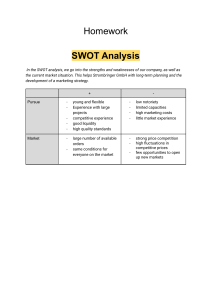

Introduction to Strategic Management Accounting Introduction to Strategic Management Accounting INTRODUCTION TO STRATEGIC MANAGEMENT ACCOUNTING Table of Contents: Page Number 1.1 Introduction: 3 1.2 Definition of Strategic Management Accounting: 3 1.3 Role of Strategic Management Accounting:: 3 1.4 Business Performance Factors: 3 1.5 Context of traditional tools and methods of Management Accounting : 6 1.6: Relationship between management Accounting and Strategic Management Tools 1.7: SWOT Analysis 1.1.Introduction and objectives Traditionally management accounting has been characterized as providing information to aid managers internally in a firm and as such the focus of the management accounting systems has also tended to be internally orientated. During the 1980s and 1990s a growing number of academics (Johnson and Kaplan, 1987; Bromwich and Bhimani, 1989, 1996) began to recognize that management accounting was not adapting to changes in the modern business environment and as such was not fulfilling its function to aid managers. In a bid to improve the quality of management accounting information for managers it was necessary to focus more widely on the external environment of the firm and thus the concept of strategic management accounting evolved. Now (strategic) management accounting involves the provision of information, which is externally orientated, market-driven and customer-focused and provides managers with a range of techniques and tools to facilitate strategically-orientated decision making. After studying this chapter you should be able to: Discuss the development and key elements of strategic management accounting Page 2 of 14 Introduction to Strategic Management Accounting Understand the difference between traditional and strategic management accounting Evaluate key analytical tools which link management accounting with strategy Strategic management accounting is a type of accounting that focuses not only on internal factors of a company, but factors that are external. This includes industry-wide financials, averages and upcoming trends. Strategy Strategic management accounting makes and implements strategies to increase a business’s profitability. Costs Strategic management accounting takes an interest in the costs of goods made. Costs such as overhead and raw material are examples of internal factors strategic management accountants use. Prices Strategic accounting studies the industry prices on goods in order to help find a good selling price for the goods a company manufactures. For example, lowering a price of a product from $2.00 to $1.95 may actually increase total profit by increasing the quantity of products sold. Trends Strategic management accountants study trends so they can forecast what goods consumers will demand in the future. For example, a strategic management accountant for a shoe manufacturer will study other shoe companies to determine the latest styles and colors. Planning Strategic management accountants compile this external and internal information to determine a plan for the company. They recommend certain products to be made, and help the company carry out the plans they have created. 1.2 Definition of Strategic management accounting: In order to fully appreciate the development of strategic management accounting it is necessary to evaluate the changes to the external environment of organizations over the last 30 years. The first main change has been in relation to the competitive environment of organizations. They have seen significant change from the opening of barriers to trade Page 3 of 14 Introduction to Strategic Management Accounting allowing for global competition which in turn has been possible because of advances in technology. The increase of competition has had the effect of shortening the lifecycle of products. This means that organizations have to work harder to develop new products and services and have less opportunity to recoup costs and generate profit before the decline of the product or service. The improvement in technology has given more information to the customer allowing the customer to make better informed decisions about which products and services they wish to buy and also to allow the customer to be more proactive in selecting products and services which are tailored specifically for them. In particular the empowerment of customers has resulted in three key challenges for businesses: Prices are being forced down because customers are able to find a much wider source of alternatives. Quality is being forced up as businesses compete to attract the customer Greater variety in the product/service offering is necessary to attract the customer. Additionally a number of new management techniques have been adopted by firms in light of the above concerns, such as total quality management, just in time and other methods to rationalize the cost of production and consumption. The above developments have forced organizations to consider their position in their markets, their prices and their costs in a different way than they had done in the past. Definitions of strategic management accounting began to spring up the earliest pioneer of which was Simmonds (1981) whose definition has subsequently been subsumed into the CIMA definition which is: A form of management accounting in which emphasis is placed on information which relates to factors external to the firm, as well as non-financial information and internally generated information. CIMA official terminology, 2005, p. 54 A number of definitions have appeared over the years but no definitive definition of what it is, or what techniques it contains, have been consolidated over the last 30 years. In their most recent work Roslender and Hart (2010) review much of the literature and contend that three distinct conceptions of strategic management accounting have appeared: The attempt to incorporate strategic ideas into management accounting by taking generic strategy tools and looking at what management accounting information can be used to support strategy. That it is designed to align management accounting with marketing Page 4 of 14 Introduction to Strategic Management Accounting management for strategic positioning. This view looks at the marketing tools used by businesses and uses management accounting within those tools. That it is just a name to group together many of the contemporary approaches in management accounting that have developed which have a strategic implication. There are a number of contemporary approaches to management accounting which have been marked as strategic management accounting techniques because of their external and market orientated content. “The provision and analysis of financial information on the firm’s product markets and competitors’ costs and cost structures and the monitoring of the enterprise’s strategies and those of its competitors in these markets over a number of periods” Strategic management accounting (SMA) is the merging of strategic business objectives with management accounting information to provide a forward looking model that assists management in making business decisions. The Chartered Institute of Management Accounting (CIMA) defines management accounting as follows: “management accounting is the sourcing, analysis, communication and use of decision-relevant financial and non-financial information to generate and preserve value for organizations.” This is quite different from the strategic management accounting definition. According to CIMA, strategic management accounting is defined as “a form of management accounting where emphasis is placed on information which relates to factors external to the entity, as well as non-financial information and internally generated information.” According to a Houston Chronicle article by Grant Houston, strategic management accounting is a form of business inquiry that combines the accounting criteria of an organization with external factors that influence the organization, such as industry trends in costing, pricing, market share and resources. The goal of strategic management accounting is to provide companies with a comprehensive means to analyze future business decisions. We realize by the definition that external factors are a key component of the concept of strategic management accounting. So what is strategic management accounting Strategic management accounting involves the evaluation of external information regarding competitors in the marketplace, political/monetary policies affecting the market, Page 5 of 14 Introduction to Strategic Management Accounting current trends in prices, share and costs. The result of this evaluation is then focused on the available resources of the firm. So, management can determine the needed responses of the organization in order to be at the top in the market. In carrying out this analysis, management brings three basic elements to play: 1. Quality 2. Cost 3. Time Enterprises evaluate the relative implication and importance of these three factors on their customers and the entire market and draw out strategic paths of actions to put them at the top of the competitions. This is carried out most effectively using behavioral, technical and cultural analysis that provides both the information and actions the firm has to take to beat the competition. Strategic planning and SWOT analysis are two well-known tools to assist this process. Strategic planning and SWOT analysis are two well-known tools to assist this process. A management accountants role could include preparing and updating such a tool. Strategic management accounting definition put into action Here is an example to properly illustrate the strategic management accounting definition works in practice: A coffee retail shop that wants to stand out of the competition, satisfy customers in terms of quality, cost, and time, and still make maximum profit and save costs can apply strategic management accounting. Based on the technical, behavioral and cultural analysis carried out on the market and customers, the management might discover that to stand out of the competition, cost is a major factor. In a move to reduce costs, it might decide to sign a contract with suppliers of coffee to supply at a fixed price for a given period of time. This will help the firm reduce the price at which they can sell to customers, keep profit high and thus be at the top of the market in terms of sales. They might, however, discover that time is the major factor and may decide to sign a contract with construction companies and real estate holders to construct outlets at various points in the locality to reach customers quickly, and thus be at the top of the competition in terms of time. Linking strategy and accounting (strategic versus traditional accounting) Management accounting systems have three primary purposes: (a) To allow for the allocation of costs between cost of goods sold and inventory for internal and external profit reporting Page 6 of 14 Introduction to Strategic Management Accounting (b) To provide relevant information to aid management decisions (c) To provide information to aid in planning, control and the evaluation of performance. Whilst these are indeed important and critical requirements of accounting systems, the traditional viewpoint has been to use internal information to achieve them and this is where the failings of traditional management accounting can be seen to be apparent. The first purpose is in line with financial reporting requirements and a failing of traditional management accounting has been that the techniques used have been orientated to satisfying financial reporting requirements rather than on providing information to help managers make better decisions which is the second purpose. The first purpose is also achieved by using absorption costing methods to achieve the cost used and we have previously commented on the failings of such a system particularly in service industries. Additionally much of the information provided for the second and third purposes has come from internal sources and historical data which have proved to also be inflexible and have failed to consider external factors such as customers or competitors. To make management accounting more strategic it is necessary to provide information which has an external as well as internal focus and which is orientated towards the future rather than the past. Table 16.1 summarises the key points 1.2 Comparison of strategic and traditional management accounting It is not surprising that the focus of SMA mirrors the features identified as important in strategic management; that is, a longer term focus, the environment external to the organisation and a future rather than historical perspective. This emphasis contrasts with the traditional focus of management accounting (see Table 1). Table 1 The focus of traditional vs strategic management accounting Traditional management accounting Strategic management accounting Historical Prospective Single entity Relative position Single period Multiple periods Single decision Sequences, patterns Introspective Outward looking Manufacturing focus Competitive focus Existing activities Possibilities Reactive Proactive Overlooks linkages Embraces linkages Strategic Management Accounting Tools Page 7 of 14 Introduction to Strategic Management Accounting There were some areas where organisation size did not seem to influence usage – strategic tools and, to a lesser extent, budgeting tools. Net profit margin. SWOT analysis. Rolling forecast. Overhead allocation. Gross margin. Strategic planning. Variance analysis. Cash forecasting. 1.3. Benefits of strategic management accounting Strategic management accounting creates a sustainable cost advantage. Companies often use sustainable cost advantages to ensure their products are the most competitively priced in the economic marketplace. ... Supplier bargaining power allows supply companies to dictate the price a business will pay for economic resources. 1.4. Techniques of ‘strategic management accounting' Many of the techniques often packaged as 'strategic management accounting' are little used. Key techniques that are used in strategy formulation include benchmarking, customer profitability analysis (at contribution margin level) and investment appraisal. Sophisticated costing techniques are little used. Surveys of Strategic Management Accounting Practices. Competitive position monitoring Strategic pricing Competitor performance appraisal Competitor cost assessment Strategic costing Value chain costing Brand value monitoring Brand value budgeting Quality costing Life cycle costing Target costing Techniques of Strategic Management Accounting Page 8 of 14 Introduction to Strategic Management Accounting The following strategic management accounting techniques are considered in the current literature’s of strategic management accounting (Ramljak et al., 2012; Shah et al., 2011 and Cinquini et al., 2006). 1. Attribute Costing: This is referred to as costing of specific product features attributes which appeal to customers (Ramljak and Rogosic, 2012). These attributes are viewed as cost object (Cinquiniet et al., 2006 and Egbunike et al., 2014). 2. Activity Based Costing: Based on the identification of activities performed by the company which are considered the causes of indirect costs in the company (Ramljak et al., 2012 and Egbunike et al., 2014). 3. Benchmarking: This requires the comparison of company performance to that of an ideal standard with the goal of improvement in organizational practices. 4. Competitive position monitoring: This requires obtaining information on competitors’ performance such as sales, market share volume and unit costs and company performance with these in order to control and formulate strategy (Cinquini and Techucci, 2006 cited in Egbunike et al., 2014). 5. Competitor Cost Assessment: This relies solely on cost information from competitors (Egbunike et al., 2014). International Journal of Academic Research in Accounting, Finance and Management Sciences Vol. 6 (3), pp. 262–271, © 2016 HRMARS 265 Competitor performance appraisal based on published financial statements: This approach requires obtaining and analyzing competitor information from published financial statement that is available for use (Egbunike et al., 2014). 6. Customer Accounting: This includes all the practices directed to appraise profit, sales or costs deriving from customers or customer segments (Cinquini and Tenucci, 2006). 7. Integrated Performance Measurement Systems: The systems combine financial and nonfinancial measures i.e. quantitative and qualitative factors in defining corporate performance (Egbunike et al., 2014). 8. Quantity Costing: This technique classifies and monitors costs as deriving from quality prevention, appraisal, internal and external failures, environmental and safety costs (Cinquini et al., 2006). 9. Life Cycle Costing: The technique calculates costs associated with a product during its entire life cycle. This corresponds to the market life of the product i.e. introduction, growth, maturity and decline (Egbunike et al., 2014). 10. Strategic Pricing: The technique regards the use of competitor information such as competitors’ reactions to price changes, price elasticity, economics of scale and experience in the pricing process (Egbunike et al., 2014). 11. Strategic Costing: This technique involves relating cost accounting systems in the organization to corporate strategy which leads to the development of strategic costing tools. Moreover, at the heart of this system there is competitive advantage that can be achieved through product positioning and market penetration (Egbunike et al., 2014). 12. Value Chain Costing: This involves all the activities performed from the design stage to the distribution stage of the product. Also, it shows that accounting theory and information technology (Kirli et al., 2011). 13. Target Costing: This is determined by deducting from the selling price a desire d profit margin, the product design is then altered to contain the target cost. Page 9 of 14 Introduction to Strategic Management Accounting 14. Social Management Accounting: This approach facilitates the identification, recording and measurement of social cost information for internal decision making (Petcharat et al., 2010). 15. Environmental Management Accounting: It is concerned with the identification, compilation, estimation and analysis of environmental cost information for better decision making within the organization. 5.2. Empirical STRATEGIC MANAGEMENT AND ANALYSIS Strategic considerations Strategic Marketing Analysis Total Value-Chain Analysis Target Costing Life-Cycle Management and Costing Operational considerations Activity Based Analysis JIT Operations: A Management Philosophy Total-Quality Management and Costing Porter’s Strategic Positions Cost leadership Product or service differentiation Focus on market niche VALUE CHAIN ANALYSIS Focus of the analysis External vs. Internal (traditional) Highlights profit improvement areas Linkages with suppliers Linkages with customers Process linkages within a business unit Linkages across business units Steps in the analysis Identify an industry’s value chain Assign costs, revenues, and assets to value activities Diagnose cost drivers Page 10 of 14 Introduction to Strategic Management Accounting Develop sustainable competitive advantages ESTABLISHMENT OF TARGET COSTS Estimated Market Price Market Research Define Product/ Customer Niche Understand Customer Requirements Target Cost Define Product Features Competitor Analysis Required Required Profit Profit SWOT analysis SWOT analysis (or SWOT matrix) is an acronym for strengths, weaknesses, opportunities, and threats and is a structured planning method that evaluates those four elements of an organization, project or business venture. A SWOT analysis can be carried out for a company, product, place, industry, or person. It involves specifying the objectives of the business venture or project and identifying the internal and external factors that are favorable and unfavorable to achieve that objective. Some authors credit SWOT to Albert Humphrey, who led a convention at the Stanford Research Institute (now SRI International) in the 1960s and 1970s using data from Fortune 500 companies.[1][2] However, Humphrey himself did not claim the creation of SWOT, and the origins remain obscure. The degree to which the internal environment of the firm matches with the external environment is expressed by the concept of strategic fit. Strengths: characteristics of the business or project that give it an advantage over others Weaknesses: characteristics of the business that place the business or project at a disadvantage relative to others Opportunities: elements in the environment that the business or project could exploit to its advantage Threats: elements in the environment that could cause trouble for the business or project Page 11 of 14 Introduction to Strategic Management Accounting Identification of SWOTs is important because they can inform later steps in planning to achieve the objective. First, decision-makers should consider whether the objective is attainable, given the SWOTs. If the objective is not attainable, they must select a different objective and repeat the process. Users of SWOT analysis must ask and answer questions that generate meaningful information for each category (strengths, weaknesses, opportunities, and threats) to make the analysis useful and find their competitive advantage. Internal and external factors So it is said that if you know your enemies and know yourself, you can win a hundred battles without a single loss. If you only know yourself, but not your opponent, you may win or may lose. If you know neither yourself nor your enemy, you will always endanger yourself. SWOT analysis aims to identify the key internal and external factors seen as important to achieving an objective. SWOT analysis groups key pieces of information into two main categories: 1. Internal factors – the strengths and weaknesses internal to the organization 2. External factors – the opportunities and threats presented by the environment external to the organization Analysis may view the internal factors as strengths or as weaknesses depending upon their effect on the organization's objectives. What may represent strengths with respect to one objective may be weaknesses (distractions, competition) for another objective. The factors may include all of the 4Ps as well as personnel, finance, manufacturing capabilities, and so on. The external factors may include macroeconomic matters, technological change, legislation, and socio-cultural changes, as well as changes in the marketplace or in competitive position. The results are often presented in the form of a matrix. SWOT analysis is just one method of categorization and has its own weaknesses. For example, it may tend to persuade its users to compile lists rather than to think about actual important factors in achieving objectives. It also presents the resulting lists uncritically and without clear prioritization so that, for example, weak opportunities may appear to balance strong threats. Page 12 of 14 Introduction to Strategic Management Accounting It is prudent not to eliminate any candidate SWOT entry too quickly. The importance of individual SWOTs will be revealed by the value of the strategies they generate. A SWOT item that produces valuable strategies is important. A SWOT item that Use of SWOT analysis The usefulness of SWOT analysis is not limited to profit-seeking organizations. SWOT analysis may be used in any decision-making situation when a desired end-state (objective) is defined. Examples include non-profit organizations, governmental units, and individuals. SWOT analysis may also be used in pre-crisis planning and preventive crisis management. SWOT analysis may also be used in creating a recommendation during a viability study/survey. When to use SWOT analysis The uses of a SWOT analysis by a community organization are as follows: to organize information, provide insight into barriers that may be present while engaging in social change processes, and identify strengths available that can be activated to counteract these barriers. A SWOT analysis can be used to: Explore new solutions to problems Identify barriers that will limit goals/objectives Decide on direction that will be most effective Reveal possibilities and limitations for change To revise plans to best navigate systems, communities, and organizations As a brainstorming and recording device as a means of communication To enhance "credibility of interpretation “to be used in presentation to leaders or key supporters.[ COMPONENTS OF STRATEGIC MANAGEMENT ACCOUNTING Strategic management accounting which is that perspective of accounting information gathering and processing system that focuses on the external and long term prospect of a company has components that makes it possible for its objectives to be achieved. The components are tools used by decision makers in their everyday to day business activities. This section of this article briefly introduces the most common components of a strategic management accounting system. Page 13 of 14 Introduction to Strategic Management Accounting Balanced scorecard (BSC) or performance measurement: you can read this article for more on balanced scorecard. Target costing: this is a system of costing whereby organizations begin the process of costing by finding out what customers are willing to pay for a product first, then complete and accurate cost of what the product will cost is ascertain, based on this, management can then focus their attention on reducing the cost of making the product. Activity based management and costing: activity based management and costing are built on the philosophy of plucking loopholes in businesses. Any activity that does not directly or indirectly bring money to the business is stopped. Life cycle costing: in ever competitive market place, for companies to remain a force to reckon with, it has to get her costing right. The life cycle costing ensures that complete and accurate costing information is gathered and processed. Characteristics of a robust strategic management accounting system Futuristic Focus on external information Aggregates information Integration of risk analysis into traditional process Advancement in computing technology and the integration of what was once complex system into simplified and fully integrated system has placed real pressure on the job of management accountants. But, the value that a management accountant brings to the table in the form of insightful analysis should not be overlooked. Page 14 of 14