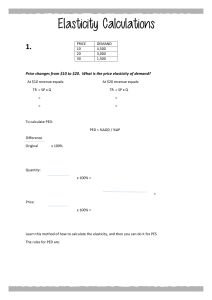

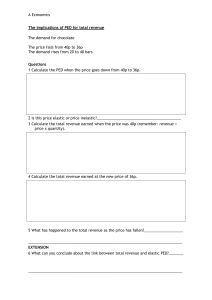

PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Chapter 11-Price Elasticity of Demand Q. Explain why demand for soap is more price-inelastic than demand for a luxury brand of perfume. [4] s22qp22 Q3b Q. Explain two reasons why demand for a product may be price-inelastic. [4] 3b m21qp22 Q. Analyse the advantages of selling a product which is price-inelastic in demand. [6]s21qp23q5c PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) 1.1 Define PED and state the formula Definition:- PED refers to the numerical measure of responsiveness of quantity demanded to the change in the price of a product. Formula:PED = % change in quantity demanded ----------------------------------------------% change in price 1.2 Calculate PED and state the types of PED (a) If price rises from 10 to 12 Quantity demand contracts from 5o to 45 % Change in Quantity Demanded=10% % Change in Price= 20% PED = 10/20=0.5 Type:- Relatively Inelastic demand (b) If price falls from 30 to 27 Quantity demand extends from 80 to 96 % Change in Quantity Demanded=20% % Change in Price= 10% PED = 20/10=2 Type:- Relatively Elastic Demand 1.3 Differentiate between relative elastic and inelastic demand with the help of suitable graph Success Criteria - Define elastic demand, give numerical example, value of PED, draw graph, give real world example Definition:- A small percentage change in price leads to a bigger percentage change in quantity demanded - Numerical e.g.:- 10% changes in price brings 20% changes in Qty. demand. If you have an answer > 1, then demand is very sensitive to price, this means a small change in price leads to a BIG change in demand Demand is said to be PRICE ELASTIC. - Shape of the DD curve:- Flatter Curve - Value : PED>1 - Example : Luxurious goods like branded clothes, cosmetics etc. PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) - Define inelastic demand, give numerical example, value of PED, draw graph, give real world example. Definition:- A big percentage change in price leads to a smaller percentage change in quantity demanded - Numerical e.g.:- 25% changes in price brings 10% changes in Qty. demand. If you have an answer < 1, then demand is in-sensitive to price, this means a BIG change in price leads to a small change in demand Demand is said to be PRICE INELASTIC. - Shape of the DD curve:- Steeper Curve - Value : PED<1 - Example : Essential goods (Needs) like wheat, medicines, petrol, etc. 1.4 Explain in detail any three factors affecting PED of a product [6] Urgency of wants- If urgency is high and cannot be post-poned, the PED will be inelastic because no matter what the price is, the consumer will still buy it. However, if the urgency is less and the want can be post-poned, then the PED in elastic, as the consumer can wait till the prices lower down in the future. Substitutes- When the product has many substitutes in the market, the PED is elastic because consumers can choose from a greater number of options and buy the cheapest one. However, when there are no substitutes, the PED is inelastic, as consumers have to buy the product regardless of the price eg salt. Proportion of income- If an individual spends a lot of money on a product, which takes a greater proportion of his income, a rise in the price of this product will cause PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) the demand to fall as these products are price sensitive for example luxury goods, due to which the PED is elastic . However a product that takes up a lower proportion of income might not have a greater fall in demand if price rises as they are less price sensitive for example newspapers, causing the PED to become price inelastic. Luxury good- As luxury goods are price sensitive, a rise in the prices would lead to a fall in the quantity demanded for example cars, branded clothes, etc. due to which the PED is elastic. However, necessities on the other hand are less price sensitive, and consumers will continue to buy it regardless of what price it is because they need it for survival for example food, water, shelter, etc. making the PED of such products inelastic Addictive goods- As people are used to consuming products such as alcohol, a rise in price of the product would not affect the quantity demanded by a greater percentage as people find it difficult to live without because they are addicted to it which means that the PED is inelastic. However, non-addictive goods such as chocolates that are elastic in nature suggest that a rise in the price would cause the demand to fall by a greater percentage. Time period- If a new product is launched, people want to explore it hence people will buy it no matter how expensive it is during the short run, hence the PED is inelastic. However in the long run, once new substitutes are introduced, the PED becomes elastic as people will choose the cheaper alternative. Income group- If an individual has a high income, they can afford to buy anything even if it is expensive, hence the PED for them is price inelastic, however those belonging to the lower income groups might reduce the quantity demanded if the price rises hence PED for them will be price elastic. 1.5 Discuss to what extent a businessman will use the knowledge of PED in business decisions [8] Success criteria [DEEDS]Definition, Example, Explanation, Diagram, Stakeholders(Producer, worker, consumer and government) Define PED Define elastic demand, give example, draw the graph, Revenue concept (Reduce the price to increase the total revenue) Define inelastic demand, give example, draw the graph, Revenue concept (Increase the price to increase the total revenue) PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Limitations (i) Difficult to calculate the value of PED (ii) The value of PED keeps changing (iii) Need to consider the value of PES as well (iv) Value of PED differs from country to country. Conclusion:If the product has inelastic demand then the producer should increase the price on the other hand If the product has elastic demand then the producer should decrease the price to increase the revenue. Chapter 12-Price Elasticity of Supply Q. Calculate the price elasticity of supply of Ecuador’s oil. 0.16 (1). PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Note:- Do not accept 16% Q. Analyse why price elasticity of supply can differ between products. [6] s17qp22q7c • Products which can be produced quickly (1) will have elastic supply (1) • Products which can be stored/non-perishable (1) will have elastic supply (1) • Products which are made with raw materials in short supply (1) will have inelastic supply (1) • Products made by firms with spare capacity/mobile resources/have a low cost of altering production/low cost of attracting resources into the industry (1) may have elastic supply (1) PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Q1. Define PES and state it’s formula [3] Price elasticity of supply refers to the numerical measure of responsiveness of quantity supplied to the change in the price of a product. Formula: % change in quantity supplied % change in price Q2. Calculate PES when there is 5% rise in the price of iPhones leading to a 12% increase in the quantity supplied. [2] PES=2.4 Q3. Calculate pes if price rises from $20 to $24 and QTY. rises from 70 units to 91 units PES= 1.5 Q4. Differentiate between relative elastic and inelastic supply with the help of suitable graph [10]SUCCESS CRITERIADefine elastic supply, give numerical example, value of PES, draw graph, give real world exampleDefine inelastic supply, give numerical example, value of PES, draw graph, give real world example. Relatively Elastic Supply: A small percentage change in price leads to a bigger percentage change in quantity supplied. Value: If you have a PES value greater than 1, then supply is very sensitive to price, this means a small change in price leads to a BIG change in supply Shape of the supply curve: flatter PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Relatively Inelastic Supply: A big percentage change in price leads to a smaller percentage change in quantity supplied. Value: If you have a PES value less than 1, then supply is insensitive to price, this means a BIG change in price leads to a small change in supply Shape of the supply curve: steeper PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Q5. Explain in detail any three factors affecting PES of a product [6] Barriers to entry: When there are difficulties to enter a firm which is dominated by one firm, the supply belongs to that of the company. However in a market where there are less barriers to entry, the overall supply keeps changing over time. Hence it is said that in a monopoly market, the PES is inelastic however in a competitive market, the PES is elastic. Resources mobility: Here we are talking about the mobility of the factors such as labour, cash, etc. Only if the resources are mobile, will a supplier be able to repay his bills, or make deliveries to consumers hence, the PES is elastic. However if the resources are immobile and cannot be changed easily then, the PES is inelastic. Inventory: If the quantity demanded for a product rises, and if there is extra inventory that can help meet the rise in demand, the PES is elastic as spare stock is available. However, if the spare stock is not available and companies cannot meet the rise in demand, the PES becomes inelastic. Time taken to produce: If one can produce a product in a shorter time, the firms can stock up the product to meet rise in demand immediately, due to which the PES of these products becomes elastic. However a few products that take a longer time to produce have an inelastic PES as producers often face difficulties to meet the consumer demand. Spare capacity: When a firm is not working to its full capacity, then they may decide to increase output if the consumer demand rises, due to which the PES in PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) this case is elastic. However a firm that is already working at its full capacity might not be able to increase output or meet rise in demand due to which the PES is inelastic. Chapter 14- Market Failure 1. The Government of Bangladesh is planning to build a new motorway with the help of private companies. It recognises that there are a number of costs and benefits, both private and social, that need to be taken into account before a final decision is taken. (a) Explain what is meant by (i) a private cost, (ii) a private benefit, (iii) an external cost and (iv) an external benefit. [4] Private cost: the costs of production that are borne by the business which produces the product or by the consumer who purchases the product (1). (ii) Private benefit: the benefits which accrue to the individual buyer or seller of a product (1). (iii) External cost: the costs which occur that are paid by a third party, rather than the producer (1). (iv) External benefit: the benefits which result from a firm’s operations, but which give benefits to a third party (1). [4] (b) For each of the following, identify one example of (i) a private cost, (ii) a private benefit, (iii) an external cost and (iv) an external benefit that might be involved in the building of a motorway. [4] (i) Private cost: the construction cost (1). (ii) Private benefit: the profit made by the private company (1). (iii) External cost: the noise pollution resulting from the noise of vehicles on the motorway (1). (iv) External benefit: the savings in time from people driving their vehicles along the motorway (1). [4] 2. An entrepreneur plans to cut down timber in a rainforest. The local community, however, are concerned that the social costs will be greater than the social benefits. (a) Distinguish between the social benefits and the social costs involved in this example. [6] Example: cutting down timber in a rainforest Up to 2 marks for definition of social benefits: social benefits – the sum of private benefits and external benefits (2) total benefits to society (1) 1 mark for relevant example: such as profit made by a firm (private benefit)/an increase in jobs for a community (external benefit) (1) Up to 2 marks for definition of social costs: social costs – the sum of private costs and external costs (2) total costs to society (1) 1 mark for relevant example: such as the cost of machinery to a firm (private cost)/the pollution caused to the community (external cost) (1) A maximum of 4 marks if the answer is not related to the example 3. Define Market Failure and explain its causes [8] Causes:- PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Merit goods: if left on market forces, goods such as healthcare and education will be under produced and under consumed as the social benefits are underestimated. Demerit goods: if left on market forces, goods such as alcohol and cigarettes will be over produced and over consumed as the social costs are underestimated. Public good: goods that have the characteristics of non-excludability and non-rivalry, if left on market forces will not be produced at all due to free rider problem. Producers lack incentives to produce products such as streetlight, etc. Information failure: can be due to lack of information, inaccurate information or asymmetric information where 1 party has more information than the other party for example car owner and car mechanic. Immobility of resources: there are 2 types of mobility of resources. Occupational immobility is when a person with 1 occupation looks for a job, however, the vacancy is for other post and the worker cannot switch his occupation due to lack of skills. Geographical immobility is when a person looking for a job finds a vacancy which is far away from his house, and the person is not wanting to travel so far to work. Monopoly: if a company is a monopoly, the firm may deliberately charge higher prices and produce less output. As there is no close substitute available, consumers are left with no other choice. 4. Analyse why the social costs of oil extraction may be greater than the private costs. [6] Private costs are the costs to the oil firms (1) e.g. cost of operating an oil rig (1). Social costs are private costs plus external costs (1) that affect everyone (1). External costs are likely to exist (1) firms will not take these into account (1) e.g. air pollution, water pollution, reduction in fertility of nearby land (maximum 2 marks for relevant examples). 5. Discuss whether government intervention to reduce market failure is always likely to be successful. [10] Advantages of government intervention: • indirect taxes to discourage consumption of demerit goods (don’t need to use that term) • subsidies to encourage consumption of merit goods (don’t need to use that term) • taxation to finance expenditure on public goods (don’t need to use that term) • regulations to control private producers, e.g. on pollution and monopolies having market dominance. Limitations of government intervention: • consumption of demerit goods (don’t need to use that term) might be discouraged, but unlikely to end completely given inelastic demand, e.g. for cigarettes and alcohol • consumption of merit goods (don’t need to use that term) might be encouraged, but still a limit to extent of increase in consumption • available finance to provide public goods (don’t need to use that term) might be limited/restricted, especially if a large budget deficit • regulations may not be adequately policed/enforced. PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) A one-sided answer can gain no more than 5 marks. A maximum of 7 marks if no understanding of ‘always’. [8] 6. Explain how a subsidy can correct market failure. [4] S20QP21 Q5B A payment to increase production (1) and lower price (1) can increase consumption of merit goods (1) products with positive externalities (1) which are under-consumed if left to market forces (1) can be paid to private sector firms to produce public goods (1) would not be produced if left to market forces (1). 7. Explain why external costs cause market failure. [4] m20QP21 Q1D External costs are not considered (1) base decisions just on private costs and benefits (1). They cause harmful effects to third parties / negative side effects (1) they result in overconsumption (1) and overproduction (1). Their existence may mean that social costs exceed social benefits (1). Examples of causes or costs: e.g. driving, pollution / environmental damage, burning fields and mining (up to 2). They result in a misallocation of resources / inefficient use of resources (1). 8. [s23_qp_23] (b) Identify two external costs arising from the milk and car industries. [2] Air pollution (1). Damages the environment (where wild animals live) (1). If more than two costs given, consider the first three. (d) Explain the two plans that the New Zealand government has to reduce external costs to the environment. [4] Logical explanation which might include: End imports of petrol-powered cars by 2032 (1) decreasing the number of petrol −powered cars in New Zealand / reduce use of fossil fuels / by imposing an embargo/increasing the price of petrol-power cars / increasing usage of greener / electric cars (1). Limit the number of cows that each farmer can have (1) decreasing the amount of air pollution emitted by cows / less habitat damaged by cows / government fines to those who have more cows than permitted/ imposing regulations (1). One mark each for each of two plans identified and one mark each for each of two explanations. Accept milk production for keeping cows. (e) Draw a demand and supply diagram to show the effect of a cheaper substitute on the market for petrol-powered cars. [4] PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Demand and supply diagram: Axes correctly labelled – price and quantity or P and Q (1). Original demand and supply curves correctly labelled (1). New demand curve shifted to the left (1). Equilibriums – shown by lines P1 and Q1 and P2 and Q2 or equilibrium points marked as E1 and E2 (1). 9. Analyse how a government could encourage the consumption of merit goods. [6] [m23-qp-22 Q2c] Coherent analysis which might include: Provide a subsidy (1) reduce any indirect tax (1) lower price (1) make the goods more affordable (1) raise quality (1). Provide information about the benefits of consuming the goods (1) e.g. health campaigns / advertisements (1) overcome information failure (1). Use regulation (1) make consumption compulsory / impose fines for non-consumption (1) e.g. school attendance (1). Provide services such as education / healthcare (1) free to consumers (1). Set maximum price (1) to make the goods more affordable (1) but may create a shortage (1). Measures to reduce demerit goods clearly linked to idea of encouraging substitution of merit goods (1) relevant example (1). 10. Discuss whether or not higher indirect taxes can reduce the market failure caused by demerit goods. [6] m22qp22 Q1h PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) 11. Explain two ways a government could decrease the consumption of demerit goods. [4] s22qp21 q3b Impose an (indirect) tax / tariff on goods (1) raise the price (1). Provide information (1) about harmful effects (1). Ban / regulate (1) to stop or reduce the availability of the product (1). Set minimum price above market price (1) raise prices (1). Import quota (1) restricts availability for purchase (1). 12. Analyse the causes of market failure. [6] Q4c s22qp23 Market failure is when market forces cause an inefficient allocation of resources (1). Demerit goods (1) example (1) imperfect information (1) where consumers may not know about the actual costs (1). Merit goods (1) example (1) consumers may not know about actual benefits (1). External costs (1) costs to the third party (1) not considered by consumers and producers (1) therefore goods are overproduced or overconsumed (1). PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) External benefits (1) benefits to the third party (1) not considered by consumers and producers (1) goods are underproduced and underconsumed (1). Public goods (1) non-rivalry (1) and non-excludable (1) free rider problem (1) people want to consume but don’t want to pay for it (1) no profit incentive for firms (1) goods are underprovided by the market (1). Abuse of monopoly power (1) when firms have no competitors (1) they will push up prices (1) or reduce quality (1). Factor immobility (1) where labour cannot move from one job to another (1) or to take up a job somewhere else (1) leads to structural unemployment (1) 13. Explain two reasons why governments tax cigarettes. [4] q4b m21qp22 To raise revenue (1) demand for cigarettes is price-inelastic / smoking is addictive / to spend on e.g. education (1). To discourage consumption / to discourage production (1) they are a demerit good / cigarettes are more harmful than smokers realise / they cause health problems (1). To reduce external costs / they create external costs (1) impose a cost on third parties / cause pollution / health problems for non-smokers (1). To improve the current account position (1) cigarettes may be imported (1). 14. Explain the difference between private and external benefits. [4] w21qp21q3b Private benefits are enjoyed by the producer (1) and consumer (1) first and second parties (1) of a product, example e.g. revenue for the producer / satisfaction for the consumer (1). External benefits are enjoyed by a third party (1) not directly involved in the production (1) or consumption process (1) example (1) Note:- Maximum 3 marks for only explaining 1 type of benefit. 15. Discuss whether or not indirect taxation can reduce market failure. [8] w21qp23q2d Why it might: • demerit goods are overconsumed and cause external costs • demerit goods and other products causing external costs can be taxed • indirect taxation on demerit goods can discourage their consumption • merit goods are under-consumed and create external benefits • indirect tax revenue can be used to subsidise or produce merit goods • public goods would not be produced by the private sector as they have the characteristics of non-rival and nonexcludable • indirect tax revenue can be used to finance the production of public goods Why it might not: • difficult to measure external costs • demerit goods may be overtaxed, changing from being overconsumed to being underconsumed • demand for some demerit goods is price inelastic PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) • indirect taxes may fall more heavily on the poor • demand may just shift to imports if other countries do not impose indirect tax or have lower tax rates • tax revenue may not be used to promote the consumption of merit and public goods Chapter 20-Firms Chapter 21-Firms and production Chapter 22-Firms, costs, revenue and objectives March 2016 qp22 2 (b) and c Q. Explain why some firms may have survival as a short-term goal. [4] Some firms may be making a loss/be in financial difficulties (1) they may hope to continue to produce until demand increases/grow in the future (1) and so revenue rises (1) or costs of production fall (1) so profit is again earned (1) or recession ends (1) and economic growth occurs (1). Q. Analyse how consumers may suffer as a result of a fall in the profits firms earn. [6] Some firms may decide to stop production (1) this may reduce competition (1) raise price (1) lower quality (1) reduce choice (1). Some firms may reduce output (1) may lower availability of products (1). Firms will have less funds available to put back into the firm/invest (1) spend less on research and development (1) so the quality of the product may not improve (1). Firms may try to cut costs of production (1) may use lower quality raw materials (1) reduce quality of product produced (1). Q. Discuss whether an increase in output will increase the profits that firms receive. [8] March 2017 qp22 Q2d Up to 5 marks for why it might: The higher output may be the response to higher demand (1) raise revenue (1) may widen the gap between revenue and cost (1). If to sell the higher output a firm has lowered price, revenue would increase if demand is elastic (1) fall in price will cause a greater percentage rise in demand (1). A higher output may enable a firm to take greater advantage of economies of scale (1) lower average costs (1) example (1). Up to 5 marks for why it might not: If demand is inelastic (1) a fall in price will cause a smaller percentage rise in demand (1) revenue will fall (1). May result in the firm experiencing diseconomies of scale (1) raise average costs (1) example (1). May occur when demand is falling (1) revenue will fall (1) may make a loss (1). Q. Explain how a fall in output will affect average fixed cost and average total cost. [4] O/N 2016/21 Q5b Average total cost = average fixed cost plus average variable cost (1). A fall in output will increase average fixed cost (1) total fixed cost will be divided by a smaller output (1) example (1). The effect of a fall in output on average total cost is uncertain (1) it will fall if variable costs fall by more than output (1). AVC will depend upon whether or not the firm is experiencing economies of scale / PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) diseconomies of scale (1). Q. D iscuss whether a merger between two large firms in the same industry will increase the price of the product. [8] O/N 2016/23 Q3(d) Up to 5 marks for why it might: Increase in size firm / reduction in competition (1) the firms may be able to raise price as consumers may have no alternative / dominate the market (1). The firm may become a monopoly (1) becoming a price maker (1). Firm becomes too large (1) may experience diseconomies of scale (1) example (1) increases average cost of production (1) and passes on higher costs in higher prices (1). Firms may produce higher quality products (1) as a result of increased spending on research and development/new technology (1) so demand for the products may be higher (1). Up to 5 marks for why it might not: The firm may experience economies of scale (1) example (1) lowering average cost of production (1) example (1) and lowers prices without affecting profits (1). The firm may still face considerable competition in the industry (1) other mergers may have taken place/may still be a high number of firms in the industry (1). The firm may not be seeking to maximise profits (1) may be trying to increase the share of the market (1) may do this by keeping price relatively low (1). Government may intervene (1) and limit price increases (1). Q. Discuss the advantages and disadvantages of small firms. [8] O/N 2016/23 Q4(d) Up to 5 marks for advantages: Able to provide a personal / specialised service (1) meet individual requirements / produce unique goods (1). May be quick to respond to changes in consumer demand (1) as owner can make decisions without consulting anyone (1) has greater flexibility than bigger firms (1). More personal contact with staff (1) staff more motivated (1) higher productivity (1). Easy to set up (1) Able to cater for a small market (1) demand for the product may be low (1). May be able to cater for a local market (1) has greater knowledge of local market (1) low transport costs (1). May receive subsidies from the government (1) making it easier to compete with bigger firms (1). Up to 5 marks for disadvantages: May be too small to take advantage of economies of scale (1) example (1) as a result prices are higher than larger firms (1) cannot compete on prices / profit margins are lower (1). May have some difficulty raising finance (1) may not be able to sell shares (1) banks may be reluctant to lend to them (1). Some small businesses may be sole proprietors and so may have unlimited liability (1) may risk losing personal wealth (1). May lack a range of ideas (1) which may reduce innovation (1) may lack variety of goods compared to large firms (1). Small firms may not be well-known (1) and so may find it difficult to attract consumers (1). Small firms may find it difficult to attract specialist staff (1) less ability to pay high wages (1) less opportunities for promotion (1). Q. Discuss whether the average cost of production always decreases when a firm increases the total output that it produces. [8] M/J 2016/21 4(d) Up to 5 marks for why it might: • The firm may experience economies of scale (1) total cost will rise by less than total output (long run average cost may fall as output increases) (1). • The firm may experience buying/purchasing economies of scale (1) may be offered a discount price when buying raw materials in bulk (1). PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) • The firm may experience technical economies of scale (1) larger, more cost efficient technological equipment may be purchased to produce a higher output (1). • The firm may experience managerial economies of scale (1) specialist staff may be employed when output is high (1) • The firm may experience financial economies of scale (1) as output increases, it may be able to borrow more cheaply / or sell its shares at a lower price (1) • The firm may experience R & D economies of scale (1) the R & D expenditure can be spread over a higher output (1). • The industry may also be growing in size (1) enabling advantage to be taken of external economies of scale (1). Up to 5 marks for why it might not: • The firm may experience diseconomies of scale (1) total cost may rise by more than total output (long run average cost may increase as output increases) (1). • The firm may experience diseconomies of scale (1) this may make the firm slower to respond to changing market conditions / more difficult to keep costs down (1). • The firm may experience communication problems (1) ideas may not be communicated or may be misunderstood (1). • The firm may experience poor industrial relations (1) e.g. strikes may increase costs of production (1). • External diseconomies of scale may occur (1) e.g. pushing up the costs of production (1). • Allow up to 2 marks for a correctly labelled average cost diagram which shows economies and diseconomies of scale as an alternative to describing average costs rising / falling as output increases Q. Analyse two internal diseconomies of scale that a large firm may experience. [6] M/J 2016/22 4(c) • Difficulties controlling/managing the firm/managerial diseconomies (1) there are more layers of management in a large firm (1) may take longer to make decisions (1). • Communication problems (1) there are more layers of communication/communication may be indirect (1) messages may be misinterpreted/take time to reach recipients (1). • Labour diseconomies (1) Workers may feel less appreciated/have low morale (1) so may become demotivated (1) which could reduce labour productivity/efficiency (1). • Poor industrial relations (1) industrial action e.g. strikes may occur (1) due to the time it takes to address workers’ grievances (1) more people to argue with (1). Q. Analyse the advantages of vertical integration [6] M/J 2014/21 Q4c 1 mark for a definition of vertical integration/for a distinction between backwards integration and forwards integration. Up to 2 marks: ensures supply of raw materials at a reasonable price/reduces the chain of production “cuts out the middle man” (1) as the firm can directly provide raw materials for manufacture (1). Up to 2 marks: may restrict access of competitors to raw materials (1) which may make their prices higher or restrict their output (1). Up to 2 marks: ensures outlets for products (1), which ensures products get to market (1). Up to 2 marks: ensures products are well displayed and promoted (1) which can increase demand (1). Up to 2 marks: may enable economies of scale to be gained (1), relevant example, e.g. financial economies. Note: a maximum of 4 marks overall. Q. Discuss whether a firm will always benefit from an increase in its size [10] M/J 2012/21 Q4c PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Q11. (d) Discuss whether or not a government should encourage firms to merge. [8] [s23_qp_21. Q5d] Why it should: economies of scale Why it should not: Q12. Explain two reasons why a merger may result in higher prices for consumers. [4] [s23_qp_22 Q2b] More market power / less competition / monopoly power / may become a monopoly (1) can raise price as consumers will not be able to switch to other firms / demand may become more inelastic / can control price / become a price maker (1). May experience diseconomies of scale / example of a diseconomy of scale that may be experienced (1) raise prices due to PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) higher (average) costs (1). Carrying out the merger may be expensive (1) price raised to cover the cost of e.g. retraining staff / making some staff redundant (1). Q13. Analyse, using a diagram, the effect of an increase in output on average fixed cost (AFC) and total fixed cost (TFC). [6] m22qp22 Q3c Up to 4 marks for the diagram: Axes correctly labelled: costs and output (1) TFC horizontal line (1). AFC downward sloping (1). Curves correctly labelled: TFC / FC and AFC (1). Up to 2 marks for coherent written analysis which might include: A higher output will have no effect on total fixed cost / fixed costs do not change with output in the short run / fixed costs have to be paid even when output is zero (1). Average fixed cost will fall with output / as the same cost figure is divided by a higher output / AFC is TFC divided by output (1). Q14. (a) Identify two internal economies of scale. [2] Q15. Analyse why a firm may become more capital-intensive. [6] s21qp22 q3c The cost of capital may fall / the price of labour may rise (1) lowering costs of production (1) making the firm more price-competitive (1) may increase profits (1). Advances in technology (1) may improve the quality of capital (1) making it more productive / efficient (1) may increase the quality of products produced (1) raise demand for the products produced (1). Firms may want to reduce human error / more consistent quality / uniform products (1) reduce wastage (1). Firms may want to avoid disruption to production (1) caused by industrial action / strikes / sickness (1) capital equipment does not need to take breaks / can work 24 hours a day (1). There may be a shortage of labour (1) making it difficult to recruit workers (1). A government may reduce taxes on capital goods (1) provide subsidies (1) the rate of interest may be reduced (1) making capital goods more affordable (1). The firm’s output may rise (1) reducing the average fixed cost of capital / benefiting from economies of scale (1). PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Q16. Discuss whether or not it is an advantage to keep a firm small. [8] s21qp22 q5d Why it might: • flexible, less people to consult, more in touch with consumers • may be able to provide more personal attention • may receive government subsidies • may be able to concentrate on a niche market • may have good labour relations • may avoid diseconomies of scale Why it might not: • may not be able to take advantage of economies of scale • may be driven out of business by larger competitors • may be difficult to raise finance • risk of being taken over by a larger firm • may have difficulty recruiting highly skilled workers • may not have the resources to survive a fall in demand Q17. Explain the difference between labour-intensive and capital-intensive industries. [4] w21qp21q5b Q18. Analyse how average cost can change as output increases. [6] w21qp22 q3c Average cost may fall due to economies of scale (1) example of an economy of scale e.g. financial economy (1) explanation of the example (up to 2 marks) e.g. banks may charge lower interest rates (1) reducing firms’ cost of borrowing (1). Another example e.g. buying economy (1) explanation of the example (up to 2 marks) e.g. able to buy in bulk (1) and receive a discount (1). Higher output may enable fixed costs to be spread over a larger output (1) which may reduce average fixed costs (1) whether average total cost will fall will depend on what happens to average fixed cost plus average variable cost (1). Average cost may rise due to diseconomies of scale (1) example e.g. managerial economy (1) explanation of the example (up to 2 marks) e.g. difficulty of keeping control of a large organisation (1) leading to more mistakes / poor decision making (1). Another example e.g. poor labour relations (1) explanation of the example (up to 2 marks) e.g. lack of contact between workers and managers (1) may be strikes (1). Note:- Nothing for reference to causes of changes in total costs e.g. employing more workers will increase wages paid. Q19. Discuss whether or not a government should stop firms merging. [8] w21qp23q4d PODAR INTERNATIONALSCHOOL (IB & CAMBRIDGE) Why it should: • will have greater market share • may abuse greater market power • may become complacent • consumers may experience higher prices and lower quality • may engage in rationalisation • may increase unemployment • may experience diseconomies of scale Why it should not: • may innovate more • may provide consumers with lower prices and higher quality • may be more international competitive • may improve current account position • may increase economic growth • may experience economies of scale