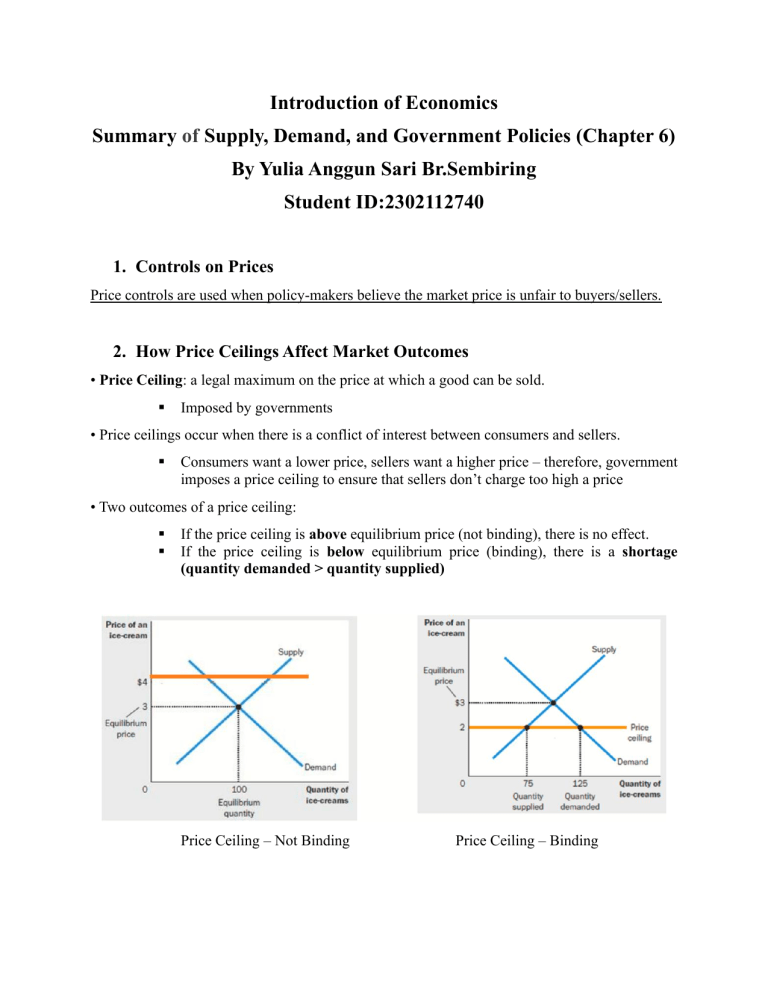

Introduction of Economics Summary of Supply, Demand, and Government Policies (Chapter 6) By Yulia Anggun Sari Br.Sembiring Student ID:2302112740 1. Controls on Prices Price controls are used when policy-makers believe the market price is unfair to buyers/sellers. 2. How Price Ceilings Affect Market Outcomes • Price Ceiling: a legal maximum on the price at which a good can be sold. ▪ Imposed by governments • Price ceilings occur when there is a conflict of interest between consumers and sellers. ▪ Consumers want a lower price, sellers want a higher price – therefore, government imposes a price ceiling to ensure that sellers don’t charge too high a price • Two outcomes of a price ceiling: ▪ ▪ If the price ceiling is above equilibrium price (not binding), there is no effect. If the price ceiling is below equilibrium price (binding), there is a shortage (quantity demanded > quantity supplied) Price Ceiling – Not Binding Price Ceiling – Binding Case Study – Lines at the Petrol Station • 1973-1981 – price ceiling for petrol in US. • 1973 – OPEC raised the price of crude oil, leading to a reduction in the supply of petrol. ▪ Therefore, the reduction in supply plus the price ceiling led to long waiting lines for petrol. 3. How Price Floors Affect Market Outcomes • Price Floor: a legal minimum on the price at which a good can be sold. ▪ Imposed by governments. • An attempt by governments to maintain prices at other than equilibrium levels. • Two outcomes of a price floor: ▪ ▪ If the price floor is below equilibrium price (not binding), there is no effect. If the price floor is above equilibrium price (binding), there is a surplus (quantity supplied > quantity demanded) Price Floor – Not Binding Price Floor – Binding Case Study – The Minimum Wage • Minimum Wage laws prevent employers from offering wages below a certain level. • Potential undesired effect – can increase unemployment level of unskilled workers. ▪ Due to minimum wage, employers want to achieve highest level of productivity and efficiency out of their employees. 4. Taxes All governments use taxes to raise revenue for public purposes. 3 steps to analyse how the tax affects the buyers and sellers: 1. Decide whether the law affects the supply or demand curve. 2. Decide which way the curve shifts. 3. Examine how the shift affects equilibrium. 5. How Taxes on Sellers Affect Market Outcomes Example – Government imposes $0.50 tax on sellers of ice-cream per ice-cream sold. • For sellers, tax is an additional input cost. Therefore, at any given quantity, sellers increase the price by $0.50 to cover the extra cost of tax. ▪ ▪ Step One: Only the supply curve is affected Step Two: Supply curve shifts left by an amount equal to the tax ($0.50) ▪ • • • Step Three: Therefore, new equilibrium point is at B, with a lower EQ and higher EP (New EP is lower than $3.50) Market price increases from $3 to $3.30. Therefore, the price buyers pay is $3.30. Price do sellers effectively receive: 3.30 – 0.50 = $2.80. Therefore, the tax makes both buyers and sellers worse off. Though sellers pay the $0.50, they share the burden of the tax with buyers since they pay more for the good and sellers receive less. 6. How Taxes on Buyers Affect Market Outcomes Example – Government imposes $0.50 tax on buyers of ice-cream per ice-cream bought. • For buyers, they must pay the price to the seller plus tax to the government. Therefore, to encourage buyers to demand any given quantity, the market price must be $0.50 lower than it was. ▪ ▪ ▪ • • Step One: only the demand curve is affected. Step Two: Demand curve shifts left by an amount equal to the tax ($0.50). Step Three: Therefore, new equilibrium point is at B, with a lower EQ and lower EP (New EP is higher than $2.50). Market price falls from $3 to $2.80. Therefore, the price sellers receive is $2.80. Price do buyers effectively pay: 2.80 + 0.50 = $3.30 • Therefore, the tax makes both buyers and sellers worse off . Though the buyers pay the $0.50 tax, they share the burden of the tax with sellers since buyers pay more for the good and sellers receive less. Implications of Taxes • • • Taxes result in a change in market equilibrium. New EQ is lower, regardless on whom the tax is levied. Therefore, taxes discourage market activity, but are necessary to raise revenue for public purposes. Buyers pay more and sellers receive less, regardless on whom the tax is levied. Therefore, buyers and sellers share the tax burden regardless. 7. Elasticity and Tax Incidence Whoever is relatively more inelastic will pay a greater proportion of the tax. Here, supply is more elastic than demand. Therefore, the price received by sellers falls only slightly and the price paid by buyers rises substantially. Thus, buyers bear most of the burden of the tax. Here, demand is more elastic than supply. Therefore, the price received by sellers falls substantially and the price paid by buyers rises only slightly. Thus, sellers bear most of the burden of the tax.