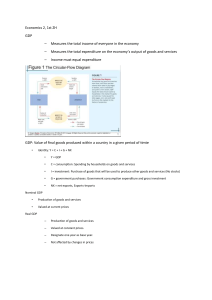

Chapter 7: Measuring GDP Valuing an Economy ● GDP is a metric used to measure the value of a national economy. ○ Sum of the market values of all final goods/services produced within a country in a set period of time. ○ 1. Market Value ■ The common unit of good/services (e.g., in Canada, measured in dollars). ○ 2. Final Goods/Services ■ Adding all the transactions involved in selling a good/service results in double-counting. ■ Therefore, count only expenditures on final goods/services (i.e., the price bought at). ○ 3. Produced Within a Country ■ The goods/services that count toward GDP are defined in terms of the location of production. ● A Canadian company selling items in Mexico counts for Mexico’s GDP, not Canada’s. ■ GNP (gross national product) is the sum of market values of all final goods/services produced as well as capital owned by the permanent residents of a country regardless of the location of production. ● Includes worldwide income earned by a country’s enterprises and permanent residents. ● Excludes production by foreign nationals operating domestically. ○ 4. Given Period of Time ■ GDP is usually calculated quarterly, but can be based on any time period. ■ Quarterly GDP usually needs adjustment to account for seasonal patterns in the economy (e.g., buying/travelling more during December). ● Therefore, quarterly GDP is typically shown as an estimate that has been seasonally adjusted at an annual rate. ■ Based on predictable seasonal patterns, we can estimate what the annual GDP will be. ● The size of an economy is based on output and production. ○ The expenditure approach: we can measure the total output by measuring total expenditure. ○ The income approach: however, every expenditure results in a seller gaining income equal to the market price. Hence, total output can be measured by adding up everyone’s income. ○ This dichotomy is what the circular-flow diagram is based on. Overall, the same GDP is obtained by measuring expenditure or income in an economy. ■ National production = national expenditure = national income. ■ Approaches to Measuring GDP ● Because of free international trade, expenditure in one country results in income in another country. ● The expenditure approach highlights the importance of consumer spending versus government purchases. ● The following are expenditure categories: ○ 1. Final goods/services: bought with the intention to use or consume. ○ 2. Goods bought as investment: investment in future production (e.g., a farmer buying a tractor to use in berry production). ○ 3. Government purchases: e.g., roads. ○ 4. Net exports (exports minus imports): since GDP is based on location of production, expenditures by Canadians on foreign items are excluded. However, exports are included since they are made in the said country. ○ To get total expenditure, add together these four categories. ● Consumption ○ Measures spending on goods/services by private individuals and households. ○ What’s consumed has to be new. That way, the economy can’t be grown by reselling the same thing over and over (i.e., secondhand things and buying already purchased property does not count). ○ House does not count towards consumpt. ● Investment ○ Includes goods bought with the intention to use to produce other goods and services in the future. Examples are capital goods like tractors and warehouses. ○ Buying a house counts as an investment while rent counts as consumption. ○ Has to be new. ○ Buying from the financial market does not count towards GDP. This includes stocks, mutual bonds, and other funds. This is because: ■ When you buy a stock, the money goes to a seller, not the company. ■ It’s a form of double-counting. ○ Include spendings on inventories, which are the excess stock of goods that a company produces now, but sells late. ● Government Purchases ○ Goods/services bought by all levels of government. ○ Note that spending that transfers money to individuals does not count as a government purchase. This includes things like subsidies and pension programs. ● Net Exports (henceforth, NX) ○ Represents the value of goods/services produced domestically and consumed abroad minus the value of goods/services produced abroad and consumed domestically. ■ If exports > imports, then NX is positive. ■ If exports < imports, then NX is negative. ■ If exports = imports, then NX is 0. ■ ● Expenditure = C + I + G + NX = production. C is consumption, I is investments, G is government spendings, and NX is net exports. ● The income approach emphasizes information about the relative importance of different factors of production. ● Add up all the income earned by everyone in a said country. ○ Income = wages + interest + rental income + profits ○ Adds up everything on the other side of the expenditure approach. ○ International trade is accounted for because: ■ Exports are income (accounted for). ■ Imports are income for another country (not accounted for). ● The value-added approach is especially useful for tracking how goods/services are sold and resold. ● Add up the values added at each stage of production. ○ Useful for considering services involved in the resale of existing goods. ■ Any intermediary involved in the sale of used goods adds value by sourcing those goods and making them available for sale in a convenient way. Using GDP to Compare Economies ● GDP is a function of both the quantity of goods/services (output) and their market value (prices). ○ Real GDP is calculated based on goods/services valued at constant prices. ■ Based on outputs in the current year and prices in the base year. ■ Isolates changes in an economy’s output. ○ ○ ○ ○ ■ Used as a reference point by economists. Nominal GDP is calculated based on goods/services valued at current prices (at the time of production). ■ Based on outputs in the current year and prices in the current year. ■ Encompasses changes in both output and prices. When output rises and prices stay constant, nominal and real GDP rise at the same rate. When prices rise and output stays constant, nominal GDP rises but real GDP does not. When both output and prices rise, nominal and real GDP rise at different rates. ■ The amount of the real GDP is how much of the nominal GDP is due to rising output; the rest is due to rising prices. ● The GDP deflator is a measure of the overall change in prices in an economy, using the ratio between real and nominal GDP. ○ ■ In the base year, nominal GDP equals real GDP because current prices are base-year prices. Hence, GDP deflator equals to 100. ■ If prices have risen such that nominal GDP is now higher than real GDP, the deflator will be greater than 100. ■ If prices have fallen such that nominal GDP is now lower than real GDP, the deflator will be less than 100. ● ○ This “deflates” nominal GDP by controlling for price changes. ● GDP per capita measures how much is produced per person in a said country; GDP divided by population size. ○ Measure of average income. ○ Does not tell us how income is distributed. ○ Does not tell us what you can buy with a given amount of money. ○ Poorer countries are cheaper to live in than rich ones (e.g., $3000 is livable in Uganda but not in Canada). ● ○ If the economy grows, the GDP growth rate will be positive. ○ If the economy shrinks, the GDP growth rate will be negative. ■ Indicates a recession. Other signs are rising unemployment, less business sales, and more bankruptcies. ■ A depression is a severe or extended recession. ○ If the economy stays the same, the GDP growth rate will be 0. ★ High GDP growth rates are not necessarily associated with high GDP/ GDP per capita (e.g., poorer countries have fast growth rates while the USA has slow growth rate). ● GDP metrics do not consider some important types of economic activity. ● Goods/services produced and consumed within a household are called home production. ○ Not included in GDP. ○ If I go to a restaurant to eat, that counts toward GDP; if I make a homemade meal to eat, it doesn’t count towards GDP. ● Goods/services sold outside of official records make up the underground economy. These do not count towards GDP. ○ These include illegal goods/services, which make up the black market. ○ Legal goods/services (e.g., mowing the lawn for money) makes up the gray market. ○ On average globally, the underground economy is worth about one-third of GDP. Varies across poor countries and wealthy countries. ● GDP does not account for externalities, whether positive or negative. ○ Green GDP accounts for the value of negative externalities. ■ Subtracts negative externality cost from the positive outputs counted in GDP. ● High GDP/GDP per capita is correlated to a higher quality of living, but does not equate to it. It does not take into account factors like literacy rates, mortality rates, leisure time (i.e., vacation time) etc. ○ Those other things mentioned above correlate to happiness, not necessarily wealth. ■ The Life Satisfaction Index suggests that the correlation between GDP per capita and happiness is far from perfect.