership contract [Art. 1816]. PAGE 308 UP LAW BOC AGENCY AND PARTNERSHIP NATURE OF INDIVIDUAL LIABILITY LIABILITY OF PARTNERS FOR PARTNERSHIP CONTRACTS SUBSIDIARY General rule: The partners are liable subsidiarily. It only arises upon exhaustion of partnership assets [Cia. Maritima v. Muñoz (1907)]. ACTS APPARENTLY FOR THE CARRYING ON OF USUAL BUSINESS Exceptions: (1) A third person who transacted with the partnership can hold the partners solidarily (rather than subsidiarily) liable for the whole obligation if the case falls under Articles 1822 or 1823 [Muñasque v. CA (1985)]. The provisions refer to wrongful acts or omission and misapplication of money or property by a partner in the ordinary course of business. (2) A person admitted as a partner into an existing partnership is liable for all the obligations of the partnership arising before his admission, except that his liability shall be satisfied only out of partnership property, unless there is a stipulation to the contrary [Art. 1826]. In other words, he is not personally liable. PRO RATA The partners are liable pro rata. This liability is not increased even when a partner: (1) Has left the country and the payment of his share of the liability cannot be enforced [CoPitco v. Yulo (1907)]; or (2) His liability is condoned by the creditor [Island Sales v. United Pioneers (1975)]. LIABILITY PARTNER OF AN CIVIL LAW General rule: Any act of a partner which is apparently for the carrying on of the usual business of the partnership binds the latter, including the execution of any instrument in the partnership name. Exception: The partnership is not bound when the following concur: (1) The partner has in fact no authority to act; and (2) The person with whom he deals has knowledge of such fact [Art. 1818, par. 1]. ACTS NOT APPARENTLY FOR CARRYING ON OF THE USUAL BUSINESS General rule: Acts of a partner which is not apparently for carrying on of the usual business does not bind the partnership. Exception: The partnership is bound if the other partners authorized him to do the act [Art. 1818, par. 2]. ACTS OF STRICT DOMINION General Rule: One or some of the partners have no authority to do the following acts of strict dominion: (1) Assign the partnership property in trust for creditors or on the assignee’s promise to pay the debts of the partnership; (2) Dispose of the goodwill of the business; (3) Do any other act which makes it impossible to carry on the ordinary business of the partnership; (4) Confess a judgment; (5) Enter into a compromise concerning a partnership claim or liability; (6) Submit a partnership claim or liability to arbitration; (7) Renounce a claim of the partnership. INDUSTRIAL An industrial partner, who is not liable for losses, is not exempt from this liability. However, he can recover the amount he has paid from the capitalist partners, unless there is a stipulation to the contrary [Cia. Maritima v. Muñoz (1907)]. STIPULATION AGAINST INDIVIDUAL LIABILITY Any stipulation against this liability is: (1) Void against third persons; but (2) Valid among the partners [Art. 1817]. Exceptions: They may do so if: (1) Authorized by all the partners; or (2) The other partners have abandoned the business [Art. 1818, par. 3]. PAGE 309 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW Where the title is in the names of all the partners, a conveyance executed by all of them passes all the rights to the property [Art. 1819, par. 5]. ACTS IN CONTRAVENTION OF A RESTRICTION Any act of a partner in contravention of a restriction on authority does not bind the partnership to persons having knowledge of the restriction [Art. 1818, par. 4]. LIABILITY OF PARTNERSHIP FOR ADMISSION BY A PARTNER CONVEYANCE OF PARTNERSHIP REAL PROPERTY An admission or representation by any partner may be used as evidence against the partnership when: (1) It concerns partnership affairs; (2) Such affairs are within the scope of his authority [Art. 1820]. TITLE IN PARTNERSHIP NAME Any partner may convey the real property in the name of the partnership. The partnership can recover it, except when: (1) The act of the partner binds the partnership, when he has authority to carry out the usual business of the partnership, under Article 1818, 1st par.; or (2) If not so authorized, the property has been conveyed by the grantee, or a person claiming under him, to a holder for value and without knowledge that the partner exceeded his authority [Art. 1819, par. 1]. LIABILITY OF PARTNERSHIP FOR WRONGFUL ACTS OF A PARTNER The partnership is solidarily liable with the partner who causes loss or injury to any person not a partner, or incurs any penalty through any wrongful act or omission: (1) In the ordinary course of the business of the partnership; or (2) Not in such ordinary course of business, but with the authority of his co-partners [Art. 1822]. A partner authorized to carry out the usual business may convey, in his own name, the equitable interest of the partnership [Art. 1819, par. 2]. LIABILITY OF THE PARTNERSHIP FOR MISAPPLICATION OF MONEY OR PROPERTY TITLE IN THE NAME OF OTHER PERSONS Where the title is in the name of one or more but not all the partners, and the record does not disclose the right of the partnership: (1) The partners having title may convey title. (2) The partnership may recover it when the partners conveying title have no authority to carry on the usual business of the partnership, unless the purchaser or his assignee is: (a) A holder for value; and (b) Without knowledge that the act exceeded authority [Art. 1819, par. 4]. The partnership is liable for losses suffered by a third person whose money or property was: (1) Received by a partner: (a) Acting within the scope of his apparent authority; and (b) Misapplied it; (2) Received by the partnership: (a) In the course of its business; and (b) Misapplied by any partner while it is in the custody of the partnership [Art. 1823]. Where the title is in the name of one or more or all the partners, or in a third person in trust for the partnership a partner authorized to carry on the usual business may convey equitable title in the partnership name or in his own name [Art. 1819, par. 4]. PAGE 310 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW consenting to the contract or representation. (3) When there are no such other persons, he is separately liable [Art. 1825, par. 1]. LIABILITY OF THE OTHER PARTNERS UNDER ART. 1822 AND 1823 All partners are solidarily liable with the partnership for its liabilities under Articles 1822 and 1823 [Art. 1824]. EFFECT ON EXISTING PARTNERSHIP OR OTHER PERSONS NOT ACTUAL PARTNERS This is without prejudice to the guilty partner being liable to the other partners. However, as far as third persons are concerned, the partnership is answerable [De Leon (2010)]. (1) When a person has been represented to be a partner (a) in an existing partnership, or (b) with one or more persons not actual partners, he is an agent of the persons consenting to such representation to bind them to the same extent and in the same manner as though he were a partner in fact, with respect to persons who rely upon the representation. (2) When all the members of the existing partnership consent to the representation, a partnership act or obligation results. (3) In all other cases, it is the joint act or obligation of the person acting and the persons consenting to the representation [Art. 1825, par. 2]. LIABILITY IN CASE OF PARTNERSHIP BY ESTOPPEL PARTNER BY ESTOPPEL A partner by estoppel is a person who, by words spoken or written or by conduct (1) represents himself as a partner or (2) consents to another representing him to anyone as a partner: (1) In an existing partnership; or (2) With one or more persons not actual partners [Art. 1825, par. 1]. NATURE OF LIABILITY LIABILITY OF A PARTNER BY ESTOPPEL Summarizing Article 1825, a partner by estoppel is liable in the following manner: (1) He is liable as though he were a partner when: (a) There is an existing partnership; (b) All the partners consented to the representation; and (c) A partnership liability results. (2) He is liable jointly and pro rata (as though he were a partner in fact) with those who consented to the representation when: (a) There is an existing partnership but not all the partners consented; or (b) There is no existing partnership and all those represented as partners consented to the representation. (3) He is liable separately when: (a) There is an existing partnership but none of the partners consented; or (b) There is no existing partnership and not all of those represented as partners consented to the representation. PERSONAL REPRESENTATION A partner by estoppel is liable to any such persons: (1) To whom such representation has been made; and (2) Who has, on the faith of such representation, given credit to the actual or apparent partnership [Art. 1825, par. 1]. PUBLIC REPRESENTATION If he has made such representation or consented to its being made in a public manner, whether the representation has or has not been (personally) made or communicated to such persons so giving credit by or with his knowledge, and: (1) Partnership liability results, he is liable as though he were an actual member of the partnership. (2) No partnership liability results, he is liable pro rata with the other persons, if any, so PAGE 311 UP LAW BOC AGENCY AND PARTNERSHIP LIABILITY OF AN INCOMING PARTNER CIVIL LAW Dissolution and Winding Up A person admitted as a partner is liable: (1) For obligations incurred subsequent to his admission as the other partners are liable; (2) For obligations incurred before his admission, but will be satisfied only out of the partnership property, unless otherwise stipulated that he fully assumes such obligations. CONCEPTS Dissolution is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on of the business. It is different from the winding-up of the business [Art. 1828]. It does not terminate the partnership, which continues until the winding up of partnership affairs is completed [Art. 1829]. Ratio: (1) The new partner partakes of the benefits of the partnership property and an already established business. (2) He has every means of obtaining full knowledge of the debts of the partnership and remedies that amply protect his interest [De Leon (2010)]. Winding up is the actual process of settling the partnership business or affairs after dissolution. It involves collection and distribution of partnership assets, payment of debts, and determination of the value of the interest of the partners in the partnership. NOTICE TO OR KNOWLEDGE OF THE PARTNERSHIP Termination is the point in time when all partnership affairs are completely wound up and finally settled. It signifies the end of the partnership life [De Leon (2010)]. The following operate as notice to or knowledge of the partnership: (1) Notice to any partner of any matter relating to partnership affairs; (2) Knowledge of the partner acting in the particular matter acquired while a partner; (3) Knowledge of the partner acting in the particular matter then present to his mind; or (4) Knowledge of any other partner who reasonably could and should have communicated it to the acting partner. CAUSES OF DISSOLUTION WITHOUT VIOLATION AGREEMENT OF THE (1) By the termination of the definite term or particular undertaking specified in the agreement; (2) By the express will of any partner, who must act in good faith, when no definite term or particular is specified. (3) By the express will of all the partners who have not assigned their interests or suffered them to be charged for their separate debts, either before or after the termination of any specified term or particular undertaking; (4) By the expulsion of any partner from the business bona fide in accordance with such a power conferred by the agreement between the partners [Art. 1830, par. 1]. These do not apply in case of fraud on the partnership committed by or with the consent of the partner [Art. 1821]. PAGE 312 UP LAW BOC AGENCY AND PARTNERSHIP If, after the expiration of the definite term or particular undertaking, the partners continue the partnership without making a new agreement, the firm becomes a partnership at will [Art. 1785]. BY DECREE OF A COURT A partner may apply for dissolution in court when: (1) A partner has been declared insane in any judicial proceeding or is shown to be of unsound mind; (2) A partner becomes in any other way incapable of performing his part of the partnership contract; (3) A partner has been guilty of such conduct as tends to affect prejudicially the carrying on of the business; (4) A partner willfully or persistently commits a breach of the partnership agreement, or otherwise so conducts himself in matters relating to the partnership business that it is not reasonably practicable to carry on the business in partnership with him; (5) The business of the partnership can only be carried on at a loss; (6) Other circumstances render a dissolution equitable. Any one of the partners may, at his sole pleasure, dictate a dissolution of the partnership at will. He must, however, act in good faith, not that the attendance of bad faith can prevent the dissolution of the partnership but that it can result in a liability for damages [Ortega v. CA (1995)]. IN CONTRAVENTION AGREEMENT OF THE Where not permit circumstances do CIVIL LAW dissolution under any other provision of Article 1830, it may also be dissolved by the express will of any partner at any time. Thus, even if there is a specified term, one partner can cause its dissolution by expressly withdrawing even before the expiration of the period, with or without justifiable cause. If the cause is not justified or no cause was given, the withdrawing partner is liable for damages but in no case can he be compelled to remain in the firm [Rojas v. Maglana (1990)]. A person who acquires the interest of a partner may likewise apply: (1) After the termination of the specified term or particular undertaking; (2) At any time if the partnership was a partnership at will when the interest was assigned or when the charging order was issued BY OPERATION OF LAW (1) By any event which makes it unlawful for the business of the partnership to be carried on or for the members to carry it on in partnership; (2) When a specific thing which a partner had promised to contribute, perishes before delivery, or by the loss of the thing, only the use or enjoyment of which has been contributed; the loss of a specific thing, however, does not dissolve the corporation after its ownership has already been transferred to the partnership; (3) By the death of any partner; (4) By the insolvency of any partner or of the partnership; (5) By the civil interdiction of any partner; OTHER CAUSES (1) When a new partner is admitted into an existing partnership; (2) When any partner retires; (3) When the other partners assign their rights to the sole remaining partner; (4) When all the partners assign their rights in the partnership property to third persons [Art. 1840]. The statutory enumeration of the causes of dissolution is exclusive [De Leon (2010)]. PAGE 313 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW Note the character of the notice required: (1) As to persons who extended credit to the partnership prior to dissolution, notice must be actual. (2) As to persons who merely knew of the existence of the partnership, publication in a newspaper of general circulation in the place of business of the partnership is sufficient. EFFECTS OF DISSOLUTION ON AUTHORITY OF THE PARTNERS In general, upon dissolution, the authority of the partners to represent the partnership is confined only to acts necessary to: (1) Wind up partnership affairs; or (2) Complete transactions begun but not then finished [Art. 1832, par. 1]. ON LIABILITY FOR TRANSACTIONS AFTER DISSOLUTION WITH RESPECT TO PARTNERS The authority of partners to act for the partnership is terminated, with respect to partners: (1) When the dissolution is not by the act, insolvency or death of a partner; or (2) When the dissolution is by such act, insolvency or death, when the partner acting for the partnership has knowledge or notice of the cause [Arts. 1832 and 1833]. The liability of a partner, in general, is the same as in ordinary contracts (pro rata and subsidiary). In the following cases, however, the liability shall be satisfied out of the partnership assets alone (i.e., there is no subsidiary liability): (1) When the partner had been, prior to the dissolution, unknown as a partner to the person with whom the contract is made; (2) When the partner had been, prior to the dissolution, so far unknown or inactive in partnership affairs that the business reputation of the partnership could not be said to have been in any degree due to his connection with it [Art. 1834]. In other cases, each partner is still liable for his share in the liability created by the partner acting for the partnership [Art. 1833]. WITH RESPECT TO THIRD PERSONS With respect to persons not partners: (1) After dissolution, a partner can bind the partnership by any act appropriate for: (a) Winding up partnership affairs; or (b) Completing transactions unfinished at dissolution. (2) He can also bind it by any transaction which would bind the partnership as if dissolution had not taken place, provided the other party to the transaction: (a) Had extended credit to the partnership prior to dissolution and had no knowledge or notice thereof; or (b) Had not so extended credit but had known of the partnership prior to dissolution, and having no knowledge or notice of dissolution, the fact had not been advertised in a newspaper of general circulation in the place (or in each place if more than one) at which the partnership business was regularly carried on [Art. 1834, par. 1]. Any act of a partner after dissolution in no case binds the partnership in the following cases: (1) Where the partnership is dissolved because it is unlawful to carry on the business, unless the act is appropriate for winding up partnership affairs; (2) Where the partner has become insolvent; or (3) Where the partner has no authority to wind up partnership affairs, except by a transaction with one who: (a) Had extended credit to the partnership prior to dissolution and had no knowledge or notice of his want of authority; or (b) Had not extended credit to the partnership prior to dissolution, and, having no knowledge or notice of his want of authority, the fact of his want of authority has not been advertised [Art. 1834]. PAGE 314 UP LAW BOC AGENCY AND PARTNERSHIP Article 1834 does not affect the liability under Article 1825 of any person who, after dissolution, represents himself or consents to another representing him as a partner in a partnership engaged in carrying on business [Art. 1834]. CIVIL LAW WINDING UP PARTNERS WHO MAY WIND UP ON LIABILITY FOR CONTRACTS AFTER DISSOLUTION BY SPECIFIC CAUSES The following partners have the right to wind up the partnership affairs: (1) Those designated in an agreement; (2) Those who have not wrongfully dissolved the partnership; or (3) The legal representative of the last surviving partner, who was not insolvent. General rule: A contract entered into by a partner acting for the partnership after dissolution by act, death or insolvency of a partner binds the other partners. Any partner or his legal representative or assignee may obtain winding up by the court, upon cause shown [Art. 1836]. Exceptions: (1) The dissolution being by act of any partner, the partner acting for the partnership had knowledge of the dissolution; or (2) The dissolution being by death or insolvency of a partner, the partner acting for the partnership had knowledge or notice of the death or insolvency [Art. 1833]. ON EXISTING PARTNERS LAIBILITY MANNER OF WINDING UP (1) Extrajudicial, by the partners themselves; or (2) Judicial, under the control and direction of the proper court. The action for liquidation of the partnership is personal. The fact that sale of assets, including real property, is involved does not change its character, such sale being merely a necessary incident of the liquidation of the partnership, which should precede and/or is part of its process of dissolution [Claridades v. Mercader (1966)]. OF General rule: Dissolution does not of itself discharge the existing liability of any partner. RIGHTS OF PARTNERS IN CASE OF DISSOLUTION Exception: A partner may be relieved when there is an agreement to that effect between: (1) Himself; (2) The partnership creditor; and (3) The person or partnership continuing the business. DISSOLUTION WITHOUT VIOLATION OF THE AGREEMENT Such agreement may be inferred from the course of dealing between the creditor having knowledge of the dissolution and the person or partnership continuing the business. Each partner may have: (1) The partnership property applied to discharge the partnership liabilities; and (2) The surplus applied in cash to the net amount owing to the respective partners. In case of dissolution by death, the individual property of a deceased partner is liable for obligations of the partnership incurred while he was a partner, after payment of his separate debts [Art. 1835]. This is a right as against his co-partners and all partners claiming through them in respect of their interests in the partnership. It cannot be availed if there is an agreement to the contrary [Art. 1837, par. 1]. PAGE 315 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW The goodwill of a business may be defined to be the advantage which it has from its establishment or from the patronage of its customers, over and above the mere value of its property and capital. The goodwill (which includes the firm name) is part of the partnership assets and may be subject of sale [De Leon (2010)]. DISSOLUTION IN CONTRAVENTION OF THE AGREEMENT PARTNER WHO DID NOT CAUSE THE DISSOLUTION The partners who did not cause the dissolution wrongfully has the following rights: (1) To demand the right under Article 1837, 1st par.; (2) To be indemnified for damages for breach of the agreement against the partner who caused the dissolution wrongfully [Art. 1837(1)]; (3) To continue the business: (a) In the same name; (b) By themselves or jointly with others; (c) During the agreed term for the partnership. RIGHTS OF PARTNERS IN CASE OF RECISSION A partner, who is induced by fraud or misrepresentation to become such partner, may rescind the contract. Without prejudice to any other right, he is entitled: (1) To a lien on, or right of retention of, the surplus of the partnership property after satisfying the partnership liabilities to third persons for any sum of money paid by him for the purchase of an interest in the partnership and for any capital or advances contributed by him; (2) To stand, after all liabilities to third persons have been satisfied, in the place of the creditors of the partnership for any payments made by him in respect of the partnership liabilities; and (3) To be indemnified by the person guilty of the fraud or making the representation against all debts and liabilities of the partnership [Art. 1838]. For the purpose of continuing the business, the said partners may possess the partnership property provided: (1) They secure the payment by bond approved by the court; or (2) They pay any partner who has caused the dissolution wrongfully the value of his interest in the partnership, less any damages recoverable, and indemnity against all present or future partnership liabilities [Art. 1837(2)]. PARTNER WHO CAUSED THE DISSOLUTION The partner who caused the dissolution wrongfully has the following rights: (1) If the business is not continued, all the rights Article 1837, par. 1, subject to liability for damages; (2) If the business is continued, the right, as against his co-partners and all claiming through them, to: (a) Ascertainment, without considering the value of the goodwill of the business, and payment to him in cash the value of his partnership interest, less any damage, or have the payment secured by a bond approved by the court; and (b) Be released from all existing liabilities of the partnership [Art. 1837(3)]. SETTLING OF ACCOUNTS BETWEEN PARTNERS Subject to any agreement to the contrary, the following rules shall be observed in settling accounts between partners after dissolution. COMPOSITION ASSETS OF PARTNERSHIP (1) The partnership property; and (2) The contributions of the partners necessary for the payment of all the liabilities [Art. 1839(1)]. In accordance with the subsidiary liability of the partners, the partnership property shall be applied first to satisfy any liability of the partnership [Art. 1839(3)]. PAGE 316 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW (3) Anything left from either shall be applied to satisfy the other [Art. 1839(8)]. AMOUNT OF CONTRIBUTION FOR LIABILITIES The rules for distribution of losses shall determine the contributions of the partners [Art. 1839(4)]. As such: (1) The contribution shall be in conformity with the agreement. (2) If only the share in profits has been stipulated, the contribution shall be in the same proportion. (3) In the absence of any stipulation, the contribution shall be in proportion to the capital contribution [Art. 1797]. DISTRIBUTION OF PROPERTY OF INSOLVENT PARTNER Where a partner has become insolvent or his estate is insolvent, the claims against his separate property shall rank in the following order: (1) Those owing to separate creditors; (2) Those owing to partnership creditors; (3) Those owing to partners by way of contribution [Art. 1839(9)]. ENFORCEMENT OF CONTRIBUTION RIGHTS OF CREDITORS DISSOLVED PARTNERSHIP The following persons have the right to enforce the contributions: (1) An assignee for the benefit of creditors; (2) Any person appointed by the court; or (3) To the extent of the amount which he has paid in excess of his share of the partnership liability, any partner or his legal representative [Art. 1839(5) and (6)]. AS CREDITORS PARTNERSHIP OF THE OF NEW In the following cases, creditors of the dissolved partnership are also creditors of the person or partnership continuing the business: (1) When the business is continued without liquidation, and the cause of dissolution is: (a) Admission of a new partner into the existing partnership; (b) Retirement or death of any partner, and his rights to partnership property are assigned to (1) two or more of the partners, or (2) one or more of the partners and one or more third persons; (c) Retirement of all but one partner, and their rights to partnership property are assigned to the remaining partner, who continues the business, either alone or with others; (d) Wrongful dissolution by any partner, and the remaining partners continue the business, either alone or with others; (e) Expulsion of a partner, and the remaining partners continue the business, either alone or with others. (2) When the cause of dissolution is the retirement or death of any partner, and business is continued with the consent of the retired partner or the representative of the deceased partner, without assignment of their rights to partnership property. The individual property of a deceased partner shall be liable for the contributions [Art. 1839(7)]. ORDER OF APPLICATION OF ASSETS The partnership liabilities shall rank, in order of payment, as follows: (1) Those owing to creditors other than partners; (2) Those owing to partners other than for capital and profits; (3) Those owing to partners in respect of capital; (4) Those owing to partners in respect of profits [Art. 1839(2)]. DOCTRINE OF MARSHALLING OF ASSETS When partnership property and the individual properties of the partners are in possession of a court for distribution: (1) Partnership creditors have priority on partnership property; (2) Separate creditors have priority on individual property, saving the rights of lien of secured creditors. PAGE 317 UP LAW BOC AGENCY AND PARTNERSHIP (3) When the cause of dissolution is the assignment by all the partners or their representatives of their rights in partnership property to one or more third persons who promise to pay the debts and who continue the business of the partnership [Art. 1840, par. 1]. right in the property of the dissolved partnership [Art. 1841]. RIGHT TO AN ACCOUNT In the absence of any agreement to the contrary, the right to an account of his interest shall accrue to any partner, or his legal representative at the date of dissolution, as against: (1) The winding up partners; (2) The surviving partners; or (3) The person or partnership continuing the business [Art. 1842]. LIABILITY OF A NEW PARTNER The liability to the creditors of the dissolved partnership of a new partner in the partnership continuing the business shall be satisfied out of the partnership property alone. However, he may, through agreement, assume individual liability [Art. 1840, par. 2]. PRIORITY OF CREDITORS DISSOLVED PARTNERSHIP CIVIL LAW Limited Partnership OF DEFINITION Creditors of the dissolved partnership have prior right to any claim of the retired partner or the representative of the deceased partner against the person or partnership continuing the business [Art. 1840, par. 3]. A limited partnership is: (1) A partnership; (2) Formed by two or more persons; (3) Having as members: (a) One or more general partners; and (b) One or more limited partners. This is without prejudice to the right of creditors to set aside any assignment on the ground of fraud [Art. 1840, par. 4]. The limited partners as such shall not be bound by the obligations of the partnership [Art. 1843]. RIGHTS OF A RETIRED PARTNER OR A REPRESENTATIVE OF DECEASED PARTNER CHARACTERISTICS (1) A limited partnership is formed by compliance with the statutory requirements [Art. 1844]. (2) The business is controlled or managed by one or more general partners, who are personally liable to creditors [Arts. 1848 and 1850]. (3) One or more limited partners contribute to the capital and share in the profits but do not manage the business and are not personally liable for partnership obligations beyond their capital contributions [Arts. 1845, 1848 and 1856]. (4) Obligations or debts are paid out of the partnership assets and the individual property of the general partners [Art. 1843]. (5) The limited partners may have their contributions back subject to conditions prescribed by law [Arts. 1844 and 1957]. Unless otherwise agreed upon, when any partner retires or dies, and the business is continued without any settlement of accounts as between him or his estate and the person or partnership continuing the business, he or his legal representative, as against such person or partnership, subject to the prior rights of creditors of the dissolved partnership: (1) May have the value of his interest at the date of dissolution ascertained; and (2) Shall receive as an ordinary creditor: (a) An amount equal to the value of his interest in the dissolved partnership with interest; or (b) At his option or at the option of his legal representative, in lieu of interest, the profits attributable to the use of his PAGE 318 UP LAW BOC AGENCY AND PARTNERSHIP A limited partnership has the following advantages: (1) For general partners, to secure capital from others while retaining control and supervision for the business; (2) For limited partners, to have a share in the profits without risk of personal liability. General partner Dissolves partnership Not assignable Extent of liability Liable only to the extent of his capital contributions Assignable GENERAL AND LIMITED PARTNERSHIP DISTINGUISHED General partnership Right to participate in management Unless otherwise agreed upon, all general partners have an equal right to manage the partnership Limited partnership Creation No right to participate in management May be constituted in any form, subject to exceptions Nature of contribution Cash, property industry or Cash or property only, not industry Only general partners Not proper party, unless (1) he is also a general partner; or (2) where the object of the proceedings is to enforce his right against or liability to the partnership Must contain the word “Company” [SEC Memo Circ No. 14-00], except for professional partnerships May or may not include the name of one or more of the partners Name must not appear in the firm name Prohibition to engage in other business Prohibited (subject to qualifications) One or more general, and one or more limited partners Firm name Firm name Name may appear in the firm name Partners must: (1) sign and swear to a certificate in compliance with Article 1844; and (2) file the certificate for record in the SEC Composition Proper party in proceedings by or against partnership Proper party Does not dissolve partnership; rights transferred to executor or administrator for selling his estate Assignability of interest Limited partner Personally, but subsidiarily, liable for obligations of the partnership Limited partner Effect of retirement, death, insanity or insolvency GENERAL AND LIMITED PARTNERS DISTINGUISHED General partner CIVIL LAW Not prohibited Must include the word “Limited” [SEC Memo. Circ. No. 14-00] Must not include name of limited partners, unless: (1) it is also the surname of a general partner, or (2) prior to the time when the limited partner became such, the business has been carried on under a name in which his surname appeared Rules governing dissolution Articles 1828-1842 PAGE 319 Articles 1860-1863 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW FORMATION FALSE STATEMENT CERTIFICATE GENERAL REQUIREMENTS If the certificate contains a false statement, one who suffers loss by reliance thereon may hold liable any party to the certificate who knew the statement to be false: (1) At the time he signed the certificate; or (2) Subsequently, but within a sufficient time before the statement was relied upon to enable him to cancel or amend the certificate, or to file a petition for its cancellation or amendment [Art. 1847]. Two or more persons desiring to form a limited partnership shall: (1) Sign and swear to a certificate stating the items in Article 1844; and (2) File for record the certificate in the SEC [Art. 1844]. A limited partnership is formed if there is substantial compliance in good faith with the requirements. When there is failure to substantially comply with the requirements: (1) In relation to third persons, the partnership is general, unless they recognized that the firm is a limited partnership; and (2) As between the partners, the partnership remains limited, since they are bound by their agreement [De Leon (2010)]. IN THE Requisites: (1) The partner knew the statement to be false: (a) At the time he signed the certificate; or (b) Subsequently, but having sufficient time to cancel or amend it, or file a petition for its cancellation or amendment, and he failed to do so; (2) The person seeking to enforce liability has relied upon the false statement in transacting business with the partnership; and (3) The person suffered loss as a result of reliance upon such false statement. PURPOSE OF FILING The purpose of filing the certificate in the SEC is: (1) To give actual or constructive notice to potential creditors or persons dealing with the partnership; and (2) To acquaint them with its essential features, including the limited liability of limited partners [De Leon (2010)]. GENERAL AND LIMITED PARTNER AT THE SAME TIME Art. 1853. A person may be a general and a limited partner in the same partnership at the same time. This fact must be stated in the certificate. FIRM NAME General rule: The surname of a limited partner shall not appear in the partnership name. Exceptions: (1) It is also the surname of a general partner; or (2) Prior to the time when the limited partner became such, the business had been carried on under a name in which his surname appeared. A person who is a general, and also at the same time a limited partner, shall have all the rights and powers, and be subject to all the restrictions of a general partner, except that, in respect to his contribution as a limited partner, he shall have the rights against the other members which he would have had if he were not also a general partner. A limited partner whose surname appears in a partnership name contrary to this prohibition is liable as a general partner to partnership creditors who extend credit without actual knowledge that he is not a general partner. MANAGEMENT Only general partners have the right to manage the partnership. If a limited partner takes part in the control of the business, he becomes liable as a general partner [Art. 1848]. PAGE 320 UP LAW BOC AGENCY AND PARTNERSHIP A general partner shall have the rights and powers and be subject to all restrictions and liabilities of a partner in a partnership without limited partners. Thus, he has general authority over the business. He holds as trustee for the partnership: (1) Specific property stated in the certificate as contributed by him, but which was not contributed or which has been wrongfully returned; and (2) Money or other property wrongfully paid or conveyed to him on account of his contribution [Art. 1858, par. 2]. However, written consent or ratification by all limited partners is necessary to authorize the general partners to: (1) Do any act in contravention of the certificate; (2) Do any act which would make it impossible to carry on the ordinary business of the partnership; (3) Confess a judgment against the partnership; (4) Possess partnership property, or assign their rights in specific property, for other than a partnership purpose; (5) Admit a person as a general partner; (6) Admit a person as a limited partner, unless the right to do so is given in the certificate; (7) Continue the business with partnership property on the death, retirement, insanity, civil interdiction or insolvency of a general partner, unless the right so to do is given in the certificate. These liabilities can be waived or compromised only by the consent of all members. Such waiver or compromise, however, shall not affect the right to enforce said liabilities of a creditor: (1) Who extended credit; or (2) Whose claim arose, after the filing or before a cancellation or amendment of the certificate, to enforce such liabilities [Art. 1858, par. 3]. Even after a limited partner has rightfully received the return in whole or in part of his capital contribution, he is still liable to the partnership for any sum, not in excess of such return with interest, necessary to discharge its liabilities to all creditors: (1) Who extended credit; or (2) Whose claims arose before such return [Art. 1858, par. 4]. OBLIGATIONS OF A LIMITED PARTNER OBLIGATIONS CONTRIBUTION RELATED CIVIL LAW A person who has contributed capital to a partnership, erroneously believing that he has become a limited partner, but his name appears in the certificate as a general partner or he is not designated as a limited partner, is not personally liable as a general partner by reason of his exercise of the rights of a limited partner, provided: (1) On ascertaining the mistake, he promptly renounces his interest in the profits of the business or other compensation by way of income [Art. 1852]; (2) He does not participate in the management of the business [Art. 1848]; and (3) His surname does not appear in the partnership name [Art. 1846]. TO The contributions of a limited partner may be cash or other property, but not services [Art. 1845]. A limited partner is liable for partnership obligations when he contributes services instead of only money or property to the partnership [De Leon (2010)]. A limited partner is liable to the partnership: (1) For the difference between his actual contribution and that stated in the certificate as having been made; and (2) For any unpaid contribution which he agreed in the certificate to make in the future at the time and on the conditions stated in the certificate [Art. 1858, par. 1]. LIABLITY CREDITORS TO PARTNERSHIP General rule: A limited partner is not liable as a general partner. His liability is limited to the extent of his contributions [Art. 1843]. PAGE 321 UP LAW BOC AGENCY AND PARTNERSHIP Exceptions: The limited partner is liable as a general partner when: (1) His surname appears in the partnership name, with certain exceptions [Art. 1846, par. 2]. (2) He takes part in the control of the business [Art. 1848]. CIVIL LAW RIGHT TO TRANSACT BUSINESS WITH THE PARTNERSHIP A limited partner may: (1) Loan money to the partnership; (2) Transact other business with the partnership; and (3) Receive a pro rata share of the partnership assets with general creditors if he is not also a general partner [Art. 1854, par. 1]. LIABILITY TO SEPARATE CREDITORS On due application to a court of competent jurisdiction by any separate creditor of a limited partner, the court may: (1) Charge his interest with payment of the unsatisfied amount of such claim; (2) Appoint a receiver; and (3) Make all other orders, directions and inquiries which the circumstances of the case may require. Limitations: A limited partner, with respect to his transactions with the partnership, cannot: (1) Receive or hold as collateral security any partnership property; or (2) Receive any payment, conveyance, or release from liability if it will prejudice the right of third persons [Art. 1854, par. 1]. Violation of the prohibition is considered a fraud on the creditors of the partnership [Art. 1854, par. 2]. The interest so charged may be redeemed with the separate property of any general partner, but may not be redeemed with partnership property [Art. 1862]. RIGHT TO SHARE IN PROFITS A limited partner may receive from the partnership the share of the profits or the compensation by way of income stipulated for in the certificate. Note: In a general partnership, the interest may be redeemed with partnership property with the consent of all the partners whose interests are not charged [Art. 1814]. This right is subject to the condition that partnership assets will still be in excess of partnership liabilities after such payment [Art. 1856] The partnership liabilities being referred to exclude the liabilities to the limited and general partners. RIGHTS OF A LIMITED PARTNER IN GENERAL A limited partner shall have the same rights as a general partner to: (1) Require that the partnership books be kept at the principal place of business of the partnership; (2) To inspect and copy any of them at a reasonable hour; (3) To demand true and full information of all things affecting the partnership; (4) To demand a formal account of partnership affairs whenever circumstances render it just and reasonable; (5) To ask for dissolution and winding up by decree of court; (6) To receive a share of the profits or other compensation by way of income; and (7) To receive the return of his contribution provided the partnership assets are in excess of all its liabilities [Art. 1851]. Ratio: Otherwise, he will receive a share to the prejudice of third-party creditors. RIGHT TO CONTRIBUTION RETURN OF A limited partner may have his contributions withdrawn or reduced when: (1) All the liabilities of the partnership, except liabilities to general partners and to limited partners on account of their contributions, have been paid or there remains property of the partnership sufficient to pay them; (2) The consent of all members is had, unless the return may be demanded as a matter of right; and PAGE 322 UP LAW BOC AGENCY AND PARTNERSHIP (3) The certificate is cancelled or so amended as to set forth the withdrawal or reduction [Art. 1857, par. 1]. CIVIL LAW who has died or has assigned his interest in a partnership. He has all the rights and powers, and is subject to all the restrictions and liabilities of his assignor, except those liabilities which: (1) The assignee was ignorant of; and (2) Cannot be ascertained from the certificate [Art. 1859, pars. 2 and 6]. The return of his contributions may be demanded, as a matter of right (i.e., even when not all the other partners consent), when (1) and (2) above are complied with: (1) On the dissolution of the partnership; (2) Upon the arrival of the date specified in the certificate for the return; or (3) After the expiration of a 6-month notice in writing given by him to the other partners, if no time is fixed in the certificate for: (a) The return of the contribution; or (b) The dissolution of the partnership [Art. 1857, par. 2]. An assignee is only entitled to receive the share of the profits or other compensation by way of income, or the return of contribution, to which the assignor would otherwise be entitled. He has no right: (1) To require any information or account of the partnership transactions; (2) To inspect the partnership books [Art. 1859, par. 3]. General rule: A limited partner, irrespective of the nature of his contribution has only the right to demand and receive cash in return for his contribution. An assignee has the right to become a substituted limited partner if: (1) All the partners consent thereto; or (2) The assignor, being empowered to do so by the certificate, gives him that right [Art. 1859, par. 4]. Exceptions: He may receive his contribution in a form other than cash when: (1) There is a statement in the certificate to the contrary; or (2) All the members of the partnership consent [Art. 1857, par. 3]. An assignee becomes a substituted limited partner when the certificate is appropriately amended [Art. 1859, par. 5]. PREFERENCE OF LIMITED PARTNERS RIGHT TO ASK FOR DISSOLUTION A limited partner may have the partnership dissolved and its affairs wound up when: (1) He rightfully but unsuccessfully demands the return of his contribution; or (2) He has a right to contribution but his contribution is not paid because the partnership property is insufficient to pay its liabilities [Art. 1857, par. 4]. General rule: The limited partners stand on equal footing. Exception: By an agreement of all the partners (general and limited) in the certificate, priority or preference may be given to some limited partners over others with respect to: (1) The return of contributions; (2) Their compensation by way of income; or (3) Any other matter [Art. 1855]. DISSOLUTION RIGHT TO ASSIGN INTEREST A limited partnership is dissolved in much the same way and causes as an ordinary partnership [De Leon (2010)]. The interest of a limited partner is assignable. The assignee may become: (1) A substituted limited partner; or (2) A mere assignee. General rule: The retirement, death, insolvency, insanity or civil interdiction of a general partner dissolves the partnership. A substituted limited partner is a person admitted to all the rights of a limited partner Exception: It is not so dissolved when the business is continued by the remaining general partners: PAGE 323 UP LAW BOC AGENCY AND PARTNERSHIP (1) Under a right to do so stated in the certificate; or (2) With the consent of all members [Art. 1860]. CIVIL LAW (2) There is a subsequent agreement fixing their share [Art. 1863]. AMENDMENT OR CANCELLATION OF CERTIFICATE Upon the death of a limited partner, his executor or administrator shall have: (1) All the rights of a limited partner for the purpose of settling his estate; and (2) The power to constitute an assignee as a substituted limited partner, if the deceased was so empowered in the certificate. CANCELLATION OF CERTIFICATE The certificate shall be cancelled when: (1) The partnership is dissolved; or (2) All limited partners cease to be such limited partners. The estate of a deceased limited partner shall be liable for all his liabilities as a limited partner [Art. 1861]. AMENDMENT OF CERTIFICATE A certificate shall be amended when: (1) There is a change in the name of the partnership or in the amount or character of the contribution of any limited partner; (2) A person is substituted as a limited partner; (3) An additional limited partner is admitted; (4) A person is admitted as a general partner; (5) A general partner retires, dies, becomes insolvent or insane, or is sentenced to civil interdiction and the business is continued; (6) There is a change in the character of the business of the partnership; (7) There is a false or erroneous statement in the certificate; (8) There is a change in the time as stated in the certificate for the dissolution of the partnership or for the return of a contribution; (9) A time is fixed for the dissolution of the partnership, or the return of a contribution, no time having been specified in the certificate; or (10) The members desire to make a change in any other statement in the certificate in order that it shall accurately represent the agreement among them [Art. 1864]. SETTLEMENT OF ACCOUNTS ORDER OF PAYMENT In settling accounts after dissolution, the liabilities of the partnership shall be entitled to payment in the following order: (1) Those to creditors, including limited partners except those on account of their contributions, in the order of priority as provided by law; (2) Those to limited partners in respect to their share of the profits and other compensation by way of income in their contributions; (3) Those to limited partners in respect to the capital of their contributions; (4) Those to general partners other than for capital and profits; (5) Those to general partners in respect to profits; (6) Those to general partners in respect to capital [Art. 1863, par. 1]. Note: In settling accounts of a general partnership, those owing to partners in respect to capital enjoy preference over those in respect to profits. REQUIREMENTS FOR AMENDMENT OR CANCELLATION SHARE IN PARTNERSHIP ASSETS The share of limited partners in respect to their claims for capital, profits, or for compensation by way of income, is in proportion of their contribution, unless: (1) There is a statement in the certificate as to their share in the profits; or To amend or cancel a certificate: (1) The amendment or cancellation must be in writing; (2) It must be signed and sworn to by all the members including the new members, and the assigning limited partner in case of PAGE 324 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW (5) Bilateral, if for compensation, giving rise to reciprocal rights and obligations, but unilateral, if gratuitous, creating obligations only for the agent. substitution or addition of a limited or general partner; and (3) The writing to amend (with the certificate, as amended) or to cancel must be filed for record in the SEC. FORMATION When a person required to sign the writing, a person desiring the cancellation or amendment may petition the court to order cancellation or amendment. The court shall order the SEC to record the cancellation or amendment if it finds that the petitioner has a right to have the writing executed. ESSENTIAL ELEMENTS (1) There is consent, express or implied, of the parties to establish the relationship; (2) The object is the execution of a juridical act in relation to third persons; (3) The agent acts as a representative and not for himself; and (4) The agent acts within the scope of his authority [Rallos v. Felix Go Chan (1978)]. From the moment the amended certificate/writing or a certified copy of a court order granting the petition for amendment has been filed, such amended certificate shall thereafter be the certificate of partnership [Art. 1865]. PARTIES (1) Principal, one whom the agent represents and from whom he derives his authority; and (2) Agent, who acts for and represents the principal, having derivative authority in carrying out the business of the latter. AGENCY Contract of Agency DEFINITION Juridical persons such as corporations and partnerships can be principals and agents [Art. 1919(4)]. By the contract of agency: (1) A person binds himself to render some service or to do something; (2) In representation or on behalf of another; (3) With the consent or authority of the latter [Art. 1868]. CAPACITY (1) A principal must have legal capacity to enter into contract in his own right. (2) An agent must have legal capacity to enter into the contract of agency, although he may not have capacity to enter into the particular contract subject of agency. Agency may refer to both a contract, as defined in the provision, and the representative relation created. As a relationship, it is fiduciary (based on trust and confidence), where the agent is empowered to contract with a third person on behalf of a principal [De Leon (2010)]. Ratio: One who acts through an agent in law does the act himself. As such, the capacity to act by an agent depends in general on the capacity of the principal to do the act himself as if he were present. The basis of agency is representation [Victorias Milling v. CA (2000)]. INTENT (1) On the part of the principal, there must be an actual intention to appoint or an intention naturally inferable from his words or actions; and (2) On the part of the agent, there must be an intention to accept the appointment and act on it [Victorias Milling v. CA (2000)]. CHARACTERISTICS The contract of agency is: (1) Consensual, perfected by mere consent; (2) Nominate, has its own name; (3) Preparatory, entered into as a means to enter into other contracts; (4) Principal, does not depend on another contract for existence and validity; PAGE 325 UP LAW BOC AGENCY AND PARTNERSHIP General rule: In the absence of such intent, there is no agency. CIVIL LAW POWER OF ATTORNEY A power of attorney is an instrument in writing by which one person, as principal, appoints another as his agent and confers upon him the authority to perform certain specified acts of kinds of acts on his behalf [De Leon (2010)]. Exceptions: (1) Agency by estoppel; and (2) Agency by operation of law. CONSENT An agency, both on the part of the principal and the agent, is either express or implied. It does not require express appointment and acceptance. FORM OF CONTRACT General rule: There are no formal requirements governing the appointment of an agent. Exceptions: The law imposes formal requirements on certain types of agency [Art. 1869, par. 2]: (1) When a sale of piece of land or any interest therein is through an agent, in which case the authority shall be in writing; otherwise the sale is void [Art. 1874]; (2) When the law requires a special power of attorney [Art. 1878]. The manner by which the parties designate the relationship is not controlling. The use of this term (“agent”) in one clause of the contract cannot dominate the real nature of the agreement as revealed in other clauses, no less than in the caption (“agency agreement”) of the agreement itself [Albadejo y Cia. v. Phil. Refining (1923)]. As to the principal, the appointment of an agent may be implied: (1) From his acts; (2) From his silence or lack of action; or (3) From his failure to repudiate the agency, knowing that another person is acting on his behalf without authority. The appointment may be oral, unless the law requires a specific form [Art. 1869]. As to the agent, acceptance may also be implied: (1) From his acts which carry out the agency; (2) From his silence or inaction according to the circumstances [Art. 1870]; (3) When both the principal and the agent being present if: (a) The principal delivers his power of attorney to the agent; and (b) The agent receives it without any objection [Art. 1871]; (4) When both the principal and the agent being absent if: (a) The principal transmits his power of attorney to the agent, who receives it without any objection; or (b) The principal entrusts to him by letter or telegram a power of attorney with respect to the business in which he is habitually engaged as an agent, and he did not reply to the letter or telegram. ACTS DELEGATED General rule: What a person may do in person, he may do through another. Exceptions: (1) Personal acts, which the law or public policy requires to be performed personally (e.g., to vote, make a will, make statements under oath, or attend board meetings as director or trustee of a corporation); (2) Criminal acts; (3) Acts not allowed by law to be done by the principal. PRESUMPTION OF EXISTENCE General rule: Agency must exist as a fact. The law makes no presumption thereof. The person alleging it has the burden of proof to show, not only the fact of its existence, but also its nature and extent [People v. Yabut (1977)]. In other cases between persons who are absent, acceptance cannot be implied from the silence of the agent [Art. 1872]. PAGE 326 UP LAW BOC AGENCY AND PARTNERSHIP Exceptions: A presumption of agency may arise: (1) Where an agency may arise by operation of law (e.g., all the partners being considered agents of the partnership when the manner of management has not been agreed upon); or (2) To prevent unjust enrichment [De Leon (2010)]. CIVIL LAW Requisites: (1) Actual notice to the agent; (2) Notice must pertain to a matter of fact and not of law; (3) The fact must be within the scope of the agent’s authority. Exceptions: (1) Where the agent’s interests are adverse to those of the principal; (2) Where the agent’s duty is not to disclose the information (e.g., he is informed by way of confidential information); (3) Where the person claiming the benefit of the rule colludes with the agent to defraud the principal [De Leon (2010)]. COMMUNICATION OF EXISTENCE There are two ways of giving notice of agency with different effects: (1) If a person specially informs another (e.g., by letter), the person appointed is considered an agent with respect to the person specially informed; (2) If a person states by public advertisement, the person appointed is considered an agent with regard to any person. AGENCY AND OTHER CONTRACTS DISTINGUISHED One factor which most clearly distinguishes agency from other legal concepts is control; one person – the agent – agrees to act under the control or direction of another – the principal [Victorias Milling v. CA (2000)]. In either case, the power of the agent continues in full force until the notice is rescinded in the same manner in which it was given [Art. 1873]. DUTY OF THIRD PERSONS The person dealing with the agent must act with ordinary prudence and reasonable diligence. Obviously, if he knows or has good reason to believe that the agent is exceeding his authority, he cannot claim protection [Keeler Electric v. Rodriguez (1922)]. Agency Partnership Representation An agent acts only for the principal EFFECT A partner acts for the other partners, the partnership and himself Control An agent’s power to bind the principal is subject to the latter’s control EXTENSION OF PERSONALITY In an agent-principal relationship, the personality of the principal is extended through the facility of the agent. The agent, by legal fiction, becomes the principal, authorized to perform all acts which the latter would have him do [Litonjua v. Eternit Corp. (2006)]. A partner’s power to bind his co-partners is not subject to their control Personal liability An agent does not assume personal liability, if he acts within the scope of his authority THEORY OF IMPUTED KNOWLEDGE General rule: Notice to the agent constitutes notice to the principal [Air France v. CA (1983)]. Thus, knowledge of the agent is ascribed to the principal [Rovels Enterprises v. Ocampo (2002)]. A partner is personally liable with all his property, after exhaustion of the partnership properties Share in profits An agent is not entitled to profits, only compensation PAGE 327 A partner is entitled to a share in the profits of the partnership UP LAW BOC AGENCY AND PARTNERSHIP Independent contractor Agency Agency An agent acts under the control and instruction of the principal An independent contractor is not subject to control, except insofar as the result of the work is concerned Agency may involve things other than property Employer is not liable for torts committed by the independent contractor Employees of independent contractor are not subject to control of his employer Agency retains Buyer ownership acquires A buyer pays purchase price the Return of goods Generally, an agent can return goods unsold Execution of piece of work or rendition of service Generally, a buyer cannot return the goods bought Dealing with the goods Authorized acts Material acts only Discretion An agent deals with the goods according to the instructions of the principal A buyer, being the owner, can deal with the goods as he pleases Agency to buy Sale Ownership of goods Ordinarily, lessor performs only ministerial functions Ownership is acquired in behalf of the principal Parties Three parties are involved (principalagent-third party) Sale An agent delivers the proceeds of the sale to the principal Purpose An agent is authorized to exercise discretion Agency to sell Payment Employment Juridical acts (creation, modification, extinction of relations with third parties) Lessee cannot bind the lessor Principal ownership Basis Execution of juridical acts in relation to third persons An agent can bind the principal Ownership of goods Lease of service Representation Lease of property involves property only Authority to bind Sub-agents Agents of the agent is still subject to the control of the principal A lessee is not subject to the control of the lessor Things involved Liability for tort Principal is liable for torts committed by the agent with the scope of his authority Lease of property Control Control An agent acts under the control and instruction of the principal CIVIL LAW Ownership transferred buyer to is the Change in price Two parties are involved (employeremployee) Generally, any change in the price is borne by the principal A buyer cannot adjust the price already agreed upon Payment Price is paid in behalf of the principal PAGE 328 Price is paid by the buyer UP LAW BOC AGENCY AND PARTNERSHIP Agency Note: Agency is presumed to be for a compensation, unless there is proof to the contrary [Art. 1875]. Guardianship Person represented An agent represents a capacitated person A guardian represents an incapacitated person As to the extent of business covered: (1) Universal; (2) General; (3) Special. Source of authority An agent is appointed by the principal A guardian is appointed by the court As to the authority conferred: (1) Couched in general terms; (2) Couched in specific terms. Control An agent is subject to the control of the principal A guardian is not subject to the control of the ward As to nature and effect: (1) Ostensible or representative, where the agent acts in the name and representation of the principal [Art. 1868]; (2) Simple or commission, where the agent acts in his own name but for the account of the principal. Authority to bind An agent can make the principal principally liable A guardian has no power to impose personal liability on the ward Agency Trust As to the kinds of principal: (1) With a disclosed principal, where, at the time the transaction was contracted by the agent, the other party thereto has known: (a) That the agent is acting for a principal; and (b) The principal’s identity; (2) Partially disclosed, where the other party knows or has reason to know that the agent is or may be acting for a principal but is unaware of the principal’s identity; (3) Undisclosed, where the party has no notice of the fact that the agent is acting as such for a principal. Title to property Title retained principal by Title passes to the trustee Control An agent is subject to the control of the principal A trustee is only subject to the stipulated guidance of the trustor Termination In general, an agency may be revoked at any time CIVIL LAW In general, a trust may be terminated only when its purpose is fulfilled AS TO MANNER OF CREATION EXPRESS AGENCY Kinds of Agency An express agency is one where the agent has been actually authorized by the principal, either: (1) Orally; or (2) In writing [Art. 1869]. IN GENERAL As to manner of creation: (1) Express; (2) Implied. IMPLIED AGENCY The appointment and acceptance are implied: (1) As to the appointment of an agent by the principal: (a) From his acts; (b) From his silence or lack of action; or As to cause or consideration: (1) Gratuitous; (2) Compensated or onerous. PAGE 329 UP LAW BOC AGENCY AND PARTNERSHIP (c) From his failure to repudiate the agency knowing that another person is acting on his behalf without authority [Art. 1869]. (2) As to the acceptance of the agency by the agent: (a) From his acts which carry out the agency; (b) From his silence or inaction according to the circumstances (i.e., presence or absence of the parties) [Arts. 1870, 1871 and 1872]. AS TO AUTHORITY CONFERRED COUCHED IN GENERAL TERMS An agency couched in general terms is one created in general terms and is deemed to comprise only acts of administration, even if: (1) The principal should state that he withholds no power; (2) He should state that the agent may execute such acts as he may consider appropriate; or (3) Even though the agency should authorize a general and unlimited management [Art. 1877]. AS TO EXTENT OF BUSINESS COVERED COUCHED IN SPECIFIC TERMS (1) Universal agency comprises all acts which the principal can lawfully delegate to an agent; (2) General agency comprises all the business of the principal. (3) Special agency comprises one or more specific transactions [Art. 1876]. General agency An agency couched in specific terms authorizes only the performance of specific acts. Certain specific acts, however, require special powers of attorney. A special power of attorney is an instrument in writing by which one person, as principal, appoints another as his agent and confers upon him the authority to perform certain specified acts or kinds of acts on behalf of the principal. Special agency Scope of authority All acts connected with the business or employment in which agent is engaged Only specific authorized acts or those necessarily implied The following acts of strict dominion require special powers of attorney: (1) To make such payments as are not usually considered as acts of administration; (2) To effect novations which put an end to obligations already in existence at the time the agency was constituted; (3) To compromise, to submit questions to arbitration, to renounce the right to appeal from a judgment, to waive objections to the venue of an action or to abandon a prescription already acquired; (4) To waive any obligation gratuitously; (5) To enter into any contract by which the ownership of an immovable is transmitted or acquired either gratuitously or for a valuable consideration; (6) To make gifts, except customary ones for charity or those made to employees in the business managed by the agent; (7) To loan or borrow money, unless the latter act be urgent and indispensable for the preservation of the things which are under administration; Nature of service authorized Involves service continuous Usually involves single transaction a Authority to bind Acts within the scope of authority, even in conflict with special instructions, may bind principal Acts beyond authority given cannot bind principal Termination of authority Notice to third persons required to terminate apparent authority No notice required, since third parties are required to inquire as to authority Instructions Notice to third persons required CIVIL LAW The instructions, in so far as they grant authority, are strictly construed PAGE 330 UP LAW BOC AGENCY AND PARTNERSHIP (8) To lease any real property to another person for more than one year; (9) To bind the principal to render some service without compensation; (10) To bind the principal in a contract of partnership; (11) To obligate the principal as a guarantor or surety; (12) To create or convey real rights over immovable property; (13) To accept or repudiate an inheritance; (14) To ratify or recognize obligations contracted before the agency; (15) Any other act of strict dominion CIVIL LAW accurate nor correct to conclude that its absence renders the compromise agreement void. In such a case, the compromise is merely unenforceable [Duñgo v. Lopena (1962)]. SPECIAL KINDS AGENCY BY ESTOPPEL Through estoppel: (1) An admission or representation; (2) Is rendered conclusive upon the person making it; and (3) Cannot be denied or disproved as against the person relying thereon [Art. 1431]. The requirement of special power of attorney refers to the nature of the authorization, not to its form. Thus, even if a document is titled as a general power of attorney, the requirement of a special power of attorney is met if there is a clear mandate from the principal specifically authorizing the performance of the act [BravoGuerrero v. Bravo (2005)]. Ratification A special power of attorney can be included in the general power when it is specified therein the act or transaction for which the special power is required [Veloso v. CA (1996)]. Estoppel Rests on intention Rests on prejudice Retroacts as if originally authorized Affects only relevant parts of the transaction Substance is confirmation of unauthorized acts after it has been done Substance is the principal’s inducement for third party to act to his prejudice For an agency by estoppel to exist, the following must be established: (1) The principal manifested a representation of the agent’s authority or knowingly allowed the agent to assume such authority; (2) The third person, in good faith, relied upon such representation; (3) Relying upon such representation, such third person has changed his position to his detriment [De Leon (2010)]. Art. 1879. A special power to sell excludes the power to mortgage; and a special power to mortgage does not include the power to sell. Art. 1879. A special power to compromise does not authorize submission to arbitration. The power to “exact the payment” of sums of money “by legal means” includes the power to institute suits for their recovery [Germann & Co., v. Donaldson, Sim & Co. (1901)]. In agency by estoppel, there is no agency. The alleged agent seemed to have apparent or ostensible authority, but not real authority to represent another. A power of attorney “to loan and borrow money” and to mortgage the principal’s property does not carry with it or imply that that the agent has a legal right to make the principal liable for the personal debts of the agent [BPI v. De Coster (1925)]. An agency by estoppel, which is similar to the doctrine of apparent authority, requires proof of reliance upon the representations, and that, in turn, needs proof that the representations predated the action taken in reliance [Litonjua v. Eternit Corp. (2006)]. Although the Civil Code expressly requires a special power of attorney in order that one may compromise an interest of another, it is neither PAGE 331 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW As to liability, implied agency and agency by estoppel are different in that, in the former, the principal is liable, while in the latter, the person who acts in bad faith is liable. Qualification: The exception only applies if the agent contracts with the properties of the principal within the scope of his authority [PNB v. Agudelo (1933)]. Article 1911 states that: “Even when the agent has exceeded his authority, the principal is solidarily liable with the agent if the former allowed the latter to act as though he had full powers.” In this case, there is a duly formed agency and estoppel only applies to the excess of authority. This is an application of the doctrine of apparent authority. AGENCY BY OPERATION OF LAW An agency may exist by operation of law, such as in the following cases: (1) Every partner is an agent of the partnership for the purpose of its business [Art. 1818]; (2) When the principal’s actions would reasonably lead a third person to conclude that an agency exists, an agency by estoppel is created by operation law [Black’s Law Dictionary (9th)]; (3) In case of certain necessity or emergency, an agency by necessity may arise. The doctrine of apparent authority is to the effect that: One who clothes another with apparent authority as his agent, and holds him out to the public as such, cannot be permitted to deny the authority of such person to act as his agent, to the prejudice of innocent third parties dealing with such person in good faith. IRREVOCABLE AGENCY Article 1927 (on agency coupled with an interest) mentions three instances where the sole will of the principal cannot terminate an agency: (1) A bilateral contract depends upon it; (2) It is the means of fulfilling an obligation already contracted; or (3) A partner is appointed manager of a partnership in the contract of partnership and his removal from the management is unjustifiable. Under the doctrine of apparent authority, the question in every case is whether the principal has, by his voluntary act, placed the agent in such a situation that a person of ordinary prudence, conversant with business usages and the nature of the particular business, is justified in presuming that such agent has authority to perform the particular act in question [Professional Services v. Agana (2008)]. Qualifications: (1) Coupled with interest or not, the authority certainly can be revoked for a just cause, such as when the attorney-in-fact betrays the interest of the principal. It is not open to serious doubt that the irrevocability of the power of attorney may not be used to shield the perpetration of acts in bad faith, breach of confidence, or betrayal of trust, by the agent for that would amount to holding that a power coupled with an interest authorizes the agent to commit frauds against the principal [Coleongco v. Claparols (1964)]. (2) A mere statement in the power of attorney that it is coupled with an interest is not enough. In what does such interest consist must be stated in the power of attorney [Del Rosario v. Abad (1958)]. AGENCY WITH UNDISCLOSED PRINCIPAL General Rule: If an agent acts in his own name (the principal is undisclosed), the agent is directly bound in favor of the person with whom he has contracted as if the transaction were his own. Ratio: There is no representation of the principal when the agent acts in his own name. The third person cannot allege that he was misled by any representation since he did not know of the existence of the undisclosed principal. Exception: The principal is bound when the contract involves things belonging to him [Art. 1883]. In this case, the contract is considered as one between the principal and the third person. PAGE 332 UP LAW BOC AGENCY AND PARTNERSHIP (3) An agency couple with an interest cannot affect third persons. They are obligatory only on the principal who executed the agency [New Manila Lumber v. Republic (1960)]. CIVIL LAW possession of the goods involved in the transaction. (5) Cashier in bank is one whose business is to represent a banking institution in its financial transactions; (6) Attorney-in-fact is one who is given authority by his principal to do a particular act not of a legal character. In its strict legal sense, it means an agent having a special authority. KINDS OF AGENTS AS TO NATURE AND EXTENT OF AUTHORITY According to the nature and extent of their authority, agents have been classified into: (1) Universal agents are authorized to do all acts for his principal which can lawfully be delegated to an agent. So far as such a condition is possible, such an agent may be said to have universal authority. (2) General agents are authorized to do all acts pertaining to a business of a certain kind or at a particular place, or all acts pertaining to a business of a particular class or series. He has usually authority either expressly conferred in general terms or in effect made general by the usages, customs or nature of the business which he is authorized to transact. An agent, therefore, who is empowered to transact all the business of his principal of a particular kind or in a particular place, would, for this reason, be ordinarily deemed a general agent. (3) Special agents are authorized to do some particular act or to act upon some particular occasion (i.e., acts usually in accordance with specific instructions or under limitations necessarily implied from the nature of the act to be done) [Siasat v. IAC (1985)]. Attorneys have authority to bind their clients in any case by any agreement in relation thereto made in writing, and in taking appeals, and in all matters of ordinary judicial procedure. But they cannot, without special authority, compromise their client’s litigation, or receive anything in discharge of a client’s claim but the full amount in cash [Sec. 23, Rule 138, Rules of Court]. Powers of the Agent AUTHORITY OF AN AGENT Authority is the power of the agent to affect the legal relations of his principal by acts done in accordance with the principal’s manifestations of consent. An agent can make the principal legally responsible only when he is authorized by the principal to act the way he did [De Leon (2010)]. KINDS OF AUTHORITY (1) Actual, when it is actually granted, and it may be express or implied. It is the authority that the agent does, in fact, have. It results from what the principal indicates to the agent; (2) Express, when it is directly conferred by words; (3) Implied, when it is incidental to the transaction or reasonably necessary to accomplish the main purpose of the agency; (4) Apparent or ostensible, when it arises by the acts or conduct of the principal giving rise to an appearance of authority. It makes the principal responsible to third persons for certain actions of the agent that were not really authorized; SPECIAL TYPES OF AGENTS (1) Attorney-at-law is one whose business is to represent clients in legal proceedings; (2) Auctioneer is one whose business is to sell property for others to the highest bidder at a public sale; (3) Broker is one whose business is to act as intermediary between two other parties such as insurance broker and real estate broker; (4) Factor or commission merchant is one whose business is to receive and sell goods for a commission, being entrusted with the PAGE 333 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW (5) General, when it refers to all the business of the principal; (6) Special, when it is limited only to one or more specific transactions; (7) By necessity or by operation of law, when it is demanded by necessity or by virtue of the existence of an emergency. The agency terminates when the emergency passes. POWER TO PRINCIPAL SCOPE OF AUTHORITY Even when the agent acts in his own name the principal is still bound in the following instances: (1) When the contract involves things belonging to the principal [Art. 1883]; or (2) When the principal ratifies the contract, expressly or tacitly [Art. 1910]. BIND THE Requisites: (1) The agent must act within the scope of his authority; and (2) The agent must act in behalf of the principal. General rule: The scope of the authority of the agent is what appears in the terms of the power of attorney [Siredy Enterprises v. CA (2002)]. Exceptions: An agent is considered acting within the scope of his authority when: (1) He performs acts which are conducive to the accomplishment of the purpose of the agency [Art. 1881]; (2) He performed the agency in a manner more advantageous to the principal than that specified by said principal [Art. 1881]; (3) The principal ratifies the act, expressly or tacitly [Art. 1910]. EFFECTS OF THE ACTS OF AN AGENT When the agent acts: (1) With authority of the principal: (a) If done in the name of the principal, the principal is bound to comply with the obligations contracted [Art. 1910] and the agent is not personally liable to the party with whom he contracts [Art. 1897]; (b) If done in the name of the agent, the agent is directly bound in favor of the person with whom he has contracted, except when the contract involves things belonging to the principal; (2) Without authority or beyond the authority granted by the principal: (a) If done in the name of the principal, it is unenforceable against him, unless he ratifies it expressly or tacitly [Art. 1910]; (b) If done in the name of the agent, the is personally liable. Art. 1900. So far as third persons are concerned, an act is deemed to have been performed within the scope of the agent’s authority, if such act is within the terms of the power of attorney, as written, even if the agent has in fact exceeded the limits of his authority according to an understanding between the principal and the agent. While third persons are bound to inquire into the extent or scope of the agent’s authority, they are not required to go beyond the terms of the written power of attorney. Third persons cannot be adversely affected by an understanding between the principal and his agent as to the limits of the latter’s authority. Third persons need not concern themselves with instructions given by the principal to his agent outside of the written power of attorney [Siredy Enterprises v. CA (2002)]. PAGE 334 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW Exception: An agent shall not carry out an agency if its execution would manifestly result in loss or damage to the principal [Art. 1888]. Obligations of Agent IN GENERAL OBLIGATION DECLINES GOOD FAITH AND LOYALTY TO HIS TRUST WHEN AGENT In case a person declines an agency, he is bound to observe the diligence of a good father of a family in the custody and preservation of the goods forwarded to him. The duty of good faith is also called the fiduciary duty, which imposes upon the agent the obligation of faithful service. The duty to be loyal to the principal demands that the agent look out for the best interests of the principal as against his own or those of third parties (see Art. 1889). The obligation lasts until the owner, as soon as practicable: (1) Appoints an agent; or (2) Takes charge of the goods [Art. 1885]. General rule: Until proven otherwise, the presumption arises that an agent has performed his duty in good faith, and the principal, until notice is received of a breach of relational duties, may rely upon his agent’s faithfulness. Declining an agency is different from withdrawal. In the former, no agency was formed. Withdrawal, on the other hand, presupposes an existing agency. The obligation of the agent, in case of withdrawal, is to continue to act as such agent until the principal has had reasonable opportunity to take the necessary steps to meet the situation [Art. 1929]. Exception: The presumption does not arise when there is no relation of trust or confidence between the parties (e.g., the agent is bound merely as an instrument/servant, or there is no agency relationship) [De Leon (2010)]. OBLIGATION TO NECESSARY FUNDS EXERCISE OF REASONABLE CARE By accepting an employment whose requirements he knows, without stipulating otherwise the agent impliedly undertakes that: (1) He possesses a degree of skill reasonably and ordinarily competent for the performance of the service; and (2) In performing his undertaking, he will exercise reasonable care, skill and diligence. ADVANCE General rule: The agent is not bound to advance the necessary funds. The principal is obliged to advance to the agent, should the latter so request, the sums necessary for the execution of the agency. Exception: He shall be bound to do so should there be a stipulation to that effect, subject to the obligation of the principal to reimburse the agent. OBLIGATION TO CARRY OUT AGENCY General rule: The agent is: (1) Bound by his acceptance to carry out the agency; (2) Liable for damages, which the principal may suffer, in case of non-performance; (3) Bound to finish the business already begun on the death of the principal should delay entail danger [Art. 1884]. Exception to the Exception: He is not bound to do so, even when there is a stipulation, when the principal is insolvent [Art. 1886]. Note: Insolvency of the principal is also a ground for extinguishment. PAGE 335 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW A specific application of this subordination of interests is found in Article 1890: (1) If the agent has been empowered to borrow money, he may himself be the lender at the current rate of interest. (2) If he has been authorized to lend money at interest, he cannot borrow it without the consent of the principal. OBLIGATION TO ACT IN ACCORDANCE WITH INSTRUCTIONS In the execution of the agency: (1) The agent shall act in accordance with the instructions of the principal; or (2) In default thereof, he shall do all that a good father of a family would do, as required by the nature of the business [Art. 1887]. OBLIGATION RECEIVED FOR THINGS Every agent is bound to: (1) Render an account of his transactions; and (2) Deliver to the principal whatever he may have received by virtue of the agency, even though it may not be owing to the principal. Note: The limits of the agent’s authority shall not be considered exceeded should it have been performed in a manner more advantageous to the principal than that specified by him [Art. 1882]. Every stipulation exempting the agent to render an account shall be void [Art. 1891]. Authority Instructions Sum total of the powers committed or permitted to the agent Private rule of guidance to the agent WHAT TO DELIVER Relates to the transaction or business with which the agent is empowered to act Refers to the manner or mode of agent’s action with respect to matters within the permitted scope of authority The agent has to deliver all money and property which may have come into his hands or in that of a sub-agent. This includes gifts from third parties in connection with the agency. It is immaterial whether such money or property is the result of the performance or violation of the agent’s duty, if it be the fruit of the agency. Binds third parties Does not bind third parties If the agent fails to deliver and instead converts or appropriates for his own use the money or property belonging to the principal, he is liable for estafa. OBLIGATION TO PREFER INTEREST OF PRINCIPAL WHEN OBLIGATION APPLICABLE General rule: The agent shall be liable for damages if, there being a conflict between his interest and those of the principal, he should prefer his own [Art. 1889]. IS NOT (1) If the agent or broker acted only as a middleman with the task of merely bringing together the vendor and the vendee [Domingo v. Domingo (1971)]. (2) If the agent had informed the principal of the gift or bonus or profit he received from the purchaser and the principal did not object thereto; (3) When a right of lien exists in favor of the agent. Exceptions: The agent is not liable for giving preference to his own when: (1) The principal waives the benefit of this rule, with full knowledge of the facts; or (2) When the interest of the agent is superior. An example of the latter is where the agent has security interest in goods of the principal in his possession, he may protect his interest even if in doing so, he disobeys the principal’s orders or injures his interest [De Leon (2010)]. PAGE 336 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW created between and among the principal, agent, and sub-agent. Neither the agent nor the substitute can be held personally liable so long as they act within the scope of their authority [Macias & Co. v. Warner, Barnes & Co. (1922)]. RESPONSIBILITY FOR ACTS OF SUBSTITUTE The agent may appoint a substitute if the principal has not prohibited him from doing so. The agent is responsible for the acts of the substitute: (1) When he was not given the power to appoint one; (2) When he was given such power, but: (a) Without designating the person; and (b) The person appointed was notoriously incompetent or insolvent. EFFECTS OF SUBSTITUTION (1) When substitution was prohibited by the principal, appointment by the agent is an act in excess of the limits of his authority. All acts of the substitute are void. (2) When substitution was authorized, the agent is only liable when he appointed one who is notoriously incompetent or insolvent, unless the person was designated by the principal. (3) When substitution was not authorized, but also not prohibited, the appointment is valid, but the agent is liable for damage caused by the substitution to the principal. (4) When substitution was authorized and the sub-agent was designated by the principal, the agent is released from any liability for the acts of the sub-agent [Art. 1892]. All acts of the substitute appointed against the prohibition of the principal shall be void [Art. 1892]. The principal may bring an action against the substitute with respect to the obligations which the latter contracted under the substitution [Art. 1893]. SUB-AGENCY A sub-agent or substitute is a person employed or appointed by an agent as his agent, to assist him in the performance of an act for the principal, which the agent has been empowered to perform. The agent is a principal with respect to the sub-agent. RESPONSIBILITY OF TWO OR MORE AGENTS General rule: The responsibility of two or more agents is not solidary, even though they have been appointed simultaneously. They are liable jointly. General rule: The agent may appoint a subagent. Exception: They are solidarily liable if solidarity has been expressly stipulated [Art. 1894]. Ratio: The law allows such substitution for reasons of convenience and practicality. If solidarity has been thus agreed upon, each of the agents is responsible for: (1) The non-fulfillment of agency, even when the fellow agents acted beyond the scope of their authority; and (2) The fault or negligence of his fellow agents, except when the fellow agents acted beyond their authority. Exceptions: (1) The appointment is prohibited by the principal [Art. 1892]; (2) The work entrusted to the agent requires special knowledge, skill, or competence, unless authorized to do so by the principal [De Leon (2010)]. RELATIONS AMONG THE PARTIES OBLIGATION FOR SUMS APPLIED TO HIS OWN USE (1) When the sub-agent has been employed for own account of the agent, to assist him, the sub-agent is a stranger to the principal. (2) When the appointment was authorized by the principal a fiduciary relationship is The agent owes interest: (1) On the sums applied to his own use from the day on which he did so; and PAGE 337 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW (2) On the sums which he still owes after the agency is extinguished [Art. 1896]. PRESENTATION ATTORNEY The liability of the agent for interest for sums converted to his own use is without prejudice to a criminal action that may be brought against him [De Leon (2010)]. A third person, with whom the agent wishes to contract on behalf of the principal may require the presentation of: (1) The power of attorney; or (2) The instructions as regards the agency. The sums referred to as still owing to the principal after extinguishment of the agency are those which were not misapplied by the agent, but were found to be owing to the principal after such extinguishment. Private or secret orders and instructions of the principal do not prejudice third persons who have relied upon the power of attorney or instructions shown them [Art. 1902]. OBLIGATIONS TO THIRD PERSONS Art. 1900. So far as third persons are concerned, an act is deemed to have been performed within the scope of the agent’s authority, if such act is within the terms of the power of attorney, as written, even if the agent has in fact exceeded the limits of his authority according to an understanding between the principal and the agent. LIABILITY OF AGENT FOR OBLIGATIONS CONTRACTED General rule: The agent who acts as such is not personally liable to the party with whom he contracts. The principal is responsible for such acts done within the scope of the authority granted to the agent, and should bear any damage caused to third persons [Art. 1910]. OF POWER OF RATIFICATION OF ACTS OF AGENT A third person, who contracts with the agent (thereby recognizing the authority of the agent), cannot later disaffirm his contract based on the fact that the agent has exceeded his powers, if the principal has: (1) Ratified the acts of the agent; or (2) Signified his willingness to ratify said acts [Art. 1901]. Exceptions: He is personally liable when: (1) He acts in his own name [Art. 1883]; (2) He expressly binds himself; or (3) He exceeds the limits of his authority without giving such party sufficient notice of his powers [Art. 1897]. The ratification has retroactive effect, relating back to the time of the act or contract ratified and is equivalent to original authority [Board of Liquidators v. Kalaw (1967)]. VOID CONTRACTS The contract entered into by an agent on behalf of the principal shall be void when: (1) The agent contracts in the name of the principal; (2) He exceeded the scope of his authority; (3) The principal does not ratify the contract; and (4) The party with whom the agent contracted is aware of the limits of the powers granted by the principal. A principal may not accept the benefits of a transaction and repudiate its burdens. Thus, a principal who seeks to enforce a sale made by the agent cannot ordinarily allege that the agent exceeded his authority. Before ratification, however, the third person may repudiate the contract. IGNORANCE OF AGENT The agent, however, is liable if he undertook to secure the principal’s ratification. If a duly authorized agent acts in accordance with the orders of the principal, the principal cannot set up the ignorance of the agent as to PAGE 338 UP LAW BOC AGENCY AND PARTNERSHIP damage and deterioration suffered by the same [Art. 1903]. (2) The commission agent who handles goods of the same kind and mark, which belong to different owners, shall: (a) Distinguish them by countermarks; and (b) Designate the merchandise respectively belonging to each principal [Art. 1904]. circumstances whereof he himself was, or ought to have been, aware [Art. 1899]. Ratio: If the principal appoints an agent who is ignorant, the fault is his alone. He is bound by the acts of the agent. The agent is not liable to third persons in this case. OBLIGATIONS OF A COMMISSION AGENT SALE OF GOODS ON WITHOUT AUTHORITY A factor or commission agent is one whose business is to receive and sell goods for a commission (also called factorage) and who is entrusted by the principal with the possession of goods to be sold, and usually selling in his own name. He may act in his own name or in that of the principal. An ordinary agent need not have possession of the goods of the principal, while the commission agent must be in possession [De Leon (2010)]. Commission agent Acts for and in behalf of the principal Acts in his own name or that of his principal Need not have possession of the goods Must have possession of the goods Broker Commission agent Has no custody of the thing to be disposed of, only acts as intermediary between seller and buyer Has custody possession of things to be sold Maintains no relations with things to be sold/bought Maintains relations with the thing, the buyer and the seller CREDIT General rule: The commission agent cannot sell on credit. Should he do so, the principal may: (1) Demand from him payment in cash, in which case the commission agent shall be entitled to any interest or benefit, which may result from such sale [Art. 1905]; or (2) Ratify the sale on credit, in which case the principal will have all the risks and advantages to him [De Leon (2010)]. FACTOR OR COMMISSION AGENT Ordinary agent CIVIL LAW Exception: The commission agent can sell on credit with the express or implied consent of the principal. SALE OF GOODS ON CREDIT WITH AUTHORITY If the commission agent was authorized to sell on credit and should he so sell on credit, he shall inform the principal of such sale, with a statement of the names of the buyers. Should he fail to inform the principal, the sale is deemed to have been made for cash as far as the principal is concerned [Art. 1906]. or the The commission agent is obliged to collect the credits of his principal when they become due and demandable [Art. 1908]. General rule: Failing to so collect, the agent shall be liable for damages. GOODS Exception: He is not liable if he proves that he exercised due diligence for that purpose. (1) The commission agent shall be responsible for goods received by him in the terms and conditions and as described in the consignment, unless upon receiving them he should make a written statement of the Should the commission agent receive a guarantee commission (del credere commission) on a sale, in addition to the ordinary commission, he shall: (1) Bear the risk of collection; and RESPONSIBILITY RECEIVED FOR PAGE 339 UP LAW BOC AGENCY AND PARTNERSHIP (2) Pay the principal the proceeds of the sale on the terms agreed upon with the purchaser [Art. 1907]. CIVIL LAW entered into between the principal and the third person [Sy-Juco and Viardo v. Sy-Juco (1920)]. RATIFICATION RESPONSIBILITY FOR FRAUD AND NEGLIGENCE Ratification is the adoption or affirmance by a person of a prior act which did not bind him, but which was done or professed to be done on his account, thus giving effect to the acts as if originally authorized. In the fulfillment of his obligation, the agent is responsible for: (1) Fraud; and (2) Negligence. The circumstance that the agency is or is not gratuitous will be considered by the courts in fixing the liability for negligence only [Art. 1909]. The liability may be to the principal or to third persons. Obligations of the Principal IN GENERAL In addition to his duties specified under the contract itself, the principal is under obligation to deal fairly and in good faith with his agent, who owes the same to his principal. OBLIGATION TO COMPLY WITH CONTRACTS General rule: The principal must comply with all the obligations which the agent may have contracted within the scope of his authority [Art. 1910, par. 1]. As for any obligation where in the agent has exceeded his power, the principal is not bound. Aside from the intent to ratify, the following conditions must be fulfilled for ratification to be effective: (1) The principal must have the capacity and power to ratify; (2) He must have had knowledge or had reason to know of material or essential facts about the transaction; (3) He must ratify the acts entirely; (4) The act must be capable of ratification; and (5) The act must be done in behalf of the principal [De Leon (2010)]. Ratification has the following effects: (1) With respect to the agent, it relieves him of liability. He may thus recover compensation from the principal. (2) With respect to the principal, he assumes responsibility for the unauthorized act as fully as if the agent had acted under an original authority. But he is not liable for acts outside the authority affirmed by his ratification. (3) With respect to third persons, they are bound by the ratification and cannot set up the fact that the agent has exceeded his powers [Art. 1901]. Exceptions: The principal is: (1) Bound by the obligation entered into by the agent in excess of his power, when he ratifies it expressly or tacitly [Art. 1910, par. 2]; (2) Solidarily liable with the agent if the principal allowed the agent to act as though he had full powers [Art. 1911]. SEPARATE CONTRACTS PRINCIPAL AND AGENT Note: If the agent acts in his own name, but the contract involves things belonging to the principal, the contract must be considered as The rules on double sales [Art. 1544] provide: (1) If the same movable property is sold to different persons, ownership is transferred PAGE 340 WITH When (1) two persons contract with regard to the same thing, one with the agent and the other with the principal, and (2) the two contracts are incompatible with each other, that of prior date shall be preferred, subject to the rules on double sales [Art. 1916]. UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW to whoever first took possession in good faith. (2) If it be an immovable: (a) Ownership belongs to the person who in good faith first recorded it in the Registry of Property. (b) If there is no inscription, ownership shall belong to the person who, in good faith was first in possession; and in the absence of such, to the one who presents the oldest title, provided there is good faith. COMPENSATION OF BROKER The liability for damages suffered by the third person whose contract must be rejected shall be borne by: (1) The principal, if the agent acted in good faith; or (2) The agent, if he acted in bad faith [Art. 1918]. Procuring cause refers to a cause originating a series of events which, without break in their continuity, result in the accomplishment of the prime objective of the employment of the broker – producing a purchaser ready, willing and able to buy on the owner’s terms. WHEN PRINCIPAL IS NOT LIABLE, IN SUMMARY Since the broker’s only job is to bring together the parties to a transaction, it follows that if the broker does not succeed in bringing the mind of the purchaser and the vendor to an agreement with reference to the terms of a sale, he is not entitled to a commission [Rocha v. Prats (1922)]. A broker is entitled to the usual commissions whenever he brings to his principal a party who is able and willing to take the property and enter into a valid contract upon the terms named by the principal. A broker is never entitled to commission for unsuccessful efforts. He must prove that he was the procuring cause of the transaction. Otherwise, he is not entitled to the stipulated broker’s commission [Inland Realty v. CA (1997)]. (1) Void or inexistent contracts [Art. 1409]; (2) Sale of a piece of land or any interest therein when the authority of the agent is not in writing [Art. 1874]; (3) Acts of the substitute appointed against the prohibition of the principal [Art. 1892]; (4) Acts done in excess of the scope of the agent’s authority [Art. 1898 and 1910]; (5) When the agent acts in his own name, except when the contract involves things belonging to the principal [Art. 1883]; (6) Unenforceable contracts [Art. 1403]. If the principal breaks off from negotiations with a buyer brought by the agent in order to deliberately deal later with the buyer personally, this is evident bad faith. In such case, justice demands compensation for the agent [Infante v. Cunanan (1953)]. LIABILITY FOR EXPENSES AND DAMAGES OBLIGATION FOR COMPENSATION OF AGENT NECESSARY FUNDS (1) The principal must advance to the agent, should the latter so request, the sums necessary for the execution of the agency. (2) In case the agent already advanced them, the principal must reimburse him therefor: (a) Even if the business or undertaking was not successful; (b) Provided that the agent is free from all fault [Art. 1912]. Art. 1875. Agency is presumed to be for a compensation, unless there is proof to the contrary. AMOUNT The principal must pay the agent: (1) The compensation agreed upon; or (2) The reasonable value of the agent's services if no compensation was specified. The reimbursement shall include the interest on the sums advanced from the day the advances were made. PAGE 341 UP LAW BOC WHEN THE PRINCIPAL LIABLE FOR EXPENSES AGENCY AND PARTNERSHIP IS CIVIL LAW (3) The agent is appointed for a common transaction or undertaking. NOT The principal is not liable for the expenses incurred by the agent in the following cases: (1) If the agent acted in contravention of the principal’s instructions, unless the latter should wish to avail himself of the benefits derived from the contract; (2) When the expenses were due to the fault of the agent; (3) When the agent incurred them with knowledge that an unfavorable result would ensue, if the principal was not aware thereof; (4) When it was stipulated that: (a) The expenses would be borne by the agent; or (b) That the latter would be allowed only a certain sum [Art. 1918]. LIABILITY FOR QUASI-DELICT BY AN AGENT The principal is solidarily liable to third persons for torts of an agent committed: (1) At the principal’s direction; or (2) In the course and within the scope of the agent’s employment. Modes of Extinguishment IN GENERAL Agency is extinguished: (1) By its revocation; (2) By the withdrawal of the agent; (3) By the death, civil interdiction, insanity or insolvency of the principal or of the agent; (4) By the dissolution of the firm or corporation which entrusted or accepted the agency; (5) By the accomplishment of the object or purpose of the agency; (6) By the expiration of the period for which the agency was constituted [Art. 1919]. DAMAGES Art. 1913. The principal must also indemnify the agent for all the damages which the execution of the agency may have caused the latter, without fault or negligence or his part. RIGHT OF RETENTION BY AN AGENT The provision enumerates only those which are peculiar to agency and is, therefore, not exclusive. Agency may also be extinguished by the modes of extinguishment of obligations in general [De Leon (2010)]. The agent may retain in pledge the things which are the object of the agency until the principal effects: (1) Reimbursement of necessary funds advanced; and (2) Payment of indemnity for damages [Art. 1914]. The modes of extinguishment may be classified into three: (1) By agreement (Nos. 5 and 6); (2) By subsequent acts of the parties: (a) By the act of both parties or by mutual consent; or (b) By the unilateral act of one of them (Nos. 1 and 2); (3) By operation of law (Nos. 3 and 4). This is a case of legal pledge. However, the agent is not entitled to the excess in case the things are sold to satisfy his claims. MULTIPLE PRINCIPALS If there are two or more principals who appointed the agent for a common transaction or undertaking, they shall be solidarily liable for all the consequences of the agency [Art. 1915]. REVOCATION BY PRINCIPAL General rule: The principal may: (1) Revoke the agency at will; and (2) Compel the agent to return the document evidencing the agency. Requisites: (1) There are two or more principals; (2) The principals have all concurred in the appointment of the same agent; and PAGE 342 UP LAW BOC AGENCY AND PARTNERSHIP CIVIL LAW There is implied revocation only where the new appointment is incompatible with the previous one. Qualifications: The right of the principal to terminate the authority of his agent is absolute and unrestricted, except that he is liable for damages in case: (1) He revokes the agency in bad faith [Danon v. Brimo (1921)]; or (2) He revokes the agency before the expiration of the period stipulated in the agency contract. EFFECT OF REVOCATION RELATION TO THIRD PARTIES IN Art. 1921. If the agency has been entrusted for the purpose of contracting with specified persons, its revocation shall not prejudice the latter if they were not given notice thereof. Exception: Agency cannot be revoked if it is coupled with an interest, such that: (1) A bilateral contract depends upon it; (2) It is the means of fulfilling an obligation already contracted; or (3) A partner is appointed manager of a partnership in the contract of partnership and his removal from the management is unjustifiable. If the agent had general powers, revocation of the agency does not prejudice third persons who acted: (1) In good faith; and (2) Without knowledge of the revocation. Notice of the revocation in a newspaper of general circulation is a sufficient warning to third persons [Art. 1922]. Art. 1925. When two or more principals have granted a power of attorney for a common transaction, any one of them may revoke the same without the consent of the others. WITHDRAWAL BY AGENT The agent may withdraw from the agency by giving due notice to the principal. MANNER Revocation may be express or implied. General rule: If the principal should suffer any damage by reason of the withdrawal, the agent must indemnify him therefor. There is express revocation when the principal clearly and directly makes a cancellation of the authority of the agent orally or in writing. Exception: The agent is not liable for damages if he should base his withdrawal upon the impossibility of continuing the performance of the agency without grave detriment to himself [Art. 1928]. There is implied revocation in the following cases: (1) The appointment of a new agent for the same business or transaction revokes the previous agency from the day on which notice thereof was given to the former agent, without prejudice to the requirement of notice to third persons [Art. 1923]. (2) The agency is revoked if the principal directly manages the business entrusted to the agent, dealing directly with third persons [Art. 1924]. (3) A general power of attorney is revoked by a special one granted to another agent, as regards the special matter involved in the latter [Art. 1926]. Art. 1929. The agent, even if he should withdraw from the agency for a valid reason, must continue to act until the principal has had reasonable opportunity to take the necessary steps to meet the situation. PAGE 343 UP LAW BOC AGENCY AND PARTNERSHIP DEATH, CIVIL INTERDICTION, INSANITY OR INSOLVENCY EXPIRATION OF TERM (1) If created for fixed period, expiration of the period extinguishes agency even if the purpose was not accomplished. (2) If no time is specified, the courts may fix the period as under the circumstances have been probably contemplated by the parties [Art. 1197]. Otherwise, the agency terminates at the end of a reasonable period of time. Either party can terminate the relationship at will by giving notice to the other [De Leon (2010)]. DEATH OF PRINCIPAL General rule: Death extinguishes agency. Exceptions: (1) The agency remains in full force and effect even after the death of the principal, if it has been constituted: (a) In the common interest of the principal and agent; or (b) In the interest of a third person who has accepted the stipulation in his favor [Art. 1930]. (2) Anything done by the agent, without knowledge of the death of the principal or of any other cause which extinguishes the agency, is valid and shall be fully effective with respect to third persons who may have contracted with him in good faith [Art. 1931]. (3) The agent must finish business already begun on the death of the principal, should delay entail any danger [Art. 1884]. The period contemplated may be implied from terms of agreement, purpose of agency, and the circumstances of the parties. DEATH OF AGENT If the agent dies, his heirs must: (1) Notify the principal thereof; and (2) In the meantime adopt such measures as the circumstances may demand in the interest of the latter [Art. 1932]. ACCOMPLISHMENT OF OBJECT OR PURPOSE The fulfillment of the purpose for which agency was created ipso facto terminates agency even though it was expressly made irrevocable. If the purpose has not been accomplished, the agency continues indefinitely for as long as the intent to continue is manifested through words or actions of the parties. DISSOLUTION OF CORPORATION FIRM CIVIL LAW OR The dissolution of a partnership or corporation which entrusted (principal) or accepted (agent) the agency extinguishes its juridical existence, except for the purpose of winding up its affairs. It is equivalent to death. PAGE 344