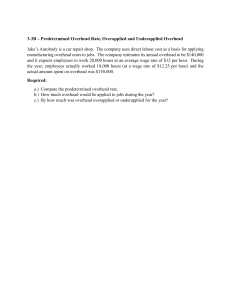

Chapter 1 Summary Accounting Information, Types • Accounting - provides information to external parties (stockholders, creditors, and various regulatory bodies) for investment and credit decisions. - helps an organization estimate the cost of its products and services. - provides information useful to internal managers who are responsible for planning, controlling, decision making, and evaluating performance. • The purposes of financial, management, and cost accounting are as follows: - financial accounting is designed to meet external information needs and to comply with generally accepted accounting principles; - management accounting is designed to satisfy internal users’ information needs; and - cost accounting overlaps financial accounting and management accounting by providing product costing information for financial statements and quantitative, disaggregated, cost-based information that managers need to perform their responsibilities. Cost Accounting Standards • Generally accepted cost accounting standards - do not exist for companies that are not engaged in contracts with the federal government; however, the Statements on Management Accounting and Management Accounting Guidelines are well researched suggestions related to high-quality management accounting practices. • Ethical behavior in organizations is addressed in part in the following items: - IMA’s Statement of Ethical Professional Practice, which refers to issues of competence, confidentiality, integrity, and credibility. - Sarbanes-Oxley Act, which requires corporate CEOs and CFOs to sign off on the accuracy of financial reports. - False Claims Act, which provides for whistleblowing protection related to frauds against the U.S. government. Mission Statements, Organizational Strategy • The organizational mission and strategy are important to cost accountants because such statements help to - indicate appropriate measures of accomplishment. - define the development, implementation, and monitoring processes for the organizational information systems. • Two common corporate strategies are - cost leadership, which refers to maintaining a competitive edge by undercutting competitor prices, and - product differentiation, which refers to offering (generally at a premium price) superior quality products, more unique services, or a greater number of features than competitors. • Organizational strategy may be constrained by - monetary capital, intellectual capital, and/or technology. - external cultural, fiscal, legal/regulatory, or political situations. - competitive market structures. Organizational Structure Ethical Standards • The organizational structure - is composed of people, resources other than people, and commitments that are acquired and arranged relative to authority and responsibility to achieve the organizational mission, strategy, and goals. - is used by cost accountants to understand how information is communicated between managers and departments as well as the level of each manager’s authority and responsibility. - has line personnel who seek to achieve the organizational mission and strategy through balanced scorecard targets. - has staff personnel, such as cost accountants, who advise and assist line personnel. - is influenced by management style and organizational culture. Value Chain • The value chain is a set of value-adding functions or processes that convert inputs into products and services for company customers. • Value chain functions include - research and development, - product design, - supply, - production, - marketing, - distribution, and - customer service. Balanced Scorecard • A balanced scorecard - indicates critical goals and targets needed to operationalize strategy. - measures success factors for learning and growth, internal business, customer satisfaction, and financial value. - includes financial and nonfinancial, internal and external, long-term and short-term, and lead and lag indicators. Ethical Behavior • Accountants need to be aware of ethical conduct and laws globally, not just in the United States. • Ethical behavior has been addressed internationally: - The Foreign Corrupt Practices Act and the OECD’s Anti-Bribery Convention prohibit companies from offering or giving bribes to foreign officials to influence those individuals to help obtain or retain business. - The OECD’s Anti-Bribery Convention has been adopted by almost 40 countries worldwide Chapter 2 Summary Cost Classification • Direct or indirect, depending on their relationship to a cost object. • Variable, fixed, or mixed depending on their reaction to a change in a related activity level. • Unexpired (assets) or expired (expenses or losses) depending on whether they have future value to the company. • Product (inventoriable) or period (selling, administrative, and financing) depending on their association with the revenue-generating items sold by the company. Assumptions Used to Estimate Product Cost within Relevant Range of Activity • Variable costs are constant per unit and will change in total in direct proportion to changes in activity. • Fixed costs are constant in total and will vary inversely on a per-unit basis with changes in activity. • Mixed costs fluctuate in total with changes in activity and can be separated into their variable and fixed components. • Step costs are either variable or fixed, depending on the size of the changes (width of the steps) in cost that occur with changes in activity Conversion Process Differences • Manufacturers require extensive activity to convert raw material into finished goods; the primary costs in these companies are direct material, direct labor, and overhead; manufacturers use three inventory accounts (Raw Material, Work in Process, and Finished Goods). • Service companies often require extensive activity to perform a service; the primary costs in these companies are direct labor and overhead; service companies may use Supplies Inventory and Work in Process Inventory accounts but typically have no Finished Goods Inventory. • Retailers require little, if any, activity to make purchased goods ready of sale; the primary costs in these companies are purchase prices of goods and labor wages; retailers use a Merchandise Inventory account. Product Cost Categories • Direct material, which is the cost of any item that is physically and conveniently traceable to the product or service. • Direct labor, which is the wages or salaries of the people whose work is physically and conveniently traceable to the product or service. • Overhead, which is any cost incurred in the conversion (or production) area that is not direct material or direct labor; overhead includes indirect material and indirect labor costs. Cost of Goods Manufactured • CGM equals the costs that were in the conversion area at the beginning of the period plus production costs (direct material, direct labor, and overhead) incurred during the period minus the cost of incomplete goods that remain in the conversion area at the end of the period. • CGM is shown on an internal management report called the schedule of cost of goods manufactured; it is equivalent to the cost of goods purchased in a retail company. • CGM is added to beginning Finished Goods Inventory to determine the cost of goods available (CGA) for sale for the period; CGA is reduced by ending Finished Goods Inventory to determine cost of goods sold on the income statement. Chapter 3 Summary Overhead Cost Allocation • Manufacturing overhead costs are allocated to products to - eliminate the problems caused by delays in obtaining actual cost data. - make the overhead allocation process more effective. - allocate a uniform amount of overhead to goods or services based on related production efforts. - allow managers to be more aware of individual product or product line profitability as well as the profitability of doing business with a particular customer or vendor. Underapplied and Overapplied Overhead • Underapplied (actual is more than applied) or overapplied (actual is less than applied) overhead is - caused by a difference between actual and budgeted OH costs and/or a difference between the actual and budgeted level of activity chosen to compute the predetermined OH rate. - closed at the end of each period (unless normal capacity is used for the denominator level of activity) to Cost of Goods Sold (CGS) if the amount of underapplied or overapplied overhead is immaterial (underapplied will cause CGS to increase, and overapplied will cause CGS to decrease) or Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold (based on their proportional balances), if the amount of underapplied or overapplied overhead is material. Predetermined Overhead Rates and Capacity • Capacity measures affect the setting of predetermined OH rates because the use of - expected capacity (the budgeted capacity for the upcoming year) will result in a predetermined OH rate that would probably be most closely related to an actual OH rate - practical capacity (the capacity that allows for normal operating interruptions) will generally result in a predetermined OH rate that is substantially lower than an actual OH rate would be. - normal capacity (the capacity that reflects a long-run average) can result in an OH rate that is higher or lower than an actual OH rate, depending on whether capacity has been overor underutilized during the years under consideration. - theoretical capacity (the estimated maximum potential capacity) will result in a predetermined OH rate that is exceptionally lower than an actual OH rate; however, this rate reflects a company’s utopian use of its capacity. High–Low Method and Least Squares Regression • Mixed costs are separated into their variable and fixed components by - the high–low method, which considers the change in cost between the highest and lowest activity levels in the data set (excluding outliers) and determines a variable cost per unit based on that change; fixed cost is then determined by subtracting total variable cost at either the highest or the lowest activity level from total cost at that level. - regression analysis, which uses the costs and activity levels in the entire data set (excluding outliers) as input to mathematical formulas that allow the determination first of variable cost and, subsequently, of fixed cost. Changing Sales or Production Levels in Absorption and Variable Costing Predetermined Overhead Rates and Flexible Budgets - absorption costing requires fixed costs to be written off as a function of the number of units sold; thus, if production volume is higher than sales volume, some fixed costs will be deferred in inventory at year-end, making net income higher than under variable costing. conversely, if sales volume is higher than production volume, the deferred fixed costs from previous periods will be written off as part of Cost of Goods Sold, making net income lower than under variable costing. • Flexible budgets are used by managers to help set predetermined OH rates by - allowing managers to understand what manufacturing OH costs are incurred and what the behaviors (variable, fixed, or mixed) of those costs are. - allowing managers to separate mixed costs into their variable and fixed elements. - providing information on the budgeted costs to be incurred at various levels of activity. - providing the impacts on the predetermined fixed OH rate (or on a plantwide rate) from changing the denominator level of activity. Absorption and Variable Costing • Absorption and variable costing differ in that - absorption costing includes all manufacturing costs, both variable and fixed, as product costs. presents nonmanufacturing costs on the income statement according to functional areas. - variable costing includes only the variable costs of production (direct material, direct labor, and variable manufacturing overhead) as product costs. presents both nonmanufacturing and manufacturing costs on the income statement according to cost behavior. • Differences between sales and production volume result in differences in income between absorption and variable costing because - variable costing requires all fixed costs to be written off in the period incurred, regardless of when the related inventory is sold; thus, if production volume is higher than sales volume, all fixed manufacturing costs are expensed in the current period and are not deferred until the inventory is sold, making net income lower than under absorption costing. conversely, if sales volume is higher than production volume, only current period fixed manufacturing costs are expensed in the current period, making net income higher than under absorption costing.