Tariff Order CCSIA

advertisement

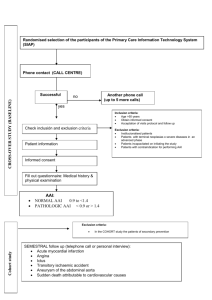

Tariff Order Lucknow for third control period (Issuance date – 15.06.2023) Background Situated in southern part of Lucknow. Hub to industries and close proximity to the Kanpur. Close to the NH27 and 11 Km from the city centre. Previously known as amausi airport. Named as CCSIA on July 17, 2008. T1 demolishing after completion of phase one of T3 Terminal. As on 31st of March, 2022 AEL 51% & AAHL 49% Profile 1,258.80 acres contains 19 aprons. T1- 8,965 sq.m and T2 – 20,850 sq.m. 4.3 MPPA (T1-0.8) (T2-3.5 MPPA) 12th busiest airport Development of CCSIA through PPP mode. AAI entered into the Concession agreement (OMDA) with Lucknow international airport ltd. on Feb 14th, 2020 From 50 years from date of Commercial operation date i.e., 2nd Nov, 2020. The operator shall pay the AAI a monthly concession fee as consideration as per the granting of such concessions (Per passenger) As per the MoU dated 21st Oct, 2020 only AAI shall under take reserve services as of CNS/ATM, Services, Security services, Meteorological services and other prescribed. (Agencies authorised by the GoI) T1 commissioned in 1986 while T2 commissioned in 2012. (Capacity constraints) T2 has five departure gates and both terminals are functioning on full capacity. Due to the reason T3 has been instated to the development. The T3 with an area of 1,50,805 sqm. 10 MPPA was handed by AAI to AO for developmen6 t under schedule T (list of existing revenue contracts and capital works in progress of ongoing projects). Schedule U is vested with AAI in regard to the detailing list of Construction works. AO after taking project from AAI has placed plans to extend the build-up area by 400 sq.m. Cargo Operations Cargo facility at CCSIA is operated by AAICLAS subsidiary of AAI. Operating in area 11,000 Sq.m. It is retained by AAI. AO is obligated for upgrading, developing, operating and maintaining the cargo facilities as per the concession agreement. AO is handling the interim cargo facility of 1000 sq.m with capacity of 5000 MT which is not sufficient to the meet the future demand and AO has planned to develop the new integrated Cargo Terminal having area 5826 sq m and capacity of 30000 MT. Ground Handling Operations AO obligated towards the infrastructure required for the ground handling services. The AO has right to transfer the ground handling services to the potential service providers on the license agreement. As per above aspect the AO has Appointed GSEC Bird Airport Services Private Limited (GBASPL) and AI Airport Services Limited (AIASL) for such ground handling. Fuel Facility AO obligated towards providing aircraft fueling services. AO is planning to purchase the current oil facilities and building new assets provide open access fuel facility to the aircrafts. Concession agreement entered between the AAI and the LIAL. Which was done on the Feb 14th 2020, and cod was filed on the Nov 2, 2020. AAI has submitted the workings for the period of the April 1 to the Nov 1, 2020 Deemed initial RAB the assets transferred by the AAI to the AO is 187.88 Crore Table 15 True up for the Traffic Projected by the AAI is 168,969 and authority has allowed traffic of 185,304 as per the data provided by the authority and noted o variances. The authority notes that the Civil Structure for the navigation services. Should be treated as the part of the RAB of the AO in line with the approach followed by the authority. The passengers were decreased as due to the impact of the pre-COVID 19 period. True up for the RAB. Capital additions 126.92 Cr. Significant variances were caused between the CAPEX and in the SCP and FY of the 201920 and the 2020-21 as due to the delay in the construction of the new terminals. Reclassification of the assets under various categories. The Assets are being classified into the three lists i.e., Aeronautical, Nar and the common Deemed initial RAB AO shall be liable to pay the authority amount equivalent to the investments made by the authority. True up for the depreciation. AAI filed the depreciation for the period SCP as 72.92 and authority has allowed the 92. 70 for the same period. Financing allowance shall be allowed to the PPP mode AO. The authority has provided that the return shall make risk lower for the AO and subsequently will disincentivise the AO from conducting the operations and due management. AAI commented the returns shall be made on the investments to be gained before such assets are been put to the use. On services to converting to the common the AAI has conveyed that such services are essentials to be served under the essential services. CISF as the same is mandatory for the ease of the aeronautical functions rather than to be entered into the common assets (threeseater chair). Greenfield and brownfield airports. True up for the FRoR The LIAL is proposing the True up for the 14.9 % and the cost of equity of the 17.38% which has been ruled out by the independent Auditor while the Authority has been providing for such rate a t the 14% at the cost of equity rate of the 15.38%. True up for the O & M of the aeronautical services. Administration and expenses at the CHQ and the RHQ Expenses by the AAI – 585.74 Approved by the Authority – 401.40 Employee benefit expense Administrative and other expense Utility expenses R & M expenses CSR expenses True up for the unamortized value of the land. AO is the owner of the land. The land has not been transferred to the AO. NAR place by the AAI 202.11 Authority value of NAR 233.10 Variance is of 30.99 True up of Aeronautical Revenue. Aeronautical revenue place by the AAI 617.80 Authority value of NAR 740.90 Variance is of 123.10 True up Taxation 25.17% True up for the Aggregate revenue requirement for the Pre COD period. 344.13 Cr was submitted by the AAI, while authority proposed the 120.60 Cr. Reasons of the variance are – Reclassification of asset reduction on return of RAB and depreciation. Chapter 05 AO submission of the true up. True up of the RAB Earlier the RAB was at the 187.88 then the AO has made further additions of 41.62 Cr. Detail study on asset allocation is provided under the annexure 1. RAB decreased as the facilities were transferred from the services to the common. True up of the Depreciation AO had submitted the proposal for the 16.25 Cr. while the authority has granted 9.09 Cr. Intangible assets proposed by the authority for the TCP. True up of FRoR Authority has to consider the rate as 5.75 up to the 31 March, 2021. The AAI was offered with the rate 14% and the LIAL is seeking for the rate of 14.79 with the cost of equity 17.30%. Independent study was conducted by the LIAL as per the norms of the AERA and cost of debt of 12% as per actuals. True up of Aeronautical O&M expenses The total is leading to the 44.55 Cr. Total expenses – the impact = Reallocated Aeronautical O&M expenses. 44.55 – 2.54 = 42.0(1) Reduction of the manpower From the Security dept., HR, Engineering and maintenance. To allow the cost of the corporate team expenditure under the ambit of the legal team. Authority stated the team and additional manpower is employed just to draw salaries and not to perform any work. True up of Aeronautical Revenue 41.67 Cr. Has been reclassified and proposed to be considered by the Authority for the true up from the COD. True up of the taxation ”Nil” Authority concluded the actual AR earned is less than the expenditure and the depreciation which has been made by the AO. True up for the ARR which is being proposed by the authority as 20.38 till march, 2021 and readjust the same for the ARR for the TCP. Chapter 06 Traffic Projections for the TCP AO engaged independent agency named as CAPA, India for assessing the air traffic. Issues: Authority examination of AO submission of traffic as per the CAPA Exempted services Chapter 07 Capital Expenditure (CAPEX), Depreciation … RAB is the regulatory asset base which is the essential element of the Aggregate Revenue Requirement. Under schedule B the developmental facilities are provided in the concession agreement. The aiport has to participate in the ratings of the ASQ. Such ratings shall be above the 4.5 or the airport shall be amongst the top 20 percentile of the world airports. The independent consultant was appointed by the Aera for the RAB capital additions and the depreciation. Verified various reports of the AO which were sought by the independent body appointed. By the reports the Authority rationalised the expenditures. Deferring the certain assets. Aeronautical Capital Expenditure of~ 4109.84 Crores in the original MYTP dated July 31. 2021, an amount of~ 4,036.98 Crores in the revised MYTP dated January lO, 2022, and ~ 4.991.78 Crores in the revised CAPEX Schedule submitted on June 23. 2022, which was subsequently increased to ~ 5.065.20 Crores based on detailed estimate of the AO. For the Third Control period Table. 68 (Pg. 148) Authority examination The authority has analysed the expenditure has been taken into the two phases the first is CWIP (75%) and the another is New Capex projects (25%) (Pg. 150) Total capacity of the T3 shall be of 13 MPPA. Sanctioned Work. (Pg. 159) T3 having area of 1,50,805.04 Projects conceived by the AAI was 1,383 Cr. It is a part of CWIP and handed over to the AO under the CA. It includes 74.50 Cr for the PMC and the 79.84 Cr. The cost of the NCC project has been increased as due to the Increase in quantities – tender was on the base of the schematic design and the actual quantities were based on the Good on Governance (GFC) drawings. COVID 19 Designs of the T3 Terminal & progress was of 33.90% Total cost of T3 amounting to 3,231.00 Cr the revised total cost by AO. Phase 1 of the total project to be completed by the FY 22-23 Phase 2 can be commissioned by the year 2022-2023 Determination of the allowable project costs of T3 by the authority Inflation adjusted normative cost. Authority has considered the rate as 7.14 at the place of the (12.97.) AO claimed for the Solar PV, Demolition Costs of the T1, PMC and other soft costs. Artwork. The amount was claimed was of the 115 Cr for which only 7.80 Crore were granted. The authority proposed by 10 Cr. Landscaping: 25 Cr and 5Cr Construction of the phase 1 of T1 building: the body may earn some revenue hence the same was not allowed to the AO. PMC: total cost estimate without including the PMC and other costs 2,207.50 which is higher than the 1,809.18 Cr. Authority allowed the Inflation adjusted Normative Cost of 1,809.18 as allowable CAPEX. Interim Cargo Facility AO had proposed for the 4.42 Crore in their MYTP over two years. Authority provided for 3.40 Cr. The proposed cost of the AO for the plant and machinery is 31.52 Cr. while the authority allowed for the project is 28.37 Cr. by applying by the revised ratio terminal building of 28.37 Cr. per sq.m. External services project 93.27 Cr. was sought by the AO of which the authority totalled to 48.17 Cr. Allowable Project Cost Inflation adjusted normative cost for FY23-24 1,24,197.00 per sq. m. Add GST @ 6% (refer Note below) 7,452 per sq. m. Normative cost including GST is 1,549.18 Cr. Inflation adjusted Normative cost for FY 2023 - 24 to 2025 - 2026 5.0% considered as per 79th Round of Survey of Professional Forecasters on macroeconomic indicators Normative cost approved by the authority for the FY1617 is 65000 For 2021 it is listed as an 95,000 – 125,000 Derived by the authority is for the year 2022-23 is 1,21,665 The cost shall be of 1,00,000 then the Gst of the 6% was included On comment on the mangalore airport the rate of interest is 12.97%. the project work handed over by AAI to AO, as part of the Concession Agreement was nearly complete, due to which application of normative costs did not arise. Capitalization: (Pg. 222) AO: Patna & Amritsar Order the Authority has been using Rs 1,00,000 per sq mtr as a Normative Costing based on the study conducted which prescribed range from Rs 95, 000 10 J,25. 000 sq tr. It is also observed that AERA has never issued the study in the public domain for comments by the stakeholders. Submitted for the Kolkata airport and excluding the GST and the same was accepted by the authority. BIAL Airport to add GST of 18% instead of 6% imposed by the authority. Authority: Solar PV: AO: To take under the Green Initiative Measures. Solar PV 3 MW solar plant 19.92 Cr. 7Cr. (Inflation adjusted) per Kw 4.50 Cr. was considered by the authority. The Aeronautical cost is 12.50 Cr. Apportioned the 13.50 into the ratio of the 90:10. Retained for the Netaji Subhash Chandra Airport. (True up for 15Mw 81.84 Cr) Authority: Development of RESA AO RWY 09 is I 50m x 90m that needs to be increased to full length RESA of 240m x 90m. RWY 27 is I50m x 90m that needs to be increased to full length RESA of 240m x 90m.m(Boundary wall) (extend to length of 182.8) Will take time in the approvals of the land of 50 acres for extending the runway. PIDS and CCTV Body Scanners AO termed as a part of Master Plan while the while the Authority has considered under the Runway Extension. AO: Approval of 10 was sought from the AO while only 5 were approved by the authority. Authority: AGL Cables and Ducts, Service Roads AO: Sought true up on the actual incurrence basis. Both ends were estimated at 22 Cr. for both side while the authority has reduced the same to the 5 km, To replace the turning pad of 09 with the 27. Terminal Area Ratio AO: IMG shall not be governing the CCSIA as per the norms provided by the IMG under the Ministry of the civil aviation. Under the Shared-Till model. 30"4 of Non-Aeronautical Revenues are accounted for cross subsidizing the ARR Therefore. there is no need to apply the a/location ratio whereby, capital and operating expenditure is reduced. Authority: Open fuel facility AO: The facility is to be offered by the IOCL who is the currently major supplier at the fuel at the CCSIA airport. With 8-10 days buffer fuel. Transportation by the tank wagon. Authority To consider the 50% of Road no. 6 as aeronautical expenditure. AO: Terminal Building as provided in the CA Land-side Works are provided which includes kerbside. access road works, central spine road, underpass etc. DIAL has proposed the same as 100% Aero which is duly approved by Authority. Authority: Body scanner: 10 Body scanner sought to be capitalized by the AERA by the AO which were disapproved and only 5 were approved as in reason to taken as a newer technology. The Pune airport was allowed for the 10 body scanners. Financing Allowance: AO: The Airport operators to be eligible for Financing Allowance as a return on the value invested during the construction phase an asset including the equity portion, before the asset is put to use. This is a Legitimate expectation of investors. Authority: The risk shall be negated from the initial stage of the functioning will disincentivize the Airport Operators from ensuring timely completion of projects and deli very of services to the users It may be further noted that the Authority has never provided financing allowance in the case of brownfield airports in its any of the Tariff Orders. Further, financing allowance for greenfield airports of BIAL, HIAL, CIAL etc. was allowed only for the initial stages of their development, after which such allowance was permitted only on the debt portion of the proposed capital expenditure. Chapter - 12 Table - 143 Taxation The AO has considered 30% NAR the aeronautical PBT cross subsidization as per the Hybrid till Model. It is to cross subsidize the airport user. Chapter - 14 Authority Determined financing charges ₹ 24.74 Crores based on Aeronautical CAPEX considered in the ARR. AO estimated the working capital by projecting AR. Authority was of the view that excess tariff shall be curbed and carry forward some portion of the ARR to the next control period. Air Freight Station Common user facility equipped with the minimum requirements and offering services handling the international Cargo. The tariff on the AFS Cargo shall be lesser than the general cargo. AO on the ARR for TCP (T. 149, 150) (1103.83) (under recovery -196.33 Cr.) In last 30 Years the investments of ₹ 400 Cr. has been made at Lucknow Airport. As due to the passenger traffic, new terminal T3 has been constructed. LIAL has been incurring the losses Lucknow Airport has been incurring losses since privatization. LIAL has incurred cash losses in FY2I and FY22 totalling to -Rs. 125 Cr. LIAL is likely to incur cash losses of Rs. I30 Cr. in FY23. Also, due to which the AO is incurring losses. Authority is of the view, if ARR will be postponed to the full recovery the shift may cause the burden over the FCP. 196.33 cr. shall be forwarded to the next control period. Also, the Kolkata and CIAL the ARR has been shifted to the next control period.