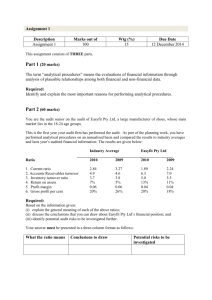

'ƌĂĚĞĚYƵĞƐƚŝŽŶƐ ŽŶ ƵĚŝƚŝŶŐ ϮϬϮϯ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐ ŽŶ ƵĚŝƚŝŶŐ ϮϬϮϯ 'ZŝĐŚĂƌĚ ZŽĞƚƐ ĚĂŵƐ ::ŽŶĐŬ Members of the LexisNexis Group worldwide Australia LexisNexis (Pty) Ltd www.lexisnexis.co.za Building 8, Country Club Estate Office Park, 21 Woodlands Drive, Woodmead, 2191 TBE Waterfront, 3 Dock Road, V & A Waterfront, Cape Town, 8001 TBE Umhlanga, Block A, Park Square, Centenary Boulevard, Umhlanga, 4319 LexisNexis, CHATSWOOD, New South Wales Austria Benelux LexisNexis Verlag ARD Orac, VIENNA LexisNexis Benelux, AMSTERDAM South Africa JOHANNESBURG CAPE TOWN DURBAN Canada LexisNexis Canada, MARKHAM, Ontario China LexisNexis, BEIJING France LexisNexis, PARIS Germany LexisNexis Germany, MÜNSTER Hong Kong LexisNexis, HONG KONG India LexisNexis, NEW DELHI Italy Giuffrè Editore, MILAN Japan LexisNexis, TOKYO Korea LexisNexis, SEOUL Malaysia LexisNexis, KUALA LUMPUR New Zealand LexisNexis, WELLINGTON Poland LexisNexis Poland, WARSAW Singapore LexisNexis, SINGAPORE United Kingdom LexisNexis, LONDON United States LexisNexis, DAYTON, Ohio © 2022 ISBN 978 1 7761 7496 6 (softback) 978 1 7761 7497 3 (e-book) Copyright subsists in this work. No part of this work may be reproduced in any form or by any means without the publisher’s written permission. Any unauthorised reproduction of this work will constitute a copyright infringement and render the doer liable under both civil and criminal law. Whilst every effort has been made to ensure that the information published in this work is accurate, the editors, authors, writers, contributors, publishers and printers take no responsibility for any loss or damage suffered by any person as a result of the reliance upon the information contained therein. Editor: Marjorie Guy Typesetter: Salome Govender Printed by CTP Printers Cape Town ŽŶƚĞŶƚƐ Page Chapter 1 An introduction to auditing and sundry auditing topics ............. 1 The purpose and nature of auditing; Terminology; Postulates; Responsibilities of auditors; Qualities and qualifications; Public interest scores Chapter 2 Corporate governance, internal auditing and audit committees ....................................................................... 19 Chapter 3 Professional conduct and ethical considerations ....................... 47 Code of Professional Conduct (ET); Auditors' liability Chapter 4 Basics: Evidence, assertions, internal control – general computerised environments: Introduction, general controls ............ 71 Evidence; Assertions; Internal control – general computerised environments; Introduction; General controls Chapter 5 Preliminary engagement activities and planning ........................ 97 Preliminary engagement activities; Engagement letters; Audit strategy and audit plan Chapter 6 Materiality, risk and fraud ......................................................... 119 Materiality; Financial statement assertions; Risk evaluation; Fraud Chapter 7 Audit sampling .......................................................................... 147 Chapter 8 The revenue and receipts cycle: Sales, debtors, cash and cash at bank .............................................................................. 167 System design/analysis, manual and computerised; Audit procedures, manual and computerised Chapter 9 Payroll and personnel cycle ........................................................ 199 System design/analysis, manual and computerised; Audit procedures, manual and computerised Chapter 10 The acquisition and payments cycle: Purchases, creditors and accruals ...................................................................... System design/analysis, manual and computerised; Audit procedures, manual and computerised ǀ 221 ǀŝ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Page Chapter 11 Inventory and production cycle ................................................ 253 System design/analysis, manual and computerised; Audit procedures, manual and computerised Chapter 12 Finance and investment cycle ................................................... 279 System design/analysis, manual and computerised; Audit procedures, manual and computerised Chapter 13 Statutory .................................................................................. 311 Auditing Profession Act 2005; The Companies Act 2008; The Close Corporations Act 1984 Chapter 14 Completion the audit ............................................................... 339 Subsequent events; Evaluating and concluding; Audit differences; Assessment of going concern ability; Trading when liabilities exceed assets Chapter 15 Reporting ................................................................................. Standard and modified audit reports; Standard and modified review reports; Related services: Compilation and factual findings; Accounting officer reports 369 ,WdZ ϭ ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐ ĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 1.1 Short questions – Audit concepts 35 marks 1.2 Explanation – Worldviews and theoretical underpinnings 10 marks 1.3 True or false 15 marks 1.4 Short questions – Confidentiality and independence 12 marks Short discussions – The expectation gap; Chartered accountants in public practice and in business; The role of the auditor; Limitations on an audit 26 marks Match ‘list 1’ to ‘list 2’: Definitions/ descriptions of individuals/bodies/terms 12 marks Short discussions – The PIS; Audit opinion; Professional competence and due care 12 marks Short discussions – The PIS and the requirement to be audited 22 marks 1.9 Multiple-choice questions 10 marks 1.10 Explanation – Limitations of internal control and the limitations of an audit 20 marks 1.5 1.6 1.7 1.8 continued ϭ Ϯ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 1.11 True or false 20 marks 1.12 Application and discussion – Fundamental ethical principles 20 marks Calculation and application – The PIS and the requirement to be audited. 12 marks 1.14 Explanation – Assertions and audit evidence 26 marks 1.15 Short questions 15 marks 1.16 Short discussions 31 marks 1.17 Short questions – Auditing postulates 22 marks 1.18 Application and discussion – Assurance engagements; Access to information; Professional conduct; The role of an audit 27 marks 1.13 ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ ϭ͘ϭ YOU ARE REQUIRED TO: Answer the following questions: 1. Give three reasons (with brief explanations) as to why auditors are needed in society. (9) 2. Briefly explain the terms listed below that you will come across in your auditing studies and in practices of auditing: • 3. 4. internal auditor; • forensic auditor; • postulates of auditing; • professional scepticism; and • applicable financial reporting framework. (10) Identify and briefly discuss the inherent limitations of an audit of a set of annual financial statements of a company. (10) Explain the difference between • an assurance engagement and a non-assurance engagement; and (4) • a statutory and a non-statutory engagement. (2) ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ ϭ͘Ϯ ϯ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Listed below are worldviews and theoretical underpinnings that you can use to interpret key stakeholder roles and responsibilities: 1 Agency theory 2. Legitimacy theory 3. Stakeholder theory 4. Ubuntu 5. Utilitarian ethics. YOU ARE REQUIRED TO: Briefly explain each of the above worldviews and theoretical underpinnings. ϭ͘ϯ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Indicate whether each of the following statements is true or false. Where you have selected false, provide a brief explanation. 1. The primary objective of the external audit of a company is to ensure that the company had complied with all the laws and regulations with which it must comply. 2. One of the duties of an auditor is to head the audit committee of an audit client. 3. If an auditor is independent, it is irrelevant whether others perceive him as not being independent. 4. With an unmodified audit opinion, the auditor certifies that the client’s financial statements are free from any misstatements. 5. Shareholders and other users can assume that the amounts reflected in a company’s financial statements are 100% correct only if they have been properly audited. 6. Independence is the characteristic common to all types of auditors, for example external auditors, government auditors etc. 7. To be able to express an opinion, the auditor must gather sufficient appropriate evidence on which to base his/her opinion. 8. To ensure that the audit is carried out to an acceptable standard, the auditor must comply with the International Financial Reporting Standards requirements. 9. The directors of a private company with a public interest score of 175 may overrule a requirement in the company’s Memorandum of Incorporation that requires that the company be externally audited annually. ϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 10. As an audit procedure, inquiry consists of seeking relevant information from the management of the entity. 11. Auditing the systems of a client should only be considered if fraud is suspected. 12. Control activities in a computerised system will be a combination of manual and automated (programmed) controls. ϭ͘ϰ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Mr Toni is the managing director of a newly incorporated company, Tiger Ltd. The company trades in a very competitive environment. Mr Toni’s son is a registered auditor. Mr Toni directed the following questions to you: • Firstly, Tiger Ltd trades in such a competitive environment, how can I be sure that the auditors would keep our customer and supplier information confidential? I surely do not want any competitors to steal business from Tiger Ltd! • Secondly, I do not understand why my son cannot be appointed as Tiger Ltd’s auditor. He is a man of high integrity and even though we are related, he will most definitely ensure that he is independent in performing his tasks as auditor. • I also know that my son will have Tiger Ltd’s best interest at heart, and I cannot say the same of an unfamiliar auditor. YOU ARE REQUIRED TO: (a) Respond to Mr Toni’s concern regarding the auditors keeping information confidential (first bullet point). (2) (b) Explain the term ‘independent’ in relation to members of the auditing profession. (3) (c) Respond to Mr Toni’s remarks regarding appointing his son as auditor of Tiger Ltd (second bullet point). (5) (d) Respond to Mr Toni’s remarks regarding the auditor having an audit client’s ‘best interest at heart’. (2) ϭ͘ϱ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ WĂƌƚ ;ϲŵĂƌŬƐϳŵŝŶƵƚĞƐͿ You are auditing a state-owned entity. The CFO of the state-owned entity asked you about an article in one of the popular business newspapers with the heading Where were the auditors? He stated that after he read the article, he does not see any use for an auditor. YOU ARE REQUIRED TO: (a) Explain the auditing expectation gap with reference to the implications thereof. (3) (b) Identify ways to overcome the auditing expectation gap. (3) ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ WĂƌƚ ϱ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Josephine Sithole and her sister, Annah Sithole, have both recently qualified as CA(SA)s. Josephine wishes to start her own auditing firm one day. As such, she is aware that she will have to register with the IRBA in future. On the other hand, Annah has taken up employment in the finance department of her local municipality. Annah’s role does not require registration with the IRBA. YOU ARE REQUIRED TO: (a) Briefly explain the difference between a chartered accountant in public practice and a chartered accountant in business. (4) (b) Give the reason why Josephine needs to register with the IRBA while Annah does not. (1) (c) Explain what requirements one must satisfy to become a member of the IRBA. (3) (d) Explain whether Annah will still be allowed to be a member of SAICA and use the designation CA(SA) if she decides later to leave her job at the municipality and instead focus on presenting auditing lectures to audit trainees. (2) WĂƌƚ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ If you are a fan of American television series, you may have noticed (on, for example, the Wikipedia page related to a specific series) that each episode is given a ‘Nielsen rating’, indicating the number of viewers for the specific episode. However, during the ‘pandemic era’ television networks have become suspicious of their ratings decreasing unexpectedly. There have since been calls for a third-party audit on these ratings. YOU ARE REQUIRED TO: (a) Explain why the networks would want these ratings audited. (b) Explain whether, if in fact these ratings were audited, that would mean that the auditor is certifying that the ratings are correct. Give reasons to support your answer. (5) ϭ͘ϲ (5) ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Appearing below, under point 1, is a list of individuals, bodies and key terms. Listed under point 2 below are broad descriptions/activities related to the individuals/ bodies/terms under point 1. 1. Individuals/bodies/terms 1.1 SAICA 1.2 registered auditor ϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 1.3 internal auditor 1.4 trainee auditor 1.5 financial director 1.6 International Standards on Auditing 1.7 special purpose auditor 1.8 management accountant 1.9 reasonable assurance 1.10 sufficient appropriate audit evidence 1.11 IT general controls 1.12 entity IT level controls. 2. Descriptions/Activities 2.1 takes responsibility at board level for the adoption and implementation of the accounting policies adopted by a company 2.2 controls that establish an overall framework of control for computer activities which should be in place before any processing of transactions get underway, and which span across all applications 2.3 analyses cost and variance reports 2.4 expresses an independent opinion on whether the financial statements of a company are fairly presented 2.5 statements that provide guidance on various aspects of the audit function to establish a standard (or quality) with which must be complied 2.6 these controls are implemented within the IT governance environment and have a pervasive impact on the IT controls environment including those at the transaction or application level 2.7 conducts procedures to determine whether a mining company is complying with environmental regulations 2.8 serves a training contract at an approved training organisation or registered training officer 2.9 support the conclusions on which the auditor bases his/her report 2.10 what the auditor provides to the users of financial statements regarding the fair presentation thereof 2.11 an accounting body whose members use the designation CA(SA) 2.12 performs, on behalf of the board of a company, an independent evaluation of whether a company is appropriately addressing the risks faced by the company. ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ ϳ YOU ARE REQUIRED TO: Match each description/activity to the individual/body/term to which it is most accurately related. (12) ϭ͘ϳ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ You are the newly appointed auditor of Rockets (Pty) Ltd. The company has a public interest score (PIS) of 380. The CEO and incorporator of the company, Rocky Rocket, has approached you with some matters that are unclear to him: What is meant by the term ‘public interest score’? And why does the auditor express an opinion on my company’s financial statements? I do not really understand what their opinion has to do with my business. Apparently, the auditors are required to act with ‘professional competence and due care’. Is there really meaning behind that statement? YOU ARE REQUIRED TO: (a) Explain the term public interest score to Rocky Rocket. (3) (b) Explain to Rocky Rocket what is meant by the term audit opinion. (3) (c) Explain to Rocky Rocket what is meant by the term professional competence and due care. (2) (d) Besides for professional competence and due care, list the other four fundamental principles applicable to chartered accountants and registered auditors under the SAICA and IRBA Codes of Professional Conduct (CPC). (4) ϭ͘ϴ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ The Companies Act 2008 and its accompanying Companies Regulations, 2011 require that every company and close corporation calculate what is termed its ‘public interest score’. YOU ARE REQUIRED TO: (a) Explain the term public interest score and how it is calculated. (8) (b) State whether the following statement is true or false: All public and stateowned companies must calculate their public interest score to determine whether they must have their annual financial statements audited. Justify your choice. (1,5) (c) Explain fully, the link between the public interest score of a private company and the type of assurance engagement (if any) to which the company must subject its annual financial statements. (8) (d) State whether the following statement is true or false: All companies that hold assets in a fiduciary capacity must have their annual financial statements audited, regardless of their public interest score. Justify your choice. (1,5) ϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (e) Briefly explain how a company that is not required to have its annual financial statements audited in terms of the Companies Act or its public interest score, may voluntarily elect an audit. (3) ϭ͘ϵ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. Which of the entities below must have their annual financial statements audited? (a) Companies with a PIS above 350. (b) Public companies. (c) State-owned enterprises. (d) All of the above. 2. The public interest score of a company is calculated by having regard to the following factors: (a) turnover; gross profit; third-party liabilities; average number of directors; (b) turnover; net profit; total liabilities; average number of employees; (c) turnover; third-party liabilities; average number of employees; beneficial interest holders; (d) turnover; long-term liabilities; total employees at year-end; beneficial interest holders. 3. In order for a public company to have its annual financial statements audited, the company must appoint (a) a registered auditor; (b) an internal auditor; (c) any independent accounting professional; (d) any SAICA member. 4. Besides the obvious element of a subject matter (for example a set of financial statements), for an engagement carried out by a registered auditor to be classified as an assurance engagement, it must contain the following additional elements: (a) a three-party relationship; (b) the availability of sufficient appropriate evidence; (c) suitable criteria on which assurance can be judged; (d) all of the above. ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ ϵ 5. In order to register with the IRBA and use the designation of registered auditor, a person must meet certain requirements. Which of the following is not such a requirement? The person (a) has passed both the ITC and APC examinations; (b) has completed the required training at a SAICA accredited training officer; (c) has completed their ADP at an audit firm; (d) has worked as an audit partner for at least five years. 6. Which of the following is not generally regarded as being an inherent limitation of an audit? (a) The use of testing (test checking) by the auditor. (b) The inherent limitations of internal control systems. (c) The complexity of the International Standards on Auditing. (d) The fact that many account balances in the financial statements being audited are subjective. 7. Which of the following statements best describes what the auditor’s opinion on a set of annual financial statements provides? (a) The presence or absence of fraud. (b) The future viability of the company. (c) The efficiency with which management has conducted the affairs of the entity for the financial year. (d) The fair presentation of the financial statements in terms of a relevant reporting framework. 8. When conducting an assurance engagement on a set of financial statements which is intended to provide the user with reasonable assurance, the most important requirement which the audit team must comply with, is (a) cost control and budget awareness; (b) confidentiality pertaining to client information; (c) independence of mind and in appearance; (d) efficiency and effectiveness. 9. On the external audit of a public company, the designated auditor is (a) the most senior partner/director of the audit firm, which holds the appointment of auditor; (b) the individual responsible for the audit in terms of section 44(1) of the Auditing Profession Act 2005; (c) the member of the audit team who is appointed to the company’s audit committee; ϭϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (d) the individual identified by the company’s audit committee to take responsibility for the audit engagement. 10. A registered auditor can carry out two broad types of assurance engagement, namely (a) independent audits and compilation engagements; (b) independent reviews and ‘agreed upon procedures’ engagements; (c) independent audits and independent reviews; (d) independent reviews and compilation engagements. ϭ͘ϭϬ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ At the conclusion of the audit team of 100 Ltd, a junior member was requested to make sure that the audit working papers were all properly filed and finalised. What struck him was just how much information/evidence had been gathered on the audit. Having seen all of the evidence together, he really felt that the audit team was in a strong position to certify the financial statements as correct, rather than just stating in the audit report that ‘in our opinion, the financial statements present fairly in all material respects . . . ’ He asked you, as his senior, why, having done all this work, the financial statements had not been certified as correct. YOU ARE REQUIRED TO: Explain in detail to your junior, why the financial statements cannot be ‘certified as correct’. Include in your answer an explanation of the limitations of internal control, and the limitations of an audit. (20) ϭ͘ϭϭ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: State whether each of the following statements is true or false. Justify your choice. 1. Because the objective of an audit is to detect any fraud which may have occurred at a client during the financial year, the audit team must include a forensic auditor. (3) 2. Provided all the directors of a private company, which must have its annual financial statements externally audited, accept personal liability for the debts of the company, the audit of the company does not need to take place and no audit report will be required. (2) 3. Whether a private company is required to have its financial statements externally audited will depend on the company’s public interest score and whether it compiles its annual financial statements internally or externally. (2) ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ ϭϭ 4. By virtue of the fact that they are employees of the company itself, internal auditors cannot be regarded as independent. (3) 5. The postulates of auditing form the philosophical foundation of the discipline of auditing. (3) 6. Auditors in public practice register with the IRBA (Independent Regulatory Board for Auditors) as this guarantees their independence. (3) 7. The audit function, in its various forms, is an important component in attempting to achieve accountability in the financial world. (2) 8. When conducting an audit, the auditor should remain unconvinced of the truth of a particular fact until suitable evidence to support the fact is provided. (2) ϭ͘ϭϮ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Consider each scenario below: 1. Sameera Naicker is a registered auditor and the engagement partner on the audit of Sunset-safaris Ltd, a large company that owns several wildlife sanctuaries and game reserves in South Africa and its neighbouring countries. One of the perks of being the engagement partner of Sunset-safaris Ltd is that the managing director of the client grants a seven-night free stay at a five-star all-inclusive lodge for four people. She is very excited about this prospect. However, in return, the managing director requires an unqualified audit opinion. (5) 2. Koki Molefe, a chartered accountant employed by a state-owned enterprise, appeared before a commission of enquiry into financial irregularities alleged to have occurred under his direction. Koki Molefe denied his involvement but was subsequently proved to have been lying to the enquiry. He then acknowledged that he had lied but said he had been instructed to do so by his superiors. (5) 3. Edu-Gro Ltd is a company that owns approximately 60 private schools in South Africa. Each year the company organises golf days in several provinces, of which the profits go towards funding bursaries for high-achieving pupils who cannot afford the full school fees of Edu-Gro. The firm Molefe and Marais Inc’s two audit partners always attend this highly popular golf day when it is hosted in Gauteng. One of the local Edu-Gro schools is an audit client of Molefe and Marais. (2) 4. Milly Miller, the registered auditor in charge of several audits of the audit firm at which she is employed, is regarded as very competent and hard-working. However, she refuses to have any male members on her audit teams because ‘all female trainees are more competent and careful’ and male trainees are ‘only interested in sport and socialising’. (3) 5. Jackson Smith is an audit partner of a small audit firm, Jackson Inc. The firm’s client portfolio consists of several small businesses, of which most do not require a statutory audit. Against this background, Jackson Smith was delighted when ϭϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Logi-Ship Ltd, a large multi-national company, appointed Jackson Inc as its auditor. However, the directors of Logi-Ship Ltd have forewarned Jackson Smith that there are specific sources of income of Logi-Ship Ltd that the audit team is not allowed to query. As the audit fee expected from the Logi-Ship Ltd audit is astronomical for a small firm such as Jackson Inc, Jackson Smith agreed to these terms without hesitation. (5) YOU ARE REQUIRED TO: Discuss whether the chartered accountants/registered auditors identified in each of the situations described above have failed to comply (or are in danger of failing to comply) with the fundamental ethical principles of integrity; objectivity; professional competence and due care; confidentiality and professional behaviour. (20) Note: Any of the given situations may amount to non-compliance with more than one of the principles. ϭ͘ϭϯ ;ϭϮŵĂƌŬƐϭϯŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: (a) Calculate the public interest scores for the following companies, Mine (Pty) Ltd and Craft (Pty) Ltd: Mine (Pty) Ltd Sales income R4m R105m Service fees R4,7m R50m Total turnover R8,7m R155m 6 8 Non-executive directors Average employees for the year 82 85 Accounts owed by third parties R7,2m R80m Amounts owed to third parties R1,6m R75m Individuals with direct or indirect interest in each company’s shares Total salaries paid to employees B-BBEE points (b) Craft (Pty) Ltd 10 40 R2,4m R17,5m 76 90 (4) Evaluate, based on your calculations in (a) above, whether Mine (Pty) Ltd and Craft (Pty) Ltd must have its annual financial statements audited or independently reviewed or neither. Give reasons for your answers. You may assume that both companies’ financial statements are internally compiled, and that none of the directors hold any shares in the companies. You may also assume that the Memorandums of Incorporation of these companies do not contain any altered provisions. (4) ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ (c) ϭϯ State whether the following statements are true or false and justify your choice for each one: (i) Once a public interest score has been calculated, it remains in effect until a significant change in one of the components of the calculation is expected, at which time the public interest score must be recalculated. (1) (ii) Companies, other than public or state-owned companies, that require a statutory audit in terms of the Companies Act, may have their annual financial statements audited by any chartered accountant, regardless of whether the chartered accountant is a registered auditor. (1) (iii) The purpose of the public interest score is simply to determine whether a company should have its annual financial statements audited or independently reviewed. (2) ϭ͘ϭϰ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ The annual financial statements of a company can be viewed as a collection of assertions made by the directors. These assertions can be categorised as: • assertions about classes of transactions and events and related disclosures for the period under audit, for example sales, purchases, interest received; and • assertions about account balances and related disclosures at year-end, for example accounts receivable, property plant and equipment, accounts payable. The auditor intends to obtain sufficient appropriate evidence pertaining to the assertions to be in a position to express an opinion on the fair presentation of the financial statements. YOU ARE REQUIRED TO: (a) Explain the term financial statement assertion. (b) Identify the assertions pertaining to each of the above two categories and provide a brief explanation for each. (12) (c) Explain the term sufficient appropriate evidence. (5) (d) Explain the term the auditor’s right of access. (4) (e) Explain the link between the assertions and the auditor’s right of access. (3) ϭ͘ϭϱ (2) ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You were a guest speaker at an introductory auditing workshop held for first-year trainee accountants, via Microsoft Teams. When concluding your session, you invited participants to post questions which they may have to the chat forum. The following questions were posted to the forum: Q1. Is it necessary for an individual who is employed as an internal auditor to register with either SAICA or IRBA? ϭϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Q2. Is the attitude of independence essential for all categories of auditor? Q3. If an auditor knows in her heart that she is acting objectively towards an audit client, why should it matter if she is seen by the public as not being independent? Q4. Do individuals who meet all the requirements to register with SAICA automatically qualify to register with the IRBA? Q5. Is it in order for the engagement partner to delegate all the responsibilities of quality assurance to an experienced senior trainee on the audit, and simply sign the working papers off without reviewing them? Q6. If a public company holds assets in a fiduciary capacity exceeding R5m, must such a company have its financial statements audited, regardless of its PIS? Q7. Does the fact that an external auditor is independent of his client enable the auditor to certify that the client’s financial statements are correct? Q8. It is my understanding that individuals registered with the IRBA are only allowed to perform audit engagements, while review engagements are reserved for those professional accountants not registered with the IRBA. Is this correct? Q9. Am I correct in saying that an unmodified external audit opinion provides a user with absolute assurance that the financial statements on which the opinion is given are, in all material respects, fairly presented? Q10. Does the auditor’s opinion given for a review engagement provide the user with limited assurance that the financial statements are correct? YOU ARE REQUIRED TO: Briefly respond to each of the 10 questions that were posted on the chat forum. ϭ͘ϭϲ ;ϯϭŵĂƌŬƐϯϳŵŝŶƵƚĞƐͿ You are a recently qualified chartered accountant. You are attending a braai at the home of your close friend, Thandi Newton. During the evening she shares with you that she has recently purchased the majority shareholding in a clothing retailer, PrettyPink (Pty) Ltd. She is also now the CEO of the company. She will retain the services of two of the company’s existing directors (the third director has recently resigned), neither of whom are shareholders (there are four other shareholders). Thandi suggests that you apply for an appointment as financial director of PrettyPink (Pty) Ltd, as there is currently a vacancy on the board (due to the director who resigned). She also informs you that the company has 27 employees, besides herself, and that the expected turnover for the year is R36 million and that the only liabilities that the company has are current creditors of just under R1 million and a bond of R4,8 million. Thandi has also just been informed by her lawyer, who is responsible ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ ϭϱ for the formalities related to the company’s purchase, that at the next annual general meeting of the company, an auditor will have to be appointed. Thandi is concerned about this and, knowing that you are a chartered accountant, she asks you the following questions: (a) What is meant by the term ‘designated auditor’? If we appoint an audit firm, would that firm then be our designated auditor? (2) (b) Is it true that the company must appoint an auditor to audit its financial statements, and, if so, should it appoint an external or internal auditor? (10) (c) Even if we aren’t required to appoint an auditor, can we still appoint one? You are a chartered accountant; can we appoint you as the auditor? (8) (d) I have heard about the term ‘professional judgement’ on several occasions. Can you please provide me with a few examples of where the auditor will have to apply professional judgement? (5) (e) Why is there a need for a company to be audited? (6) YOU ARE REQUIRED TO: Respond to Thandi Newton’s questions. ϭ͘ϭϳ (31) ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Each of the following statements may or may not be regarded as a postulate of auditing: 1. The auditor must adopt an attitude of professional scepticism. 2. The professional status of the independent auditor imposes commensurate professional obligations on the auditor. 3. When conducting an audit of annual financial statements, the auditor must plan and carry out procedures specifically designed to detect fraud. 4. Internal controls reduce the probability of errors and irregularities. 5. Professional competence outweighs independence (objectivity) when conducting an audit. 6. Fair presentation of the financial statements must be evaluated in terms of sound principles of corporate governance. 7. An auditor must act exclusively as auditor in order to be able to offer an independent and objective opinion on the fair presentation of financial information. 8. With regard to achieving fair presentation of the financial statements, there is no conflict of interest between the auditor and the company’s management. YOU ARE REQUIRED TO: (a) Explain the term postulate in the context of auditing. (2) ϭϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) Identify which of the above statements may be regarded as postulates of auditing and explain briefly each of the postulates you have identified. (12) (c) For each of the above statements which you have not identified as a postulate, state whether the statement is true or false. Justify your choice. (8) ϭ͘ϭϴ ;ϮϳŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ WĂƌƚ ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ PartyTime (Pty) Ltd is a company that owns several kiddies party venues in Gauteng. The company rents out these venues on weekdays and over weekends, and the venue can be booked for a three-hour time slot, twice per day. Venue hire for parties hosted over weekends and public holidays is charged at twice the weekly rate. The amount charged consists of a fixed venue cost plus a variable cost that is calculated at an hourly rate multiplied by the number of children attending the party – the latter also covers the cost of a meal and drink for each child. All terms and costs related to each venue’s hire are set out on each branch’s website. The venue managers then provide PartyTime (Pty) Ltd’s head office with a breakdown of their monthly turnover figures. To satisfy itself that venue managers are submitting the correct figures, PartyTime (Pty) Ltd has engaged Jackson and Co, a firm of registered auditors, to perform an audit on the financial information (for example monthly turnover figures) provided by the venue managers. The venue managers must allow Jackson and Co access to all the accounting records of the various branches. While conducting such an audit, one of the audit team members of Jackson and Co uncovered that a manager, who happens to be a registered CA(SA), of one of PartyTime (Pty) Ltd’s venues was directing more than half of the enquiries for venue bookings to a competitor, HappyParties (Pty) Ltd. Upon further inspection, it was noticed that HappyParties (Pty) Ltd is owned and managed by the manager in question’s wife. The directors of PartyTime (Pty) Ltd were unaware of this relationship between the manager involved and HappyParties (Pty) Ltd. YOU ARE REQUIRED TO: Consider the scenario above, keeping in mind that an assurance engagement, whether it is an audit or a review, has five elements. The first of these elements is the ‘threeparty relationship’, and the second is the ‘subject matter’: (a) (i) Identify the three parties in this assurance engagement. (3) (ii) Describe the subject matter. (1) (iii) Identify and explain the other three elements of the assurance engagement. (6) (b) Discuss the importance of the venue managers giving Jackson and Co access to the financial information of each branch. (3) ŚĂƉƚĞƌϭ͗ŶŝŶƚƌŽĚƵĐƚŝŽŶƚŽĂƵĚŝƚŝŶŐĂŶĚƐƵŶĚƌLJĂƵĚŝƚŝŶŐƚŽƉŝĐƐ (c) ϭϳ Regarding the enquiries for bookings being directed to HappyParties (Pty) Ltd, comment on the manager’s actions in light of the SAICA Code of Professional Conduct (CPC). Limit your answer to the principles of integrity and objectivity. (4) WĂƌƚ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ One of your family members is considering buying and opening a new franchise restaurant, Toast-and-Eggs. The holding company in the Toast-and-Eggs group is a large public company listed on the JSE. When you asked him whether he had considered the impact which the predicted recession may have on the restaurant industry, he replied that he is ‘not concerned as all listed companies are externally audited, which is not a requirement for unlisted companies, and, as the auditors are one of the big four audit firms, buying a Toast-and-Eggs restaurant must be a good investment’. He also added that he had not looked at the financial statements of the group. YOU ARE REQUIRED TO: Discuss whether you would agree with your family member’s reasoning with regard to his intended purchase of a Toast-and-Eggs franchise restaurant. (10) CHAPTER Ϯ ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐ ĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 2.1 True or false 37 marks 2.2 Short theory and discussion questions 36 marks 2.3 Multiple-choice questions 12 marks 2.4 Corporate governance as it relates to – Auditor rotation; Entrusting the auditor with information; Non-audit services 10 marks 2.5 Short questions – The audit committee 28 marks 2.6 Short questions – Risk governance 32 marks 2.7 Application and discussion – Corporate governance 20 marks Application and discussion – Corporate governance 20 marks 2.9 Short questions and discussion 27 marks 2.10 Application and discussion – Members to be appointed to the audit committee 22 marks Application and discussion – General corporate governance; Board composition; Social media and data breach 20 marks Discussion – Risk and sustainability 38 marks 2.8 2.11 2.12 continued ϭϵ ϮϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 2.13 Discussion – Internal audit 47 marks 2.14 Application and discussion – The board; Integrated reporting 46 marks Application and discussion – Board composition; Board committees 45 marks 2.16 Application and discussion – Integrated reporting 41 marks 2.17 Discussion – Dispute resolution 33 marks 2.18 Application and discussion – Internal audit appointment and function 20 marks Application and discussion – Audit committee duties 29 marks Application and discussion – Internal auditor characteristics/attributes 30 marks 2.15 2.19 2.20 Ϯ͘ϭ ;ϯϳŵĂƌŬƐϰϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: State whether each of the following is true or false. Justify your answers. 1. King IV recommends that the audit committee should oversee the integrity of the annual financial statements and other external reports. 1.1 The audit committee should be responsible for monitoring the integrity and completeness of the company’s financial reporting. (2) 1.2 The audit committee should encourage ‘opinion shopping’ (for example approaching other auditors for a different opinion on the company’s AFS), but only if the board unanimously supports this action. (2) 1.3 The chairman of the audit committee should recuse himself from the AGM when the financial results are discussed with the shareholders so as not to undermine the position of the financial director. (2) 1.4 The audit committee should review management’s assessment of the going concern ability of the company at the financial year-end. (2) 1.5 If the board deems it appropriate, the audit committee may be given the responsibility of reviewing the integrated report. (2) 2. As part of combined assurance, the external auditor should oversee that internal audit follows a risk-based internal audit plan. (2) ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ Ϯϭ 3. The ‘six-capitals’ that a company has available to it are applicable to all companies and, as such, the integrated report should be structured in terms of all six capitals. (2) 4. Reporting in the triple context requires that companies report on historical profits, future profits and dividend distributions. (2) 5. The external auditor should appoint the chief audit executive. (No need to justify answer.) (1) 6. The internal auditors and the external auditors should co-operate where possible. (No need to justify answer.) (1) 7. The Companies Act 2008 requires that all companies appoint an audit committee. (2) 8. Internal audit’s primary function is to detect fraud and corruption. (2) 9. In terms of King IV, the board should ensure that a quality review of the internal audit function is carried out by the external auditors at least once every five years. (3) 10. Compliance with King IV requires that the chief executive officer should be the chair of the remuneration and nomination committee. (2) 11. The senior partner of the company’s firm of legal advisers should not be the chairperson of the company. (2) 12. All directors, both executive and non-executive, must be financially literate. (2) 13. The nominations committee should comprise a balance of executive and nonexecutive directors. (2) 14. The company secretary’s duties include reporting to the board on failure on the part of the company or a director to comply with the Companies Act 2008. (2) 15. The chief audit executive (CAE) should be a member of executive management. (2) Ϯ͘Ϯ ;ϯϲŵĂƌŬƐϰϯŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. King IV introduces the idea of proportionality which means that its recommended practices are intended to be applied proportionately to suit the circumstances of each organisation. Briefly discuss the factors that should be considered in this regard. (3) 2. Principle 1 of the King IV Code states that ‘the board should lead ethically and effectively’. Identify the characteristics that board members should cultivate and exhibit in their conduct to achieve this principle. (3) ϮϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3. Responsible corporate citizenship is simply about the company obeying the laws and regulations which relate to it and paying its taxes. Discuss. (5) 4 In the foreword to the King IV Code, the committee states that the 21st century has been characterised by fundamental changes in both society and business and that these ‘global realities’ are severely testing the leadership of companies and other organisations. Identify six such global realities and explain broadly how each of them impacts business leadership. (12) 5. To fulfil their role as stewards of the company, directors must exercise five moral duties. Identify and explain five moral duties, all beginning with the letter ‘c’, which a director should exercise in his actions. (5) Note: The answer to this question is not directly related to the King IV Code. 6. King IV states that the board should adopt a stakeholder-inclusive approach that balances the needs, interests and expectations of material stakeholders in the best interest of the organisation over time. Name eight (8) such stakeholders. (8) Ϯ͘ϯ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the correct alternative (a)–(d)/(e) for each question (1–12). Bear in mind that each question may have more than one correct answer. 1. Which of the following option(s) is/are not an objective of King IV? (a) To encourage transparent and meaningful reporting to stakeholders. (b) To enforce a process whereby companies are directed and controlled. (c) To present corporate governance as concerned with ethical consciousness and behaviour. (d) To enforce the holistic implementation of the King IV Code across all sectors and organisational types. 2. Which phrase best describes the basis (application regime) on which the King IV Code is built? (a) Comply or else. (b) Comply or explain. (c) Apply and explain. (d) Apply and comply. 3. Which of the following is not specifically regarded by the King IV Code as one of the characteristics of ethical leadership? (a) Responsibility. (b) Accountability. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ (c) Ϯϯ Fairness. (d) Efficiency. (e) Transparency. 4. Which of the following is not a principle of leadership ethics and corporate citizenship? (a) The board should lead ethically and effectively. (b) The board should ensure that the company is, and is seen to be, a responsible corporate citizen. (c) The board should ensure the company is efficiently and effectively managed to maximise shareholder’s wealth. (d) The board should govern the ethics of the company in a way that supports the establishment of an ethical culture. 5. Which of the following duties may be assigned to the company secretary? (a) Keeping board and committee charters up to date. (b) Assisting with the evaluation of the board and its committees. (c) Advising on matters of corporate governance. (d) Preparing and circulating board papers for meetings. 6. Which of the following is false? In terms of the King IV Code, the chairperson of the board (a) may not be the chair of the risk committee; (b) may not be a member of the remuneration committee; (c) should be a member of the audit committee; (d) should be a member of the nominations committee. 7. Which of the following is true? In terms of the King IV Code, the CEO (a) is not prohibited from being a non-executive director of another company; (b) should be a member of the audit committee; (c) should be accountable, and report to the chairperson of the board; (d) should be the chairperson of the remuneration committee. 8. The balance of power on the board is best attained from which of the following combinations? (a) A majority of executive directors, with the other directors being nonexecutive directors, the majority of whom should be independent. (b) A majority of non-executive directors, the majority of whom should be independent. Ϯϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (c) A majority of non-executive directors, the minority of them being independent. (d) A clear majority of executive directors with a non-executive chairman. 9. Which of the following is not a committee specifically recommended by the King IV Code? (a) Audit Committee. (b) Risk Committee. (c) Sustainability Committee (d) Nomination Committee. (e) Remuneration Committee. 10. Which of the following statements is not correct in terms of King IV? (a) A company should disclose the remuneration of each individual director and certain senior executives, provided it has the individual’s consent to do so. (b) Shareholders should exercise a non-binding advisory vote on the board’s remuneration policy every two years or when other specified conditions exist. (c) Companies should remunerate fairly, responsibly and transparently. (d) The names of the directors appointed to the remuneration committee should remain confidential other than to members of the board. 11. Which of the following does not form part of the oversight responsibilities of the audit committee? (a) Audit and assurance requirements. (b) The company secretary function. (c) The integrity (reliability and usefulness) of reports. (d) External audit quality. 12. Companies should report in the triple context. Which of the following is not part of this kind of reporting? (a) Social performance. (b) Economic performance. (c) Comparative performance. (d) Environmental performance. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ Ϯ͘ϰ Ϯϱ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Thulani transport Ltd was established nearly five years ago. You are employed by the company as its financial director. You received the email below from the CEO of the company, Thulani Mtsweni: From: Thulani Mtsweni Mtsweni@ttransport.co.za Sent: 20 January 2023 10:15AM To: Gavin Phasa Phasa@ttransport.co.za Subject: Queries regarding the auditors Good day Gavin, Hope you are well. I was wondering whether you could explain the purpose of the rotation of auditors. We have a great business relationship with our existing auditor, and to me it makes no sense to have a new person performing our audit. What concerns me further is that we now have to entrust someone new with client information and, in light of the new POPI Act, I cannot see how this can be legal. I also cannot understand why the audit committee restricts the auditor from performing certain other functions. Auditors are experts in the financial field, and therefore it would be of great value to us if we could include the auditors in as many aspects of our business as possible. I hope you can shed some light on these matters. Regards. Thulani YOU ARE REQUIRED TO: (a) Comment on how the Companies Act requirement of auditor rotation may improve corporate governance. (2) (b) Comment on Thulani’s concern regarding entrusting the auditor with information – do not limit your answer to corporate governance. (6) (c) Comment on the point that Thulani has raised regarding the performance of non-audit services by the auditor by explaining how this requirement of the Companies Act improves corporate governance. (2) Ϯ͘ϱ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. In accordance with the Companies Act, the audit committee should receive and deal appropriately with certain concerns/complaints. Name the four categories that these concerns/complaints relate to. (4) Ϯϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. The Companies Act requires the audit committee to prepare a report to be included in the annual financial statements for the financial year. This report should (in terms of the Companies Act): (i) describe_________________________ (ii) state____________________________ (iii) comment on ____________________. (3) State whether each of the following statements (3 to 12) is true or false, and explain your choice: 3. In terms of the Companies Act, private companies are not required to appoint an audit committee, but the King IV Code recommends that if a private company is required to issue audited financial statements, it should establish an audit committee. (2) 4. The audit committee of a public company should consist of five members, three of whom should be non-executive members of the board. (3) 5. The audit committee may consist of material suppliers or customers of the company. (2) 6. To be appointed to the audit committee, a director must have a recognised financial qualification, for example B.Com, CA(SA). (2) 7. Members of the audit committee are appointed by the chairman of the board and, once elected, the members of the audit committee will determine which member will be the chairman of the audit committee. (2) 8. Where possible, the chairman of the audit committee should serve as chairman of the risk, nomination and remuneration committees to achieve integration and collaboration among important committees. (2) 9. The audit committee’s terms of reference should be reviewed annually and should be approved by the board. (2) 10. One of the important functions of the audit committee is to approve the external audit report. (2) 11. The audit committee must prepare a report to be included in the AFS, which includes a statement as to whether the audit committee is satisfied that the auditor was independent of the company. (2) 12. In terms of King IV, the board must evaluate the performance of the audit committee annually by reviewing the decisions made by the committee and the reaction thereto from the company’s shareholders. (2) Ϯ͘ϲ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ Companies face numerous risks in all aspects of carrying on their business and it would not be an exaggeration to say that if risk within the business is not identified and responded to, the sustainability of the company will be under severe threat. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ Ϯϳ In the King IV Code the importance of risk governance is reflected in a number of the principles, primarily Principle 8 (Committees of the Board) and Principle 11 (Risk governance). YOU ARE REQUIRED TO: Answer the following questions: 1. Who is ultimately responsible for the governance of risk? (1) 2. What is management’s responsibility for risk management? (2) 3. Suggest four (4) activities which should be included in the risk management process. (4) 4. Effective risk governance takes into consideration not only risks but also opportunities for the company. Explain this statement. (3) 5. A risk committee 5.1 is formed only if the audit committee cannot perform the role of the risk committee. (2) 5.2 should include only non-executive directors. (1) 5.3 should be restricted to five members. (1) 5.4 should be chaired by the chairman of the board. (1) 5.5 must convene at least monthly. (1) 5.6 should report to the chief audit executive (head of internal audit). (2) Comment on each of the above in terms of King IV. 6. An important part of risk governance is how the company responds to risk. Appropriate responses include • avoiding the risk; • exploiting the risk; and • transferring the risk. Explain the three responses listed above and provide a short example for each. (3) 7. Suggest four matters which the board/risk committee is likely to consider when determining the severity/significance of a risk. (2) 8. Because companies operate in an increasingly volatile environment, it is unrealistic and unfair to expect the directors/risk committee to identify and respond to the ‘not so obvious risks facing the company’. Comment on this statement. (3) 9. Explain what is meant by reputational risk and compliance risk. (2) 10. In terms of Principle 11, what specific information should be disclosed in the integrated report pertaining to risk governance? (4) Ϯϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Ϯ͘ϳ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are a chartered accountant employed in the finance department of MedSupplies Ltd, a company that imports and sells medical supplies. The company’s CEO, Mr Barty Monroe, accidentally forwarded the following email to you (George Smith) that was meant for the CFO, Mr George Simpson. From: Barty Monroe bmonroe@medsupplies.co.za Sent: 13 February 2023 4:40 PM To: George Smith gsmith@medsupplies.co.za Subject: Profits on vitamins and other matters Hi George, I have just looked at our figures for the past financial year, and I must say, I am impressed! It was a good decision to inflate the selling price of our vitamins and falsely market them as 100% effective against monkey-pox. After the scare that the public had with the Covid pandemic, they are so gullible! Those vitamins sold like hot cakes! My only concern is that, as the financial year end is approaching, that team of nosy external auditors will be here soon. Hopefully they will not ask too many questions. I must say I am not a fan of the auditors. They raised all kinds of issues about the composition of our board and its committees, with which I do not agree. I firmly believe that as the CEO and member of the board, I must be part of every committee of the board to enable me to properly run this company. I remembered a few years ago, the auditors informed me that there are apparently all kinds of requirements regarding the frequency of meetings. Who has time for that? A meeting once a year for each committee is more than enough. Luckily, we have an all-male board of directors, so that keeps meetings short and sweet, if you know what I’m saying! Anyhow, just wanted to let you know that I am happy with the figures. Keep up the good work. Barty YOU ARE REQUIRED TO: Comment on the corporate governance of MedSupplies Ltd with reference to the King IV Code and the Companies Act. (20) Ϯ͘ϴ ;ϮϬŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ Net-Caterers Ltd is a company that supplies a wide range of catering goods to hotels, conference venues and offices. The company has recently been under scrutiny for ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ Ϯϵ importing coffee, sugar and cocoa from countries that make use of child and forced labour. Below is an extract from Net-Caterers Ltd’s latest board meeting: EXTRACT OF MINUTES OF BOARD MEETING OF NET-CATERERS LTD HELD ON 20 APRIL 2023 Present Sandy Kolisi Chief executive officer; member of nominations committee; chair of risk committee Michael Marx Financial director; member of audit committee Peter Kolbe Marketing director; member of nominations committee Vincent de Klerk Communications director; member of risk committee Brandon de Allende Human resources director; chair of the nominations committee Present Martin Etzebeth Procurement director Lourens Smith Sales director Trevor Mapimpi Director of IT Elvis Jantjies Non-executive director; chair of audit committee Billy Mbonambi Non-executive director; member of audit committee Apologies Hannes Kitshoff Non-executive director; member of risk committee; member of nominations committee Welcome As chair of the board, Sandy Kolisi welcomed all the members to the meeting. She specifically thanked Elvis Jantjies for taking time out of his busy schedule to attend the meeting, as he is currently managing the KZN branches. She further thanked him for the effective leadership that he displayed regarding the project to repair some of the buildings affected by the 2022 flooding. She also emphasised how valuable his loyalty to Net-Caterers Ltd was. Sandy informed the board that her brother, Hannes Kitshoff, could not attend the meeting, as he was diagnosed with malaria. ϯϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Unfavourable publicity Peter Kolbe raised the issue surrounding the negative image of the company created by the importing of products from countries supporting child and forced labour practices. Martin Etzebeth stated that the financial performance of the company was all that mattered, as that was what made Net-Caterers Ltd successful, and that it should continue sourcing products as cheaply as possible. Martin Etzebeth further suggested that Peter Kolbe arrange for Net-Caterers Ltd to hand out food parcels to children in need, take some photos of these events and post them onto social media in order to create the impression that the company cared about children and those in need. Technology Trevor Mapimpi, the director of IT, confirmed the impact of social media and asked how many of Net-Caterers Ltd’s employees had access to the company’s social media page. He also discussed a paper about IT governance specifically relating to the King IV Code recommendations. YOU ARE REQUIRED TO: (a) Based on the information provided, comment on the composition of the board and board committees of Net-Caterers Ltd. You may assume that no other committees exist except those mentioned in the table above. You may also assume that the members in the table above are the only members of the committees. (10) (b) Comment on whether Net-Caterers Ltd is acting as a good corporate citizen (in terms of King IV) in light of the matters included in the extract above. (4) (c) Anticipating Trevor Mapimpi paper’s context, discuss IT governance specifically relating to King IV recommendations. (6) Ϯ͘ϵ ;ϮϳŵĂƌŬƐϯϯŵŝŶƵƚĞƐͿ In terms of Principle 1 of the King IV Code, the board should lead ethically and effectively and, in terms of Principle 2, should govern the ethics of the company in a way that supports the establishment of an ethical culture. This means building and sustaining an ethical corporate culture. Furthermore, an ethical culture is not just about ethics within the company; it extends to all stakeholders and creating an ethical corporate culture requires a well-designed and properly implemented ethics management process. Petrochem Ltd is a listed company that has various fuel processing plants located in a number of port cities in the country. The board of directors (consisting of eight directors) takes its responsibilities relating to ethics management seriously and has developed a Code of Ethics which lays down the ethical values, standards and specific guidelines for the company in its dealings with internal and external stakeholders. Petrochem Ltd’s Code of Ethics is broken down into sections that deal with different stakeholders. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϯϭ YOU ARE REQUIRED TO: (a) Identify the factors the board should consider to determine the appropriate number of members of the board. (4) (b) Identify six characteristics that directors should display in their endeavour to lead ethically. (3) (c) Identify three further requirements (other than having a Code of Ethics) which are necessary to create and sustain an ethical culture. (3) (d) Discuss what should be done to ensure that Petrochem Ltd’s Code of Ethics is not just a document but rather something the company stands by in its dealings with its stakeholders. (8) (e) Give four examples* of matters which could be included in the sections of the Code of Ethics which deal with ethical matters relating to: 1. personal conduct of employees; 2. the local community; and 3. employment practices. (9) *Illustrative example for part (e) Under the section relating to ‘personal conduct of employees,’ the code should include the company’s policy in respect of the ‘receipt of gifts by employees from individuals outside the company’ (for example from a supplier). Ϯ͘ϭϬ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Power Structures Ltd is a large industrial company that supplies heavy equipment and installation services to the power generation industry. The company does a significant amount of work for the government for which it is required to tender. Recently it came to light that certain senior individuals at the company had been involved in tender fraud. Although not implicated in any way in the tender fraud, all three members of the audit committee had resigned from the board as they felt collectively that they had failed in their oversight duties. One of the items on the agenda for the upcoming annual general meeting of the shareholders is the appointment of a new audit committee. The names of the following individuals have been submitted from various sources to the nominations committee for consideration before a final list of individuals is submitted to the AGM. 1. Zweli Sithole – An investigative journalist who had been prominent in exposing the tender fraud at Power Structures Ltd. (3) 2. Zane Dane – One of the existing directors of Power Structures Ltd. He was not implicated in the fraud. He is the executive head of installation services and an electrical engineer. (2) ϯϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3. Mary Middleton – CA(SA), a financial analyst engaged in the power sector, whose company (she is the major shareholder) conducts extensive and ongoing research for Power Structures Ltd. (4) 4. Eric Williams – CA(SA), the chief audit executive at Power Structures Ltd. (2) 5. Bheki Zondi – The most senior union leader at Power Structures Ltd. He has a degree in Industrial Relations. (3) 6. Jill Wade – The former majority shareholder of Voltage (Pty) Ltd. During the previous financial year Jill Wade, who has a law degree, sold all of her shares in Voltage (Pty) Ltd to Power Structures Ltd and resigned from the company. Jill Wade is highly thought of in the industry but, has signed a restraint of trade agreement with Power Structures Ltd, preventing her from starting another business in the power sector for five years. (5) 7. Markus Booste – CA(SA), independent non-executive director of Power Structures Ltd. He was originally implicated in the tender fraud by virtue of his son’s role in the government department with which the tender fraud was perpetrated. However, charges were not brought against him due to ‘lack of evidence’. (3) YOU ARE REQUIRED TO: Discuss whether, based on the information provided, you would recommend each of the above individuals for appointment to the audit committee of Power Structures Ltd if the company is to comply with the highest standards of corporate governance. Ϯ͘ϭϭ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are an expert on corporate governance. The matters below pertain to one of your clients, AffordableClothing Ltd: • AffordableClothing Ltd is a large chain of clothing stores with branches all over South Africa. The company was founded over 40 years ago, and all of the directors are now in their sixties or seventies. • The company has struggled to keep up with technological advances, mainly due to its directors not being prone to change. The company’s CEO, Mr William Smit, is known for having a particular dislike in working with the younger ‘Millennial’ and ‘Zoomer’ generations. • The company, however, launched a Facebook page last year, where its suppliers are allowed to freely post advertisements of their products. AffordableClothing Ltd does not oversee these advertisements, as it has longstanding relationships with all of its suppliers, built on trust. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϯϯ • Recently the company has come under severe scrutiny after a supplier posted photos of its new line of clothing (which can be exclusively bought at AffordableClothing Ltd), which included design patterns that offended certain religious groups. • William Smit, who is also the chair of the board, has discussed the matter with the media, where he aimed to ensure the public that AffordableClothing Ltd does not discriminate against any religion and that the advertisement has since been removed from its Facebook page. • This incident followed shortly after an earlier scandal, where the personal information of customers holding store cards, was leaked. This occurred mainly because the directors of the company were not keen on investing in the upkeep of their system’s security. YOU ARE REQUIRED TO: Comment on and make recommendations relating to the corporate governance of AffordableClothing Ltd in terms of the King IV Code. Ensure that your answer covers the composition of the board of directors of AffordableClothing Ltd and incidents relating to the advertisement and data leak. (20) Ϯ͘ϭϮ ;ϯϴŵĂƌŬƐϰϲŵŝŶƵƚĞƐͿ The sustainability of a company can be threatened by any number of risks. Obviously not all companies face the same risks. The risks identified below have all been taken from the annual reports of companies listed on the JSE. The annual reports were selected from different types of companies, for example banking, mining, farming etc. All of the risks listed below threaten the sustainability of companies of more than one type: 1. climate change 2. HIV/AIDS 3. proliferation of fake branded goods on the market 4. impact of the company’s operations on the environment 5. withdrawal of licence to operate 6. internet downloads 7. fire 8. decline in government infrastructure spending 9. rising costs of private medical care. Virtually every single company listed on the JSE will face technology and information risk frequently referred to as IT risk. The responsibility for governance of this risk appropriately is, in terms of King IV Principle 12, a duty of the board. The board’s overall responsibility is to formulate an IT governance framework. IT ϯϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ management should be delegated the responsibility for the implementation of the IT framework, which will include what is termed the ‘information security management system’ (ISMS). YOU ARE REQUIRED TO: (a) Identify for each of the risks listed above (1–9), two types of companies which are likely to regard the risk as being a material and specific risk to their sustainability. Justify your selection. (27) Note: (b) Many of the risks listed in the question (1–9) affect all large companies to some degree. This question requires you to identify risks which are ‘material and specific’ threats to the company. For example, HIV/ AIDS affects most large companies to some degree, but some types of company are materially and specifically threatened. Identify three high-level information security principles which the ISMS for any listed company should include and explain why the implementation of these principles is particularly important for the sustainability of a listed company which operates private hospitals. (11) Ϯ͘ϭϯ ;ϰϳŵĂƌŬƐϱϲŵŝŶƵƚĞƐͿ WĂƌƚ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Airblast (Pty) Ltd, a large manufacturing company for alternative sources of energy, has recently established an internal audit department. The company has a properly constituted audit committee in place. As often happens when departments are established, there is some confusion as to exactly what the department should and should not be doing. Elon Tusk, the financial director is preparing for a meeting with the chief audit executive and, not being particularly familiar with the role of internal audit, has asked you to provide him with a general overview of what internal audit is about, whether the chief audit executive will report to him (Elon Tusk) and whether the following procedures/responsibilities should be undertaken by the internal audit department: 1. performing the monthly bank reconciliations on the company’s bank account; 2. being part of the disciplinary procedure relating to alleged sexual misconduct against a factory foreman brought by a junior employee; 3. performing inventory cycle counts every month as part of the company’s internal control processes over their perpetual inventory; 4. investigating suspected instances of fraud within the company; 5. searching for (‘head hunting’) suitable financial staff; 6. conducting a review of the extent to which the marketing department complies with the practices and procedures laid down by the company with particular reference to business ethics; ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϯϱ 7. on a regular basis, to analyse and follow up on calls from suppliers as to the conduct of the company’s buying/purchasing personnel registered on the company’s ‘telephonic complaints hotline’; 8. reviewing the draft integrated report (which includes, the financial statements) before it is provided to the external audit team; 9. evaluate whether the recommendations made by the risk management committee to address the risk of tender fraud occurring when the company negotiates with municipal and government departments, have been implemented; and 10. recommending salary increases for senior executives. YOU ARE REQUIRED TO: (a) Provide Elon Tusk with an overview of the roles of an internal audit department to the extent that he will have a better understanding of what he is likely to be told by the chief audit executive. (4) (b) Inform Elon Tusk as to whom the chief audit executive will report. (c) Indicate to Elon Tusk (giving brief reasons) whether the internal audit department should undertake the procedures/responsibilities listed above. (16) WĂƌƚ (2) ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ The President of South Africa announced a set of actions to respond to the energy crisis South Africa is confronted with. One of these actions was that surplus capacity would be bought from existing independent power producers. Furthermore, to increase electricity generation, the renewable energy procurement program will allow parties other than Eskom to generate wind and solar electricity. Elon Tusk immediately saw the president’s announcement as an opportunity to grow his business, improve the profile of Airblast and raise capital. Accordingly, Airblast was listed on the JSE in January 2023. Your firm has recently been appointed as external auditor of Airblast Ltd. Being a public company, Airblast Ltd has an audit committee, and in your discussions with the committee pertaining to the upcoming audit, they have made it quite clear that your firm should make use of the internal audit department of Airblast Ltd. You are aware that the internal audit department has about 20 staff members and is headed by John Cody. The engagement partner, Bharat Mboweni, has indicated to the audit committee that, where possible, external audit will work with internal audit, as this is a common and acceptable practice. As the senior in charge of the audit, you have been requested by the engagement partner to compile a questionnaire to be used in the evaluation of the internal audit department. He has reminded you that ISA 610 (revised) – Using the work of internal auditors, requires that in determining whether and to what extent to use the work of the internal auditors, the following should be evaluated: • the organisational status/objectivity of the internal audit department; ϯϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ • the level of competence of its members; and • whether the internal audit function applies a systematic and disciplined approach including quality control. YOU ARE REQUIRED TO: Compile a questionnaire as requested by your manager to assist in the evaluation of the internal audit department. Ϯ͘ϭϰ ;ϰϲŵĂƌŬƐϱϱŵŝŶƵƚĞƐͿ Prima-plastic Ltd (‘Prima-plastic’) is listed on the JSE. The company is known for its unique development of polymer materials using . The board of directors (including the Audit Committee and the Remuneration Committee) currently consists of the following members: Name Note Description Non-executive directors Mr Blade 1 Mr Ronald Chairman of the board Chairman of the audit committee Mr Gwede 2 Member of the audit committee Ms Angie 4 Member of the audit committee Mr Pravin 6 Chairman of the remuneration committee Mr Ebrahim Member of the remuneration committee Mr Fikile Member of the remuneration committee Executive directors Mr Tito 3, 5 Mr Nathi Mr Thulas Chief Executive Officer Chief Financial Officer 4, 5 Director: Strategy and Risk Management Note 1: Mr Blade is one of the co-founders of the Prima-plastic group and plays a critical role as chairman of the board. Mr Blade has acted as the chairman of the company for 13 years. He is still a significant shareholder, who has the wellness of the Prima-plastic group at heart. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϯϳ Note 2: Mr Gwede is a long-time friend of Mr Nathi. Note 3: The former CEO retired towards the end of FY2022 and was replaced by Mr Tito, Mr Blade’s son-in-law, on 1 January 2023. Note 4: Ms Angie was the former Director: Strategy and Risk Management. Due to her experience with risk management, immediately upon her resignation from executive management, she was appointed as a non-executive director and member of the Audit Committee on 1 August 2022. Mr Thulas was appointed to replace Ms Angie as executive director. Note 5: Both Mr Tito and Mr Thulas have worked at Prima-plastic prior to their appointment to their current positions. Note 6: Mr Pravin is the lead independent non-executive director. Mr Pravin is a representative of one of Prima-plastic’s main suppliers. Extract from the latest audit committee meeting, to which the CFO, Mr Nathi, was also invited: All members of the committee agreed that very little information was contained in the integrated report of the company. Mr Ronald specifically expressed his concern regarding the report, as it for instance, included the performance overview of Primaplastic, highlighting the following: Extract of highlights from Prima-plastic’s Integrated report for the year ended 28 February 2023 Capital Shareholders: 2023 2022 Return on equity 13% 27.3% Revenue R300 million R1.5 billion Headline earnings Environmental Recycled plastic used in production 2 million tons 2.5 million tons Employees Number of employees 400 380 Remuneration R50 million R80 million Number of employees trained in bioplastics 50 25 Mr Ronald elaborated that there were no explanations and/or reasons for the significant drop in the financial indicators. When comparing this information to the financial statements, some of the figures did not agree with the financial statements. The integrated report is a one-page document which only includes these seven indicators and no discussion on the way forward. ϯϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ All members of the audit committee indicated their concern about these matters and Mr Gwede emphasised how this will have significant consequences in terms of market perception, reputation and the future value of Prima-plastic in the long run. Mr Gwede further stressed ‘the awareness of sustainability issues has grown rapidly in the global landscape given the impact on climate change and economies. Investors are increasingly interested in sustainability issues as this pertains to all their investments. We have to link the Corporate Social Responsibility (CSR) disclosures to the drivers of value creation.’ Mr Nathi indicated that he could not understand why they were making all this fuss, as the integrated report was just included as additional information and that nobody would ever have to express an opinion on it. The Chairman tried to explain to Mr Nathi that it was not the case and that Prima-plastic was required to include this document as part of their annual financial statements as they were a listed entity. Mr Nathi was adamant that there was nothing further to discuss, as no adjustments would be made to the document and that the board has already decided that the integrated report would not be included in Prima-plastic’s audited financial statements. YOU ARE REQUIRED TO: (a) Critically discuss the composition of Prima-plastic’s governing board, with reference to the King IV Code. (12) (b) Explain in your own words what CSR is. (4) (c) Explain in your own words what the aim of integrated reporting is. (5) (d) Explain the reporting requirements related to CSR in terms of the King IV Code. (4) (e) Identify the stakeholders that Prima-plastic should consider when CSR decisions are made. (6) (f) Discuss the extract from the integrated report against the requirements of the IIRC Framework’s six capitals. (5) (g) Discuss the corporate governance concerns relating to Prima-plastic’s responsibilities with regard to sustainability reporting and disclosure in terms of the King IV Code. (10) Ϯ͘ϭϱ ;ϰϱŵĂƌŬƐϱϰŵŝŶƵƚĞƐͿ You are a member of the ‘Governance and Regulation’ department of your audit firm. The primary function of this department is to advise clients in respect of their compliance with matters of corporate governance, statute and financial reporting. Your firm recently received a phone call from Matt Holland, the Chairman and Chief Executive Officer of Kaltron (Pty) Ltd, a large manufacturer of electronic equipment with a public interest score of about 600. He requested a meeting with you and your partner and at the meeting he raised the following matter with you: ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϯϵ ‘20% of the shares in Kaltron (Pty) Ltd are held by Aflens Ltd, a listed company. The Board of Aflens Ltd requires that we comply with the recommendations of the King IV Code on Governance 2016. Kaltron (Pty) Ltd needs to respond positively to this request as our link with Aflens Ltd provides significant benefits for the company. What I would like you to do is explain some of the terminology that is being used, such as the “stakeholder inclusive approach to corporate governance”, integrated reporting and “reporting in the triple context and the six capitals model”. We would also like you to comment and advise on certain aspects of our governance structures.’ A few days later (in response to your enquiries), Matt Holland provided you with the following information: Board of Directors ‘The Board consists of the following members: Matt Holland Brian Giggs (manufacturing director and deputy chairperson) Steve Dhlamini (marketing and research director) Faith Fortune (financial director) Zeke Sepeng (non-executive director) note 1 Will Klinton (human resources director) Vish Sidhu (non-executive director) note 2 Jane Lane (non-executive director) note 3. Note 1: Zeke Sepeng, is the major shareholder of Gigabite (Pty) Ltd, Kaltron (Pty) Ltd’s largest customer. Note 2: Vish Sidhu is the former financial director (and deputy chairperson) of Kaltron (Pty) Ltd having retired at the end of the previous financial year. Note 3: Jane Lane is a partner in the legal practice which advises Kaltron (Pty) Ltd. Board committees We do make use of board committees but only to a limited extent. With respect to the committees, you specifically asked about: Remuneration committee No need for a committee here. Executive remuneration is determined by me and Will Klinton. We decide on a percentage increase for the year and apply it to all executive directors. ϰϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Audit committee I recently appointed our first audit committee. The current members are Faith Fortune, Steve Dhlamini, Brian Giggs and me. I am the chairperson of the committee. Faith Fortune is on the committee to advise on any financial matters the committee might have to deal with. Steve, Brian and I are computer scientists, definitely not accountants! Social and ethics committee We don’t have such a committee – not quite sure what it does! Internal audit We have an internal audit section. It is headed up by Dicky Butt, the senior internal audit clerk. He has two assistants and reports directly to the financial controller. To be perfectly honest, internal audit is regarded as rather low key and I suppose we will have to remedy this if we are to comply with Aflens Ltd’s request.’ YOU ARE REQUIRED TO: (a) Explain the terms: • stakeholder inclusive approach to corporate governance; (2) • integrated reporting; (3) • reporting in the triple context; and (2) • the six capitals model. (5) (b) Comment on whether the current composition of the board enables Kaltron (Pty) Ltd to appoint board committees as recommended by King IV, which will all comply with the King IV Code recommendations with regard to the members who serve as the committee. (7) (c) Comment on Matt Holland’s contention that there is ‘no need for a remuneration committee’ and indicate what Kaltron (Pty) Ltd will need to do to comply with King IV in respect of the appointment of members of the remuneration committee. (7) (d) Comment on the appointment and composition of the audit committee. (e) Advise Kaltron (Pty) Ltd on what the company should do to enhance the status of the internal audit department. (7) (f) Outline for Matt Holland the functions of a social and ethics committee and advise him as to whether Kaltron (Pty) Ltd is required to appoint such a committee. (7) Ϯ͘ϭϲ (5) ;ϰϭŵĂƌŬƐϱϬŵŝŶƵƚĞƐͿ Deepgold Ltd is a large, listed gold mining company with its head office in South Africa. It also operates in a number of other African countries. A number of these ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϰϭ mines are in remote and/or underdeveloped countries and are operated under licence or mining rights agreements with local tribal or government authorities. Mining operations in the company’s mines in South Africa are all conducted at deep levels, which is both extremely costly and dangerous. At these levels the inherent dangers of mining, such as poisonous gas emissions, flooding and rock falls, are intensified, and the extraction of ore, waste products and polluted water is extensive and can fall foul of the extensive environmental legislation with which mines must comply. The mines use vast quantities of water and electricity. Deepgold Ltd has a very large workforce within South Africa and in their mines in other countries. At many of the mines in remote areas, the employees are the only people in the area and become communities within themselves. Unskilled labour is generally in reasonable supply but in remote mines obtaining skilled/management staff is difficult. The latest annual report from Deepgold Ltd contains the following paragraph relating to the company’s approach to sustainability reporting: ‘Deepgold Ltd has adopted the principle of integrated reporting for its 2023 annual and sustainability reports. The overall aim of Deepgold Ltd’s reporting effort is to improve communication with all stakeholders. This is consistent with our policy of adopting a stakeholder-inclusive approach in the execution of our governance role, which is consistent with Principle 5 and Principle 16 of the King IV Code. Wherever feasible, information has been presented in terms of the Global Reporting Initiative guidelines and the JSE Socially Responsible Investment Index criteria. Our sustainability reporting and disclosure has been independently assured.’ YOU ARE REQUIRED TO: (a) Explain what is meant by each of the following statements taken from Deepgold Ltd’s annual report: (i) Deepgold Ltd has adopted the principle of integrated reporting for its 2023 annual and sustainability reports. (3) (ii) Wherever feasible, information has been presented in terms of the Global Reporting Initiative guidelines and the JSE Socially Responsible Investment index criteria. (3) (iii) Our sustainability reporting and disclosure have been independently assured. (3) (b) Comment on whether the overall aim of ‘Deepgold Ltd’s reporting effort’ is consistent with the principles laid out in the King IV Code. (3) (c) Identify the stakeholders with which Deepgold Ltd is attempting to improve communication through its integrated reporting and indicate briefly why you consider each of these parties to be a stakeholder. (14) ϰϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (d) Identify and briefly discuss the sustainability issues you would expect Deepgold Ltd to report on in its integrated report. Structure your answer using the following headings: (i) Economic sustainability Ϯ͘ϭϳ (6) (ii) Environmental sustainability (3) (iii) People and communities. (6) ;ϯϯŵĂƌŬƐϰϬŵŝŶƵƚĞƐͿ As a part of stakeholder relationship management (Principle 16), the King IV Code recommends that formal dispute resolution mechanisms be adopted by the company to resolve disputes. KayDarren Ltd is a listed industrial company interested in mining, engineering and manufacturing. The company has a large workforce, is involved in import and export and has a significant customer and supplier base. Some of the company’s operations, for example, mining, are in remote areas of the country. As with any company of this size, a wide range of disputes can arise with both internal and external parties, for example, labour disputes, disputes with suppliers, landowners etc. The company has a well-staffed legal department and retains the law firm of Redfern and Findlay as its professional legal advisers. Both the head of the internal legal department and Redfern and Findlay believe that, where possible, disputes should be settled by alternative dispute resolution and this philosophy has been endorsed by the board of KayDarren Ltd. The following matters, inter alia, have arisen during the year at KayDarren Ltd: 1. A senior member of management in one of the company’s divisions defrauded the company of approximately R1 million. The board wishes to recover this money and send a clear message to all employees that this type of action will not be tolerated by KayDarren Ltd under any circumstances. 2. The company and one of its major customers in France are in dispute about the amount owed to KayDarren Ltd in respect of a transaction between the two parties. Redfern and Findlay has advised that the problem appears to have arisen because of a difference in an important clause in the contract relating to the transaction. The wording of the French contract is different from the wording of the same clause in the English contract. This contract does not contain a dispute resolution clause. 3. The employees on a remote, recently opened mine belonging to the company had threatened to strike if KayDarren Ltd does not improve the living conditions of employees, which they allege were promised when the mine opened. The mine employs most of the small local community, and the company is of the opinion that it has more than fulfilled its promises. The employees do not belong to a union. ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϰϯ YOU ARE REQUIRED TO: (a) Briefly explain the term alternative dispute resolution. (b) Explain with reference to the King IV Code, why dispute resolution is considered to be part of sound corporate governance. (4) (c) Explain the terms mediation, conciliation and arbitration. (d) Describe, with a brief explanation, the factors which should be considered by KayDarren Ltd in deciding, in general, which dispute resolution method to follow. (10) (e) Discuss which method of dispute resolution should be adopted in each of the matters listed above (1–3). Your discussion must include a justification for your choice. (11) Ϯ͘ϭϴ (2) (6) ;ϮϬŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You are a corporate governance expert. The matters below relate to one of your clients, Mzanzi Motors Ltd: • During the year, the chairman of Mzanzi Motors Ltd, Mr Nissan, approved the appointment of Mrs Benz, a CA(SA), as the company’s CAE. • Mrs Benz’s appointment follows the removal of Mr Fiat from the position as CAE, by the audit committee of Mzanzi Motors Ltd. • Mrs Benz directly reports to Mr Ferrari, the financial director of Mzanzi Motors Ltd. • Mrs Benz has also been appointed to the board of Mzanzi Motors Ltd, however, she holds no voting rights because she is the CAE. She has also been appointed to the remuneration committee of the company. • The role, authority and responsibilities of the internal audit of Mzanzi Motors Ltd are defined in the Memorandum of Incorporation of Mzanzi Motors Ltd. • As part of these responsibilities, the internal audit’s responsibility to prevent and detect fraud is highlighted as the most important responsibility. • The internal audit is also responsible for performing alternative dispute resolution and systematically analysing and evaluating the business processes of Mzanzi Motors Ltd. • The board ensures that an external, independent, quality review of the internal audit function is conducted once every seven years. • Ms Beemer is the CIO at Mzanzi Motors. She consulted internal audit about governance in her division, and they concluded that technology was not a significant part of the value chain in Mzanzi Motors and therefore Ms Beemer should rather focus on the day-to-day activities. ϰϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: Comment on the matters listed in the scenario in relation to the King IV Code on corporate governance. (20) Ϯ͘ϭϵ ;ϮϵŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ Brix Ltd is a large manufacturer of building materials. The company has complied with the requirements of the Companies Act 2008 and appointed an audit committee. Brix Ltd is a public company but is not listed on the JSE. Brix Ltd is focused on climate action and has evolved its manufacturing concern to be more sustainable for the future. Besides the audit committee, the company has a risk committee, a nominations committee, a remuneration committee and a social and ethics committee. The audit committee is scheduled to meet twice a year and since the last meeting the following matters or decisions have arisen or been made: 1. An unauthorised loan of R6 million was made to Max Priest, the financial director. Max Priest had arranged for the amount to be paid to him by EFT. The loan is unlikely to be repaid within the foreseeable future as Max Priest has invested heavily in a long-term project (in his personal capacity) in Dubai. (6) 2. The board decided to change the company’s accounting policy for deferred tax. (3) 3. A new human resources manager was appointed. 4. A decision was made not to take forward cover on a large import contract as the board considered that the rand had stabilised. (2) 5. The board changed the company’s discount policy for sales to other companies within the Brix Ltd group of companies. Intergroup transactions are significant. (3) 6. The internal audit department finalised its charter. 7. The chairman of the board authorised a payment of R500 000 to a government official to ensure that a tender, which Brix Ltd had submitted for a government project, was accepted. (4) 8. The manager and staff of the external audit team had, on a number of occasions, experienced a significant lack of co-operation with the production manager and his staff on matters pertaining to the audit, for example asset verification and valuation of work in progress. (3) 9. It has come to the attention of the board that the engagement partner of Brix Ltd’s external audit team has invested heavily in the same long-term project in Dubai as Max Priest. (4) (2) (2) ŚĂƉƚĞƌϮ͗ŽƌƉŽƌĂƚĞŐŽǀĞƌŶĂŶĐĞ͕ŝŶƚĞƌŶĂůĂƵĚŝƚŝŶŐĂŶĚĂƵĚŝƚĐŽŵŵŝƚƚĞĞƐ ϰϱ YOU ARE REQUIRED TO: Discuss fully whether any of the above matters should be referred to the audit committee for their consideration and whether any of the decisions made should have been referred to the audit committee before being made. Ϯ͘ϮϬ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Dyson (Pty) Ltd is a large manufacturing company that adheres to high corporate governance standards. The company has a strong internal audit department and an audit committee. The chief audit executive, Floyd Mayweather, has obtained board approval to appoint a senior audit manager in his department. Floyd Mayweather, having provided human resources with the characteristics he is looking for in the appointee, is currently reviewing the comments pertaining to each of the applicants who had been interviewed. The comments are as follows: Carmen Naidi newly qualified chartered accountant, with two years post-trainee experience as a line accountant in a retail organisation. Very quietly spoken and nervous. Zee Zidane B.Com (Accounting) has six years of experience with internal audit at SARS. Very thorough, independent thinker, very aggressive in her approach to people. Joe Royle C.I.S. (Chartered Institute of Secretaries), five years’ experience as the company secretary of a large non-listed company. Five years’ experience as an internal auditor in a government parastatal. Member of the Institute of Internal Auditors. Ashad Vialli BA. LLB. MBA. Recently returned from a two-year secondment to a large banking organisation in New York where he was involved in takeover financing and risk management. Meticulous in his presentation, flamboyant and charming. Very ambitious. Jon Carstens No formal qualification. 20 years’ experience in internal audit. Very confident in himself to the extent that he does not value the opinion of others. Displays an attitude of ‘I’ve seen this all before . . .’ Cameron King Eight years as a senior internal auditor at Dyson (Pty) Ltd. Regarded as a very hard worker and responsible individual. Generally very nervous when dealing with senior personnel. Has served on the risk committee at Dyson (Pty) Ltd for two years, making a quiet but meaningful contribution. Lance Carredo A chartered accountant, member of the Institute of Internal Auditors and part-time wildlife conservationist. Resigned from his previous appointment as an internal audit manager because of an alleged leak of information to the media about environmental damage caused by one of the divisions of the company where he conducted an environmental audit. ϰϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Justice Matese A chartered accountant and member of the Institute of Internal Auditors. Currently an internal audit manager at Eskom. Prior to that he had spent a number of years as an arbitrator in the labour market where he gained a reputation for his fair-mindedness and hard work. Scott Fines A well-qualified computer-systems analyst who had been responsible for most of the financial systems at Dyson (Pty) Ltd. As he has worked on computer systems throughout the company at some time or other, he is well known by the staff. Very friendly and popular with all. Currently in the final year of his internal auditing examination studies and looking for a career change. YOU ARE REQUIRED TO: Indicate for each of the applicants above, whether Floyd Mayweather is likely to consider the applicant suitable for appointment, based on the information given above. Your answer should convey your understanding of the characteristics/ attributes needed by an internal auditor in this position. (30) ,WdZ ϯ WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 3.1 True or false 20 marks 3.2 Short questions 20 marks 3.3 True or false 24 marks 3.4 Short questions 26 marks 3.5 Discussion – Conceptual framework; Threats and safeguards 20 marks Application and discussion – CPC and fundamental principles 23 marks 3.7 Short questions and discussion 21 marks 3.8 Short application and discussion – Corporate governance 34 marks Application and discussion – Fundamental principles 28 marks 3.10 Application and discussion – Professional ethics 28 marks 3.11 Application and discussion – Negligence and collusion 24 marks 3.12 Application and discussion 28 marks 3.13 Application and discussion – Fundamental principles and threats 33 marks 3.6 3.9 continued ϰϳ ϰϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 3.14 Application and discussion – CPC and improving corporate governance 33 marks 3.15 Application and discussion 30 marks 3.16 Application and discussion – Various 37 marks 3.17 Application and discussion – Compliance with CPC 21 marks Application and discussion – Audit quality, negligence and liability 35 marks Application and discussion – Various 28 marks 3.18 3.19 ϯ͘ϭ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: State whether each of the statements below is true or false. Justify your answer. 1. While it is clear that all professional accountants, whether they are in public practice or business, are required to comply with the fundamental principles of the Code of Professional Conduct, professional accountants in business are not required to apply the conceptual framework. 2. Audit firms should never accept gifts from their clients. 3. The fundamental principle of objectivity applies to a professional accountant but only when he/she is on an assurance engagement. 4. Fees should be charged in accordance with what the ‘market can bear’. 5. Advice given to a client by a chartered accountant on taxation matters should preferably not be put in writing, as the chartered accountant may be held accountable at a later stage if anything goes wrong. 6. Provided an auditor is independent in mind, he/she need not be independent in appearance. 7. For the purposes of the Code of Professional Conduct, the immediate family of a professional accountant in public practice consists of: 7.1 the spouse; and 7.2 dependants. 8. Carter Repson, a professional accountant in public practice, is not in breach of the Code if he takes a loan from Peoples Bank, a registered financial institution, of which he is the audit engagement partner. ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϰϵ 9. Lolly Patrick has recently been appointed as the advertising manager of Homeware Hut (Pty) Ltd. Her husband, Peter Patrick, is the auditor of the company. As a result, Peter Patrick is automatically in breach of the independence requirements of the Code. 10. Desai and Co – Registered Auditors (and professional accountants) – wish to advertise their services on television during the evening ‘soap opera’ period. They are permitted to do so. 11. A professional accountant who replaces another professional accountant as the auditor of a company must determine whether there are any professional reasons for not accepting the engagement. 12. Chivanga and Cohen Inc is about to be replaced as Provincial (Pty) Ltd auditors by De Villiers and Phosa Inc. Chivanga and Cohen Inc is under no obligation to discuss the audit strategy and plans they adopted on the prior year audit with De Villiers and Phosa Inc. 13. A firm of professional accountants in public practice may not accept a referral commission from an assurance client for referring the client’s products to other firm clients. 14. Due to the nuances and intricacies of technology these days, an audit partner will be allowed to test around the computer if he is not comfortable with technology. 15. A partner of the audit firm, Williams Inc, and his wife owns a placement agency where they place technology consultants (mainly project managers) at large financial-services organisations, including some of William Inc’s audit clients. The audit partner remains adamant that this matter does not have to be disclosed as the project managers will not directly work on the financial statements, even if these contractors are placed at audit clients of Williams Inc. 16. A professional accountant who inherits shares in his audit client, which is a listed company, is not required to dispose of the shares or give up the audit appointment. 17. If a professional accountant who acts as a director of a company is offered the position of auditor of that company, he may accept the position as auditor immediately, provided he resigns from his directorship. 18. If a professional accountant’s son is appointed as financial director of a company to which the professional accountant acts as auditor, the professional accountant may retain the audit, provided he discloses the relationship in the audit report. 19. With regard to money held on behalf of his clients, a professional accountant should: 19.1 bank the money in a separately designated bank account unless the client agrees otherwise; ϱϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 19.2 use the money only in accordance with client instructions; and 19.3 not breach the fundamental principle of professional behaviour by enquiring about the source of the money. 20. Subject-matter experts such as tax consultants and IT auditors that contribute to any given financial audit will have their own conduct rules to comply with. ϯ͘Ϯ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. A conceptual framework approach to professional conduct is confusing; there should be a fixed set of rules to regulate professional conduct. Comment. (3) 2. It is unnecessary to have a Code of Professional Conduct, as professional accountants should know how to act ethically and professionally. State whether you agree or disagree. Justify. (3) 3. What are the fundamental principles on which the SAICA Code of Professional Conduct is based? Briefly describe each of them. (5) 4. What is the meaning of the phrase public interest in the context of the accountancy profession? (3) 5. Professional accountants in public practice must put safeguards in place against contravening the fundamental principles of the Code; however, this does not apply to professional accountants in business as the Code is not aimed at them. True or false? Justify. (2) 6. With which fundamental principle(s) has a professional accountant in business who lies to a parliamentary commission of enquiry failed to comply? (1) 7. With which fundamental principle(s) has a professional accountant in public practice who ignores evidence of fraudulent practices at an audit client to retain the audit failed to comply? (1) 8. Concerning professional accountants in public practice, the fundamental principles on which the SAICA Code is based do not apply to non-assurance engagements. Comment. (2) ϯ͘ϯ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Indicate whether each of the following statements is true or false. Provide a brief justification for your choice. 1. Where an engagement partner holds shares in an audit client, a self-review threat exists, affecting his compliance with the fundamental principle of confidentiality. (2) ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϱϭ 2. Where an engagement partner holds shares in an audit client, an adequate safeguard against non-compliance with the Code will be to hold the shares in the name of a trust controlled by the partner and of which he is a beneficiary. (2) 3. Intimidation threats can affect the auditor’s objectivity, integrity and professional competence. (2) 4. The spouse of a professional accountant in public practice is regarded as a close family member for purposes of applying section 510 – Financial Interests, of the Code of Professional Conduct. (2) 5. When conducting a review of a company’s financial statements with a public interest score of less than 100, the public accountant in public practice need not concern himself with the independence requirements of the Code of Professional Conduct. (2) 6. Trainee accountants are not subject to the requirements of the Code of Professional Conduct. They will be disciplined by the firm with which they are serving their training contract. (2) 7. A professional accountant in public practice may not take custody of cash belonging to a client until he has satisfied himself that the money does not come from illegal sources. (2) 8. A professional accountant in public practice may accept gifts from a client provided the approval of SAICA is obtained before accepting the gift. If the gift is insignificant, approval need not be obtained. (2) 9. If a professional accountant in business is faced with a situation where his compliance with the fundamental principles of the Code of Professional Conduct conflicts with the interests of the company which employs him, he must comply with the fundamental principles. (2) 10. Where a professional accountant in business owns shares in the company that employs him, a self-interest threat that could threaten his compliance with the fundamental principle of objectivity, could arise. (2) 11. In terms of the Code of Professional Conduct, if an audit client has a tight reporting deadline, the engagement partner may assign members of the audit team to assist the client’s accounting personnel in preparing supporting schedules, carrying out debtors and creditors reconciliations, and approve final journal entries to ensure that the reporting and audit deadlines are met. (2) 12. In terms of the Code of Professional Conduct, provided the audit firm’s personnel does not make any management decisions on behalf of the client, members of the audit team may assist an audit client in implementing off-the-shelf (packaged) software. (2) ϱϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϯ͘ϰ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. All Professional Accountants in Public Practice are required to comply with Parts 1 and 3 of the Code and the International Independence Standards as contained in Parts 4A and 4B of the Code. True or false? Justify. (2) 2. Section 300 of the Code identifies five categories of threats which may result in a professional accountant in public practice failing to comply with one or more of the fundamental principles of the Code. Identify four of the five categories. (4) 3. Identify the possible threat(s) to which each of the following relates: 3.1 A professional accountant in public practice has a close business relationship with the majority shareholder of an assurance client. (1) 3.2 A professional accountant in public practice has prepared the annual financial statements for a client and provided an audit opinion on the financial statements. (1) 3.3 A professional accountant in public practice accepted an overseas holiday paid for by an audit client and is now being threatened that the senior partner of the audit firm will be notified of the trip. (1) 3.4 A professional accountant in public practice who does not form part of the engagement team performing assurance services is engaged to arbitrate in a dispute between the audit client and a third party. (1) 3.5 A professional accountant in public practice agrees not to give a qualified opinion on a set of financial statements (for which a qualified opinion is appropriate) to secure his firm’s appointment as an auditor for the following year. (1) 3.6 A professional accountant in public practice, whose son has recently been appointed as the financial accountant at a client, performs the annual independent review of that client’s annual financial statements. (1) 4. State the general requirement to which a professional accountant in public practice must adhere with regard to conflicts of interest (section 310). (1) 5. State the general requirement to which a professional accountant in public practice must adhere if asked by a potential client to replace another accountant (section 320). (1) 6. Discuss the threats which may arise for a professional accountant in public practice when requested to provide a second opinion to a company that is not an existing client, such as applying an accounting policy in the annual financial statements (section 321). (4) 7. Identify the requirements to which a professional accountant in public practice must adhere before and after taking custody of a client’s assets (section 350). (5) ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ 8. ϱϯ Describe the objectives of the professional accountant in public practice in relation to non-compliance with Laws and Regulations (NOCLAR) (section 360). (3) ϯ͘ϱ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ The SAICA Code of Professional Conduct adopts a conceptual-framework approach as its basis of construction. To apply the approach, the professional accountant must understand: • the fundamental principles on which the Code is based; • the types of threat to the professional accountant’s compliance with the fundamental principles; and • the safeguards which may be put in place to address the threat of non-compliance. YOU ARE REQUIRED TO: (a) Discuss the steps a professional accountant should take in applying the conceptual-framework approach. (8) (b) Identify and briefly explain any four of the five categories of threat suggested by the Code. Examples are not required. (6) (c) Describe briefly six general safeguards in the work environment of an audit firm that will contribute to ensuring that threats to compliance with the fundamental principles will be responded to appropriately. (6) ϯ͘ϲ WĂƌƚ ;ϮϯŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ ;ϳŵĂƌŬƐϵŵŝŶƵƚĞƐͿ Zanele Trump is a professional accountant working as a financial manager at Towers Ltd. Zanele received an invitation to the final for the rugby world cup in France by one of Towers Ltd’s suppliers. The specific supplier’s contract is up for renewal at the end of the year. YOU ARE REQUIRED TO: Discuss how Zanele Trump should act in this situation to comply with the fundamental principles. (7) WĂƌƚ ;ϰŵĂƌŬƐϱŵŝŶƵƚĞƐͿ Mr Steinhoff is a professional accountant working as an internal auditor at Check Ltd. During an internal audit of the sales division at Check, he detected fictitious sales recorded by the sales clerk. The sales clerk tried to bribe Mr Steinhoff by offering to pay a substantial amount into Mr Steinhoff’s bank account in return for his silence. ϱϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: Discuss the matter with reference to the Code of Professional Conduct. WĂƌƚ (4) ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ Ken Kildair is a chartered accountant working as the head of internal audit at a mining company. During the internal-audit performance, he found that dirty water is being piped directly into the river close by. Furthermore, he found that the mining company has been dumping waste outside in a wetland. YOU ARE REQUIRED TO: Discuss whether there are any actions that Ken Kildair should take with reference to the Code of Professional Conduct. (12) ϯ͘ϳ ;ϮϭŵĂƌŬƐϮϱŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. All Professional Accountants in Business are required to comply with Parts 1 and 2 of the Code and the International Independence Standards as contained in Parts 4A and 4B of the Code. True or false? Justify. (2) 2. Section 200 of the Code identifies five categories of threats which may result in a professional accountant in business failing to comply with one or more of the fundamental principles of the Code. Identify five of the five categories. (5) 3. Identify the possible threat(s) to which each of the following relates: 3.1 A professional accountant in business participates in a performance bonus scheme for managers. Financial decisions made by the professional accountant can materially affect the bonus he/she receives. (1) 3.2 A professional accountant in business determines the appropriate accounting treatment for a new joint venture after he/she has performed a feasibility study. (1) 3.3 A professional accountant in business has accepted an overseas holiday paid for by a major supplier. (1) 3.4 A professional accountant in business manipulated information in a prospectus to obtain favourable financing. (1) 3.5 An individual is dominating the decision-making processes of the professional accountant in business. (1) 4. State the general requirement to which a professional accountant in business must adhere concerning conflicts of interest (section 210). (1) ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϱϱ 5. Discuss the threats which may arise for a professional accountant in business when accepting a position as a tax consultant without sufficient expertise or training (section 230). Discuss the safeguards that can be implemented. (4) 6. Discuss the threats which may arise for a professional accountant in business when he/she is using confidential information for personal gain (section 240). (1) 7. Describe the objectives of the professional accountant in business in relation to non-compliance with Laws and Regulations (NOCLAR) (section 260). (3) ϯ͘ϴ ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. Under what conditions may a professional accountant in public practice breach his duty of confidentiality to his client without contravening the Code of Professional Conduct? (2) 2. If a professional accountant, who is the financial manager of a company, discloses confidential information about the company to other employees at a social function of the company, can he be charged with a breach of the Code of Professional Conduct? (2) 3. Give three examples where a professional accountant in public practice has a right or duty to disclose confidential information about a client (without the client’s permission). (2) 4. Explain why the receipt of a referral commission by a professional accountant in public practice may threaten the fundamental principles of the Code of Professional Conduct. Provide an example to illustrate. (3) 5. What is ‘lowballing’ and why is it considered to be unacceptable in the context of the auditing/accounting profession? (2) 6. Ron Quin, a professional accountant in public practice, was notified by one of his audit clients, Windfall (Pty) Ltd, that the company had appointed Reg Minnaar as the financial manager at Windfall (Pty) Ltd. Reg Minnaar had recently left Ballen (Pty) Ltd, a company which is also an audit client of Ron Quin’s. From having read the minutes of directors’ meetings while conducting the recent audit of Ballen (Pty) Ltd, Ron Quin was aware that Reg Minnaar had been dismissed from Ballen (Pty) Ltd for fraud, but for various reasons, had not been charged and had been allowed to resign. Ron Quin immediately sent an email to each member of Windfall (Pty) Ltd board notifying them that Reg Minnaar had been dismissed for fraud. Comment on whether Ron Quin has breached the Code of Professional Conduct. (4) 7. Joe Tick, a professional accountant in public practice, wrote an article on personal tax for a popular magazine ‘Moneycents’. Next to the article, Joe Tick paid for a full-page advertisement promoting his firm. Is the inclusion of the ϱϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ advertisement a breach of the Code of Professional Conduct? Explain your answer. (3) 8. May a firm of professional accountants advertise: • on Instagram? (1) • on the internet site Facebook? (1) 9. Donnie Brasco, a highly competent professional accountant, was not made a partner of the audit firm by which he was employed because he did not hold the same religious beliefs as the other partners and it was felt that it would affect the firm’s relationship with a number of the firm’s clients. Comment on this situation in terms of the Code of Professional Conduct. (3) 10. Krib Ltd (which is audited by Kissall Finesting Inc) has approached you, a professional accountant in public practice, to review the salary structures, including directors’ emoluments within the company. They insist that you do not inform Kissall Finesting Inc of the engagement because of the confidential nature of salaries and directors’ emoluments. Would you agree to this? Explain your answer. (2) 11. Harbejahn Sing, a senior manager at Mowitt and Partners, was phoned by a partner from Downs and Co. He was told in confidence that Downs and Co were opening an office in East London. The partner offered Harbejahn Sing the position of senior manager in the new office with a promise of a partnership within two years. The partner from Downs and Co told Harbejahn Sing to keep the offer quiet for the moment, which Harbejahn Sing agreed to do. Comment on this situation in terms of the Code of Professional Conduct. (3) 12. May a partner delegate the signing of an audit report to his audit manager under normal circumstances, provided the manager is a professional accountant? Justify your answer. (2) 13. Du Toit and Buys conducts the audit of a large listed group. The audit fee is R12 million. At the completion of the audit, the financial director offers, as a gift, to take the entire audit team to Mauritius. In view of the large audit fee, some members of the audit team consider that it would be permissible to accept. Discuss. (4) ϯ͘ϵ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ As you have a sound knowledge of the SAICA Code of Professional Conduct, you have been asked to comment on the following unrelated situations which have arisen at your audit firm. 1. One of the firm’s audit clients, Glencord Ltd, provides educational bursaries for the children of its employees, including children of senior management. The company now wants to introduce a program to assist bursary students who graduate, to find employment. The company has requested your firm to offer ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϱϳ training contracts to students who qualify with a Bachelor of Commerce degree. The Glencord Ltd group is a major client of your firm. (5) 2. Another major audit client of your firm is Megasure Ltd. Clive Owen, whose wife runs a catering business called Owen Spout CC, is the manager on the audit. Megasure Ltd spends a significant amount of money on internal businessrelated entertainment and is about to put its catering contract out for tender. While reviewing the minutes of a directors meeting, Clive Owen came across the amount which the directors regarded as a reasonable tender price. That night he discussed the tender with his wife and suggested that she submit a tender in the name of Owen Spout CC. Although Clive Owen was a member of Owen Spout CC he instructed his wife (the only other member of the CC) not to use his name in any correspondence and under no circumstances to reveal that she was his wife. He also told her to tender just below the expected amount and agreed to get as much information as possible about Megasure Ltd’s catering expenditure. The following day he instructed a trainee accountant on the audit team to comprehensively analyse the company’s catering expenditure, although this work was not necessary for audit purposes. (10) 3. Football League (Pty) Ltd is also an audit client of the firm. Along with other companies, the company has the rights to manufacture and distribute Football League merchandise. The company has a number of exciting business opportunities and its financial director has approached your firm to enter into a joint venture with it in the form of a private company, to develop these opportunities. Your firm’s contribution to the joint venture will be for the partners to invest an initial R5 million as start-up loan capital, to provide advice on the financial systems and to carry out the annual audit of the joint venture company. (The company’s Memorandum of Incorporation will require an annual audit.) Football League (Pty) Ltd will own all the shares in the joint venture company, and the board of directors of the joint venture company will be made up of directors of Football League (Pty) Ltd and two of your firm’s partners. (5) YOU ARE REQUIRED TO: (a) Briefly explain each of the fundamental principles of the SAICA Code of Professional Conduct. (8) (b) Discuss each of the above situations (1–3) in terms of the SAICA Code of Professional Conduct. (20) ϯ͘ϭϬ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ Manoj Ravjee, registered with SAICA as a chartered accountant in business, is the recently appointed financial accountant at Raintech (Pty) Ltd, a water purification and irrigation company. The company is a wholly-owned subsidiary of Hydroworks Ltd, a company listed on the JSE. One of his duties is to prepare the annual financial statements for submission to the holding company. ϱϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ These annual financial statements are used to calculate bonuses paid to management, including executive directors at the subsidiary. On presenting the March 2022 figures to Willy Hagen, the financial director of Raintech (Pty) Ltd, Willy Hagen, suggested to Manoj Ravjee that he go and work on the figures to reflect a far better profit for the year, reminding him that the management bonuses depended on the profit reflected. On protesting that he could not manipulate the figures, Willy Hagen replied, ‘I suggest you do as I say.’ On his way back to his office, Manoj Ravjee decided to discuss the matter with Dave Vance, a chartered accountant employed by Raintech (Pty) Ltd. His response was, ‘Manoj, just do it; you are no longer in the profession. Hagen will fire you if you do not do what he says – just look on the bright side, our bonuses will also be bigger. Besides, it’s not as though you are stealing! In any event, who will ever know – the auditors they send here are always pretty inexperienced and you can tell them anything you like!’ YOU ARE REQUIRED TO: (a) Discuss the situation in which Manoj Ravjee finds himself in relation to the SAICA Code of Professional Conduct. (15) (b) Discuss Dave Vance’s attitude to professional ethics. (c) Discuss the action Manoj Ravjee could take, assuming he is not prepared to comply with Willy Hagen’s instructions. (5) ϯ͘ϭϭ (8) ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ Early in the financial year of Sennet (Pty) Ltd, Abstrakt (Pty) Ltd made a substantial loan to Sennet (Pty) Ltd. An important condition stipulated in the loan agreement was that, should specific ratios, calculated on the figures reflected in the audited yearend financial statements, not be maintained at agreed-on levels (for example the current ratio cannot drop below 1,5 to 1), Abstrakt (Pty) Ltd would be entitled to demand repayment of the loan immediately. Sennet (Pty) Ltd raised no other loans. On completion of the year-end audit, Sennet (Pty) Ltd’s auditors issued an unmodified audit report. A few months thereafter, Sennet (Pty) Ltd found themselves in deep financial trouble with very little chance of recovery. Abstrakt (Pty) Ltd was alerted to this when Sennet (Pty) Ltd failed to meet its monthly interest payment on the loan. On further investigation, Abstrakt (Pty) Ltd established that Sennet (Pty) Ltd had been in financial trouble for some time and that important account headings in the year-end financial statements, on which an unmodified audit report had been issued, had been manipulated. This was done to satisfy the specified ratio requirements so that Abstrakt (Pty) Ltd would not demand repayment of its loan. Abstrakt (Pty) Ltd are considering suing the auditors of Sennet (Pty) Ltd as Abstrakt (Pty) Ltd is of the opinion that, had the audit been appropriately carried out, the misstatements (manipulation) would have been uncovered and the failure to maintain the specified ratios would have been revealed. Abstrakt (Pty) Ltd would then have demanded repayment of its loan as per the loan agreement. ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϱϵ YOU ARE REQUIRED TO: (a) Identify which of the fundamental principles of the Code of Professional Conduct the auditors of Sennet (Pty) Ltd would have breached should they be found guilty of being negligent in performing the audit of Sennet (Pty) Ltd. Justify your answer. (4) (b) Identify which of the fundamental principles of the Code of Professional Conduct the auditors of Sennet (Pty) Ltd would have breached should they be found guilty of having colluded with Sennet (Pty) Ltd to manipulate the financial statements to reflect the required ratios. (8) (c) Discuss whether Abstrakt (Pty) Ltd would be successful in suing the auditors of Sennet (Pty) Ltd for negligence (assuming that there was no collusion). (12) ϯ͘ϭϮ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ The following situations relating to chartered accountants in public practice have arisen: 1. Mitchell Cord CA(SA) recently completed the audit of Summerhouse (Pty) Ltd, a manufacturer of exclusive furniture. The audit fee amounted to R180 000. Having recently bought a new house, Mitchell Cord proposed the following to Summerhouse (Pty) Ltd: 1.1 Instead of invoicing Summerhouse (Pty) Ltd with a fee of R180 000, he would invoice the company an amount of R80 000 for the audit fees. 1.2 Summerhouse (Pty) Ltd would then supply Mitchell Cord free of charge with furniture for his new house to a cost value of R100 000. 1.3 Summerhouse (Pty) Ltd would not raise a sale in the company’s accounting records and would write the amount of R100 000 off as part of the allowance for obsolete inventory. (8) 2. Randle String CA(SA) assisted a non-audit client in tax litigation (non-assurance engagement) and charged his fee as a percentage of the taxation he had saved the client. This basis of charging had been agreed prior to the service being rendered with the additional proviso that if the litigation ended unfavourably for Randle String’s client, he would charge only a nominal fee of R100 to cover phone calls, postages and petties related to the case. The client won the case and saved a significant amount of tax. This resulted in Randall String charging a fee, which the client considered to be exorbitant in relation to the advice he had given. (8) 3. Jannie Knott CA(SA), a partner in a small country practice, negotiated the sale of an office building on behalf of a client. For this service he charged a fee of 1% below that normally charged by estate agents on the selling price of the building. (3) ϲϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 4. Willie Windsor CA(SA) is an agent for the reputable Smartacc software. In terms of the agreement with Smartacc, Willie Windsor receives a 20% commission on the selling price of any accounting software he sells to his (both assurance and non-assurance) clients and 25% commission on any sales he might make to the general public. (4) 5. Ronald Reef CA(SA) has been engaged by Castel (Pty) Ltd for some years. However, the relationship between Ronald Reef and his client has become unpleasant as Castel (Pty) Ltd has failed to pay fees owed to Ronald Reef for his services. In an attempt to pressure the client into paying, Ronald Reef refused to return certain accounting books and records belonging to Castel (Pty) Ltd that he had in his possession. (5) YOU ARE REQUIRED TO: Discuss each of the situations (1–5) above in terms of the SAICA Code of Professional Conduct. ϯ͘ϭϯ ;ϯϯŵĂƌŬƐϰϬŵŝŶƵƚĞƐͿ Each year Marrion Waterhouse Kooper, a large auditing firm, runs a two-week introduction program for prospective trainee accountants interested in joining the firm. As you are studying towards becoming a chartered accountant, you applied to join the program and were accepted. On day one of the program, Ashwell Zondi, a partner of the firm, conducted a workshop on professional ethics. His introduction was as follows: ‘Marrion Waterhouse Kooper strives to obtain the highest level of professional ethics. We will be taking you out to audit clients during this program to assist with basic audit procedures. We expect you to comply with the fundamental principles of professional ethics as laid down by the SAICA Code of Professional Conduct. You have all studied this Code and should be familiar with the principles of objectivity, confidentiality and professional behaviour.’ At this point, one of the students interrupted: ‘While I understand that compliance with the Code is really important, can we assume that as we are not actually trainee accountants, we are not bound by the Code of Professional Conduct?’ Ashwell Zondi informed the student that he would provide him with a response to his question once he had concluded his presentation and he continued with a discussion on independence and provided practical examples of possible threats to independence: ‘We are going to talk about the importance of independence, particularly in respect of assurance engagements such as the audits on which we will be taking you. As you know, the auditor (the firm and the members of the audit team) must be, and must be seen to be, independent of the client. There are ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϲϭ many situations which can threaten this independence, and these are categorised into self-interest threats, self-review threats, advocacy threats, familiarity threats and intimidation threats.’ The following situations could face an audit firm like Marrion Waterhouse Kooper: Situation 1 A large audit client has not paid its audit fees for two years. The client company has expanded quickly but is illiquid. The amount owed in audit fees is substantial and after repeated requests that the fees be paid, the directors of the company have offered to settle the debt by issuing shares in the company to each of the partners of the audit firm with a total value equal to the amount of the fees owed. Situation 2 As part of its social responsibility program, one of Marrion Waterhouse Kooper’s audit clients has offered to pay the university fees of all trainee accountants employed by Marrion Waterhouse Kooper who are studying by distance learning through Unisa towards an accounting qualification. The only conditions are that students must prove that they are financially unable to pay their own fees and that if the trainee accountant fails a year, the full amount must be repaid to the client company by the trainee, within 24 months. Situation 3 Rudolf Nel, the senior-in-charge of the Quickies (Pty) Ltd audit, completes his training contract in December 2022. In April 2022, Quickies (Pty) Ltd offered him the position of financial accountant at the company from January 2023. The existing financial accountant is due to retire at the end of 2022. Quickies (Pty) Ltd’s financial year end is 31 October. YOU ARE REQUIRED TO: (a) Explain in your own words, in the context of an audit engagement, the fundamental principles of objectivity, confidentiality and professional behaviour. (6) (b) Discuss how Ashwell Zondi would have responded to your fellow student’s assumption that ‘as we are not actually trainee accountants we are not bound by the Code of Professional Conduct’. (3) (c) Explain: (i) Why the concept of independence is more important in respect of assurance engagements than it is in respect of non-assurance engagements. (3) (ii) The terms self-review threat and familiarity threat and provide one example for each threat. (4) (d) State whether each of the situations (1–3) provided in the scenario would give rise to a threat or threats to the auditor’s independence. Where a threat(s) arises you must (i) categorise the threat or threats; and ϲϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (ii) explain why you believe independence would be threatened or, provide reasons where you believe independence has not been threatened. Mark allocation for part (d) ϯ͘ϭϰ Situation 1 (5) Situation 2 (8) Situation 3 (4) ;ϯϯŵĂƌŬƐϯϵŵŝŶƵƚĞƐͿ The audit firm of Messi and Mudau has an extensive number of audit and other clients. The firm has an internal ‘ethics and governance’ committee that meets frequently to consider any breaches or potential breaches of the ethical standards of the profession by its partners and employees (including trainee accountants). As a first-year trainee you have been invited to sit on this committee to contribute your knowledge of the SAICA Code of Professional Conduct and to gain experience. The following matters have been presented for discussion: Matter 1: Actiontravel (Pty) Ltd The firm has recently completed the year-end audit of Actiontravel (Pty) Ltd, a company which organises tours to major sporting events around the world. The audit fee for the year is approximately R125 000 but has not yet been paid by Actiontravel (Pty) Ltd. To settle the account, the company has offered to give your firm five tour packages on one of its tours to a Formula 1 Grand Prix in Europe. The cost of a single tour package to a member of the public is approximately R25 000. If your firm agrees to this, Actiontravel (Pty) Ltd will include a further two tour packages free of charge provided the packages are given to the manager and senior-in-charge of the audit team which carried out the audit of Actiontravel (Pty) Ltd. They would be accompanied by the financial director and the financial manager of Actiontravel (Pty) Ltd. Matter 2: Wissles (Pty) Ltd Wissles (Pty) Ltd, an audit client of your firm, wishes to improve its corporate governance and has put the following proposals to your firm: 1. The senior partner of your firm, Danial Messi, be appointed as a non-executive director of Wissles (Pty) Ltd and Chairman of the Board of Directors. (Danial Messi does not play any role on the audit of Wissles (Pty) Ltd.) 2. Tom Boonin, the partner in charge of the audit (engagement partner) of Wissles (Pty) Ltd be appointed to a two-member Remuneration Committee (the other member being Ted Fredd, Wissles (Pty) Ltd’s Human Resources manager). Ted Fredd is not a director of the company. This committee would be responsible for setting and authorising the remuneration of all executives of the company. ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϲϯ Matter 3: Burlyn Ltd Eliza Meiring, the manager on the audit of Burlyn Ltd, recently married Steve Meiring, a CA(SA). By coincidence Steve Meiring has been employed by Burlyn Ltd as the company accountant responsible for financial reporting. He will join the company on 1 May 2023, the first day of the new financial year. Eliza Meiring has commenced the 30 April 2023 year-end audit, and expects to be completed in mid-June. Matter 4: Copycat (Pty) Ltd One of the firm’s audit clients, Copycat (Pty) Ltd sells photocopy and other business machines. The sales manager of Copycat (Pty) Ltd has approached your firm with the following proposal in an attempt to increase its sales: ‘Your firm supplies Copycat (Pty) Ltd with a list of all the firm’s clients, the age and depreciated value of their existing business machines and the name of a specific person whom Copycat (Pty) Ltd can contact to sell the clients new machines. For every sale made in this manner, your firm will receive a payment equal to 10% of the machine’s selling price.’ The projections provided by Copycat (Pty) Ltd suggest that this could be a lucrative (profitable) venture for your firm. Matter 5: Advertising Your firm is considering an advertising campaign to promote the range of services it offers. As part of the campaign the partners wish to include a catchy phrase (slogan) which will appear, with the firm’s logo, on all letterheads, advertisements etc. The following two phrases (slogans) have been submitted for the ‘ethics and governance’ committee to consider: 1. Messi and Mudau ‘simply the best, better than all the rest’. 2. Messi and Mudau ‘X-streme X-cellence’. YOU ARE REQUIRED TO: (a) In respect of matter 1, discuss Actiontravel (Pty) Ltd’s offer in terms of the SAICA Code of Professional Conduct. (7) (b) In respect of matter 2, discuss Wissles (Pty) Ltd’s proposal to improve its corporate governance in terms of: (c) (i) the King IV Code (4) (ii) the SAICA Code of Professional Conduct (4) (iii) the Companies Act 2008. (3) In respect of matter 3, discuss whether it would be a breach of the SAICA Code of Professional Conduct for Eliza Meiring to continue in her capacity as manager on the 30 April 2023 year-end audit of Burlyn Ltd. (4) ϲϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (d) In respect of matter 4, discuss Copycat (Pty) Ltd’s proposal in terms of the SAICA Code of Professional Conduct. (6) (e) In respect of matter 5, comment on the appropriateness of each of the phrases submitted, in terms of the SAICA Code of Professional Conduct. (5) ϯ͘ϭϱ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Rendal Miller is a partner in Botha and Nquni, a large audit firm. Phil Kumalo, a newly appointed partner at the firm, is concerned about a number of ethical matters which he has encountered since joining the firm. 1. Phil Kumalo was invited to join Rendal Miller and several clients for dinner some weeks ago. One of the topics of conversation was that Rendal Miller’s wife, Anna, had recently inherited 60 000 shares in Bondai Ltd. (This company has 10 million shares in issue, and these shares are currently quoted on the Johannesburg Stock Exchange at R20 per share.) Because of his position as engagement partner on the audit of Bondai Ltd, Rendal Miller had been able to entertain the guests at dinner with gossip about the directors’ private lives and information about the company. (8) 2. While carrying out planning activities for the audit of Dowd (Pty) Ltd, Phil Kumalo had asked Martina Chest, the engagement partner on this audit for the previous three years, for guidance as to the budget for the upcoming audit. Martina Chest replied that she merely increased the audit fee by the consumer price index each year to consider inflation. On discussing the matter with the financial director of Dowd (Pty) Ltd, he (the financial director) indicated that: • he was never quite sure what he was being charged for, as the fee notes he received provided very little detail and gave no indication as to how fees were calculated, but • he was expecting a reduced fee because improvements in the accounting system during the year, which was currently under audit, should result in less involvement of senior audit staff and the completion of the audit two weeks earlier than in prior years. (6) 3. While performing certain tax services for Nelson Naidoo, a client of Botha and Nquni, Rendal Miller, had advised Nelson Naidoo to consult Mike Raw, an investment broker, about retirement planning. In response to a question from Nelson Naidoo as to the commission that Rendal Miller would receive from Mike Raw, Rendal Miller had indignantly denied that he received any reward for referring clients to Mike Raw. Phil Kumalo has since learned that Mike Raw pays Botha and Nquni a 5% commission on all investments placed with him due to referrals by Botha and Nquni staff and partners. (4) 4. At a partners meeting, Rendal Miller informed the other partners that he had been approached by the financial director of Webcam (Pty) Ltd to provide a second opinion of some financial information it was submitting to the bank. ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϲϱ Webcam (Pty) Ltd is not a client of Botha and Nquni and the first opinion had been provided by its auditors. Rendal Miller told the meeting that he had talked the matter through with the financial director of Webcam (Pty) Ltd and provided an opinion acceptable to the financial director. He also told the meeting that he had not charged a fee for this service, as he was ‘working on the financial director to recommend to the shareholders that Botha and Nquni take over the audit of Webcam (Pty) Ltd. Webcam (Pty) Ltd’s public interest score requires that the company have its annual financial statements audited externally. (12) YOU ARE REQUIRED TO: Discuss the matters described in points 1 to 4 above in relation to the SAICA Code of Professional Conduct. ϯ͘ϭϲ ;ϯϳŵĂƌŬƐϰϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. In terms of the Code of Professional Conduct, a professional accountant in business who becomes aware of non-compliance (or suspected non-compliance) with laws and regulations by the organisation which employs him may be faced with a threat(s) to his compliance with the fundamental principles of integrity and professional behaviour. Identify the threats which may arise from this situation and explain how the fundamental principles of integrity and professional behaviour are threatened. (5) 2. Besides needing professional accountants in business to comply with the fundamental principles of integrity and professional behaviour, what are the objectives of the Code in requiring professional accountants to respond to non-compliance or suspected non-compliance with laws and regulations by the organisation which employs them? (3) 3. Beckie Nchunu is a professional accountant registered with SAICA recently employed in a senior financial position by a listed company with diverse business activities in retail. During the course of his professional activities, he became aware that 3.1 the directors had decided to invest substantial amounts in cryptocurrencies, a practice which was specifically prohibited in terms of an amendment to the company’s Memorandum of Incorporation (MOI) approved at the AGM held three years ago; (3) 3.2 the company is planning to sell certain information about its customers to third parties without the express permission of the customers to which the information relates; (3) ϲϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3.3 the financial director to whom Becki Nchunu reports is involved in his personal capacity as a material shareholder in a private company which is engaged in the alleged illegal harvesting and sale of crayfish; and (2) 3.4 the company intends to obtain a lucrative provincial tender by making a substantial contribution to purchasing a large private home for the premier of the province, which is calling for tenders. (3) Discuss whether, for each of the above situations, it will be necessary for Beckie Nchunu to take any action/respond to satisfy the Code of Professional Conduct requirements with regard to the section dealing with non-compliance with laws and regulations. You must consider each situation (1 to 4) separately and must justify your answer. You are not required to discuss the action/response which should be taken/made. 4. Within an organisation, with whom does the responsibility lie to identify and address any non-compliance with laws and regulations by the organisation itself or individuals within the organisation. (2) 5. Although the general principle of responding to non-compliance with laws and regulations apply to all professional accountants, the Code does distinguish between senior professional accountants in business and professional accountants other than senior chartered accountants. 5.1 Define a senior professional accountant in business. (1,5) 5.2 Explain why it is necessary to distinguish them from other chartered accountants in business. (1,5) 6. Dicky Button is a chartered accountant in business registered with SAICA and is an executive director of Jacobsfire (Pty) Ltd, a large industrial company. At a board meeting of the company, the seven directors passed a resolution by six votes to one to implement a process to dispose of the company’s industrial waste in a manner which is in serious contravention of various environmental regulations, but which is very difficult for the authorities to identify and successfully prosecute. Dicky Button had voted against the resolution and explained to his fellow directors the potentially severe consequences of implementing this process. However, the other directors ignored his warnings on the grounds that it was an inexpensive process and that the risk of the company being caught and prosecuted was very low. Consider the following further actions which Dicky Button could take and state, for each further action, whether it would be appropriate or not appropriate. Justify your answers. 6.1 Report the matter to the Independent Regulatory Board for Auditors as a reportable irregularity. (3) 6.2 Change his vote from a no vote to an abstention to protect himself from any negative consequences. (5) ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϲϳ 6.3 Accept that the resolution was passed by all the other directors but report the intended implementation of the process to the environmental regulators without informing the board. (5) ϯ͘ϭϳ ;ϮϭŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Roz Sabbatini, a sole proprietor, is registered with SAICA as a professional accountant in practice. She is also registered with the IRBA as her firm conducts a limited number of assurance engagements. One of her audit clients is Sportz (Pty) Ltd, a company for which she also acts in tax matters. In terms of its agreement with Sportz (Pty) Ltd, Nedtrust Bank, which has a substantial long-term investment in the company, requires that its annual financial statements are audited by a registered auditor and submitted to the bank. During the current year’s audit of this client, Roz Sabbatini discovered by chance that Kurt Curren, sole shareholder and managing director of the company, has been keeping an alternate set of accounting records which reflect the true situation while she has been auditing annual financial statements and submitting tax returns based on an incomplete (fraudulent) set of accounting records, for example not all sales have been accounted for. When Roz Sabbatini confronted Kurt Curren with this evidence, he admitted that he has been doing this for some years but indicated that he is not at all worried about it because he was only able to get away with it due to the inadequate audits which Roz Sabbatini had conducted over the years. He further states that should Roz Sabbatini report the matter to anyone, Kurt Curren will state that she was a willing partner to the fraud and benefited from the exorbitant fees she had charged Sportz (Pty) Ltd and which the company had paid without query. On thinking about it, Roz Sabbatini realised that Sportz (Pty) Ltd’s willingness to pay her fees without query might have resulted in her overcharging on prior audits/assignments. On scrutiny of correspondence of her past dealings with Kurt Curren and prior audit working papers, Roz Sabbatini realised that she could indeed appear to have conspired with Kurt Curren as her audit documentation could be considered inadequate. She had frequently not followed up on several queries raised by the (small) audit team and recorded in the audit documentation concerning the various audits. She also realised that she may not ‘have paid much attention’ to these audits because the falsified AFS always reflected a healthy financial position. Furthermore, a large percentage of her professional fees comes from work referred to her by Kurt Curren and, in relation to the quality of the documentation supporting this work, the fees could also appear exorbitant. YOU ARE REQUIRED TO: Discuss fully the situation in which Roz Sabbatini finds herself in terms of her compliance with the SAICA Code of Professional Conduct. ϲϴ ϯ͘ϭϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ;ϯϱŵĂƌŬƐϰϬŵŝŶƵƚĞƐͿ You are the technical partner in the audit firm Touchwood and Co. Some months ago your firm was approached by an existing client, Hadlee Ltd, an unlisted public company, to provide an audit report on a set of financial statements at 31 December 2022. The financial year end of Hadlee Ltd is 30 September but the company had applied for a substantial loan from Nedcorp Bank, who in turn had requested a set of audited financial statements at 31 December 2022. A strict reporting deadline had been set. The engagement had come at a particularly bad time for the firm as both the audit partner (designated auditor) and the audit manager responsible for this client were away on holiday. However, as the September 2022 year-end audit had been completed without problems, your firm agreed to accept the engagement. Martin Hughes, a second-year graduate trainee accountant who, at the time, was already involved in another audit with a strict deadline, but who had formed part of the audit team on the September audit of Hadlee Ltd, was assigned to oversee the engagement. Besides for Martin Hughes, a graduate trainee accountant who had served a year of his contract as well as a student (who had recently left school and was working for the firm part-time before going to university), was allocated to assist with the audit. Martin Hughes had reviewed the working papers from the September audit and decided that the only way he could meet the tight deadline on the audit was to audit only those assertions for which he could obtain evidence quickly. He also chose not to worry about debtors and sales, despite a large increase in these figures, as extensive work had been done on these accounts at year-end. He had instructed the two junior audit team members to carry out detailed procedures on liabilities on the assumption that, if Hadlee Ltd wanted to improve their financial statements for the purposes of the loan application, they would understate liabilities. Wherever possible, he used the client’s staff to obtain third-party evidence, and supply various certificates, for example, bank confirmations, and inventory certificates, to speed up the audit. The vast majority of the work had been delegated to the two junior audit team members so that Martin Hughes could focus on the other audit deadline that had to be met. Due to time constraints, all instructions to the audit team had been verbal. At the completion of the audit, Martin Hughes conducted a hasty review of what had been done, drafted an unqualified audit report and passed on the file to Joe Crowe, the only partner he could find. Joe Crowe glanced through the audit file, enquired ‘how it had gone’ and signed the audit report. Joe Crowe then personally handed the audited financial statements to the loans manager of Nedcorp Bank. On the strength of the audited financial statements, Nedcorp Bank loaned the money to Hadlee Ltd. Shortly thereafter, Hadlee Ltd went insolvent, and it was discovered that during the three months prior to 31 December 2022, the company had ŚĂƉƚĞƌϯ͗WƌŽĨĞƐƐŝŽŶĂůĐŽŶĚƵĐƚĂŶĚĞƚŚŝĐĂůĐŽŶƐŝĚĞƌĂƚŝŽŶƐ ϲϵ processed a large number of fictitious credit sales resulting in vastly overstated sales, debtors and profits at 31 December 2022. Nedcorp Bank was unable to recover the loan they had made and proceeded to sue the auditors for the recovery of their losses. YOU ARE REQUIRED TO: Discuss fully whether your firm would be liable to Nedcorp Bank. ϯ͘ϭϵ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ 1. Garth Naidoo is a newly qualified chartered accountant. At the audit he is currently working on, he is being pressured by the manager on the audit (an older and far more experienced chartered accountant) into signing off the audit program for a section of the audit to which he was assigned, although he has not completed the work, so that the budget for the audit can be met. When he protested, the manager informed him that should he not do as he was told he (Garth Naidoo) would receive a very poor report at his next performance assessment, which could lead to the termination of his employment contract. 2. Carl King, a third-year trainee accountant on the audit of Emex Ltd, discovered, by having access to the minutes of directors’ meetings, that Emex Ltd was considering changing its insurance brokers. That evening Carl King phoned his father, an insurance broker, and told him about the possible change and suggested that he phone Richie Wrisk, the administration manager at Emex Ltd. He also told his father that Emex Ltd spent R123 000 on insurance premiums each month. 3. Curtis Rose and Co are the auditors of Fairways Ltd, a company which develops housing estates around golf courses. When Fairways Ltd develops a new estate, it offers a few plots to its professional advisors, such as its bankers, architects or attorneys at a discounted price (that is to say, less than prices charged when the development is put on the market). If an advisor purchases a plot, no interest is charged (the market rate is charged on ordinary sales) but the amount owed must be settled within 12 months. For their latest development Fairways Ltd has offered a plot to Franklin Curtis, a partner of Curtis Rose and Co. 4. Blakey, Bell and Co, a firm of chartered accountants in public practice, offers a range of services to their clients, including holding client monies in trust accounts and offering investment advice. Tina Bell, the partner responsible for looking after client funds, has been offered a higher rate of interest by the firm’s bank, if she can maintain the balance of the amount invested at a particular level. To achieve this level, she decided to move all client trust monies and Blakey, Bell and Co monies into one account. This enabled her to earn the additional interest (which was credited to Blakey, Bell and Co) and to improve the firm’s cash flow. For example, to meet the monthly salary bill, she was able to draw funds from the money market rather than make use of the firm’s bank overdraft facilities. ϳϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Discuss the situation in which Garth Naidoo finds himself in the context of the SAICA Code of Professional Conduct and indicate how he should act. (8) (b) Discuss whether any breaches of the SAICA Code of Professional Conduct have occurred arising out of the actions of Carl King. (5) (c) Discuss whether, in terms of the SAICA Code of Professional Conduct, Franklin Curtis may accept the plot offered to him by Fairways Ltd. (7) (d) Discuss Tina Bell’s actions in relation to the requirements of the SAICA Code of Professional Conduct relating to custody of client assets. (8) ,WdZ ϰ ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ʹŐĞŶĞƌĂůĐŽŵƉƵƚĞƌŝƐĞĚĞŶǀŝƌŽŶŵĞŶƚƐ͗ /ŶƚƌŽĚƵĐƚŝŽŶ͕ŐĞŶĞƌĂůĐŽŶƚƌŽůƐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 4.1 Audit evidence principles 17 marks 4.2 Audit procedures to obtain audit evidence and the relationship between audit procedures and audit evidence 17 marks Professional scepticism, professional judgement and hierarchy of reliability for audit evidence 10 marks Short questions – Audit evidence, assertions, test of controls and limitations of internal control 14 marks 4.5 Control activities 22 marks 4.6 End-user computing 12 marks 4.7 IT general controls 20 marks 4.8 Short questions – Audit evidence and assertions 25 marks 4.9 Weaknesses in IT controls 15 marks 4.10 IT general controls and automated application controls 14 marks 4.11 Assertions 16 marks 4.12 Entity level controls, IT general controls and automated application controls 26 marks 4.3 4.4 continued ϳϭ ϳϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 4.13 System development and interfaces 40 marks 4.14 Internal control, segregation of duties and documentation 24 marks 4.15 Assertions 42 marks 4.16 Control activities and control environment 24 marks 4.17 Internal control 38 marks 4.18 Internal control; Automated controls; Softwareas-a-Service 34 marks 4.19 IT general controls 35 marks 4.20 System software; End-user computing; Interfaces 25 marks 4.21 IT risks; Decommissioning; Social media 50 marks 4.22 Control activities; Segregation of duties; Risk assessment 43 marks 4.23 Automated application controls 24 marks 4.24 IT general controls; Automated controls; Mobile application testing 25 marks ϰ͘ϭ ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ Audit evidence is fundamental to the audit function. The auditor has a duty to gather evidence to support his opinion on whether the assertions of the directors, embodied in the annual financial statements, are fairly presented. ISA 500 – Audit Evidence, is one of the International Standards on Auditing. It serves to guide the auditor in obtaining audit evidence through the application of an appropriate mix of tests of control systems and substantive tests of transactions and balances. ISA 500 states that ‘the objective of the auditor is to design and perform audit procedures in such a way as to enable the auditor to obtain sufficient, appropriate audit evidence to be able to draw reasonable conclusions on which to base the auditor’s opinion’. The key to this standard is the phrase sufficient, appropriate evidence. YOU ARE REQUIRED TO: Answer the following questions, which are based on the abovementioned statement. 1. What is audit evidence? (1) ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϳϯ 2. ISA 500 states the auditor will require ‘sufficient, appropriate evidence’. Will accounting records which are accurate, complete and properly maintained provide sufficient audit evidence for the auditor to fulfil her function? (2) 3. Upon what do the relevance and reliability of evidence depend? (3) 4. Explain the difference between tests of controls and substantive procedures. (3) 5. List the types of evidence available to the auditor. (3) 6. The reliability of audit evidence is influenced by its source and by its nature. What are the sources of evidence available to the auditor? (3) 7. What is the relationship between audit evidence and audit risk? ϰ͘Ϯ (2) ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ It is obvious that to gather evidence, the auditor will have to carry out a number of procedures. In some instances, procedures are considered collectively, for example, ‘risk assessment procedures’ and in other instances, the procedure may be a simple description which illustrates the type of procedure, for example observation. YOU ARE REQUIRED TO: (a) Explain the term ‘risk assessment procedures’ in the context of auditing. (2) (b) Explain the term ‘further audit procedures’. (2) (c) What is the relationship between audit procedures and audit evidence? (2) (d) Briefly describe the seven types of audit procedures, to obtain audit evidence. (7) (e) Comment on whether the procedures described in (d) above will be suitable for use when the auditor is assessing the risk of material misstatement. (2) (f) Comment on the following statement ‘The most effective test of controls is observation, because the auditor himself is making the observation.’ (2) ϰ͘ϯ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Sashin Pillay recently joined an established audit firm, Abacus Auditors, as a firstyear article clerk. On Sashin’s first audit, at Clement Dubakus’ Cement factory, Azure (Pty) Ltd, he meets the newly appointed internal auditor George Guru. They discuss what audit evidence is available at Azure (Pty) Ltd and George is inquisitive to find out from Sashin what evidence is deemed by Abacus Auditors as reliable, concrete audit evidence and the hierarchy of the evidence, as some evidence is simply more reliable than other evidence. In addition, knowing Sashin is a first-year article clerk, George wanted to get Sashin’s views on professional scepticism and professional judgement when considering audit evidence. ϳϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: 1. Explain the link between audit evidence and professional scepticism. (2) 2. Explain the link between audit evidence and professional judgement. (2) 3. Explain the hierarchy of reliability for audit evidence (6) ϰ͘ϰ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer for each of the following questions: 1. In terms of ISA 500, Audit Evidence, the auditor is required to obtain: 1.1 relevant and appropriate evidence 1.2 sufficient appropriate evidence 1.3 reliable and sufficient evidence 1.4 relevant, reliable and corroborative evidence. 2. Which of the following factors will not influence the auditor in determining whether he has gathered the necessary evidence to support his audit opinion? 2.1 The time spent on gathering the evidence 2.2 The source of the evidence gathered 2.3 The persuasiveness of the evidence gathered 2.4 The quantity of evidence gathered. 3. Which of the following factors should not influence the auditor’s decision on how much evidence he must gather pertaining to a particular assertion? 3.1 The inherent risk applicable to the assertion 3.2 The hours in the budget allocated to the audit of the account heading to which the assertion relates 3.3 The materiality of the account heading to which the assertion relates 3.4 The auditor’s experience gained on previous audits of the client company’s financial statements. 4. When deciding on the appropriateness of audit evidence gathered, the auditor will consider: 4.1 the relevance and reliability of the evidence 4.2 which member of the audit team gathered the evidence 4.3 the reliability and confidentiality of the evidence 4.4 the time spent on gathering the evidence. 5. When deciding on the reliability of audit evidence gathered, the auditor will consider: 5.1 the extent (quantity) of the evidence gathered ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů 5.2 ϳϱ the relevance of the audit evidence 5.3 the nature of the evidence gathered 5.4 the nature and source of the evidence gathered. 6. Which of the following evidence pertaining to the existence of the client’s inventory, would be considered to be the most reliable by the auditor? 6.1 An oral representation as to the existence of inventory from the operations director 6.2 A physical inspection of the client’s inventory by the audit team 6.3 A written representation from the warehouse manager as to the existence of inventory 6.4 An invoice from the supplier of the inventory reflecting the quantity and description of the goods supplied. 7. A piece of evidence obtained on one section of the audit which supports another piece of evidence on another section of the audit is described as: 7.1 corroborative evidence 7.2 persuasive evidence 7.3 significant evidence 7.4 concurring evidence. 8. In terms of ISA 330 tests of controls are conducted to: 8.1 detect material misstatements at assertion level 8.2 reduce the need to perform substantive tests 8.3 replace tests of detail 8.4 determine the effectiveness of the operation of controls. 9. The term further audit procedures includes: 9.1 risk assessment procedures 9.2 tests of controls 9.3 substantive tests 9.4 substantive tests and tests of controls. 10. Which of the following is not a test of controls? 10.1 Inquiry 10.2 Observation 10.3 Analytical procedures 10.4 Inspection. 11. Whether a piece of audit evidence is appropriate depends on . . . 11.1 relevance and reliability of the audit evidence ϳϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 11.2 professional judgement 11.3 professional scepticism 11.4 whether it was gathered for a substantive test 12. Which one of the following is not an influencing factor when determining whether audit evidence is appropriate? 12.1 The materiality of the account being examined 12.2 Reliability of information available 12.3 The extent of control tests that need to be performed 12.4 Experience gained during previous audits 12.5 Persuasiveness of the audit evidence. 13. ISA 315 (revised 2019) states that the system of internal control, no matter how effective, can provide a company with only reasonable assurance about achieving the entity’s financial reporting objectives. The likelihood of their achievement is affected by the inherent limitations of internal control. In other words, even the best designed internal control systems have inherent limitations. Which one of the following statements is not related to a limitation of internal control? 13.1 Breakdown in an entity’s system of internal control due to human error, or a design decision. 13.2 The operational aspect of controls is not effective, for example, an exception report is not effectively used because the individual responsible for reviewing the information does not understand its purpose or fails to take appropriate action. 13.3 Controls cannot be circumvented by the collusion of two or more people. 13.4 In designing and implementing controls, management may make judgements on the nature and extent of the controls it chooses to implement, and the nature and extent of the risks it chooses to assume. 14. Select the incorrect option below. Substantive procedures seek to provide evidence to support the financial statement assertions. When performing substantive tests, the auditor is interested in the following assertions: 14.1 balances – completeness, existence, valuation, rights and obligation, presentation and disclosure 14.2 transactions – completeness (totals), occurrence, accuracy, cut-off, classification, and presentation and disclosure 14.3 sampling – completeness, existence, valuation, rights and obligation, presentation and disclosure 14.4 disclosures – occurrence and rights and obligations, completeness, classification and understandability, accuracy and valuation. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϰ͘ϱ ϳϳ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Plant-tech Ltd is a pharmaceuticals company engaged in the formulation, manufacture and sale of medications derived from indigenous plants. The following actions, policies and procedures form part of Plant-tech Ltd’s system of internal control: 1. Plant-tech Ltd requires each of its employees to sign an ethical code of conduct agreement every year, the conditions of which are set by the directors. The conditions and consequences of breaching the code are explained to employees at a seminar attended by the chairman and the board. Any alleged code violations are investigated by a committee of the board. (3) 2. Plant-tech Ltd does not allow research staff to remove laptops or other portable data storage devices from the laboratory. This is enforced by monitored electronic and X-Ray scanners located at the laboratory’s only entrance. (2) 3. Plant-tech Ltd employs a research cost accountant who records the on-going cost and details of different research projects. He makes use of specialised software to do this. (2) 4. The financial director of Plant-tech Ltd meets with the research director quarterly to compare actual and budgeted costs and follow up on any unexpected variances. (2) 5. The financial director and the sales director meet to assess the trade accounts receivable on a monthly basis. Plant-tech Ltd’s terms are 30 days, and debts over 120 days are considered to be bad debts and will usually be written off with the approval of the financial director. Both directors sign necessary journal entry supporting documentation at the conclusion of the meeting. (3) 6. Every two months, a Plant-tech Ltd board committee meets to discuss the industry’s regulatory environment, potential market developments and health care trends. (3) 7. Finished goods (medications) are kept in an air-conditioned/temperaturecontrolled warehouse. (2) 8. The Plant-tech Ltd marketing department has set up a customer phone-in service which enables customers to phone in complaints relating to product quality, pricing, availability etc. Phone calls are recorded and analysed. (2) 9. The warehouse manager has read-only access to the inventory master file and pickers have no access to the inventory master file. (3) YOU ARE REQUIRED TO: (a) List the components of a system of internal control. (5) (b) Identify the component(s) of the system of internal control to which each of the above points (1–9) relates. Give reasons for your choice. If you have chosen ‘control activity’, state which type(s) of control is (are) being implemented, for example segregation of duties. (17) ϳϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϰ͘ϲ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Tournaments of Thrones (Pty) Ltd develops and sells online games. The company was registered in 2018. The company was founded by John Snowstorm and Tshepo Joy. They started small, but their online games were an instant hit, and they managed to double their profits quarterly over the past few years. They were recently awarded internationally for their innovative games and the fact that their graphics were exceptional. Due to the company’s rapid growth, Tshepo and John were forced to hastily broaden their workforce. Luckily, they could rely on trusted sources for the referral of dependable individuals. The company employed, inter alia, Kit Harissa and Khali Dragon, both reputable chartered accountants, to run the finance team. Khali filled the position of chief financial officer (CFO), and Kit headed the team under Khali. They successfully implemented a new accounting system (TAP) and gradually implemented new accounting policies and procedures. Kit, however, prefers to extract the financial data and performs his own analysis of the numbers when preparing the accounts monthly. He quite often uses Microsoft Excel to run macros and perform his own set of CAATs. He also uses excel to independently maintain the fixed-asset register. YOU ARE REQUIRED TO: (a) Briefly describe end-user computing. (b) List the risk implications for Tournaments of Thrones (Pty) Ltd due to the extensive use of end-user computing. (4) (c) Suggest controls that Tournaments of Thrones (Pty) Ltd should consider, to reduce their end-user computing risk. (5) ϰ͘ϳ (3) ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Due to the ongoing power crisis, Anele Choke and her sister, Lungile, established a new company, Sithembile (Pty) Ltd, which developed a low-cost solar solution two years ago. The Southern African market loves their trustworthy inexpensive products, and Sithembile has struggled with the fulfilment of huge orders. Sithembile does not have a store, outlet or physical footprint and all sales are completed on an online mobile application, whether it’s a large retailer ordering or a small order from a member of the public. The company was recently awarded two prestigious prizes from a well-known global entrepreneurial magazine. One prize was for their product solution and the other prize was for the mere fact that they are a small business driving such extensive sales volumes. When thanking the magazine for the prizes, Anele said: ‘This is the result of hard work, long hours, commitment, sophisticated IT systems, limited manual intervention and optimal end-to-end processes.’ ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϳϵ Sithembile is committed to the sustainability goals and wants to contribute to the Earth summit to be held in Africa in the near future. YOU ARE REQUIRED TO: You are engaged to test the IT systems at Sithembile (Pty) Ltd; discuss which IT general controls you will consider testing. (20) ϰ͘ϴ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. If an auditor does not understand the assertions, he/she will not be able to gather the necessary audit evidence to support the audit opinion. True or false? Justify. (3) 2. The greater the risk of misstatement in an account balance, the greater the amount of evidence must be gathered about all the assertions pertaining to that account heading. Comment. (3) 3. A proper set of accounting records will generally provide sufficient information for the auditor to form an opinion on the fair presentation of the financial statements. True or false? Explain your answer. (2) 4. What does the phrase appropriateness of audit evidence mean? (2) 5. Place the following sources of evidence in their order of reliability, starting with the least reliable: 5.1 evidence obtained directly by the auditor (for example, conducting test counts at an inventory count) 5.2 oral evidence provided by a director of the client company 5.3 a confirmation of balance obtained from a reliable, independent source. (2) 6. What does the term reasonable assurance mean in the context of audit evidence? (2) 7. Explain why the auditor only needs to gather sufficient appropriate evidence to reduce audit risk to an acceptable level and not to eliminate audit risk altogether. (2) 8. Auditors do not generally conduct tests on 100% (all items) of a population; they tend to gather evidence by sampling. Give two situations where the auditor may decide to conduct procedures on 100% of a population. (2) 9. Briefly list how audit functions can be performed using data-orientated computer-assisted audit techniques. (5) 10. One of the lessons of the information age is that data is only as useful as our ability to manage it. What turns the chaos of massive amounts of data into business opportunities is how you analyse the data. Briefly explain the benefits of data management. (2) ϴϬ ϰ͘ϵ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Wavelength (Pty) Ltd is an international hair product manufacturer and distributor to salons across the globe. The matters below relate to the company’s 2022 financial year: 1. The company has recently implemented a new financial application. 2. The Group Data Officer has provided procedures for the company to adhere to data privacy. These procedures have been treated as guidelines and have been implemented where possible. 3. Wavelength (Pty) Ltd has a very large social media following and, due to the nature of the organisation, the traffic on its social media platforms is high. Many of its suppliers’ sales representatives have also been granted access to the organisation’s social media accounts and they are allowed to post positive feedback that they receive relating to their products. 4. Access to the new financial application has been granted in accordance with user profiles. Venitia Haridopolous, the CIO, has, however, decided to grant certain users wider access to prevent a backlog of user modification requests in the IT call centre. 5. Business continuity is a key focus area of the organisation’s and, as such, it was decided to implement an annual ‘disaster recovery simulation weekend’. During this weekend, key financial applications will be ‘switched off safely’ and backups restored to ascertain whether the organisation will be able to function in case of a disaster. Members of senior management are very keen on this initiative and have personally committed to be onsite for the weekend the disaster recovery is scheduled. As this will be a first for the company, it has been decided that the focus will be on peripheral systems and processes to get the cadence right. 6. Wavelength (Pty) Ltd is considering outsourcing a number of its IT operations to a well-known IT company, CouchPotato.com, due to the potential costeffectiveness thereof. The company is specifically considering to outsource backups and the storage thereof. 7. As it is a global organisation Wavelength (Pty) Ltd has a number of different applications that interface. 8. The second biggest reason for calls to the IT call centre is to reset passwords. This has, however, been resolved by changing configurations to reset passwords every six months (instead of once a month). 9. The organisation has ‘harvested’ their big data throughout the financial year. 10. The server room has recently been revamped. The server room has been equipped with new neatened wiring and cable work, fire extinguishers, air-conditioning and a very sophisticated biometric access system. According to Venetia Haridopolous, this is all the physical protection that the room requires. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϴϭ 11. Due to all the power disruptions, the UPS’s battery has been impacted. Venitia Haridopolous paid a hefty fee to have the UPS tested, but Wavelength (Pty) Ltd is still waiting for the report to determine whether the UPS is in working condition. 12. Due to the high attrition of resources, the organisation has decided to remove access of terminated employees only at the end of every month. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the internal control for Wavelength (Pty) Ltd based on the information above. For each weakness identified, you must explain why you regard the specific matter as a weakness. (15) ϰ͘ϭϬ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ You are the audit manager of the audit of M&M, short for Move Me (Pty) Ltd, a large taxi company. M&M has, over the past few years, gained the trust of the market and improved their customer service and experience, mostly due to system improvements and enhancements. The company has gained the majority of the market share and competitors, such as Rebu’s and Daisies taxis, who will have to work hard in future to compete with M&M. As part of the entity-level assessment that was performed, you noted complex back-end infrastructure and a fully computerised accounting system. The following controls were identified at M&M: 1. M&M has a mobile application that serves as a client portal where customers can reserve a taxi ride. The mobile application interfaces with both the bank portals and M&M’s accounting system. 2. All M&M employees have had to complete biometrics to be able to access the office. For the drivers, biometrics are also used to open their mobile application. 3. M&M’s administration team is small and efficient, and all users are super users. 4. Due to the nature of the taxi business, M&M deems it important to strictly manage their social-media visibility and reputation. M&M has a social-media management process and curation team that manages and monitors all socialmedia activities, inclusive of adverse comments posted by the public about the organisation. 5. All back-ups are now in the cloud. 6. When a change or enhancement request is made to the mobile application, it must be approved by the IT steering committee and the head of the user department before it is affected. 7. M&M has gradually moved to Software-as-a-Service due to volume and cost efficiency. 8. All clients must have an M&M account on the mobile application, and all personal data fields have to be completed for regulatory purposes, or the account will not register. The Protection of Personal Information Act 2013 applies. ϴϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 9. Passengers that do not know each other can do ride-share, and the option exists on the mobile application to add this as a preference. Recently changes were made to the mobile application . The app will now calculate the number of rideshare customers for any ride, divide the ride’s cost among the number of customers, and charge them their portion individually. 10. A new employee cannot be successfully added to the employee master file without a valid ID number or passport number. 11. The M&M drivers are all permanent employees and M&M has a driver ‘admin’ app to manage the 10 000+ drivers. They have agreed to hours they are allowed to work per day (not more than 8) for the safety of the passengers and their own. They also have to take an hour’s break during the middle of their shift. They log their hours in the mobile application, including the break. A daily report indicates transgressions. 12. M&M’s management team meets quarterly to assess risks and simulate potential risks that M&M may face, such as banking portals being ‘down’ and automated application controls and interfaces not being effective due to loadshedding, strikes, socio-economic factors and more. 13. The mobile application ‘reads’ payment card details due to the interface to the bank portal and will reject card details that are loaded which are not valid. 14. All systems development is carried out in accordance with predefined standards and pre- and post-implementation reviews are scheduled by M&M’s internal audit team. YOU ARE REQUIRED TO: Indicate whether each of the controls listed under 1 to 14 above, is a general control or an automated application control (or both). For the controls that you identify as general controls, indicate the category of general control to which each relates. (14) ϰ͘ϭϭ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ While carrying out the audit of property, plant and equipment and investments at Jabali Ltd, a manufacturing company, the auditor carried out the following procedures: 1. Physically inspected a sample of items of equipment selected from the fixed asset register, agreeing their asset numbers and description to the register and assessing their condition. 2. Reviewed the purchase journal for large amounts, traced the amounts and details to the supplier invoice to determine the nature of the goods supplied and confirmed that the amounts had been correctly allocated to the appropriate account in the general ledger. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϴϯ 3. Selected a sample of additions to plant and equipment from the fixed-asset register and traced each addition to the supporting purchase contract to confirm that the documentation was made out to Jabali Ltd and was signed by an authorised signatory. 4. Inspected payment records to confirm that Jabali Ltd was not behind on monthly payments for a delivery vehicle purchased on instalment. 5. Inspected a sample of lease agreements that had been capitalised to confirm that they are in the name of Jabali Ltd. 6. Evaluated the process by which Jabali Ltd identifies and quantifies impairments. 7. Inspected a relevant stock-exchange publication to confirm the market value of listed shares held by Jabali Ltd at year-end. 8. Confirmed by a discussion with the directors that the patent on a piece of equipment designed and patented by the company during the year has a useful life of 15 years. 9. Inspected brokers’ notes from the firm of stockbrokers used by Jabali Ltd to confirm details of cost, brokerage fees and date of purchase of shares purchased during the year. 10. Inspected the vehicle registration documents for all vehicles owned by Jabali Ltd and physically inspected a small sample of the vehicles. 11. Obtained a confirmation directly from Compushare of dematerialised shares held by Jabali Ltd. 12. Enquired of the financial manager how the cost of the ‘significant parts’ of one of the company’s items of the plant was determined. 13. Reperformed the depreciation calculation for all items of plant and equipment. 14. Evaluated the risk of manipulation of the non-current asset balances by overstatement. 15. Inspected the share certificates for shares held by Jabali Ltd in a private company for authenticity and to confirm they were made out to Jabali Ltd. 16. Inspected the accounting policy notes for property, plant and equipment. YOU ARE REQUIRED TO: Identify the assertion(s) to which each of the procedures listed above (1–16) relates. (16) ϴϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϰ͘ϭϮ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ You are an auditor at AuditMe and have been assigned a new client, Fashionistas (Pty) Ltd. Through several exploratory conversations with the client, you have gathered the following information: In recent years Fashionistas (Pty) Ltd has diversified and created a mobile application where customers can gain advice online from a personal stylist while shopping. The mobile app has proven to be very popular and has a few thousand subscribers that pay a monthly fee. Fashionistas is planning to expand their services during the next 12 months to cater for male customers and to provide online articles and advice to subscribers through push notifications to their phones. Due to expensive hardware and storage costs, Fashionistas made a strategic decision at the beginning of the year to move to the cloud. This move was successfully completed during the financial year. The company has invested a significant amount in automating controls, and is determined to have end-to-end automated processes within the next 18 months. The company has a separate program within their change portfolio, managing this integral piece of work. YOU ARE REQUIRED TO: (a) Briefly describe entity-level controls and the overall overarching landscape that the controls may include. (4) (b) List the topics that you will document as part of the entity-level controls assessment at Fashionistas (Pty) Ltd. (5) (c) Taking the investment in automated application controls into consideration, the client has requested you to discuss the risks that they need to consider when designing their automated application controls (include the risk categories in your answer). (9) (d) List password controls deemed good practice as part of logical access controls. (8) ϰ͘ϭϯ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ You are the audit manager overseeing the audit of Mzanzi (Pty) Ltd. This organisation is extremely passionate about the 17 sustainability goals and has made it their key objective to contribute to delivering the fourth sustainability and development goal, which is Ensuring quality education and lifelong learning for all. Mzanzi (Pty) Ltd’s core focus is to renew, restore and re-distribute previously loved educational toys to impoverished communities. They rely heavily on donations, but to help fund their activities, they have started an online shop during the financial year, where they sell clever marketing and branded goods. This also helps brand management and marketing to the broader public. This initiative has taken the nation by storm, as people feel that it is a very worthy cause. It also has the backing of many well-known humanitarians. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϴϱ When discussing the online shop with Tim Tswalu, the CIO, he mentions that the online shop was very easy to implement (even though it was not an off-the-shelf solution); the difficult part was enabling the integration of the mobile application purchases for the online shop, due to the more complex financial systems that already exist. YOU ARE REQUIRED TO: (a) List interfaces that may exist within Mzanzi (Pty) Ltd’s environment. (3) (b) As Mzanzi (Pty) Ltd is a new audit client with more complex IT systems, describe the entity-level control procedures you will perform as part of the audit. (7) (c) Briefly discuss the phases of system development that you can anticipate when auditing Mzanzi (Pty) Ltd, and provide one audit procedure you will need to consider for each phase. (20) (d) Automated control tests will determine whether the applications were configured correctly to send and receive data and whether the transfers are accurate and complete. Briefly discuss the audit procedures you would perform on configurations to interface and exception reports. (10) ϰ͘ϭϰ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ The list below includes some of the components of internal control, a number of control activities, as well as a number of matters which relate directly to the company’s information system: 1. control environment; 2. source document design; 3. segregation (division) of duties; 4. isolation of responsibility; 5. access/custody controls; 6. risk assessment; 7. frequent comparison and reconciliation; and 8. journal entries. YOU ARE REQUIRED TO: (a) Identify (i) which of these items on the list above are components of internal control, and (ii) which items relate directly to the company’s information system. (b) Explain the term control environment. (2) (2) ϴϲ (c) 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Explain segregation of duties (also known as division of duties). (4) (d) Explain the importance of good source-document design. (3) (e) Explain how a company would protect the following assets: (i) cash at bank; and (3) (ii) debtors. (3) (f) Explain ‘comparison and reconciliation’ in the context of a company’s inventory, assuming that the company maintains a perpetual inventory system. (4) (g) Explain the link between journal entries and isolation of responsibility. ϰ͘ϭϱ (3) ;ϰϮŵĂƌŬƐϱϬŵŝŶƵƚĞƐͿ You are the auditor of Ubuntu (Pty) Ltd, a company based in Howick, which manufactures mohair blankets. It started as a community project but has successfully grown into a large business, employing many of the local artisanal crafters that help create authentic African designs. The company has a year end of 30 June. The following matters have been identified at the ‘identifying and assessing the risks of material misstatement’ stage: 1. Due to the significant expansion, Ubuntu (Pty) Ltd purchased more machinery this year to thread and weave, which will not just increase capacity, but double the volume of blankets that can be produced within a year. Some of the older machines are not used as frequently anymore and probably won’t be used in future as they use too much electricity. 2. Due to a global pandemic, there has been a decrease in mohair in the market with the result that Ubuntu (Pty) Ltd now imports mohair to help fulfil orders. One of these mohair shipments from Bolivia will arrive in early July. 3. Ubuntu decided to get rid of old stock and samples shortly before year end and initiated a large online sale. Due to logistics and the overwhelming response, orders are slightly delayed. 4. In an effort to further boost sales the company relaxed certain of its credit limits during the year. 5. The company discontinued making sales for cash. All the sales are on credit to account holders or by credit card to non-account holders. The number of account holders has increased accordingly. 6. Due to the authenticity of the Ubuntu blanket designs, it’s easy to identify a real Ubuntu mohair blanket. Recently a large retail organisation seems to have ‘copied’ an Ubuntu design and is selling a synthetic blanket version which has been mass produced. Interestingly, it was not Ubuntu that originally noticed this, but social media was a buzz, with people commenting, asking whether Ubuntu designed these blankets. This has necessitated getting lawyers involved, and Ubuntu has made a claim against the retailer. The retailer, in return, responded with a defamation claim against Ubuntu. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϴϳ 7. Significant improvements have been made to the company’s corporate governance policies and procedures. 8. IT general controls have been tested, and all users are categorised as super users. YOU ARE REQUIRED TO: (a) Explain the link between the risk of material misstatement and the assertions. (4) (b) List all the assertions and indicate whether they are applicable to (i) transactions, events and related disclosures, or (ii) balances, assets, liabilities, equity interests and related disclosures. (14) (c) Identify the assertions which may be affected by each of the above matters (1–8). Justify your answer. Consider each matter individually. (16) (d) State whether each of the above matters (1–8) will increase or decrease the risk of material misstatement in the account heading to which the assertions relate. (8) ϰ͘ϭϲ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ The following actions, policies or procedures have been put in place at Fusion (Pty) Ltd, a company which sells a wide variety of lights and light fittings to the general public. Fusion (Pty) Ltd pays its creditors by electronic funds transfer. A combination of any two of three authorised senior employees is required to effect (put in motion) an EFT payment. The first senior employee is required to ‘authorise’ the EFT payment file and the second senior employee is required to ‘release’ the file. This is basically achieved by the use of unique passwords. 1. Gavin Globe, the financial manager who is one of the three employees authorised to effect EFT payments, scrutinises very carefully all supporting documentation, which is signed and presented to him by Lilly Lite, the creditor clerk, before authorising the payments file on the system. The file is then transferred to the second senior employee for release. Before the second employee releases the file, he also scrutinises the supporting documentation, confirming, inter alia, that it has been signed by Gavin Globe. 2. Whenever a delivery is made to Fusion (Pty) Ltd, Fred Fillement, whose only function is to receive goods, completes and signs a sequenced pre-printed multipart goods received note. No other employees are authorised to receive goods. Before signing the GRN, Fred Fillement counts the goods being delivered and matches the quantities and description of the goods received to the corresponding purchase order. 3. Larry Lamp, the human resource manager follows up on any previous work references supplied by prospective employees. All new employees, regardless of ϴϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ what they are employed to do, spend the first two weeks at Fusion (Pty) Ltd, learning about all aspects of the business. Employees are fairly remunerated and treated with respect by management. 4. The board of directors, who is clearly committed to sound corporate governance, meets each month to discuss in detail the performance of the company in comparison to budgets and forecasts for the month and provide constructive suggestions to management. 5. Every three months an inventory count takes place. A team of four employees independent of the ‘inventory’ function, counts the inventory in the warehouse and the shop. Physical quantities counted are then compared to the quantities per the inventory records. All discrepancies are followed up. YOU ARE REQUIRED TO: (a) Identify with an explanation, the type(s) of control activity, if any, which is (are) evident in each of the statements (1–5) above. If you decide that the statement does not describe a control activity, justify your decision. (18) (b) Comment on the control environment at Fusion (Pty) Ltd based on the information given above. (6) ϰ͘ϭϳ ;ϯϴŵĂƌŬƐϰϱŵŝŶƵƚĞƐͿ In a business, management is responsible for running all aspects of the entity. In theory, the broad objectives for the business will be set, for example operating the business efficiently and effectively, the risks which threaten these objectives set will be identified, and suitable responses to these risks will be put in place. These responses will include implementing a proper information system (including proper books, records and documents), employing competent staff, and implementing policies and procedures, including sound-control activities. ISA 315 (revised 2019) states that the system of internal control, no matter how effective, can provide a company with only reasonable assurance about achieving the entity’s financial reporting objectives. The likelihood of their achievement is affected by the inherent limitations of internal control. In other words, even the best-designed internal control systems have inherent limitations. YOU ARE REQUIRED TO: (a) Identify four broad objectives which the management of any business will set (other than operating the business efficiently and effectively). For each broad objective, give a specific example of a risk which may threaten the achievement of the objective. (4) (b) Explain, from an internal-control perspective, why it is important for management/directors to set objectives for the activities of the company. (2) (c) Define internal control. (2) ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů (d) ϴϵ Identify the components of a system of internal control and state to which component each of the following points is most relevant: (i) stipulating procedures to process sales transactions; (ii) obtaining board approval for capital expenditure; (iii) independent assessment of the credit management department by internal audit; (iv) the appointment of a senior risk officer; and (v) the publication and distribution of a code of conduct to all employees. (5) (e) State four ways a large company may address the need to identify and assess the numerous risks faced by the company. (3) (f) Describe what the information system is, and what the term related business processes means. Explain briefly how the information system and business processes are linked. (4) (g) Because of the potential major consequences of poor control in a computerised system, a strong control environment is very important. These controls are implemented within the IT governance environment and have a pervasive impact on the IT control environment, including those at the transaction or application level. Briefly explain what entity-level controls may include. (4) (h) ISA 315 (revised 2019) suggests that the auditor should also understand emerging technologies of clients. Briefly explain. (2) (i) ISA 315 (revised 2019) refers to risks related to inappropriate reliance on IT applications that are inaccurately processing data, processing inaccurate data, or both. Briefly explain these risks. (4) (j) Explain what limitations may be included in the system of internal control. (8) ϰ͘ϭϴ ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ In terms of ISA 315 (revised 2019) – Identifying and assessing the risks of material misstatement, the interrelated components of the system of internal control are as follows: (i) control environment; (ii) the entity’s risk assessment process; (iii) the entity’s process to monitor the system of internal control; (iv) the information system and communication; and (v) control activities. At your audit client, Black ’n Blue Ltd, the following policies, procedures or conditions exist: 1. There is strong segregation of duties in the inventory cycle between receiving inventory, its custody, the issue of inventory and the recording of all movement in the perpetual inventory records. ϵϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. The board of directors and senior management meet every six months to identify the challenges facing the company and how successfully they are being addressed. 3. The company’s organisational structure is designed in such a way as to provide the board with a realistic chance of achieving its objectives on an ongoing basis. 4. The human resource department goes to great lengths to define the skills necessary for each job category and to recruit suitable personnel. 5. The financial director meets frequently with the financial accountant to ensure that information required to be disclosed by IFRS (the reporting standard used by the company) is properly accumulated, recorded and processed. 6. Access to the company’s network is controlled by using comprehensive logical controls, for example user IDs, user profiles and passwords, and is granted on a need-to-know basis. 7. The recording in the general ledger of sales, purchases etc., processed by the computer, is achieved by passing journal entries. All journal entries are scrutinised and authorised by two senior financial accounting-department employees. 8. New cloud usage policies have been implemented at Black ’n Blue as the company moves to software-as-a-service as it is more cost efficient and sustainable. 9. All transactions keyed into the computer via terminals are subject to a wide range of input controls. 10. The internal audit department conducts frequent reviews of breakdowns in internal control and how these are corrected. 11. To enter Black ’n Blue Ltd’s computer facility, warehouse and processing plant, an individual must place his thumb on a biometric scanner. YOU ARE REQUIRED TO: (a) Briefly describe each of the components of the system of internal control as identified by ISA 315 (revised 2019). (10) (b) Indicate to which component each of the policies, procedures or conditions listed in points 1 to 10 relate. (10) (c) Explain the difference between an automated application control and a manual control. (2) (d) Suggest four ways in which computerisation (IT) benefits a company’s internal control. (4) (e) Provide a brief description of the three cloud services that Black ’n Blue Ltd can use. (3) (f) Provide a brief overview of the factors you would consider regarding Black ’n Blue’s cloud solution. (5) ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϰ͘ϭϵ ϵϭ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You are a member of the audit team engaged in the audit of Bamboo (Pty) Ltd, a furniture manufacturing company. You have been requested to perform a review of the general controls at Bamboo (Pty) Ltd. As there is no IT steering committee, you have been directed to Ted Timber (financial accountant) and Presley Pine, the IT manager. The following information is relevant: 1. Data is processed on the company’s small mainframe, which is located in the IT department. This department is linked to the user departments by online terminals. In addition to the mainframe there are various other pieces of hardware, for example, print servers. Some of the general IT staff also have work areas/workstations in the department. 2. To assist you in your review, Ted Timber, the financial accountant, arranged for you to obtain his secretary, Sally Maranti’s password, should you want to gain access to the system and its various applications. She gave you her user ID and informed you that her password was ‘SM’ and that, as she would be away the next day, you could work at her terminal. 3. Although access to the IT department was controlled by a security keypad, it was not necessary for you to obtain the entry code as, on the day of your visit, the door was held open by the fire extinguisher to enable a stationery company to make a delivery of printer paper. You also noticed that the extinguisher’s nozzle had been removed from the extinguisher and was being used as a flower vase. It had been attractively placed on top of a server. 4. On discussing disaster recovery with Presley Pine, the IT manager, he indicated that a disaster recovery plan was not regarded as necessary as: • the size and complexity of the IT facility did not warrant it; • no ‘disaster’ had occurred in the last few years; • the IT personnel were honest; and • he felt that modern-day hardware was very reliable. 5. In response to your enquiry relating to the use of computer-generated logs, Presley Pine was fairly vague and indicated that he thought the only logs which may be used were related to specific applications such as master-file amendments. 6. IT staff are encouraged to experiment and explore potential improvements to application software, but in their own time. Where program-enhancement changes are needed to affect the improvements, the staff member may implement the improvement but must inform Presley Pine. ϵϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Discuss fully, based on the information given above, the weaknesses in general controls at Bamboo (Pty) Ltd, in respect of: 1. access controls; and (10) 2. continuity of operations. (10) (b) Comment on the controls over program enhancements (changes). (c) Detail the controls that should be in place over program enhancements (changes). (12) ϰ͘ϮϬ (3) ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are the auditor of Boatfloat (Pty) Ltd, a boat manufacturing company in the Eastern Cape. They have organically grown from a small family-owned organisation to the number-one supplier of boats for the ‘World’s toughest race’. Their boats are not just super light and agile, but they are highly sophisticated from a technology perspective. When meeting with Mr Float, the founder of Boatfloat (Pty) Ltd, to prepare for the audit, he shares that they have an amazing track record. All the boats that they have built are still afloat! To accelerate the production process, the company has automated certain parts of the process by using exclusive system-development software which enables them to easily adapt and adjust according to specifications. Boatfloat (Pty) Ltd also has a network of different applications that they have implemented over the years. They have implemented Wayzzz to manage the system traffic and there are several applications that interface. These applications include an inventory management application, payroll management application, financial management application, database management application, virus management application and an operating system management application. During the meeting, Mr Float, shares the following facts with you: • Annual disaster recovery tests are performed. • 14 daily backups are performed. • Access management is allocated via user profiles. • Three additional creditors were approved to the master data list. • There are no super users. • Natural attrition of staff is at an all-time low of 5%. • Debtors’ days are at a record low of 35 days. • 165 changes were made to systems during the financial year. • 257 boats were built during the year. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϵϯ • 88 EUC spreadsheets are managed and governed. • 25 new staff members were appointed during the financial year. • No access violations occurred during the year. YOU ARE REQUIRED TO: (a) List the various kinds of system software present at Boatfloat (Pty) Ltd and provide a brief description of each type of software. (8) (b) Briefly discuss the audit and control procedures you will apply when testing end-user computing at Boatfloat (Pty) Ltd. (5) (c) Explain how CAATs may be used to assist in the performance of substantive audit procedures to test the interfaces at Boatfloat (Pty) Ltd. (5) (d) Briefly explain the qualitative and quantitative implications when interface differences are identified. (2) (e) Discuss the risk implications Boatfloat (Pty) Ltd are inherently exposed to with regards to interface management. (5) ϰ͘Ϯϭ ;ϱϬŵĂƌŬƐϲϬŵŝŶƵƚĞƐͿ Adverse Limited is a manufacturing company that has many applications that host financial and operational data. During the financial period, Adverse Limited revised their architectural model. Strategically it was decided to upgrade some of their older applications to embrace newer technologies that would also enable mobile applications and improve overall user and client experiences. The Head of IT at Adverse Limited, Andy Abbott, has informed you that they decided during the financial year to replace their financial accounting application. This is because the application supports their mobile application, which is fast becoming their leading revenue stream. The new financial application replaces four applications that contribute to the simplification agenda. The financial application also supports Zanaplan, a comprehensive business management application widely used across Adverse Limited. Adverse Limited has decided to convert the holding company via a phased approach, but the subsidiary will be converted at year-end. The CEO of Adverse Limited, Tshepo Tshabalala, raised his concern with the new IT architectural roadmap and has requested the auditors to perform an independent review as part of the audit, the main reason being that when the first phase went live, the business experienced an IT outage which resulted in impacting their customers and losing three business days. YOU ARE REQUIRED TO: (a) Briefly describe the IT risks embedded and the impact on Adverse Limited. (15) ϵϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) Discuss the audit procedures you will test as part of the IT audit when auditing decommissioning and include the planning, execution and conclusion phase. (20) (c) The negative effect of a social-media incident can cause much damage. Discuss the social-media audit approach that should be included for Adverse Limited. (15) ϰ͘ϮϮ ;ϰϯŵĂƌŬƐϱϭŵŝŶƵƚĞƐͿ Morgan Chetty, a friend of yours and owner of Chetkit (Pty) Ltd, patented a useful kitchen device which has proved popular in the marketplace. Initially he manufactured and sold the device himself, but as sales increased, he found it necessary to move into a small factory park and employ 17 staff members to assist with manufacture, selling, inventory, accounting etc. He soon realised that he would have to improve his internal controls, and having no accounting background or formal business training, he decided to make an appointment with a business consultant. However, he found the information he was given very confusing and has asked you to explain some of the views expressed by the consultant. He says: ‘The business consultant says I must implement control activities including segregation of duties and proper access/custody controls over the assets of the business and that I must watch out for collusion. He also told me that I would have to ensure a strong control environment, and that although having a risk assessment process is an important part of a good system of internal control, as an owner/ manager of a small company I didn’t need to worry about it. I really do not understand what he is talking about! He also says my financial statements must be prepared in terms of IFRS for SMEs.’ At this stage Morgan Chetty is not considering computerising his business. YOU ARE REQUIRED TO: (a) Explain (see note 1) to Morgan Chetty what the consultant means by: (i) control activities (see also note 2 and note 3); (12) (ii) segregation of duties (see note 4); (10) (iii) access/custody controls; and (5) (iv) collusion. (4) (b) Explain to Morgan Chetty what the term control environment means, and how he can ensure a strong control environment in his business. (8) (c) Comment on the consultant’s contention that Morgan Chetty does not need to worry about a risk assessment process. (4) Note 1: You must explain points (i) to (iv) to Morgan Chetty in the context of his business. Use examples to assist your explanation. ŚĂƉƚĞƌϰ͗ĂƐŝĐƐ͗ǀŝĚĞŶĐĞ͕ĂƐƐĞƌƚŝŽŶƐ͕ŝŶƚĞƌŶĂůĐŽŶƚƌŽů ϵϱ Note 2: Include in your answer to (i) an explanation of how control activities will relate to the accounting system of the business. Note 3: You are not required to explain the categorisation of control activities as preventive, detective or corrective, or as general or automated application controls. Note 4: In your explanation of segregation of duties, use a purchase (and payment) transaction as your illustrative example. ϰ͘Ϯϯ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ You are the auditor of Africa (Pty) Ltd, a company that specialises in the export of handmade African products. The company has a global footprint. Africa (Pty) Ltd exports products in bulk, but occasionally deals with art curators that seek unique pieces. Approximately two years ago, Africa (Pty) Ltd implemented a new end-toend accounting application and was adamant to embed as many automated application controls to reduce the risk within the organisation. During your audit of Africa (Pty) Ltd, you noted the following: • There is an automated alert when goods are shipped. • The aged debtor report alerts for bad debt; these alerts are sent to a generic mailbox. • The credit limits for customers can be configured in accordance with their approved credit limits. • A streamlined authorisation process exists for purchase requisitions and purchase orders. Africa (Pty) Ltd have programmed their systems to publish key stats to the company intranet which automatically distributes information to key staff via email. • The financial application has been configured to automate reminders for annual tax and VAT returns. Through conversations with Simphiwe Nomusa, the finance manager at Africa (Pty) Ltd, you established that notifications are sent to users when an invoice is allocated to the wrong nominal code. Key financial reports are automatically created and distributed. Simphiwe also mentioned that during the year they had noticed one or two of the vendors had the same VAT and bank account numbers. There was also an incident where three IT users had access to make changes in the incorrect accounting period and generic accounts were used to access the database. YOU ARE REQUIRED TO: (a) Briefly describe what an automated application control is and provide an example. (3) ϵϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) List the automated application controls at Africa (Pty) Ltd that you would consider for testing during the audit; also include potential risks of failure that you may encounter – if any. (5) (c) Briefly describe the audit procedures you would consider to obtain assurance over the automated application controls at Africa (Pty) Ltd. Limit your answer only to inventory impairment. (6) (d) List the IT general controls that you need to test, which are considered key critical when planning to rely on automated application controls. (10) ϰ͘Ϯϰ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You have been the auditor of S-Dry (Pty) Ltd for many years. S-Dry (Pty) Ltd manufactures towels and supplies the hospitality industry in Southern Africa. The company has a reputation in the market for good-quality towels, made of organic cotton, all produced in South Africa. Their slogan does them justice, ‘super dry super absorbent’. With recent market constraints and the global pandemic, the hospitality industry in Southern Africa has struggled, and S-Dry (Pty) Ltd has considered throwing in the towel. When preparing for the audit, you meet with CEO, Lerato Duma, who explains that S-Dry (Pty) Ltd embarked on a new sales channel this year due to the market conditions. S-Dry (Pty) Ltd decided to expand their market by also selling to the public. The premises that S-Dry (Pty) Ltd operates from is not ideal for the public to visit and therefore a mobile application was launched. Lerato Duma also mentioned that S-Dry (Pty) Ltd has revamped their manufacturing processes and reduced 10% of their inefficiencies which contributes to a significant energy saving. S-Dry (Pty) Ltd is on a drive to, as far as they can, support the 17 Sustainable Development Goals and have also aligned themselves with a courier with the same goals. S-Dry (Pty) Ltd has been fortunate and has not been impacted by recent riots and floods and has enacted its disaster recovery and business resilience. YOU ARE REQUIRED TO: (a) Describe the audit procedures you would consider to obtain assurance over the mobile application (including IT controls). (20) (b) Briefly explain disaster recovery and business resilience. (c) Discuss the sampling approach you would consider when testing logical access management at S-Dry (Pty) Ltd. (3) (2) ,WdZ ϱ WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ KEdEd^K&Yh^d/KE^ Question no. 5.1 Description of content of the question Total marks Short questions – Preliminary engagement activities and planning 24 marks 5.2 Short questions – Audit planning 21 marks 5.3 Short questions – Audit planning and engagement 10 marks 5.4 Short questions – Audit planning stages 10 marks 5.5 Short questions – Preliminary engagement activities 30 marks 5.6 Short questions – Risks and risk assessments 26 marks 5.7 Considerations when assessing prospective audit clients 22 marks 5.8 Audit engagement letter 25 marks 5.9 Planning stage analytical review procedures 29 marks 5.10 Identifying risks relating to financial reporting, related parties and evaluating the control environment 35 marks 5.11 Scope, timing and direction of the audit 30 marks 5.12 Audit strategy and risk assessment 45 marks 5.13 Short questions – Risks assessments and risks to consider when planning an audit 35 marks continued ϵϳ ϵϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 5.14 Description of content of the question Total marks Understanding the client’s environment, materiality and internal control 32 marks 5.15 Audit approach 35 marks 5.16 ISA 315 and risk indicators 16 marks 5.17 Considerations when assessing prospective audit clients 22 marks Considerations when accepting an audit engagement 28 marks Considerations when accepting an audit engagement 15 marks 5.18 5.19 ϱ͘ϭ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. What should an auditor approached by a prospective audit client do to establish whether the preconditions for an audit are present in respect of the prospective client? (4) 2. Why does the auditor need to determine whether the preconditions for an audit exist? (4) 3. Which member of the audit team bears ultimate responsibility for the quality of the work of the members of the audit team? (1) 4. What is the objective of the engagement partner in implementing quality management procedures on the audit? (2) 5. It is the engagement partner’s responsibility to remain alert for evidence of noncompliance with ethical requirements by members of the engagement team. What are the ethical fundamental principles to which the members of the audit team must adhere? (2,5) 6. When considering accepting a prospective audit client, the audit firm should evaluate (broadly stated) three important matters. List these three matters. (1,5) 7. Are determining whether the preconditions for an audit and evaluating the matters referred to in 6 above considered part of the preliminary engagement activities or the planning activities of an audit? Justify. (2) 8. If an auditor is satisfied that a prospective audit client prepares its financial statements in terms of an acceptable financial reporting framework, but the management of the prospective client will not agree to provide written acknowledgment ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϵϵ and acceptance of its responsibilities relating to the auditor’s access, the auditor may not accept the audit. True or false? Justify. (1) 9. It is the responsibility of the engagement partner to consider whether the engagement team has the necessary competence and capabilities. In doing so, the engagement partner will consider certain aspects. List eight of these aspects. (4) 10. The auditor’s considerations regarding the preconditions for an audit and the desirability of the relationship do not apply where the auditor is simply continuing a relationship with an existing audit client. True or false? Justify. (2) ϱ͘Ϯ ;ϮϭŵĂƌŬƐϮϱŵŝŶƵƚĞƐͿ ‘The objective of the auditor is to plan the audit so that it will be performed in an effective manner.’ ISA 300 – Planning an Audit of Financial Statements. YOU ARE REQUIRED TO: Answer the following questions. 1. Planning an audit involves establishing the overall audit strategy and developing an audit plan. True or false? (1) 2. What stage of the audit process comes before planning? (1) 3. As part of the planning phase of the audit, the auditor will make conclusions and form a basis for his/her audit opinion. True or false? (1) 4. What are the ‘preconditions for an audit’. (2) 5. If only one of the preconditions of the audit is not present can the auditor accept the audit engagement but with the agreement of the client that a qualified audit opinion will be given in the audit report? Justify your answer. (2) 6. Suggest four ways in which sound planning benefits an audit. (2) 7. When conducting planning activities, the auditor establishes the overall audit strategy; broadly describe the matters to which the auditor will give attention in establishing the audit strategy. (3) 8. What is an audit program and when is it compiled? (1) 9. What is a significant risk, and when are significant risks, if any, identified? (2) 10. When conducting risk assessment procedures, the auditor’s primary objective is to identify the risks of material misstatement at financial statement level. True or false? Justify. (2) 11. When planning the audit, the IT environment, and any changes to the IT environment during the financial year, should also be considered. True or false? Justify. (2) 12. If the engagement partner is satisfied with the preliminary engagement activities, she does not need to be involved in the planning stage of the audit and may delegate the planning of the audit to the manager on the audit team. True or false? Justify. (2) ϭϬϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϱ͘ϯ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer for each of the following questions (1–10): 1. Which of the following is not considered preliminary engagement activity? 1.1 Establishing whether the prospective client can be appropriately serviced. 1.2 Determining the audit strategy. 1.3 Agreeing the terms of the engagement with the prospective client. 1.4 Evaluating whether the firm is able to comply with the ethical requirements relating to the engagement. 2. In terms of the ISAs, an audit engagement can only be accepted if: 2.1 the auditor has established with the client that the preconditions for an audit are present 2.2 the prospective client has signed an agreement limiting the auditor’s liability for negligent performance 2.3 the designated auditor and audit team have been approved by those charged with governance at the client 2.4 the company’s board of directors confirms the auditor’s appointment by directors’ resolution. 3. Which of the following is not a precondition for an audit? 3.1 The acknowledgement by management that it understands its responsibilities to provide unrestricted access to persons within the company from whom the auditor determines it is necessary to obtain audit evidence. 3.2 The financial statements are prepared in terms of an acceptable financial reporting framework. 3.3 An acknowledgement by management that it is responsible for such internal control as it (management) determines is necessary to enable the preparation of financial statements which are free from material misstatements. 3.4 Compliance with the requirements of the King IV Code on corporate governance. 4. If management attempts to impose a material limitation on the scope of the auditor’s work prior to the acceptance of an audit engagement, the auditor: 4.1 should decline the engagement 4.2 accept the engagement but include details of the scope limitation in the engagement letter 4.3 accept the engagement but inform the client in writing that the audit report will be qualified, or a disclaimer of opinion will be issued ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϬϭ 4.4 report the matter to the Independent Regulatory Board for auditors and decline the audit. 5. The engagement letter must contain reference to: 5.1 the auditor’s evaluation of the integrity of the client’s management 5.2 the audit strategy to be adopted 5.3 the audit firm’s quality control procedures 5.4 the financial reporting framework to be adopted for the preparation of the annual financial statements. 6. The engagement letter must explain that: 6.1 the auditor is responsible for the detection of fraud in the financial statements but not the prevention of fraud 6.2 the auditor will detect all material misstatement due to fraud but cannot be expected to detect immaterial misstatement due to fraud 6.3 the auditors are not concerned with fraud resulting from the misappropriation of assets but will be interested in all fraud arising from fraudulent financial reporting 6.4 none of the above. 7. The audit plan is best described as: 7.1 the scope, timing and direction of the audit 7.2 the scope, timing and direction of risk assessment procedures 7.3 the nature, timing and extent of planned risk assessment procedures, ‘further’ and ‘other’ procedures 7.4 the nature, timing and extent of the evaluation of the company’s internal controls. 8. Which of the following will not be part of the audit strategy? 8.1 Deciding to engage the services of an expert to assist in the valuation of work in progress. 8.2 Deciding to make use of statistical sampling techniques. 8.3 Determining relevant sample sizes. 8.4 Deciding to conduct an interim audit two months prior to year end. 9. Planning materiality for an audit: 9.1 is a judgement made by the auditor about the size of misstatements in the financial statements that will be considered material 9.2 is set once the risk assessment procedures have been conducted 9.3 is not changed once it has been initially set 9.4 is part of performance materiality. ϭϬϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 10. Which of the following is not part of the auditor’s responsibility when carrying out the concluding stage of the audit process? 10.1 Evaluating whether the financial statements adequately disclose the significant accounting policies selected and applied. 10.2 Authorising journal entries to correct factual misstatements. 10.3 Evaluating whether the terminology used in the financial statements is appropriate. 10.4 Evaluating whether sufficient, appropriate evidence has been obtained to reduce audit risk to an acceptable level. ϱ͘ϰ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ The following procedures/actions take place during the audit process: 1. Performing a physical inspection of plant and equipment. 2. Deciding on the need to use other audit firms to assist in attending inventory counts at a large client operating in multiple locations. 3. Analysing the change in gross-profit percentage from the prior year to the current year to gain a better understanding of the client’s trading activities. 4. Making enquiries about the integrity of the client’s management. 5. Selecting trainee accountants with specific skills for the audit team. 6. Carrying out tests of controls on the company’s new payroll system. 7. Evaluating the effect of uncorrected misstatements in the financial statements. 8. Considering the audit firm’s independence in relation to an audit client. 9. Drawing up a diagram which shows the companies within a group and the directors and officers of each, inter alia, to understand related parties and relationships that affect the company. 10. Discussing the suitability of planning and performance materiality limits used on the prior year audit with the engagement partner. The audit process consists of the following stages: preliminary engagement activities, planning, responding to assessed risk and concluding. The planning stage can be further broken down into the following activities: • establishing the (preliminary) audit strategy and • materiality • planning risk assessment procedures • conducting risk assessment procedures • planning further audit procedures. ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ YOU ARE REQUIRED TO: ϭϬϯ Identify the stage of the audit process into which each of the above procedures/ actions falls. Briefly explain your choice and where you select the planning stage, identify the activity within planning to which the action relates. ϱ͘ϱ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are an audit senior and are currently planning the audit of an existing client, Bambanani (Pty) Ltd. As you go through the planning process, you record your steps on your firm’s standard ‘planning memorandum’ form. Assisting you during this planning phase is a junior trainee, Promise Sithole. While conducting the audit planning stage, Promise Sithole asks you the following questions: (a) It seems to me that you are not carrying out any preliminary engagement activities, which I read somewhere are very important. I have three questions. 1. How would you describe preliminary engagement activities? (1) 2. Why do we carry them out? (4) 3. Can you describe four audit procedures which would be carried out as preliminary engagement activities? (2) (b) What practical purpose is served by planning the audit? Is it not just done to comply with the auditing standards? (5) (c) I see there are risks called significant risks. What is a significant risk and what circumstances might give rise to a risk being significant? Could it include IT risks? (7) (d) As I understand it, analytical review procedures are done at the end of the audit for the purpose of assessing the overall reasonableness of the annual financial statements; why are you carrying them out now in the planning phase – we haven’t even got the annual financial statements yet? (3) (e) Can you explain why we need to set planning materiality before we conduct risk assessment procedures? (2) (f) ISA 315 (Revised) refers to risks related to inappropriate reliance on IT applications that are inaccurately processing data, processing inaccurate data, or both. Can you provide me with some examples of such risks? (4) (g) The client mentioned that their systems were integrated as they implemented a new financial application during the financial year. Do we really need to consider testing systems, as historically, the audit has been mostly substantive? (2) YOU ARE REQUIRED TO: Respond to your trainee’s enquiries. (30) ϭϬϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϱ͘ϲ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. Forming an understanding of the entity and its environment is a very important part of the planning of an audit. Comment on the validity of this statement. (2) 2. Define the following terms: 2.1 business risk 2.2 inherent risk 2.3 risk assessment procedures. (3) 3. Identify five (different) types of risk assessment procedure. (2) 4. ISA 315 (revised) requires a separate assessment of inherent and control risk (at assertion level) to provide a basis for designing and performing further audit procedures to respond to the assessed risks of material misstatement. True or false? (1) 5. In terms of ISA 315 (revised), the client’s system of internal control can be broken down into five components, one of which is the ‘control environment’. What are the other four? (2) 6. If the auditor understands the client’s business environment, it is not that important for the auditor to evaluate the company’s accounting system and related internal controls. True or false? Justify. (2) 7. Computerised systems pose specific risks to an entity’s internal control system achieving its objectives. An example would be that a programmed sales transaction processing error will be repeated every time a sales transaction is processed. List four other specific risks. (2) 8. Give six examples of control activities. (3) 9. Explain what is meant by ‘the spectrum of inherent risk’. (2) 10. How does the auditor respond to a high level of assessed risk of material misstatement at the financial statement level? (3) 11. As part of the entity level controls procedures, the auditor should consider controls over computer operations. List the IT risk assessment procedures the auditor will need to consider. (4) ϱ͘ϳ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Before your firm accepts any additional ongoing engagements, for example, new audits, the partners meet to decide on whether the engagement should be accepted. The firm is mindful of the requirements to conduct preliminary engagement activities including, compliance with ISA 220 – Quality Management for an Audit of Financial Information. The following prospective audit clients are being evaluated. Your firm has seven partners and a diverse portfolio of clients ranging from small business ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϬϱ entities to medium-sized companies. None of its existing audit clients is a listed company. 1. Guptique (Pty) Ltd, a company which sells equipment to the mining industries, has approached your firm with an offer to take over the audit of the company. A significant amount of additional non-audit work has also been promised. Two of the five shareholders of the company, who are also executive directors, were recently alleged to have been involved in tender fraud, but nothing has been proved. They have both denied any involvement. The current auditors have indicated their intention to not make themselves available for reappointment. 2. Fishy Business Ltd, a large fishing company in Durban, was recently convicted for exceeding its fishing quotas and threatened with closure by the authorities should it occur again, as this was not a first offence. Should your firm accept the engagement, your firm will be the third audit firm to have been appointed in the last four years. The previous auditors have resigned. The company is a public company but is not listed. 3. Middleman (Pty) Ltd is a medium-sized company that is about to expand considerably through a BB-BEE deal that involves a large, listed company. The listed company requires that Middleman (Pty) Ltd be externally audited annually. Our firm has no experience in the industry in which Middleman (Pty) Ltd and the listed company operate. 4. Stonebridge (Pty) Ltd is a small company owned by Harry Jack, the father of one of your firm’s partners. Harry Jack believes that having the company audited externally adds to its credibility when negotiating with prospective business partners. 5. Mishin (Pty) Ltd is a medium-sized company in the light engineering sector. The directors informed your firm that they were changing their auditors because their previous auditors held ‘different views’ to them (the directors) on which accounting policies were appropriate for their company. They have declined to provide specific details. The previous auditors would not comment on this, stating only that the directors of Mishin (Pty) Ltd had not given them permission to discuss the company’s affairs. 6. Soldier Boy (Pty) Ltd, a company which provides companies and governments operating in Africa with security personnel, including bodyguards and equipment such as armoured vehicles and firearms. The audit fees paid to the previous auditors were substantial. 7. A blue-chip financial services client, Extra Bank, is looking for a new auditor. During the previous year, the company has been in the news for several reasons, including landing a multi-million-dollar deal; a cybercrime incident where some of its clients’ information may have been compromised (the scale of the event has not been determined); making a large donation to a welfare organisation; and lastly the firing of its head of trading due to ‘suspicious trading’. The cybercrime incident and the firing of the head of trading have caused much socialmedia traffic. ϭϬϲ YOU ARE REQUIRED TO: 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Discuss the matters to which your firm should give consideration, when deciding on whether to accept the above, prospective audit appointments. (22) ϱ͘ϴ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ Your firm has recently been appointed as the auditors of Vortex (Pty) Ltd, a company which manufactures a large range of diving and hang-gliding equipment. The company has been in operation for 20 years. The audit is not complicated as the systems are well established and the staff is generally competent. One complication is that before any of the company’s diving equipment can be sold, it must be rigorously quality-control tested for safety purposes. In prior years, all year-end inventories have been tested by an independent expert to ensure that it is saleable. The company has an internal audit department (function). No other services will be rendered to Vortex (Pty) Ltd. Having satisfactorily concluded the preliminary engagement activities in terms of ISA 220 and ISQM 1, Kirsten Wild, the manager in charge of the audit, requested a trainee to draft an engagement letter. The trainee provided the following letter: Firm’s letterhead To: The Shareholders Vortex (Pty) Ltd 14 Wave Road Springfield 0312 To the Chairman Having carried out the preliminary investigation into your company, we are pleased to record our acceptance of the appointment as auditors and hereby confirm the terms of the engagement as follows: 1. We will conduct the 31 July year-end audit for which we have been appointed. 2. The engagement will be completed by 31 August. 3. Our role is to certify the fair presentation of the financial statements. 4. Your role as management will be to provide our staff with all the information they require to gather sufficient, appropriate evidence of the fair presentation. 5. We do not guarantee an unqualified audit report, as auditing does have its limitations. 6. Fees will be a matter of negotiation but we will base ours on the prior years. Please would you sign this letter, retain a copy, and return the original to us. I look forward to working on your audit. Signed: ........................................... Audit manager ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ YOU ARE REQUIRED TO: ϭϬϳ Identify any weaknesses in this letter. You are not required to redraft the letter. However, you must indicate omitted information that should have been included. ϱ͘ϵ ;ϮϵŵĂƌŬƐϯϱŵŝŶƵƚĞƐͿ In planning an audit, the use of analytical procedures may be used to assist in identifying and assessing the risks of material misstatement. The following information pertains to Dough Ball (Pty) Ltd, one of your audit clients: 1. Dough Ball (Pty) Ltd bakes bread products which it supplies to numerous supermarkets, petrol-station shops etc., throughout Gauteng. 2. The company operates from one central bakery and uses a fleet of vans to make deliveries to its customers. 3. Minimal inventory is held at any time. 4. The company employs a small number of administration staff and a reasonably large labour force. Temporary staff members are employed on public holidays when bakery-product sales increase. 5. The accounts department maintains detailed production and delivery records. Reasonably detailed monthly accounts are prepared. 6. There is a detailed annual budget which is broken down into months. All of the above documentation for the current and prior year is available to your firm and the draft financial statements for the financial year ending 31 October 2022. YOU ARE REQUIRED TO: (a) Justify the performance of analytical procedures as a risk assessment procedure. (3) (b) Briefly discuss the characteristics which must be present in data if the auditor is to use the data to perform analytical procedures (at any stage of the audit). (4) (c) Discuss the factors you would consider in deciding whether analytical procedures will be appropriate substantive tests for a particular account heading when conducting further audit procedures on those account headings. (8) (d) Detail the analytical-review procedures you might conduct at the planning stage for your audit of Dough Ball (Pty) Ltd based on the information provided. (14) ϱ͘ϭϬ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You are a senior on the audit team of Dynamix Ltd, a company that manufactures components for the engineering industry both locally and throughout Africa. The company has a number of subsidiary companies. You are currently involved in the planning stage of the audit and you and your manager have compiled the audit plan reflecting the nature, timing and extent of risk assessment procedures. A meeting of ϭϬϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ the audit team has been called. The team includes two trainee accountants who have just started with the firm. All members of the audit team are encouraged to ask questions about the risk assessment procedures they will be carrying out. Although the new trainee accountants will not be conducting procedures on their own, they are expected to understand what they will be doing. The following questions have been raised: 1. One of the new trainees asked why risk assessment procedures are carried out and why the team does not simply get on with ‘doing the audit’. (5) 2. The other new trainee (who will be working with a senior trainee) asked why it was necessary for the two of them to be taken on a guided tour of the company’s complete manufacturing process. He asked what the benefits would be, particularly as he didn’t understand how this guided tour would help identify risks relating to financial reporting. (10) 3. A senior trainee who is allocated to evaluating the control environment, asked for guidance on the elements of the control environment, which he should consider when gaining an understanding of it. (12) 4. The same trainee has also been given the responsibility of identifying related parties and related party transactions. He says he has noted that he should identify significant related party transactions outside Dynamix Ltd’s normal course of business but asks if you could give him some examples of related party transactions that may be outside the normal course of the company’s business. (5) 5. One of the new trainees then asked why we are concerned with risks arising from transactions with related parties, adding that he would have thought that transacting with people or companies known to Dynamix Ltd, would be a good thing. (3) YOU ARE REQUIRED TO: Respond to each of the questions posed by the trainees (1–5 above). ϱ͘ϭϭ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ In terms of ISA 300 – Planning an Audit of Financial Statements, the engagement partner and the key engagement team members must establish the audit strategy and develop the audit plan. Your audit firm has recently been appointed as auditors of Action Ltd, a listed company, and you have been assigned to assist with planning the audit for the 30 June 2022 year-end. Due to several reasons, the appointment was only finalised in March, and, as a result, work has already begun on formulating the overall audit strategy. You have ascertained, inter alia, that: 1. Action Ltd is engaged in importing sports equipment. 2. Its head office (and one warehouse) is in Tshwane, and it has distribution warehouses in four other major cities. ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϬϵ 3. The company’s turnover is around R900 million per annum and the company is consistently profitable. 4. There is a workforce of 250 employees spread around the five locations, for example, buyers, admin clerks, warehouse personnel. 5. The company has an internal audit function regarded as very efficient and effective. 6. The company’s systems are computerised and resident on a wide and local area networks. Action Ltd has many operational automated controls. 7. The company sells to the retail sports trade and has more than 8 000 debtors. It sells only on credit. 8. The reporting deadline is 28 July 2022. 9. The year-end inventory count takes place on either the last or second last Sunday of the financial year but at least seven days before the end of the year, to facilitate the clearing of problems before year end. All the inventory is counted at the same time. 10. The board of Action Ltd is regarded as highly competent and has a good reputation in the business world. Because of the late appointment, the audit committee has requested a monthly meeting with the auditors to discuss audit progress commencing with a meeting in April. The engagement partner has requested you give some thought to a preliminary audit strategy for the first audit. YOU ARE REQUIRED TO: (a) Identify two pieces of information from those given above (1–10), which will positively affect your assessment of risk at the financial statement level. Explain your choice. (3) (b) Identify which of the three components of the overall audit strategy, that is to say, scope, timing and direction, will be affected by the information given in the question. Give brief reasons for your choice. (27) ϱ͘ϭϮ ;ϰϱŵĂƌŬƐϱϰŵŝŶƵƚĞƐͿ Your audit firm has recently been appointed as auditor of Totally Toys (Pty) Ltd. You have been placed in charge of the audit, and in carrying out procedures to gain an understanding of Totally Toys (Pty) Ltd and its environment you ascertained, inter alia, that 1. Totally Toys (Pty) Ltd is a subsidiary of Toy World Ltd. The holding company has numerous subsidiaries, all of which are in the toy retail industry. Subsidiaries are required to comply and report on their compliance with group corporate governance policies. ϭϭϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. Totally Toys (Pty) Ltd sells toys to the general public through its 25 retail outlets situated in shopping malls around the country. It has a central warehouse at the head office in Johannesburg, from where inventory is sent to the outlets. 3. Toy World Ltd has a large internal audit department that it uses to carry out risk evaluations and internal control and systems reviews at its subsidiaries. 4. Totally Toys (Pty) Ltd has standardised accounting systems and related internal controls at all its outlets, for example, all branches use the same in-house developed software. Branches are not linked to head office. A small IT department is located at head office. 5. The outlets send standardised monthly reports on sales, cash flow, sundry expenditures etc. to head office. 6. Profit margins are not high, overall revenue has declined and certain outlets are starting to show monthly trading losses. The declines in revenue are attributed to competition in the toy industry, particularly from online toy purchases and reductions in consumer spending. 7. The outlets sell only for cash or by credit card. No accounts (debtors) are operated. 8. Each outlet operates its own bank account at branches of Nedbank located in the shopping mall in which the outlet is situated. 9. Totally Toys (Pty) Ltd must present its year-end audit pack to Toy World Ltd within 21 days of the financial year end, 31 March. 10. The annual inventory count takes place simultaneously at all outlets and at the head-office warehouse, after the close of business on 31 March, to ensure that there is no disruption to trading. YOU ARE REQUIRED TO: (a) Indicate how each of the above points (1–10) will affect your audit strategy for the upcoming audit. (30) (b) Based on the scenario, briefly discuss what sources of information you will use to perform risk assessment to gain an understanding of Totally Toys (Pty) Ltd and its environment. Provide reasons. (15) ϱ͘ϭϯ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. What is the auditor’s overall objective of gaining an understanding of the entity and its environment? (2) 2. List six broad areas or aspects of conducting an audit for which having a thorough knowledge of the entity will greatly assist the auditor. (3) ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϭϭ 3. Audit procedures to obtain an understanding of the entity are referred to as ‘risk assessment procedures’. Identify three categories of risk assessment procedures and give two examples of each category. (6) 4. Explain what is meant by ‘scalability’. (2) 5. The auditor’s understanding of the entity and its environment consists of an understanding of various aspects. State three of these aspects? (3) 6. Explain what ‘significance’ is, especially as it relates to inherent risk. (2) 7. Identify five potential benefits of information technology for a company’s internal control system. (5) 8. Identify five specific risks to a company’s internal control, where the financial information systems are computerised. (5) 9. List four ways in which the auditor may apply professional scepticism. (4) 10. List the matters that the auditor may consider when understanding the policies that define the flows of information in the information system and communication component (of the system of internal control). (3) ϱ͘ϭϰ ;ϯϮŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You have been appointed the senior-in-charge of the audit of Suncon (Pty) Ltd. Although your audit firm has had this client for years, you have never been the senior on the audit before. Early in the financial year, you commence planning this audit. You have only a basic knowledge of the client at this stage, but are aware that: 1. Suncon (Pty) Ltd is a manufacturer of sophisticated heat resistant materials used in industry. 2. The company imports most of its raw materials. 3. The accounting systems are computerised and there is effective monthly management reporting. 4. The major shareholder is Fireworkz Ltd, a listed company who holds 55% of the shares in Suncon. 5. At various stages in each financial year, the group internal auditors perform assignments, including risk evaluations at Suncon (Pty) Ltd. Suncon (Pty) Ltd has appointed its own audit committee. You have decided to break your planning into the following activities: 1. gaining an understanding of Suncon (Pty) Ltd and its environment; (10) 2. gaining an understanding of Suncon (Pty) Ltd’s system of internal control; (8) 3. making a preliminary judgement of materiality; and (6) 4. identifying and assessing the risk of material misstatement. (8) ϭϭϮ YOU ARE REQUIRED TO: 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Describe how you would carry out each activity (1–4) and give reasons as to why you would carry out the procedures you have described. ϱ͘ϭϱ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You have recently joined the audit firm of Bath and Cutter and have been appointed as the senior in charge of the audit of Foodfare (Pty) Ltd, a medium-sized company in the domestic foods sector. The company has a 31 July year end, and this year will be the first year that your firm has held the appointment as auditor. The company has a public interest score of more than 350, due mainly to the size of its labour force. Foodfare (Pty) Ltd has a number of food production facilities spread around KwaZulu-Natal, with its head office in Pinetown. The company has fully integrated computerised financial accounting and management reporting systems which it developed in-house, several years ago. The systems were developed in-house to accommodate a number of unique (and complex) features pertaining to the company’s business model and financial reporting system. Most data processing takes place at the IT centre at head office. The production facilities are all linked to head office and each other, which allows for real-time processing of certain applications. Bath and Cutter has five partners and about 20 additional audit staff members. The Foodfare (Pty) Ltd audit will be the firm’s largest and most computerised client. The fact that you have been appointed as senior-in-charge has presented you with an important opportunity to use your experience gained at your previous firm in auditing in complex computerised environments. Unfortunately, things did not get off to a good start. Willy Duhdle, the manager in charge of the audit, has (like most of the other staff members) little experience in ‘more complex’ computerised audit environments and believes that adopting a strategy of auditing around the computer is perfectly adequate. The ‘planning meeting’ for the 31 July audit, in fact, turned out to be Willy Duhdle simply issuing instructions to the audit team, mainly about the verification of year-end balances, with hardly any discussion of Foodfare (Pty) Ltd’s computerisation being held. On challenging Willy Duhdle, he responded as follows: ‘I don’t know what you did at your previous firm, but this firm adheres to the planning statement ISA 300 in developing the overall audit strategy plan. This statement does not even mention the word computer which suggests to me that auditing around the computer is a perfectly adequate strategy for the audit.’ YOU ARE REQUIRED TO: (a) Comment on whether Bath and Cutter should have accepted the audit engagement of Foodfare (Pty) Ltd, based on the information given in the scenario. (5) (b) Discuss whether Willy Duhdle’s decision to audit ‘around the computer’ is appropriate and whether his justification is valid. (11) ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϭϯ (c) Explain why a combination of ‘auditing through the computer’ and ‘with the computer’ is often the most appropriate audit strategy for an audit such as Foodfare (Pty) Ltd. (6) (d) Identify the components of Foodfare (Pty) Ltd’s system of internal control pertaining to its computerisation, about which the audit team should gain an understanding, to be in a position to perform an effective audit. Provide a brief comment on each component. (10) (e) Explain the objective of computerised controls in an accounting environment. (3) ϱ͘ϭϲ ;ϭϲŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ You are the auditor of Gigantic-Gigs (Pty) Ltd, a company that promotes live entertainment events and merchandising. The company also offers hospitality and venue management services. The company has been facing an exponential decline in turnover, mainly because of the effect of COVID-19 pandemic on live entertainment events. The directors of Gigantic-Gigs (Pty) Ltd receive bonuses linked to the profit of the company. The CEO of Gigantic-Gigs (Pty) Ltd had a discussion with you, where she asked you to explain certain aspects surrounding the audit to her. During this discussion, the CEO asked the following questions: • Can you explain what a significant risk is and whether revenue would be regarded as a significant risk? • Gigantic-Gigs (Pty) Ltd has a sound system of internal controls. Would this not lower audit risk to zero? • Our company does not employ a complex accounting system, even though we are quite a large entity. Would it thus be necessary to apply ISA 315 to our audit at all? • I do not want to pay an unnecessary high audit fee. If you really do need to perform risk assessment procedures as part of the audit, can your team not perhaps limit such procedures to analytical procedures and be done with it? YOU ARE REQUIRED TO: (a) Respond to the CEO of Gigantic-Gig (Pty) Ltd’s questions. (12) (b) Briefly list any risk indicators you have identified from the scenario above. (4) ϱ͘ϭϳ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ Recently your audit firm received a letter from Gregory Grace, the financial director of Foil (Pty) Ltd, a medium-sized engineering company, requesting that the firm submit a tender proposal for the appointment as auditor of Foil (Pty) Ltd. Gregory Grace is not a shareholder of Foil (Pty) Ltd. The content of the letter was as follows: ‘Dear Partner This letter is an invitation to you to make a presentation to the audit committee of which I am the chairman, on the services you have to offer. I am the ϭϭϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ newly appointed financial director of Foil (Pty) Ltd, and I will be removing the existing audit firm as soon as I have appointed a firm to replace them. I find the existing firm, like most auditors I might add, to be inefficient, too expensive and simply incapable (or unwilling) of doing things my way. So that you don’t waste my committee’s time, I have the following conditions you should consider before you make a presentation: Although our public interest score requires the company to have its annual financial statements audited, we are not a listed company, so we do not expect you to conduct a comprehensive audit. The audit committee requires that the annual audit be conducted on a verification-of-year-end-balancesonly basis. I am not interested in interim audits, engaging experts etc., risk assessments, internal control evaluations and all the other so-called audit procedures which simply increase the audit fee. At the presentation you must state your fee for the audit. I have explained that we require only a verification of the year-end balances and I have allowed ten working days for this. Quote accordingly. If we appoint you, the audit committee will determine your audit fee. If you wish to be considered, you have a week to respond to this letter. I have extended the invitation to make a presentation to several other firms. You will each be given 30 minutes to sell your product. Gregory Grace YOU ARE REQUIRED TO: Indicate whether your firm should accept the invitation to make a presentation for the audit of Foil (Pty) Ltd based on the contents of the letter from Gregory Grace, the financial director. Your answer must explain fully all the reasons for your decision. ϱ͘ϭϴ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ You are an audit partner at an audit firm named BeyondAudit Inc (hereafter Beyond). Your firm specialises in the retail and manufacturing industries. Your firm’s offices are based in Johannesburg and the staff complement consists of the following personnel: • Three (3) audit partners (including yourself) • Two (2) audit managers (both who recently passed the SAICA APC exams) • Ten (10) trainee accountants. You have been approached by the managing director of Builders Mecca Ltd (hereafter Builders), Mr Thabo Phooko, to represent them as their auditors for the foreseeable future. Mr Phooko requested the audit to be finalised one month after the year end of 28 February 2023. Beyond has a number of concurrent audits running from January up until April each year. ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϭϱ Builders, a country-wide hardware retailer, was incorporated in 2005 by Mr Phooko. The company has considerably increased its number of branches over the country, to such an extent that it currently has 34 branches in total, located across South Africa. To raise additional share capital, Builders listed on the Johannesburg Stock Exchange (JSE) in 2019. Builders has distribution warehouses in Rustenburg and Johannesburg, wherefrom building materials are supplied to its retail stores across South Africa. Mr Phooko currently holds 60% of Builders’ total issued shares, with the rest being held by the general public. You and Mr Phooko are old school friends and still have casual drinks over weekends and often play golf together. During one of your recent golf sessions, he mentioned that Builders had cash flow problems, and as a result, Builders was struggling to pay their suppliers. Mr Phooko told you that he knew a government official that could offer Builders a grant without any formal proceedings, and that he was considering taking the government official up on his offer. In return, Builders would supply him (the government official) with free building materials for his new home, which he was currently building. While performing risk assessment procedures, you became aware of the following matters: • The warehouse manager indicated that it was common practice for Mr Phooko to override controls and force managers to sign documentation to seem like transactions have taken place. • During the current financial year, the Rustenburg warehouse was hit by a severe thunderstorm and some of the inventory (especially wood items) got water damaged and were written off. • The competition in the market became fierce when a Chinese competitor entered the market and started to sell high quality bricks at cheaper prices. • Mr Phooko was recently accused in the media of paying bribes to a municipal officer in order to secure business rights in a residential area. The accusation is still under investigation. • Builders’ current auditors, Dinamo Inc, did not offer any comments to the media, except that Builders still has an outstanding audit fee with them. When you questioned Mr Phooko on this matter, he mentioned that Builders is in the process of settling their outstanding audit fees with Dinamo Inc and that Dinamo Inc has been informed by him of his decision to replace them. Mr Phooko also stated that he believes that the audit can be done for a lot cheaper, and that Dinamo quoted excessive audit fees. • In order to improve the profitability of Builders, the board of directors decided to pay incentive bonuses to senior management and branch managers, based on the profitability of the company, for the 2023 financial year. Builders implemented SageBooks, a new complex software package, during the year to process its highvolume inventory and accounting transactions. None of Beyond’s personnel is familiar with the new software as it is relatively new on the market and incorporates cloud functionalities. ϭϭϲ YOU ARE REQUIRED TO: 1. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ With specific reference to the information provided, discuss the matters that Beyond Audit Inc would have to consider when deciding whether or not they should accept the audit engagement of Builders Mecca Ltd for the 28 February 2023 year-end. (15) Note: Limit your answer to only those aspects that are clearly indicated in the information. 2. Reference was made to a complex accounting system and that Builders’ has a high volume of transactions. Considering these factors, explain if you do go ahead with the audit engagement, whether or not to use CAATs when considering the audit strategy (scope, timing and direction) and the audit plan (nature, timing and extent of testing). Please refer to the three different approaches/options the auditor may consider. (9) 3. Briefly describe two advantages and two disadvantages of auditing with the computer. (4) ϱ͘ϭϵ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Introduction to the audit of Sipla: You are an audit partner at Pro-Audit Auditors Incorporated (hereafter Pro-Audit), one of the world’s major accounting and consulting networks, with 200 member firms and 500 offices in 80 countries. Pro-Audit has a national presence with firms in Cape Town, Durban, Johannesburg and Polokwane. Your client portfolio comprises mostly businesses in the retail, health and food industries. Pro-Audit has been appointed as the auditors of Sipla Limited (hereafter Sipla) during the current year, after the Chief Financial Officer (CFO) of Sipla (Xolisa Mtopi) informed the previous auditors of her intention to replace them. Xolisa made the decision as she felt the previous auditors were ‘losing their touch.’ You are very good friends with Xolisa and you still visit her regularly when time permits. During a recent visit, you discussed how well the company is currently doing, and you consequently decided to buy more shares in Sipla. The following information was documented by the audit team during an initial visit to Sipla: Sipla is the largest pharmaceutical company in Africa and has a proud heritage dating back more than 160 years. Sipla’s year end is 28 February 2023. Sipla is committed to sustaining life and promoting healthcare through increasing access to its high quality, effective, affordable medicines and products. Sipla is listed on the Johannesburg Security Exchange (JSE) and, therefore should comply with the JSE-listing requirement, stating that audited financial statements should be submitted within six weeks after year end. The founder and current CEO, Mr Thomas, is still the major shareholder in the company. ŚĂƉƚĞƌϱ͗WƌĞůŝŵŝŶĂƌLJĞŶŐĂŐĞŵĞŶƚĂĐƚŝǀŝƚŝĞƐĂŶĚƉůĂŶŶŝŶŐ ϭϭϳ Sipla provides a diverse basket of branded, generic consumer health and infant nutritional products, which are supplied to pharmacies, retail pharmacy chains, hospitals, dispensing general practitioners, managed healthcare funders and retail stores across the private and public sectors in South Africa. Sipla’s product ranges cover several therapeutic categories. These include anaesthetics, analgesics, antiretroviral, cardiovascular system, infant-nutritional products, oncology, oral hygiene and more. Sipla has two pharmaceutical manufacturing sites situated in Johannesburg and Stellenbosch, and five distribution centres in Port Elizabeth, Durban, Cape Town, Pretoria and Bloemfontein. During the current year, Sipla acquired the majority shareholding in Packsters (Pty) Ltd (hereafter Packsters). All the packaging used by Sipla is purchased from Packsters. The acquisition of Packsters has put severe pressure on Sipla’s cash resources. Sipla’s manufacturing plant in Port Elizabeth is presently undergoing an upgrade. The capital investment is being incurred to increase production capabilities and to provide on-going compliance with Pharmaceutical Inspection Convention Standards. Inspections by the Medical Control Council (MCC) and other international regulatory authorities including the US FDA, are scheduled to take place within the next year. Sipla converted their tailor-made accounting system to a SAP IT package during October 2022, in order to provide management with more comprehensive information. The new accounting system enables Sipla to implement a new remuneration policy for management that are based on profits of the company Sipla recently received bad publicity. They are being sued by a woman who claims that, while using Sipla’s new Canna-pain tablets, her husband became very ill and subsequently died of a stroke. Although there is no clear evidence to support these allegations, the public took to facebook complaining that Sipla is a money-oriented company who is not interested in sustainable results. The new product (Canna-pain tablets) is a herbal cannabis oil option for patients who prefer alternative pain medication. Sipla did not send the new herbal medicine for any type of clinical trial. Sipla has issued a statement to the public stating the facts and that they will assist the family with relevant expenses. The company has also discontinued its manufacturing and distribution of the Canna tablets while awaiting the results of a clinical trial. YOU ARE REQUIRED TO: With specific reference to the information provided, discuss the matters that ProAudit Auditors Incorporated should have considered when deciding whether or not to accept the audit engagement. Note: Limit your answer to only the aspects clearly indicated in the information. ,WdZ ϲ DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 6.1 Multiple-choice questions 10 marks 6.2 Short questions – Replace the incorrect wording 10 marks 6.3 Short questions – Agree Column A to Column B 10 marks 6.4 Short questions – Fraud (ISA 240) 23 marks 6.5 Short questions – Correct/incorrect and significant risk 15 marks Business risks; Internal Controls and Using the Work of a Service Organisation 15 marks 6.7 Short questions – Materiality 29 marks 6.8 Impact of scenarios on materiality 17 marks 6.9 Materiality calculation and discussion 16 marks 6.10 Impact of scenarios on fraud risk 30 marks 6.11 Classification of fraud risk indicators 19 marks 6.12 Classification of fraud risk indicators 16 marks 6.13 Identify fraud risk factors for misappropriation of assets 38 marks Identify fraud risk factors for fraudulent financial reporting and audit strategy 35 marks 6.6 6.14 continued ϭϭϵ ϭϮϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 6.15 Risk of material misstatement at assertion level 20 marks 6.16 Risk of material misstatement at the overall and assertion level 20 marks Risk of material misstatement at the overall financial statement level 20 marks 6.18 Risk of material misstatement 28 marks 6.19 Risk of material misstatement at the overall and assertion level 30 marks Risk of material misstatement, risk responses and audit approach 54 marks Risk of material misstatement and overall audit responses 27 marks Factors to consider in order to follow a combined audit approach (including IT considerations) 11 marks 6.17 6.20 6.21 6.22 ϲ͘ϭ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer: 1. Which one of the following risks can be controlled by the auditor? (a) Inherent risk. (b) Significant risk. (c) Control risk. (d) Detection risk. (e) Business risk. 2. The following is not an inherent risk factor: (a) uncertainty; (b) subjectivity; (c) change; (d) quality; (e) complexity. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ 3. Which one of the following statements is true? ϭϮϭ (a) The auditor must obtain an understanding of the entity’s information processing activities for material classes of transactions, account balances and disclosures. (b) The auditor can use his/her professional judgement to decide on whether to obtain an understanding of internal controls over significant risks. (c) The auditor must obtain an understanding of the entity’s information processing activities for significant classes of transactions, account balances and disclosures. (d) If the auditor decides to follow a substantive audit approach, he/she does not need to obtain an understanding of the internal controls of the company. (e) None of the above. 4. The auditor can implement the following responses to lower detection risk: (a) increase sample sizes to perform risk assessment procedures; (b) decrease the performance materiality figure; (c) decrease professional scepticism; (d) only perform analytical review procedures; (e) none of the above. 5. Which of the following procedures are not perceived to be a ‘further audit procedure’ as defined? (a) Substantive analytical procedures. (b) Test of controls. (c) Risk assessment procedures. (d) Substantive test of details. (e) None of the above. 6. Risk assessment procedures are performed to (a) identify fraud that occurred during the year; (b) obtain sufficient audit evidence about the going-concern assumption; (c) provide a basis of understanding in order to identify and assess the risk of material misstatement; (d) test whether the internal controls are functioning for the whole period of reliance; (e) none of the above. 7. The following would not be seen as a significant risk: (a) a risk where the likelihood of occurrence and the magnitude of the potential misstatement is at the lower end; ϭϮϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) significant related parties; (c) a risk of which the assessment is close to the upper end of the spectrum of inherent risk; (d) a risk of fraud. (e) none of the above. 8. Which one of the following definitions is correct? (a) A relevant assertion is an assertion that has an identified risk of material misstatement included in the assertion. (b) A relevant assertion is an assertion that has an identified control risk included in that assertion. (c) A relevant assertion is an assertion that has a risk of complexity included in the assertion. (d) A relevant assertion is an assertion that is seen as the most risky assertion for the specific class of transaction, account balance or disclosure. (e) None of the above. 9. If the auditor does not plan to test the operating effectiveness of controls, the auditor will assess the control risk as (a) lower than the inherent risk; (b) higher than inherent risk because controls are always more risky; (c) the same as inherent risk in order for the risk of material misstatement to be the same as inherent risk; (d) control risk will not be assessed because the auditor does not plan to use controls; (e) none of the above. 10. The following is not normally a risk arising from the use of IT: (a) unauthorised changes to the data in master files; (b) potential loss of data and inability to access data as required; (c) approved manual intervention by IT staff; (d) unauthorised access to data; (e) none of the above. ϲ͘Ϯ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider each of the incorrect statements below (1–10) and correct the highlighted parts of each of the statements. 1. Audit risk is a function of detection risk and fraud risk. 2. Risk which requires special audit consideration is referred to as inherent risk. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϮϯ 3. The risk of material misstatement is made up of control risk and assertion risk. 4. Occurrence is the risk that a misstatement will not be prevented, or detected and corrected, on a timely basis by the entity’s system of internal control. 5. For the identified risks of material misstatement at the assertion level, a combined assessment of inherent risk and control risk is required. 6. The auditor assesses risk for the financial statements as a whole, and at income statement level. 7. The ‘wrap-up’ provision is a provision to ensure that no risk of material misstatement relating to material classes of transactions, account balances and disclosures have been left unidentified, thus confirming that the risks identified are, in fact, complete. 8. Selecting an inappropriate audit procedure is an example of inherent risk. 9. The risk that the auditor expresses an inappropriate opinion when the financial statements are materially misstated, is referred to as expression risk. 10. The fact that most audit procedures are conducted on samples is an example of the inherent risk of controls. ϲ͘ϯ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Listed below under List A, are the first parts of ten sentences. Listed under List B are the second parts of the sentences. When the parts (List A and List B) are combined, a complete and correct sentence is made. YOU ARE REQUIRED TO: Select the part of the sentence from List B which, when matched to a part of the sentence from List A, forms a complete and correct statement. List A A1 Events or conditions that indicate an incentive or pressure to commit fraud are referred to as . . . A2 The element or characteristic which distinguishes fraud from error, is . . . A3 Intentionally using an inappropriate accounting policy for revenue recognition to inflate profits is an example of . . . A4 The auditor does not simply accept everything he is told by the client; this attitude is referred to as . . . A5 The auditor should consider the risk of fraudulent financial reporting in terms of management’s attitude, opportunity and . . . A6 Embezzlement of cash sales by a cashier would be classified as . . . A7 To state that the auditor has a responsibility to prevent fraud is . . . ϭϮϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ A8 Where the auditor considers that there is a risk of fraudulent financial reporting, the risk would be considered to be a . . . A9 To state that an increased risk of fraudulent financial reporting would generally result in stricter performance materiality, is . . . A10 Authorising a journal entry designed to manipulate an account balance is a form of . . . List B B1 . . . professional scepticism. B2 . . . incentive/pressure. B3 . . . misappropriation of assets and employee fraud. B4 . . . fraud risk factors. B5 . . . significant risk. B6 . . . fraudulent financial reporting and management fraud. B7 . . . true. B8 . . . management override. B9 . . . intention (of the perpetrator). B10 . . . false. ϲ͘ϰ ;ϮϯŵĂƌŬƐϮϳŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions. 1. Misstatements in the financial statements can arise from either fraud or error. What is the distinguishing factor between fraud and error? (1) 2. Why is the auditor interested in fraud at an audit client? (2) 3. Is it the auditor’s duty to report fraud to the police? Explain. (2) 4. Distinguish between ‘management fraud’ and ‘employee fraud’ and explain why the distinction is made. (2) 5. In terms of ISA 240 – The Auditor’s Responsibilities relating to Fraud in an Audit of Financial Statements, two types of intentional misstatement are relevant to the auditor. They are misstatements resulting from (a) fraudulent financial reporting and (b) misappropriation of assets. Give three examples of how each of the two types of intentional misstatements can be accomplished. (6) 6. What are the responsibilities of management and those charged with governance, with regard to fraud? (2) 7. What is the general responsibility of the auditor for detecting material misstatement due to fraud? (2) ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϮϱ 8. Should the auditor adopt the attitude that there is no fraud unless he finds it, or should he adopt the attitude that there is fraud, and he should specifically look for it? Explain. (2) 9. What is management override and why is it important in relation to fraud? (2) 10. Why is it important that the auditor tests journal entries at an audit client (for authority in particular)? (2) ϲ͘ϱ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are involved in the training department of an audit firm. As part of the firm’s commitment to learning, junior audit trainees are provided the opportunity to lecture their fellow trainees once a month. Your task is to sit in at these lectures, listen and coach/correct the junior trainee who is conducting the lecture, and to facilitate questions. You are currently attending such a session, and while paying close attention to the trainee’s lecture, you note that she makes the following statements: 1. If the auditor conducts his audit competently and in terms of his firm’s quality management standards, audit risk is reduced to zero. 2. The components of audit risk are inherent risk, control risk and materiality. 3. The need to meet the expectations of third parties to obtain additional equity financing may create pressure to commit fraud. 4. Risk assessment procedures can also be described as ‘further audit procedures’. 5. If an audit client’s financial accounting personnel are not up to date with the accounting standards, detection risk is significantly increased. 6. Audit procedures such as enquiry, observation and analytical procedures are not carried out as risk assessment procedures, but as tests of controls. 7. The risk of material misstatement is the same as audit risk. 8. Audit risk can be defined as the risk that the auditor will express an inappropriate audit opinion when the financial statements are materially misstated. 9. When conducting risk assessment procedures, the auditor should gain a thorough understanding of, inter alia, the control environment at the audit client. 10. The most effective response to an increase in the assessed risk of material misstatement at financial-statement level is to increase the extent of the test of controls. YOU ARE REQUIRED TO: (a) Evaluate whether each of the statements made by the junior trainee (1–10) is correct or incorrect. Where she made an incorrect statement, you are required to explain to her why it is incorrect. (12) (b) Except for fraud or manipulation, provide three other examples of factors that could give rise to significant risk. (3) ϭϮϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϲ͘ϲ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Hamba Kahle (Pty) Ltd (Hamba Kahle) is a logistics company based in Johannesburg. The company is not owner-managed. The CEO of Hamba Kahle decided that it would be in the best interest of the company to outsource certain financial functions related to revenue and debtors. As such, an agreement was signed in the current financial year with Do4Me Financial Services (an independent company), with, inter alia, the following terms: • The invoicing of clients, the collection and recovery of amounts due from clients and the storage of all historical data related to this, will be performed by Do4Me. • Amounts collected from customers will be paid over to Hamba Kahle in the month it is collected. • Historical data will be kept at Do4Me for the duration of the agreement. • Monthly registers of activities related to the activities undertaken by Do4Me will be provided to Hamba Kahle’s CEO. • Do4Me’s fees will be based on a fixed figure for each type of activity undertaken, multiplied by the number of clients that are affected by that activity (for example fixed fee for invoicing x number of clients invoiced in that month; fixed fee for collection of x number of invoice amounts collected in that month etc.). YOU ARE REQUIRED TO: (a) Discuss Hamba Kahle (Pty) Ltd’s business risks related solely to the outsourcing of certain financial functions as described in the scenario. (8) (b) Briefly describe how the auditor of Hamba Kahle (Pty) Ltd may obtain comfort over the operating effectiveness of the internal controls of Do4Me Financial Services. (4) (c) Based on your understanding of ISA 402 – Audit Considerations Relating to an Entity Using a Service Organisation, which type of report would you require from the service organisation, and how would this be determined? (3) ϲ͘ϳ ;ϮϵŵĂƌŬƐϯϱŵŝŶƵƚĞƐͿ The word ‘materiality’ is used frequently in auditing. ISA 320 – Materiality in Planning and Performing an Audit, and ISA 450 – Evaluation of Misstatements Identified During the Audit, relate directly to the concept. YOU ARE REQUIRED TO: Answer the following questions. 1. Define materiality in the context of auditing. (2) 2. The higher the risk of material misstatement, the higher materiality would be set. True or false? Justify. (2) ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ 3. Explain why materiality is subjective. ϭϮϳ (2) 4. When determining materiality, the auditor uses professional judgement to decide what the financial information needs of users of the financial statements are. In this context, what assumptions may the auditor reasonably make about users? (3) 5. Explain the difference between qualitative and quantitative materiality. (3) 6. What do the judgements about materiality made at the planning stage provide a basis for? (2) 7. If a misstatement is detected below the materiality limit, can it be ignored? Justify. (3) 8. Provide four reasons, with a brief explanation, why management may refuse to correct material misstatements in the financial statements identified by the auditor. (6) 9. List four circumstances where a misstatement that is not quantitatively material may be qualitatively material. (4) 10. Materiality is not static and can be adjusted as the audit progresses. True or false? Justify. (2) ϲ͘ϴ ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ You are a member of the team on the audit of Consumex Ltd, a listed company that sells a wide range of consumer goods. You and other members of the team are currently discussing the materiality limits for the planning of the current audit. As a starting point you used the prior year materiality limits set for the various account balances and classes of transactions with a clear understanding that these limits could be revised as more information was gathered during the audit. Before the discussion among team members got underway, Beckie Zulu, a junior trainee, posed the following question ‘When deciding on our planning materiality, is there a “cost/benefit” issue we should be considering?’ During the stage of identification and assessing risk of material misstatement, the following information was obtained: 1. Early in the year, Consumex Ltd had increased the number of staff in the internal audit department and appointed an experienced individual as the chief audit executive (CAE). (2) 2. The company negotiated two large long-term loans during the year. Both loans included loan covenants which require strict adherence to specified liquidity ratios. The company has not had to contend with this in prior years. (3) 3. The number of major transactions with related parties increased considerably during the year. (2) 4. The directors have notified you that the financial statements will be submitted to the Department of Trade and Industry in an attempt to raise capital for a rural ϭϮϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ expansion program which the company wishes to commence. Before they will advance loans, the DTI requires that the financial statements reflect certain profit, turnover and asset levels. (3) 5. Halfway through the year the company relaxed its credit terms in an attempt to boost sales. The amount of credit made available to customers was increased substantially and repayment terms extended. (3) YOU ARE REQUIRED TO: (a) Respond to the question from Beckie Zulu. (b) Discuss whether the information above (1–5) will have any effect on the planning and performance materiality limits and your assessment of risk for the upcoming audit (points allocated as indicated above). (13) ϲ͘ϵ (4) ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ You are an audit manager employed by PWK Inc auditors and have been assigned to the audit of New Age Limited (NA) for the year ended 31 March 2023. NA is a manufacturing company. At your request the audit senior has extracted the following financial information from NA’s audited financial statements. The 2023 financial information is not available yet: 2022 R 2021 R 2020 R 2 314 000 2 079 000 2 133 000 216 000 177 000 198 000 Total assets 1 908 000 1 783 000 1 637 000 Total liabilities 1 394 000 1 320 000 1 221 000 514 000 463 000 416 000 Description Revenue Profit before taxation Total equity The operating results for 2021 were disappointing due to the emergence of a new competitor; however, they recovered in 2022. The expectation for 2023 is that the growth in profitability will be close to 10%. Past audit experience is that NA has a stable and effective control environment. The financial director, Benji Lehasa, is adamant that all the employees of NA must be thorough and rigorous in exercising internal financial controls. You have assessed the overall risk of material misstatement and the detection risk as ‘MEDIUM’. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϮϵ Extract from the Audit Methodology Handbook of PWK Inc The following percentages are used as a guide for calculating the relevant materiality figures: Total revenue 0.5% to 1% Gross profit 1% to 2% Profit before taxation 5% to 10% Total assets 1% to 2% Performance materiality (% of overall planning materiality figure) 60% for a high risk of material misstatement client and 80% for a low risk of material misstatement client. YOU ARE REQUIRED TO: (a) State the stages of the audit process where the auditor will use materiality, as well as the goal thereof during each stage. (6) (b) Indicate whether you will be using the figures of 2022, 2021 or 2020 in the materiality calculation and give a short reason for using/not using the figures. (3) (c) Indicate which of the benchmarks (total revenue, profit before taxation, total assets or a combination thereof) will be used to calculate overall planning materiality. Give short reasons why you will be using or will not be using a figure. (3) (d) Calculate the overall planning materiality and performance materiality figures based on the audit methodology used by PWK Inc. Provide a short reason for the figure you calculated. (3) (e) Calculate the performance materiality figure based on the audit methodology used by PWK Inc. (1) ϲ͘ϭϬ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider whether each of the conditions or events listed below will increase, decrease, or have no noticeable effect on the risk of fraud/misappropriation of assets of a company. Provide brief reasons for your answer. Consider each factor individually. 1. The company adheres to the principles of sound corporate governance. 2. The company has converted itself from a complex corporate structure to a simpler structure by unbundling itself. ϭϯϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3. The directors’ remuneration is largely dependent on the company’s financial results. 4. Management decisions are strongly influenced by the managing director, a clever but forceful autocratic man. 5. The company’s motto is ‘no question – we will be number one’ and employees are encouraged to be aggressive and competitive as progress and promotion depends upon results. 6. The financial director has little regard for the auditors, describing the annual audit as an irritation. 7. Recommendations made by the auditors to the company at the conclusion of the audit are implemented timeously. 8. The IT department of a large company is generally inexperienced and has a number of vacancies. 9. The company has two major customers, who are both experiencing a serious decline in the demand for their products. 10. The financial director is proposing changes in accounting policies which will improve the financial position of the company in appearance, but not necessarily in fact. 11. A number of complex year-end adjustments have been made. 12. A large number of consultants have been engaged during the year to render advice or services, but no tangible benefits or services seem to have accrued to the company. 13. Independent reviews of financial reconciliations (for example cash book, creditors, inventory) are carried out by the internal audit function on a surprise basis. 14. Systems development controls are sound but subsequent program changes are not always documented, approved and tested properly. 15. There are numerous transactions with related parties, but authority is obtained from the board for such transactions. 16. The company has a well-defined formal risk assessment process in place. 17. Privileged user activity is not reviewed. 18. The company was recently trending on twitter with regards to poor service delivery and made international headlines. 19. The company has 18 applications that all hold and calculate various financial results that ultimately interface with the ledger to produce the monthly financial reports. 20. Multiple changes have been made to the employees’ master-data file during the financial year by several different employees. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϲ͘ϭϭ ϭϯϭ ;ϭϵŵĂƌŬƐϮϯŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider each of the following situations individually. Indicate whether each of the below amounts to misappropriation of assets or fraudulent financial reporting. Briefly justify your answers. 1. The directors obtained fake title deeds for a fictitious property included in the company’s statement of financial position. (1) 2. The operations director used the company’s staff transport vehicles over the weekend as taxis for his account. (1) 3. The chief buyer places orders with the supplier who provides the largest discount for the company but only if the supplier deposits 5% of the purchase price into the chief buyer’s bank account, provided the goods supplied are of the required quality. (2) 4. The directors accounted for a complex transaction in a way that favoured the company. (2) 5. The financial director elected not to disclose a contingent liability in the notes to the financial statements because it might be harmful to the company. All the information pertaining to the matter was deliberately hidden from the auditors. (2) 6. All scrap materials from the manufacturing activities of the company are sold for cash. The cash is not accounted for in the accounting records and is not banked in the company’s bank account. The cash is kept in the safe and then used to pay for the official, very expensive year-end function held in December for all employees. The company has an October year end. (3) 7. The financial director increased the sales revenue for the year by pre-invoicing several large orders to be filled in the new financial year. All the customers concerned were related parties of the company. (3) 8. The warehouse manager, in collusion with a supplier and the warehouse administration clerk, receives short deliveries from the supplier but has them recorded as full deliveries. (1) 9. The company has a sophisticated financial system which is highly automated. However, the depreciation per category on the application does not align with the depreciation percentages on the policy, and are slightly lower in comparison. (2) 10. A CEO of a JSE listed company made inappropriate comments on his personal twitter account. Many people follow the influential CEO and, subsequently, the comment was retweeted over two million times within 24 hours. In addition, nearly one million comments were made on other social-media platforms, calling for the organisation to be boycotted. This occurred over year end. No adjustments were made to the financial statements. (2) ϭϯϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϲ͘ϭϮ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ According to ISA 240 – The Auditor’s Responsibilities relating to Fraud in an Audit of Financial Statements, the auditor is required to recognise situations which may result in misstatement in the financial statements arising from the misappropriation of assets. ISA 240 classifies the factors which could lead to the risk of misstatement arising from misappropriation as follows: Classification a – incentives/pressures to misappropriate assets Classification b – opportunities to misappropriate assets Classification c – attitudes/or rationalisation which suggest that misappropriation may take place. YOU ARE REQUIRED TO: Consider the following risk factors (1–8). Indicate into which classification each of the risk factors falls and give a brief explanation as to why each of the factors increases the risk of misappropriation. 1. A client company which holds large quantities of inventory does not keep perpetual inventory records. Relations between the warehouse manager and the warehouse personnel are very poor as the warehouse manager does not treat his staff with respect. 2. A company which has a centralised accounting department makes all its payments (for example wages, salaries, creditors) by electronic funds transfer (EFT). Ten employees are provided with the facilities on their computers to authorise and effect electronic transfers for their various sections. 3. The company reconciles its creditors ledger with creditors statements only at year-end. 4. The company pays salaries well below the industry norm and adopts the attitude that ‘if staff don’t like it, they can leave’. 5. Employees caught stealing from the company or making unauthorised use of company assets are dismissed immediately and prosecuted. 6. The company makes a significant number of cash sales. 7. Management and other employees constantly complain about the company (many of the complaints being unproven). Company morale is low. 8. There is inadequate authorisation of expenditure incurred by management and employees on behalf of the company, for example salesmen’s expense claims, management travel claims. ϲ͘ϭϯ ;ϯϴŵĂƌŬƐϰϲŵŝŶƵƚĞƐͿ Your firm has recently been appointed as auditor of Air-Co (Pty) Ltd, a company involved in heating and air-conditioning. The company consists of two divisions, ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϯϯ with the heating division being managed by Jim de Jager, and the air-conditioning division being managed by Benjamin Gamede. They are executive directors on a board which in addition has two non-executive directors, one of whom is the chairman of the board. None of the directors is a shareholder. The two executive directors have very different management styles. Jim de Jager, being a very autocratic and authoritarian chartered accountant, runs his division according to company policies and procedures and co-operates with Emily Pilot, the company’s internal auditor. Benjamin Gamede, on the other hand, has an outgoing personality, a flamboyant, expensive lifestyle, and is well known in horse racing circles (the four directors have joint ownership of a number of racehorses) and in the business community at large. Even though Air-Co (Pty) Ltd has sound internal control policies and competent accounting personnel, Benjamin Gamede pays little attention to either, disregarding controls and referring to the accounting staff as ‘boring bean counters’, and to Emily Pilot as ‘that little lady in internal audit’. Benjamin Gamede and his assistant manager are close friends and between them they control the air-conditioning division’s activities. In particular they prepare and submit tenders for jobs, order all the air-conditioning units required, arrange delivery to site, control inventory and inventory records, supervise installations of airconditioning units, invoice the customers and collect payment from them. Although they authorise all air-conditioning division purchases before payment, payment of creditors is left to the accounting staff. Emily Pilot, the internal auditor, tells you that she doesn’t concern herself with the air-conditioning division because Benjamin Gamede, although always very friendly, will simply not co-operate. She also informs you that the board of directors refuse to intervene because the air-conditioning division makes ‘lots of money’. YOU ARE REQUIRED TO: (a) Identify any fraud risk factors which may alert the audit team to the possibility of misstatements in the financial statements from misappropriation of assets. (20) (b) Describe five ways in which misappropriation of the company’s assets could be perpetrated by Benjamin Gamede and his assistant manager in the airconditioning division. (10) (c) List your responsibilities in the planning phase of the audit of Air-Co (Pty) Ltd, in relation to the detection of fraud. (3) (d) Except for management, those charged with governance and those who form part of the internal audit function, provide examples of others in an entity to whom the auditor may direct enquiries about the existence or suspicion of fraud. (5) ϲ͘ϭϰ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ Following the unexpected resignation of the previous auditor, your audit firm was recently appointed as auditors of The House of Persia (Pty) Ltd, a medium-sized ϭϯϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ company which sells expensive carpets. The company has a public interest score of around 200 and its annual financial statements are compiled internally. The following information pertains to the company: 1. The company was founded 20 years ago and has grown into a large business with ten outlets situated in upmarket shopping malls in three major cities in South Africa. Individual outlets are not particularly large, but collectively the inventory of carpets is considerable. 2. The shares in the company are held by the Irani family and a small number of private investors who are not active in the business and who cumulatively have a minor holding. All senior positions are held by members of the Irani family. Other positions, for example in the accounting department, are also held by family members. The accounting system is computerised. 3. All carpets are imported. Suppliers are mainly situated in Turkey, Iran and Morocco. Ronnie Irani, the managing director and major shareholder of The House of Persia (Pty) Ltd, and his oldest son are responsible for purchasing the carpets. They visit suppliers three or four times a year. 4. A major issue in the imported carpet trade is the sale of fake carpets and many of the dealers in South Africa have dubious reputations. Fake carpets, which can be obtained very cheaply, are sold to the public as genuine hand-knotted imported carpets. It is very difficult for anyone who does not have the necessary expertise and experience to determine whether a carpet is genuine or fake. The House of Persia (Pty) Ltd claims that it deals only in genuine carpets but is currently in dispute with a wealthy customer who is challenging the authenticity of a number of carpets she purchased. 5. Every carpet is unique (no two carpets are the same) in terms of colour, pattern, material used and density of the knots and cost can vary considerably. While each carpet is supported by some form of purchase documentation (certificate), this documentation is not always comprehensive and is frequently in a foreign language, for example Turkish. Purchases are made in various foreign currencies. Carpets do not carry any form of identification tag or number, but an expert can identify a carpet by its style, colour, pattern, region etc. When carpets are sent to The House of Persia (Pty) Ltd’s outlets, a label (giving a brief description of the carpet and its selling price) is attached to the carpet. All selling prices are set by Ronnie Irani. Because of the uniqueness of each carpet, there is no standard mark-up, and prices can vary considerably. As the carpets sell consistently and do not deteriorate over time, only a small allowance for ‘obsolete stock’ is made each year. 6. There is no tight audit deadline for the upcoming financial year-end audit. However, as the bank relies on the audited financial statements when reviewing its continued support of the company’s overdraft banking facilities, a copy must be sent to the bank once the audit is complete. The private investors also require a set of the audited financial statements. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϯϱ 7. Although the Irani family is concerned about political tensions in the Middle East, they are satisfied that their supply of carpets will be unaffected. YOU ARE REQUIRED TO: (a) Evaluate the risk that the annual financial statements, on which your firm will report, contain material misstatement as a result of fraudulent financial reporting. (10) (b) Discuss your audit strategy for the upcoming audit of The House of Persia (Pty) Ltd. (12) (c) Assess the risk of material misstatement of The House of Persia (Pty) Ltd’s inventory for the upcoming financial year-end audit. Structure your answer in terms of the assertions. You are not required to consider the assertions relating to presentation or the related disclosures. (13) ϲ͘ϭϱ WĂƌƚ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ ;ϴŵĂƌŬƐϭϬŵŝŶƵƚĞƐͿ You are the auditor overseeing the audit of Toybox (Pty) Ltd. While concluding procedures on the account headings reflected in the 31 March 2022 year-end financial statements, one of the audit team members brought the following information to your attention relating to property, plant and equipment: 1. An expensive piece of equipment used for manufacturing toys was purchased in February 2022 and brought into production in April 2022. However, the machine has been depreciated for a full 12 months as at 31 March 2022. 2. A jointing machine leased during the year had been expensed in full at 31 March 2022 (the machine should have been capitalised). 3. No adjustment/write-off had been made in the accounting records for a crosscut machine which had been stolen during the year. The machine was not insured. 4. While conducting a physical verification of assets, a trainee accountant identified a number of items of equipment which had not been recorded in the fixedasset register. 5. The company extended its warehouse during the year under audit. Most of the work was carried out by Toybox (Pty) Ltd’s own employees. Wages of the construction team were capitalised to the cost of the extension. YOU ARE REQUIRED TO: State, with reasons, which assertions relating to property, plant and equipment may be affected by each of the above points (1–5). ϭϯϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ WĂƌƚ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ While conducting procedures on various cycles on the audit of Hallmark (Pty) Ltd, a wholesaler of stationery and paper products, the following situations arose: 1. Several supplier invoices (purchases) which had subsequently been paid were found which were not made out to Hallmark (Pty) Ltd. 2. While reperforming the calculation of overtime hours on a sample of clock cards, several errors, all of which favoured the wage earner, were identified. A trainee also noticed that some overtime hours recorded on the clock cards had not been authorised as required. 3. No sales invoices had been raised for a number of Hallmark (Pty) Ltd dispatch (delivery) notes which had been signed by the customer and matched to the customer’s order. 4. VAT on all the sales for the month of January (financial year end 31 March) had been charged at 10% (instead of 15%) due to an error in processing. By year-end no correction of this error had taken place. 5. A sample of test counts of different inventory items on the warehouse floor revealed that some of the items were not included on the inventory sheets at the year-end inventory count. 6. A batch of goods received notes for goods received in the last week of the financial year had not been matched to supplier invoices at year-end, and hence the corresponding purchase had not been raised. 7. A number of credit sales made in the first two weeks of the new financial year were included in the March sales due to a mix up with dates on the dispatch notes. 8. Numerous errors were found in the depreciation calculations for plant and equipment. YOU ARE REQUIRED TO: Identify the assertions which would be affected by each of the above points (1–8). ϲ͘ϭϲ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are currently carrying out risk assessment procedures at your client, Swinn (Pty) Ltd, a manufacturing company and subsidiary within an industrial multinational company. The following information pertains to this assessment: 1. The financial director has been evasive in answering questions, generally displaying a dismissive attitude to the audit and the audit team. 2. Some of the products manufactured by Swinn (Pty) Ltd have not kept up with market requirements. ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϯϳ 3. In prior years directors’ annual bonuses were based on earnings reflected in the audited annual financial statements. This policy has been abandoned and directors’ monthly salaries have been increased. 4. The company decided to retrench its internal auditors in a cost cutting exercise; the holding company’s internal auditors will be available if required. 5. Close to the end of the year a number of complex entries relating to asset revaluations were processed. 6. For the six weeks prior to year-end, the credit controller was absent from work due to ill health. During this period, a number of employees in the section took over his duties, for example authorising credit terms, passing credit notes etc. 7. Management is regarded by the staff as being very dictatorial as certain members of management will frequently override controls. Some staff members have expressed the view that the holding company puts too much pressure on management to perform. 8. Numerous transactions take place with other companies within the group. 9. Although Swinn (Pty) Ltd have a sophisticated computerised accounting system, they have a significant number of end-user computing and they perform a host of calculations, reconciliations and spreadsheets to complete the monthly financials. 10. Due to the reduced number of staff, the financial manager requested that four more users were made super-users to streamline the turnaround time of processing transactions. YOU ARE REQUIRED TO: Explain whether each of the above points (1–10) will increase or decrease your assessment of the risk of material misstatement. Your explanations should indicate whether the risk of misstatement at financial-statement level or at assertion level will be affected. You are not required to consider the information collectively. (20) ϲ͘ϭϳ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You have just completed the risk assessment procedures that you have planned to perform on a new client, Power Surge Ltd. You have established the following information: 1. The financial director has been summoned to appear before a parliamentary enquiry relating to alleged tender fraud perpetrated by the company in collusion with a government department. 2. The financial accountant and financial director are not at all co-operative with the auditors. 3. 60% of the company’s operating equipment is in remote, isolated areas of South Africa and other countries in Africa. ϭϯϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 4. The company is involved in long-term construction contracts which can last up to five years. These contracts are frequently with provincial/government departments both local and in other African countries. 5. Some of the operating equipment used on the contracts is leased from foreign companies. 6. Numerous complex journal entries were processed prior to year-end. Supporting documentation is minimal, but the entries were all authorised by the financial director. 7. The financial accountant is highly regarded for his technical ability and knowledge of IFRS. 8. The financial director is the chairman of the audit committee. The committee has two other members who are non-executive directors and experts in the electrical engineering field. 9. The internal auditors completed a high-level IT general controls audit during the financial year and only noted a couple of house-keeping issues. 10. The company decommissioned three financial applications during the financial year. They relate to the original accounting system which was replaced two years ago. No archiving was completed. YOU ARE REQUIRED TO: Based on the information provided, discuss and assess the risk of material misstatement at financial-statement level for the current audit of Power Surge Ltd. (20) ϲ͘ϭϴ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ Superior Knowledge (Pty) Ltd is a company in the information technology sector. It has a 30 June year end. The company was formed some years ago by Harvey Hughes and enjoyed a number of years of rapid growth brought about by the boom in the information-technology industry. Your firm has held the position of external auditor since the company’s inception. The company offers a number of services, for example installing networks and developing software, as well as wholesaling software packages and hardware. Harvey Hughes has surrounded himself with a team of ambitious and, in some cases, demanding directors, all of whom have shares in the company. The success of the company can be largely attributed to two factors. Firstly, Marvin Maharaj, the product development director, whose innovative thinking and technical knowledge led the company into new markets (Marvin Maharaj has recently resigned from the company and emigrated to the USA). Secondly, over the years, the directors, including Harvey Hughes, have invested much of their personal wealth in the company and have worked hard to protect it. You have been put in charge of a special audit of Superior Knowledge (Pty) Ltd for the nine months ended 31 March 2022 (you have been on the audit team for ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϯϵ two years) and, in preparation for the audit, you have obtained the following information: 1. These audited financial statements are required for a meeting to be held with the company’s bankers. The directors intend to raise additional finance and obtain extension of the repayment date of the company’s loans (see point 3 below). 2. Due mainly to the growth in the smartphone market, trading conditions for many companies in the information-technology sector have proved difficult over the last year to the extent that the draft income statement at 31 March reflects a small profit, but one which is significantly reduced compared to the previous financial year. 3. During its growth years the company borrowed extensively to finance expansion. Loans, mostly secured by the assets of the company and the directors’ personal guarantees, were taken from various banks and investment companies, and a number of these loans must be repaid within the next 12 months. The company’s rapidly slowing cash flow suggests that repayment of these loans will prove difficult. 4. During October 2021 an action was brought against Superior Knowledge (Pty) Ltd by Massgoods Ltd, a consumer goods retailer and one of its larger clients. Massgoods Ltd is claiming damages in excess of R10 million from Superior Knowledge (Pty) Ltd. The basis of their claim is that application software developed by Superior Knowledge (Pty) Ltd for their acquisition and payment cycle was defective and had facilitated a major fraud at Massgoods Ltd. The directors of Superior Knowledge (Pty) Ltd are considering an out of court settlement, as Harvey Hughes put it ‘to avoid legal costs and to keep it quiet’. 5. Due to declining consumer expenditure and slow business growth many of the retailers and wholesalers supplied by Superior Knowledge (Pty) Ltd are having to reduce prices and give extended credit to make sales. A number of retailers have not been able to continue trading and have been placed in liquidation. In addition, two of the four large system implementations in which Superior Knowledge (Pty) Ltd is currently involved have been suspended by the respective clients until such time as there is an ‘upturn in business activity’. 6. The slowdown in trading has also resulted in a fairly large increase in Superior Knowledge (Pty) Ltd’s inventory holding, including hardware and software specifically purchased for the four system implementations referred to in paragraph 5 above. YOU ARE REQUIRED TO: (a) Indicate whether it is necessary for you to plan this special audit of the financial statements at 31 March in the same manner as you would plan the annual financial year-end audit. Justify your answer. (5) (b) Explain the difference between inherent risk and control risk. (3) ϭϰϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (c) Assess the risk of material misstatement in the 31 March 2022 financial statements of Superior Knowledge (Pty) Ltd. Fully justify your answer by discussing all the factors indicated above which could impact on your assessment. (20) ϲ͘ϭϵ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are on the audit team of Chemtrade (Pty) Ltd, a company which manufactures and distributes a range of industrial chemical products to other manufacturers. While conducting risk assessment procedures on the 31 March 2022 audit, you gathered the following information, about the company: 1. During the course of the year Edgar Hoover, the newly appointed chairman of the board, requested the resignation of the financial director John Dillinger, a conservative, independently minded and well-respected chartered accountant who had been at Chemtrade (Pty) Ltd for some years. John Dillinger had angered the chairman by refusing to implement certain accounting policies which would improve the performance of the company as reflected in the financial statements. As their working relationship had become untenable, John Dillinger resigned. John Dillinger has sued the company for R5 million in respect of monies due to him when he left the company some months prior to year-end. 2. John Dillinger had been replaced by Floyd Nelson, a young and inexperienced but aggressive chartered accountant whom the chairman had recruited from another company. Edgar Hoover also appointed Floyd Nelson as chairman of the audit committee. 3. Under the direction of Edgar Hoover, the company has recently set up several joint ventures and other business alliances and a fair number of transactions have taken place between them and Chemtrade (Pty) Ltd. Documentation relating to these entities and transactions appears to be minimal. 4. The valuation of inventory at year-end had in prior years been conducted in conjunction with the external auditors, by an independent specialist chemical engineer on the insistence of John Dillinger to satisfy audit requirements. For the current year Floyd Nelson decided against this practice as he deemed it unnecessary, stating that ‘the auditors don’t make the rules here; they must accept the valuation arrived at by myself and the production manager’. 5. During the financial year, the company ceased production of a particular range of chemicals which it only exported to Europe. Due to the slow economy in Europe, the orders for this range of chemicals have virtually ceased. However, the company has a very large stockpile of this range of chemicals and the plant and equipment used in the manufacture of these products have been lying idle for the seven months prior to the year-end. According to the production manager, there are no plans to commence with production of this range or to adapt the plant and equipment to manufacture another type of chemical. 6. During the financial year, a government environmental agency filed a lawsuit against the company for the material sum of nearly R10 million for what it ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϰϭ describes as ‘extensive environmental damage to certain wetland areas’. The matter is being handled by the company’s lawyers, but at the financial year-end the matter was unresolved. Should the decision go against the company, there could be serious consequences, other than financial, for the company, for example loss of certain manufacturing licences. 7. An analysis of the accounts receivable balance at year-end revealed that the percentage of debt owed by foreign debtors (in South American companies) had increased substantially compared to the prior year, mainly due to the fact that the company’s trading partners are taking considerably longer to pay than they had in prior years. Management attributes this to ongoing political and social unrest in these countries. 8. The company has various financial applications that interface with one another. These financial applications manage various ledgers and components of the business. The financial manager is of the opinion that this in itself brings segregation of duties. YOU ARE REQUIRED TO: Evaluate, based on the information given above, the risk of material misstatement at financial-statement level and at assertion level for the year-end audit of Chemtrade (Pty) Ltd. Where you believe that there is risk of material misstatement at assertion level, you must identify the assertion(s) to which the misstatement relates. (30) ϲ͘ϮϬ ;ϱϰŵĂƌŬƐϲϱŵŝŶƵƚĞƐͿ Metalman (Pty) Ltd is a scrap-metal dealer situated in Germiston. You have worked on the audit for the last three years and have been placed in charge of the audit for the current year ended 28 February 2023. Metalman (Pty) Ltd’s shareholders have included a clause in the company’s Memorandum of Incorporation which requires that the company’s annual financial statements be externally audited. Most of the company’s inventory (scrap metal) is bought on credit from 11 mines and four car manufacturers in Gauteng, although it purchases a certain amount from other lesser sources for cash. When scrap is delivered to Metalman (Pty) Ltd’s premises, it is sorted by type, weighed and then dumped on the existing stockpiles using front-end loaders. The weights are recorded on the perpetual inventory records and the documentation is then passed through to the accounting department for processing. Roughly 70% of the company’s scrap is sold to 10 to 15 Taiwanese industrialists who purchase the scrap for recycling. The scrap is loaded into containers, transported to Durban and shipped to Taiwan. Local sales make up the balance of the company’s turnover and are mainly made for cash. As with purchases, sales are made on the basis of weight and the type of metal sold. Early in January you received a call from Ben Burger, the company’s major shareholder and managing director. He informed you that the company’s bank was concerned about the increase in the overdraft and would require the audited financial ϭϰϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ statements by no later than 31 March 2023. On this date, a meeting is to be held with Ben Burger to consider the state of the company and the bank’s continued support. You had scheduled an interim audit at Metalman (Pty) Ltd for the middle of January but in view of this development, you decided to get started a few days after the phone call. After sorting out some administration matters, you commenced your risk assessment procedures and ascertained, inter alia, the following: 1. Metalman (Pty) Ltd has been experiencing cash-flow problems for some months and the overdraft has increased alarmingly. 2. This has mainly been due to falling prices on the world markets, an unstable local market, which is in decline, and slow payment from overseas debtors. 3. Because of the difficult trading conditions, the financial director left the company to take up a position at another company, leaving Ben Burger and Louis Green (operations director) as the only two directors of the company. Louis Green is also a shareholder. 4. A number of other administrative staff, mainly in the accounting section, have also left or been retrenched leaving Julius Miles, the financial accountant, as the most senior accounting employee. While he is competent, his role in the company has been to run the computerised accounting system. In prior years the financial director had made all major financial decisions and overseen the preparation of the annual financial statements. Financial decisions are currently being made by Ben Burger. Julius Miles will prepare the annual financial statements with Ben Burger who has some accounting knowledge from his years in business. In his normally aggressive manner, Ben Burger has indicated that the financial statements will ‘show the bank what they need to see’. 5. Metalman (Pty) Ltd has continued to purchase scrap from the mines (the company is contracted to do so) which has resulted in a material increase in the stockpile of scrap metal. YOU ARE REQUIRED TO: (a) Discuss your assessment of the risk of material misstatement at the financialstatement level for the financial statements at 28 February 2023. (15) (b) Discuss briefly your firm’s overall responses to the risk of misstatement at the financial-statement level. (5) (c) Discuss your assessment of the risk of material misstatement at the account balance/classes of transaction level for the financial statements at 28 February 2023. (18) (d) Discuss your planned nature, timing and extent of your further audit procedures for the account balances/classes of transactions identified in (c) above. (16) ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϲ͘Ϯϭ ϭϰϯ ;ϮϳŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ You are an audit partner at Pro-Audits Inc (Pro-Audits), a firm of registered auditors. You have been requested by Crown Investments Ltd (Crown) to take on the company as an audit client for the 31 December 2022 financial year-end. You accepted the appointment as the new engagement partner and subsequently started the audit with your audit team. After performing risk assessment procedures, you were able to gather the following relevant information about Crown. Nature and background of the company Crown’s primary focus is its property portfolio. The company invests through the acquisition of properties throughout South Africa. The properties are geographically diversified properties across the retail (malls), office and industrial sectors in various major cities in South Africa. These properties are actively managed by an expert and agile team of 252 property and financial professionals. Crown’s secondary focus is the investment in equity of other companies through the acquisition of shares. These investments include investment in local companies listed on the Johannesburg Stock Exchange Ltd (JSE) and also equity investments in companies abroad. Crown’s head office is based in Sandton, Gauteng, with smaller offices in some major cities. The company has been consistently profitable and profits have grown relatively strong from the incorporation of the company. In 2000 the company listed on the JSE and became one of the top ten listed companies in the Real Estate Investment sector of the JSE since then. Company strategy Crown’s business strategy is focused on investments and includes • proactive asset management in order to remain cost-effective; • disposal of non-core properties/equity interests; • strategic acquisitions, when they become available; and • maintaining tenant retention, even if growth is stagnant. Consequently, during the year, the company decided to sell 49% interest of the 100% interest in Hygroprop (Pty) Ltd on 28 February 2022. Crown has only one other material equity interest, namely a 35% interest in Sea Catchers (Pty) Ltd. Sea Catchers (Pty) Ltd is a company incorporated in Mauritius and owns the property of various holiday resorts. Revenue streams Crown’s main revenue sources consist of contractual rent income (leases) from the leasing of their property portfolio and also dividends and interest on their equity portfolio. ϭϰϰ Financial Reporting Framework 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Crown has adopted International Financial Reporting Standards (IFRSs) as their financial reporting framework. Personnel The company employs highly qualified professional personnel. This enables the company to ensure that they comply with all laws, for example the Companies Act 71 of 2008 and accounting requirements. The board stated that they do not foresee any problems with the financial statements as all personnel in the finance department are qualified with at least five years of relevant experience. Crown lost a few staff members in the finance department during the current financial year, but management ensured that the personnel who were left had an incredibly high work ethic and were willing to work day and night to complete the financial statements. The CFO requested that, although this is a new engagement, the audit (as well as a review of the company’s governance structures) should be finalised by 1 February 2023,. On 1 July 2022, the new chief financial officer (CFO) was appointed as the previous CFO unexpectedly resigned, effective 1 May 2022. Information Technology (IT) Crown uses an integrated paperless computer software program named COMPRO, which links the various departments within the company to one another. Invoices are automatically generated at the end of the month based on standing information on the debtor’s master file. The COMPRO computer software automatically accesses the company’s e-mail application and sends the invoices and a debtor’s statement to the various debtors for payment. The COMPRO software also has a function to assist the finance department in compiling annual financial statements with the push of a button. COMPRO is used by the human resource (HR) department for the processing of leave due to employees and the monthly calculations of the employees’ net salaries. Due to the complexity of the system, the previous auditors were not able to perform a proper audit and consequently decided to resign as the auditors. New directors’ incentive Although the company was able to increase its revenue from year to year there is a downward trend in tenant occupancy rates overall. Furthermore, the company’s capital reserve is somewhat under pressure. As such, the directors took a formal decision at the beginning of the year to implement an incentive scheme applicable to all senior managers and directors. In accordance with the incentive scheme, bonuses are awarded to motivate management to increase occupancy rates and to identify new and creative investment opportunities. YOU ARE REQUIRED TO: (a) Discuss the risks of material misstatement at the overall financial-statement level for Crown for the 31 December 2022 financial year-end. (15) ŚĂƉƚĞƌϲ͗DĂƚĞƌŝĂůŝƚLJ͕ƌŝƐŬĂŶĚĨƌĂƵĚ ϭϰϱ (b) Briefly describe the overall audit responses to be considered to address the overall financial statement-level risks identified in (a) above. (12) Note: You should not address the risks identified individually but describe the risk responses in general. ϲ͘ϮϮ ;ϭϭŵĂƌŬƐϭϯŵŝŶƵƚĞƐͿ You are currently working as a SAICA trainee accountant at Tick Inc (Tick). Your audit firm has been the auditors of Independent Tertiary University of South Africa Limited (ITUSA) for the last three years and Ms Lebo Kgankga has been assigned as the engagement partner. ITUSA has been listed on the JSE Limited since 2013 and has a 31 December 2022 year end. The deadline for the audit has been set at 20 February 2023. Tick has access to computerised software that integrates with the system of ITUSA. Tick will employ an IT expert in the current year (as in the previous year) if needed. Company background ITUSA is a vibrant and dynamic private tertiary institution (university) and since their humble beginnings they have grown steadily over the past few years and now also include various business schools, information-technology schools as well as hair and beauty schools. Each of these schools are located on each of ITUSA’s six campuses situated in Mbombela, Polokwane, Johannesburg, Bloemfontein, Durban and Cape Town. The Cape Town campus is viewed as the main campus and consequently also seen as the head office of the company. Information systems ITUSA’s computer system comprise of • an integrated accounting information system, named Zero Accounts, which integrates with the e-learning management; and • an e-learning management system, called e-Learn. This system is used by the lecturers and students to upload and download resources for lectures. In the 2020 calendar year the board of directors resolved to revamp the accounting system during the 2021 financial year by introducing a single accounting package (Zero Accounts) for integration across the whole of ITUSA’s accounting operations. The accounting package also has the functionality to incorporate add-on modules that are custom-made for the industry in which ITUSA operates. ITUSA consequently had a custom-made revenue and accounts receivable module ordered to integrate with the e-learning platform for registrations and access. The accounting package was developed by a newly established service provider located in Europe. The service provider not only supplies the software but performs all installations and aftersales services. A comprehensive service-level agreement that includes aspects such as data ownership was signed by the service provider after a thorough review by ITUSA’s lawyers. The newly chosen software functions is ϭϰϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ a cloud-based, online accounting software application which will allow all campuses’ students to register online through the internet. Currently ITUSA has roughly 11 600 students and by inserting their username and password, students are able to register themselves (with the use of good input application controls) and this automatically processes the revenue and accounts receivable transaction in Zero Accounts. Accounting and supporting staff will have the functionality to capture all transactions through a web browser using the internet. These transactions remain secure due to advanced encryption and good internal controls over the input of data. All data will be stored on the cloud at the European service provider’s facilities. Management will also be able to approve transactions and query accounting reports via the internet from anywhere in the world with the use of their username and password. The financial year and the academic year of ITUSA begin on 1 January 2022 and end on 31 December 2022. Students register for all their year modules and firstsemester modules during January 2022/February 2022 and for their second semester during July 2022. Consequently, the accounting records are updated in the period of registration. Apart from the revenue transactions, the expenses and payments done annually are processed by each school’s accountant. The company employs roughly 1 250 fulltime lecturers, 150 contract lecturers and 150 supporting staff and has one centralised human resources department at the head office in Cape Town. These monthly transactions are processed with the information on the Payroll application. YOU ARE REQUIRED TO: Discuss the factors that you will need to consider to conclude that a combined approach will be appropriate for the 2022 audit of ITUSA. CHAPTER ϳ ƵĚŝƚƐĂŵƉůŝŶŐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 7.1 Short questions – Definitions 15 marks 7.2 Short questions – True and false 18 marks 7.3 Short questions 20 marks 7.4 Discussion on sampling 12 marks 7.5 Effect on sample sizes 16 marks 7.6 Sampling risk versus non-sampling risk 15 marks 7.7 Sampling; Audit procedures and Controls 30 marks 7.8 Evaluation of planned sample methods 22 marks 7.9 Short application questions – Sampling 25 marks 7.10 Sampling and Audit procedures 22 marks 7.11 Risk assessment; Sampling and Audit approach 34 marks 7.12 Sampling; Audit tests and Business risk 34 marks 7.13 Selection methods 26 marks 7.14 Sampling concerns and further action 14 marks 7.15 Factors in selection of branches 10 marks 7.16 Selection methods 10 marks 7.17 Statistical methods 7 marks 7.18 Statistical methods 10 marks Ann A Random Number Table ϭϰϳ na ϭϰϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϳ͘ϭ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ There is a great deal of terminology in auditing and sampling is no exception. YOU ARE REQUIRED TO: Define each of the terms below as they relate to audit sampling: (15) 1. audit sampling 2. anomaly 3. population 4. sampling risk 5. sampling unit 6. statistical sampling 7. stratification 8. tolerable misstatement 9. tolerable rate of deviation 10. non-sampling risk. ϳ͘Ϯ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider each of the following statements below (1–10). Indicate whether each of the statements below is true or false. Justify your choice. (18) 1. Audit sampling is the term used to describe the use of statistical sampling on an audit. 2. The major benefit of using statistical sampling from the auditor’s perspective is that professional judgement does not have to be applied because the theory of probability is the basis of the method. 3. As a general rule, sampling will not be used when carrying out risk assessment procedures. 4. Sampling is a useful exercise when conducting substantive analytical procedures. 5. The sampling approach for IT general controls should be different from the sampling approach for the financial audit. 6. A sampling approach which does not require random selection of sample items and does not involve the use of probability theory to evaluate sample results, including the measurement of sampling risk, is considered to be non-statistical sampling. 7. When an auditor uses monetary unit sampling, the larger items in the population will have a greater chance of selection than smaller items. ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϰϵ 8. When determining the sample size for tests of controls, the sample size will increase if the auditor increases the tolerable rate of deviation. 9. Computer-assisted audit techniques can only be used after testing IT general controls. 10. When testing automated-application controls, the auditor should complete a walkthrough and a sample test of 1. ϳ͘ϯ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the questions below. 1. Explain the difference between deviations and misstatements in the context of audit sampling. (2) 2. If a sample is not a statistical sample, on what basis is the sample size determined and the sample selected? (1) 3. What are the two characteristics that a sampling approach (method) must have to be regarded as statistical sampling? (2) 4. Are all further audit procedures conducted on a sample basis? Justify. (2) 5. Explain the difference between audit effectiveness and audit efficiency. (3) 6. Before the auditor undertakes a sampling exercise, he should ensure that the population from which the sample is to be drawn, conforms to two characteristics. Identify these characteristics. (2) 7. When an exercise to test detail statistical sampling is carried out, it is necessary to project the monetary errors found in the sample over the population, but this is not necessary if the sampling exercise is not statistical. True or false? Justify.(2) 8. If the auditor expects a decrease in the rate of deviation from the prescribed control procedures when conducting a sampling exercise for tests of controls, the sample size will have to be increased. True or false? Justify. (2) 9. Data-orientated CAATs are concerned mainly with substantive testing. True or false? Justify. (2) 10. When using CAATs to perform substantive testing there is no need to reconcile the population extracted to the clients’ population as you will be testing the entire population. True or false? Justify. (2) ϳ͘ϰ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ While conducting the audit of Interphace (Pty) Ltd, a large computer software wholesaler you got into conversation with Joe David, the company’s marketing manager. Interphace (Pty) Ltd sells only to retail suppliers; it does not sell to the ϭϱϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ general public. In the course of the conversation, you commented on the heading used in their latest national advertising campaign: ‘Research shows Interphace software is the most commonly used software on home computers in the country.’ You asked Joe David what research was done. He replied: ‘We sent out a short questionnaire to a sample of the retail suppliers listed on our debtors’ master file. To get a good response, we only sent the questionnaire to customers we thought would take the time to respond. Two of the questions we asked were: First, whether they “agreed” or “disagreed” that Interphace software meets the needs of home computer users; and second, whether or not they, the retail suppliers, sold more Interphace software to their customers than other brands of software. Most of our customers who returned the questionnaire “agreed” that Interphace software did meet the needs of home computer users, and 72% of those who replied indicated that they did sell more Interphace software to their customers than they did other brands. So that is statistically pretty conclusive.’ YOU ARE REQUIRED TO: Based on your knowledge of the requirements of meaningful sampling, comment on Joe David’s response. (12) ϳ͘ϱ ;ϭϲŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ 1. You received a memorandum from your audit manager stating that your tolerable rate of deviation for certain tests of controls to be conducted in the acquisitions cycle on the audit of Buy-It Ltd, should be increased from the prior year’s tolerable rate of deviation. 2. Your evaluation of the extent to which management has failed to monitor internal controls in the payroll cycle of Messi Ltd, has led you to believe that an increase in the expected rate of deviation over the authorisation of overtime payments on time records is necessary. 3. As a result of information obtained when conducting risk assessment procedures on the audit of Castles (Pty) Ltd, you have concluded that the risk of non-existent inventory being included in the inventory balance at year-end is substantially higher than for the prior year’s audit. You are about to select a sample of inventory items for existence testing. 4. Due to more efficient and timeous record keeping at Spartan (Pty) Ltd, your audit plan for the year-end audit will include meaningful subsequent receipts testing for the existence of debtors at year-end. This is likely to have an effect on the sample size for the planned positive debtor’s circularisation. ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϱϭ 5. The audit manager on the audit of Bolton (Pty) Ltd has instructed the team that he would like to be in a position to gain more assurance from the operating effectiveness of controls so that less substantive work can be conducted. 6. On the audit of Folsom Ltd, the number of inventory items on the spare-parts inventory master file has increased by 3 000. This is a result of the company introducing a number of new products. For budgeting purposes, the audit senior wants to know what effect the increased number of inventory items is likely to have on the sample size for items to be counted at the year-end inventory count. The sample will be statistically based. 7. Citizin Ltd, a large manufacturing company, has a substantial amount of money invested in plant and equipment. The fixed-asset register reveals thousands of items which vary greatly in value. The audit senior wishes to stratify the plant and equipment population by monetary value in an attempt to make the audit of this section more effective and efficient. However, he is unsure as to whether stratification will, in general terms, reduce sample sizes, all other factors being equal, for example, there is no increase in the risk of material misstatement. 8. Reliable Bank, the largest bank in Africa, has approximately 15 million home loans on its books. The manager has proposed using CAATs to test the entire population (instead of sampling) to review the interest rates granted. YOU ARE REQUIRED TO: (a) Indicate what the effect on the relevant sample sizes would be for each of the situations described above (1–7). Consider each situation separately and justify your answer for each. (14) (b) For point 8 above, indicate the effect on risk. ϳ͘ϲ (2) ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ The following four situations have arisen at different audit clients: 1. A trainee accountant was conducting audit procedures on sequenced requisitions for EFT payments (selected by requisition number) using statistical sampling. A requisition (requisition number 1728) that had been identified by random selection for inclusion in the sample was missing. The trainee failed to realise it was missing and simply chose the next requisition (number 1729) in the sequence for his sample. An investigation into the missing requisition would have revealed a material fraud. (2) 2. When designing audit procedures to be implemented in the revenue cycle, the trainee omitted a procedure which required the tracing of invoices to the sales journal. As a result, a substantial number of unrecorded sales remained undetected by the auditor. (2) 3. Using a statistical sampling method, a trainee selected a sample from the inventory master file of a large wholesaler of consumer goods. The sample was used for testing of inventory for existence by physical count. The trainee carried out ϭϱϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ the sampling exercise correctly and efficiently, enabling him to satisfy himself that the inventory balance did not contain material misstatements arising from the inclusion of non-existent inventory. However, a few days later, the company’s internal audit department unexpectedly picked up a major fraud in the warehousing section, which led to the discovery of non-existent inventory in the inventory master file. (2) 4. The audit senior planned to obtain his assurance in respect of the client’s allowance for doubtful debts in part from tests of controls over credit control and in part from analytical review procedures on doubtful debts applied at year-end. The auditor failed to detect that the allowance was materially understated. An enquiry into the procedures employed by the trainee revealed that the trainee had set his tolerable rate of deviation too high when conducting his tests of controls. Breakdowns (deviations) in key controls over the granting of credit were not detected. (3) YOU ARE REQUIRED TO: (a) Explain sampling risk and non-sampling risk (do not simply give definitions).(6) (b) Indicate, with reasons, whether the situations described above (1–4) should be categorised as sampling risk or non-sampling risk. (9) ϳ͘ϳ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are a member of the audit team of MakeaBrake Ltd, a company that manufactures braking systems for trucks and cars. The company has a staff of 400 hourlypaid employees who are spread over the ten cost centres which make up the entire process of manufacture. The number, grade and category of employees vary from cost centre to cost centre; some centres, such as quality control, have as few as ten employees, the majority of whom are skilled, while other centres may have as many as 70 employees, the vast majority of whom are unskilled. Each cost centre is controlled by a foreman. Hours worked are recorded using clock cards and a conventional timing device. The foremen authorise all overtime for their cost centres. Engagements, dismissals and grade wage rates (which vary considerably from grade to grade) are handled by human resources in conjunction with the foremen and union officials, where necessary. Wage earners are only paid for hours clocked, that is to say, if an employee is ill for a period, he is not paid. (An independent ‘sick leave’ system is in operation.) No wage payouts are conducted, wages are paid directly into employees’ bank accounts by electronic funds transfer. The company’s computerised payroll contains the following information: 1. Employee number, name and surname 2. Cost centre 3. Grade and category (skilled/unskilled) ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϱϯ 4. Normal and overtime hours worked 5. Gross earnings 6. PAYE deduction 7. UIF deduction 8. Metalworkers Union deductions (compulsory) 9. Net earnings 10. Bank account number 11. SARS tax reference number 12. Identity number. Your firm’s audit plan for the audit of wages is to select a base wage period which is comprehensively audited and then to perform analytical procedures for selected other wage periods comparing those periods to the base period. The base period for the current year’s audit has been selected and you have been requested by your senior to select a sample from the base wage period payroll for audit. The sample will be used to: 1. assist in determining whether any fictitious workers appear on the payroll; and 2. determine whether the figures on the payroll for the wage period selected are valid and accurate. He further informs you that he does not require you to select a statistical sample; a well-thought-through non-statistical sample will be sufficient. You have general audit software which is compatible with the client’s system available to you. YOU ARE REQUIRED TO: (a) Distinguish between statistical and non-statistical sampling. (b) Discuss the factors you would consider in deciding on the size of the sample you will select. (7) (c) Indicate whether the population from which you will select your sample, will be all wage earners on the payroll (master file) or only wage earners who actually worked during the wage period selected as the base wage period, that is to say excluding employees who were absent from work. Justify your answer. (3) (d) Suggest two appropriate stratifications which you may consider carrying out on this population. Justify. (4) (e) To comply with your senior’s request, describe the audit procedures you will carry out on the employees selected for testing in respect of: (f) (2) (i) whether they are fictitious; and (4) (ii) normal and overtime hours worked. (4) What assumptions will need to be true for you to rely on the payroll automated controls? (3) ϭϱϰ (g) 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Briefly describe how you would go about testing the fully automated controls surrounding pay rates. (3) ϳ͘ϴ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ You are an audit manager at Fergusson and Co. You are reviewing the plan for the audit of a manufacturing company, Rowz (Pty) Ltd. Steven Denham, the senior on the audit, has done the planning. This is his first large audit as a senior. As part of their standard planning procedures, Fergusson and Co requires the completion of a pre-printed document titled ‘Sampling Methods’, which details the sampling methods to be used on all major areas of an audit. Steven Denham’s completed a ‘Sampling Methods’ form for the upcoming Rowz (Pty) Ltd audit, part of which is reproduced below: Area Method Reasoning 1. Inventory count I will choose large value items from the inventory. I will continue doing this until 50% of the inventory value has been counted. As the auditor’s concern is generally overstatement of assets, inventory items must be selected with an emphasis on large items. (4) 2. Purchases A haphazard selection of 200 purchases of R5 000 or more made by the junior trainee working on the purchases section. By making a totally random selection, we can, at a later stage, evaluate the results on a statistical basis should we want to. (6) 3. Completeness of creditors The completeness of creditors’ balances at year-end will be tested using monetary unit sampling. I can use our firm’s step-by-step instructions to implement this statistically based sampling plan as completeness is an important assertion for creditors. (5) 4. Directors minutes I suggest a statistical sample here but need advice on which one would be appropriate. A directors’ meeting is held every two weeks except when the company is shut down for holiday periods. This year there were 24 meetings. I know that we usually review all directors’ minutes, but this seems excessive. A statistical sample would give us a better result sooner. (3) continued ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϱϱ Area Method Reasoning 5. Cost of plant and equipment To verify the cost of plant and equipment, all we need to do is full verification procedures on all additions for the year. No sampling required. If we agree the opening balance on the cost of plant and equipment accounts to our prior year work papers and verify all additions, the year-end balance will be correct. (4) YOU ARE REQUIRED TO: In your capacity as audit manager, evaluate, with full explanation, Steven Denham’s planned sampling methods and reasoning. (22) ϳ͘ϵ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are the senior on the 2023 audit of Egoli Ltd, a large Johannesburg-based company. Some of the junior trainees on the audit with you have learnt the principles of sampling in an audit environment from their respective universities. However, they have never conducted sampling exercises in practice. During the course of the audit, they approach you with the following practical problems that they have encountered related to sampling: 1. ‘I’m busy gaining an understanding of the company’s trade accounts receivable and I have found that the debtor’s population is not homogeneous, that is to say, there are trade accounts receivable which arise from the company’s wholesale operation and trade accounts receivable which arise from the company’s retail outlets. Further, the trade accounts receivable vary from R5,21 to R795 873. Trade debtors from the wholesale operations also seem to be better payers! Are we going to treat all the trade accounts receivable as one single population when doing our year-end verification procedures, or are there alternatives?’ (4) 2. ‘I am examining directors’ interests in contracts and have found that only 15 instances are recorded in the register of directors interests in contracts. How can one sample such a small population when sampling is based on probability theory and large populations? How should I proceed?’ (5) 3. ‘I’m using a sampling plan which requires that I estimate the misstatement we expect to find in the population. Obviously, I will require help with this, but what information must I gather for us to be able to make this estimate and what effect is our estimate likely to have on our sample size?’ (6) 4. ‘I am going to extract a sample to perform tests of controls in the revenue cycle. The client files all the hardcopy documents relating to a sale together, for example, customer order, internal sales order, delivery note etc. and I have worked ϭϱϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ out that I can test the controls I need to test using the batch of documents for each sale. My question is, can I use the same sample of batches of documents, or must I extract a different sample for each control I want to test?’ (3) 5. ‘When carrying out some tests of controls on the validity of EFT payments we used statistical sampling. Based on the parameters we used, we were required to select a sample of 63 items for testing. Unfortunately, I misread the figure and only extracted 36 items for the sample. In the 36 items, we found no deviations. As we found no deviations, can we conclude in terms of the parameters we set?’ (4) 6. ‘I want to perform computer-assisted audit techniques (CAATs), do I need to always test a complete population, or can I select a sample when testing using computer-assisted audit techniques? Also, the client asked me if I was going to test for ‘ghost employees’: what are ghost employees and what CAATs should I perform?’ (3) YOU ARE REQUIRED TO: Answer, with a clear, non-technical explanation, each of the above questions put to you by your junior trainees. (25) ϳ͘ϭϬ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ You are the auditor in charge of the audit of Screens (Pty) Ltd, a company which rents out television sets. At the financial year end 30 April, the company’s records revealed inventory of 14 000 television sets on hand, valued on average at R2 500 each, of which 12 321 were out on rental. Rental payments are received monthly and are identified in the cash book and debtor’s ledger by name and the rental agreement number. The trainee on the job, Elvis Adams, decided that he should perform tests on the existence assertion relating to television sets owned by Screens (Pty) Ltd. To achieve this, he selected 12 clients from the list of rental agreements on a random basis and drafted a confirmation letter to each of them requesting that they positively confirm the existence of the TV set they had rented. The results were as follows: 1. 10 of the 12 confirmation letters were returned. 2. Of the 10 returned 9 confirmed that the television set did exist. 3. The tenth confirmation letter stated that the television set had been returned. The work paper presented by Elvis Adams revealed that his response had been as follows: 1. For the two confirmations not returned, he had sent a second letter but had not received any reply. Follow up by email and phone had also not provided any response. ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ 2. ϭϱϳ For the letter which revealed that the television set had been returned, he checked the rental agreement and established that it had expired. The work paper also revealed the following conclusion: ‘I am satisfied with the existence assertion for television sets owned by Screens (Pty) Ltd. Of the 12 positive confirmations sent out, in effect ten of the 12 confirmed the existence of the television set. This equates to an 83% positive response which is excellent for a circularisation. No further tests are necessary.’ YOU ARE REQUIRED TO: (a) Explain fully why you would not be satisfied with the work performed by Elvis Adams. (12) (b) Indicate and explain what further tests should be carried out in respect of the existence assertion relating to the television sets, assuming that time does not allow for a full statistically based positive circularisation to be carried out and that you regard the risk surrounding the existence assertion to be high. (10) ϳ͘ϭϭ ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ Kuhle Ltd, a large manufacturing company in the printing and stationery sector, has a fully computerised accounting system. The applications are menu driven and are access controlled. One of the modules on the network is ‘journal entries’ and the controls for passing a journal entry are as follows: 1. Write access to the module is restricted to a single clerical assistant and the financial controller. 2. All journal entries regardless of which cycle/account headings are involved, are captured through this module. 3. When an employee requires that a journal entry be passed, for example, an adjustment for discount to a debtor’s account, a ‘Journal Entry Request’ (JER) showing the accounts to be debited/credited must be made out and submitted with supporting documentation to one of three senior accounting personnel for authorisation. JERs are numerically sequenced. 4. The senior member of staff, having scrutinised the supporting documentation, authorises the JER (by signing) and returns the JER and the supporting documentation to the requester of the journal entry. 5. The supporting documentation is filed, and the JER is given to the clerical assistant for entry. She captures the journal entries she is given and files the JER numerically in the accounting department’s filing room. 6. No further controls are exercised over journal entries once the clerical assistant has entered the JER. Your senior is somewhat concerned about the controls over journal entries and has assessed the risk that unauthorised journal entries could be passed as high. He has ϭϱϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ decided to conduct a statistically based sample on the journal entries. He has asked you to prepare a document (for discussion with the audit team) listing the ten steps in the sampling exercise and relating each step to testing the authorisation of the journal entries. YOU ARE REQUIRED TO: (a) Based on the information given above, state whether you agree with your senior’s assessment that the risk of unauthorised journal entries is high. Justify your answer. (8) (b) Prepare the document requested by your senior. (c) Indicate, assuming that we carried out the statistical sampling exercise and that our projected deviation rate exceeded our tolerable deviation rate, whether we can justifiably assume that fraudulent journal entries have been passed. Explain. (3) (d) Considering Kuhle Ltd has a fully computerised accounting system, discuss the option to rely on automated application controls. (2) (e) As the auditor you need to decide whether or not to use CAATs when considering the audit strategy (scope, timing and direction) and the audit plan (nature, timing and extent of further testing), which is necessary to reduce audit risk to an acceptable level. The decision made will result in the auditor following one or more approach(es). List the three approaches and briefly describe them. (6) ϳ͘ϭϮ (15) ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ You are working on the audit of Nceba (Pty) Ltd, a company that wholesales computer gaming consoles, such as Nintendo and Sony. The company’s business model is simple and effective. It imports four different types of gaming consoles; these are stacked in their sealed boxes in four designated areas of the warehouse. As orders come in from retailers, the gaming consoles are promptly shipped out in their sealed boxes. At year-end there were roughly 15 000 units on hand. Of the 15 000 units held, approximately 10 000 were the expensive Sony and Nintendo gaming consoles (about 5 000 of each make), with the balance being made up of the cheaper Creativ and Blaster gaming consoles, also in approximately equal quantities. One of the procedures your firm has carried out each year at the annual inventory count has been to carefully open a small sample of sealed boxes to confirm that each box contains a gaming console. The box is then resealed. In prior years no instances of empty boxes had been found; internal controls in the receiving and issuing of inventory and physical controls over inventory are sound. The company has a strong control environment. However, at the year-end inventory count, which is currently underway, the same procedure identified a box stacked with the other boxes, which was empty but had ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϱϵ been carefully resealed. This was the only empty box from a non-statistical sample of 30 boxes randomly selected from the 15 000 units. The members of the audit team are divided on what should be done about this and the following conversation takes place: Peter Dean: We can ignore it – one empty box in 15 000 hardly makes a difference – it’s not material. Roy Sidhu: No, I think we should open another 30 boxes and if we find no empty boxes in that sample, we can ignore it. Bob Mmetha: I agree with Peter, one out of 30 is a tolerable error rate. Creedence Ndlovu: How can you have a tolerable error rate for a test like this? Obviously, there has been theft here, which is serious. If we think there is theft, we have to do something about it. If it comes out later that there has been major theft, the company can sue us for not picking it up. If necessary, every box will have to be checked. Peter Dean: You know the warehouse manager is very fussy about us being careful when opening the boxes, so let’s just record our finding and move on. YOU ARE REQUIRED TO: (a) State the assertion to which the procedure of checking the contents of the boxes relates. (1) (b) Comment on the size of the sample selected for this procedure. (c) Comment on the opinions of the audit team based on the conversation recorded above. (12) (d) Comment on whether the warehouse manager should be notified of the empty box. (3) (e) Describe, giving reasons, how you would go about increasing your tests on the contents of boxes. (7) (f) The risk still exists that some boxes may have been emptied and carefully resealed. Discuss the potential impact on the business of an empty box being sold. (4) ϳ͘ϭϯ (7) ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ ISA 530 – Audit Sampling requires that, when designing audit procedures, the auditor should determine appropriate means for selecting items for testing. in order to gather sufficient, appropriate audit evidence that will enable him to draw reasonable conclusions on which to base the auditor’s opinion. When gathering audit evidence, the auditor is required to obtain sufficient appropriate evidence to support the audit opinion. For obvious reasons, the auditor cannot ϭϲϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ test every transaction or event that has occurred during the year and what happens generally, is that the auditor uses different means for selecting items. The means available to the auditor for selecting items for testing are: (i) selecting all items (100% examination) of a population or a stratum of a population (ii) selecting specific items from a population (iii) applying audit sampling, which is defined as the application of audit procedures to less than 100% of items within a population such that all sampling units in the population have a chance of selection. A combination of the above may also be used. On the audit of Marsbars (Pty) Ltd, a manufacturer of a very large range of metal products and a subsidiary in the Steelman Ltd group of companies, the following procedures will take place: 1. The company’s finished-goods inventory will be tested for completeness; items of inventory will be traced from the warehouse floor to the inventory records. 2. The minutes of the monthly directors’ meeting will be inspected to identify any important decisions taken of which the auditor should be aware. 3. Tests of controls will be carried out to determine whether all purchase orders are signed by the chief buyer. The company makes thousands of purchases each year. 4. Lease agreements entered into by the company will be inspected to determine whether the leases have been appropriately accounted for. The company entered into 29 leases. 5. The recoverability of amounts owed by debtors which have been outstanding for longer than 90 days will be discussed with the credit manager and the financial manager. The company has over 700 debtors of which approximately 10% have amounts outstanding in excess of 90 days. The amount outstanding for longer than 90 days compared to the prior year has increased by nearly 60%, while sales have remained reasonably constant. 6. A positive circularisation of debtors will take place. The company has 22 major customers (of the over 700 debtors) who, between them, account for nearly 50% of the amount owed by debtors. 7. Our firm’s software will be used to compare the cost-price and selling-price fields in the inventory master file. The company has nearly 3000 different products in its inventory master file. 8. Purchases from other companies in the Steelman group will be identified in the purchase journal for testing in detail. YOU ARE REQUIRED TO: (a) Explain the various sampling techniques an auditor can use. (10) ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ (b) ϭϲϭ Indicate which means of selecting items for testing (as listed in (i) to (iii) above) is most likely to be used for each of the intended procedures listed above (1–8). Justify your choice. (16) ϳ͘ϭϰ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ You are the audit senior of a new client, Lucky’s Convenience Store, a retail giant across Africa. The client has grown over many years as they have acquired smaller independent convenience stores in rural areas. Their claim to fame is that they always have a wide range of stock available (even when taking into account soaring fuel prices), and their doors are always open, even when there are strikes and loadshedding. Due to all the acquisitions over the past few years, the accounting systems are not consistent, but the finance team has tried to bring consistency to the ledger, which eases the consolidation process. Entity-level controls and IT general control tests have been performed and access and change-management controls have been tested successfully. While auditing, the following occurred: 1. The junior trainee accountant on the audit did not receive the adjusted sampling plan; this happened on the previous audit too. 2. The sampling guidance is as per below: Control frequency Population size Minimum sample size Yearly 1 time 1 Quarterly 4 times 2 Monthly 12 times 3 Weekly 52 times 5 Daily 250 times 20 Multiple times per day More than 250 times 25 The expected misstatement/rate of deviation is 5% based on past experience and knowledge of the business. Should there be a 5% deviation (and with good reasons), the auditor is required to extend the sample and an exception of 0% is deemed acceptable. If another exception should occur, the control fails. 1. Lucky Convenience Store has a master data list of all products and their pricing and all changes are reported daily through a daily exception report. When testing the manual review of the daily exception report, five reports did not have any evidence of review. ϭϲϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. The junior on the audit selected a sample of 25 to test the automated application control that prevents duplicate vendors by comparing VAT and bank account numbers. The test will confirm that the application has been configured to only enter a vendor once off and that a validity check is performed when a new vendor is captured to identify a duplicate VAT and or bank account number. 3. The audit partner requested analytical procedures to be performed on the trial balance (year-on-year) and the junior clerk is curious about which control frequency he should use to perform the analytical procedures. 4. In addition to the control testing, the audit plan includes a combination of substantive testing. One such test is to perform computer-assisted audit techniques on sales orders to ascertain sequential numbers. 5. When testing the IT general controls and the termination of access (sample of 25), one user’s access was not revoked immediately, as she was going on longterm maternity leave and the employee suddenly went into labour a few weeks earlier than planned. YOU ARE REQUIRED TO: Discuss the sampling concerns you need to consider during the audit and the further action relating to each sampling procedure listed. (14) ϳ͘ϭϱ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ ChemTrade is a chemical manufacturing company that sells its products for both cash and on credit to the public. Apart from the manufacturing plants and warehouses, the company has 115 stores (branches) located across the country, which trade seven days a week. Your audit strategy indicated that you do not need to attend an inventory count for all the retail stores and consequently only the locations selected in your sample will be physically visited at the interim date and at year-end audits. YOU ARE REQUIRED TO: Describe the factors to consider when determining which of the 95 stores should be selected for an inventory count to obtain sufficient and appropriate audit evidence about the existence of the company’s inventory as at year-end. ϳ͘ϭϲ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ The auditor uses different methods in selecting items to test, which could be one of the following methods of selection: • Selection of all the items (100%) • Selection of specific items • Sampling (statistical or non-statistical). ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϲϯ YOU ARE REQUIRED TO: For each of the following scenarios, explain which one of the above-mentioned options would be the most appropriate method for the following tasks: 1. You must physically verify property, plant and equipment for existence. The total of all the assets is R1 521 000. The value of two motor vehicles is R1 100 000. The other R421 000 comprises of 8 000 small assets. (2) 2. You must perform test of controls on purchase transactions. The entity had 8 million purchase transactions for the year. (2) 3. The minutes of the monthly directors’ meetings will be inspected to identify any important decisions taken of which the auditor should be aware. (2) 4. You must verify the existence of debtors. The company has three debtors. The values of the individual debtors are: Debtor A 5. R30 556 Debtor B R31 479 Debtor C R29 321. (2) You must select debtors for a debtor’s circulation. The following debtors list is available. According to your audit firm’s policy, you must select at least 60% of the value of the debtors: Debtor A R944 Debtor B R168 Debtor C R12 Debtor D R122 Debtor E R16 Debtor F R233 886 Debtor G R65 118. ϳ͘ϭϳ (2) ;ϳŵĂƌŬƐϵŵŝŶƵƚĞƐͿ You are the auditor of AgriMark (Pty) Ltd. The company is a retailer of various agricultural goods that is sold to the general public, including farmers. For each sale, a sales invoice is generated by the system. During the year pre-numbered sales invoice number 22 119 up to number 27 668 were issued in number sequence. You have decided to perform test of controls and consequently selected a sample size of 150 sales invoices (using a risk of 5%, an expected deviation rate in the population of 2.5% and a maximum tolerable deviation rate of 6%, with 95% reliance). YOU ARE REQUIRED TO: (a) Calculate the population size. (1) ϭϲϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) Identify the first three sales invoice numbers to be selected using the systematicnumber selection method. Use the 12th invoice number as your starting point.(3) (c) Identify the first three sales invoice numbers to be selected by using the randomnumber selection method (please refer to Annexure A of this chapter for the random number table. Use the starting point as column 5, row 6 and work downwards and when you reach cell E30, move to cell F1 and work downwards again). (3) ϳ͘ϭϴ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ You are an auditor for the South African Revenue Services (SARS) at the Bloemfontein office. The official SARS policy is that all tax returns (IT12 Return), where the taxable income exceeds R1 million, should be reviewed by a senior assessor. The senior assessor signs the return as proof that it has been reviewed. The Auditor General of South Africa (AGSA) indicated in the previous year’s audit findings that the control procedure is not adhered to. Consequently management reported the weakness to staff members, who assured them that they will be adhering to this procedure in the new financial year. The audit committee would like assurance that this is actually the case. They would like you to audit the policy/control procedures and formally report whether this control procedure is working effectively or is still not working. You have decided to test the internal control procedure for compliance (test of controls), by executing the engagement using your knowledge of statistical sampling for audit purposes. You have selected a sample of 125 tax returns. In the period under review, the Bloemfontein SARS office had 25 000 tax returns, where the taxable income exceeds R1 million. YOU ARE REQUIRED TO: (a) Name the three selection methods available to the auditor. (b) Indicate the first three tax returns you would audit, using the random number table (refer to the Annexure to this chapter) to select your sample. Start in column B, line 2 and work downwards and when you reach cell B30, move to cell C1 and work downwards again. Assume the 25 000 tax returns are sequentially numbered from No. 53001 to No. 78 000. (3) (c) Indicate the first three tax returns you would audit, using the systematicnumber selection method. Start with the 23rd tax return. Assume the 25 000 tax returns are sequentially numbered from No. 53001 to No. 78 000. (4) (3) ŚĂƉƚĞƌϳ͗ƵĚŝƚƐĂŵƉůŝŶŐ ϭϲϱ APPENDIX Random Number Table (For all relevant questions in chapter 7) A B C D E F G H 1 61948 33220 05921 21724 77652 08701 01702 40438 2 43609 00433 80564 16539 32302 62548 28306 68775 3 27464 72374 96393 51626 01731 49849 47784 86436 4 97364 35010 46717 39204 55669 71690 97371 85744 5 02025 27419 59528 39295 14869 02352 77785 00401 6 89279 06824 92501 75882 02854 45574 68693 51804 7 51453 59173 91322 91730 68419 24654 71254 70139 8 86421 96162 49154 59087 79940 67508 47169 87911 9 97283 04779 14125 20956 50279 45349 87777 48904 10 28306 68996 46267 52888 24409 89741 78004 81598 11 66833 17203 60069 57112 44653 17831 96035 69584 12 42910 39189 98907 99909 03196 30078 45573 48057 13 17100 96496 34486 50092 59196 41529 38910 84744 14 18731 65414 09668 15030 90841 33465 23741 80698 15 06028 57035 61742 07835 00897 01722 44863 38439 16 63392 04305 35686 41862 47255 59151 16731 46337 17 65603 27792 40624 15999 50464 22334 08060 59840 18 68469 89878 78577 55345 41357 40020 75060 84860 19 98952 47272 97842 42040 40213 62118 08595 14499 20 47946 41436 71734 94643 52056 30353 25051 11704 21 09231 22213 57609 77955 13545 35665 61095 87844 22 80323 74082 20783 01326 78160 67749 69272 49592 23 52968 50937 23851 01491 16499 97935 46084 88501 24 68086 04105 05452 24552 09977 30473 05228 40402 25 25872 99414 30724 66520 74694 45680 25066 77467 26 89278 61822 30859 94198 13916 29436 26869 64597 27 16128 42049 37871 51026 23513 88568 48602 34374 28 60549 53576 29639 60585 63532 40518 24394 30978 29 30270 71072 60642 26707 16899 78243 67908 95187 30 46214 82115 71523 38546 25679 12235 55563 63457 ,WdZ ϴ dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗ ^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ KEdEd^K&Yh^d/KE^ Question no. 8.1 Description of content of the question Total marks Short questions – Business risk and source documentation 14 marks Application – Classification of control procedures 15 marks Short discussion – Controls; Security policy; Functions of revenue and receipts cycle 16 marks 8.4 Application – Classification of controls 12 marks 8.5 Discussion and application – Business risks and controls 35 marks Discussion – Risks, controls (over master file) and fraud 45 marks Application and discussion – Weaknesses in internal control 35 marks Application and discussion – Internal controls and program change controls 33 marks Application and discussion – Internal control objectives; Assertions and weaknesses in internal controls 36 marks Application and discussion – Substantive audit procedures and CAATs 25 marks 8.2 8.3 8.6 8.7 8.8 8.9 8.10 continued ϭϲϳ ϭϲϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 8.11 Application and discussion – Control weaknesses 35 marks Application and discussion – Control weaknesses 40 marks 8.13 Application and discussion – Controls 42 marks 8.14 Application and discussion – Controls 28 marks 8.15 Application and discussion – Controls and risk of material misstatement 22 marks Application and discussion – Controls, weaknesses, debtors circulation and assertions 32 marks Application and discussion – Debtors circulation; Companies Act integration 49 marks Classification – Risk assessment and further audit procedures 12 marks Application and discussion – Risk assessment procedures; Risk factors; Controls; Subsequent receipts testing; Procedures to test allowance for doubtful debts 44 marks Application and discussion – Response to address risk; Concerns related to audit procedures 14 marks Application and discussion – Risk of material misstatement; Nature of testing; Subsequent receipts testing; Procedures to test allowance for doubtful debts 35 marks Automated application controls for bank reconciliations 18 marks 8.12 8.16 8.17 8.18 8.19 8.20 8.21 8.22 ϴ͘ϭ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ You are an audit senior providing training on the revenue and receipts cycle, to first year trainee accountants at the firm where you are employed. During the training session several questions were posed to you and you also engaged in different discussions with some of the trainees during tea time. ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϲϵ YOU ARE REQUIRED TO: Respond to the following matters which were raised as questions during the training sessions and the tea-time discussions: (a) Briefly explain why selling goods for cash poses a business risk. (b) In practice, revenue and receipts systems in different businesses do not vary much and is basically ‘one size fits all’. True or false? Justify. (2) (2) (c) Briefly explain why selling goods on credit (that is sales charged to a customer account) poses a business risk. (2) (d) Explain what the purpose of the following documents are: (i) customer order; (ii) delivery note; (iii) back-order note; (iv) credit note; and (v) goods returned voucher. (e) (5) Briefly explain why a business would sequentially number their documents used in the revenue and receipts cycle. (3) ϴ͘Ϯ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Greenbox (Pty) Ltd is a large wholesaler of garden equipment. The company’s revenue and receipts cycle is well staffed and is divided into clearly defined functions, namely receiving of orders, warehousing (picking), despatch, invoicing, recording of sales, mailroom and receipting/cashier. It also has a ‘goods returned’ function which handles the return of goods by customers and a credit management section. The following control procedures take place in the day-to-day running of the company. Note: These procedures are in random order. 1. Jonny Greenfingers follows up on trade references supplied by prospective customers seeking credit. 2. Carl Camelion checks the detail on all internal sales orders prepared by the six order clerks. 3. Walter Weed, one of the warehouse clerks, makes out a back-order note for an item which is ordered but is not ‘in stock’. 4. The gate controller counts the number of boxes on the company’s delivery truck and agrees it to the delivery notes held by the driver. 5. Themba Treetops compares the goods to be delivered to the picking slip and delivery note as they are packed into boxes for delivery. 6. Harriet Hedge phones all debtors who have exceeded their credit terms every 48 hours to establish when Greenbox (Pty) Ltd can expect payment. 7. When customers collect goods they have ordered, they sign a delivery note and retain a copy. ϭϳϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 8. Benji Berry checks the sequence of the invoices entered in the sales journal to identify missing invoices. 9. Gustav Glass compares prices on the invoice to the official price list and reperforms the VAT calculation. 10. Petrus Prunus regularly reviews bank deposits from customers made by EFT. 11. Lolly Lupin makes out credit notes for defective goods which are sold and returned by customers. Before doing so, she obtains the authority of Petrus Prunus to issue a credit note. 12. Daisy Dumisa goes through the ‘back orders’ file weekly to ascertain the status of the backorder. 13. Petrus Prunus reviews the general journal frequently and follows up on any journal entries pertaining to debtors, such as bad debts written off. 14. Internal sales orders sent to the accounting department are filed in numerical sequence. 15. Themba Treetops goes through the day’s picking slips at the end of each day to confirm that they have all been acted upon. YOU ARE REQUIRED TO: Indicate the function under which each of the control procedures (1–15) is most likely to occur at Greenbox (Pty) Ltd. (15) ϴ͘ϯ ;ϭϲŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ You are on the audit team of SimplyGoods (Pty) Ltd, a wholesaler of consumer goods. The company’s accounting system consists of all the usual modules that such a company requires, for example revenue and receipts, payroll, acquisition and expenditure etc. The company sells mainly on credit to approved account holders (debtors). The only form of payment by debtors accepted by SimplyGoods (Pty) Ltd is payment made by electronic funds transfer. The company employs two people in its accounting department and this makes segregation of duties in the department difficult. The financial director, Mr Dinesh Coopasammy, is however not too concerned about this, as the two employees assist each other in their duties and review each other’s work. When you visited the premises of the client to do a system walkthrough, Mr Coopasammy provided you with a ‘sticky-note’ with the username ‘SimplyG’ and password ‘SG123’ written on it. He asked you not to leave the note lying around, as only he and the two employees in the accounts department are allowed to use the login details to the accounting system. He also informed you that the password is changed at least once a year, by which time former employees will no longer have access to the system. Furthermore, he said that employees are required to log out of the system whenever they are away from their desks. The only exception to the latter rule is when the company’s month-end statements have to go out to its ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϳϭ customers, as this is such a busy period that constantly logging in and out of the system wastes too much time. As you concluded your visit to the premises, Mr Coopasammy indicated to you that, as the company is growing rapidly, he realises that it is time to update the security policy of the company in order to maintain the integrity of the company’s hardware and software. YOU ARE REQUIRED TO: (a) Briefly explain the need for segregation of duties and what it involves. Provide an example. (3) (b) Indicate your concerns regarding the access controls to the accounting system specifically as it relates to controls over passwords. (5) (c) Provide Mr Coopasammy with a brief overview of four important principles which should be included in the company’s security policy. (4) (d) As part of your system walkthrough, identify the functions you would expect to find in the revenue and receipts cycle at SimplyGoods (Pty) Ltd, placing them in the order the activity takes place. Do not concern yourself with the function that deals with cash sales or goods returned by customers. (4) ϴ͘ϰ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ You are on the audit team of FryIt (Pty) Ltd, a company that manufactures and distributes air fryers. The company’s accounting systems are all computerised and located on a local area network. The company has recently made program enhancements to its revenue and receipts software. These changes were subject to a full range of program change controls. Furthermore, the company’s employees were all sent on a training course relating to their functions within the cycle, specifically as it relates to the program enhancements. During this training session, employees were also updated on the Protection of Personal Information Act (POPIA), after which they were required to sign a confidentiality agreement to the effect that they will not disclose any information pertaining to the company’s clients, customers, suppliers etc. Benjamin Cook is the credit controller of FryIt (Pty) Ltd. Once he has investigated a potential client’s creditworthiness, he signs the relevant credit application before taking it to the financial accountant, Angela Baker, for final authorisation. When a debtor exceeds their payment terms, the system automatically puts a ‘hold’ on the debtor’s account which prevents the debtor from making any further purchases. Orders from customers who have a hold on their accounts are written to a ‘pending sales order’ file. Warehouse pickers at FryIt (Pty) Ltd have neither read nor write access to the sales order file. Suitable physical protection is provided to inventory held in the warehouse and the despatch area. Online access to the company’s bank account is limited to only five individuals in the company. The ability to download a daily ϭϳϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ listing of electronic transfers from debtors (receipts) is restricted to two of those five individuals, Themba Fryer and Tsatsi Grill. YOU ARE REQUIRED TO: Distinguish between the application and general controls provided in the scenario above. Where you have identified a ‘general control’, indicate the category of general control into which it falls. (12) ϴ͘ϱ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ Cookies and Crumbs (Pty) Ltd is a Cape Town based company that supplies handbaked cookies to clients in South Africa. The company empowers and up-skills woman from informal settlements in the greater Cape Town region to enable them to support their dependents with their income derived from baking cookies. Boxes containing individually wrapped cookies are sold via an online platform. Customers create an online profile after which they place their order. The system confirms whether the customer is valid and whether the detail of the order is accurate and complete. The system then compares the ordered cookies against the available stock and provides the customer with a total payable amount, including the delivery fee. For items not in stock, the customer is provided with the option to accept a three to five day delay in delivery (and thus proceed with the order as it is) or to remove the items that are currently out of stock from their ‘shopping basket’. Payments are accepted via PayPal or credit card. Orders are processed only once payment has been cleared. Once payment has been confirmed (via the banking or PayPal interface) the order is approved, and the warehouse department is instructed electronically to select the boxes of cookies ordered so that the items can be despatched to customers. The system also automatically sends an e-mail to the production department to inform them about the cookies that need to be baked. A picking clerk ticks off the goods picked on an electronic tablet and indicates the items that are not available. An order cannot be marked as complete until all the cookies that form part of a particular order have been ‘ticked’ as packed. Once the picking clerk has completed the picking, he/she does a final check to confirm all quantities agree and signs off electronically. The system generates a barcode which is printed on a sticker and attached to the box containing the customer’s order. The box is ‘scanned out’ by the warehouse security, with a barcode scanner (linked to the system), after which it can be moved to the despatch area. The despatch clerk also scans the barcode, allowing the detail of the goods picked to show up on his/her electronic tablet. After the goods have been compared, the despatch clerk signs off on the tablet to indicate the transfer of the goods to his/her custody after which the box is sealed. The customer automatically receives an SMS-notification, indicating that the order is ready for despatch, and is also given a PIN (personal identification number). The company’s delivery driver then scans the bar code when the goods are loaded onto the delivery vehicle as acknowledgement of taking custody of the goods. Once the driver arrives at the customer, the customer provides the PIN to the driver, ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϳϯ who enters the PIN into a smartphone application. If the PIN is accepted by the application, the driver releases the goods to the customer. Once the goods have been released (via the PIN confirmation), the system automatically sends out an e-mail invoice to the customer. Cookies and Crumbs (Pty) Ltd makes use of internet and email monitoring software. YOU ARE REQUIRED TO: (a) Explain the business risks with which a Cookies and Crumbs (Pty) Ltd is faced relating to selling of its products over the internet. (5) (b) Provide examples of what internet and email monitoring software do. (c) Identify the business risks related to the order, picking and despatch function of Cookies and Crumbs (Pty) Ltd. (10) (d) Indicate which controls you would expect to be present over the picking and despatch function of Cookies and Crumbs (Pty) Ltd. (15) ϴ͘ϲ (5) ;ϰϱŵĂƌŬƐϱϰŵŝŶƵƚĞƐͿ A friend of yours, Reg Park, recently purchased all the shares in Crazytimes (Pty) Ltd, a wholesale company that sells all kinds of goods for outdoor pursuits, for example skateboarding, BMX, kayaking etc. The company sells only on credit. Debtors pay only by EFT. The previous owners, who were also the directors, spent more time engaged in outdoor pursuits than in looking after the business, choosing to leave the running of the business in the hands of various ‘managers’ and other employees. The goods that the company sells are popular so the business has survived this ownership neglect and your friend (an entrepreneur) sees potential in the company. He asked you to have a look at the accounting system and internal controls which you do, only to find that, despite the design, and the documentation of the system being basically sound, the control awareness and proper operation of control activities by employees are poor. The cycle has been broken down into the usual functions for a revenue and receipts cycle and all functions are adequately staffed. On reporting to Reg Park, his response was: ‘OK, as I am the sole director and will not be involved much in the business, I want you to explain four things to me. Firstly, if we assume that the staff are honest but careless or as you say, not very control aware, what could go wrong in the revenue and receipts cycle, and, secondly, if some of the staff are dishonest, including the managers, how could they be stealing from or defrauding the company?’ I would also like you to explain to me what is meant by ‘toxic combinations’ and, lastly, please provide me with examples of sound controls over the debtors master file and over amendments of the master file. YOU ARE REQUIRED TO: Respond to Reg Park by: (a) explaining what could go wrong in the revenue and receipts cycle, assuming that the staff are honest but careless and not very control aware; (15) ϭϳϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) explaining how dishonest employees (including managers) could be stealing from/defrauding the company in this cycle; (10) (c) briefly explaining what is meant by ‘toxic combinations’; and (d) providing Reg Park with examples of the controls over a debtors master file and over amendments to the master file. (18) ϴ͘ϳ (2) ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You have been on the audit team of Brandwear (Pty) Ltd, a clothing manufacturer, for the last two years. You are currently (July) working on the 30 June 2022 year-end audit, and have been assigned to the audit of ‘cash and bank’. As part of risk assessment procedures carried out at the planning stage, you have been requested by Otis Redding, the financial manager of Brandwear (Pty) Ltd, to evaluate the internal controls at Cashwear. Cashwear is the sales outlet (factory shop) attached to the factory from which clothing, manufactured by the company, can be bought at reduced prices for cash. Your enquiries into Cashwear revealed the following. 1. The outlet was opened in September 2021 for employees of Brandwear (Pty) Ltd only, but had proved so popular that the decision was made to open the outlet to the general public. Although this increased sales significantly, internal controls at the outlet were not adequately adapted to deal with the increase. 2. Sales are made only for cash, that is to say no other form of payment is accepted. The directors will not consider running the shop on anything other than a ‘cashonly’ basis, as this significantly reduces administration costs and no losses can be suffered from bad debts. 3. The outlet is located at the back of Brandwear (Pty) Ltd’s finished goods warehouse. Clothing for the outlet can be conveniently transferred onto the shelves and racks in the outlet through an interleading door and employees can come and go as they wish. Customers also have easy access to the outlet, entering (and leaving) directly from the street. 4. The outlet is open during factory hours only, that is to say from 7:30 a.m. to 4:30 p.m. 5. The outlet is run by Greta Garbo. If the outlet gets too busy for her to handle, she calls one (or two) of the finished-goods stores clerks to assist. 6. As sales are made only for cash, customers receive a receipt. To prepare a receipt, Greta Garbo writes out details of the goods purchased on a blank piece of paper (using a sheet of carbon paper to make a duplicate), enters the sale details and stamps both copies with a Brandwear (Pty) Ltd stamp. The customer is then required to sign both copies of the receipt. Greta Garbo keeps the carbon copy in a file and the customer retains the ‘top copy’. Receipts are only prepared by Greta Garbo, that is to say if she is being assisted by a stores clerk, the stores clerk is not authorised to make out a receipt. ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ 7. 8. 9. ϭϳϱ Cash from customers is placed in a large metal cash box, which is kept under the counter. Only Greta Garbo and Vish Naidoo, one of the clerks in the accounting department, have keys to the cash box. At 4:30 p.m. each day Greta Garbo, or one of the store’s clerks, drops off the locked cash box containing the day’s takings with Vish Naidoo. At some stage prior to the commencement of business the following day, Vish Naidoo empties the cashbox, placing the cash in the company safe. At 7:30 a.m. each morning Greta Garbo collects the empty cashbox from Vish Naidoo. Note: All items sold in Cashwear are priced in multiples of R5, for example R25, R30, R55. This works very effectively to reduce the need for Greta Garbo to keep a change float of more than R200. The daily cash from sales in Cashwear is kept in the company safe as described above. On Friday morning Joe Phule, the factory administration clerk and senior wages supervisor, takes the money from the safe to make up the week’s wages packets for factory workers who do not have bank accounts (the majority of employees are, however, paid their wages/salaries by EFT). There is always enough cash from Cashwear sales to pay these cash wages and any extra cash from the week is left in the safe. At the end of each month, Joe Phule takes any excess cash which has accumulated and deposits it in the company’s bank account. At the end of each month, Greta Garbo and Joe Phule notify Otis Redding of the total amount of cash sales made (taken from the filed receipts) and the total amount of cash used for wages (taken from the wage records) respectively. The excess cash banked by Joe Phule every month is picked up by the cash book clerk. Otis Redding passes the following journal entry, for example: Dr Wages 4 593 Cr Cash Sales 4 593 Narration: Raising of wage expense and cash sales. YOU ARE REQUIRED TO: Identify and explain the weaknesses in internal control relating to Brandwear (Pty) Ltd’s factory shop, Cashwear, evident from the information provided in points 1 to 9 above. (Ignore any VAT implications.) (35) ϴ͘ϴ ;ϯϯŵĂƌŬƐϯϵŵŝŶƵƚĞƐͿ Ultratool (Pty) Ltd is a wholesaler of power tools, for example drills, compressors etc. Your firm has been engaged to evaluate the company’s internal control systems and you have been assigned to the revenue and receipts cycle. At a meeting with Ben Dekker, the financial accountant, you noted the following: 1. All the company’s systems are resident on a local area network. The company has a small IT department that is responsible for maintaining the network, improving systems and making program changes etc. ϭϳϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. The company sells only on credit to account holders. 3. Only hard-copy orders from customers are accepted; phone orders are not accepted. Customers can phone to enquire about prices etc., but are asked to post, fax or email their orders. 4. Xavier Frans, the order clerk, is responsible for initiating the processing of orders. He accesses the ‘orders’ module of the revenue application software and keys in the details of the order (taken from the customer order) to produce an internal sales order (ISO). 5. A two-part ISO is printed. The top copy is sent to the warehouse administration clerk and Xavier Frans keeps the second copy. 6. The warehouse administration clerk accesses the ‘create picking slip’ module from his terminal and keys in all the information from the ISO. 7. Once he has keyed in the information, he prints a two-part picking slip; the top copy is placed in a tray outside the warehouse office. The warehouse pickers remove the picking slips from the tray and select the goods ordered, initialling the picking slip against each item ordered as it is picked. Ben Dekker is of the opinion that the application software is poorly designed and does not make satisfactory use of programmed controls. He informs you that the company is experiencing a number of problems in the cycle including: • unauthorised changes being made to debtors’ credit limits on the debtors master file; • inaccurate and incomplete internal sales orders and picking slips being created; and • customer orders which are not processed because an internal sales order is never created. Ben Dekker has indicated that the company is prepared to make whatever changes to the software which are necessary to significantly reduce the problems in the cycle. YOU ARE REQUIRED TO: (a) Advise Ben Dekker on the internal controls which should be put in place to ensure that unauthorised amendments to the debtors master file cannot be made. (8) (b) Describe the control procedures (including program controls) which could be put in place at Ultratool (Pty) Ltd to reduce the creation of inaccurate and incomplete internal sales orders and picking slips. (10) (c) Describe the control procedures which should be put in place to ensure that an internal sales order is generated for all orders received from customers. (5) (d) Outline the program change controls which should be complied with should Ultratool (Pty) Ltd decide to make changes to the revenue and receipts application software. (10) ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϴ͘ϵ ϭϳϳ (ϯϲŵĂƌŬƐϰϮŵŝŶƵƚĞƐ You are a member of the team on the audit of Tapp Tapp (Pty) Ltd, a company that supplies plumbing requisites (baths, basins, pipes, joints etc.) to plumbing contractors. You have been assigned to the audit of the revenue and receipts cycle and are in the process of evaluating the accounting system and related internal controls in the cycle. Information pertaining to certain aspects of the cycle appears below (1–6). 1. The company sells only on credit. This reduces the risks arising from having cash on the premises. 2. All sales are made from Tapp Tapp (Pty) Ltd’s premises, which consist of a showroom, warehouse and administrative offices under one roof. 3. Plumbing contractors must visit the company’s premises to make purchases as Tapp Tapp (Pty) Ltd does not deliver. This suits the contractors as it means they can make their purchases early in the day (the company’s business hours are 7 am to 5 pm) and collect the goods at the same time. 4. Customers (contractors) are served by any one of six technically trained salespeople who sit behind a long counter in the sales area. Each salesperson has his/her own computer terminal. 4.1 When a contractor arrives at the counter, one of the salespeople will enquire as to the contractor’s name and, having accessed the ‘create sales invoice’ module, will enter the given name, for example Watertite Plumbers CC, into the computer. This brings up the customer details on screen, which is formatted as a sales invoice. The salesperson confirms the details, for example account number, address etc. with the customer by reading the details off the screen to the customer. 5. The contractor’s order is then taken as follows: 5.1 To determine inventory availability and price, the salesperson accesses the inventory master file. 5.2 If the item is available (which is usual) and the customer is satisfied with the price, the salesperson proceeds with taking the order. 5.3 To complete the invoice, the salesperson enters the inventory item code and quantity of each item required in the relevant fields. This automatically completes the other fields on the invoice, for example description of goods, selling price, VAT and total selling price. The invoice is automatically sequenced by the computer software. 5.4 The computer prints a four-part invoice. The top copy remains in the sales department and is filed. The second copy is sent to the accounting department where it is filed. The remaining two copies are handed to the customer who takes them to the ‘despatch department’ which is a secure area attached to the warehouse. Both copies of the invoice are handed to any one of five despatch clerks who picks the items required from the warehouse. Once the items have been picked, the despatch clerk, using an ink ϭϳϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ stamp, stamps both copies of the invoice ‘FILLED’ and hands one copy of the invoice to the customer with the goods. The customer then loads the goods onto his/her vehicle and leaves Tapp Tapp (Pty) Ltd’s premises. The remaining copy of the invoice is filed in the despatch department. 6. If a contractor does not have an account, the salesperson will select the ‘open new account’ module of the accounts receivable software and, following the screen prompts, will enter the contractor’s name, trading name, registration number (if applicable), address and bankers. The salesman will request the contractor’s identity document and enter the identity number into the computer. Once this has been completed, the contractor is automatically allocated an account number and added to the debtor’s master file. He/she can then make whatever purchases he/she requires. YOU ARE REQUIRED TO: (a) Explain the internal control objectives of validity, accuracy and completeness in the context of sales in the revenue and receipts cycle. (3) (b) Explain the following assertions pertaining to the accounts receivable balance in the year-end financial statements of Tapp Tapp (Pty) Ltd: existence, accuracy, valuation and allocation, completeness and classification. (5) (c) Identify the two assertions pertaining to the audit of accounts receivable which, under normal circumstances, are likely to attract a greater risk of material misstatement. Provide brief reasons. (4) (d) Identify and explain the weaknesses in internal control in the aspects of Tapp Tapp (Pty) Ltd’s revenue and receipts cycle which are described in points 1 to 6 above. Do not concern yourself with backorders. (24) ϴ͘ϭϬ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are currently engaged in the 28 February year-end audit of Honeybee (Pty) Ltd (Honeybee), one of the largest honey producers in South Africa. The company runs roughly 7 000 beehives in different areas in the country and owns a packaging and bottling plant in Pretoria. Honeybee offers a wide range of honey and honey-related products both locally and abroad. As part of the audit of the revenue and receipts cycle of Honeybee, the following invoice was selected for testing. Chapter 8: The revenue and receipts cycle: Sales, debtors, cash and cash at bank 179 YOU ARE REQUIRED TO: (a) Formulate the substantive audit procedures that you would perform specifically in relation to the selected invoice above. (Ignore VAT.) (10) (b) Assume that the audit partner has asked you to consider including CAATs in your testing of credit sales at Honeybee (Pty) Ltd. List the factors that will influence the decision to use CAATs. (7) ϭϴϬ (c) 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Describe briefly the CAATs that you would consider in order to perform audit procedures on credit sales at Honeybee (Pty) Ltd. (8) ϴ͘ϭϭ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You are the senior on the audit of Smartpart (Pty) Ltd, a company that wholesales a large range of motor-vehicle accessories to garages, panel beating businesses and specialist accessory shops. The company sells only on credit to account holders. Smartpart (Pty) Ltd has expanded quickly over the past few years and the accounting system and related internal controls are proving to be inadequate. You have therefore requested various members of the audit team to document the company’s systems to enable you to evaluate them. One of your best trainees, Anton Goosen, has presented you with the following narrative pertaining to certain functions in the revenue and receipts cycle: Order receiving/sales authorisation No aspect of the order receiving function is computerised. Orders are received by phone or mail. Customers sometimes place an order by phone and within two or three days send a written order to confirm the phone order. When a customer phones, the call is put through to Eddie Mercs, the sales order clerk. On taking the call, if he does not recognise the voice of the caller, he asks for the customer’s name and confirms that the customer has an account by referring to an up-to-date hardcopy list of Smartpart (Pty) Ltd’s customers. This list reflects the customer’s account number, name, address and contact details. He also keeps an up-to-date product price list so that he can answer customers’ price queries. If Eddie Mercs is satisfied that the caller is an account holder, he fills out a single part (original only, no copies) pre-printed, prenumbered internal sales order (ISO) by inserting the customer’s account number (which he obtains from the customer list) and recording the description and quantity of the goods ordered on the ISO. At this point, the telephone conversation is terminated. Eddie Mercs then completes the ISO by filling out the customer’s name and delivery address and signing it. If the caller does not appear on the list of customers (that is to say is not an account holder), Eddie Mercs fills out a pre-printed ‘new customer form’ (NCF) by obtaining (over the phone) the prospective customer’s business name, postal/delivery address and contact details as well as the names of the business’s bankers and two trade references. Eddie Mercs then completes the ISO in the normal manner with the exception of inserting the customer’s account number. All incoming mail is received by Pearl Pillay, the receptionist, who, assisted by one of the clerks from accounting, enters details of all letters, customer orders etc. in a mail register. She and the accounts clerk both sign the mail register. Whatever has been received is then distributed. All customer orders go to Eddie Mercs, who makes out an ISO for each order, taking the details from the customer order. ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϴϭ Before he goes home at 4:30 p.m., Eddie Mercs places the day’s ISOs on the store controller, Kobus Marais’, desk and, if there are any NCFs, he gives them to Precious Gumede, the senior debtors administrator. (She allocates an account number to the new customer, files the NCF and updates the customer list.) Warehouse and despatch Again no aspect of these functions is computerised. Each morning Kobus Marais splits the ISOs between his two assistant storemen who pick the goods ordered from the shelves. The goods picked are placed in cardboard boxes with the ISO but the box is not sealed. As the items are picked, the assistant storeman ticks them off on the ISO. If the quantity ordered is greater than the quantity on hand, the storeman changes the quantity ordered on the ISO to the quantity actually picked. If the item ordered is completely out of stock, the ISO will be changed to 0 for that item. The assistant storemen sign the ISOs once they have picked the items ordered. Once the goods have been picked, they are moved to the despatch area. Hawke Mathabula, the despatch clerk, extracts the ISO from the box and makes out a preprinted, sequenced, four-part delivery note (DN), copying all details from the ISO onto the DN. He places the top copy in the box, and addresses and seals the box. The second copy, along with a delivery list, are handed to the company’s delivery driver who checks the boxes to be delivered against the copies of the despatch notes and delivery list as the boxes are loaded onto the truck. Hawke Mathabula attaches the ISO to the third copy of the DN and sends them (in well-controlled batches) to the accounting section for invoicing at a later stage. The fourth copy of the DN remains as a fast (fixed in the book) copy in Hawke Mathebula’s office in despatch. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the order receiving/sales authorisation and warehouse/despatch functions as described above. (35) Note 1: Your explanation should convey the reason why you believe the weaknesses identified are, in fact, weaknesses. Note 2: You are not required to make recommendations to address the weaknesses. ϴ͘ϭϮ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ You are a member of the newly established internal audit section of Cold Front (Pty) Ltd, a company that supplies parts and accessories to refrigeration and air-conditioning maintenance businesses in the Gauteng region. Cold Front (Pty) Ltd was started by Frans Frost, an engineer, some years ago and has never had particularly sound internal controls. The company has grown steadily over the years and the weaknesses in the internal controls have started to have an adverse effect on the business, for example lost sales, theft of inventory etc. Hence the establishment of the internal audit section. You have been assigned to evaluate controls in the revenue and ϭϴϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ receipts cycle, and, as your first step, you have compiled the following narrative description of the cycle: 1. Customers email their orders to the company receptionist and all orders received from customers are printed and placed in a box marked ‘Incoming Orders’. The box is then sent to the senior warehouse clerk who initiates the picking of the items ordered. 2. The company does not accept telephonic orders or orders by post; if customers phone to place an order, they are requested to submit an order by email. 3. Sales are only made on credit (no cash sales). There is no demand for ‘over-thecounter’ sales. 4. On receipt of customer orders (from the receptionist), the senior warehouse clerk makes a copy of each order. He/she files the originals alphabetically (by customer name) in a lever-arch file. He/she splits the photocopy orders roughly into two piles and hands a pile to each of the two junior warehouse clerks who, among other duties, are responsible for picking the items ordered from the shelves. 5. As the junior warehouse clerks pick the goods from the shelves, they tick off each item picked on the photocopy order. If an item ordered is out of stock, the warehouse clerk puts a cross against the item on the photocopy order. If the order for a particular item can only be partially filled (say 3 out of 5), the clerk crosses out the 5 on the photocopy order and enters a 3. He/she then ticks the item off. The clerks place the items picked for each order in a plastic basket (called a picking basket) which the junior warehouse clerk places on a rack in the despatch section once the order has been picked. The relevant photocopy order is placed in the picking basket with the items picked. 6. In the despatch section, the senior despatch clerk makes out a three-part, preprinted, numerically sequenced delivery note, taking the details required to complete the delivery note from the photocopy order. Where an item has a cross against it (out of stock) on the photocopy order, it is not included on the delivery note. 7. Once the delivery note has been made out, the items are taken from the picking basket and packed in a box for delivery. The box is labelled by a junior despatch clerk and the delivery-note number written on the side of the box. 8. The company delivers all orders to its customers using a fleet of small delivery vehicles. Boxes to be delivered are loaded onto the vehicles under the supervision of the driver. The driver is given the list of deliveries to make, as well as two copies of the delivery note for each delivery. As the goods are loaded, the driver checks the delivery number written on each box against his list and copies of the delivery notes to ensure that all the correct boxes have been loaded. 9. When a delivery vehicle leaves (or arrives at) the company’s premises, a guard at the security gate records the time of departure (or arrival). ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϴϯ 10. On receipt of the goods, the customer is required to sign and date both copies of the Cold Front (Pty) Ltd delivery note. The customer retains one copy and the driver keeps the other. On returning to Cold Front (Pty) Ltd, the driver gives the signed delivery notes to Carmen Chetty, the company bookkeeper, who is responsible for writing up invoices, reconciling and entering EFT payments from customers, passing credit notes etc. Carmen Chetty and the driver reconcile the signed delivery notes to the driver’s list of deliveries and both sign the list. 11. On Friday mornings, Carmen Chetty makes out an invoice for each delivery note received during the week. She obtains the customer details as well as the description and quantity of items delivered from the delivery note and the prices of the items from the official price list. To complete the invoice, she does the extensions, casts and VAT calculations. Invoices are preprinted, sequenced and in duplicate. The top copy is sent to the customer promptly and the second copy remains in the invoice book. 12. Once she has made out all of the invoices, Carmen Chetty writes up the ‘weekly sales journal’ and posts (enters) the sale to the individual debtors account in the debtors ledger. If the entity to whom the sale has been made, does not have an account, Carmen Chetty opens a ledger account for the new debtor. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the revenue and receipts cycle at Cold Front (Pty) Ltd, based on the information given above. (40) You are not required to make recommendations to resolve the weaknesses. ϴ͘ϭϯ ;ϰϮŵĂƌŬƐϱϬŵŝŶƵƚĞƐͿ Countryfare (Pty) Ltd supplies household goods to small general dealers in the rural villages of KwaZulu-Natal and the Eastern Cape. The company’s head office and warehouse are situated in Pietermaritzburg. Orders are taken as follows: 1. The company’s 15 sales representatives spend Monday to Thursday of each week on the road calling on the customers and taking orders. Not all customers can be visited every week. Sales are only made on credit to account holders. Typically, these general dealers are in areas where there is minimal landline, cell phone or internet connection. 2. Countryfare (Pty) Ltd sells a standard range of goods. Each sales representative carries a sales order book and a catalogue which lists the inventory code, description and price for every item which the company sells, for example B4049,5 litre galvanised bucket, R67,50. To take the order, the sales representative completes a preprinted, sequenced, multipart order form in triplicate by entering: • the customer name and account number • inventory code, quantity and price for each item ordered ϭϴϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ • the date • the sales representative’s identity code. The sales representative does not calculate the total sale or VAT. The customer is then required to sign the order and is given a copy. The other two copies remain in the order book. Each sales representative takes an average of 35 orders a week. 3. On Friday mornings, the sales representatives return to the head office. They hand their order books to Maria Mathews, the sales administration clerk. She removes the second copy of each order and returns the order book to the sales representative. She then batches the orders before passing them to Nicholas Zondi for capturing into the system. 4. The company’s accounting systems are run on a local area network and are menu-driven. 5. Nicholas Zondi keys in the sales orders batch by batch and as he does so, a number of program controls take place. The details of each batch are held on a temporary file until he selects the ‘proceed’ option. When he selects the proceed option, the system carries out the extensions (quantity × price), VAT and total sale calculations on each sales order and the batch of sales orders is written to a sales-order file to await the picking of the goods from the warehouse shelves. Nicholas Zondi then moves onto the next batch. 6. To initiate the picking process, Beckie Jay, the warehouse administration clerk, accesses the sales-order file from his terminal. This reveals the list of sales orders by transaction number. Beckie Jay selects the orders which he wants to have picked and a hard copy ‘picking slip’ is printed. To identify the sales orders that have been picked, the system attaches a ‘PS’ status code to the sales order on the file. 7. The picking slips are then distributed to the five warehouse pickers who select the goods listed on the picking slip. They place the goods with the picking slip in the ‘pre-despatch area’. 8. At this point, Gavin Reddy, the picking control clerk, checks the physical goods picked against the picking slip and, if all is in order, approves the picking slip on the system. The goods and the picking slip (hard copy) are transferred to the despatch area. 9. Carmen Swart, the despatch controller, creates the invoice for the goods in the despatch area. To do so she accesses the sales-order file and selects the sales order which is to be despatched. On selecting the ‘approve’ option on her screen: • a hard-copy invoice is printed for inclusion with the goods • a delivery label(s) is produced • the status code attached to the sales order on the file changes from ‘PS’ to ‘IV’ to indicate that the goods have been invoiced ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ • ϭϴϱ the debtors master file, inventory master file and sales journal are immediately updated. Because Countryfare (Pty) Ltd sells a standard range of products which are in plentiful supply and manages its inventory well, no inventory availability test is considered necessary. Occasionally, however, when pickers are selecting the items ordered, they do come across shortages. Although the company allocates a credit limit and terms of 30 days or 60 days to each customer, it is not practical to enforce these terms due to the nature of operating the business in rural areas. Communications are poor and the general dealers themselves face difficult trading conditions. Countryfare (Pty) Ltd’s losses from bad debts have been minor as the general dealers are slow but regular and reliable payers and, for this reason, the company does not conduct a creditworthiness test before a sales order is processed. However, follow-up procedures are conducted when a debtor exceeds its limit, for example ‘friendly reminder’ notes are sent with the sales representatives. This policy will not change for the foreseeable future. YOU ARE REQUIRED TO: (a) Describe the procedures which should be carried out by Maria Mathews to ensure that all sales orders taken by the sales representatives are received by Nicholas Zondi. (5) (b) Describe the controls which should be carried out by Maria Mathews, Nicholas Zondi and the system to ensure that Nicholas Zondi enters all sales orders and all individual inventory items ordered. (8) (c) Describe the program controls which should be in place relating to the entry of the sales orders onto the system (by Nicholas Zondi) to ensure that the order is from a valid customer and is accurately entered. (10) (d) Outline the controls which should be in place to ensure that only valid additions of new customers are made to the debtors master file. (5) (e) Describe the controls which should be in place from the time the sales orders are written to the sales-order file until the time the goods are moved into the despatch area to ensure that only valid sales orders are filed and that the goods to be despatched are correct in terms of the original sales order. (8) (f) Explain how the warehouse manager can determine whether sales orders are being processed promptly. (2) (g) Discuss the control procedures which should be in place prior to the goods being invoiced and despatched once they have been transferred to the despatch area. (4) ϴ͘ϭϰ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ PartTime (Pty) Ltd is a wholesaler of car parts to the local trade. The company operates out of large premises in Port Elizabeth. PartTime (Pty) Ltd does not deliver ϭϴϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ and does not take orders through the mail or over the phone. Sales are only made to customers who come to the premises. Most of the building is taken up by the inventory warehouse. Parts are laid out in logical locations on shelving and in bins. Each different part has a unique part number which is entered on the inventory database with other details of the part, inter alia, quantity on hand, description, selling price and location in the warehouse. All parts carried by the company are also listed in catalogues which are placed on the sales counter. Generally customers know exactly what parts they require but will not necessarily know the part number and are thus able to refer to the catalogues. The sales counter is one long counter behind which the eight parts sales personnel are seated. Due to the risk of having cash on the premises, PartTime (Pty) Ltd does not make cash sales. The company sells only on credit to approved account holders, for example garages, workshops, panel beaters and a number of car-accessory outlets. Customers approach the counter when a salesperson is available and must produce a customer purchase order. The company’s accounting systems are all resident on a local area network. Each salesperson has his own workstation on the network. Applications on the system are menu driven. Before creating an invoice, the salesperson and customer confirm by reference to the inventory master file and parts catalogue on the counter that the part numbers for goods required are correct. The salesperson also confirms the availability of the parts by reference to the inventory master file ‘quantity on hand’ field. (The inventory master file is updated immediately as sales are made and when deliveries are received from suppliers.) If the parts are available (which is usually the case), the salesperson enters the necessary details, for example customer account number, part number and quantity, onto the system via his keyboard to produce a computer-generated three-part invoice. On keying in the data, a number of program controls are carried out, prices are ‘fetched’ from the inventory master file and casts and calculations are carried out by the computer. The program checks include a check to determine whether the sale being entered will result in the customer’s credit limit being exceeded. If so, the sales person cannot proceed with the sale unless the credit controller is called and agrees to override the control which she is able to do by entering her password and activating a command via the keyboard. The customer is given two copies of the invoice (the third copy remains in the sales department) and the customer is directed to ‘warehouse despatch’. A warehouse clerk picks the parts listed on the invoice from the shelves and hands the parts to the customer who leaves the premises through a designated security area. From time to time there are discrepancies between the theoretical inventory and actual inventory on hand which results in the clerk not being able to pick the parts as listed on the invoice. As part of an internal audit review of PartTime (Pty) Ltd’s systems you, a member of internal audit, have been asked to evaluate the application controls in those ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϴϳ aspects of the system described above. The company is generally regarded as having well designed and implemented internal controls. YOU ARE REQUIRED TO: (a) Discuss the controls which should be in place to prevent unauthorised access to the sales application. (8) (b) Describe the controls which should be in place to ensure that only valid overrides of the control which prevents an invoice being generated for a sale which will result in a customer’s credit limit being exceeded, are made. (5) (c) Explain the following program controls in the context of the creation of a sales invoice by PartTime (Pty) Ltd’s sales personnel: (d) (i) minimum keying in of information; and (3) (ii) mandatory fields. (3) Describe the control procedures/activities that should be in place over the despatch of parts sold, from the time the customer is directed to ‘warehouse despatch’ until he leaves the company’s premises. Your answer should include controls over instances where the warehouse clerk is not able to pick the goods as listed on the invoice. (9) ϴ͘ϭϱ ;ϮϮŵĂƌŬƐϮϳŵŝŶƵƚĞƐͿ Beautify (Pty) Ltd is a company in the cosmetics industry. The company provides cosmetic products to various retailers across South Africa and abroad. You are currently performing audit work on the revenue and receipts cycle of the client for the 28 February year-end audit. Beautify (Pty) Ltd has had a high staff turnover in its accounts department during the year under review. Management mainly ascribes this to the implementation of the new accounting software package, which placed pressure on staff, as they had to attend a lot of training and had to work long hours in order to allow for smooth conversion from the old to the new system. The company runs a fully computerised accounting system, and your firm’s interim testing confirmed that the system is well designed and operates effectively. Due to a steep increase in competitors over the past few years, Beautify (Pty) Ltd has expanded its operations during the year under review, to also include the international market. As management receives performance bonuses based on sales, they are very grateful for the increase in sales which this market expansion has brought about (sales has shown an increase of 15% above the market average). When a new customer applies for an account with Beautify (Pty) Ltd, they are required to complete an online application form, which is then received by Estelle Lauder who works in the accounts department. The prospective customer is credit vetted, using a reputable institution. Estelle then processes and approves the application electronically, whereafter she grants payment terms to the customer as she ϭϴϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ deems suitable. In the year under audit, Beautify (Pty) Ltd’s debtors-days ratio has rapidly deteriorated. Payments from debtors are processed by Annique Dior, who connects to the internet from a dedicated terminal and accesses the bank application to obtain up-to-date transactions and statements. As of the beginning of the year under audit, cash payments are no longer accepted. YOU ARE REQUIRED TO: (a) Identify the controls which you would expect to find in place at Beautify (Pty) Ltd to prevent the unauthorised downloading of bank statements via the internet. (7) (b) Identify and discuss the factors which would increase/decrease risks of material misstatement relating to the accounts receivable balance as at 28 February. (15) ϴ͘ϭϲ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ WZd ;ϭϯŵĂƌŬƐϭϲŵŝŶƵƚĞƐͿ Riley’s Kitchen (Pty) Ltd is a small business that manufactures and sells homecooked meals from an online platform. Customers are required to create an account online before being able to make purchases. Customers select items that they want to purchase from a drop-down menu on Riley’s Kitchen’s website, and once they have confirmed their selection, the customer proceeds to a payment page. Customers have the option of paying via credit card at check-out or cash on delivery. When a customer has opted to pay with cash on delivery, the company’s driver collects the cash from the customer. The driver keeps the cash on him until such a time that he has accumulated what he deems a large sum of money. The driver then hands the cash over, in a sealed envelope, to the accounting clerk, together with all the relevant delivery notes. The accounting clerk keeps all envelopes from drivers sealed in her desk drawer until a bi-weekly wage pay-out occurs. Money not applied for the wage pay-out, is banked. YOU ARE REQUIRED TO: (a) Once a customer has successfully logged into his/her account, explain which controls you expect to be present over orders placed on Riley’s Kitchen’s accounting system. (8) (b) Identify weaknesses in the cash-receipts procedures explained in the scenario and provide suggestions to address these weaknesses. (5) WZd ;ϭϵŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You are a senior trainee on the audit of ProClean (Pty) Ltd, a company that provides monthly professional cleaning services to offices, apartment blocks and holiday resorts. The existence of accounts receivables has been identified as a high-risk area. ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϴϵ As part of your on-the-job training, you are responsible for coaching a first-year audit trainee. YOU ARE REQUIRED TO: (a) Explain to the trainee two major procedures used for existence testing for trade receivables. (3) (b) Explain to the trainee how a debtors circulation is performed. (c) Apart from the existence assertion, explain to the trainee which other assertions relate to the accounts receivable balance. (4) (12) ϴ͘ϭϳ ;ϰϵŵĂƌŬƐϱϵŵŝŶƵƚĞƐͿ WZd ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ You are engaged in the audit of MeanMachine (Pty) Ltd, a company that provides equipment for hire, such as rammers, compactors, cutters, mixers, generators, scaffolding etc. You are in charge of the audit of accounts receivable. The company has a 30 June financial year-end and an audit deadline of 15 July 2022. As a result of the audit deadline, you decided to circularise debtors at 30 April 2022 and to perform roll-forward tests for the months of May and June. The debtors’ master file reflects that the company has approximately 375 debtors ranging from very large property developers to individual contractors. Your firm uses generalised audit software which has a very effective circularisation application. Your initial analysis of the debtors’ master file at 30 April revealed the following: Total amount owed to MeanMachine (Pty) Ltd R4 738 294 Number of new accounts opened during the current financial year Number of accounts with balances over R205 000 9 Number of accounts under R7 500 235 Number of duplicated accounts, credit balances, missing fields etc. Ageing of total amount: 47 nil 30 days – R2 319 512 60 days – R1 788 837 90 days – R165 578 120 days – R464 367 Your firm’s policy is to perform only positive debtors circularisations and with the cooperation of Vincent Talisman, the debtors controller, you were able to successfully incorporate your circularisation letters into the company’s debtors statement run on 30 April 2022. ϭϵϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ By the end of May, all debtors, other than the three below, had confirmed that the balances reflected on their confirmations were correct and you are about to follow up on the following responses: Debtor Balance Response Gingerberry Properties R43 076 As our previous correspondence with MeanMachine (Pty) Ltd has indicated, we are not going to pay one cent of this amount. It represents a charge for incorrect equipment which was delivered to one of our building sites. The equipment has been taking up space in our warehouse for six months awaiting collection by MeanMachine (Pty) Ltd. We simply will not pay. Build-Me-Up (Pty) Ltd R116 250 This balance is overstated by R45 511. A payment by EFT which we made to MeanMachine (Pty) Ltd in February 2022 (and which reflects on our bank statement on 7 February) does not appear to have been credited to our account. Bilson Developers Ltd R62 500 This balance is overstated by R22 000. In error, we placed the same order for equipment twice. We indicated the issue on the second delivery note and the equipment was not offloaded on our site, but returned to MeanMachine (Pty) Ltd. See your goods-returned note RN2471 on 18 April. YOU ARE REQUIRED TO: (a) Explain whether a positive debtors circularisation provides evidence in respect of all the assertions relating to accounts receivable. (6) (b) Explain why some auditing firms may choose not to perform negative debtors circularisations. (2) (c) Indicate, giving reasons, the basis on which you would have decided which debtors accounts you would have included in your sample of debtors to be circularised. (5) (d) Describe briefly the ‘roll-forward procedures’ you will conduct to supplement your debtors circularisation. (6) ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ (e) ϭϵϭ Describe the procedures you would carry out in respect of the responses received from debtors included in the table above. (15) WZd ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ While inspecting the minutes of directors’ meetings on the audit of MeanMachine (Pty) Ltd, you noted that one of the directors, Mr Coastal, voted on the approval of a contract between MeanMachine (Pty) Ltd and Coastal-and-Sons CC, whereby MeanMachine (Pty) Ltd would supply rental equipment to Coastal-and-Sons CC for a 12-month period at a discounted price. Mr Coastal, together with his two sons, are the owners of Coastal-and-Sons CC. YOU ARE REQUIRED TO: (a) Formulate the substantive audit procedures that you would perform relating to the contract between MeanMachine (Pty) Ltd and Coastal-and-Sons CC. (12) (b) Assume that management refuses to provide you with any rental invoices issued to Coastal-and-Sons CC. Comment briefly. (3) ϴ͘ϭϴ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Your firm has recently been appointed as the auditor of Praktikal (Pty) Ltd, a wholesaler of industrial materials. The company has a public interest score of 280 and compiles its AFS internally. The following procedures were carried out: 1. Reviewed a report compiled by the internal audit section on a risk evaluation conducted by the section pertaining to credit management at Praktikal (Pty) Ltd. 2. Held discussions with the IT manager on the levels of access granted to employees in the revenue and receipts cycle. 3. Selected a sample of debtors from the list of aged debtors and reperformed the ageing by inspecting dates on relevant invoices and receipts to confirm that the ageing had been carried out correctly. 4. Conducted extensive analytical procedures on sales with the specific intention of gathering evidence relating to the completeness assertion for sales. 5. Inspected agreements applicable to long-term finance providers to identify and evaluate any terms and conditions (for example loan covenants which relate to ratios) which may have implications for the audit of accounts receivable. 6. Inspected a sample of applications for credit from prospective debtors for the signatures of the credit manager and sales director, approving the credit terms granted to successful applicants. 7. Discussed the nature of the company’s customer/client base, major product lines and competitors with the sales director. ϭϵϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 8. Obtained an understanding of the manner in which the performance of the credit management section is measured. 9. Observed whether the gate-control personnel actually checked goods sold leaving the premises against the deliver note/invoice. 10. Conducted a positive circularisation of a small sample of debtors. 11. Enquired of the sales director and financial accountant as to whether any of the company’s key customers were related parties (as defined by the IFRS). 12. Inspected the minutes of directors’ meetings, bank confirmations and loan agreements to determine whether accounts receivable have been factored, ceded or encumbered in any way. YOU ARE REQUIRED TO: State whether each of the procedures above would be classified as a ‘risk assessment’ or a ‘further audit procedure’. Where you select ‘further audit procedure’, state whether the procedure is a substantive test or a test of controls and where you select substantive test, state to which assertion the evidence gathered is relevant. (12) ϴ͘ϭϵ ;ϰϰŵĂƌŬƐϱϮŵŝŶƵƚĞƐͿ Broadmans (Pty) Ltd is a large company that sells a wide range of household goods, furnishings, crockery etc. You have worked on the audit team for the last two years and you have been put in charge of the audit of accounts receivable for the current audit (financial year-end 31 March 2023). The company has neither an internal audit department nor an audit committee but does have a company secretary. The following information pertains to accounts receivable: 1. All financial systems are fully computerised. On two interim visits to the client during the year under audit, your firm’s computer audit division performed some tests of controls on Broadmans (Pty) Ltd’s systems and found them to be well maintained and effective. 2. The majority of the company’s debtors are members of the general public. However, also included in accounts receivable, are a significant number of corporate customers, such as hotels and timeshare resorts. 3. Amounts owed to Broadmans (Pty) Ltd range considerably. 4. Broadmans (Pty) Ltd relaxed its credit-control policies early in the year under audit. Credit limits were increased and payment terms extended in an attempt to stimulate sales. This resulted in a significant number of new debtors accounts being opened. 5. The accounts receivable balance in the statement of financial position is material. 6. Veejay Singh, the credit controller, and Mariah Julio, the financial manager, are responsible for accounts receivable. Their responsibilities include submission of ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϵϯ a monthly report on accounts receivable to the directors which includes an analysis of relevant ratios, lists of doubtful debtors etc. 7. Broadmans (Pty) Ltd obtained a long-term loan from Cityfin Ltd during the year under audit. The loan agreement contains a number of clauses relating to the current ratio as reflected in the annual financial statements. Contravention of these clauses could have negative consequences for Broadmans (Pty) Ltd. Your audit firm saves all important client information onto memory sticks thereby creating a ‘databank’ for each client. These memory sticks are kept in the firm’s client library along with previous years’ hard-copy audit files. At the commencement of each year’s audit, information can be downloaded from the memory sticks onto the audit team’s laptops to assist in numerous audit activities, for example, considering audit strategy, conducting risk assessment procedures, reviewing prior year schedules etc. This system has worked very well except that on occasion memory sticks have been mislaid or lost, resulting in the permanent loss of client information. Fortunately, the memory sticks containing the information for the previous five audits of Broadmans (Pty) Ltd, including information relating to accounts receivable, are available for your use. In addition to having this information downloaded onto your laptop, arrangements have been made to download the debtors master file at 31 March 2023 onto your laptop in order for you to use your audit software. The following fields are included on the debtors master file: • account number • name • address and contact details, for example telephone numbers, email etc. • total amount owed • ageing of total amount owed: current, 30 days, 60 days, 90 days, 120 days and over • credit limit: for example R5 000 • credit terms: for example 60 days • credit rating • – category A (low risk, regular payer) – category B (slow but regular payer) – category C (erratic payer) type of customer – gen (general public) cor (corporate). After discussing the year-end audit of accounts receivable with your manager, it was decided that you would conduct a limited positive debtors’ circularisation, supplemented by other appropriate tests, to obtain evidence of the existence of debtors included in the accounts receivable balance. He also requires extensive procedures relating to the allowance for doubtful debts (credit losses) assertion to be performed. ϭϵϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ There is no strict audit deadline, but it is anticipated that the audit will be concluded on 15 June 2023. YOU ARE REQUIRED TO: (a) Describe the risk assessment procedures you would carry out in respect of the audit of accounts receivable for the financial year-end 31 March 2023. (12) (b) Identify two factors which are likely to increase your assessment of the risk of material misstatement in the accounts receivable balance at 31 March 2023 as compared to the previous year’s assessment. Explain why you believe each factor will increase your assessment. (3) (c) Define detection risk and explain how it relates to audit risk. (d) Identify two factors which should reduce the risk that your firm expresses an inappropriate opinion on the accounts receivable balance as reflected in the financial statements at 31 March 2023. (4) (e) Identify controls that should be in place at your audit firm to minimise the risk of memory sticks, on which client information is stored, being lost or mislaid.(6) (f) Explain how you would conduct subsequent receipts testing to gather evidence pertaining to the existence of debtors included in the accounts receivable balance at 31 March 2023. (4) (g) Describe the procedures you would carry out in respect of the allowance for doubtful debts set for the financial year end 31 March 2023. (12) ϴ͘ϮϬ (3) ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ You are the manager on the 31 August 2022 year-end audit of Hair-Affair (Pty) Ltd, a company that owns several hair salons across Johannesburg and Pretoria. The company provides hair dressing services and it also sells hair products to its customers. The completeness of cash sales has been identified as a significant risk at the client. Below is an extract of a working paper compiled by one of the trainees on the audit team: Client name: Hair-Affair (Pty) Ltd Year-end: 31 August 2022 Planned by J Dlamini Reviewed by P Ndlovu Performed by J Dlamini Final review Ref: 61 Revenue work program Applicable materiality: R25 000 Audit procedures continued ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϵϱ Procedure: Obtain a list of revenue per category (sales and services), with comparative figures for the previous years, and compare items per category with previous years and obtain reasons for unusual changes. Finding: Revenue from both categories (sales and services) has decreased by 15% from the prior year. I enquired from a hairdresser at one of the salons about this decrease and she explained that, since people are working from home more, there are fewer people interested in having their hair done. This seems reasonable and, as such, I am happy with the fluctuation. Procedure: Test the completeness of revenue by following a selection of transactions from the accounting records to the relevant invoices to ensure that all income is accounted for. Finding: No exceptions found. Procedure: Select revenue transactions from the general ledger/sales journal and enquire from management whether the transaction prices agree with the standard price lists. Finding: Management confirmed that the prices do agree. Procedure: Select a sample of sales invoices and reperform casts and calculations. Finding: A total difference of R8 500 has been found due to calculation errors on some invoices. This is below materiality and can thus be ignored. Procedure: Select entries from the inventory ledger before and after year-end and trace these entries to source documentation to ensure that these transactions are accounted for in the correct period. Finding: No expectations found. Conclusion: I can certify that the revenue is not materially misstated and is free from fraud. YOU ARE REQUIRED TO: (a) Provide four examples of overall responses that you would implement to address the significant risk related to the completeness of cash sales. (4) (b) Discuss your concerns related to the work that is documented in the working paper above. (10) Note 1: This is merely an extract of the procedures performed. Note 2: You may assume that all relevant tick marks, references and detail regarding samples have been included in the working paper. ϴ͘Ϯϭ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ Your firm has recently been appointed as auditors of Wallandall (Pty) Ltd, a distributor of paint. The company’s financial statements have not been audited in prior years, as its public interest score was less than 100. ϭϵϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The following information, inter alia, was obtained when conducting procedures to identify and assess the risk of material misstatement through understanding the company and its environment: 1. Accounting systems at Wallandall (Pty) Ltd (although computerised) were not well maintained and internal controls were generally poor. 2. Although the directors realised that attention needed to be given to the systems, little was done to resolve the problems until the latter part of the year. 3. On 1 March 2022 (a month before year-end), Cherry Checkitt joined the company as internal auditor. This was a new position. Her first responsibility was to evaluate and improve systems at Wallandall (Pty) Ltd and to this end she obtained approval for the appointment of a credit controller from 1 April 2022. 4. Shortly after it was announced (in early February 2022) that Cherry Checkitt would be joining the company as internal auditor, the company’s debtors manager, Adam Brown, resigned suddenly requesting that he be allowed to leave within a week as he intended emigrating. He had been with Wallandall for five years during which time he had been solely responsible for all aspects of accounting for sales and debtors, for example recording payments, passing adjusting entries, credit control, maintaining ledgers etc. His responsibilities were taken over by Gunston Smith, the senior debtors clerk, who quickly discovered that Adam Brown had ‘done things his way’. There were numerous long outstanding debts, unexplained adjusting entries to debtors, a lack of audit trail (documentary evidence) as well as little evidence of regular reconciliations and problem resolution. Other than obtaining approval for the appointment of a credit controller (see point 3), Cherry Checkitt was not able to spend much time on the revenue and receipts cycle prior to year-end. For the purposes of the year-end balance, Gunston Smith produced a reconciliation of the debtors ledger and the debtors control account and produced an aged list of debtors. 5. The debtors balance has increased steadily over the years and there are, at yearend, some 1 400 debtors in the debtors master file ranging from nil balances to thousands of rand. The debtors balance at year-end is material. 6. The company has a substantial overdraft facility which the directors wish to retain, although, ultimately, they would like to reduce it. The bank is pleased that the company will be presenting audited financial statements to support its request to retain the overdraft facility, but have indicated that they are hoping to see a ‘healthy set of figures’. 7. There is no specific audit deadline particularly because this is the first audit of the company. YOU ARE REQUIRED TO: (a) Based on the information given above, evaluate the risk of material misstatement in the trade debtors (accounts receivable) account balance at 31 March 2022. (8) ŚĂƉƚĞƌϴ͗dŚĞƌĞǀĞŶƵĞĂŶĚƌĞĐĞŝƉƚƐĐLJĐůĞ͗^ĂůĞƐ͕ĚĞďƚŽƌƐ͕ĐĂƐŚĂŶĚĐĂƐŚĂƚďĂŶŬ ϭϵϳ (b) Discuss the nature of testing you will incorporate into your audit plan for the 31 March year-end audit of debtors (accounts receivable). (8) (c) Explain why your audit team will have difficulty in testing the completeness of sales at Wallandall (Pty) Ltd. (4) (d) Describe how you would perform subsequent receipts testing and comment on whether subsequent receipts testing will identify fictitious debtors. (5) (e) Describe the procedures you will carry out in respect of the allowance for doubtful debts (credit losses). (10) ϴ͘ϮϮ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ Organisations are all seeking opportunities to automate and remove mundane routine tasks. Your audit client, RockingSocks (Pty) Ltd is the largest sock manufacturer in the southern hemisphere and has recently implemented an automated bank reconciliation system. CFO, Thabo Ramba, discussed the new tool with you and mentioned that the tool had been a real game changer, having made a significant difference in their work schedule. YOU ARE REQUIRED TO: (a) Explain the benefits of implementing a bank reconciliation system and thereby automating the reconciliation process. (6) (b) Briefly explain automated bank reconciliations. (c) Briefly explain the IT general and automated application controls that you will consider testing. (10) (2) ,WdZ ϵ WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 9.1 Short questions 27 marks 9.2 Application – Components of internal control and control activities 12 marks 9.3 Short questions 17 marks 9.4 Application – Components of internal control and control activities 12 marks Application – General and automated application controls 20 marks 9.6 Application and discussion – Assertions 12 marks 9.7 Application – Risk assessment procedures; Substantive procedures; Tests of details and control objectives 16 marks 9.8 Application – Controls 38 marks 9.9 Application and discussion – Risks and controls 34 marks 9.10 Application and discussion – Extracting reports/ lists/samples and CAATs procedures 13 marks 9.11 Application and discussion – Controls 45 marks 9.12 Automated application controls 40 marks 9.13 Discussion – Audit procedures and audit plan 30 marks 9.5 continued ϭϵϵ ϮϬϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 9.14 9.15 9.16 9.17 9.18 9.19 Description of content of the question Total marks Application and discussion – Analytical procedures and substantive tests of detail 23 marks Application and discussion – Directors remuneration; Audit procedures and King IV and Companies Act integration 42 marks Application and discussion – Controls over EFTs; Weaknesses and recommendations over appointment practices 20 marks Application – Weaknesses, risks and recommendations regarding master file amendments 15 marks Application and discussion – Criticise audit procedures 12 marks Application and discussion – Recommendations with regard to the wage system 50 marks ϵ͘ϭ ;ϮϳŵĂƌŬƐϯϯŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. The major difference between wages and salaries is that wages are paid in cash and salaries are paid by electronic funds transfer. True or false? Justify. (2) 2. Identify the main functions into which the payroll cycle of a large manufacturing company should be divided. (2) 3. Explain the control objectives of completeness, accuracy and validity in the context of wages paid based on hours worked. (3) 4. Describe briefly the assertions relating to the salaries account heading. 5. Briefly describe the three standard methods companies use to record hours worked by hourly paid employees. (4) 6. Explain the term cashless wage system. 7. Explain briefly why the payroll cycle of a large organisation will be susceptible to fraud if internal controls in the cycle are not strong. (3) 8. Provide four characteristics/circumstances of a business that will influence its decision to select a suitable wage system. (4) (4) (1) ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ 9. ϮϬϭ Salaries paid to the directors of a company may be included in the employee cost line item on the financial statements and requires no additional disclosure. True or false? Justify. (2) 10. Except for the disclosure requirements in section 30 of the Companies Act, what other requirements govern the presentation and disclosure of information pertaining to the payroll cycle? (2) ϵ͘Ϯ ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ UK2010 (Pty) Ltd is a manufacturing company with a large labour force. Each of the procedures or actions listed below (1–10) relates to one (or more) of the components of internal control, as identified by ISA 315 (Revised 2019), namely: 1. control environment; 2. the entity’s risk assessment process; 3. information system and communication; 4. control activities; and 5. the entity’s process for monitoring the system of internal control. Actions 1. UK2010 (Pty) Ltd engages an independent labour consultancy to review the company’s payroll activities annually. This includes a report to the directors on employee satisfaction, the company’s adherence to fair labour practice, legality of employees etc. 2. The human resource manager and her senior administration clerk restrict access to hardcopy employee records. 3. When the factory administration clerk has batched the wage period’s clock cards, he takes control totals, including the total number of clock cards in the batch. When the data capture clerk in the payroll section receives the clock cards, he counts them before signing a batch control sheet to acknowledge receipt. 4. The foremen are responsible for checking and authorising (signing each clock card) overtime hours entered on the clock card and calculated by the wage administration clerk. 5. Employees are paid by electronic funds transfer. To effect the transfer, two senior employees are required to enter their unique passwords. One password ‘approves’ the transfer and the second password ‘releases’ the payment. Before ‘approving’ and ‘releasing’, the senior employees must check the supporting documentation. 6. The paymaster (senior manager) carefully reviews the bi-weekly reconciliation of wages paid for the current wage period to the previous wage period. ϮϬϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 7. The company subscribes to Labourwatch, a quarterly journal that contains important information about any current or pending strike action and other labour-related threats to the industry. 8. Write access to the employee master file is restricted to the human resource manager’s senior administration clerk. 9. All individuals who apply to work in the payroll section must pass a test of competency (set by the company’s human resource department) on the payroll package used by the company before they can be considered for the position. 10. The company uses a well-known payroll package, Payday, for processing the payroll. YOU ARE REQUIRED TO: Indicate which component(s) of internal control each action or procedure listed above (1–10) applies. Where you select control activity as the component, indicate the type of control activity you consider the action or procedure to be. ϵ͘ϯ ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. List three benefits of having wages paid by electronic funds transfer directly into employee’s bank accounts. (2) 2. Material misstatement of the wage expense is more likely to arise from fraudulent financial reporting than from misappropriation of assets. True or false? Explain. (2) 3. Give two terms that are used to describe ‘fictitious employees’. (1) 4. Identify three advantages a company will derive from changing from a clockcard system to a biometric reader to record the time worked by hourly paid employees. (3) 5. Physical verification of salaried employees is a test of controls. True or false? Explain. (1) 6. When an auditor performs a physical verification of wage employees, evidence pertaining to the existence assertion is being obtained. True or false? Explain. (1) 7. If a company pays wages below the minimum wage rate, is it fraud? Explain. (2) 8. Why would an auditor conduct a reverse physical verification, that is to say from employee to wage records? (1) 9. Payroll applications have embedded audit facilities. For example, the audit module could be programmed to perform reasonableness tests when salaries are processed and report on any exceptional items outside of given reasonableness ranges. True or false? Explain. (2) ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ ϮϬϯ 10. When testing the automated controls for payroll, testing who has access to the master file and who made changes to the master file during the financial period, should be included. True or false? Explain. (2) ϵ͘ϰ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Metalmade (Pty) Ltd is a manufacturing company with a labour force that is paid hourly. It is in rural KwaZulu-Natal. There is one entry/exit point to the factory and, on arriving or leaving work, each employee must ‘swipe’ his/her identity tag through the access machine situated at the entry/exit point. The access machine, which is linked into the company’s computer network, records the times of arrival and departure of each employee and calculates daily, normal and overtime hours worked for each employee. The transaction file of hours worked is processed against the master file to produce the payroll at the end of the wage period. Wages are paid every two weeks. Wages are still paid in cash as the labour force requires this. Each of the procedures, practices or policies listed below (1–8) is related to one of the components of internal control, that is to say: • control environment; • the entity’s risk assessment process; • information system and communication; • control activities; and • the entity’s process for monitoring the system of controls. 1. The pay-outs are conducted by StrongArm Security, the company that draws the cash from the bank, makes up the pay packets and transports the made-up pay packets to Metalmade (Pty) Ltd’s premises. 2. Access to the computerised employee records is restricted by user ID and password to the human resource manager and her senior administration clerk. The computer logs all changes. 3. The factory manager is responsible for checking and authorising overtime hours. Each morning he accesses the previous day’s overtime report and, after checking the hours worked, approves the hours on the system. The ability to approve the overtime is restricted (by user profile) to the factory manager. He cannot, however, alter the overtime hours reflected on the report. 4. The company operations manager receives a detailed monthly report on crime in the region from the local police-station commander. 5. The paymaster (senior manager) reviews the payroll and the reconciliation of wages paid for the current wage period to the previous wage period. When he is satisfied, he signs the document as part of the authorisation to transfer funds to StrongArm Security. 6. The company uses a suite of payroll software called Payout, which is compatible with SARS efiling. ϮϬϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 7. Before an administrative employee is offered employment in the payroll section, he must undergo testing to determine whether he can work under deadline pressure and whether working in an isolated rural environment will suit his personality. 8. At the end of every six months, a report is produced for the board of directors that deals with several matters pertaining to the payroll, for example: 8.1 production hours lost due to strikes and labour unrest; 8.2 employee turnover in the payroll section; 8.3 disciplinary matters relating to all employees; and 8.4 incorrect wage payments. YOU ARE REQUIRED TO: Identify the component of internal control to which each of the above procedure, practice or policy (1–8) relates. Where you have identified a control activity, indicate the type of control activity implemented – for example, approval and authorisation. (12) Note: ϵ͘ϱ Information given in each sentence (1–8) may relate to more than one component and more than one type of control activity. ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are currently a member of the team on the audit of PrismaFood (Pty) Ltd, a company with a large labour force. You have gathered the following information about the payroll and personnel cycle of the company: 1. To gain access to PrismaFood (Pty) Ltd’s local area network, an employee must enter his/her unique user ID and password. Since 2020, the company has been using a fully computerised payroll system. Any program changes to the payroll software must be authorised by the internal audit division of the company. For an employee to be successfully entered into the employee master file of the payroll system, a valid income tax number and identity number for the new employee must be entered into a designated field. Toni Puth, the human resource manager, frequently reviews the log of amendments to the employee master file. 2. All new employees of the company must write a computer-literacy test to demonstrate their computer skills, and training is provided to those employees who lack the required skills. 3. The company has a computerised (biometric scanner) timekeeping system; every morning, the factory manager reviews an on-screen report that lists the name and section of any employee absent from or late for work. Before the payroll is processed, the factory manager approves the schedule of overtime hours recorded. The company’s network is linked to its bank via the internet; the bank’s software that enables this access and facilitates the payment of wages and salaries by EFT, is loaded on only two terminals at PrismaFood (Pty) Ltd. To effect ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ ϮϬϱ any EFT payment, the transfer must be ‘authorised’ by a senior employee and ‘released’ by a second senior employee (two-signatory principle). Khathu Ramabulana, the financial director, has the sole authority to ‘release’. Before he releases the salary EFT, he carries out a comprehensive review of the payroll, particularly regarding the effects of master-file amendments. 4. At the monthly directors’ meeting, a report on various statistics pertaining to the labour force is presented. This includes month-to-month comparisons of such things as time lost to labour disruption, disciplinary hearings, hours lost to sick leave etc. The report is discussed by the directors and any action required is minuted. YOU ARE REQUIRED TO: (a) Identify, and differentiate between, the general controls and automated application controls from the scenario. Where you have identified a general control, indicate the category of general control into which it falls. (10) (b) Explain briefly whether each control is a preventive or detective control. ϵ͘ϲ (10) ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ On the current audit of Peroxaid (Pty) Ltd the balance on the wages expense account for the year amounted to R3 936 124. You asked a junior trainee on the audit team to explain the assertions applicable to this account heading. He informs you that the shareholders are making the following assertions relating to this expense: Valuation: The value of wages paid for the year is R3 936 124. Completeness: All wages earned for the year are included in the amount. Existence: All employees who earned these wages exist at reporting date. Rights: Peroxaid (Pty) Ltd has the right to pay wages at hourly rates it sees fit provided it complies with labour law. YOU ARE REQUIRED TO: State, giving reasons, whether you agree with your fellow trainee accountant. ϵ͘ϳ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ You are on the audit team of Blooms (Pty) Ltd, a large seedling nursery. Where a client’s wage expense is material, your firm’s approach to the audit of wages is to carry out risk assessment procedures followed by conducting tests of controls and (usually) some substantive tests of detail and analytical procedures. The following procedures were carried out during the current audit of wages: 1. Observed the supervision of the clocking-in procedure one Monday morning on a surprise basis. Nursery workers are required to insert their clock cards into a clocking device when entering or leaving the nursery area. ϮϬϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. Inspected a sample of clock cards for the signature of a nursery foreman (there are 4), authorising the overtime hours reflected on the clock cards. 3. Enquired of the company’s human resource officer as to the disciplinary process followed by the company. 4. Traced the overtime hours on a sample of clock cards to the schedule of planned overtime, prepared by the nursery production manager. 5. Reviewed the prior year audit work papers to gain an understanding of the payroll system and discussed changes with the financial accountant. 6. Selected a sample of wage payments made and confirmed, by reference to the relevant tables, for example PAYE, that the correct deductions had been made. 7. Reperformed the calculation of net wages for a small sample of wage payments selected for detailed testing. 8. Inquired of the financial accountant as to whether any wage frauds had occurred during the year under audit. 9. Performed a comparison of wages for the current year to previous years’ wages by section (for example planting, pruning etc.) and by wage period. 10. Inspected the half-yearly wage rate increase schedule for evidence of the human resource manager’s signature authorising the schedule. 11. Inspected the company’s communication with the nursery staff relating to the recently introduced performance bonus scheme. 12. Attempted to process a test pack of clock cards through the system, some of which contained invalid data, for example 85 hours of normal time for the twoweek wage period. YOU ARE REQUIRED TO: (a) Indicate whether each of the procedures above (1–12), is a risk assessment procedure, substantive procedure or a test of controls. (8) (b) Where you have selected ‘test of controls’ in (a), indicate which control objective (validity, accuracy or completeness) the control is designed to address, and where you have selected a substantive test, indicate the assertion you are testing. (8) ϵ͘ϴ ;ϯϴŵĂƌŬƐϰϲŵŝŶƵƚĞƐͿ Tie-a-Fly (Pty) Ltd manufactures flies for fishing, fishing rods and accessories, which are exported worldwide as well as sold locally. The business has expanded rapidly over the last few years and as a result of increased demand for the company’s product, there has been a significant increase in the number of hourly paid employees. Most of the business’s products are made by hand and there are currently approximately sixty hourly paid employees. There are also 15 salaried staff, including the three directors of the company. ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ ϮϬϳ Although most of the accounting systems at Tie-a-Fly (Pty) Ltd are computerised (resident on a local area network) the wage cycle has always been manual due to the relatively small number of hourly paid employees. Until his recent departure to Mexico to run a fishing lodge, John Santana, formerly a director of the company, was responsible for all business computer (IT) aspects. This responsibility has now been delegated to Morcom Wallis, another director. However, by his own admission, Morcom Wallis does not have sufficient computer knowledge or skills and as a result, the company has decided to engage a small IT consultancy firm, Whizzkids Inc, to keep the LAN ‘up and running’ and assist Morcom Wallis with IT matters. The directors have also decided that the payroll cycle, both salaries and wages, should be computerised and, to get this underway, Morcom Wallis arranged a meeting with Whizzkids Inc to discuss various IT matters. At the meeting Morcom Wallis took detailed notes of what was discussed, firstly for record purposes and secondly because of his lack of knowledge. Not wanting to appear too ‘stupid’, he chose, instead of asking questions at the meeting, to write down anything he didn’t really understand! He has now come to you with the following queries: 1. In our discussions, the consultant mentioned general controls and application controls several times and emphasised that we must maintain a strong control environment. Can you explain the difference between general controls and application controls; what maintaining a strong control environment means; and how we do it at Tie-a-Fly? (8) 2. During the discussion, I wrote down a number of procedures the consultant mentioned, but I don’t know whether they are general controls or automated application controls. Can you help, please? 2.1 Management at the company must carry out background checks on any new staff we employ to work in the payroll section. 2.2 The clocking in and out of the hourly paid employees should be supervised. 2.3 All staff involved in the payroll section must be sent on a course to learn how to use the new software. 2.4 An exception report will be generated for any employee who has recorded more than 10 hours of overtime a week. 2.5 The factory manager must approve all overtime before it is worked. 2.6 Whizzkids Inc’s responsibilities in respect of the Tie-a-Fly network must be laid down in a contract. 2.7 A disaster recovery plan must be put in place and tested, for example, if the LAN goes down and the payroll cannot be run, how will the company pay wages? ϮϬϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2.8 Amendments to the wage employee master file must be authorised by myself and another senior staff member. 2.9 If an employee is dismissed, his or her user ID and password should be deleted from the system on dismissal. This is very important for employees in the payroll section. 2.10 The computer will generate a reconciliation of the current wage period to the prior wage period for the number of employees and net wages and deductions. (10) 3. The consultant also said that the payroll cycle software would be placed on the LAN and will be menu driven. I think I understand what this means, but I don’t quite understand how we are going to keep salary and wage information on the system confidential and protected from all the employees who work with other accounting systems which are on the LAN or, in fact, other individuals who may be in the offices. Can you explain? (12) 4. It seems that one of the risks we run by computerising our wages system is that it will be easier for employees to commit fraud. I understand that all employee details will be kept in an ‘employee master file’ and that when the computer calculates the gross wages for an employee, it will read the employee hourly rate of pay category from this master file – but how do we know that someone hasn’t made an unauthorised change to the pay-rate category in the master file? (8) YOU ARE REQUIRED TO: (a) Respond to Morcom Wallis’s queries as laid out in points 1 to 3 above. (b) Describe to Morcom Wallis, the controls that will need to be implemented to ensure that unauthorised (invalid) changes to the pay rate category are not made on the employee master file. See his query 4. (8) ϵ͘ϵ WZdϭ (30) ;ϯϰŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ ;ϱŵĂƌŬƐϲŵŝŶƵƚĞƐͿ Deepdiggers Ltd, a mining company, has a large workforce of around 5 000 workers, many of whom are migrant workers from rural regions and neighbouring countries. The company has a formal risk assessment process that includes a risk committee. The risk committee meets twice a year to identify and assess risks faced by the company and consider whether the risks are being appropriately responded to. The risks relating to human resources are always an item for discussion on the agenda. YOU ARE REQUIRED TO: Describe briefly five risks that a company such as Deepdiggers Ltd might face relating to its workforce. (5) ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ WZdϮ ϮϬϵ ;ϭϭŵĂƌŬƐϭϯŵŝŶƵƚĞƐͿ Magoo (Pty) Ltd has a workforce of approximately 100 hourly paid employees. Hours worked are recorded using a conventional clock card and clocking device system, but the preparation of the payroll is computerised, and wages are paid by EFT. Wages are paid every two weeks. After the wage period, the factory administration clerk, Joel Jantjies, carries out various control procedures on the clock cards for the preceding two weeks, batches them, and takes them to Brandon August the wage clerk, for entry into the system. YOU ARE REQUIRED TO: (a) Describe the control procedures Joel Jantjies should carry out on the clock cards before batching them. (3) (b) Describe the batch controls that should be carried out on the clock cards up to the point when they are accepted by Brandon August. (8) WZdϯ ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ Glasscon (Pty) Ltd, a manufacturer of glass containers, has recently been awarded a major contract which will require the company to employ approximately 30 new hourly paid factory workers. With recruiting procedures completed, the newly appointed personnel must be added to the employee master file. The company’s payroll cycle is fully computerised. YOU ARE REQUIRED TO: Describe the controls that should be in place to ensure that only validly appointed new employees are added to the employees’ master file and that all details pertaining to the additions are accurately and completely recorded. (12) WZdϰ ;ϲŵĂƌŬƐϳŵŝŶƵƚĞƐͿ Hourly paid employees at Bingo (Pty) Ltd record their hours worked on clock cards. Each employee’s hours are then entered onto the system by the wage clerk. YOU ARE REQUIRED TO: Briefly describe six program (automated) controls that will contribute to ensuring that hours are only entered by the wage clerk for valid employees; and that hours entered are accurate and complete. (6) ϵ͘ϭϬ ;ϭϯŵĂƌŬƐϭϲŵŝŶƵƚĞƐͿ You have been assigned to audit salaries on the audit of Libvest Ltd, a large, listed investment company. The company has approximately 5 000 employees, located in ten offices around the country. As a result of information gathered when conducting ‘identifying and assessing the risk of material misstatement’ procedures, it has been ϮϭϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ decided that testing for fictitious employees should be carried out. You have been requested to select a sample of employees for verification. All salaried employees are listed in the salaried employees master file. The master file contains inter alia the following fields: 1. surname and initials; 2. bank account number (salaries are paid by EFT); 3. taxation reference number; 4. identity number; 5. grade, for example grade 1 – company director, grade 12 – junior clerk; 6. date of employment; 7. date of resignation, dismissal, retirement; 8. home address; and 9. work location, for example Cape Town office. Your senior has instructed you to extract any reports/samples from the salaried employees master file, which could be used to gather evidence that might assist in determining whether the master file includes any fictitious employees, for example, lists of employees (if any) whose records on the master file reveal information which may raise uncertainty as to their existence as valid employees of Libvest Ltd. YOU ARE REQUIRED TO: (a) Briefly describe the reports/lists/samples you would extract to comply with the instructions from your senior. Explain briefly why each list or sample would be selected. Include only reports/samples which could be extracted using the fields listed above (1–9). (8) (b) List the CAATs procedures you plan to perform as part of your audit, and the reason why you would include each CAATs procedure. (5) ϵ͘ϭϭ ;ϰϱŵĂƌŬƐϱϰŵŝŶƵƚĞƐͿ Your firm holds the appointment of auditor of Rubix Ltd, an industrial company. In the management letter resulting from the previous year’s audit, you raised several concerns with the directors relating to the company’s salaries system. Your evaluation of the salary application suggested to you that the controls over amendments to the employee master file were not adequate. In response to your report, the human resources director, Nate Frisk, had, at the time, concurred with your concerns and explained that the payroll system that the company had been using had become unsuitable as the total number of salaried employees had increased significantly. He had informed you that the company intended installing a new software package for the salaries application and introducing payment of salaries directly into employees’ bank accounts by electronic funds transfer. On your return to Rubix Ltd for the current year’s audit, you discovered that the new software package and the electronic fund transfer system have been successfully installed during the year. ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ Ϯϭϭ At Rubix Ltd the payment of salaries to the approximately 300 salaried employees is the responsibility of the salaries section within the human resources division. The section is headed by Morgan Govind, who has a team of six administration clerks. Morgan Govind reports to Sias Reyneke, the Human Resources manager, who reports to Nate Frisk. Your enquiries into the new salaries application revealed, among other things, the following: 1. Controls over master file amendments have been significantly improved. 2. To facilitate the payment of salaries by EFT, the banking details of each salaried employee are entered in the employee’s record on the employee master file. 3. The electronic funds transfer is effected over the internet. Rubix Ltd’s bankers have installed the necessary software and, as one of the controls initiated by the bank, the senior personnel who authorise transfers have been issued with random number generating devices. 4. Mary Topper, the financial manager, Sias Reyneke, and Nate Frisk have been issued random number generators to effect an EFT. Morgan Govind approves the final payroll which his staff has prepared. Approval is given on the system. YOU ARE REQUIRED TO: (a) Describe the conversion controls which would have been put in place by Rubix Ltd when converting to the new salaries application. (8) (b) Explain how random-number generator devices are used and why they are issued. (5) (c) Describe the controls that should be in place to confirm that changes to employees’ banking details on the employee master file are valid, accurate and complete. (12) (d) Describe the controls that should be in place with regard to the payment of salaries from the point where Morgan Govind approves the payroll on the system. Your answer should include a description of applicable access controls.(20) ϵ͘ϭϮ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ Hay Sixteen (Pty) Ltd is a wholesale distributor of agricultural products. Its accounting systems are computerised and are resident on a local area network. The following information pertains to the company’s computerised salary system: 1. All employees at Hay Sixteen (Pty) Ltd are salary earners. There are no hourly paid employees. 2. The company has a staff of approximately 75 employees. 3. All personnel matters are the responsibility of the company’s human resource section headed by Katherine Pear and staffed by Ian Patty and Kim Robbits. ϮϭϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 4. Derek Dark is the financial manager and he has overall responsibility for all accounting and financial matters. 5. All salaries are paid by electronic funds transfer on the last Friday of every month. 6. The employee master file is maintained by the human resource department along with all relevant supporting employee documentation. 7. EFT payments are made via the internet. The company’s bank has loaded its software onto its system to facilitate the payment of salaries by EFT and the downloading of bank statements and other documentation as required. There is also an enquiry facility on the company’s bank accounts. YOU ARE REQUIRED TO: Describe the automated application controls you would expect to find in place at Hay Sixteen (Pty) Ltd to ensure that salary payments are valid, accurate and complete. (40) ϵ͘ϭϯ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Canned Heat (Pty) Ltd manufactures heaters of various kinds, including domestic appliances and industrial heating units. You have been included in the team for the current year-end (31 July) audit and are delighted to have been placed in charge of the audit of wages. As Canned Heat (Pty) Ltd is labour intensive, ‘wages’ is a significant expense. The company is a subsidiary of a listed company and there is a tight reporting deadline. While conducting risk identification and assessment procedures in late April, you ascertained the following: 1. No major changes in the accounting system and related control activities have occurred since the prior year’s audit. 2. Generally internal controls are satisfactory – 2.1 there is sound division of duties in the payroll and personnel cycle; 2.2 employee hours are recorded using a conventional clock-card system. A reliable software package is then used for the processing of wages and the production of the wage sheets and related documentation, including ‘period-to-period’ reconciliations; 2.3 wages are calculated and paid (by EFT) every two weeks; and 2.4 the personnel department maintains a file for each employee in which important copies of documents pertaining to the employee are filed, for example employment contract, notification of wage rate and increases etc. 3. The company is split into four manufacturing divisions, each with several cost centres. ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ Ϯϭϯ 4. Month-to-month production is reasonably constant throughout the year (inventory on hand is built up gradually throughout the year to meet winter sales). 5. The wage employee master file contains fields for name, personal details (for example, identity number, tax reference number), grade, division, cost centre, relevant dates, employment, resignation/dismissal, earnings and deductions, and current week year to date. Your firm’s audit software (good analytical facilities) is compatible with the client’s system. Your scrutiny of the prior year audit work papers revealed that the further audit procedures conducted on the prior year audit of Canned Heat (Pty) Ltd’s wages were based on the following plan: • A single two-week wage period in May was selected (in prior years, the overall audit strategy included an interim audit held during May). • During these two weeks, tests of controls on the payroll system were conducted. • The wage payroll for the selected period was substantively audited. • Using this (audited) two-week period as a base period, analytical procedures were conducted on the wage periods before the base period. • At the year-end audit, wages paid after the base period were also compared to the base period. Your firm’s strategy always includes testing for fictitious employees at clients where ‘wages’ is a major expense. The prior year’s audit had been efficiently and effectively conducted. As part of the supervisory process at your firm, trainees are required to discuss the further audit procedures they plan to conduct with the audit manager before commencing the procedures. You decided it would be appropriate to adopt the same plan as the prior year’s audit on the current audit of wages. At your meeting with the manager held at the end of April, he posed the following questions: (a) How do you justify your decision to adopt the prior year’s plan (as explained above) for the current year’s wage audit of Canned Heat (Pty) Ltd? (7) (b) What procedures do you intend to carry out to ensure that there are no fictitious employees on the payroll for the selected two-week period? (8) (c) Can you broadly describe the substantive tests of detail you will carry out on the selected period’s payroll. (8) (d) Can you outline briefly the analytical procedures you intend to conduct on wages once you have carried out the detailed testing of the base period. (3) (e) What is our firm’s responsibility in respect of the prevention and detection of wage fraud at Canned Heat (Pty) Ltd? (4) YOU ARE REQUIRED TO: Respond to the questions posed by your manager. Ϯϭϰ ϵ͘ϭϰ WZd 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ;ϮϯŵĂƌŬƐϮϴŵŝŶƵƚĞƐͿ ;ϳŵĂƌŬƐϵŵŝŶƵƚĞƐͿ You are the auditor of Eventz (Pty) Ltd, a leading event-management company. Eventz provides specialised event planning and coordinating services across South Africa, offering gourmet catering and world-class entertainment. Eventz employs a relatively small workforce in different divisions. The company’s employees include salaried employees (paid monthly) and wage employees (paid weekly, for example employees working as crew members, who are responsible for the set up and clean up at events). The company has a February year-end. You have already performed risk assessment procedures and the risk of material misstatement for salaries and wages has been assessed as low. As a result, you have decided to simply perform analytical procedures to obtain comfort over these accounts. YOU ARE REQUIRED TO: Describe the analytical procedures that you will perform over salaries and wages at Eventz (Pty) Ltd. (7) WZd ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ The analytical procedures that you performed on the salaries and wages at Eventz (Pty) Ltd (in PART A above) indicated a significant increase in salaries from October. Furthermore, you noted that wages paid for the periods from October to December were almost double that of the other periods of the year. The salary reconciliations you inspected relating to this fluctuation, indicated that 12 new salaried employees were employed in October. Similarly, the wage reconciliations indicated about 30 additional wage workers for the periods indicating the fluctuations, as well as a significant increase in overtime hours worked. You discussed these fluctuations with management, who informed you that Eventz (Pty) Ltd gained a big client, necessitating the company to employ more employees, dedicated to rendering services to the client. Management further explained that Eventz (Pty) Ltd had focused a lot on promoting year-end functions combined with teambuilding activities. These functions proved to be very popular and resulted in a huge influx in bookings for events for October to December; hence the additional wage workers were employed on short-term contracts. Additionally, wage workers were required to work longer hours, to accommodate the function attendees, resulting in increased overtime paid. YOU ARE REQUIRED TO: Describe the procedures that you would perform to corroborate the explanations you have obtained, from the reconciliations and management, for the fluctuations as indicated in the scenario. (10) ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ Ϯϭϱ WZd ;ϲŵĂƌŬƐϳŵŝŶƵƚĞƐͿ After having performed further audit procedures at Eventz (Pty) Ltd (in PART B above), you are now concerned that some of the employees on the payroll of the company may be fictitious. YOU ARE REQUIRED TO: Describe the procedures you would perform to confirm that the employees on the payroll of Eventz (Pty) Ltd are not fictitious. You should also include any procedures that you would perform using audit software. (6) ϵ͘ϭϱ ;ϰϮŵĂƌŬƐϱϭŵŝŶƵƚĞƐͿ FlickNet Ltd is a South African subscription streaming service company based in Johannesburg. The company has eight board members. Executive directors receive monthly salaries and the executive directors who qualify for a bonus receive their bonus with their December salary. All executive directors belong to a group medical scheme and retirement fund, to which FlickNet Ltd contributes. Non-executive directors are paid a fee for their services (for example attending meetings and serving on committees etc.). The directors’ remuneration for the year ended February 2023 was as follows: Executive directors Salary Retirement and medical contributions Bonus Total R R R R 2 500 Mr Dlamini 7 500 820 Mr Khumalo 3 100 350 3 880 Mr Mthembu 3 900 460 4 840 Mr Botha 3 900 530 4 630 18 400 2 160 R R Total Non-executive directors Mr Chauke 2 500 R 11 110 24 460 R 1 600 1 600 750 750 Mr Cele 1 000 1 000 Total 3 350 Mr Pretorius 0 0 3350 One of the directors, Mr Dlamini, has asked you to explain to him the disclosure requirements with regard to directors’ remuneration, as he feels it is not fair that his income is published for all to see. Ϯϭϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Briefly criticise the composition of the board of FlickNet Ltd with reference to the King IV Code on Corporate Governance. (4) (b) Respond to Mr Dlamini’s question in terms of King IV Code and the Companies Act by (i) briefly explaining to him the need for the disclosure of director’s remuneration; and (ii) providing him with a detailed breakdown of all aspects of director’s remuneration that should be disclosed. (20) (c) Formulate the substantive audit procedures that you would perform with regard to the director’s remuneration of FlickNet Ltd. (18) ϵ͘ϭϲ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Drive360 (Pty) Ltd is a company that provides on-demand grocery shopping and delivery services. The company employs a number of ‘shoppers’ that purchase groceries on behalf of its customers and deliver the groceries to the customer’s doorstep on a Drive360 motorbike. Shoppers are paid their wages on a bi-weekly basis. The company uses a reputable payroll package loaded onto the personal computer of Josephine Mguni, the payroll administrator of Drive360. Wages are paid via EFT. When the need arises for the employment of additional shoppers, Helen Boswell, the head shopper, gives the head of personnel (Lucy Lloyd) a call and requests additional shoppers to be appointed. Helen usually also recommends candidates whom she deems suitable for the job. Due to the fast pace of the business, Lucy Lloyd usually adheres to Helen’s requests almost immediately, as delays will result in unhappy customers. Twice a year, Helen will request an increase to the pay rates of the shoppers based on what she confirms with shoppers working for competitors. It is company policy that these requests should be submitted in writing for approval. Similar to the employee appointment requests, Lucy Lloyd also approves these requests without much delay, as she does not see the point of arguing about pay rates if Helen has already confirmed the rates with what she views to be the ‘market norm’. YOU ARE REQUIRED TO: (a) Indicate which controls you would expect Drive360 (Pty) Ltd to have in place over the payment of wages by EFT. (12) (b) Identify weaknesses and make recommendations regarding the appointment practices and pay-rate adjustments at Drive360 (Pty) Ltd. (8) ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ ϵ͘ϭϳ Ϯϭϳ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ LuxElect (Pty) Ltd is a global appliance company that manufactures and sells various types of vacuum cleaners and is based in Benoni. The human resources department of LuxElect is responsible for the information on the employees master file of the company. When a new employee takes up employment at LuxElect, the employee visits the human resource department to give one of the two clerks working in the department (Mr Hoover or Ms Dyson) verbal instruction to add them to the system. Mr Hoover or Ms Dyson obtains all the necessary information from the employee (for example ID document and letter of appointment) and enters the information onto the system by using their joint login details. After the information has been captured, either Mr Hoover or Ms Dyson prints the information out, and writes a number in the top left corner of the first page, in order to keep track of the amendments to the employee master file. The alternate clerk then reviews the file of all amendments made to the master file to ensure that the information keyed in is complete and that the clerk has signed the printed document. YOU ARE REQUIRED TO: (a) Identify the weaknesses in LuxElect (Pty) Ltd’s process of adding new employees to its system. For each weakness, identify one risk related to the weakness. (10) (b) Make recommendations to improve the controls over the employee master file of LuxElect (Pty) Ltd. (5) ϵ͘ϭϴ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Venus Semenya is the audit manager on the audit of EcoSportz (Pty) Ltd. She is in the process of reviewing the audit work performed by one of the trainees on the audit team, Shaquille Bolt. The following audit procedures were performed by Shaquille Bolt, relating to the salaries and wages of EcoSportz (Pty) Ltd: 1. For a sample of employees, compare the gross salary used on the payroll system to the payslips of employees to ensure that the amounts are authorised. 2. For a sample of employees, compare bonuses paid to the general ledger, to ensure that the employee did indeed qualify for a bonus and that the payment is indeed valid and accurate. 3. For hourly paid employees, confirm that the hourly wage rate used for the employee is in accordance with the minimum wage as prescribed by the minister to ensure that it is in line with company policy. 4. For hourly paid employees, inspect any overtime reports and confirm that the rate used for overtime complied with company policy and labour requirements, for example overtime rate is normal time and a half, to confirm that the rate is authorised and disclosed properly. Ϯϭϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 5. Enquire from management whether the salary schedule is arithmetically accurate. 6. Trace amounts posted from the selected payroll to the relevant accounts in the general ledger to ensure occurrence. YOU ARE REQUIRED TO: Criticise each of the procedures (1–6) performed by Shaquille Bolt and provide him with guidance (coaching notes) on how to improve on these procedures. (12) ϵ͘ϭϵ ;ϱϬŵĂƌŬƐϲϬŵŝŶƵƚĞƐͿ Cucumber House (Pty) Ltd grows and sells cucumbers and other similar vegetables under environmentally controlled conditions (in hothouses) at their premises in the semi-rural area of Shongweni, near Durban. The majority of the company’s employees travel to Shongweni from surrounding residential areas daily. During the last 12 months, there has been a sharp increase in attacks on employees in which they have been injured and robbed of their wages. As a result, the hourly paid employees have requested that wages be paid directly into their bank accounts by means of electronic funds transfer (EFT). The workers’ representative committee has assured management that the employees who do not currently operate bank accounts are prepared to open bank accounts. Clarry Karrott, the financial manager of Cucumber House (Pty) Ltd, is willing to implement the payment of wages by EFT. Before doing so, he wishes to have the existing wage system reviewed as he believes that ‘some neglect has crept into the system’. He added that ‘as everyone is so busy and, without knowing too much about it, I’m sure an electronic funds transfer system would place us at greater risk of suffering a wage fraud.’ He has, therefore, asked you to evaluate the existing wage system and recommend improvements, along with any additional controls, for the implementation of the new EFT system. You commenced the assignment and have established the following about the existing system: 1. The company’s administration offices are situated at the farm in Shongweni. The general manager is Stu Croxley. 2. There are 40 hothouses and approximately 150 hourly paid employees responsible for planting, picking, pruning, irrigating and soil testing. Two salaried foremen are each responsible for 20 hothouses. The hothouse manager is Gideon Grower. 3. The premises are externally secured by an electric fence and there is a single manned gate through which vehicles and people can pass. There are two groups of 20 hothouses securely fenced off in ‘camps’ within the premises, each with a single entry/exit gate. ŚĂƉƚĞƌϵ͗WĂLJƌŽůůĂŶĚƉĞƌƐŽŶŶĞůĐLJĐůĞ Ϯϭϵ 4. Each employee is allocated to one of the two hothouse camps. To gain access to, or exit from the camp, he/she must activate a turnstile situated at the camp’s gate by entering his/her clock card into a time clock which also records the time of entry or exit, on the clock card. Clock cards are kept on racks situated on either side of the covered turnstile. 5. Employees are required to ‘clock in’ in the morning before 7:30 a.m. and ‘clock out’ at 3:30 p.m. Clocking in and out is supervised randomly. 6. The wage period runs from Thursday morning to Wednesday afternoon two weeks later. During the week before the commencement of each wage period, Tunzi Asraff, the wage clerk, draws a batch of blank clock cards, which he keeps in his office. He then prepares a new clock card for each employee using the previous period’s payroll as well as any written notification of hiring, dismissal or resignation received from Hermann Jerman (see point 8). Early (6 a.m.) on Thursday morning at the start of the wage period, Tunzi Asraff collects the completed period’s clock cards, keeping each camp’s cards separate. The new cards are then placed in the racks. 7. During the Thursday morning, Tunzi Asraff calculates the hours worked, both normal and overtime, on each clock card and enters the two totals in the appropriate spaces on the clock card. Then, using reputable packaged payroll software available on the company’s local area network, he keys in the hours worked for each employee to facilitate the processing of the week’s payroll. 8. All matters relating to personnel are dealt with by Hermann Jerman and his assistant, Martha Pritt, who make up the personnel section. If there is a new employee or an existing employee resigns or is dismissed, Hermann Jerman sends an internal memorandum notifying Tunzi Asraff of the employee’s details, such as name, staff number, rate of pay etc. Tunzi Asraff then adds the employee to the employee master file by accessing the relevant module of the payroll application. The same procedure applies where changes to an existing employee’s details are required, for example an employee’s grade. When an employee resigns, his record is left on the payroll in a non-active state. Although you mentioned the possibility of introducing some form of computerised timekeeping, for example biometric scanners, Clarry Karrott has indicated that the company wishes to retain the use of clock cards to record time but is prepared to bear the cost of the software/hardware necessary to facilitate the introduction of electronic funds transfer. They are not prepared to employ any additional staff. You have also established that the existing wage application software has a comprehensive range of programmed controls (some of which have not been enabled) and control capabilities and that it can produce a period-to-period reconciliation of wages paid. ϮϮϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: Draft a letter to Clarry Karrott recommending control procedures, both programmed (automated) and manual, which should be implemented: (i) to address the weaknesses in the functions of the existing wage system that will be relevant to the new wage system; and (ii) in respect of the electronic funds transfer system itself. You are not required to record the weaknesses in the system in your letter, but you must record the reasons for your recommendations. Do not concern yourself with the payment of deductions to third parties, for example PAYE to SARS. (50) ,WdZ ϭϬ dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ͗ WƵƌĐŚĂƐĞƐ͕ĐƌĞĚŝƚŽƌƐĂŶĚĂĐĐƌƵĂůƐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 10.1 Short questions 10 marks 10.2 Short and longer discussion questions 35 marks 10.3 Short questions 23 marks 10.4 Application and short discussion – Identify business risks; Describe documentation; Determining reordering levels; Classify as risk assessment procedures or tests of controls 25 marks 10.5 Application – Classify controls 12 marks 10.6 Application, discussion and short questions – Weaknesses in acquisition cycle; Short questions on audit tests and approach 40 marks Application and discussion – Weaknesses in acquisition of inventory 35 marks 10.8 Multiple-choice questions 15 marks 10.9 Application and discussion – Assertions; Controls over preparation and approval of payment schedule 22 marks Application and discussion – Improvements to the ordering and receiving function 40 marks 10.7 10.10 continued ϮϮϭ ϮϮϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 10.11 10.12 10.13 10.14 10.15 10.16 10.17 10.18 10.19 10.20 Description of content of the question Total marks Application and discussion – Weaknesses in acquisition and payments cycle 40 marks Application and discussion – Substantive procedures on creditors reconciliations 32 marks Application and discussion – Control environment; Control activities; Controls of EFTs; Toxic combinations 37 marks Application and discussion – Risk of material misstatement; Application controls over purchase orders; Internal controls over new suppliers; Audit procedures on reconciliations; Risks and control activities relating to receiving of goods 58 marks Application and discussion – Creditors confirmations; Risk assessment procedures; Audit procedures on trade creditors and accruals 32 marks Application and discussion – Control weaknesses and recommendations 42 marks Application and discussion – Control weaknesses 45 marks Risk of material misstatement; Application controls; Substantive procedures on accounts payables and accruals; Automated application controls over exchange rates used 44 marks Application and discussion – Overall response to risk of fraud; Substantive procedures on purchases 15 marks Application and discussion – Analytical review; Comparing amounts; Vouching unusual items/ fluctuations 20 marks ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ ϮϮϯ ϭϬ͘ϭ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ The following lists identify a number of the departments and documents at Steelworks (Pty) Ltd, a supplier of steel products. Departments Documents 1. Receiving (warehouse) 1. Purchase invoice 2. Despatch (warehouse) 2. Internal sales order 3. Marketing 3. Purchase order 4. Administration (warehouse) 4. Payroll 5. Buying/ordering 5. Delivery note (company) 6. Accounting 6. Delivery note (supplier) 7. Human resources 7. Goods received note 8. Wages 8. EFT requisition 9. Inventory requisition YOU ARE REQUIRED TO: (a) Identify, in order, the departments which would be involved in the acquisition of and payment for credit purchases in this company. (2) (b) For each department identified, indicate which documents, if any, would be used/generated. (4) (c) Indicate, with a brief explanation, the sequence in which the documents would be used. (4) ϭϬ͘Ϯ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. Describe a company’s overall objectives concerning the acquisition of goods and the payment of the goods acquired. (3) 2. Provide two examples of how the misappropriation of company assets might occur in the acquisition and payments cycle. (3) 3. Distinguish between a ‘reorder level’ and a ‘reorder quantity’. 4. Knightclubs (Pty) Ltd imports golf equipment. At the financial year-end you selected a small number of foreign creditors as part of your valuation testing. Describe the procedures you would carry out to verify that the foreign creditors balances have been included at appropriate amounts. (4) 5. Omni (Pty) Ltd has a computerised ordering system but does not use all the facilities offered by the software. Currently, the order clerk creates a batch of purchase orders (based on requisitions from the store’s controller) on his computer. (3) ϮϮϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ He prints the purchase orders and takes them to the senior buyer to be approved. However, on a fair number of occasions, the senior buyer deems it necessary to make changes to the orders. This means the purchase order must be cancelled and a new order created and printed. It has been suggested to the senior buyer that he could approve the purchase orders (on screen) on the system, which would be much more efficient. He is, however, sceptical, as he doesn’t understand how the ordering clerk would be prevented from creating and approving an order, or how any changes he wants to make will be executed in a controlled manner. Explain to the senior buyer how on-screen approval would work and how his concerns would be addressed. You may assume that the software has been designed to facilitate on-screen approval. (7) 6. Joe Powder, an employee at Greenstem (Pty) Ltd, is being trained for a supervisory position in the creditors division. He has approached you with the following question: ‘What controls should be in place to prevent an employee from calling up the creditors master file and reducing the balance owed by a friend, for example, or deleting the creditor’s entire record from the file?’ (6) 7. Explain, using an example related to the acquisition and payments cycle, the difference between the following two control activities: (i) segregation of duties; and (ii) isolation of responsibilities. 8. (4) Briefly discuss whether management claiming VAT on purchases which did not occur may constitute a reportable irregularity. (5) ϭϬ͘ϯ ;ϮϯŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. State the two major activities of the acquisitions and payment cycle and describe what each of the activities sets out to achieve. (3) 2. List three ways in which a company might pay its creditors. (2) 3. Describe two important divisions (segregations) of duty in the acquisition phase of the cycle. (2) 4. The acquisitions and payment cycle links with the inventory and production cycle. True or false? Justify. (2) 5. If a company has an ‘approved supplier’ list from which they make purchases, what should a supplier be evaluated for before being placed on the ‘approved supplier’ list? (2) 6. What is the most common method of fraudulent financial reporting relating to the acquisitions and payments cycle? (1) ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ ϮϮϱ 7. List three different ways in which the assets of a company may be misappropriated in the acquisitions and payment cycle. (3) 8. Which assertion(s) is affected by: 8.1 Omitting certain creditors balances at year-end? 8.2 Recording the purchase of goods on credit for the personal use of the directors as company expenditure just before year-end? 8.3 Using the wrong conversion rate on a foreign creditor’s balance at yearend? (3) 9. Categorise each of the following procedures as a test of controls or a substantive test: 9.1 Observed the receiving clerk counting goods delivered to the company. 9.2 Inspected the supporting documentation for a payment to a creditor to confirm that the documents had been stamped in some manner so that they could not be used to support another payment. 9.3 Reperformed a creditors reconciliation. (3) 10. Describe an automated application control that would prevent duplicate suppliers on the system. (2) ϭϬ͘ϰ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ WZd ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Nitemoves (Pty) Ltd is a manufacturer of security equipment including certain items that are subject to government legislation (controlled substances are used in manufacture). The company’s head of procurement, Ms Moagi, is focused on running a smooth operation whereby raw materials or parts are always at optimum levels and the quality of goods received is of the highest standard. YOU ARE REQUIRED TO: (a) Indicate the business risk associated with the ordering function of a company such as Nitemoves (Pty) Ltd. (5) (b) Briefly explain what requisitions and purchase order forms are. (c) Explain how the warehouse department will determine when goods are required where a computerised perpetual inventory system is used. (3) (2) ϮϮϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ WZd ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ The following procedures relating to the acquisitions and payments cycle were carried out during the audit of Nitemoves (Pty) Ltd. YOU ARE REQUIRED TO: Indicate whether each of the procedures listed below (1–15) is a risk assessment procedure, a test of controls or a substantive test. (15) 1. Inspected a sample of inventory (purchases) requisitions for the authorising signature of the production foreman. 2. Discussed the stages and methods of production of the company’s products with the production manager. 3. Observed the goods receiving clerk as he counted and checked a delivery of goods from a supplier. 4. Inspected a sample of supplier invoices to determine whether orders were placed with approved suppliers only. 5. Enquired of the operations director as to any amendments to the regulations pertaining to the purchase of controlled substances used in production by the company. 6. Inspected the same sample as used in 4 above to confirm that the invoices were all made out to Nitemoves (Pty) Ltd. 7. Identified any debit balances on the list of creditors at year-end and, by enquiry of the financial controller, established the reason for the debit balance. 8. Enquired of the financial manager whether any of the company’s purchase requirements were put out to tender. 9. Reperformed the reconciliation of the creditors control account in the general ledger to the creditors ledger. 10. Inspected the work papers for attendance at the year-end inventory count to identify any instances of physical inventory materially exceeding recorded inventory per the perpetual inventory. 11. Enquired of the financial manager whether any purchases were made from related parties. 12. Positively circularised a selection of creditors. 13. Evaluated a detailed description of the newly implemented EFT system for the payment of creditors. 14. Selected a sample of purchases from the purchase journal for the month after year-end and by inspection of the date on the corresponding supplier delivery note and goods received note, confirmed that the goods were received after year-end. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ ϮϮϳ 15. Obtained a comprehensive list of all employees who had access privileges to the EFT facility and inspected the extent of the privileges given to each. ϭϬ͘ϱ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Consider each of the following policies/procedures/activities related to the acquisitions and payment cycle at Blackcharge (Pty) Ltd, a large industrial equipment supply company. YOU ARE REQUIRED TO: Indicate whether each of the policies/procedures/activities below (1–12) is a general control, IT general control, automated application control or manual review of an automated application control. (12) Note: The policies/procedures/activities listed below are in no particular order. Consider each one separately. 1. Each morning, after careful scrutiny of the inventory requisitions to be sent to the ordering department, the warehouse manager signs each requisition. 2. All Blackcharge (Pty) Ltd employees are required to attend a business-ethics workshop annually. 3. Blackcharge (Pty) Ltd places orders with approved suppliers only. Each supplier has a supplier code, and if the ordering clerk does not enter a valid code when creating an order, she cannot proceed with preparing an order. 4. As part of the acquisitions and payments cycle, senior and middle management meet regularly with the company’s risk committee to discuss operational supply risks in its industry. 5. Once the ordering clerk has processed the requisitions from the warehouse, the file of purchase orders must be approved by the senior buying officer. Write access to the approval function is restricted to the senior buyer. 6. Each year, a systems analyst from Blackcharge (Pty) Ltd’s IT department meets with employees in the acquisitions and payments cycle to explore and suggest changes to the application software that could improve the cycle’s efficiency and effectiveness. 7. Any proposed changes arising out of (6) above, must be, inter alia, evaluated by Giles Jacobs, the financial accountant, internal audit, and the IT manager. 8. When Blackcharge (Pty) Ltd receives an invoice, it is matched and crosschecked to the corresponding order, supplier delivery note, and goods received note. 9. Before any employee in the acquisitions and payment cycle can access the computer system, he/she must identify him/herself and authenticate him/herself. ϮϮϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 10. When goods ordered are delivered by a supplier, the goods receiving clerk must enter Blackcharge (Pty) Ltd’s order number (taken from the supplier’s delivery note) onto the system. This will bring details of the order onto the screen in the form of a goods-received note (GRN). 11. To effect an EFT payment to a trade creditor, Silent Mthembu, the senior creditors manager must authorise the payment file (on the system), and Giles Jacobs, the financial accountant, must release the payment. 12. Once a week, a log of all purchase orders that have been outstanding for longer than ten working days is printed and followed up on by the ordering clerk. ϭϬ͘ϲ ;ϰϬŵĂƌŬƐϰϵŵŝŶƵƚĞƐͿ WZd ;ϯϮŵĂƌŬƐϯϵŵŝŶƵƚĞƐͿ C-Saw (Pty) Ltd is situated in East London. The company manufactures outdoor play equipment for children, for example swings, jungle gyms, motorised go-carts etc. Somewhat concerned about the internal controls at the company, the newly appointed financial manager, Alonso Rossi, has requested you to evaluate the internal controls in the acquisitions and payments cycle. By enquiry of employees in the cycle, an inspection of relevant documentation and observation of the activities in the cycle, you have established the following: 1. The company manufactures its products according to production schedules compiled by the factory manager. At least 15 working days prior to a production run being scheduled to commence, the factory manager gives a copy of the production schedule and a list of raw materials and parts, for example paint, tubing, motors, to Shamus Rennie or Lukas Radebbe, the administration clerks in the cycle. These documents are sequentially numbered and signed by the factory manager. 2. Using the list of raw materials and parts, the administration clerks write out twopart (one white, one pink) sequentially numbered purchase orders for the items required. Having decided on the supplier with whom they wish to place the order (the decision is based on personal preference), they mail the original (white) copy of the order to the supplier and retain the second (pink) copy in a pending (temporary) file. The order is also cross-referenced to the corresponding production schedule and once the order has been placed, the production schedule is returned to the factory manager. 3. In addition to purchasing raw materials and parts per the production schedules, the administration clerks regularly purchase parts and raw materials when suppliers offer special/promotional deals. A two-part purchase order is also made out for these purchases. 4. C-Saw (Pty) Ltd has a large physically secure warehouse in which raw materials and parts and finished goods are separately stored. Clint Castro, the warehouse ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ ϮϮϵ supervisor, and his team of three warehouse clerks are responsible for the custody of all inventory. C-Saw (Pty) Ltd has a secure receiving bay adjoining the warehouse. 5. Shamus Rennie and Lukas Radebbe are located in an office next to the receiving bay so that they can receive the goods that have been ordered. When a supplier’s truck arrives to make a delivery, either of the two will extract the second (pink) copy of the purchase order from the pending file. As the goods are offloaded by the supplier into the receiving area, whoever is receiving the goods will tick off each item on the pink purchase order and sign the supplier’s delivery note. At a later stage, either Shamus Rennie or Lukas Radebbe compares the pink purchase order to the supplier’s delivery note to identify any items which have not been correctly delivered (for example over or under deliveries). The details of under-delivered items are entered onto a new purchase order which is sent to the supplier in the normal manner. 6. The original pink purchase order is placed on Clint Castro’s (the warehouse supervisor) desk so that he can enter the details of the goods received into the inventory records he maintains. The pink purchase order is then sent to the accounting department. At the end of the day the warehouse clerks move the goods from the receiving bay into the warehouse. 7. To streamline the purchase-order process, senior management at C-Saw (Pty) Ltd decided a few months ago to give all the employees who provide input to the purchase-order process access to the inventory and creditors’ master data file. This has resulted in saving a significant amount of time as everyone can continue with their own responsibilities. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the acquisitions cycle of C-Saw (Pty) Ltd based on the information given above. (32) Note 1: Your explanation should convey the reason why you believe the weaknesses identified are, in fact, weaknesses. Note 2: You are not required to make recommendations to address the weaknesses. WZd ;ϴŵĂƌŬƐϭϬŵŝŶƵƚĞƐͿ Bennie-Books (Pty) Ltd is a retailer of academic books. The company sells new as well as second-hand books. You are the manager on the audit of the company and you are currently in the process of reviewing a working paper on tests of controls over purchases, prepared by a trainee on the audit team. The following matters came to your attention: 1. The trainee concluded on the working paper: ‘As the tests of controls are functioning effectively, and risk of material misstatement has been set as low, there is no need to perform substantive testing.’ ϮϯϬ 2. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Most of the tests of controls performed by the trainee, were performed by means of observation. YOU ARE REQUIRED TO: (a) Relating only to matter 1, briefly explain to the trainee why her conclusion is not correct. You may assume that purchases are material. (2) (b) Briefly explain to her the two types of tests that substantive tests consist of. Provide one example of each. (4) (c) Briefly explain to the trainee why she cannot rely so heavily on observation as an audit procedure. (2) ϭϬ͘ϳ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You have recently been appointed to the newly created position of internal auditor at Streetwheels (Pty) Ltd, a wholesale company that supplies vehicle accessories to auto shops. Your first assignment was to review the acquisitions and payments cycle at Streetwheels (Pty) Ltd as part of an ongoing project to improve the accounting systems at the company. A systems description prepared by the company accountant was presented to you for your review. The systems description is as follows: 1. The company’s inventory is held in a single warehouse. The different products sold by the company are stored on shelves and in bins that are clearly marked with a description of the item and an inventory code. Percy Garmin is in charge of the warehouse. He is very knowledgeable and maintains the warehouse in a neat and organised condition. 2. Each week Percy Garmin works his way through the shelves and bins to identify ‘out of stock’ items and items that appear to be running low on quantity. Having completed this exercise, he prepares a warehouse requisition, (a preprinted, numerically sequenced document) by listing the inventory code, description and quantity of each item to be ordered. Percy Garmin decides on the quantities to be ordered based on his experience in the vehicle accessories market. Once he has completed the requisition, he signs and dates it, and drops it off with Arnold Image, the buying clerk. 3. The company uses preprinted, properly designed sequentially numbered purchase order forms. Each order form consists of three parts (the original and two copies) which are distributed as follows: 4. Original – sent to the supplier 1st copy – sent to the accounting department 2nd copy – filed in numerical sequence in the buying office. On receiving the weekly requisition from Percy Garmin, Arnold prepares orders for each item on the requisition. Where more than one item can be ordered from the same supplier, a single purchase order is made out to that supplier. The purchase orders are cross-referenced to the requisition. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϯϭ In choosing the supplier, Arnold Image refers to his list of regular suppliers, which he has built up over his seven years at Streetwheels (Pty) Ltd. Once he has completed a purchase order, he signs, scans and emails it to the supplier. He then stamps the original ‘confirmation of emailed order’ and posts it to the supplier. At the end of the week, he sends the first copy of each of the purchase orders to the creditors clerk in the accounting department, who files the purchase orders in a temporary file to await the supplier invoice. Arnold Image files the second copy in his office in numerical sequence so that he can follow up on any queries from suppliers. Preparing and placing orders (and following up on any queries from suppliers) takes up most of Arnold Image’s time, but when he is not busy, he helps out in the receiving department or the warehouse. Streetwheels (Pty) Ltd’s warehouse has a separate receiving area adjoining the warehouse. When a supplier arrives, a goods receiving clerk obtains a copy of the supplier delivery note from the driver making the delivery. He then checks the description and condition of the boxes being delivered against the supplier delivery note as they are offloaded into the receiving bay. Once this control has been carried out, he signs two copies of the supplier delivery note and retains one copy. The other copy is returned to the driver. All errors in delivery are clearly marked on both copies of the supplier delivery note and signed by the goods receiving clerk and the driver. The goods receiving clerk then move the goods into the warehouse, where the boxes are unpacked and the items placed on shelves or in bins. A photocopy of the supplier delivery note is made and retained in the receiving bay and the original (supplier delivery note) is sent to the creditors clerk in the accounting department. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the acquisition of inventory by Streetwheels (Pty) Ltd based on the information given above. Note: Your explanation should convey why you believe the weaknesses identified are, in fact, weaknesses. You are not required to make recommendations to address the weaknesses. (35) ϭϬ͘ϴ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer for each of the following questions (1–15): 1. In a typical acquisition cycle, which one of the following documents will be generated by the supplier? (a) Requisition. (b) Delivery note. (c) Remittance advice. (d) Goods-received note. ϮϯϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. Which of the following functions do not relate to the acquisitions and payments cycle? (a) Credit management. (b) Receiving of goods. (c) Ordering of goods. (d) All of the above relate to the cycle. 3. The record of the sequence of activities for a purchase transaction to be tracked from start to finish is referred to as (a) sequence testing; (b) document flow; (c) audit trail; (d) matching. 4. The initiation of a purchase order and the approval of the order are carried out by different people at BoysToys (Pty) Ltd. To which component of internal control does this relate? (a) The information system and communication. (b) The entity’s process for monitoring the system of internal control. (c) Control environment. (d) Control activities. 5. Besides the accuracy, valuation and allocation assertion, the assertions applicable to the trade creditors balance are (a) rights, completeness, existence and presentation; (b) completeness, occurrence, cut-off and classification; (c) obligation, existence, completeness, classification and presentation; (d) occurrence, accuracy, completeness and presentation. 6. The assertion relating to trade creditors generally considered to be most at risk from the auditor’s perspective is (a) occurrence; (b) cut-off; (c) existence; (d) completeness. 7. A trainee is vouching the purchase (transaction) of a large piece of machinery. What are the assertions relating to the purchase that the auditor should consider? (a) Occurrence, accuracy, existence and completeness. (b) Occurrence, cut-off, accuracy, completeness and classification. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ (c) Obligation, occurrence, valuation and classification. (d) Completeness, cut-off, classification, accuracy and valuation. Ϯϯϯ 8. The logging and follow up of amendments to the creditors master file are regarded as (a) a detective control; (b) a general control; (c) a preventive control; (d) an output control. 9. The intentional understatement of the trade creditors balance in the financial statements is an example of (a) management override; (b) collusion; (c) fraudulent financial reporting; (d) misappropriation of assets. 10. On the audit of Snapshot (Pty) Ltd, the auditor inspected the agreements for two new loans that the company had raised, to determine, inter alia, whether the agreements contained any loan covenants relating to the working capital ratios. This procedure would be regarded as (a) an analytical procedure; (b) a substantive procedure; (c) a risk assessment procedure; (d) a test of controls. 11. To test for the completeness of trade creditors, the direction of testing will be (a) from the list of creditors balances making up the creditors balance to source documents; (b) from source documents and records to the list of creditors balances; (c) an equal combination of 11(a) and 11(b); (d) none of the above. 12. With regard to the payment of creditors by EFT, physical devices such as ‘dongles’ and random number generators, which produce ‘one-time’ passwords, are regarded as additional (a) identification controls; (b) authorisation controls; (c) authentication controls; (d) approval controls. Ϯϯϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 13. On an audit where the auditor has assessed the risk of material misstatement of the trade creditors as low, the auditor may justifiably decide (a) not to perform any substantive testing at all; (b) not to perform any substantive testing at all provided he has persuasive evidence that the controls had operated effectively for the period under audit; (c) perform only analytical procedures provided he has persuasive evidence that the controls had operated effectively for the period under audit; (d) not to perform any ‘further’ or ‘other’ procedures. 14. In the context of the audit of trade creditors, which of the following is most likely to be considered a significant risk by the auditor? (a) A large increase in the trade creditors balance. (b) An increase in the number of approved suppliers. (c) A discernible trend by suppliers to tighten the terms of credit they allow. (d) A large increase in the number of purchase transactions being entered into with related parties. 15. When conducting audit procedures on the trade creditors account balance, the extent of the testing will be determined by (a) the allocation in the budget for the audit; (b) the audit strategy; (c) the assessed risk of material misstatement; (d) the assessed risk of material misstatement and the results of the tests of controls. ϭϬ͘ϵ ;ϮϮŵĂƌŬƐϮϳŵŝŶƵƚĞƐͿ WZd ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ The final trial balance of Croxley (Pty) Ltd for the current financial year-end 31 March 2022 reflects the following. Trade accounts payable R7 211 313 You asked a junior trainee working on the audit of Croxley (Pty) Ltd, what the assertions pertaining to trade accounts payable are. He answered as follows: Croxley (Pty) Ltd is obliged to pay suppliers for the goods Occurrence: purchased. Completeness: All orders for goods placed by year-end had been filled by suppliers. Measurement: I don’t know what this means, but I know it is an assertion. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϯϱ Materiality: The trade accounts payable at 31 March 2022 balance is material. Existence: Croxley (Pty) Ltd has not understated its trade accounts payable. Fair presentation: The trade accounts payable balance is fairly presented YOU ARE REQUIRED TO: Comment on your junior trainee’s understanding of the financial statement assertions. Your answer must convey that you understand the assertions applicable to trade accounts payable. WZd ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ Croxley (Pty) Ltd pays its creditors monthly via electronic funds transfer. A payments schedule is prepared by the creditors clerk, setting out the amounts due for payment, based on unpaid invoices listed on the company’s system, ‘Neon-Accounting’. YOU ARE REQUIRED TO: Describe the controls you would expect to be in place over the preparation and approval of the payments schedule at Croxley (Pty) Ltd. Note: You may assume that creditors’ statements are only received and reconciled after payment has already been made. (12) ϭϬ͘ϭϬ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ You have recently been employed as a junior accountant by Footprint (Pty) Ltd, a wholesaler of sports shoes. Your first responsibility is to review the acquisitions and payments cycle to identify weaknesses in the cycle. Zakes Khumalo, the financial accountant, has told you that the company has been experiencing problems with overstocking, substandard inventory, inventory shortages and, possibly, incorrect or invalid payments to creditors. You have obtained the following information: Staffing The buying department is staffed solely by Andy Hall, the company buyer, who has been with the company for many years. The warehouse manager, Ram Sarwan, has a staff of six warehouse assistants who are responsible collectively for receiving deliveries from suppliers, picking and dispatching sales orders, and generally maintaining the warehouse. Ordering Andy Hall is responsible for placing orders with suppliers. In deciding what items and quantities to order, Andy Hall refers to a record he keeps of the orders he placed during the previous year. He also places orders with suppliers when they have promotional sales or ‘specials’. Ϯϯϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Branded sports shoes are purchased from the local importers of the brand (that is to say, they are not imported directly by Footprint (Pty) Ltd itself) while Andy Hall decides on where to purchase other footwear. Footprint (Pty) Ltd does not maintain perpetual inventory records. Andy Hall regularly visits footwear manufacturers to look at their products and is often visited by sales representatives from shoe companies. Although he is extremely busy, he has consistently declined the offer by management of Footprint (Pty) Ltd to appoint an order clerk in the buying department. Andy Hall makes out a preprinted two-part (original plus copy) order form for all orders. The original order is either sent by post to the supplier, left with a supplier when Andy Hall visits the supplier, or given to the supplier’s sales representatives when they call on Footprint (Pty) Ltd. The copy remains in the order book. Prices for branded shoes are set by the importer; for products from other suppliers, prices are negotiated by Andy Hall. Receiving When goods from suppliers are delivered to Footprint (Pty) Ltd, any one of the six warehouse assistants will receive the goods. To receive the goods, the warehouse assistant checks the number of boxes delivered against the supplier delivery note, signs the delivery note and retains a copy. Where the boxes delivered do not agree with the supplier’s delivery note, the difference is recorded on the delivery note and signed by both the warehouse assistant and the supplier’s delivery personnel. The boxes are left in the receiving area until the warehouse assistants have time to move them into the warehouse where the goods are unpacked and stored. This usually occurs a day or two later. Although Footprint (Pty) Ltd’s accounting records are kept on computer, the company does not wish to ‘computerise’ the ordering or receiving functions. The company is prepared to incur reasonable expenditure arising from your recommendations including the cost of employing an order clerk if you make such a recommendation. YOU ARE REQUIRED TO: Recommend improvements to the ordering and receiving functions of the acquisitions and payments cycle at Footprint (Pty) Ltd, based on the information given above. For each recommendation, you are required to provide reasons/justifications for the recommendation. There may be more than one reason/justification for a single recommendation. Note: Structure your answer under the following headings: 1. Ordering function (25) 2. Receiving function (15) ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ ϭϬ͘ϭϭ Ϯϯϳ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ Clearcut (Pty) Ltd is a company that manufactures a large range of garden equipment, for example lawn mowers, edge trimmers etc. The company purchases all its parts for manufacturing from local suppliers. One of your firm’s clients has entered into negotiations for the purchase of Clearcut (Pty) Ltd and, as part of the exercise, your firm has been asked to evaluate the company’s internal control systems to determine whether costs will need to be incurred to rectify any weaknesses. All cycles are computerised and are run on a local area network (LAN). You have been requested to evaluate certain functions of the acquisitions and payments cycle, and have obtained the following information: Ordering 1. A master file is maintained for the extensive range of parts used in assembly (manufacture). Each record in the master file contains a reorder level and a reorder quantity field for that part. Each morning Gilbert Simoni, the parts store administration clerk, extracts a (single part) printout of inventory items that have reached their reorder level. The printout reflects the part number, description and quantity to be ordered, as well as the supplier and supplier code. Gilbert Simoni signs and dates the printout and takes it to Bob Marli, the buying clerk. 2. During the morning, Bob Marli produces a four-part, multi-coloured purchase order (PO) for the items to be purchased. (Where different items are ordered from the same supplier, only one purchase order is made out.) He does this by accessing the company’s local area network, using the general password ‘clearcut’, and then selecting the acquisitions application from the menu which appears on the screen. To access this application, he uses a password known only to employees in the company sections that deal with acquisitions and payments. This password enables these employees to access any modules included in the acquisition and payments software. 3. When Bob Marli accesses the ‘prepare purchase order’ module, whichever screen he works at comes up formatted as a purchase order. He then enters the details onto the system, for example name, address and code of the supplier, and the part number, description and quantity of each part to be purchased from that particular supplier. For the entry to proceed, a valid supplier code must be entered, as Clearcut (Pty) Ltd purchases only from approved suppliers. When he has completed the entry of the parts to be ordered, he selects the ‘print’ option and prints all the purchase orders. The computer automatically prints the date on the purchase order and number sequences them (the computer stores the number of the last purchase order printed and continues the numerical sequence as new POs are printed). Ϯϯϴ 4. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Once the POs have been printed, Bob Marli splits them into the four colours: White copies – go to the administration clerk for posting to the customer. Pink copies – go to the goods receiving depot where the receiving clerk, Ziggi Marli (Bob’s brother), files them in a pending file to await the delivery from the supplier. Light blue copies – go to Norah Jones, a clerk in the creditors section. She files them to await the supplier documentation. Yellow copies – remain with Bob Marli who files them in numerical sequence. The transfer of documentation between departments is well controlled by using simple but efficient batch controls. Once the POs have been distributed, the printout produced by Gilbert Simoni, is thrown away. Master file amendments Clearcut (Pty) Ltd only purchases from approved suppliers. Pieter Tosh, the company buyer, investigates potential suppliers for product quality, reasonableness of pricing and reliability. If he decides that a new supplier should be added to the supplier master file, he accesses the ‘update supplier master file’ module and adds the supplier’s details, including a supplier code. He then accesses the inventory master file and inserts all the necessary details of the parts to be purchased from that supplier, that is to say, description and part number, reorder levels and reorder quantities, and supplier code. He also prints a log of these entries (for both master files) which he files in date order, in his office. YOU ARE REQUIRED TO: Identify and explain the weaknesses in the internal control for the functions of Clearcut (Pty) Ltd’s acquisitions and payments cycle, described above. Your explanation must convey why you have identified each weakness as a weakness. (40) Note 1: You are not required to make recommendations to address the weaknesses. Note 2: Do not concern yourself with purchases of items not for manufacture, for example office supplies, staff refreshments etc. ϭϬ͘ϭϮ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ You are currently engaged on the 30 April 2022 financial year-end audit of Homethings (Pty) Ltd. As part of your substantive testing of year-end creditors, you have selected the following creditors reconciliations for detailed testing shortly after yearend: ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϯϵ Creditors reconciliation: Perfect Pots (Pty) Ltd Balance per Perfect Pots (Pty) Ltd statement at 25 April 2022 R181 250 Less: Payment not recorded Note 1 R66 455 Less: Goods short delivered Note 2 R26 440 R88 355 Add: Goods received Note 3 Balance as per creditors ledger at 30 April 2022 R33 111 R121 466 Note 1: Payment made by electronic funds transfer on 28 April 2022. Note 2: This relates to an order for 42 waterless cooking pots – 24 were delivered. See purchase discrepancy report no. CDR372. The supplier is unable to supply the outstanding 18 pots due to inventory shortages. Note 3: This relates to goods delivered by Perfect Pots (Pty) Ltd on 27 April, see goods-received note GRN 4572. Creditors reconciliation: Zebro Publishing (Pty) Ltd Balance as per Zebro Publishing (Pty) Ltd statement 23 April 2022 Less: Incorrect invoice Note 1 R236 910 R62 105 R174 805 Add: Undercharge on Zebro invoice Note 2 R18 000 Add: Purchase not reflected Note 3 R60 555 Balance as per creditors ledger at 30 April 2022 R253 360 Note 1: This invoice is for goods never ordered or received by Homethings (Pty) Ltd and invoiced by Zebro in January 2021. Note 2: This undercharge resulted from no VAT being charged by Zebro Publishing (Pty) Ltd on invoice XT1339. Note 3: The supplier invoice reflecting the charge for the goods received in respect of GRN MM691 (dated 25 April) was only received on 10 May. YOU ARE REQUIRED TO: Describe the substantive tests of detail you will conduct on Perfect Pots (Pty) Ltd and Zebro Publishing (Pty) Ltd’s creditors reconciliations at 30 April 2022. (32) ϮϰϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϬ͘ϭϯ ;ϯϳŵĂƌŬƐϰϱŵŝŶƵƚĞƐͿ You are a member of the team on the audit of Lighttime (Pty) Ltd, a manufacturer of a range of torches, lamps, light fittings etc. You have been assigned to audit the acquisitions and payments cycle. The following information pertains to the cycle: 1. All employees in the company are issued with strict ethical guidelines pertinent (relating) to their functions. In respect of the acquisitions and payments cycle, this includes guidelines for the purchase order clerk and the purchasing manager on how to react if they are offered bribes or kickbacks by suppliers. Appropriate action is taken against any employees who transgress the guidelines, but no such action has been necessary during the year under audit. 2. Ongoing training is also provided to all employees in the cycle. 3. To initiate a purchase order, the factory clerk identifies materials required for manufacture from production schedules. If the required materials are unavailable in Lighttime (Pty) Ltd’s warehouse, he completes and signs a hard-copy purchase requisition form for the materials not ‘in stock’. The requisitions are sent to Pete Peters, the factory manager, who carefully checks that the goods are required, and that all the details on the requisition are accurate. He then approves the requisition by signing it. The requisition will reflect the approved supplier code and the supplier’s inventory code for the items to be ordered. 4. The purchase requisitions are then sent to Clive Crawley, the order clerk. He accesses the ‘prepare purchase order’ module on the system and compiles the purchase order. Before Clive Crawley emails the orders to suppliers, the orders are approved ‘on screen’ by Dave Parker, the creditors manager. Orders are only placed with approved suppliers (on the creditors master file). The ability to approve the purchase orders on screen is restricted to Dave Parker. 5. When the ordered goods are delivered (to a secure, separate receiving bay), Marcos Masters checks the goods against the supplier delivery note and relevant purchase order he accesses on the system. The purchase order is displayed on his terminal screen as a goods-received note and before he approves the goodsreceived note (GRN), Marcos Masters will check the goods delivered and amend quantities on the screen GRN if necessary. Goods which have not been ordered will not be accepted. Marcos Masters then prints out a GRN in duplicate. One copy is filed numerically in the receiving bay and the second copy goes with the goods when they are transferred to the warehouse. When Marcos Masters selects the ‘approve’ option, the inventory master file is automatically updated. 6. Invoices from suppliers are sent directly to the accounting department where they are filed by Norman Anderson, the creditors clerk. To determine whether the supplier invoice is valid and accurate, Norman Anderson accesses the purchase order file on the system relevant to the supplier invoice and, if a valid purchase order number has been entered, all the details of the relevant purchase will ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϰϭ appear on screen, formatted as an invoice. Norman Anderson will then confirm that the detail of the on-screen invoice agrees exactly with the supplier invoice. The on-screen invoice is approved by a second creditors clerk. Once the approve option is ‘clicked on’, the file of unpaid invoices and the creditors master file are updated. 7. Creditors are paid by electronic funds transfer. A schedule of payments is compiled in the creditors section by the creditors clerk and approved after meticulous scrutiny by Dave Parker, the creditors manager. Once he has approved the schedule, he notifies Jake Lekota, the chief accountant, that the schedule is ready for payment to be made. From this point Dave Parker has nothing further to do with EFT payments to creditors, as he has no authorisation privileges. 8. EFT payments are made from the company’s bank account. The company’s bank has loaded the necessary software onto the terminals of Jake Lekota and Cyril Regis, the financial director. A full range of controls over EFT payments have been implemented, including the use of ‘dongles’, which are issued to certain employees to effect EFT payments. 9. Lighttime (Pty) Ltd also runs a toxic combination report monthly. This report is reviewed and managed by Keke Maniswa, the IT manager, and she manages all exceptions. YOU ARE REQUIRED TO: (a) Discuss the control environment within the acquisitions and payments cycle at Lighttime (Pty) Ltd based on the information provided above. (8) (b) Identify two examples, one manual and one programmed (automated), of each of the control activities listed below, evident from the description of the cycle provided above: (i) isolation of responsibility; and (ii) segregation of duties. (4) (c) Explain how effective on-screen approval of purchase orders is achieved. (8) (d) Explain why, with regard to paying its creditors by EFT, control over the creditors master file is very important. (4) (e) Explain how access to the function that allows EFT payments to be made from Lighttime (Pty) Ltd’s bank account will be protected. (10) (f) Describe toxic combinations and explain the benefit of a toxic-combination report. (3) ϭϬ͘ϭϰ ;ϱϴŵĂƌŬƐϳϬŵŝŶƵƚĞƐͿ WZd ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ You are a member of the team on the audit of Sporting Life (Pty) Ltd, a wholesaler of a large range of sports goods purchased from both local and foreign suppliers. You ϮϰϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ have been assigned to the 30 April 2022 year-end audit and are currently (late May) assisting with the auditing of various aspects of the acquisitions and payments cycle. You have obtained the following information, inter alia, while assisting with risk assessment procedures: 1. The company has had a successful trading run for the last few years, and with the current high level of interest in sport, the board of directors has decided to build an additional warehouse. This warehouse will be used exclusively for receiving, storing and dispatching imported sports goods. The company’s bankers will supply the necessary finance, provided that the 30 April 2022 financial statements satisfy certain existing loan covenants relating to working capital ratios. 2. Sporting Life (Pty) Ltd is a ‘family owned’ business and most management positions/directorships are held by members of the Clarkson family. Accounting systems are sound, and a strong control environment exists. Your manager has overseen the audit for some years and has got to know the company’s business very well. 3. The balance on the trade creditors account at 30 April 2022 was R9 267 914 (2021 – R11 900 418), a material amount in the context of the business. 4. The company’s systems are all computerised and are resident on a local area network. Applications are menu-driven. 5. Purchase orders are generated on the system by the buying clerks and approved on the system by the senior buyer, Polly Clarkson. 6. The creditors master file is an extremely important component of the system (for all purchases). Purchase orders can only be generated for suppliers listed in the master file, and payments to suppliers (made by electronic funds transfer) can only be made to suppliers (creditors) on the creditors master file. YOU ARE REQUIRED TO: (a) Comment on the risk of material misstatement at financial-statement level for the 30 April 2022 audit. (5) (b) Comment on the risk of material misstatement in the trade accounts payable account in the 30 April 2022 annual financial statements. (5) (c) Explain the process of online approval of purchase orders. Include in your answer the application controls which should be in place. (8) (d) Describe the internal control procedures you would expect to find in place at Sporting Life (Pty) Ltd to ensure that the addition of new suppliers to the creditors master file are valid. (10) WZd ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ As part of your duties on the Sporting Life (Pty) Ltd audit you have been requested to audit a sample of the client-prepared creditors reconciliations at 30 April 2022. You extracted a sample of reconciliations for audit, one of which appears below. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϰϯ Creditors reconciliation: Racketman (Pty) Ltd: 30 April 2022 Balance per creditors statement at 25 April 2022 R592 876 Less: Payment: electronic transfer on 28 April 2022 R134 533 Note 1 R458 343 R76 913 Less: Goods returned note 1017 Note 2 R381 430 R46 290 Add: Invoicing error Note 3 R335 140 R13 320 Less: Invoice number 7493 Balance as per creditors ledger 30 April 2022 R348 460 Note 1 The goods relating to this invoice were only received by Sporting Life (Pty) Ltd on 7 May 2022 due to a strike at the Racketman (Pty) Ltd warehouse. Note 2 The consignment of tennis racquets relating to this invoice was delivered to Sporting Life (Pty) Ltd on 15 April 2022. However, on unpacking the racquets in May, it was discovered that they were cracked. Racketman (Pty) Ltd acknowledged that the damage was caused in its warehouse and has agreed to take back the entire consignment and credit Sporting Life (Pty) Ltd. Racketman (Pty) Ltd’s invoice number 7216. This is expected to be resolved in July 2022. Note 3 Racketman (Pty) Ltd undercharged items on its invoice number 7001. 100 rugby balls were charged at R14,80 each instead of R148,00 each, inclusive of VAT. YOU ARE REQUIRED TO: Describe the audit procedures you would conduct in respect of the reconciliation presented above. (20) WĂƌƚ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Racketman (Pty) Ltd manufactures, among other products, high quality tennis racquets. A high-end tennis racquet is produced by melting a composite of graphite, copper and titanium and moulding it into a racquet-shaped frame. Thereafter the frame is sanded and small holes are drilled into it. Nylon or polyester (depending on the racquet) strings are then threaded through the holes. Lastly, flexible polyurethane foam is moulded and stitched to form the grip of the racquet. The grip can also be made out of leather at a customer’s request. As the raw material used in manufacturing these racquets are very expensive, management of Racketman (Pty) Ltd is concerned about the risk of theft by its employees or external delivery personnel. Ϯϰϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Except for theft by employees or delivery personnel, list four other business risks relating to the receiving of goods function at a company. (4) (b) Briefly explain the control activities that should be performed as part of the receiving of goods function at Racketman (Pty) Ltd. (6) ϭϬ͘ϭϱ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ You are a senior on the audit of Wheelies (Pty) Ltd, a company that manufactures a large range of cycling accessories, for example clothing and components. You have been assigned to the audit of the acquisitions and payments cycle for the financial year-end 31 March 2022. The audit is due to be completed by the end of June 2022. You have gathered the following information from several sources: 1. The company has numerous suppliers due to the fact that its products are manufactured from a wide range of materials and components. All suppliers are local. The company’s output and product range have remained reasonably constant over the last few years. 2. The company’s accounting systems are computerised and the creditors (supplier) master file contains the following fields for each creditor: 1. Supplier code 2. Supplier name 3. Supplier details: address, contact numbers etc. 4. Total amount owed 5. Total amount owed broken into days outstanding, that is to say 30 days, 60 days, 90 days, 120 days and over 6. Credit terms, for example 60 days, 5% discount for settlement within 30 days 7. Query: (a correspondence reference number is entered in this field if the account is under enquiry) 8. Banking details necessary to pay the creditor by EFT. 3. When suppliers deliver goods to Wheelies (Pty) Ltd, details of the order are called up on screen (using the Wheelies (Pty) Ltd order number on the supplier delivery note), the goods are counted and checked, and a goods-received note (GRN) is generated. One copy of the GRN is attached to the signed supplier delivery note and sent to the creditors’ payments section where it is filed alphabetically to await the supplier invoice. 4. When the audit team attended the year-end inventory count on 31 March 2022, Gregg Minnaar, the audit senior, recorded, inter alia, the number of the last GRN for the year (X 7392). He also obtained a printout from the system of GRNs for which no invoice had been received at year-end. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϰϱ 5. The ‘trade creditors and accruals’ balance in the trial balance at 31 March 2022 is R6 329 167 (2021 R8 183 888). 6. A detailed list of creditors balances at 31 March 2021 (prior year) is included in the previous year’s audit work papers. Your firm has audit software compatible with the client’s system and you use it where it is efficient to do so. 7. The creditors’ section is headed by Lance Pantani who has three creditors clerks reporting to him. Month-end creditors’ reconciliations are carried out by these clerks and reviewed by Lance Pantani. During discussions with the audit team about the further audit procedures to be conducted, one of the trainees raised the question of whether it would be appropriate to circularise creditors to confirm their balances. Although your firm had not carried out this procedure before, you decided to perform a positive circularisation on creditors listed at 31 March 2022 as risk assessment procedures had suggested that a risk of understatement of creditors might exist. Due to the large number of creditors, you decided to select a sample for this circularisation. YOU ARE REQUIRED TO: (a) Discuss briefly the requirements which should be met to ensure that any thirdparty confirmation obtained by the auditor ranks highly on the hierarchy of audit evidence. (3) (b) Indicate, giving brief reasons, which creditors you would include in the sample of creditors to be positively circularised. (5) (c) Provide three different pieces of information the auditor might obtain when conducting risk assessment procedures to suggest that creditors may be understated. (4) (d) Describe the further audit procedures you would conduct to verify the ‘trade creditors and accruals’ balance of R6 329 167 in the annual financial statements of Wheelies (Pty) Ltd at 31 March 2022. (20) Note 1: You are not required to describe the procedures necessary to carry out the creditors circularisation. Note 2: You need only consider the completeness and accuracy, valuation and allocation assertions. ϭϬ͘ϭϲ ;ϰϮŵĂƌŬƐϱϬŵŝŶƵƚĞƐͿ You are the newly appointed internal auditor of Massbuild (Pty) Ltd, a construction company that builds low-cost housing complexes. The head office of the company is in Johannesburg and building sites are spread around Gauteng. You are currently evaluating the acquisition and payments system and have established the following in discussion with Brin Gigg, the newly appointed financial manager. Ϯϰϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Purchases 1. Quantity surveyors at head office compile a detailed list of materials (materials list) for each new project. The construction manager then approves this. A copy is sent to the site administration office (see below) and the original is filed away to be used in the event of a query. 2. It is Massbuild (Pty) Ltd’s policy not to work on any more than four projects concurrently. This enables the company to employ four administration teams, each consisting of three clerks, who move to a new project as one project is completed. The administration teams are responsible for purchasing and receiving materials from local suppliers, paying wages and maintaining inventory records, while the site managers and site foremen (one at each project) are responsible for the construction and physical protection of building materials held in stock. From a building efficiency perspective, these functions must be carried out at the project site. 3. All purchases are made on credit. On arrival at a new project site, the senior administration clerk will open accounts with whichever additional suppliers in the area he considers necessary, because the project sites are sometimes geographically spread. It is not efficient or cost-effective to use existing suppliers. 4. As materials are required, the site foreman will request the senior administration clerk at the site to purchase them. After checking the details of the materials requested to the materials list, the clerk places a phone order with the relevant supplier. If the materials requested by the foreman are not on the materials list, the administration clerk asks the foreman to submit a written, signed request. 5. When the materials are delivered to the site, the senior administration clerk checks them against the supplier’s delivery note and signs and retains a copy to await the supplier’s invoice. (Some suppliers send the invoice with the delivery.) 6. When the supplier’s invoice is received at the site, details on the invoice are matched to the delivery note by the senior administration clerk and filed. 7. The only part of the acquisitions and payments cycle that is computerised is the payment of creditors. All creditors are paid by electronic funds transfer from head office. Payments 8. At the end of each month, the senior administration clerk (at each site) compiles a list of amounts to be paid to creditors according to the invoices on file. The list contains the name of the supplier, the supplier’s bank-account details, the document numbers of the invoices being paid and the amount to be paid. 9. This list is faxed to head office and the original filed at the site in month order. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϰϳ 10. Ansi Jansen, an assistant accountant at head office, is responsible for EFT payments. 10.1 Massbuild (Pty) Ltd pays its creditors over the internet but does not have its bank’s software loaded onto its system, that is to say, it has no ‘bank certificated’ terminals. When Massbuild (Pty) Ltd decided to set up EFT payment of creditors, Ansi Jansen was sent to the bank to arrange the EFT facility on the company’s bank account with the necessary documentation and authority from the company. The cell phone number she provided to the bank (as required) was her own cell phone number as she was responsible for making EFT payments. The bank provided Ansi Jansen with a PIN. Ansi Jansen also set up the initial list (profile) of suppliers on the system. 10.2 On receiving the lists of suppliers to be paid from the four sites, Ansi Jansen accesses the bank’s website from her terminal by entering the required account number, PIN and password. 10.3 By checking the names of suppliers on the four lists against the list of beneficiaries on the bank’s system, Ansi Jansen identifies which suppliers must be added to the list of beneficiaries on the system. To do this, she selects the ‘add beneficiary’ option and follows the prompts and enters the ‘once-off’ password sent to her cell phone by SMS. 10.4 To actually pay the beneficiary (supplier), Ansi Jansen accesses the bank in the normal manner (PIN, passwords) and, following the prompts, selects each supplier to be paid, enters the amount and selects the proceed option. 11. If Ansi Jansen is too busy to pay suppliers, she asks one of her two assistants to do it. Both know the PIN and passwords and are given Ansi Jansen’s cell phone to make any once-off passwords available. 12. EFTs to suppliers are usually made in the first week of the month. At the end of the month when the bank statement sent by the bank arrives, Ansi Jansen writes up the cash book from the bank statement. 13. As Ansi Jansen is really busy, she requested from the head of IT that she and her two assistants are given privileged user actions on the system in order for her to have the peace of mind that, should they encounter an application error that might affect their deadlines, they can resolve the issues themselves. As privileged users are strictly governed, her request was denied, and the privileged access was granted to only one of her assistants, who works flexible hours, and as such, would be in a position to resolve issues after hours, if need be. YOU ARE REQUIRED TO: (a) Identify and explain the weaknesses in the internal control procedures for purchases as described in points 1 to 7 above, and to recommend improvements that Ϯϰϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ should be made. The company does not wish to computerise the site office, but temporary telephone/facsimile lines are always installed in the site offices. (25) (b) Identify and explain the weaknesses in the internal control procedures for payments to creditors as described in points 8 to 13 above. You are not required to recommend improvements. (17) ϭϬ͘ϭϳ ;ϰϱŵĂƌŬƐϱϰŵŝŶƵƚĞƐͿ Toy-Toy (Pty) Ltd is a wholesaler of toys. The company purchases its inventory from local companies that either manufacture or import toys. Little attention has been paid to the accounting and related internal control systems at Toy-Toy (Pty) Ltd over the last few years and evidence of this has started to show. The financial controller has asked you to review the company’s systems commencing with the acquisitions and payments cycle. Ordering of goods The buying department consists of five buying officers and the senior buyer, Goliath Booysen. The company’s toys are broken down into five product categories, namely board games, balls, dolls, video games and model cars. Each buying officer is allocated to a product category and is responsible for purchasing inventory for his or her category. Goliath Booysen is responsible for monitoring and analysing the toy market and working with the sales department to decide on new toy lines that should be purchased. All the company’s applications are resident on a local area network. Employees must enter their user ID and a general password to access the network. However, access to the modules on the acquisition application is restricted to ‘ordering’ and ‘receiving’ employees by using a password known only to employees in these departments (and one or two senior personnel). The inventory master file is divided into the five product categories. Each morning, the buyers access the category they are responsible for and decide whether to place an order based on the quantity on hand per the master file. The inventory master file contains details of the company’s preferred supplier and the buyers will normally place the order with that supplier. However, if the preferred supplier is ‘out of stock’, the buyer will source the item from another supplier. If this is the case, the buyer will add the new supplier’s details to the inventory master file. A supplier code must also be entered so a computer-generated purchase order can be printed. To create the purchase order, the buyer accesses the ‘create purchase order’ module of the acquisitions software. The screen comes up formatted as a purchase order that the buyer completes by entering the supplier’s details and of the goods to be ordered, quantity, description etc. The supplier code must also be entered. Once all the details have been captured, a two-part sequenced order is printed. The buyer mails the top copy to the supplier and files the second copy numerically in a lever ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϰϵ arch file. Each buyer’s purchase orders have its own numerical sequence. To ensure they do not duplicate an order once it has been placed, the buyer updates the inventory master file by entering a date in the ‘pending order field’. Receiving of goods Goods ordered by Toy-Toy (Pty) Ltd are delivered in boxes which display the quantity and description of the contents of the box on the outside of the box, for example ten Leggo sets. Each delivery is supported by a supplier delivery note that lists the quantities and description of the goods being delivered. All goods delivered are directed to the ‘receiving department’, a physically secure area attached to the warehouse. Any one of the three receiving clerks will accept a delivery. The clerk will determine the validity of the order for the goods being delivered by entering the purchase order number (taken from the supplier delivery note) into the computer via a terminal in the receiving department. If the purchase order is valid, the words ‘accept delivery’ appear on the screen. The receiving clerk then agrees the number of boxes delivered and the quantity and description of the goods as per the details recorded on the boxes, to the supplier delivery note. If there are any discrepancies, the receiving clerk changes the delivery note accordingly. He/she and the person delivering the goods will sign both the copies of the delivery note to acknowledge the changes. The boxes are placed in a secure area until the warehouse packers have time to move them into the warehouse, unpack them and place the toys on their respective shelves in the warehouse. At 3 p.m. each working day, one of the receiving clerks (they rotate this function weekly) accesses the ‘create goods received note’ module. The screen comes up formatted as a goods-received note which the receiving clerk then completes taking the information from the supplier delivery notes. Once the goods-received notes have been completed, the quantities on the inventory master file are automatically updated and the date in the ‘pending order field’ is deleted to convey that the order has been received. The receiving clerk prints one copy of the goods-received note which is attached to the supplier delivery note and is filed sequentially and retained in the receiving department. (The goods-received notes remain on the system to be accessed and printed by the creditors/accounting department where they are matched to the supplier invoice when it arrives.) YOU ARE REQUIRED TO: Identify and explain the weaknesses in the internal controls over those functions of the acquisitions cycle at Toy-Toy (Pty) Ltd described above. (45) ϭϬ͘ϭϴ ;ϰϰŵĂƌŬƐϱϮŵŝŶƵƚĞƐͿ You are the senior in charge of the audit of Crowded House (Pty) Ltd, a large wholesaler of household furnishings and interior decorating requisites. The company ϮϱϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ imports many of its inventory lines from foreign companies but does not take forward cover on these purchases. The company has numerous creditors and the amount owed to creditors is substantial. At 30 April 2022, the financial year-end, the balance reflected in the financial statements for trade accounts payable and accruals was R14 372 810 (2021 – R18 291 630). The year-end substantive work is being carried out in June. You have obtained the following information: 1. Crowded House (Pty) Ltd’s purchases system is computerised. Hard-copy purchase documents are printed, for example orders and goods-received notes (GRNs), and are attached to suppliers delivery notes, invoices and statements, and filed by month alphabetically by supplier name. 2. When goods are delivered to Crowded House (Pty) Ltd, one of the receiving clerks accesses to the Receive Goods module of the purchases application, and calls up details of the delivery by keying in the Crowded House (Pty) Ltd order number reflected on the suppliers delivery note. The details are displayed on the terminal screen. Once the delivery is completed, a two-part GRN is printed, one of which is sent to the accounting department to await the suppliers invoice. Creditors are paid by electronic funds transfer. 3. All correspondence with creditors in respect of disputed amounts is filed in date order in a disputes file. 4. Tim Finn, the accountant responsible for looking after creditors, reconciles the creditors master file to the creditors control account in the general ledger monthly, while his two clerks reconcile individual creditors accounts in the creditors master file with creditors statements. 5. At each month end, Tim Finn produces a list of creditors off the creditors master file split into two sections, namely local creditors and foreign creditors. (Each creditor’s record on the master file contains a field designating the creditor as ‘foreign’ or ‘local’.) The total of the two sections is reconciled to the creditors control account. (You have the necessary audit software and expertise to interrogate files on the system and you have copies of all important prior year master files stored on a memory stick and kept with the working papers.) 6. Your audit team has carried out some work on internal controls in the acquisitions cycle and has concluded that controls are reasonably sound. The team is satisfied that purchases are properly authorised and accurately recorded. No work has been done on ‘cut-off’ at 30 April 2022, but your audit team, when attending the inventory count, recorded the last document numbers for the year and also made a list of unmatched GRNs (that is to say GRNS filed and awaiting the arrival of the supplier invoice) at year-end. 7. Tim Finn and the financial accountant are responsible for identifying and listing accruals at year-end. ŚĂƉƚĞƌϭϬ͗dŚĞĂĐƋƵŝƐŝƚŝŽŶĂŶĚƉĂLJŵĞŶƚƐĐLJĐůĞ Ϯϱϭ YOU ARE REQUIRED TO: (a) Discuss the risk of material misstatement of the trade accounts payable and accruals account at 30 April 2022. (5) (b) Describe the application controls (both manual and computerised) which would be in place to ensure that deliveries in respect of valid orders only, are accepted and accurately recorded by the receiving department. (9) (c) Describe the substantive procedures which you will carry out to verify the trade accounts payable and accruals balance at 30 April 2022. Do not concern yourself with related disclosures. (25) (d) Briefly explain for what purposes automated application controls can be used in the testing of exchange rates. (5) ϭϬ͘ϭϵ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are the auditor of AudioWired Ltd, a company that imports and sells electronic devices and household appliances. The company has recently been fined for underpaying taxes. Although management has explained to you that this was merely due to a clerical error, personnel in the accounts department have mentioned that management is unwilling to delegate certain accounting functions relating to the purchases cycle. After further investigation, you have assessed the risk of management fraudulently increasing purchases (to reduce profits and thereby evade taxes) as high. YOU ARE REQUIRED TO: (a) Explain to the junior trainees on your audit team why the completeness of purchases will likely not be a risk at AudioWired Ltd. (2) (b) Briefly explain your overall response to the fraud risk that you have identified. (3) (c) Formulate the substantive audit procedures that you will perform on the audit of AudioWired Ltd, to obtain comfort over the occurrence, accuracy, cut-off and classification assertions, relating to purchases. (10) ϭϬ͘ϮϬ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ HeatMasters (Pty) Ltd is South Africa’s largest manufacturer of outdoor braais. For the February 2023 year-end audit, the auditors have completed their risk assessment procedures and have assessed the risk of material misstatement over ‘other expenses’, as low. As such, the auditors have decided to take mainly a controls testing approach to audit these line items, with limited substantive tests, consisting mainly of substantive analytical procedures. Below is a schedule (with comparative figures) for ‘other expenses’ of HeatMasters (Pty) Ltd as at 28 February 2023. ϮϱϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Account name 2023 Accounting fees 144,000 129,600 Advertising 230,000 32,000 Airfare and accommodation 2022 R R 300,000 – Bank charges 30,000 27,000 Fuel and oil 88,000 88,000 Gardening services 36,000 34,000 – 129,000 Interest paid 12,000 11,000 Internet 14,400 12,500 Printing 30,000 27,000 Rates and taxes 12,000 11,000 Repairs and maintenance 69,000 72,000 9,600 8,640 180,000 – Telephone 90,000 81,000 Training 56,000 79,000 Insurance Stationery Smeg industrial baker’s oven Unallocated expenses 90,000 – Water and electricity 180,000 162,000 YOU ARE REQUIRED TO: (a) Briefly list the procedures that an auditor will typically include when performing an analytical review (5) (b) Based only on the information in the schedule, perform a comparison of the ‘other expenses’ line items of HeatMasters (Pty) Ltd and: (i) Identify and discuss any concerns/unusual items/fluctuations that you may have noted. (8) (ii) Briefly explain how you would go about to obtain reasons for the items/ fluctuations identified. Your response should be specific to each line item identified. (7) ,WdZ ϭϭ /ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 11.1 Application – Assertions 10 marks 11.2 Short discussion – Components of inventory and production cycle 19 marks 11.3 Short questions 21 marks 11.4 Multiple-choice questions 16 marks 11.5 Application – Classification of controls; Control procedures on logical access controls 19 marks 11.6 Application and discussion – Assertions 15 marks 11.7 Short questions 25 marks 11.8 Application and discussion – Internal controls over inventory 32 marks Application and discussion – Weaknesses in inventory count; Audit procedures on inventory count 35 marks Application and discussion – Substantive audit procedures on inventory 20 marks Application and discussion – Business risks and control activities over the production function 20 marks Application and discussion – Costing of inventory and manufactured goods; Subsequent events; Additional matter to be researched and briefly discussed 25 marks 11.9 11.10 11.11 11.12 continued Ϯϱϯ Ϯϱϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 11.13 11.14 11.15 11.16 11.17 11.18 11.19 11.20 ϭϭ͘ϭ Description of content of the question Total marks Application and discussion – Risk of material misstatement on inventory; Audit procedures on inventory count and rights 38 marks Application and discussion – Internal controls over raw materials; Working with the internal audit department; Business risk relating to warehouse function 38 marks Application and discussion – Risk assessment procedures; Risk of material misstatement 25 marks Application and discussion – Risk of material misstatement; Audit procedures on the valuation of inventory 27 marks Application and discussion – Risk of material misstatement; Auditor’s expert; Audit procedures on consignment stock and commission accrued. 36 marks Application and discussion – Audit procedures on inventory count and inventory costing; Controls over warehousing. 35 marks Application and discussion – Using CAATs to extract information 30 marks Application and discussion – Tests of controls; Costing of imported goods. 27 marks ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ You are a member of the audit team engaged on the audit of Origin (Pty) Ltd, a wholesaler of a large range of items for the workplace. The following procedures were carried out in respect of inventory for the 28 February financial year-end: 1. The audit team performed test counts by selecting items from the inventory sheets and counting the physical items. 2. The audit team selected inventory items from the shelves in the warehouse, counted them and agreed the quantity to the inventory sheets. 3. The senior on the audit team worked her way through the warehouse looking for evidence of damaged, dust covered inventory. 4. The senior enquired from the inventory controller as to whether any entities held consignment inventory on behalf of Origin (Pty) Ltd. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϱϱ 5. The junior also checked the extensions (quantity × price) on the inventory sheets and cast the total column. 6. The senior enquired from the inventory controller as to whether Origin (Pty) Ltd held consignment inventory on behalf of anyone. 7. The senior obtained a sample of sales invoices for March and compared the selling price of the items sold per the invoices to the cost price for the same items listed on the 28 February inventory sheets. 8. The senior scrutinised the minutes of directors’ meetings and bank confirmations to determine whether Origin (Pty) Ltd’s inventory had been pledged as security. 9. The senior discussed with the inventory controller the method of determining any inventory obsolescence, write-downs/impairments, and how the inventory obsolescence write-down is approved. 10. The senior inspected the accounting policy note and related disclosures for inventory in the annual financial statements. YOU ARE REQUIRED TO: Indicate, for each of the above procedures (1–10), the assertion to which the procedure relates. (10) ϭϭ͘Ϯ ;ϭϵŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Toyco (Pty) Ltd manufactures unique toys in small batches and uses the following documentation: • purchase order; • picking slip; • inventory adjustment form; • sales invoice; • production report; • supplier delivery note; • customer remittance advice; • transfer to finished goods note; • clock cards; and • job cards. All components used in the manufacturing process are received from suppliers at the central receiving bay and subsequently transferred to the components warehouse. Toys that have been manufactured are transferred from production to the finishedgoods warehouse. The company uses a ‘job cost’ costing basis for accumulating costs and maintains computerised perpetual inventory records. The accounts and IT departments can access these records. Ϯϱϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Identify from the list above, those documents that Toyco (Pty) Ltd would use in their inventory and production cycle and briefly describe the purpose of each document. (6) (b) Explain why a job costing system would be suitable for Toyco (Pty) Ltd. (c) Indicate the cycle to which each document you have not identified in (a) above, relates. (4) (d) State the three broad objectives a well-designed, properly implemented internal control process for the inventory and production cycle will achieve. (3) (e) Briefly describe any risks that you have identified from the information in the scenario. (4) ϭϭ͘ϯ (2) ;ϮϭŵĂƌŬƐϮϱŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. When auditing inventory, the auditor will mainly focus on performing tests of controls. True or false? Justify. (1,5) 2. Explain which costs may be capitalised to the cost of inventory (excluding manufactured goods). (3) 3. All storage costs and selling costs may be capitalised to the cost of inventory. True or false? Justify. (1,5) 4. Which assertion relating to inventory will be most affected if: 4.1 the theft of inventory items is not discovered, assuming the company has a perpetual inventory system? (1,5) 4.2 the company’s products are subject to rapid and frequent technological advances? (1,5) 4.3 the company holds inventory on consignment in its warehouse on behalf of other companies? (1,5) 4.4 all the products sold by the company are imported? (1,5) Justify your choice. Consider each of the above separately. 5. Suggest two ways a company could manipulate the balance on the inventory account to reflect an increased profit. (1) 6. Identify the cost formulae allowed by IAS 2 – Inventory, which may be used when measuring inventory movements. (2) 7. If the auditor’s risk assessment procedures suggest that internal control in the inventory and production cycle is weak, he/she will: 7.1 increase his test of controls; ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϱϳ 7.2 increase his substantive tests; 7.3 perform only analytical procedures. Justify your choice and explain why you rejected the other options. 8. (4) When the auditor selects a sample of items in the warehouse and traces them to the inventory count sheets, is he/she testing for accuracy, valuation and allocation, existence or completeness? Explain your answer. (2) ϭϭ͘ϰ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the correct answer for each of the following questions: 1. Which of the following is not an assertion applicable to inventory? (a) Occurrence. (b) Rights. (c) Classification. (d) Completeness. 2. During the year-end inventory count at Maddly (Pty) Ltd, the auditors selected a sample of items held in the warehouse and confirmed by inspection that these items were included in the year-end inventory records. To which inventory assertion does this procedure relate? (a) Accuracy, valuation and allocation. (b) Completeness. (c) Rights. (d) Existence. 3. Also on the audit of Maddly (Pty) Ltd, members of the audit team at the yearend inventory count selected a sample of inventory items from the inventory records and agreed the quantity on hand as reflected in the records, to the physical items held in the warehouse. To which inventory assertion does this procedure relate? (a) Existence. (b) Completeness. (c) Rights. (d) Accuracy, valuation and allocation. 4. The understatement of the inventory write-down for obsolescence at year-end will relate directly to which inventory assertion? (a) Completeness. (b) Accuracy, valuation and allocation. Ϯϱϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (c) Rights. (d) Existence. 5. Bonto (Pty) Ltd holds inventory on consignment in its warehouse for several other companies. From an audit perspective, this will directly affect the ‘further’ audit procedures relating to which inventory assertion? (a) Completeness. (b) Rights. (c) Existence. (d) Valuation. 6. The senior on the audit of Maddly (Pty) Ltd enquired of the financial controller as to whether the company held any inventory for other parties on consignment. This procedure would primarily be (a) a test of controls; (b) a risk assessment procedure; (c) a substantive test; (d) an analytical procedure. 7. Making use of internal audit personnel by the external audit team to assist with attendance at the year-end inventory count, would be (a) part of the audit strategy only; (b) a contravention of the auditing standards; (c) part of the audit strategy and the audit plan; (d) part of the audit plan only. 8. On the Trix (Pty) Ltd audit, the auditor decided that there was a high risk of the inventory balance at year-end being manipulated by the inclusion of fictitious inventory. This is likely to result in further audit procedures being carried out relating in particular to the (a) obligation assertion; (b) rights assertion; (c) occurrence assertion; (d) existence assertion. 9. While conducting audit procedures on inventory, the senior on the audit of Portland (Pty) Ltd enquired of the inventory controller as to whether any events which might have impaired inventory on hand at year-end, had occurred. To which assertion relating to inventory, does this procedure primarily relate? (a) Existence. (b) Accuracy, valuation and allocation. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ (c) Classification. (d) Presentation. Ϯϱϵ 10. On the Make-it (Pty) Ltd audit, the auditor inspected the signatures on a sample of materials requisitions and materials issue notes to confirm that the requisition and issue had been authorised. This procedure is (a) a substantive test; (b) a test of controls; (c) a risk assessment procedure; (d) a test of detail. 11. When finalising the inventory audit at Rufus (Pty) Ltd, the audit senior inspected the draft financial statements to confirm, inter alia, that inventory had been appropriately disaggregated in the notes. This procedure relates to the (a) classification assertion pertaining to inventory; (b) rights of the company pertaining to inventory; (c) allocation assertion pertaining to inventory; (d) presentation assertion pertaining to inventory. 12. On the Legacy (Pty) Ltd audit, the auditor obtained a listing of imported goodsin-transit at year-end and inspected relevant documents to determine whether ownership had passed to Legacy (Pty) Ltd at financial year-end. This procedure will provide evidence relating to which inventory assertion (a) obligation; (b) classification; (c) rights; (d) occurrence. 13. Which of the following is not an acceptable cost formula to be adopted by a company for inventory? (a) Replacement value. (b) Weighted average. (c) Specific identification. (d) FIFO (first in, first out). 14. Which of the following may be included in the cost of inventory? (a) Non-reclaimable duties on imported raw materials. (b) Increases in production costs (which can be accurately measured) resulting directly from a labour strike. (c) Salary costs for finished goods warehouse personnel. (d) Costs of skills training courses for factory workers. ϮϲϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 15. Which of the following may not be included in the cost of inventory? (a) Transport costs incurred in the acquisition of goods for sale. (b) Variable production overheads. (c) Storage costs for finished goods. (d) Normal amounts of wasted materials. 16. Which of the following will test IT general controls as opposed to automated application controls? (a) Determine the cost formulae and whether the rules have been configured in the application. (b) Determine whether the application has been configured to receive daily currency exchange rates that would have been applied to imported inventory. (c) Review user access to determine whether there are super users, and whether they have access to the inventory module on the computerised system. (d) Perform a walkthrough to determine whether the inventory formulae/ rules are accurate. ϭϭ͘ϱ ;ϭϵŵĂƌŬƐϮϯŵŝŶƵƚĞƐͿ Santacruz (Pty) Ltd manufactures a wide range of pumps, generators and other pieces of equipment for the industrial sector. The company’s financial systems are fully computerised and internal controls are well designed and implemented. The company holds large inventories of components for manufacturing and finished goods at its manufacturing and warehousing facility. Below is an extract of some of the actions/policies/procedures that are in place at Santacruz (Pty) Ltd: 1. Santacruz (Pty) Ltd’s insurers carry out a comprehensive analysis of the company’s insurance requirements concerning the manufacturing facility and the company’s inventory annually. 2. Employees in the warehousing section are given access to the inventory records on a ‘need to know’ basis. 3. Senior warehouse personnel meet with the IT section once every six months to discuss any inventory-system related matters. The head of IT must approve any program changes of warehousing, internal audit and the IT steering committee itself. 4. Physical access to the component’s store is strictly controlled by keypad and password technology. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϲϭ 5. Pickers in the components store do not have write access to the inventory master file but do have read access which allows them to check certain details, for example part numbers, should they need to do so. 6. All employees’ performance in both the component and finished goods stores are subjected to performance reviews annually. YOU ARE REQUIRED TO: (a) State whether each of the above actions/policies/procedures (1–6) is a general control or an automated application control. Where you have identified the action/policy/procedure as a general control, identify the category(ies) of general control to which it relates. Where you have identified the action/policy/ procedure as automated application control, identify the type(s) of control activity it relates to. (9) (b) Briefly discuss whether you would test the IT general controls at Santacruz (Pty) Ltd. (3) (c) List the control procedures you will perform specifically to test the logical access controls at Santacruz (Pty) Ltd. (7) ϭϭ͘ϲ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are the senior trainee on the audit of Boom (Pty) Ltd, a company that manufactures and sells explosives used in the construction and mining industries. You asked a junior trainee to explain the assertions relating to Boom (Pty) Ltd’s inventory of R1 832 916 reflected in the financial statements at 31 March 2022. He responded as follows: Completeness: Only complete inventory is included in the figure of R1 832 916. Work in progress is excluded. Validity: Only saleable inventory is included. Any inventory that has expired because of deterioration, is excluded from the amount of R1 832 916, that is to say, it is invalid. Rights: Boom (Pty) Ltd has a licence (the rights) to manufacture the explosives that it sells. Existence: The inventory which is included in the amount of R1 832 916 actually existed at reporting date, that is to say, it had already been manufactured. Clarification: The nature of the company’s inventory is clearly described in the notes to the financial statements. Timing: Only inventory relating to the 2022 financial year is included in the year-end balance. ϮϲϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: Based on his response, discuss your junior trainee’s understanding of the assertions pertaining to Boom (Pty) Ltd’s inventory. (15) ϭϭ͘ϳ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. If a company maintains perpetual inventory records, there is no need to conduct any physical inventory counts. True or false? Justify. (2) 2. Which of the following costs can be included in the cost of purchase of inventory by Capespin (Pty) Ltd, a large wholesaling company? • Transport costs between the sea port and the company’s ten warehouses. • Financing costs due to extended payment terms. • VAT. • Sales promotion costs on a specific item of inventory. (2) 3. Inventories must be valued at year-end at the lower of cost or net realisable value. True or false? (1) 4. Explain why the inventory balance gives the directors an effective opportunity to manipulate the financial statements. (2) 5. Identify four factors, with brief explanations, that may directly affect the likelihood of a company’s inventory being misappropriated (stolen) from the company’s warehouse. (4) 6. With which two cycles do the inventory and production cycle interface? (1) 7. Provide examples of inventory that illustrate the diversity of inventory in respect of its nature, location, permanence and stage of development. (4) 8. Which assertions relating to inventory are the auditor normally most concerned about? (1) 9. It is sometimes thought that when auditors attend clients’ inventory counts, they are only concerned with the existence assertion. However, auditors are usually concerned with all the assertions relating to inventory at the time of the inventory count to some extent. Explain. (4) 10. With regard to inventory, auditors often find it more difficult to obtain sufficient assurance in respect of the valuation assertion than in respect of the existence assertion. Explain. (2) 11. Explain the principle of ‘two-directional testing’ in the context of attendance at an inventory count. (2) ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ ϭϭ͘ϴ Ϯϲϯ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ You are the newly appointed financial manager of The Shoebox (Pty) Ltd, which operates a chain of 20 large retail shoe stores in and around Port Elizabeth, selling on a cash-only basis. The stores are controlled from a central head office and all inventory is issued to the stores from a central warehouse. All inventory deliveries to stores are made by The Shoebox (Pty) Ltd’s own delivery vans. An analysis of the most recent branch accounts revealed that the average gross profit margin for the 20 stores was 51%, but five stores reported margins below 20%. You approached the managers of the stores in question and the company’s internal auditor, and they all ascribed the poor margins to weak internal control systems, which enables theft to go undetected. Their explanation for this, with which you agreed, is that the internal control system has not kept up with the company’s rapid growth. You, therefore, decided to design internal controls to improve the control over branch inventories. It is not feasible to computerise branch activities for several reasons, although all processing at the head office is computerised. The stores are staffed by a branch manager, a cashier and between two and five sales assistants (depending on the size of the store). The company does not wish to change this. All the branches’ inventory is on display or in storerooms at the back of the shop. All inventory items are coded. A cash sales invoice, which indicates the item code and description, is made out for each pair of shoes sold. No inventory records are kept at the branches. Due to the nature of the store’s clientele, the company introduced a ‘down payment scheme’. This enables a customer to purchase shoes over six months by making payments when they are able to. The selected shoes are put aside, and only once the six payments have been made are the shoes handed over to the customer. Internal controls over this scheme are particularly poor. YOU ARE REQUIRED TO: Design an internal control system for the control of the inventory of The Shoebox (Pty) Ltd. Structure your answer under the following headings: 1. Despatch from central warehouse to stores 2. Receiving of goods by stores 3. Physical control over inventory at stores 4. The ‘down payment scheme’. (12) (4) (10) (6) Note: Detailed computer applications should not be considered. ϭϭ͘ϵ ;ϯϱŵĂƌŬƐϰϭŵŝŶƵƚĞƐͿ You are the manager on the audit of Firezone Ltd. The company is a wholesaler of numerous domestic and industrial heating products, fire extinguishers and other Ϯϲϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ fire-fighting chemicals and equipment. The company’s year-end is 31 July. The senior on the audit took ill shortly before the financial year-end and you had no choice but to put a far less experienced trainee, Ted Mitton, in charge of the audit. Pertinent information about the company’s inventory is: 1. Inventory is kept in a single warehouse in Durban. 2. The warehouse is divided into six sections according to the type of goods stored, such as domestic heaters, chemicals etc. and neatly stacked. 3. The majority of items are packaged in sealed boxes or cartons. 4. Some of the chemicals have a limited shelf life. Where this is the case, the expiry date is stamped on the container. 5. Firezone Ltd holds inventory on consignment from Bushblaze Inc, an Australian fire-fighting company. You asked Ted Mitton to submit a report to you on his attendance at the year-end inventory count. The report contained the following information. 1. The inventory count took place over two afternoons, from 1 pm to 5 pm on 30 and 31 July. This enabled the company to receive and dispatch goods during the morning. 2. The count was carried out by the six warehouse employees who usually pick the goods to fill orders. This worked well because they were familiar with the nature of the inventory and where everything is stored. 3. The pickers decided among themselves which section of the warehouse to count. Maggie Motolo, the warehouse administration clerk, printed a list off the computerised perpetual inventory system (inventory sheet) of each item (description and quantity) in the section chosen by the picker. The numerically sequenced inventory sheets were handed to the pickers, who then counted each item in their warehouse section, ticking off the quantities on the inventory sheets once they had counted the item. 4. If the count quantity differed from the quantity on the inventory sheet, the counter (picker) highlighted the item and quantity and wrote in the number he had counted. 5. After the count on the second day, the counters returned the inventory sheets to Maggie Motolo, who identified the highlighted items and amended the quantities on the perpetual inventory records to reflect the actual quantities on hand. 6. Before the count, I confirmed with the financial accountant that we would be attending the inventory count. He confirmed the dates and times with me. 7. I was assisted at the count on both days by Zane Mulla (also a second-year trainee), and we carried out the following procedures: 7.1 accompanied each picker for a short time on each day to observe them counting; ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϲϱ 7.2 allocated the six sections between us, compiled a count work paper by selecting inventory items (on a random basis) from the counters’ inventory sheets, and performed a physical count of the items selected; 7.3 entered the count quantity for each item counted on our work paper (which is attached); 7.4 observed Maggie Motolo adjust the quantities on the perpetual inventory records; and 7.5 I initialled each of the inventory sheets and left them in the custody of Maggie Motolo. YOU ARE REQUIRED TO: (a) Discuss the weaknesses in the year-end inventory count based on the information given above. (17) (b) State whether you would be satisfied with the procedures conducted by the trainee accountant in connection with the year-end inventory count at Firezone Ltd. Fully justify your answer. (18) ϭϭ͘ϭϬ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are the manager on the audit of Shady-Solutions (Pty) Ltd, a company that sells low-cost awnings. The company’s factory is located in Cape Town and distributes its products to retailers through various outlets throughout the country. The awnings are available in different colours and sizes and customers can purchase them for selfinstallation, in flat packs, from their local hardware store. Shady-Solutions manufactures the brackets locally through a process of plastic injection moulding. The polycarbonate tops of the awnings are imported from the UK, are spray painted and cut into the required sizes. The company’s year-end inventory balance consists of raw-materials purchased locally, raw-materials imported and manufactured goods. For imported materials, management compiles a costing-schedule, setting out how the cost of the materials are calculated. Shady-Solutions (Pty) Ltd applies the FIFO method to account for its inventory. Your audit procedures over the year-end inventory count provided sound evidence relating to the accuracy of the quantities and descriptions of inventory held by the client. YOU ARE REQUIRED TO: Describe the further substantive audit procedures that you will perform over the inventory of Shady-Solutions (Pty) Ltd. Limit your response to the rights, accuracy, valuation and allocation assertions. Do not include procedures relating to work-inprogress or obsolete stock allowances. (20) Ϯϲϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϭ͘ϭϭ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Louis-Gianni (Pty) Ltd is a manufacturer of leather handbags and purses. The company started out as a small business, founded by two friends, Louis Moholo and Gianni Smith. The company’s products proved to be extremely popular, and the business grew much faster than anticipated. As a result of this rapid growth and the introduction of various new product lines, Louis and Gianni realised that their business might be exposed to certain risks. The two friends came knocking at your door for advice regarding Louis-Gianni’s controls over its production function. During the discussion, they explained that the leather products are manufactured by a trusted team of factory workers. Employees responsible for the cutting and sewing the products fill out forms each morning to request the needed material for the day’s production (based on job-orders drawn up weekly), which is then issued to them by the warehouse clerk. The cutting and sewing team tries to complete as many products as possible before the close of business each day. The completed products are then collected by the warehouse manager, who makes a note on the job-order, indicating the quantities of products collected. Prices of products are based on market research, to ensure that a Louis-Gianni handbag, for example, will not cost much more or much less than other leather handbags in the market. YOU ARE REQUIRED TO: (a) Explain to Louis Moholo and Gianni Smith the business risks related to the production function of the company. (6) (b) Suggest control activities that should be implemented over Louis-Gianni (Pty) Ltd’s production function. (14) ϭϭ͘ϭϮ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are the engagement partner on the 2022 December year-end audit of Pattel Ltd, a toy manufacturing company. Pattel Ltd is the manufacturer and seller of the number one toy brand in the world, the Darbie-Doll. Every year various new designs of Darbie-Dolls are manufactured, and released to the market. The whole process from the initial design of a doll until the actual mass production thereof can take up to 18 months. Manufacturing the dolls Four different departments are involved in the manufacturing of a Darbie-Doll: The initial design department (responsible for drawing up sketches and designing what the final product should look like); the production department (where the body parts are produced and assembled); the final design department and the fashion department. It should be noted that Pattel Ltd is committed to adapt its manufacturing process in such a way as to use 100% recyclable materials in all of its products by 2030. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϲϳ The production department produces the separate components of the dolls from different materials (sourced locally and abroad) as per the breakdown in the table below: Table 11.12 Heads Vinyl compound Torsos Ethylene-vinyl acetate (EVA) Arms Thermoplastics polymer (ABS) Legs Polypropylene and PVC Hair PVDC (thermoplastic resin) After the body parts of the dolls have been assembled, the dolls are transferred to the final design department, where designers sew on and style the hair, hand paint the faces of the dolls and dress the dolls in the clothing and accessories received from the fashion department. Costing of inventory and manufactured goods While you were performing audit work on the cost of inventories and manufactured goods, you noted the following matters relating to management’s cost calculations: 1. Production hours, which are used as the basis to allocate overheads, fluctuates significantly from month to month. 2. Labour costs for the month of June are abnormally high as compared to the other months. 3. Cost of imported raw materials does not show a breakdown of what it consists of. 4. An amount for storage costs is included in the calculation of cost of inventory. 5. The month of December indicates a significantly high amount of ‘wastage’. You followed up on these matters with the production manager, Mr Ken Carson, and he provided the following explanations: 1. All company overheads are allocated to the cost of manufactured inventory based on total production hours. Production hours fluctuate significantly from month to month, as the company is sometimes understaffed and has to work extra hours to make up for the lack of manpower. 2. All direct labour cost is allocated to the cost of manufactured inventory. During the month of June, Pattel Ltd paid an out-of-court settlement to an employee, Ms Millicent Roberts, who got injured on duty. This amount has also been allocated to the cost of manufacturing, as the employee was directly involved in the manufacturing process. Ϯϲϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3. Cost of raw materials imported includes import duties, transaction costs and administrative costs (relating to the clerk processing the purchase documents in Pattel Ltd’s procurement department). 4. At times, completed products exceed Pattel Ltd’s in-house storing capacity and additional space is rented to temporarily store the stock. 5. In early December, an injection moulding machine overheated and caused a small fire in the factory. This resulted in a large batch of doll heads burning beyond repair. Damaged machine After further inspection, you verified that the moulding machine, with a carrying value of R600 000, was severely damaged in the fire. The machine was sent in for repairs just before year-end. Shortly after year-end the company responsible for the repairs, provided Pattel Ltd with a report, indicating that the machine is damaged beyond repair, and must be replaced. The machine was written off in Pattel Ltd’s accounting records in January 2023. YOU ARE REQUIRED TO: (a) Briefly state whether the cost of salaries paid to the initial designers working on the concept sketches of the dolls, may be capitalised to the cost of inventory. (2) (b) Comment on the matters that you have noted relating to management’s cost calculations and Ken Carson’s subsequent explanations. (10) (c) Indicate whether the damaged machine’s write-off was treated correctly in Pattel Ltd’s accounting records. You may assume that the amount is material. (5) (d) Optional question: As you also specialise in the area of environmental matters, you have been asked to prepare a short memo to the directors of Pattel Ltd, setting out the recyclability and biodegradability of the materials used to manufacture the different components of the dolls (see Table 11.12). (You may assume that the writing of this memo does not infringe on your independence.) (8) ϭϭ͘ϭϯ ;ϯϴŵĂƌŬƐϰϲŵŝŶƵƚĞƐͿ You are a member of the team on the year-end audit of Kitchenstuff (Pty) Ltd. The company has a 31 July 2022 financial year-end. In late June, your audit manager informed you that you would oversee the audit team attending the inventory count and assist with certain other aspects of the inventory audit. You have gathered the following information: 1. The company operates out of a single very large ‘warehouse-type’ outlet in a shopping centre in Gauteng, which consists of a showroom and adjoining warehouse. The internal control process is sound. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϲϵ 2. The company sells a large range of general kitchen appliances, both large and small, for example, fridges, stoves, microwaves and expensive knives etc., some of which are imported. Material quantities of inventory are held. 3. A well-designed computerised perpetual inventory system is maintained and physical control over inventory is efficient, the only weakness being, in your firm’s opinion, that cycle counts are not conducted. Other than fridges and stoves etc. on the shop floor, inventory is kept in its original packaging. The warehouse is well laid out, with different appliances being kept in designated areas and stacked by make and model. Despite the sound controls, inventory sometimes gets damaged and dented, and there are always items which do not sell as well as expected. 4. The year-end inventory count is planned for the close of business (4.00 pm) on 31 July. 5. The directors are anxious that the company’s financial situation be presented as favourably as possible. 6. The company holds an extensive line of expensive cooking pots on consignment for Modernpots CC. It does not sell any other cooking pots. 7. The method for counting inventory will be as follows: 7.1 Sequenced inventory count sheets will be printed off the inventory master file but will reveal only the inventory item number, description and location of the inventory. The theoretical quantity on hand will not be shown. 7.2 The warehouse will be divided into ten designated areas and ten two-man teams will perform the count. 7.3 As each item is counted, the first count team member will attach a bright pink label to it, and the second member will record the quantity of the items on hand on the inventory sheet. 7.4 Once the count has been completed, the count teams will return the inventory count sheets to Freddie Sithole, the warehouse manager, who will be in charge of the count. 7.5 While the count teams have a break, the quantities recorded on the inventory count sheets will be compared to the quantities recorded on the inventory master file (using a simple program) and a list of differences will be printed. The count teams will then recount/follow up on items for which there is a difference. Where there are physical quantity errors, they will be corrected on the inventory count sheets so that, by the end of the count, Freddie Sithole will be satisfied that the inventory count sheets accurately represent the physical inventory on hand. 8. Subsequent to the inventory count, any quantity differences resulting from errors in the perpetual inventory records will be investigated and the master file amended accordingly. Once this has been done, the final inventory count sheets ϮϳϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ will be produced and the value of inventory will be calculated from the inventory master file. 9. Around mid-July, count teams were provided with written count information and instructions by Freddie Sithole. YOU ARE REQUIRED TO: (a) Discuss whether the risk of material misstatement relating to Kitchenstuff (Pty) Ltd’s inventory balance at 31 July 2022 should be regarded as low, medium or high, based on the information given above. In your discussion, deal with all the assertions directly related to inventory. (12) (b) Describe the procedures you would have carried out in your capacity as audit team leader prior to the year-end inventory count. (7) (c) Describe the procedures the audit team will conduct when attending the 31 July 2022 inventory count at Kitchenstuff (Pty) Ltd. (12) (d) Describe the procedures you will conduct to confirm that Kitchenstuff (Pty) Ltd has the rights (of ownership) for the inventory reflected in the financial statements at 31 July 2022. (4) (e) Explain why conducting cycle counts would be beneficial to Kitchenstuff (Pty) Ltd. (3) ϭϭ͘ϭϰ ;ϯϴŵĂƌŬƐϰϲŵŝŶƵƚĞƐͿ WZd ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Farmer Joe (Pty) Ltd manufactures various items of machinery for the agricultural sector. The company manufactures items such as irrigation pumps and small trailers, as required by its customers. All raw materials and parts for manufacturing are held in the raw material and component store, a separate warehouse adjoining the factory, and are issued to production as required. Once manufactured, the items move from the factory to the finished-goods warehouse, which also adjoins the factory. Each warehouse is controlled by its own foreman. After consultation with the farmer, the product-development department designs the item required and draws up a ‘build schedule’ that identifies every part required to manufacture the item. Build schedules are preprinted and numerically sequenced. Farmer Joe (Pty) Ltd has good internal controls, including sound departmental division of duties within each cycle. The only function within the acquisitions cycle that is not computerised is ordering, which is still carried out manually. The company also has an internal audit department. It is headed by Murree Turner, a chartered accountant, and is well staffed. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϳϭ Murree Turner, who reports to the Board of Directors, ensures that his department does not involve itself with operational matters. The department concentrates its efforts on a well-planned schedule of risk and control evaluations, compliance testing and similar activities. The annual inventory count for the financial year-end will occur on 30 April (the last day of the financial year). No manufacturing will take place on this day and management requires that the entire inventory count, including work in progress, be completed on this day. You believe that if proper planning takes place, this can be achieved. As part of your planning activities, you assessed the work papers of the internal audit’s recent evaluation of several cycles. You found the work papers comprehensive and well prepared and the internal control systems sound. YOU ARE REQUIRED TO: (a) Describe the internal controls that should be in place at Farmer Joe (Pty) Ltd in respect of: (i) the ordering of raw materials and parts for manufacturing; and (10) (ii) the transfer of raw materials and parts from the raw material and component store to the factory. (9) (b) State, giving reasons, whether it would be appropriate for you to work with the internal audit department on the year-end inventory count to be held on 30 April. (11) WZd ;ϴŵĂƌŬƐϭϬŵŝŶƵƚĞƐͿ Cashbro Ltd is a multinational company in the gaming and toy-manufacturing industry. You are the engagement partner on the audit of Cashbro Ltd’s subsidiary, Clay-Doh (Pty) Ltd, a manufacturer of children’s play dough. The dough is manufactured primarily from water, salt, flour, colourants and chemicals. Management of the company used to feel at ease over the warehousing function of the company, due to the fact that the raw materials were not high-value items. However, in recent months it came to management’s attention that materials might indeed be going missing, presumably for the private use of employees. YOU ARE REQUIRED TO: Briefly list the business risks related to the warehousing function of a company such as Clay-Doh (Pty) Ltd. (8) ϭϭ͘ϭϱ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ Fabric (Pty) Ltd is a very large company in the textile sector. The risk assessment procedures you have carried out revealed that the company imports fabric from many countries and also purchases from local suppliers. Fabric (Pty) Ltd sells the fabric and manufactures garments for both the mass and fashion markets. ϮϳϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The company leases warehousing facilities in Durban, East London and Cape Town and owns a warehouse in Johannesburg. The manufacturing plant is also situated in Johannesburg. The company’s fabrics and garments are sold through approximately 2 000 outlets, some of which are part of the company, but most of which are independent retailers of varying sizes, ranging from national chain stores to small sole traders. Inventory is purchased from Fabric (Pty) Ltd by the larger outlets. The approximately 500 small outlets make purchases from Fabric (Pty) Ltd and hold certain Fabric (Pty) Ltd fashion lines on a consignment basis. The small outlets can also return any out-of-fashion or slow-moving inventory. Fabric (Pty) Ltd then sells this inventory by auction to the highest bidder. The internal control system for inventory has not always proved to be reliable due mainly to the volume of business and the constant movement of inventory between warehouse, consignment inventory holders and the outlets in general. The statement of financial position for the year ended 31 March 2022 shows inventory to be valued at R28 million, a material amount in the context of the company. YOU ARE REQUIRED TO: (a) Explain to the junior trainee who is on the audit with you, why auditors conduct risk assessment procedures. (7) (b) Assess the risk of material misstatement in the inventory balance in the financial statements of Fabric (Pty) Ltd at 31 March 2022. Structure your answer in terms of the assertions, but do not concern yourself with the risk of material misstatement applicable to related disclosures or the presentation assertion. (18) ϭϭ͘ϭϲ ;ϮϳŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ You are the auditor of Households (Pty) Ltd, a retailer of home appliances, for example fridges, stoves and televisions. The financial year-end of the company is 28 February and you are currently planning attendance at the inventory count, which is scheduled for 28 February, as well as the subsequent inventory procedures you will conduct. Households (Pty) Ltd operates out of a large warehouse/outlet in Port Elizabeth and also holds inventory at outlets in Grahamstown and Port Alfred. The majority of the appliances sold by the company is manufactured in South Africa, but certain more expensive lines are imported from Austria and the United States. In addition to their regular products, the company also sells an expensive range of technologically advanced audio equipment, which is also imported. All imported goods are shipped to the Port Elizabeth warehouse in containers. At year-end there are likely to be several containers that have been delivered to the warehouse but not unpacked. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϳϯ Households (Pty) Ltd is well managed with sound systems of internal control and is profitable. In addition to its inventory of new appliances, Households (Pty) Ltd also has a large inventory of second-hand appliances for sale at its Port Elizabeth warehouse. These appliances are taken as ‘trade-ins’ on new appliances and repaired/repainted in Households (Pty) Ltd’s workshop. Each of these ‘trade-ins’ is given a job number, and repair costs are recorded on a job card. A computerised inventory ledger of second-hand goods is maintained, each item having a unique record of its details including item serial numbers, date of trade-in and sales-agreement numbers, tradein value and repair costs. YOU ARE REQUIRED TO: (a) Assess the risk of material misstatement of the inventory account balance in the financial statements at 28 February 2022. Consider each of the assertions relating to inventory. Do not concern yourself with the assertions relating to presentation and disclosure. (12) (b) Describe the procedures you will carry out to verify the valuation of secondhand appliances on hand at year-end having satisfied yourself with the existence of second-hand appliances by attending the annual inventory count. (15) ϭϭ͘ϭϳ ;ϯϲŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ Algoa (Pty) Ltd is a large manufacturer and wholesaler of industrial chemicals and welding consumables. The company holds significant inventories in warehouses and bulk storage tanks in Port Elizabeth, Cape Town and East London. At year-end (31 March), the company normally has a substantial quantity of chemicals still in the process of manufacturing. For financial reporting purposes, the directors place a value on this work in progress. For audit purposes your firm engages an expert to provide a written report on the directors’ valuation. Due to the death of the expert your firm engaged for the prior year’s audit, your firm appointed another expert, Syd Sulfer, to fulfil the engagement. Algoa (Pty) Ltd sells a wide range of welding rods and related products, but also holds substantial inventory on consignment on behalf of Powerweld Ltd. This Durban-based company manufactures a unique type of welding rod used by several contractors on marine-based projects. Algoa (Pty) Ltd operates a simple ‘quantities only’ ledger account to record the movement of these rods. Each month a return listing the name of contractors who have purchased rods from Algoa (Pty) Ltd, the quantity of rods purchased, and the relevant Algoa (Pty) Ltd delivery-note number, is sent to Powerweld Ltd, which then invoices the contractors. Algoa (Pty) Ltd retains a copy of the monthly return. Contractors pay Powerweld Ltd directly. Algoa (Pty) Ltd is paid commission once a year in April based on the quantity sold up to Ϯϳϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ the end of March of each year. The commission received by Algoa (Pty) Ltd is a material amount and is calculated as follows: Number of rods ‘sold’ by Algoa (Pty) Ltd for the year Less: xxx Number of rods unaccounted for (for example lost or stolen) Number of rods damaged (not saleable) Number of rods on which commission is paid xx xx xxx The number of rods on which commission is payable is multiplied by 20% of the standard selling price per rod (agreed between Algoa (Pty) Ltd and Powerweld Ltd at the start of each financial year). Algoa (Pty) Ltd counts consignment inventory during the year-end inventory count. YOU ARE REQUIRED TO: (a) Discuss the risk of material misstatement relating to Algoa (Pty) Ltd’s inventory at 31 March 2022. (5) (b) Discuss the information your firm would have sought relating to Syd Sulfer prior to engaging him and describe briefly how this information would have been obtained. (8) (c) Identify the matters your firm would have included in the written agreement with Syd Sulfer, specifically relating to the engagement to submit a report on the directors’ valuation of the company’s work in progress. (10) (d) Explain why it will be necessary to conduct audit procedures on consignment inventories. (3) (e) Describe the procedures you would carry out to verify the amount of commission accrued by Algoa (Pty) Ltd at 31 March 2022. (10) ϭϭ͘ϭϴ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ WZd ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are engaged on the 31 March 2022 audit of Formweld (Pty) Ltd, a company in the light engineering sector. You have been assigned to the audit of inventories. Towards the end of the financial year, the company was involved solely in the manufacturing of 20 pivot irrigation systems for Turnerfarms Ltd, a commercial farming company. Four of the twenty 20 systems ordered had been completed at year-end and were awaiting collection. Six systems were ‘work in progress’ and manufacturing of the balance of ten had not commenced. All materials used in the manufacturing of the systems are purchased locally, except for the high-pressure pumps imported as a batch of 20 from Speck Pumps Inc in Germany. ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϳϱ The company operates a job costing system. Each unit is treated as a separate job, and costs and other information are recorded on a numerically sequenced job card on which costs are recorded. Prior to the commencement of the manufacturing of the units, a ‘materials and labour schedule’ is prepared by the company’s engineer and cost accountant. This document details the estimated manufacturing hours for the different grades of employees working on the unit and the description and estimated costs of materials to be used. At year-end the chief engineer, John Graham, estimated the stage of completion of the six units in progress and provided you with the six job cards updated to 31 March 2022. The year-end inventory count took place on the last day of the year. Prior to the year-end, you evaluated the underlying internal control systems and conducted tests of controls. You have concluded that the accounting system and related controls at Formweld (Pty) Ltd are sound. The job card for the seventh irrigation system (unit 7), which is included in work in progress at 31 March (at an amount of R158 395), includes: • hours worked by four permanent employees for wage weeks 49–52; • a speck pump at the unit cost of R54 292; • a pivot arm, piping, joints and consumables; • overheads of R14 200 allocated to the job; and • an amount of wastage of R18 610 allocated to the job for a pivot arm that fell off a fork-lift. This irrigation system is 80% completed. YOU ARE REQUIRED TO: (a) Describe the further audit procedures you would have conducted at the yearend inventory count regarding work in progress. (5) (b) Describe the further audit procedures you will conduct regarding the costs relating to the seventh irrigation system (unit 7) included in work in progress at 31 March 2022. (20) WZd ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ Pandor (Pty) Ltd is a company that designs and manufactures sterling silver jewellery. As the cost of the company’s inventory (both raw material and finished goods) are very valuable, management of the company has approached you for inputs with regards to the controls over the movement, damage, theft and loss of inventory at Pandor (Pty) Ltd’s warehouse. YOU ARE REQUIRED TO: List the controls that should be in place over the warehouse function at Pandor (Pty) Ltd, relating to the movement, damage, theft and loss of inventory. (10) Ϯϳϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϭ͘ϭϵ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the senior in charge of the 28 February 2022 year-end audit of Parts ’n Pieces (Pty) Ltd, a motor spares and accessories company. Parts ’n Pieces (Pty) Ltd uses a computerised perpetual inventory system and carries out regular physical inventory test checks (cycle counts) rather than a count at year-end. Your firm does not attend these cycle counts. Pre-numbered goods-received notes are used to record inventory receipts, while pre-numbered stores goods issue slips are used to record issues of goods from inventory. The company uses an online data entry and validation system whereby the transactions, once recorded onto the manually prepared source documents, are input individually into the system via terminals located in the inventory section. The following information is held on the inventory master file: Field Example Inventory number: SP2673 Inventory category: accessories Inventory description: chrome exhaust cap Inventory location: W4 Quantity on hand: 150 Unit of issue: single item Unit selling price: R120,52 Unit cost (calculated as weighted average): R73,20 Date of last receipt: 13/01/2022 Date of last sale: 18/02/2022 Date of last physical inventory count: 31/11/2021 Date of last inventory adjustment: n/a Year-to-date sales quantity: 925 Year-to-date purchases quantity: 1035 Code number of last supplier used: Exh 321 Your firm has a range of audit software suitable for use on the inventory master file and you are competent to use it. YOU ARE REQUIRED TO: Detail the information you could extract from the inventory master file for the yearend verification of inventory. Explain what you would do with the information obtained. (30) ŚĂƉƚĞƌϭϭ͗/ŶǀĞŶƚŽƌLJĂŶĚƉƌŽĚƵĐƚŝŽŶĐLJĐůĞ Ϯϳϳ ϭϭ͘ϮϬ ;ϮϳŵĂƌŬƐϯϯŵŝŶƵƚĞƐͿ WZd ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are the external auditor overseeing Late Night Owl’s February 2021–2022 yearend audit (Pty) Ltd. Late Night Owl (Pty) Ltd embarked on changing their business model during the financial year under review, which can only be described as an unprecedented year due to an international pandemic. Some salient points to note: • Late Night Owl (Pty) Ltd sells corporate clothing and until the first quarter of 2020, they had one warehouse and seven retail stores located in financial hubs across South Africa. • The key factor differentiating them from competitors is that their trading hours are from 7 a.m. to 9 p.m., which give their usual clientele more flexibility to shop as they consist mostly of businesspeople with busy schedules. • During the previous financial year, Late Night Owl (Pty) Ltd embarked on an online marketing campaign and launched an online selling platform. This additional sales channel proved to be very successful. • This success, combined with the pandemic’s impact, resulted in Late Night Owl (Pty) Ltd exercising their right to cancel all their lease agreements, except for the warehouse, to solely pursue online sales. • Their mobile application has been downloaded from the App store by circa 200k users and most of the online purchases are through the mobile app. • The inventory system is fully automated and interfaces with the mobile app. • Due to the store closures, Late Night Owl (Pty) Ltd decided to perform an interim inventory verification and found that a quarter of the inventory that was held in the stores was obsolete. YOU ARE REQUIRED TO: Briefly list the procedures that you would consider to obtain an understanding of the working of, security and controls surrounding the mobile application as well as the interface between the mobile application and the inventory system (including the financial applications). (20) WZd ;ϳŵĂƌŬƐϵŵŝŶƵƚĞƐͿ You are the manager on the December 2022 year-end audit of Bride-and-Groom (Pty) Ltd, a commercial supplier of wedding attire. The company sells their wide range of imported products from stores located in various shopping malls in South Africa. Ϯϳϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ One of the trainees on the audit team, who is busy conducting audit tests related to the costing of inventory brought the following matters to your attention: ‘1. The sample of inventory items I selected as part of my testing, included an item with the description “Ivory Milano Wedding Dress”. At year end, there were 817 of these dresses on hand. The costing schedule for the dresses indicated that a batch of dresses (2500 items) was imported in February 2022 while another batch of dresses (1500) was imported in August 2022. All the dresses were recorded at the exchange rate on the date on which the dresses were paid. The dresses for the first shipment had a slightly higher cost per unit than that of the second shipment. The inventory records indicate that the 817 dresses at year end relate to the first shipment. No “Ivory Milano Wedding Dresses” were in stock at the beginning of the financial year. 2. The sample of inventory items I selected also included an item with the description “Sage Roma bridesmaid dress”. At year-end the client had 1372 of these dresses on hand. All of the dresses were valued by using the exchange rate at the financial year-end. 3. If my own understanding of these matters is correct, there will be an audit difference for both of these inventory items. The difference is, however not material.’ YOU ARE REQUIRED TO: Provide the audit trainee with brief feedback on the matters (1–3) brought to your attention. (7) ,WdZ ϭϮ &ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 12.1 Short questions 25 marks 12.2 Multiple-choice questions 15 marks 12.3 True or false questions 22 marks 12.4 Short questions and multiple-choice questions 22 marks 12.5 Integrated application and discussion – Fraud; Substantive procedures over estimates and longterm loans; Risk assessment procedures; Relying on the work of an expert; Provisions; Audit opinion. 42 marks Application and discussion – Relying on the internal audit department; Audit procedures on property, plant and equipment 40 marks Application and discussion – Controls; Audit procedures relating to share capital 20 marks 12.8 Application – Assertions 15 marks 12.9 Application – Weaknesses and recommendations 40 marks Application and discussion – Substantive audit procedures relating to property, plant and equipment acquired 40 marks 12.6 12.7 12.10 continued Ϯϳϵ ϮϴϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 12.11 Description of content of the question Total marks Application and discussion – Audit response to risk of manipulation; Substantive audit procedures relating to loans advanced; Limited Companies Act integration. 25 marks Application and discussion – Audit procedures relating to investments 23 marks Integrated application and discussion – Risk of material misstatement; Provision/contingency; Substantive procedures relating to motor vehicles and debenture issues; Composition of the board 57 marks Application and discussion – Contingent liabilities and provisions 16 marks 12.15 Application and discussion – Related parties 32 marks 12.16 Application and discussion – Audit procedures relating to share issue; Leases 26 marks Application and discussion – Substantive procedures relating to property, plant and equipment; Impairment losses 28 marks Application and discussion – Inherent risk factors; Automated application controls; Automated control procedures 27 marks Integrated application and discussion – Pre-engagement; King IV; Companies Act; CPC; Provisions; Contingencies; Audit procedures 37 marks Application and discussion – Audit procedures to audit property, plant and equipment; Advantages and disadvantages of specifically developed accounting system 30 marks 12.12 12.13 12.14 12.17 12.18 12.19 12.20 ϭϮ͘ϭ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: 1. Comment briefly on the following concerning the Finance and Investment cycle: 1.1 frequency of transactions; ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϴϭ 1.2 size (materiality) of transactions; 1.3 internal controls relating to transactions; 1.4 legal and regulatory requirements; and 1.5 documentation. (5) 2. Why is it possible that a significant property, plant and equipment figure on the balance sheet can be regarded as having only low/medium audit risk? (5) 3. Why will the audit team conduct tests to determine whether any impairment of property, plant and equipment had occurred in addition to auditing the allowance for depreciation? Provide an example. (5) 4. Why are some property, plant and equipment accounted for on the cost model and some on the revaluation model? (3) 5. Comment on how the factors listed below would affect your evaluation of the risk of material misstatement in the financial statements of Chadwick (Pty) Ltd and discuss your firm’s overall response to that. (7) • Chadwick (Pty) Ltd concluded several material transactions in the finance and investment cycle in the year under audit. • Management of Chadwick (Pty) Ltd, including those in the accounting department, lacked knowledge and an appropriate understanding of the complexities of the financial reporting standards relating to these transactions. ϭϮ͘Ϯ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer for each of the questions listed below: 1. Rouge (Pty) Ltd made a long-term loan to one of its subsidiaries during the year. The assertions applicable to this transaction are (a) obligation, accuracy, valuation and allocation, completeness, and existence; (b) occurrence, accuracy, cut-off, classification, completeness and presentation; (c) occurrence, cut-off, valuation and accuracy; (d) obligation, occurrence, cut-off and completeness. 2. While planning the audit of Bleu (Pty) Ltd, a manufacturing company, you decided to rely on the internal audit section to assist with certain aspects of the audit of property, plant and equipment. This decision would be regarded as part of your (a) risk assessment procedures; ϮϴϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) audit strategy; (c) audit plan; (d) materiality assessment. 3. Jaune (Pty) Ltd imported a piece of manufacturing equipment on 31 January 2023 (transaction date). The cost was $100 000. The foreign creditor was paid on 15 February 2023 (settlement date). The company’s financial year end is 28 February 2023 (reporting date). The rand/dollar exchange rate was different on each of these three dates. The company adopts the cost model for its PPE. At the financial year end the cost of the equipment will be reflected in the AFS at the rand/dollar exchange rate on the (a) reporting date; (b) transaction date; (c) settlement date; (d) none of the above. 4. Which of the following is a condition that must be satisfied for the recognition of a provision? (a) The outflow of future economic benefits must be probable. (b) The company must have a present obligation arising from a past event. (c) The obligation must be a legal obligation. (d) The provision must be material. 5. Contingent assets (a) can only be recognised in the financial statements where the inflow of economic benefit is possible; (b) are always disclosed (assuming they are material) in the financial statements but never recognised; (c) will be recognised as an asset in the financial statements where the flow of economic benefit is virtually certain; (d) can be disclosed or recognised provided the company adopts a policy consistent with the prior year. 6. Which of the following is not an assertion applicable to the ‘property, plant and equipment’ account heading? (a) Existence. (b) Rights. (c) Occurrence. (d) Accuracy, valuation and allocation. ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϴϯ 7. Which of the following is not an assertion applicable to the long-term liabilities account heading? (a) Classification. (b) Obligation. (c) Rights. (d) Existence. 8. Which of the assertions listed below is generally considered to present the highest risk of material misstatement regarding long-term liabilities? (a) Completeness. (b) Accuracy, valuation and allocation. (c) Existence. (d) Occurrence. 9. In terms of IAS 16 – Property, Plant and Equipment, a company (a) must apply the cost model for the valuation of its PPE; (b) may apply the replacement model for the valuation of its PPE; (c) must choose between the cost and revaluation models for the valuation of its PPE; (d) may apply the cost model to some classes of PPE and the revaluation model to other classes of PPE. 10. In terms of IAS 16 – Property, Plant and Equipment, the directors of a company are required to review the residual value and useful life of its property, plant and equipment at least (a) at the end of every second financial year; (b) at the end of every financial year; (c) whenever major capital expenditure takes place; (d) whenever the disposal of a major item of capital expenditure takes place. 11. The depreciable amount of an item of plant and equipment is (a) the initial cost of the item of plant and equipment divided by its useful life; (b) the estimate of the amount which the company would obtain should the item of plant and equipment be disposed of at the current date; (c) the cost of the item of plant and equipment less the residual value; (d) none of the above (11(a)–11(c)). Ϯϴϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 12. Mastertech Ltd recently acquired an item of plant and equipment from Germany for R150 million. Which of the following costs should not be included in the initial cost of this item of plant and equipment? (a) VAT charged by local contractors to transport and install the plant and equipment. (b) Engineer’s fees for the design of the platform on which the plant was installed. (c) Non-refundable import duties. (d) Road freight costs incurred in moving the equipment from the harbour in Durban to Pretoria. 13. Which of the following costs should be included in the initial cost of the item of plant and equipment purchased by Mastertech Ltd (see 12 above)? (a) Training of skilled employees to operate the machine. (b) Costs of bringing the CEO of the German company which supplied the equipment to South Africa for the unveiling of the new plant. (c) A R70 000 fine for failing to implement proper safety procedures while the equipment was being transported from Durban. (d) Costs incurred in testing the equipment incurred before commencing production. 14. Cartrite (Pty) Ltd, a transport company, invests some of its surplus cash in shares in both listed and unlisted companies. Besides accuracy, valuation and allocation the assertions which apply to the balance on ‘investment in the listed companies account’ will be (a) occurrence, cut-off, classification and completeness; (b) classification, completeness, accuracy and existence; (c) existence, completeness, presentation and obligation; (d) rights, existence, classification, presentation and completeness. 15. The investment in shares held by Cartrite (Pty) Ltd (see 14 above) should be valued at (a) cost less brokerage fees (transaction costs); (b) cost plus brokerage fees (transaction costs); (c) fair value; (d) replacement value. ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϭϮ͘ϯ Ϯϴϱ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: State whether each of the following statements is true or false and provide reasons for your answers. Consider each statement separately. 1. When the auditor confirms that a company had the necessary authorised, but unissued, shares to make a new issue of shares during the year under audit, he gathers evidence to support the classification assertion applicable to the transaction. (2) 2. Every issue of shares to a director must be supported by a special resolution of the shareholders. (2) 3. Where a company has issued debentures at a premium, the debenture must be reflected in the financial statements at amortised cost. (2) 4. Where a company enters into a long-term lease for an expensive piece of machinery, it can recognise the lease by recognising a ‘right of use’ asset and a lease liability, or it can simply treat the lease payment as an expense. (2) 5. The classification assertion does not apply to property, plant and equipment. (2) 6. A company may choose the cost model or the revaluation model for its property, plant and equipment. (2) 7. The carrying amount of plant and equipment using the cost model will always be reflected as cost less accumulated depreciation. (2) 8. When the definition and recognition criteria for an asset, for example, a large machine, are met for significant parts of the machine, the cost of each significant part should be recognised in a separate asset account. (2) 9. If a company adopts the revaluation model for its property, plant and equipment and the assets carrying amount increases as a result of a revaluation, the increase is always recognised in profit and loss as revaluation income. (2) 10. The directors of a company are required to review the residual value and useful life of property, plant and equipment at the end of every financial year. (2) 11. A liability is a possible (it will only be confirmed by the occurrence or nonoccurrence of a future event) obligation that arises from a past event, whereas a (2) contingent liability is a present obligation arising from a past event. ϭϮ͘ϰ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the questions listed below: 1. Define property, plant and equipment in the context of IAS 16. 2. What assertions relate to property and its related disclosures reflected in the company’s financial statements? (2) (2) Ϯϴϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 3. State the two measurement models acceptable for property, plant and equipment. (1) 4. The assertions relating to property, plant and equipment will depend on the measurement model selected by the company. True or false? Justify. (2) 5. Landgrab Ltd uses huge bulldozers to move sand and rubble on construction sites. It has recently purchased three new bulldozers at R4 000 000 each. The bulldozers have two significant parts: the chassis and structure of the bulldozer (R3 000 000) and the hydraulic lifting motor and gearing (R1 000 000). The useful life of the chassis etc., is estimated at 15 years, and the useful life of the hydraulics is estimated at five years. 5.1 When is a part of an asset considered to be a ‘significant part’? (1) 5.2 What is the reason for identifying parts of an asset as significant? (2) 5.3 Should the significant parts of an asset be recognised in separate accounts? (1) 5.4 If a set of tyres for each bulldozer, which lasts five months under normal conditions, costs R200 000 (R50 000 each), should the tyres be identified as a significant part and be recognised in a separate (asset) account? Justify your answer. (3) 6. If a large industrial company elects the cost model for its property, plant and equipment, can it include the following as part of the cost of a new machine? 6.1 VAT. 6.2 The cost of hiring a crane to position the machine on the factory floor. 6.3 The production cost of an instruction manual for operators who will be working on the machine. 6.4 The annual insurance premium. (3) 7. Distinguish between the depreciable amount and residual value of an asset. (2) 8. Explain the relationship between the useful life of an asset and its depreciable amount. (1) 9. Ringking (Pty) Ltd imported a piece of manufacturing equipment on 31 January 2023 (transaction date). The cost was $100 000. The foreign creditor was paid on 15 February 2023 (settlement date). The company’s financial year-end is 28 February 2023 (reporting date). The rand/dollar exchange rate was different on each of these three dates. The company adopts the cost model for its PPE. At the financial year-end, the cost of the equipment will be reflected in the AFS at the rand/dollar exchange rate on the: 9.1 reporting date; 9.2 transaction date; 9.3 settlement date; 9.4 none of the above. (1) ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϴϳ 10. Which of the following is a condition that must be satisfied to recognise a provision? 10.1 The outflow of future economic benefits must be possible. 10.2 The company must have a present obligation arising from a past event. 10.3 The obligation must be a legal obligation. 10.4 The provision must be material. ϭϮ͘ϱ (1) ;ϰϮŵĂƌŬƐϱϭŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of Constructaco (Pty) Ltd (Constructaco), a company in the business of constructing roads and developing mixed-use integrated housing. Mixed-use integrated housing (that combines residential and nonresidential buildings) has become very popular in South Africa, as it offers residents the opportunity to live close to their jobs; integrates lower and higher income living and does away with the separation of areas into living, working and entertainment spaces. The deadline for the audit has been set at six weeks after year end. During the 2023 financial year under review, Constructaco was involved in many long-term building projects. The contracts for these projects usually specify the dates whereby phases of work have to be completed. Constructaco normally receives payment in advance. The company employs the services of an actuary to assist its engineers with estimating the stage of completeness of the work and, thereby, the work-in-progress and contract income received in advance. For contracts where payment is not received in advance, Constructaco obtains finance from GNB bank. Shortly before year-end, Constructaco obtained a property valuation for their office building, whereby the value of the building has been increased by R3 500 000. Besides the office building, Constructaco’s property, plant and equipment consist of various storage facilities where machinery is kept. Machinery is constantly purchased to expand on or replace existing machinery. Final materiality has been set at R2 000 000. Ϯϴϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Below is an extract of Constructaco statement of financial position as at 28 February 2023: Non-current assets Property, plant and equipment Investments 134 000 000 34 000 000 168 000 000 Current assets Trade and other receivables Work-in-progress 73 000 000 169 000 000 242 000 000 Non-current liabilities Long-term loan GNB Bank Debentures Provision for future operating losses 80 000 000 1500 000 7 000 000 88 500 000 Current liabilities Contract income received in advance Short-term portion of long-term loan GNB Bank 137 000 000 6 700 000 143 700 000 YOU ARE REQUIRED TO: (a) Explain the methods whereby the directors of Constructaco (Pty) Ltd can improve the financial statements through fraud. (8) (b) Explain the nature, timing and extent of the substantive tests that you will perform at Constructaco (Pty) Ltd. (6) (c) Describe the risk assessment procedures that you would have performed, at the assertion level, over the estimates relating to the work-in-progress and contract income received in advance, during the planning phase of the audit. (10) (d) Explain the factors that you would consider when obtaining an understanding of the work undertaken by the actuary employed by Constructaco (Pty) Ltd. (8) (e) Formulate the substantive audit procedures that you will perform to obtain comfort about the completeness of Constructaco (Pty) Ltd’s long-term loans. (4) (f) Comment briefly on the provision for future operating losses, included on the face of Constructaco (Pty) Ltd’s statement of financial position. (2) (g) Your audit procedures indicated that Constructaco (Pty) Ltd had overstated provisions by R7 000 000. Management refuses to adjust in this regard. Briefly discuss the effect that this misstatement will, in isolation, have on your audit opinion. (4) ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϭϮ͘ϲ Ϯϴϵ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ Blockbuster (Pty) Ltd is a large company that manufactures cement blocks, curb stones, pavers etc. The company has seven production yards situated in Gauteng, and each yard is under the control of a production manager. You are in charge of the audit of property, plant and equipment for the year-end 31 March 2023, having worked on the audit for the past two years. You have gathered the following information: 1. Early in the year the company established an internal audit department headed by Rudolf Adams, a young, recently qualified chartered accountant, and staffed by two other members, both of whom are completing their accounting qualifications. Rudolf Adams reports to Daniel Mudow, the financial manager. Internal audit adheres strictly to a work schedule prepared by Daniel Mudow, whom your firm has found to be very domineering, uncompromising and intolerant of criticism in the past. 2. Blockbuster (Pty) Ltd has a large amount of money invested in ‘hi-tech’ plant and equipment at the seven production yards. The accounting records are all computerised. Plant and equipment is recorded in the plant and equipment master file, which includes, inter alia, the following fields: Field Example Asset number: 3-2075 (the first digit ‘3’ indicates the production yard at which the plant is located). Description: compactor (where applicable serial numbers are included) Date of purchase: 1.04.2014 Supplier: A G Berlin Source: ‘F’ (F = foreign supplier, L = local supplier) Cost: R480 000 (including installation charges, where applicable) 3. Blockbuster (Pty) Ltd purchases all of its plant and equipment. It does not enter into lease agreements. 4. Any additions to plant and equipment must be included in the capital budget for the year. Before the order is placed, it must be approved first by the capital committee and then by the directors before the order is placed. 5. Blockbuster (Pty) Ltd maintains its plant and equipment very carefully, ensuring that it complies with the supplier’s maintenance requirements. From time to time foreign suppliers send out maintenance personnel and/or replacement parts for some of the equipment used by the company. All equipment is comprehensively insured. ϮϵϬ 6. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Most of the large equipment used by Blockbuster (Pty) Ltd has to be installed. Some suppliers carry this cost while others require that Blockbuster (Pty) Ltd carry the cost. Detailed schedules of installation costs are prepared by the company. You discussed the audit approach for plant and equipment with your manager. He decided that you should request Rudolf Adams and his team to assist you with the year-end audit by visiting three of the production yards to carry out certain procedures on the plant and equipment on your behalf. In addition, your manager has specifically asked you to vouch purchases of plant and equipment from foreign suppliers. As they have done in the past, Blockbuster (Pty) Ltd is prepared for you to interrogate their plant and equipment master file using your audit software. YOU ARE REQUIRED TO: (a) Identify and discuss briefly, the factors you would consider in the assessment of the internal audit department at Blockbuster (Pty) Ltd. Where applicable, relate your answer to the information given in the question. (12) (b) Outline the procedures Rudolf Adams and his team could conduct when visiting the company’s production yards to assist in the audit of plant and equipment. For each procedure outlined, identify the assertion to which it relates. Detailed audit procedures are not required. (8) (c) Describe the procedures you would conduct to vouch additions to plant and equipment purchased from foreign suppliers for the year-ended 31 March 2023. (20) ϭϮ͘ϳ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Tembiso Manufacturing (Pty) Ltd is a company that specialises in manufacturing furniture for the hotel and gaming industry. The company has quite an extensive asset register. You noted that, during the year under review, the company purchased two new 18-wheeler delivery trucks. Tembiso Manufacturing (Pty) Ltd has also acquired and installed a new production line, capable of mass production of identical parts. The expenditure related to the trucks and the production line was partially financed through a long-term loan from Business-Brokers Ltd, a business loan provider. The balance of the costs was financed through the issue of shares (to the company’s existing shareholders). YOU ARE REQUIRED TO: (a) Provide a brief overview of the controls you would expect to be in place at Tembiso Manufacturing (Pty) Ltd to compensate for the risk of its finance and investment cycle. (10) ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ (b) Ϯϵϭ Describe the substantive audit procedures you will perform to obtain comfort over the assertions related to Tembiso Manufacturing (Pty) Ltd’s share capital. Do not concern yourself with procedures relating to presentation and disclosure. (10) ϭϮ͘ϴ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Xpaper Ltd is a manufacturer of a large range of paper products. Xpaper Ltd also has several investments in shares of both private and listed companies. The following procedures were carried out during the audit of the finance and investment cycle at Xpaper Ltd: 1. Inspected minutes of the investment committee meetings for authority for the purchase of shares in a private company that had taken place during the year under audit. 2. Reperformed the calculation of interest paid to debenture holders for the year. 3. Inspected the accounting policy note regarding the valuation of investments to confirm that it was relevant and understandable in the context of the IFRS. 4. Compared the schedule of long-term liabilities at the current year-end to the schedule of long-term liabilities at the previous year-end. 5. Inspected the share certificates for a sample of investments in private companies to determine whether the certificates were in the name of Xpaper Ltd. 6. Inspected Xpaper Ltd’s final bank statement for the year to confirm that the repayment of a loan made by Xpaper Ltd to a client had been recorded in the year under audit. 7. Discussed and evaluated the basis on which the useful life of one of the company’s registered trademarks was determined. 8. Inspected the notes to the financial statements to confirm that all disclosures regarding the company’s intangible assets required in terms of the financial reporting standards had been made. 9. Obtained written confirmation of the balance owing at year-end directly from Cartons Ltd, a company to whom Xpaper Ltd had made a loan. 10. Obtained the share market price of the company’s listed investments at yearend. 11. Discussed with management whether any of the company’s paper manufacturing equipment was lying idle. 12. Traced the journal entries’ postings that recorded the profit or loss on sale of fixed assets to the general ledger to confirm that the ‘transactions’ had been recorded in the proper accounts. 13. Reviewed correspondence with Xpaper Ltd’s attorneys to confirm that an economic inflow from a court case that had been disclosed in the notes as a contingent gain would ‘probably’ but not ‘virtually certain’ occur. ϮϵϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 14. Enquired of management as to the source of funding for major acquisitions identified during the audit of fixed assets. 15. Selected a sample of plant and equipment items from the fixed-asset register and physically inspected them, matching the description/asset numbers to the details extracted from the register. YOU ARE REQUIRED TO: Indicate to which assertion each of the procedures listed above relates. ϭϮ͘ϵ (15) ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ You have recently been appointed as the internal auditor of North Shore (Pty) Ltd, a large shipping company in Port Elizabeth. Your first assignment was to evaluate the company’s accounting systems and related internal controls. The company is divided into five sections, each of which has its own section accountant who is responsible for producing monthly accounts and ensuring that sectional financial matters run smoothly. While reviewing the financial records of the warehousing section, you were surprised to see that considerable capital expenditure had been incurred just before the financial year-end (30 June). You found that the same occurred in the other four sections of the company and, on visiting the various sections (in July), you noticed a fair amount of equipment still in boxes and not in use. Deciding to follow this up, you approached Andy Bell, the most senior sectional accountant, for an explanation of how the system for capital expenditure operated. He responded as follows: 1. Each sectional accountant is responsible for capital expenditure for his section. 2. A budget is prepared in the office of the financial director. Budgeting figures are calculated by increasing the prior year’s budget by the average consumer price index for the year. Sectional accountants are notified as to what their section can spend on the purchase of capital items. 3. However, if sections do not spend their capital budget in any financial year, that section’s budget is reduced for the following year. As you can see, we all try to avoid a cut in our budget by making sure we spend our budget before the end of the financial year. 4. If a staff member in the section requires equipment, for example in my warehouse section the foreman may decide he needs a new forklift, he will email my assistant with the precise details of what is required as well as the name of a supplier. None of the equipment used by North Shore (Pty) Ltd is particularly complicated, so this method works fine. 5. My assistant will then complete a pre-printed, numerically sequenced, multicopy order form (which I as sectional accountant will sign) and send the top copy to the supplier. The second copy of the order is sent with the supplier delivery note, to the central creditors department for payment. The third copy is left in the ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϵϯ order book and used by the assistant to write up the new equipment in the assets register. 6. The supplier delivers the equipment to the section and my assistant signs the supplier delivery note after agreeing the items to the supplier delivery note. He retains a signed copy of the supplier delivery note which is sent to the creditors department as described in point 5 above. YOU ARE REQUIRED TO: Identify and describe the weaknesses in the system of investing in capital equipment at North Shore (Pty) Ltd, based on the information given above and to recommend improvements to address the weaknesses you have identified. Do not concern yourself with payments to creditors. Lay your answer out on a double page as follows: Weakness Recommendations 1. .................................................. 1. .................................................. .................................................. .................................................. 2. .................................................. 2. .................................................. .................................................. .................................................. ϭϮ͘ϭϬ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ Mega Mines Ltd owns a fleet of huge dump trucks used to move iron ore and other bulk materials at its remote mining and construction sites around Africa. The company’s most recent purchase is a giant ‘Supatruck’ purchased at the start of the current financial year. The cost of the vehicle is reflected in the fixed-asset register at R8 402 400. As part of the audit team responsible for the year-end audit (30 June 2023) of noncurrent assets, your senior has asked you to carry out year-end verification procedures on the Supatruck. He has indicated that it will not be necessary for you to visit the Northern Cape in his opinion. See point 1.5. You have gathered the following information: 1. A schedule provided by the financial accountant revealed that the cost of the Supatruck was made up as follows: 1.1 Purchase price The truck was purchased from Fiatrucks Inc, the manufacturer in Italy for 513 121 euros. Mega Mines Ltd paid Fiatrucks Inc in full through its bank on 31 July 2022 R7 440 250 continued Ϯϵϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 1.2 Shipping costs, clearing charges, import duties The importation of the truck was handled by a local company Seacarriage (Pty) Ltd who acted as both forwarding and clearing agents. Seacarriage (Pty) Ltd paid all parties involved on behalf of Mega Mines Ltd and then invoiced Mega Mines Ltd for the total amount owed including Seacarriage (Pty) Ltd’s fees. The Supatruck was loaded onto a ship on 1 July 2022 and shipped FOB. The Supatruck was cleared from the Durban Port on 31 August 2022. None of the charges/ duties are refundable. 1.3 Assembly costs This amount was paid to Fiatrucks (South Africa) (Pty) Ltd in respect of the final assembly and commissioning of the truck. Four engineers from the South African company performed this specialised work. Due to insurance and warrantee restrictions, no Mega Mines Ltd staff were involved in this activity. 1.4 R439 000 R96 200 Driver and mechanic training costs This amount covers the cost of training four drivers to operate the Supatruck and three mechanics to service and maintain it. 1.5 Training was provided by Fiatrucks (South Africa) (Pty) Ltd. Abnormal load transport Although registered and licenced as a vehicle the Supatruck is not permitted to be driven on public roads and must be transported on a special purpose flatbed truck as an abnormal load. Two payments were made to Outsize Flatbeds (Pty) Ltd. * The first payment of R110 000 was in respect of moving the Supatruck from Durban to the company’s head office and truck yard in Northern KwaZulu-Natal for final assembly (see 1.3). This transfer took place on 1 September 2022. * The second payment of R198 500 was in respect of moving the Supatruck from the head office to a remote mine in the far Northern Cape on 1 November 2022. R40 000 R308 500 continued ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ 1.6 Unveiling of truck This amount represents the cost of the truck unveiling ceremony held on the Northern Cape mine that would be using the truck and at which the Supatruck will operate for 18 months. Costs include the transport, accommodation and entertainment costs of bringing provincial dignitaries to the ceremony. Ϯϵϱ R78 450 R8 402 400 2. At the financial year-end, the Supatruck was on the mine in the Northern Cape. It started operating on 2 January 2023 at the start of its 18-month contract. Until 1 January, the Supatruck had not been operated other than while minor tests were being carried out. On completion of the 18-month period the Supatruck will be transported back to the head office for cleaning and routine maintenance before moving to its next assignment. 3. Due to the rugged conditions in which the truck operated and the fact that it is normally in operation for 18 hours a day, six days a week, its useful life is expected to be eight years. After eight years the Supatruck is expected to have a residual value of R500 000. The Supatruck is not worth rebuilding and will be sold off to be stripped for saleable parts and scrap. 4. The depreciation on the Supatruck for the financial year has been calculated by the accountant as follows: Cost of Supatruck Less: Residual value R 8 402 400 500 000 Depreciation 12.5% straight line 7 902 400 987 800 Carrying value at 30 June 2023 6 914 600 YOU ARE REQUIRED TO: Discuss the substantive procedures you would carry out to satisfy yourself that the Supatruck is fairly presented in the financial statements at 30 June 2023. (40) Note 1: Structure your answer in terms of the following assertions: existence; rights; accuracy, valuation and allocation; completeness. Do not concern yourself with related disclosures. Note 2: If, in your opinion, any adjustments are required to achieve fair presentation, they should be included in your answer. Ϯϵϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϮ͘ϭϭ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are the manager on the 28 February 2023 year-end audit of Panther-brands Ltd, one of the largest food manufacturers in Southern Africa. Panther-brands owns 80% shares in Chocolate (Pty) Ltd, a company that manufactures and sells chocolates and sweets. The risk of manipulation of the financial statements is perceived as high. The following matters came to your attention: • Panther-brands has been facing severe financial difficulty since the third quarter of the financial year. • During the year under audit, Panther-brands Ltd provided loans to: ¦ Miss Honeycomb, a director of Panther-brands Ltd The loan was approved on 3 May 2022, and repayment was to commence, in monthly instalments, from 1 February 2023. Interest on the loan will accrue at a prime + 2% rate. ¦ Chocolate (Pty) Ltd The loan was approved on 1 January 2023, and no fixed repayment terms have been set. • No other loans made by the company are reflected in its accounting records. • The client seems rather hostile towards members of the audit team. YOU ARE REQUIRED TO: (a) Discuss your firm’s overall response to the perceived risk of manipulating the financial statements. (5) (b) Describe the substantive audit procedures you will perform to audit the loans advanced by Panther-brands Ltd. You may ignore procedures relating to presentation and disclosure. (16) (c) Briefly state the concerns that you may have with regard to the loan granted to Chocolate (Pty) Ltd. (4) ϭϮ͘ϭϮ ;ϮϯŵĂƌŬƐϮϴŵŝŶƵƚĞƐͿ You are a member of the audit team on the audit of Maximum Ltd, an industrial company. The company has an investments committee which is, inter alia, responsible for the purchase of minor holdings of shares in other companies when the company has spare cash available for such investment. The policy of the investment committee is to build up a solid portfolio of shares with the intention of holding them long term and the committee has elected to recognise gains and losses through profit and loss. You have been given the responsibility of auditing investments for the financial year-end 31 March 2023. At 31 March the schedule of shares presented to you by the investment committee is as follows: ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϵϳ Listed investments Company Purchase date No of shares Cost Market value 31 March 2022 R R Market value 31 March 2023 R Amwell Ltd Jun 2022 10 000 2 837 416 – 3 235 206 Baxter Ltd CKS Holdings Ltd Dec 2022 Sept 2020 5 000 15 000 465 000 227 750 – 252 750 419 230 240 000 Spanta Ltd Oct 2020 40 000 184 000 157 200 204 300 409 950 4 098 736 Market value 31 March 2022 Market value 31 March 2023 All shares held are ordinary shares. Unlisted investments Company Purchase date No of shares Cost 4 000 10 000 100 000 150 000 R Tarzan (Pty) Ltd Swingz (Pty) Ltd Nov 2022 July 2019 R R – 220 000 100 000 236 000 220 000 336 000 You have also obtained the following information: 1. The investment committee instructs the company’s brokers Dhlamini and Dobson in writing when a purchase of shares is to be made. 2. All the listed shares are listed on the JSE and are dematerialised (electronic ownership through Computer Share Services). 3. Neither of the shares purchased during the year were purchased cum div. 4. All details pertaining to share investments are recorded in a register of investments. 5. The company uses the fair-value model for valuing its shares. However, in respect of the two unlisted investments, you have been informed as follows by the investment committee chairman: 5.1 The investment in Tarzan (Pty) Ltd has been shown at cost as the shares are not readily tradable and there is absolutely no way for the investment committee to place a ‘fair value’ on the investment, although the committee believes that what the company paid was a fair value at the time. Ϯϵϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 5.2 With regard to the investment in Swingz (Pty) Ltd, the investment committee has determined a fair value at 31 March 2023. Shortly after the financial year-end the company had received an offer from another shareholder of Swingz (Pty) Ltd to purchase the shares for R236 000. The investment committee had considered this to be a fair offer but as the company has no intention of selling the investment, the committee turned down the offer. YOU ARE REQUIRED TO: Describe the further audit procedures you will carry out to satisfy yourself as to the fair presentation of listed and unlisted investments in the statement of financial position at 31 March 2023. Do not concern yourself with the presentation assertion. ϭϮ͘ϭϯ ;ϱϳŵĂƌŬƐϲϵŵŝŶƵƚĞƐͿ Your firm, which has offices in Durban, Johannesburg and Cape Town, has recently been appointed as auditors of Glassguard (Pty) Ltd, a company that installs door and window glass. The company was formed many years ago by Dave Dean and, due to sound management and quality service, has grown steadily. Dave Dean has retained the major shareholding in the company and is also the chairperson and managing director of the company. The other directors, all of whom are key to the success of the company, are Tom Perry, the operations director, Peter Terry, the financial director, and Gordon Green, the marketing director, all of whom have shares in the company. The company has 30 branches spread around the country and approximately 160 delivery vans which are used for transporting glass and installation crews to job sites. A branch manager is in charge of each branch. The company’s accounting records are computerised and are centralised at the head office in Durban. Branches submit details of operating costs (including running costs for each of their vehicles) to head office monthly. ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ Ϯϵϵ Details of all of the company’s vehicles are held in the vehicle master file, which contains the following fields: Field Registration number Engine number Description Location Cost Date of purchase Depreciation rate Current year depreciation Accumulated depreciation Book value Date of disposal/scrapping Disposal price Profit/Loss on disposal Example ND 673 219 327x29B418 Isuzu 2.5 diesel Nelspruit R150 000 1 Aug 2020 20% p.a. reducing balance R24 000 R54 000 R96 000 Date Rand amount Rand amount All vehicles are purchased for cash from Tekwini Motors, a General Motors dealer in Durban, and are registered/licenced in Durban. No vehicles are leased. Before Glassguard (Pty) Ltd takes delivery, Tekwini Motors adapts the vehicles to facilitate the transport of sheets of glass. Shatterprufe Shabalala, the company’s financial controller, has prepared the following schedules and notes for the 31 July 2023 audit: Motor vehicles – cost Opening balance Additions Disposals Closing balance R24 200 000 R3 650 000 R2 520 000 (note 1) R25 330 000 Motor vehicles – accumulated depreciation Opening balance Provision Disposals Closing balance R8 742 000 R3 197 500 R907 200 R11 032 300 Note 1: The vehicles disposed of were 20 Corsa ‘bakkies’ which had originally been purchased (at different times) for use at country branches. However, they had proved to be too small. The vehicles were placed on a vehicle auction in Durban and sold as a single lot for R1 400 000. Details of each vehicle are listed on the ‘Auctioneer’s Sale List.’ Note 2: In June 2023 one of the company’s new Isuzu bakkies (purchased 1 May 2023, cost R250 000) was extensively damaged (it cannot be repaired and ϯϬϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ has no scrap value) when it rolled backwards down a hill and was hit by a passing cement truck owned by Conmix. All our vehicles are comprehensively insured but the insurance company has refused to pay out for the Isuzu or the R300 000 damage to the cement truck. A clause in the insurance contract states clearly that company vehicles may only be driven by a permanent employee of the company. In the case of this vehicle, a casual labourer who had been hired for the day was asked to move the vehicle in question. He did so, parked the vehicle but failed to engage the handbrake. A directors’ minute relating to this matter reads as follows: ‘We have referred the matter to our lawyers who intend to contest the insurance company’s refusal to pay on the grounds that, as no one was actually driving the vehicle at the time of the accident, the specific clause does not apply. Our lawyers will not comment on the likelihood of the case succeeding. We acknowledge that we are responsible for the damages to the cement truck but believe we are fully covered by insurance. No entries will be made in the accounting records (including the vehicle master file) in respect of this matter for the 31 July 2023 financial year. We will treat this entry entirely as a 2023 matter assuming that a decision is reached in the courts in the new financial year.’ You have been placed in charge of the audit of motor vehicles (by far the largest account heading on the statement of financial position) and are about to commence work (early October) on the year-end audit. Your manager has indicated that a comprehensive audit of motor vehicles should be carried out. Your firm’s audit software is compatible with the client’s system and you intend to make use of it. You are located in the Durban office. As you have a sound knowledge of statutory matters and corporate governance you have also been asked to deal with the following: In April 2023 Glassguard (Pty) Ltd issued ten, 9% redeemable debentures of R100 000 each to ten private investors to finance the purchase of state-of-the-art machinery for the manufacturing of armour-plated glass. The debentures are repayable in five years’ time at a premium on redemption of 10%. There are no other debentures in issue. Glassguard (Pty) Ltd put the supply of the armour plating machinery out to tender and the best tender was submitted by Namandla (Pty) Ltd, a black economic empowerment company. However, before Namandla (Pty) Ltd are prepared to do business with Glassguard (Pty) Ltd, it requires that Glassguard (Pty) Ltd undertakes to comply within a reasonable time, with the recommendations of the King IV Code on Corporate Governance in respect of, inter alia, the composition of its board of directors. As Glassguard (Pty) Ltd anticipates significant business dealings with Namandla (Pty) Ltd, they are quite prepared to comply. ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϯϬϭ YOU ARE REQUIRED TO: (a) State whether the risk of material misstatement in the motor vehicles account at 31 July 2023 should be regarded as low, medium or high. Justify your answer. (4) (b) Indicate, giving reasons, whether Glassguard (Pty) Ltd’s decision to treat the matter described in note 2 ‘entirely as a 2023 matter assuming that a decision is reached in the courts’, is appropriate. (8) (c) Describe the substantive audit procedures you will conduct in respect of the assertions relating to the account heading ‘Motor Vehicles’ reflected in the 31 July 2023 draft financial statements. Do not concern yourself with the presentation assertion or with related disclosures. (30) (d) Describe the substantive audit procedures you will conduct in respect of the debenture issue. Do not concern yourself with the presentation assertion. (10) (e) Advise Dave Dean on the changes that need to be made to the composition of Glassguard (Pty) Ltd’s Board of Directors to satisfy the King IV’s recommendations. (5) ϭϮ͘ϭϰ ;ϭϲŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are an auditor employed by the firm Holomisa Inc. The matters listed below relate to clients of Holomisa Inc, with a February 2023 year-end. 1. Fanatics Ltd is in the process of refurbishing one of its stores. The company purchased new mahogany bookshelves from Tembiso Manufacturing (Pty) Ltd. The bookshelves were delivered and fitted shortly before year-end. However, payment is only due 30 days from delivery. 2. In February 2023 Serious-Juice (Pty) Ltd announced the recall of certain of its 100% apple-juice products. The recall followed the results of laboratory tests that identified high levels of patulin (a toxic chemical produced by certain mould species) in the juice. Members of the public have been informed to return any juice products with a manufacturing date between 1 October 2022 and 31 January 2023 to the retailers from where the items have been purchased. SeriousJuice (Pty) Ltd will collect the affected products from the retailers. Credit notes will be issued after the manufacturing dates have been inspected, whereafter the products will be destroyed. It is unsure what the total cost of the refunds and destruction of the stock will amount to, however, calculations indicate that the cost can be estimated at R22 million. Serious-Juice (Pty) Ltd does not have product-recall insurance. 3. After the media coverage related to the recall of Serious-Juice (Pty) Ltd’s products, Koki-Koli Ltd decided to conduct similar laboratory tests on samples of their popular ‘Tizer-Apple Juice’, to put the public at ease. The samples were sent for tests in March 2023. By the time the company’s financial statements were finalised, the results of the tests were still outstanding. ϯϬϮ 4. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ In August 2022, the court ordered VTN Ltd, a cell phone network company, to pay an amount of R40 million to a disgruntled employee. The employee invented the popular ‘call-me-back’ function, whereby users of the cell phone network can send a call request to any other cell phone number on any network. VTN Ltd has correctly accounted for the 40 million in their accounting records. However, the employee has sought a High Court review, as he believes that he is entitled to at least an additional 20% of the income generated by VTN Ltd, stemming from the ‘call-me-back’ function. The High Court will hear the matter in April 2023. It is unclear what the outcome of the court review will be. YOU ARE REQUIRED TO: (a) Define a contingent liability. (2) (b) Distinguish between a contingent liability and a provision. (2) (c) Categorise the matters listed above (1–4) as either: (i) a liability; (ii) a provision; (iii) contingent liability; or (iv) none of the above. Provide reasons for your choices. ϭϮ͘ϭϱ (12) ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ You have been assigned responsibility for the identification of related parties (and material related party transactions) on the audit of Baggdad Ltd, a large diversified holding company. Management have supplied you with a list of related parties and you have carried out basic procedures in respect of the completeness of the list. You are about to instruct the audit team on the kind of transactions which they should look out for during the course of the audit which may indicate the existence of related parties not included on the list supplied by management. YOU ARE REQUIRED TO: (a) Explain why the auditor is concerned about the identification of related parties. (3) (b) Define an arm’s-length transaction (in terms of ISA 550 – Related Parties). (c) Describe the procedures you would have adopted to determine the completeness of the list of related parties supplied by management. (7) (d) Describe to your audit team the kinds of transactions which may assist in identifying related parties not on the list supplied by management. (6) (e) Describe the action you would take if your procedures identified an undisclosed related party or significant related party transaction. (6) (2) ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϯϬϯ (f) State the two matters to which reference should be made by the directors in the management representation letter in respect of related parties. (2) (g) Define a ‘related person’ in terms of the Companies Act 2008 and indicate whether a related person should be regarded as a related party from an audit perspective. Do not concern yourself with juristic persons. (3) (h) State whether the following would be regarded as ‘related parties’ in respect of Baggdad Ltd: (i) Ed Reddy, the non-executive chairperson of the company. (ii) Jordan Ltd, an associate company of Baggdad Ltd. (iii) King Carpet CC, a close corporation owned by the wife of Baggdad Ltd’s financial director. (3) ϭϮ͘ϭϲ ;ϮϲŵĂƌŬƐϯϭŵŝŶƵƚĞƐͿ You are a member of the audit team of Flintstones (Pty) Ltd, a company that prepares granite work surfaces, for example for kitchens and hotel reception areas. With the increase in the popularity of granite, Flintstones (Pty) Ltd has, in the last few years, grown to the extent that during the financial year-end 31 July 2023, the company needed to raise additional finance. You are engaged on the audit of the finance and investment cycle for the 31 July 2023 audit and have established the following: 1. According to the 31 July 2022 financial statements, Flintstones (Pty) Ltd had 200 000 shares of no par value in issue. The authorised share capital was 220 000 shares of no par value. 2. The 200 000 shares in issue were held by Fred Flint 50 000 shares Stan Stones 50 000 shares 10 other investors holding various quantities of shares. 3. At 31 July 2022, Fred Flint and Stan Stones were the only directors of the company but at the annual general meeting held in September 2022, Klippies Kritzinger and Rocky Radebe were appointed as directors. 4. In November 2022 the company issued an additional 100 000 shares of no par value at R10 a share. These shares were issued equally to the four directors. 5. Share-issue expenses of R5 000 were incurred. 6. The money raised by Flintstones (Pty) Ltd from the share issue was used to purchase a stone polishing machine. In addition, the company agreed with Technicut Ltd to lease a high-speed granite cutter. This lease was capitalised as a ‘right-of-use’ asset in the 31 July 2023 financial statements and a long-term liability was raised. ϯϬϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Describe the further audit procedures you would conduct in respect of the issue of shares by Flintstones (Pty) Ltd. Structure your answer in terms of the assertions applicable to transactions and explain the meaning of each assertion in the context of the share issue. Do not concern yourself with the presentation assertion. (16) (b) Refer to note 6 in the scenario and discuss the audit procedures that you would perform to satisfy yourself that (i) the lease was recognised at the correct amount; and (7) (ii) all leases that should have been included in the accounting records have been included. (3) ϭϮ͘ϭϳ ;ϮϴŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ You are a member of the team on the audit of MVP Ltd, a large company that manufactures and distributes protein energy bars. You have been assigned to the audit of certain aspects of the finance and investment cycle for the financial year-end 30 June 2023. The company is situated in Durban. The company owns the land on which its manufacturing plant and storage units are built and investment in plant and equipment is substantial. Idris Bond, the financial controller, has provided you with, inter alia, the following information pertaining to plant and equipment: 1. Accounting policy The company accounts for its plant and equipment using the cost model. 2. Additions Cost of additions for the financial year-end 30 June 2023 amounted to R8 321 941. New equipment is purchased from both local and foreign suppliers. Forward cover is not taken on foreign purchases. 3. Disposals Numerous items of plant and equipment were disposed of during the year mainly to keep abreast of the advancements the machinery used in the manufacturing processes. 4. Impairments The only impairment which the company recognised at 30 June 2023 was in respect of eight printing machines (used for printing the wrappers for the bars) with a carrying value at 30 June 2023 of R505 291. As the ink which was used for the printing is no longer available, the machines cannot be used and will be replaced before the first production cycle of 2023 commences. A local machine ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϯϬϱ repair company has agreed to purchase the eight machines for a total of R60 000. They intend to strip the machines for spare parts. 5. Data The company maintains a computerised fixed-asset register. The chief engineer also maintains extensive information pertaining to plant and equipment, for example capital budgets which include planned disposals, maintenance records, insurance etc. Included in the additions of R8 321 941 mentioned above is a high-speed industrial mixer purchased by the company to increase its production capacity. This machine was shipped (FOB) by a German supplier on 1 November 2022 and was finally cleared through customs and delivered to MVP Ltd on 5 December 2022 by FreightIn (Pty) Ltd, the company’s locally based shipping agents. FreightIn (Pty) Ltd administers both the shipping and clearing of all equipment which MVP Ltd imports. All shipping and custom clearing charges are paid by FreightIn (Pty) Ltd on behalf of MVP Ltd as they occur. FreightIn (Pty) Ltd in turn invoices MVP Ltd to recover these costs, as well as invoicing for its fees. During December MVP Ltd’s maintenance crew installed the machine on the specially designed (by MVP Ltd’s chief engineer) and reinforced concrete floor prepared for the mixer. Extensive testing of the machine was carried out by a specialist firm, ManuFunctions (Pty) Ltd. The mixer was brought into use on 2 January 2023. On 31 December 2022, in terms of their normal trading terms, MVP Ltd paid the supplier the full invoice price of 300 000 Euros. Reference to financial bulletins revealed that the euro/rand exchange rate on the various dates were as follows: 1 November 2022 1 euro = R14,50 5 December 2022 1 euro = R14,30 31 December 2022 1 euro = R14,95 Having completed your procedures for testing existence of plant and equipment during July, you are, towards the end of July, addressing other aspects of your audit of the cycle. YOU ARE REQUIRED TO: (a) Describe the substantive procedures you would have conducted in respect of the existence assertion applicable to plant and equipment at 30 June 2023. When testing existence, your firm includes a search for unrecorded disposals as part of the audit plan when it is appropriate to do so. (6) (b) Describe the substantive procedures you will conduct to verify that the cost at which the new industrial mixing machine has been included in the accounting records is appropriate in terms of financial reporting standards. (14) (c) Describe the audit procedures you will conduct to: (i) vouch the impairment loss recognised in respect of the printing machines; and (4) ϯϬϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (ii) satisfy yourself that no other impairment losses in respect of plant and machinery are required. (4) ϭϮ͘ϭϴ ;ϮϳŵĂƌŬƐϯϯŵŝŶƵƚĞƐͿ WĂƌƚ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are auditing the pension fund of a large South African corporate, based on IAS 19 – Employee Benefits. You come across the following six issues detailed below: No Issue 1 The pension fund investments include investing in international markets, as detailed by Regulation 28 of the Pension Funds Act. 2 In the calculation, there are various expected annual interest rates to be applied in the calculation. 3 Management is deciding on an option pricing model to be applied – this will affect the value of the liability. 4 The life expectancies of pension fund members (in years) are used in the valuation calculation. 5 A range of possible estimated values for the pension fund have been prepared by the actuaries of the company. Management has selected the midway point in the range of estimates. 6 The valuation method selected for the pension fund liability is the projected unit credit method. Inherent risk factor most affected by issue Explanation YOU ARE REQUIRED TO: List the inherent risk factors most affected by the issues raised in the scenario and provide a brief explanation for your answer. Base your explanations on ISA 540 ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϯϬϳ (Revised) Auditing of Accounting Estimates and Related Disclosures. Limit your inherent risk factors to estimation uncertainty, complexity and subjectivity. (15) WĂƌƚ ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ You are the auditor overseeing the 28 February 2023 year-end audit of Snatched .com, an online electronics company that specialises in selling big-screen TVs. Due to the nature of the business, Snatched.com purchased their own delivery vehicles in 2014 to ensure products are delivered timely and to reduce the risk of theft and damage. The asset policy of the company is aligned with the tax wear-and-tear allowance. During the year under review, two delivery vehicles were sold and replaced with two new ones. You and your team have completed the entity level control assessments and your specialist IT auditor has completed the IT general controls audit, prior to your team commencing with the audit. The IT general controls audit report included five findings which were rated as low risk and deemed ‘housekeeping issues’. The financial manager of Snatched.com, Rhoda Radebe, is extremely tech savvy and has, where possible, tried to automate controls. As such, the debtors-, creditors-, all related parties and asset management processes have significantly improved over the past three years. The asset register and tax-asset register of the company have also been fully automated since the previous year’s audit. The IT manager, Simon Sinister, has been employed by Snatched.com from its inception and has worked closely with Rhoda to implement the controls. Both of them have a keen interest in each other’s processes and, as such, they have worked together well to optimally integrate IT and finance. YOU ARE REQUIRED TO: (a) Provide a rationale why you would consider changing your audit approach to rely on automated application controls. (2) (b) Assuming the related parties are maintained on a master file, briefly list the aspects that you would consider if you want to perform automated control procedures when testing related party transactions at Snatched.com. (5) (c) Describe the automated control procedures that you would perform when testing fixed assets at Snatched.com. Limit your answer only to those automated control procedures related to depreciation. (5) ϭϮ͘ϭϵ ;ϯϳŵĂƌŬƐϰϱŵŝŶƵƚĞƐͿ Your firm has been approached by Hewlett-Bell Ltd, a multi-national company that develops laptop computers, printers and related supplies, to take up the position as ϯϬϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ its auditor. While gathering information on the client, as part of your pre-engagement activities, you performed a Google search, and learned the following: 1. Hewlett-Bell is committed to achieve zero greenhouse-gas emissions across its value chain and aspires to become a world leader in this regard. 2. The company has received negative press, after it came to light that two of its directors, Mr Lenovo CA(SA) and Mr Dell CA(SA), were involved in a bribery scandal to win government tenders. The case will go to court, and should Hewlett-Bell be found guilty, it is estimated that an amount of R110 million will have to be paid in fines. 3. A whistleblower working in the human resource department of Hewlett-Bell made disclosures to a national newspaper, claiming that the company purposefully misclassified employees as external contractors to save on paying employee benefits. The whistleblower further claimed that she had already brought the matter to the company’s social and ethics committee, however, no action was taken. According to the whistleblower, the affected employees were underpaid by a total of R32 million. 4. The company has issued a recall notice on certain of its computers, due to the risk of its batteries overheating and potentially combusting. The company has calculated the cost of the recall and has made a provision for the amount. YOU ARE REQUIRED TO: (a) Discuss the considerations that should be taken into account, when deciding on accepting the appointment as auditor of Hewlett-Bell Ltd. (5) (b) With reference to matter 1 in the scenario, briefly explain why companies should care about other matters beside maximising profits. Your answer should also indicate and define two of the ‘six capitals’ to which the matter in the scenario would specifically relate in terms of King IV. (5) (c) With reference to matter 2 in the scenario, discuss the involvement of Mr Lenovo and Mr Dell in the bribery scandal, with reference to the SAICA Code of Professional Conduct. (3) (d) With reference to matter 3 in the scenario: (i) Discuss whether the whistleblower would enjoy protection in terms of the Companies Act. (4) (ii) Briefly explain the function of the social and ethics committee of a company. (5) (e) Suppose you do accept the audit, refer to matters 2, 3 and 4 in the scenario and: (i) List and briefly explain the assertions relating to provisions included in the general ledger. (5) ŚĂƉƚĞƌϭϮ͗&ŝŶĂŶĐĞĂŶĚŝŶǀĞƐƚŵĞŶƚĐLJĐůĞ ϯϬϵ (ii) Formulate the procedures that you will perform to determine whether Hewlett-Bell Ltd: (10) • has appropriately classified these amounts as either provisions or contingent liabilities; and • has included all provisions and contingent liabilities in its accounts and/or notes. ϭϮ͘ϮϬ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of Hello-Heli (Pty) Ltd, a company that provides aviation services. The company’s clients include government departments, entities providing emergency services, film production companies and the mining industry. Hello-Heli’s operations require a lot of specialised equipment, such as geo-referenced digital cameras, thermos and infrared cameras, air-lifting gear etc. During the past financial year, Hello-Heli expanded its helicopter fleet by six additional helicopters. Below is a summary of the company’s property, plant and equipment as at 28 February 2023: COST Description Opening balance Additions Disposals Closing balance ’000 ’000 ’000 ’000 Helicopters 3,600,000 222,000 – 3,822,000 Equipment 164,800 – – 164,800 Software 28,000 – – 28,000 Furniture 12,000 – – 12,000 Motor vehicles 14,000 – 1,200 12,800 ϯϭϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ACCUMULATED DEPRECIATION Closing balance Opening balance Current year ’000 ’000 Helicopters 1,920,000 249,000 – 2,169,000 Equipment 65,920 13,184 – 79,104 Software 9,400 8,970 – 18,370 Furniture 2,400 1,790 – 4,190 11,200 1,876 1,199 11,877 Description Motor vehicles Disposals ’000 ’000 The company uses an off-the-shelf accounting package for all its bookkeeping needs, however, the managing director, Mr Prop, has informed you that management is contemplating the in-house development of an accounting system specifically for the needs of Hello-Heli (Pty) Ltd. YOU ARE REQUIRED TO: (a) Describe the audit procedures that you will perform to audit the property, plant and equipment of Hello-Heli (Pty) Ltd. Where possible, you should incorporate CAATs into your procedures. (24) Note 1: Do not include procedures related to presentation and disclosure. Note 2: You may assume that the helicopters where purchased locally. Note 3: Do not include any procedures related to leases or revaluation. (b) Discuss Mr Prop’s comment on the accounting system, with reference to the advantages and disadvantages of the in-house development of an accounting system, as compared to an off-the-shelf package. (6) ,WdZ ϭϯ ^ƚĂƚƵƚŽƌLJ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 13.1 True or false 24 marks 13.2 Short application questions – Auditing Profession Act 16 marks Application and discussion – Reportable irregularities 30 marks Application and discussion – Reportable irregularities 30 marks Application and discussion – Reportable irregularities; Protection for whistleblowers; Removal of the auditor 36 marks 13.6 Multiple-choice questions 16 marks 13.7 Multiple-choice questions 15 marks 13.8 Application and discussion – Company secretary 20 marks 13.9 Application and discussion – Public interest score; Independent reviews; Auditors 36 marks Application and discussion – Financial assistance; Meetings; Voting; Directors’ conduct 23 marks Application and discussion – Directors; Miscellaneous 30 marks 13.3 13.4 13.5 13.10 13.11 continued ϯϭϭ ϯϭϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. Description of content of the question Total marks 13.12 Application and discussion – Audit/review requirement; Requirement to appoint an audit committee/company secretary/social and ethics committee 33 marks 13.13 Application and discussion – Share issue 20 marks 13.14 Short application – Alterable/non-alterable provisions 16 marks Application and discussion – Directors personal financial interest; Pre-incorporation contracts; Reckless trading 18 marks Application and discussion – Sale of greater part of assets; Share issue; Distribution 36 marks High level application – King IV; Companies Act; Ethics 12 marks Application and discussion – Removal of directors; Directors’ personal financial interest; Financial assistance 30 marks Application and discussion – Removal/ appointment of directors; Directors’ conduct; Strategy; Financial assistance; Subsidiary purchasing holding company shares 33 marks Application and discussion – Financial assistance; Distributions; Substantive procedures (special resolutions); Miscellaneous 40 marks 13.15 13.16 13.17 13.18 13.19 13.20 ϭϯ͘ϭ ;ϮϰŵĂƌŬƐϯϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider the following statements 1. Adherence to the Companies Act is mandatory for all public and state-owned entities. Private companies can, however, choose to comply with the Act voluntarily. (1,5) 2. The POPI Act applies to anyone (individual or organisation) who keeps records relating to personal information of anyone (unless such records are subject to other legislation which protects the information more rigorously). (1,5) ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϭϯ 3. The subsidiaries of a listed company must each calculate their public interest score to determine whether its annual financial statements should be audited. (1,5) 4. The following company names would be allowed in terms of the Companies Act: (i) Anti-LGBTQI (Pty) Ltd; (ii) Adidas Fitness Centre (Pty) Ltd; (iii) Transnet Transportation (Pty) Ltd. 5. All close corporations must calculate a public interest score. (3) (1,5) 6. The South African Institute of Chartered Accountants (SAICA) was established by the IRBA and accredited by it as a professional body. (1,5) 7. One of the responsibilities of the IRBA is to oversee the conduct of the audit committees of public companies and state-owned companies. (1,5) 8. An individual who is serving a period of time (not less than 18 months) under the supervision of a registered auditor is defined as a registered candidate auditor. (1,5) 9. A close corporation that is required to be audited because of its public interest score, may have its audit carried out by its accounting officer, provided the accounting officer is registered with the IRBA. (1,5) 10. An individual who is disqualified from an appointment as a director on the grounds of having been sentenced to ten years in jail for theft, can be appointed as a director, five years after he has completed his sentence. (1,5) 11. The IRBA is not permitted to register as a registered auditor an individual who has at any time been declared insolvent due to his direct actions, which involved gambling and financial mismanagement. (1,5) 12. Richard Naidoo CA(SA), the financial director of a Gauteng-based company, has recently been convicted of Personal Protective Equipment (PPE) fraud. He will therefore face disciplinary charges brought by the IRBA. (1,5) 13. If a firm wishes to register as a registered auditor with the IRBA, the majority of the partners must be registered with the IRBA themselves. (1,5) 14. If a company wishes to register as a registered auditor with the IRBA, every shareholder of the company must be a registered auditor and will be required to be a director of the company. (1,5) 15. Where a registered auditor that is a company is appointed to perform the audit of a client’s financial statements, the audit firm (company) must decide on a designated auditor for that client. (1,5) YOU ARE REQUIRED TO: Indicate whether each of the statements listed above is true or false. Provide a brief justification for each of your answers. (24) ϯϭϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϯ͘Ϯ 1. ;ϭϲŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ Davy Jones and Edward Teach own an audit firm, Jones and Teach Inc. The two of them are considering bringing a new, younger, managing partner on board. The candidates they are considering are: • Lisa Blackbeard. She is a registered internal auditor and she also holds a master’s degree in taxation. • Elizabeth Swan. She is a CA(SA) and has recently registered as an RA with the IRBA. Davy Jones and Edward Teach have, however, decided not to include the new managing partner’s details on their letter head just yet, in order not to create any uncertainty with their clients. 2. Swann and Rawlinson, a firm of registered auditors, has decided to reorganise and incorporate itself. The following proposals, inter alia, have been made: 2.1 Sam Swann the current senior partner of Swann and Rawlinson, will not be a shareholder as he wishes to be less active in the practice. However, he will be appointed chairman of the board as he is well respected in the business world and will guide the new incorporated practice. 2.2 Robbie Rawlinson, who is also currently a partner in Swann and Rawlinson, will become the majority shareholder and managing director of the new incorporated practice. 2.3 Dickie Dann CA(SA), currently the financial director of Exis (Pty) Ltd a manufacturing company, will become a shareholder and director. His role at the new practice will be advisory and he will not leave his current position at Exis (Pty) Ltd. 2.4 Jacob Nda will be appointed as a director to head up the new practice’s proposed ‘independent accounting professional’ section. The section is being set up to cope with the expected increase in demand for independently compiled annual financial statements from companies and close corporations. Sam Swann believes that Jacob Nda is perfect for this position as he is a member of two professional bodies, ACCA and CIMA. 2.5 Grace Good BA LLB who is currently in charge of taxation and legal matters at Swann and Rawlinson, will become a minor shareholder and director of the new practice. 2.6 Susan Lang who is an environmental, sustainability and governance (ESG) specialist, will be appointed as a director to head up the new ESG consultation section due to the increase in queries from clients. She is not a member of a professional body, however she completed her ESG CFA investor certificate. ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϭϱ YOU ARE REQUIRED TO: (a) Comment on scenario 1 above in terms of the Auditing Profession Act 2005. (4) (b) Comment on the proposed appointments listed in 2.1 to 2.6 above in terms of the Auditing Profession Act 2005. (12) ϭϯ͘ϯ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are an auditor at the firm Mbeki and Radebe Inc. You have come across the unrelated matters below at three of your clients: CCR (Pty) Ltd CCR is a company that offers wedding planning services. The company runs large competitions to market their services. These competitions are overseen by the financial and marketing directors of the company. Couples can enter a competition at a fee of R5 per SMS-entry. Winners are expected to pay a non-refundable deposit of R20 000 to secure their prize of a wedding worth R100 000. The minister however prescribes a maximum amount of R1,50 to enter into a competition of this nature and the law (Consumer Protection Act) is clear that winners should not be paying a fee to claim their prize. During the audit it came to your attention that CCR has been appearing in several newspapers and the company has also been trending on social media, due to several brides complaining that the weddings they have supposedly won are not taking place. Upon further investigation you uncovered evidence which indicate that CCR uses the R20 000 deposits of couples who ‘won’ their competition, to finance these prizes: the deposits of five couples in aggregate are used to pay for one such a wedding of R100 000. The company is however running out of deposit money and is struggling to finance further weddings. REM (Pty) Ltd REM (Pty) Ltd is a company with an inherently complex revenue system. Contracts with its customers include recurring billing for goods and services and often also include finance components. Management thus employed an IFRS specialist’s services, who provided advice on the recognition of revenue. However, during the audit, you concluded that revenue was materially understated for the period under review. Your findings further indicated that several stakeholders were financially affected by this understatement. (You may assume that the advice of the IFRS specialist and management did not intend to cause the company harm or to act maliciously.) PPE (Pty) Ltd PPE (Pty) Ltd is a company with a public interest score of 198 and has its financial statements independently compiled. During the course of the review, you found that the sales transactions require customers to pay up-front fees for personal protective equipment that will be provided over an extended period of time. PPE (Pty) Ltd ϯϭϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ recognised the full amount of the contract for the amount of the fees received before the goods were delivered (and before revenue is earned). Furthermore, PPE (Pty) Ltd also did not pay any VAT on the items sold. You are convinced that the company is involved in fraudulent trading activities which constitute a reportable irregularity. YOU ARE REQUIRED TO: (a) For the first two clients, CCR (Pty) Ltd and REM (Pty) Ltd, identify and comment briefly on the matters you would have considered in satisfying yourself on whether a reportable irregularity has taken place. You should also conclude on whether a reportable irregularity has indeed taken place. (9) (b) In the case of CCR (Pty) Ltd, what is the action that you should take after you have concluded that a reportable irregularity is indeed taking place? (7) (c) In the case of CCR (Pty) Ltd state whether you would still report the irregularity if: (i) the financial director realised before you made your first report, that you suspected what was going on and offered to repay all the deposits back to the couples who have not yet received a wedding; and (2) (ii) you had discovered the scheme while conducting additional work (nonaudit work) for CCR (Pty) Ltd. (2) (d) In the case of PPE (Pty) Ltd, indicate whether each of the following statements is true or false. Justify your answers: (i) You can ignore the matter on the grounds that the Auditing Profession Act refers only to reportable irregularities in the context of an audit engagement. (2) (ii) You can ignore the matter on the grounds that the AFS was not prepared by the company itself. (2) (iii) You need not report the matter to any external body but must submit a full report of the findings to the chairman of the board of PPE (Pty) Ltd. (2) (iv) You should report the matter to the IRBA. (v) ϭϯ͘ϰ (2) You can ignore the matter on the grounds that if there is a reportable irregularity, it is the responsibility of the independent accounting professional who compiled the AFS to report it to the IRBA. (2) ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the engagement partner in charge (designated auditor) of the audit of Road2-Shop (Pty) Ltd, a road transport company with an annual turnover of approximately R85 million. In terms of its public interest score, Road-2-Shop (Pty) Ltd must have its financial statements externally audited annually. The audit senior has raised the following matters concerning the audit for the year ended 28 February 2022 for your attention: ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϭϳ The minutes of directors’ meetings include a resolution approving payment of R15 000 per month to a Jaco Pelser, for consultancy fees. Further enquiries revealed that Jaco Pelser is a senior road traffic inspector at the provincial vehicle testing station. When the audit senior enquired about the services Jaco Pelser rendered for his fee, the financial director explained that since they had begun paying these fees, the following benefits have accrued to the company: • Their vehicles no longer need to go for the annual provincial roadworthy inspection which is required for all vehicles used for commercial transportation purposes. This has resulted in increased earnings, as vehicles which would have been taken off the road for two full days for servicing and inspection, are now able to continue with scheduled work, without interruption. • Repair and maintenance expenses have decreased significantly as the directors no longer consider it necessary to carry out such extensive servicing and preventative maintenance on the company’s vehicles. Although your audit senior pointed out to the directors that it is a statutory requirement that the company’s vehicles pass the annual roadworthy inspection, they maintain that part of their agreement with Jaco Pelser is that he sees to it that the necessary paperwork is completed to ensure that the company encounters no difficulties with the provincial authorities. YOU ARE REQUIRED TO: (a) Discuss fully whether the above situation constitutes a reportable irregularity in terms of the Auditing Profession Act 2005. (16) (b) Comment on whether the fact that Road-2-Shop (Pty) Ltd is a private company (as opposed to a public company) affects your duties in terms of section 45 of the Auditing Profession Act 2005. (2) (c) Explain what action you would take in terms of the Auditing Profession Act 2005, if any, regarding this matter. If no action is required, justify your answer. (8) (d) Comment on whether we would still have a duty to report a reportable irregularity if Road-2-Shop (Pty) Ltd’s public interest score required that the company’s AFS be independently reviewed and not externally audited. (4) ϭϯ͘ϱ ;ϯϲŵĂƌŬƐϰϯŵŝŶƵƚĞƐͿ You are the auditor overseeing the audit of Leisure Travel Ltd, a large travel agency that specialises in luxury travel. During the audit, a member of the audit team brought to your attention that the number of flights and hotel reservations actually booked by Leisure Travel Ltd seems to be significantly higher than the number of bookings made for clients. As clients are not given a detailed breakdown of the costs of their travel arrangements (flights, hotels, leisure activities etc.), the additional costs were simply loaded onto the quotes they were given. On discussing this with ϯϭϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ the financial director (and minority shareholder), Frank Abagnale assured you that this was simply a system error. However, on the same day, you received a phone call from a whistleblower, who informed you that these additional flights and hotel reservations were personal travels of the company’s directors. Although the whistleblower chose to remain anonymous, he informed you that he was in fact a representative of one of the hotel groups that Leisure Travel Ltd frequently deals with. You subsequently informed your audit team that this matter could not be ignored and that they should perform audit procedures to gather evidence to support the allegation. You also instructed your team not to discuss the phone call with anyone at Leisure Travel Ltd. After your team was unsuccessful in gathering any conclusive evidence without discussing the matter with the client’s employees, you decided to raise the phone call with Frank Abagnale. He firmly denied the allegation and threatened that your audit firm would be fired with immediate effect should you continue to pursue the matter. YOU ARE REQUIRED TO: (a) Comment on the instruction given to the audit team not to ignore the phone call and not to discuss it with anyone at Leisure Travel Ltd. (4) (b) Identify the procedures your team would have carried out in their attempt to gather evidence to support the allegation made by the whistleblower. (4) (c) Discuss fully whether the situation described above constitutes a reportable irregularity in terms of the Auditing Profession Act 2005. (12) (d) Discuss Frank Abagnale’s threat to ‘fire’ your firm from the appointment of auditor with immediate effect. (8) (e) Would the anonymous whistleblower be eligible for protection in terms of the Companies Act? (8) ϭϯ͘ϲ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the correct option(s) (a) to (d) below, for each of the following questions. Note: A question may have more than one correct option. 1. For the purposes of the Companies Act 2008, a juristic person is related to another juristic person if (a) either of them indirectly controls the business of the other; (b) either of them holds at least 10% of the shares of the other; (c) an individual directly controls both of them; (d) either is a subsidiary of the other. ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϭϵ 2. For the purposes of the Companies Act 2008, an individual is related to another individual if (a) they both have shareholdings exceeding 25% in the same company; (b) the individuals are father and adopted son; (c) the individuals are mother and daughter-in-law; (d) both individuals are equal owners in a business entity, for example a close corporation or company. 3. Which one of the following statements is true? (a) A company may, under no circumstances, buy back its own shares. (b) Each subsidiary of a company may hold no more than 10% of the shares in that company. (c) A subsidiary may not exercise voting rights of shares that it holds in its holding company. (d) A company may buy back all the shares for a specific class of shares. 4. Which of the following applies to a personal liability company? (a) The Memorandum of Incorporation cannot restrict the transferability of its securities. (b) The Memorandum of Incorporation must prohibit the company from offering any of its securities to the public. (c) A personal liability company is exempt from having its annual financial statements audited. (d) The Memorandum of Incorporation must state that the company is a personal liability company. 5. Which of the following documents must be lodged with the CIPC when incorporating a company? (a) A Memorandum of Incorporation. (b) An Association Agreement. (c) A Notice of Incorporation. (d) Share certificates. 6. In terms of the Companies Act 2008, a person who owns shares in a profit company has a right to inspect the (a) company’s Memorandum of Incorporation; (b) minutes of directors’ meetings; (c) the company’s record of directors; (d) the auditor of the company’s working papers. ϯϮϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 7. A company’s Memorandum of Incorporation may be amended by (a) an ordinary resolution of the shareholders; (b) a special resolution of the shareholders; (c) a majority decision of the board; (d) an ordinary resolution adopted at the annual general meeting (AGM). 8. In terms of the Companies Act 2008, a public company must: (a) prepare its annual financial statements in terms of IFRS; (b) prepare its annual financial statements within 12 months after its financial year-end; (c) have its annual financial statements externally audited or independently reviewed, depending on its public interest score; (d) have its annual financial statements approved by the board and signed by an authorised director. 9. With regard to the capitalisation of profit companies, (a) a company’s MOI must set out the classes of shares and the number of shares of each class, that the company is authorised to issue; (b) shares with a nominal or par value may be issued provided they are specified as such in the MOI; (c) an authorised share has no rights associated with it until it has been issued; (d) the rights attaching to any class of shares issued can be amended by the board. 10. With regard to the issue of shares in a private company, (a) the board may resolve to issue shares of the company at any time provided the shares to be issued are authorised and are within the classes of shares stipulated in the MOI; (b) an existing shareholder’s pre-emptive right to be offered a percentage of the shares to be issued before any other person who is not a shareholder, cannot be negated under any circumstances; (c) an existing shareholder, in exercising his pre-emptive right, may subscribe for fewer shares than he is entitled to in terms of his pre-emptive right; (d) if the board issues shares that have not been authorised in the MOI, the issue is automatically null and void, and subscribers must be repaid. 11. MNO (Pty) Ltd would like to make an issue of shares in the company to two newly appointed directors, neither of whom hold shares in the company. This issue must be approved by (a) an ordinary resolution of the shareholders; ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϮϭ (b) a majority decision by the directors; (c) a special resolution of the shareholders; (d) a majority decision of the directors, excluding any votes cast by the two newly appointed directors. 12. STU (Pty) Ltd, a manufacturing company, wishes to make loans to its employees to purchase shares in the company as part of an employee share scheme. Which of the following requirements will NOT apply to the making of these loans? (a) The loans must be authorised by the board. (b) A special resolution of the shareholders must be obtained. (c) Immediately after providing the loans, the company must satisfy the liquidity/solvency test. (d) The employee share scheme must comply with the requirements of the Companies Act 2008. 13. Cards (Pty) Ltd wishes to purchase shares in its holding company, Bridges Ltd but this transaction (a) is expressly prohibited by the Companies Act 2008; (b) is permitted provided Cards (Pty) Ltd is the only subsidiary of Bridges Ltd; (c) is permitted provided special resolutions are obtained from the Cards (Pty) Ltd and Bridges Ltd shareholders; (d) is permitted provided the board of Cards (Pty) Ltd approves it and that not more than 10% in aggregate of the number of issued shares (of Bridges Ltd) are held by all the subsidiaries of Bridges Ltd. 14. In terms of the Companies Act 2008, Regulation 43, which of the following companies must appoint a social and ethics committee? (a) Eskom Holdings SOC Ltd. (b) Every listed company. (c) We Sell Cars (Pty) Ltd with a public interest score of 500. (d) Fiber (Pty) Ltd, which had a public interest score of 520 in 2021 and 480 in 2022. 15. In terms of the Companies Act 2008, which of the following will be regarded as a distribution, as defined? (a) A payment instead of capitalisation shares. (b) Bonuses paid to executive directors. (c) A dividend paid to shareholders. (d) Expenses paid to non-executive directors for attending meetings. ϯϮϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 16. Indicate which one of the following options below is false: The King IV objectives are listed below, ultimately the report strives to promote corporate governance as integral to running an organisation, and delivering governance outcomes, such as (a) ethical culture; (b) good performance; (c) effective control; (d) risk management. ϭϯ͘ϳ ;ϭϱŵĂƌŬƐϮϯŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the correct answer(s) for each of the questions below (1–15). Note: For some of the multiple-choice questions there may be more than one correct answer. 1. A special resolution is required for (a) calling a meeting of shareholders; (b) granting a loan to a director in the ordinary course of business; (c) ratify the actions of directors in excess of their authority. 2. The authority required for the sale of the major part of a company’s assets is (a) a directors’ resolution; (b) a special resolution; (c) an ordinary resolution. 3. In terms of the Companies Act, a public company must appoint (a) a minimum of one director; (b) a company secretary; (c) a remuneration committee. 4. Loans by a subsidiary to a director of its holding company are prohibited unless (a) a special resolution of the shareholders has been obtained; (b) the terms of the loan are fair and reasonable; (c) the company granting the loan satisfies the liquidity/solvency test. 5. In terms of the Companies Act 2008 the notice period for a meeting of shareholders of a public company is (a) 28 business days; (b) 15 business days; (c) 21 business days. ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϮϯ 6. A company is permitted to provide financial assistance to a person for the purchase of (a) 7. shares in its holding company; (b) shares in itself; (c) shares in its subsidiary company. To qualify for the appointment as company secretary to a public company, the applicant must (a) be a natural person; (b) be a member of the South African Institute of Chartered Accountants; (c) have the requisite knowledge of and experience in relevant laws. 8. A private company (a) restricts the right of transfer of its shares in its Memorandum of Incorporation; (b) prohibits any offer of its shares to the public; (c) may not issue shares to its directors. 9. A company’s Memorandum of Incorporation is binding between the company and each shareholder and each director. True or false? 10. In terms of the Companies Act 2008 the Memorandum of Incorporation of a company may be amended if (a) consent is obtained from 100% of the shareholders; (b) a special resolution is passed; (c) the majority of the shareholders (over 50%) are in agreement with the alteration. 11. When a company wishes to acquire (buy back) its own shares, it must (a) obtain a directors’ resolution authorising the transaction; (b) comply with any relevant sections of its MOI; (c) be liquid (able to pay its debts in the ordinary course of business) but not necessarily solvent at the time of acquiring the shares. 12. An unlisted public company, with a PIS of 380, is required by the Companies Act to appoint a social and ethics committee. True or false? 13. Which of the following persons may not be a director of a company? (a) A member of its audit committee. (b) The company’s auditor. (c) A related person to an existing director. ϯϮϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 14. Which of the following persons may be appointed as auditor of a company (provided they are suitably qualified and registered)? (a) The head of the company’s audit committee, provided they are independent. (b) The son of the company’s production director. (c) A person who was formerly an employee of the company in a senior position, but who left the company six years ago to return to the auditing profession. 15. If a director has a personal financial interest in a matter to be considered at a board meeting (a) the director should disclose his interest and the general nature thereof before the meeting; (b) the director may not vote on the approval of the matter; (c) the director may not execute any documents relating to the matter on behalf of the company. ϭϯ͘ϴ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Hamba Amazwe Ltd is a tour operating company that owns a number of luxury passenger buses. The company operates all over South Africa and is a popular choice with international tourists. The company secretary of Hamba Amazwe Ltd has recently resigned, and the directors are considering for appointment the following candidates: • Lorax (Pty) Ltd, a company specialising in providing company secretarial services. The company has two directors, Mr Seuss and Mr Grinch. They are also the only two employees of Lorax (Pty) Ltd. Both Mr Seuss and Mr Grinch have the requisite knowledge and experience to perform the duties of company secretary, and both are South African citizens. • Mr Higgins, a resident of Zimbabwe, who has several years’ experience performing company secretarial services. He permanently resides in Zimbabwe, but he often undertakes business trips to South Africa. • Mrs Clarke, a South African resident who holds the requisite knowledge and experience to perform the duties of company secretary. She has recently been declared delinquent to be appointed as a director of a company. • You, the auditor in charge of the audit of Hamba Amazwe Ltd. The directors are, however, wondering whether it is at all necessary to appoint a company secretary, as they are unsure what the use of this position is. YOU ARE REQUIRED TO: (a) Briefly explain the Companies Act requirements relating to the notice period for the resignation of a company secretary. (2) ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϮϱ (b) In terms of the Companies Act, discuss the eligibility of each of the listed candidates for appointment as company secretary. (8) (c) In terms of the Companies Act, respond to the directors as to whether they may choose not to appoint a company secretary and list the company secretary’s duties to explain to them the purpose of the position. (10) ϭϯ͘ϵ ;ϯϲŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ WZd ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. Name the four factors that should be considered when calculating a company’s public interest score. (2) 2. King (Pty) Ltd is a company that manufactures and sells mattresses. The company employs on average 150 factory workers, 20 administrative employees (including five employees in its accounting department) and ten cleaners. The company’s turnover has decreased from R220 million for the 2021 financial year, to R180 million for the 2022 financial year. The company’s debtors’ book value is R52 million, while its third-party liabilities amount to R12 million. The only known beneficial interest holders of the company are its seven shareholders. Prince (Pty) Ltd is a subsidiary of King (Pty) Ltd. Prince (Pty) Ltd has the same seven shareholders as King (Pty) Ltd, is owner-managed, and employs eight employees. Prince (Pty) Ltd had a turnover of R7,2 million for the 2022 financial year. The company has no third-party liabilities but holds assets in a fiduciary capacity of R7,4 million. Both companies’ financial statements are compiled independently. 2.1 Calculate the public interest score for each company (show workings). (5) 2.2 State, giving brief reasons, whether each of the companies will have to be audited or reviewed, or will require no external intervention. (4) 2.3 What does it mean that Prince (Pty) Ltd is owner-managed? WZd (1) ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ Cornpatch (Pty) Ltd has a public interest score of 154 and currently compiles its annual financial statements internally. This, in turn, means that the AFS must be audited. However, the company has decided that it would be cheaper and less disruptive to have the AFS compiled by an independent accounting professional and then have the AFS independently reviewed. The financial director of Cornpatch (Pty) Ltd is considering whom to appoint as the independent accounting professional to compile the AFS and has approached you for advice. It is worth noting that Cornpatch (Pty) Ltd is as an organisation mainly focused on goal 10 of the 17 sustainable ϯϮϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ development goals, which is to reduce inequality in South Africa. The following individuals/firms are being considered: 1. Your firm of registered auditors The firm has been the auditors of Cornpatch (Pty) Ltd for a number of years. 2. Uys and Buys CC A close corporation that offers bookkeeping and financial services. The CC members are all members of CIMA and neither they nor the CC itself have any involvement with Cornpatch (Pty) Ltd in any way. 3. Herb Malherbe Herb Malherbe has no formal qualifications but serves as an independent non-executive director and audit committee member for two listed companies. His strengths lie in financial reporting. 4. Pitso Motaung A registered auditor in his own practice. He is the husband of Majestic Motaung, the marketing director of Cornpatch (Pty) Ltd. 5. Verbena Williams A chartered accountant who, up until a year ago, was the financial manager at Cornpatch (Pty) Ltd. She left to join her sister, Saturn Williams, in the IT systems firm of ‘Saturn Verbena & Co – financial systems consultants’. Over the past year she has gained a great deal of systems experience and is of interest to Cornpatch (Pty) Ltd as she knows the company and can provide an independent view of the highly integrated systems. 6. Gordy Ringasund A chartered accountant and registered auditor and the father of Steve Ringasund, one of the shareholders of Cornpatch (Pty) Ltd. YOU ARE REQUIRED TO: State with reasons, which of the above persons (1–6) would be eligible for appointment as the independent accounting professional to compile Cornpatch (Pty) Ltd’s annual financial statements. (12) WZd ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ The shareholders of Note-for-Note (Pty) Ltd, a profit company which sells a large range of music-related goods, have recently included a clause in its MOI which requires that the company has its annual financial statements externally audited. Based on its public interest score, the company is required to have its financial statements reviewed but as none of the shareholders are active in the business, they have ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϮϳ decided to include the audit requirement in the MOI. The following individuals/ firms are being considered for appointment as the company’s auditor: 1. Jandre Kruger A newly qualified chartered accountant who is registered with the IRBA. While studying fulltime at university before he commenced his training contract, Jandre Kruger worked for short periods in the accounting department at Note-for-Note (Pty) Ltd during his university vacations. 2. Wilson Pickett and Co A firm of registered auditors. Wilson Pickett the senior partner, is one of the shareholders of Note-for-Note (Pty) Ltd. 3. Wim Grove A chartered accountant and financial consultant who has been working on a project for the last year to expand Notefor-Note (Pty) Ltd’s business into Africa. 4. John Stemmet The former financial director of Note-for-Note (Pty) Ltd. He left the company three years ago and has since set up a successful practice specialising in medium-size company external audits and independent reviews. 5. Emo Adams and Co A small financial services partnership that does all of Notefor-Note (Pty) Ltd’s company secretarial work, for example, submitting returns to the Commission. Emo Adams himself would not be the auditor. This role would be filled by Seb Shabani, a chartered accountant and partner in the business. Emo Adams and Co also has a Tax and IT auditing division. 6. Shanai Stemmet A registered auditor and daughter-in-law of John Stemmet. She does not work in John Stemmet’s practice and is a sole practitioner. YOU ARE REQUIRED TO: (a) Describe the procedures the shareholders would have gone through to add the audit requirement to the company’s MOI. (2) (b) Discuss whether the individuals/firms listed above (1–6) would be eligible to take up the appointment of auditor of Note-for-Note (Pty) Ltd. (10) ϭϯ͘ϭϬ ;ϮϯŵĂƌŬƐϮϴŵŝŶƵƚĞƐͿ You are a member of the audit team of Gold Diggers Ltd, a large gold mine which operates in South Africa and is listed on the Johannesburg Stock Exchange (JSE). During the financial year under review, the board of Gold Diggers Ltd approved interest-free, unsecured loans in the amount of R4,5 million to two of its directors, Ms Mosimane and Mr Zungu. By inspection of all the minutes of directors and shareholders meetings, you gathered that no other authorisation was obtained to ϯϮϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ approve these loans. Gold Diggers Ltd’s financial records indicate that the company was solvent and liquid before and after the loans were granted. Tim Dlamini CA(SA) is the financial manager and is responsible for preparing the company’s Integrated Report. He is in the process of preparing the report for the 31 December 2022 year-end. One of the reporting areas in the Integrated Report relates to the health and safety statistics of employees, especially the occupational incidents covering fatality and injury data. Tim has prepared the Integrated Report and presented it to the audit committee for approval. During the meeting an independent non-executive director and member of the audit committee, Rohl Ackers, commented on the significant increase in the number of injury data. Rohl is concerned that the increase in the number of injury data will negatively affect their business. Rohl Ackers proposes that Tim reports a lower number of injury data for the 2022 financial year. YOU ARE REQUIRED TO: (a) Discuss the legality of the loan granted to the directors as well as the possible consequences for the company and the directors who authorised this loan in terms of the Companies Act. (10) (b) Gold Diggers Ltd’s shareholders want to conduct their AGM electronically. Advise them whether this is allowed in terms of the Companies Act. (4) (c) Explain the difference between voting by poll and voting by a show of hands. (2) (d) Name any six matters that must be dealt with at the AGM in terms of section 61 of the Company Act 2008. (3) (e) Discuss Rohl Ackers conduct in terms of the Companies Act. ϭϯ͘ϭϭ (4) ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Two friends, Mr Thulani Hlatshwayo and Mr Deon Koverjee, are on the verge of incorporating their new private company, ‘Just-Do-It’. The company will supply sportswear and gear to the public and will also provide weekly soccer training at schools in Gauteng. In order to raise capital for the business to get off the ground, they consider marketing the shares to the public. Thulani and Deon are also concerned about the requirements that exist for the appointment of an auditor and an audit committee. They therefore decide that it would be best to obtain the input of a professional. Thulani and Deon asked you about the standards of directors conduct with which they must comply as a director of Just-Do-It. YOU ARE REQUIRED TO: (a) Comment on the proposed name of the company. (2) ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϮϵ (b) Comment on the number of directors in accordance with the Companies Act. (2) (c) Comment on the proposal to raise capital by marketing shares to the public. (2) (d) Consider the following: the two additional directors that Thulani and Deon are considering for appointment are Thulani’s younger brother, who is 16 years old and an expert on IT. The other potential director is a company of sports therapists, managed by Dr Vinesh Naidoo. Comment on the eligibility of each of these two proposed directors in accordance with the Companies Act. (4) (e) Briefly explain to Thulani and Deon whether their new company would be required to appoint an auditor and an audit committee, with reference to the Companies Act. (8) (f) Respond to Thulani and Deon’s question concerning director’s conduct ϭϯ͘ϭϮ (12) ;ϯϯŵĂƌŬƐϰϬŵŝŶƵƚĞƐͿ You are a first-year audit trainee attending an in-house workshop at your audit firm. During the workshop you were grouped with other trainees and presented with an exercise to determine whether a list of supposed clients needed to be audited, reviewed or neither; and whether they must appoint an audit committee, company secretary and social and ethics committee, in terms of the Companies Act. You are expected to present your answer as a schedule. A brief explanation should be given in a note for each company at the end of the schedule. The column headings of the schedule must be as follows: Client name Audited/ reviewed/ neither Must appoint audit com Must appoint company secretary Must appoint a social and ethics com The supposed clients that you have to evaluate are: 1. Apples Ltd A listed company that manufactures and sells toys. The company has a public interest score of 382 and its financial statements are internally compiled. The company does not hold assets in a fiduciary capacity. 2. Pears (Pty) Ltd Pears imports and sells printer cartridges. The company has a public interest score of 115 and its financial statements are compiled by its financial manager. 3. Grapes (Pty) Ltd A property management company that manages hundreds of office buildings and rents out office space on behalf of investors. The company collects rent on behalf of the investors and also keeps deposits on behalf of the tenants of the office buildings in an interest-bearing trust account. At year-end the company held deposits to the ϯϯϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ amount of R85 million. The company has a public interest score of 273 and its financials are compiled by an independent third party. 4. Bananas (Pty) Ltd This family-run company wholesales a range of braais. The four shareholders of the company are also the directors of the company. The company has a public interest score of 100 and compiles its own financial statements. 5. Strawberries (Pty) Ltd This entity wholesales generators and invertors. At the beginning of the year it had a public interest score of 115, however, at the end of its financial year the score was just over 350. 6. Mango (Pty) Ltd This company builds small boats. Its MOI requires that it appoints a company secretary and an audit committee. It has a public interest score of 375. 7. Raspberry (Pty) Ltd This company sells and repairs lawnmowers. It has a public interest score of 63. The company’s AFS are compiled by the company’s bookkeeper. There is only one director and he is not a shareholder in the company. 8. Salad (Pty) Ltd This company supplies meals to airport lounges and corporate cafeterias. It has a public interest score (at yearend – Feb 2023) of 520 (in 2022 the public interest score was 501 and in 2021 it was 517). 9. Tomato (Pty) Ltd This company retails machine tools. It has a public interest score of 240 and its financial statements are compiled by your firm. 10. Orange (Pty) Ltd This owner-managed company transports containers. It has a public interest score of 320 and its financial statements are compiled by Deloitte. YOU ARE REQUIRED TO: (a) State which companies are required to appoint a social and ethics committee in terms of the Companies Act and its regulations. (3) (b) Compile the schedule as requested during the workshop exercise. (Do not forget to include the explanatory note as required.) (25) (c) List the requirements necessary for an individual to be classified as an independent accounting professional. (5) ϭϯ͘ϭϯ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Kwin (Pty) Ltd is a wholesaler of medical supplies. Due to sustained growth in the business, the directors have decided that additional shares in the company should be issued to raise the amount of R10 million needed to fund a proposed expansion of ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϯϭ the business. The directors have considered various other financing options but have decided that a share issue would be the best option. Dick Kwin, the financial director, has approached you for some initial advice on the issue and has provided you with the following: 1. Kwin (Pty) Ltd has 350 000 ordinary shares in issue. The authorised share capital is 400 000 ordinary shares. All shares are of the same class. 2. The 350 000 shares are held as follows: : 90 000 by BioMed (Pty) Ltd : 45 000 by each of three of the directors of Kwin (Pty) Ltd. (The two other directors do not hold any shares.) : 50 000 by a share scheme trust for employees of Kwin (Pty) Ltd : 75 000 by eight private investors who hold various quantities of the shares (totalling 75 000). 3. The intention is to issue a further 250 000 shares at R40 a share. Shares would be offered to the existing five directors and the private investors in equal quantities, but not to BioMed (Pty) Ltd or the share trust scheme. 4. The MOI requires that the issue of shares be carried out in terms of the Companies Act 2008. It contains no additional requirements relating to the issue. Ordinary resolutions and special resolutions must be approved by 50% and 75% of the voting rights, respectively. YOU ARE REQUIRED TO: Advise Dick Kwin on the statutory requirements applicable to this proposed issue. Your answer must cover, inter alia, notice requirements for meetings, quorum requirements etc. (20) ϭϯ͘ϭϰ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ In terms of the Companies Act 2008, some provisions of the Act are regarded as ‘alterable provisions’ and others are ‘unalterable provisions’. Consider the following provisions of the Act: 1. The shareholders of a public company must appoint an audit committee. 2. The board of a company must call a meeting of directors, if 25% of the directors of a board consisting of at least 12 directors, require it to do so. 3. A person who is an unrehabilitated insolvent is disqualified from being appointed a director of a company. 4. The shares of a company will not have a nominal or par value. 5. If a company has more than two shareholders, a meeting of shareholders may not begin unless at least three shareholders are present. ϯϯϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 6. For an ordinary resolution to be approved by the shareholders, it must be supported by more than 50% of the voting rights exercised on the resolution. 7. For a special resolution to be approved by the shareholders, it must be supported by at least 75% of the voting rights exercised on the resolution. 8. The quorum for a directors’ meeting is a majority of the directors present at the meeting. 9. Every share issued by a company has associated with it an irrevocable right of the shareholder to vote on any proposal to amend the preferences, rights, limitations and other terms associated with that share. 10. If a director is present at a meeting to consider a matter in which that director has a personal financial interest, the director must leave the meeting after disclosing his interest in the matter. 11. A director of a company must act in the best interests of the company. 12. A meeting of the board may be conducted by electronic communication. YOU ARE REQUIRED TO: (a) Explain the difference between an alterable provision and an unalterable provision of the Companies Act 2008. (2) (b) Indicate whether each of the provisions listed above (1–12) is alterable or unalterable. Where a provision is alterable, describe briefly what alteration to the provision can be made. (14) ϭϯ͘ϭϱ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You are the auditor on the audit of CandyCanes (Pty) Ltd, a company that manufactures and sells sweets to supermarkets all over South Africa. The company has had a difficult financial year and it saw a steep decline in the demand for its products. Below is an extract of matters that were discussed at CandyCanes (Pty) Ltd’s latest board meeting: Matter 1 The company’s financial director, Michael Money, shared with the board that CandyCanes (Pty) Ltd is in a position of factual insolvency. He further explained that the future of CandyCanes (Pty) Ltd depends on the success of the agreement recently entered into with Hyper-Cash-and-Carry. (CandyCanes (Pty) Ltd decided at the previous board meeting that sweets would be sold to Hyper-Cash-and-Carry at special wholesale prices, provided that CandyCanes (Pty) Ltd would be Hyper-Cashand-Carry’s sole supplier of sweets – all the directors of the company voted in favour.) However, one of the directors, Steven Short, assured the board that, as his brother, Sam Short, is the managing director of the Hyper-Cash-and-Carry group, he would put in a good word with him. The board was pleasantly surprised to learn about this relationship. ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϯϯϯ Matter 2 If the contract referred to in matter 1 above is indeed approved, CandyCanes (Pty) Ltd will need to enter into an agreement with Tipsy-Trucks, a transport company, to transport the goods to the various Hyper-Cash-and-Carry branches all over South Africa. The only problem is, however that Tipsy Trucks has not yet been incorporated. Matter 3 The managing director of CandyCanes (Pty) Ltd, Elaine Ebrahams, proposed that a 25% salary increase for all executive directors be implemented. The board agreed to this proposal and it was approved immediately. YOU ARE REQUIRED TO: (a) Refer to matter 1 and discuss any concerns that you may have in terms of the Companies Act in relation to the contract entered into between CandyCanes (Pty) Ltd with Hyper-Cash-and-Carry, particularly given the relationship between Sam and Steven Short. You may assume that the agreement is material. (8) (b) Refer to matter 2 and discuss in detail, in terms of the Companies Act, whether a person may enter into a contract on behalf of Tipsy Trucks, in light of the fact that Tipsy Trucks has not yet been incorporated. (5) (c) Keeping the background information and the information in matter 1 in mind, refer to matter 3 and discuss any concerns you may have regarding the managing director’s proposal. Limit your answer to those concerns pertaining to the Companies Act. (5) ϭϯ͘ϭϲ ;ϯϲŵĂƌŬƐϰϰŵŝŶƵƚĞƐͿ You are a manager in the audit practice of Kenyon and De Waal. As you are a specialist in company law, statutory matters are frequently referred to you. One of your clients, Cookware (Pty) Ltd has approached you for advice. The directors, none of whom are shareholders, have put a proposal together which they wish to present to the shareholders. Although the company is not in a situation where a business rescue plan is required, the directors think that the proposals will ultimately make the business more profitable. The company manufactures household appliances but has been beset by labour problems and competition from cheap imports for some time. Their intentions are as follows: 1. The directors would dispose of the manufacturing plant and equipment and the factory building. The current warehouse would be retained as a warehouse for the proposed new line of business. (12) ϯϯϰ 2. 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The proposed new line of business would be the importation and wholesaling of electrical components for industrial and commercial air conditioning installations. The name of the company would be changed to Airware (Pty) Ltd. Mark plan: New line of business New name of business (3) (4) 3. As the production director, Ken King, would no longer have a role to play, he would resign and be paid out a R500 000 lump sum. He would use this money to buy shares in the company which would be issued to him by the directors. Ken King would not be employed by Airware (Pty) Ltd (the company’s new name) but would retain his connection to the company through his shareholding and an appointment to the board as a non-executive director. (10) 4. A portion of the proceeds of the sale of the plant and equipment and the factory building would be used to redeem the R1,5 million redeemable preference shares which Cookware (Pty) Ltd has in issue. The ordinary shareholders hold all the preference shares, and the redemption is due shortly. (7) Grant Cox, the director who came to see you, is certain that the 20 or so shareholders he expects will come to the meeting, will question him closely on the statutory implications of each part of the proposal. He also wants to be sure that he understands the implications and that the company complies with the Act’s requirements with regard to setting up meetings, quorums, voting etc. YOU ARE REQUIRED TO: Advise Grant Cox accordingly. You are not required to recommend alternative actions or proposals. You are also not required to deal with the actual disposal of the plant and factory building or the detail of section 164 of the Companies Act 2008. ϭϯ͘ϭϳ ;ϭϮŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ You are a Companies Act and Corporate Governance specialist, employed by Don’tCook Ltd, a company that produces and provides ready-made fitness meals all across South Africa. Don’t-Cook Ltd has a public interest score of 512. The company and its directors have recently come under scrutiny after it was reported on social media that the company falsely advertised one of its outlets as ‘fully halal’. You were requested by the board of Don’t-Cook Ltd to compile a report breaking down the governance and ethical issues as it relates to the accusation, should it be true. YOU ARE REQUIRED TO: Compile a report as requested by the board of Don’t-Cook Ltd, dealing with any King IV, Companies Act and other ethical considerations, relating to the accusation in the scenario above. (12) ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ ϭϯ͘ϭϴ ϯϯϱ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Saska (Pty) Ltd is a large company in the sporting goods sector. Ross McKewan, the sole non-executive director of the company, has consulted you regarding a number of concerns which he has, arising out of a recent meeting of the company’s board of directors. None of the directors holds any shares in the company. Your discussions with Ross McKewan revealed that he had opposed the matters described below and a number of other matters, but that they had ultimately all been approved by the board of directors. He also informed you that Barry Black, the managing director, had ended the meeting by announcing that he could not work with a person who responded negatively to virtually everything that he proposed. He put it to the board that either Ross McKewan or he himself should leave the board. The rest of the board of directors unanimously resolved to remove Ross McKewan from the board immediately. Matter 1 A contract for R16 million to refurbish the company’s offices, had been awarded to Singer Designs, ahead of three other contractors who had tendered for the job. Ross McKewan had opposed this decision as he preferred a far less expensive proposal made by one of the other contractors. Barry Black was, however, very much in favour of the Singer Designs proposal and had convinced the rest of the board to vote accordingly. Ross McKewan had coincidentally found out, after the meeting, that Singer Designs was owned by Jackie and Cilla Black, Barry Black’s daughter and wife respectively. Ross McKewan is satisfied that the other directors were unaware of this when the contract was approved and may still be unaware. Matter 2 Ben Johnson, the marketing director of Saska (Pty) Ltd, had asked at the board meeting whether it would be possible for the company to provide him with an interest-free loan of R2 million to assist him in the purchase of a new house, into which he and his family are planning to move. Barry Black had responded by telling Ben Johnson that he would personally authorise the loan in his capacity as chairman (provided the other directors agreed). Also subsequent to the meeting, Ross McKewan discovered that Barry Black had arranged for the loan to be made by Calgary (Pty) Ltd, a wholly-owned subsidiary of Saska (Pty) Ltd, rather than by Saska (Pty) Ltd as Ben Johnson is not a director of Calgary (Pty) Ltd. YOU ARE REQUIRED TO: (a) Discuss the legality of Ross McKewan’s removal from the board. (b) Discuss Barry Black’s compliance with the requirements of the Companies Act 2008 with regards to the contract awarded to Singer Designs and comment on the validity of the contract, in terms of the Act. (14) (c) Discuss the legality of the loan to be made to Ben Johnson. (8) (8) ϯϯϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϯ͘ϭϵ ;ϯϯŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ WZd ;ϮϭŵĂƌŬƐϮϱŵŝŶƵƚĞƐͿ Pumpkin and Spice Ltd owns a chain of restaurants all over South Africa. The company has not been performing as well during the 2023 year under review as in the prior financial years. The CEO, Mr Thyme, is of the opinion that a set of fresh directors is what is needed ‘to turn the company around and restore it to its former glory’. At one of the company’s board meetings, Mr Thyme suggested that at least half of the executive directors be replaced by ‘young and innovative’ members, which he will personally source. He highlighted that the directors that he wishes to let go, are not performing up to standard and that he is sure that they are not meeting the standards of conduct that is expected of a director as per the Companies Act. YOU ARE REQUIRED TO: (a) Comment on whether Mr Thyme can remove half of the executive board members if they are not performing well in his opinion? (5) (b) Explain what the standards of conduct with which a director must comply in terms of the Companies Act are? (12) (c) Comment on whether the group of ‘young and innovative’ directors can be appointed by Mr Thyme? (4) WZd ;ϭϮŵĂƌŬƐϭϱŵŝŶƵƚĞƐͿ As the financial situation of Pumpkin and Spice Ltd is worsening, the company is in need of additional funding to keep its operations afloat. Three suggestions to obtain funding came up in the board meeting: 1. Obtaining a further loan from Parsley Bank Ltd. Note: Pumpkin and Spice Ltd is already highly geared. 2. Listing on the JSE in order to issue shares to the public. 3. Obtaining a loan from Mr Thyme, who in turn will obtain the money as a directors loan from Cake-and-Bake (Pty) Ltd, another company were Mr Thyme is a director. 4. Selling Pumpkin and Spice Ltd shares to Salt-and-Pepper (Pty) Ltd, a subsidiary of Pumpkin and Spice Ltd. YOU ARE REQUIRED TO: (a) From a strategic perspective, comment on suggestions 1 and 2 above. (b) With reference to suggestion 3 above, list the Companies Act requirements that Cake-and-Bake (Pty) Ltd will have to adhere to when issuing a directors loan to Mr Thyme. (5) (4) ŚĂƉƚĞƌϭϯ͗^ƚĂƚƵƚŽƌLJ (c) ϯϯϳ With reference to suggestion 4 above, what Companies Act requirements will have to be met in order for Pumpkin and Spice Ltd to legally sell shares to its subsidiary? (3) ϭϯ͘ϮϬ ;ϰϬŵĂƌŬƐϰϴŵŝŶƵƚĞƐͿ You are a member of the audit team working on the 30 June 2021 audit of Smugglers (Pty) Ltd, an export/import company. Borders Ltd holds 70% of Smugglers (Pty) Ltd’s capital while other companies in the group are Guards (Pty) Ltd, which is 100% held by Borders Ltd, and Contraband (Pty) Ltd which is 60% held by Smugglers (Pty) Ltd. The remaining shares in Smugglers (Pty) Ltd are held by 11 private investors. Of the four companies within the group, you hold only the audit appointment of Smugglers (Pty) Ltd, the three remaining companies being audited by other firms. Borders Ltd purchased 30% of its shares in Guards (Pty) Ltd on 31 October 2020. Prior to this, it already owned 70% of the shares. Your permanent audit file revealed the following: 1. Directors of : Borders Ltd Billy Kidd Roy Rogers Davy Crockett Horst Trigger : Smugglers (Pty) Ltd JT Edson Louis L’Amour Bill Ocean : Contraband (Pty) Ltd Roy Rogers Willy Nelson : Guards (Pty) Ltd Bill Haley Chuck Berry You have been assigned to the audit of statutory matters and, as part of your procedures, have extracted the following matters for consideration: 1. A loan of R2,5 million made by Smugglers (Pty) Ltd to Borders Ltd. Borders Ltd has used the money to pay the shareholders of Guards (Pty) Ltd for the shares acquired in October 2020. The loan was adequately secured and subject to market-related terms. 2. A loan of R1,5 million made to Roy Rogers for his personal use. 3. During the financial year, Smugglers (Pty) Ltd revalued certain of the company’s property portfolio upward by R3 million on the instruction of Border Ltd. Shortly thereafter, Border Ltd instructed the board of directors of Smugglers (Pty) Ltd to distribute the R3 million as a dividend. ϯϯϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Discuss your firm’s right of access to the books and records/financial information of Guards (Pty) Ltd and Contraband (Pty) Ltd. (5) (b) Discuss the loans made by Smugglers (Pty) Ltd in terms of the Companies Act 2008. Loan 1 (R2,5 million by Smugglers (Pty) Ltd to Borders Ltd) (7) Loan 2 (R1,5 million by Smugglers (Pty) Ltd to Roy Rogers) (8) (c) Discuss the legality of the dividend distributed by Smugglers (Pty) Ltd in respect of the fixed asset revaluation. (10) (d) State the procedures you would carry out to determine whether any special resolutions passed by Smugglers (Pty) Ltd during the year complied with the requirements of the Companies Act 2008. Your answer should cover notice of meetings, quorums, approval etc., but it is not necessary to cover adjourned meetings. (10) ,WdZ ϭϰ ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 14.1 Multiple-choice questions on the topic 12 marks 14.2 Short questions 30 marks 14.3 Short questions – Going concern 15 marks 14.4 Evaluation of uncorrected misstatements 35 marks 14.5 Evaluation of uncorrected misstatements 35 marks 14.6 Schedule of uncorrected misstatements 14 marks 14.7 The auditor’s responsibility with regard to fraud and reportable irregularities 30 marks The auditor’s responsibility with regard to fraud and reportable irregularities 25 marks 14.9 Subsequent events – Classifications 14 marks 14.10 Subsequent events 17 marks 14.11 Subsequent events – How matters must be treated in the financial statements 20 marks Subsequent events – How matters must be treated in the financial statements 16 marks Impact of a provision/lawsuit 30 marks 14.8 14.12 14.13 continued ϯϯϵ ϯϰϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Question no. 14.14 Description of content of the question Total marks Audit procedures of subordination agreement and cash flow forecast 15 marks Accounting treatment of provision and impact on audit report 20 marks 14.16 Further audit procedures to perform 30 marks 14.17 Going concern 27 marks 14.18 Going concern 25 marks 14.15 ϭϰ͘ϭ ;ϭϮŵĂƌŬƐϭϰŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the most appropriate answer: 1. Which one of the following statements is not true? (a) The auditor is responsible for concluding whether the uncorrected misstatements are material, individually or in aggregate. (b) The auditor will consider whether the accounting policies are consistent with IFRS (or IFRS for SMEs). (c) It is essential for the auditor to ensure that no audit risk (the risk of expressing an inappropriate opinion) exist. (d) The auditor should form an opinion on the financial statements based on an evaluation of the conclusions drawn from the audit evidence obtained. 2. When concluding whether the financial statements have been prepared in all material respects in accordance with the applicable financial reporting standards, the auditor will evaluate (a) whether the terminology used in the financial statements is appropriate; (b) whether the financial statements achieve fair presentation; (c) whether the accounting policies selected and applied are consistent with the financial reporting standards and appropriate for the company’s business; (d) all of points (a), (b) and (c) above; (e) points (b) and (c) above but not point (a); (f) points (a) and (b) above but not point (c). 3. When concluding on the financial statements, the auditor will evaluate whether the information presented in the financial statements are (a) accurate and valid; ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ (b) relevant, reliable, comparable and timeous; (c) relevant, reliable, comparable and understandable; (d) relevant, reliable, valid and material. ϯϰϭ 4. By extrapolating the misstatements identified in a sample, the auditor estimated the amount of misstatement in the population from which the sample was drawn. This misstatement would be termed a (a) judgemental misstatement; (b) projected misstatement; (c) provisional misstatement; (d) factual misstatement. 5. Management considers that a reasonable impairment write-off on a particular piece of machinery is R375 000; the auditor’s opinion is that a reasonable impairment would be R450 000. Management refuses to correct the misstatement. Assume that this is the only misstatement the auditors identified during the audit and that materiality is set at R70 000. Select the most appropriate option: The auditor is likely (a) to issue an unmodified audit opinion; (b) to issue an adverse audit opinion; (c) to withhold his/her audit opinion; (d) to issue a qualified (‘except for’) audit opinion. 6. Which of the following statements is true? (a) Misstatements should be considered in isolation; a collective evaluation of misstatements can distort the true situation. (b) When evaluating misstatements at the concluding stage, only the quantitative (and not qualitative) circumstances of the misstatement need to be considered by the auditor. (c) Where a misstatement reflects a level of dishonesty by the directors, it should be corrected, even if the misstatement is below the final materiality level. (d) Uncorrected misstatements should be off set against each other whenever possible. 7. The auditor has identified a number of misstatements which must be corrected by the client to avoid having to issue a modified audit report. Which of the following would justify the auditor giving an unmodified report even if the misstatements were not corrected by the client? (a) Providing the audit committee with written notification of the misstatements. ϯϰϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (b) A written notification from the directors that they disagree with the auditor’s contention that the financial statements are misstated. (c) A written request by the directors that the audit report not be modified as to do so may jeopardise important negotiations which are currently underway and which, if successful, will significantly benefit shareholders. (d) None of the above. 8. Which of the following statements is incorrect? (a) The auditor has a duty to carry out procedures to identify subsequent events up until the AGM at which the financial statements are accepted by the shareholders. (b) The auditor should request management to provide a written representation that all events occurring subsequent to (after) the date of the financial statements which require adjustment or disclosure, have been adjusted or disclosed. (c) After the financial statements have been issued, the auditor has no obligation to make any enquiry regarding those financial statements. (d) If the auditor believes it is necessary to prevent further reliance on his audit report, he may address the shareholders at the AGM. 9. PrettyPink (Pty) Ltd has a 31 December 2022 year-end. On 15 February, during the post-reporting period, it came to the attention of the auditor that a material amount of inventory, reflected in the Statement of Financial Position of PrettyPink (Pty) Ltd, was dated incorrectly and had already expired in November 2022. The appropriate accounting treatment would be (a) for the auditor to request management to disclose the write-off in the 2022 annual financial statements, as the reporting period has already passed; (b) for the auditor to request management to adjust the financial statements as at 31 December 2022 with the amount of the inventory to be written off; (c) for management to disclose the write-off in the directors’ report of the 2022 annual financial statements; (d) not to take any action as this event came to the auditor’s attention after the period-end date, and, as such, it does not relate to the period under review. 10. The auditor should sign his audit report (a) once the annual financial statements have been discussed and accepted by the shareholders; (b) as instructed by the audit committee; (c) no earlier than on the date he has obtained sufficient appropriate evidence to base his opinion; ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ (d) ϯϰϯ before the directors have signed the financial statements to assert that they have taken responsibility for those financial statements. 11. SharkBait (Pty) Ltd specialises in cybercrime solutions for financial services clients. During the year the company has made a significant investment in changing its IT architecture from on-premise to cloud. SharkBait’s management subsequently decided to write off their bespoke disaster recovery site, which includes the value of the equipment, building and land, due to the fact that onpremise solutions will not be relevant again (at least not in the near future). Management is not willing to ‘negotiate’ with the auditors regarding the carrying value of these assets. Select the most appropriate option below: The auditor is likely (a) to issue an adverse audit opinion, should the matter be pervasive; (b) to issue an unmodified audit opinion as the disaster recovery site would never be relevant again; (c) to withhold his/her audit opinion[ (d) to issue a qualified (‘except for’) audit opinion, should the matter be pervasive. 12. The auditor of MicroManagement.Com tested their IT general controls as part of the audit, as the company has sophisticated IT systems that have automated 50% of the finance function. The testing concluded that the IT general controls in place were effective, except for one issue that was noted: One of the financial managers, who was pregnant during the year, went into labour earlier than expected and, as a result, her access was not revoked on the day she left to go on maternity leave, but only three days later. Select the most appropriate option below. (a) The auditor is responsible for concluding whether the access granted for three additional days is material and the auditor is likely to issue an adverse audit opinion. (b) The auditor is likely to issue a qualified (‘except for’) audit opinion as unauthorised access and changes may have occurred over the three days. (c) The auditor should assess reports on any unauthorised access which occurred during the three days and should conclude in their audit report on its relevance, reliability, comparability and understandability. (d) From a professional-judgement perspective, the lady was in labour and gave birth, and would probably not have been in a position to make any unauthorised changes. A house keeping issue should be noted for management to address, should a similar situation arise in future. ϭϰ͘Ϯ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ Part of the concluding stage of the audit process will be to evaluate the effect of uncorrected/unadjusted misstatements identified on the audit. An important factor ϯϰϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ in this regard will be the materiality of the misstatement, but it is by no means the only factor that comes into the evaluation. One might also reasonably assume that if a material misstatement has been identified, it could be corrected/adjusted and the directors would be willing to correct it. YOU ARE REQUIRED TO: (a) Define a misstatement in the context of an audit. (b) Explain why the directors may decide not to correct a material misstatement in the financial statements. (6) (2) (c) Explain whether a significant risk identified in the planning of the audit, would have any effect on the evaluating and concluding stage of the audit. (2) (d) Explain briefly what characteristic distinguishes an ‘error’ from ‘fraud’. (e) Explain why the materiality of an uncorrected/unadjusted misstatement is important for the auditor when evaluating and concluding. (2) (1) (f) Explain how an auditor evaluates the quality of the disclosures in the notes to the financial statements. (4) (g) Identify five circumstances which may cause the auditor to evaluate a misstatement as material even if the misstatement is lower than the quantitative final materiality limit. (5) (h) Comment on whether the following factors will have any influence on the auditor when deciding whether various misstatements should be corrected. Consider each situation separately: (i) Although the misstatements fall just short of the quantitative final materiality limit/amount, if the correction is made, the financial statements will reflect a loss for the first time in ten years. (ii) Although the misstatement falls just short of the final materiality limit/ amount for the financial statements as a whole, if the misstatement is corrected, certain debt covenants based on the audited annual financial statements will not be satisfied. This could have serious consequences for the company. (iii) Although the misstatement is above the quantitative final materiality limit/amount, if the correction is made, it will reduce bonuses paid to management and directors. (iv) Although the misstatement is above the quantitative final materiality limit/amount, if the correction is made, it will reduce a special bonus which has been promised to hourly paid employees. Management has assured the auditors that if the bonus is not paid at the original amount, the employees will strike until the full amount is paid. (8) ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϭϰ͘ϯ ϯϰϱ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. In terms of ISA 570 (Revised) – Going Concern, the adoption of the going concern basis of accounting in the preparation of the annual financial statements means . . . . (2) 2. What are the objectives of the auditor when conducting audit procedures relating to the going concern assumption? (2) 3. Is going concern an assertion? Justify. 4. If the auditor issues an unmodified report on the annual financial statements, can a user take this as a guarantee that the company will remain a going concern for the foreseeable future? Justify. (2) 5. ISA 570 (Revised) states that ‘the auditor shall, when performing risk assessment procedures as required by ISA 315 (Revised), consider whether there are events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern’. Is the risk assessment stage of the audit the only stage during the audit that the auditor needs to consider the going concern ability of the company? Justify. (3) 6. If management (the directors) have already performed an assessment of their company’s going-concern ability, is it necessary for the auditor to perform an assessment of going concern? Justify. (2) 7. With regards to going concern, what is a mitigating factor? 8. If the financial statements are prepared on the going-concern basis and the auditor is convinced that this basis is inappropriate, what type of audit opinion should the auditor give? (1) ϭϰ͘ϰ (2) (1) ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of Printplan (Pty) Ltd, a commercial art and printing requisites company. In terms of its public interest score, Printplan (Pty) Ltd is not required to have its financial statements audited, but the shareholders have included a clause in the Memorandum of Incorporation (MOI) which stipulates that the company’s annual financial statements must be externally audited as they believe this adds to the credibility of the financial statements. ϯϰϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Extracts from the draft financial statements as at 31 December 2022 are as follows: R’000 Current assets Inventory Trade debtors 3 240 1 728 Total current assets 4 968 Non-current assets Property – warehouse Property – vacant land Fixtures and fittings 1 875 652 145 Total non-current assets 2 672 Long-term liabilities Long-term loan Debentures 3 500 550 4 050 Current liabilities Trade creditors Bank overdraft 1 483 362 1 845 You have also obtained the following information: 1. Turnover and operating figures for the previous year and the current year are as follows: Turnover 2022 2021 13 142 066 12 981 326 Gross profit 4 468 302 4 179 351 Net income before taxation 1 787 320 1 713 534 2. The long-term loan is from Prestige Finance Ltd. The agreement with Prestige Finance contains a loan covenant in which, should the ratio of current assets to current liabilities as reflected in the audited financial statements fall below 2.5:1, Prestige Finance Ltd will have the option of increasing the interest payable on the loan significantly. The loan is repayable in full in 2026. 3. The debentures are secured to their full value by a bond over a vacant section of Printplan (Pty) Ltd’s property which has been sub-divided from the main lot. The value of this piece of property is reflected in the financial statements at R600 000. ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ 4. ϯϰϳ As a guideline your audit firm uses the following percentages when evaluating the materiality of uncorrected misstatements: 4.1 3% of total assets; and 4.2 7,5% of net income before taxation. The following matters have been raised by the audit team: 1. Included in the trade debtors balance as at 31 December 2022 is an amount of R96 500 owing by Art Stencils CC. However, this sale, which was raised late in December is not supported by any order. According to Printplan (Pty) Ltd’s accountant, the sale was raised on the instruction of the sales manager based on a quote given to Art Stencils CC. No delivery of goods has taken place as no order has been received. The sales manager is confident that the order will be received. 2. Procedures carried out subsequent to year-end revealed that an order of printing ink, invoiced at R72 000 (cost R35 000) to Printmedia (Pty) Ltd during November 2022, had in fact never been delivered. The ink had been packaged but had been left in the despatch area. Printmedia (Pty) Ltd cancelled the order in midJanuary 2023 and Printplan (Pty) Ltd passed a credit note for the full amount of R72 000. Neither the client nor the audit team has been able to establish whether the ink had been included in the inventory count as at 31 December 2022. 3. The workpapers on allowances/impairments revealed the following notes from the senior member of the audit team: ‘3.1 My opinion, based on extensive work we have carried out in respect of aging; ratio analysis and previous year debt write offs, is that the client’s bad debts allowance is understated by R75 000. The financial director of the client does not agree. 3.2 I further believe that certain ink valued at R136 126 should be written down to nil as they are not saleable. This is based on the fact that these inks had reached their expiry date by 31 December 2022. If not used by the expiry date the ink thickens and may block the ink jets on printing machines. The sales manager says that some printing companies aren’t that fussy and will buy the ink at a reduced cost. There is no evidence to support this claim (the ink was not sold by 31 January 2023).’ 4. An amount of R52 148 has been capitalised to property – vacant land. This represents costs incurred in cleaning up the vacant land owned by Printplan (Pty) Ltd to comply with municipal regulations. 5. While conducting procedures to identify unrecorded current liabilities, the senior member of the audit team identified two goods-received notes for which no invoice had been received from the suppliers at year-end. The goods were received on 28 December 2022 and included in the year-end inventory count. ϯϰϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ However, the corresponding creditor had not been raised in the accounting records at year-end. The supplier’s invoices (received in January 2023) revealed that the cost of the goods amounted to R63 210. 6. The return documentation received on 25 January 2023, from one of Printplan (Pty) Ltd’s agents who sells printing requisites on consignment for Printplan (Pty) Ltd, revealed that net sales (after commission) of R92 625 (cost R45 175) had been made during December 2022. The amount of R45 175 has been included in inventory at 31 December 2022. An electronic transfer for R92 625 was made into Printplan (Pty) Ltd’s bank account on 25 January 2023. YOU ARE REQUIRED TO: Evaluate whether any adjustments should be made for the above matters in the financial statements as at 31 December 2022. Your evaluation should consider each matter individually as well as all matters collectively. You must show your workings (ignore any VAT implications) and provide a conclusion. ϭϰ͘ϱ ;ϯϱŵĂƌŬƐϰϮŵŝŶƵƚĞƐͿ You are the senior in charge of the audit of Inside Out (Pty) Ltd, a company that sells a range of products for both inside and outside the home, for example furniture, appliances, lawnmowers and shrubs. Like most retail companies, Inside Out (Pty) Ltd has been affected by changes in consumer spending patterns. This has resulted in a decline in profits, as well as a noticeable shift to customers purchasing on account and not for cash. It has also resulted in pressure being placed on Syd Spade, the financial director, and the other directors to improve the situation. The company operates out of rented premises in the Johannesburg area, and in addition, owns a piece of vacant land used for storing seedlings and shrubs for its garden section. You have commenced the concluding stage of the audit and are currently evaluating the schedule of uncorrected misstatements (unresolved audit differences) with a view to determining whether adjustments are required to the draft financial statements as at 28 February 2023. Your evaluation is recorded on a workpaper attached to the schedule of audit differences for the audit manager to review. The manager on the Inside Out (Pty) Ltd audit is Megan Margret. Final materiality guidelines Megan Margret has suggested that in your evaluation you consider the final materiality figure to be R449 887. ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϰϵ Extracts from the draft financial statements and other sources 2022 2021 R R Net profit before tax 5 458 868 8 374 040 Current assets Inventory Debtors Bank 9 197 740 8 311 002 Property plant and equipment Land Vehicles Fittings, computers etc. 2 348 631 2 264 473 Current liabilities 3 848 425 3 809 478 33 104 910 35 652 826 Revenue Credit sales Cash sales Unresolved audit differences Difference 1 – Foreign creditor The company has one foreign supplier, Homegoods PLC, located in the United Kingdom. Consignments of goods are purchased from Homegoods PLC about three times a year. At 28 February 2023, the balance on Homegoods PLC’s account amounted to R627 300, converted at an exchange rate of R19 to £1, which was the ruling rate at the date of transaction for a consignment of goods imported in November. By the financial year-end (28 February 2023), the exchange rate had worsened to R24 to £1. Inside Out (Pty) Ltd does not use forward cover or any other form of hedge. Syd Spade does not believe any adjustment to the financial statements at 28 February 2023 is necessary in this regard, as the amount owed had been settled on the due date shortly after year-end. Difference 2 – Land revaluation One of Inside Out (Pty) Ltd’s accounting policies is to revalue its piece of land (where plants and shrubs bought in bulk are stored) to market value each year just prior to the financial year-end. The details pertaining to the land are as follows: Property 2 : original cost: purchased December 2017 R895 000 : carrying value as at 28 February 2022 R895 000 : carrying value reflected in the draft AFS as at 28 February 2023 R895 000 : market value per Proprand Inc certificate as at 28 February 2023 R780 000 ϯϱϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The property valuation has been carried out by Proprand Inc, a reputable firm of valuers, each year since the property was acquired. This is the first year in which the property value has declined but Syd Spade has decided that no ‘fair value’ adjustment will be made as he feels that Proprand Inc has been too conservative in their valuation, particularly in view of the fact that the market value has remained stable since the property was acquired. Difference 3 – Security During the course of the year the three directors of the company had taken loans of R500 000 each, from Inside Out (Pty) Ltd.’s bank, in their personal capacities, to enable them to participate in a private investment venture. Having obtained the appropriate statutory authority in terms of section 45 of the Companies Act 2008, Inside Out (Pty) Ltd provided security for the three loans. Syd Spade believes that no disclosure of this matter is necessary as the Board of Directors is satisfied that while there is a risk that the private investment venture may collapse, resulting in the three directors failing to repay their loans to the bank, the risk is ‘nothing to worry about’. Difference 4 – Allowance for bad debts (credit losses) Carly Singh, the trainee responsible for the audit of all major allowances, believes that, based on the information presented below and the testing she carried out on the debtors age analysis and in discussion with Syd Spade, the allowance for bad debts has been understated by between R250 000 and R320 000. Syd Spade’s response was simply to reject Carly Singh’s opinion as unfounded. Pertinent information is as follows: Debtors at year-end Allowance Days outstanding 2022 2021 R R 4 788 874 3 492 024 167 610 314 282 89 65 Difference 5 – ‘Cut-off’ testing A supplier’s invoice and related documentation selected in respect of a purchase transaction from the March 2023 purchase journal revealed that the goods in question had been received before 28 February 2023. On discovering this, the trainee accountant carried out comprehensive ‘cut-off’ procedures and established that goods costing R211 613 had been received prior to 28 February 2023, but the purchases had not been raised in the accounting records at year-end. Inside Out (Pty) Ltd does not operate a perpetual inventory system. A review of the records of the thorough inventory count, which was conducted after hours on 28 February, revealed that these goods had been included in the count. Syd Spade’s response was simply that ‘the company makes purchases in excess of R15 million annually so R211 613 is hardly a factor’ (ignore VAT). ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϱϭ YOU ARE REQUIRED TO: Prepare the work paper in respect of your evaluation of the uncorrected misstatements (unresolved audit differences) to be presented to your manager, Megan Margret. Your work paper must be set out as follows: Matter No 1–5 Known (Factual) or likely (judgemental/projected) misstatement Materiality guideline considerations Other factors to consider and recommendation This must be followed by an overall conclusion relating to all matters. You will need to look at all matters collectively to be in a position to draw a conclusion. ϭϰ͘ϲ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of Medi-Rite Hospitals (Pty) Ltd for the 30 December 2022 financial year-end. The Hospital group operates from various hospitals located throughout South Africa. You are currently busy with the finalisation of the audit. During the audit, the audit team identified the following misstatements for your attention. Uncorrected misstatement 1 While processing the cash book, the cash book clerk accidentally allocated a payment of R1 245 634 received from Detection Medical Aid to the revenue account and not to the debtors’ account. Uncorrected misstatement 2 An amount of R252 684 was not separately disclosed in the notes to the annual financial statements. This amount relates to bonuses that were paid to the directors during the financial year. This amount has been included under normal salaries and wages. Uncorrected misstatement 3 In October 2022 one of the hospital buildings was vandalised due to riots in the area. Medi-Rite subsequently accounted for the impairment, but also capitalised all cost associated with fixing the building. They submitted an insurance claim to the amount of R741 365 and accounted for the expected pay-out as an income receivable. On 25 January 2023 Medi-Rite received a letter from the insurer indicating that they will not be making any pay-out as Medi-Rite does not have SASRIA (South African Special Risk Insurance Association) Riot insurance which is needed for this type of claim. On further inspection of the insurance contract it was confirmed that this clause was not included in the insurance contract. ϯϱϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Uncorrected misstatement 4 Management has calculated the allowance for credit losses as R9 721 335. Based on our calculation, taking the increased credit risk within South Africa into account, this amount should be R13 165 445. Uncorrected misstatement 5: On 10 January 2023 Medi-Rite received a letter from Mrs Montgomery’s lawyers claiming compensation of R6 million. Mrs Montgomery’s husband died on 30 November 2023 due to unforeseen complications during a knee operation. Management accounted for this amount in the 2022 financial statements. The legal department indicated that the chances of the claim succeeding were very slim (0% chance), but the directors felt that they would provide for the claim, just to be conservative. YOU ARE REQUIRED TO: Based on the information provided and a final materiality figure of R5 000 000 (ignore taxation): • classify each misstatement based on the type of misstatement (factual, judgemental or projected misstatement); and (5) • prepare a schedule of unadjusted audit differences (using the accounting equation); and (5) • briefly discuss which of these five misstatements will have an effect (individually and in aggregate) on the fair presentation of the financial statements and which should be adjusted for. (4) You should use the following format: Misstatement number Classification of misstatement Total assets Total liabilities Equity 1. ϭϰ͘ϳ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the senior in charge of the recently completed 28 February 2023 audit of Masterheat (Pty) Ltd, a medium-sized company in the heating and cooling industry. The company does not have an internal audit function or an audit committee. The company supplies electric/gas heaters, air-conditioning etc. During the audit, you found the senior financial staff to be slightly uncooperative, but you put this down to the fact that the company has not had a particularly good business year. You also got the impression that the financial director was in a rush to get the audit completed and the financial statements and audit report signed and sent to the company’s shareholders, loan finance providers and the bank. Besides this strange atmosphere which you sensed, you were able to carry out the procedures you deemed necessary and all outstanding audit matters were resolved. ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϱϯ The financial statements and audit report were signed off by the financial director, the chief executive officer and the engagement partner on 15 April 2023, and distributed to users that afternoon. The week after the financial statements were signed, you returned to Masterheat (Pty) Ltd to finish off one or two things and were very surprised to be approached by the financial manager, who indicated that he needed to discuss an audit matter with you in private. He informed you that there had been some deliberate manipulation of the financial statements, which he wanted you to know about, as it had been ‘done with good intentions and nobody got hurt’. He went on to explain that one of the company’s loan finance providers had clauses in its loan agreement with Masterheat (Pty) Ltd, which enabled the finance provider to elect to have its loan repaid immediately if the audited annual financial statements did not reflect certain ratios and percentages. Unfortunately, because the company did not have a particularly good trading year, the specified ratios and percentages would not have been achieved unless the financial statements were manipulated. At this point you asked him how the financial statements had been manipulated and he responded as follows: ‘We overstated sales and debtors by manipulating cut-off at year-end to include some sales made in March in the February sales and debtors’ figures, as well as creating a few fictitious sales to related parties. We also overstated inventory and didn’t record some of the amounts owed to trade creditors at year-end. Having been auditors ourselves, we had a reasonable idea of what procedures you and your team would be carrying out and what you would be looking for. Although the financial misstatements are probably materially misstated overall, we made sure that individual account headings were individually not materially misstated. You may have noticed that we were all a little tense. Anyway, we are expecting a good profitable year this year (an assumption supported by your going-concern procedures), so there is no likelihood of this happening again or the investor suffering any loss. As you know, the audited financial statements have been sent to all the interested parties and we hope the matter can rest. The financial director is aware that I have spoken to you, and we hope that you will keep it confidential. We won’t be conveying this information to your manager or engagement partner, or anyone else for that matter, so you and your audit team will not have anything to answer for with regard to your audit. YOU ARE REQUIRED TO: (a) Explain, giving reasons, whether you would ‘keep this matter confidential’ or whether you would notify your manager and/or the engagement partner. (7) (b) Discuss whether you and your team could justifiably be accused of failing to carry out risk assessment and further audit procedures properly. (7) ϯϱϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ (c) Discuss whether the audit manager could justifiably be accused of failing to conduct the evaluation and concluding procedures properly. (4) (d) Discuss whether the manipulation of the financial statements constitutes a reportable irregularity. (7) (e) Discuss whether the annual financial statements at 28 February 2023 should be revised, and explain the action your firm will take to prevent/reduce liability, should the directors refuse to revise them. (5) ϭϰ͘ϴ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are the partner in charge of the audit of Swetts (Pty) Ltd. The company sells a large range of sports equipment under the trading name of Swettshops. You recently attended the company’s annual general meeting (AGM), at which the financial statements for the year were accepted and your firm’s appointment for the following year was confirmed. You are now shocked to read in the financial press that an investigation has revealed that large consignments of fake famous brand sportswear and shoes have been brought into South Africa illegally during the previous year and are being sold (knowingly) by various sports outlets as the genuine product. Swettshops is alleged to be an offender. After reading this article, you immediately re-examined the audit work papers, particularly the risk assessment procedures for the 31 March 2023 audit, and were satisfied that the audit had been competently performed. No reference to, or suspicion of, the purchase/sale of fake branded sportswear could be found. However, in the light of the information, you decided to return to Swetts (Pty) Ltd to resolve your concerns. You contacted the financial director of Swetts (Pty) Ltd to discuss the article and to inform him that you wished to carry out further procedures. He responded as follows: ‘I’m not denying it or admitting it. We knew about the investigation and have taken steps to protect ourselves. Anyway, the audit is over and I don’t really see what it has to do with you. There is no need for you to carry out further procedures – we’ll worry about how we run the business.’ YOU ARE REQUIRED TO: (a) Comment briefly on the auditor’s responsibility in respect of fraudulent acts at a client. (3) (b) Explain how it is possible that an audit that has been ‘competently performed’ may not reveal material fraud. (8) (c) Comment on whether you have any duty in respect of this matter specifically in view of the fact that the annual financial statements have been accepted at the annual general meeting. (5) (d) Discuss whether this matter constitutes a reportable irregularity as contemplated by section 45 of the Auditing Profession Act 2005. (9) ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϭϰ͘ϵ ϯϱϱ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ The following unrelated events (subsequent events) took place after the reporting period at various audit clients of your firm: 1. The internal audit department discovered (while conducting a site visit) that machinery and equipment had been stolen from the site during the financial year under audit. 2. A final judgement was given by the court in a case in which the audit client was successfully sued for damages amounting to R5 million. At year-end the client had provided R3 million in respect of this claim. 3. An explosion at the audit client’s factory (after the financial year-end) resulted in the directors announcing a plan to discontinue that specific manufacturing operation. 4. Due to escalating fuel prices after year-end, Transrail Ltd disposed of a major subsidiary which operated a commuter bus service. 5. The company has a 28 February 2023 year-end. An inventory item included in the year-end inventory balance at R200 000 was sold at a reduced price of R175 000 in March 2023. This item had been damaged in a flooding of the company’s warehouse in January 2023. 6. The company declared a dividend of 25c per share to its ordinary shareholders shortly after year-end. 7. The collapse of the audit client company’s market in Asia shortly after year-end has resulted in the assumption that the company is a going concern, no longer being appropriate. 8. The board of directors made the decision to terminate the employment of two of its senior executives after year-end. The two executives have agreed to accept the termination with a severance package of R2 million each, payable in three months’ time. 9. On 25 January 2023 a fire destroyed one of the warehouses belonging to the client. The client has a December year-end. 10. Inventory existing at year-end was stolen shortly after year-end. This occurred mainly due to the faulty alarm system of the client. The directors are of the opinion that the incident should be recognised at year-end as the alarm system was already faulty before year-end. 11. In February 2023 the company ratified a plan to spend R600k on a new system and data warehouse. The implementation is to commence June 2023. 12. CISO (Chief Information Security Officer) has reported that they have uncovered unauthorised access during the financial year and that upon further investigation, they have found that a hacker has managed to steal, through initiating small transactions, a total of R50k. ϯϱϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Distinguish between the two types of subsequent events. (b) Classify with a brief reason, each (1–12) of the subsequent events according to the type you identified in (a) above. Consider all matters to be material. (12) ϭϰ͘ϭϬ (2) ;ϭϳŵĂƌŬƐϮϬŵŝŶƵƚĞƐͿ You are the auditor in charge of the audit of Clevacomp (Pty) Ltd, an importer of computers and computer components. You are currently finalising the 31 December 2022 audit of the company’s inventory and have the following outstanding matters, inter alia, to deal with: 1. The 22 January 2023 edition of the Business Day newspaper carried an article describing how the price of computer memory chips had increased dramatically due to a huge fire (in late December 2022) at the Japanese factory which manufactures 60% of the world supply of the high-grade epoxy resins used in the manufacturing of computer chips. As a direct result of this, Clevacomp (Pty) Ltd has written up the value of their imported memory-chip inventory at year-end by a material amount and has made full disclosure in the financial statements. Your audit procedures confirmed that the cost of memory chips has risen dramatically on world markets and was not likely to reverse until at least 2024. (4) 2. In January 2023 Clevacomp (Pty) Ltd imported (with sole distributing rights) a consignment of unique software packages for R5 million. At virtually the same time, a local software house and direct competitor of Clevacomp (Pty) Ltd, launched a very similar package at a selling price 60% lower than the selling price of Clevacomp (Pty) Ltd’s package and sales of the Clevacomp (Pty) Ltd software package virtually ceased. Clevacomp (Pty) Ltd immediately brought a civil action against the local software house to prevent them from selling their package but was unsuccessful. The matter was taken on appeal but on 15 January 2023 the court once again ruled against Clevacomp (Pty) Ltd. In the 31 December 2022 financial statements, the directors had valued the inventory of the imported software package at R4,35 million, being the cost price of the packages on hand at that date. No mention was made of the court case. Despite the court decision, the directors are unwilling to consider any amendments to the financial statements as they claim that their superior service and backup will recapture this particular market. (8) YOU ARE REQUIRED TO: (a) List the procedures commonly performed by auditors to identify subsequent events. (5) (b) State, giving reasons, whether you would be satisfied with the directors’ treatment of the two matters described above in the 31 December 2022 financial statements. Assume that the amounts involved are material. (12) ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϭϰ͘ϭϭ ϯϱϳ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Each of the following unrelated subsequent events took place at different audit clients of your firm. The following events took place at the various clients between the date of the financial statements and the date of the auditor’s report: 1. During an internal quality check in January 2023, your client, Kuu Ltd, a canned food producer, realised that some of the cans used for baked beans have a defective side-seam weld which may cause the cans to leak. Kuu Ltd has also identified that the issue only affects cans of baked beans produced between 1 August 2022 and 1 October 2022. The company acted swiftly, recalling all affected cans of baked beans. The total value of the cans of baked beans produced (including those on hand and already sold) within this period is not material. Kuu Ltd has a 31 December year-end. (3) 2. Cupie-Foods (Pty) Ltd received a complaint shortly after year-end, of a baby falling ill from their new range of baby foods (produced before year-end). After having lab tests done on the product line, it was determined that dangerous chemicals are present in the food, which can cause babies to become mildly ill (not life-threatening). The decision has since been made to remove all the inventory related to this product line from supermarket shelves and to write off the inventory. The amount of the inventory comprises 50% of the company’s stock held at year-end. (5) 3. Legislation was passed shortly after the financial year-end which immediately lifted import restrictions on the type of product manufactured and sold by your client Rubtek (Pty) Ltd. Within a short period, demand for your client’s product dropped as the market was flooded with cheap imports of a similar product from China. Rubtek (Pty) Ltd was forced to drop the selling price of its product drastically. (4) 4. Your client, Oil of Olives Ltd, has been sued by a customer after the customer had a severe allergic reaction to skin products. Oil of Olives Ltd has a 31 December 2022 year-end and the customer filed the lawsuit on 15 January 2023, after the incident occurred during the first week of January. The incident seems to be isolated, and the amount of the lawsuit is not material. (4) 5. A major safety defect was discovered relating to a line of vehicles manufactured and sold by your client, MotoComp (Pty) Ltd. This will result in recalls and modifications having to be made. All the affected vehicles are still under warranty. The directors are also of the opinion that a number of lawsuits may follow, as some vehicles have caught fire, and at least one person has died, while several others have been injured. The matter has also attracted a lot of bad publicity for MotoComp (Pty) Ltd. (4) YOU ARE REQUIRED TO: Indicate, giving reasons, how each of the above (1–5) should be treated, if at all, in the financial statements of the respective companies. (20) ϯϱϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϰ͘ϭϮ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ You are the senior on the audit of Coca Bola (Pty) Ltd and are currently engaged in the 28 February 2023 year-end audit. While conducting procedures to identify subsequent events, you came across the following: 1. A payment of R1 million was made to Clive Clover, a former director of Coca Bola (Pty) Ltd, on 3 March 2023. This was a contractual payment in respect of a restraint of trade for Clive Clover’s services with Coca Bola Ltd, which were terminated at year-end. No mention of this payment has been made in the annual financial statements as at 28 February 2023 although the restructuring was dealt with in the directors’ report. Directors’ minutes dated 21 March 2023 indicate that the company intends to institute proceedings against Clive Clover for the recovery of the R1 million paid to him. The reason for this recovery is that it is alleged that Clive Clover joined the board of directors of a competitor, Pebsi (Pty) Ltd, effective from 1 March 2023, thereby breaching his loss of office contract terms with Coca Bola (Pty) Ltd. In terms of the contract, Clive Clover could not join a competitor for one year. Coca Bola (Pty) Ltd’s lawyers are not prepared to comment at this stage on the likelihood of the action being successful. (4) 2. Correspondence from the liquidator of Suga Cain (Pty) Ltd indicating that creditors of that company, which was declared insolvent on 10 March 2023, were unlikely to receive any more than 20 cents in the rand on their claims. The correspondence also indicated that legal proceedings for the liquidation have already started in January 2023. At 28 February 2023 Butter (Pty) Ltd had owed Coca Bola (Pty) Ltd R400 000. No allowance has been made for this loss at year-end in the accounting records of Coca Bola (Pty) Ltd. (4) 3. Correspondence from Coca Bola (Pty) Ltd’s lawyers indicating that several claims against Coca Bola (Pty) Ltd for personal damages had been received from the public. These had arisen from publicity surrounding an out-of-court settlement of R150 000 made prior to year-end. Coca Bola (Pty) Ltd had made this payment to a member of the public who had sued the company for personal damages for having consumed contaminated cooldrinks supplied by the company. You establish that the contamination was restricted to one small consignment of cooldrink, and that the publicity had not affected subsequent sales. The lawyers are unable to give any indication of the possible liability arising from the claims. Although the directors admit that other members of the public could have been poisoned, they consider that the matter should simply be ignored altogether or dealt with in the 2024 financial statement if the need arises. (6) 4. An article in the company magazine detailing an upcoming minor restructuring of the company’s human resource section. (2) ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϱϵ YOU ARE REQUIRED TO: State, giving reasons, the effect, if any, that each of the above matters (1–4) will have on the financial statements as at 28 February 2023. ϭϰ͘ϭϯ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the senior in charge of the audit of Sun Paradise (Pty) Ltd, a holiday resort. The company has a 31 January 2023 year-end and final materiality is set at R900 000. One of the trainees on your audit team alerted you to a newspaper article, published on 15 February 2023, regarding your client: RESORT CLOSES GIANT SUPERSLIDE DUE TO SAFETY CONCERNS All is not well in paradise after two serious injuries occurred at the ever so popular Sun Paradise holiday resort. This follows after the December 2022 grand opening of Sun Paradise’s giant superslide, the Velociraptor, did not go as planned. At the day of the opening event, one holiday maker suffered a severe head injury, while another was left with a fractured rib. The resort has since been sued by the two parties. Upon enquiry, it was confirmed that Sun Paradise had decided to close the Velociraptor until a full investigation has been performed. The resort is, however, still welcoming guests and the CEO, Maurice Siyila, has stated that ‘despite the unfortunate incident, guests can still enjoy a great variety of recreational activities for the whole family’. You then discussed the matter with Maurice Siyila, who informed you that Sun Paradise is being sued for R3,4 million. It is unclear when the matter will be settled or what amount may be awarded as damages. For various reasons it is uncertain whether any damages awarded in this case will be covered wholly or partially by the company’s insurance if the complainants are successful. He further informed you that the investigation into the construction and safety of the Velociraptor has since been completed. On 28 February 2023, safety officials and civil engineers from the firm, Adams and Sons Inc, provided Sun Paradise (Pty) Ltd with a report and a cost estimation to fix the slide, amounting to R1,2 million. The Velociraptor was originally constructed using the funds of investors. Subsequent to the discussion with Maurice Siyila, you have inspected the agreement between Sun Paradise (Pty) Ltd and the investors and confirmed that there is an obligation on Sun Paradise (Pty) Ltd to construct the slide and to keep the slide in a good working condition. You have also performed audit procedures on the estimation of the cost to fix the Velociraptor and have concluded that the estimate is reasonably accurate. Additionally, you have confirmed that the contractor responsible for the initial construction of the slide has filed for bankruptcy and that Sun Paradise (Pty) Ltd will not be able to claim any money from him. ϯϲϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ YOU ARE REQUIRED TO: (a) Indicate whether provision should be made for the R3,4 million and the R1,2 million respectively. (6) (b) Assume that you have concluded that no provision should be made for the R3,4 million, and that it should rather be disclosed as a contingent liability. Briefly indicate the information that should be disclosed in the financial statements relating to the contingent liability. (3) (c) Assume the R3,4 million lawsuit is in fact a contingent liability. Discuss the assertions that relate to the R3,4 million lawsuit. (5) (d) Describe the substantive audit procedures you would perform in respect of the assertions relating to the R3,4 million. (6) (e) Comment on whether the R3,4 million could not simply be ignored for financial reporting purposes. (2) (f) Describe the procedures that you would perform to rely on the work of Adams and Sons Inc. (8) ϭϰ͘ϭϰ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ You are the senior on the audit of Super Eateries (Pty) Ltd (SEAT) for the year-end 28 February 2023. SEAT is a restaurant group that operates various coffee shops and restaurants. According to the draft company financial statements of SEAT as at 28 February 2023, which include all the company’s assets and liabilities at fair value, SEAT has become factually insolvent. You enquired about management’s plans, and they responded with the following: Dear Auditor, We refer to your enquiry regarding SEATs poor operating performance. We take note of your warning that SEATs management must have specific plans to improve the situation if the company wants to avoid a modification to the audit opinion owing to its going concern status. I wish to assure you that the management of SEAT believes that the company will continue as a going concern in the foreseeable future. In support of this belief, we have implemented the following mitigating plan and drafted a cash-flow projection. Plan 1 As you are also the auditor of Tiger Eateries Ltd, the holding company of SEAT, you are already aware of the loan of R2 million payable by SEAT to Tiger Eateries Ltd. The financial director of Tiger Eateries Ltd has agreed to subordinate this loan until SEAT has restored its financial position from a net liability to a net asset situation. continued ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϲϭ Cash-flow projections Cash-flow forecasts were prepared for the 2024 financial year and are available for your perusal. We hold a R1 000 000 overdraft with the bank. Cash-flow forecast for the 2024 financial year Prepared by the Financial Accountant Opening cash balance R -789 332 Plus: Cash inflows operational 12 332 554 Minus: Cash outflow operational -9 873 412 Closing cash balance 1 669 810 We are sure that you can deduce that this will resolve the cash-flow problems until we recover to a net asset situation. YOU ARE REQUIRED TO: (a) Describe the audit procedures that you will perform on the subordination agreement signed between SEAT and Tiger Eateries Ltd. (6) (b) Describe the audit procedures you will perform on the cash-flow projection drafted by management. (9) ϭϰ͘ϭϱ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of High Fashions (Pty) Ltd (H&F) for the year ended 31 March 2023. You recently had a meeting with the directors of H&F due to rumours of price fixing that came to your attention. The social and ethics committee received documentation from the Competition Tribunal of allegations of anti-competitive behaviour levelled against H&F. The allegation is that the fixing of the price of clothing, at which suppliers supply to H&F, is anti-competitive. Further discussions with the directors revealed that price fixing allegations were also levelled against H&F in 2019. The Competition Commission investigated the allegations and escalated their findings to the Competition Tribunal in January 2023. The Competition Tribunal ruled on 20 April 2023 that H&F was guilty of price fixing and was ordered to immediately cease the price fixing arrangement and to pay a fine of R52 million. The directors are of the opinion that the company will not be able to continue trading as a going concern, unless the amount of the fine imposed by the Competition Tribunal is drastically reduced. Management further refuses to reflect anything relating to the fine in the 2023 annual financial statements of H&F. ϯϲϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The directors resolved to imminently enter into serious negotiations with the Competition Tribunal to significantly reduce the amount of the fine. Failure to have the amount reduced would mean that H&F may not be able to pay the fine, as it does not currently have the cash resources to settle R52 million. YOU ARE REQUIRED TO: (a) Discuss the accounting treatment of the R52 million fine imposed by the Competition Tribunal in the 2023 annual financial statements of H&F. (10) (b) Discuss the effect on the audit report assuming that a material uncertainty for H&F to continue as a going concern exists. Assume that the annual financial statements for the year ended 31 March 2023 have been prepared on the goingconcern basis and that management refuses to disclose the event of the R52 million fine in the annual financial statements. (10) ϭϰ͘ϭϲ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are the senior on the audit of Weston (Pty) Ltd, a large manufacturing company. The company is efficiently run and has a sound management reporting system in place. It has a head office and manufacturing plant in Cape Town and manufacturing plants in East London and Durban. You have just completed your identification of subsequent events for the financial year-end 28 February 2023, and have made the following notes: 1. On 31 March 2023 an incentive bonus of R1.8 million was paid out to employees. This arose out of an agreement with the union that, should a particular production target be met by the manufacturing plant at 28 February 2023, the bonus would become payable. The complicated computations to determine the amounts to be paid were completed for all employees at the Durban plant by 20 March and the amount (R1.8 million) was paid out on 31 March. You were not aware of the agreement until you had conducted your identification of subsequent events. (7) 2. On 1 August 2022 Weston (Pty) Ltd brought an action against another manufacturing company. The company alleged that Cordfit (Pty) Ltd has been manufacturing a product for which Weston (Pty) Ltd has the exclusive licence. On 20 March 2023 Weston (Pty) Ltd’s lawyers informed the company that Cordfit (Pty) Ltd had offered R2.5 million as an out-of-court settlement. The directors of Weston (Pty) Ltd had decided to accept the offer at a directors’ meeting held on 1 April 2023. (8) 3. On 4 March 2023 a fault in the automatic fire extinguishing system caused the water sprinklers to come on. This has destroyed raw materials inventory used for packaging. The sprinkler system was installed in October 2022 but the inventory insurance policy had never been amended to cover damage to inventory by accidental operation of the sprinkler system. Although the value of the inventory ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϲϯ was material, no disruption to production is envisaged. The company that supplied the system will not accept responsibility. (5) 4. On 1 April 2023, Weston (Pty) Ltd went live with their new financial application. They have subsequently noted that although the system was signed off to go live with all the tests having been completed, there were still several significant issues after the ‘go-live’ event and the team will have to continue to fix forward. (5) 5. During April 2023, the company recorded a social media event where a disgruntled employee, who was legally dismissed, caused negative press on social media. The event seems to have snowballed. Senior management believes that the event will blow over soon. (5) The directors of Weston (Pty) Ltd are willing to comply with your advice concerning the treatment of the above matters as they wish to comply fully with financial reporting standards and wish to make their financial statements as informative as possible. Your reporting deadline is 15 April 2022. YOU ARE REQUIRED TO: Describe the additional audit procedures you would carry out in respect of the above matters (1–5) and indicate, with reasons, how each matter should be treated in the 2023 year-end financial statements. Assume that all matters are material. ϭϰ͘ϭϳ ;ϮϳŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ You are responsible for the audit of Swytch (Pty) Ltd, a small company that tenders for contracts to supply (and install) electrical fittings on mass housing projects. Swytch (Pty) Ltd does not have the resources to install the fittings and therefore subcontracts installation to Litefit CC. Although Swytch (Pty) Ltd does not have a public interest score which requires that it have its financial statements audited, Ray Bright, its major shareholder who is not involved in the day-to-day running of the business, requires that a proper set of financial statements be drawn up each year and that they are externally audited for use if needed by the bank and SARS. On commencing the audit for the year-end 28 February 2023, you were concerned to find that the company’s trading position had worsened significantly since the previous year. The previous year’s financial statements had shown a small profit and a small amount of ϯϲϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ retained earnings. The current situation is reflected in the draft statement of financial position as at 28 February 2023 shown below: 2023 R ’000 ASSETS Non-current assets Property, equipment and vehicles Note 1 Investment (unlisted) Note 2 1 188 200 Current assets 5 902 Inventory 1 526 Trade receivables 4 376 Cash – Total assets 7 290 EQUITY AND LIABILITIES Share capital 1 000 Accumulated loss (639) Non-current liabilities Long-term loan Note 3 Current liabilities 500 6 429 Trade payables Note 4 4 902 Bank overdraft Note 5 1 527 Total equity and liabilities 7 290 Note 1: The non-current assets all fairly valued, are made up as follows: Small storage facility in a business park Fittings and office equipment 2 Izuzu bakkies R850 000 38 000 300 000 R1 188 000 Note 2: The unlisted investment represents a 10% holding purchased in 2001 in Kablex (Pty) Ltd, which manufactures electrical cable. The fair value of this investment is about R500 000 as at 28 February 2023. (The financial records have not been adjusted to reflect the fair value of the investment but the adjustment will take place prior to the final preparation of the AFS.) ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϲϱ Note 3: The long-term liability represents a 13% unsecured loan made to the company by Ray Bright who also holds 70% of the share capital. The balance of the shares is held by the two directors of Swytch (Pty) Ltd. As indicated above, Ray Bright is not a director and does not play an active role in the day-to-day activities of the business. Note 4: An amount of R213 816 included in creditors is still owed to Litefit CC, the electrical contractors subcontracted by Swytch (Pty) Ltd to install the fittings that Swytch (Pty) Ltd supplies. At reporting date this debt was already 120 days overdue, and Litefit CC is pressing for payment. Note 5: The directors are currently negotiating to have the overdraft limit of R1,5 million increased. The bank overdraft is currently secured by the company’s non-current assets and guarantees from Ray Bright in his personal capacity. Other information 1. The company operates a simple but efficient cash forecasting and management reporting system. 2. The market for mass housing is expected to increase steadily as a result of the government’s intentions, but is expected to remain very competitive. 3. The company’s lawyers are currently trying to settle a dispute with a construction company which claims that defective light fittings supplied by Swytch (Pty) Ltd resulted in fire damage to six newly built houses. 4. Swytch (Pty) Ltd experiences great difficulty in obtaining payment for completed contracts mainly because they have to deal with provincial and local authorities, and do not have the administrative staff to constantly follow up outstanding payments. 5. At reporting date, the company had submitted a number of tenders for provincial housing contracts. While you were finalising the audit, Shawn Gregg, a director of Swytch (Pty) Ltd, phoned to inform you that the company had been awarded one of the provincial housing contracts for which it had tendered. This, he felt, would assure the ‘future of the company’. YOU ARE REQUIRED TO: (a) Discuss whether the presentation of the financial statements on the goingconcern basis is appropriate for the financial year-end 28 February 2023. (You are not required to reach a conclusion.) (20) (b) State briefly the enquiries you would make of Shawn Gregg to determine whether the awarding of the contract would have any effect on your goingconcern evaluation. (You are not required to go into detail.) (7) ϯϲϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϰ͘ϭϴ ;ϮϱŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ You are in charge of the audit of ShoeShuffle (Pty) Ltd, a South African company that manufactures various types of footwear. The company has a 30 April year-end. Ongoing reporting in the business press about the difficulties facing the shoe industry has prompted you to plan a comprehensive evaluation of the going-concern ability of ShoeShuffle (Pty) Ltd, to be carried out in May. The senior trainee on the audit has provided you with the following: Draft abridged statement of financial position as at 30 April 2023 2023 R ’000 ASSETS Non-current assets Property, plant and equipment Investment Current assets Inventory Accounts receivable Bank Total assets Note 1 Note 2 Note 3 9 436 8 236 1 200 8 650 4 875 3 666 109 18 086 EQUITY AND LIABILITIES Capital and reserves Share capital Retained earnings Non-current liabilities Long-term loans Current liabilities Accounts payable Current portion of long-term loans Total equity and liabilities 8 024 7 500 520 Note 4 Note 5 2 700 7 362 5 362 2 000 18 086 Note 1: Property, plant and equipment is fairly valued provided ShoeShuffle (Pty) Ltd continues as a going concern (interim audit work carried out in March 2023 supports this conclusion). Note 2: The investment of R1,2 million represents the cost of a 25% share in Its Shoetime (Pty) Ltd, a company that opened a chain of retail shoe shops about a year ago selling shoes at discounted prices. Due to negative public ŚĂƉƚĞƌϭϰ͗ŽŵƉůĞƚŝŽŶŽĨƚŚĞĂƵĚŝƚ ϯϲϳ perceptions about ‘discount’ shoes, these outlets have performed poorly and three (of the original ten) have closed. Note 3: The company has an overdraft limit of R1 million secured by a notarial bond over the company’s property. Note 4: The loan of R2,7 million provided by Industrial Finance Inc is repayable in full in July 2024. Interest of 10% per annum is payable in arrears. The interest accrual at year-end has been included in accounts payable. Note 5: This R2 million is to be repaid on 1 August 2023. It represents four loans of R500 000 that were made to the company by the four major shareholders in the company (they own 80% of the shares among them). Interest of 12% per annum is payable in arrears on these loans. The four shareholders are executive directors of the company. The interest accrual has been included in accounts payable. Other financial data/comparative information Turnover (sales are made only on credit) Accounts receivable (net of allowance) Allowance for doubtful debts/credit losses Inventory (net of allowances) Allowances for slow moving/damaged inventory Profit for the year before taxation 2023 R’000 14 058 3 666 10% 4 875 5,73% 287 2022 R’000 16 323 2 907 10% 3 490 8% 1003 Further information 1. Most of the sectors within the shoe industry that the company supplies, for example sports shoes and men’s and women’s formal shoes, are very competitive. 2. The government sector, for example military boots, gumboots, police footwear, is also competitive and there is a complex tendering system that must be followed to obtain this business (see point 5 below). 3. Significant competition comes from cheap imports from China, Taiwan and India and local manufacturers. This competition has been the direct cause of the drop in turnover. To counter this, ShoeShuffle (Pty) Ltd has relaxed its credit limits. This has partially been successful but many of the company’s customers are facing even stiffer competition and the resultant liquidity problems, as the large hyper stores carry more and more imported shoes. 4. At 30 April 2023 orders placed by value are only 60% of orders placed at 30 April 2022. The company has maintained its normal production, mainly due to a threat of strike action by the factory employees if working hours were to be reduced. ϯϲϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ In the minutes of directors’ meetings, it was noted that the directors have received notification from the Government Health Department that from August 2023 all suppliers of footwear to the department will have to satisfy certain black economic empowerment requirements if they wish to submit tenders to supply the department. Tenders that run for 12 months must be submitted by 1 August each year for supply commencing 1 November. The directors noted in the minutes that in their estimation, it would take approximately 12 months for ShoeShuffle (Pty) Ltd to meet the tender requirements. 5. The notification from the Health Department also stated that from August 2023 the department would not accept tenders from non-South African (foreign) companies. Foreign companies currently supply 40% of this substantial market. ShoeShuffle (Pty) Ltd has supplied the Health Department with coloured gumboots for many years. It is one of the three government departments that the company supplies to, and the sale of gumboots accounts for about 33% of the company’s R4,5 million sales to the government annually. 6. Our attendance at the year-end inventory count revealed that the quantity of finished goods on hand had increased substantially compared to the prior year, while raw material and work-in-progress had remained reasonably constant. No other audit work on inventory has been carried out. YOU ARE REQUIRED TO: Evaluate whether the presentation of the financial statements of ShoeShuffle (Pty) Ltd at 30 April on the going-concern basis is appropriate based on the information given above. You are not required to present a conclusion. (25) ,WdZ ϭϱ ZĞƉŽƌƚŝŶŐ KEdEd^K&Yh^d/KE^ Question no. Description of content of the question Total marks 15.1 Multiple-choice questions on the topic 10 marks 15.2 Short questions – True and false 26 marks 15.3 Short questions – Complete the table 16 marks 15.4 Short questions on the topic 27 marks 15.5 Short questions on the topic 18 marks 15.6 Short questions on the topic 24 marks 15.7 Reportable irregularity 29 marks 15.8 Impact of information on the audit report 20 marks 15.9 Draft the audit report – Emphasis of matter 22 marks 15.10 Draft the audit report – Qualified 18 marks 15.11 Draft the audit report – Going concern 22 marks 15.12 Draft the audit report – Disclaimer 24 marks 15.13 Identify errors/deficiencies 30 marks 15.14 Identify errors/deficiencies 10 marks 15.15 Key audit matters (ISA 701) 32 marks 15.16 Compilation report 18 marks 15.17 Agreed-upon procedures 13 marks 15.18 Review engagements 20 marks 15.19 Independent review 18 marks ϯϲϵ ϯϳϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϱ͘ϭ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Select the appropriate answer to the following: 1. The title of the audit report (Independent Auditor’s Report) includes the word ‘Independent’ to (a) signify that the audit is an assurance engagement; (b) enhance the credibility of the report by emphasising the independence of the auditor; (c) distinguish it from the report of the internal auditors contained in the financial statements; (d) limit the auditor’s liability should the audit report prove inappropriate. 2. The annual audit report for a listed company will be addressed to (a) the audit committee; (b) the shareholders; (c) the chairman of the board; (d) the chief audit executive. 3. The audit report does not provide an opinion on (a) the fair presentation of the financial position of the company; (b) the fair presentation of the cash flows of the company; (c) the effectiveness of the company’s internal control; (d) the fair presentation of the company’s financial performance. 4. The auditor may need to modify his audit opinion because (a) there is a disclosure in the financial statements that must be brought to users’ attention due to its importance; (b) the budget for the audit was exceeded; (c) there are uncorrected misstatements that are material to fair presentation; (d) none of the above. 5. Which of the following will result in a disclaimer of opinion in the audit report? (a) The auditors disagree with the selected accounting policies, which results in pervasive misstatement because they are inappropriate. (b) The auditors agree that the selected accounting policies have been appropriately selected but result in pervasive misstatement because they have not been applied correctly in terms of the applicable standard. (c) Significant limitations have been placed on the auditor by the client’s management. ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ (d) ϯϳϭ The company had adverse commentary on their social media during the financial year, which impacted its going concern. 6. Which of the following will result in an adverse opinion in the audit report? (a) A disclosure that has a material effect (not pervasive) on fair presentation, has been omitted from the financial statements. (b) The auditors disagree with management’s selected accounting policies, which result in pervasive misstatements, because these policies are inappropriate. (c) The auditor wishes to draw users’ attention to a very important matter which is disclosed in the notes. (d) The auditor is unable to obtain sufficient appropriate audit evidence due to circumstances beyond his control. 7. Which of the following combinations is possible in the same audit report on the financial statements as a whole? (a) An adverse opinion and a disclaimer of opinion. (b) An ‘except for’ qualification based on disagreement and a disclaimer of opinion. (c) An ‘except for’ qualification based on disagreement and an adverse opinion. (d) Two ‘except for’ qualifications, one based on a limitation of the auditor’s scope and the other on a disagreement. 8. With regard to other information in documents containing audited financial statements, for example a group report, the auditor (a) has no responsibility;. (b) is responsible for conducting audit procedures appropriate to determine whether the other information is fairly presented; (c) has a duty to test the other information to confirm that the information is factually correct; (d) has a duty to read the other information with the intention of identifying material inconsistencies between the other information and the financial statements. 9. Where a registered auditor has conducted the audit of a private company and is required to give a qualified opinion, the title of his audit report will be (a) Qualified Report of the Independent Auditor; (b) Independent Auditor’s Report; (c) Qualified Auditor’s Report; (d) Modified Auditor’s Report. ϯϳϮ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 10. Which of the following sections will not be included in a qualified audit report for a private company? (a) Key audit matters section. (b) Other information section. (c) Opinion section. (d) Basis for qualified opinion section. ϭϱ͘Ϯ ;ϮϲŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Consider the following statements. State, giving reasons, whether each of the statements below (1–13) is true or false. 1. Audit reports on the annual financial statements of listed companies are addressed to the shareholders or to the audit committee, while audit reports for private companies are addressed to the directors. 2. The auditor may give an unmodified audit opinion where a modified audit opinion is required if, with the consent of the directors, he (the auditor) addresses the matter which gave rise to the need to modify the audit opinion at the annual general meeting. This applies only to private companies. 3. Where the only unresolved audit matter relates to inadequate disclosure, albeit material inadequate disclosure, the auditor can avoid a qualification by giving an emphasis of matter. 4. An unresolved audit difference (misstatement), which is based on a disagreement with management and those charged with governance, and which renders the financial statements fundamentally misleading, must result in an adverse opinion. 5. An ‘except for’ qualification (modification of the audit opinion) can be given for a matter arising out of either a scope limitation or a disagreement with the management/directors. 6. To avoid a qualification (modification of the audit opinion) of the audit report, the auditor can adjust the financial statements if the directors refuse to do so, provided the shareholders agree. If this occurs, an ‘Other matter’ paragraph must be added to the audit report. 7. The auditor has no responsibilities in respect of information contained in an annual report other than the information he must report on in terms of the Companies Act. 8. The audit report should not be signed prior to the date the directors sign the financial statements (the directors must sign first). 9. If the auditor ends up with two unresolved audit differences, both of which are material and pervasive, but one is based on a limitation of scope (inability to ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϳϯ obtain sufficient appropriate evidence), and the other is based on a disagreement (misstatement), the auditor should give an adverse opinion and not a disclaimer of opinion. 10. Key audit matters must be communicated to shareholders for all companies with public interest scores of more than 350. 11. When conducting an independent review engagement on a set of annual financial statements, a registered auditor is not required to comply with the International Standards on Auditing. 12. When conducting an independent audit, the auditor is required to formulate a strategy for the audit, but for an independent review, a strategy for the review is not specifically required. 13. An audit report gives rise to an audit opinion and a review engagement gives rise to a review opinion. ϭϱ͘ϯ ;ϭϲŵĂƌŬƐϭϵŵŝŶƵƚĞƐͿ Circumstance Nature Note Material/ pervasive Opinion 1. Company no longer a going concern. No disclosure of this and AFS prepared on goingconcern basis. 2. Directors refuse to give auditors access to any of the bank statements and no purchase records kept. 3. No cash sales records. Material; pervasive 4. Deferred tax policy inappropriately applied. Qualified (except for) 5. Inventory stated at replacement cost. Material; pervasive 6. Going concern dependent on award of contract; adequate disclosure made. Material 7. Misclassification of liabilities. Qualified (except for) continued ϯϳϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Circumstance Nature Note 8. Inability to obtain sufficient appropriate audit evidence. Material/ pervasive Material; pervasive 9. Insufficient evidence relating to capitalisation of intangible asset development costs. 10. Non-disclosure of subsequent event. Opinion Qualified (except for) Material Note: The nature refers to whether this is a scope limitation or a disagreement (misstatement) with management or a going-concern matter. You should clearly indicate if any additional paragraphs should be added to the audit report. YOU ARE REQUIRED TO: Complete the table given above. Consider each circumstance separately. ϭϱ͘ϰ (16) ;ϮϳŵĂƌŬƐϯϮŵŝŶƵƚĞƐͿ YOU ARE REQUIRED TO: Answer the following questions: 1. When reporting on a set of financial statements, what are the objectives of the auditor? (2) 2. What is general purpose financial statements? (1) 3. Fred Dedd, the designated auditor on the audit of Pottholes (Pty) Ltd, has been requested by the financial director of the company not to provide a written audit report for the current year-end audit, but rather to present an oral auditor’s report at the company’s upcoming AGM. The financial director believes this will give shareholders a much better understanding of the audit report as they can ask Fred Dedd probing questions. Should Fred Dedd agree to this? Justify your answer. (3) 4. In terms of ISA 700 (Revised), in forming his opinion, the auditor is required to evaluate whether the financial statements are prepared, in all material respects, in accordance with the applicable financial reporting framework, including consideration of the qualitative aspects of the entity’s accounting practices. List five other matters the auditor should evaluate before forming the audit opinion. (5) 5. List the information which should be included in the auditor’s opinion section of the audit report. (3) ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϳϱ 6. Which of the following statements is false? Justify your answer. 6.1 A disclaimer of an opinion and an adverse opinion arise from matters which are considered to be material and pervasive. (1) 6.2 An emphasis of matter can be given instead of an except for opinion but not instead of a disclaimer of opinion. (2) 6.3 The audit report must be signed by the registered auditor responsible for the audit and must reflect the auditor’s full name. (1) 7. What are the characteristics of a misstatement that has a pervasive effect on the financial statements? (2) 8. Indicate whether each of the following should be included in the audit report: 8.1 a statement that the auditor maintains professional scepticism throughout the audit; 8.2 a statement that the auditor is not responsible for detecting fraud; 8.3 a statement that the auditor concludes on the appropriateness of the directors’ use of the going-concern basis of accounting; 8.4 a summary of the audit issues discussed with the audit committee and how any such issues were resolved. (2) 9. Impacts of the Covid-19 pandemic may amplify conditions that give rise to modifications to the auditor’s opinion. Modifications to the auditor’s opinion may also arise due to the inability to obtain sufficient appropriate audit evidence, including circumstances beyond the entity’s control or circumstances relating to the nature or timing of the auditor’s work. What type of opinion should the auditor express due to the inability to obtain sufficient appropriate audit evidence that is material but not pervasive? (2) 10. State whether each of the following statements is true or false. Justify your choice: 10.1 Because an independent review is not as detailed as an audit, only reasonable assurance is given that fair presentation has been achieved. (1) 10.2 A registered auditor conducting an independent review must set planning, performance and final materiality limits for the review engagement. (1) 10.3 An independent review engagement does not normally include risk assessment procedures. (1) ϭϱ͘ϱ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You have recently completed the audit of Wearever (Pty) Ltd’s trade accounts receivable for the financial year-end 31 March 2023. You had paid particular attention to the allowance for bad debts/credit losses and, having evaluated all ‘problem’ accounts individually, found the allowance of R263 510, 10,5% of debtors was fair ϯϳϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ and consistent with the allowances for the previous four years, which ranged between 10% and 11%. Shortly before your manager was due to review your working papers you conducted a final check of the balance on your trade accounts receivable lead schedule against the draft financial statements. As all aspects of your audit of debtors had been successfully completed, you were surprised to find that they did not agree. On further investigation, you established that the allowance for doubtful debts/credit losses had been reversed subsequent to your audit. Besides increasing current assets, the reversal has resulted in an increase of 8% in net profit before taxation. You immediately raised the matter with the financial manager, who informed you that ‘the directors decided to reverse the allowance for bad debts at 31 March and to write off any bad debts as and when they occur in the future. As far as we are concerned, this policy is consistent with current accounting theory trends that aim at fair value accounting.’ When you met with your manager to discuss this matter, he decided to take the opportunity to give you some ‘on-the-job training’ by posing the following questions: (a) What is the justification behind your view that our audit report must be modified? (4) (b) I agree that we need to address the matter in the audit report, but must we qualify our audit opinion, or can we give an emphasis of matter? Can you explain your answer please? (3) (c) If this matter was immaterial, we could ignore it for reporting purposes, so what indications do you have that (i) it is not immaterial (that is to say it is material)? (2) (ii) it is not actually material and pervasive? (3) (d) Do you regard this as a factual misstatement or a judgemental misstatement? (3) (e) What is the phrase we will use to convey our qualified opinion in the audit report? (1) (f) Do we need to include a Key Audit Matters section in the audit report? Explain your answer. (2) YOU ARE REQUIRED TO: Respond to the questions put to you by your manager. ϭϱ͘ϲ ;ϮϰŵĂƌŬƐϯϬŵŝŶƵƚĞƐͿ During late March, while conducting the audit of Tothepublic (Pty) Ltd, a consumergoods wholesaler, for the financial year-end 28 February 2023, one of your trainees obtained evidence he wanted to share with you. In his opinion, the evidence suggested that the company had been overclaiming input taxes on its VAT returns by claiming VAT on certain purchases in the month in which the purchases were made ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϳϳ and then again on the same purchases in the subsequent month, when the suppliers are paid. This had been going on for a number of months. Without raising the matter with the financial director, you immediately carried out further procedures and as a result, were satisfied that your trainee had uncovered a carefully managed plan to illegally reduce VAT payments with the knowledge of some members of the board of directors. To meet your Auditing Profession Act responsibilities, you dispatched a report to the Independent Regulatory Board for Auditors without delay, and made an appointment the following day to see the financial director, Michael Bruce. After a somewhat aggressive start to the discussion, during which he accused you of going ‘behind his back’ by reporting the matter to the IRBA, Michael Bruce calmed down and admitted that the company had been claiming the input tax twice. He explained that these actions were not intended to defraud SARS but rather to avert a liquidity crisis. He then asked whether there was any way in which the matter could be kept confidential, particularly from the shareholders and the directors who did not know about the fraud. His suggested that, to keep the matter confidential, he would go to the SARS office the next day and make a full disclosure to them and agree to pay the amount owed in back taxes, penalties etc. He felt this would obviate (get around) the need for any mention of the matter in the annual report for the 28 February 2023 year-end. You responded accordingly to Michael Bruce and advised him on the action he should take. Just prior to the expiry of the 30-day period within which you needed to make your second report to the IRBA, you contacted Michael Bruce, who informed you that he had not taken your advice and would be taking legal advice on your failure to discuss the matter with him prior to reporting to the IRBA, and your breach of confidentiality. YOU ARE REQUIRED TO: (a) Discuss how you would have responded to Michael Bruce’s suggestion as to how the matter could be kept confidential. (Do not concern yourself with matters related to the Companies Act or the King IV Code on Corporate Governance.) (6) (b) Explain the advice you would have given Michael Bruce. (Do not concern yourself with matters related to the Companies Act or the King IV Code on Corporate Governance.) (3) (c) Comment on the response you expect Michael Bruce will receive from his legal counsel with regards to your actions. (3) (d) Draft the audit report you will give for the financial year-end 28 February 2023 assuming that you submitted the appropriate second report to the IRBA. (12) Note: You are not required to include the sections dealing with the directors’ and auditor’s responsibilities. ϯϳϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ϭϱ͘ϳ ;ϮϵŵĂƌŬƐϯϱŵŝŶƵƚĞƐͿ WĂƌƚ ;ϭϰŵĂƌŬƐϭϳŵŝŶƵƚĞƐͿ ISA 705 (Revised) – Modifications to the Opinion in the Independent Auditor’s Report, guides the modification of audit reports. Consider the following, unrelated, situations: 1. During the audit, significant restriction was placed on the scope of the audit work to be concluded by the external auditor by the audit committee. 2. The company failed to comply with a section of the Companies Act 2008 that does not affect the annual financial statements. 3. The company is in financial difficulty. It has presented the financial statements on the going-concern basis (which, in the auditor’s opinion, is appropriate) and has made full disclosure of the going-concern problem. 4. The annual financial statements do not provide for deferred tax and the amount, if provided for, would be material. 5. The auditor could not obtain sufficient appropriate evidence regarding an investment in a foreign associate of an audit client. The audit committee attempted to obtain the required evidence but was not successful. The effect of the matter is considered to be material only. 6. The directors have committed an unlawful act that resulted in a reportable irregularity. The matter was reported to the IRBA, at the financial year-end date the directors had acknowledged the act, had repaid the money the company and others had lost and made full adjustment to and disclosure in the financial statements to the satisfaction of the auditor. 7. While auditing the systems, and completing the IT general controls tests, the auditor realised that a new reconciliation application was implemented during the financial year. Upon further enquiries and inspection, the old (now decommissioned application) had a material balance of unmatched items that were not transferred to the new application. Management later declared that they were unaware of the issue, but made an adjustment to the new application. YOU ARE REQUIRED TO: Indicate whether, in each of the situations described (1–7) above, the audit opinion would need to be modified. Justify your answers. (14) WĂƌƚ ;ϭϱŵĂƌŬƐϭϴŵŝŶƵƚĞƐͿ The following unrelated situations have occurred at various clients. In each case, they were the only outstanding issues at the concluding stage of the audit: 1. The previous auditor passed away before the year-end and you were appointed after the year-end of the client, hence neither he nor you attended the year-end ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϳϵ inventory count. You were also unable to apply sufficient alternative procedures to verify inventory at year-end. The inventory figure is significant to the financial statements as a whole, but having carried out the other procedures, you are satisfied that the maximum misstatement that could have existed in inventory at year end, is material, but not pervasive to the financial statements. (3) 2. Your client has failed to disclose in the annual financial statements that the company has been sued by a customer for failure to perform in accordance with the terms of an agreement. Evidence obtained from the client’s attorneys indicates that the customer may be successful but that the amount which may become payable, cannot be accurately estimated. It is likely to be a material amount but will not threaten the company’s going concern ability. (3) 3. Your client has leased a number of items of plant and equipment for the first time during the financial year under audit. All the leases qualify as ‘right of use assets’ in terms of IFRS 16 but the company has decided not to recognise the leases as such and raise a lease liability. (3) 4. Your client’s premises were damaged by a flood and the bulk of the financial records were destroyed. The client had to make very rough estimates in respect of all the items in the financial statements, except accounts receivable, the records of which were rescued. You have satisfied yourself with the gross amount of the client’s accounts receivable. However, the client has not made an allowance for doubtful debts/credit losses. You are certain that such an allowance is necessary. (3) 5. Your client made a few mistakes during the financial period, which caused a lot of negative social-media attention. The client’s products have been withdrawn from their three largest outlets, which contribute to 60% of the company’s revenue. You have conducted all necessary procedures and concluded that it is uncertain that your client will be able to continue trading as a going concern. Management, however, does not agree, although they cannot provide you with evidence to change your conclusion on the matter. Consequently, they did not disclose anything with regard to this matter in the financial statements. (3) YOU ARE REQUIRED TO: Indicate, with reasons, the type of opinion you would give in each (1–5) of the above situations. (15) ϭϱ͘ϴ ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ You are working in the technical audit department at you audit firm. You have received the following unrelated enquiries from various trainees. 1. The management of the client has decided to adopt an IFRS standard one year earlier than its effective date. This matter has been disclosed in note 6 of the directors’ report. (2) ϯϴϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 2. The directors’ report has incorrectly disclosed a dividend payment of 456 cents in the share. The annual financial statements correctly indicate the amount as 654 cents in the share. Management is not willing to adjust the directors’ report as it has already been uploaded to the company’s website and they have indicated that they will simply tell the shareholders of this mistake at the AGM. (3) 3. During the performance of the current year’s audit a misstatement of R586 221 was found. Management has understated property, plant and equipment with this amount and is not willing to adjust the financial statements. (1) 4. The client has set the allowance for doubtful debts (credit losses) at R7 500 000 but based on the audit team’s conservative calculation, it should be set at R11 500 000. Management is not prepared to adjust the financial statements. (4) 5. The audit report for the previous financial year was qualified because the auditors were not able to perform an inventory count and no alternative procedures could be performed. In the current financial year the auditors attended an inventory count for the end of the year. (2) 6. Management has identified a material uncertainty with regards to the goingconcern basis of accounting. Management has disclosed this in note 18 of the financial statements. (3) 7. The audit partner has identified the audit of goodwill impairments and revenue recognitions as the most significant risks that used most of the audit team’s resources to audit. These risks have been reported and communicated to those charged with governance. (2) 8. During the audit, one of the audit clerks made a remark in an internal meeting that they were surprised that the business had not had to close its doors due to the unpleasant social-media publicity the company had to face during the financial year. Upon further investigation, the company had 50% less sales compared to the previous year in quarter 4. (2) 9. A system error was identified during the audit, while testing automated application controls. The inventory value (related to imported goods) was calculated incorrectly due to a ‘fixed’ exchange rate configured in the application for the complete financial period. Management is of the opinion that due to the exchange-rate fluctuations, the differences will ‘net off’ and they are not willing to recalculate the value as and when ownership of the inventory is taken. An exchange-rate difference of R367 908 was calculated by the junior audit clerk. (1) YOU ARE REQUIRED TO: For each of the queries received (1–9), discuss, with reasons, the impact it would have on the audit report. You can assume a materiality figure of R2 million for all the queries and that all clients are listed. (20) ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϭϱ͘ϵ ϯϴϭ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ You are the auditor of Habitat (Pty) Ltd, a residential housing development company. One of the tracts of land (already divided into plots) belonging to the company, borders on an informal settlement that sprung up (and which continues to grow) during the current financial year (year-end 31 March 2023). No plots have been sold in this particular development and all interest by prospective customers has ceased. The directors have applied to the provincial government to remove the informal settlement and are optimistic that this will happen. In addition to this development, Habitat (Pty) Ltd has other developments which are progressing well. The company is reasonably liquid and has recorded an after-tax profit of R12 million for the current year. At the current financial year-end, share capital and reserves amounted to R21 million. The directors have chosen to include the plots in the development adjoining the informal settlement in the financial statements at the cost of the land purchased for cash in 2008 (R5 000 000) plus development costs paid to date (R4 000 000) which include, for example, internal roads, gutters, water connections etc. These plots represent 30% of the current assets of the company. As you were concerned about the price at which the plots could actually be sold, or whether they could be sold at all, you contacted an independent and reputable estate agent (with the permission of Habitat (Pty) Ltd) who informed you as follows: ‘Your question as to the potential saleability and selling price of these plots cannot be answered with any certainty. It is possible that in the foreseeable future no sales will take place, while, on the other hand, the settlement may be moved by the provincial government to another site. This has occurred in other similar situations. As an application has been made to the provincial government, it would probably be premature to assume that this particular development will not recover and become profitable.’ A second estate agent whom you approached held a similar opinion. YOU ARE REQUIRED TO: Write the audit reports you would consider appropriate, assuming: (a) The directors include these plots in the financial statements at R9 000 000 and make full disclosure relating to the informal settlement which has sprung up.(12) (b) The directors include these plots in the financial statements at R9 000 000 but refuse to make any disclosures pertaining to the informal settlement. (10) Note: You are not required to include the paragraphs dealing with the directors’ or auditor’s responsibilities or the paragraph dealing with ‘Other reports’ required by the Companies Act in either report (a) or (b). You are also not required to repeat the title, address or signing off in report (b). ϯϴϮ ϭϱ͘ϭϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You recently carried out the audit of Blockz (Pty) Ltd, a cement brick and block manufacturer. By the time the concluding stage of the audit had been reached, all audit differences (misstatements) had been resolved except for the following matter: While scrutinising correspondence between Blockz (Pty) Ltd and its insurance company, you came across a letter referring to a very expensive computerised block compactor that had been severely damaged after someone had disabled the power surge control unit, something which does not usually occur accidentally. The letter confirmed that Blockz (Pty) Ltd was insured against this type of accident, provided that it was not the result of sabotage (a deliberate attempt to damage the machine). The letter also stated that the insurance company would be investigating the matter fully as ‘there appear to be some inconsistencies in the report on the event and because Blockz (Pty) Ltd had been experiencing severe labour unrest at the time’. You checked the accounting records and draft financial statements and could find no reference at all to the damage done to the machine. You raised this matter with Billy Bragg, the financial manager, who responded as follows: ‘You haven’t found any adjusting entries or disclosures because we haven’t made any, there is no need. I agree that in theory the machine has been temporarily impaired and its recoverable amount at reporting date was its scrap value of R50 000, but we have chosen to reflect the machine at its depreciated historic cost of R1,7 million because we are comprehensively insured. There is no permanent impairment of the asset, no loss to the company. What point is there in writing down the machine only to write it up again in a few months’ time when the machine is restored to use? The insurance company will bear the full cost . . . they can’t prove sabotage.’ You have established that the impairment of the asset was equal to approximately 7,5% of the net profit after tax reflected in the draft financial statements. YOU ARE REQUIRED TO: Draft the audit report of Blockz (Pty) Ltd for the financial year ended 31 March 2023, assuming that no changes will be made to the draft financial statements. You must include a working that justifies your choice of report. Justification Report (6) (12) Note: You are not required to include the sections dealing with the auditor’s responsibility, the directors’ responsibility or other regulatory matters in the report. ϭϱ͘ϭϭ ;ϮϮŵĂƌŬƐϮϲŵŝŶƵƚĞƐͿ You are the auditor of Workz (Pty) Ltd, a medium-sized engineering firm that exports to various countries worldwide. One of the company’s major creditors is ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϴϯ Precision (Pty) Ltd from which drilling components are purchased for export into Africa. This arrangement suits Precision (Pty) Ltd as they cannot obtain the necessary permits to export the components themselves. Due solely to the collapse of the company’s markets in Eastern Europe and Africa, Workz (Pty) Ltd has found itself in severe financial difficulty to the extent that, at the end of the current financial year (31 March 2023), the liabilities of the company exceed its assets fairly valued. The directors of Workz (Pty) Ltd believe that the company will return to profitable trading once the economies of their trading partners in Eastern Europe and Africa are restructured. Precision (Pty) Ltd has agreed to subordinate (back rank) the amount owed to it by Workz (Pty) Ltd until Workz (Pty) Ltd can re-establish its Eastern European and African markets. As a result of this subordination agreement, the directors of Workz (Pty) Ltd have prepared the financial statements on the goingconcern basis. YOU ARE REQUIRED TO: (a) Draft the audit report which you consider to be appropriate, assuming that you are satisfied with the subordination agreement itself, as well as the disclosures the directors have made about the going-concern problem, but in your opinion the restructuring of the Eastern European and African economies and the company’s plans to achieve this, are too uncertain to make any predictions about the re-establishment of the company’s markets in those countries. Do not include the sections dealing with the directors’ or auditor’s responsibilities, or other regulatory matters, in your report. (12) (b) Discuss the audit report which you consider to be appropriate, assuming that you are satisfied with the subordination agreement, as well as the disclosures the directors have made about the going concern problem and that, in your opinion, there is a realistic chance that the economies of the Eastern European and African countries will be restored within a reasonable period. (5) (c) Discuss the audit report which you consider to be appropriate, assuming that you are satisfied with the subordination agreement, and that the adoption of the going-concern basis for the preparation is appropriate but that the directors are not prepared to disclose anything relating to the collapse of their Eastern European and African markets. (5) ϭϱ͘ϭϮ ;ϮϰŵĂƌŬƐϮϵŵŝŶƵƚĞƐͿ You are the manager on the audit of Missiles (Pty) Ltd, a large weapons manufacturing company. The company has a public interest score of well over 350. While the company has appointed various board committees it does not have an audit committee and has not appointed a company secretary. During the audit of the financial year-end 31 March 2023, the financial director of Missiles (Pty) Ltd refused you and your team access to material parts of the sales and ϯϴϰ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ accounts receivable records, on the grounds that during the year, the company had signed contracts to manufacture and supply sensitive defence equipment and is not prepared to divulge any information about these contracts. You were also denied access to the statutory registers. Other than obtaining a small amount of corroborating evidence, you were unable, by the use of alternative audit procedures, to satisfy yourself as to the validity of these contracts, or the assertions relating to the company’s sales/accounts receivable. You informed the financial director that denying access was contrary to the Companies Act 2008 and that modification of the audit report was inevitable. He responded that ‘you must do what you must do, the confidentiality of our customers comes first’. During your audit, you identified various deficiencies in the internal controls/control activities of the client. YOU ARE REQUIRED TO: (a) State, giving brief reasons, with which of the duties in terms of section 44 of the Auditing Profession Act 2005 you, and your audit team, would not be able to comply in this situation. (5) (b) Draft the audit report you would issue for the financial year-end 31 March 2023, assuming that the company will not allow you or your firm access as indicated by the financial director. You are not required to include the paragraphs dealing with the directors’ and auditor’s responsibilities or other regulatory matters. (13) (c) Discuss the responsibilities of the auditors to communicate significant deficiencies in internal controls. (6) ϭϱ͘ϭϯ ;ϯϬŵĂƌŬƐϯϲŵŝŶƵƚĞƐͿ You are a senior on the 30 June 2023 audit of Litetech (Pty) Ltd, a company that manufactures lighting systems. At the conclusion of the audit, the following audit report was drafted by a junior trainee on the audit team as part of her ‘on-the-job’ training. You have been asked to evaluate her report as part of your training. Note: The shareholders of Litetech (Pty) Ltd included a clause in the company’s Memorandum of Incorporation, which requires that the company’s annual financial statements are externally audited. Independent report To the board of directors. We have evaluated the accompanying financial statements of Litetech (Pty) Ltd for fairness based on our annual audit carried out in terms of the Memorandum of Incorporation of the company. Management is responsible for the preparation of the financial statements and for the prevention of fraud. ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϴϱ The auditor’s responsibility is to perform the audit and in doing so, to detect any fraud which may have a material effect on the financial statements not having been prevented by the directors. We report on the following aspects of the audit: 1. An expert was engaged by our firm to assist in the valuation of work-in-progress. Due to the complexity of some of the company’s lighting systems, the risk of misstatement in work-in-progress warranted this. 2. The company is currently being sued by a former employee who suffered personal injury at work while testing electric current flow during quality control procedures. 3. With regards to the detection of fraud: we detected a small wage fraud relating to unauthorised overtime. We reported this to management, who subsequently dismissed the perpetrators. In our opinion, except for the matters raised in 1 to 3 above, there are no outstanding issues arising from the audit conducted in terms of the International Standards on Auditing and the International Financial Reporting Standards. Emphasis of matter There are no matters which require emphasis. Mayweather and Mosely 30 June 2023 Packia Place Pretoria YOU ARE REQUIRED TO: Identify (with reasons where applicable) the errors/deficiencies in the audit report presented to you for evaluation. You are not required to redraft the report. ϭϱ͘ϭϰ ;ϭϬŵĂƌŬƐϭϮŵŝŶƵƚĞƐͿ You are the engagement partner on the audit of Pet Paradise Ltd (a listed company) for the year ended 28 February 2023. One of your trainees has compiled a draft audit report to assist the audit team. Draft Independent Auditor’s Report INDEPENDENT AUDITOR’S REPORT To the Directors of Pet Paradise (Pty) Ltd Report on the Audit of the Consolidated Financial Statements continued ϯϴϲ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ Adverse opinion We have audited the financial statements of Pet Paradise (Pty) Ltd, which comprise the consolidated statement of financial position as at 28 February 2023 and the consolidated statement of profit or loss, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended. In our opinion, except for the effects of the matters described in the Basis of opinion section of our report, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position as at 28 February 2023, and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs). Basis of opinion Pet Paradise has recorded depreciation in its statement of profit or loss as R14 000 000. Management has made an error in the calculation of depreciation and this amount should have been R14 445 332. We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the financial statements section of our report. We are independent of the company in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide for our opinion. [Other information] Material uncertainty regarding going concern The company is experiencing substantial financial problems, which has not been disclosed in the financial statements. Due to the significance, we draw your attention to this fact. [Responsibilities of Management and Those Charged with Governance for the Financial statements] [Auditor’s Responsibilities for the Audit of the Financial Statements] A Partner A Partner 15 March 2023 ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϴϳ YOU ARE REQUIRED TO: Based on the draft audit report prepared, and assuming that the wording of the paragraphs in brackets are correct, discuss the deficiencies of the draft audit report. (10) ϭϱ͘ϭϱ ;ϯϮŵĂƌŬƐϯϴŵŝŶƵƚĞƐͿ ISA 701 – Communicating Key Audit Matters in the Independent Auditor’s Report is a statement intended to enhance the communicative value of the audit report and provide users with a better understanding of the audit. Consider the following unrelated matters: 1. The auditor of Titles Ltd, a listed company, provided the audit committee with a timetable for the upcoming financial year-end audit. (3) 2. In terms of the basic evidence gathered on the audit of Pulsar Ltd, a listed company, the auditor was of the opinion that the directors’ impairment write-down for a particular piece of machinery was understated. The matter was communicated to the audit committee, who, after a short discussion, agreed with the auditor and requested management to make the necessary adjustments, which they did. (4) 3. On the audit of Vyfster Ltd, a listed company, the auditor qualified the audit opinion on the basis of material misstatement due to the incomplete disclosure of directors’ remuneration. The directors and audit committee would not make any amendments requested by the auditor. (4) 4. On the audit of Intercom Ltd, a listed company, the audit of related parties and related party transactions required significant audit attention due to the complexity of Intercom Ltd’s group structure (particularly the identification of related parties). In the auditor’s judgement, knowledge of related parties and related party disclosures were fundamental to a user’s understanding of the financial statements and as such, extensive audit resources were allocated to addressing this situation (5) 5. At the commencement of the current year-end audit, the engagement partner of ConText Ltd, a listed company, provided the audit committee with a statement to the effect that there were no threats to the independence of the firm or the members of the audit team in relation to ConText Ltd. (2) 6. On the audit of Sandrock Ltd, based on audit evidence obtained, the auditor concluded that a material uncertainty relating to events or conditions, which cast significant doubt on the company’s ability to continue as a going concern, existed. However, the audit committee and management had come to the same conclusion and adequate disclosure in the financial statements relating to the material uncertainty had been made. The auditor was satisfied with this treatment after conducting extensive procedures on the matter itself and its disclosure. (5) ϯϴϴ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ 7. During the course of the financial year under audit, Pinarello Ltd, a listed company, commenced a major restructuring of the company (and its subsidiaries). This required the timely and appropriate recognition of costs and provisions, which, due to their materiality and complexity, were considered by the engagement partner to give rise to significant risk. Both asset valuers and tax specialists were extensively used by the audit team to address the risk which resulted in a large increase in the annual audit fee. (5) 8. On the audit of Dominate (Pty) Ltd, the auditor was required to report a reportable irregularity to the IRBA based on evidence that the directors had implemented a scheme to evade significant municipal business levies by making fraudulent declarations relating to turnover and employment numbers. The directors have ignored the auditor’s communications with them on the matter. (2) YOU ARE REQUIRED TO: (a) Define the term key audit matter. (b) Discuss whether each of the matters above (1–8) should be communicated in the audit report as a key audit matter. Your discussion should include your reason(s) for including or excluding each matter. (30) ϭϱ͘ϭϲ (2) ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ You are a sole practitioner with a varied portfolio of clients to whom you offer audit, review, tax and accounting services. One of your tax clients, Ricoh (Pty) Ltd, that has a public interest score of 115, has engaged you to compile the annual financial statements for its bankers for the year ended 31 March 2023. In prior years this has been done by the company’s bookkeeper, but she resigned recently. The company prepares its financial statements in terms of the IFRS for SMEs. You have performed the engagement and are now preparing your report in respect of the compilation engagement. YOU ARE REQUIRED TO: (a) Discuss the practitioners’ objectives in a compilation engagement. (b) Briefly describe the fundamental principles of professional ethics with which a practitioner must comply in relation to compilation engagements. (6) (c) Draft the appropriate report for this compilation engagement. (d) Comment on whether Ricoh (Pty) Ltd’s financial statements compiled by you will have to be audited or reviewed and whether you will be eligible to carry out the audit or review. (2) ϭϱ͘ϭϳ (2) (8) ;ϭϯŵĂƌŬƐϭϲŵŝŶƵƚĞƐͿ You are a registered auditor in public practice. You have been engaged by the directors of Checkx (Pty) Ltd to conduct an agreed-upon procedures engagement in ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϴϵ respect of certain aspects of the company’s inventory. Your brother sits on the board of Checkx (Pty) Ltd. The procedures you agreed to conduct were the following: 1. Count all inventory in the warehouse and compare the quantities on hand to the inventory master file as at 28 February 2023. 2. Open 10% of the boxes selected at random to confirm that the boxes contained the correct items. 3. Identify any inventory items (using generalised audit software) where the item’s cost price exceeded the selling price in the inventory master file. 4. Agree the cost price of every 20th inventory item in the inventory master file to the supplier’s invoice. You carried out the procedures with the following results: 1. With the exception of 13 inventory items, the quantities counted agreed with the inventory master file. 2. 42 boxes (10%) were opened and resealed. All boxes were found to contain the correct item. 3. The cost price and selling price of every inventory item in the inventory master file were compared. The cost price of 21 items exceeded the selling price as listed in the master file. 4. For all inventory items selected, the cost price in the master file was found to agree with the supplier’s invoice. YOU ARE REQUIRED TO: (a) Draft the appropriate report for this engagement. (b) Comment on whether, based on the procedures conducted, you would have been in a position to give an opinion on the fair presentation of inventory in the financial statements of Checkx (Pty) Ltd at 28 February 2023 if the board requested you to do so. (3) ϭϱ͘ϭϴ (10) ;ϮϬŵĂƌŬƐϮϰŵŝŶƵƚĞƐͿ Impressions (Pty) Ltd is a company that imports photographic equipment. The company has a public interest score of 168 for the financial year-end 30 April 2023. It has its financial statements independently compiled by Kumalo Inc., a firm of registered auditors who specialise in providing services as ‘independent accounting professionals’. Your firm, Makgalemele Inc., was the auditor of Impressions (Pty) Ltd but after the promulgation of the Companies Act 2008, changed its professional relationship with Impressions (Pty) Ltd to that of an independent reviewer of the annual financial statements. The company’s financial statements are prepared in terms of IFRS for SMEs. You have just completed the review for the 30 April 2023 financial statements and have only the following matter to deal with: ϯϵϬ 'ƌĂĚĞĚYƵĞƐƚŝŽŶƐŽŶƵĚŝƚŝŶŐ The company holds a number of listed investments on a long-term basis. In prior years, the company presented these on a ‘fair value’ basis, but for the year-end 30 April 2023 they included them at the value at which they were presented at the end of the prior year, 30 April 2022. Had the fair value of the investments at 30 April 2023 been used, an impairment of R327 206 would have had to be recognised. Keegan Naidoo, the financial accountant, tells you that the directors feel that as the value of the company’s investments fluctuates, it is simply a pointless exercise to revalue them when the intention is to hold them in the long term. He also tells you that the independent accounting professional didn’t think that not revaluing them at the reporting date was anything to worry about. When you informed Keegan Naidoo that you would have to modify your conclusion in the review report, he said that the board understood fully that you were required to fulfil your duties responsibly. A modification was not an issue for the board, particularly as the users of the reviewed annual financial statements were only going to be the 15 shareholders and possibly the bank and SARS. YOU ARE REQUIRED TO: (a) Explain the term ‘independent accounting professional’ in the context of Impressions (Pty) Ltd. (5) (b) Comment on whether your firm could compile and perform the review of the annual financial statements of Impressions (Pty) Ltd since your firm had previously been the auditor of the company. (3) (c) Draft the report that would be appropriate for this engagement, based on the information given in the question. You are not required to write the paragraphs dealing with the Independent Reviewer’s Responsibility or Other Reports Required by the Companies Act. (12) ϭϱ͘ϭϵ ;ϭϴŵĂƌŬƐϮϮŵŝŶƵƚĞƐͿ Your firm has been engaged to perform an independent review of the annual financial statements (financial year-end 31 March 2023) of Blackjack (Pty) Ltd, a company that retails a range of home-entertainment products through its own retail outlets. You commenced your review but quickly realised there was a problem with inventory. You found that inventory records were incomplete and that adequate internal controls were not in operation at the retail outlets in respect of inventory and cash sales. As a result, you found yourself unable to perform the procedures you deemed necessary on inventory or cash sales (particularly completeness). When you discussed the problem with Graham Black, he responded as follows: ‘We are fully aware of the shortcomings in our inventory system. We estimated inventory at 31 March instead of counting it for precisely this reason. As for the internal controls over cash sales, we should perhaps have a look at it. However, I can’t see that it should be a problem for you as we have not engaged you to perform an audit. Just ignore the problems and get the review done!’ ŚĂƉƚĞƌϭϱ͗ZĞƉŽƌƚŝŶŐ ϯϵϭ YOU ARE REQUIRED TO: (a) Comment on Graham Black’s perception of your responsibilities in relation to this engagement. (4) (b) Draft the audit report you consider appropriate for this engagement. You are not required to include the paragraphs dealing with the directors’ and auditor’s responsibilities or other regulatory matters. Justify your choice. (14)