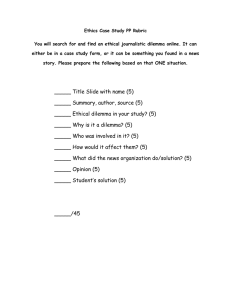

Chapter 4 solutions to the assigned exercise problems 4-1 a) PW = $6,500 (P/A, 4%, 45) = $6,500 (20.720) = $134,680 b) FW = $6,500 (F/A, 4%, 45) = $6,500 (121.029) = $786,689 Using the spreadsheet we get: c) Ethical dilemma for employee: The goal to pass the exam may tempt someone to cheat the system to get the reward. The employee should be motivated for other reasons to pass the FE aside from just the financial reward. Ethical dilemma for the employer: (1) Should these funds be used to give raises to all employees instead of rewarding just a few? (2) Introduces stress on the employees. (3) It may be viewed as favoring engineers over other employees. 4-2 a) PW = $8,000 (P/A, 7%, 30) = $8,000 (12.409) = $99,272 b) FW = $8,000 (F/A, 7%, 30) = $8,000 (94.461) = $755,686 4-6 P = $33,000, i = 9%/12 = 0.75% /month, n = 48 months, A = ? A = $33,000 (A/P, 0.75%, 48) = $821 per month will be the payments. 4-9 Let X = toll per vehicle. Then: A = 3,000,000 X i = 8% F = $25,000,000 n = 3 3,000,000 X (F/A, 8%, 3) = $25,000,000 3,000,000 X (3.246) = $25,000,000 X = $2.57 per vehicle 4-32 So Jennifer figures she can afford a mortgage payment of $900 if the home insurance and real estate taxes are included. That means the portion of the mortgage payment going to pay off the house is $725. She wants to figure out how much money she can afford to borrow if it’s a 30 year loan with monthly payments and a fixed nominal interest rate of 3%/year. The effective interest rate per cash flow period equals the effective interest rate per compounding period (monthly) = r/m = 3%/12 = 0.25%/month. PW of the loan = $725/month * (P/A, 0.25%, 360) = $500 (237.191) = $171,962 Since she is going to save up until she has a 10% down payment and the closing costs, this means the house can’t cost more than $171,962/(0.90) = $191,069 She must save = $191,069(0.1) + $4,250 = $23,357 In recent years, interest rates have been at historically low value. This is good for borrowers (not so good for savers!). 4-35 Receipts (upward) at time 1: PW = B + $800 (P/A, 5%, 3) = B + $800 * 2.723 = B + $2,178.40 Expenditures (downward) at time 1: PW = B (P/A, 5%, 2) + 1.5B (P/F, 5%, 3) = 2.758B PW = B (1.859) + 1.5B (0.8638) = 3.1547B Equating: B + $2,178.40 = 3.1547B 2.1547B = $2,178.40, B = $2178.40/2.1547 = $1,011.00 4-36 a) A = F(A/F, i, n) = $1M (A/F, 5.0%, 45) = $1.5M (0.00626) = $9,390. So she must deposit this amount every year for 45 years starting on her 23rd birthday in order to have $1,500,000 in the account immediately after she makes the 45th deposit. b) Under this scenario, she doesn’t start saving money until her 33rd birthday so n = 35 years. She’s still depositing the same amount each year but there will only be 35 deposits instead of 45. The future worth of the account will be less. F = A(F/A, i, n) = $9,390 (F/A, 5.0%, 35) = $9390 (90.320) = $848,105 Overall, she’s depositing $9390(10) = $93,900 less in the account, and in combination with the effects of compounding interest she will have $651,895 less at retirement. She would do well to start saving as soon as possible. 4-50 The solution may follow the general approach of the end-of-year derivation in the book. (1) F = B (1 + i)n +.… + B (1 + i)1 Divide equation (1) by (1 + i): (2) F (1 + i)−1 = B (1 + i)n−1 + B (1 + i)n−2 + … + B Subtract equation (2) from equation (1): (1) − (2) F − F (1 + i)−1 = B [(1 + i)n − 1] Multiply both sides by (1 + i): F (1 + i) − F = B [(1 + i)n+1 − (1 + i)] So the equation is: F = B[(1 + i)n+1 − (1 + i)]/i Applied to the numerical values: F = 100/0.08 [(1 + 0.08) 7 − (1.08)] = $792.28 4-54 P = $350 (P/A, 6%, 15) + $250 (P/G, 6%, 15) = $350 (9.712) + $250 (57.554) = $17,788 4-67 a) P = [$100(P/A, 8%, 4) + $50(P/G, 8%, 4)](P/F, 8%, 2) = [$100(3.312) + $50(4.650)] (0.8573) = $483.26 b) Advantages: quieter, zero emissions, no petroleum consumption, lower maintenance, easier to start, etc. Disadvantages: less powerful, can handle larger areas, electrocution possibilities, less durable, some require power cord, etc. 4-102 Interest Paid = 0.0075*(Previous month’s Balance Due) Principal = (Monthly Payment) – (Current month’s Interest) Balance Due = (Previous month’s Balance Due) – (Current month’s Principal)