OD5535 Digital Advertising Agencies in Australia Industry Report

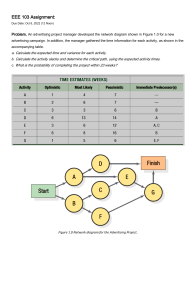

advertisement