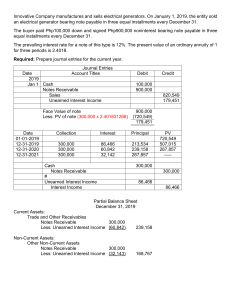

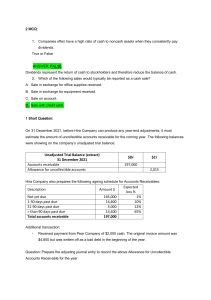

Finals - FS to RECEIVABLE Problem 1. On May 1, 2020, Cristine Company established an imprest petty cash fund for P 20,000 by writing a check drawn against the checking account. On May 31, 2020, the fund consisted the following: Currency and coins Receipts for supplies Receipts for transportation Due from employees Traveler’s check 2,000 4,000 3,000 1,200 3,000 At the end of the month, the entity wrote a check to replenish the fund. What is the replenishment under the imprest fund system? a) 6,800 b)18,000 c) 11,800 d) 20,000 2. Houghton Company has the following items: share capital–ordinary, $720,000; treasury shares, $85,000; deferred taxes, $100,000 and retained earnings, $313,000. What total amount should Houghton Company report as shareholders’ equity? a. $848,000. b. $948,000. c. $1,048,000. d. $1,118,000. 3. On December 31, 2020, the accounts receivable of Harem Company had a balance of P8,200,000. An analysis of the accounts receivable showed the following: Accounts known to be worthless Advance payments to creditors on purchase orders Advances to affiliated entities Customer’s accounts reporting credit balances arising from sales returns interest receivable on bonds Trade accounts receivable Subscription receivable due in 30 days Trade installments receivable die 1-18 months, Including unearned finance charge of P50,000 Trade accounts receivable from officers, due recently Trade accounts on which post dated checks are held (no entries were made on receipt of checks) What is the correct balance of trade accounts receivable? a. 4,650,000 b. 4,700,000 100,000 400,000 1,000,000 (600,000) 400,000 3,500,000 2,200,000 850,000 150,000 200,000 c. 4,150,000 d. 4,050,000 4. Korte Company reported the following information for 2020: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale securities Cash dividends received on the securities $500,000 350,000 55,000 20,000 2,000 For 2020, Korte would report comprehensive income of a. $117,000. b. $115,000. c. $97,000. d. $20,000. 5. Net cash flow from operating activities for 2021 for Spencer Corporation was $300,000. The following items are reported on the financial statements for 2021: Cash dividends paid on ordinary shares Depreciation and amortization Increase in accounts receivables 20,000 12,000 24,000 Based on the information above, Spencer’s net income for 2021 was a. $312,000. b. $296,000. c. $264,000. d. $256,000. 6. During 2021, Orton Company earned net income of $384,000 which included depreciation expense of $78,000. In addition, the company experienced the following changes in the account balances listed below: Accounts payable Inventory Increases $45,000 36,000 Decreases Accounts receivable $12,000 Accrued liabilities 24,000 Prepaid insurance 33,000 Based upon this information what amount will be shown for net cash provided by operating activities for 2021? a. $492,000 b. $465,000 c. $285,000 d. $267,000 7. Melissa Company provided the following information for the current year: Beginning inventory Freight in Purchase returns Ending inventory Distribution costs Sales discount The cost of goods sold is six times the distribution costs. 400,000 300,000 900,000 500,000 1,250,000 250,000 What is the amount of gross purchases? a. 6,500,000 b. 6,700,000 c. 8,000,000 d. 8,200,000 8. Caticlan Company provided the following data on December 31, 2020: Cash, including sinking fund of P500,000 for bond Payable due on June 30, 2021 Notes receivable Note receivable discounted Accounts receivable – unassigned Accounts receivable – assigned Equity of assignee in accounts receivable assigned Inventory, including P600,000 cost of goods in transit Purchased FOB destination. The goods were Receive on January 3, 2021 Allowance for doubtful accounts 2,000,000 1,200,000 700,000 3,000,000 800,000 500,000 2,800,000 100,000 What total amount of current assets should be reported on December 31, 2020? a. 7,900,000 b. 8,400,000 c. 7,400,000 d. 7,700,000 9. Jerome Company sold P 5, 750, 000 in accounts receivable for cash payment of P 4, 950,000.An allowance for bad debts of P500, 000 had previously been established by the entity in relation to these accounts. To allow adjustments and possible customer returns the factor withheld 10% of the cash proceeds. What is the loss on factoring that should be recognise? a.300, 000 b.498, 875 c. 500, 000 d.800, 000 10. Selected information from Dinkel Company's 2021 accounting records is as follows: Proceeds from issuance of ordinary shares $ 400,000 Proceeds from issuance of bonds 1,200,000 Cash dividends on ordinary shares paid 160,000 Cash dividends on preference shares paid 60,000 Purchase of treasury shares 120,000 Sale of ordinary shares to officers and employees not included above 100,000 Dinkel's statement of cash flows for the year ended December 31, 2021, would show net cash provided (used) by financing activities of a. $60,000. b. $(220,000). c. $160,000. d. $1,360,000. 11. Trans Co. had the following balances at December 31, year 2: Cash in checking account $ 35,000 Cash in money market account 75,000 US Treasury bill, purchased 11/1/year 2, maturing 1/31/year 3 350,000 US Treasury bill, purchased 12/1/year 2, maturing 3/31/year 3 400,000 Trans’s policy is to treat as cash equivalents all highly liquid investments with a maturity of three months or less when purchased. What amount should Trans report as cash and cash equivalents in its December 31, year 2 balance sheet? a. $110,000 b. $385,000 c. $460,000 d. $860,000 12. The net income for Akira Industries for 2022 was ¥302,000. During 2022, depreciation on plant assets was ¥114,000, amortization of patent was ¥50,000, and the company incurred a loss on sale of plant assets of ¥27,000. What is the net cash flow from operating activities? a. ¥111,000 b. ¥439,000 c. ¥339,000 d. ¥493,000 13. On April, 31, 2020, Alex Company’s bank reconciliation was received but the closing balance of the account was illegible. Amongst the attempt of communicating with the bank none has been successful in securing the desired information. March 31, 2020 book balance Note collected by Bank NSF check of customer Interest earned on note Bank Service Charge on NSF check Other bank Service Charges Outstanding checks Deposits made but kept in night depository 2,560,000 250,000 150,000 15,000 5,000 3,000 250,000 380,000 Below are the data obtainable in preparing bank reconciliation: What is the cash balance per bank statement? a.2,560,000 b.2, 667,000 c.2,825,000 d.2,983,000 14. Beldad Company reported its December 31, 2020 checkbook balance at P5,000,000.Data about certain cash items follows: • A customer check amounting to P150, 000 dated January 3, 2021 was included in the December 31, 2020 checkbook balance. • • • • Check drawn to Beldad’s account worth P 300,000, payable to a vendor, dated and recorded in Beldad’s books on December 31, 204 but not delivered until January 11, 2021. Another customer check for P500,000 deposited on November 30, 2020 was included in the checkbook balance but returned for insufficiency of fund. The check was redeposited on December 20, 2020 and cleared two days later. A check worth P150, 000 payable to supplier dated and recorded on December 29, 2020 was mailed on January 13,2021. A petty cash fund of P55, 000 with the following summary on December 31,2020: Coins and currencies P5, 000 Petty cash vouchers 43,000 Employee’s vales 2,000 Check drawn by Beldad Company marked “collections for Thanksgiving party” 5,000 • A check of P43, 000 was drawn on December 31, 2020 payable to Petty Cash. What total amount should be reported as “cash” on December 31,2020? a. 5,000,000 b. 5,048,000 c. 5, 348,000 d. 5,355,000 15. Gar Company reported the following account balances on December 31, 2020: Accounts payable Bonds payable Premium on bonds payable Deferred tax liability Dividend payable Income tax payable Note payable, due January 31, 2021 1,900,000 3,400,000 200,000 400,000 500,000 900,000 600,000 On December 31, 2020, What total amount should be reported as current liabilities? a. 7,100,000 b. 4,300,000 c. 3,900,000 d. 4,100,000 16. For Randolph Company, the following information is available: Capitalized leases Trademarks Long-term receivables R280,000 90,000 105,000 In Randolph’s statement of financial position, intangible assets should be reported at a. R 90,000. b. R105,000. c. R370,000. d. R385,000. 17. LB Company reported petty cash fund which comprised the following: Coins and Currency Paid vouchers Transportation P 600 Gasoline 400 Office supplies 1,500 Postage Stamps 150 IOU’ signed by employees 750 Check drawn by LB Company to the order of the petty cash custodian P 5,300 3,400 3,000 What is the correct amount of petty cash fund for statement presentation purposes? a.5, 300 b.8, 300 c.8, 700 d.11, 700 18. During 2021, equipment was sold for $156,000. The equipment cost $252,000 and had a book value of $144,000. Accumulated Depreciation—Equipment was $687,000 at 12/31/2020 and $735,000 at 12/31/2021. Depreciation expense for 2021 was a. $60,000. b. $96,000. c. $156,000. d. $192,000. 19. Kimberly Company provided the following data for the purpose of reconciling the cash balance per book with the balance per bank statement on December 31,2020: Balance per bank statement Oustanding checks (including certified check of 70,000) Deposit in Transit. December NSF checks (of which 35,000 had been redeposited and cleared by December 26) Erroneous credit to Kimberly's account, representing proceeds ofloan granted to another company Proceeds of note collected by bank for Kimberly net of service charge of 18,000 1,300,000 400,000 150,000 100,000 280,000 650,000 What amount should be reported as cash in bank on December 31,2020? a) 1,780,000 b) 856,000 c) 780,000 d) 1,500,000 20. For the year ended December 31, 2020, Transformers Inc. reported the following: Net income Preference dividends declared Ordinary share dividends declared Unrealized holding loss, net of tax Retained earnings, beginning balance Share capital – Ordinary Accumulated Other Comprehensive Income, Beginning Balance $ 60,000 10,000 2,000 1,000 80,000 40,000 5,000 What would Transformers report as total stockholders' equity? a. b. c. d. $172,000 $168,000 $128,000 $120,000 21. Gumamela Company provided the following data at year-end: Accounts payable, including cost of goods Received on consignment of P150,000 Accrued taxes payable Customers’s deposit Manila Company as guarantor Bank overdraft Accrued electric and power bills Reserve for contingencies 1,350,000 125,000 100,000 200,000 55,000 60,000 150,000 What total amount should be reported as current liabilities? a. 1,840,000 b. 1,740,000 c. 1,650,000 d. 1,540,000 22. The following items were among those that were reported on Dye Co.'s income statement for the year ended December 31, 2020: Legal and audit fees $130,000 Rent for office space 180,000 Interest on inventory floor plan 210,000 Loss on abandoned equipment used in operations 35,000 The office space is used equally by Dye's sales and accounting departments. What amount of the above-listed items should be classified as general and administrative expenses in Dye's income statement? a. $220,000 b. $255,000 c. $310,000 d. $430,000 23. The following information on selected cash transactions for 2021 has been provided by Mancuso Company: Proceeds from sale of land Proceeds from long-term borrowings Purchases of plant assets Purchases of inventories $160,000 400,000 144,000 680,000 Proceeds from sale of Mancuso ordinary shares 240,000 What is the cash provided (used) by investing activities for the year ended December 31, 2021, as a result of the above information? a. $16,000 b. $256,000. c. $160,000. d. $800,000. 24. At year-end, the current assets of Hazel Company revealed cash and cash equivalents of P700,000, accounts receivable of P1,200,000 and inventories of P600,000. The examination of accounts receivable disclosed the following: Trade accounts Allowance for doubtful accounts Claim against shipper for goods lost in transit Selling price of unsold goods sent by Hazel On consignment at 130% of cost and not Included in ending inventory Total accounts receivable 930,000 ( 20,000) 30,000 260,000 1,200,000 What total amount should be reported as current assets at year-end? a. 2,412,000 b. 2,440,000 c. 2,240,000 d. 2,500,000 25. At Ruth Company, events and transactions during 2020 included the following. The tax rate for all items is 30%. (1) Depreciation for 2018 was found to be understated by $30,000. (2) A litigation settlement resulted in a loss of $25,000. (3) The inventory at December 31, 2018 was overstated by $40,000. (4) The company disposed of its recreational division at a loss of $500,000. The effect of these events and transactions on 2020 income from continuing operations net of tax would be a. $17,500. b. $38,500. c. $66,500. d. $416,500. 26. On April 1,2021, CPA company began operating a service proprietorship with an initial cash investment of 500,000. The proprietorship provided 320,000 of services in April and received full payment in May. It incurred expenses of 150,000 in April, which were all paid in June. During May, CPA Company withdrew 50,000 against her capital account. Determine the profit for two months ended May 31,2021 under cash basis and accrual basis accounting. a. 320,000 and 170,000 b. 170,000 and 320,000 c. 320,000 and 320,000 d. 170,000 and 170,000 27. Pullman Corporation had retained earnings of $700,000 at January 1, 2020. During the year the company experienced a net loss of $300,000 and declared cash dividends of $80,000. It was discovered in 2020 that $50,000 of repair expense was debited to the land account in 2019. The income tax rate is 20%. Determine the retained earnings balance at December 31, 2020. a. b. c. d. $270,000 $360,000 $350,000 $280,000 28. Mill Company reported the following account balances on December 31, 2020: Accounts payable Bonds payable, due 2021 Discount on bonds payable Dividend payable Note payable, due 2022 1,500,000 2,500,000 300,000 800,000 2,000,000 What total amount should be reported as current liabilities? a. 4,500,000 b. 5,100,000 c. 6,500,000 d. 7,800,000 29. On December 1, 2019, Nonchalant Bank gave a borrower a P250,000, 11% loan. The bank paid proceeds of P200,000 after deduction of a 50,000 nonrefundable loan origination fee. Principal and interest are due in sixth monthly installments of P4,540 beginning January 1, 2020. The repayment yield an effective interest rate of 11% at a present value of P250,000 at 12.4% at a present value of P200,000. What amount of interest income should be reported in the 2019 income statement? a. 2, 067 b. 1, 833 c. 2, 076 d. 0 30. Joshtin Company used the allowance method of accounting for uncollectible accounts. During 2019, the entity had charged 750,000 to bad debt expense and wrote off accounts receivable of 780,000 as uncollectible. What was the decrease in working capital? a) 750,000. b) 780,000 c) 650,000. d) 0 31. Compass Company sold machinery on January 1, 2019 for which the cash selling price was P758, 200. The buyer entered into an installments sale contract at an implicit interest rate of 10%. The contract required payment of P200,000 a year over 5 years with the first payment due on December 31, 2019. What amount of interest income should be reported in 2020? a. 63, 402 b. 0 c. 100, 000 d. 75, 820 32. Delta, Inc. sells to wholesalers on terms of 2/15, net 30. Delta has no cash sales but 50% of Delta’s customers take advantage of the discount. Delta uses the gross method of recording sales and trade receivables. An analysis of Delta’s trade receivables balances at December 31, year 2, revealed the following: Age Amount Collectible 0 - 15 days $100,000 100% 16 - 30 days 60,000 95% 31 - 60 days 5,000 90% Over 60 days 2,500 $500 $167,500 In its December 31, year 2 balance sheet, what amount should Delta report for allowance for discounts? a. $1,000 b. $1,620 c. $1,675 d. $2,000 33. Diane Company provided the following information in relation to cost of goods sold for the current year: Inventory, January 1 Purchases Loss on inventory writedown Inventory, December 31 at net realizable value 4,500,000 6,000,000 1,500,000 1,000,000 The inventory writedown is due to an unexpected and unusual technological advance by a computer. In the income statement, what amount should be reported as cost of goods sold after inventory writedown? a. 9,500,000 b. 9,000,000 c. 8,000,000 d. 9,250,000 34. Kaila World assigned 2,500,000 of accounts receivable as collateral for a 1,700,000 loan with a bank. The bank assessed a 4% finance fee and charged 6% interest on the note at maturity. What would be the journal entry to record the transaction? a) Debit cash 2,432,000, debit finance charge 68,000 and credit note payable 2,500,000 b) Debit cash 2,342,000, debit finance charge 68,000 and credit note payable 2,050,000 c) Debit cash 2,500,000, debit finance charge 68,000 and credit note payable 2,500,000 d) Debit cash 2,656,000, debit finance charge 86,000 and credit note payable 2,500,000 35. On July 1, 2018, Mavis Company sold equipment to Dundas Company for 1,500,000. Mavis accepted a 10% note receivable for the entire sales price. This note is payable in two equal installments of 400,000 plus accrued interest on December 31, 2018 and December 31, 2019. On July 1, 2019, the entity discounted the note at a bank at an interest rate of 12%. What is the amount received from the discounting of note receivable? a) 416,500 b) 413,600 c) 431,600 d) 421,300 36. The following information is from Sampaguita Corp’s first year of operations: 1. Merchandise purchased 2. Ending Merchandise Inv. 3. Collections from customers 4. All sales are on account and goods sell at 20% above cost. p550, 000 150, 000 185, 000 What is the accounts receivable balance at the end of the company’s first year of operation? a.P295, 000 b.P345, 900 c.P322, 988 d.P564, 876 37. Ivan Company prepared the following bank reconciliation in December 31, 2020: Balance per Bank Statement Add: Deposit in Transit Checkbook Printing Charge Error made by Ivan in recording check No.13 NSF Check 2, 800,000 185, 000 8, 000 45, 000 120, 000 358, 000 3, 158,000 Less: Outstanding Check 95, 000 Note Collected by Bank(includes 15, 000 interest) 355,000 Balance per Book 450, 000 2, 700, 000 The entity had P 230,000 cash on hand on December 31, 2020. What amount should be reported as cash in the statement of financial position on December 31, 2020 a. b. c. d. 3, 120, 000 3, 140, 500 3, 150, 600 3, 950 ,000 38. Violago Company provided the following account balances at year-end: Accounts receivable Financial assets at fair value through profit or loss Financial assets at amortized cost Cash Inventory Equipment and furniture Accumulated Depreciation Patent Prepaid Expenses Equipment held for sale What total amount should be reported as current assets at year-end? a. 8,100,000 b. 6,300,000 1,600,000 500,000 1,300,000 1,100,000 3,000,000 2,500,000 1,500,000 400,000 100,000 1,800,000 c. 8,000,000 d. 7,600,000 39. On January 1, 2020, Zhang Inc. had cash and share capital of ¥5,000,000. At that date, the company had no other asset, liability, or equity balances. On January 5, 2020, it purchased for cash ¥3,000,000 of equity securities that it classified as available-for-sale. It received cash dividends of ¥400,000 during the year on these securities. In addition, it has an unrealized loss on these securities of ¥300,000. The tax rate is 20%. Compute the amount of accumulated other comprehensive income/(loss). a. b. c. d. ¥(300,000) ¥100,000 ¥80,000 ¥240,000 40. Snickers Company prepared an aging of its accounts receivable on December 31, 2022, and determined that the net realizable value of the accounts receivable was P2, 000,000. Additional information is available as follows: Allowance for uncollectible accounts on January 1 Accounts written off as uncollectible Accounts receivable at December 31 Uncollectible accounts recovery 230,000 200,000 2,200,000 50,000 For the year ended December 31, 2022, what is the uncollectible expense? a. 100,000 b. 80,000 c. 160,000 d. 40,000 41. Ivan Company kept all cash in checking account. An examination of the accounting records and bank statement for the month ended June 30, 2020 revealed the following information: • • • • • • • The cash balance per book on June 30, 2020 is P9, 550, 000. The bank statement shows a P35, 000 service charge for June A deposit of P 450, 000 which was placed in the bank’s night depository on June 28 but did it appear on the bank statement. Checks outstanding on June 30 amount to P250, 000. Notes collected by the bank that shows an amount of P850, 000 and was credited to Ivan’s account. Ivan discovered that a check written in June 23, 2020 for P350, 000 in payment of an account payable had been recorded in the book’s record for only P35, 000. Included in the bank’s statement was NSF check for P150, 000 that Ivan had received from a customer on June 13. What amount should be reported as cash in bank on June 31, 2020? a. b. c. 10, 400, 000 10, 085, 000 9, 950, 000 d. 9, 900,000 42. On December 1, 2022, Death Company signed a specific accounts receivable totaling 5,000,000 as collateral on a 3,000,000, 10% notes from a certain finance entity. Death Company will continue to collect the assigned account receivable. In addition to the interest on the note, the entity also charged a 5% finance fee deducted in advance on the 3,000,000 value of the note. The December collections of assigned accounts receivable amounted to1, 500,000 less cash discount of 100,000. On December 31, 2022, Death Company remitted the collection to the finance entity in payment of the interest accrued on December 31, 2022 and the note payable. What amount should be disclosed as the equity of Death Company in assigned accounts on December 31, 2022? a. 25 b. 125,000 c. (125,000) d. (25.000) 43. In the December 31, 2020 statement of financial position of CUTE Company, the current receivables consisted of the following: Trade accounts receivable Allowance for doubtful accounts Claims against shipper for goods lost in transit in November 2020 Selling price of unsold goods sent by Cute Company on consignment Security deposit on lease of warehouse Total 3. 000, 000 (300,000) 500, 000 800,000 300,000 4,300,000 What total amount should be reported as current trade and other receivables? a. 3,400,000 b. 3,300,000 c. 3,200,000 d. 3,000,000 44. Burr Company had the following account balances at December 31, year 2: Cash in banks $2,250,000 Cash on hand 125,000 Cash legally restricted for additions to plant (expected to be disbursed in year 3) 1,600,000 Cash in banks includes $600,000 of compensating balances against short-term borrowing arrangements. The compensating balances are not legally restricted as to withdrawal by Burr. In the current assets section of Burr’s December 31, year 2 balance sheet, total cash should be reported at a. $1,775,000 b. $2,250,000 c. $2,375,000 d. $3,975,000 45. Alberta Company sold an office equipment with a carrying amount of 739,000, receiving a noninterest-bearing note due in three years with a face amount of 1,300,000. There is no established market value for the equipment. The interest rate on similar obligations is estimated at 12%. The present value of 1 at 12% for three periods is .712. What amount should be reported as gain or loss on the sale and interest income for the first year? a) b) c) d) Gain (loss) 200,000. 168,600. 186,600. 110,072. Interest Income 288,00 110,072 110,072 186,600 46. On December 31, 2019, Capperine Company sold a building, receiving a consideration a P6, 000, 000 noninterest bearing note due in three years. The building had a cost of P2, 500,000 and the accumulated depreciation was P1, 000,000 at the date of sale. The prevailing rate of interest for a note of this type was 12%. The present value of 1 for three periods at 12% is 0.71. What amount should be reported as gain on sale in 2019? . a. 2, 500,000 b. 6,000,000 c. 1, 000, 000 d. 2, 760, 000 47. Under the accrual basis, Lucena Company reported rental income for the current year at 600,000. The entity provided the following additional information regarding rental income. Unearned rental income - January 1 Unearned rental income - December 31 Accrued rental income - January 1 Accrued rental income - December 31 50,000 75,000 30,000 40,000 What total amount of cash was received from rental in the current year? A. 585,000 B. 615,000 C. 625,000 D. 655,000 48. The board of directors of Akiko Corp. declared cash dividends of ¥265,000 during the current year. If dividends payable was ¥83,000 at the beginning of the year and ¥77,000 at the end of the year, how much cash was paid in dividends during the year? a. ¥425,000 b. ¥271,000 c. ¥259,000 d. ¥265,000 49. During the current year, Samar Company reported total operating expenses of 3,200,000 consisting of 1,000,000 depreciation, 700,000 insurance and 1,500,000 salaries. The prepaid insurance is 150,000 on January 1 and 200,000 on December 31. The accrued salaries payable totaled of 120,000 on January 1 and 100,000 on December 31. What total amount was paid for operating expenses? A.? 3,270,000 B.? 2,270,000 C.? 2,130,000 D.? 2,230,000 50. Lindsay Corporation had net income for 2021 of $3,000,000. Additional information is as follows: Depreciation of plant assets Amortization of intangibles Increase in accounts receivable Increase in accounts payable $1,200,000 240,000 420,000 540,000 Lindsay's net cash provided by operating activities for 2021 was a. $4,560,000. b. $4,440,000. c. $4,320,000. d. $1,680,000. 51. Kensington Industries reported net income of £50,000 in 2022. Depreciation expense was £19,000. The following working capital accounts changed: Accounting receivable £11,000 increase Non-trading equity investment 16,000 increase Inventory 7,300 increase Non-trade note payable 15,000 increase Accounts payable 12,200 increase If Kensington uses IFRS reporting and the indirect method, what amount is their adjustments to reconcile net income to net cash provided by or (used in) operating activities? a. £3,100 b. £49.500 c. £12,900 d. £10,500 52. During 2021, Stout Inc. had the following activities related to its financial operations: Carrying value of convertible preference shares in Stout, converted into ordinary shares of Stout $ 360,000 Payment in 2021 of cash dividend declared in 2020 to preference shareholders 186,000 Payment for the early retirement of long-term bonds payable (carrying amount $2,220,000) 2,250,000 Proceeds from the sale of treasury shares (on books at cost of $258,000) 300,000 The amount of net cash used in financing activities to appear in Stout's statement of cash flows for 2021 should be a. $1,590,000. b. $1,776,000. c. $2,136,000. d. $2,148,000. 53. Burma Company disclosed the following liabilities: Accounts payable, after deducting debit balances In suppliers’ accounts amounting to P100,000 Accrued expenses Credit balances of customers’ accounts Stock dividend payable 4,000,000 1,500,000 500,000 1,000,000 Claims for increase in wages and allowance by Employees, covered in a pending lawsuit Estimated expenses in redeeming prize coupons 400,000 600,000 What total amount should be reported as current liabilities? a. 6,700,000 b. 6,600,000 c. 7,100,000 d. 7,700,000 54. Use the following information: Gross profit Loss on sale of investments Interest expense Gain on sale of discontinued operations Income tax rate £7,800,000 20,000 15,000 60,000 20% Compute the amount of income tax applicable to continuing operations. a. £1,553,000 b. £1,640,000 c. £1,569,000 d. £1,568,000 55. Joshtin Company reported the following balances after adjustment at year-end: Accounts Receivable. Net Realizable Value. 2019. 6,360,000. 6,050,000. 2020 4,780,000 4,520,000 During 2020, the entity wrote off accounts totaling 148,500 and collected 52,000 on accounts written off in previous year. What amount should be recognized as doubtful accounts expense for the year ended December 31,2020? a) 169,500 b) 196,500 c) 198,500 d) 169,050 56. The following information was taken from the 2021 financial statements of Dunlop Corporation: Bonds payable, January 1, 2021 Bonds payable, December 31, 2021 $ 500,000 2,000,000 During 2021 • A $450,000 payment was made to retire bonds payable with a face amount of $500,000. • Bonds payable with a face amount of $200,000 were issued in exchange for equipment. In its statement of cash flows for the year ended December 31, 2021, what amount should Dunlop report as proceeds from issuance of bonds payable? a. $1,500,000 b. $1,750,000 c. $1,800,000 d. $2,200,000 57. Gracia Company reported the following current assets at year-end: Cash including sinking fund of P500,000 with trustees Accounts receivable Inventory, including P200,000 cost of goods in transit Purchased FOB point of destination Advances to officers collectible currently Dividend receivable Total current assets 1,500,000 2,500,000 2,000,000 400,000 100,000 6,500,000 What total amount should be reported as current assets? a. 5,400,000 b. 5,300,000 c. 5,800,000 d. 5,900,000 58. Moorman Corporation reports the following information: Correction of understatement of depreciation expense in prior years, net of tax Dividends declared Net income Retained earnings, 1/1/2020, as reported $ 430,000 320,000 1,000,000 2,000,000 Moorman should report retained earnings, December 31, 2020, of a. $1,570,000. b. $2,250,000. c. $2,680,000. d. $3,110,000. 59. Bin Corporation had the following information relating to its accounts receivable: Accounts receivable, 12/31/2021 Credit sales for 2022 Collections from customers for 2022 Accounts written off, August 30, 2022 Estimated uncollectible receivables per aging of receivables, 12/31/2022 2,000,000 7,100,000 6,500,000 250,000 355,000 In the December 31, 2022 statement of financial position, what is the amortized cost of the receivable? a. 2,000,000 b. 7,100,000 c. 1,995,000 d. 2,350,000 60. Loeb Company assigned P 4, 000, 000 of accounts receivables as collateral for a P1, 500, 000 5% loan with a bank. The entity was also assessed by the bank for a finance charge of 6% on the transaction and is paid up front. What amount should be recorded as a gain or loss on the transfer of accounts receivables? a.150, 000 gain b.100, 000 gain c.240, 000 loss d. 0 61. On December 31, 2019, Lakeshore Company sold for P3,000,000 an old equipment having an original cost of P5,400,000 and carrying amount of P2,400,000. The terms of the sale were P600, 000 down payment and P1,200,000 payable each year on December 31 of the next two years. The sale agreement made no mention of interest. However, 9% would be a fair rate for this type of transaction. The present value of an ordinary annuity of 1 at 9% for two years is 1.76. What is the carrying amount of the note receivable on December 31, 2020? a. 1,009,920 b. 1,102,080 c. 1,200,000 d. 2,302,080 62. Use the following information (in thousands): Sales revenue Gain on sale of equipment Cost of goods sold Interest expense Selling & administrative expenses Income tax rate ¥150,000 45,000 82,000 8,000 15,000 30% Determine the amount of net income. a. ¥63,000 b. ¥10,500 c. ¥21,000 d. ¥31,500 63. Winterton Company discounted with recourse a note at the bank, On July 31 of the current year, at discount rate of 13%. The note was received from the customer on August 1, 2019, is for 60 days, has a face value of P5, 500,000 and carries an interest rate of 10%. The customer paid the note to the bank on October 30, 2019, the date of maturity. Given that the discounting is accounted for a secured borrowing. 1. What amount of interest expense should be recognized on July 31, 2019? a. 300, 175 b. 235, 895 c. 135, 895 d. 532, 598 2. What should be the amount to be recognized as the net proceeds? a. 5,500,000 b. 5,545, 833.33 c. 5,409, 937.50 d. 5, 000, 000 64. On January 1, 2019, Mavis Company sold land with carrying amount of 1,600,000 in exchange for a 9-month, 10% note with face value of 3,000,000. The 10% rate properly reflects the time value of money for this type of note. On April 1, 2019, the entity discounted the note with recourse. The bank discount rate is 12%. The discounting transaction is accounted for as a secured borrowing. On October 1, 2019, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of 23,000. On December 31, 2019, the entity collected the dishonored note in full plus 12% annual interest on the total amount due. 1. What is the amount received from discounting of note receivable? a) 3,301,050 b) 3,301,500 c ) 3,031,500 d) 3,103,500 2. What is the interest expense to be recognized on April 1, 2019? a) 50,000 b) 43,500 c) 21,500 d) 34,500 3. What is the amount collected from the customer on December 31, 2019? a) 3,450,600 b) 3,345,440 c) 3,345,044 d) 3,432,440 65. On the beginning of the accounting period, January 1, 2019, Mississauga Company reported the following balances: • • Note receivable from an officer 1,950,000 Note receivable from a sale of building 7,125,000 The P7, 125,000 note receivable is dated April 1, 2018, bears interest at 10%. Principal payments of P2, 000, 000 plus interest are due annually beginning April 1, 2019. The P1, 950,000 note receivable is dated December 31, 2016, bears interest at 8% and is due on December 31, 2020. Interest is payable annually on December 31, and all interest payments were made through December 31, 2019. On July 1, 2019, Mississauga Company sold a parcel of land to Binay Company for P4, 000,000 under an instalment sale contract. Binay Company made a P1, 200,000 cash down payment on July 1, 2019, and signed a 4-year 10% note for the P2,900,000 balance. The equal annual payments of principal and interest on the note totaled P878,000, payable on July 1 of each year from 2022 through 2023. 1 . What is the total amount of notes receivable including accrued interest that should be classified as current assets on December 31, 2019? a. b. c. d. 2 . 3, 117, 375 2,200,000 2,384,375 3,384,000 What is the total amount of notes receivable that should be classified as noncurrent assets on December 31, 2019? a. b. c. d. 7,300,000 7, 150,000 6,250,000 4,300,000 66. Kings Company accepted from a customer P 2,000,000 face amount, 6- month, 10% note dated January 15, 2015. On the same date, the entity discounted the note without recourse at a 12% discount rate. What amount of cash was received from discounting? a. 2,000,000 b. 1,974,000 c. 126,000 d. 100,000 2) What is the loss on note receivable discounting? a. b. c. d. 32,000 52,000 16,000 26,000 67. Miguel Bank granted a loan to a borrower on January 1, 2019. The interest rate on the loan is 10% payable annually starting December 31, 2019. The loan mature in five years on December 31, 2023. The date related to the loan are: Principal amount P4,000,000 Direct origination cost 61, 500 Origination fee received from borrower 350,000 The effective rate on the loan after consideration the direct origination cost and origination fee received is 12%. Q1. What is the carrying amount of the loan receivable on January 1, 2019? A. 4,000,000 B. 4,650,000 C. 3, 711, 500 D. 4, 411, 500 Q2. What is the interest income for 2019? A. 445, 380 B. 400,000 C. 529, 000 D. 588, 000 68. Sunny Company sells a variety of imported goods. By selling on credit, Sunny cannot expect to collect 100% of its accounts receivable. At December 31, 2020, Sunny reported the ff. in its statement of financial position: Accounts receivable 2,197,500 Less: Allowance for bad debts (183,500) Accounts receivable, net p2, 014, 000 During the year ended December 31, 2021, Sunny earned sales revenue of P542, 312, 500 and collected cash of P432, 765, 200 from customers. Assume bad debt expense for the year was 1% of sales revenue and that Sunny wrote off uncollectible accounts receivable totalling p5, 567,500 Q1. What is the accounts receivable balance at December 31, 2021? a.P106, 177, 300 b.P105, 900, 788 c.P178, 000, 787 d.P108, 900, 300 Q2. What is the December 31, 2021, balance of the Allowance for Bad Debts accounts? a.P39, 125 b.P43, 000 c.P34, 000 d.P39, 124 Finals - FS to RECEIVABLE Answer Section PROBLEM 1. B Petty cash fund Currency and coins Expense 20,000 (2,000) 18,000 2. B 3. A Trade accounts receivable Trade installments receivable die 1-18 months, Including unearned finance charge of P50,000 (850,000-50,000) Trade accounts receivable from officers, due recently Trade accounts on which post dated checks are held (no entries were made on receipt of checks) 4. 5. a a 6. a 7. D 3,500,000 800,000 150,000 200,000 4,650,000 $500,000 – $350,000 – $55,000 + $20,000 + $2,000 = $117,000. X + $12,000 – $24,000 = $300,000; X = $312,000. $384,000 + $78,000 + $45,000 – $36,000 + $12,000 – $24,000 + $33,000 = $492,000. Beginning inventory Gross purchase Freight In Purchase returns Goods available for sale Ending inventory Cost of goods sold (1,250,000 x 6) 400,000 8,200,000 300,000 ( 900,000) 8,000,000 ( 500,000) 7,500,000 8. B Cash Notes receivable Notes receivable discounted Accounts receivable – unassigned Accounts receivable – assigned Allowance for doubtful accounts Inventory (2,800,000 – 600,000) Total current assets 2,000,000 1,200,000 ( 700,000) 3,000,000 800,000 ( 100,000) 2,200,000 8,400,000 9. Solution: Answer A Sale price Carrying amount of accounts receivable (5, 750, 000 – 500, 000) Loss on Factoring 10. D P4, 950, 000 5, 250, 000 (P 300, 000) $400,000 + $1,200,000 – $160,000 – $60,000 – $120,000 + $100,000 = $1,360,000. 11. (c) The definition of cash includes both cash (cash on hand and demand deposits) and cash equivalents (shortterm, highly liquid investments). Cash equivalents have to be readily convertible into cash and so near maturity that they carry little risk of changing in value due to interest rate changes. This will include only those investments with original maturities of three months or less from the date of purchase by the enterprise. Common examples of cash equivalents include treasury bills, commercial paper, and money market funds. Trans should report a total of $460,000 ($35,000 + $75,000 + $350,000) on its December 31, year 2 balance sheet. The US treasury bill purchased on 12/1/Y2 is not included in the calculation because its original maturity is not within three months or less from the date of purchase. 12. D ¥302,000 + (¥114,000 + ¥50,000 + ¥27,000) = ¥493,000. 13. B Solution: March 31 book balance Note collected by bank Interest earned on note NSF check of customer Bank Service Charge (5,000+ 3,000) 2,560,000 250,000 15,000 (150,000) (8,000) 2, 667, 000 Adjusted Book Balance Balance per bank Statement(SQUEEZE) Deposit in Transit Outstanding checks 2, 537, 000 380, 000 (250,000) 2, 667, 000 14. C Solution: Checkbook balance P 5,000,000 Postdated customer check (150,000) Undelivered check payable to supplier 150,000 Undelivered Company check 300,000 Adjusted cash in bank 5,300,000 Petty cah: Coins and currencies P5, 000 Replenishment check 43,000 Total 48,000 P5, 348,000 15. C Accounts payable Dividends payable 1,900,000 500,000 Income tax payable Note payable Total current liabilities 900,000 600,000 3,900,000 16. A 17. B Solution: Coins and Currency Check drawn by Hugo Company to the order of the petty cash custodian Total 3,000 P 8,300 $735,000 – $687,000 + ($252,000 – $144,000) = $156,000. 18. C 19. C Balance per bank. Deposit in Transit. Total. Oustanding checks (400,000-70,000) Erroneous bank credit. Adjusted bank balance. 1,300,000 150,000 1,450,000 ( 390,000) ( 280,000) 780,000 ($80,000 + $60,000 – $10,000 – $2,000) + $40,000 + ($5,000 – $1,000) = $172,000. 20. A 21. D 22. A 23. A 24. B P 5,300 Accounts payable (1,350,000 – 150,000) Accrued taxes payable Customers’ deposit Bank overdraft Accrued electric and power bills Total current liabilities $130,000 + $90,000 = $220,000. $160,000 – $144,000 = $16,000. 1,200,000 125,000 100,000 55,000 60,000 1,540,000 Cash and cash equivalent Trade and other receivables (1,200,000 minus 260,000) Inventories (600,000 + 200,000) Total current assets Adjustments 1. Sales 260,000 Accounts Receivable 260,000 25. A 26. A 2. Inventory (260,000 / 130%) Cost of goods sold $25,000 – $7,500 = $17,500. Revenues. Expenses. Profit. 27. D 200,000 200,000 Cash basis. Accrual Basis 320,000. 320,000 ---150,000 320,000. 170,000 $700,000 – $300,000 – $80,000 – ($50,000 0.80) = $280,000. 700,000 940,000 800,000 2,440,000 28. A Accounts payable Bonds Payable Discount on bonds payable Dividends payable Total current liabilities 1,500,000 2,500,000 ( 300,000) 800,000 4,500,000 29. A Solution: Principal Origination fee, Carrying amount Effective rate x P250,000 50,000 P200,000 12.4% P24, 800 Months Dec1 to Dec31 x 1/12 2, 067 30. A Only bad debts expense decreases working capital. The write off does not affect anymore the working capital because the effect is offsetting. 31. D Solution : Date 12/31/11 12/31/12 Annual Payment Interest income 200,000 75, 820 Principal 124, 180 Present Value 758,200 637, 020 32. A If material, an allowance for discounts must be reported at year-end in order to match the discounts with the related sales and to report receivables at their collectible amount. At 12/31/Y2, $100,000 of the accounts receivable have the potential to be discounted by 2% because they are less than fifteen days old (terms 2/15, net 30). Since 50% of the customers are expected to take advantage of the 2% discount, the allowance for discounts should be $1,000 [($100,000 × 50%) × 2%]. None of the other categories require a discount allowance because they are older than the maximum age of fifteen days to receive the 2% discount. 33. A Inventory – January 1 4,500,000 Purchases 6,000,000 Goods available for sale 10,000,000 Less: Inventory – December 31 2,500,000 Cost of goods sold before writedown 8,000,000 Loss on inventory writedown 1,500,000 Cost of good sold after writedown 9,500,000 34. A Face amount of loan. Finance Fee (4% x 1,700,000) Cash Received. 2,432,000 35. B Principal. 400,000 Add: Interest (400,000 x 10%) 40,000 Maturity Value. 440,000 2,500,000 68,000 Less: Discount ( 440,000 x 12% x 6/12 ) Net Proceeds.413,600 ( 264,000) 36. Solution: A Purchases Less: Merchandise inventory, ending Cost of goods sold Multiply by sales ratio Sales Less: Accounts receivable, ending 37. A Balance per Bank Deposit in Transit Outstanding Check Adjusted Cash in Bank Cash in Hand Total Cash P550, 000 150, 000 400, 000 x 120% 480, 000 185, 000 P295, 000 P 2, 800, 000 185, 000 (95, 000) 2, 890, 000 230, 000 P 3, 120, 000 38. A Accounts receivable Financial assets at fair value through profit or loss Cash Inventory Prepaid expenses Equipment held for sale 39. D 40. B 1,600,000 500,000 1,100,000 3,000,000 100,000 1,800,000 8,100,000 ¥300,000 – (¥300,000 0.20) = ¥240,000 Allowance for uncollectible accounts on January 1 Uncollectible accounts recovery Uncollectible Account expense Accounts written off as uncollectible 230,000 50,000 80,000 360,000 cr 200,000 dr 160,000 41. D Balance per Book Note Collected by Bank Total Book Error(350, 000 – 35, 000) NSF check P 9, 550, 000 850, 000 10, 400, 000 (315, 000) (150, 000) Service Charge (35, 000) Adjusted Book Balance P 9, 900,000 42. C 1,500,000 – 1,625,000 = (125,000) 43. C Trade accounts receivable Allowance for doubtful accounts Claims against shipper for goods lost in transit in November 2020 Total 3. 000, 000 (300,000) 500, 000 3,200,000 44. C Cash on hand ($125,000) and cash in banks ($2,250,000) are both reported as cash in the current asset section of the balance sheet because they are both unrestricted and readily available for use. Cash legally restricted for additions to plant ($1,600,000) is not available to meet current operating needs, and therefore should be excluded from current assets. Instead, it should be shown in the long-term asset section of the balance sheet as an investment. 45. C Present value of note receivable (1,300,000 x .712) Carrying Amount of equipment. Loss on Sale. 925,600 439,000 186,600 Interest Income for first year (12% x 925,600) 110,072 46. D Solution: 6,000,000 x 0.71 2, 500, 000 – 1, 000, 000 Gain on sale = = 4, 260, 000 1, 500, 000 2, 760, 000 47. B Rental income - accrual basis Unearned rental income - January 1 Unearned rental income - December 31 Accrued rental income - January 1 Accrued rental income - December 31 Rental received - cash basis 48. B 49. B 600,000 (50,000) 75,000 30,000 (40,000) 615,000 ¥265,000 + ¥83,000 – ¥77,000 = ¥271,000. Operating expenses per book Depreciation Prepaid insurance - December 31 Prepaid insurance - January 1 Accrued salaries payable - December 31 payable - January 1 3,200,000 (1,000,000) 200,000 (150,000) (100,000) Accrued salaries 120,000 Cash paid for operating expenses 50. 51. 52. 53. A C C A 54. A 55. B 2,270,000 $3,000,000 + $1,200,000 + $240,000 - $420,000 + $540,000 = $4,560,000. £50,000 + (£19,000 + £12,200 – £11,000 – £7,300) = £62,900. $300,000 – $186,000 – $2,250,000 = $2,136,000. Accounts payable (4,000,000 + 100,000) Accrued expenses Credit balances in customers’ accounts Estimated liability for coupons Total current liabilities (£7,800,000 – £20,000 - £15,000) × 0.20 = £1,553,000. 4,100,000 1,500,000 500,000 600,000 6,700,000 Allowance - 12/31/2019 (4,780,000 - 4,725,000) 260,000 Recovery of accounts written off in previous year. 52,000 Doubtful Accounts expense for 2020 (SQUEEZE) 196,500 Total.508,500 Accounts written off in 2020.( 198,500) Allowance- 12/31/2019 (6,360,000 - 6,050,000) 310,000 56. C 57. C 58. B 59. C $2,000,000 – $500,000 + $500,000 – $200,000 = $1,800,000. Cash (1,500,000-500,000) 1,000,000 Trade and other receivables 3,000,000 Inventory (2,000,000-200,000) 1,800,000 Total current assets 5,800,000 $2,000,000 – $430,000 + $1,000,000 – $320,000 = $2,250,000. Accounts receivable, 12/31/2021 Add: Credit sales Total Less: Collection from customers 6,500,000 Accounts written off 250,000 Accounts receivable, 12/31/2022 Less: Estimated uncollectible accounts Amortized cost (expected net cash inflow) 2,000,000 7,100,000 9,100,000 6,750,000 2.350.000 355,000 1,995,000 60. D No gain or loss is recognized because assignment of accounts receivable is a secures borrowing and not a sale 61. B Note receivable – December 31, 2019 Present value (1,200,000 x 1.76) Unearned interest income Interest income for 2020 (9% x 2,112,000) 2,400,000 (2,112,000) 288,000 190,080 Note Receivable – December 31, 2020 Unearned interest income – 12/31/2020 (288,000 – 190,080) 1,200,000 ( 97,920) Carrying amount – December 31, 2020 1,102,080 ¥150,000 – ¥82,000 – ¥15,000 + ¥45,000 – ¥8,000 = ¥90,000; ¥90,000 – ¥27,000 = ¥63,000 62. A 63. C,C Question 1 and 2: Answer C Principal Interest (5,500,000 x 10% x 60/360) P 5,500,000 91,666.67 Maturity value 5,591,666.67 Discount (5, 591, 666.67x 13% x 90/360) Net proceeds 181, 729 P5,409, 937.50 Principal P 5,500,000 Accrued interest receivable (5,500,000 x 10% x 30/360) 45, 833.33 Carrying amount of note receivable P 5,545, 833.33 Net proceeds Carrying amount of note receivable Interest expense P 5,409, 937.50 5,545, 833.33 P ( 135, 895.7) 64. C,B,B • Question No. 1. c Principal. Interest (3,000,000 x 10% x 9/12) Maturity Value. Discount (3,225,000 x 12% x 6/12) Net Proceeds. 3,000,000 225,000 3,225,000 ( 193,500) 3,031,500 • Question No. 2 b Principal. Accrued Interest Receivable. (3,000,000 x 10% x 3/12) Carrying Amount of Note Receivable. 75,000 3,075,000 Net Proceeds. Carrying Amount of Note Receivable. Interest Expense. 3,031,500 3,075,000 ( 43,500) • Question No. 3. b Maturity Value. Protest Fee. 3,000,000 3,225,000 23,000 Total Amount Due. 3,248,000 Interest (3,248,000 x 12% x 3/12) 97,440 Amount collected from customer. 3,345,440 65. A,C Note receivable from sale of building due 4/1/2018 P2, 000,000 Accrued interest on note receivable from sale of building from 4/1/2019 to 12/31/2019 (5, 125,000 x 10% x 9/12) 384, 375 Principal payment of note receivable from sale of land due on 7/1/2019: Annual Interest 878,000 Interest from 7/1/2018 to 7/1/2019 (290,000) 588,000 Accrued interest on NR from sale of land from 7/1/2019 to 12/31/2019 (6/12 x 290,000) 145,000 Total current receivable – December 31, 2019 P3, 117, 375 NR from sale of building due April 1, 2019 NR from officer due December 31, 2019 NR from sale of land – noncurrent portion: Principal Due July 1, 2019 – current portion Total noncurrent notes receivable (12/31/2019) 66. B,D Principal Interest (2,000,000x .10x 6/12) Maturity Value Discount (2,100,000x .12x 6/12) Net proceeds P2,000,000 1,950,000 2,900,000 (600,000) 2,300,000 P6,250,000 2,000,000 100,000 2,100,000 (126,000) 1,974,000 Net proceeds Carrying amount of note receivable (equal to principal) (2,000,000) Loss on receivable discounting 1,974,000 (26,000) 67. C,A Principal amout Direct origination cost Origination fee received from borrower P4,000,000 61, 500 ( 350,000 ) P3,711, 500 3,711,500 x 12% = 445, 380 68. A,A Solution: A Accounts receivable, Jan 1, 2021 Sales Collections 2, 197, 500 P542, 312, 500 (P432, 765, 200) Accounts written off Accounts receivable, Dec. 31, 2021 (p5, 567, 500) P106, 177, 300 Q2. Solution: A Allowance for bad debts, Jan. 1, 2021 Bad debts exp. (P542, 312, 500x 1%) Accounts written off Allowance for bad debts, Dec. 31, 2021 p183, 500 5, 423, 125 (p5, 567, 500) P39, 125