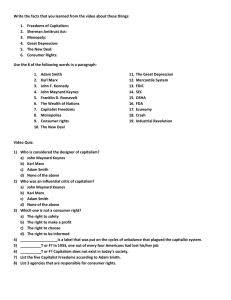

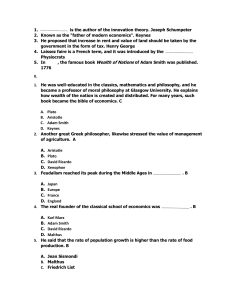

The Big Three in Economics OTHER ACADEMIC BOOKS BY MARK SKOUSEN TheStructureofProduction EconomicsonTrial DissentonKeynes (editor) TheInvestor’sBible: MarkSkousen’sPrinciplesofInvestment PuzzlesandParadoxesinEconomics (co-authoredwithKennaC.Taylor) EconomicLogic ThePowerofEconomicThinking ViennaandChicago,FriendsorFoes? TheCompleatedAutobiographybyBenjaminFranklin (editorandcompiler) The Big Three in Economics Adam Smith Karl Marx and John Maynard Keynes Mark Skousen M.E.Sharpe Armonk, New York London, England Copyright2007byMarkSkousen Allrightsreserved.Nopartofthisbookmaybereproducedinanyform withoutwrittenpermissionfromthepublisher,M.E.Sharpe,Inc., 80BusinessParkDrive,Armonk,NewYork10504. LibraryofCongressCataloging-in-PublicationData Skousen,Mark. Thebigthreeineconomics:AdamSmith,KarlMarx,andJohnMaynardKeynes/ MarkSkousen. p.cm. Includesbibliographicalreferencesandindex. ISBN-10:0-7656-1694-7(cloth:alk.paper) ISBN-13:978-0-7656-1694-4(cloth:alk.paper) 1.Economists—History.2.Economics—Philosophy.3.Economists—Biography. 4.Smith,Adam,1723–1790.5.Marx,Karl,1818–1883.6.Keynes,JohnMaynard, 1883–1946.I.Title. HB76.S582007 330.15092’2--dc22 2006020466 PrintedintheUnitedStatesofAmerica Thepaperusedinthispublicationmeetstheminimumrequirementsof AmericanNationalStandardforInformationSciences PermanenceofPaperforPrintedLibraryMaterials, ANSIZ39.48-1984. ~ BM(c) 10 9 8 7 6 5 4 3 2 1 Dedicatedto TheBigThreeinmylife, Myeditor,myfriend,andmywife, JoAnnSkousen Contents Introduction Photosfollowpage104 Chapter1.AdamSmithDeclaresanEconomicRevolution in1776 ix 3 Chapter2.FromSmithtoMarx:TheRiseandFallof ClassicalEconomics 46 Chapter3.KarlMarxLeadsaRevoltAgainstCapitalism 64 Chapter4.FromMarxtoKeynes:ScientificEconomics ComesofAge 105 Chapter5.JohnMaynardKeynes:CapitalismFacesIts GreatestChallenge 133 Chapter6.ATurningPointinTwentieth-CenturyEconomics 163 Chapter7.Conclusion:HasAdamSmithTriumphedOver MarxandKeynes? 191 Bibliography Index AbouttheAuthor 219 231 243 vii Introduction Duringthepastthreecenturies,threeeconomistsstandoutasarchetypes, symbolsofthreedistinctapproachestoeconomicphilosophy.Inthe eighteenthcentury,AdamSmith,astudentoftheScottishEnlightenment,expoundeda“systemofnaturalliberty”(whatwemightterma liberaldemocraticorderconsistingofanunfetteredmarketandlimited government),andelucidatedhowanationflourishesandadvancesthe standardoflivingofitscitizens.Inthenineteenthcentury,theGerman philosopherKarlMarxattractedandinspiredworkersandintellectuals whofeltdisenfranchisedbyindustrialcapitalismandsoughtradicalsolutionstoinequality,alienation,andexploitationoftheunderprivileged. Finally,inthetwentiethcentury,theBritisheconomistJohnMaynard Keynessoughttostabilizeacrisis-pronemarketsystemthroughactivist fiscalandmonetarygovernmentpolicies. ThePendulumandtheTotemPole ThestoriesandideasoftheseBigThreeeconomistsaretoldincontext ofalargerhistoryIhavedescribedingreaterdetailinTheMakingof ModernEconomics.Intheintroductiontothatwork,Idescribetwo possibleapproachestowritingaboutthelivesandideasofeconomists, whatItermthespectralversusthehierarchalapproach. ThemostpopularmethodofanalysisIdescribeasapendulum,by whichhistoriansplaceeacheconomistsomewherealongapolitical spectrum,fromextremelefttoextremeright.FigureAillustratesthe pendulumapproachusedinmanyeconomicstextbooks. ThePendulumApproachtoCompeting EconomicTheories Simplethoughitis,Iseeseveralproblemswiththespectralapproach.First,ittreatsKarlMarxandAdamSmithascoequals,thatis, ix x INTRODUCTION FigureA ThePendulumApproachtoCompetingEconomicTheories “extreme”intheirpositionsandthereforeequallybad.Byimplication, neitherman’spositionissensibleandmustberejected.Theresultis apendulum-likeswingbetweenthetwoextremes,eventuallycoming to rest in the middle. Consequently, the moderate, middle-of-theroadpositionheldbyJohnMaynardKeynesappearstobethemore balancedandideal.Butishissystemthewaytoachievegrowthand prosperity?Oristhemiddleoftheroadsimplythepathtowardbig governmentandacumbersomewelfarestate? I suggest as an alternative the “hierarchal” approach. In Indian folklore,thehigherone’splacementonthetotempole,thehigherthe rankofsignificance.Insteadofcomparingeconomistshorizontally onapendulumorspectrum,wemightchoosetorankthembyheight accordingtothesamestandardofachievement.Usingthistotempole structure,IwouldreformulatethediagramaccordingtoFigureB. TheTotemPoleofEconomics Ihavechosenarankingsystemconsistentwiththeopinionsofmost economists.Alargemajorityofeconomistsandhistoriansofeconomic thoughtconsiderAdamSmiththegreatestoftheBigThree.Hismodel ofcompetitivemarketsconstitutesthe“firstfundamentaltheoremof welfareeconomics,”whatGeorgeStiglercalledthe“crownjewel” ofeconomics,the“mostimportantsubstantivepropositioninallof economics”(Stigler1976,1201). Next on the list is John Maynard Keynes. Despite substantial criticismoftheKeynesianmodel,itcontinuestoendureasamacroeconomicmodelininstitutionalanalysisandpolicymatters.Asa defenderofbourgeoisvalues,Keynessupportedindividualliberty, butonalargerscale,hethoughtthatmacroeconomicinterventionis INTRODUCTION xi FigureB TheTotemPoleApproach:TheRankingofThreeEconomists (Smith,Keynes,andMarx)AccordingtoEconomicFreedom andGrowth essentialtostabilizetheeconomy,aviewstillheldbymanyeconomiststoday. ThethirdmanonthetotempoleisKarlMarx.Althoughhisendorsementofcentrallyplannedcommandeconomiesatboththemicroand macrolevelhasbeenlargelydiscredited,Marxistinterpretationsof classconflictandeconomiccrisisstilldrawtheattentionofsociologists,historians,andeconomists.1 Thestoryofmoderneconomicscanbetoldthroughtheeyesofthe BigThree.Ihaveaddedvitaltransitionalchaptersbetweenthethree biographiestocompletethestory.Asyouwillsee,itisacunningplot thathasmanyunexpectedtwistsandturns.Letusbegin. 1.ThoseradicaleconomistswhotakeissuewithmyrankingofMarxas“low man”onthetotempolemaytakecomfortintheargumentmadebysomeexpertsin Indianfolklorewhoclaimthatthefigureonthebottommayinfactbethefounder ormostsignificantchiefinthehistoryofthetribe. The Big Three in Economics 1 AdamSmithDeclaresan EconomicRevolutionin1776 AdamSmithwasaradicalandarevolutionaryinhistime—just asthoseofuswhopreachlaissezfaireareinourtime. —MiltonFriedman(1978,7) Thestoryofmoderneconomicsbeginsin1776.Priortothisfamous date,6,000yearsofrecordedhistoryhadpassedwithoutaseminal workbeingpublishedonthesubjectthatdominatedeverywaking hourofpracticallyeveryhumanbeing:makingaliving. Formillennia,fromRomantimesthroughtheDarkAgesandthe Renaissance,humansstruggledtosurvivebythesweatoftheirbrow, oftenonlyekingoutabareexistence.Theywereconstantlyguarding againstprematuredeath,disease,famine,war,andsubsistencewages. Onlyafortunatefew—primarilyrulersandaristocrats—livedleisurely lives,andeventhosewerecrudebymodernstandards.Forthecommon man,littlechangedoverthecenturies.Realpercapitawageswere virtuallythesame,yearafteryear,decadeafterdecade.Duringthis 3 4 THE BIG THREE IN ECONOMICS age,whentheaveragelifespanwasamerefortyyears,theEnglish writerThomasHobbesrightlycalledthelifeofman“solitary,poor, nasty,brutish,andshort”(1996[1651],84). 1776,aPropheticYear Thencame1776,whenhopeandrisingexpectationswereextended tothecommonworkingmanforthefirsttime.Itwasaperiodknown astheEnlightenment,whichtheFrenchcalledl’agedeslumieres. Forthefirsttimeinhistory,workerslookedforwardtoobtaininga basicminimumoffood,shelter,andclothing.Eventea,previouslya luxury,hadbecomeacommonbeverage. The signing ofAmerica’s Declaration of Independence on July 4wasoneofseveralsignificanteventsof1776.InfluencedbyJohn Locke,ThomasJeffersonproclaimed“life,liberty,andthepursuitof happiness”tobeinalienablerights,thusestablishingthelegalframeworkforastrugglingnationthatwouldeventuallybecomethegreatesteconomicpowerhouseonearth,andprovidingtheconstitutional foundationoflibertythatwastobeimitatedaroundtheworld. AMonumentalBookAppears Fourmonthsearlier,anequallymonumentalworkhadbeenpublished acrosstheAtlanticinEngland.OnMarch9,1776,theLondonprinters WilliamStrahanandThomasCadellreleaseda1,000–page,two-volume workentitledAnInquiryintotheNatureandCausesoftheWealthofNations.Itwasafatbookwithalongtitledestinedtohavegargantuanglobal impact.TheauthorwasDr.AdamSmith,aquiet,absent-mindedprofessor whotaught“moralphilosophy”attheUniversityofGlasgow. TheWealthofNationswastheintellectualshotheardaroundthe world.AdamSmith,aleaderintheScottishEnlightenment,hadput onpaperauniversalformulaforprosperityandfinancialindependence thatwould,overthecourseofthenextcentury,revolutionizetheway citizensandleadersthoughtaboutandpracticedeconomicsandtrade.Its publicationpromisedanewworld—aworldofabundantwealth,riches beyondthemereaccumulationofgoldandsilver.Smithpromisedthat newworldtoeveryone—notjusttherichandtherulers,butthecommon man,too.TheWealthofNationsofferedaformulaforemancipating ADAM SMITH DECLARES A REVOLUTION 5 Figure1.1 TheRiseinRealperCapitaIncome,UnitedKingdom, 1100–1995 Income of England (1100–1995) 18,000 GDP per Capita (1990 $) 16,000 14,000 12,000 10,000 8,000 6,000 4,000 Wealth of Nations published (1776) 2,000 0 1100 1200 1300 1400 1500 1600 1700 1800 1900 1995 CourtesyofLarryWimmer,BrighamYoungUniversity. theworkingmanfromthedrudgeryofaHobbesianworld.Insum,The WealthofNationswasadeclarationofeconomicindependence. Certaindatesareturningpointsinthehistoryofmankind.Theyear 1776 is one of them. In that prophetic year, two vital freedoms were proclaimed—politicallibertyandfreeenterprise—andthetwoworkedtogethertosetinmotiontheIndustrialRevolution.Itwasnoaccidentthatthe moderneconomybeganinearnestshortlyafter1776(seeFigure1.1). TheEnlightenmentandtheRumblingsof EconomicProgress Theyear1776wassignificantforotherreasonsaswell.Forexample, itwastheyearthefirstvolumeofEdwardGibbon’sclassicwork, History of the Decline and Fall of the Roman Empire (1776–88), appeared. Gibbon was a principal advocate of eighteenth-century Enlightenment,whichembodiedunboundedfaithinscience,reason, andeconomicindividualisminplaceofreligiousfanaticism,superstition,andaristocraticpower. ToSmith,1776wasalsoanimportantyearforpersonalreasons. 6 THE BIG THREE IN ECONOMICS Hisclosestfriend,DavidHume,died.Hume,awriterandphilosopher, was a great influence onAdam Smith (see “Pre-Adamites” intheappendixtothischapter).LikeSmith,hewasaleaderofthe ScottishEnlightenmentandanadvocateofcommercialcivilization andeconomicliberty. For centuries, the average real wage and standard of living had stagnated,whilealmostabillionpeoplestruggledagainsttheharsh realitiesofdailylife.Suddenly,intheearly1800s,justafewyears aftertheAmericanRevolutionandthepublicationofTheWealthof Nations,theWesternworldbegantoflourishasneverbefore.Thespinningjenny,powerlooms,andthesteamenginewerethefirstofmany inventionsthatsavedtimeandmoneyforenterprisingbusinessmen andtheaveragecitizen.TheIndustrialRevolutionwasbeginningto unfold,realwagesstartedclimbing,andeveryone’sstandardofliving,richandpoor,beganrisingtounforeseenheights.Itwasindeed theEnlightenment,thedawningofmoderntimes,andpeopleofall walksoflifetooknotice. AdvocatefortheCommonMan JustasGeorgeWashingtonwasthefatherofanewnation,soAdam Smithwasthefatherofanewscience,thescienceofwealth.Thegreat BritisheconomistAlfredMarshallcalledeconomicsthestudyof“the ordinarybusinessoflife.”Appropriately,AdamSmithwouldhavean ordinaryname.HewasnamedafterthefirstmanintheBible,Adam, whichmeans“outofmany,”andhislastname,Smith,signifies“one whoworks.”SmithisthemostcommonsurnameinGreatBritain. Themanwiththepedestriannamewroteabookforthewelfareof theaverageworkingman.Inhismagnumopus,heassuredthereader thathismodelforeconomicsuccesswouldresultin“universalopulencewhichextendsitselftothelowestranksofthepeople”(1965 [1776],11).1 1.AllquotesfromTheWealthofNationsarefromtheModernLibraryedition (RandomHouse,1937,1965,1994).InthisbookIrefertothe1965edition,which hasanintroductionbyMaxLerner.TherehavebeenmanyeditionsofTheWealth ofNations,includingtheofficialeditionissuedbytheUniversityofGlasgowPress, butthiseditionisthemostpopular. ADAM SMITH DECLARES A REVOLUTION 7 Itwasnotabookforaristocratsandkings.Infact,AdamSmith had little regard for the men of vested interests and commercial power.Hissympathieslaywiththeaveragecitizenswhohadbeen abusedandtakenadvantageofoverthecenturies.Nowtheywould beliberatedfromsixteen-hour-a-dayjobs,subsistencewages,anda forty-yearlifespan. AdamSmithFacesaMajorObstacle After taking twelve long years to write his big book, Smith was convincedhehaddiscoveredtherightkindofeconomicstocreate “universalopulence.”Hecalledhismodelthe“systemofnaturalliberty.”Todayeconomistscallitthe“classicalmodel.”Smith’smodel wasinspiredbySirIsaacNewton,whosemodelofnaturalscience Smithgreatlyadmiredasuniversalandharmonious. Smith’sbiggesthurdlewouldbeconvincingotherstoaccepthis system,especiallylegislators.HispurposeinwritingTheWealthof Nationswasnotsimplytoeducate,buttopersuade.Verylittleprogress hadbeenachievedoverthecenturiesinEnglandandEuropebecauseof theentrenchedsystemknownasmercantilism.OneofAdamSmith’s mainobjectivesinwritingTheWealthofNationswastosmashthe conventionalviewoftheeconomy,whichallowedthemercantiliststo controlthecommercialinterestsandpoliticalpowersoftheday,and toreplaceitwithhisviewoftherealsourceofwealthandeconomic growth,thusleadingEnglandandtherestoftheworldtowardthe “greatestimprovement”ofthecommonman’slot. TheAppealofMercantilism Followingalong-standingtraditionintheWest,themercantilists(the commercialpoliticosoftheday)believedthattheworld’seconomy wasstagnantanditswealthfixed,sothatonenationgrewonlyatthe expenseofanother.Theeconomiesofcivilizationsfromancienttimes throughtheMiddleAgeswerebasedoneitherslaveryorseveralforms ofserfdom.Undereithersystem,wealthwaslargelyacquiredatthe expenseofothers,orbytheexploitationofmanbyman.AsBertrand deJouvenelobserves,“Wealthwasthereforebasedonseizureand exploitation”(Jouvenel1999,100). 8 THE BIG THREE IN ECONOMICS Consequently, European nations established government-authorizedmonopoliesathomeandsupportedcolonialismabroad,sendingagentsandtroopsintopoorercountriestoseizegoldandother preciouscommodities. Accordingtotheestablishedmercantilistsystem,wealthconsisted entirelyofmoneyperse,whichatthetimemeantgoldandsilver.The primarygoalofeverynationwasalwaystoaggressivelyaccumulate goldandsilver,andtousewhatevermeansnecessarytodoso.“The greataffair,wealwaysfind,istogetmoney,”SmithdeclaredinThe WealthofNations(398). Howtogetmoremoney?Thegrowthofnationswaspredatory. NationssuchasSpainandPortugalsenttheiremissariestofaraway landstodiscovergoldminesandtopileupasmuchoftheprecious metalastheycould.Noexpeditionorforeignwarwastooexpensive whenitcametotheirthirstforbullion.OtherEuropeancountries, imitatingthegoldseekers,frequentlyimposedexchangecontrols, forbidding,underthethreatofheavypenalties,theexportofgold andsilver. Second,mercantilistssoughtafavorablebalanceoftrade,which meantthatgoldandsilverwouldconstantlyfilltheircoffers.How? “The encouragement of exportation, and the discouragement of importation, are the two great engines by which the mercantilist system proposes to enrich every country,” reported Smith (607). Smithcarefullydelineatedthehostofhightariffs,duties,quotas, and regulations that aimed at restraining trade. Ultimately, this systemalsorestrainedproductionandahigherstandardofliving. Such commercial interferences naturally led to conflict and war betweennations. SmithDenouncesTradeBarriers Inadirectassaultonthemercantilesystem,theScottishphilosopher denouncedhightariffsandotherrestrictionsontrade.Effortstopromoteafavorablebalanceoftradewere“absurd,”hedeclared(456). Hetalkedofthe“naturaladvantages”onecountryhasoveranotherin producinggoods.“Bymeansofglasses,hotbeds,andhotwalls,very goodgrapescanberaisedinScotland,”Smithsaid,butitwouldcost thirtytimesmoretoproduceScottishwinethantoimportwinefrom ADAM SMITH DECLARES A REVOLUTION 9 France. “Would it be a reasonable law to prohibit the importation ofallforeignwines,merelytoencouragethemakingofclaretand burgundyinScotland?”(425). AccordingtoSmith,mercantilistpoliciesmerelyimitaterealprosperity,benefitingonlytheproducersandthemonopolists.Because it did not benefit the consumer, mercantilism was antigrowth and shortsighted.“Inthemercantilesystem,theinterestoftheconsumer is almost always constantly sacrificed to that of the producer,” he wrote(625). Smitharguedthattradebarrierscrippledtheabilityofcountriesto produce,andthusshouldbetorndown.Anexpansionoftradebetween BritainandFrance,forexample,wouldenablebothnationstogain. “Whatisprudenceintheconductofeveryprivatefamily,canscarce befollyinthatofagreatkingdom,”declaredSmith.“Ifaforeign countrycansupplyuswithacommoditycheaperthanweourselves canmakeit,betterbuyitofthem”(424). RealSourceofWealthRevealed Theaccumulationofgoldandsilvermighthavefilledthepocketsof therichandthepowerful,butwhatwouldbetheoriginofwealthfor thewholenationandtheaveragecitizen?ThatwasAdamSmith’s paramountquestion.TheWealthofNationswasnotjustatracton freetrade,butaworldviewofprosperity. TheScottishprofessorforcefullyarguedthatthekeystothe“wealth ofnations”wereproductionandexchange,nottheartificialacquisitionofgoldandsilverattheexpenseofothernations.Hestated, “thewealthofacountryconsists,notofitsgoldandsilveronly,but in its lands, houses, and consumable goods of all different kinds” (418).Wealthshouldbemeasuredaccordingtohowwellpeopleare lodged,clothed,andfed,notaccordingtothenumberofbagsofgold inthetreasury.In1763,hesaid,“thewealthofastateconsistsinthe cheapnessofprovisionsandallothernecessariesandconveniences oflife”(1982[1763],83). SmithbeganhisWealthofNationswithadiscussionofwealth. Heasked,whatcouldbringaboutthe“greatestimprovementinthe productivepowersoflabour”?Afavorablebalanceoftrade?More goldandsilver? 10 THE BIG THREE IN ECONOMICS No,itwasasuperiormanagementtechnique,“thedivisionoflabor.” Inawell-knownexample,Smithdescribedindetailtheworkingsof apinfactory,whereworkerswereassignedeighteendistinctoperations in order to maximize the output of pins (1965 [1776], 3–5). Thisstages-of-productionapproach,wheremanagementworkswith labortoproducegoodsandfulfillconsumerwants,formsthebasisof aharmoniousandgrowingeconomy.Afewpageslater,Smithused anotherexample,thewoolencoat:“theassistanceandco-operation ofmanythousands”oflaborersandvariousmachineryfromaround theworldwererequiredtoproducethisbasicproductusedbythe “day-laborer”2(11–12).Furthermore,expandingthemarketthrough worldwidetradewouldmeanthatspecializationanddivisionoflabor couldalsoexpand.Throughincreasedproductivity,thrift,andhard work,theworld’soutputcouldincrease.Hence,wealthwasnotafixed quantityafterall,andcountriescouldgrowricherwithoutharming orexploitingothers. SmithDiscoverstheKeytoProsperity Howcanproductionandexchangebemaximizedandtherebyencouragethe“universalopulence”andthe“improvementoftheproductivepoweroflabor”?AdamSmithhadaclearanswer:Givepeople theireconomicfreedom!ThroughoutTheWealthofNations,Smith advocatedtheprincipleof“naturalliberty,”thefreedomtodowhat onewisheswithlittleinterferencefromthestate.Itencouragedthe freemovementoflabor,capital,money,andgoods.Moreover,said Smith,economicfreedomnotonlyleadstoabettermateriallife,but isafundamentalhumanright.ToquoteSmith:“Toprohibitagreat people...frommakingallthattheycanofeverypartoftheirown produce,orfromemployingtheirstockandindustryinthewaythat theyjudgemostadvantageoustothemselves,isamanifestviolation ofthemostsacredrightsofmankind”(549). UnderAdamSmith’smodelofnaturalliberty,wealthcreationwas 2.ThispassageinthefirstchapterofTheWealthofNationsisremarkablysimilartothethemedevelopedbyLeonardReadinhisclassicessay,“I,Pencil,”which describeshowasimpleproductlikethepencilinvolvedproductionprocessesfrom aroundtheworld(Read1999[1958]). ADAM SMITH DECLARES A REVOLUTION 11 nolongerazero-sumgame.Nolongerwasthereaconflictofinterests, butaharmonyofinterests.AccordingtoJouvenel,thiscameasan “enormous innovation” that greatly surprised European reformers. “Thegreatnewideaisthatitispossibletoenrichallthemembers ofsociety,collectivelyandindividually,bygradualprogressinthe organizationoflabor”(Jouvenel1999,102).Thisdevelopmentcould berapidandunlimited. Herewassomethingthatcouldcapturetheimaginationandhope notonlyoftheEnglishworker,butoftheFrenchpeasant,theGermanlaborer,theChinesedayworker,andtheAmericanimmigrant, forSmithwasadvocatingaworldwideprincipleofabundance.The freedom to work could liberate everyone from the chains of daily chores. Whatconstitutesthisneweconomicfreedom?Naturallibertyincludes,accordingtoSmith,therighttobuygoodsfromanysource, includingforeignproducts,withouttherestraintsoftariffsorimport quotas.Itincludestherighttobeemployedinwhateveroccupation a person wants and wherever desired. Smith trenchantly criticized Europeanpolicyintheeighteenthcenturywhereinlaborershadto obtain government permission (via certificates) to move from one towntoanother,evenwithinacountry(1965[1776],118–43). Natural liberty also includes the right to charge whatever wage themarketmightbear.Smithstronglyopposedthestate’seffortsto regulateandartificiallyraisewages.Hewrote,“Wheneverthelawhas attemptedtoregulatethewagesofworkmen,ithasalwaysbeenrather tolowerthemthantoraisethem”(131).Likeeveryworker,Smith desiredhighwages,buthethoughttheyshouldcomeaboutthrough thenaturalworkingsofthelabormarket,notgovernmentedict. Finally,naturallibertyincludestherighttosave,invest,andaccumulate capital without government restraint—important keys to economicgrowth. AdamSmithendorsedthevirtuesofthrift,capitalinvestment,and labor-saving machinery as essential ingredients to promote rising livingstandards(326).Inhischapterontheaccumulationofcapital (Chapter3,BookII)inTheWealthofNations,Smithemphasized savingandfrugalityaskeystoeconomicgrowth,inadditiontostable governmentpolicies,acompetitivebusinessenvironment,andsound businessmanagement. 12 THE BIG THREE IN ECONOMICS Smith’sClassicWorkReceivesUniversalAcclaim AdamSmith’seloquentadvocacyofnaturallibertyfueledtheminds of a rising generation. His words literally changed the course of politics,dismantlingtheoldmercantilistdoctrinesofprotectionism andenforcedlabor.Muchoftheworldwidemovementtowardfree tradecanbeattributedtoAdamSmith’swork.TheWealthofNations wastheidealdocumenttousherintheIndustrialRevolutionandthe politicalrightsofman. Smith’smagnumopushasreceivedalmostuniversalacclaim.H.L. Menckenstated,“ThereisnomoreengrossingbookintheEnglish language”(inPowell2000,251).HistorianArnoldToynbeeasserted that“TheWealthofNationsandthesteamenginedestroyedtheold worldandbuiltanewone”(inRashid1998,212).TheEnglishhistorianHenryThomasBucklestretchedthehyperboleevenfurtherto claimthat,intermsofitsultimateinfluence,Smith’stome“isprobably themostimportantbookthathaseverbeenwritten,”notexcludingthe Bible(inRogge1976,9);andPaulA.SamuelsonplacedSmith“on apinnacle”amongeconomists(Samuelson1962,7).3EvenMarxists sometimesextolthevirtuesofAdamSmith. TheLifeofAdamSmith WhowasAdamSmith,andhowdidhecometowritehisrevolutionaryworkonmoderneconomics? SeaportsandcommercewereanintegralpartofAdamSmith’slife. BorninKirkcaldy,ontheeastcoastofScotlandnearEdinburgh,in June1723,hehadtheunfortunatedistinctionofcomingintotheworld inthesameyearthathisfatherdied.Itappearedthatthenewborn AdamSmithwasdestinedtobeastudentoftradeandacustomsagent. Hisfather,alsonamedAdamSmith,wasacomptrollerofcustomsat Kirkcaldy.Hisguardian,namedAdamSmithaswell,wasacustoms collectorinthesametown,andacousinservedascustomsinspector inAlloa.Thecousin’snamewas—youguessedit—AdamSmith. 3.ThiswasSamuelson’spresidentialaddressbeforetheAmericanEconomic Association.Ayearlater,Samuelsondeclared,“ThefirsthumanwasAdam.The firsteconomist...wasAdamSmith”(Samuelson1966,1408). ADAM SMITH DECLARES A REVOLUTION 13 ThelastoccupationofourAdamSmith(thefamousone)was,not surprisingly,customscommissionerofScotland.Butwe’regetting aheadofourstory.InhisearlydaysinKirkcaldy,Adamwasregarded asa“delicatechild.”Atagefour,hewaskidnappedbygypsiesbut wassoonreturnedtohismother.“Hewouldhavemadeapoorgypsy,” commentedbiographerJohnRae(1895,5).Hisfocusofaffectionwas alwayshismother,whomhecherished. AlthoughSmithhadmanyfemaleacquaintances,henevermarried. “Hespeaksharshly,withbigteeth,andhe’suglyasthedevil,”wrote MadameRiccoboni,aFrenchnovelist,uponmeetingAdamSmith forthefirsttimeinParisinMay1766.“He’samostabsent-minded creature,”shelaterwrote,“butoneofthemostlovable”(inMuller 1993,16).Weknowpitifullylittleabouthisloveinterests.HisbiographersrelatethatasayoungmanSmithfellinlovewithabeautiful andaccomplishedyounglady,butunknowncircumstancesprevented theirmarriage(Ross1995,402).SeveralFrenchladiespursuedthis unhandsomesavant,butnothingcameofit. Smithoccupiedhissparetimeattendingnumerousclubs,suchas the Poker Club, the Club of Edinburgh,theLondon“literati,”and Johnson’sClub,althoughDavidHumefrequentlyscoldedhimfor beingtooreclusive.“Hismother,hisfriends,hisbooks—thesewere Smith’sthreegreatjoys,”declaredJohnRae(1895,327). Attheyouthfulageoffourteen,SmithattendedGlasgowUniversity, then won a scholarship to Oxford, where he spent half a dozenyearsstudyingGreekandLatinclassics,FrenchandEnglish literature,andscienceandphilosophy.ReferringtoOxfordUniversity,hewroteinTheWealthofNationsthat“thegreaterpartofthe publicprofessorshave,forthesemanyyears,givenupaltogether even the pretence of teaching” (Smith 1965 [1776], 718).A few pageslater,Smithmadehisfamousdenunciationofthe“sham-lecture”bycollegeprofessors:“Iftheteacherhappenstobeamanof sense,itmustbeanunpleasantthingtohimtobeconscious,while he is lecturing his students, that he is either speaking or reading nonsense,orwhatisverylittlebetterthannonsense.Itmusttoobe unpleasanttohimtoobservethatthegreaterpartofhisstudents deserthislectures;orperhapsattenduponthemwithplainenough marksofneglect,contempt,andderision....Thedisciplineofcollegesanduniversitiesisingeneralcontrived,notforthebenefitof 14 THE BIG THREE IN ECONOMICS thestudents,butfortheinterest,ormoreproperlyspeaking,forthe easeofthemasters”(720).4 Intermsofphysicalappearance,Smithwasofaverageheightand slightlyoverweight.Heneversatforapicture,butseveralsketches show“ratherhandsomefeatures,fullforehead,prominenteyeballs, wellcurvedeyebrows,slightlyaquilinenose,andfirmmouthandchin” (Rae1895,438).Hehimselfexclaimed,“Iamabeauinnothingbut mybooks”(Rae1895,329). Aftergraduation,heheldthepositionofProfessorofMoralPhilosophyattheUniversityofGlasgowbetween1751and1763.His firstmajorwork,TheoryofMoralSentiments,waspublishedin1759 andestablishedAdamSmithasaninfluentialScottishthinker. TheAbsent-MindedProfessor Astohispersonalityquirks,thefamousprofessorhadaharsh,thick voiceandoftenstuttered.Hewasthequintessentialabsent-minded professor.Hislifewasoneofubiquitousdisorganizationandambiguity.Booksandpaperswerestackedeverywhereinhisstudy.From hischildhood,hehadthehabitoftalkingtohimself,“smilinginrapt conversationwithinvisiblecompanions”(Rae1895,329).Storiesof hisbumblingnatureabound:oncehefellintoaleather-tanningpit whileconversingwithafriend;onemorningheputbreadandbutter intoateapot,andaftertastingthetea,declaredittobetheworstcupof teahehadeverhad;anothertimehewentoutwalkinganddaydreaminginhisoldnightgownandendedupseveralmilesoutsidetown. 4.GeorgeStigler,whosefavoriteeconomistwasAdamSmith,wasknownfortellinghisstudentsatChicagothatherecommendedallofTheWealthofNations“except page720”(Stigler1966,168n).Ifstudentslookedupthispassage,foundinbookV, partII,article2,theyencounteredSmith’sattackontheteachingprofessionandthe “sham-lecture.”Butifyouaskme,thatcitationisnothingcomparedtowhatAdam Smithwroteafewpageslater,inwhichhecondemnedacertain“Englishcustom” thatwouldcauseayoungpersontobecome“moreconceited,moreunprincipled, moredissipated,andmoreincapableofanyseriousapplicationeithertostudyorto business....”Afatherwhoallowedhissontoengageinthis“absurdpractice”would soonseehisson“unemployed,neglectedandgoingtoruinbeforehiseyes.”Whatwas thisterriblepractice?Youths(agesseventeentotwenty-one)travelingabroad!Smith criticizedthepracticeofsendingteenagechildrenabroad,contendingthatitweakens characterbyremovingthemfromthecontrolofparents(1965[1776],720). ADAM SMITH DECLARES A REVOLUTION 15 “HewasthemostabsentmanIeverknew,”declaredacontemporary (inWest1976,176). HowHeWroteHisMagnumOpus In1764,CharlesTownsend,aleadingBritishmemberofParliament, offeredSmithahandsomefeeandlifetimepensiontotutorhisstepson, HenryScott,theDukeofBuccleuch.TheytraveledtoFrance,where Smith met withVoltaire,Turgot, Quesnay, and other great French thinkers.“ThisSmithisanexcellentman!”exclaimedVoltaire.“We havenothingtocomparewithhim”(inMuller1993,15). ItwasinFrancethatSmithindicatedhehadlostinterestinhis tutoring duties and began researching and writing TheWealth of Nations.Ittookhimtenyearstowriteit.Whenfinallypublished bythepremierEnglishpublisher,itbecameaninstantbestseller, andthefirsteditionofathousandcopiessoldoutinsixmonths. DavidHumeandThomasJefferson,amongothers,praisedthebook, whichwentthroughseveraleditionsandforeigntranslationsduring Smith’slifetime.5AfirstprintingofTheWealthofNationsthencost thirty-sixshillings.Todayacollectormightwellpayover$150,000 forafirstedition. TheWealthofNationsremainsaclassic,andvariouseditionscan befoundinanymajorbookstore.Whicheditionshouldyouread? Sincethecopyrightexpired,manypublishershaveputouttheirown editions,includingtheUniversityofGlasgow,UniversityofChicago, Everyman’sLibrary,andLibertyPress;there’sevenaBantampaperback,unabridged!Mypreferenceisthe1937(latestreprint,1994) ModernLibraryedition,editedbyEdwinCannan. ThesignificanceofTheWealthofNationshasreachedsuchbiblicalproportionsthatacompleteconcordancewaspreparedbyFred R.Glahe(1993),economicsprofessorattheUniversityofColorado.Oh,thewondersofcomputers!Didyouknowthattheword “a”appears6,691timesinTheWealthofNations?Aconcordance isundoubtedlyvaluable,especiallyforscholars.Forexample,“de5.IrecommendthebookAdamSmithAcrossNations:TranslationsandReceptionsofTheWealthofNations,editedbyCheng-chungLai(2000),forafascinating accountoftheinfluenceofAdamSmith’sbookoverthecenturies. 16 THE BIG THREE IN ECONOMICS mand”appears269timeswhile“supply”appearsonly144times. Keyneswouldbepleased. SmithIsAppointedCustomsOfficialandBurns HisClothes Followingthepublicationofhisclassicbook,Smithwasappointed customscommissionerinEdinburgh,asnotedearlier.Healsospent timerevisinghispublishedbooks,livedamodestlifedespitehispension,andovertheyearsgaveawaymostofhisincomeinprivateacts ofcharity,whichhetookcaretoconceal(Rae1895,437).Helived inEdinburghfortheremainderofhislife. Hispositionasacustomsagentisfullofirony.InTheWealthof Nations,Smitharguedinfavoroffreetrade.Heendorsedtheeliminationofmosttariffsandevenwroteinsympathyofsmuggling.Two yearslater,in1778,Smithactivelysoughtahigh-levelgovernment appointment,possiblytoenhancehisfinancialcondition.Smithsucceeded in his quest and was named Commissioner of Customs in Scotland,despitehispreviouswritingsonfreetradeandthewordsof hisfriendDr.SamuelJohnson,whosaidthat“oneofthelowestofall humanbeingsisaCommissionerofExcise”(inViner1965,64).The jobwasaprestigiouspositionthatpaidahandsome£600ayear.Ina strangeparadox,thechampionoffreetradeandlaissez-fairespentthe lasttwelveyearsofhislifeenforcingScotland’smercantilistimport lawsandcrackingdownonsmugglers. Once in office, Smith acquainted himself with all the rules and regulationsofcustomslawandsuddenlydiscoveredthatforsometime hehadpersonallyviolatedit:Mostoftheclotheshewaswearinghad beenillegallysmuggledintothecountry.WritingtoLordAuckland, heexclaimed,“Ifound,tomygreatastonishment,thatIhadscarcea stock[neckcloth],acravat,apairofruffles,orapockethandkerchief whichwasnotprohibitedtobewornorusedinGreatBritain.Iwished tosetanexampleandburntthemall.”6HeurgedLordAucklandand hiswifetoexaminetheirclothinganddothesame. 6. Letter toWilliam Eden (LordAuckland), Edinburgh, January 3, 1780, in Smith1987,245–46.Inhisletter,Smithadvocatedthecompleteabolitionofall importprohibitions,tobereplacedbyreasonableduties. ADAM SMITH DECLARES A REVOLUTION 17 Smithintendedtowriteathirdphilosophicalworkonpoliticsand jurisprudence,asequeltohisTheoryofMoralSentimentsandThe WealthofNations.7Yetheapparentlyspentadozenyearsenforcing arcanecustomslawsinstead.Suchisthelureofgovernmentoffice andjobsecurity. AnotherBurningAffairinHisFinalYears AsecondburningincidentoccurredattheendofSmith’slifein1790. HedinedeverySundaywithhistwoclosestfriends,JosephBlack thechemistandJamesHuttonthegeologist,atataverninEdinburgh. Severalmonthsbeforehisdemise,hebeggedhisfriendstodestroy allhisunpublishedpapersexceptforafewhedeemednearlyready forpublication.(Whyhedidn’tburnthepapershimselfisamystery.) Thiswasnotanewrequest.Seventeenyearsearlier,whenhetraveled toLondonwiththemanuscriptofTheWealthofNations,heinstructed DavidHume,hisexecutor,todestroyallhisloosepapersandeighteen thinpaperfoliobooks“withoutanyexamination,”andtosparenothingbuthisfragmentonthehistoryofastronomy. Smith had apparently read about a contemporary figure whose privatepapershadbeenexposedtothepublicina“tell-all”biography andhefearedthesamemighthappentohim.Hemayhavealsobeen concernedaboutlettersoressayswrittenindefenseofhisfriendHume, whowasareligioushereticduringaperiodofintolerance.ButHume diedbeforeSmithdid,andanewexecutoroftheestatewasneeded. Approachingtheendofhislife,Smithbecameextremelyanxious abouthispersonalpapersandrepeatedlydemandedthathisfriends Black and Hutton destroy them. Black and Hutton always put off complying with his request, hopingthatSmithwouldcometohis sensesandchangehismind.Butaweekbeforehedied,heexpressly sentforhisfriendsandinsistedthattheyburnallhismanuscripts, withoutknowingoraskingwhattheycontained,exceptforafewitems readyforpublication.Finally,thetwoacquiescedandburnedvirtuallyeverything—sixteenvolumesofmanuscript,includingSmith’s manuscriptonlaw. 7.Fortunately,extensivestudentnotesontheselectureswerediscoveredin1958 andpublishedlaterasLecturesonJurisprudence(1982[1763]). 18 THE BIG THREE IN ECONOMICS Aftertheconflagration,theoldprofessorseemedgreatlyrelieved. WhenhisvisitorscalleduponhimthefollowingSundayeveningfor theirregularsupper,hedeclinedtojointhem.“Iloveyourcompany, gentlemen,butIbelieveImustleaveyoutogotoanotherworld.”It washislastsentencetothem.HediedthefollowingSaturday,July 17,1790. AdamSmith’sCrownJewel LetusexamineindepthAdamSmith’smagnumopusandhisrevolutionaryeconomicphilosophy.Aneconomicsystemthatwouldallow menandwomentopursuetheirownself-interestunderconditions of“naturalliberty”andcompetitionwould,accordingtoSmith,lead to a self-regulating and highly prosperous economy. Eliminating restrictionsonimports,labor,andpriceswouldmeanthatuniversal prosperitycouldbemaximizedthroughlowerprices,higherwages, andbetterproducts.Itwouldprovidestabilityandgrowth. SmithIdentifiesThreeIngredients Smithbeganhisbookwithadiscussionofhowwealthandprosperity arecreatedthroughdemocraticfree-marketorder.Hehighlightedthree characteristicsofthisself-regulatingsystemorclassicalmodel: 1. Freedom:individualshavetherighttoproduceandexchange products,labor,andcapitalastheyseefit. 2. Competition: individuals have the right to compete in the productionandexchangeofgoodsandservices. 3. Justice:theactionsofindividualsmustbejustandhonest, accordingtotherulesofsociety. Note that the following statement byAdam Smith incorporates thesethreeprinciples:“Everyman,aslongashedoesnotviolate thelawsofjustice,isleftperfectlyfreetopursuehisowninteresthis ownway,andtobringbothhisindustryandcapitalintocompetition withthoseofanyotherman,ororderofmen”(1965[1776],651, emphasisadded). ADAM SMITH DECLARES A REVOLUTION 19 TheBenefitsoftheInvisibleHand Smitharguedthatthesethreeingredientswouldleadtoa“natural harmony” of interests between workers, landlords, and capitalists. Recall the pin factory, where management and labor had to work togethertoachievetheirends,andthewoolencoatthatrequiredthe “jointlabor”ofworkmen,merchants,andcarriersfromaroundthe world.Onageneralscale,thevoluntaryself-interestofmillionsof individuals would create a stable, prosperous society without the needforcentraldirectionbythestate.Hisdoctrineofenlightened self-interestisoftencalled“theinvisiblehand,”basedonafamous passage (paraphrased) from TheWealth of Nations: “By pursuing hisownselfinterest,everyindividualisledbyaninvisiblehandto promotethepublicinterest”(423). AdamSmith’sinvisiblehanddoctrinehasbecomeapopularmetaphorforunfetteredmarketcapitalism.AlthoughSmithusestheterm only once in TheWealth of Nations, and sparingly elsewhere, the phrase“invisiblehand”hascometosymbolizetheworkingsofthe marketeconomyaswellastheworkingsofnaturalscience(Ylikoski 1995).Defendersofmarketeconomicsuseitinapositiveway,characterizingthemarkethandas“gentle”(Harris1998),“wise”and“far reaching”(Joyce2001),onethat“improvesthelivesofpeople”(Bush 2002),whilecontrastingitwiththe“visiblehand,”“thehiddenhand,” “thegrabbinghand,”“thedeadhand,”andthe“ironfist”ofgovernment,whose“invisiblefoottramplesonpeople’shopesanddestroys theirdreams”(ShleiferandVishny1998,3–4;Lindsey2002;Bush 2002).Criticsusecontrastingcomparisonstoexpresstheirhostility towardcapitalism.Tothem,theinvisiblehandofthemarketmaybe a“backhand”(BrennanandPettit1993),“trembling”and“getting stuck”and“amputated”(Hahn1982),“palsied”(Stiglitz2001,473), “bloody”(Rothschild2001,119),andan“ironfistofcompetition” (Roemer1988,2–3). The invisible hand concept has received surprising praise from economists across the political spectrum. One would expect high praisefromfree-marketadvocates,ofcourse.MiltonFriedmanrefers toAdamSmith’ssymbolasa“keyinsight”intothecooperative,selfregulating“powerofthemarket[to]produceourfood,ourclothing, ourhousing”(FriedmanandFriedman1980,1).“Hisvisionofthe 20 THE BIG THREE IN ECONOMICS wayinwhichthevoluntaryactionsofmillionsofindividualscanbe coordinatedthroughapricesystemwithoutcentraldirection...is a highly sophisticated and subtle insight” (Friedman 1978, 17; cf. Friedman1981). NottobeoutdoneareKeynesianeconomists.Despiteitsimperfections,“theinvisiblehandhasanastonishingcapacitytohandlea coordinationproblemoftrulyenormousproportions,”declareWilliamBaumolandAlanBlinder(2001,214).FrankHahnhonorsthe invisiblehandtheoryas“astonishing”andanappropriatemetaphor. “WhatevercriticismsIshalllevelatthetheorylater,Ishouldliketo recordthatitisamajorintellectualachievement....Theinvisible handworksinharmony[that]leadstothegrowthintheoutputof goodswhichpeopledesire”(Hahn1982,1,4,8). TheFirstFundamentalTheoremofWelfareEconomics The invisible hand theory of the marketplace has become known asthe“firstfundamentaltheoremofwelfareeconomics.”8George Stiglercallsitthe“crownjewel”ofTheWealthofNationsand“the mostimportantsubstantivepropositioninallofeconomics.”Headds, “Smithhadoneoverwhelminglyimportanttriumph:heputintothe centerofeconomicsthesystematicanalysisofthebehaviorofindividualspursuingtheirself-interestsunderconditionsofcompetition” (Stigler1976,1201). Building on the general equilibrium (GE) modeling ofWalras, Pareto,Edgeworth,andmanyotherpioneers,KennethJ.Arrowand Frank Hahn have written an entire book analyzing “an idealized, decentralizedeconomy,”andrefertoSmith’s“poeticexpressionof themostfundamentalofeconomicbalancerelations,theequalization ofratesofreturn....”Hahnexpectsanarchicchaos,butthemarket createsa“differentanswer”—spontaneousorder.Inabroaderperspective,ArrowandHahndeclarethatSmith’svision“issurelythe mostimportantintellectualcontributionthateconomicthoughthas madetothegeneralunderstandingofsocialprocesses”(Arrowand Hahn1971,v,vii,1).Notonlydoeswelfareeconomics(Walras’slaw, 8.Inwelfareeconomics,“welfare”referstothegeneralwell-beingorcommon goodofthepeople,nottopeopleonwelfareorgovernmentassistance. ADAM SMITH DECLARES A REVOLUTION 21 Pareto’soptimality,Edgeworth’sbox)confirmmathematicallyand graphicallythevalidityofAdamSmith’sprincipalthesis,butitshows how,inmostcases,government-inducedmonopolies,subsidies,and otherformsofnoncompetitivebehaviorleadinevitablytoinefficiency andwaste(IngraoandIsrael1990). Smith’sReferencestotheInvisibleHand Surprisingly,AdamSmithusestheexpression“invisiblehand”only threetimesinhiswritings.Thereferencesaresosparsethateconomists and political commentators seldom mentioned the invisible hand idea by name in the nineteenth century. No references were madetoitduringthecelebrationsofthecentenaryofTheWealthof Nationsin1876.Infact,inthefamededitedvolumebyEdwinCannan,publishedin1904,theindexdoesnotincludeaseparateentry for“invisiblehand.”Thetermonlybecameapopularsymbolinthe twentiethcentury(Rothschild2001,117–18).Butthishistoricalfact shouldnotimplythatSmith’smetaphorismarginaltohisphilosophy; itisinrealitythecentralelementtohisphilosophy. ThefirstmentionoftheinvisiblehandisfoundinSmith’s“History ofAstronomy,”wherehediscussessuperstitiouspeopleswhoascribed unusualeventstothehandiworkofunseengods: Amongsavages,aswellasintheearlyagesofHeathenantiquity,itisthe irregulareventsofnatureonlythatareascribedtotheagencyandpower oftheirgods.Fireburns,andwaterrefreshes;heavybodiesdescendand lightersubstancesflyupwards,bythenecessityoftheirownnature;nor was the invisible hand of Jupiter ever apprehended to be employed in thosematters.(Smith1982,49) Afullstatementoftheinvisiblehand’seconomicpoweroccurs inTheTheoryofMoralSentiments,whenSmithdescribessomeunpleasantrichlandlordswhoin“theirnaturalselfishnessandrapacity” pursue“theirownvainandinsatiabledesires.”Andyettheyemploy severalthousandpoorworkerstoproduceluxuryproducts: Theresthe[theproprietor]isobligedtodistribute...amongthose . . . which are employed in the economy of greatness; all of whom 22 THE BIG THREE IN ECONOMICS thusderivefromhisluxuryandcaprice,thatshareofthenecessaries of life, which they would in vain have expected from his humanity orhisjustice....[T]heydividewiththepoortheproduceofalltheir improvements.Theyareledbyaninvisiblehandto,...withoutintendingit,withoutknowingit,advancetheinterestsofthesociety.(Smith 1982[1759],183–85) Thethirdmention,alreadyquotedabove,occursinachapteron internationaltradeinTheWealthofNations,whereSmithargues against restrictions on imports, and against the merchants and manufacturers who support their mercantilist views. Here is the completequotation: Aseveryindividual,therefore,endeavoursasmuchashecanbothtoemployhiscapitalinthesupportofdomesticindustry,andsotodirectthat industrythatitsproducemaybeofthegreatestvalue;everyindividual necessarilylabourstorendertheannualrevenueofthesocietyasgreatas hecan.Hegenerally,indeed,neitherintendstopromotethepublicinterest,norknowshowmuchheispromotingit....[A]ndbydirectingthat industryinsuchamannerasitsproducemaybeofthegreatestvalue,he intendsonlyhisowngain,andheisinthis,asinmanyothercases,led byaninvisiblehandtopromoteanendwhichwasnopartofhisintention.Norisitalwaystheworseforthesocietythatitwasnopartofit. Bypursuinghisowninteresthefrequentlypromotesthatofthesociety moreeffectuallythanwhenhereallyintendstopromoteit.Ihavenever known much good done by those who affected to trade for the public good.(Smith1965[1776],423) APositiveorNegativeInterpretation? MostobserversbelievethatAdamSmithusestheinvisiblehandina positiveway,butinherrecentbook,EconomicSentiments,Cambridge professorEmmaRothschilddissents.Using“indirect”evidence,she concludes,“WhatIwillsuggestisthatSmithdidnotespeciallyesteem theinvisiblehand.”AccordingtoRothschild,Smithviewstheinvisible handimageryasa“mildlyironicjoke.”Shegoessofarastoclaim thatitis“un-Smithian,andunimportanttohistheory”(Rothschild 2001,116,137).SheevensuggeststhatSmithmayhaveborrowed theexpressionfromShakespeare.RothschildnotesthatSmithwas thoroughlyfamiliarwithActIIIofMacbeth.Inthesceneimmediately ADAM SMITH DECLARES A REVOLUTION 23 beforethebanquetandBanquo’smurder,Macbethaskshisdarkbeing tocoverupthecrimesheisabouttocommit: Come,seeingnight, Scarfupthetendereyeofpitifulday, Andwiththybloodyandinvisiblehand Cancelandteartopiecesthatgreatbond Whichkeepsmepale. Thusweseeaninvisiblehandthatisnolongeragentlehand,but abloody,forcefulhand.ButRothschildproteststoomuch.Although Smithusedthe“invisiblehand”phraseonlyafewtimes,theideaof abeneficialinvisiblehandisubiquitousinhisworks.Overandover again,hereiteratedhisclaimthatindividualsactingintheirownselfinterestunwittinglybenefitthepublicweal.AsJacobVinerinterprets Smith’sdoctrine,“Providencefavorstradeamongpeoplesinorderto promoteuniversalbrotherhood”(Viner1972,foreword).Smithrepeatedlyadvocatedremovaloftradebarriers,state-grantedprivileges,and employmentregulationssothatindividualscanhavetheopportunity to “better their own condition” and thus make everyone better off (1965[1776],329).Theideaoftheinvisiblehanddoctrineoccurs moreoftenthanRothschildrealizes.VeryearlyinTheTheoryofMoral Sentiments,Smithmadehisfirststatementofthisdoctrine: Theancientstoicswereoftheopinion,thatastheworldwasgoverned bytheall-rulingprovidenceofawise,powerful,andgoodGod,every single event ought to be regarded as making a necessary part of the planoftheuniverse,andastendingtopromotethegeneralorderand happinessofthewhole:thatthevicesandfolliesofmankind,therefore, madeasnecessarypartofthisplanastheirwisdomandtheirvirtue; andbythateternalartwhicheducesgoodfromill,weremadetotend equallytotheprosperityandperfectionofthegreatsystemofnature. (Smith1982[1759],36). AlthoughSmithfailedtomentiontheinvisiblehandbynamein thispassage,thethemeisvividlyportrayed.TheauthorcitedGod throughoutTheTheoryofMoralSentiments,usingsuchnamesasthe AuthorofNature,Engineer,GreatArchitect,Creator,thegreatJudge ofhearts,Deity,andtheall-seeingJudgeoftheworld. 24 THE BIG THREE IN ECONOMICS HowReligiousWasAdamSmith? ThatGodisnotmentionedinTheWealthofNationshascausedsome observerstoconcludethatAdamSmith,likehisclosestfriendofthe ScottishEnlightenment,DavidHume,wasanonbeliever.Smithdidin factsharemanyvalueswithHume.Neitherofthemwasachurchgoer ortraditionalbelieverintheChristianfaith.BothScottishphilosophersopposedtheGreco-Christiandoctrineofantimaterialismand anticommercialism,andtheChristianphilosophythatcarnaldesires areinherentlyevil.Smith,likeHume,believedthatamoral,prosperoussocietywaspossibleinthislife,andnotjustinthelifetocome, and that this civil society should be based on science and reason, notreligioussuperstitionandauthoritarianism.Bothadvocatedfree trade,opposedthemercantilistsystemofgovernmentsubsidiesand regulations,andwarnedofthedangersofbiggovernment(Fitzgibbons1995,14–18). YetSmithexplicitlyopposedimportantaspectsofHume’sphilosophy,especiallyhishostilitytowardorganizedreligion.Humefavoreda noncompetitivestatereligionbecauseitwouldsapthezealofreligious followersandmaintainpoliticalorder.Smith,ontheotherhand,opposedastatereligion,whichhethoughtwouldencourageintolerance andfanaticism.Hethoughtreligionwasbeneficialifreligiousbeliefs andorganizationswerefreeandopen.“Inlittlereligioussects,the moralsofcommonpeoplehavebeenalmostremarkablyregularand orderly:generallymuchmoresothanintheestablishedchurch”(1965 [1776],747–48).Hefavored“agreatmultitudeofreligioussects” andacompetitiveatmospherethatwouldreducezealandfanaticism andpromotetolerance,moderation,andrationalreligion(744–45).9 Smith himself secretly made many charitable contributions in his lifetime,andoncehelpedablindyoungmantoprepareforanintellectualcareer(Fitzgibbons1995,138). SmithrejectedHume’samoralphilosophyandbothhisnihilistic 9.LaurenceIannaccone(GeorgeMasonUniversity),RobertBarro(Harvard),and EdwinWesthavetestedSmith’shypothesisonreligiousfreedom,comparingattendanceat churchandthedegreeofmonopolyinvariousProtestantandCatholiccountries,andhave concludedthatchurchattendancetendstoincreaseincountrieswithreligiousfreedom andawidevarietyofreligiousfaiths.SeeIannaccone(1991),West(1990). ADAM SMITH DECLARES A REVOLUTION 25 attitudetowardinformedjudgmentandhisextremeskepticismtoward traditionalvirtue,asfoundinATreatiseonHumanNature.Unlike Hume,Smithwasabelieverinafinalreconciler.Hisfaithwasmore inkeepingwiththeDeistbeliefinaStoicGodandStoicnaturethan inapersonalChristianGodofrevelation,orrewardsandpunishments inafuturelife.HisTheoryofMoralSentimentsenduredsixeditions duringhislifetime,andthefinalone,writtenafterTheWealthofNations,makesfrequentreferencestoGod.AsRobertHeilbronerstates, thethemeof“theInvisibleHand...runsthroughalloftheMoral Sentiments....TheInvisibleHandreferstothemeansbywhich‘the Authorofnature’hasassuredthathumankindwillachieveHispurposes despitethefrailtyofitsreasoningpowers”(Heilbroner1986,60). Smith followed Hume in rejecting creeds and institutionalized churches, but there is little doubt thatAdam Smith did believe in a Creator.AsA.L.Macfieconcludes,“thewholetoneofhisworkwillconvincemostthathewasanessentiallypiousman”(Macfie1967,111). AdamSmith’soverwhelmingthemethroughouthisworkswasto provide a liberal democratic society, a “system of natural liberty,” wherefreedomismaximizedeconomically,politically,andreligiously, withinaworkablemoralfoundationoflaws,customs,andvalues. FaithinanInvisibleGod HistorianAtholFitzgibbonshasaptlycalledthisneweconomicblueprint“AdamSmith’sSystemofLiberty,Wealth,andVirtue”(1995). Ifthis“newaccountofSmith”istrue,theinvisiblehandmetaphoris anentirelyappropriatewaytodescribehissystemofnaturalliberty, sinceestablishingavirtuoussocietyrequiresasystematicunderstandingofrightandwrong. Asindicatedearlier,theinvisiblehandisanothernameSmithused todescribeGod.AsSalimRashidstates,“perhapsthe‘InvisibleHand’ canbethoughtofasthedirectinghandoftheDeity”(Rashid1998, 219).ThoughnotatraditionalChristian,Smithwasfamiliarwiththe BibleandChristianbeliefs.IntheBible,providenceissometimes called the “Invisible God.” St. Paul wrote toTimothy, “Now unto theKingeternal,immortal,invisible,theonlywiseGod,behonour and glory for ever.Amen” (1 Timothy 1:17; see also Colossians 1:15–16). 26 THE BIG THREE IN ECONOMICS Itiscurioushowfrequentlymodern-dayeconomistshaveinvoked religiousterminologyindescribingtheinvisiblehand.Inhisfamous essay,“I,Pencil,”LeonardRead(adevoteeoftheAustrianschool) characterizestheinvisiblehand’sworkinthecreationofthepencil asa“mystery”anda“miracle”(Read1999[1958],10–11).Milton Friedmanusessimilarlanguage(FriedmanandFriedman1980,3, 11–13).FrankHahnnotesthattheinvisiblehandconceptassumes “alivelysenseoforiginalsin[inherentin]asocietyofgreedyand self-seekingpeople”(Hahn1982,1,5).JamesTobintalksof“true believersintheinvisiblehand”(Tobin1992,119).Andthisreligious symbolismbringsustothefourdegreesoffaithandhowtoapplyit tothewarringschoolsofeconomics. VaryingDegreesofFaithinCapitalism TheBiblediscussesahierarchyofindividualfaithinGodandhis works, differentiating among those who have no faith, little faith, greatfaith,andcompletefaithintheexistenceofahigherbeing.God is“invisible.”Consequently,peopledifferwidelyintheirreligious beliefs.Intoday’sworld,afewtruebelievershaveabsolutefaithin God,thathelivesandworksmiraclesintheirlives,andneverdoubt. Othershavegreatfaithinmiraculouspowers,thoughtheymayoccasionallydoubt.Atthesametimetherearemanywhohavelittlefaith inGod;theyoccasionallyseehis“invisible”handiwork,butseldom attendchurch.Finally,thereareagnosticsandatheists,whohaveno faithinGod,whorejecttheideaofrevelationorthesupernatural,and whorelysolelyonthefivesenses,thenaturalworld,andreason. Justaspeoplehavevaryinglevelsoffaithinan“invisibleGod,” sopeoplehavedifferingdegreesofbeliefinthebeneficial“invisible hand”ofcapitalismandfreedom.Byfaith,Imeanacertaindegreeof confidencethat,lefttotheirowndevices,individualsactingintheir ownself-interestwillgenerateapositiveoutcome.Faithrepresents a level of predictability of the future:Will an unfettered economy recoveronitsownfromarecession?Willeliminatingtariffsbetween twocountriesincreasetradeandjobsbetweenthem?Willdecontrollingoilpriceseliminatetheenergycrisis?Willtechnologicalunemploymentinoneindustryleadtonewemploymentinanother?Willa competitiveenvironmenteventuallybreakdownmonopolisticpower ADAM SMITH DECLARES A REVOLUTION 27 inaparticularmarket?Individualshavedifferinglevelsofconfidence inthemarketplacetorespondpositivelytochangeorcrisis.Somehave fullfaiththatallwillworkoutforthebetter.Othershavegreatfaith thatinmostcasesprivateactionswillbenefitsociety.Stillothershave littlefaithinthefreemarketandworrythat,mostofthetime,private enterprisedoeswhatisbestforindividualpeoplebutnotforsociety. Finally,thereareafewwhodenythatanygoodthingcancomefrom the dog-eat-dog chaotic world of Mammon, that the multinational corporateworldissocorruptandcrisis-pronethatnothingcanimprove themattersavemajorinstitutionalreformoroutrightrevolution. Inchapter9ofmybookViennaandChicago,FriendsorFoes? Iidentifyfourschoolsofeconomicsthatfitthesevaryinglevelsof beliefincapitalismandfreemarkets:thehard-coreMarxistshaveno faiththatthecapitalistsystemcansolvesocialproblems;theKeynesianshavedoubtsabouttheinvisiblehand;theChicagoeconomists havegreatfaiththatcapitalismworks;andtheAustrianshaveperfect, sometimesevenblind,faithincapitalism(Skousen2005,261–67). DoesAdamSmithCondoneEgotismandGreed? CriticsworrythattheScottishblueprintforfreedomwouldalsogive licensetoavariceandfraud,even“socialstrife,ecologicaldamage, andtheabuseofpower”(Lux1990).IsnotTheWealthofNations anunabashedendorsementofselfishgreedandvanity?Howcould AdamSmithignoreeverydaycasesofrapaciouscapitalistsdeceiving, defrauding,andtakingadvantageofcustomers,thuspursuingtheir ownself-interestattheexpenseofthepublic? Contrarytopopularbelief,Smithdidnotcondonegreed,egotism,and Western-styledecadence,nordidhewanteconomicefficiencytoreplace morality.Self-interestdoesnotmeanignoringtheneedsofothers;infact, itmeansjusttheopposite:hissystemassuresthatbothbuyerandseller benefitfromeveryvoluntarytransaction.Mostreadershavemisjudged Smith’sfamousquote,“Itisnotfromthebenevolenceofthebutcher,the brewer,orthebaker,thatweexpectourdinner,butfromtheirregardto theirowninterest.”Hereisthecontextofthisstatement: Butmanhasalmostconstantoccasionforthehelpofhisbrethren,anditis invainforhimtoexpectitfromtheirbenevolenceonly.Hewillbemore 28 THE BIG THREE IN ECONOMICS likelytoprevailifhecaninteresttheirself-loveinhisfavour,andshew themthatitisfortheirownadvantagetodoforhimwhatherequiresof them....GivemethatwhichIwant,andyoushallhavethiswhichyou want,isthemeaningofeverysuchoffer.Itisnotfromthebenevolence ofthebutcher,thebrewer,orthebaker,thatweexpectourdinner,but fromtheirregardtotheirowninterest.Weaddressourselves,nottotheir humanitybuttotheirself-love,andnevertalktothemofourownnecessitiesbutoftheiradvantages.(Smith1965[1776],14) WhatAdamSmithissayingisthatyoucanonlyhelpyourselfby helpingothers—theGoldenRule.Businessesthatfocusonfulfilling theneedsanddesiresoftheircustomerswillbethemostprofitable. Althoughcapitalistsaremotivatedbythedesireforpersonalgain, thewaythattheymaximizetheirprofitsisbyfocusingtheireveryday attention on meeting the needs of the public.Thus, the successful capitalistinevitablyorientshiseverydayconducttowardthetaskof helpingandservingothers.Self-interestleadstoempathy. Smithfavoredself-restraint.Indeed,hefirmlyassertedthatafree commercialsocietyfunctioningwithinthelegalrestraintsheoutlined wouldmoderatethepassionsandpreventadescentintoaHobbesian jungle,athemeheinheritsfromMontesquieu(seepages40–41)and laterSeniorNassau.10Hetaughtthatcommerceencouragespeople tobecomeeducated,industrious,andself-disciplined,andtodefer gratification.Itisthefearoflosingcustomers“whichrestrainshis[the seller’s]fraudsandcorrectshisnegligence”(1965[1776],129). Alllegitimateexchangesmustbenefitboththebuyerandtheseller, notoneattheexpenseoftheother.Smith’sinvisiblehandonlyworksif businessmenhaveanenlightenedlong-termviewofcompetition,where theyrecognizethevalueofreputationandrepeatbusiness.Inshort, self-interestpromotestheinterestsofsocietyonlywhentheproducer respondstotheneedsofthecustomer.Whenthecustomerisdefrauded ordeceived,aneventthatoccursalltoofrequentlyinthemarketplace, self-interestsucceedsattheexpenseofsociety’swelfare. 10.InhisinauguraladdressasthefirstDrummondProfessorofPoliticalEconomy atOxford,SeniorNassaupredictedthatthenewscience“willrankinpublicestimationamongthefirstofmoralsciences,”andclaimedthat“thepursuitofwealth... is,tothemassofmankind,thegreatsourceofmoralimprovement”(Schumacher 1973,33–34). ADAM SMITH DECLARES A REVOLUTION 29 Smithrecognizedthatpeoplearemotivatedbyself-interest.Itis naturaltolookoutforone’sselfandone’sfamilyaboveallinterests, andtorejectthiswouldbetodenyhumannature.Yetatthesame time,Smithdidnotcondonegreedorselfishness.ForAdamSmith, greedandselfishnessarevices.HewouldbeuncomfortablewithAyn Rand’scallingselfishnessavirtue,orWalterWilliams’slabelinggreed agoodthing(Rand1964).However,Smithacceptedtheseashuman frailties,andhecontendedthatthesebasemotivescannotbeoutlawed orprohibited,onlythattheymightbediscouragedandmoderatedin acommercialsocietywiththerightincentives.AsDineshD’Souza interpretsSmith,“Capitalismcivilizesgreedinmuchthesameway that marriage civilizes lust. Greed, like lust, is part of our human nature;itwouldbefutiletotrytorootitout.Whatcapitalismdoes istochannelgreedinsuchawaythatitworkstomeetthewantsand needsofsociety”(D’Souza2005). Infact,Smith’sidealsocietywouldbeinfusedwithvirtue,mutual benevolence,andciviclawsprohibitingunjustandfraudulentbusiness practices.Smith’s“impartialspectator”reflectsthemoralstandards andjudgmentofthecommunity(Smith1982[1759],215passim). Hiseconomicmaniscooperativeandfairwithoutharmingothers. A good moral climate and legal system would benefit economic growth. Smith supported social institutions—the market, religious communities,andthelaw—tofosterself-control,self-discipline,and benevolence(Muller1993:2).Afterall,AdamSmithwasnotjustan economist,butaprofessorofmoralphilosophy. DasAdamSmithProblem:SympathyVersusSelf-Interest Inhis1759work,TheTheoryofMoralSentiments,AdamSmithwrote that“sympathy”wasthedrivingforcebehindabenevolent,prosperous society.InTheWealthofNations,“self-interest”becametheprimary motive.GermanphilosopherscalledthisapparentcontradictionDas AdamSmithProblem,butSmithhimselfsawnoconflictbetweenthe two.Hetookanhistoricalperspective.Inaprecapitalistcommunity describedinTheTheoryofMoralSentiments,benevolence,orlove, wasprobablythemostdominantfactorwithinthefamilyorinrelationswithcolleaguesandfriendsinavillagewhereeveryoneknew eachother.However,inthecapitalistindustrialworld,citiessuchas 30 THE BIG THREE IN ECONOMICS LondonandParisattractthousandsofstrangersandthemotivation changesfromsympathytoself-interestineconomicactivity,for“itis invaintoexpectitfromtheirbenevolenceonly”(1965[1776],14). Smith combined both motives in TheWealth of Nations, where sympathyandself-interestwerethedrivingmotivatorsinamodern capitalistsociety.Smithbelievedthateverymanhadabasicdesireto beacceptedbyothers.Toobtainthissympathy,peoplewouldactin amannerthatwouldgainrespectandadmiration.Ineconomiclife, thismeantenlightenedself-interest,whereinbothsellerandbuyer mutually benefit in their transactions. Moreover, Smith contended thateconomicprogressandsurpluswealthwereaprerequisitefor sympathyandcharity.Inshort,Smithdesiredtointegrateeconomics andmoralbehavior(Fitzgibbons1995,3–4;Tvede1997,29). TheScottishphilosopherbelievedmantobemotivatedbyboth self-interest and benevolence, but in a complex market economy, where individuals move away from their closest friends and family,self-interestbecomesamorepowerfulforce.InRonaldCoase’s interpretation,“Thegreatadvantageofthemarketisthatitisableto usethestrengthofself-interesttooffsettheweaknessandpartiality of benevolence, so that those who are unknown, unattractive, and unimportantwillhavetheirwantsserved”(Coase1976,544). HowMonopolyHurtstheMarketSystem Smithsaidthatcompetitionwasabsolutelyessentialtoturningselfinterestintobenevolenceinaself-regulatingsociety.Hepreferredthe cheaper“naturalprice,orthepriceoffreecompetition”tothehigh priceofmonopolypowerand“exclusiveprivileges”grantedcertain corporationsandtradingcompanies(suchastheEastIndiaCompany). Smithvehementlyopposedthe“meanrapacity”and“wretchedspirit of monopoly” (428) to which privileged businessmen were accustomed.Competitionmeanslowerpricesandmoremoneytobuyother goods,whichinturnmeansmorejobsandahigherstandardofliving.AccordingtoSmith,monopolypowercreatesapoliticalsociety, characterized by flattery, fawning, and deceit (Muller 1993, 135). Monopolyfostersquickandeasyprofitsandwastefulconsumption (Smith1965[1776],578). Whilebelievinginthemarketplace,Smithwasnoapologistfor ADAM SMITH DECLARES A REVOLUTION 31 merchantsandspecialinterests.Inoneofhismorefamouspassages, he complained, “People of the same trade seldom meet together, evenformerrimentanddiversion,buttheconversationendsina conspiracyagainstthepublic,orinsomecontrivancetoraiseprices” (128).Hisgoalwastoconvincelegislatorstoresistsupportingthe vestedinterestsofmerchantsandinsteadtoactinfavorofthecommongood. AdamSmithUpdated AdamSmith’smodelofferstwohypotheses:first,thathissystemof naturallibertywouldleadtoahigherstandardofliving;andsecond, thattheeffectsofeconomicliberalismwouldbenefitrichandpoor alike. Since Smith wrote his book, have economists confirmed or deniedthesepropositions?Letusexamineeachhypothesis. Update1:FreeEconomiesAreRicher First,haseconomicfreedomledtohigherlivingstandards?IfAdam Smith were alive today, he would undoubtedly credit a free and democraticcapitalismwiththewidespreadincreaseinthestandard ofliving.AnexhaustivestudybyJamesGwartney,RobertA.Lawson, andWalter Block released in 1996 and updated subsequently eachyearbyGwartneyandLawson(see2004)appearstoconfirm thisSmithianviewthateconomicfreedomandprosperityareclosely related.Theauthorspainstakinglyconstructedanindexmeasuring thelevelofeconomicfreedomformorethan100countries,basedon fivecriteria(sizeofgovernment,propertyrightsandlegalstructure, soundmoney,trade,andregulations).Thentheycomparedtheeach country’slevelofeconomicfreedomwithitsgrowthrate,basedon per capita income in purchasing power terms.Their conclusion is documentedintheremarkablegraphinFigure1.2. According to this study, the greater the degree of freedom, the higherthestandardofliving,asmeasuredbypercapitarealgross domesticproduct(GDP)inpurchasingpowerterms.Nationswiththe highestleveloffreedom(e.g.,theUnitedStates,NewZealand,Hong Kong)grewfasterthannationswithmoderatedegreesoffreedom (e.g.,theUnitedKingdom,Canada,Germany)andsubstantiallymore 32 THE BIG THREE IN ECONOMICS Figure1.2 RelationshipBetweenEconomicFreedomandper CapitaGDP,2005 Countrieswithmoreeconomicfreedomhavesubstantiallyhigherper-capitaincomes. Source:TheFraserInstitute,Vancouver,B.C. rapidlythannationswithlittleeconomicfreedom(e.g.,Venezuela, Iran,Congo).Theauthorsconclude,“Countrieswithmoreeconomic freedomattractmoreinvestmentandachievegreaterproductivityfrom theirresources.Asaresult,theygrowmorerapidlyandachievehigher incomelevels”(GwartneyandLawson2004,38). Whataboutthosecountriesthatchangepolicies?Gwartneyand Lawson state, “Countries stagnate when their institutions stifle tradeanderodetheincentivestoengageinproductiveactivities.... Countrieswithlowinitiallevelsofincome,inparticular,areableto growrapidlyandmoveuptheincomeladderwhentheirpoliciesare supportiveofeconomicfreedom”(2004,38). Update2:ThePoorBenefitfromCapitalism Second,AdamSmitharguedthatbothrichandpoorbenefitfroma liberaleconomicsystem.Hedeclared,“universalopulence...extends itselftothelowestranksofthepeople”(Smith1965[1776],11).The modern-daystatisticalworkofStanleyLebergottandMichaelCox ADAM SMITH DECLARES A REVOLUTION 33 Table1.1 U.S.LivingStandards,1900–70 Percentageof householdswith Flushtoilets Runningwater Centralheating One(orfewer) occupantsperroom Electricity Refrigeration Automobiles Amongall familiesin1900(%) Amongpoor familiesin1970(%) 15 24 1 99 92 58 48 3 18 1 96 99 99 41 Source:Lebergott(1976,8). ReprintedbypermissionofPrincetonUniversityPress. confirmsthisSmithianviewanddisputesthecommonlyheldcriticism thatunderafreemarkettherichgetricherandthepoorgetpoorer. Thepooralsogetrich,accordingtorecentstudiesbyLebergott(1976) andCoxandAlm(1999). Stanley Lebergott, professor emeritus at Wesleyan University, hasstudiedindividualconsumermarketsinfood,clothing,housing, fuel,housework,transportation,health,recreation,andreligion.For example,hedevelopedthestatisticsshowninTable1.1toshowimprovementsinlivingstandardsfrom1900to1970. AsLebergott’stableshows,thestandardoflivinghasrisensubstantiallyforallclasses,includingthelowest,inthetwentiethcentury.He confirmsthestatementoncemadebyAndrewCarnegie:“Capitalism isaboutturningluxuriesintonecessities.”Throughthecompetitiveeffortsofentrepreneurs,workers,andcapitalists,virtuallyallAmerican consumershavebeenabletochangeanuncertainandoftencruelworld intoamorepleasantandconvenientplacetoliveandwork.Atypical homesteadin1900hadnocentralheating,electricity,refrigeration, flushtoilets,orevenrunningwater.Todayevenalargemajorityof poorAmericansbenefitfromthesegoodsandservices. AnotherrecentstudybyMichaelCox,aneconomistattheFederal ReserveBankofDallas,andRichardAlm,abusinesswriterforthe DallasMorningNews,concludesthattherealpricesofhousing,food, gasoline, electricity, telephone service, home appliances, clothing, 34 THE BIG THREE IN ECONOMICS and other everyday necessities have fallen significantly during the twentiethcentury.Theresearchersalsodemonstratethatthepoorin Americahaveseengradualimprovementsintheireconomiclivesas well.Morepoorpeopleownhomes,automobiles,andotherconsumer productsthaneverbefore,andtelevisionsarefoundineventhepooresthouseholds(CoxandAlm1999). Finally,GwartneyandLawsonhavedonestudiesshowingthatthe poorest10percentoftheworld’spopulationearnmoreincomewhen thecountriesinwhichtheyliveadoptinstitutionsfavoringeconomic freedom(2004,23).Economicfreedomalsoreducesinfantmortality, theincidenceofchildlabor,blackmarkets,andcorruptionbypublic officials, while increasing adult literacy, life expectancy, and civil liberties(2004,22–26). SmithFavorsaStrongButLimitedGovernment AsaproponentoftheScottishEnlightenmentandthevirtuesofnatural liberty,AdamSmithwasafirmbelieverinaparsimoniousbutstrong government.Hewroteofthreepurposesofgovernment:“Littleelse isrequiredtocarryastatetothehighestdegreeofopulencefromthe lowestbarbarism,butpeace,easytaxes,andatolerableadministration ofjustice”(inDanhert1974,218).Morespecifically,Smithendorsed (1) the need for a well-financed militia for national defense; (2) a legal system to protect liberty and property rights, and to enforce contracts and payment of debts; (3) public works—roads, canals, bridges,harbors,andotherinfrastructureprojects;and(4)universal public education to counter the alienating and mentally degrading effectsofspecialization(divisionoflabor)undercapitalism(Smith 1965[1776],734–35). Ingeneral,theScottishprofessorfavoredamaximumdegreeof personallibertyinsociety,includingadiversityofentertainment—as longasitwas“withoutscandalorindecency”(748).Smithwasno purelibertarian. SmithWarnsAbouttheDangersofBigGovernment Atthesametime,hewasasharpcriticofstatepower.Politiciansare usuallyspendthrifthypocrites,accordingtoSmith.Someofthefol- ADAM SMITH DECLARES A REVOLUTION 35 lowingquotesfromTheWealthofNationscouldbeusedinpolitical debatestoday: Thereisnoartwhichonegovernmentsoonerlearnsofanother,thanthat ofdrainingmoneyfromthepocketsofthepeople.(813) Itisthehighestimpertinenceandpresumption,therefore,inkingsand ministers,topretendtowatchovertheeconomyofprivatepeople,and torestraintheirexpense,eitherbysumptuarylaws,orbyprohibitingthe importationofforeignluxuries.Theyarethemselvesalways,andwithout exception,thegreatestspendthriftsinthesociety.Letthemlookwellafter theirownexpense,andtheymaysafelytrustprivatepeoplewiththeirs. Iftheirownextravagancedoesnotruinthestate,thatoftheirsubjects neverwill.(329) Greatnationsareneverimpoverishedbyprivate,thoughtheysometimes arebypublicprodigalityandmisconduct.Thewhole,oralmostthewhole publicrevenue,isinmostcountriesemployedinmaintainingunproductive hands.Sucharethepeoplewhocomposeanumerousandsplendidcourt, agreatecclesiasticalestablishment,greatfleetsandarmies,whointime ofpeaceproducenothing,andintimeofwaracquirenothingwhichcan compensatetheexpenseofmaintainingthem,evenwhilethewarlasts. Suchpeople,astheythemselvesproducenothing,areallmaintainedby theproduceofothermen’slabour.(325) Smithpleadedforbalancedbudgetsandopposedalargepublicdebt.Headvocatedprivatization,thesaleofcrownlandsasa waytoraiserevenuesandcultivateproperty.Hefavoredminimal governmentinterferenceincitizens’personallivesandeconomic activity.Smitharguedthatwarisunnecessaryandilladvisedin mostcases,andthatendingawarwillnotresultinmassiveunemployment(436–37). Hesoundedasifhehadjustbeenauditedbyrevenueagentswhen he expressed sympathy for taxpayers “continually exposed to the mortifying and vexatious visits of the tax-collectors” (880).After lambastingthecomplexityandinequalityofthetaxsystem,heprescribedtaxcutsacrosstheboard,althoughhefavoredrigidusurylaws andprogressivetaxation. Perhaps the following statement by Smith, taken from The TheoryofMoralSentiments,mosteloquentlyexpressestheuniversalprinciplesofindividualismandliberty,andthedangersof government: 36 THE BIG THREE IN ECONOMICS Themanofsystem...seemstoimaginethathecanarrangethedifferentmembersofagreatsocietywithasmucheaseasthehandarrangesthedifferentpiecesuponachess-board.Hedoesnotconsider thatthepiecesuponthechess-boardhavenootherprincipleofmotion besidesthatwhichthehandimpressesuponthem;butthat,inthegreat chess-boardofhumansociety,everysinglepiecehasaprincipleof motionofitsown,altogetherdifferentfromthatwhichthelegislature mightchoosetoimpressuponit.Ifthosetwoprinciplescoincideand actinthesamedirection,thegameofhumansocietywillgooneasily andharmoniously,andisverylikelytobehappyandsuccessful.If theyareoppositeordifferent,thegamewillgoonmiserably,andthe societymustbeatalltimesinthehighestdegreeofdisorder.(Smith 1982[1759],233–34) SmithEndorsesSoundMoneyandtheGoldStandard Smithalsoworriedaboutgovernments’manipulationofthemonetary system.Whilerejectingtheideathatgoldandsilveraloneconstitute acountry’swealth,hefavoredastablemonetarysystembasedon preciousmetals,andsupportedthedoctrineoffreebanking.Healso rejectedtheprevalent“quantitytheoryofmoney,”whichholdsthat thepricelevelrisesorfallsinproportiontochangesinthemoney supply.Inhis“DigressiononSilver,”Smithshowedthatpriceshave varied considerably when the supply of silver (money) increased (1965[1776],240). TheEssenceoftheClassicalModelofEconomics Insum,theclassicalmodeldevelopedbyAdamSmithandendorsed by his disciples in generations to come consisted of four general principles: 1. Thrift,hardwork,enlightenedself-interest,andbenevolence toward fellow citizens are virtues and should be encouraged. 2. Governmentshouldlimititsactivitiestoadministerjustice, enforceprivatepropertyrights,engageincertainpublicworks, anddefendthenationagainstaggression. ADAM SMITH DECLARES A REVOLUTION 37 3. Thestateshouldadoptageneralpolicyoflaissez-fairenoninterventionism in economic affairs (free trade, low taxes, minimalbureaucracy,etc.). 4. The classical gold/silver standard restrains the state from depreciating the currency and provides a stable monetary environmentinwhichtheeconomymayflourish. Asweshallsee,theclassicalmodelofAdamSmithwouldrepeatedly comeunderattackoverthecenturiesbyfriendsandfoesalike. AdamSmithandtheAgeofEconomists AdamSmithwasnotperfectbyanymeans.HeleddisciplesDavid RicardoandThomasMalthusdownthewrongroadwithhiscrude labortheoryofvalue,hiscritiqueoflandlords,hisstrangedistinctionbetween“productive”and“unproductive”labor,andhisfailure torecognizethefundamentalprincipleofsubjectivemarginalutilityinpricetheory.Buttheseareparentheticaldeviationsthatwere unfortunatelymagnifiedbytheclassicaleconomistsanddistorthis overwhelmingpositivecontributiontoeconomicscience. AdamSmithistobecongratulatedforhisfiercedefenseoffree tradeandfreemarkets,hiscentralthemeof“naturalliberty,”anda self-regulatingsystemofcompetitivefreeenterpriseandlimitedgovernment.Hiseloquentexpressionofeconomiclibertyhelpedfreethe worldfromprovincialmercantilismandheavy-handedintervention bythestate.Withouthisleadership,theIndustrialRevolutionmight havestalledforanothercenturyormore. TheGreatOptimist Adam Smith, a child of the Scottish Enlightenment, was above allanoptimistaboutthefutureoftheworld.Hisprincipalfocus throughout his economic magnum opus was the “improvement” of the individual through “frugality and good conduct,” saving and investing, exchange and the division of labor, education and capitalformation,andnewtechnology.Hewasmoreinterestedin increasingwealththandividingit(insharpcontrasttohisdisciple 38 THE BIG THREE IN ECONOMICS DavidRicardo).AccordingtoAdamSmith,evenapowerful,sinister governmentcannotstopprogress: “Theuniform,constant,anduninterruptedeffortofeverymanto betterhiscondition...isfrequentlypowerfulenoughtomaintainthe naturalprogressofthingstowardimprovement,inspitebothofthe extravaganceofgovernment,andofthegreatesterrorsofadministration”(1965[1776],326;cf.508). AdamSmithMakesaFamousRemark DuringtheAmericanRevolution,AdamSmithwasapproachedbya citizenwhowasalarmedbythedefeatoftheBritishatSaratogain 1777.“Thenationmustberuined,”themanexclaimedwithpanic inhisvoice.Smith,theninhisfifties,repliedcalmly,“Beassured, my young friend, that there is a great deal of ruin in a nation” (Rae 1895, 343; Ross 1995, 327). Smith’s dictum is frequently citedbyMiltonFriedman,GaryBecker,andothereconomistsin responsetoeconomicdoomsayers.Itsuggeststhatanationhas builtupsuchtremendouswealth,institutions,andgoodwillover thecenturiesthatitwouldtakemorethanamajorwarornatural disastertodestroyit. Hislifecomplete,AdamSmithmaywellhaveentertainedthewords ofthepsalmist,“Returnuntothyrest,Omysoul:fortheLordhath dealtbountifullywiththee”(Psalm116:7). Appendix:ThePre-Adamites AdamSmithdidnotcreatemoderneconomicsoutofavacuum, thewayAthenasprangfullgrownandfullyarmedfromthebrow of Zeus. Instead, Smith was influenced by a wide number of economicthinkers,goingallthewaybacktotheancientGreek philosophers. PlatoandAristotle A child of the Scottish Enlightenment, Smith would find little appeal in reading Plato’s Republic, which advocated an ideal city-stateruledbycollectivistphilosopher-kings.Heconsidered ADAM SMITH DECLARES A REVOLUTION 39 Aristotle better, because of his defense of private property and hiscritiqueofPlato’scommunism.Privateproperty,accordingto Aristotle,wouldgivepeopletheopportunitytopracticethevirtuesofbenevolenceandphilanthropy,allpartoftheAristotelian “goldenmean”and“goodlife.”ButAdamSmithwouldhaveno partofAristotle’sscornofmoneymakingandhisdenunciationof monetarytradeandretailcommerceasimmoraland“unnatural,” aphilosophythatwaslatersanctionedbymanyChristianwriters intheMiddleAges. Protestants,Catholics,andtheSpanishScholastics AdamSmithwasgreatlyinfluencedbyCalvinistdoctrinesfavoring thriftandhardworkwhilecondemningexcessiveluxury,usury,and “unproductive”servicelabor.CatholicsandProtestantsalikedebated what constituted “just price” in a market economy. The Spanish scholasticsinthesixteenthcenturydeterminedthatthe“justprice” wasnothingmorethanthecommonmarketprice,andtheygenerally supportedalaissez-fairephilosophy(Rothbard1995a,97–133).As Montesquieulaterwrote,“Itiscompetitionthatputsajustpriceon goodsandestablishesthetruerelationsbetweenthem”(Montesquieu 1989[1748],344). Inmanyways,AdamSmithaimedtoreplacetheantimaterialist Greco-ChristiandoctrinesofWesternEurope,whichwereahindrance tolibertyandeconomicgrowth,withasystemthatcombinedmoral living and the reasonable pursuit of material desires (Fitzgibbons 1995,v,16). BernardMandevilleandTheFableoftheBees SomeeconomistscontendthatAdamSmithdevelopedhis“invisible hand” concept from the scandalous work The Fable of the Bees(1997[1714]),byBernardMandeville(1670–1733),aDutch psychiatrist and pamphleteer. In the first version, Mandeville toldthestoryofathriving“grumblinghive”ofbeesthatturned “honest”andwasswiftlyreducedtopovertyanddestructionafter convertingtoamoralcommunity.Inthesecondpopularedition, Mandeville described a prosperous community in which all the 40 THE BIG THREE IN ECONOMICS citizensdecidedtoabandontheirluxuriousspendinghabitsand militaryarmaments.Theresultwasadepressionandcollapsein tradeandhousing.Hisconclusion:privatevicesofgreed,avarice, and luxury leadto public benefits ofabundantwealth,and“the Moment Evil ceases, the Society must be spoiled, if not totally dissolved.”Clearly,underMandeville’sinfamousparadox,selfinterestresultsinsocialbenefit. BothFriedrichHayekandJohnMaynardKeyneshavewrittenapprovinglyofMandeville’sfable.AccordingtoHayek,AdamSmith gained insights into the division of labor, self-interest, economic liberty,andtheideaofunintendedconsequencesfromMandeville (Hayek1984,184–85).KeynesapprovedofMandeville’santisaving sentimentsandstatistpressurestoassurefullemploymentinsociety (Keynes1973a[1936],358–61). However,itisclearinTheTheoryofMoralSentimentsthatSmith didnotapproveofMandeville.Callinghisbook“whollypernicious” andhisthesis“erroneous,”Smithdisagreedthateconomicprogressis achievedthroughgreed,vanity,andunrestrainedself-love,complainingthatMandevilleseemstomakenodistinctionbetweenviceand virtue(Smith1982[1759],308–10). MontesquieuandDouxCommerce Smith’sattitudetowardself-interestwasmorepositivelyaffectedbythe greatFrenchjuristandphilosopherCharlesdeSecondatMontesquieu (1689–1755).HisbookTheSpiritoftheLaws,firstpublishedin1748, encouragedJamesMadisonandAlexanderHamiltontopushforconstitutionalseparationofpowers,aconceptendorsedbySmith.Montesquieu, whowrotebeforetheIndustrialRevolution,sawmanyvirtuesindoux commerce(gentlecommerce).Heexpressedthenovelviewthatthepursuitofprofitmakingandcommercialinterestsserveasacountervailing bridleagainsttheviolentpassionsofwarandabusivepoliticalpower. “Commerce cures destructive prejudices,” Montesquieu declared, “it polishesandsoftensbarbarousmores....Thenaturaleffectofcommerce istoleadtopeace”(1989,338).AccordingtoMontesquieu,SirJames Steuart,andotherphilosophesoftheera,theimageofthemerchantand moneymakerasapeaceful,dispassionate,innocentfellowwasinsharp contrast with “the looting armies and murderouspiratesofthetime” ADAM SMITH DECLARES A REVOLUTION 41 (Hirschman1997,63).Commerceimprovesthepoliticalorder:“The spiritofcommercebringswithitthespiritoffrugality,ofeconomy,of moderation,ofwork,ofwisdom,oftranquility,oforder,andofregularity” (Hirschman1997,71).11Aspointedoutinthischapter,Smithendorsed thisprogressiveviewofcommercialsociety. IntheFrencheditionofTheGeneralTheory,JohnMaynardKeynes ratedMontesquieuasFrance’sgreatesteconomist,primarilydueto hisembryonicliquidity-preferencetheoryofinterest,hisopposition tohoarding,andhisadvocacyofahighlevelofmoneyexpenditure tomaintainandpromoteeconomicwelfare.Yet,unlikeKeynes,Montesquieuwasapassionatesupporterofthedoctrineoflaissez-faire. Hedetestedauthoritarianregimesandrejectedallformsofcentral planning,which,hesaid,robbedsocietyofitsnaturaldynamics.He defendedfreetradeasacivilizing,educating,andcooperativeforce betweennations.LikeAdamSmith,herecognizedthatgoodsand servicesratherthanpreciousmetalsrepresentedtherealwealthof anation.Heopposedexcessivemonetaryinflationasruinous,using Spainasanexample.BeforethePhysiocratspopularizedtheerroneousdoctrinethatagriculturewasthesolesourceofwealth,Montesquieutaughtthatindustryandcommercewereequallysignificantas fountainsofprosperity.Entrepreneurshipandfrugalitywereessential ingredientstoeconomicgrowth.And,unlikeMalthus,Montesquieu regardedalarge,growingpopulationasdesirable. Dr.FrançoisQuesnayandHisTableauÉconomique ThemostprominentPhysiocratencounteredbyAdamSmithinFrance wastheeminentsurgeonanddoctorFrançoisQuesnay(1694–1774), whoatonetimewasthepersonalphysicianofKingLouisXV’sfavoritemistress.Hisfamousdiagram,thetableauéconomique,was 11.Montesquieu’spropitiousimageofcapitalismreflectsthefamouslineby Dr.SamuelJohnson,“Therearefewwaysinwhichamancanbemoreinnocently employed than in getting money” (Boswell 1933, I, 657). It was John Maynard Keyneswhowrote,“Itisbetterthatamanshouldtyrannizeoverhisbankbalance thanoverhisfellow-citizens”(Keynes1973a[1936],374).Todaywemightsay, “Betterthatapersontyrannizesoverhisfavoritesportsteam(orhisfavoritestock) thanoverhisfellowman.” 42 THE BIG THREE IN ECONOMICS consideredbycontemporariesasoneofthethreegreatesteconomics inventionsofmankind,afterwritingandmoney(Smith1965[1776], 643). Quesnay’szigzagdiagram,firstpublishedin1758,hascreated considerable interest and controversy over the years. It has been hailedasaforerunnerofmanydevelopmentsinmoderneconomics:econometrics,Keynes’smultiplier,input–outputanalysis,the circularflowdiagram,andaWalrasiangeneralequilibriummodel. Itiscertainlya“macro”viewoftheeconomy,withoutanyreference toprices,butnooneissureofitsrealmeaning.Astheprincipal spokesmanforthePhysiocrats,Quesnayendorsedthefalsebelief inagricultureastheonly“productive”expenditureandindustryas “sterile.” AstoQuesnay’sinfluence,TheWealthofNationsproclaimedDr. Quesnaya“veryingeniousandprofoundauthor”whopromotedthe popularslogan“Laissezfaire,laissezpasser,”aphraseSmithwould endorse wholeheartedly, although he himself never referred to his systemaslaissez-faireeconomics.(Hepreferred“naturalliberty”or “perfectliberty.”)AsaleadingPhysiocrat,QuesnayopposedFrench mercantilism,protectionism,andstateinterventionistpolicies.However,TheWealthofNationsdeniedthebasicphysiocraticpremisethat agriculture,notmanufacturingandcommerce,wasthesourceofall wealth(1965[1776],637–52). RichardCantillon TheotherprominentinfluencesontheScottisheconomistwereRichardCantillon,JacquesTurgot,andEtienneBonnotdeCondillac.RichardCantillon(1680–1734)isregardedbyMurrayRothbardandother economichistoriansasthetrue“fatherofmoderneconomics.” AnIrishmerchantbankerandadventurerwhoemigratedtoParis, CantillonbecameinvolvedinJohnLaw’sinfamousMississippibubble in1717–20,butshrewdlysoldallofhissharesbeforethefinancial stormhit.Hisindependentstatusallowedhimtowriteashortbookon economics,EssayontheNatureofCommerceinGeneral(published posthumously in 1755). He died mysteriously in London in 1734, apparentlymurderedbyanirateservantwhosubsequentlyburned downhishousetocoverupthecrime. ADAM SMITH DECLARES A REVOLUTION 43 Cantillon’sEssayisreallyquiteimpressiveandundoubtedlyinfluencedAdamSmith.Itfocusesontheautomaticmarketmechanismof supplyanddemand,thevitalroleofentrepreneurship(downplayedin TheWealthofNations),andasophisticated“pre-Austrian”analysisof monetaryinflation—howinflationnotonlyraisesprices,butchanges thepatternofspending. JacquesTurgot JacquesTurgot(1727–81)wasaleadingFrenchPhysiocratwhose profound work, Reflections on the Formation and Distribution of Wealth(1766),alsoinspiredAdamSmith.Asadevotedfreetrader andadvocateoflaissez-faire,Turgotwasanableministeroffinance underLouisXVI;hedissolvedallthemedievalguilds,abolishedall restrictions on the grain trade, and maintained a balanced budget. TurgotwassoeffectivethatheprovokedtheireoftheKing,who dismissedhimin1776. AsaPhysiocrat,Turgotdefendedagricultureasthemostproductivesectoroftheeconomy,butbeyondthat,hisReflectionsexhibited aprofoundunderstandingofeconomics,evensurpassingSmithin manyareas.Hislucidworkoffersabrilliantunderstandingoftime preference,capitalandinterestrates,andtheroleofthecapitalistentrepreneurinacompetitiveeconomy.Heevendescribedthelawof diminishingreturns,laterpopularizedbyMalthusandRicardo. Condillac AnotherinfluentialFrencheconomistandphilosopherwasEtienne Bonnot de Condillac (1714–80). He lived the life of a Paris intellectualinthemid-1770sandcametothedefenseofTurgotinthe difficultieshefacedin1775asfinanceministeroverthegrainriots. LikeTurgotandMontesquieu,Condillacsupportedfreetrade.His importantworkCommerceandGovernmentwaspublishedin1776, onlyonemonthbeforeTheWealthofNations.Condillac’seconomicswasamazinglyadvanced.Herecognizedthatmanufacturingwas productive,thatexchangerepresentedunequalvalues,thatbothsides gainfromcommerce,andthatpricesaredeterminedbyutilityvalue, notlaborvalue(Macleod1896). 44 THE BIG THREE IN ECONOMICS DavidHume ThegreatphilosopherDavidHume(1711–76)wasaclosefriendofAdam Smithandwashighlyinfluentialinhislimitedwritingsontradeand money.SmithidentifiedhisScottishfriendas“byfarthemostillustrious philosopherandhistorian”ofhisage(Fitzgibbons1995,9)and“nearly totheideaofaperfectlywiseandvirtuousman,asperhapsthenature ofhumanfrailtywillpermit”(Smith1947,248).Humeopposedascetic self-denialandendorsedluxuryandthematerialisticgoodlife. LikeSmith,Humecondemnedthemercantilistrestraintsoninternational trade. Using his famous “specie-flow”mechanism,Hume provedthatattemptstorestrictimportsandincreasespecie(precious metals)inflowwouldbackfire.Importrestrictionswouldraisedomesticprices,whichinturnwouldreduceexports,increaseimports,and generateareturnoutflowofspecie. Humealsodebunkedmercantilistclaimsthatacquiringmorespecie wouldlowerinterestratesandpromoteprosperity.Humemadethe classicalargumentthatrealinterestratesaredeterminedbythesupplyofsavingandcapital,notbythemoneysupply.Anadherentto thequantitytheoryofmoney,Humefeltthatanartificialexpansion ofthemoneysupplywouldsimplyraiseprices. Smith’s close friendship with Hume caused many observers to conclude that he endorsed Hume’s antireligious rebellion and his purelysecularcommercialsociety.TheypointtothefactthatGodis notmentionedinTheWealthofNations.However,asnotedearlier, Smith did not abandon his religious beliefs. His Theory of Moral Sentiments,whichheeditedagainafterthepublicationofTheWealth ofNations,makesnumerousreferencestoGodandreligion. SmithwasadmittedlynolongerapracticingPresbyterian,rebellingagainstaustereCalvinistbehavior,buthewasabeliever,aDeist whoadoptedtheStoicbeliefthatGodworksthroughnature.Asan optimist,Smithbelievedinthegoodnessoftheworldandenvisioned aheavenonearth. BenjaminFranklin BiographersJohnRaeandIanSimpsonRossgivecredencetothe storythattheAmericanfoundingfather,BenjaminFranklin(1706–90), ADAM SMITH DECLARES A REVOLUTION 45 developedafriendshipwithAdamSmithandhadsomeinfluenceon hiswritingTheWealthofNations.JohnRaerecountedhowFranklin visitedwithSmithinScotlandandLondonand,accordingtoafriend ofFranklin,“AdamSmithwhenwritinghisWealthofNationswas inthehabitofbringingchapterafterchapterashecomposeditto himself[Franklin],Dr.Price,andothersoftheliterati;thenpatiently heartheirobservationsandprofitbytheirdiscussionsandcriticisms, sometimes submitting to write whole chapters anew, and even to reversesomeofhispropositions”(Rae1895,264–65;seealsoRoss 1995,255–56). Inhiseconomicwritings,Franklinwroteabouttheadvantagesof thrift,freetrade,andagrowingpopulation,themesreadilyapparent inTheWealthofNations.(However,I’mnotsureSmithwouldagree withFranklin’scase,publishedin1728,foradvocatingalargeincrease ofpapercurrencytostimulatetradeinPennsylvania.)Smith’sfavorableremarkstowardAmericanindependencemayhavebeendueto Franklin(Smith1965[1776],557–606). 2 FromSmithtoMarx TheRiseandFallofClassicalEconomics Thatablebutwrong-headedman,DavidRicardo,shuntedthe carofeconomicscienceontoawrongline—aline,however,on whichitwasfurtherurgedtowardconfusionbyhisequallyable andwrong-headedadmirer,JohnStuartMill. —WilliamStanleyJevons(1965,li) ThetimebetweenAdamSmithandKarlMarxwasmarkedbythethrill ofvictoryandtheagonyofdefeat.TheFrenchlaissez-faireschoolof Jean-BaptisteSayandFrédéricBastiatadvancedtheSmithianmodel tonewheights,butitwasnottolast,astheclassicalmodelofThomas RobertMalthus,DavidRicardo,andJohnStuartMilltookeconomics downintodesperatestraits.Thischaptertellsanominousstory. UponthepublicationofAdamSmith’sWealthofNationsin1776, aneweraofoptimismsweptEurope.SocialreformerswerehopefullyfollowingtheAmericanrevolutionthatpromised“life,liberty andthepursuitofhappiness,”andaFrenchrevolutionthatpledged “liberté,égalité,fraternité.”WilliamWordsworthdescribedtheearly idealismoftheFrenchRevolutionwhenhewrote,inThePrelude (Book11,lines108–09): Blisswasitinthatdawntobealive, ButtobeyoungwasveryHeaven! Ever since Sir Thomas More wrote Utopia, philosophers have dreamedofaworldofuniversalhappinesswithnowars,nocrime, andnopoverty.ThegeniusofAdamSmithwashisdevelopmentof an economic system of “natural liberty” that could bring about a peaceful,equitable,anduniversalopulence. Smith’s model of universal prosperity was encouraged initially by 46 FROM SMITH TO MARX 47 disciplesfromacountrythathadforcenturiesbeenGreatBritain’sfiercestenemy.TheFrencheconomistsJean-BaptisteSay(1767–1832)and FredericBastiat(1801–50),buildinguponthesoundprinciplesdeveloped by Cantillon, Montesquieu,Turgot, and Condillac, championed the boundlesspossibilitiesofopentradeandafreeentrepreneurialsociety. TheyimprovedupontheclassicalmodelofAdamSmithbyrejectingthe notionsofalabortheoryofvalueandtheexploitationofworkersunder free-enterprisecapitalism.Theirswasthefamousschoolof“laissezfaire, laissezpasser”(leaveusalone,letgoodspass)and“pastropgouverner” (nottogoverntoostrictly).Freetradeandlimitedgovernmentwould encourageeconomicperformanceandentrepreneurialexcellence. Bastiat,abrilliantFrenchjournalist,wasanindefatigableadvocate of free trade and laissez-faire policies, a passionate opponent ofsocialism,andanunrelentingdebaterandstatesman.Bastiatwas unrivaledinexposingfallacies,condemningsuchpopularclichesas “warisgoodfortheeconomy”and“freetradedestroysjobs.”Inhis classicessay,TheLaw(1850),Bastiatestablishedthepropersocial organizationbestsuitedforafreepeople,onethat“defendslife,liberty,andproperty...andpreventsinjustice.”Underthislegalsystem, “ifeveryoneenjoyedtheunrestricteduseofhisfacultiesandthefree dispositionofthefruitsofhislabor,socialprogresswouldbeceaseless,uninterrupted,andunfailing”(Bastiat1998[1850],5). SmithwasdeeplyinfluencedbyQuesnay,Turgot,andVoltaire,and onceTheWealthofNationswaspublished,theFrenchweresuccessful in publicizing Smith’s model of free enterprise and liberalized tradethroughouttheWesternworld.TheytranslatedSmith’sbook, publishedthefirstencyclopediaofeconomicsandthefirsthistoryof economicthought,andwrotethefirstmajortextbookineconomics, Say’sTreatiseonPoliticalEconomy,whichwastheprincipaltextbook intheUnitedStatesandEuropeduringthefirsthalfofthenineteenth century.ManyoftheSmithianprincipleswereadoptedbyAlexisde TocquevilleinhisprofoundstudyDemocracyinAmerica,including individualism,enlightenedself-love,industry,andfrugality. “TheFrenchAdamSmith” J.-B.Say(1767–1832)wascalled“TheFrenchAdamSmith.”WitnesstoboththeAmericanandFrenchrevolutions,hewasacotton 48 THE BIG THREE IN ECONOMICS manufacturerwhobelievedthatsoundeconomicsshouldbebuiltupon goodtheoryandmodelsthatcouldbetestedbyobservationlestthey becomeunrealisticandmisleading.Hewascriticalofhiscolleague DavidRicardo’slabortheoryofvalueandhispenchanttoabstract modelbuilding,leadingeconomicsdownadangerousroad.According toSay,economistslikeRicardowhodon’tsupporttheirtheorieswith factsare“butidledreamers,whosetheories,atbestonlygratifying literarycuriosity,werewhollyinapplicableinpractice”(Say1971 [1880],xxi,xxxv) SayintroducedseveralsoundprinciplesofeconomicsinhisTreatise onPoliticalEconomy,firstpublishedin1805,particularlytheessential roleoftheentrepreneurandSay’slawofmarkets,whichbecamethe fundamentalprincipleofclassicalmacroeconomics. In Chapter 7 of Book II, “On Distribution,” Say introduced the roleoftheentrepreneur,the“master-agent”or“adventurer,”asan economicagentseparatefromthelandlord,worker,orevencapitalist. ForSay,theentrepreneurservesasacreatorofnewproductsandprocesses,andmanageroftherightcombinationofresourcesandlabor. Tosucceed,theentrepreneurmusthave“judgment,perseverance,and knowledgeoftheworld,”Saynoted.“Heiscalledupontoestimate, withtolerableaccuracy,theimportanceofthespecificproduct,the probableamountofthedemand,andthemeansofproduction:atone timehemustemployagreatnumberofhands;atanother,buyorordertherawmaterial,collectlaborers,findconsumers,andgiveatall timesarigidattentiontoorderandtheeconomy;inaword,hemust possesstheartofsuperintendenceandadministration.”Hemustbe willingtotakeon“adegreeofrisk”andthereisalwaysa“chanceof failure,”butwhensuccessful,“thisclassofproducers...accumulates thelargestfortunes”(Say1971[1880],329–32). Say’sLaw:TheClassicalModelofMacroeconomics Sayisalsofamousfordevelopingtheclassicalmodelofmacroeconomics, knownasSay’slawofmarkets—“supplycreatesitsowndemand.”Ithas beenthesourceofmuchmisunderstanding,especiallybyKeynes,who distortedthetruemeaningofSay’slaw(formoreonthis,seechapter5 onKeynes).Inchapter15ofhistextbook,Sayintroducedtheideathat production(supply)isthesourceofconsumption(demand).Heusedan FROM SMITH TO MARX 49 exampleinagriculture:“Thegreaterthecrop,thelargerarethepurchases ofthegrowers.Abadharvest,onthecontrary,hurtsthesaleofcommoditiesatlarge”(1971[1880],135).Inotherwords,Say’slawisreallythis: thesupply(sale)ofXcreatesthedemand(purchase)forY.Touseanupto-dateexample,whenMicrosoftcreatedWindowssoftware,itcreated aboominjobsandconsumerspendinginSeattle;whenMicrosoftwas suedbythefederalgovernmentforantitrustviolationsanditsstockfell, Seattle’seconomysufferedandconsumptiondeclined. Say’s law is consistent with business-cycle statistics. When a downturnstarts,productionisthefirsttodecline,aheadofconsumption.Andwhentheeconomybeginstorecover,productionisthefirst tomakeacomeback,followedbyconsumption.Economicgrowth beginswithanincreaseinproductivity,ariseinnewproductsand newmarkets.Hence,businessspendingisalwaysaleadingindicator overconsumerspending.Sayconcluded,“Thus,itistheaimofgood governmenttostimulateproduction,ofbadgovernmenttoencourage consumption”(1971[1880],139). AcorollaryofSay’slawisthatsavingsisbeneficialtoeconomic growth.Hedeniedthatfrugalityandthriftmightleadtoadeclinein expendituresandoutput.Savingsissimplyanotherformofspending, andperhapsevenabetterformofspendingthanconsumptionbecause savingsisusedintheproductionofcapitalgoodsandnewprocesses.No doubtSaywasinfluencedbyhisreadingofBenjaminFranklin’sdefense ofthriftasavirtueinthelatter’sAutobiography,andinadagessuchas “apennysavedisapennyearned”and“moneybegetsmoney.” StevenKatessummarizestheconclusionsofSay’slawofmarkets andclassicalmacroeconomics(Kates1998,29): 1. Acountrycannothavetoomuchcapital. 2. Savingandinvestmentformthebasisofeconomicgrowth. 3. Consumptionnotonlyprovidesnostimulustowealthcreation butisactuallycontrarytoit. 4. Demandisconstitutedbyproduction. 5. Demanddeficiency(i.e.,over-production)isneverthecauseof economicdisturbance.Economicdisturbancearisesonlyifgoods arenotproducedinthecorrectproportiontoeachother. 50 THE BIG THREE IN ECONOMICS TheClassicalModelandthe“DismalScience” Adam Smith’s optimistic vision was never in more capable hands thanthoseoftheFrenchdevoteesoflaissez-faire.Shortofmarginal analysis,theycarriedthedoctrineoftheinvisiblehandandthenatural harmonyofthemarketsystemtoitszenith.Unfortunately,though, thestoryofeconomicssuddenlytookanunexpectedshiftfromthe upbeatworldofAdamSmithtowhatwouldbelabeled“thedismal science.”Remarkably,theapostasyawayfromSmith’smasterpiece beganwiththewritingsoftwoofhisowndisciplesinhisowncountry, ThomasMalthusandDavidRicardo. TheBritisheconomistsThomasRobertMalthus(1766–1834),David Ricardo(1772–1823),andJohnStuartMill(1806–73)continuedthe classicaltraditioninsupportingthevirtuesofthrift,freetrade,limited government,thegoldstandard,andSay’slawofmarkets.Inparticular,Ricardovigorouslyandeffectivelyadvocatedananti-inflation, gold-backedBritishpoundsterlingpolicyaswellasarepealofboth theCornLaws,England’snotoriouslyhightariffwallonwheatand otheragriculturalgoods,andthePoorLaws,England’smodestwelfaresystem. TheDiamond-WaterParadox Yet there was a problem. Classical economics afterAdam Smith suffered from a serious theoretical flaw that provided ammunition toMarxists,socialists,andothercriticsofcapitalism.Smithhimself supportedanoptimisticmodelfavoringtheharmonyofinterestsand universalprosperity.Heusedthemakingofpinsandthewoolencoat toexplainhowlaborersandcapitalistsworktogethertocreateusable products.Buthehadnorealconceptofhowpricesandthecostsof productivefactorsweredeterminedinthemarketplacetosatisfyconsumerwants,aflawthatunderminedhisharmonicmodel. ThequestionSmithandtheclassicaleconomiststriedtoanswer was:Howaregoodsandservices,andtheproductivefactors,valuedin agrowingeconomytosatisfyconsumerwants?Theytriedtoanswer thisquestionbyresolvingthefamousdiamond-waterparadox.Whyis itthatanessentialcommoditylikewaterissolittlevaluedinthemarketplacewhileimpracticaldiamondsaresohighlyprized?ToSmith FROM SMITH TO MARX 51 andhisdisciples,thisparadoxwasirresolvable.Theywerebaffled bytheobservationthatsomegoodswerevaluedmorein“exchange” thanin“use.”Thefailuretoresolvethisparadox,whichremained unanswereduntilagenerationlaterbythemarginalistrevolution(see chapter4),ledtodisastrousresults.Marxistsandsocialistsusedthis wedgetolabelcommercialsocietyasunjustandimmoral,asystem inwhichprofittrumpsconsumersatisfaction. Furthermore,Smith’sdisciples,especiallyMalthus,Ricardo,and Mill,promotedanantagonisticmodelofincomedistributionunder capitalism that gave classical economics a bad reputation, leading EnglishcriticThomasCarlyletolabelit“thedismalscience.”Instead offocusingonSmith’spositiveviewofwealthcreationandharmony ofinterests,hisBritishdisciplesemphasizedthedistributionofwealth, theconflictofinterests,andthelabortheoryofvalue. MalthusChallengestheNewModelofProsperity ThefirstchallengetoSmith’swonderfulworldcamefromanirreverentyoungparson,ThomasRobertMalthus.In1798,attheageof thirty-two,Malthuspublishedananonymouswork,entitledEssayon Population,whichcontendedthatearth’sresourcescouldnotkeep upwiththedemandsofanever-growingpopulation.Hisbrooding tractforeverchangedthelandscapeofeconomicsandpolitics,and quicklycutshortthepositiveoutlookofSmith,Say,andotherstudents of the Enlightenment. Malthus, along with his best friend, David Ricardo,assertedthatpressuresonlimitedresourceswouldalways keeptheoverwhelmingmajorityofhumanbeingsclosetotheedge ofsubsistence.Accordingly,MalthusandRicardoreversedthecourse ofcheerfulSmithianeconomics,eventhough,ironically,theywere stringentfollowersofSmith’slaissez-fairepolicies. Malthushashadapowerfulimpactonmodern-daythinking.He isconsideredthefounderofdemographyandpopulationstudies.He isacknowledgedtobethementorofsocialengineerswhoadvocate strictpopulationcontrolandlimitstoeconomicgrowth.Hisessay onpopulationunderlinesthegloomyandfatalisticoutlookofmany scientistsandsocialreformerswhoforecastpoverty,crime,famine, war, and environmental degradation due to population pressures onresources.HeeveninspiredCharlesDarwin’stheoryoforganic 52 THE BIG THREE IN ECONOMICS evolution, which explains how limited resources facing unlimited demandscreatedthepowerofnaturalselectionandsurvivalofthe fittest.Ultimately,thefatalisticpessimismofMalthusandRicardo hasgiveneconomicsitsreputationasa“dismalscience.” Malthus’sdoomsdaythesiswasthat“thepowerofpopulationis indefinitelygreaterthanthepoweroftheearthtoproducesubsistence forman,”andthereforethemajorityofhumansweredoomedtolive a Hobbesian existence (1985 [1798], 71). His book identified two basic“lawsofnature”:first,populationtendstoincreasegeometrically(1,2,4,8,16,32,etc.),andsecond,foodproduction(resources) tendstoincreaseonlyarithmetically(1,2,3,4,5,etc.).Themeans ofsupportinghumanlifewere“limitedbythescarcityofland”and the“constanttendencytodiminish”theuseofresources,areference tothelawofdiminishingreturns.Theresultwouldbeaninevitable crisisof“miseryandvice”wherebytheearth’sresourceswouldnot satisfythedemandsofagrowingpopulation(Malthus1985[1798], 67–80,225). IsMalthusrightaboutthefirst“lawofnature,”thathumanpopulationgrowsgeometrically?Indeed,sinceMalthuswrotehisessay,the world’spopulationhasskyrocketedfromfewerthan1billionpeople toover6billion.However,inlookingmoredeeplyatthesharprisein worldpopulationsince1800,weseethatthecauseisnotMalthusian innature.Theincreasehasbeenduetotwofactorsunforeseenby Malthus.First,therehasbeenasharpdropintheinfantmortalityrate duetotheeliminationofmanylife-threateningdiseasesandillnesses throughmedicaltechnology.Second,therehasbeenasteadyrisein theaveragehumanlifespanduetohigherlivingstandards;medical breakthroughs;improvementsinsanitation,healthcare,andnutrition; andadeclineintheaccidentrate.Asaresult,morepeopleareliving toadulthood,andmoreadultsarelivinglonger. Atthesametime,thereisagoodchancethatworldpopulationwill soontopout,dueespeciallytothesharpslowdowninthebirthrate overthepastfiftyyearsinbothindustrialanddevelopingcountries. Thisislargelyduetothewealtheffect:wealthierpeopletendtohave fewerchildren(contrarytowhatMalthuspredicted).Overthepast fiftyyears,thebirthrateindevelopedcountrieshasfallenfrom2.8to 1.9childrenperfamily,andindevelopingcountriesfrom6.2to3.9. Thetrendisunmistakable:womenarehavingfewerchildren,andin FROM SMITH TO MARX 53 somemoredevelopedcountries,especiallyinEurope,thebirthrate isfarbelowreplacement. Malthus’sSinsofOmission WhataboutMalthus’ssecond“lawofnature,”whichsaysthatresourcesarelimitedandrestrictedbythelawofdiminishingreturns? Hereagain,historyhasnotsupportedMalthus.Thelawofdiminishingreturnsonlyappliesifweassume“allotherthingsequal,”that technologyandthequantityofotherresourcesarefixed.Butnoinput isfixedinthelongrun—neitherland,norlabor,norcapital.Theeconomicimportanceoflandhasinfactdwindledinthemodernworld, duetointensivefarmingtechniquesandthegreenrevolution.Malthusignoredthetechnologicaladvancesinagriculture,theconstant discoveryofnewmineralsandotherresourcesintheearth,andthe roleofpricesindetermininghowfastorslowresourcesareusedup. Inshort,hefailedtorecognizehumaningenuity.1 Malthus proved to be spectacularly wrong about food production,theadventoffarmingtechnology,theuseoffertilizers,and thevastexpansionofirrigation.Theamountofcultivatedlandand thevolumeoffoodproductionhavebothrisendramatically.Infact, mostfamineshavebeenblamedonill-advisedgovernmentpolicies, notnature. The story of Thomas Malthus is instructive in developing an understandingofthedynamicsofagrowingeconomyandarising population.Granted,Malthusrecognizedthatgovernmentintervention istypicallycounterproductiveinalleviatingpovertyandcontrolling population growth, and thus he joinedAdam Smith in adopting a laissez-fairepolicy(hewasvilifiedbycriticsforopposingpoverty programs,birthcontrol,andevenvaccines).ButheultimatelyabandonedhismentorbydisavowingfaithinMotherEarthandthefree market’sabilitytomatchthesupplyofresourceswiththegrowing demandsofarisingpopulation.Essentially,hefailedtocomprehend theroleofpricesandpropertyrightsasanincentivetorationscarce 1.ForanalternativeviewtoMalthusianism,seeJulianL.Simon,ed.,TheState ofHumanity(1995)andTheUltimateResource2(1996). 54 THE BIG THREE IN ECONOMICS resourcesandasaproblem-solvingmechanism.Worse,hemisunderstood the dynamics of a growing entrepreneurial economy—how alargerpopulationcreatesitsownseedsofprosperitythroughthe creationofnewideasandnewtechnology. AlthoughAdamSmithdidhintattheideaofasubsistencewage, he firmly believed that wage earners could rise above subsistence throughtheadoptionofmachinery,tools,andequipment.Free-market capitalismwastheescapemechanismfrompoverty.Malthus,onthe other hand, was gloomy and even fatalistic about man’s ability to breakawayfrommiseryandvice.Forhim,mankindwasdestinedto bechainedtotheironlawofwages. DavidRicardo,forGoodorBad TheeminentBritisheconomistDavidRicardofellintothesametrap ashisfriendMalthus.Afinancialeconomistwhomadeafortunein governmentsecurities,Ricardomademanypositivecontributionsto economicscience,especiallythelawofcomparativeadvantageand thequantitytheoryofmoney.Hepromotedfreetradeandhardmoney, andhiswritingsinfluencedtherepealoftheCornLaws,England’s notorioushightariffwallonagriculturalgoodsin1846,andEngland’s returntothegoldstandardin1844.YetDavidRicardohadadark side.Hisanalyticalmodelingisatwo-edgedsword.Itgaveusthe quantitytheoryofmoneyandthelawofcomparativeadvantage,but italsogaveusthelabortheoryofvalue,theironlawofsubsistence wages,andsomethingeconomistscallthe“Ricardianvice,”defined aseithertheexcessiveuseofabstractmodelbuildingortheuseof falseandmisleadingassumptionsto“prove”theresultsonedesires (suchashislabortheoryofvalue).Someoftheworstideaspickedup byKarlMarxandthesocialistscomedirectlyfromreadingRicardo’s textbook On Principles of Political Economy and Taxation (1951 [1817]).MarxhailedRicardoashisintellectualmentor.Aschoolof “neo-Ricardian”socialistshasdevelopedundertheinfluenceofPiero Sraffa,Ricardo’sofficialbiographer.2 2.ForacriticalexaminationofSraffianeconomics,seeMarkBlaug,Economics Through the Looking Glass: The Distorted Perspective of the New Palgrave DictionaryofEconomics(1988). FROM SMITH TO MARX 55 Essentially,Ricardo,forallhisloveofSmith,tookeconomicsdown averydangerousroad,apartfromhispolicyrecommendations.He createdaneweconomicwayofthinking,awayfromtheharmonious “growth”modelofAdamSmithandtowardanantagonistic“distribution”model,whereworkers,landlords,andcapitalistsfoughtover theeconomy’sdesserts.MarxandthesocialistsexploitedRicardo’s hostilesystemtothefullest.Smith’smodelfocusesonhowtomake theeconomygrow,whileRicardo’smodelstresseshowtheeconomy isdividedupamongvariousgroupsorclasses.Ricardoemphasized classconflictratherthanSmith’s“naturalharmony”ofinterests. TheRicardianDeviceorVice? Ricardoisconsideredthefounderofeconomicsasarigorousscience involving mathematical precision. The financial economist had a remarkablegiftofabstractreasoning,developingasimpleanalytical toolinvolvingonlyafewvariablesthatyielded,afteraseriesofmanipulations,powerfulconclusions.Thismodel-buildingapproachhas beenadoptedbymanyprominenteconomists,includingJohnMaynard Keynes,PaulSamuelson,andMiltonFriedman,andhasledtothe popularityofeconometrics.MarkBlaugcomments,“Ifeconomics isessentiallyanengineofanalysis,amethodofthinkingratherthan abodyofsubstantialresults,Ricardoliterallyinventedthetechnique ofeconomics”(Blaug1978,140). But “blackboard economics,” as Ronald Coase calls it, has its drawbacks.Itusesunrealisticandsometimesevenfalseassumptions. Withoutreferencetohistory,sociology,philosophy,orinstitutional framework,Ricardo’sdevicebecomesaRicardianvice,strippingeconomicsofitssoul.Purelydeductivereasoningandhighmathematical formulasdivorcetheoryfromhistory.TakealookatPaulSamuelson’s Foundations of Economic Analysis (1947) or neo-Ricardian Piero Sraffa’sProductionofCommoditiesbyMeansofCommodities(1960). Samuelson’sbookisvirtuallynothingbutdifferentialequationsand assumptionsfarremovedfromreality.Sraffa’sworkhardlycontainsa singlesentencethatreferstotherealworld.Theyarebothverymuch inthetraditionofRicardo. “The origin of the misapprehension upon which the whole of economic theory is based must be traced to David Ricardo,” writes 56 THE BIG THREE IN ECONOMICS EltonMayo,abusinessprofessoratHarvard(1945,38).Mayoblames Ricardo’sunrealistictheorizingonhisbackgroundasastockbroker,3 farremovedfromtherealitiesoftheproducingeconomy(1945,39). Adam Smith’s Wealth of Nations abounded with theoretical propositions,buthistheorieswerefollowedbynumeroushistorical illustrations.NotsowithRicardo.“Hisingeniousmind,”writesone historian,“essentiallythatofabrillianttheoretician,neverdisplayed anysignificantinterestinthepast”(Snooks1993,23).Itwasthiskind ofabstracttheorizingthatcausedJ.-B.Saytolabeleconomists“idle dreamers”(1971[1880],xxxv).EvenPaulSamuelson(himselfan abstractthinker)confessedonce,“Ithassometimesbeensuggested thatourmostadvancedstudentsknoweverythingexceptcommon sense” (1960, 1652). Indeed, studies byArjo Klamer and David Colandersuggestacertaindisillusionmentwiththehighlyabstract mathematicalmodelingthatpervadesPh.D.programsineconomics. After surveying the graduate programs at six Ivy League schools, KlamerandColanderconcludethat“economicresearchwasbecomingseparatefromtherealworld”(1990,xv).Formalismhasaniron griponthediscipline. Heuristicmodelbuildingcanbeusefulingeneratingbestestimates anddecentresults,butmodelingcaneasilydistortrealityandleadto damagingresults.Inhisclassicwork,OnthePrinciplesofPolitical EconomyandTaxation,Ricardocarriedhistheorizingtoextremelevels,wherebyhemadeallkindsoflimitinganddubiousassumptions inordertogettheresultshewaslookingfor.Ricardo’sPrinciples wastediousandabstract,fullofEuclidian-likedeductionswithno historicalcasestudies.Studentsoftencalledit“Ricardo’sbookof headaches”(St.Clair1965,xxiii). EconomistsareseldomindifferentaboutRicardo.Theyeitherlove orhatehim,andsometimesboth.PerhapsJohnMaynardKeynesbest sumsupthisattitude:“Ricardo’smindwasthegreatestthateveraddresseditselftoeconomics,”Keynessaid,andthencomplainedthat “thecompletedominationofRicardo’s[economics]foraperiodof 3.AhighlysuccessfulspeculatorwhomadeafortuneasastockjobberandgovernmentloancontractorduringtheNapoleonwars.Seemyarticle,“HowRicardo Became the Richest Economist in History,” The Making of Modern Economics (2001,96–97). FROM SMITH TO MARX 57 ahundredyearshasbeenadisastertotheprogressofeconomics” (Keynes1951[1931],117). RicardoFocusesonDistribution,NotGrowth HowdidRicardoshiftawayfromhismentor,AdamSmith?Smith recognized that economic freedom and limited government would create“universalopulence,”butthefounderofclassicaleconomics struggledtodevelopasoundtheoreticalframework(otherthanthe divisionoflabor)withwhichtoexplainhowconsumersandproducersworkthroughtheprofit-and-losssystemtoachievethis“universal opulence.”RicardoandtheBritishdisciplestookSmith’sparenthetical statements(suchashislabortheoryofvalueinacrudeeconomy,and hiscriticismoflandlords)andcreatedamodelofclassstrugglerather thanoneofharmonyofinterests—theironlawofsubsistencewages insteadofuniversaleconomicgrowth.Theyviewedtheeconomyasif itwerealargecake,wherealargerdessertforcapitalistsandlandlords couldonlymeanasmallerpieceforworkers. InalettertoMalthus,Ricardoexplainedhisprimarydifference: “Politicaleconomy,youthink,isanenquiryintothenatureandcauses ofwealth[AdamSmith’sview];Ithinkitshouldratherbecalledan enquiryintothelawswhichdeterminethedivisionoftheproduce of industry among the classes who concur in its formulation” (in Rothbard1995b,82). ThedifferencebetweenAdamSmithandRicardoonthismacro modeloftheeconomycanbestbeillustratedintermsofapiechart (seeFigure2.1).ForRicardo’s“classconflict”model,thefocalpoint ishowthefruitsoftheeconomy(thepie)shouldbedividedbetween workers,landlords,andcapitalists.Clearly,iflandlordsandcapitalistsgetmoreofthepie,workersgetless.Andviceversa.ForAdam Smith’s“harmonyofinterests”model,thefocalpointisonmakingthe economygrow,tomakethepiebigger.Inthisway,thereneednotbe aconflictofinterests.Ifthepiegetsbigger,everyone—theworkers, landlords,andcapitalists—getsmore. Ricardo’santagonisticsystemwastragicforeveryoneexceptthe landlords.Inhis“cornmodel,”asitiscalled,Ricardo’sworkerswere machinelikeunitsearningonlysubsistencewagesoverthelongrun. If wages rose, workers would have more children, which would in 58 THE BIG THREE IN ECONOMICS � Figure2.1 TwoModelsoftheEconomy Landlords Landlords (rents) � � (rents) Capitalists Workers Capitalists (wages) � DavidRicardo’s antagonisticmodel � (profits & interest) (profits & interest) Workers (wages) � AdamSmith’s harmonicmodel turnincreasethesupplyoflaborersandforcewagesbackdown.Thus, Ricardo’s“ironlawofwages”presentedableakoutlookforworkers. Capitalists fared better, but were hardly animated. In Ricardo’s model,theywereauniform,boringlotmechanicallysavingandaccumulatingcapital.Moreover,profitscouldincreaseonlyattheexpense oflowerwages,andviceversa.InhisPrinciples,Ricardocalledthis inverse relationship between wages and profits the “fundamental theoremofdistribution.”Herepeatedlystated,“Inproportionthen aswagesrose,wouldprofitsfall”(Ricardo1951,I,111)and“profits dependonwages”(1951,I,143,35). Worse,profitswerealsoinclinedtofallinthelongrunduetothe “law of diminishing returns.” Under Ricardo’s myopic worldview, higherwageswouldstimulatepopulationgrowth,whichinturnmeant farmingmorelandtofeedmoremouths,andthatmeantusinglessproductiveland.Thepriceofgrainwouldrise,benefitinglandlords’rents, butprofitswouldfallbecausecapitalistswouldhavetopayworkers moretokeepthemfromstarving(duetohigherfoodprices). The only beneficiaries in Ricardo’s picture were the landlords. Theyearnedhigherrentsasgrainpricesrose.Thetenantfarmersdid notbenefitfromhighergrainpricesbecausetheyhadtopayhigher rents.RicardovindicatedthewordsofAdamSmith:“landlordslove toreapwheretheyneversowed”(Smith1965[1776],49). FROM SMITH TO MARX 59 AccordingtoRicardo’sfatalisticsystem,wagestendtowardsubsistencelevels,profitsdeclinelongterm,andlandlordskeepaddingto theirshareofunjustreturns.AsOswaldSt.Claircomments,landlords, “thoughcontributingnothinginthewayofworkorpersonalsacrifice, willneverthelessreceiveanever-increasingportionofthewealthannuallycreatedbythecommunity”(St.Clair1965,3). WhatwastheflawinRicardo’sthinking?Hiscornmodelignored the benefits that workers accrue from technological advances that makethemmoreproductive.Theirwageswouldtendtoriseascompaniesbecamemoreprofitable.(Empiricalstudiesdemonstratethat industrieswithhighprofitmarginstendtopayworkersmore.)He failedtoseelandlordrentsaspricesignalsdeterminingthehighest value or opportunity cost of land.Yet most economists would not recognizetheseinsightsforanothergeneration.Meanwhile,Marxand thesocialistspickeduponRicardo’sattackontheidlelandlordsand theexploitivecapitalists.Inaddition,Ricardo’scritiqueencouraged HenryGeorge’slandnationalizationandsingletaxmovementinthe latenineteenthcentury. RicardoSearchesinVainforIntrinsicValueinLabor Finally,Ricardowasdeterminedtofindan“invariablemeasureof value.”Insteadofgold,theultimateunitofaccount,hefocusedon quantity of labor units (not wages!) as the numeraire. In classical tradition,Ricardofixeduponacost-of-productiontheoryofvalue, arguingthatpricewasgenerallydeterminedbycosts(supply)rather thanutility(demand).Hewasawareofexceptionstothiscosttheory, suchas“rarestatuesandpictures,scarcebooksandcoins,winesofa peculiarquantity”(Ricardo1951,12),andtheimpactofmachinery. But machinery and capital were nothing more than “accumulated labour”(1951,410).Helaterwrote,“mypropositionthatwithfew exceptionsthequantityoflabouremployedoncommoditiesdeterminestherateatwhichtheywillexchangeforeachother...isnot rigidlytrue,butIsaythatitisthenearestapproximationtotruth,as aruleformeasuringrelativevalue,ofanyIhaveeverheard”(Vivo 1987,193). Hestruggledwiththelabortheoryofvalueuntiltheverylastdays ofhislife.Aboutamonthbeforehisdeathhewroteafellowecono- 60 THE BIG THREE IN ECONOMICS mist,“Icannotgetoverthedifficultyofthewinewhichiskeptina cellarfor3or4years,orthatoftheoaktree,whichperhapshadnot 2/-expendedonitinthewayoflabour,andyetcomestobeworth £100”(Vivo1987,193).EvenThomasMalthusdisagreedwithhis friend,writing,“neitherlabournoranyothercommoditycanbean accuratemeasureofrealvalueinexchange”(Ricardo1951,416). Economists over the years have had difficulty understanding Ricardo’s“cornmodel”andhisPrinciplestextbook,especiallythe twistedassumptionsherequiredtoprovehistheories.Ricardoonce remarked that only twenty-five people in the entire country could understandit.Acenturylater,ChicagoeconomistFrankH.Knight remarked,“thereismuch[here]Icannotfollow”(1959,365).Joseph Schumpeter lambasted Ricardo for making most of the economic players“frozenandgiven,”piling“onesimplifiedassumptionupon another,” and developing a theory “that can never be refuted and lacksnothingsavesense”(Schumpeter1954,472–73).Justthekind oftheoryMarxneeded! PerhapsKeyneshadRicardoinmindwhenhewrote,“Itisastonishingwhatfoolishthingsonecantemporarilybelieveifonethinkstoo longalone,particularlyineconomics”(Keynes1973a[1936],xxiii). ADefectiveClassicalModelSolidifiesUnder JohnStuartMill YetDavidRicardowasabletoconvincepracticallyallhiscontemporariesofhislabortheoryofvalueandhislaissez-fairedoctrines. “RicardoconqueredEnglandascompletelyastheHolyInquisition conqueredSpain,”saidKeynes(1973a[1936],32).Itwasprincipally throughJohnStuartMillthatthenextgenerationadoptedthisclassical modelthatwasmoreinlinewithRicardo’ssystemof“classconflict” thanAdamSmith’supbeat“harmonyofinterests”model. Theyear1848wasespeciallysignificantinthisregard.Itwasa yearofrebellionandmassprotestincontinentalEurope.KarlMarx and Friedrich Engels wrote their revolutionary tract, The Communist Manifesto.A specter was indeed haunting Europe—not just communism, but a whole string of isms—Fourierism, Owenism, Saint-Simonism,andtranscendentalism.Theyallfellunderthenew expression“socialism.”Therewasutopiansocialism,revolutionary FROM SMITH TO MARX 61 socialism,andnationalsocialism.Allgrewoutofareactiontothe rapid transformation from a rural economy to an industrial world. Thefirsthalfofthenineteenthcenturywasaneraofdiscontent—the IndustrialRevolution,theNapoleonicwars,anddemocraticrevolts throughoutEurope.ThegrowthmodelofAdamSmithwasalready underminedbythediscouragingworksofMalthusandRicardo.The revolt of the masses in 1848 reflected the practical difficulties of adjustingtoanewindustrialera. Theyear1848wasalsosignificantforJohnStuartMillandhis influenceintheworld:itwastheyearofpublicationofMill’stextbook,PrinciplesofPoliticalEconomy,aworkthatwoulddominatethe Westernworldforhalfacentury,goingthroughthirty-twoeditions, untilAlfredMarshall’slandmarktextbooktookoverin1890. ItwasMill’stextbookthatdeclaredthatthelawsofproductionwere objectivelydeterminedbutthelawsofdistributionwerevariable.“The DistributionofWealthisamatterofhumaninstitutionsolely.They canplacethem[goods]atthedisposalofwhomsoevertheyplease, andonwhateverterms”(Mill1884[1848],155).Headded,“Ifthe choiceweretobemadebetweenCommunismwithallitschances andthepresentstateofsocietywithallitssufferingsandinjustices, allthedifficulties,greatorsmall,ofCommunism,wouldbebutas dustinthebalance”(1884[1851],159).Hisbookalsoquestionedthe veracityofprivateproperty. Millwasareflectionofhistimes,enigmaticandlostinanageof turmoil.Inmanyways,hewastheembodimentofaGreektragichero, adashingprotagonistwhoendedhiscareerinbewilderedmisfortune, includingtheearlydeathofhisbelovedwife,Harriet.Herewasa greatintellect,aclassicalliberal,andthelastmajorproponentofthe classicalschoolofeconomics.LikeRicardo,Millespousedpersonal libertyinhisclassiclibertariantractOnLiberty(1989[1859]).He vigorouslydefendedSay’slawofmarkets,thefoundationofclassical macroeconomics, and opposed irredeemable paper money. He objectedtocoercivemorality,intolerance,andastatereligion.And hewasanabolitionistwhosupportedawoman’srighttovote. YetMillwasfamousforhisinconsistenciesandcontradictions. Hedefendedfreeenterprisebutinsistedhewasasocialist.Heflirted withsocialismthroughouthiscareer,favoredrevolutionarychange inVictorian culture, railed against overpopulation, and advocated 62 THE BIG THREE IN ECONOMICS Ricardo’sdistributiontheory,separatingproductionentirelyfrom distribution.4HisloveofBenthamiteutilitarianismblindedhimto frequentgovernmentinterventionintheeconomy.Hesawnothing wrongwithheavytaxationofinheritancesandnationalizationof land,andquestionedthejusticeofprivateproperty.Accordingto FriedrichHayek,itwasthiskindofthinkingthatledintellectualsto supportallkindsofattacksonpropertyandwealth,andgrandiose tax and confiscation schemes aimed at redistributing wealth and income, thinking that such radical schemescanbeaccomplished withouthurtingeconomicgrowth.Hayekobserved,“Iampersonally convincedthatthereasonwhichledtheintellectualstosocialism wasamanwhoisregardedasagreatheroofclassicalliberalism, JohnStuartMill”(Boaz1997,50). MillinfluencedintellectualsfromH.G.WellstoSidneyandBeatriceWebb toward socialist thinking, so much so that SirWilliam Harcourt,chancelloroftheexchequer,couldsayin1884,“weare allsocialistsnow”(Stafford1998,18).Itwouldbeyearslaterbeforeeconomists,educatedinmarginalanalysis,wouldcounterthe radicalredistributionists,whoarguedthatthetheoryofdistribution cannot be separated from the theory of production.According to themarginalistrevolution,theproducersofgoodsandservicesare paidaccordingtothefruitsoftheirlabor,basedontheirdiscounted marginalproduct,andheavytaxationcanonlydistorttheirincentive toproduce.Socialistmeasurestoredistributewealthandincomedo indeedaffecteconomicactivity.AsHayekstates,“ifwediddowith thatproductwhateverwepleased,peoplewouldneverproducethose thingsagain”(Boaz1997,50). Millwascriticalofrevolutionarysocialism,butexpressedconsiderablysympathywithutopiancommunitarianism,whichoperatedwith asocialconscienceandwithoutcoercion.Itwasthiskindofsocialismthatheidentifiedwith.Thus,Millsetthestage“onadownward slopeleadingfromtheeighteenth-centurysanityandconservatism ofDavidHumetotheFabiansocialismandcollectivismofBeatrice Webb”(Stafford1998,19). 4.SomecriticsblamehislongloveaffairandmarriagetoHarrietTaylorforhis socialisttendencies.SeeSkousen(2001,118–19). FROM SMITH TO MARX 63 JohnStuartMilllongedfortheblissofavoluntarycommunitarian village,butallsuchcommunitieshavesufferedfromonedefect:they neverlasted.NewHarmony,ModernTimes,UnitedOrder—theyall had high-minded names, yet they all eventually disintegrated as a resultoflaziness,debt,orfraud. ADismalScience? ItwasThomasCarlyle(1795–1881),theEnglishcritic,wholashedout attheclassicaleconomicsofMalthus,Ricardo,andMillandlabeled it“thedismalscience,”becausehethoughtfreecompetitionandutilitariandemocracywouldleadto“anarchyplustheconstable.”Behold thepessimismoftheironlawofsubsistencewagesandamiserly MotherNature:Carlylesawamoresinisterviewoftheubiquitous marketplace.AromanticconservativeandVictorianmoralist,Carlyle complainedthatsupplyanddemandputsapriceoneverything,and “reducesthedutyofhumangovernorstothatoflettingmenalone,” leadingto“adreary,desolate,andindeedquiteabjectanddistressing ...dismalscience”(Carlyle1904,IV,353–54). Classicaleconomics,ascharacterizedbyCarlyle,lefttheWestin intellectualdisequilibrium.NotlongafterMill’stime,anewformof socialismcameontothehorizon,theviolentrevolutionarykind.If fellowcitizenscouldnotbepersuadedtocooperateandescapethe illsofrawanarchyandbarbariccompetition,thentheymustbeforced toobeythroughtheironfistandthebayonet.Graduallytheeyesof reformersallturnedtowardoneauthority,thesecondofthe“bigthree” ineconomics.KarlMarxisthesubjectofournextchapter. 3 KarlMarxLeadsaRevolt AgainstCapitalism Jenny!Ifwecanbutweldoursoulstogether,thenwith contemptshallIflingmygloveintheworld’sface,then shallIstridethroughthewreckageacreator! —KarlMarxtohisfiancée(Wilson1940) KarlMarxwaspossessedofdemonicgeniusthatwasto transformthemodernworld. —SaulK.Padover(1978) IftheworkofAdamSmithistheGenesisofmoderneconomics,thatof KarlMarxisitsExodus.IftheScottishphilosopheristhegreatcreator oflaissez-faire,theGermanrevolutionaryisitsgreatdestroyer.Marxist JohnE.Roemeradmitsasmuch.Accordingtohim,the“maindifference”betweenSmithandMarxisasfollows:“Smitharguedthatthe individual’spursuitofself-interestwouldleadtoanoutcomebeneficial toall,whereasMarxarguedthatthepursuitofself-interestwouldlead toanarchy,crisis,andthedissolutionoftheprivateproperty–based 64 KARL MARX LEADS A REVOLT AGAINST CAPITALISM 65 systemitself....Smithspokeoftheinvisiblehandguidingindividual,self-interestedagentstoperformthoseactionsthatwouldbe, despitetheirlackofconcernforsuchanoutcome,sociallyoptimal; forMarxismthesimileistheironfistofcompetition,pulverizingthe workersandmakingthemworseoffthantheywouldbeinanother feasiblesystem,namely,onebasedonthesocialorpublicownership ofproperty”(Roemer1988,2–3). ForallthehorrorscommittedinMarx’sname,theGermanphilosopherhasformorethanacenturystruckaninspirationalchord amongworkersandintellectualsdisenfranchisedbyglobalcapitalism. MalthusandRicardomayhavesowntheseedsofdissension,butKarl Marx(1818–83)brokethebondsofcapitalismandtoreasunderthe foundations ofAdam Smith’s system of natural liberty. No longer couldthecommercialsystembeviewedas“innocent”(Montesquieu), “mutuallybeneficial”(Smith),or“naturallyharmonious”(Sayand Bastiat).Now,underMarx,itwaspicturedasalien,exploitative,and self-destructive.InMarx’smind,emancipationcameaspeoplemoved awayfromtheAdamSmithmodel. Hismarkontheworldisindelibleandtheevidenceofabrilliantifnot disturbedmind.ThatMarxwasageniusisnotindispute—hehadagenuine doctorateinGreekphilosophy;spokeFrench,German,andEnglishfluently;couldtalkintelligentlyaboutscience,literature,art,mathematics,and philosophy;andwroteaclassicbookthatcreatedapowerfulnewmodelof economicthinking.Nevermindthathecouldn’tbalanceacheckbookor keepajob.Anon-Marxistbiographercalledhima“towering,learned,and extraordinarilygiftedman”(Padover1978:xvi).MartinBronfenbrenner deemedMarx“thegreatestsocialscientistofalltimes”(1967:624).1 MarxandCommunism Yet,likeCainintheBible,Marxiscursedwithablackmarkinhistory. Hisnamewillforeverbeassociatedwiththedarksideofcommunism.A specterishauntingKarlMarx—thehistoryofLenin,Stalin,Mao,andPol Pot,andthemillionswhodiedandsufferedunderthe“evilempire,”as RonaldReagancalledit.ApologistssayMarxcannotbeheldaccountable 1.IthinkGermansociologistMaxWeberdeservesthishonor.SeeSkousen (2001),chapter10. 66 THE BIG THREE IN ECONOMICS forhiscommunistfollowers’atrocitiesandevenassertthatMarxwould havebeenoneofthefirsttobeexecutedorsenttotheGulag.Perhaps. Foronething,hevehementlyopposedpresscensorshipthroughouthis career.Yet,withoutMarx,couldtherehavebeensuchaviolentrevolutionandrepression?DidnotMarxsupporta“reignofterror”onthe bourgeoisie?Asonebittercriticputit,“Inthenameofhumanprogress, Marxhasprobablycausedmoredeath,misery,degradationanddespair thananymanwhoeverlived”(Downs1983,299). MarxEngendersYouthfulFanaticism Amongschoolsofthought,noothereconomistorphilosopherengenderssomuchpassionandreligiousfeverasMarx.Aboveall,Marx wasavisionaryandarevolutionaryidol,notjustaneconomist.In readingTheCommunistManifesto,writtenover150yearsago,one cannothelpfeelingthepassionatepower,thepungentstyle,andthe astonishingsimplicityofMarxandEngels’swords(1964[1848]). Youthful followers become true believers, and it usually takes themyearstogrowoutoftheirMarxistaddiction.Ithappenedto RobertHeilbroner,MarkBlaug,WhittakerChambers,andDavid Horowitz.IevensawitamongmystudentsatRollinsCollege,a decadeafterSovietcommunismhadcollapsedandMarxismwas supposedlydead.Inmyclass,“SurveyofGreatEconomists,”Irequirestudentstoreadabookauthoredbyaneconomist.Onestudent choseTheCommunistManifesto.Afterreadingit,hecametome andexclaimedwithsomeemotion,“Thisisincredible!Imustdo mybookreportonthis!”pointingtohiswell-markedcopy.Itwas eerie.Inmylectures,IdidmybesttocounterMarxiandoctrine,but itdidn’tmatter.Hewasconverted. Icaneasilyseehowayoungrevolutionarycouldbeswayedby theseunforgettablelinesfromthepolemicalCommunistManifesto: AspecterishauntingEurope—thespecterofCommunism....Thehistoryofallhithertoexistingsocietyisthehistoryofclassstruggles.... The bourgeoisie has pitilessly torn asunder the motley feudal ties that bound man to his ‘natural superiors,’ and has left remaining no other nexusbetweenmanandmanthannakedself-interest,thancallous‘cash payment.’...Veiledbypoliticalandreligiousillusions,ithassubstituted KARL MARX LEADS A REVOLT AGAINST CAPITALISM 67 naked,shameless,direct,brutalexploitation....Lettherulingclasses trembleatthecommunisticrevolution.Theproletarianshavenothingto losebuttheirchains.Theyhaveaworldtowin.WORKINGMENOF ALLCOUNTRIES,UNITE!(1964[1848]) Marshall Berman, a longtime Marxist living in NewYork City, recounts how he, as a youth, encountered another book by Marx, EconomicandPhilosophicalManuscriptsof1844.Thisbookgeneratedthesamekindoffanaticenthusiasm.“SuddenlyIwasinasweat, melting,sheddingclothesandtears,flashinghotandcold”(Berman 1999,7)—notfromstaringatPlayboymagazineortradingapenny stockforthefirsttime,butfromreadingMarx! Inmanyways,Marxismhasbecomeaquasi-religion,withitsslogans, symbols,redbanners,hymns,partyfellowship,apostles,martyrs,bible, anddefinitivetruth.“Marxhadtheself-assuranceofaprophetwhohad talkedtoGod....Hewasapoet,prophet,andmoralistspeakingasa philosopherandeconomist;hisdoctrineisnottobetestedagainstmere factsbuttobereceivedasethical-religioustruth....Marxwastolead theChosenPeopleoutofslaverytotheNewJerusalem....Becominga MarxistoraCommunistislikefallinginlove,anessentiallyemotional commitment”(Wesson1976,29–30,158).Aguidebookforyouthwas publishedin1935entitledTeachingsofMarxforGirlsandBoys,authored byprotestantministerWilliamMontgomeryBrown,highlightedbypicturesonthecoverofMarx’s“greatestpupils,”LeninandStalin. Marx’sContributionstoEconomics FeweconomistsbreakoutintootherdisciplinesasdidKarlMarx. There’sMarxthephilosopher,Marxthehistorian,Marxthepolitical scientist,Marxthesociologist,andMarxtheliterarycritic.Hewas prolificandwroteunendinglyaboutnearlyeverything.Eventodaya compilationofthecompleteworksofMarxandhiscolleagueFriedrichEngelshasnotbeenfinished.ThecommentariesonMarxand relatedsubjectsaresovastthatitwouldtakevolumestotellitall. (OntheInternet,Amazon.comlistsover4,000entriesonMarxand communism,secondonlytoJesusandChristianity.)Thus,ourchapter onMarxmustofnecessitybelimitedlargelytohiseconomiccontributions.Eventhen,Marxtheeconomistisnotaneasysubject. 68 THE BIG THREE IN ECONOMICS Marxwasprobablythefirstmajoreconomisttoestablishhisown schoolofthought,withitsownmethodologyandspecializedlanguage. Increatinghisownschoolinhisclassicwork,Capital(1976[1867]), hecontrastedhissystemwiththatoflaissez-faire—asespousedby Adam Smith, J.-B. Say, and David Ricardo, among others. It was Marxwhodubbedlaissez-fairethe“classicalschool.”Indeveloping a Marxist approach to economics, he created his own vocabulary: surplusvalue,reproduction,bourgeoisieandproletarians,historical materialism,vulgareconomy,monopolycapitalism,andsoon.He inventedtheterm“capitalism.”2SinceMarx,economicshasnever beenthesame.Today,thereisnouniversallyacceptablemacromodel oftheeconomyasthereisinphysicsormathematics—thereareonly warringschoolsofeconomics. EarlyTraining:Marx’sInternalContradictions WhowasthisGermanphilosopher?Whocouldhavebroughtabout suchpassion,suchdevotion,suchapowerfulnewmodelofeconomics thatwouldchallengetheclassicalmodelofAdamSmith? KarlHeinrichMarxwasbornonMay5,1818,inaneleganttownhouseinTrierintheRhineprovinceofPrussia.Trieristheoldesttown inGermany.Fromcribtocoffin,Marxwasfullofcontradictions.He railedagainstthepettybourgeois,yetgrewupinabourgeoisfamily.Helivedyearsofhisadultlifeindesperatepovertydespitehis relativelywell-to-doorigins.Heexaltedcapitalism’stechnologyand materialadvances,yetdamnedthecapitalistsociety.Hefeltdeeply fortheworkingman,yetneverheldasteadyjoborvisitedafactory duringhisadultlife.Hismothercomplained,“IfonlyKarlhadmade capitalinsteadofwritingaboutit!”(Padover1978,344). Marxshoutedanti-Semiticepithetsathisopponents,yetwasJewish frombothsidesofhisfamily.Inanessaypublishedin1843,“Onthe JewishQuestion,”Marxexpressedanti-Jewishsentimentsthatwere commoninEuropeatthetime.Hislanguagewasvindictive:“What istheworldlycultoftheJew?Schacher.WhatishisworldlyGod? Money!...MoneyisthejealousgodofIsraelbeforewhomnoother 2.FrankH.Knightandothermarket-orientedeconomistsprefer“freeenterprise”to “capitalism”asadescriptionofthemarketeconomy.SeeKnight(1982[1947],448). KARL MARX LEADS A REVOLT AGAINST CAPITALISM 69 godmayexist.Moneydegradesallthegodsofmankind—andconvertsthemintocommodities....Whatiscontainedabstractlyinthe Jewishreligion—contemptfortheory,forart,forhistory”(Padover 1978,169).Marx’sracialslanderneverletup.Heneverretractedhis 1843defamationoftheJews.“Onthecontrary,”wrotebiographer SaulPadover,“heharboredalifelonghostilitytowardthem....His lettersarerepletewithanti-Semiticremarks,caricatures,andcrude epithets:‘Levy’sJewishnose,’‘usurers,’‘Jew-boy,’‘nigger-Jew,’etc. ForreasonsperhapsexplainablebytheGermanconceptSelbsthass [self-hate],Marx’shatredofJewswasacankerwhichneithertime norexperienceevereradicatedfromhissoul”(Padover1978,171). ProminentMarxistshavedeniedMarx’santi-Semitism,however.A DictionaryofMarxianThoughtstates,“AlthoughweknowthatMarx wasnotaversetousingoffensivevulgarismsaboutsomeJews,thereisno basisforregardinghimashavingbeenanti-Semitic”(Bottomore1991, 275).GarethStedmanJoneswrites,“Marx’sallegedanti-Semitism... cannotbeunderstoodexceptinthecontextofhishatredofallformsof nationalandethnicparticularism”(Blumenberg1998[1962],x). Marxsufferedcontradictionsthroughouthislife.Hecherishedhis children,yetsawthemdieprematurelyfrommalnutritionandillness ordrovethemtosuicide.Marxprotestedtheevilsofexploitationinthe capitalistsystem,andyet,accordingtoonebiographer,he“exploited everyone around him—his wife, his children, his mistress and his friends—witharuthlessnesswhichwasallthemoreterriblebecause itwasdeliberateandcalculating”(Payne1968,12).PaulSamuelson adds,“Marxwasagentlefatherandhusband;hewasalsoaprickly, brusque, egotistical boor” (Samuelson 1967b, 616). In sum, Marx rantedabouttheinnercontradictionsofcapitalism,yethehimself wasconstantlybesetbyinnerdissension. Marx’sChristianFaith ThemostsurprisingironyisthatKarlMarx—consideredoneofthe most vicious opponents of religion—was brought up a Christian thoughmanyofhisancestorswererabbis. His father, Heinrich Marx, overcame insuperable obstacles to become a well-to-do Jewish lawyer. When he was faced with a newPrussianlawin1816prohibitingJewsfrompracticinglaw,he 70 THE BIG THREE IN ECONOMICS switchedfromJudaismtotheLutheranfaith.Hismother,Henrietta Pressborch,wasthedaughterofarabbi,yetshealsosawthesocial valueinconvertingtoChristianity. Karl, the oldest surviving son in a family of nine children, was baptizedaChristianandwroteseveralessaysonChristianlivingwhile attendinggymnasium(highschool).Asaseniorinhighschool,Karl wroteanessayentitled“TheUnionoftheFaithfulwithChrist,”which spokeofalienation,afearofrejectionbyGod.Hewasmesmerized bythestoryofapeacefulparadiseinGenesisandthecomingofa dreadfulapocalypseinTheRevelationofSt.John.Later,thesefirst andlastbooksoftheBiblewouldhelpformulateMarx’sdoctrines ofalienation,classstruggle,arevolutionaryoverthrowofbourgeois society,andthegloriesofastateless,classlessmillennial-typeeraof peaceandprosperity.Hisvisionofaproletarianvictorymayhave comefromthisearlytraininginChristianmessianism.Hewasfirst andforemostamillennialcommunist. ManyofMarx’sdogmaswerenotoriginal.Theycamefromthe Bible,whichhetwistedandchangedtosuithispurposes.AsbiographerRobertPaynenotes,“whenhe[Marx]turnedagainstChristianity hebroughttohisideasofsocialjusticethesamepassionforatonement andthesamehorrorofalienation”(1968,42). MarxBecomesaCollegeRadical Marx’sfaithwaschallengedalmostimmediatelyuponattendingthe UniversityofBonn,wherehe,likemanycollegefreshmen,spentmore timedrinkingandcarousingthanstudying.Hepiledupbills,joineda secretrevolutionarygroup,andwaswoundedinaduel.Laterhewas arrestedforcarryingapistol,andjailedforrowdiness. Hisfatherhopedtoreformhiseldestsonbytransferringhimto therenownedUniversityofBerlin,whereMarxspentthenextfive years.Buthisundisciplinedlifestylecontinued.Hereadvoraciously andlivedthelifeofabohemian.Hefanciedhimselfapoet,translated Greekplays,andfilledhisnotebookswithdarktragediesandromantic poetry.HejoinedtheDoctor’sClub(Doktorklub),asmallsocietyof radicalYoungHegelians. Fellowstudentsdescribedhimashavingabrilliantmindandbeing ruthlessly opinionated, his dark excitable eyes staring in defiance. KARL MARX LEADS A REVOLT AGAINST CAPITALISM 71 Hisblackbeardandthickmaneofhair,hisshrillvoiceandviolent temper,stoodout.Hewassoexceptionallyswarthythathisfamily andfriendscalledhim“Mohr”or“Moor.”Duringhiscollegeyears, hewasdescribedcolorfullyinashortpoem(Payne1968,81;Padover 1978,116). Whocomesrushingin,impetuousandwild— DarkfellowfromTrier,infuryraging? Norwalksnorskips,butleapsuponhisprey Intearingrage,asonewholeapstograsp Broadspacesintheskyanddragsthemdowntoearth, Stretchinghisarmswideopentotheheavens. Hisevilfistisclenched,heroarsinterminably Asthoughtenthousanddevilshadhimbythehair. TheInfluenceofRadicalGermanPhilosophers TworadicalphilosophersgreatlyinfluencedMarxduringthesecollege yearsandsoonafter:G.W.F.Hegel(1770–1831)andacontemporary, Ludwig Feuerbach (1804–72). From Hegel, Marx developed the drivingforceofhis“dialecticalmaterialism”—thatallprogresswas achievedthroughconflict.FromFeuerbach’sTheEssenceofChristianity(1841),Marxrationalizedhismythicalviewofreligionandhis rejectionofChristianity.Goddidnotcreateman;mancreatedGod! EngelsdescribedtheliberatingimpactofFeuerbach’sbook:“Inone blowit...placedmaterialismbackuponthethrone....Thespell wasbroken....Theenthusiasmwasuniversal:Wewereallforthe momentFeuerbachians”(Padover1978,136). Marx’s parents were worried sick about their prodigal son who wantedtobecomeawriterandacriticinsteadofalawyer.Hisletters reveal the often harsh correspondence between him and his parents.Hisfather,Heinrich,wasaclassicliberalandadefenderof bourgeoisculture,soonecanimaginehisdespairoverhisson.His letterschargedKarlwithbeing“aslovenlybarbarian,ananti-social person,awretchedson,anindifferentbrother,aselfishlover,anirresponsiblestudent,andarecklessspendthrift,”allaccurateaccusations thathauntedMarxthroughouthisadultlife.HeinrichMarxrailed, “Godhelpus!Disorderliness,stupefyingdabblinginallthesciences, stupefyingbroodingatthegloomyoillamp;barbarisminascholar’s 72 THE BIG THREE IN ECONOMICS dressing-gownandunkempthair”(Padover1978,106–07).Inanother letter,heaccusedKarlofbeingpossessedbya“demonicspirit”that “estrangesyourheartfromfinerfeelings”(Berman1999,25).This letterofKarl’sfatherwouldnotbetheonlytimeMarxwouldbeaccusedofdevilishbehavior,however. Marx’sSatanicVerses OneofthenightmarishaspectsofMarx’slifewashisfascinationwith Goethe’sFaust,thestoryofayoungmanwhoisatwarwithhimself overgoodandevilandmakesapactwithSatan.Faustexchangeshis soul(throughhisintermediaryMephistopheles)foralifeofpleasure andfortherightultimatelytocontroltheworldthroughmassiveorganizedlabor.Goethe’sFaustwasMarx’sbiblethroughouthislife. HememorizedwholespeechesofMephistopheles,andcouldrecite longpassagestohischildren.(HeequallylovedShakespeare,whom healsoquotedregularly.) WhilehewasastudentatBerlinUniversityin1837,Marxwrote romantic verses dedicated to his fiancée, Jenny von Westphalen. Oneofthesepoems,“ThePlayer,”waspublishedinaGermanliterarymagazine,Athenaeum,in1841(reprintedinPayne1971,59).It describesaviolinistwhosummonsupthepowersofdarkness.The player,eitherLuciferorMephistopheles,boldlydeclares, Looknow,myblood-darkswordshallstab Unerringlywithinthysoul. Godneitherknowsnorhonorsart. Thehellishvaporsriseandfillthebrain. TilIgomadandmyheartisutterlychanged. Seethissword—thePrinceofDarknesssoldittome. Formehebeatsthetimeandgivesthesigns. EvermoreboldlyIplaythedanceofdeath. MarxWritesaGreekTragedy ApactwiththedevilwasthecentralthemeofOulanem,apoeticplay Marxwrotein1839.Hecompletedonlythefirstact,butitrevealsa numberofviolentandeccentriccharacters.Themaincharacter,Ou- KARL MARX LEADS A REVOLT AGAINST CAPITALISM 73 lanem,isananagramforManuelo,meaningImmanuelorGod(Payne 1971,57–97).InaHamlet-likesoliloquy,Oulanemaskshimselfifhe mustdestroytheworld.Hebegins, Ruined!Ruined!Mytimehascleanrunout! Theclockhasstopped,thepygmyhousehascrumbled, SoonIshallembraceeternitytomybreast,andsoon Ishallhowlgiganticcursesatmankind. Andends, Andwearechained,shattered,empty,frightened, EternallychainedtothismarbleblockofBeing, Chained,eternallychained,eternally. Andtheworldsdraguswiththemontheirrounds, Howlingtheirsongsofdeath,andwe— WearetheapesofacoldGod. Marx’sfixationwithself-destructivebehaviorwasprevalentthrough mostofhislife.Heevencomposedandpublishedanentirebookon suicidewhilelivinginexileinBelgiumin1835.Andhetranslatedthe workofJacquesPeuchetdetailingtheaccountsoffoursuicides,three byyoungwomen.Thefocusisontheindustrialsystemthatwould encouragesuicidalbehavior(PlautandAnderson1999). MarxMarriesandMovestoParis MarxfinallyleftBerlinongroundsthattheuniversityadministration hadbeentakenoverbyanti-Hegelians.FearinghisPh.D.dissertationonGreekphilosophymightberejected,hesubmittedittothe UniversityofJena,whichaccepteditwithoutanyattendancerequirements.In1842,heworkedbrieflyaseditorofaGermannewspaper, fearlesslydefendingfreespeech.Heresignedwhenthecensorsmade itimpossibleforhimtocontinue. In1843,Marxmarriedhisteenagesweetheartandneighbor,Jenny von Westphalen, over objections from both families. Jenny, four yearsolderthanMarx,wasthedaughterofBaronJohannLudwig vonWestphalen,awealthyaristocratwhorepresentedthePrussian governmentinthecitycouncil.Afterthebarondied,theMarxeslived 74 THE BIG THREE IN ECONOMICS offthebaroness’slargess.JennywasdeeplydevotedtoKarlandhis revolutionaryideas.Fortherestoftheirlives,theywereinseparable throughpoverty,illness,andfailure.Theirlovewasdeepandlasting, thoughnotwithoutheartacheandtrouble.Theyexchangednumerousloveletters.Theyhadsixchildren,althoughonlytwodaughters survivedthem. Inlessthanayear,KarlandhisnewwifemovedtoParis,where hebecameeditorofamonthlyGermanmagazine.KarlandJenny MarxlovedParisandFrenchculture.HereMarxhadlittleinterest inassociatingwithBastiatandtheFrenchlaissez-faireschool—he laterlabeledBastiatthemost“superficial”apologistofthe“vulgar economy”(Padover1978,369)—butfellinamongtheradicalFrench socialists,includingPierreProudhonandLouisBlanc.Heplunged intooceansofbooksandwouldoftengothreetofourdayswithout sleep(Padover1978,189).Seeingtheclassstrugglefirsthand,hewrote eloquentlyofalienationandlaborsufferingundercapitalisminThe EconomicandPhilosophicalManuscriptsof1844,acompilationof articlesnotpublisheduntil1932. MarxMeetsFriedrichEngels ItwasinParisthatMarxmethislifelongcolleagueinarms,Friedrich Engels(1820–95).Five-and-a-halffeettall,blond,Teutonic-looking withcoldblueeyes,Engelshadacriticaleyefordetail.TogetherMarx andEngelsstartedworkingonabookattackingtheirsocialistrivals. Itwouldbeaclosecollaborationthatwouldlastanotherfortyyears, untilMarxdiedin1883. Engels,thesonofawealthyGermanindustrialist,hatedhistyrannicalfatherandhis“boring,dirty,andabominable”business,evenas hehimselfachievedfinancialsuccessrunningatextileoperationin Manchester(thoughthereisnoevidenceheimprovedthecondition ofhisworkers).EngelswasasfascinatingasMarx:agiftedcartoonist,anexpertonmilitaryhistory,andamasterofnearlytwodozen languages.Whenexcited,hecould“stutterintwentylanguages”!He wasalsoanotoriouswomanizer. Engels’s influence on Marx was twofold: His vast financial resourcesallowedhimtosubsidizeMarxfordecades,andheplayeda criticalroleindirectingMarx’sthinkingtowardpoliticaleconomy. KARL MARX LEADS A REVOLT AGAINST CAPITALISM 75 Engels’sownwork,TheConditionoftheWorkingClassinEngland in1844,hadaprofoundimpactonMarx,anditwasEngelswhoconvertedMarxtorevolutionarycommunism,nottheotherwayaround. HecoauthoredTheCommunistManifestobut,ineveryotherway, livedintheshadowofthegreatphilosopher. EngelsoutlivedMarxbyadecade,correspondingwithrevolutionaries,editingandpublishingMarx’sbooks,andkeepingtheMarxist flameablaze. TheWorld’sGreatestCritic ThespitefulnatureofMarxandEngels’sstylewasclearinthetitle of their first collaboration: Critique of Critical Critique! (A more palatabletitle,TheHolyFamily,wassuperimposedonthecoverwhile thebookwasbeingprinted.)Thisemphasisonfault-findingreflected Marx’sharshhostilityandhishot-bloodedangeragainsthisenemies. “Hedenouncedeveryonewhodaredtoopposehisopinions”(Barzun 1958[1941],173).Heinitiatedthepracticeof“partypurges,”which wouldbeperfectedagenerationlaterbyLeninandStalin(Wesson 1976,34).In1847,respondingtofellowsocialistProudhon’sThe PhilosophyofPoverty,Marxwroteacausticrejoinder,ThePovertyof Philosophy.IftheGuinnessBookofWorldRecordslistedtheWorld’s MostCriticalMan,Marxwouldhaveeasilywontheaward.Almost everyoneofhisbooktitlescontainedtheword“critique.”Hewrote sparinglyaboutthehappyworldofutopiancommunism,prodigiously abouttheflawsofcapitalism. MarxWritesaPowerfulPolemic Marx’slifeinParisdidnotlastlong.HewasexpelledforincitingrevolutioninGermany.HeleftforBrussels,thefirststageofalifeofpermanent exile.ItwasinBelgiumthatMarxandEngelswerecommissionedbythe London-basedLeagueoftheJust,laterrenamedtheCommunistLeague, towritetheirfamouspamphlet,TheCommunistManifesto. TheCommunistManifesto,thefinalversionwrittenbyMarx,was aforcefulcalltoarms,apowerfulreflectionofthenewmachineage andnewhardshipsasmen,women,andchildrenmovedtoenormous chaotic cities, worked sixteen hours a day in factories, and often 76 THE BIG THREE IN ECONOMICS livedindesperatesqualor.“Thebourgeoisie,whereverithasgotthe upperhand,hasputanendtoallfeudalpatriarchal,idyllicrelations. ...Ithasleftremainingnootherbondbetweenmanandmanthan nakedself-interest,thancallous‘cash-payment.’”Consequently,“the bourgeoisiehasstrippedofitshaloeveryoccupationhithertohonored andlookeduptowithreverentawe.Ithasconvertedthephysician, thelawyer,thepriest,thepoet,themanofscienceintoitspaidwagelaborers.”Further,“allthatissolidmeltsintoair,allthatisholyis profane.”Capitalism“hassubstitutednaked,shameless,direct,brutal exploitation”(MarxandEngels1964[1848],5–7). WhentheManifestowaspublishedinGermaninFebruary1848, thetimingcouldnothavebeenbetter.Bythesummer,workerrevolts spreadthroughoutEurope—inFrance,Germany,Austria,andItaly. Images of the French Revolution a generation earlier dominated thespiritofthetimes.However,theEuropeanrevoltswerequickly quelledandMarxwasarrestedbyBelgianpoliceforspendinghis inheritance from his father (6,000 gold francs) on arming Belgian workerswithrifles.Hewasreleasedfromjailin1849andmovedto Cologne,Germany,whereheeditedanotherjournal.Thelastissue wasprintedinredink,therevolutionarycolor. HungryYearsinLondon Marxwasconstantlygettingintotroubleandcontinuallyontherun. AfterbeingexpelledfromGermanyinAugust1849,anddeeplydepressedbythefailureofworkerrevolutions,hemovedtoLondonwith hiswifeandtheirthreechildren.Thiswouldturnouttobehisfinal move.Forthenextthirtyyears,hewouldlive,research,andwritein thelargestbourgeoiscityintheworld. ThefirstsixyearsinLondonweretryingtimesfortheMarxfamily, whichsufferedfromseriousillness,prematuredeath,anddesperate poverty.Marxpawnedeverythingtokeephisfamilyalive—thefamily silver,linens,eventhechildren’sclothing(Padover1978,56).While thefamilywaslivinginasmallapartmentinSoho,aPrussianpolice spycamebyin1853andmadeadetailedreport: Marxisofmediumheight,34yearsold;despitehisrelativeyouth,his hairisalreadyturninggray;hisfigureispowerful....Hislarge,piercing KARL MARX LEADS A REVOLT AGAINST CAPITALISM 77 fieryeyeshavesomethinguncannilydemonicaboutthem.Atfirstglance oneseesinhimamanofgeniusandenergy.... In private life he is a highly disorganized, cynical person, a poor host;heleadsarealgypsyexistence.Washing,grooming,andchanging underwearareraritieswithhim;hegetsdrunkreadily.Oftenheloafsall daylong,butifhehasworktodo,heworksdayandnight...veryoften hestaysupallnight.... Marxlivesinoneoftheworst,andthuscheapest,quartersinLondon ...everythingisbroken,raggedandtattered;everythingiscoveredwith finger-thick dust; everywhere the greatest disorder. When one enters Marx’sroom,theeyesgetsodimmedbycoalsmokeandtobaccofumes thatforthefirstmomentsonegropes....Everythingisdirty,everything fullofdust....ButallthiscausesnoembarrassmenttoMarxandhis wife.(InPadover1978:291–93) Marx,livinginsqualorandsorrow,wasconstantlybrokeandtook fewworkopportunities.Whatworkhedidwasmainlyasapart-time journalist for the NewYork Daily Tribune and other newspapers. Hestubbornlyrefusedtobe“practical,”andattimesEngelshadto ghostwritehisarticles.ThreeofMarx’syoungchildrendiedofmalnutritionandillness.Suchwasthelifeofthisdemonicgeniusand hislong-sufferingwife. Marx’sPersonalityQuirks Keyneswasfascinatedbypeople’shands,Marxbypeople’sskulls. WilhelmLiebknecht,oneofMarx’sdisciples,wrotethatwhenhemet hisleaderforthefirsttimeatasummerpicnicforcommunistworkersnearLondoninthe1850s,Marx“beganatoncetosubjectmeto arigidexamination,lookedstraightintomyeyesandinspectedmy headratherminutely.”Liebknechtwasrelievedtohavepassedthe examination(Liebknecht1968[1901],52–53). NoteveryonesurvivedMarx’sskullduggery.FerdinandLassalle,a Germansocialdemocratandlabororganizer,wasviciouslyattacked byMarx,whocalledhim“theJewishNigger”anda“greasyJew.”“It isnowperfectlycleartome,”MarxwroteEngelsin1862,“that,asthe shapeofhisheadandthegrowthofhishairindicates,heisdescended fromtheNegroeswhojoinedinMoses’flightfromEgypt(unlesshis motherorgrandmotheronthefather’ssidewascrossedwithanigger). 78 THE BIG THREE IN ECONOMICS ThisunionofJewandGermanonaNegrobasewasboundtoproduce anextraordinaryhybrid”(MarxandEngels41,388–90). Marxwasapparentlytakeninbythepseudoscienceofphrenology, thepracticeofexaminingaperson’sskulltodeterminehisorhercharacter,developedduringtheearly1800sbytwoGermanphysicians. Marxwasnottheonlypersonwhobelievedinphrenology.Queen VictoriainGreatBritainandtheAmericanpoetsWaltWhitmanand EdgarAllanPoedidaswell. WhyDidMarxGrowSuchaLongBeard? RevolutionaryfollowersoftenplayedonMarx’svanitybycomparing himtotheGreekgods.Hewasmuchpleasedbyan1843political cartoonportrayinghimasPrometheuswhenhisnewspaper,Rheinische Zeitung,wasbanned.Marxisshownchainedtohisprintingpress, whileaneaglerepresentingthekingofPrussiatearsathisliver.The editorlooksdefiant,hopingsomedaytofreehimselfandpursuehis revolutionarycauses. While working on Das Kapital in the 1860s, Marx received a larger-than-life statue of Zeus as a Christmas present. It became oneofhisprizedpossessions,whichhekeptinhisLondonstudy. Fromthenon,MarxsoughttoimitatethestatueofZeus.Hestopped cuttinghishairandlethisbeardgrowoutuntilitassumedtheshape andsizeofZeus’sbeardedhead.Hepicturedhimselfasthegodof theuniverse,castinghisthunderboltsupontheearth.Oneofthelast photographsofMarxshowshiswhitehairflowingeverywherein magnificentsplendor,remindingusoftheselinesinHomer’sIliad (BookI,line528): Zeusspoke,andnoddedwithhisdarkishbrows, andimmortallocksfellforwardfromthelord’sdeathlesshead, andhemadegreatOlympustremble. Cover-up:MarxFathersanIllegitimateSon In1850–51,Marxhadanaffairwithhiswife’sunpaidbutdevoted maidservantHeleneDemuth,knownasLenchen,andfatheredanillegitimateson.TheaffairwashushedupbyMarx,whobeggedEngels KARL MARX LEADS A REVOLT AGAINST CAPITALISM 79 topretendtobethefather.Engelsagreed,eventhoughtheboy,named Freddy,lookedlikeMarx.“IfJennyhadknownthetruth,itmighthave killedher,orattheveryleastdestroyedhermarriage”(Padover1978, 507).Jennymayinfacthaveknown;sheandKarlallegedlydidnot sleeptogetherforyearsafterward. Marxcompletelydisownedthisson.Finally,Engelsdeclaredthe childtobeMarx’sonhisdeathbedin1895.Hewasspeakingto Marx’sdaughterEleanor,whotookthenewshard(shelatercommittedsuicide).Thefactsbecamepubliconlyinthenextcentury inWerner Blumenberg’s 1962 biography of Marx (Blumenberg 1998[1962],111–113).Theyprovedtobeanembarrassmentto MarxistapologistswhohadalwaysmaintainedthatMarxwasa goodfamilymandespitetheprematuredeathsofthreechildrenand thesuicidesoftwodaughtersinadulthood.Fordecades,Robert HeilbronerdeclaredMarxa“devotedhusbandandfather”inhis best-seller, TheWorldly Philosophers (1961, 124), only later to admitMarx’sindiscretion.YetHeilbronerdefendedMarx,arguing thattheinfidelity“couldnotundoarelationshipofgreatpassion” (1999,149). Marx:RichorPoor? ThingsfinallystartedlookingupforMarxin1856.MoneyfromEngels andalegacyfromJenny’smother’sestateallowedtheMarxfamilyto movefromSohotoanicehomeinfashionableHampstead.Suddenly Marxstartedlivingthelifeofabourgeoisgentleman,wearingafrock coat,tophat,andmonacle.TheMarxesgavepartiesandballs,and traveledtoseasideresorts.Marxevenplayedthestockmarket.He speculatedinAmericansharesandEnglishjoint-stockshares,realizingsufficientgainstowriteEngelsin1864,“Thetimehasnowcome whenwithwitandverylittlemoneyonecanreallymakeakillingin London.”Detailsofhisspeculationsarelost,however(Payne1968, 354;North1993,91–103).3 3.Marx’sstockmarketspeculationswereallthemoreironicgiventhatoneof thefirstactsinacommunisttakeoverwastoabolishthestockexchangeasacase of“vulgareconomy.” 80 THE BIG THREE IN ECONOMICS Sympathetic historians have always noted the poor conditions underwhichMarxlived,butduringmostofhislifeitwasnotfor lack of money. Historian Gary North investigated Marx’s income andspendinghabits,andconcludedthatexceptforhisself-imposed poverty of 1848–63, Marx begged, borrowed, inherited, and spent lavishly.In1868,EngelsofferedtopayoffalltheMarxes’debtsand provideMarxwithanannuityof£350ayear,aremarkablesumatthe time.Northconcludes:“Hewaspoorduringonlyfifteenyearsofhis sixty-five-yearcareer,inlargepartduetohisunwillingnesstousehis doctorateandgoouttogetajob....Thephilosopher-economistof classrevolution—the‘RedDoctorofSoho’whospentonlysixyears in that run-down neighborhood—was one of England’s wealthier citizensduringthelasttwodecadesofhislife.Buthecouldnotmake endsmeet....After1869,Marx’sregularannualpensionplacedhim intheuppertwopercentoftheBritishpopulationintermsofincome” (North1993,103). MarxWritesDasBuchandChangestheCourse ofHistory Basically,Marxdidnotwanttowastehistimedoingroutinework to support his young family. He preferred to spend long hours, months, and years at the British Library in London researching andwriting.HewouldcomehomeandtellJennyhehadmadethe colossaldiscoveryofeconomicdeterminism,thatallsociety’sactionsweredeterminedbyeconomicforces.Hisworkculminated inhisclassicDasKapital,publishedinGermanin1867.Capital (the English title) introduced economic determinism and a new “exploitive” theory of capitalism based on universal “scientific” lawsdiscoveredbyMarx. Marxconsideredhisworkthe“bibleoftheworkingclass,”andeven expectedlaborerstoreadhisheavypedantictome.Hesawhimself as“engagedinthemostbitterconflictintheworld,”andhopedhis bookwould“deliverthebourgeoisieatheoreticalblowfromwhich itwillneverrecover”(Padover1978,346).Marxviewedhimselfas the“Darwinofsociety,”andin1880hesentCharlesDarwinacopy of Capital. Darwin courteously replied, begging ignorance of the subject. KARL MARX LEADS A REVOLT AGAINST CAPITALISM 81 Onlyathousandcopieswereprintedanditsoldslowly,primarily because “Das Buch” was theoretically abstract and scholastically dense,withover1,500sourcescited.ThereviewsofCapitalwere almostuniversallypoor,butthroughtheeffortsofEngelsandother die-hardsupporters,theworkwastranslatedintoRussianin1872and Frenchin1875.TheRussianeditionwasamomentouspublishing event,luckilypassingczaristcensorsas“nonthreatening”hightheory. ItwasstudiedheavilybyRussianintellectuals,andeventuallyacopy fellintothehandsofVladimirIlichUlyanov—V.I.Lenin.ItwasLenin, Marx’smostpowerfuldisciple,whobroughtMarxtolight.“Without MarxtherewouldhavebeennoLenin,withoutLeninnocommunist Russia”(Schwartzchild1947,vii). TheEnglisheditiondidnotappearuntil1887.In1890,anAmericaneditionbecameabest-sellerandtheprintrunof5,000soldout quicklybecauseCapitalwaspromotedasabookinformingreaders “howtoaccumulatecapital”—acourseonmakingmoney!(Padover 1978,375). Mosteconomistswonderhowsucha“long,verbose,abstract,tedious,badlywritten,difficultlabyrinthofabook[could]becomethe TalmudandKoranforhalftheworld”(Gordon1967,641).Marxists respond,“That’sthebeautyofit!”Capitalhassurvivedandblossomed asaclassicinpartbecauseofitsintellectualappeal.Accordingtoan eminentsocialist,theprestigeofCapitalowesmuchto“itsindigestible length,itshermeticstyle,itsostentatiouserudition,anditsalgebraical mysticism”(Wesson1976,27). MarxDiesinObscurity Marxwasonlyforty-nineyearsoldwhenhepublishedCapital,but herefusedtofinishanymorefull-lengthbooksandinsteadread,researched,andtooknotesonhugequantitiesofbooksandarticleson suchwidetopicsasmathematics,chemistry,andforeignlanguages. “Hedelvedintosuchproblemsasthechemistryofnitrogenfertilizers,agriculture,physics,andmathematics....Marximmediately wroteatreatiseondifferentialcalculusandvariousothermathematicalmanuscripts;helearnedDanish;helearnedRussian”(Raddatz 1978,236). Marxhadahardtimecompletinganythinginhislateryears,es- 82 THE BIG THREE IN ECONOMICS peciallywithregardtoeconomics.Heneverfinishedthenexttwo volumes of Capital, which exasperated Engels, who finally edited andpublishedthemhimself. Marxwasasickmanmostofhislife,constantlybesetwithchronic illnesses—asthmaattacks,prolongedheadaches,strepthroat,influenza,rheumatism,bronchitis,toothaches,liverpains,eyeinflammations,laryngitis,andinsomnia.Hisboilsandcarbunclesweresosevere thatbytheendofhislife,hisentirebodywascoveredwithscars.His “eternallybeloved”Jennydiedofcancerin1881;Marxwassoill hecouldn’tattendherfuneral.Hisdaughter,alsonamedJenny,died ofthesamediseasetwoyearslater.Thatsameyear,onMarch17, 1883,Marxpassedawaysittinginhiseasychair.Notsurprisingly, therewasnowillorestate. Marx was buried at Highgate Cemetery in London along with hiswifeJenny,hishousemaidLenchen(in1890),andotherfamily members.Atwelve-footmonumentwithabustofMarxwaserected inthe1950sbytheCommunistParty.Thefamousphrase“Workers of all lands, unite!” is emblazoned on the monument in gold.At thebottomareprintedthewordsofMarx,“Thephilosophershave onlyinterpretedtheworldinvariousways;thepoint,however,is tochangeit.” EngelsconductedtheserviceatMarx’sburial.Hespokeeloquently of Marx’s position in history, proclaiming him the Darwin of the socialsciences.4“Hisnamewillliveonthroughthecenturies,and sowillhiswork.” Indeed.InThe100MostInfluentialBooksEverWritten,byMartin Seymour-Smith (1998), seven economists are listed:Adam Smith, Thomas Robert Malthus, John Stuart Mill, Herbert Spencer, John MaynardKeynes,FriedrichvonHayek...andKarlMarx. TheLivingMarx:ADismalFailure EngelswouldhavetowaituntilthetwentiethcenturybeforeMarx’s influencewouldbefelt.In1883,itwasmerelyadelusionofgran4.Thereisalong-persistentmyththatMarxwroteDarwintoaskifhecould dedicateavolumeofCapitaltoDarwin.Infact,nosuchletterwaswritten.See Colb(1982:461–81). KARL MARX LEADS A REVOLT AGAINST CAPITALISM 83 deur.Atthetimeofhisdeath,Marxwaspracticallyaforgottenman. Fewer than twenty people showed up for his funeral. He was not mournedbyhisfellowworkersintheSiberianmines,asEngelshad suggested,andfewrememberedevenTheCommunistManifesto,let aloneCapital.JohnStuartMillneverheardofhim.Attheendofhis life,MarxcouldrecallwithagreementthewordsoftheBible,“Fora testamentisofforceaftermenaredead:otherwiseitisofnostrength atallwhilethetestatorliveth”(Heb.9:17). Thefateofhisfamilyissadtocontemplate.Itwasanightmare. Marxwassurvivedbyonlytwodaughtersandhisillegitimateson. In1898,hisdaughterEleanorMarx,knownasTussyandastrongwilledrevolutionarylikeherfather,committedsuicideafterlearningthatFreddywastheillegitimatesonofherfatherandthather cynicalIrishrevolutionaryhusbandwasabigamist.In1911,Marx’s survivingdaughter,Laura,aneloquentspeakerandastrikingbeauty, consummatedasuicidepactwithherhusband,aFrenchsocialist.In sum,therewaslittlejoyinthelastyearsofKarlandJennyMarxand theirdescendants.Engels,knownasthe“General,”diedofcancer in1895. Marx’sExploitationModelofCapitalism LetusnowreviewMarx’smajorcontributionstoeconomicsanddeterminewhathashadalastingimpactandwhathasbeendiscarded. InCapital,publishedin1867,KarlMarxattemptedtointroduce analternativemodeltotheclassicaleconomicsofAdamSmith.This systemaimedtodemonstratethroughimmutable“scientific”lawsthat thecapitalistsystemwasfatallyflawed,thatitinherentlybenefited capitalistsandbigbusiness,thatitexploitedworkers,thatlaborhad beenreducedtoamerecommoditywithapricebutnosoul,andthat itwassocrisis-pronethatitwouldinevitablydestroyitself.Inmany ways,theMarxistmodelrationalizeditscreator’sbeliefthatthecapitalistsystemmustbeoverthrownandreplacedbycommunism. TheLaborTheoryofValue Marx found the Ricardian system well suited for his exploitation model.Inmanyways,DavidRicardowashismentorineconomics. 84 THE BIG THREE IN ECONOMICS Asnotedinchapter2,Ricardofocusedonproductionandhowitwas distributedbetweenlargeclasses—landlords,workers,andcapitalists. Ricardoandhissuccessor,JohnStuartMill,attemptedtoanalyzethe economyintermsofclassesratherthantheactionsofindividuals. SayandtheFrenchlaissez-faireschool(chapter2)didfocusonthe subjectiveutilityofindividuals,butMarxrejectedSayandfollowed Ricardobyconcentratingontheproductionofasinglehomogeneous “commodity”andthedistributionofincomefromcommodityproductionintoclasses. InRicardo’sclasssystem,laborplayedacriticalroleindeterminingvalue.FirstRicardoandthenMarxclaimedthatlaboristhesole producerofvalue.Thevalueofa“commodity”shouldbeequaltothe averagequantityoflabor-hoursusedincreatingthecommodity. TheTheoryofSurplusValue Ifindeedlaboristhesoledeterminantofvalue,thenwheredoesthat leaveprofitsandinterest?Marxlabeledprofitsandinterest“surplus value.”Itwasonlyashortlogicalsteptoconclude,therefore,that capitalistsandlandlordswereexploitersoflabor.Ifindeedallvalue wastheproductoflabor,thenallprofitobtainedbycapitalistsand interestobtainedbylandlordsmustbe“surplusvalue,”unjustlyextractedfromthetrueearningsoftheworkingclass. Marxdevelopedamathematicalformulaforhistheoryofsurplus value.Therateofprofit(p)orexploitationisequaltothesurplusvalue (s)dividedbythevalueofthefinalproduct(r).Thus, p=s/r Forexample,supposeaclothingmanufacturerhiresworkerstomake dresses.Thecapitalistsellsthedressesfor$100apiece,butlaborcosts are$70perdress.Thereforetherateofprofitorexploitationis p=$30/$100=0.3,or30% Marxdividedthevalueofthefinalproductintotwoformsofcapital, constantcapital(C)andvariablecapital(V).Constantcapitalrepre- KARL MARX LEADS A REVOLT AGAINST CAPITALISM 85 sentsfactoriesandequipment.Variablecapitalisthecostoflabor. Thus,theequationfortherateofprofitbecomes p=s/[v+c] Marxcontendedthatprofitsandexploitationareincreasedbyextendingtheworkdayforemployees,andbyhiringwomenandchildren at lower wages than men. Moreover,machineryandtechnological advancesbenefitthecapitalist,butnottheworker,Marxdeclared. Machinery,forexample,allowscapitaliststohirewomenandchildren torunthemachines.Theresultcanonlybemoreexploitation. Criticscounteredthatcapitalisproductiveanddeservesareasonable return, but Marx offered the rebuttal that capital was nothing morethan“frozen”laborandthat,consequently,wagesshouldabsorb theentireproceedsfromproduction.Theclassicaleconomistshad noanswertoMarx,atleastinitially.AndthusMarxwonthedayby “proving”throughimpeccablelogicthatcapitalisminherentlycreatedamonstrous“classstruggle”betweenworkers,capitalists,and landlords—andthecapitalistsandlandlordshadanunfairadvantage. Murray Rothbard observes, “As the nineteenth century passed its mid-mark, the deficiencies of Ricardian economics became ever moreglaring.Economicsitselfhadcometoadeadend”(Rothbard 1980,237).ItwasnotuntiltheworkofPhilipWicksteed,theBritish clergyman,andEugenvonBöhm-Bawerk,theinfluentialAustrian economist,thatMarxwasansweredeffectively,withafocusonthe risk-taking and the entrepreneurial benefits the capitalists provide. Butthistopicmustwaituntilchapter4. FallingProfitsandtheAccumulationofCapital Marxhadaperverseviewofmachineryandtechnology.Theaccumulationofcapitalwasconstantlygrowinginordertomeetcompetition andkeepthecostsoflabordown.“Accumulate,accumulate!Thatis Mosesandtheprophets!...Therefore,save,save,i.e.,reconvertthe greatest possible portion of surplus-value, or surplus-product into capital!”pronouncedMarxinCapital(1976[1867],742). Yetthisleadstotrouble,acrisisincapitalism,allaccordingtothe “lawofthefallingrateofprofit.”For,accordingtoMarx’sformula 86 THE BIG THREE IN ECONOMICS fortheprofitrate,s/[v+c],wecanseethataddingmachineryincreasescandthereforedrivesdownprofits.Bigbusinessbecomes moreconcentratedasthelargerfirmsproducemorecheaply,which “alwaysendsintheruinofmanysmallcapitalists.”Meanwhile,workersbecomeallthemoremiserable,havinglessandlesswithwhich tobuyconsumergoods.Moreandmoreworkersarethrownoutof work,becomingincreasinglyunemployedinan“industrialreserve army”earningasubsistencewage. TheCrisisofCapitalism Loweringcosts,fallingprofits,monopolisticpower,underconsumption, massive unemployment of the proletarian class—all these conditionsleadto“moreextensiveandmoredestructivecrises”and depressionsforthecapitalisticsystem(MarxandEngels1964[1848], 13).Andallthisisderivedfromthelabortheoryofvalue! MarxrejectedSay’slawofmarkets,whichhelabeled“childish babble...claptrap...humbug”(Buchholz1999,133).Therewas nostabilityincapitalism,notendencytowardequilibriumandfull employment.Marxemphasizedboththeboomandthebustnatureof thecapitalistsystem,andthatitsultimatedemisewasinevitable. TheImperialismofMonopolyCapitalism Marxwasgreatlyimpressedwiththeabilityofcapitaliststoaccumulate morecapitalandcreatenewmarkets,bothdomesticallyandabroad.The CommunistManifestodescribedthisphenomenoninafamouspassage: “Thebourgeoisie,duringitsruleofscarceonehundredyears,hascreatedmoremassiveandmorecolossalproductiveforcesthanhaveall precedinggenerationstogether.”Thecapitalistsareengagedpell-mell “bytheconquestofnewmarkets,andbythemorethoroughexploitation oftheoldones”(MarxandEngels1964[1848],12–13). Marxistseverafterhavecharacterizedcapitalismandbigbusiness asinherently“imperialistic,”exploitingforeignworkersandforeign resources.Thetheoryofimperialismandcolonialismwasdeveloped largelybyJ.A.HobsonandV.I.Lenin.Muchofthedevelopingworld’s anti-Americanandantiforeignattitudesduringthetwentiethcentury camefromMarxistorigins,andtheresultsofthisanticapitalistattitude KARL MARX LEADS A REVOLT AGAINST CAPITALISM 87 havebeendevastating,resultinginretardedandevennegativegrowth inmanypartsofAsia,Africa,andLatinAmerica. HistoricalMaterialism Sowherewascapitalismheaded?Marxwasheavilyinfluencedby GeorgeWilhelmHegelindevelopinghisprocessofeconomicdeterminism.Hegel’sbasicthesiswas“Contradiction(innature)isthe rootofallmotionandofalllife.”Hegeldescribedthiscontradiction intermsofthedialectic,opposingforcesthatwouldeventuallybring aboutanewforce.Anestablished“thesis”wouldcausean“antithesis” todevelopinopposition,whichinturnwouldeventuallycreateanew “synthesis.”Thisnewsynthesisthenbecomesthe“thesis”andthe processstartsalloveragainascivilizationprogresses. ThediagraminFigure3.1reflectsthisHegeliandialectic.Marx appliedHegel’sdialectictohisdeterministicviewofhistory.Thus, thecourseofhistorycouldbedescribedbyusingHegelianconcepts— fromslaverytocapitalismtocommunism. Figure3.1 TheHegelianDialecticUsedtoDescribetheCourse ofHistory THESIS SYNTHESIS ANTITHESIS According to this theory, slavery was viewed as the principal meansofproductionorthesisduringGreco-Romantimes.Feudalism becameitsmainantithesisintheMiddleAges.Thesynthesisbecame capitalism, which became the new thesis after the Enlightenment. Butcapitalismfaceditsownantithesis—thegrowingthreatofsocialism.Eventually,thisstrugglewouldresultintheultimatesystemof production,communism.Inthisway,Marxwasaneternaloptimist. Hefirmlybelievedthatallhistorypointedtohigherformsofsociety, culminatingincommunism. 88 THE BIG THREE IN ECONOMICS Marx’sSolution:RevolutionarySocialism But while communism was supposedly inevitable, Marx felt that revolutionwasnecessarytobringitabout.Firstandforemost,Marx was a leading proponent of the violent (“forceful”) overthrow of government and the establishment of revolutionary socialism. He delightedinviolence.MarxpromotedrevolutionarycausesinThe CommunistManifestoin1848,theFirstInternationalin1860,andthe ParisCommunein1871.AlthoughtheGermanrevolutionaryfailed torevealhisplansindetail,TheCommunistManifestodidincludea ten-pointprogram(MarxandEngels1964[1848],40): 1. Abolitionofpropertyinlandandapplicationsofallrentsof landtopublicpurposes. 2. Aheavyprogressiveorgraduatedincometax. 3. Abolitionofallrightofinheritance. 4. Confiscationofthepropertyofallemigrantsandrebels. 5. Centralizationofcreditinthehandsofthestatebymeansofa nationalbankwithstatecapitalandanexclusivemonopoly. 6. Centralizationofthemeansofcommunicationandtransport inthehandsofthestate. 7. Extensionoffactoriesandinstrumentsofproductionowned bythestate;thebringingintocultivationofwastelands,and theimprovementofthesoilgenerallyinaccordancewitha commonplan. 8. Equalobligationofalltowork.Establishmentofindustrial armies,especiallyforagriculture. 9. Combinationofagriculturewithmanufacturingindustries;gradualabolitionofthedistinctionbetweentownandcountry,bya moreequitabledistributionofthepopulationoverthecountry. 10. Freeeducationforallchildreninpublicschools.Abolition of child factory labor in its present form. Combination of educationwithindustrialproduction,andsoon. KARL MARX LEADS A REVOLT AGAINST CAPITALISM 89 Itisdifficulttoimagineinstigatingsomeofthesemeasureswithout violence.Butthiswasnotall.Marxalsoadvocatedanauthoritarian “dictatorshipoftheproletariat.”Hefavoredacompleteabolitionof privateproperty,basedonhistheorythatprivatepropertywasthe causeofstrife,classstruggle,andaformofslavery(1964[1848], 27).HeagreedwithProudhonthat“propertyistheft.”Withoutprivate property,therewasnoneedforexchange,nobuyingandselling,and thereforeMarxandEngelsadvocatedtheeliminationofmoney(30). Productionandconsumptioncouldcontinueandeventhrivethrough centralplanningwithoutexchangeorcurrency. MarxandEngelsalsodemandedtheabolitionofthetraditional family in an effort to “stop the exploitation of children by their parents”andto“introduceacommunityofwomen.”Thefounders ofcommunismsupportedaprogramofyoutheducationthatwould “destroythemosthallowedofrelations”and“replacehomeeducationbysocial”(33–35). Whataboutreligion?Marxnotedthat“religionistheopiumofthe people.”“Communismabolisheseternaltruths,itabolishesallreligion, andallmorality,insteadofconstitutingthemonanewbasis;ittherefore actsincontradictiontoallpasthistoricalexperience”(38). Marxanticipatedthatrevolutionarysocialismwouldforthefirst timeallowthefullexpressionofhumanexistenceandhappiness.The goalof“universalopulence”thatAdamSmithsoughtwouldfinallybe achievedundertruecommunism.Marxwasamillennialistatheart. Heavencouldbeachievedonearth.Eventuallythedictatorshipofthe proletariatwouldbereplacedbyaclassless,statelesssociety.Homo Marxistwouldbeanewman! Marx’sPredictionsFailtoMaterialize Butallthiswasnottobe.Marx’spredictionswentawry,thoughnotall rightaway.Aslateas1937,WassilyLeontief,theRussianémigréwho laterwontheNobelPrizeforhisinput–outputanalysis,proclaimed thatMarx’srecordwas“impressive”and“correct”(Leontief1938,5, 8).ButLeontief’spraisewaspremature.Sincethen,asLeszekKolakowski,formerleaderofthePolishCommunistParty,declared,“All ofMarx’simportantpropheciesturnedouttobefalse”(Denby1996, 339).Toreview: 90 THE BIG THREE IN ECONOMICS 1. Undercapitalism,therateofprofithasfailedtodecline,even whilemoreandmorecapitalhasbeenaccumulatedoverthe centuries. 2. The working class has not fallen into greater and greater misery.Wageshaverisensubstantiallyabovethesubsistence level.Theindustrialnationshaveseenadramaticriseinthe standardoflivingoftheaverageworker.Themiddleclasshas notdisappeared,butexpanded.AsPaulSamuelsonconcludes, “Theimmiserizationoftheworkingclass...simplynever tookplace.AsaprophetMarxwascolossallyunluckyand hissystemcolossallyuseless”(1967,622). 3. Thereislittleevidenceofincreasedconcentrationofindustriesinadvancedcapitalistsocieties,especiallywithglobal competition. 4. Socialist utopian societies have not flourished, nor has the proletarianrevolutioninevitablyoccurred. 5. Despitebusinesscyclesandevenanoccasionalgreatdepression,capitalismappearstobeflourishingasneverbefore. Update:MarxistsasModern-DayDoomsdayers InTheCommunistManifesto,MarxandEngelswarned,“Itisenough tomentionthecommercialcrisesthatbytheirperiodicalreturnput onitstrial,eachtimemorethreatening,theexistenceoftheentire bourgeoissociety”(1964[1848],11–12). Followingtheirleader’sfootsteps,modern-dayMarxistsareconstantlypredictingthecollapseofcapitalism,onlytoberebuffedtime andagain.In1976,inthemidstoftheenergycrisisandinflationary recession,socialistMichaelHarringtonpublishedabookentitledThe TwilightofCapitalism,whichhededicatedtoKarlMarx.Hepredicted thatthecrisisofthe1970swouldbetheendofcapitalism. Inthesameyear,MarxistErnestMandelwroteanintroductionto Capital,forcefullydeclaring,“Itismostunlikelythatcapitalismwill surviveanotherhalf-centuryofthecrises(military,political,social, monetary,cultural)whichhaveoccurreduninterruptedlysince1914” (Mandel1976[1867],86). KARL MARX LEADS A REVOLT AGAINST CAPITALISM 91 PaulM.Sweezy,theMarxistprofessoratHarvard,wasalongtime pessimist.Sincethe1930s,heforecastedthatcapitalismwasonthe declineandthatsocialism,promotinghigherstandardsofliving,would advance“byleapsandbounds”(Sweezy1942,362).Hecoauthored abookentitledTheEndofProsperityin1977. Yet,enteringanewcentury,capitalismisevenmoredynamicthan everbefore.Themodern-dayMarxists,alwaysthepessimists,have beenprovedwrongagain. TheCuriousCaseofNikolaiKondratieff One famous Russian economist to contradict the official Marxist predictionofcapitalism’sinevitabledemisewasNikolaiKondratieff (1892–1938). In 1926, he delivered a paper before the prestigious EconomicInstituteinMoscow,makingthecaseforafifty-tosixtyyearbusinesscycle.Basedonpriceandoutputtrendssincethe1780s, Kondratieffdescribedtwo-and-a-halfupswinganddownswing“long wave” cycles of prosperity and depression. Kondratieff found no evidence of an irreversible collapse in capitalism; rather, a strong recoveryalwayssucceededdepression. In 1928, Kondratieff was removed from his position as head of Moscow’sBusinessConditionsInstituteandhisthesiswasdenounced intheofficialSovietencyclopedia(Solomou1987,60).Hewassoon arrestedastheallegedleaderofthenonexistentWorkingPeasantsParty anddeportedtoSiberiain1930.OnSeptember17,1938,duringStalin’s greatpurge,hewassubjectedtoasecondtrialandcondemnedtoten yearswithouttherighttocorrespondwiththeoutsideworld;however, Kondratieffwasexecutedbyfiringsquadonthesamedaythisdecree wasissued.Hewasforty-sixatthetimeofhismurder.5 5.JustbecauseKondratieffwaspersecutedbytheSovietsshouldnotimplythat histheorythatcapitalismautomaticallygoesthroughfifty-to-sixty-yearcyclesis correct.Beliefintheso-calledKondratiefflong-wavecyclestillsurvivesonamong someeconomists,historians,andfinancialanalystswhoregularlypredictanother depressionandeconomiccrisis.However,ithasnowbeennearlyeightyyearssince thelastworldwidedepression.AsVictorZarnowitzconcludedrecently,“Thereis muchdisagreementabouttheveryexistenceofsomeofthelongwavesevenamong thesupportersoftheconcept,andmoredisagreementyetaboutthetimingofthe wavesandtheirphases”(Zarnowitz1992,238). 92 THE BIG THREE IN ECONOMICS CriticismsofMarx WhywasMarxsoterriblywrongafterestablishingwhatheinsisted were“scientific”lawsofeconomics? Firstandforemost,hislabortheoryofvaluewasdefective.InrejectingSay’slawofmarkets,healsodeniedSay’ssoundtheoryofvalue. Saycorrectlynotedthatthevalueofgoodsandservicesisultimately determinedbyutility.Ifindividualsdonotdemandorneedaproduct, itdoesn’tmatterhowmuchlabororeffortisputintoproducingit;it won’tcommandvalue. AshistorianJacquesBarzunnoted,“Pearlsarenotvaluablebecause mendiveforthem;mendiveforthembecausepearlsarevaluable” (Barzun1958,152).AndPhilipWicksteed,writingthefirstscientific criticismofMarx’slabortheoryin1884,noted,“Acoatisnotworth eighttimesasmuchasahattothecommunitybecauseittakeseight timesaslongtomakeit....Thecommunityiswillingtodevoteeight timesaslongtothemakingofacoatbecauseitwillbewortheight timesasmuchtoit”(Wicksteed1933,vii).6 Andwhataboutallthosevaluablethingsthatkeepincreasingin valueeventhoughtheyrequirelittleornolabor,suchasartorland? Marxrecognizedthesewereexceptionstohistheory,butconsidered themofminorimportancetothefundamentalissueoflaborpower. TheTransformationProblem Marxalsofacedadilemmathatbecameknownasthe“transformationproblem,”knownastheprofitrateandvalueproblem.AconflictarisesunderMarx’ssystembecausesomeindustriesarelabor intensive and others are capital intensive. (In Marxist language, theyhaveahigherorganiccompositionofcapital.)Involume1of Capital,Marxinsistedthatpricesvarieddirectlywithlabortime, concludingthereforethatcapital-intensiveindustriesshouldbeless profitablethanlabor-intensiveindustries.Yettheevidenceseemsto 6.Itwaspreciselythisarticle,appearinginthesocialistmonthlyTodayinOctober1884,thatconvincedGeorgeBernardShawandSidneyWebbthatthelabor theoryofvaluewasuntenableandtherebybroughtthewholeMarxistedificedown inruins(Lichtheim1970,192–93). KARL MARX LEADS A REVOLT AGAINST CAPITALISM 93 indicatesimilarprofitabilityacrossallindustriesoverthelongrun, sincecapitalandinvestmentcouldmigratefromlesstomoreprofitable industries. Marx never could resolvethisthornyissue,which Rothbardcalled“themostglaringsingleholeintheMarxianmodel” (Rothbard1995b,413). Marx wrestled with this transformation problem his entire life, promisingtohaveananswerinfuturevolumesofCapital.Intheintroductiontovolume2ofCapital,Engelsofferedaprizeessaycontest onhowMarxwouldsolvethedilemma.Forthenextnineyears,a largenumberofeconomiststriedtosolveit,butuponthepublication ofvolume3ofCapital,Engelsannouncedthatnoonehadsucceeded7 (Rothbard1995b,413).EugenBöhm-Bawerkjumpedonthissingular failureinMarxianeconomics;inthewordsofPaulSamuelson,“make nomistakeaboutit,Böhm-Bawerkisperfectlyrightininsistingthat volumeIIIofCapitalneverdoesmakegoodthepromisetoreconcile thefabricatedcontradictions”(Samuelson1967,620). TheVitalRoleofCapitalistsandEntrepreneurs Second,Marxblunderedinfailingtovaluetheknowledgeandwork ofcapitalistsandentrepreneurs.Asweshallseeinthenextchapter, Böhm-Bawerk,AlfredMarshallandothergreateconomistsrecognized thehugecontributioncapitalistsandentrepreneursmakeintakingon riskandprovidingthenecessarycapital(saving)andmanagement skillsnecessarytooperateaprofitableenterprise. TheWorker-CapitalistPhenomenon One of the biggest problems facing Marxism today is the gradual disintegrationofeconomicclasses.Nolongeristhereisacleardivisionbetweencapitalistandworker.Fewerandfewerworkersare simplyemployeesorwageearners.Theyareoftenshareholdersand partownersofthecompaniestheyworkfor—throughprofit-sharing andpensionplans,wheretheyownsharesinthecompaniestheywork for.Manyworkersareself-employedandarepart-timecapitalists. 7.AcompletesummaryofthetransformationdebateamongMarxistscanbe foundinHowardandKing(1989,21–59). 94 THE BIG THREE IN ECONOMICS Today,overhalfofAmericanfamiliesownstockinpubliclytraded companies.MainStreethasteamedupwithWallStreettocreatea newmassofworker-capitalists,whichhasgreatlydiminishedrevolutionaryzealwithinthelabormarkets. Finally,Marx’sviewofmachineryandcapitalgoodsisperverseand one-sided.Time-savingandlabor-savingmachinerydoesnotsimply layoffworkersorreducewages.Itfrequentlymakesthejobeasier toperformandallowsworkerstoengageinotherproductivetasks. Machineryandtechnologyhavedoneanamazingjobinreducingor eliminatingthe“workeralienation”Marxcomplainedaboutsobitterly.Bycuttingcosts,machineryandtechnologicaladvancescreate newdemandsandnewopportunitiestoproduceotherproducts.They createotherjobs,oftenatbetterpay,forworkerswhoaredisplaced. AsLudwigvonMisesstatedacenturylater,“thereisonlyonemeans toraisewageratespermanentlyandforthebenefitofallthoseeager toearnwages—namely,toacceleratetheincreaseincapitalavailable asagainstpopulation”(Mises1972,89).Theevidenceisoverwhelmingthatincreasinglaborproductivity(outputperman-hour)leadsto higherwages. TosumupMarxisteconomics,PaulSamuelsonyearsagoconcludedthatalmostnothingintheeconomicsofclassicalMarxism survivesanalysis(Samuelson1957).AndJonathanWolff,aBritish professorsympathetictoMarxistideas,recentlyconcludedthatwhile “Marx remains the most profound and acute critic of capitalism, evenasitexiststoday,wemayhavenoconfidenceinhissolutions. ...Marx’sgrandesttheoriesarenotsubstantiated”(Wolff2002, 125–26). Marx,theAnti-economist? Michael Harrington claimed that Marx was the ultimate antieconomist(1976,104–148).Indeed,hemayberight.Marxwasa naiveidealistwhofailedprofoundlytocomprehendtheroleofcapital, markets,prices,andmoneyinadvancingthematerialabundanceof mankind. Theironyisthatitiscapitalism,notsocialismorMarxism,thathas liberatedtheworkerfromthechainsofpoverty,monopoly,war,and oppression,andhasbetterachievedMarx’svisionofamillennium KARL MARX LEADS A REVOLT AGAINST CAPITALISM 95 ofhope,peace,abundance,leisure,andaestheticexpressionforthe “full”humanbeing. CouldMarxistsocialismcreatetheabundanceandvarietyofgoods andservices,breakthroughtechnologies,newjobopportunities,and leisure time of today? Hardly. Marx was incredibly ingenuous in thinkingthathisbrandofutopiansocialismcouldachievearapidrise intheworkers’livingstandards.Hewroteinthe1840s,“incommunistsociety...nobodyhasoneexclusivesphereofactivitybuteach canbecomeaccomplishedinanybranchhewishes,...thusmaking itpossibleformetodoonethingtodayandanothertomorrow,to huntinthemorning,fishintheafternoon,rearcattleintheevening, criticize after dinner, in accordance with my inclination, without becominghunter,fisherman,shepherdorcritic”(Marx2000,185). Thisissheerivory-towernaiveté,acharacteristicoftheearlyMarx. Marx’sidealismwouldtakeusbacktoaprimitive,ifnotbarbaric, ageofbarterandtriballiving,withoutthebenefitofexchangeand divisionoflabor. Thus,asweenterthetwenty-firstcentury,AdamSmith—thefather ofcapitalism—ismovingbackinfrontofKarlMarx—thefatherof socialism.InthefirsteditionofThe100:The100MostInfluential PeopleintheWorld(1978),authorMichaelHartplacedMarxahead ofSmith.Butinthesecondedition,writtenin1992afterthecollapse ofSovietcommunism,SmithmovedaheadofMarx. DidMarxRecant? Marx is said to have said, “I am not Marxist,” in the late 1870s, butapparentlyithasbeentakenoutofcontext.Attimeshewasso despairingoverhisson-in-lawLafargue’ssocialist“theoreticalgibberish,”thatMarxdeclared,“IfthatisMarxist,IamnoMarxist.” BiographerFritzJ.Raddatzconcludes,“Itiscertainlynottobetaken asarecantationordeviationfromhisowndoctrinebut,onthecontrary,asadefenseofthatdoctrineagainstthosewhowoulddistort it”(Raddatz1978,130).ButwhileMarxmaynothaverelinquished histasteforviolentrevolutionandhisowntheories,Engelsappears tohaverevisedhisviewsinlateryears.Heconcededthatworkers may earn more than subsistence wages, that other noneconomic factorscouldplayaroleinsociety,andthatlegalpoliticalmeans 96 THE BIG THREE IN ECONOMICS mightachievereform.“Theone-timewould-bedashinggeneralof revolutionhadalmostbecomeaSocial-Democraticreformer,”writes RobertWesson(1976,37–38). What’sLeftofMarxism? IfMarx’seconomictheoriesandpredictionshaveprovedtobeinaccurate, is there anything salvageable from Capital and the rest of Marx’seconomicwritings?Indeed,thereis. Firstandforemostistheissueofeconomicdeterminism.What movessociety—ideasorvestedinterests?Inhis“law”ofhistoricalmaterialism,Marxcounteredthetraditionalviewthatreligion oranyotherinstitutionalphilosophydeterminedthecultureofa community.Instead,Marxcontendedtheopposite,thatthematerialoreconomicforcesofsocietydeterminedthelegal,political, religious,andcommercial“superstructure”ofnationalculture.In ThePovertyofPhilosophy,Marxexplained,“thehandmillgives yousocietywiththefeudallord,thesteam-millgivesyousociety withtheindustrialcapitalist”(Marx1995,219–20).Todaymost sociologists recognize the important role economic forces play insociety. Secondistheissueofclassesinsociety.Marx’stheoryofclass consciousness and class conflict has engaged historians and sociologists. To what extent are behavior and thought reflections ofbourgeoisorproletarianvalues?Towhatpointdoestheruling classprotectandadvanceitsintereststhroughthepoliticalprocess? Does the group that owns or controls property and the means of production dominate? Is it true that “law and politics are in the service of industrial capital”? If so, asks Wolff, “why are trade unionsallowed?WhydouniversitieshaveArtsFacultiesaswellas Engineering (indeed, why allow the teaching of Marxism)?Why don’tthemultinationalswineveryoneoftheircourtcases?”(Wolff 2002,59)Ifthestateisunderthethumbofthecapitalistinterests, why did the Great Depression occur, since it severely harmed them?KarlPopperridiculedtheall-knowingMarxistposition:“A Marxistcouldnotopenanewspaperwithoutfindingoneverypage confirmingevidenceforhisinterpretationofhistory;notonlyinthe news,butalsoinitspresentation—whichrevealedtheclassbiasof KARL MARX LEADS A REVOLT AGAINST CAPITALISM 97 thepaper—andespeciallyofcourseinwhatthepaperdidnotsay” (Popper1972,35). Third,MarxistsstressseveralcontemporaryissuesthatMarxraised: • Theproblemofalienationandmonotonousworkintheworkplace. • Theproblemsofgreed,fraud,andmaterialismunderamoneyseekingcapitalistsociety. • Theconcernsoverinequalityofwealth,income,andopportunity. • Conflictsoverrace,feminism,discrimination,andtheenvironment. DavidDenby,anessayistwhoreadMarxasanadultinacollege classic literature course, discusses several modern-day issues frequentlyraisedbytoday’sMarxists.First,alienation.Denbystates: “Alienationisalossofself:Weworkforothers,tofulfillotherpeople’s goals,andoftenweconfrontwhatweproducewithanindifference borderingondisgust”(1996,349).Howdowedealwithboredomand meaninglessnessintoday’sbusinessworld?Yetwhatisthealternative? Isacommunalorsocialistsocietyanylessboringormeaningless?A capitalistsocietythatgraduallyimprovesthequantity,quality,and varietyofgoodsandservicesofferslessboredomandagreaterchance offulfillment,oftenbyprovidingshorterworkdaysthatallowworkers tofindfulfillmentinavocationsoutsidetheirwork. Whataboutgreed?Doesthemarketsystemreducehumanactivitytoa completefocusonmaterialthings?Marxcomplainedthatthecapitalism ofAdamSmithcausessocietytobea“commercialenterprise,”where “everyoneofitsmembersisasalesman....Thelessyoueat,drink,and buybooks,gotothetheaterortheballs,ortothepublic-house,andthe lessyouthink,love,theorize,sing,paint,fence,etc.,themoreyouwill beabletosaveandthegreaterwillbecomeyourtreasurewhichneither mothnorrustwillcorrupt—yourcapital.Thelessyouare,thelessyou expressyourlife,thegreaterisyouralienatedlifeandthegreateristhe savingofyouralienatedbeing”(Fromm1966,144). Modern-dayMarxistscomplainabouttoday’smaterialisticsociety. “Wegotoworktoearnmoney,andthengotoshopstospendit.We arepeoplewithtunnelvision,”contendsWolff.Inherbook,TheOverworkedAmerican(1991),HarvardeconomistJulietSchorcontendsthat 98 THE BIG THREE IN ECONOMICS moderncapitalism,especiallysinceWorldWarII,hasforcedAmericans tobecomeworkaholics.8Denbywrites,“Capitalismcreatedenvyandthe desiretodefineoneselfthroughgoods.Capitalismitself,initsAmerican version,bearspartoftheresponsibilityforlowmorals”(1996,349).Accordingtothisview,capitalismcrushesthehumanspirit’spotentialbyforcingustothinkalwaysofwork.Thus,accordingtoMarx,themarketplace becomesamonster,the“universalwhore”(Marx2000,118). Thisargumentispopular,butiscounteredbythethesisofAdam SmithandMontesquieu,amongothers,thatthebusinessculturegraduallyrestrainsfraudandgreed(seechapter1).Smithnotedthatmanis notsimplyaworkmachine:“Itisintheinterestofeverymantolive asmuchathiseaseashecan”(Smith1965[1776],718).Capitalism alsoproduceswealthyindividualswhospendmuchtimeandeffort on spiritual, artistic, nonmaterial, nongreedy initiatives, providing manybenefitstosociety.Itevenallowsindividualstodropoutof thematerialworld,andengageinspiritualinterests.Privatesurplus wealthgoestowardmanygoodcauses,includingthearts,charities, foundations,andprogramstohelptheneedy. Denby’s college professor posed another Marxist criticism: “In bourgeois society the relations between human beings imitate the relationsbetweencommodities....Ifcashistheonlythingconnectingus,whatkeepssocietytogether?”Theyearningforcommunityin ahighlyindividualisticmarketeconomyisamajorconcern.Dowe measurepeoplesolelybytheirincomeandnetworth?Doesthechasingofthealmightydollarcausethetearingdownofhistorichomes andthebuildingofhigh-riseapartments?Doescapitalismpressureus toworksolongandhardthatwedon’thavetimetodeveloprelationshipsoutsidetheoffice?Denbywarns,“InAmerica,thereseemedless andlessholdingustogether”(1996,344–351). Thereisnoquestionthatthefast-pacedmarketeconomymakesus livemoreindependentlyfromthecommunity.Theexchangeofgoods 8.OthereconomistsdisputeSchor’scontentionthatAmericansareoverworked. See“NewStudySuggestsAmericansAren’tOverworkedAfterAll,”WallStreet Journal,September15,2005,p.D2.Itstates,“TheBureauofLaborStatisticsfound Americansovertheageof15onaveragesleep8.6hoursadayandfull-timeworkersonaverageclockin8.1hoursonthejob.That’smoreworkthanoccursinmany Europeancountries,butstillleavestimeforotheractivities.” KARL MARX LEADS A REVOLT AGAINST CAPITALISM 99 andservicesoftenbecomesanonymousandunfriendly.Undoubtedly inacommunitariansociety,wewouldallknowourneighborsand localbusinesspeoplebetter.Butwhatarewegivingup? TheMoneyNexus Beyondtheissuesofeconomicdeterminism,classconsciousness,and contemporarysocialissues,IfindMarx’scommentaryontheevolutionaryroleofcapitalismvaluableinmyownworkasafinancialeconomist. Inchapter3ofCapital,hebeginswithadiscussionofthebarteroftwo commodities,CandC´.Theexchangetakesplaceasfollows: C–C´ Whenmoneyisintroduced,therelationshipchangesto: C–M–C´ Here,moneyrepresentsthemediumofexchangeoftwocommodities. Normallyintheproductionprocessfromrawcommoditiestothefinal product,moneyisexchangedseveraltimes.Thefocusofthecapitalist systemisontheproductionofusefulgoodsandservices,andmoney simplyservesasamediumofexchange—ameanstoanend. However,Marxpointedoutthatitisveryeasyforthemoneycapitalisttostartviewingtheworlddifferentlyandmorenarrowlyinterms of“makingmoney”ratherthan“makingusefulgoodsandservices.” Marxrepresentsthisnewbusinesswayofthinkingasfollows: M–C–M´ Inotherwords,thebusinessmanuseshismoney(capital)toproducea commodity,C,which,inturn,issoldformoremoney,M´.Byfocusing onmoneyasthebeginningandendoftheiractivities,itisveryeasyfor capitaliststolosesightoftheultimatepurposeofeconomicactivity—to produceandexchangegoods.ThegoalisnolongerC,butM. Finally,themarketsystemadvancesonestepfurthertothepoint wherecommodities(goodsandservices)donotenterthepictureat all.Theexchangeprocessbecomes: 100 THE BIG THREE IN ECONOMICS M–M´ Thisfinalstagereflectsthecapitalorfinancialmarkets,suchas moneymarketsandsecurities(stocksandbonds).Bynow,itiseasier forcommoditycapitalismtobecomepurefinancialcapitalism,further removedfromitsrootsofcommodityproduction.Inthisenvironment, businesspeopleoftenforgetthewholepurposeoftheeconomicsystem—toproduceusefulgoodsandservices—andconcentratesolely on“makingmoney,”whetherthroughgambling,short-termtrading techniques,orsimplyearningmoneyinabankaccountorfromT-bills. Ultimatelythegoalofmakingmoneyisbestachievedbyproviding usefulgoodsandservices,butitisalessonthatmustbelearnedover andoveragaininthecommercialworld. Thus,wecanseehowacapitalisticculturecanleadtothelossof bothultimatepurposeandasenseofcommunity.Thistendencytomove awayfromthetruepurposeofeconomicactivityconstantlychallenges businessleaders,investors,andcitizenstogetbacktothebasics. In sum, Karl Marx cannot be entirely dismissed. His economic theorymayhavebeendefective,hisrevolutionarysocialismmayhave beendestructive,andMarxhimselfmayhavebeenirascible,buthis philosophicalanalysisofmarketcapitalismhaselementsofmeritand deservesourattention. Update:MarxistsKeepTheirHeroAliveandKicking Marxismhasnevermademuchofaninroadintoeconomics,which emphasizeshightheoryandeconometricmodel-building.Thefew MarxistsoncampushaveincludedMauriceDobbatCambridge,Paul BaranatStanford,andPaulSweezyatHarvard.Sweezy(1910–2004) wasthemostfascinating,beingtheonlyeconomistIknowwhowent fromlaissez-fairetoMarxism.(WhittakerChambers,MarkBlaug, andThomasSowellallwentintheoppositedirection.)BorninNew YorkCityin1910toaMorganbanker,PaulSweezygraduatedwith honorsfromthebestprivateschools,Exeter,andHarvard.Brilliant, handsome, and witty, Sweezy left Harvard in 1932 as a classical economist,wenttotheLondonSchoolofEconomicsforgraduate work,becameanardentHayekian,thenbrieflyfellunderthespell ofHaroldLaskiandJohnMaynardKeynes,andfinallyconvertedto KARL MARX LEADS A REVOLT AGAINST CAPITALISM 101 Marxism!Fromthenon,thedebonairSweezymadeeveryeffortto makeMarxismrespectableoncollegecampuses. ReturningtoHarvardasaninstructorduringthegoldeneraofthe Keynesianrevolution,hebefriendedJohnKennethGalbraith,tutored RobertHeilbroner,andcollaboratedwithJosephSchumpeteronhis forthcomingCapitalism,SocialismandDemocracy.Sweezywrotehis mostfamousarticleonthe“kinked”demandcurve,helpedorganize theHarvardTeachers’Union,andpublishedTheTheoryofCapitalist Development(1942),anextremelycoherentandcompellingexpositionofMarxism(althoughtheauthoroverlycommittedhimselfto citingStalin).LikeSchumpeter,Sweezypredictedattheendofhis bookthatcapitalismwouldinevitablycollapseandsocialismwould “demonstrateitssuperiorityonalargescale”(1942,352–63). HisteachingatHarvardwasinterruptedwhenhejoinedtheOfficeof StrategicServices(thepredecessoroftheCentralIntelligenceAgency) in1942.Afterthewar,SweezycameupfortenureatHarvard,butdespite vigorousbackingbySchumpeter,wasrejected,nevertohaveapermanentacademicpositionagain.In1949,heco-foundedMonthlyReview, “anindependentsocialistmagazine,”whosefirstissuemadeamajor splashbypublishing“WhySocialism?”byAlbertEinstein.(Einstein’s essayisremarkablyMarxistintone.)Sweezyhasbeenassociatedwith MonthlyRevieweversince,inadditiontocollaboratingwithPaulBaran onwritingMonopolyCapital(1966).Yetthroughouthiscareer,Sweezy wasknownfortaking“far-fetchedandunreal”positions(hiswords), such as his arch defense of Fidel Castro’s Cuba (a nation currently rankedbytheUNastheworld’sworsthumanrightsviolator)andhis constantanticipationofcapitalism’simminentcollapse(1942,363).In 1954,duringtheMcCarthyera,hewasjailedforrefusingonprinciple toanswerquestionsabout“subversiveactivities”inNewHampshire; in1957theSupremeCourtoverturnedtheverdict. OtherRadicalTrends OtherradicaljournalsandorganizationsemergedduringtheVietnam War:thejournalsDissentandNewLeftReview,andtheUnionofRadicalPoliticalEconomists,orURPEforshort.Theyallreachedtheir heydayintheprotestdaysofthe1960sandthecrisis-prone1970s.It was1968whenseveralMarxistsmetattheUniversityofMichigan 102 THE BIG THREE IN ECONOMICS toestablishtheUnionofRadicalPoliticalEconomistsandchosethe acerbic-soundingacronymURPE.ThepurposeofURPEistodevelop a“critiqueofthecapitalistsystemandallformsofexploitationand oppressionwhilehelpingtoconstructaprogressivesocialpolicyand createsocialistalternatives”(URPEwebsite). By1976,PaulSamuelsonreportedthatatleast10percentofthe profession consisted of Marxist-style economists.Although Marxism has had a far greater influence in sociology, political science, andliterarytheory,someeconomicsdepartmentsareknownfortheir radicalism,includingtheUniversityofMassachusettsatAmherst,the NewSchoolofSocialResearchinNewYorkCity,theUniversityof CaliforniaatRiverside,andtheUniversityofUtah. SincethecollapseoftheSovietUnionandthecentral-planningsocialist paradigm,thelureofMarxismhasfaded,atleastineconomics.AttendanceatURPEsessionsattheannualAmericanEconomicAssociation meetingsisdown,andURPEmembershiphasfallentoaround800. Marxandhisfollowershavetraditionallytakenadimviewofthe future of capitalism. In the twentieth century, Marxists frequently wroteofthe“twilightofcapitalism,”afavoritebooktitle(William Z.Fosterin1949,MichaelHarringtonin1977,andBorisKagarlitsky in2000).Theyallpredictedtheimminentcollapseofthecapitalist system.However,LordMeghnadDesai,aneconomistattheLondon SchoolofEconomics,recentlyproposedthestartlingthesisthatMarx wouldhavesupportedtheresurgenceofcapitalismaroundtheworld. TheCommunistManifestospokeeloquentlyaboutthe“evergrowing …constantlyexpanding…rapid”advanceofvigorousandvitalcapitalistforces,reachingbeyondnaturalborderstoaworldmarket(1964 [1848],4).TheoldMarxistswereprematureintheirdirepredictions. Butwhathappensafterglobalcapitalismrunsitscourse?Desaiasks, “WillthereeverbeSocialismbeyondCapitalism?”(Desai2004,315). SomeMarxists,suchasDavidSchweickart,suggestsomeformof “economicdemocracy”willdevelopafterthe“currentlatedecadent” stageofcapitalismplaysitselfout(Schweickart2002). TheRiseandFallofLiberationTheology Inthelate1960sandearly1970s,aMarxist-drivenideologydeveloped inLatinAmerica,especiallyamongCatholicpriestswhoworkedin KARL MARX LEADS A REVOLT AGAINST CAPITALISM 103 thebarriosandfavelas,knownas“liberationtheology.”WhilerejectingtheMarxistextremesofatheismandmaterialism,thesepolitical activistssoughttoliberatethepoorbycombiningMarxistdoctrines of exploitation, class struggle, and imperialism with the Christian theologyofcompassionforthepoorandunderprivileged.Popular bookscarriedthetitlesCommunismandtheBibleandTheologyof Liberation,bothpublishedinEnglishbyOrbisBooks,asubsidiaryof theCatholicministryMaryknollFathersandSisters.“Christledme toMarx,”declaredErnestoCardenal,theNicaraguanpriest,toPope JohnPaulIIin1983.“I’maMarxistwhobelievesinGod,follows Christandisarevolutionaryforthesakeofhiskingdom”(Novak 1991,13). The father of liberation theology, Gustavo Gutiérrez, is a short, mild-manneredprofessoroftheologywhowroteabouthisworkwith thepoorinhisnativecityofLima,Peru,inTheologyofLiberation (1973).Gutiérrezexplainedhis“liberationtheology”inMarxistterms (McGovern1980,181–82): Idiscoveredthreethings.Idiscoveredthatpovertywasadestructivething, somethingtobefoughtagainstanddestroyed,notmerelysomethingwhichwas theobjectofourcharity.Secondly,Idiscoveredthatpovertywasnotaccidental. Thefactthatthesepeoplearepoorandnotrichisnotjustamatterofchance, buttheresultofastructure.Itwasastructuralquestion.Third,Idiscoveredthat povertywassomethingtobefoughtagainst…..[I]tbecamecriticallyclearthat inordertoservethepoor,onehadtomoveintopoliticalaction. Marxisttheologistsblamedcapitalism,andespeciallythe“imperialistic”UnitedStatesanditsmultinationalcorporations,forthisoppressiveatmosphereinLatinAmerica.Theyexpressedaradicalhostility toprivateproperty,markets,andprofitsasan“exploitive”processin favoroftherichattheexpenseofthepoor.Andifthechoicewasbetweenrevolutionanddemocracy,revolution,evenviolentrevolt,was preferable.Theirpoliciesincludednationalization,aversiontoforeign investment,andimpositionofpricecontrolsandtradebarriers. Criticsofliberationtheologycontendthatthesestatistpolicieshave onlymadepovertyandinequalityworseinLatincountries.Michael NovakseestheLatinAmericansystemdifferentlyfromtheMarxists:“Thepresentorderisnotfreebutstatist,notmarket-centered butprivilege-centered,notopentothepoorbutprotectiveoftherich. 104 THE BIG THREE IN ECONOMICS Largemajoritiesofthepoorarepropertyless.Thepoorareprevented bylawfromfoundingandincorporatingtheirownenterprises.They aredeniedaccesstocredit.Theyareheldbackbyanancientlegal structure,designedtoprotecttheancientprivilegesofapre-capitalist elite”(Novak1991,5). WhatistheAdamSmithsolutiontopovertyandinequalityinLatin America?Thechallenge,accordingtoNovak,istocreategenuine private-sectorjobs,therealsolutiontopoverty.“Revolutionaries,”he states,“seemmostlytocreatehugearmies.Economicactivistscreate jobs.”TotrulyliberateLatinAmerica,heandotherdisciplesofAdam Smithadvocateopenmarkets,foreigninvestment,lowtaxes,opportunitiesforbusinesscreationandownershipofpropertybyallcitizens, andpoliticalstabilityundertheruleoflaw—a“liberal,pluralistic, communitarian,public-spirited,dynamic,inventive”nationnotunlike theAsiantigersadoptedintherecentpast(Novak1991,32).9 SincethefallofSovietcommunismandthesocialistcentral-planning model, liberation theology has lost its steam and most Latin American countries have adopted a more open economy. Consequently,Latinnationshavegrownrapidlyandthepercentageofpoor has declined. Orbis Books and the Maryknoll Fathers and Sisters ministrynolongerpublishbooksonliberationtheology. TheNextRevolution OnlyafewyearsafterMarx’smasterpiece,Capital,waspublished,a newbreedofEuropeaneconomistscameonthescene.TheseeconomistscorrectedtheerrorsofMarxandtheclassicaleconomists,and broughtaboutapermanentrevolution.Asnotedearlier,thecost-ofproductionapproachtopricetheoryhadputeconomicsinabox,abox containingabombshellthatcouldannihilatetheclassicalsystemof naturalliberty.Itwouldtakearevolutionarybreakthroughineconomic theorytorejuvenatethedismalscienceandrestorethefoundationsof AdamSmith’smodel.Thatisthesubjectofchapter4. 9.PeruvianeconomistHernandodeSotohaswrittenseveralpopularbookson theneedforlegalandeconomicreformsinLatinAmericaanddevelopingcountries ingeneral.SeeSoto(2002,2003). Scottish economist Adam Smith (1723–90) was a professor of moral philosophy at Glasgow University between 1751 and 1763. “I am a beau in nothing but my books.” SkousenPhotoSec.indd 1 11/21/2006 12:17:24 PM In 1776, Adam Smith published the “crown jewel” of economics, The Wealth of Nations. “It contains the most important substantive proposition in all economics: the pursuit of self-interest under conditions of competition.” Three writers who influenced Adam Smith’s “system of natural liberty”… Charles Louis de Montesquieu (1689–1755) France SkousenPhotoSec.indd 2 David Hume (1711–76) Scotland Benjamin Franklin (1706–90) United States 11/21/2006 12:17:25 PM The French advanced Smith’s laissez faire model . . . Jean-Baptiste Say (1767–1832) Frédéric Bastiat (1801–50) Alexis de Tocqueville (1805–59) . . . while the British classical economists took it down a dangerous road. Thomas Robert Malthus (1766–1834) SkousenPhotoSec.indd 3 David Ricardo (1772–1823) John Stuart Mill (1806–73) 11/21/2006 12:17:26 PM Marx and Engels among socialists in Paris, the late summer of 1844. They released The Communist Manifesto in 1848. German Philosopher G.W.F. Hegel (1770–1831): His theory of recurring rhythm of destruction and re-creation formed the basis of Marx’s dialectical materialism. German philosopher and economist Karl Marx (1818–83) published the first volume of Das Kapital, his magnum opus, in 1867. “The most powerful attack on capitalism ever written.” SkousenPhotoSec.indd 4 11/21/2006 12:17:27 PM Marx and Engels with Marx’s daughters Laura and Eleanor, 1864 Author views Karl Marx’s tomb in Highgate Cemeter y in London: “Workers of the World, Unite!” Marx grew his beard in order to imitate a statue of Zeus given by his friends in the 1860s. Chinese banners honoring the founders of Communism: Marx and Engels, Lenin and Stalin, Mao Zedong (1960s) SkousenPhotoSec.indd 5 11/21/2006 12:17:27 PM Austrian Eugen Böhm-Bawerk (1851– 1914) was the first economist to critique Marxist theory of capitalism. Columbia professor John Bates Clark (1847–1938) countered Marx’s exploitation theory of labor with his marginal productivity theory. Cambridge professor Alfred Marshall (1842-1924) helped transform economics into a formal, rigorous science following the marginalist revolution. Yale Professor Irving Fisher (1867– 1947) created the first price indexes and developed the quantity theory of money, but failed to predict the 1929–33 economic crisis. SkousenPhotoSec.indd 6 11/21/2006 12:17:27 PM THE GENERAL THEORY OF EMPLOYMENT INTEREST AND MONEY BY JOHN MAYNARD KEYNES FELLOW OF KING’S COLLEGE, CAMBRIDGE MACMILLAN AND CO., LIMITED ST. MARTIN’S STREET, LONDON 1936 John Maynard Keynes (1883–1946), British economist and statesman, published his influential General Theory in 1936: “I believe myself to be writing a book which will largely revolutionise the way the world thinks about economic problems.” Keynes was a financial wizard who made trading decisions while still in bed in the morning (1940). SkousenPhotoSec.indd 7 Keynes shocked his Bloomsbury friends when he married Russian ballet dancer Lydia Lopokova in 1925. 11/21/2006 12:17:28 PM Keynes, meeting Harry Dexter White at Bretton Woods, New Hampshire, in 1944, helped frame the post-war international economic system based on fixed exchange rates and the creation of the International Monetary Fund and the World Bank. MIT Professor Paul Anthony Samuelson (1915-) and his popular textbook, Economics (1948), made Keynesianism the standard theory in the post-war period. Samuelson was the first American to win the Nobel prize in Economics in 1970. In the 1970s, Austrian economist Friedrich von Hayek (1899–1992) and Chicago professor Milton Friedman (1912–2006) led a free-market counterrevolution. “Half a century later, it is Keynes who has been toppled and Hayek and Friedman, the fierce advocates of free markets, who are preeminent.” SkousenPhotoSec.indd 8 11/21/2006 12:17:28 PM 4 FromMarxtoKeynes ScientificEconomicsComesofAge Thesuccessofthemarginalrevolutionisintimatelyassociated withtheprofessionalizationofeconomicsinthe lastquarterofthenineteenthcentury. —MarkBlaug(inBlack,Coats,andGoodwin1973) The period between Karl Marx and the next big-three economist, JohnMaynardKeynes,witnessedagiganticleapineconomicsasa powerfulnewengineofanalysisthatachievedunparalleledsuccess amongthesocialsciences. Inthepreviouschapter,weendedwithKarlMarxandhisdamning indictmentoftheAdamSmithmodel.HowdidAdamSmithandhis systemofnaturallibertymakeacomebackafterbeingleftfordeadby thesocialistcritics?Thefirststeptorecoverycameasaresultofpowerful economicforces.ThecolossalmightoftheIndustrialRevolutioncatapultedtheWesternworldintoanewageofprosperityofthesortnever beforewitnessedinhistory.Thecommercialpowerofcapitalismspread fromBritaintoGermanytotheUnitedStatesduringthenineteenthcenturyandthroughouttheworldinthetwentieth.WhileMarxanticipated theexpansionarygrowthofcapitalism,heoverlookedasignificantevent: alleconomicclasses—capitalists,landlords,andworkers—experienced improvementintheirmateriallivingconditions,andtheproportionof thepopulationlivingindirepovertyfellsharply.BythetimeKarlMarx diedin1883,evidencewasmountingthattheMalthus-Ricardo-Marx “subsistence wage” thesis was terribly wrong.Adam Smith’s upbeat systemofuniversalprosperitywasgainingcredence. Yet,whiletheindustrialeconomywasmakingprogress,economic theory was at a dead end.Adam Smith recognized that economic freedomandlimitedgovernmentwouldunleashwealthandubiquitousprosperity,buthehadonlyalimitedtheoreticalframeworkwith 105 106 THE BIG THREE IN ECONOMICS whichtoexplainhowconsumersandproducersworkedthroughthe price system to achieve a higher standard of living. Ricardo, Mill and the classical school developed a cost-of-production rationale forpricesofgoods,commodities,andlabor;butindoingso,they ignoredconsumerdemandandbecamehostagetoMarxianpolemics. Havingnounderstandingofpricetheoryandmarginalanalysis,the classicaleconomistscreatedafalsedichotomybetween“production for profits” and “production for use.” Under this defective model, capitalistscouldmakemoneywithoutnecessarilyfulfillingconsumer needs.“Exchange”valuewasunrelatedto“use”value.Moreover,the Ricardiansystemwasantagonistic.Ifprofitsorrentsincreased,they didsoonlyattheexpenseoftheworkers’wages.Asclassstruggle appearedinevitable,theSmithianworldofuniversalprosperityand harmonyofinterestsdisintegrated.Theclassicaleconomiststragically separatedthequestionsof“production”and“distribution,”which,as wehavenoted,gaveammunitiontothesocialistcausesofredistribution,nationalization,andstatecentralplanning. EconomicsasasciencestagnatedinEngland.JohnStuartMillhad arrogantlydeclaredinhispopularPrinciplestextbook,“Happily,there isnothinginthelawsofvaluewhichremainsforthepresentorany futurewritertoclearup;thetheoryofthesubjectiscomplete”(Black, Coats,andGoodwin1973,181).Classicaleconomicswasoutoffavor inFrance.Theprofessionhadreachedsuchalowpointthatprofessors inGermany,Marx’shomeland,rejectedtheideathattherewasany suchthingaseconomictheory.“UndertheonslaughtsoftheHistorical School,”FriedrichHayekconfessed,“notonlyweretheclassicaldoctrinescompletelyabandoned—butanyattemptattheoreticalanalysis cametoberegardedwithdeepdistrust”(Hayek1976,13). Ifcapitalismwastosurviveandprosper,itwouldrequireanew epistemology,abreakthroughineconomictheory.Economicsdesperatelyneededanewimpetus,ageneraltheorythatcouldexplain how all classes gain—landlords, capitalists, and workers—and all consumersbenefit.Butwherewoulditcomefrom? ThreeEconomistsMakeaRemarkableDiscovery Wehavenotedhowcertainyearsstandoutinthehistoryofeconomics,howaclusterofeventsoccursatthesametime,suchas FROM MARX TO KEYNES 107 1776,theyearoftheDeclarationofIndependenceandtheWealth of Nations, and 1848, the year of The Communist Manifesto and Mill’sPrinciplestextbook.Theearly1870s—andespeciallytheyear 1871—wasasimilartime,markingtheperiodinwhichthreeeconomistsindependentlydiscoveredtheprincipleofmarginalsubjective utilityandusheredinthe“neoclassical”marginalistrevolution.The ideathatpricesandcostsaredeterminedbyfinalconsumerdemand andtheirrelativemarginalutility,wasthelastmajorpiecemissing from the evolution of modern economics. Its discovery resolved the paradox of value that had frustrated the classical economists fromAdamSmithtoJohnStuartMill,andwasalsotheundoingof Marxianeconomics. Who were these economists? FromAustria came Carl Menger (1840–1921); from France, Leon Walrus (1834–1910); and from Britain,WilliamStanleyJevons(1835–1882).Whileitistruethata fewforerunners,suchasHermannGossen,SamuelLongfield,AntoineCournot,andJulesDupuit,hadearlieremployedtheprinciples ofmarginalutility,itwasnotuntilthesethreecametogetherthatthe marginalityprinciplebecamewidelyrecognizedandadoptedinthe profession.SwedisheconomistKnutWicksell,aneyewitnesstothe marginalistrevolution,describeditasa“boltfromtheblue”(Wicksell 1958,186). TheMeaningoftheMarginalistRevolution BothMengerandJevonspublishedtheirnewtheoriesin1871,althoughJevonsgavealectureonhisfundamentalideasin1862.Menger publishedhisGrundsätzederVolkswirtschaftslehre,latertranslatedas PrinciplesofEconomics(1976[1871]),andJevonsissuedTheTheory ofPoliticalEconomy.Afewyearslater,in1874and1877,Walras publishedhistwo-partElementsofPureEconomics.Together,these economistsdevelopedwhathascometobecalledthe“neoclassical” schoolofeconomics.ItcombinestheoriginalworkofAdamSmith’s model of free competition with the marginal theory of subjective value.Bythenextgeneration,themarginalistrevolutionhadswept throughtheeconomicsprofessionand,toalargeextent,replacedthe Ricardianframeworkwithaneworthodoxy.Thoughnotasrapidas theKeynesianrevolutioninthelate1930s,themarginalistrevolution 108 THE BIG THREE IN ECONOMICS ofthe1870sconqueredtheprofessionwithequalunanimityandforce overthenextgeneration. The triumvirate of the marginalist revolution—Menger, Jevons, andWalras—rejected the objective cost-of-production theories of valueandfocusedinsteaduponthesubjectiveprincipleofutilityand consumerdemandasthekeystoneofanewapproachtoeconomics. Theynotedthatindividualsmakechoicesonthebasisofpreferences andvaluesintherealworld.LikeJ.-B.Say,theyrecognizedthatno amountoflabororproductionconfersvalueonaproduct.Thereis nosuchthingas“intrinsicvalue,”asRicardoalleged.Valueconsists ofthesubjectivevaluationsofindividualusers.Inshort,customers have to be willing to pay a certain amount before producers will employproductiveresourcestoproduceaproduct,enoughtomake areasonableprofit. Asnotedearlier,AdamSmithmadeastrategicerrorindistinguishingbetweenvaluein“use”andvaluein“exchange.”ThisgaveammunitiontothesocialistsandMarxists,whocomplainedaboutthe difference in the marketplace between “production for profit” and “productionforuse.”Theyblamedcapitalistsforbeingmoreinterestedin“makingprofits”thanin“providingausefulservice,”asif profitableexchangeisunrelatedtoconsumeruse. Nowthemarginalrevolutionresolvedtheparadoxofvalueand,in doingso,undercutthesocialists’argument.Resolvingthediamondwaterparadox,themarginalistsdemonstratedthatthedifferencein valuebetweenwateranddiamondsisduetotherelativeabundance ofwaterandtherelativescarcityofdiamonds(giventhedemandfor each).Sincethesupplyofwaterisabundant,thedemandforeach additionalunit(marginalutility)islow.Sincethesupplyofdiamonds isextremelylimited,thedemandforeachadditionaldiamondishigh. Hence,thereisnolongeracontradictionbetweenvalueinuseand valueinexchange.1Theyareequalizedatthemargin. 1. Here’s a strange twist in the history of economics:Adam Smith actually had the correct answer to the diamond-water paradox a decade prior to writing TheWealthofNations.Smith’slecturesonjurisprudence,deliveredin1763,reveal thatherecognizedthatpricewasdeterminedbyscarcity.Smithsaid,“Itisonlyon accountoftheplentyofwaterthatitissocheapastobegotforthelifting,andon accountofthescarcityofdiamonds....thattheyaresodear.”TheScottishprofessoraddedthatwhensupplyconditionschange,thevalueofaproductchanges FROM MARX TO KEYNES 109 Underthenewmicroeconomics,profitsandusearedirectlyconnected.Pricesofgoodsandsupplies(costs)aredeterminedbysubjectivedemandsandtheirbestmarginaloralternativeuse(knownas “opportunity cost”). Price–cost margins determine profit and loss, thedrivingforcebehindwhatisproduced,atwhatprice,andinwhat amount,allaccordingtowhatcustomersarewillingtopayanddemand.Pricesreflectconsumerdemands,andprofit-drivenproduction seekstomeetthosedemands.Ifproducersdonotprovideauseful service,theirbusinesswillbeunprofitable. Under this advance in economic thinking, a new generation of economistsfoundthatproductionanddistributioncouldonceagain belinkedtogether.Thedemandsofconsumersultimatelydetermine thefinalpricesofconsumergoods,whichinturnsetthedirection for productive activity. Final demand establishes the prices of the cooperativefactorsofproduction—wages,rents,andprofits—accordingtothevaluetheyaddtotheproductionprocess.Inshort,income wasnotdistributed,itwasearned,accordingtothevalueaddedby eachparticipantintheproductionprocess.Inthecaseoflabor,the ideathatwagesaredeterminedbythemarginalproductivityoflabor evolvedoutofthismarginalprincipleofvalueandwasmorefully perfectedbyJohnBatesClark,anAmericaneconomistatColumbia University, at the turn of the century.According to Clark, under also.SmithnotedthatarichmerchantlostintheArabiandesertwouldvaluewater veryhighly.Ifthequantityofdiamondscould“byindustry...bemultiplied,”the priceofdiamondswoulddrop(Smith1982[1763],33,3,358).Oddly,hiscogent explanationofthediamond-waterparadoxdisappearedwhenhewaswritingChapter 4,BookI,ofTheWealthofNations.WasSmithsufferingfromabsent-mindedness? Economist Roger Garrison doesn’t think so. He blames the change on Smith’s Calvinistbackground,whichemphasizedthebenefitsofhardwork,usefulproduction,andfrugality.Inhismind,diamondsandjewelswerevainluxuryitemsand relatively“useless”comparedtowaterandother“useful”goods.Garrisonpoints toSmith’sodddichotomybetween“productive”and“unproductive”labor;seethe thirdchapterofBookIIinTheWealthofNations,whereSmithreferstoprofessions suchasminister,physician,musician,orator,actor,andotherproducersofservices as“frivolous”occupations(1965[1776],315).Farmersandmanufacturers,onthe otherhand,are“productive.”Why?BecauseSmith’spreferenceforPresbyterian consciencearguesagainstconsumptioninfavorofsavingandwork.AsGarrison states,“ThebasisforthedistinctioninnotPhysiocraticfallaciesbutPresbyterian values.Productivelaborisfutureoriented;unproductivelaborispresentoriented” (Garrison1985,290;Rothbard1995a,444–50). 110 THE BIG THREE IN ECONOMICS competitiveconditions,eachfactorofproduction—land,labor,and capital—receivedfaircompensationforitsaddedvalue. Böhm-BawerkMakesTwoDevastatingArguments AgainstMarx AnotherAustrianeconomist,EugenBöhm-Bawerk(1851–1914),was the first major economist to contest Marx’s critique of capitalism, andhisblisteringattackonMarx’stheorieswassodevastatingthat Marxismhasneverreallytakenholdintheeconomicsprofessionas ithasdoneinsociology,anthropology,history,literarytheory,and otherdisciplines. Böhm-BawerkintroducedhiscritiqueofKarlMarxinhisclassicwork,CapitalandInterest(1959[1884]),inwhichhefirstfully reviewedthehistoryofinteresttheoriesfromancienttimes.Thelast halfofthissectiondealswiththeexploitationtheoriesofRodbertus, Proudhon, Marx, and other socialists.Yet Böhm-Bawerk was not simply a bitter critic of Marx. He built upon the work of Menger andmadeoriginalcontributionsintheareasofsavingandinvesting, capitalandinterest,andeconomicgrowth.Eventoday,noworkon economicgrowththeoryiscompletewithoutadiscussionofBöhmBawerk’scontributions. Recallfromchapter3thatMarx’stheoryofsurplusvalueargued thatworkersdeservethefullvalueoftheproductstheyproduce.Landlordswhoreceiverentsandcapitalistswhoearnprofitsandinterest exploittheworkersandtakefromthemthefruitsoftheirlabors.In response,Böhm-Bawerkmadetwopointsofrebuttal. First,Böhm-Bawerk’s“waiting”argument.Here,hereliedonthe abstinencetheoryofinterest,aconceptearlierdevelopedbyNassau Senior.Capitalistsabstainfromcurrentconsumptionandusetheir savingstoexpandandimprovegoodsandservices.Interestincome reflectsthiswaitingfactorinalleconomiclife,andisthereforejustified asalegitimatecompensationtocapitalistsandinvestors.Capital-goods producersmustwaitfortheirgoodstobemanufacturedandsoldto theircustomers(furtherdowntheroadtowardconsumption)before theycanbepaid.Investorsinbondsandrealestatemustwaitbefore theyfullyearnbacktheirinvestment. In short, businesspeople, capitalists, investors, and landlords all FROM MARX TO KEYNES 111 havetowaittobepaid.Butwhatabouthiredworkers?Theydonot havetowait.Theyagreetoperformacertainamountoflaborfora wageorsalary,andtheyarepaideverymonthoreverytwoweeks, regardlessofwhethertheproductstheyproducearesoldornot.They donothavetoworryaboutaccountsreceivableoraccountspayable, aboutinvestmentdebtorchangingmarkets.Theygetpaidlikeclockwork,assumingtheiremployersarehonestandsolvent.Infact,the capitalist-ownerisconstantlyadvancingthefundstopaytheworkers’ wages,priortoreceiptofpaymentfortheproductstobesold,which maymeanwaitingmonthsandsometimesyears,dependingonhow quicklytheproductscanbesoldandthemoneyreceived.AsBöhmBawerkconcluded,“theworkerscannotwait....[T]heycontinue tobedependentonthosewhoalreadypossessafinishedstoreofthe so-calledintermediateproducts,inaword,onthecapitalists”(1959 [1884],83). CapitalistsasRiskTakers Böhm-Bawerk made another important point. Business capitalists take risks that workers do not.They combine the right amount of land,labor,andcapitaltocreateaproductthatcompetesinthemarketplace,aproductonwhichtheymayormaynotmakeaprofit.The capitalist-entrepreneur takes that risk while hired workers do not. Workersgetpaidregularlyand,ifthebusinessgoesunder,themost theywillloseisapaycheck;theyonlyneedtosearchforanotherjob. Butthebusinessentrepreneurmayfacefinancialruin,heavydebts, andbankruptcy.Inshort,theworkers’risklevelissubstantiallyless thanthecapitalist-entrepreneurs’. Howdoesthemarketrewardthisadditionalrisk?Bycompensating thecapitalist-entrepreneurwithasignificantportionoftheproduct’s value,viaprofitsandinterest.Insum,thehiredworkersarejustifiably notpaidthefullproductoftheirlabor,butonlythatpartcommensurate withtheirimmediatesatisfactioninwagesandthelowerdegreeof riskinvolvedinworkinginthebusiness. AfterBöhm-Bawerk’sattackonMarxistdoctrinesofsurplusvalue, fewmainstreameconomistsacceptedthelabortheoryofvalue,Marx’s exploitationtheory,orhistheoryofsurplusvalue.Marxistseverafter havebeenonthedefensivewhenitcomestotheoreticalrigor. 112 THE BIG THREE IN ECONOMICS Böhm-BawerkIntroducesaNon-Marxist CapitalistTheory Afterdemolishingthesocialistargumentsagainstcapitalism,BöhmBawerkcreatedawholenewchapterineconomictheorybyfocusing onhis“positive”theoryofcapitaldevelopment.Infact,his1884book wasaptlytitledinEnglish,ThePositiveTheoryofCapital.LikeMarx, Böhm-Bawerk focused on capital in all its forms—saving, investing,technology,capitalgoods,productivity,knowledge,education, research and development—as the key to fulfillingAdam Smith’s worldviewofuniversalprosperity. Böhm-Bawerk,likeAdamSmith,wasastridentdefenderofsaving andinvestmentasacriticalelementineconomicgrowth.Simplelabor andhardworkarenotenoughtoachieveahigherstandardofliving. “Itissimplynottruethatthemanis‘merelyindustrious.’Heisboth industriousandthrifty”(Böhm-Bawerk1959[1884],116). Injustifyingtheneedforsavingandinvestment,hebeganhistheory withadiscussionofthefunctionofcapitalasatoolofproduction. AccordingtoBöhm-Bawerk,aneconomygrowsthroughtheadoption ofnew“roundabout”productionprocesses.Ittakestimeandmoney toadoptanewtechnologyorinvention,butonceitisfinished,new productsandproductionprocessesexpandatafasterpace.Anincrease in savings may mean a temporary reduction in the production of currentconsumergoods,butinvestmentgoodswouldincrease.“For aneconomicallyadvancednationdoesnotengageinhoarding,but investsitssavings.Itbuyssecurities,itdepositsitsmoneyatinterest insavingsbanksorcommercialbanks,putsitoutonloan,etc..... Inotherwords,thereisanincreaseincapital,whichreboundstothe benefitofanenhancedenjoymentofconsumptiongoodsinthefuture” (Böhm-Bawerk1959[1884],113). AlfredMarshallandtheCambridgeSchoolAdvance EconomicScience Asaresultofthemarginalistrevolution,thedisciplineofeconomicswasneverthesame.ItleftMarxismbehindandrapidlybecame agrown-upscience,withitsownboxoftools,systematiclaws,and quantitativeanalysis.Economistshopedthatpoliticaleconomy,once FROM MARX TO KEYNES 113 thedomainoftheology,philosophy,andlaw,couldbecomeanew science that would match the logic and precision of mathematics andphysics.ItwastimetounburdentheworldofwhatCarlylehad causticallylabeledthe“dismalscience”andreplaceitwithamore formal,rigorousdiscipline. TheprincipaleconomisttoleadthisrevolutionaryshiftwasAlfred Marshall(1842–1924),afamedCambridgeprofessor.Marshallmade asingularchangethatreflectedthistransformation.Bycallinghis textbookPrinciplesofEconomics(Marshall1920[1890]),healtered thenameofthedisciplinefrom“politicaleconomy”to“economics,”sendingasignalthateconomicsisasmuchaformalscience asphysics,mathematics,oranyotherprecisebodyofknowledge. Moreover,thischangeacknowledgedthattheeconomyisgoverned bynaturallawratherthanpoliticalpolicy.Marshall’spath-breaking 1890textbookintroducedgraphsofsupplyanddemand,mathematicalformulas,quantitativemeasurementsof“elasticity”ofdemand, andothertermsborrowedfromphysics,engineering,andbiology. Economicswouldsoonbecomeasocialsciencesecondtononein rigorandprofessionalstatus.(ThateconomicsqualifiesasaNobel Prizecategoryisproofenoughthatitisthe“queenofthesocial sciences.”) TheperiodsurroundingMarshall’stextbookwasatimeofnew beginningsineconomicscience.Officialassociationswereestablished, such as theAmerican EconomicAssociation in 1885 and theBritishEconomicAssociationin1890(renamedtheRoyalEconomicSocietyin1902).Journalswerepublished—theQuarterly JournalofEconomicsatHarvardin1887,theEconomicJournalat Cambridgein1891,andtheJournalofPoliticalEconomyatChicagoin1892(althoughtheJournaldesEconomistesinFrancehas beenpublishedsinceDecember1841).Bytheturnofthecentury, majoruniversitieshadfinallyestablishedtheirowndepartmentsof economics,separatefromlaw,mathematics,andpoliticalscience, andhadbegungrantingdegreesintheirownfield.Thiswasoneof Marshall’smostcherishedambitions.In1895,theLondonSchool of Economics (LSE) was established, devoted almost entirely to economicstudies. Insum,AdamSmithhadtalkedabouthis“Newtonian”method inhisstudyofthewealthofnations,butnotforanothercentury 114 THE BIG THREE IN ECONOMICS dideconomicstrulybecomeestablishedasascienceandaseparate discipline. TheRoleofJevons AlfredMarshallwasattheforefrontofthemovementtoestablish economicsasascience,buthisstorycannotbetoldwithoutrecounting thetremendousinfluenceofseveralothercolleaguesonbothsidesof theocean.WilliamStanleyJevonswasolderthanMarshallandone ofthefoundersofthemarginalistrevolution.Jevons’smostimportant contributionwashismathematicalandgraphicaldemonstrationof theprincipleofmarginalutility.Hispurposewastooverthrow“the noxious influence of authority” of David Ricardo and John Stuart Mill. “Our English Economists,” he wrote, “have been living in a fool’sparadise”(Jevons1965[1871],xiv).Hisaimwastocastfree “fromtheWage-Fundtheory,theCostofProductiondoctrineofValue, theNaturalRateofWages,andothermisleadingorfalseRicardian doctrines”(Jevons1965[1871],xlv–xlvi). Jevonschallengedtheclassicalmodelthatcostdeterminesvalue. HecametothesameconclusionasMenger,thoughindependently: “Repeatedreflectionandinquiryhaveledmetothesomewhatnovel opinionthatvaluedependsentirelyuponutility”(Jevons1965[1871], 2). Furthermore, he asserted, the Ricardian doctrine that value is determinedbylabororcostsofproduction“cannotstandforamoment.”Jevonsnotedthatlabor(orcapital)oncespenthasnoinfluence onthefuturevalueofanarticle;bygonesareforeverbygones(1965 [1871],157,159). Jevonsdevelopedatheoryofconsumerbehavioranddesigneda graphicdisplayofdecliningmarginalutility.Yetheneverdeveloped thedownward-slopingdemandcurve,noracompletesupply-anddemanddiagram.ThatworkwasleftforMarshalltoaccomplish. Keynessummeditupwell:“Intruth,Jevons’sTheoryofPolitical Economyisabrilliantbuthasty,inaccurate,andincompletebrochure, asfarremovedaspossiblefromthepainstaking,complete,ultraconscientiousmethodsofMarshall.Itbringsoutunforgettablythe notionsoffinalutilityandofthebalancebetweenthedisutilityof laborandutilityoftheproduct.Butitlivesmerelyinthetenuous worldofbrightideaswhenwecompareitwiththegreatworking FROM MARX TO KEYNES 115 machineevolvedbythepatient,persistenttoilandscientificgenius ofMarshall”(Keynes1963,15). WhatdidMarshallaccomplish?UnlikeJevons,Marshallfounded hisownschool,theso-calledBritishorCambridgeschool,withstudent prodigiessuchasA.C.PiguoandJohnMaynardKeynes.Hewasa synthesizer,combiningtheclassicaleconomicsofcost(supply)and themarginalisteconomicsofutility(demand).Heoftencompared supply and demand to the combination of the blades of scissors; eachisnecessarytodetermineprice.Hetooksupplyanddemandfar beyondawrittenexpression:Hedevelopedthegraphicsforsupply anddemand,themathematicsofelasticity,andnewconceptssuch asconsumer’ssurplus.Hisformulasnowserveasthefoundationfor anycourseinmicroeconomics. In short, Marshall advanced Smith’s model into a more precise quantitativescience.AdamSmithprovidedthefundamentalphilosophyofeconomicgrowth—universalprosperity,thesystemofnatural liberty,andthesymboloftheinvisiblehand.AlfredMarshallprovided theenginetoadvanceSmith’ssystem. What is this engine? It consists of the principles of supply and demand,marginalanalysis,thedeterminationofprice,thecostsof production,andequilibriumintheshortrunandthelongrun.Allthese toolsarefoundintoday’smicroeconomics,thetheoryofindividual consumersandproducers.Itisthetoolboxeconomistsemploytoday toanalyzeandillustrateatheoryofconsumerandfirmbehavior. TheEuropeanWizardsofEconomics:Walras,Pareto, andEdgeworth Marshall’sworkwasfollowedupbytheworkofothersinEurope andAmerica who helped professionalize economics. LeonWalras (1834–1910)fromFrance,VilfredoPareto(1848–1923)fromItaly, andFrancisEdgeworth(1845–1926)fromIrelandintroducedsophisticatedmathematicalmethodsandattemptedtovalidateAdamSmith’s invisiblehanddoctrineinmathematicalform.Theinvisiblehandidea, thatlaissez-faireleadstothecommongood,hasbecomeknownasthe firstfundamentaltheoremofwelfareeconomics(asnotedinchapter 1).Welfare economics deals with the issues of efficiency, justice, economicwaste,andthepoliticalprocessintheeconomy.Sincethe 116 THE BIG THREE IN ECONOMICS late1930s,whenwelfareeconomicswaspopularizedbyJohnHicks, KennethArrow,PaulSamuelson,andRonaldCoase(allofwhombecameNobelPrizewinners),thetechniqueofwelfareeconomicshas beenextendedtoissuesofmonopolyandgovernmentpolicies.Inmost cases,thewelfareeconomistshavedemonstratedthatgovernmentimposedmonopolyandsubsidiesleadtoinefficiencyandwaste. Walras, Pareto, and Edgeworth were the first economists to use advancedmathematicalformulasandgraphicdevicestoprovecertain hypothesesinwelfareeconomics.Walras,whomSchumpeterranked as“thegreatestofalleconomists”intermsofpuretheoreticalcontribution,introducedthenotionofa“generalequilibrium”theory.Asone ofthefoundersofthemarginalistrevolution,hesoughttodemonstrate mathematicallythemeritsoflaissez-faireongroundsofefficiencyand justice.Usingatwo-party,two-commoditybartersystem,hewasable toshowthata“freelycompetitive”marketwouldmaximizethesocial utilityofthetwopartiesthroughaseriesofexchanges.InElements ofPureEconomics(1954[1874,1877]),Walrasextendedhisanalysis tomultiparty,multicommodityexchangesundertheassumptionsof freecompetition,perfectmobilityoffactorsofproduction,andprice flexibility. By simulating a market auctioneering process, Walras showedthatpriceschangeaccordingtosupplyanddemand,andgrope towardequilibrium.Thus,hewasabletodemonstratethat,without centralauthority,atrial-and-errormarketsystemcouldstillachieve maximumsocialsatisfactionorgeneralequilibrium(GE). Pareto is best known for the concept of Pareto optimality. Like Walras,heattemptedtoshowthataperfectlycompetitiveeconomy achievesanoptimallevelofeconomicjustice,wheretheallocation ofresourcescannotbechangedtomakeanyonebetteroffwithout hurtingsomeoneelse.Edgeworth,likeMarshall,wasatoolmaker,and developedindifferencecurves,utilityfunctions,andfundamentalsof theEdgeworthbox,awayofexpressingvarioustradingrelationships betweentwoindividualsorcountries.(ItisnamedafterEdgeworth, butwasactuallydrawnfirstbyPareto!) TheworksofWalras,ParetoandEdgeworthinitiallyupheldAdam Smith’svisionofabeneficialcapitalism,buttheirunrealisticassumptionsmadeitdifficulttosustainafree-marketdefense.BothWalras andPareto,afteryearsoflayingthefoundationofwelfareeconomics,foundthemselvesmovingawayfromtheSmithianvision.For FROM MARX TO KEYNES 117 example, the problem with Pareto optimality is that it ignores the omnipresenttrade-offsineconomiclife.Seldomisonepolicyundertakenthatimprovessomepeople’sliveswithoutinjuringothersin theshortrun.Openingtrade,eliminatingsubsidies,andderegulating industriescouldhelpsomegroupsandhurtothers.Eliminatingtariffs betweentheUnitedStatesandMexicowillcreatemanynewjobs,but itwillalsodestroymanytraditionaljobs.Thisisaninevitablefeature ofthemixedeconomy.Theneteffectisundoubtedlybeneficial,but thetransitionmightnotfitParetooptimality. AmericansSolvetheDistributionProbleminEconomics TheEuropeanschoolsofeconomics—followersofMenger,Marshall, andWalras, among others—had made a major breakthrough with thediscoveryofthesubjectivemarginalityprinciple.Theprinciple explainedhowpricesaredeterminedandvalueiscreatedinamarket economytoimprovethelivesofallparticipants.Butwhataboutthe distributionproblem?Whatdeterminesrents,wages,profits,andinterestincome?Doesthemarginalityprincipleapplytoincomeearned bylandlords,workers,andcapitalists? Capitalismhasalwaysbeenhailedasapowerfulproducerofgoods andservices,anunsurpassedengineofeconomicgrowth,butitwas heavilycriticizedbyKarlMarxaswellasJohnStuartMillforits disturbinginequalityofwealthandincome.Isthiscriticismvalid? It fell upon the shoulders ofAmerican economists, especially JohnBatesClark,toaddressthefundamentalquestionsofincome distribution.AstheUnitedStatesbecamethelargesteconomicpowerhouseintheworldattheturnofthetwentiethcentury,soalsodid theAmericaneconomicsprofessionbegintogainprominence.The mostprominentscholarsinthiserawereJohnBatesClarkatColumbia University,FrankA.FetteratCornellandPrinceton,RichardT.Elyat theUniversityofWisconsin,andThorsteinVeblen,whoestablished theinstitutionalschoolofeconomics. ItwouldbefairtosaythattheAmericansweremoreremodelers than architects of a new building. Using the marginality principle developedinEurope,theywereabletosolveamysterythathadremainedunsolvedformanyyears,theso-calleddistributionproblem ineconomics. 118 THE BIG THREE IN ECONOMICS JohnBatesClark(1847–1938)wasinstrumentalinthisdiscovery. HewasthefirstAmericaneconomisttogaininternationalfameasan originaltheorist,andhisprincipalclaimtofamewashiscontribution towagetheory,whathecalled“thelawofcompetitivedistribution.” Clarkwasbyinclinationasocialreformer,buthegraduallyshifted groundandbecameaconservativedefenderofthecapitalistsystem. What changed his mind? Largely it was his marginal productivity theoryoflabor,land,andcapital. Clark developed his marginal productivity thesis while seeking toresolveatroublesomeprobleminmicroeconomics:Howaretwo ormorecooperatinginputscompensatedfromthetotalproductthey jointly produce? This joint-input problem had long been viewed asunsolvable,likedecidingwhetherthefatherorthemotherwere responsibleforthebirthofachild.Indeed,SirWilliamPettycalled laborthefatherofproductionandlandthemother.Marxresolved theriddlebyproclaimingthatlabordeservedtheentireproduct,but thisprovednaïve,unproductive,andunsatisfactorytotherestofthe profession. BuildingonthemarginalityconceptoftheAustrianeconomists, Clarkpioneeredtheconceptthateachinputcontributesitsmarginal product.Essentially,hearguedthatundercompetitiveconditions,each factorofproduction—land,labor,andcapital—ispaidaccordingto the“valueadded”tothetotalrevenueoftheproduct,oritsmarginal product.Inhisvitalwork,TheDistributionofWealth,Clarkcalled histheoryofcompetitivedistributiona“naturallaw”thatwas“just” (Clark1965[1899],v).“Inotherwords,freecompetitiontendsto give labor what labor creates, to capitalists what capital creates, andtoentrepreneurswhatthecoordinatingfunctioncreates”(1965 [1899],3). FollowingJevons,Clarkcreatedadiagramshowingadownwardslopingdemandcurveforlabor,andillustratinghowwagesareequal tothemarginalproductofthelastworkeraddedtothelaborforce. Thus,ifworkersbecomemoreproductiveandaddgreatervalueto thecompany’slong-termprofitability,theirwageswilltendtorise. Ifwagesriseinoneindustry,competitionwillforceotheremployers toraisetheirwages,andthus,“wagestendtoequaltheproductof marginallabor,”orwhatthelastworkerispaid(Clark1965[1899], 106). Clarkusedhismarginalproductivitytheorytojustifythewageratesin FROM MARX TO KEYNES 119 theUnitedStatesandcriticizedlaborunionsfortryingtoraiseratesabove this“naturallaw.”Forexample,althoughhesupportedtheKnightsof Labor,Clarkadvocatedcompulsoryarbitrationtoendlonglabordisputes, believingthatstrikingworkersshouldbepaidwagesprevailingincomparablelabormarketselsewhere(Dewey1987,430).Ontheotherhand, Clarkopposedthepowerofmonopoliesandbigbusinessthatattempted toexploitworkersbyforcingwagesbelowlabor’smarginalproduct.AccordingtoClark,acompetitiveenvironmentinbothlaborandindustry isessentialtoalegitimatewageandsocialjustice.Hewroteabookon thesubjectentitledSocialJusticeWithoutSocialism(1914). Clark’s prescriptive economics was heavily criticized by fellow economists,whomadetheallegationthat“neoclassicaleconomics wasessentiallyanapologeticfortheexistingeconomicorder”(Stigler1941,297).ThorsteinVeblen,inparticular,usedClarkasafoil inhisdiatribesagainsttheprevailingeconomicsystem.YetClark’s applicationofthemarginalityprincipletolaborhaditsimpact.Even Marxistsfeltcompelledtoaltertheirextremeviewsofexploitation basedonthelabortheoryofvalue.Nolongercouldtheydemandthat workersbepaid“thewholeproductoftheirlabor.”Nowemployees wereseentobeexploitedonlyiftheyreceivedwageslessthanthe valueoftheirmarginalproductoflabor(Sweezy1942,6). HenryGeorgeandtheLandTax ClarkalsowasavociferouscriticofHenryGeorge(1839–97),the socialreformerwhoblamedthemonopolisticpoweroflandlordsfor povertyandinjusticeintheworld.AccordingtoGeorge,whodrew heavilyuponRicardianrenttheory,thesolutiontopovertyandinequalitywasasingletaxonunimprovedland.AlthoughGeorgewas popular,ClarkcondemnedhissingletaxideainTheDistributionof Wealth.ClarkbeganhiscritiquebyrejectingtheRicardianviewthat landisfixed.“Theideathatlandisfixedinamount,”hewrote,“isreallybasedonanerrorwhichoneencountersineconomicdiscussions withwearisomefrequency”(1965[1899],338).Whiletheamount oflandexistingonearthdoesindeedremainconstant,thesupplyof landavailableforsalevarieswiththeprice,asanyothercommodity. Andlandprices,likewagesandcapitalgoods,aredeterminedbytheir marginalproductivity—“atthemargin”—allocatedaccordingtoits most“productive”use(346–48).AccordingtoClark,taxingawaythe valueofland,evenifunimproved,willdrivecapitaloutoflandinto 120 THE BIG THREE IN ECONOMICS housing,andmisallocatecapitalinfavorofhousing.Rentandland priceshelpinvestorstoallocateascarceresource(land)toitsmost valueduseinsociety.Rentcontrolsandconfiscatorylandtaxescan onlycreatedistortionsinlanduse.2 Finally,Clarkappliedhismarginalproductivitytheorytocapitaland interest.HedifferedstrenuouslywiththeAustriansonthestructure ofthecapitalmarkets,arguingthatinvestmentcapitalwasa“permanentfund,”likeabigreservoir,where“thewaterthatatthismoment flowsintooneendofthepondcausesanoverflowfromtheotherend” (Clark1965[1899],313).Ontheotherhand,theAustriansviewedthe capitalstructureasanarrayofcapitalgoods,fromearlystagestofinal stagesofproduction,andbelievedthatthisstructurewasinfluencedby interestrates,whichweredeterminedbytimepreference.Progressis achieved,accordingtoBöhm-BawerkinEuropeandFrankFetterin America,bycapitalistsinvestingtheirsavingsinmore“roundabout” production processes. Despite these differences, Clark recognized thatinvestmentwouldincreaseifsocietysavedmore,interestrates woulddecline,andthesizeofthecapitalstockwouldincrease—all leadingtohighereconomicperformance. TwoCriticsDebatetheMeaningofthe NeoclassicalModel Bytheturnofthetwentiethcentury,awholenewmodelofthecapitalisteconomyhadbeenfashioned,thankstothemarginalistrevolution inEuropeandtheUnitedStates.AdamSmithandtheclassicaleconomistshadprovidedthefoundation,butittookanothergenerationof economiststofinishthejob.Itwasnowtimetostandbackandtake alookatthisbrand-newmodelofmoderncapitalism. CriticssuchasThomasCarlyleandKarlMarxhadassaultedthe house thatAdam Smith built, but that was before the marginalist revolution. It was time to take a second look, and it fell upon the shouldersoftwosocialeconomists(todaytheywouldbeknownas sociologists)toexamineindetailthemeaningofthenewstructure. 2.Oddlyenough,whileHenryGeorgewaslargelyanadvocateoflaissez-faire, hislandtaxschemeencouragedmanyofhislisteners,includingGeorgeBernard ShawandSydneyWebb,tobecomesocialists.SeeSkousen(2001,229–30). FROM MARX TO KEYNES 121 TheyaretheAmericanThorsteinVeblen(1857–1929)andtheGerman MaxWeber(1864–1920). ThorsteinVeblen:TheVoiceofDissent Veblenwastheprincipalfaultfinderandcensorofthenewtheoretical capitalism.Havingtaughtatteninstitutions,includingtheUniversityof ChicagoandStanford,hehadlittleusefortherational-abstract-deductiveapproachoftheneoclassicalmodel.Aboveall,hewasacritic,nota creatorofanewworldview.Inhisbest-knownwork,TheTheoryofthe LeisureClass,VeblenappliedaDarwinianviewtomoderneconomics. Hesawindustrialcapitalismasaformofearly“barbaric”evolution, liketheape.ImitatingProudhon’sfamousstatement,“propertyistheft,” Veblenstatedthatprivatepropertywasnothinglessthan“bootyheldas trophiesofthesuccessfulraid”(Veblen1994[1899],27).Capitalists’ pursuitofwealth,leisure,andtheacquisitionofgoodsincompetition withtheirneighborswaspartofthe“predatoryinstinct”(29).Alife ofleisurehad“muchincommonwiththetrophiesofexploit”(44). Gamblingandrisk-takingreflecteda“barbariantemperament”(276, 295–96).Womenwere,likeslaves,treatedasproperty,tobedominated bytheprowessoftheowner(53).Patriotismandwarwerebadgesof “predatory,notofproductive,employment”(40). Progressmeantthatprimitivecapitalismneededtobeadvanced toward a higher social plane.War must be rejected (Veblen was a pacifist).Capitalismmustbereplacedbyaformofworkers’socialismandtechnocracy,a“sovietoftechnicians.”ButherejectedMarxismasaphilosophy.Marxistdoctrines,accordingtoVeblen,failed theevolutionarytest.Manynationshadcollapsedwithoutanyclass struggle,hesaid.“Thedoctrinethatprogressivemiserymusteffect asocialisticrevolution[is]dubious,”hedeclared.“Thefactsarenot bearing...out[Marx’stheories]oncertaincriticalpoints”(Jorgensen andJorgensen1999,90). Veblen envisioned a different kind of class conflict than Marx. Ratherthandividingtheworldintocapitalistsandproletariats,the havesandthehave-nots,Veblenemphasizedtheallianceofthetechniciansandtheengineers,andtheopposingbusinessmen,lawyers, clergymen,military,andgentlemenofleisure.Hesawconflictbetweenindustryandfinance,betweentheblue-collarmanuallaborers 122 THE BIG THREE IN ECONOMICS andthewhite-collarworkers,andbetweentheleisureclassandthe workingclass. Inchapter4ofTheTheoryoftheLeisureClass,Veblencynically describedingreatdetailthe“conspicuousconsumption”ofthewealthy class.“High-bredmannersandwaysoflivingareitemsofconformity tothenormofconspicuousleisureandconspicuousconsumption,” hewrote(1994[1899],75).Veblencondemnedthewealthyforpurposelyengagingin“wasteful”spendingandostentatiousbehavior, withdrawnfromtheindustrialclass.Moreover,“theleisureclassis morefavorabletoawarlikeattitudeandanimusthantheindustrial classes”(271). Inhighlightingtheexcessesofthe“vulgar”class,Veblenexpressed hostilitytobusinessculture,whichhecharacterizedas“waste,futility,andferocity”(1994[1899],351).AsRobertLakachmanwrotein theintroductiontoTheTheoryoftheLeisureClass,Veblendismissed commercialsocietyas“aprofoundlyanti-evolutionarybarriertothe fullfruitionofman’slife-givinginstinctofworkmanship,”clearlyin oppositiontoAdamSmith’sviewofabenevolentcommercialsociety. WhereAdamSmithsaworder,harmony,benevolence,andrational self-interest,Veblensawchaos,struggle,andgreed.“Veblenwasable tocontradictflatlyalmosteverypremiseandassumptionuponwhich theideologyofcapitalismrested”(Diggins1999,13). Veblenignoredthebenefitsofwealthcreation—theexpansionof capital,theinvestmentinnewtechnology,thefundingofhighereducation,andthephilanthropicgenerosityofthebusinesscommunity. Amazingly,heclaimedabsolutelynoimprovementinthestandardof livingofthecommonmanduringhislifetime(Dorfman1934,414). HecitedapprovinglyaviewfirstexpressedbyJohnStuartMill,who wroteinhisPrinciplesofPoliticalEconomytextbook,“Hithertoitis questionableifallthemechanicalinventionsyetmadehavelightened theday’stoilofanyhumanbeing”(Mill1884[1848],516).Thissame quoteisfoundinMarx’sCapital(1976[1867],492). WecanforgiveMillandMarxformakingsuchuninformedstatementsinthemid-nineteenthcentury,butforVeblenitdemonstrates astonishingignoranceofconsumerstatistics.By1918,whenVeblen madethisstatement,millionsofAmericanconsumerswerebeginningtoenjoyrefrigeration,electricity,thetelephone,runningwater, indoortoilets,andautomobiles.NowonderVeblenleftthislifeina FROM MARX TO KEYNES 123 depressed state—his gloomy view of capitalism transpired during theRoaringTwenties,whenAmericanconsumersweremakingtremendousadvances. MaxWeber:ASpiritedDefenseof“Rational”Capitalism Fortunately,ThorsteinVeblenwasnottheonlysocialcommentator oncapitalismattheturnofthecentury.Hischiefantagonistcame fromacrosstheAtlantic—theGermansociologistandeconomistMax Weber,authorofthefamousbookTheProtestantEthicandtheSpirit ofCapitalism.Weber’sviewsoncapitalismweremoreinthespiritof AdamSmiththanVeblen.AsJohnPatrickDigginsstates,“Notwo social theorists could be more intellectually and temperamentally opposedthanThorsteinVeblenandMaxWeber”(1999,111). BothVeblenandWeberwereobsessedwiththemeaningofcontemporaryindustrialsociety—theissuesofpower,management,and surpluswealth.Bothpublishedtheirbest-sellingworksneartheturnof thecentury.AndbothwerehighlycriticaloftheMarxistinterpretation ofhistory.YetWebercametofardifferentconclusionsthanVeblen orMarx.HerejectedbothVeblen’sdescriptionofmoderncapitalism asaformofbarbaricevolutionandMarx’stheoryofexploitationand surplusvalue.Rather,thedevelopmentofmodernsociety(“theheroic ageofcapitalism”)cameaboutbecauseofstrenuousmoraldiscipline andjoylessdevotiontohardwork,leadingtolong-terminvestments andadvancedcorporatemanagement.Whatwasthepowerfulsource ofWesterneconomicdevelopment?UnlikeVeblenandMarx,Weber sawthesourceasbeingreligion,specificallytheProtestantReformationanditsdoctrinesoffrugalityandamoraldutytowork,andits conceptofthe“calling.” Weber’sProtestantEthicandtheSpiritofCapitalismcountered thepopularintellectualviewsofKarlMarxandFriedrichNietzsche thatreligionwasadelusion,acrutch,orworse,anirrationalneurosis. WeberpraisedChristianityasa“socialbondofworld-encompassing brotherhood”(Diggins1996,95).HedisapprovedofMarx,contending thatcapitalismhaditsoriginsinreligiousidealsratherthanhistorical materialism. AccordingtoWeber,itwasnotunbridledavariceandtheunfettered pursuitofgainthatbroughtabouttheageofcapitalism.Suchanim- 124 THE BIG THREE IN ECONOMICS pulsehasexistedinallsocietiesofthepast.That“greed”isthedriving forcebeyondcapitalismisa“naïveidea”that“shouldbetaughtin thekindergartenofculturalhistory.”EchoingMontesquieuandAdam Smith,Weberexclaimed,“Unlimitedgreedforgainisnotintheleast identicalwithcapitalism,andisstilllessitsspirit.Capitalismmay evenbeidenticalwiththerestraint,oratleastarationaltempering, ofthisirrationalimpulse”(Weber1930[1904/5],17). Sowhatdidcausethehistoricaldevelopmentofmoderncapitalism, especiallyintheWest—“themostfatefulforceinourmodernlife” (Weber1930[1904/5],17)?Weber’sthesisisthatreligion,whichhad afirmgriponpeople’smindsforcenturies,keptcapitalismbackuntil theProtestantreformationoftheseventeenthcentury.Untilthen,the makingofmoneywasfrowneduponbyalmostallreligions,including Christianity.Allthatchanged,accordingtoWeber,withtheLutheran doctrineofthe“calling,”theCalvinistandPuritandoctrineoflabor topromotethegloryofGod,andtheMethodistadmonitionagainst idleness.OnlyamongtheProtestantscouldthedevoutChristianhear JohnWesley’ssermononwealth:“Earnallyoucan,saveallyoucan, giveallyoucan”(Weber1930[1904/5],175–76). Protestantismnotonlypromotedindustry;italsostressedacritical elementineconomicgrowth,thevirtueofthrift.AsWeberexplained, Christianity proclaimed self-denial and abstinence while warning againstmaterialismandpride.Protestantpreachersdisapprovedof “conspicuousconsumption,”andsocapitalistsandworkerssavedand savedandsaved.WebersawintheAmericanfoundingfatherBenjamin FranklintheepitomeoftheProtestantethic.Hisbookcitesquotation afterquotationfromFranklin’svirtuoussayings,suchas“Remember, timeismoney,”and“Apennysavedisapennyearned.” HistorianshavedisagreedwithWeber’sthesis,pointingoutthat capitalismfirstflourishedinItaliancity-states,whichwereCatholic. CatholicAntwerpinthesixteenthcenturywasaflourishingfinancial andcommercialcenter.TheSpanishscholastics,mainlyJesuitsand Dominicansinthemid-sixteenthandseventeenthcenturies,advocated economicfreedom.Yet,despitethesecriticisms,Weber’sthesiswent alongwaytowarddispellingthenegativeculturalnotionsofmodern capitalismandreligiousfaithexpressedbyVeblen.Weberstressed spiritualratherthanmaterialfactorsinthedevelopmentofcapitalism.WhileVeblentheanthropologistviewedmoderncapitalismas FROM MARX TO KEYNES 125 an example of barbarian exploitation, Weber the sociologist saw capitalist ethics and moral discipline as a decisive break from the predatorybehaviorofmen.WhileVeblendepictedthecapitalistasa predatorandstatus-seeker,Weberemphasizedindividualconscience andChristianexhortationsagainstidlenessandwastefulness. IrvingFisherandtheMysteryofMoney Theneoclassicalmodelofmoderneconomics,havingbeenremodeled andscrutinizedmanytimesover,wasnowfacingonemorechallenge asitenteredthetwentiethcentury.Therewasakeyelementmissing inthecapitalistmodelofprosperity:afundamentalunderstandingof money.Thefinancialandeconomiccrisesofthenineteenthcentury raisedseriousquestionsabouttheroleofmoneyandcredit:Whatis theidealmonetarystandard?Whatconstitutesasoundmoneybankingsystem?WasAdamSmith’ssystemofnaturallibertyinherently unstable?Comprehendingtheroleofmoneyandcredit,thelifeblood oftheeconomy,wastheunresolvedissueoftwentieth-centurymacroeconomics;thislingeringmysteryposedthegreatestchallengeto the defenders of the neoclassical model, and ultimately led to the Keynesianrevolution. Themanwhospenthisentirecareerseekingananswertothemystery ofmoneywasIrvingFisher(1867–1947),theeminentYaleprofessor andfounderofthe“monetarist”school.FromJamesTobintoMilton Friedman, top economists have hailed Fisher as the forefather of monetarymacroeconomicsandoneofthegreattheoristsintheirfield. MarkBlaugcallshim“oneofthegreatestandcertainlyoneofthemost colorfulAmericaneconomistswhohaseverlived”(Blaug1986,77). Fisher’sentirecareer,bothprofessionalandpersonal,wasdevotedto theissueofmoneyandcredit.HeinventedthefamedQuantityTheory ofMoney,andcreatedthefirstpriceindexes.Hebecameacrusaderfor manycauses,fromhealthylivingtopricestability.Hewroteoverthirty books.Hewasawealthyinventor(oftoday’sRolodex,orcardcatalog system) who became the Oracle onWall Street, but was destroyed financiallybythe1929–33stockmarketcrash. Fisher’sfailureasamonetaristtoanticipatethegreatesteconomic collapseinthetwentiethcenturymustliesquarelywithhisincomplete monetarymodeloftheeconomy,anditwasthisdefectivemodelthat 126 THE BIG THREE IN ECONOMICS leddirectlytothedevelopmentofKeynesianeconomics,thesubject ofournextchapter. Fisher’sQuantityTheoryofMoney The problem is with Fisher’s interpretation of his famed Quantity TheoryofMoney.ThemainthemeofhisQuantityTheory,published inThePurchasingPowerofMoney(1963[1911]),isthatinflation(the generalriseinprices)iscausedprimarilybytheexpansionofmoney andcredit,andthatthereisadirectconnectionbetweenchangesin thegeneralpricelevelandchangesinthemoneysupply.Ifthemoney supplydoubles,priceswilldouble. Thismonetaristconceptwasnotnew.Manyeconomistshadheldto thistheorypriortoFisher,includingDavidHumeandJohnStuartMill. ButFisherwentfurtherbydevelopingamathematicalequationforthe quantitytheory.Hestartedwithan“equationofexchange”between moneyandgoodsformulatedbySimonNewcombin1885: MV=PT, where M=quantityofmoneyincirculation V=velocityofmoney,ortheannualturnoverofmoney P=generalpricelevel T=totalnumberoftransactionsofgoodsandservicesduringthe year. Theequationofexchangeisreallynothingmorethananaccounting identity.Theright-handsideoftheequationrepresentsthetransferof money,theleft-handsiderepresentsthetransferofgoods.Thevalue ofthegoodsmustbeequaltothemoneytransferredinanyexchange. Similarly,thetotalamountofmoneyincirculationmultipliedbythe averagenumberoftimesmoneychangeshandsinayearmustequal thedollaramountofgoodsandservicesproducedandsoldduringthe year.Hence,bydefinition,MVmustbeequaltoPT. However,Fisherturnedtheequationofexchangeintoatheory.He assumedthatbothV(velocity)andT(transactions)remainedrelatively stable,andthereforechangesinthepricelevelmustbedirectlyrelated FROM MARX TO KEYNES 127 tochangesinthemoneysupply.AsFisherstated,“Thelevelofprices variesindirectproportionwiththequantityofmoneyincirculation, providedthatthevelocityofmoneyandthevolumeoftradewhichit isobligedtoperformarenotchanged”(1963[1911],14).Hecalled thistheQuantityTheoryofMoney. Fisherfirmlybelievedinthelong-termneutralityofmoney;that is,anincreaseinthemoneysupplywouldresultinaproportional increaseinpriceswithoutcausinganylong-termilleffects.Whilehe referredto“maladjustments”and“overinvestments”(termsusedby theAustrians)thatmightoccurinspecificlinesofproduction,Fisher regardedthemaspointsofshort-termdisequilibriathatwouldeventuallyworkthemselvesout(Fisher1963[1911],184–85). Thus,inthemid-1920s,hesuggestedthatthebusinesscycleno longerexisted.Hebelievedina“newera”ofpermanentprosperity,in bothindustrialproductionandstockmarketperformance.Thisnaïve convictionledtohisundoing.Hefavoredthegradualexpansionof creditbytheFederalReserveand,aslongaspricesremainedrelatively stable,hefeltthereshouldbenocrisis.Fisher,aNewEraeconomist, hadagreatdealoffaithinAmerica’snewcentralbankandexpected theFederalReservetointerveneifacrisisarose. FisherIsDeceivedbyPriceStability According to Fisher, the key variable to monitor in the monetary equationwasP,thegeneralpricelevel.Ifpriceswererelativelystable, therecouldbenomajorcrisisordepression.Pricestabilizationwas Fisher’sprincipalmonetarygoalinthe1920s.Healsofeltthatthe internationalgoldstandardcouldnotachievepricestabilityonitsown. ItneededthehelpoftheFederalReserve,whichwasestablishedin late1913inordertocreateliquidityandpreventdepressionsandcrises.AccordingtoFisher,ifwholesaleandconsumerpricesremained relativelycalm,everythingwouldbefine.Butifpricesbegantosag, threateningdeflation,theFedshouldinterveneandexpandcredit. Infact,wholesaleandconsumerpricesintheUnitedStateswere remarkablystable,anddeclinedonlyslightlyduringthe1920s.Thus, theNewEramonetariststhoughteverythingwasfineontheeveofthe 1929crash.InOctober1929,aweekbeforethestockmarketcrash, Fishermadehisinfamousstatement,“stocksappeartohavereached 128 THE BIG THREE IN ECONOMICS apermanentplateau.”MiltonFriedman,amodern-daymonetarist, referstothe1920sas“TheHighTideoftheFederalReserve,”stating,“TheTwentieswere,inthemain,aperiodofhighprosperityand stableeconomicgrowth”(FriedmanandSchwartz1963,296). AfundamentalflawinFisher’sapproachwashisoveremphasison long-runmacroeconomicequilibrium.InFisher’sworld,theprimary effectofmonetaryinflationwasageneralriseinprices,notstructural imbalances,assetbubbles,andthebusinesscycle.Hefocusedalmost exclusivelyonthepricelevel,ratherthanthemonetaryaggregatesor interestrates.Butan“easymoney”policydevelopedinthemid-1920s whentheFedartificiallyloweredinterestratestohelpstrengthenthe Britishpound,andthislow-interest-ratepolicycreatedamanufacturing,realestate,andstockmarketboomthatcouldnotlast. AustrianEconomistsWarnofImpendingDisaster Duringthe1920s,therewasaschoolofeconomicsthatdidpredict a monetary crisis: Specifically, the up and coming generation of Austrianeconomists,LudwigvonMises(1881–1973)andFriedrich Hayek(1899–1992).MisesandHayekargued,contrarytoFisher,that monetaryinflationandeasy-moneypoliciesareinherentlyunstable andcreatestructuralimbalancesintheeconomythatcannotlast.In Mises’sview,moneyis“non-neutral,”especiallyintheshortrun.The fatefuldecisionbycentralbankstoinflateandreduceinterestratesin the1920sinevitablycreatedanartificialboom.Underaninternational goldstandard,suchaninflationaryboomcouldonlybeshortlived andmustleadtoacrashanddepression. WhenthedirepredictionsofMisesandHayekcametruein1929– 32, the economics profession paid attention. Economists from all overtheworldflockedtoViennatoattendthefamousMisesseminar. Mises’sworksweretranslatedintoEnglishandHayek,hisyounger colleague,wasinvitedtoteachattheprestigiousLondonSchoolof Economics.Decadeslater,in1974,HayekwonaNobelPrizeforhis pathbreakingworkinthe1930s. Mises’srevolutionaryworkwasnottheworkofoneindividual; hedrewuponthespecie-flowmechanismofDavidHumeandDavid Ricardo;the“naturalrateofinterest”hypothesisofSwedisheconomist KnutWicksell;andthecapitalmodelofhisteacher,EugenBöhm- FROM MARX TO KEYNES 129 Bawerk.LikeFisher,Mises’sfirstmajorbookwasonmoney.The TheoryofMoneyandCredit(1971[1912])offeredamonetarymodel thatchallengedIrvingFisher’sQuantityTheoryofMoney. ThefirstandprimarygoalMisestriedtoachievewastointegrate moneyintotheeconomicsystemandthemarginalistrevolution.The classical and neoclassical economists treated money as a separate box,notsubjecttothesameanalysisastherestofthesystem.Irving Fisher’sequationofexchange,notmarginalutilityorpricetheory, formedthebasisofmonetaryanalysis.EconomistssuchasFisher spoke in aggregate terms—price level, money supply, velocity of circulation,andnationaloutput.Moreover,nationalcurrenciessuchas thedollar,thefranc,thepound,andthemark,wereviewedasunitsof accountthatwerearbitrarilydefinedbygovernment.AstheGerman historicalschooldeclared,moneyisthecreationofthestate.Thus, microeconomics (the theory of supply and demand for individual consumersandfirms)wassplitfrommacroeconomics(thetheoryof moneyandaggregateeconomicactivity).Whowouldfindthemissing linkandconnectthetwo? TheTheoryofMoneyandCreditlinkedmicroandmacrobyfirst showingthatmoneywasoriginallyacommodity(gold,silver,copper, beads,etc.),andthereforesubjecttomarginalanalysislikeeverything else.Misesshowedthatmoneyisnodifferentfromanyothercommoditywhenitcomestomarginalvalue.Inmicroeconomics,theprice ofanygoodisdeterminedbythequantityavailableandthemarginal utilityofthatgood.Thesameprincipleappliestomoney,onlyinthe caseofmoney,the“price”isdeterminedbythegeneralpurchasing powerofthemonetaryunit.Thewillingnesstoholdmoney(“cash balances”)isdeterminedbythemarginaldemandforcashbalances. The interaction between the quantity of money available and the demandforitdeterminesthepriceofthedollar.Thus,anincreasein thesupplyofdollarswillleadtoafallinitsvalueorprice. Mises’sapplicationofmarginalanalysisonmoneyis,ofcourse,a confirmationofthefirstapproximationofFisher’sQuantityTheory ofMoney.Ifyouincreasethemoneysupply,thepriceofmoney willfall. Butthenthequestionis,byhowmuch? Fisher,asyouwillrecall,assumedthatV(velocity)andT(transactions)wererelativelyconstant,andthereforeM(moneysupply)and 130 THE BIG THREE IN ECONOMICS P(pricelevel)wouldvarydirectlyandproportionately.InTheTheory ofMoneyandCredit,MiseswentfurtherthanFisher.Hecontended thatifeventhenation’spriceindexwerestable,abusinesscyclecould develop.Fisher’sproposalofastablepriceindex“couldnotinanyway amelioratethesocialconsequencesofvariationsinthevalueofmoney,” hewrote(Mises1971[1912],402).Whynot?Businessactivitycould boomwithoutariseincommodityorconsumerpricesand,equally,the economycouldcollapsebeforegeneralpricedeflationsetin.According toMises,Mistheculprit.Misanindependentvariablethatcouldcreate havocintheeconomy,notbysimplyraisingprices,asFishertheoretized, butbyintroducingstructuralimbalancesintotheeconomy.InMises’s model,moneyisneverneutral.ItaffectsalltheothervariablesinFisher’s equationofexchange—velocity(V),prices(P),andtransactions(T).The relationshipbetweenmoneyandpriceswasscarcelyproportional. WicksellandtheNaturalRateofInterest Moreover,ifmonetarypolicypushed“market”interestratesbelowthe “natural”rate,thecentralbankcouldcreateanunstablebusinesscycle thatcouldleadtofinancialdisaster.With“natural”rate,Misesborrowed anideafromthebrilliantSwedisheconomistKnutWicksell(1851–1926), whodefinedthe“natural”rateofinteresttobetheratethatequalizesthe supplyanddemandforsavingbasedonthesocialrateoftimepreference. Forexample,iftheSwisshaveanaturalsavingsratehigherthantheSwedish,thenaturalrateofinterestwilltendtobelowerinSwitzerlandthan inSweden,assuminganeutralmonetarypolicybythegovernment. Ontheotherhand,Wickselldefinedthe“market”rateofinterestas therateofinterestbankschargeforloanstoindividualcustomersand businesses.Inastableeconomy,Wicksellnoted,thenaturalrate(time preference)isnormallythesameasthemarketrate(loanmarket).When thetwoarethesame,youhavemacroeconomicstability.Ifthetwopart ways,however,troublebrews. IftheFederalReserveartificiallylowersthemarketrateofinterest throughan“easymoney”policybelowthenaturalrate,itcreatesa cumulativeprocessofinflationandanunsustainableboom,especially inthecapitalmarkets.Thiscouldtakeavarietyofforms,dependingon howthemoneyisspent—itcouldcauseabullmarketonWallStreet, aboominconstructionandmanufacturing,orarealestatebubble. However,accordingtoMisesandHayek,theinflationaryboomcan- FROM MARX TO KEYNES 131 notlast.Eventually,inflationarypressureswillraiseinterestratesand chokeofftheboom,resultinginadepression. Hayek expanded on Mises’s theory of the business cycle while servingunderMisesasmanageroftheAustrianInstituteofEconomic Research.InPricesandProduction(1935[1931]),acompilationof aseriesoflecturesgivenattheLondonSchoolofEconomics,Hayek createdthe“Hayekiantriangles”todemonstratethetime-structureof production.Thetrianglerepresentsspendingateachstageofproduction—fromnaturalresourcestofinalconsumption—witheachstage addingvalue.AccordingtoHayek,thestructureofthetrianglechanges withinterestrates,butifthemarketrateofinterestfallsbelowthe naturalrate,thesizeofthetriangleincreasesandthenshrinks.3 MisesalsoappliedBöhm-Bawerk’stheoryof“roundaboutness” and the structure of capital.A government-induced inflationary boom would inevitably cause the roundabout production process to lengthen, especially in capital-goods industries, a process that couldnotbereversedeasilyduringaslump.Oncenewfundsare invested in machinery, tools, equipment, and buildings, capital wouldbecomeheterogeneous,anditwouldnotbeeasytoselloff assets, equipment, and inventories during a slowdown. In short, whenaboomturnsintoabust,ittakestime,sometimesyears,for theeconomytorecover. Finally,Misessawtheinternationalgoldstandardasadisciplinarian thatwouldcutshortanyinflationaryboominshortorder.Borrowing from the Hume-Ricardo specie-flow mechanism, Mises outlined a seriesofeventswherebyaninflationaryboomwouldquicklycome toanendundergold: 1. Underinflation,domesticincomesandpricesrise. 2. Citizens buy more imports than exports, causing a trade deficit. 3. Thebalance-of-paymentsdeficitcausesgoldtoflowout. 4. Thedomesticmoneysupplydeclines,causingadeflationary collapse. 3. For a more complete explanation of Hayek’s triangles, see chapter 12 of Skousen(2001,294–95)andGarrison(2001). 132 THE BIG THREE IN ECONOMICS TheAustrianModelUltimatelyLosesPopularity Mises,Hayek,andWicksellhelpedfillthegapsinneoclassicalmonetaryeconomics,andhelpedcompletethestructurethatAdamSmith hadbegun.Butiftheirmonetarytheoriesofthebusinesscyclehad alltheanswers,whydidn’ttheycatchon?Primarily,theirmodelwas notappreciateduntilaftertheGreatDepressiontookhold.Andwhen theGreatDepressiondidn’tendquickly,astheAustrianspredicted, economistsstartedsearchingforanewmodelthatcouldexplainsecularstagnationinacapitalisteconomy.HayekandMisesadvocated standard neoclassical solutions such as cutting wages and prices, loweringtaxes,andreducinggovernmentinterferenceincommerce andtrade,buttheyadamantlycounseledagainstreinflationanddeficit spending.“Itwouldonlymeanthattheseedwouldalreadybesownfor newdisturbancesandnewcrises,”Hayekwarned.Theonlysolution totheGreatDepressionwas“toleaveittimetoeffectapermanent cure”—inotherwords,waititoutandletthemarkettakeitsnatural course(Hayek,1935,98–99).Suchaprescriptionmighthaveworked duringagarden-varietyrecession,butitapparentlywasnotenough tocounterthefull-scaledeflationarycollapse. WiththeAustriansofferingfewexplanationsandnocureforthe seemingly never-ending depression, economists eventually looked elsewhere for a solution.Who could come to the rescue and save capitalism? One economist did step forward to offer an exciting newtheoryofmacroeconomicsandavigorouspolicyforcuringthe depression—a new model that excited the minds of a whole new generationofeconomists. 5 JohnMaynardKeynes CapitalismFacesItsGreatestChallenge A thousand years hence 1920–1970 will, I expect, be the time for historians. It drives me wild to think of it. I believe it will make my poor Principles, with a lot of poor comrades, into waste paper.1 —Alfred Marshall (1915) Keyneswasnosocialist—hecametosavecapitalism,notto buryit....TherehasbeennothinglikeKeynes’s achievementintheannalsofsocialsciences. —PaulKrugman(2006) 1.ThispropheticstatementwasmadeinaletterfromAlfredMarshalltoaCambridge Universitycolleague,ProfessorC.R.Fay,datedFebruary23,1915.Hemadenoreference toKeynesastheinstigatorofthisrevolution,butMarshalldidhaveafavorableopinion ofhisstudent.SeePigou(1925,489–90). 133 134 THE BIG THREE IN ECONOMICS Thecapitalistsystemofnaturalliberty—foundedbyAdamSmith, revisedbythemarginalistrevolution,andrefinedbyMarshall,Fisher, andtheAustrians—wasundersiege.Theclassicalvirtuesofthrift, balancedbudgets,lowtaxes,thegoldstandard,andSay’slawwere underattackasneverbefore.ThehousethatAdamSmithbuiltwas threateningtocollapse. TheGreatDepressionofthe1930swasthemosttraumaticeconomiceventofthetwentiethcentury.Itwasespeciallyshockinggiven thegreatadvancesachievedinWesternlivingstandardsduringthe NewEratwenties.Thoselivingstandardswouldbestrainedduring 1929–33,thebruntofthedepression.IntheUnitedStates,industrial output fell by over 30 percent. Over one-third of the commercial banksfailedorconsolidated.Theunemploymentratesoaredtoover 25percent.Stockpriceslost88percentoftheirvalue.Europeand therestoftheworldfacedsimilarturmoil. TheAustrians Mises and Hayek, along with the sound-money economists in the United States, had anticipated trouble, but felt helplessinthefaceofaslumpthatjustwouldn’tgoaway.Anascent recoveryunderRoosevelt’sNewDealbeganinthemid-1930s,but didn’tlast.U.S.unemploymentremainedatdouble-digitlevelsfora fulldecadeanddidnotdisappearuntilWorldWarII.Europedidn’t faremuchbetter;onlyHitler’smilitantGermanywasfullyemployed aswarapproached.Inthefreeworld,fearoflosingone’sjob,fearof hunger,andfearofwarloomedominously. ThelengthandseverityoftheGreatDepressioncausedmostof theAnglo-Americaneconomicsprofessiontoquestionclassicallaissez-faireeconomicsandtheabilityofafree-marketcapitalistsystem to correct itself. The assault was on two levels—the competitive natureofcapitalism(micro)andthestabilityofthegeneraleconomy (macro). WastheClassicalModelofCompetitionImperfect? On the micro level, two economists simultaneously wrote books thatindependentlychallengedtheclassicalmodelofcompetition.In 1933,HarvardUniversityPressreleasedTheTheoryofMonopolistic CompetitionbyEdwardH.Chamberlin(1899–1967),andCambridge UniversityPresspublishedEconomicsofImperfectCompetitionby KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 135 JoanRobinson(1903–83).Botheconomistsintroducedtheideathat therearevariouslevelsofcompetitioninthemarketplace,from“pure competition”to“puremonopoly,”andthatmostmarketconditions were “imperfect” and involved degrees of monopoly power. The Chamberlin-Robinson theory of imperfect competition captured theimaginationoftheprofessionandhasbeenanintegralfeature of microeconomics ever since. It has strong policy implications: Laissez-faireisdefectiveandcannotensurecompetitiveconditions incapitalism;thegovernmentmustintervenethroughcontrolsand antitrust actions to curtail the natural monopolistic tendencies of business. TheRadicalThreattoCapitalism But this threat was minor compared to the radical noncapitalist alternativesbeingproposedinmacroeconomics.Marxismwasall therageoncampusesandamongintellectualsduringthe1930s. PaulSweezy,aHarvard-trainedeconomist,hadgonetotheLondonSchoolofEconomics(LSE)intheearly1930s,onlytoreturn a full-fledged Marxist, ready to teach radical ideas at his alma mater.SidneyandBeatriceWebbreturnedfromtheSovietUnion brimmingwithoptimism,firmintheirbeliefthatStalinhadinaugurateda“newcivilization”offullemploymentandeconomic superiority. Was full-scale socialism the only alternative to an unstablecapitalistsystem? WhoWouldSaveCapitalism? Moresoberintellectualssoughtanalternativetowholesalesocialism,nationalization,andcentralplanning.Fortunately,therewasa powerfulvoiceurgingamiddleground,awaytopreserveeconomic libertywithoutthegovernmenttakingoverthewholeeconomyand destroyingthefoundationsofWesterncivilization. It was the voice of John Maynard Keynes, leader of the new Cambridge school. In his revolutionary 1936 book, The General TheoryofEmployment,InterestandMoney,Keynespreachedthat capitalismisinherentlyunstableandhasnonaturaltendencytoward fullemployment.Yet,atthesametime,herejectedtheneedtona- 136 THE BIG THREE IN ECONOMICS tionalizetheeconomy,imposeprice-wagecontrols,andinterfere with the microfoundations of supply and demand.All that was neededwasforgovernmenttotakecontrolofawaywardcapitalist steeringwheelandgetthecarbackontheroadtoprosperity.How? Not by slashing prices and wages—the classical approach—but by deliberately running federal deficits and spending money on publicworksthatwouldexpand“aggregatedemand”andrestore confidence.Oncetheeconomygotbackontrackandreachedfull employment,thegovernmentwouldnolongerneedtorundeficits, andtheclassicalmodelwouldfunctionproperly.AsKeyneshimself wrote,“Butbeyondthisnoobviouscaseismadeoutforasystem ofStateSocialismwhichwouldembracemostoftheeconomiclife ofthecommunity”(Keynes1973a[1936],378).Hismessagewas reallyquitesimple,yetrevolutionary:“Massunemploymenthada singlecause,inadequatedemand,andaneasysolution,expansionaryfiscalpolicy”(Krugman2006). Keynes’smodelofaggregatedemandmanagementchangedthe dismalsciencetotheoptimists’club:mancouldbethemasterof hiseconomicdestinyafterall.Hisclaimthatgovernmentcouldexpandorcontractaggregatedemandasconditionsrequiredseemed to eliminate the cycle inherent in capitalism without eliminating capitalism itself. Meanwhile, a laissez-faire policy of economic freedom could be pursued on a microeconomic level. In short, Keynes’smiddle-of-the-roadpolicieswereviewednotasathreat tofreeenterprise,butasitssavior.Infact,Keynesianismbrought itschiefrivaltheory,Marxism,toatotalhaltinadvancedcountries (Galbraith1975[1965],132). “LikeaFlashofLightonaDarkNight” The Keynesian revolution took place almost overnight, especially amongtheyoungestandthebrightest,whoswitchedallegiancefrom theAustrianstoKeynes.JohnKennethGalbraithwroteofthetimes, “Here was a remedy for the despair. . . . It did not overthrow the systembutsavedit.Tothenon-revolutionary,itseemedtoogoodto betrue.Totheoccasionalrevolutionary,itwas.Theoldeconomics wasstilltaughtbyday.Butintheevening,andalmosteveryevening from1936on,almosteveryonediscussedKeynes”(Galbraith1975 KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 137 [1965],136).MiltonFriedman,wholaterbecameavociferousopponentofKeynesiantheory,said,“Bycontrastwiththisdismalpicture[theAustrianlaissez-faireprescription],thenewsseepingoutof Cambridge(England)aboutKeynes’sinterpretationofthedepression andoftherightpolicytocureitmusthavecomelikeaflashoflight onadarknight.Itofferedafarlesshopelessdiagnosisofthedisease. Moreimportantly,itofferedamoreimmediate,lesspainful,andmore effectivecureintheformofbudgetdeficits.Itiseasytoseehowa young,vigorous,andgenerousmindwouldhavebeenattractedto it”(1974,163). TheKeynesianmodelofaggregatedemandmanagementsweptthe professionevenfasterthanthemarginalistrevolution,especiallyafter WorldWarIIseemedtovindicatethebenefitsofdeficitspendingand massivegovernmentspending.Itwasn’tlongbeforecollegeprofessors,underthetutorageofAlvinHansen,PaulSamuelson,Lawrence Klein,andotherKeynesiandisciples,beganteachingstudentsabout theconsumptionfunction,themultiplier,themarginalpropensityto consume,theparadoxofthrift,aggregatedemand,andC+I+G.It wasastrange,new,excitingdoctrine.Anditwasthebeginningofa wholenewareaofstudycalled“macroeconomics.”2 TheDarkSideofKeynes Keynes may have offered a plausible cure for the depression, but his theoretical heresies also created a postwar environment favorabletowardubiquitousstateinterventionism,thewelfarestate,and boundlessfaithinbiggovernment.Histheoriesencouragedexcess consumption,debtfinancing,andprogressivetaxationoversaving, balancedbudgets,andlowtaxes.CriticssawKeynesianeconomics 2.WithKeynescamethedivisionof“macroeconomics,”thestudyofeconomic aggregatessuchasthepricelevel,themoneysupply,andGrossDomesticProduct, and“microeconomics,”thetheoryofindividualandfirmbehavior.PaulSamuelson, whodidnotusetheterminthefirsteditionofhistextbook,Economics(1948),says thedistinctionbetween“micro”and“macro”goesbacktoeconometriciansRagnar FrischandJanTinbergen,thefirstNobelPrizewinnersineconomics.ButRogerGarrisonnotesthattheAustrianeconomistEugenBöhm-Bawerkwrotethissentencein January,1891:“Onecannoteschewstudyingthemicrocosmifonewantstounderstand properlythemacrocosmofadevelopedcountry”(Böhm-Bawerk1962:117). 138 THE BIG THREE IN ECONOMICS asadirectassaultontraditionaleconomicvaluesandthemostserious threat to the principles of economic freedom since Marxism. Tothem,Keynes’sGeneralTheory“constitutesthemostsubtleand mischievousassaultonorthodoxcapitalismandfreeenterprisethat hasappearedintheEnglishlanguage”(Hazlitt1977[1960],345).As PaulKrugmannotes,“Ifyourdoctrinesaysthatfreemarkets,leftto theirowndevices,producethebestofallpossibleworlds,andthat governmentinterventionintheeconomyalwaysmakesthingsworse, Keynesisyourenemy”(Krugman2006). DespiteoccasionalpronouncementsthatKeynesisdead,Keynesianthinkingisstillsopervasiveinacademia,thehallsofparliament, andWall Street, that Time magazine aptly voted Keynes the most influential economist of the twentiethcentury.BiographerCharles Hessionwrites,“Morebooksandarticleshavebeenwrittenabout himthananyothereconomist,withthepossibleexceptionofKarl Marx”(1984,xiv).Appropriately,TheNewPalgravegivesKeynesits longestbiography—twentypages,ascomparedtofifteenforMarx. And Keynes’s latest biographer, Robert Skidelsky, places Keynes onapedestal:“Keyneswasamagicalfigure,anditisfittingthathe shouldhaveleftamagicalwork.Therehasneverbeenaneconomist likehim”(1992,537). KeynesBornAmidBritain’sRulingElite WhatkindofmanwasKeynes,whocouldengendersuchdevotion andsuchhostility? John Maynard Keynes (1883–1946) was an intellectual elitist fromhisearliestchildhood.Whenaskedoncehowtopronouncehis name,hereplied,“Keynes,asinbrains.”Bornin1883(theyearMarx died)inthecenterofBritain’smostcerebralenvironment,hewasthe sonofJohnNevilleKeynes,aneconomicsprofessoratCambridge UniversityandafriendofAlfredMarshall.Nevillewouldactually outlivehisson,Maynard,bythreeyears,dyingin1949atageninetyseven.Hismother,FlorenceAdaKeynes,alsodistinguishedherself asCambridge’sfirstwomanmayor.Keyneswasalwaysclosetohis mother,whilehisfatherwasdistant.Hisfatherwroteinhisdiaryin 1891,whenMaynardwasonlyeightyearsold,“Theonlypersonhe wouldliketobeishismother;atanyrate,hewoulddesiretoresemble KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 139 herineverything”(inHession1984,11). KeyneswenttoBritain’sbestprivateschool,Eton,andthenattended, as expected, Cambridge University, where he obtained a degreeinmathematicsin1905.Hewouldlaterwriteacontroversial bookonprobabilitytheory. His friends considered him precocious, clever, and sometimes rude.Hismostdistinguishingfeatureswerehis“riotouseyes”and “leaping mind” (Skidelsky 1992, xxxi). Keynes viewed himself as“physicallyrepulsive.”Nevertheless,hewasselectedasoneof onlyadozenmembersoftheApostles,anexclusivesecretsociety atCambridge(notunliketheSkullandBonesatYale).Membershipisforlife.Othernoteworthymembershaveincludedthepoet AlfredLordTennyson,biographerLyttonStrachey,andphilosophers BertrandRussell,G.E.Moore,andAlfredNorthWhitehead.The Apostleswereaclose-knitgroup,meetingeverySaturdaynightto discusspapers. TheTruthAboutKeynes’sHomosexuality Attheturnofthetwentiethcentury,theApostles,undertheinfluence ofG.E.Moore,developedadeepcontemptforVictorianmorality andbourgeoisvalues.Theyevenpropoundedthesubversiveidea that homosexuality was morally superior. Keynes was a practicinghomosexualduringhisearlyadultlife,althoughheapparently abandonedituponmarryingLydiaLopokovain1925.Thisfactwas coveredupbyhisofficialbiographer,RoyHarrod,forfearitwould destroyKeynes’sreputation.Inhisintroduction,Harrodexplained, “Inregardtohisfaults,Iamnotconsciousofanysuppression[of facts].Criticismshavebeenmadebythemaliciousorill-informed which have no foundation in fact” (Harrod 1951, viii).Yet there wassuppression.MorerecenthistoriesbyRobertSkidelsky(2003), D.E.Moggridge(1992),andCharlesHession(1984)sparefewdetailsofKeynes’ssexualadventures.Moggridgeevengoessofaras toprintKeynes’ssexualengagementdiaryinanappendix(1992, 838–39). Keynes’s sexual proclivities may have been influenced by his familylife(overprotectivemother,weakfather);theEtonschool,an all-maleinstitutionwhereGreekphilosophytaughtthatplatoniclove 140 THE BIG THREE IN ECONOMICS betweenmenisspirituallyhigherthanthecarnallovebetweenman andwoman;andthecollegiateideasofG.E.Moore,whopreached adisregardformoralsanduniversalrulesofconduct.Keynesfirmly believedinlivingthe“goodlife,”withoutconcernforrightorwrong. “[It]istoolatetochange.Iremain,andwillalwaysremain,animmoralist,”hewrote(Hession1984,46). WasKeynesamisogynist?Keynes’spredilectionformenmay haveaffectedhisattitudestowardwomeninhisearlyyears.Like Marshall,hedislikedthepresenceoffemalestudentsinhisclasses. In1909,whileteachingatCambridge,hewrote,“IthinkIshallhave togiveupteachingfemalesafterthisyear.Thenervousirritation causedbytwohours’contactwiththemisintense.Iseemtohate everymovementoftheirminds.Themindsofthemen,evenwhen theyarestupidandugly,neverappeartomesorepellent”(Moggridge1992,183–34). But Keynes shocked his homosexual friends in Bloomsbury whenheannouncedhisengagementandsubsequentmarriageto LydiaLopokova,aRussianballerina,in1925.Basedonprivate lettersbetweenMaynardandLydia,theirmarriagewasfarfrom platonic.“Sexualrelationscertainlydeveloped,”biographerRobertSkidelskywrites(1992,110–11;2003,300,356–60).Keynes also developed friendships with women in the 1930s, including JoanRobinson. Butwearegettingaheadofourstory.Aftergraduation,Keynes enteredtheBritishCivilService,spendingtwoyearsintheIndiaoffice (althoughnevervisitingIndia).In1909hebecameateachingfellow atCambridge,andfrom1911to1944heservedasthegeneraleditor ofCambridge’sEconomicJournal.Hewasnottrainedineconomics, havingtakenonlyasinglecoursefromAlfredMarshall,butquickly acquiredtheskillstoteachit. KeynesWritesaBest-Seller In1919,followingWorldWarI,KeynesservedasaseniorTreasury officialintheBritishdelegationtotheVersaillesPeaceConference. Distressedbytheproceedings,heresignedandwroteTheEconomic ConsequencesofthePeace(1920).Itbecameabest-sellerandpropelledKeynesintofameandfortune. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 141 ManycriticsconsideritKeynes’sbestbook.Writingintrenchant prose, he revealed peculiar personal characteristics of theAllied leaders.3KeynescondemnedtheAlliesforimposingimpracticaland unrealisticreparationsontheGermans.Thedefeatednationswere requiredtopaythecompleteAlliedcostsofthewar,includingpay, pensions,anddeathbenefitsoftroops—upto$5billion“whether ingold,commodities,ships,securitiesorotherwise,”beforeMay1, 1921.“Theexistenceofthegreatwardebtsisamenacetofinancial stabilityeverywhere,”warnedKeynes(1920,279).Apessimistic Keynes predicted negative consequences in Europe. He implied thatGermanywouldhavenorecoursebuttoinflateherwayout.In afamouspassage,Keynesnoted,“Leninwascertainlyright.There isnosubtler,nosurermeansofoverturningtheexistingbasisof societythantodebauchthecurrency.Theprocessengagesallthe hiddenforcesofeconomiclawonthesideofdestruction,anddoes itinamannerwhichnotonemaninamillionisabletodiagnose” (1920,236).4 3.OneofKeynes’seccentricitieswashisobsessionwithpeople’shands.Hemade alifelongstudyofthesizeandshapeofhands,whichheregardedasaprimaryclueto character.Hewassoenamoredofchirognomy—thereadingofpersonalitybytheappearanceofthehands—thathehadcastsmadeofhisandhiswife’shands,andeventalked ofmakingacollectionofthoseofhisfriends(Harrod1951:20).WheneverKeynesmeta colleague,politician,orstranger,hefocusedimmediatelyonthehands,oftenmakinga snapjudgmentabouttheperson’scharacter.UponmeetingPresidentWoodrowWilson attheTreatyofVersailles,henotedthathishands,“thoughcapableandfairlystrong, werewantinginsensitivenessandfinesse”(Keynes1920:40).Atthesameconference, Keynes expressed disappointment that French President Georges Clemenceau wore gloves(20–21).(NowonderKeynesdidnottakewelltoAdamSmith’sdoctrineofthe invisiblehand!)UponmeetingPresidentFranklinD.Rooseveltthefirsttimein1934, KeyneswassopreoccupiedwithexaminingFDR’shandsthathefaltered,“hardlyknowingwhatIwassayingaboutsilverandbalancedbudgetsandpublicworks.”Roosevelt reportedlywasunimpressedwithKeynes,andKeyneswasdisappointedaswell.FDR’s handanalysis:“Firmandfairlystrong,butnotcleverorwithfinesse,shortishroundnails likethoseattheendofabusiness-man’sfingers”(Harrod1951:20). 4. In a misguided review called The Carthaginian Peace or the Economic ConsequencesofMr.Keynes,FrencheconomistEtiennedeMantouxlaterblamed KeynesforstartingWorldWarII.AccordingtoMantoux,KeynesvastlyunderestimatedGermany’scapacitytopaythewarreparationsandconvincedtheworldthat theVersaillesPeaceAccordshadcrushedGermanyandthatthereforesomehowthe Nazidangerwasminor.It’shardtoimagineamorewrong-headedinterpretationof Keynes’sbook.SeeMantoux(1952). 142 THE BIG THREE IN ECONOMICS KeynesMakesAnotherBrilliantPredictionin1925 Keynesfollowedthissuccesswithanotherinsightfulanalysisin1925 whenBritain,underChancelloroftheExchequerWinstonChurchill, returnedtothegoldstandardattheovervaluedprewarfixedexchange rateof$4.86.Keynescampaignedagainstthisdeflationarymeasure. InhisbookletTheEconomicConsequencesofMr.Churchill,theCambridgeprofessorwarnedthatdeflationwouldforceBritaintoreduce realwagesandretardeconomicgrowth(Keynes1951[1931],244–70). Onceagain,Keynesprovedprescient;Britainsufferedfromaneconomic malaisethatonlyworsenedastheGreatDepressionapproached. Unfortunately, Keynes’s gift of prophecy disappeared in the late 1920s.InhisTractonMonetaryReform(whichMiltonFriedmanratesas Keynes’sgreatestwork),hejoinedthemonetaristIrvingFisherinrejectingthegoldstandard,andlaterhailedthestabilizinginfluenceoftheU.S. dollarbetween1923and1928asa“triumph”oftheFederalReserve. “WeWillNotHaveAnyMoreCrashesinOurTime” LikeFisher,KeyneswasaNewEraadvocatewhowasbullishonstocks andcommoditiesthroughoutthe1920s.In1926,hemetwithSwiss bankerFelixSomary,anxioustobuystocks.WhenSomaryexpressed pessimismaboutthefutureofthestockmarket,Keynesdeclaredfirmly, “Wewillnothaveanymorecrashesinourtime”(Somary1986[1960], 146–47).SomaryhadbeentrainedinAustrianeconomicsattheUniversityofViennaandknewthattheNewEraboomwasunsustainable. ButKeynes,likeIrvingFisher,ignoredtheAustriansandpinnedhis hopesontheFederalReserveandpricestabilization. Inlate1928,Keyneswrotetwopapersdisputingthata“dangerous inflation” was developing onWall Street, concluding that there was “nothingwhichcanbecalledinflationyetinsight.”Referringtobothreal estateandstockvaluesintheUnitedStates,Keynesadded,“Iconclude thatitwouldbeprematuretodaytoasserttheexistenceofover-investment. ...Ishouldbeinclined,therefore,topredictthatstockswouldnotslump severely(i.e.,belowtherecentlowlevel)unlessthemarketwasdiscountingabusinessdepression.”Suchwouldnotbeprobable,hewrote,since theFederalReserveBoardwould“doallinitspowertoavoidabusiness depression”(Keynes1973b,52–59;Hession1984,238–39). KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 143 MakingMoneyfromHisBedroom Keynesshouldnothavebeensoconfident.Bythelate1920s,he haddevelopedareputationforfinancialwizardrytradingcurrencies, commodities,andstocks.HewaschairmanoftheNationalMutual LifeInsuranceCompanyandbursarofKing’sCollegeinCambridge. Hispersonalaccountincludedaheavycommitmenttocommodities andstocks.Heheldlongpositionsinfuturescontractsinrubber, corn,cotton,andtin,aswellasseveralBritishautomobilestocks. Indeed,hewasknownformakingtradingdecisionswhilestillin bed.ReportsHession,“Someofthisfinancialdecision-makingwas carriedoutwhilehewasstillinbedinthemorning;reportswould cometohimbyphonefromhisbrokers,andhewouldreadthenewspapersandmakehisdecisions”(Hession1984,175). KeynesIsWipedOutbytheCrash Tragically,Keynesmisreadthetimesandfailedtoanticipatethecrash. Hisportfoliowasalmostwipedout:helostthree-quartersofhisnet worth,primarilyduetocommoditylosses(Moggridge1983,15–17; Skidelsky1992,338–43).InhisTreatiseonMoney,publishedin1930, headmittedthathehadbeenmisledbystablepriceindicesinthe 1920s,andthata“profitinflation”haddeveloped(1930,190–98). However,Keynes,astubborninvestor,heldontohisstocksandadded substantiallytohisportfoliostartingin1932.Althoughhewasincapable ofgettingoutatthetop,hehadanuncannyabilitytoacquirestocksat thebottomofthemarket(Skousen1992,161–69).Heboughtsecuritiesthatwereclearlyoutoffavor,suchasutilitiesandgoldstocks,and wassosureofhisstrategythatheboughtheavilyonmargin.In1944, hewroteafellowmoneymanager,“Mycentralprincipleofinvestment istogocontrarytogeneralopinion,onthegroundthat,ifeveryone isagreedaboutitsmerits,theinvestmentisinevitablytoodearand thereforeunattractive”(Moggridge1983,111). KeynesStillManagestoDieSpectacularlyRich Keyneswassospectacularlysuccessfulinchoosingstocksthathis networthreached£411,000bythetimehediedin1946.Giventhat 144 THE BIG THREE IN ECONOMICS his portfolio was worth only £16,315 in 1920, that’s a 13 percent compoundedannualreturn,farsuperiortowhatmostprofessional moneymanagersachieveandanamazingfeatduringanerawhen there was little or no inflation and, in fact, much deflation.And thisextraordinaryreturnwasachieveddespitefantasticsetbacksin 1929–32and1937–38.OnlyDavidRicardohadasuperiorrecordas afinancialeconomist. ARevolutionaryBookAppears Keynes’sfailuretopredictthecrashandtheGreatDepressiondeeply influencedhisthinking.Hewasbitterlyresentfulofthespeculators who drove prices down to ridiculously low levels and nearly put himinthepoorhouse.Hehadlongbeforerejectedlaissez-faireasa generalorganizingprincipleinsociety,butthe1929–33crisisonly strengthened his rejection of conventional classical economics. In BBCradioaddresses,helashedoutathoarders,speculators,andgold bugs,whileurgingdeficitspending,inflation,andabandonmentof thegoldstandardassolutionstotheslump.HecriticizedFriedrich HayekandtheLondonSchoolofEconomicsforbelievingthatthe economywasself-adjustingandforurgingwagereductionsandbalancedbudgetsassolutionstothedepression. Allthewhile,athishomeinCambridge,Keyneswasworkingon abookcreatinganewmodelofeconomics,withthehelpofRichard Kahn, Joan Robinson, and the Cambridge Circus that developed around him. On NewYear’s Day 1935, Keynes wrote playwright George Bernard Shaw, “I believe myself to be writing a book on economictheory,whichwilllargelyrevolutionise—not,Isuppose,at oncebutinthecourseofthenexttenyears—thewaytheworldthinks abouteconomicproblems”(Skidelsky2003,518).Itwasanarrogant prognostication,butonethatprovedtoberight. Asalreadymentioned,TheGeneralTheoryofEmployment,Interest and Money first appeared in 1936.5 Like other economists, 5. Some Keynesians, such as Charles Hession and John Kenneth Galbraith, emphaticallyinsistthatthecorrecttitleisTheGeneralTheoryofEmploymentInterestandMoney,withoutthecomma.True,nocommaswereusedonthecoverofthe original,butinthepreface,Keynesaddedacommaafter“employment.” KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 145 Keynesidentifiedwiththegreatscientistsofthepast.AdamSmith and Roger Babson compared their analytical systems to those of SirIsaacNewton,andKeynesemulatedAlbertEinstein.Keynes’s booktitlereferstoEinstein’sgeneraltheoryofrelativity.Hisbook, hesaid,createda“general”theoryofeconomicbehaviorwhilehe relegatedtheclassicalmodeltoa“special”caseandtreatedclassicaleconomistsas“Euclideangeometersinanon-Euclideanworld” (Skidelsky1992,487). LikeMarx,Keyneshadhighhopesthathismagnumopuswouldbe readbystudentsandthegeneralpublicandconvincedMacmillanto pricethe400-pagetreatiseatonlyfiveshillings.Butthiswaswishful thinking.TheGeneralTheoryturnedouttobeKeynes’sonlyunreadablebook,fulloftechnicaljargonandincomprehensiblelanguage. RicardoandMarxhadtheirbookofheadachesandsodidKeynes.The followingsimpleQandAwilldemonstrateafewofthedifficulties foundinTheGeneralTheory.(ThankstoRogerGarrison,economics professoratAuburnUniversity,forprovidingthisbitofsatire.) Keynes’sBookofHeadaches Q:Please,ProfessorKeynes,whatdoyoumeanby“involuntary unemployment”? A:“Mydefinitionis...asfollows:Menareinvoluntarilyunemployedif,intheeventofasmallriseinthepriceofwage-goodsrelative tothemoney-wage,boththeaggregatesupplyoflabourwillingto workforthecurrentmoney-wageandtheaggregatedemandforitat thatwagewouldbegreaterthantheexistingvolumeofemployment” (1973a[1936],15). Q:Humm...soundsveryenlightening,ProfessorKeynes.Nowtell us,please,whatgovernsprivateinvestmentinamarketeconomy? A:“Ourconclusionscanbestatedinthemostgeneralform...as follows:Nofurtherincreaseintherateofinvestmentispossiblewhen thegreatestamongsttheown-ratesofown-interestofallavailable assetsisequaltothegreatestamongstthemarginalefficienciesofall assets,measuredintermsoftheassetwhoseown-rateofown-interest isgreatest”(236). Q:Yes,Isee....Onelastquestion,ProfessorKeynes.Doesn’t monetaryexpansiontriggeranartificialboom? 146 THE BIG THREE IN ECONOMICS A:“[A]tthispointweareindeepwater.Thewildduckhasdived downtothebottom—asdeepasshecanget—andbittenfasthold oftheweedandtangleandalltherubbishthatisdownthere,andit wouldneedanextraordinarilycleverdogtodivedownandfishher upagain”(183). EvenPaulSamuelson,adevoteKeynesian,declared,“Itisabadly writtenbook,poorlyorganized;anylaymanwho,beguiledbythe author’spreviousreputation,boughtthebookwascheatedofhis fiveshillings.Itisnotwellsuitedforclassroomuse.Itisarrogant, bad-tempered,polemical,andnotoverlygenerousinitsacknowledgements.Itaboundsinmares’nestsorconfusions....Flashes of insight and intuition intersperse tedious algebra.An awkward definitionsuddenlygiveswaytoanunforgettablecadenza.When finallymastered,itsanalysisisfoundtobeobviousandatthesame timenew.Inshort,itisaworkofgenius”(Samuelson1947[1946], 148–89).6 And Paul Krugman writes that “although The GeneralTheory is still worth reading and rereading,” he admits that he “labored through”partsofit,andfindsithelpfultodescribethebookas“a mealthatbeginswithadelectableappetizerandendswithadelightfuldessert,butwhosemaincourseconsistsofrathertoughmeat” (Krugman2006). TheGeneralTheoryisstillinprint,butonlybecauseoftheelucidatingworkofKeynes’sdisciples,especiallyAlvinHansenandPaul Samuelson,whodecipheredKeynes’sconvolutedjargon,translated itintoplainEnglish,andtransformedtheprofession. KeynesatWar Keyneswasfifty-twowhenhecompletedTheGeneralTheory,his finalmajorwork.Hewasattheheightofhispowers.Keyneswas 6.BiographerCharlesHessionerectedanoveltheorythatKeynes’srevolutionaryideasandcreativegeniusweretheresultofhisandrogynousbackground,which combined“themasculinetruthofreasonandthefemininetruthofimagination” (Hession1984:107,17–18).Skidelskyagrees,“Evenhissexualambivalenceplayed itspartinsharpeninghisvision”(1992:537).Butwhyshouldintuitionandcreativity besolelyfeminineandreasonandlogicsolelymasculine? KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 147 neverabookishscholarandrecluselikehisCambridgecolleagues ArthurPigouorDennisRobertson.Hewasamanofworldlyaffairs wholovedthelimelightandthesociallife,enjoyedthecompanyof writersandartists,andwasadevoteeofcards,roulette,andspeculationsonLombardStreetandWallStreet.Hismagneticpersonality attractedthehighestleadersofgovernment,whosoughthiscounsel. Hewasamasterofthewrittenwordandanentertainingspeakerwho regularlyappearedonBBCradio. Aftersufferingaheartattackin1937,Keyneshadtoslowdown. Heandhiswifebecameactiveinpromotingtheartsandestablishing theArtsTheatreinCambridge.In1940,whenthewarwithGermany brokeout,KeynesreturnedtotheTreasuryasanadvisorandwrote aninfluentialbooklet,HowtoPayfortheWar.Herecommended restrictionsonconsumptionandinvestment,andaforcedsavings programasawaytoreducedemandandinflation. InMay1942,Keynes’snamewassubmittedtotheking,nominating himtobecomeBaronKeynesofTilton,andinJulyhetookhisseatin theHouseofLords.Onhissixtiethbirthday,KeyneswasmadeHigh StewardofCambridge,anhonorarypost.Hethrivedontheadulation andelitiststatus. Neartheendofthewar,KeynesandhiswifetraveledtotheUnited Statestohelpnegotiateanewinternationalfinancialagreement.Keynes wasoneofthearchitectsoftheBrettonWoodsagreement,whichestablishedafixedexchangeratesystembasedongoldandthedollarand createdtheInternationalMonetaryFund(IMF)andtheWorldBank. Twoyearslater,hediedofaheartattackattheageofsixty-two. Keynes’sDisdainforKarlMarxandMarxism LetusnowturntoKeynes’sapproachtoeconomics.Itshouldbe notedattheoutsetthatKeyneshadseriousreservationsaboutthe economicsofbothAdamSmithandKarlMarx.Themostinfluential economistofthetwentiethcentury,Keyneswasaninterventionist andasupporterofBritain’sLabourParty.LikeMarx,hewasno friend of laissez-faire. He argued that capitalism was inherently unstableandrequiredgovernmentintervention.Butthatwasasfar asitwent.Keynescouldn’tstandKarlMarxorthecommunistexperiment,whichheregardedas“aninsulttoourintelligence”(Mog- 148 THE BIG THREE IN ECONOMICS gridge1992,470;Skidelsky1992,519;2003,514–18).Following atriptoRussiain1925,KeyneswrotethreearticlesfortheNation, debunkingtheSoviet“religion”as“unscrupulous,”“ruthless,”and “contrarytohumannature.”Therewasnoneofthatnaïve“I’veseen thefuture”optimismforKeynes.Individualfreedomandaliberal opensocietymeanttoomuchtohim.“Forme,broughtupinafree airundarkenedbythehorrorsofreligion,withnothingtobeafraid of,RedRussiaholdstoomuchwhichisdetestable.”Headded,“How canIadoptacreedwhich,preferringthemudtothefish,exaltsthe boorishproletariatabovethebourgeoisandtheintelligentsiawho, with whatever faults, are the quality in life and surely carry the seedsofallhumanachievement?...Wehaveeverythingtoloseby themethodsofviolentchange.InWesternindustrialconditionsthe tacticsofRedRevolutionwouldthrowthewholepopulationintoa pitofpovertyanddeath”(1951[1931],306).HelambastedMarx’s magnum opus, Capital, as “an obsolete economic textbook” that was“scientificallyerroneous”and“withoutinterestorapplication forthemodernworld”(298–300). InthemiddleoftheGreatDepression,thebestandthebrightest intellectualsembracedMarxism,butnotKeynes.Atadinneramong friendsin1934,Keynessaidthat,ofallthe“isms,”Marxismwas“the worstofall&foundedonasillymistakeofoldMrRicardo’s[labor theory of value]” (Skidelsky 2003, 515). In a letter to playwright George Bernard Shaw, Keynes labeled Das Kapital “dreary, outof-date,academiccontroversialising.”HecomparedittotheKoran. “Howcouldeitherofthesebookscarryfireandswordroundhalfthe world?Itbeatsme.”InasecondlettertoShawdatedJanuary1,1935, KeynescomplainedofMarx’s“vilemannerofwriting”(Skidelsky 1992,520;2003,517).7 7.Marxists,inturn,havedisdainedthebourgeoisKeynesandKeynesianeconomics.“Suchatheoryisaseriousdangertotheworkingclass,”wroteMarxist JohnEatoninhislittlebook,MarxAgainstKeynes(1951:12).AccordingtoEaton, Keynesianismdefends“wageslavery”and“policiesofimperialism”(75).EatonaccusedKeynesofnothaving“everreadandunderstoodMarx’sprofoundlyscientific analysis”inCapital(33).Inshort,Keynesianeconomicsisthe“vulgareconomy ofmonopolycapitalismincrisisanddecay”(85),accordingtoEaton,andthusis doomedtofail. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 149 Keynes’sCritiqueofAdamSmithandHisInvisible HandDoctrine Keyneshasbeenlaudedasthesaviorofcapitalism,buthismodel andpolicyrecommendationswereinmanywaysadirectrepudiationandassaultonAdamSmith’slaissez-fairesystem.IntheNew Era twenties he wrote, “It is not true that individuals possess a prescriptive‘naturalliberty’intheireconomicactivities....Nor isittruethatself-interestgenerallyisenlightened....Experience doesnotshowthatindividuals,whentheymakeupasocialunit,are alwayslessclear-sightedthanwhentheyactseparately”(Keynes 1951[1931],312).Thisspeech,appropriatelytitled,“TheEndof Laissez-Faire,”wasgivenin1926,afulldecadebeforeTheGeneral Theorywaswritten.ItwasaclearattackonAdamSmith’ssystem ofnaturalliberty. In the early 1930s, Keynes became increasingly disillusioned withcapitalism,bothmorallyandaesthetically.TheideasofSigmundFreudwerefashionableatthetime,andKeynesadoptedthe Freudian thesis that moneymaking was a neurosis, “a somewhat disgustingmorbidity,oneofthesemi-criminal,semi-pathological propensitieswhichonehandsoverwithashuddertospecialistsin mentaldisease”(1951[1931],369).Later,in1933,heindictedthe capitalist system: “The decadent international but individualistic capitalism,inthehandsofwhichwefoundourselvesafterthewar, isnotasuccess.Itisnotintelligent,itisnotbeautiful,itisnotjust, itisnotvirtuous—anditdoesn’tdeliverthegoods.Inshort,wedislikeitandarebeginningtodespiseit.Butwhenwewonderwhat toputinitsplace,weareperplexed”(Hession1984,258).Thisis afarcryfromAdamSmith! Keynes,theHeretic,TurnsClassicalEconomics UpsideDown The GeneralTheory did not aim to rebuild the classical model; it aimed to replace it with elaborate unconventional concepts and a newWeltanschauung.Untilthe1930s,theeconomicsprofessionhad largelysanctionedthebasicpremisesoftheclassicalmodelofAdam Smith—thevirtuesofthrift,balancedbudgets,freetrade,lowtaxes, 150 THE BIG THREE IN ECONOMICS the gold standard, and Say’s law. But Keynes turned the classical modelupsidedown. InsteadofSmith’sclassicalsystembeingconsideredthegeneral oruniversalmodel,Keynesrelegatedittoa“specialcase,”applicable onlyintimesoffullemployment.Hisowngeneraltheoryof“aggregate effectivedemand”wouldapplyduringtimesofunderemployedlabor andresources,which,underKeynesianism,couldexistindefinitely. Undersuchcircumstances,Keynesofferedthefollowingprinciples: 1. An increase in savings can contract income and reduce economic growth. Consumption is more important than productioninencouraginginvestment,thusreversingSay’s law: “Demand creates its own supply” (1973a [1936], 18–21,111). 2. Thefederalgovernment’sbudgetshouldbekeptdeliberately inastateofimbalanceduringarecession.Fiscalandmonetarypolicyshouldbehighlyexpansionaryuntilprosperity isrestored,andinterestratesshouldbekeptpermanentlylow (128–31,322). 3. Governmentshouldabandonitslaissez-fairepolicyandintervene in the marketplace whenever necessary.According toKeynes,indesperatetimesitmaybenecessarytoreturn to mercantilist policies, including protectionist measures (333–71). 4. Thegoldstandardisdefectivebecauseitsinelasticityrendersit incapableofrespondingtotheexpandingneedsofbusiness.A managedfiatmoneyispreferable(235–56;1971,140).Keynes heldadeep-seateddisdainforthegoldstandardandwaslargely successful in dethroning gold as a worldwide monetary numeraire. WhatDidKeynesReallyMeanby“IntheLongRunWe AreAllDead”? Keynes’scavalierstatement,“Inthelongrunwearealldead,”isin manywaysasymbolofhisturninghisbackonclassicaleconomics. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 151 ManyeconomistsconsiderhisremarkanaffronttoFrédéricBastiat’s classicalview(“WhatIsSeenandWhatIsNotSeen”)thateconomists musttakeintoaccountthelong-runandnotjusttheshort-runeffects ofgovernmentpolicies.Forexample,deficitspendingmaystimulate certainsectorsoftheeconomyintheshortrun,butwhatwillbethe impactinthelongrun?Tariffsmaysavesomemanufacturingjobs,but whatimpactwillthishaveonconsumers?AsHenryHazlittdeclares, “Theartofeconomicsconsistsinlookingnotmerelyattheimmediate butatthelongereffectsofanyactorpolicy;itconsistsintracingthe consequencesofthatpolicynotmerelyforonegroupbutforallgroups” (1979[1946],17).AndLudwigvonMises,anothercriticofKeynes, concludes,“wehaveoutlivedtheshort-runandaresufferingfromthe long-run consequences of [Keynesian] policies” (1980 [1952], 7). Keynesmayhaveindeedusedhisdictumtosupportshort-termpolicies likedeficitspending,buthealsouseditinothercontexts. KeynesAttacksMonetarism ThefirsttimeKeynesmadethefamousremarkquotedabove,heused ittoderideIrvingFisher’sextrememonetarism,whichclaimedthat monetaryinflationhasnoilleffectsinthelongrunbutonlyraises prices(seechapter4).Keynesretorted,“Now‘inthelongrun’this isprobablytrue...butthislongrunisamisleadingguidetocurrent affairs.Inthelongrunwearealldead.Economistssetthemselves tooeasy,toouselessataskifintempestuousseasonstheycanonly tellusthatwhenthestormislongpasttheoceanisflatagain”(1971, 65).NodoubtHazlittandMiseswouldfindmuchtoagreewithin thisstatement. BritainFirst! KeynesalsousedhisfamousphraseinthecontextofBritishforeign policyinwartime.In1937,whenChurchilladvocatedrearmament and warned against appeasing Hitler, Keynes seemed to support short-termpeaceinitiatives:“Itisourdutytoprolongpeace,hour byhour,daybyday,foraslongaswecan....Ihavesaidinanother contextthatitisadisadvantageof‘thelongrun’thatinthelong runwearealldead.ButIcouldhavesaidequallywellthatitisa 152 THE BIG THREE IN ECONOMICS greatadvantageof‘theshortrun’thatintheshortrunwearestill alive.Lifeandhistoryaremadeupofshortruns.Ifweareatpeace intheshortrun,thatissomething.Thebestwecandoisputoff disaster”(Moggridge1992,611).WasKeynesadvocatingpeaceat anyprice? AfterPearlHarborwasattackedinDecember1941,KeynesreactedwithdismaytotheBritishForeignOfficeargumentthatfree tradewithAmericawouldbebeneficialtoBritain“inthelongrun.” Keynesblustered,“Thetheorythat‘togetourwayinthelongrun’we mustalwaysyieldintheshortremindsmeofthebombshellIthrew intoeconomictheorybythereminderthat‘inthelongrunweareall dead.’Iftherewasnoonelefttoappease,theF.O.[ForeignOffice] wouldfeeloutofajobaltogether”(Moggridge1992,666).Thiswas Keynesthemercantilist. Keynes’sLongTerm Keyneswastrulyasocialmillennialistwhoultimatelyenvisioned a world evolving to the point of infinite accumulation of capital. Hisutopianvisionisbestexpressedinhisessay,“EconomicPossibilities for Our Grandchildren” (1951 [1931], 358–73). Keynes believedthatbyprogressivelyexpandingcredittopromotefullemployment,theuniversaleconomicproblemofscarcitywouldfinally beovercome.Interestrateswouldfalltozeroandmankindwould reentertheGardenofEden.InKeynes’smind,thegoldstandard severelylimitedcreditexpansionandpreservedthestatusquoof scarcity.Thus,gold’sinelasticity—whichtheclassicaleconomists considereditsprimaryvirtue—stoodinthewayofKeynes’sparadise andneededtobeabandonedinfavoroffiat-moneyinflation(1951 [1931],360–73).TheBrettonWoodsagreementwasthefirststep towardremovinggoldfromtheworld’smonetarysystem.Keynes wouldundoubtedlybepleasedtoseegoldplayingsuchamoribund roleininternationalmonetaryaffairsinthetwenty-firstcentury. Inshort,Keynes’sgoalwasnottosaveAdamSmith’shouse,ashis adherentscontended,buttobuildanotherhouseentirely—thehouse thatKeynesbuilt.Itwashisbeliefthateconomistswouldliveand workmostofthetimeinKeynes’shouse,whileusingSmith’shouse occasionally,perhapsasavacationhome. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 153 IsCapitalismInherentlyUnstable? Keynes rejected the classical notion that the capitalist system is self-adjustingoverthelongrun.TheGeneralTheorywaswritten specifically to create a model based on the view that the market systemisinherentlyandinescapablyflawed.AccordingtoKeynes, capitalismwasunstableandthereforecouldbecomestuckindefinitelyatvaryingdegreesof“unemployedequilibrium,”dependingon thelevelofuncertaintyinafragilefinancialsystem.Keyneswanted toshowthattheeconomycouldremain“inachronicconditionof sub-normalactivityforaconsiderableperiodwithoutanymarked tendencyeithertowardrecoveryortowardcompletecollapse”(1973a [1936],249,30).PaulSamuelsoncorrectlyunderstoodthemeaning ofKeynes:“Withrespecttotheleveloftotalpurchasingpowerand employment,Keynesdeniesthatthereisaninvisiblehandchanneling theself-centeredactionofeachindividualtothesocialoptimum” (Samuelson1947,151). Keynesexplainedwhathemeantby“unemploymentequilibrium,” butusednodiagramtoillustrateit.Inamasterfularticle,“Mr.Keynes andtheClassics,”BritisheconomistJohnHicksdevelopedagraphic framework(knownastheIS-LMdiagram)todemonstrateKeynes’s versionoffull-employmentequilibrium(thespecialclassicaltheory) versusunemploymentequilibrium(thegeneraltheory)(Hicks1937). Today’stextbooksuseasimilardiagramtodemonstrateaggregatesupply(AS)andaggregatedemand(AD). InFigure5.1weseehowtheeconomyisdepressedatlessthan fullemployment.AccordingtoKeynes’smodel,theclassicalmodel onlyapplieswhentheeconomyreachesfullemployment(Qf),while theKeynesiangeneraltheoryappliesatanypointalongtheAScurve whereitintersectswiththeADcurve. Who’stoBlame?IrrationalInvestors! Keynes blamed the instability of capitalism on the bad behavior ofinvestors.TheGeneralTheorycreatesamacroeconomicmodel basedessentiallyonafinancialinstabilityhypothesis.AsKeynesian economist Hyman P. Minsky declares, “The essential aspect of Keynes’s General Theory is a deep analysis of how financial 154 THE BIG THREE IN ECONOMICS Figure5.1 AggregateSupply(AS)andAggregateDemand(AD)Model fromaKeynesianPerspective P P AS Classical range(long run) AD Pricelevel P1 Intermediate range(short run) Keynesian depressonrange P0 O Potentialreal outputatfull employment Q0 Q1 Q f Q Q Realoutput Source:ByrnsandStone(1987:311).ReprintedbypermissionofScott,ForesmanandCo. forces—which we can characterize asWall Street—interact with productionandconsumptiontodetermineoutput,employment,and prices”(1986,100).AllanH.MeltzeratCarnegieMellonUniversity offersasimilarinterpretation,thatKeynes’stheoryofemployment andoutputwasnotsomuchrelatedtorigidwagesandpricesasto expectationsanduncertaintyintheinvestmentandcapitalmarkets (Meltzer1988[1968]).8 Numerous passages in The General Theory support this view. Keynescomplainedoftheirrationalshort-term“animalspirits”of speculatorswhodumpstocksinfavorofliquidityduringsuchcrises. Such “waves of irrational psychology” could do much damage to long-termexpectations,hesaid.“Ofthemaximsoforthodoxfinance none,surely,ismoreanti-socialthanthefetishofliquidity,thedoctrinethatitisapositivevirtueonthepartofinvestmentinstitutionsto 8.Seealsomyversionofthisthesisin“KeynesasaSpeculator:ACritiqueof KeynesianInvestmentTheory,”inSkousen1992:161–69. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 155 concentrateresourcesupontheholdingof‘liquid’securities”(1973a [1936],155).AccordingtoKeynes,thestockmarketisnotsimply anefficientwaytoraisecapitalandadvancelivingstandards,butcan belikenedtoacasinooragameofchance.“Foritis,sotospeak,a gameofSnap,ofOldMaid,ofMusicalChairs—apastimeinwhich heisvictorwhosaysSnapneithertoosoonnortoolate,whopasses theOldMaidtohisneighborbeforethegameisover,whosecuresa chairforhimselfwhenthemusicstops”(1973a[1936],155–56). Keynes was speaking from experience. He reasoned that the 1929–33crisisdestroyedhisportfoliowithoutanyrationaleconomic cause—thepanicwasduetoWallStreet’sirrationaldemandforcash, what he termed “liquidity preference” and a “fetish of liquidity” (1973a[1936],155). TheCulprit:UninvestedSavings IfKeyneswereSherlockHomes,theeconomist-investigatorwould point an accusing finger at Miss Thrifty in his murder mystery, “The Case of the Missing Savings.” In Keynes’s model, the key factorcausinganindefiniteslumpisthede-linkingofsavingsand investment.Ifsavingsfailedtobeinvested,totalspendinginthe economywouldfalltoapointbelowfullemployment.Ifsavings werehoardedorleftinexcessivereservesinthebanks,aswasthe caseinthe1930s,thefetishforliquiditywouldmakenationalinvestmentandoutputfall.Thus,thriftnolongerservedasadependable socialfunction. InTheGeneralTheory,Keynesarguedthatasincomeandwealth accumulateundercapitalism,thethreatgrowsthatsavingswillnot beinvested.Heintroduceda“psychologicallaw”thatthe“marginal propensitytosave”increaseswithincome(1973a[1936],31,97). Thatis,asindividualsearnmoreincomeandbecomewealthier,they tendtosaveagreaterpercentageoftheirincome.Thus,thereisa strongtendencyforsavingstorisedisproportionatelyasnational incomeincreases.Butwouldn’tagrowingcapitalisteconomyalwaysbeunderpressuretoinvestthoseincreasedsavings?Keynes responded, “Maybe, maybe not.” If savings are not invested, the boomwillturnintoabust. Actually, this criticism of uninvested saving is an old saw with 156 THE BIG THREE IN ECONOMICS Keynes.Heacknowledgedthenecessityofthriftandself-denialduringthenineteenthcenturyinadelightfulpassageofTheEconomic ConsequencesofthePeace(1920,18–22),statingthatthrift“made possiblethosevastaccumulationsoffixedwealthandofcapitalimprovementwhichdistinguishedthatagefromallothers”(19).But inATreatiseonMoney(1930),theCambridgeeconomistraisedthe likelypossibilitythatsavingandinvestmentcouldgrowapart,creating abusinesscycle.Inamodernsociety,savingandinvestingaredone bytwoseparategroups.Savingisa“negativeactofrefrainingfrom spending,”whileinvestmentisa“positiveactofstartingormaintainingsomeprocessofproduction”(1930,155).Theinterestrateisnot an“automaticmechanism”thatbringsthetwotogether—theycan “getoutofgear”(1951[1931],393)andsavingscanbe“abortive.” If investment exceeds savings, a boom occurs; if savings exceeds investment,aslumphappens.9 Duringthedepressionofthe1930s,Keyneslashedoutatfrugal savers and hoarders who kept down “effective demand.”The conventionalwisdominbadtimeshasalwaysbeentocutcosts,getout ofdebt,buildastrongcashposition,andwaitforarecovery.Keynes wasopposedtothis“old-fashioned”approach,andhewasjoinedby othereconomists,includingBritishTreasuryofficialRalphHawtrey andHarvard’sFrankTaussig,inencouragingconsumerstospend.Ina radiobroadcastinJanuary1931,Keynesassertedthatthriftinesscould causea“viciouscircle”ofpoverty,thatif“yousavefiveshillings,you 9.HistoriansElizabethandHarryJohnsonevenwentsofarastosuggestthat Keynes’snegativeattitudetowardsavingwasrelatedtohismisogynistictendencies.TheJohnsonsnotedthatKeynesandhisfollowersoftenreferredtosavingsas femaleandinvestmentasmale.Femalesavingwasusuallyseeninanegativelight andmaleinvestmentinapositiveway.“Themalenessofinvestmentisattestedtoby amongotherthingsthefrequentreferencesbyJoanRobinsonandotherCambridge writersto‘theanimalspirits’ofentrepreneurs;thefemalenessofsavingsisevident inthepassiveroleassignedtosavingsintheanalysisofthedeterminationofemploymentequilibrium”(Johnson1978:121).KeyneshimselfwroteinhisTreatise onMoney,“Thus,thriftmaybethehandmaidandnurseofenterprise.Butequally shemaynot”(1930,2:132).However,Keyneswassometimesambiguousaboutthe sexualidentityofsaving.InthesameTreatise,Keynescommentedonthelackof economicprogressinEuropeinthe1920s.“Tenyearshaveelapsedsincetheendof thewar.Savingshavebeenonanunexampledscale.Butaproportionofthemhas beenwasted,spiltontheground”(1930,2:185).Thisisanallusiontothebiblical storyofOnan,whospilledhisseedontheground(Genesis38:8–9). KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 157 putamanoutofworkforaday.”HeencouragedBritishhousewives togoonabuyingspreeandgovernmenttogoonabuildingbinge. He urged, “Why not pull down the whole of South London from WestminstertoGreenwich,andmakeagoodjobofit....Wouldthat employmen?Why,ofcourseitwould!”(1951[1931],151–54). Keynes’sbiasagainstthriftreacheditszenithinTheGeneralTheory, wherehereferredtotraditionalviewsonsavingsas“absurd.”Heboldly wrote,“Themorevirtuousweare,themoredeterminedbythrift,the moreobstinatelyorthodoxinournationalandpersonalfinance,the moreourincomeswillfall”(1973a[1936],111,211).Keynespraised theheterodoxnotionsofunderworldfiguresandmonetarycranks,such asBernarddeMandeville,J.A.Hobson,andSilvioGessell,whoheld underconsumptionistviews(333–71).Hewasundoubtedlyinfluenced bythepopularityofMajorDouglasofthesocialcreditmovementand underconsumptionistsFosterandCatchingsduringthe1920s. AnAntisavingTradition Keyneswasnotthefirsttoquestionthevirtueofthrift.Overtheyears, asmallgroupofradicalthinkers,knowngenerallyasunderconsumptionists, have dissented from the traditional endorsement of thrift. TheyincludeSimondedeSismondi,KarlRodbertus,J.A.Hobson, andKarlMarx.Keynesexpressedsympathytowardthe“heretical” viewsofMajorC.H.Douglas,anengineerwhobeganthesocialcredit movementinCanadainthe1920sandwroteseveralbookschampioning“economicdemocracy”(1973a[1936],370–71).Believingthat savingcreatedapermanentdeficiencyinanation’spurchasingpower, MajorDouglasadvocatedstrictbelow-marketpricecontrolssothat consumerscouldaffordtobuytheproductstheyproduced. William T. Foster, past president of Reed College, andWaddill Catchings,anironmanufacturerandpartnerintheinvestmentfirmof GoldmanSachs,proposedadifferentscheme.FosterandCatchings wroteaseriesofbooksonasimilarantisavingtheme.“[E]verydollar whichissavedandinvested,insteadofspent,causesonedollarof deficiencyinconsumerbuyingunlessthatdeficiencyismadeupin someway”(FosterandCatchings1927,48).Whatway?Fosterand Catchingsadvocatedthatthegovernmentissuenewmoneycreditsto consumerstomakeupforconsumerbuyingdeficiency. 158 THE BIG THREE IN ECONOMICS Togenerateinterestintheirtheoryandproposal,in1927theyoffered aprizeof$5,000toanyonewhocouldrefutethem.Theypublishedthe bestessaysafewmonthslater,butthebestcritiquewaswrittenbythe AustrianeconomistFriedrichA.Hayekin1929.Hisessay,“The‘Paradox’ ofSaving,”wastranslatedandpublishedinEconomicainMay1931. AccordingtoHayek,theFoster-and-Catchingsdilemmadependedon asingleerroneousassumption.Theyassumeda“single-stage”model, so that investment depends entirely and immediately on consumer demand.Undersucharestrictiveassumption,“therewouldbenoinducement[forconsumers]...tosavemoney...[or]...toinvesttheir savings,”notedHayek(1939[1929],224,247).Withacapital-using, time-orientedperiodofproduction,Hayekdemonstratedthatincreased savingslengthensthecapitalisticprocess,increasesproductivity,and therebyenlargesprofits,wages,andincomesufficientlyforconsumers tobuythefinalproduct.10 KeynesFocusesonSpendingastheKeyIngredient InKeynes’smind,savingisanunreliableformofspending.Itisonly “effective”ifsavingsareinvestedbybusiness.Thus,savingsthatare hoardedunderamattressorpiledupinabankvaultareadrainon theeconomyandaggregatedemand. Only “effective demand”—a powerful new term introduced in chapter3ofTheGeneralTheory—counts.Whatconsumersandbusinesses spend determines national output. Keynes defined effective demandasaggregateoutput(Y),whichisthesumofconsumption (C)andinvestment(I).Hence, Y=C+I TodaywerefertoY,or“aggregateeffectivedemand,”asgrossdomestic product(GDP).GDPisdefinedasthevalueoffinaloutputofgoodsand servicesduringtheyear.SimonKuznets,aKeynesianstatistician,developednationalincomeaccountingintheearly1940sasawaytomeasure Keynes’saggregateeffectivedemand.Keyneseffectivelydemonstrated 10. Foster and Catchings rejected all arguments and never paid the prize money. KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 159 thatifsavingsarenotinvestedbybusiness,GDPdoesnotreachitspotential;recessionordepressionindicatesalackofeffectivedemand. DemandCreatesItsOwnSupply WhatwasKeynes’ssolutiontorecession?Increaseeffectivedemand! Ifdemandisstimulatedthroughadditionalspending,moregoodshave tobeproducedandtheeconomyshouldrecover.Inthissense,Keynes turnedSay’slawupsidedown.Demandcreatessupply,nottheother wayaround. ToincreaseY(nationaloutput),thechoicesarelimitedinarecession.Duringadownturn,thebusinesscommunitymightbeafraid to risk its capital on I (investment). Equally, consumers might be unwillingtoincreaseconsumption(C)duetotheuncertaintyoftheir incomes.Bothinvestorsandconsumersaremorelikelytopullintheir hornswhenlefttotheirowndevices. AddingGtotheEquation Thereisonlyonewayout,wroteKeynes.Getgovernmenttostart spending. Keynes added G (government) to the national income equation,sothat Y=C+I+G Keynessawgovernment(G)asanindependentagentcapableof stimulating the economy through the printing presses and public works.Anexpansionarygovernmentpolicycouldraise“effective demand”ifresourceswereunderutilized,anditcoulddosowithout hurtingconsumptionorinvestment.Infact,duringarecession,arise inGwouldencouragebothCandIandtherebyboostY. DiggingHolesintheGround:KeynesEndorsesan ActivistFiscalPolicy Keynes overturned the classical solution to a slump, which had beento“tightenone’sbelt”bycuttingprices,wages,andwasteful spendingwhilewaitingouttheslump.Instead,duringarecession, 160 THE BIG THREE IN ECONOMICS herecommendeddeliberatedeficitspendingbythefederalgovernmenttojump-starttheeconomy.Heendorsedanevenmoreradical approachduringadeepdepressionlikethatofthe1930s:government spending could be totally wasteful and it would still help. “Pyramid-building,earthquakes,evenwarsmayservetoincrease wealth,”heproclaimed(1973a[1936],129).Ofcourse,“Itwould, indeed,bemoresensibletobuildhousesandthelike,”butproductivebuildingwasnotessential.AccordingtoKeynes,spendingis spending,nomatterwhattheobjective,andithasthesamebeneficial effect—increasingaggregatedemand. KeynesFavorsPublicWorksoverMonetaryInflation Keynesfeltthattinkeringwithfiscalpolicy(changesinspendingand taxes)wasmoreeffectivethanmonetarypolicy(changesinthemoney supplyandinterestrates).Hehadlostfaithinmonetarypolicyand theFederalReserveinthe1930s,wheninterestratesweresolowthat reducingthemwouldn’thavemademuchdifference(seeFigure5.2). InducingtheFederalReservetoexpandthemoneysupplywouldnot beveryeffectiveeither,becausebanksrefusedtolendexcessreserves anyway.Keynescalledthisa“liquiditytrap.”Thenewmoneywouldjust pileupunspentanduninvestedbecauseof“liquiditypreference,”the desiretoholdcashduringaseveredepression(1973a[1936],207). HowtheMultiplierGeneratesFullEmployment Public works would serve several benefits. First, public works are positivespending,puttingpeopletoworkandmoneyintobusiness’s pockets.Moreover,theyhaveamultipliereffect,basedonthenation’s marginalpropensitytoconsume. Themultiplier,aconceptintroducedbyRichardKahn,wasapowerful newtoolintheKeynesiantoolbox,demonstratingthata“smallincrement ofinvestmentwillleadtofullemployment”(Keynes1973a[1936],118). Supposeinarecessionthatthegovernmenthiresconstructionworkers andsupplierstoconstructanewfederalbuildingcosting$100million. Thesepreviouslyunemployedworkersarenowgettingpaid.Inthefirst roundofspending,$100millionisaddedtotheeconomy. Nowsupposethatthepublic’smarginalpropensitytoconsumeis90 KEYNES RESPONDS TO CAPITALISM’S GREATEST CHALLENGE 161 Figure5.2 TheGeneralTheoryWasWrittenWhenInterestRatesWereat TheirAll-TimeLows percent,thatis,theseworkersspend90centsofeverynewdollarearned. (Anotherwayofsayingit:theirmarginalpropensitytosaveis10percent.) Inthesecondroundofspending,$90millionisaddedtotheeconomy. Then there is a third round.After the workers spend their new money,that$90millionbecomestherevenuesofotherbusinesses— shoppingmalls,gasstations,supermarkets,cardealerships,andmovie theaters.Thesebusinessmayinturnhirenewworkerstohandlethe newdemand,payingthemmorewages,too,andtheseworkersalso spend90percentofthatincome.Theyreceiveanadditional$81million(90percentof$90million)ofspendingpower.Ultimately,the publicinvestmenthasamultipliereffectthatgeneratesroundafter roundofgraduallydecliningspending.Bythetimethenewspendinghasrunitscourse,theaggregatespendinghasincreasedtenfold. Keynes’sformulaforthemultiplier(k)is, 1 k=__________ 1–MPC whereMPC=marginalpropensitytoconsume. 162 THE BIG THREE IN ECONOMICS SinceMPC=.90intheexampleabove,k=10.AsKeynesstated, “the multiplier k is 10; and the total employment caused by . . . increased public works will be ten timestheprimaryemployment providedbythepublicworksthemselves,assumingnoreductionof investmentinotherdirections”(1973a[1936],116–17). KeynesMakesaMischievousAssumption NotethatintheKeynesianmodel,onlyconsumptionspendinggeneratesadditionalincomeandemploymentintheeconomy.Keynesassumesthatsavingissterile,thatitabortsintocashhoardingorexcess bankreserves.Thus,theKeynesianmodelasoriginallyproposedis considereda“depression”model.Asweshallseeinthenextchapter, thiswasacrucialmistakethatledtomuchmischiefandmisunderstandingineconomicsinthepostwarera. KeynesOffersaDrasticMeasuretoStabilizeCapitalism TheCambridgeleaderwasnotsatisfiedwithtemporarymeasuressuch aspublicworksanddeficitspendingtoreestablishfullemployment. Oncemaximumoutputwasreached,hereasoned,thereisnoreasonto believeitwillstaythere.Investmentisunpredictableandephemeral, Keynessaid.Long-termexpectations,astablebusinessclimate,and savingsequaltoinvestmentcouldneverbeguaranteedaslongasirrational“animalspirits”operatedinalaissez-fairefinancialmarketplace. WhatwasKeynes’ssolution?Hefavoredagradualbutcomprehensive “socialisationofinvestment”asthe“onlymeansofsecuringanapproximationtofullemployment”(1973a,378).Thiswasbynomeans “statesocialism,”butitcouldmeangovernmentownershipoftheentire capitalmarket.Keynesalsosanctionedasmall“transfertax”onall securitiessalesasawaytodampenspeculativefever.11 11.NobellaureateJamesTobinhasentertainedasimilarmeasure,knownasthe Tobintaxonstockandforeignexchangetransactions,alegalstepthatwouldsurely reduceliquidityandenlargethebid-askspreadsonstocksandforeignexchange. 6 ATurningPointin Twentieth-CenturyEconomics Keynsesianeconomicsis...themostseriousblowthatthe authorityoforthodoxeconomicshasyetsuffered. —W.H.Hutt(1979,12) TwofactorscreatedtherightatmospherefortheKeynesianrevolution tosweeptheeconomicsprofessionafterWorldWarII.First,thedepth andlengthoftheGreatDepressionseemedtojustifytheKeynesianMarxianviewthatmarketcapitalismwasinherentlyunstableandthat themarketcouldbestuckatunemployedequilibriumindefinitely. Economichistoriansnotedthattheonlygovernmentsthatappearedto makeheadwayineliminatingunemploymentinthe1930sweretotalitarianregimesinGermany,Italy,andtheSovietUnion.Curiously,Keynes himselfacknowledgedintheintroductiontotheGermaneditionofThe GeneralTheory, that his theory “is much more easily adapted to the conditionsofatotalitarianstate,thanisthetheoryoftheproductionand distributionofagivenoutputproducedunderconditionsoffreecompetitionandalargemeasureoflaissez-faire”(1973a[1936],xxvi). Second,WorldWarIIcamealongrightafterthepublicationofThe GeneralTheory,givingstrongempiricalevidenceofKeynes’spolicy prescription.Governmentspendinganddeficitfinancingincreased dramaticallyduringWorldWarII,unemploymentdisappeared,and economicoutputsoared.Warwas“good”fortheeconomy,justas Keynessuggested(1973a[1936],129).AshistorianRobertM.Collins wrote,“WorldWarIIsetthestageforthetriumphofKeynesianism by providing striking evidence of the effectiveness of government expendituresonahugescale”(1981,12).Thefollowingquotefrom apopulartextbookrepeatedwhatothertextbooksweresayinginthe postwarperiod:“Oncethemassive,war-gearedexpenditureofthe 1940sbegan,incomerespondedsharplyandunemploymentevapo163 164 THE BIG THREE IN ECONOMICS rated.Governmentexpendituresongoodsandservices,whichhad beenrunningatunder15percentofGNPduringthe1930s,jumped to46percentby1944,whileunemploymentreachedtheincredible lowof1.2percentofthecivilianlaborforce”(Lipsey,Steiner,and Purvis1987,573). PaulSamuelsonRaisestheKeynesianCross Asnotedearlier,Keynesdiedin1946,rightafterthewar.Itwould belefttohisdisciplestoleadthechargeandcreatea“neweconomics.”FortunatelyforKeynes,ayoungwunderkindwasreadytofill his shoes. His name was Paul Samuelson, and he would write a textbookthatwoulddominatetheprofessionformorethananentire generation. Theyearwas1948,oneofthosewatershedyearsthatoccasionally cropsupineconomics.Remember1776,1848,and1871?Inearly 1948,theAustrianémigréLudwigvonMises,secludedinhisNew Yorkapartment,wastypingashortarticle,“StonesintoBread,the KeynesianMiracle,”foraconservativepublication,PlainTalk.“What isgoingontodayintheUnitedStates,”hedeclaredsolemnly,“isthe finalfailureofKeynesianism.ThereisnodoubtthattheAmerican publicismovingawayfromtheKeynesiannotionsandslogans.Their prestigeisdwindling”(Mises1980[1952],62). Perhapsitwaswishfulthinking,butMisescouldnothavemisread thetimesmoreegregiouslyin1948.Itwasinthatveryyearthatthe neweconomicsofJohnMaynardKeyneswasbeinghailedbyKeynes’s rapidlygrowingnumberofdisciplesasthewaveofthefutureand the savior of capitalism. Literally hundreds of articles and dozens ofbookshadbeenpublishedaboutKeynesandthenewKeynesian modelsinceKeyneswroteTheGeneralTheoryofEmployment,InterestandMoney. TheOtherCambridge Theyear1948wasalsowhenSeymourE.Harris,chairmanofthe economicsdepartmentatHarvard,producedaneditedvolumeentitled SavingAmericanCapitalism.Thiswasasequeltohis1947edited work,TheNewEconomics.Bothbest-sellerswerefilledwithlauda- A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 165 toryarticlesbyprominenteconomistspreachingtheneweconomics ofKeynes. Darwin had one bulldog to propagate his revolutionary theory, butKeyneshadthreeintheUnitedStates—SeymourHarris,Alvin Hansen,andPaulA.Samuelson.Theyallcamefromthe“otherCambridge”—Cambridge,Massachusetts.BothHarrisandHansenwere conservativeHarvardteacherswhohadconvertedtoKeynesianism anddevotedtheirenergiestoconvincingstudentsandcolleaguesof theefficacyofthisstrangenewdoctrine. TheAmericanadvancementofKeynesianeconomicsrepresenteda subtlebutclearshiftfromEuropetotheNewWorld.Beforethewar, LondonandCambridgeintheUnitedKingdomshapedtheeconomic world.Afterthewar,themagnetsforthebestandthebrightestgraduatestudentswereBoston,Chicago,andBerkeley.Studentscamefrom allovertheworldtodotheirworkintheUnitedStates,andnotjust ineconomics. TheYearoftheTextbook Finally,1948wastheyearinwhichanexcitingnewbreakthrough textbookcameforthfromHarvard’sneighboringuniversity,theMassachusettsInstituteofTechnology(MIT).Writtenbythe“brashwhippersnappergo-getter”PaulSamuelson(hisownwords!),Economics wasdestinedtobecomethemostsuccessfultextbookeverpublished inanyfield.Sixteeneditionshavesoldmorethan4millioncopies andhavebeentranslatedintooverfortylanguages.Noothertextbook, includingthoseofJean-BaptisteSay,JohnStuartMill,andAlfredMarshall,cancompare.Samuelson’sEconomicssurvivedahalf-centuryof dramaticchangesintheworldeconomyandtheeconomicsprofession: peaceandwar,boomandbust,inflationanddeflation,Republicans andDemocrats,andanarrayofneweconomictheories. Samuelson’s textbook was popular not so much because it was wellwritten,butbecauseitelucidatedandsimplifiedthebasicsof Keynesianmacroeconomicsthroughthedeftuseofsimplealgebra andcleargraphs.Ittooktheprofessionbystorm,sellinghundreds ofthousandsofcopieseveryyear.Samuelsonupdatedthetextbook everythreeyearsorso,apracticethateverytextbookpublishernow imitates. Economics sold over 440,000 copies at the height of its 166 THE BIG THREE IN ECONOMICS popularityin1964.EvenaconservativeinstitutionsuchasBrigham YoungUniversity,myalmamater,usedtheSamuelsontextbook. TheAcmeofProfessionalSuccess SamuelsonisknownformorethanjustpopularizingKeynesianeconomics.Heisconsideredthefatherofmodernmacroeconomictheorizing.Hehasmadeinnumerablecontributionstopuremathematical economics,forwhichhehasbeenbothhonoredandblamed—honored formakingeconomicsapurelogicalscience,andblamedforcarrying theRicardianviceandWalrasianequilibriumanalysistoanextreme, devoidofanyempiricalwork.(Seechapters2and4.) For his popular and scientific works, the academic community hasawardedSamuelsonvirtuallyeveryhonoritconfers.Hewasthe firstAmericantowintheNobelPrizeineconomics,in1970.Hewas awardedthefirstJohnBatesClarkMedalforthebrightesteconomist underforty,andbeyondeconomics,hereceivedtheAlbertEinstein Medalin1971.There’sevenanannualawardnamedafterhim,the PaulA.SamuelsonAward,givenforpublishedworksinfinance.His articleshaveappearedinallthemajor(andmanyminor)journals.He waselectedpresidentoftheAmericanEconomicAssociation(AEA), hasreceivedinnumerablehonorarydegreesfromvariousuniversities, andhasbeenthesubjectofmanyFestschrifts,gatheringsatwhich scholarshonorafellowcolleaguewithessaysabouthiswork. “TheYoung,BrashWunderkind” PaulA.SamuelsonwasborninGary,Indiana,in1915toJewishparents,andmovedtoChicago,wherehereceivedhisB.A.in1935—at thetenderageoftwenty—fromtheUniversityofChicago.Chicago inthe1930s,asitistoday,wasthecitadeloflaissez-faireeconomic thought.Inthosedays,itwasrunbyFrankKnight,JacobViner,and Henry Simons, among others. Paul’s first class in economics was taughtbyAaronDirector,whowasperhapsthemostlibertarianamong thefacultyandwholaterbecameMiltonFriedman’sbrother-in-law. Both Friedman and George Stigler were graduate students at the time.Director’slaissez-fairephilosophyfailedtotakeintheyouthful reformistSamuelson,whoenjoyedbeinganintellectualhereticina A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 167 conservativeinstitutionandwhowasinfluencedbyafatherknownas a“moderatesocialist.”Moreover,duringthedepression,mostofthe leadersoftheChicagoschooladvocateddeficitspendingandother governmentactivistpoliciesastemporarymeasures.Samuelsondid inheritoneconceptfromChicagothathecarriedwithhimuntilhe encounteredKeynes—monetarism.Hecalledhimselfa“jackass”for havingbeentakenin(Samuelson1968,1). AlvinHansenSwitchesSidestoBecomethe “AmericanKeynes” AfterChicago,SamuelsonimmediatelywenttoHarvard,wherehe witnessedanamazingtransition.Histeacher,AlvinHansen(1887– 1975),along-standingclassicaleconomist,convertedtoKeynesianism.MostoldereconomistsatfirstrejectedKeynes’shereticalideas, including Hansen, who was at the University of Minnesota. Only MarrinerEccles,theexceptionalUtahbankerwhobecameheadofthe FederalReserve,andLauchlinCurrie,aneconomicaidetoRoosevelt, wereprominentKeynesianadvocates. Then,inthefallof1937,HansentransferredtoHarvardandsuddenly—attheageoffifty—recognizedtherevolutionarynatureof Keynes.Hewouldbecomeanoutspokenexponent—the“American Keynes.”Hisfiscalpolicyseminarattractedmanyenthusiasticstudents,includingSamuelson,andconvincedmanycolleagues,includingSeymourHarris.KeyneshadtobetranslatedintoplainEnglishand easy-to-understandgraphsandmath,andHansenwastheprincipal interpreter,fromFiscalPolicyandBusinessCycles(1941)toAGuide toKeynes(1953).HansenalsocampaignedfortheEmploymentAct of 1946.According to Mark Blaug, “Alvin Hansen did more than anyothereconomisttobringtheKeynesianRevolutiontoAmerica” (Blaug1985,79). “StagnationThesis”DiscreditsHansenandAlmost DestroysSamuelson’sReputation However, Hansen fell into a trap. He logically extended Keynes’s unemploymentequilibriumtheoryintoa“secularstagnationthesis.” (Keyneshimselfbelievedthatconditionsofthe1930scouldpersist 168 THE BIG THREE IN ECONOMICS indefinitely.) In his presidential address before theAEA in 1937, HansenboldlyannouncedthattheUnitedStateswasstuckina“matureeconomy”rutfromwhichitcouldnotescape,duetoitslackof technologicalinnovations,theAmericanfrontier,andthepopulation growthrate.HisstagnationthesiswasvigorouslyattackedbyGeorge TerborghinhisbookTheBogeyofEconomicMaturity(1945)andthen soundlydisprovedbyavibrantrecoveryafterWorldWarII.Thestigma ofthisunfulfilledpredictionhauntedHansenthroughouthislife. PaulSamuelson,undertheHansenstagnationspell,almostsuffered thesamefate.In1943,hewroteanarticlewarningthatunlessthe governmentactedvigorouslyaftertheendofthewar,“therewould be ushered in the greatest period of unemployment and industrial dislocationwhichanyeconomyhaseverfaced.”Inatwo-partarticle inpublishedinTheNewRepublicintheautumnof1944,Samuelson predictedareplayofthe1930sdepression(Sobel1980,101–02). Althoughhe,alongwithmostKeynesians,wasprovedinaccurate about the postwar period, Samuelson gradually began expressing strongoptimismabouttheU.S.economyinsuccessiveeditionsof histextbook.“Ourmixedeconomy—warsaside—hasagreatfuture beforeit”(1964,809). Samuelsonfounditanexcitingtimetobeaneconomist:“Tohave beenbornasaneconomistbefore1936wasaboon—yes.Butnotto havebeenborntoolongbefore!”(inHarris1947,145).Heapplied thefollowingfamiliarlinesfromWilliamWordsworth’sThePrelude (Book11,lines108-9,previouslyquotedinchapter2): Blisswasitinthatdawntobealive, ButtobeyoungwasveryHeaven! Samuelsoncompletedhisdissertationin1941,anditwontheDavid A.WellsAwardthatyear.(Itwaspublishedin1947asFoundations ofEconomicAnalysis.)Inthiswork,SamuelsonbrokewithAlfred Marshall by contending that mathematics, not literary expression, shouldbetheprimaryexpositionofeconomics. ButaftergraduationSamuelsondiscoveredthatheavenwasnotso sweet.HedeclaredhispreferencetoteachatHarvard,buthisyouthful exuberance,arrogantpersonality,andJewishbackgroundallworked againsthim.Hiscockyattitudehadlongirritatedhischairman,Harold A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 169 HitchingsBurbank,andthedepartmentofferedhimonlyaninstructorship.DeterminedtostayinCambridge,heacceptedapositionatthe relativelyunheraldeddepartmentofeconomicsattheMassachusetts InstituteofTechnology. Harvardsooncametoregretitsmistake.By1947,Samuelsonhad beenawardedthefirstJohnBatesClarkMedalforbeingthebrightest youngeconomist,hisschoolhadgrantedhimafullprofessorship, andMIThadbeenrankedasoneofthebesteconomicsdepartments inthecountry.AndSamuelsonwasonlythirty-two!Ayearlaterhe would drop the bomb that would be the envy of every economics department:thefirsteditionofEconomics,Samuelson’snewtestamentofmacroeconomics.HarvardprofessorOttoEcksteinremarked, “Harvard lost the most outstanding economist of the generation” (Sobel1980,101). HowSamuelsonCametoWriteHisFamousTextbook: “ASingularOpportunity” In the early postwar period, Harvard students studied economics fromoutdatedtextbooksthatsaidnothingaboutthewarandlittle about the new economics of Keynes. “Students at Harvard and MIToftenhadthatglassy-eyedlook,”commentedSamuelson.His departmentheadaskedhimtowriteanewtext.Threeyearslater, after toiling through nights and summers(“mytennissuffered”), Economicswasborn. AttackedfromBothSides Thefirstedition,publishedbyMcGraw-Hill,soldover120,000copiesthrough1950andjustkeptselling.Butitsooncameunderattack fromthebusinesscommunity,ontheonehand,whichcomplained ofitssocialistictendencies,andtheMarxists,ontheotherhand, whocomplainedofitscapitalistictendencies.WilliamF.Buckley, Jr.,protestedinGodandManatYale(1951)thatSamuelson’stextbookwasantibusinessandprogovernment.Anorganizationcalled theVeritasFoundationpublishedKeynesatHarvardandidentified Keynesianism with Fabian socialism, Marxism, and fascism. On theotherside,MarxiststookumbrageatSamuelson’sassertionthat 170 THE BIG THREE IN ECONOMICS Marx’spredictionsaboutthecapitalistsystemwere“deadwrong.” Amassivetwo-volumecritique,Anti-Samuelson(1977),waspublished to counter Samuelson and introduce Marxism to students. SamuelsonwaspleasedtohearthatinStalin’sday,Economicswas keptonaspecialreserveshelfinthelibrary,alongwithbookson sex,forbiddentoallbutspeciallylicensedreaders.“Actually,”respondedSamuelson,“whenyourcheekissmackedfromtheRight, thepainmaybeassuagedinpartbyaslapfromtheLeft”(1998, xxvi).Meanwhile,Samuelsonofferedaseeminglybalancedbrandof economicsthatfoundmainstreamsupport.Whilehefavoredheavy involvementin“stabilizing”theeconomyasawhole,heappeared relativelylaissez-faireinthemicrosphere,supportingfreetrade, competition,andfreemarketsinagriculture. TheHighTideofKeynesianEconomics The success of Keynesian economics and Samuelson’s textbook reached its zenith in the early 1960s. The MIT professor became presidentoftheAEAin1961,theyearJohnF.Kennedywasinauguratedpresident.Samuelson,alongwithWalterHellerandothertop Keynesians,wasacloseadvisortoKennedyandhelpedsteerthrough CongresstheKennedytaxcutof1964,aKeynesianprogramdesigned tostimulateeconomicgrowththroughdeliberatedeficitfinancing.It appearedtowork,astheeconomyflourishedthroughthemid-1960s. Bythattime,Samuelson’stextbookreignedatoptheprofession,sellingmorethanaquarterofamillioncopiesayear.Andayearafter theNobelPrizeineconomicswasestablishedin1969bytheBank ofSweden,theprizewenttoPaulA.Samuelson. Samuelson’stextbookhasbeenonthedeclinesincetheturbulent and inflationary 1970s, and today—a half-century after the first edition—itnolongertopsthelistinpopularity.However,thenew front-runners(especiallyCampbellMcConnell’stextbook,whichhas beenamongthetopsellersforyears)aremostlyconsideredclones of Samuelson. Since 1985, new editions of Economics have been coauthoredbyYaleprofessorWilliamD.Nordhaus,andSamuelson’s hairhasturnedfromblondtobrowntograyinhissunsetyears.Yet “hismemorydazzlesevenwhenitfails,”writesanadmirer(Elzinga 1992,878). A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 171 Figure6.1 TheKeynesianCrossofNationalIncomeDetermination:How SavingandInvestmentDetermineIncome HOWSAVINGANDINVESTMENT DETERMINEINCOME Savingand Investment S,I + S E I O M S – I B NI F NationalIncome Source:Samuelson(1948:259).ReprintedbypermissionofMcGraw-Hill. Samuelson’sGoal:ToRaisetheKeynesianCrossAtopa NewHouseofEconomics What was Paul Samuelson trying to achieve? There is no real Samuelson school of economics; he considers himself “the last generalist in economics.” (But what about Kenneth Boulding?) TheMITprofessor’sintentionwas,firstandforemost,tointroduce Keynesianism to the classroom: the multiplier, the propensity to consume,theparadoxofthrift,countercyclicalfiscalpolicy,national incomeaccounting,andC+I+Gwereallnewtopicsintroducedin thefirsteditionofEconomicsin1948.OnlyJohnMaynardKeynes washonoredwithabiographicalsketchinearlyeditions,andonly Keynes,notAdamSmithorKarlMarx,waslabeled“amany-sided genius”(Samuelson1948,253). The“Keynesiancross”income-expenditurediagram,inventedby SamuelsonandreproducedinFigure6.1,wasprintedonthecoverof thefirstthreeeditions.TheKeynesiancrossincorporatesalltheelementsofthenew“general”theory.InthediagraminFigure6.1,note thatsaving(S)increaseswithnationalincome(NI).Aspeopleearn more,theysavemore.However,investment(I)isautonomousand independentofsaving.Itissetatafixedamountbecause,according 172 THE BIG THREE IN ECONOMICS toKeynes’stheory,investmentisfickleandvarieswiththe“animal spirits”andexpectationsofinvestorsandbusinessmen.Sotheinvestmentscheduleissetatanylevel,unrelatedtoincome.Equilibrium (M)issetatthepointwhereS=I,whichyouwillnotefallsshort offull-employmentincome(F).Thus,theKeynesiancrossreflects underemploymentequilibrium. This static equilibrium model represents Samuelson’s (and Keynes’s) view that capitalism is inherently unstable and can be stuckindefinitelyatlessthanfullemployment(M).No“automatic mechanism”guaranteesfullemploymentinthecapitalisteconomy (SamuelsonandNordhaus1985,139).Samuelsoncomparedcapitalismtoacarwithoutasteeringwheel;itfrequentlyrunsofftheroad andcrashes:“Theprivateeconomyisnotunlikeamachinewithout an effective steering wheel or governor,” he wrote. “Compensatoryfiscalpolicytriestointroducesuchagovernororthermostatic control device” (Samuelson 1948, 412). Krugman compares the marketeconomytoasystemthatneedsa“newalternator”(Krugman2006). HowtheMultiplierWorksMagic Howdoescompensatoryfiscalpolicywork?Therearetwowaysfor theeconomytogrowandreachfullemploymentunderKeynesian theory:ShiftinvestmentscheduleIupward,orshiftsavingschedule Stotheright. First,let’slookatinvestment.ScheduleIcanbeshiftedupwardby restoringbusinessconfidence,primarilythroughincreasedgovernment spendingortaxcuts.Bothtechniqueshaveamultipliereffect—either a$100billionspendingprogramorataxcutcancreate$400billion innewincome. ButSamuelsonnotedthatundertheKeynesiansystem,governmentspendinghasahighermultiplierthanataxcut.Why?Because 100percentofafederalprogramisspent,whileonlyaportionofa taxcutisspent—someofitissaved.Samuelsoncalledhisdiscoverythe“balancedbudgetmultiplier.”Thus,anewfederalspending programispreferredoverataxcutbyKeynesiansbecausetheexpendituresideisconsideredamorepotentweaponagainstrecession thanataxcut. A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 173 Figure6.2 Samuelson’s“ParadoxofThrift” SavingandInvestmentDiagramShowsHow ThriftinessCanKillOffIncome SavingandInvestment + S´ 400 100 300 200 100 0 –100 _ E´ I Q* S E I S´ S 3,000 3,500 GNP 1,000 300 GrossNationalProduct(billionsofdollars) Q* Note:Q*=FullemploymentoutputorGNP. Source: Samuelson and Nordhaus (1989: 184). Reprinted by permission of McGraw-Hill. TheParadoxofThriftDeniesAdamSmith Thesecondwayoutofarecessionistoincreasethepublic’spropensity toconsume,whichwouldshiftsavingscheduleStotheright. Note that in the Keynesian model, if the public decides to save moreduringaneconomicdownturn,itonlymakesmattersworse. Consumersbuyless,producerslayoffworkers,andhouseholdsendup savingless.Anincreasedsupplyofsavingscannotlowerinterestrates andencourageinvestmentunderthecrudeKeynesianmodelbecause interestratesareassumedtobeconstant.IntheFigure6.1diagram, moresavingsmeansthatthesavingscheduleSshiftsbackwardtothe left,andhasnoeffectonraisingtheIschedule. Samuelson called this phenomenon the “paradox of thrift” (see Figure6.2)—anincreaseindesiredthriftresultsinlesstotalsavings! “Underconditionsofunemployment,theattempttosavemayresult inless,notmore,saving,”hedeclared(1948,271).Keynes,ofcourse, said practically the same thing, only more eloquently: “The more virtuousweare,themoredeterminedlythrifty,themoreobstinately orthodoxinournationalandpersonalfinance,themoreourincomes willhavetofall”(Keynes1973a[1936],111). 174 THE BIG THREE IN ECONOMICS SamuelsondelightedinthisattackontheorthodoxyofAdam SmithandBenjaminFranklin.Smithfoundthriftauniversalvirtue,writingthat“Whatisprudenceintheconductofeveryprivatefamily,canscarcebefollyinthatofagreatkingdom”(1965 [1776],424).Franklincounseledeverychild,“Apennysavedisa pennyearned.”ButSamuelsonlabeledthisthinkinga“fallacyof composition.”“Whatisgoodforeachpersonseparatelyneednot begoodforall,”hecountered.Moreover,Franklin’s“oldvirtues [ofthrift]maybemodernsins”(1948,270).Asonemodern-day textbookputit,“Whilesavingsmaypavetheroadtorichesforan individual,ifthenationasawholedecidestosavemore,theresult could be a recession and poverty for all” (Baumol and Blinder 1988,192). TheKeynesiansreadilyendorsedsavingsasavirtueduringperiodsoffullemployment,butSamuelsonwasconvinceditseldom happened.“[F]ullemploymentandinflationaryconditionshaveoccurredonlyoccasionallyinourrecenthistory,”hewrote.“Muchof thetimethereissomewastageofresources,someunemployment, someinsufficiencyofdemand,investment,andpurchasingpower” (1948,271).Thisparagraphremainedvirtuallythesamethroughout thefirsteleveneditionsofhistextbook.1 SavingsasLeakage Echoing Keynes, Samuelson declared war on uninvested savings, which could “leak” out of the system and “become a social vice” (1948, 253). He produced a diagram (see Figure 6.3) separating savingsfrominvestment.Thediagramshowssavingsleakingoutof thesystem,unconnectedtotheinvestmenthydraulichandleabove. (Thisdiagramledobserverstocallthemodel“hydraulicKeynesianism,”withtheemphasisonprimingthepumpthroughgovernment spending.) 1.Amazingly,Samuelsonrecentlyprotestedbeinglabeledan“antisavingKeynesian”(Samuelson1997).AfternotingthatMartinFeldsteinpubliclycomplainedthat economistsatHarvardalsoattackedsavingsinhiscollegedays,Samuelsonsaidhe regularlyappearedbeforeCongresstourgemoresavingandinvestmentandless consumption.Myresponse:Thenwhydidn’thesaysoinhistextbook? A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 175 Figure6.3 SavingLeaksOutoftheSystemWhiletheHydraulic InvestmentPressPumpsUptheEconomy Tech. Change, etc. Investment A $ Wages, Interest,etc. BUSINESS Consumption $ PUBLIC Z Saving Source:Samuelson(1948:264).ReprintedbypermissionofMcGraw-Hill. IsConsumptionMoreImportantThanSaving? TheKeynesianmodelleadstotheoddconclusionthatconsumptionis moreproductivethansaving.AsnotedaboveintheKeynesiancross model,anincreaseinthe“propensitytoconsume”(alowersavingrate) leadstofullemployment.Keynesapplauded“allsortsofpoliciesfor increasingthepropensitytoconsume,”includingconfiscatoryinheritancetaxesandtheredistributionofwealthinfavoroflower-income groups,whoconsumeahigherpercentageoftheirincomethanthe wealthy(1973a[1936],325).CanadianeconomistLorieTarshis,the firsttowriteaKeynesiantextbook,warnedthatahighrateofsaving is“oneofthemainsourcesofourdifficulty,”andoneofthegoals ofthefederalgovernmentshouldbe“reducingincentivestothrift” (Tarshis1947,521–12). Keynesian economist Hyman Minsky confirmed this unorthodox approach when he said, “The policy emphasis should shift from the encouragementofgrowththroughinvestmenttotheachievementoffull employmentthroughconsumptionproduction”(Minsky1982,113).Of course,allofthisKeynesiantheorygoescountertotraditionalclassical growththeorythatahighlevelofsavingisakeyingredienttoeconomic growth. 176 THE BIG THREE IN ECONOMICS IsKeynesianismPoliticallyNeutral? SamuelsoncontendedthattheKeynesian“theoryofincomedetermination” is politically “neutral.” For example, “it can be used as welltodefendprivateenterpriseastolimitit,aswelltoattackasto defendgovernmentfiscalinterventions”(1948,253).Buttheevidence disputesthisclaim. For instance, the balanced-budget multiplier (which Samuelson considersoneofhisproudest“scientificdiscoveries”)favorsgovernmentspendingprogramsovertaxcutsasacountercyclicalpolicy. AccordingtoSamuelson,progressivetaxation(imposinghighertax ratesonthewealthy)hasa“favorable”redistributionisteffectonthe economy:“Totheextentthatdollarsaretakenfromfrugalwealthy peopleratherthanfrompoorreadyspenders,progressivetaxestend tokeeppurchasingpowerandjobsatahighlevel”(1948,174). SamuelsonalsoendorsedSocialSecuritytaxes,farmaid,unemploymentcompensation,andtherestofthewelfarestateas“built-in stabilizers” in the economy. The index of Samuelson’s textbook consistentlylists“marketfailures”(includingimperfectcompetition, externalities, inequalities of wealth, monopoly power, and public goods) but not “government failures.” His bias is overwhelmingly evident. ApologistfortheNationalDebt Inearlyeditions,Samuelsondeniedthatthenationaldebtwasaburden.Thefirsteditionfavorsthe“weoweittoourselves”argument: “TheinterestonaninternaldebtispaidbyAmericanstoAmericans; thereisnodirectlossofgoodsandservices”(1948,427).Intheseventhedition(1967a),afterraisingthespecterof“crowdingout”of privateinvestment,Samuelsonwentontosay:“Ontheotherhand, incurringdebtwhenthereisnootherfeasiblewaytomovetheC+ I+Gequilibriumintersectionuptowardfullemploymentactually representsanegativeburdenontheintermediatefuturetothedegree thatitinducesmorecurrentcapitalformationthanwouldotherwise takeplace!”(1967a,346).Attheendofanappendixonthenational debt, Samuelson compared federal debt financing to private debt financing, such asAT&T’s “never-ending” growth in debt (1967a, A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 177 358).Byimplication,hesuggestedthatgovernmentdebtcouldalso grow continually, rather than necessarily being balanced over the businesscycle.2 Insum,KeynesianeconomicsaspresentedbySamuelsonbecame anapologyforbig-governmentcapitalisminthepostwarperiod.“A laissez-faireeconomycannotguaranteethattherewillbeexactlythe requiredamountofinvestmenttoinsurefullemployment”(1967a, 197–78).Onlyapowerfulstatecan. CriticsBeginaLongBattleAgainstKeynesianEconomics Samuelson claimed in his first edition that the Keynesian system was“increasinglyacceptedbyeconomistsofallschoolsofthought” (1948,253).JudgingfromthepopularityofSamuelson’stextbook,he wasright.Inthe1950sand1960s,scholarsinthemajoreconomics departmentsspenttheirentirecareersdoingempiricalstudiesonthe consumptionfunction,themultiplier,nationalincomestatistics,and otherKeynesianaggregates.Keynesianmacroeconomicsalsobecame popular among journalists, because it was easy to understand (increasingconsumerspendingis“goodfortheeconomy”),andamong politicians, because deficit spending bought votes. Robert Solow, Samuelson’s colleague at MIT and a Nobel laureate, summarized theneworthodoxywhenheproclaimedwithconsiderablepridethat “short-termmacroeconomictheoryisprettywellinhand....Allthat isleftisthetrivialjoboffillingintheemptyboxes”(1965,146). ThePigouEffect:TheFirstAssault ButovertimecriticshavechippedawayattheKeynesianstructure. Thefirstobjectionwasthe“liquiditytrap”doctrine,Keynes’sfear thattheeconomycouldbetrappedindefinitelyinadeepdepression whereinterestratesaresolowand“liquiditypreference”sohighthat reducinginterestratesfurtherwouldhavenoeffect(Keynes1973a 2.ApopularworkcoincidingwithSamuelson’ssupportofdeficitspendingwas APrimeronGovernmentSpending,byRobertL.HeilbronerandPeterL.Bernstein. Itstated,“Recentexperienceindicatesthattheeconomygrowsfasterwhenthegovernmentrunsadeficitandslowerwhenrevenuesexceedoutlays”(1963,119). 178 THE BIG THREE IN ECONOMICS [1936],207).Themanwhofirstcounteredtheliquidity-trapdoctrine wasArthurC.Pigou,ironicallythestrawmanKeynesvilifiedinThe GeneralTheory.Inaseriesofarticlesinthe1940s,Pigousaidthat Keynesoverlookedabeneficialsideeffectofadeflationinpricesand wages:deflationincreasestherealvalueofcash,Treasurysecurities, cash-valueinsurancepolicies,andotherliquidassetsofindividuals andbusinessfirms.Theincreasedvalueoftheseliquidassetsraises aggregate demand and provides the funds to generate new buying powerandhirenewworkerswhentheeconomybottomsout(Pigou 1943,1947).Thispositiverealwealtheffect,orwhatIsraelieconomist DonPatinkinlaternamedthe“realbalanceeffect”inhisinfluential Money,InterestandPrices(1956),didmuchtounderminetheKeynesiandoctrineofaliquiditytrapandunemployedequilibrium. ThePigou“wealth”or“realbalance”effectcanalsobeextended totheissueofwagecutsduringadownturn.Keynesrejectedtheclassicalargumentthatwagecutsarenecessarytoadjusttheeconomyto newequilibriumconditions,fromwhichasolidrecoverycouldoccur. Arguing against the conventional view that persistent unemploymentiscausedbyexcessivewagerates,Keynesclaimedthatwage cutswouldsimplydepressdemandfurtheranddonothingtoreduce unemployment.ButKeynesandhisfollowersconfusedwagerates withtotalpayroll.Facingarecessionandwidespreadunemployment, businessleadersrecognizethatareductioninwageratescanactually boostnetemploymentandtotalpayroll.Cuttingwagesallowsfirms tohiremoreworkersatthebottomofaslump.Whentheeconomy bottomsout,well-managedcompaniesbeginhiringmoreworkersat lowwages,sothateventhoughthewagerateremainslow,thetotal payroll increases, and thus puts the economy back on the road to recovery(Hazlitt1959,267–69;Rothbard1983[1963],46–48). GrowthDataContradictAntithriftDoctrine Economichistorianshadseriousdoubtsalmostimmediatelyaboutthe Keynesianantipathytowardsaving,whichhasalwaysbeenconsidered akeyingredienttolong-termeconomicgrowth.Theypointespecially toEuropeanandAsiancountries,suchasGermany,Switzerland,Japan, andSoutheastAsia,whosegrowthrateshavebenefitedtremendously fromhighratesofsavingduringthepostwarperiod.Nobellaureate A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 179 Figure6.4 ConnectionBetweenGrowthandSavingsRates 25% O.E.C.D.Norm 15 France Canada Britain 1 U.S. 2 3 10 4 5 6 7 SAVINGSRATE 20 Italy W.Germany (Personalsavings%ofdisposableincome) Japan 5 8% GROWTH (Compoundannualgrowthinpercapitadisposableincome) Source:FrancoModigliani(1986:303). ReprintedbypermissionofTheNobelFoundation. FrancoModigliani,aswellastoptextbookwriterCampbellMcConnell, bothKeynesians,haverecognizedthedirectrelationshipbetweensaving ratesandeconomicgrowth.Forexample,thegraphinFigure6.4was includedinFrancoModigliani’sNobelPrizepaperin1986. Historically,theevidenceisoverwhelming:highersavingrateslead tohighergrowthrates–justtheoppositeofthestandardKeynesian prediction.AsonerecentKeynesiantextbookdeclaredafterteaching studentsabouttheparadoxofthrift:“Thefactthatgovernmentsdo notdiscouragesavingsuggeststhattheparadoxofthriftgenerallyis notareal-worldproblem”(BoyesandMelvin1999,265). Butthenwhyteachtheparadoxofthriftatall?Notonlyisithistoricallyunproved,butitisfundamentallyflawed.Theproblemisthat Keynesianstreatsavingsasifitdisappearsfromtheeconomy,that itissimplyhoardedorleftlanguishinginbankvaults,uninvested. Inreality,savingissimplyanotherformofspending,notoncurrent 180 THE BIG THREE IN ECONOMICS consumption,butonfutureconsumption.TheKeynesiansstressonly thenegativesideofsaving,thesacrificeofcurrentconsumption,while ignoringthepositiveside,theinvestmentinproductiveenterprise. Asnotedinchapter4,theAustrianeconomistEugenBöhm-Bawerk stressedthepositivesideofsaving:“Foraneconomicallyadvanced nationdoesnotengageinhoarding,butinvestsitssavings.Itbuys securities,itdepositsitsmoneyatinterestinsavingsbanksorcommercialbanks,putsitoutonloan,etc.”(1959[1884],113). SavingHasaMultiplier,Too! Savingisinfactabetterformofspendingbecauseitoffersapotentiallyinfinitepayoffinfutureproductivity(thusFranklin’srefrain,“A pennysavedisapennyearned”).Ifthepublicsavesmoregenerally, thepoolofsavingsenlarges,interestratesdecline,oldequipmentis replaced,andmoreresearchanddevelopment,newtechnology,and newproductionprocessesevolve.Thefuturebenefitsareincalculable. Meanwhile,fundsspentonpureconsumergoodsareusedupwithin acertainperiod,ordepreciatedovertime. TheKeynesianmultiplier(k)ishigherasthepublicconsumesmore. Butproponentsassumethatthesavingsremainuninvested—afalse assumptionundernormalconditions.Intruth,bothcomponentsof income—consumptionandsavings—arespent.Thus,themultiplier (k)isinfinite!Thesavingcomponentalsohasamultipliereffectin theeconomyasitisinvestedintheintermediateproductionstages. Moreover, the savings k is theoretically more productive than the consumptionkbecauseitisnotusedupasfast. GoingbacktoSamuelson’shydraulicmodel(Figure6.2),saving does not leak out of the system, but goes back into the system to improvethefactorsofproduction(land,labor,andcapital)through newtechnology,education,andtraining.Figure6.5demonstrateshow saving,consumption,andtheeconomyreallyoperate. TheEkinsdiagraminFigure6.5iswhatSamuelsonshouldhave publishedovertheyearsinhistextbookinsteadofthehydraulicmodel. Inthischart,theultimatepurposeofeconomicactivityistoprovide increasingutility.Notehowinthediagram,consumptionisusedup. Itisconsumption—notsaving—that“leaks”outandisconsumedas utility.Saving,ontheotherhand,isinvestedbackintotheeconomic A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 181 Figure6.5 TheGrowthModelDrivenbySaving/Investment(PaulEkins) Utility/Welfare FactorsofProduction Improvement Educaton Training Machines etc. Land Labour Consumption Economic Process Goodsand Services PhysicallyProduced Capital Investment Source:EkinsandMax-Neef(1992:148).ReprintedbypermissionofRoutledge. processoverandoveragain,facilitatingnewinvestmentandimproving ourstandardofliving(utility/welfare).Anamazingcontrast. ACriticalFlawintheKeynesianModel The central problem with the Keynesian model is that it fails to comprehendthetruenatureoftheproduction-consumptionprocess. The Keynesian system assumes that the only thing that matters is currentdemandforfinalconsumergoods—thehighertheconsumer demand,thebetter.DespitetalkthatKeynesisdead,thisKeynesian preoccupationwithconsumerdemandisalmostuniversallyaccepted intheestablishmentmediatoday.Forexample,WallStreetmonitors retail sales figures to determine the direction of the economy and themarkets.Theyseemtobedisappointedifconsumersdon’tspend enough—asiftheywanttheChristmasseasontolastallyear! Yetisconsumerspendingthecauseortheeffectofprosperity?If everyonewentonabuyingspreeatthelocaldepartmentstoreorgrocerystore,wouldinvestmentinnewproductsandtechnologyexpand? Certainlyinvestmentinconsumergoodswouldexpand,butincreased expendituresforconsumergoodswoulddolittleornothingtoconstruct 182 THE BIG THREE IN ECONOMICS abridge,buildahospital,payforaresearchprogramtocurecancer,or providefundsforanewinventionoranewproductionprocess. Accordingtobusiness-cycleanalysts,retailsalesandothermeasures ofcurrentconsumerspendingarelaggingindicatorsofeconomicactivity.AlmostallofthecomponentsoftheU.S.CommerceDepartment’s IndexofLeadingEconomicIndicatorsareproductionandinvestment oriented,forexample,contractsandordersforplantequipment,changes inmanufacturingandtradeinventories,changesinrawmaterialprices, andthestockmarket,whichrepresentslong-termcapitalinvestment (Skousen1990,307–12).Typicallyinabusinesscycle,consumption startsdecliningaftertherecessionhasalreadystarted;similarly,consumerspendingpicksupaftertheeconomybeginsitsrecoverystage. Thismythofaconsumer-driveneconomypersistsinpartbecause ofamisunderstandingofnationalincomeaccounting.Themediafrequentlyreportthatconsumerspendingaccountsfortwo-thirdsofGDP. RecallthatGDP=C+I+G,andtypicallyintheUnitedStates: C I G = 70percent = 12percent = 18percent Therefore,themediaconcludethat,sinceconsumptionaccountsforapproximatelytwo-thirdsofGDP,theeconomymustbeconsumer-driven. Notso.GDPisdefinedasthevalueofallfinalgoodsandservices produced in a year. It ignores all intermediate production in the economyatthewholesale,manufacturing,andnatural-resourcestages. Ifonemeasuresspendingatalllevelsofproduction,theresultsare surprisinglydifferent. I have created a national income statistic called gross domestic expenditures(GDE),whichmeasuresgrosssalesatallstagesofproduction.3Usingthisnew,broaderdefinitionoftotalspendinginthe economy,itbecomesapparentthatconsumptionrepresentsonlyabout 3.SeeSkousen(1990,185–92)fordetailsofthisnewstatistic.Recently,the U.S.DepartmentofCommercehasdevelopedanewstatisticcalled“grossoutput” thatapproachesmyGDE(althoughitleavesoutgrosswholesaleandretailfigures). SeeTable8inU.S.DepartmentofCommerce,“GrossOutputbyIndustry,1987–98,” SurveyofCurrentBusiness(2000),p.48. A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 183 one-thirdofeconomicactivity,andthatbusinessspending(investmentplusgoods-in-processspending)accountsformorethanhalfof theeconomy.Thus,businessinvestmentisfarmoreimportantthan consumerspendingintheUnitedStates(andinmostothernations). The Keynesian macroeconomic model suffers from the defect of oversimplification—itassumesonlytwostages,consumptionandinvestment,anditassumesthatinvestmentisadirectfunctionofcurrent consumptiononly.Ifcurrentconsumptionincreases,sowillinvestment, andviceversa. HowtheEconomyReallyWorks William Foster andWaddill Catchings committed this same error. AsHayekpointedoutinhiscritiqueoftheFoster-Catchingsdebate, investment is actually multistaged and changes form and structure wheninterestratesriseorfall.Investmentisnotsimplyafunctionof currentdemand,butoffuturedemand;bothlong-termandshort-term interestratesinfluenceinvestmentandcapitalformation(Hayek1939 [1929]).Forexample,supposethepublicdecidestosavemoreoftheir incomeforabetterfuture.Spendingforcars,clothing,entertainment, andotherformsofcurrentconsumptionmightlevelofforevenfall.But thistemporaryslowdowninconsumptiondoesnotcauseabroad-based recession.Instead,theincreasedsavingsleadstolowerinterestrates, whichencouragebusinesses,especiallyincapital-goodsindustriesand researchanddevelopment,toexpandoperations.Lowerinterestrates meanlowercosts.Businessescannowaffordtoupgradecomputers andofficeequipment,constructnewplantsandbuildings,andexpand inventories.Lowerinterestratescanevenreversetheslowdownincar salesbyofferingcheaperfinancingtoprospectivecarbuyers.Contrary tothedirepredictionsoftheKeynesians,anincreaseinthepropensity tosavepaysforitself.Itdoesnotleadtoa“recessionandpovertyfor all”(BaumolandBlinder1988,192).Onlythestructureofproduction andconsumptionchanges,notthetotalamountofeconomicactivity. AnExample:BuildingaBridge Ahypotheticalexamplecouldbeusefulinreinforcingthebenefitsof increasedsavings.SupposeSt.PaulandMinneapolisareseparated 184 THE BIG THREE IN ECONOMICS byariverandthattheonlytransportationbetweenthetwocitiesis bybarge.Travelbetweenthetwincitiesisexpensiveandtime-consuming.Finally,thecityfatherscallameetinganddecidetobuild abridge.Everyoneagreestocutbackoncurrentspendingandput theirsavingstoworktobuildthebridge.Intheshortrun,retailsales, employment,andprofitsinlocaldepartmentstoresdecline.Yetnew workersandnewinvestmentfundsareassignedtothebuildingofthe bridge.Intheaggregate,thereisnoreductioninoutputandemployment.Moreover,oncethebridgeiscompleted,thetwincitiesbenefit immenselyfromlowertravelcostsandincreasedcompetitionbetween St.PaulandMinneapolis.Intheend,thetwincities’sacrificehasbeen transformedintoahigherstandardofliving. Say’sLawRedux:ProductionIsMoreImportant ThanConsumption In essence, the Keynesian demand-driven view of the economy fails to recognize another force that is even stronger than current demand—thedemandforfutureconsumption.Spendingmoneyon currentconsumergoodsandserviceswilldonothingtochangethe qualityandvarietyofgoodsandservicesofthefuture.Suchchange requiresnewsavingsandinvestment. Thus,wereturntothetruismofSay’slaw:Supply(production) ismoreimportantthandemand(consumption).Consumptionisthe effect,notthecause,ofprosperity.Production,saving,andcapital formationarethetruecause. KeynescreatedanotherstrawmaninTheGeneralTheory.Thestraw manwasJ.-B.Sayandhisfamouslawofmarkets.StevenKatescalls TheGeneralTheory“abook-lengthattempttorefuteSay’sLaw.”But todothis,KeynesgravelydistortedSay’slawandclassicaleconomics ingeneral.AsKatesdisclosedinhisremarkableSay’sLawandthe KeynesianRevolution,“Keyneswaswronginhisinterpretationof Say’sLawand,moreimportantly,hewaswrongaboutitseconomic implications”(Kates1998,212).IntheintroductiontotheFrench editionofTheGeneralTheory,publishedin1939,Keynesfocused onSay’slawasthecentralissueofmacroeconomics.“Ibelievethat economicseverywhereuptorecenttimeshasbeendominated...by thedoctrinesassociatedwiththenameofJ.-B.Say.Itistruethathis A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 185 ‘lawofmarkets’haslongbeenabandonedbymosteconomists;but theyhavenotextricatedthemselvesfromhisbasicassumptionsand particularlyfromhisfallacythatdemandiscreatedbysupply.... Yetatheorysobasedisclearlyincompetenttotackletheproblemsof unemploymentandofthetradecycle”(1973a[1936],xxxv). Unfortunately,KeynesfailedtounderstandSay’slaw.Heincorrectly paraphrased it as “supply creates its own demand” (1973a [1936],25),adistortionoftheoriginalmeaning.Ineffect,Keynes alteredSay’slawtomeanthateverythingproducedisautomatically bought.Hence,accordingtoKeynes,Say’slawcannotexplainthe businesscycle.Keynesfalselyconcluded,“Say’sLaw...isequivalent tothepropositionthatthereisnoobstacletofullemployment”(26). Interestingly,KeynesneverquotedSaydirectly,andsomehistorians havethussurmisedthatKeynesneverreadSay’sactualTreatise,relyinginsteadonRicardo’sandMarshall’scommentsonSay’slawof markets.(ForadetaileddiscussionofSay’slaw,seechapter2ofthis book.)KeyneswentontosaythattheclassicalmodelunderSay’s law“assumesfullemployment”(15,191).OtherKeynesianshave continuedtomakethispoint,butnothingcouldbefurtherfromthe truth.Conditionsofunemploymentdonotprohibitproductionand salesfromtakingplacethatformthebasisofnewincomeandnew demand. Sayactuallyusedhisownlawtoexplainrecessions.Assuch,Say’s lawspecificallyformedthebasisofaclassicaltheoryofthebusiness cycleandunemployment.AsKatesstates,“Theclassicalpositionwas thatinvoluntaryunemploymentwasnotonlypossible,butoccurred often, and with serious consequences for the unemployed” (Kates 1998,18). Say’slawconcludesthatrecessionsarenotcausedbyfailureof thelevelofdemand(Keynes’sthesis),butbyfailureinthestructure ofsupplyanddemand.AccordingtoSay’slaw,aneconomicslump occurswhenproducersmiscalculatewhatconsumerswishtobuy,thus causingunsoldgoodstopileup,productiontobecutback,workersto belaidoff,incometofall,andfinally,consumerspendingtodrop.As Kateselucidates,“Classicaltheoryexplainedrecessionsbyshowing howerrorsinproductionmightariseduringcyclicalupturnswhich wouldcausesomegoodstoremainunsoldatcost-coveringprices” (1998,19).Theclassicalmodelwasa“highly-sophisticatedtheory 186 THE BIG THREE IN ECONOMICS ofrecessionandunemployment”thatwas“obliterated”withonefell swoopbytheillustriousKeynes(Kates1998,20,18).4 Keynes’sNemesis OnonepointKeyneswasright:Say’slawisKeynes’snemesis.It specificallyrefutesKeynes’sbasicthesisthatadeficitinaggregate demandcausesarecessionandthatartificiallystimulatingconsumer spending through government deficits is a cure for depression.To quoteKates,“Sayclearlyunderstoodthateconomiescananddoenter prolongedperiodsofeconomicdepression.Butwhathewasatpains toarguewasthatincreasedlevelsofunproductiveconsumptionare notaremedyforadepressedlevelofeconomicactivity,andcontribute nothing to the wealth creation process. Consumption, whether productiveorunproductive,usesupresources,whileonlyproductive consumptioniscapableofleavingsomethingofanequivalentoreven highervalueinitsplace”(1998,34). LetusreturntoSamuelson’smodelofincomedetermination—the Keynesiancrossheinventedtorepresentunemploymentequilibrium (seeFigure6.1).Weseenowthatsavingandinvestmentdonotinvolvetwoseparateschedulesatall.Exceptinextremecircumstances, savingsareinvested.Asincomeincreases,savingsandinvestment bothincreasetogether.Thus,thereisnointersectionofSandIata single point and therefore no determination of macro equilibrium. TheKeynesiancrosscrumblesunderitsownweight. TheInflationarySeventies:KeynesianEconomicson theDefensive Experienceisoftenafargreaterteacherthanhightheory.Whilethe theoreticalbattleoverKeynesianeconomicsensuedduringthepostwar era,noeventraisedmoredoubtsabouttheKeynes-Samuelsonmodel thantheinflationarycrisesofthe1970s,whenoilandcommodity 4.Inhisbroad-basedbook,Kateshighlightsotherclassicaleconomists,includingDavidRicardo,JamesMill,RobertTorrens,HenryClay,FrederickLavington, andWilhelmRöpke,whoextendedthisclassicalmodelofSay’slaw.Manyclassical economistsfocusedonhowmonetaryinflationexacerbatedthebusinesscycle. A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 187 Figure6.6 ThePhillipsCurveTrade-OffBetweenInflationandFull Employment TRADE-OFFBETWEENINFLATION ANDFULLEMPLOYMENT AnnualPriceRise(percent) +9 +5 +8 +4 +7 PhillipsCurve +3 +6 +2 +5 +1 +4 +3 0 –1 1 2 3 4 5 6 7 8 AnnualWageRise(percent) ∆W/W ∆P/P +6 +2 –2 Source:Samuelson(1970:810).ReprintedbypermissionofMcGraw-Hill. pricesskyrocketedwhileindustrialnationsroiledinrecession.Under standardKeynesiananalysisofaggregatedemand,inflationaryrecessionwasnotsupposedtohappen. KeynesiansreliedheavilyonthePhillipscurve,aconceptpopularizedinthe1960sandbaseduponempiricalstudiesonwageratesand unemploymentconductedinGreatBritainbyeconomistA.W.Phillips (1958).Manyeconomistswereconvincedthattherewasatrade-off betweeninflationandunemployment.ReproducinganidealizedPhillips trade-offcurve(seeFigure6.6),Samuelsondescribedthe“dilemmafor macropolicy”:ifsocietydesireslowerunemployment,itmustbewillingtoaccepthigherinflation;ifsocietywishestoreducethehighcost ofliving,itmustbewillingtoaccepthigherunemployment.Between thesetwotoughchoices,Keynesiansconsideredunemploymentamore seriousevilthaninflation(Samuelson1970,810–12). Butinthe1970sand1980s,theidealizedPhillipstrade-offfell apart—Western nations found that higher inflation did not reduce unemployment,butmadeitworse.Theemergenceofaninflationary recessionandthecollapseofthePhillipscurvecausedeconomists toquestionforthefirsttimetheirtextbookmodels.Intheirsearch foralternativeexplanations,asuddenrenaissanceofneweconomic theoriesarose—fromMarxismtoAustrianeconomics. 188 THE BIG THREE IN ECONOMICS Figure6.7 AggregateSupply(AS)andAggregateDemand(AD)Model ExplainsanInflationaryRecession P PotentialOutput AS´ AS P´ E´ E P AD Q Q Q RealGDP Source:Samuelson(1998:385).ReprintedbypermissionofMcGraw-Hill. KeynesianEconomicsMakesaComeback:The CreationofAggregateSupplyandDemand Yet Keynesian economics was able to make a surprising recovery withthediscoveryofanewtoolthatcouldexplainthecrisesofthe 1970s:aggregatesupplyanddemand,orAS-AD.WhenBillNordhaus signed up as coauthor of the twelfth edition (1985), Samuelson’s Economics added the new AS-AD diagrams. Samuelson and other KeynesiansusedAS-ADtoexplaintheinflationaryrecessionofthe 1970s(seeFigure6.7). As Samuelson stated, “Supply shocks produce higher prices, followedbyadeclineinoutputandanincreaseinunemployment. Supplyshocksthusleadtoadeteriorationofallthemajorgoalsof macroeconomicpolicy”(SamuelsonandNordhaus1998,385). Alan Blinder, a leading Keynesian, also used AS-AD to explainthecontortionsinthetraditionalPhillipscurve.According toBlinder,priortothe1970s,fluctuationsinaggregatedemand A TURNING POINT IN TWENTIETH-CENTURY ECONOMICS 189 haddominatedthedata.Inthe1970s,however,aggregatesupply dominated,andtheresultwasstagflation.“ThatinflationandunemploymentrosetogetherfollowingtheOPECshocksin1973–74 andin1979–80innowayscontradictsaPhillips-curvetrade-off” (Blinder1987,42). Thus,Keynesianeconomicsrecoveredfromthe1970scrisesandASADdiagramsfilledthepagesofmoderntextbooks.InthewordsofG.K. Shaw,modernKeynesiantheory“notonlyresistedthechallengebutalso underwentafundamentalmetamorphosis,emergingevermoreconvincingandevermoreresilient”(Shaw1988,5).TheremainingKeynesian preceptsachievedacertainkindof“permanentrevolution.” Post-KeynesianEconomicsToday What’sleftofmodernKeynesiantheory?WasKeynesianisma“permanent”revolution,asG.K.Shawsays,oranunfortunateinterlude,asLeland Yeagercallsit,atemporary“diversion”fromtheneoclassicalmodel? Keynesandhisdisciplesstillholdfasttoacentralbeliefthatthesystem ofAdamSmithisinherentlyprecarious,especiallyunderalaissez-faire globalfinancialsystem,andrequiresgovernmentintervention(expansionaryfiscalandmonetarypolicy)tomaintainahighlevelof“aggregate effectivedemand”andfullemployment.PaulKrugman(2006)identifies fourKeynesianideasthatpermeatetoday’seconomics: 1. Economies often suffer from a lack of aggregate demand, whichleadstoinvoluntaryunemployment. 2. Themarketresponsetoshortfallsindemandoperatesslowly andpainfully. 3. Governmentpoliciescanmakeupforthisshortfallindemand, reducingunemployment. 4. Monetarypolicymaynotalwaysbesufficienttostimulate privatesectorspending;governmentspendingmustattimes stepintothebreach. Keynesianismstillpermeatesoureconomicwayofthinking,such aswhenthemediawarnsthatfallingconsumerconfidenceposesa 190 THE BIG THREE IN ECONOMICS threattotheeconomy,orwhenpoliticianspromisethattheirtaxcuts willcreatejobsbyputtingspendingmoneyinpeople’spockets,or whentheywarnconsumersthatsavingtheirtaxcutwon’tstimulate theeconomy. Inourfinalchapter,weseehowpromarketeconomistshaveraised seriousobjectionstoKeynesianism,bothonatheoreticalandempirical level.Asaresult,theeconomicsprofessionhaswitnessedagradual returntoa“neoclassical”position.Butclearly,afterKeynes,thehouse ofAdamSmithwillneverbethesame. 7 Conclusion HasAdamSmithTriumphedOver MarxandKeynes? IntheaftermathoftheKeynesianrevolution,toomany economistsforgotthatclassicaleconomicsprovidestheright answerstomanyfundamentalquestions. —N.GregoryMankiw(1994) Tojudgefromtheclimateofopinion,wehave wonthewarofideas.Everyone—leftorright—talks aboutthevirtuesofmarkets,privateproperty, competition,andlimitedgovernment. —MiltonFriedman(1998) Attheendofthetwentiethcentury,theeditorsofTimemagazine gatheredaroundtochoosetheEconomistoftheCentury.Theychose JohnMaynardKeynes,whomorethananyothereconomistprovided thetheoreticalunderpinningofanactiveroleforanenlargedwelfare state during the post–Great Depression era.And yet Keynes left economics in a state of disequilibriumwhenhediedafterWorld WarII.Hisdiscipleshadclearlytakentheprofessiontoofaraway fromtheclassicaltradition.DuringtheheydayofKeynesianism, whichlastedintothelate1960s,toomanyeconomistswerefearful that thrifty consumers might damage the economy, that progressivetaxationandfederaldeficitscoulddonoharm,thatmonetary policydidn’tmatter,andthatcentrallyplannedeconomiessuchas theSovietUnioncouldgrowfasterthanthefreeWest.Thespirit ofKeynes,andevenMarx,dominatedthepoliticalandintellectual atmosphere. 191 192 THE BIG THREE IN ECONOMICS MiltonFriedmanLeadsaMonetaryCounterrevolution However,bytheearly1960s,acounterrevolutionhadbegunthatwent alongwaytowardrestoringthevirtuesoffreemarketsandclassical economics.TheprimaryforcebehindthisrevoltagainstKeynesianismwastheChicagoschoolofeconomics,ledbyMiltonFriedman (1912–2006).Hisfierce,combativestyleandideologicalrootswere ideallysuitedforthetaskoftakingontheKeynesians.Moreover,he hadimpeccablecredentialsintechnicaleconomicstocommandrespect from the profession. Friedman earnedhisPh.D.ineconomicsfrom ColumbiaUniversity;hewonthehighlyprestigiousJohnBatesClark MedaltwoyearsafterPaulSamuelsonwonit;andhetaughteconomicsatoneofthepremierinstitutionsinthecountry,theUniversityof Chicago.In1967,hewaselectedpresidentoftheAmericanEconomic Association.Hisfocusonmonetarypolicyandthequantitytheoryof moneywasparticularlyattractiveinanageofinflation.In1976,on the200thanniversaryofboththeDeclarationofIndependenceandthe publicationofTheWealthofNations,itwasfittingthatFriedmanwon theNobelPrize.AdamSmithwashismentor.“Theinvisiblehandhas beenmorepotentforprogressthanthevisiblehandforretrogression,” he wrote in his best-seller, Capitalism and Freedom (1982 [1962], 200).ItisworthnotingthatTimemagazinecameveryclosetonaming FriedmantheEconomistoftheCenturybecauseofhisuniqueability to“articulatetheimportanceoffreemarketsandthedangersofundue governmentintervention”(Pearlstine1998,73). ExceptforFriedman,thefree-marketresponsetoKeynesiantheory wasalmostcompletelyineffectual.LudwigvonMises,thedeanofthe Austrianschool,wrotelittleaboutKeynes;hismagnumopus,Human Action(1966),makesonlyahandfulofreferences.FriedrichHayek,the leadinganti-Keynesianinthe1930s,madethestrategicerrorofignoringTheGeneralTheorywhenitcameoutin1936,adecisionhelater regretted.DuringWorldWarII,Hayeklostinterestineconomicsand wentontowriteaboutpoliticalphilosophyinworkssuchasTheRoad toSerfdom(1944)andTheConstitutionofLiberty(1960).Otherfreemarketeconomists,suchasHenryHazlittandMurrayRothbard,wrote largelyfromoutsidetheprofessionandhadmarginalinfluence. HowdidFriedmanalmostsingle-handedlychangetheintellectual climatebackfromtheKeynesianmodeltotheneoclassicalmodelof HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 193 AdamSmith?Afteracquiringacademiccredentials,hefocusedon scholarlytechnicalwork,particularlyempiricalevidencetotestthe Keynesianmodel.HelearnedtheimportanceofsophisticatedquantitativeanalysisfromSimonKuznets,WesleyMitchell,andotherstars attheNationalBureauofEconomicResearch. Friedman started teaching at Chicago in 1946, where he stayed untilhisofficialretirementin1977.FollowingFrankKnight’sretirementin1955,FriedmancontinuedtheChicagotraditionandeven strengtheneditwithanupgradedversionofIrvingFisher’squantity theoryofmoney,whichheappliedtomonetarypolicy.Hewroteon numeroustopicsrelatedtomonetaryeconomics,culminatinginthe researchandwritingofhismostfamousempiricalstudy,AMonetary HistoryoftheUnitedStates,1867–1960,whichwaspublishedbythe prestigious National Bureau of Economic Research and Princeton University,andcoauthoredbyAnnaJ.Schwartz(1963). Essentially, his monumental study thoroughly contradicted the Keynesianviewthatmonetarypolicywasineffective.Accordingto Friedman,itwasquitetheopposite.Hismagnumopusdemonstrated theunrelentingpowerofmoneyandmonetarypolicyintheupsand downsoftheU.S.economy,includingtheGreatDepressionandthe postwarera.EvenYale’sJamesTobin,afriendlycritic,recognized itsgreatness:“Thisisoneofthoserarebooksthatleavestheirmark onallfutureresearchonthesubject”(1965,485). FriedmanhadatwofoldmissioninresearchingandwritingMonetary History.First,hewantedtodispeltheprevailingKeynesiannotionthat “moneydoesn’tmatter,”thatsomehowanaggressiveexpansionofthe moneysupplyduringarecessionordepressioncannotbeeffective,like “pushingonastring.”FriedmanandSchwartzshowedtimeandtime againthatmonetarypolicywasindeedeffectiveinbothexpansions andcontractions.Friedman’sworkonmonetaryeconomicsbecame increasinglyimportantandapplicableasinflationheadedupwardin the1960sand1970s.Hismostfamouslineis“Inflationisalwaysand everywhereamonetaryphenomenon”(Friedman1968,105). FriedmanDiscoverstheRealCauseoftheGreatDepression Thatmoneymatteredwasanimportantproof,buttheresearchby Friedman and Schwartz revealed a deeper purpose. One startling 194 THE BIG THREE IN ECONOMICS sentenceintheentire860-pagebookchangedforeverhoweconomists andhistorianswouldviewthecauseofthemostcataclysmiceconomic eventofthe20thcentury:“FromthecyclicalpeakinAugust1929to thecyclicaltroughinMarch1933,thestockofmoneyfellbyovera third”(FriedmanandSchwartz1963,299). Forthirtyyears,anentiregenerationofeconomistsdidnotreally know the extent of the damage the Federal Reserve had inflicted ontheU.S.economyfrom1929to1933.Theyhadbeenunderthe impression that the Fed had done everything humanly possible to keepthedepressionfromworsening,butlike“pushingonastring,” wereimpotentinthefaceofoverwhelmingdeflationaryforces.According to the official apologia of the Federal Reserve System, it haddoneitsbest,butwaspowerlesstostopthecollapse.Friedman radicallyalteredthisconventionalview.“TheGreatContraction,”as FriedmanandSchwartzcalledit,“isinfactatragictestimonialto theimportanceofmonetaryforces”(FriedmanandSchwartz1963, 300).Thegovernmenthadacted“ineptly,”turningagarden-variety recessionintotheworstdepressionofthecenturybyraisinginterest ratesandfailingtocounterdeflationaryforcesandbankcollapses. Onanotheroccasion,Friedmanexplained,“Farfrombeingtestimony totheirrelevanceofmonetaryfactorsinpreventingdepression,the early1930sareatragictestimonytotheirimportanceinproducinga depression”(1968,78–79). Oneofthereasonsforthisignoranceaboutmonetarypolicyis thatthegovernmentdidnotpublishaggregatemoneysupplyfigures until Friedman and Schwartz developed the statistical concepts of M1 and M2 in their book (1963). Friedman commented, “If theFederalReserveSystemin1929to1933hadbeenpublishing statisticsonthequantityofmoney,Idon’tbelievethattheGreat Depressioncouldhavetakenthecoursethatitdid”(Friedmanand Heller1969,80).SeeFigure7.1forthemoneysupplyfiguresduringthe1929–32crash. DidtheGoldStandardCausetheGreatDepression? KeynesianshaveblamedtheinternationalgoldstandardforprecipitatingtheGreatDepression.“Farfrombeingsynonymouswithstability, thegoldstandarditselfwastheprincipalthreattofinancialstabilityand HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 195 Figure7.1 TheDramaticDeclineintheMoneyStock,1929–33 THEGREATCONTRACTION TheStockofMoneyandItsProximateDeterminants,Monthly, 1929–March1933 BillionsofDollars 50 BillionsofDollars 45 40 Moneystock 35 30 9 High-PoweredMoney 8 RatioScales 7 6 Source:FriedmanandSchwartz1963:333.ReprintedbypermissionofPrinceton UniversityPress. economicprosperitybetweenthewars,”contendsBarryEichengreen (1992,4).Criticsofthegoldstandardhavepointedoutthatinacrucial time,1931–32,theFederalReserveraisedthediscountrateforfear ofarunonitsgolddeposits.IfonlytheUnitedStateshadnotbeen shackledbyagoldstandard,theyargued,theFederalReservecould haveavoidedtherecklesscreditsqueezethatpushedthecountryinto depressionandabankingcrisis. ButFriedmanandSchwartzdisputethiswidelyheldbelief.They pointoutthattheU.S.goldstocksroseduringthefirsttwoyearsof thecontraction,buttheFedonceagainactedineptly.“Wedidnot permittheinflowofgoldtoexpandtheU.S.moneystock.Wenot only sterilized it, we went much further. Our money stock moved perversely,goingdownasthegoldstockwentup”(Friedmanand Schwartz1963,360–61).TheU.S.goldstockreachedanall-timehigh inthelate1930s.Inshort,evenunderthedefectivegoldexchange standard,theremayhavebeenroomtoavoidadevastatingworldwide depressionandmonetarycrisis. 196 THE BIG THREE IN ECONOMICS IsFree-MarketCapitalismUnstable? Onamorephilosophicalscale,Friedman’smonetaryresearchcounteredacoreassumptionbehindKeynesianeconomics—thatfree-enterprisecapitalismwasinherentlyunstableandcouldbestuckatless thanfullemploymentindefinitelyunlessthegovernmentintervened toincrease“effectivedemand”andrestoreitsvitality.AsJamesTobin putit,the“invisible”handofAdamSmithrequiredthe“visible”hand ofKeynes(BreitandSpencer1986,118).Friedmanconcludeddifferently:“ThefactisthattheGreatDepression,likemostotherperiods ofsevereunemployment,wasproducedbygovernmentmismanagement rather than any inherent instability of the private economy” (1982[1962],38).Furthermore,hewrote:“Farfromthedepression beingafailureofthefree-enterprisesystem,itwasatragicfailure ofgovernment”(1998,233).Fromthistimeforward,thankstothe profoundworkofFriedmanandSchwartz,mosttextbooksgradually replaced“marketfailure”with“governmentfailure”intheirsections ontheGreatDepression. Friedmancametotheconclusionthatoncethemonetarysystem isstabilized,andpricesandwagesremainflexible,AdamSmith’s system of natural liberty could flourish. In contrast to Keynes, Friedmanfaithfullymaintainedthattheneoclassicalmodelrepresentsthe“general”theoryandonlyamonetarydisturbancebythe government’s central bank can derail a free-market economy. In short,accordingtoFriedman,thebusinesscycleisgovernment-,not market-,induced,andmonetarystabilityisanessentialprerequisite foreconomicstability. TheQuantityTheoryofMoney:Friedmanvs.Keynes FriedmanalsotookissuewithKeynesandhisdisciplesoverthe quantitytheoryofmoney.RecallFisher’sequationofexchange, MV=PT, whereM=thequantityofmoney,V=velocityofcirculation,P=price level,andT=transactions,orrealoutputofgoodsandservices. KeynesarguedinTheGeneralTheorythatmonetarypolicywas HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 197 largelyimpotentbecauseifyouincreasedM,Vwoulddecline,since thenewfundswouldsimplygointobankreservesandnotbeloaned out.Hence,monetarypolicywouldbeincapableofstimulatingthe economy.However,FriedmandiscoveredinhisempiricalworkthatV alwaysmovedinthesamedirectionasM.WhenMincreased,sodid V,andviceversa.AnincreaseinMcouldgeneratearecovery.Friedmanconcludedthateventhough“Keynes’stheoryistherightkindof theoryinitssimplicity....IhavebeenledtorejectitbecauseIbelieve ithasbeencontradictedbyexperience”(Friedman1986,48). FriedmanRaisesDoubtsAbouttheMultiplier TheChicagoeconomistbeganhisattackonKeynesianisminhis1962 bookCapitalismandFreedom,wherehequestionedtheeffectiveness andstabilityofKeynesiancountercyclicalfinance.Hedebunkedthe conceptofthemultiplier,callingit“spurious.”“ThesimpleKeynesian analysisimplicitlyassumesthatborrowingthemoneydoesnothave anyeffectonotherspending”(Friedman1982[1962],82).Inflation andcrowdingoutofprivateinvestmentaretwopossibleoutcomesof Keynesiandeficitspending.Subsequentstudieshavedemonstrated thatthespendingmultiplierhashistoricallyneverreachedtheheights of5–7astheKeynesiansoriginallyestimated,whilethemoneymultiplierhasproventobeconsistentlyhigher. Regardingtheroleoffiscalpolicy,Friedmannotedthatthefederal budgetisthe“mostunstablecomponentofnationalincomeinthe postwar period.” The Keynesian balance wheel is usually “unbalanced,”andithas“continuouslyfosteredanexpansionintherange ofgovernmentactivitiesatthefederallevelandpreventedareduction intheburdenoffederaltaxes”(1982[1962],76–77). FriedmanTakesOnthePhillipsCurve InhisAmericanEconomicsAssociation(AEA)presidentialaddress,publishedin1968,Friedmanintroducedthe“naturalrateofunemployment” concepttocounterthePhillipscurve.Asnotedinchapter6,Keynesians quicklyincorporatedthePhilipscurvetojustifyaliberalfiscalpolicy; tothem,inflationcouldbetoleratedifitmeantlowerunemployment.A “littleinflation”coulddonoharmandconsiderablegood. 198 THE BIG THREE IN ECONOMICS Friedman objected, arguing that “there is always a temporary trade-offbetweeninflationandunemployment;thereisnopermanent trade-off.”Accordingly,anyefforttopushunemploymentbelowthe “naturalrateofunemployment”mustleadtoanacceleratinginflation.Moreover,“theonlywayinwhichyouevergetareductionin unemploymentisthroughunanticipatedinflation,”whichisunlikely. Friedmanconcludedthatanyaccelerationofinflationwouldeventuallybringabouthigher,notlower,unemployment.Thus,effortsto reduceunemploymentbyexpansionarygovernmentpoliciescould onlybackfireinthelongrunasthepublicanticipateditseffect(Friedman1969,95–110).Inthelate1960s,Friedmanevenpredictedthat unemploymentandinflationcouldrisetogether,aphenomenonknown asstagflation. Bythelate1970s,Friedmanwasprovenright.ThePhillipscurve becameunrecognizableasinflationandunemploymentstartedrising together,oppositetowhathadhappenedinBritaininthe1950s.Ina famousstatement,BritishprimeministerJamesCallaghanconfessed in1977,“Weusedtothinkyoucouldspendyourwayoutofarecession....Itellyou,inallcandor,thatthatoptionnolongerexists; andthatinsofarasiteverdidexist,itonlyworkedbyinjectingbiggerdosesofinflationintotheeconomyfollowedbyhigherlevelsof unemploymentatthenextstep.Thisisthehistoryofthepasttwenty years”(Skousen1992,12).InhisNobellecture,Friedmanwarnedthat thePhillipscurvehadbecomepositivelyinclined,withunemployment andinflationrisingsimultaneously. OutofthisPhillipscurvecontroversyroseawholenew“rational expectations”school,ledbyRobertLucas,Jr.,whowontheNobel Prize in 1995. Rational expectations undermine the theory that policymakerscanfoolthepublicintofalseexpectationsaboutinflation.Accordingly,governmentpoliciesarefrequentlyineffectivein achievingtheirgoals. RulesVersusAuthority OneprincipleFriedmanlearnedfromHenrySimons,amonetarist mentoratChicago,wasthatstrictmonetaryrulesarepreferableto discretionarydecisionmakingbygovernmentauthorities.“Anysystem whichgivessomuchpowerandsomuchdiscretiontoafewmenthat HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 199 [their]mistakes—excusableornot—canhavesuchfar-reachingeffectsisabadsystem,”hewrote(Friedman1982[1962],50).Among manychoices,includingthegoldstandard,Friedmanhasfavoreda “monetaryrule”wherebythemoneysupply(usuallyM2)isincreased atasteadyrateequaltothelong-termgrowthrateoftheeconomy. OneoftheproblemswithFriedman’smonetaryruleishowtodefine themoneysupply.IsitM1,M2,M3,orwhat?Itishardtomeasure inanageofmoneymarketfunds,short-termCDs,overnightloans, andEurodollars.Notwithstandingtheoreticalsupportforamonetary rule, central bankers have largely focused on “inflation targeting,” thatis,pricestabilizationandinterestratemanipulation,asapreferablemethod. TheShadowofMarxandtheCreativeDestruction ofSocialism The Herculean efforts of Milton Friedman, Friedrich Hayek, and other libertarian economists were nottheonlyreasonneoclassical economics has made a stupendous comeback.The other reason is thecollapseofMarxist-inspiredSovietcommunismandthesocialist centralplanningmodelintheearly1990s.Sincethen,globalization hasopenedthefloodgatestofreereconomicpolicies,especiallywithin developingcountries.Nationsthatfordecadesengagedinsystematic policies of nationalization, protectionism, import substitution, foreignexchangecontrols,andcorporatecronyismhaveopenedtheir borders to foreign investment, denationalization and privatization, deregulation,andothermarketpolicies.EventheWorldBank,once a severe critic of the capitalist model, has shifted dramatically in favorofmarketsolutionstounderdevelopmentproblems(withsome importantexceptions).TheradicalmodelofMarxandthesocialists wasclearlylosingground. Butitwasn’talwaysthatway.Infact,duringmostofthetwentieth century,heavy-handedcentralplanningwasconsideredmoreefficient andmoreproductivethanlaissez-fairecapitalism.Atthedepthsof theGreatDepression,radicalthinkingdominatedtheatmospherein intellectualandpoliticalcircles.Suspiciousoffree-marketcapitalism, manywereattractedtocentralplanningandtheSovietmodel. LudwigvonMisesandFriedrichHayekwereintheminorityin 200 THE BIG THREE IN ECONOMICS questioningthecollectivistzeitgeistandofferingacritiqueofsocialism onpurelyeconomicgrounds.HayekpublishedMises’s1920article, “EconomicCalculationintheSocialistCommonwealth,”andother essaysinavolumeentitledCollectivistEconomicPlanning(Hayek 1935).Inthesearticles,MisesandHayek,amongothers,contended thatcompetitivepricesprovidedcriticalinformationnecessaryfora well-run,coordinatedeconomybetweenproducersandconsumers. Vitalinformationisinherentlylocalinnature,Hayeknoted,andif channeledthroughadistantcentralplanningboard,actionsdetermined bythestatewoulddistortthesignalsnecessarytorunaneconomy efficiently.Foracentralauthorityto“assumealltheknowledge...is ...todisregardeverythingthatisimportantandsignificantinthereal world”(Hayek1984,223).Insum,decisionmakingmustbedecentralized,andprofitincentivesandpropertyrightsmustbeestablished. But Mises’s and Hayek’s arguments were largely ignored as a result of counterarguments and historical trends. In the 1930s and 1940s,NaziGermanyandtheSovietUnionwereheraldedasapparent economicsuccessstories.JournalistsreturnedfromtoursofRussia exclaiming“Ihavebeentothefuture,anditworks”(Malia1999, 340).In1936,SidneyandBeatriceWebbcamebackwithglowing reportsofa“newcivilization”andthe“re-makingofman,”avibrant nationwithfullemployment,goodworkingconditions,freeeducation,freemedicalservices,childcareandmaternitybenefits,andthe widespreadavailabilityofmuseums,theaters,andconcerthalls.Oskar Lange,aPolishsocialist,andFredM.Taylor,presidentoftheAEA, contendedthatcentralplanningboardscouldimitatethemarket’ssuccess.AustrianeconomistandHarvardprofessorJosephSchumpeter chidedMisesandHayekbyconcluding,“Cansocialismwork?Of courseitcan,”addingevenmoredamagingly,“Thecapitalistorder tendstodestroyitselfandcentralistsocialismis...alikelyheirapparent”(Schumpeter1950[1942],167). ForeignAidandDevelopmentEconomics AfterWorldWarII,EuropeanandLatinAmericancountriesbegan experimentingwithsocialismonagiganticscale,nationalizingindustry after industry, raising taxes, imposing wage–price controls, inflatingthemoneysupply,creatingnationalwelfareprograms,and HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 201 engaginginallkindsofcollectivistmischief. ThepostwarMarshallPlandemonstratedtheefficacyofgovernment aid,andthenewKeynesianapproachtodevelopmentofThirdWorld countries became state-driven growth. International development organizations,suchastheWorldBankandtheAllianceforProgress, wereestablishedtoassistdevelopingnationssufferingfromdisease, famine, low literacy rates, high unemployment, rapid population growth,andagriculture-basedeconomies.MIT’sW.W.Rostowwrote his “noncommunist manifesto,” The Stages of Economic Growth (1960),which,alongwiththeHarrod-Domarmodel,promotedthe centralizednation-stateandhighlevelsofgovernment-drivencapital formationviaforeignaidandgovernmentinvestmentasthekeyto sustainedgrowth. EconomistswereconvincedbydatafromtheCentralIntelligence Agency (CIA) that Soviet-style socialist planning had produced highlevelsofeconomicgrowth,evenexceedingthatexperiencedby marketeconomiesintheWest.PaulSamuelsonwasonewhobecame convincedofSovieteconomicsuperiority.Bythefiftheditionofhis Economicstextbook,Samuelsonbeganincludingagraphindicating thatthegapbetweentheUnitedStatesandtheUSSRwasnarrowing andpossiblyevendisappearing(1961,830).Inthetwelfthedition, thegraphwasreplacedwithatabledeclaringthat,between1928and 1983,theSovietUnionhadgrownataremarkable4.9percentannual growthrate,higherthanthatoftheUnitedStates,theUnitedKingdom, orevenGermanyandJapan(SamuelsonandNordhaus1985,776). Ironically,rightbeforetheBerlinWallwastorndown,Samuelsonand Nordhausconfidentlydeclared,“TheSovieteconomyisproofthat, contrarytowhatmanyskepticshadearlierbelieved[areferenceto MisesandHayek],asocialistcommandeconomycanfunctionand eventhrive”(1989,837). Even conservativeYale economist Henry C. Wallich, a former member of the Federal Reserve Board, was so convinced by CIA statisticsthathewroteawholebookarguingthatfreedomleadsto lowereconomicgrowth,greaterinequality,andlesscompetition.In TheCostofFreedom,heconcluded,“Theultimatevalueofafree economyisnotproduction,butfreedom,andfreedomcomesnotas aprofit,butatacost”(Wallich1960,146). OneardentcriticoftheKeynesiandevelopmentmodelwasP.T. 202 THE BIG THREE IN ECONOMICS BaueroftheLondonSchoolofEconomics.Inthepostwarperiod, Bauerwagedalonelybattleagainstforeignaid,comprehensivecentral planning,andnationalization.AccordingtoBauer,stateplanningwas neitherbenevolentnorsustainable,butwouldleadtoaconcentration ofpowerinthehandsofapoliticalelitethatwouldinevitablycreate acorruptandabusivesystem.Inoneofhisclassicessays,hewrote abouthowthetinycolonyofHongKongprospereddespitenocentral planning,itslackofnaturalresources,includingwater,anddespite beingthemostdenselypopulatedplaceintheworld(Bauer1981, 185–90).ButBauer’sviewswerelargelyignoreduntilthe1980s. “Miseswasright!” The collapse of the Soviet Union and Eastern-bloc communism virtuallyendedthecentury-olddebateovercomparativeeconomic systemsandchangedthemindsofmanyeconomistsaboutthevirtues ofsocialism.AprominentexampleisRobertHeilbroner,asocialist whotoyedwithMarxisminhisearlyyears.HewouldlaterwriteThe WorldlyPhilosophers(1999[1953]),apopularhistoryofeconomics. UndertheinfluenceofSchumpeterandAdolphLowe,amongothers, HeilbronerjoinedtherestoftheprofessionandconcludedthatMises waswrongandsocialismcouldwork.Hemaintainedthatposition fordecades. Inthelate1980s,shortlybeforethecollapseoftheBerlinWall, Heilbronerbegantoreconsiderhisviews.Inastunningarticleinthe NewYorkerentitled“TheTriumphofCapitalism,”Heilbronerwrote thatthelongstandingdebatebetweencapitalismandsocialismwas overandcapitalismhadwon.Hewentontosay,“TheSovietUnion, China,andEasternEuropehavegivenustheclearestpossibleproof thatcapitalismorganizesthematerialaffairsofhumankindmoresatisfactorilythansocialism:thathoweverinequitablyorirresponsiblythe marketplacemaydistributegoods,itdoessobetterthanthequeuesof theplannedeconomy;howevermindlessthecultureofcommercialism,itismoreattractivethanstatemoralism;andhoweverdeceptive theideologyofabusinesscivilization,itismorebelievablethanthat ofasocialistone”(Heilbroner1989,98). Inafollow-uparticleafterthedemiseoftheEasternbloc,Heilbronerwasevenmoreexplicit:“Socialismhasbeenagreattragedy HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 203 thiscentury....Thereisnodoubtthatthecollapsemarksitsend asamodelofeconomicclarity.”Furthermore,thedebatebetween thesocialistsandMiseshadtobereexaminedinlightofcontemporaryevents.“Itturnsout,ofcourse,thatMiseswasright,”declared Heilbroner(1990,91–92). NewEmpiricalWorkConfirmsMises’sThesis ThefalloftheSovietUnionbroughtaboutamajorrevisionofeconomichistoryundercommunism.Basedonresearchcomingoutof the previously secret KGB files in Moscow, historians confirmed negativeviewsaboutsocialcentralplanningthatMises,Hayek,and Bauerelucidated.InherworkaboutSovietRussiainthe1930sentitled EverydayStalinism,SheilaFitzpatrickcounteredtheoldconventional viewheldbySidneyandBeatriceWebbandGeorgeBernardShawthat theSovietsystemduringthe1930swasaglorious“newcivilization.” Onthecontrary,Fitzpatrickwrote,“Withtheabolitionofthemarket, shortagesoffood,clothing,andallkindsofconsumergoodsbecame endemic.Aspeasantsfledthecollectivevillages,majorcitieswere sooninthegripofanacutehousingcrisis,withfamiliesjammedfor decadesintinysingleroomsincommunalapartments....Itwasa worldofprivation,overcrowding,endlessqueues,andbrokenfamilies, inwhichtheregime’spromisesoffuturesocialistabundancerang hollow....Governmentbureaucracyoftenturnedeverydaylifeinto anightmare”(Fitzpatrick1999,dustjacket). NationsGrowFasterUnderEconomicFreedom Inaddition,recentstudiescomparingtheeconomicgrowthofnations andtheirdegreeoffreedomhaveconfirmedMises’sthesis.According totheworkofJamesGwartneyandRobertLawson,countrieswith thegreatestlevelofeconomiclibertyenjoythehigheststandardof living(seeFigure1.2inchapter1). Andsoendsacriticalchapterinthehistoryofeconomics.Mises, longdead,wasfinallyvindicated.ThewordsofthephysicistMax Planckapplyhere:“Scienceprogressesfuneralbyfuneral.” As we begin the twenty-first century, the winds of change are everywhere.AsFrancisFukuyamadeclaredinTimemagazine,“If 204 THE BIG THREE IN ECONOMICS socialismsignifiesapoliticalandeconomicsysteminwhichthegovernmentcontrolsalargepartoftheeconomyandredistributeswealth toproducesocialequality,thenIthinkitissafetosaythelikelihood ofitsmakingacomebackanytimeinthenextgenerationiscloseto zero”(2000,111). TheWindsofChangeinDevelopmentEconomics With the downfall of Eastern-bloc communism, the paramount questionbecamehowtodismantlethesocialiststateandreestablish capitalismandtheculturethatgoeswithit.Thewatchwordsbecame denationalization,privatization,deregulation,andflattaxrates.Developingcountries,whichinthepasthaddependedonforeignaid andgovernmentprogramstostimulatetheeconomy,nowopenedup theireconomiestotradeandforeigninvestment. SincethecollapseoftheSovietcentralplanningmodel,Rostow’s thesishasbeenlargelydiscreditedandBauer’slessorthodoxviews havetriumphed.EvenRostowadmitted,“Thereare,evidently,seriousandcorrectinsightsintheBauerposition”(Rostow1990,386). Recently,theWorldBankhasmovedtowardBauer’sside.Ina1993 studyoftheFourTigersandtheEastAsianeconomicmiracle,itconcludes,“Therapidgrowthineachcountrywasprimarilyduetothe applicationofasetofcommon,market-friendlyeconomicpolicies, leadingtobothhigheraccumulationandbetterallocationofresources” (WorldBank1993,vi). Perhapsthebestexampleofchangeindevelopmenteconomicsis reflectedintheworkofMuhammadYunus,presidentoftheGrameen BankinBangladeshandfounderofthemicro-creditrevolution.In hisbook,BankertothePoor,Yunustellshowhegrewupunderthe influenceofMarxisteconomics.ButafterearningaPh.D.ineconomicsatVanderbiltUniversity,hesawfirsthand“howthemarket[inthe UnitedStates]liberatestheindividual....Idobelieveinthepowerof theglobalfree-marketeconomyandinusingcapitalisttools.....Ialso believethatprovidingunemploymentbenefitsisnotthebestwayto addresspoverty.”HestronglyopposesforeignaidfromtheWorldBank andtheInternationalMonetaryFund.Believingthat“allhumanbeings arepotentialentrepreneurs,”Yunusisconvincedthatpovertycanbe eradicatedbyloaningpoorpeoplethecapitaltheyneedtoengagein HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 205 profitablebusinesses,notbygivingthemagovernmenthandoutor engaginginpopulationcontrol(Yunus1999,203–07). In2006,YunuswontheNobelPeacePrize.ButhisformerMarxist colleaguescallitacapitalistconspiracy.“Whatyouarereallydoing,”a communistprofessortoldYunus,“isgivinglittlebitsofopiumtothepoor people....Theirrevolutionaryzealcoolsdown.Therefore,Grameenis theenemyofthe[communist]revolution”(Yunus1999,204). NeoclassicalEconomicsToday Wheredoeseconomicthinkingstandtoday?Wehaveseenthroughout thishistoryoftheBigThreethateacheconomisthasattimesstood tallerthantheothertwo.Duringtimesofstrongeconomicperformance,AdamSmithhasbeenontop;duringcrisesanddepression, KeynesandMarxhavestoodout.SincetheendofWorldWarII,we have seen a gradual advance in esteem for the founder of modern economics,AdamSmith,andthisdespiteoccasionalmonetarycrises, recessions,naturaldisasters,terroristattacks,andcomplaintsabout inequality,tradedeficits,andwastefulgovernmentprograms. A growing number of economists recognize that the neoclassical model is the keystone of economic analysis. In microeconomics,thismeansincorporatingtheprinciplesofsupplyanddemand, andprofitandloss,which,underbroad-basedcompetition,leadsto an efficient allocation of resources, economic growth, and a selfregulatingeconomy.Undercompetitionandareasonablesystemof justice,man’snaturaltendencytowardself-assertionleadstosocial well-being.AsAdamSmithwroteover200yearsago,“Littleelseis requiredtocarryastatetothehighestdegreeofopulencefromthe lowestbarbarism,butpeace,easytaxes,andatolerableadministration ofjustice”(Danhert1974,218). Inmacroeconomics,itmeansteachingtheclassicalmodelofthrift, astablemonetarypolicy,fiscalresponsibility,freetrade,widespread economicandpoliticalfreedom,andaconsistentruleoflawforthe justicesystem.AsJamesGwartneynotes,“Itturnsoutthatthelegal system—theruleoflaw,securityofpropertyrights,anindependent judiciary,andanimpartialcourtsystem—isthemostimportantfunctionofgovernment,andthecentralelementofbotheconomicfreedom andcivilsociety,andisfarmorestatisticallysignificantthantheother 206 THE BIG THREE IN ECONOMICS variables,”includingsizeofgovernment,monetarysystem,trade,and regulation(Skousen2005,32).GwartneyandcoauthorLawsonpoint toanumberofcountriesthatlackadecentlegalsystemandasaresultsufferfromcorruption,insecurepropertyrights,poorlyenforced contracts,andinconsistentregulatoryenvironments,particularlyin LatinAmerica,Africa,andtheMiddleEast.“Theenormousbenefits ofthemarketnetwork—gainsfromtrade,specialization,expansion ofthemarket,andmassproductiontechniques—cannotbeachieved withoutasoundlegalsystem”(GwartneyandLawson2005,35).All thesebasicprincipleswereestablishedover200yearsagoinAdam Smith’sWealthofNations. ASurpriseCounterrevolutionatHarvard TheshiftbacktomarketprinciplesandtheclassicalmodelofAdam Smith is best illustrated by the recent work of Harvard’s Gregory Mankiw.Inhistextbook,Macroeconomics,writtenintheearly1990s, Mankiwsurprisedtheprofessionbybeginningwiththeclassicalmodel andendingwiththeshort-termKeynesianmodel,thereverseofthe standardSamuelsonpedagogy. RecallthatKeynesin1936attemptedtoreplacetheAdamSmithmodel withhisown“generaltheory”oftheeconomy.Theclassicalmodel,Keynes insisted,wasactuallya“specialcase”ofthegeneraltheory,andonlyappliedattimesoffullemployment.NowweseethatMankiw,whoconsidershimselfa“neo-Keynesian,”hasonceagainmadetheclassicalmodel ofSmiththerealgeneraltheoryandtheKeynesianmodelofaggregate supplyanddemandthe“special”case,relegatedtothebackofthebook. Itwasabrilliant,revolutionary—orrathercounterrevolutionary—move, areflectionofachangingfundamentalphilosophy. Dubbingtheclassicalmodel“therealeconomyinthelongrun,” Mankiwpinpointedtheeffectsofanincreaseingovernmentspending—thatratherthanactasamultiplier,it“crowdsout”privatecapital.“Theincreaseingovernmentpurchasesmustbemetbyanequal decreasein[private]investment....Governmentborrowingreduces nationalsaving”(Mankiw1994,62). Inprevioustextbooks,Samuelsonandhiscolleaguesemphasized thecyclicalnatureofcapitalismandhowtheeconomycouldbestabilizedthroughKeynesianpolicies.Incontrast,inMacroeconomics, HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 207 Mankiwdiscussedeconomicgrowthupfront,aheadofthechapters onthebusinesscycle.UsingtheSolowgrowthmodel,Mankiwtook astrongprosavingapproach.Accordingly,“thesavingrateisakey determinantofthesteadystatecapitalstockandhighlevelofoutput. Ifthesavingrateislow,theeconomywillhaveasmallcapitalstock andalowlevelofoutput”(1994,62).Whatistheeffectofhigher savings?“Anincreaseintherateofsavingraisesgrowthuntilthe economyreachesanewsteadystate.”Farfromacceptingtheparadoxofthrift,Mankiwwrotefavorablyaboutthosenationswithhigh ratesofsavingandinvestment,andevenincludesacasestudyonthe miraclesofJapaneseandGermanpostwargrowth(examplesvirtually ignoredinSamuelson’stextbook).Mankiwthereforesupportspoliciesaimedatincreasingtheratesofsavingandcapitalformationin theUnitedStates,includingthepossibilityofalteringSocialSecurity fromapay-as-you-gosystemtoafullyfundedplan,thoughhedid notdiscussoutrightprivatization(1994,103–34). Unemployment is another issue Mankiw approached in a nonKeynesianway.Whatcausesunemployment?RelyingonFriedman’s “natural”rateofunemployment,insuranceandsimilarlaborlegislationreduceincentivesfortheunemployedtofindwork.Heprovided evidencethatunionizedlaborandtheadoptionofminimum-wageand living-wagelawsactuallyincreasestheunemploymentrate.Finally, heofferedacasestudyonHenryFord’sfamous$5workdayasan exampleofhigherproductivityandincreasingwages. HeapprovinglyquotedMiltonFriedmanonmonetarypolicy:“Inflationisalwaysandeverywhereamonetaryphenomenon.”Mankiw usednumerousexamples,includinghyperinflationininterwarGermany,toconfirmthesocialcostsofinflation(1994,161–69). MankiwhasfollowedupwithanewPrinciplesofEconomicstextbook,publishedsince1997.Likehisintermediatetext,itisdevoted almostentirelytoclassicaleconomics,relegatingtheKeyensianmodel totheendchapters.Amazingly,Mankiw’stextbookdoesnotmention mostofthestandardKeynesiananalysis:noconsumptionfunction, noKeynesiancross,nopropensitytosave,noparadoxofthrift,and onlyabriefreferencetothemultiplier.Thus,wehaveaseachange ineconomics,andthiscomingfromCambridge,Massachusetts,the sameplacetheKeynesianrevolutionoriginatedinAmerica. 208 THE BIG THREE IN ECONOMICS Samuelson:FiscalPolicyDethroned! EvenPaulSamuelsonhasbeenforcedtochangehisfocusinrecent editionsofhistext,inpartbecauseoftheforceofhistory,inpartdue totheinfluenceofhiscoauthor,BillNordhaus.Samuelson’sfiftieth anniversaryedition(1998)istelling.Inadditiontothereplacement oftheparadoxofthriftwithaprosavingssectionandthestatement that “a large public debt is likely to reduce long-run economic growth” (Samuelson and Nordhaus 1998, 652), the biggest shock isSamuelson’sabandonmentoffiscalpolicy.Thissixteenthedition highlightsthisstatementincolor:“Fiscalpolicyisnolongeramajor toolofstabilizationintheUnitedStates.Overtheforeseeablefuture, stabilization policy will be primarily handled by Federal Reserve monetarypolicy”(1998,655). Inshort,MiltonFriedman,FriedrichHayek,andthefree-market proponentsmayhavelostthedebateearlyon,buttheyseemtohave wonthewar.“Thegrowingorientationtowardthemarket,”concluded Samuelson, “has accompanied widespread desire for smaller government,lessregulation,andlowertaxes”(1998,735).Samuelson expressed dismay at this outcome, ending his fiftieth anniversary editiononasournotebycallingthenewglobaleconomy“ruthless” andcharacterizedby“growing”inequalityanda“harsh”competitive environment.Butthedeed—thetriumphofthemarketandclassical economics—appears irreversible. Friedman and Hayek, representingthetwoschoolsoffree-marketeconomics(ChicagoandVienna) havecombinedforcesforaone-twopunchthathasreversedthetide ofideas(YerginandStanislaw1998,98). FromDismalSciencetoImperialScience:Maya ThousandFlowersBloom Spearheaded by economists from the University of Chicago, the reestablishmentofclassicalfree-marketeconomicsintheclassroom andthehallsofgovernmenthasresultedinasurprisingplethoraof applicationstosocialandeconomicproblems.KennethE.Boulding (1919–93), longtime professor at the University of Colorado and formerAEA president, always believed that economics should be eclecticandsharedwithotherdisciplines.Nowhisdreamisbeing HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 209 fulfilled.Likeaninvadingarmy,thescienceofAdamSmithisoverrunningthewholeofsocialscience—law,criminaljustice,finance, management,politics,history,sociology,environmentalism,religion, andevensports. Economics used to be the “dismal science,” a term of derision coinedbytheEnglishcriticThomasCarlyleinthe1850s.Butattitudes arequicklychanginginthetwenty-firstcenturybyapplyingitsmicro principlesofcompetition,incentives,andopportunitycosttosolve ahostofpublicandprivateproblems.Inshort,twenty-first-century economicsisthe“imperialscience”(Skousen2001,7–10). Herearejustafewexamplesoftheexpandingroleofeconomics inotherareas:GaryBeckerhasbeeninstrumentalinapplyingthe principlesofsupplyanddemandtothehumanbehavioralsciences inareassuchasracialdiscrimination,crime,andmarriage.Ronald Coase,RichardPosner,andRichardEpsteinhavecontributedtothe developmentoflawandeconomics. HarryMarkowitz,MertonMiller,WilliamSharpe,BurtonMalkiel, andFischerBlack,amongothers,havecreatedthefieldoffinancial economics,especiallytheapplicationofefficiencymarketstoWall Street.RobertFogelandDouglassC.Northhaveappliedstatistical analysis(knownas“cliometrics”)toavarietyofhistoricaleventsand trends.RobertMundell,ArtLaffer,andPaulCraigRobertshaveadvancedthe“supplyside”impactofeconomicsontheissuesoftaxes, regulation,andtrade,andhavebeenamajorforceinthemovement towardlowflattaxesinsteadofprogressivetaxes. Market-orientedeconomistshavealsoappliedtheirtoolstopublic financeissues.Duringthe1950sand1960s,thefieldwasdominated byKeynesians,ledbyRichardMusgravewithhistextbook,Public FinanceinTheoryandPractice(1958).Musgravesawtheneedfora three-prongedgovernmentpolicy:(1)allocation—toprovidepublic goodsthattheprivatesectorcouldnot;(2)distribution—toredistribute wealthandinstitutesocialjustice;and(3)stabilization—tosteadyan inherentlyvacillatingcapitalisteconomy. MusgravedebatedJamesBuchanan,aprofessoratGeorgeMason Universityandoneofthefoundersofthepublic-choiceschool.In their1998publisheddebate,Musgravedefendedsocialinsurance,progressivetaxation,andthegrowthofthepublicsectorasthe“pricewe payforcivilization”(BuchananandMusgrave1999,75).Addressing 210 THE BIG THREE IN ECONOMICS today’sworriesaboutanoverbloatedgovernment,Musgravewrote, “Isthestateofourcivilizationreallythatbad?...Thereismuchthat shouldgoonthecreditsideoftheledger.Thetamingofunbridled capitalismandtheinjectionofsocialresponsibilitythatbeganwith theNewDeal.....Socializingthecapitalistsystem...wasneeded foritsownsurvivalandforbuildingagoodsociety”(1999,228).He alsomentionedthe“enormousgains”byblacksandwomeninthe twentiethcentury. Buchanan, on the other hand, blamed democratic politics for a “bloated”publicsector,“withgovernmentsfacedwithopen-ended entitlementclaims,”resultingin“moraldepravity”(Buchanan1999, 222).Hearguedinfavorofconstraininggovernmentthroughconstitutionalrulesandlimitations.Hesuccinctlydescribedthedifference betweenthetwo:“Musgravetrustspoliticians;we[Buchanan]distrust politicians”(BuchananandMusgrave1999,88). Who won the debate? Musgrave’s views are still prevalent in Keynesiantextbooks,buthisbooksareseldomcitedandlongout ofprint.Ontheotherhand,JamesBuchananwonaNobelPrizein 1986andpublic-choicetheoryhasbeenaddedtomostcurricula.Even Samuelson cites the public-choice work of Buchanan and Gordon Tullockinhislatesttextbook. Accordingtopublic-choicetheory,theincentivesanddiscipline foundinthemarketplacearefrequentlymissingfromgovernment. Votershavelittleincentivetocontroltheexcessesoflegislators,who inturnaremoreresponsivetopowerfulinterestgroups.Asaresult, governmentsubsidizesthevestedinterestsofcommerceandother groupswhileimposingcostly,wastefulregulationsandtaxesonthe general public. Buchanan and other public-choice theorists have recommendedaseriesofconstitutionalrulesandrestrictionstoalter themisguidedpublicsectorintoactingmoreresponsibly(Buchanan andTullock1962). EconomicHistorianResolvestheMysteriesofthe GreatDepression Anotherexampleoftherevisionisthistoryisanewinterpretationof theGreatDepressionbyhistorianRobertHiggsofSeattleUniversity. AccordingtoHiggs,therewereessentiallythreetransitionalperiods HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 211 inthiscriticalevent:theGreatContraction(1929–32),theGreatDuration(1933–39),andtheGreatEscape(1940–46).Whatcausedthe GreatDepression?Whydiditlastsolong?DidWorldWarIIreally restoreprosperity? Aswelearnedearlierinthischapter,MiltonFriedmanwasinstrumentalinaddressingthecauseoftheGreatContraction.Itwasnot freeenterprise,butthegovernment-controlledFederalReservethat pushedtheeconomyovertheedgein1929–32. Whatproducedthedecade-longstagnationoftheworldeconomy that in turn caused a paradigm shift from classical economics to Keynesianism?Higgsprovidesananswerthateconomistshadonly vaguelyconsidered.Inanin-depthstudyofthe1930s,Higgsfocused onthelackofprivateinvestmentduringthisperiod.Mosteconomists recognizethatinvestmentisthekeytorecoveryinaslump.Higgs showedhowtheNewDealinitiativesgreatlyhamperedprivateinvestmenttimeandtimeagain,destroyingmuch-neededinvestorand businessconfidence.TheseprogramsincludedtheNationalRecovery Act,prolaborlegislation,governmentregulation,andstifftaxincreases (Higgs2006,3–29). In another brilliant analysis, Higgs attacked the orthodox view that World War II saved us from the depression and restored the economytofullemployment.Thewargaveonlytheappearanceof recoverybecauseeveryonewasemployed.Inreality,however,private consumptionandinvestmentdeclinedwhileAmericansfoughtand diedfortheircountry.Areturntogenuineprosperity—thetrueGreat Escape—didnothappenuntilafterthewarwasover,whenmostof thewartimecontrolswereliftedandmostoftheresourcesusedin themilitarywerereturnedtocivilianproduction.Onlyafterthewar didprivateinvestment,businessconfidence,andconsumerspending returntothefore(Higgs2006,61–80). Ignoringthegovernment(G)inGDPfiguresleadstoabetterunderstandingofwhatoccurredduringWorldWarII.Consumption(C) andinvestment(I)slowedandevendeclinedslightlyduring1940–45, thenrosesharplyafterthewarin1946–48. Not everyone has accepted these relatively new findings, but a growingconsensuscontendsthat“governmentfailure”hastotake much of the responsibility for the troublesome 1930–45 period of theU.S.economy. 212 THE BIG THREE IN ECONOMICS Figure7.2 TheGrowthofGovernmentinFiveIndustrialNations 60 GovernmentSpending as%ofGDP 50 Germany 40 Britain 30 Japan France 20 10 UnitedStates 0 1870 1913 20 37 60 80 90 94 Source:Economist(April6,1996).Reprintedbypermission. Today’sDebates:TheNewChallengeof KeynesandMarx Theapplicationofmarketprincipleshasexpandedineverydirection intherecentpast,butthetriumphoffree-marketeconomicsisfar fromcomplete.Manyvictorieshavebeenwononpaper,butnotin policy.DespiteU.S.presidentBillClinton’sobservationthat“[t]he eraofbiggovernmentisover,”thesizeofgovernmentinindustrial nationshasreachedgiganticproportions(seeFigure7.2). Onthepositiveside,itappearsthatthegovernmentsizeshavereached theirupperbounds.Inmostcountries,theprivatesectorisnowgrowing fasterthanthepublicsector.Thisisespeciallytrueindevelopingcountries(governmentasapercentageofGDPhasfallenfrom80percent to20percentinChina,forexample).Butthattrendcouldreverseitself quicklyifeconomicconditionschangeandanationorregionsuffers HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 213 anotherslumporcrisis.Witnessthegrowthofgovernmentfollowingthe terroristattacksintheUnitedStatesandaroundtheworldin2001. Despiteprivatization,deregulation,andsupply-sidetaxcuts,governmentsarestillintrusive,revenuehungry,andbureaucratic.Freemarketeconomistshavemuchtoofferlegislatorsandbusinessthat canhelpthemimproveefficiency. ItwouldbeinaccurateandhighlymisleadingtosuggestthatKeynes,or evenMarx,isdead.Quitethecontrary.KeynesianandMarxistthinking stillcarryastrongvoicetoday.Ifacountryfallsintoamilitaryconflict, adeepslump,orothercrisis,theKeynesianmodelimmediatelycomes totheforefront:maintainspendingatallcosts,evenifitmeanssignificantdeficitfinancing.ThemisleadingKeynesiannotionthatconsumer spending,ratherthansaving,capitalformation,andtechnology,drives theeconomy,isstillverymuchinvogueinthehallsofgovernmentand infinancialcircles.CountriessuchasChinaandJapanarecriticizedfor savingtoomuch;Keynesiansinsistthattheyneedtostimulate“domestic demand”iftheyhopetoadvance.Fearthatalaissez-faireglobalfinancialworldissubjecttounexpectedanddebilitatingcrisesiscommon amongbothKeynesiansandMarxists.Theyalsoexpressdeepconcern thattheentrepreneurs,speculators,andthewealthyclassingeneralare benefitingmorefromthenewglobaleconomyandthepoliticalprocess thanthemiddleandlowerclasses.“Taxcutshelptherichmorethan thepoor”isacommonrefrain.Criticsofthemarketalsoconstantly complainaboutgrowinginequalityofincome,wealth,andopportunity, despite claims to the contrary by free-market economists.They are sharplycriticaloffree-tradeagreementsandthepotentiallossofjobs toproducersinChina,Mexico,andotherdevelopingcountries. Thecentralroleofgovernmentmonetarypolicyisaglobalconcern. Fiscal policy may have been dethroned as a stabilization tool, but centralbankpolicymightfailtodoitsjobinmaintainingmacroeconomicstability.Monetaryauthoritieshavebeenknowntoblunder, overshootingtheirinterest-rateorinflationtargets.Theirresponseto everycrisis,whetheritbeacurrencycrisisoreconomicdownturn, seemstobetoadoptan“easymoney”policybyinjectingliquidity intothesystemandcuttinginterestratesbelowthenaturalrate.The resulthasbeenanincreasingstructuralimbalanceandassetbubbles instocks,realestate,andothersectors.Howfartheycangowith suchunstablepolicieswithoutcreatingamajorglobalfinancialcrisis 214 THE BIG THREE IN ECONOMICS remainstobeseen.Thepriceofgoldisavaluablemonitorofglobal economicinstability,andithasbeenrisinglately. Environmentalismisamajorsubjectofdebate.Howcannations growandincreasetheirstandardsoflivingwithoutdestroyingthe air,pollutingthewater,devastatingtheforests,andcausingglobal warming? The debate goes back to Thomas Malthus (chapter 2) andisrelatedtohistoricalandpresent-dayconcernsoverunlimited growthandlimitedresources.Inthisecologicaldebate,economists, whilenotalarmists,havemadenumerouscontributionstominimizing pollutionandotherenvironmentalproblems.Tosolvethe“tragedy ofthecommons,”forexample,marketeconomistshaveemphasized theneedtoestablishdefensiveresourcerightsinwater,fishing,and forestland,sothatownershavetheproperincentivestopreservethese resourcesinabalancedway.Inthecaseofairpollution,economists haverecommendedpollutionfeesandmarketablepermitstopollute. Pollutionfeesaretaxedonpolluters,penalizingtheminproportion totheamounttheydischarge,acommonpracticeinEurope.Marketablepermitsallowpolluterstoselltheirpermitstootherfirms,and havesuccessfullyreducedtherateofpollutionintheUnitedStates (AndersonandLeal2001). Stiglitz’sChallenge:IsMarketImperfectionPervasive? JosephStiglitz,ColumbiaprofessorandwinneroftheNobelPrizein 2001forhisworkintheeconomicsofinformation,isaKeynesianwho hastakenahardenedstanceagainstAdamSmithandthecompetitive equilibriummodel.Theinvisiblehand,accordingtoStiglitz,iseither “simplynotthere,oratleast…ifthere,itispalsied”(Stiglitz2001, 473).Hedeclaresthatmarketimperfectionsandmarketfailuresare sopervasiveandsoseriousthatthemarketisalwaysinefficientand requiresgovernmentcorrection.Imperfectinformationexistsinlabor, products,money,trade,andcapitalmarkets.1Seriousunemployment 1.Neo-Keynesianshavecontributedextensivelytothenewfieldof“behavioral economics,”whichquestionstheefficiency/rationalexpectationsmodeloftheChicago school,andproposeswaystocounterthetendencyofindividualstomakefinancial mistakes,suchasundersaving,over-consuming,andunderperformingthestockmarket averages.See,forexample,RichardThaler(2004)andRobertShiller(2005).However, notallbehavioraleconomistsareKeynesian.SeeJeremySiegel(2005). HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 215 could exist even without minimum wage laws or labor unions, he contends.DuringtheGreatDepression,“hadtherebeenmorewage andpriceflexibility,mattersmighthavebeenevenworse,”hestates (2001,477).AccordingtoStiglitz,involuntaryunemploymentisstill aproblem!GaryBecker,MiltonFriedman,andotherChicagoeconomistsmayclaimthatthecompetitivemarketplacediscouragesdiscrimination,unemployment,andpoverty,butStiglitz’shometownof Gary,Indiana,“eveninitsheyday...wasmarredbypoverty,periodic unemployment,andmassiveracialdiscrimination”(2001,473). StiglitzmakesanotherparadigmshiftbacktoaKeynesianmodelof imperfectinformationthat“undermines”thefoundationsofcompetitiveanalysis,includingthedenialofthe“law”ofsupplyanddemand, thelawofthesingleprice,andtheefficientmarkethypothesis(2001, 485).Why?Becauseinformationinadecentralizedmarketeconomy is“asymmetric”—“differentpeopleknowdifferentthings,”whichin turncanleadto“thinornon-existentmarkets”(2001,488–89).What Hayekviewsaspositive,Stiglitzseesasnegative. MarketeconomistscounterStiglitzbyarguingthatwhileimperfect informationmayindeedbepervasive,theoutcomeoftheimperfect competitive market system acts “as if” it is perfectly competitive. Forexample,experimentaleconomicsseemstoconfirmthis“asif” approach.VernonL.Smith,NobellaureatefromGeorgeMasonUniversityandfounderofexperimentaleconomics,rananexperimentto testtheChamberlin-Robinson“imperfectcompetition”model.Recallfromchapter5thatthismodelsuggestedthatasmallnumberof sellers(orbuyers)createsanimperfectformofcompetition,causing pricestorise,andoutputtofall.Theimperfectmonopolisticmodel wasthereforeinefficient,andgavesupporttogovernmentantitrust actionstobreakupbigbusinessesandforcemorecompetitioninto theindustry. However,Smithmadeaninterestingobservation.Whenhereduced thenumberofbuyersandsellerstoonlyafewinhisexperiments, the results were the same—the final price approached the same competitivepricethatwasachievedwithalargenumberofbuyers and sellers. By implication, competition within an industry is not necessarilyreducedwhenitislimitedtoonlyafewlargecompanies (Smith1987,241–46). Smith’sobservationconfirmedtheearlierworkofGeorgeStigler, 216 THE BIG THREE IN ECONOMICS HarryJohnson,andothermembersoftheChicagoschoolthatcompetitionisstrongevenamongonlyafewlargefirms.Monopolistic firmstendtokeeppricescompetitivebecauseoftheever-presentthreat ofentrybyotherlargefirms.Theworldis“asif”fullycompetitive (Bhagwati1998,411–12). TheReturnofAdamSmith’sVision WehavecomealongwaysinceAdamSmithproposedthatthepathto economicgrowth,prosperity,andsocialjusticeliesinnations’grantingcitizensthemaximumfreedompossibletopursuetheirpublicand privateinterestsunderatolerablesystemofjustice.ButAdamSmith’s systemofnaturallibertyhasbeenchallengedineverygenerationsince hisWealthofNationswaspublishedin1776.Todayisnoexception. Adam Smith’s vision of unfettered markets flourished initially acrosstheEnglishchannelamongJ.-B.Say,FrédéricBastiat,and theFrenchphilosophes,butitwasnotlongbeforetherevolutionary Smithcameunderattackfromtheleastlikelyplace—hisownBritish school.ThomasRobertMalthusandDavidRicardoturnedtheoptimisticworldofAdamSmithupsidedownintotheabyssoftheiron lawofsubsistencewages.JohnStuartMilljoinedthesocialreformersinseekingautopianalternativetotheso-calleddismalscience and,whenvoluntarymeanswerenotforthcoming,alongcamethe irrepressibleradicalKarlMarx,whoplungedeconomicsintoanew ageofalienation,classstruggle,exploitation,andcrisis. Justaswewereabouttogiveuponouralmost-deadprotagonist, three good Samaritans revived the life ofAdam Smith—Stanley Jevons,CarlMenger,andLeonWalras.Themarginalistrevolution restoredtheSmithiansoul,andwiththehelpofAlfredMarshallin BritainandJohnBatesClarkintheUnitedStates,amongothers,it resurrectedSmithandtransformedhimintoawholenewclassical man.DespiteeffortstorenouncethenewcapitalistmodelbyThorstein Veblenandotherinstitutionalists,thecriticswereeffectivelycountered,especiallybyMaxWeber.Theneoclassicalparadigmstoodtall, readytomakecontributionstothenewscientificage. Thegoldenageofneoclassicaleconomicscontinuedtofacehurdles asIrvingFisher,KnutWicksell,andLudwigvonMisessearchedfor theidealmonetarystandardtohouseAdamSmith,butnoconsensus HAS ADAM SMITH TRIUMPHED OVER MARX AND KEYNES? 217 hadbeenachievedbytimethe1929stockmarketcrashplungedthe worldintotheworstdepressionofmoderntimes.Onceagain,Adam Smithfacedimminentdemise.Marxistswereinthewingswaitingto takeoverwhenanewdoctor,JohnMaynardKeynes,presentedthe worldwithnewmedicine,withwhichheproposedtosaveAdamSmith andrestorehimasthefatherofcapitalism.ButKeynesturnedoutto beatemporarysavioronly,asthelong-runeffectsofhismedicineled toanoverbloatedpatient.ItwouldtaketheinventivenessofMilton Friedman and Friedrich Hayek, intellectual descendants ofAdam Smith,tocorrectlydiagnosethecauseofthedistressandrestorethe modelunderliningacompetitive,robusteconomy. NodoubttheboldchallengesmadebyMarxandKeynesandtheir discipleshavehadapositiveeffect.Theyhavecausedmarketeconomiststorespondtotheirdeftcriticismsandimprovetheclassicalmodel thatAdamSmithcreated.Todaytheneoclassicalmarketframeworkis strongerthaneverbefore,anditsapplicationsareubiquitous. In1930,atthebeginningoftheGreatDepression,JohnMaynard Keyneswroteanoptimisticessay,“EconomicPossibilitiesforOur Grandchildren.”Afterlambastinghisdiscipleswhopredictedneverendingdepressionandpermanentstagnation,Keynesforesawabright future. Goods and services would become so abundant and cheap thatleisurewouldbethegreatestchallenge.Whatproductivethings canbedoneinone’ssparetime?AccordingtoKeynes,capitalwould becomesoinexpensivethatinterestratesmightfalltozero.Interest rateshavenotfallentozero,butourstandardsoflivinghaveadvanced remarkably,atleastinmostareasoftheworld.Keynesconcluded, “Itwouldnotbefoolishtocontemplatethepossibilityofagreater progressstill”(Keynes1963[1930],365). Market forces are on the march.The collapse of the Keynesian paradigmandMarxistcommunismhasturned“creepingsocialism” into“crumblingsocialism.”Thereisnotellinghowhightheworld’s standardoflivingcanreachthroughexpandedtrade,lowertariffs,a simplifiedtaxsystem,schoolchoice,SocialSecurityprivatization,a fairsystemofjustice,andastablemonetarysystem.Yetbadpolicies, wastedresources,andclasshatreddieslowly.AsMiltonFriedman once wrote, “Freedom is a rare and delicate flower” (1998, 605). Unlessmarketeconomistsarevigilant,naturallibertyanduniversal prosperitywillbeonthedefensiveagain. Bibliography Anderson,TerryL.,andDonaldR.Leal.2001.FreeMarketEnvironmentalism.2d ed.NewYork:Palgrave. Arrow,KennethJ.,andF.H.Hahn.1971.GeneralCompetitiveAnalysis.SanFrancisco:Holden-Day. Barzun,Jacques.1958[1941].Darwin,Marx,Wagner.2ded.NewYork:Doubleday. Bastiat, Frédéric. 1998 [1850]. The Law. NewYork: Foundation for Economic Education. Bauer,P.T.1981.Equality,theThirdWorldandEconomicDelusion.Cambridge, MA:HarvardUniversityPress. Baumol,WilliamJ.,andAlanS.Blinder.1988.Economics:PrinciplesandPolicy. 4thed.NewYork:HarcourtBraceJovanovich. ______.2001.Economics:PrinciplesandPolicies.8thed.Ft.Worth,TX:Harcourt CollegePublishers. Bean,CharlesR.1994.“EuropeanUnemployment:ASurvey.”JournalofEconomic Literature32,2(June):573–619. Berman,Marshall.1999.AdventuresinMarxism.NewYork:Verso. Bhagwati,Jagdish.1998.AStreamofWindows.Cambridge:MITPress. Black,R.D.Collison,A.W.Coats,andCraufurdD.W.Goodwin,eds.1973.The MarginalRevolutioninEconomics.Durham,NC:DukeUniversityPress. Blaug,Mark.1978.EconomicTheoryinRetrospect.3ded.Cambridge,UK:CambridgeUniversityPress. ______.1985.GreatEconomistsSinceKeynes.Cambridge,UK:CambridgeUniversityPress. ______.1986.GreatEconomistsBeforeKeynes.AtlanticHeights,NJ:Humanities PressInternational. ______.1999.Who’sWhoinEconomics.3ded.Cheltenham,UK:EdwardElgar. Blinder,AlanS.1987.HardHeads,SoftHearts.Reading,MA:Addison-Wesley. Blumenberg,Werner.1998[1962].KarlMarx:AnIllustratedBiography.London: Verso. Boaz,David.1997.Libertarianism:APrimer.NewYork:TheFreePress. Böhm-Bawerk,Eugen.1959[1884].CapitalandInterest.SouthHolland,IL:LibertarianPress. ———.1962.“TheAustrianEconomists.”InShorterClassicsofBöhm-Bawerk. South Holland, IL: Libertarian Press. Originally appeared in Annals of the AmericanAcademyofPoliticalandSocialSciences(January1891). Boswell,James.1933.LifeofJohnson.2vols.NewYork:OxfordUniversityPress. Bottomore, Tom, ed. 1991. A Dictionary of Marxist Thought. 2d ed. Oxford: Blackwell. 219 220 BIBLIOGRAPHY Boyes, William, and Michael Melvin. 1999. Macroeconomics. 4th ed. Boston: HoughtonMifflin. Breit,William,andRogerW.Spencer,eds.1986.LivesoftheLaureates.Cambridge, MA:MITPress. Brennan,Geoffrey,andPhilipPettit.1993.“HandsInvisibleandIntangible.”Synthese94:191–225. Bronfenbrenner, Martin. 1967. “Marxian Influences in ‘Bourgeois’ Economics.” AmericanEconomicReview57,2(May):624–35. Brown,WilliamMontgomery.1935.TeachingsofMarxforGirlsandBoys.Galion, Ohio:Bradford-BrownEducationalCo. Buchanan,JamesM.,andGordonTullock.1962.TheCalculusofConsent.Ann Arbor:UniversityofMichiganPress. Buchanan,JamesM.,andRichardA.Musgrave.1999.PublicChoiceandPublic Finance:TwoContrastingViewsoftheState.Cambridge,MA:MITPress. Buchholz, Todd G. 1999. New Ideas from Dead Economists. 2d ed. NewYork: Penguin. Buckley,WilliamF.,Jr.1951.GodandManatYale.Chicago:Regnery. Bush,GeorgeW.2002.“PresidentHonorsMiltonFriedmanforLifetimeAchievements.”www.whitehouse.gov/news/releases/2002/05/20020509-1.html. Byrns, Ralph T., and GeraldW. Stone. 1989. Economics. 4th ed. Glenville, IL: Scott,Foresman. Carlyle, Thomas. 1904. Critical and Miscellaneous Essays. London: Charles Scribner’sSons. Chamberlin,EdwardH.1933.TheTheoryofMonopolisticCompetition.Cambridge, MA:HarvardUniversityPress. Clark, John Bates. 1914. Social JusticeWithout Socialism. Boston: Houghton Mifflin. ______.1965[1899].TheDistributionofWealth.NewYork:AugustusM.Kelley. Coase,RonaldH.1976.“AdamSmith’sViewofMan.”JournalofLawandEconomics19:529–46. Colb,Ralph,Jr.1982.“TheMythoftheMarx-DarwinLetter.”HistoryofPolitical Economy14,4:461–82. Collins,RobertM.1981.TheBusinessResponsetoKeynes,1929–1964.NewYork: ColumbiaUniversityPress. Cox,Michael,andRichardAlm.1999.TheMythsofRichandPoor.NewYork: FreePress. Danhert, Clyde E., ed. 1974. Adam Smith, Man of Letters and Economist. New York:Exposition. D’Aulaire,Ingrid,andEdgarD’Aulaire.1962.D’Aulaire’sBookofGreekMyths. NewYork:Doubleday. Denby,David.1996.GreatBooks.NewYork:SimonandSchuster. Desai,Maghnad.2004.Marx’sRevenge.NewYork:Verso. Dewey,Donald.1987.“JohnBatesClark.”InTheNewPalgrave:ADictionaryof Economics.Vol.1,428–31.London:Macmillan. Diggins,JohnPatrick.1996.MaxWeber:PoliticsandtheSpiritofTragedy.New York:BasicBooks. ______. 1999. ThorsteinVeblen, Theorist of the Leisure Class. Princeton, NJ: PrincetonUniversityPress. BIBLIOGRAPHY 221 Dorfman,Joseph.1934.ThorsteinVeblenandHisAmerica.NewYork:Augustus M.Kelley. Downs,RobertB.1983.BooksThatChangedtheWorld.2ded.NewYork:Penguin. D’Souza, Dinesh. 2005. “How Capitalism Civilizes Greed.” www.dineshdsouza. com/articles/civilizinggreed.html. Dobbs,Zygmund.1962.KeynesatHarvard.NewYork:Probe. Eaton,John.1951.MarxAgainstKeynes.London:LawrenceandWishart. Eichengreen,Barry.1992.GoldenFetters:TheGoldStandardandtheGreatDepression.NewYork:OxfordUniversityPress. Ekins,Paul,andManfredMax-Neef.1992.Real-LifeEconomics:Understanding WealthCreation.London:Routledge. Elzinga,KennethG.1992.“TheElevenPrinciplesofEconomics.”SouthernEconomicJournal58,4(April):861–79. Engels,Friedrich.2000[1844].TheConditionoftheWorkingClassinEngland. NewYork:Pathfinder. Feuerbach,Ludwig.1957[1841].TheEssenceofChristianity.NewYork:Harper Torchbooks. Fisher,Irving.1963[1911].ThePurchasingPowerofMoney.2ded.NewYork: AugustusM.Kelley. Fitzgibbons,Athol.1995.AdamSmith’sSystemofLiberty,Wealth,andVirtue.New York:Clarendon. Fitzpatrick, Sheila. 1999. Everyday Stalinism. NewYork: Oxford University Press. Foster,WilliamT.,andWaddillCatchings.1927.BusinessWithoutaBuyer.Boston: HoughtonMifflin. Friedman,Milton.1968.DollarsandDeficits.NewYork:Prentice-Hall. ______. 1969. The Optimum Quantity of Money and Other Essays. London: Macmillan. ______.1974.“CommentontheCritics.”InMiltonFriedman’sMonetaryFramework,ed.RobertJ.Gordon,132–37.Chicago:UniversityofChicagoPress. ______.1978.“AdamSmith’sRelevancefor1976.”InAdamSmithandtheWealthof Nations:1776–1976BicentennialEssays,ed.FredR.Glahe.Boulder:Colorado AssociatedUniversityPress,7–20. ______.1981.TheInvisibleHandinEconomicsandPolitics.Singapore:Institute ofSoutheastAsianStudies. ______.1982[1962].CapitalismandFreedom.Chicago:UniversityofChicago Press. ______.1986.“Keynes’sPoliticalLegacy.”InKeynes’sGeneralTheory:FiftyYears On,ed.JohnBurton.London:InstituteofEconomicAffairs. Friedman,Milton,andRoseFriedman.1980.FreetoChoose:APersonalStatement. NewYork:HarcourtBraceJovanovich. ______.1998.TwoLuckyPeople.Chicago:UniversityofChicagoPress. Friedman,Milton,andWalterW.Heller.1969.Monetaryvs.FiscalPolicy.New York:W.W.Norton. Friedman,Milton,andDavidMeiselman.1963.“TheRelativeStabilityofMonetaryVelocityandtheInvestmentMultiplierintheUnitedStates,1897–1958.” InStabilizationPolicies.ReportfromtheCommissiononMoneyandCredit. EnglewoodCliff,NJ:Prentice-Hall,165–268. 222 BIBLIOGRAPHY Friedman,Milton,andAnnaJ.Schwartz.1963.AMonetaryHistoryoftheUnited States,1867–1960.Princeton,NJ:PrincetonUniversityPress. Fromm,Eric.1966.Marx’sConceptofMan.NewYork:Continuum. Fukuyama, Francis. 2000. “Will Socialism Make a Comeback?” Time, May 22, 110–12. Galbraith,JohnKenneth.1975[1965].“HowKeynesCametoAmerica.”InEssays onJohnMaynardKeynes,ed.MiloKeynes,132–41.Cambridge,UK:Cambridge UniversityPress. Garrison,RogerB.1985.“West’s‘CantillonandAdamSmith’:AComment.”Journal ofLibertarianStudies7,2(Fall):287–94. ______.2001.TimeandMoney.London:Routledge. Glahe,FredR.,ed.1978.AdamSmithandtheWealthofNations:1776–1976BicentennialEssays.Boulder:ColoradoAssociatedUniversityPress. ———.1993.AdamSmith’sAnInquiryintotheNatureandCausesoftheWealth ofNations:AConcordance.Landam,MD:RowmanandLittlefield. Gordon,H.Scott.1967.“DiscussiononDasKapital:ACentenaryAppreciation.” AmericanEconomicReview52,2(May):640–41. Gutiérrez,Gustavo.1973.ATheologyofLiberation:History,Politics,andSalvation, trans.CaridadIndaandJohnEagleson.Maryknoll,NY:OrbisBooks. Gwartney,JamesD.,andRobertA.Lawson.2004.EconomicFreedomoftheWorld. Vancouver:FraserInstitute. Gwartney, James D., RobertA. Lawson, andWalter E. Block. 1996. Economic FreedomoftheWorld:1975–1995.Vancouver:FraserInstitute. Hahn,Frank.1982.“ReflectionsontheInvisibleHand.”LloydsBankReview,April, 1–21. Hansen,Alvin.1941.FiscalPolicyandBusinessCycles.NewYork:W.W.Norton. ———.1953.AGuidetoKeynes.NewYork:McGraw-Hill. Harrington,Michael.1976.TheTwilightofCapitalism.NewYork:Macmillan. Harris,Sharon.1998.“TheInvisibleHandIsaGentleHand.”HarryBrowne.org/ articles/InvisibleHand.htm(September14). Harris,SeymourE.,ed.1947.TheNewEconomics:Keynes’InfluenceonTheory andPublicPolicy.NewYork:AlfredA.Knopf. ———.1948.SavingAmericanCapitalism.NewYork:AlfredA.Knopf. Harrod, Roy. 1951. The Life of John Maynard Keynes. NewYork: Harcourt, Brace. Hart,MichaelH.1978.The100:ARankingoftheMostInfluentialPersonsinHistory.NewYork:Hart. ———.1992.The100:ARankingoftheMostInfluentialPersonsinHistory.2d ed.NewYork:Citadel. Hayek, Friedrich. 1935 [1931]. Prices and Production. 2d ed. London: George RoutledgeandSons. ______, ed. 1935. Collectivist Economic Planning. London: George Routledge andSons. ______.1939[1929].“The‘Paradox’ofThrift.”InProfits,InterestandInvestment. London:Routledge,199–263. ______.1944.TheRoadtoSerfdom.Chicago:UniversityofChicagoPress. ______. 1960. The Constitution of Liberty. Chicago: University of Chicago Press. BIBLIOGRAPHY 223 ______.1976.“Introduction:CarlMenger.”InPrinciplesofEconomics,ed.Carl Menger.NewYork:NewYorkUniversityPress. ______.1984.TheEssenceofHayek,ed.ChiakiNishiyamaandKurtR.Leube. Stanford,CA:StanfordUniversityPress. Hazlitt,Henry.1959.TheFailureofthe“NewEconomics.”Princeton,NJ:D.Van Nostrand. ______.1977[1960].TheCriticsofKeynesianEconomics.2ded.NewYork:ArlingtonHouse. ______. 1979 [1946]. Economics in One Lesson. 3d ed. NewYork:Arlington House. Heilbroner,Robert.1961.TheWorldlyPhilosophers.2ded.NewYork:Simonand Schuster. ______.1986.TheEssentialAdamSmith.NewYork:W.W.Norton. ______.1989.“TheTriumphofCapitalism.”NewYorker,January23,98–109. ______. 1990. “ReflectionsAfter Communism.” NewYorker, September 10, 91–100. ———. 1999 [1953]. TheWorldly Philosophers. 7th ed. NewYork: Simon and Schuster. Heilbroner,Robert,andPeterL.Bernstein.1963.APrimeronGovernmentSpending.NewYork:RandomHouse. Hession,CharlesH.1984.JohnMaynardKeynes.NewYork:Macmillan. Hicks,JohnR.1937.“Mr.Keynesandthe‘Classics’;ASuggestedInterpretation.” Econometrica5:2(April),147–59. Higgs,Robert.2006.Depression,War,andtheColdWar.NewYork:OxfordUniversity Press. Hirschman,AlbertO.1997.ThePassionsandtheInterests.2ded.Princeton,NJ: PrincetonUniversityPress. Hobbes,Thomas.1996[1651].Leviathan.NewYork:OxfordUniversityPress. Howard,M.C.,andJ.E.King.1989.AHistoryofMarxianEconomics,1823–1929. Princeton,NJ:PrincetonUniversityPress. Hutt,W.H.1979.TheKeynesianEpisode:AReassessment.Indianapolis,IN:Liberty Press. Iannaccone,Laurence.1991.“TheConsequencesofReligiousMarketStructure.” RationalityandSociety3,2(April):156–77. Ingrao,Bruna,andGiorgioIsrael.1990.TheInvisibleHand:EconomicEquilibrium intheHistoryofScience.Cambridge,MA:MITPress. Jevons,W.Stanley.1965[1871].TheTheoryofPoliticalEconomy.5thed.New York:AugustusM.Kelley. Johnson,Elizabeth,andHarryG.Johnson.1978.TheShadowofKeynes.Oxford: BasilBlackwell. Jorgensen, Elizabeth, and Henry Jorgensen. 1999. ThorsteinVeblen:Victorian Firebrand.Armonk,NY:M.E.Sharpe. Jouvenel,Bertrandde.1999.EconomicsandtheGoodLife:EssaysonPoliticalEconomy,ed.DennisHaleandMarcLandy.NewBrunswick,NJ:Transaction. Joyce,Helen.2001.“AdamSmithandtheInvisibleHand.”http://plus.maths.org/ issue14/features/smith/feat.pdf. Kates,Steven.1998.Say’sLawandtheKeynesianRevolution.Cheltenham,UK: EdwardElgar. 224 BIBLIOGRAPHY Keynes,JohnMaynard.1920.EconomicConsequencesofthePeace.NewYork: Harcourt,Brace. ______.1923.ATractonMonetaryReform.London:Macmillan. ______.1930.ATreatiseonMoney.2vols.London:Macmillan. ______.1951[1931].EssaysinPersuasion.NewYork:W.W.Norton. ______.1963[1930].EssaysinBiography.NewYork:W.W.Norton. ______.1971.Activities1906–1914:IndiaandCambridge.TheCollectedWorks ofJohnMaynardKeynes.Vol.15.London:Macmillan. ______.1973a[1936].TheGeneralTheoryofEmployment,InterestandMoney. London:Macmillan. ______.1973b.TheGeneralTheoryandAfter,PartI,Preparation.TheCollected WorksofJohnMaynardKeynes.Vol.13,ed.byDonaldMoggridge.London: Macmillan. Klamer,Arjo,andDavidColander.1990.TheMakingofanEconomist.Boulder, CO:Westview. Knight, Frank H. 1959. “Review of Ricardian Economics.” Southern Journal of Economics25,3(January):363–65. ______.1982[1947].FreedomandReform.Indianapolis,IN:LibertyFund. Krugman,Paul.2006.“IntroductiontoTheGeneralTheoryofEmployment,Interest andMoney.”www.pkarchive.org/economy/GeneralTheoryKeynesIntro.html. Kuttner,Robert.1985.“ThePovertyofEconomics.”AtlanticMonthly(February): 74–84. Lai,Cheng-chung.2000.AdamSmithAcrossNations.NewYork:OxfordUniversity Press. Leamer,Edward.1983.“Let’sTaketheConoutofEconomics.”AmericanEconomic Review73,1(March):31–43. Lebergott,Stanley.1976.TheAmericanEconomy.Princeton,NJ:PrincetonUniversityPress. Lenin,V.I.1970.SelectedWorks.12vols.Moscow:Progress. Leontief,Wassily.1938.“TheSignificanceofMarxianEconomicsforPresent-Day Economic Theory.” American Economic Review 28, 2 (March supplement): 1–9. Lichtheim,George.1970.AShortHistoryofSocialism.NewYork:Praeger. Liebknecht,Wilhelm.1968[1901].KarlMarxBiographicalMemoirs.NewYork: Greenwood. Linder,Marc.1977.Anti-Samuelson.2vols.NewYork:Urizen. Lindsey,Brink.2002.AgainsttheDeadHand:TheUncertainStruggleforGlobal Capitalism.NewYork:JohnWiley. Lipsey,RichardG.,PeterO.Steiner,andDouglasD.Purvis.1987.Economics.8th ed.NewYork:Harper&Row. Lux,Kenneth.1990.AdamSmith’sMistake.Boston:Shambhala. McCloskey,Deirdre.1998[1985].TheRhetoricofEconomics.2ded.Madison,WI: UniversityofWisconsinPress. Macfie,A.L. 1967. The Individual in Society: Papers on Adam Smith. London: GeorgeAllen&Unwin. McGovern,ArthurF.1980.Marxism:AnAmericanChristianPerspective.Maryknoll,NY:OrbisBooks. Macleod,H.D.1896.TheHistoryofEconomics.London:Bliss,Sands. BIBLIOGRAPHY 225 Malia,Martin.1999.RussiaUnderWesternEyes.Cambridge,MA:HarvardUniversityPress. Malthus,ThomasRobert.1985[1798].AnEssayonthePrincipleofPopulation. NewYork:Penguin.(Thiseditioncontainstheoriginal1798firsteditionandA SummaryViewofthePrincipleofPopulation,publishedin1830.) Mandel,Ernest.1976.“Introduction.”Capital.Vol.1.NewYork:Penguin. Mandeville,Bernard.1997[1714].TheFableoftheBees,andOtherWritings.New York:Hackett. Mankiw,N.Gregory.1994.Macroeconomics.2ded.NewYork:Worth. ______.1997.PrinciplesofEconomics.NewYork:DrydenPress. Mantoux,Etiennede.1952.TheCathagianPeace.Pittsburgh,PA:Universityof PittsburghPress. Marshall,Alfred.1920[1890].PrinciplesofEconomics.8thed.London:Macmillan. Marx,Karl.1976[1867].Capital.Vol.1.NewYork:Penguin. ———. 1980. The Holy Family, or Critique of Critical Criticism. NewYork: Firebird. ———. 1988. The Economic and Philosophic Manuscripts of 1844. NewYork: Prometheus. ———.1995.ThePovertyofPhilosophy.NewYork:Prometheus. ______.2000.SelectedWritings.2ded.Oxford:OxfordUniversityPress. Marx,Karl,andFriedrichEngels.1964[1848].TheCommunistManifesto.New York:MonthlyReviewPress. ———.Nodate.CollectedWorks(Letters1860–64).Vol.41.NewYork:InternationalPublishers. Mayo,Elton.1945.TheSocialProblemsofanIndustriousCivilization.Cambridge, MA:HarvardUniversityPress. Meltzer,AllanH.1988[1968].Keynes’sMonetaryTheory:ADifferentInterpretation.Cambridge,UK:CambridgeUniversityPress. Menger,Carl.1976[1871].PrinciplesofEconomics,trans.JamesDingwalland BertF.Hoselitz.NewYork:NewYorkUniversityPress. Mill,JohnStuart.1884[1848].PrinciplesofPoliticalEconomy,ed.J.Laurence Laughlin.NewYork:D.Appleton. _______. 1989 [1859]. On Liberty. Cambridge, UK: Cambridge University Press. Minsky,HymanP.1982.Can“It”HappenAgain?EssaysonInstabilityandFinance. Armonk,NY:M.E.Sharpe. ______.1986.StabilizinganUnstableEconomy.NewHaven,CT:YaleUniversity Press. Mises,Ludwigvon.1966.HumanAction.3ded.Chicago:Regnery. ______.1971[1912].TheTheoryofMoneyandCredit.2ded.NewYork:FoundationforEconomicEducation. ______.1972.TheAnti-CapitalistMentality.SpringMills,PA:LibertarianPress. ———.1980[1952].PlanningforFreedom.4thed.SpringMills,PA:Libertarian Press. Modigliani,Franco.1986.“LifeCycle,IndividualThrift,andtheWealthofNations.” AmericanEconomicReview76,3(June):297–313. Moggridge,D.E.1983.“KeynesasanInvestor.”InTheCollectedWorksofJohn MaynardKeynes,1–113.Vol.12.London:Macmillan. 226 BIBLIOGRAPHY ______.1992.MaynardKeynes.London:Routledge. Montesquieu,Charles.1989[1748].TheSpiritoftheLaws,ed.AnneCohler,Basia Miller,andHaroldStone.Cambridge,UK:CambridgeUniversityPress. Muller,JerryZ.1993.AdamSmithinHisTimeandOurs.Princeton,NJ:Princeton UniversityPress. Musgrave,RichardA.1958.PublicFinanceinTheoryandPractice.NewYork: Macmillan. North,Gary.1993.“TheMarxNobodyKnows.”InRequiemforMarx,ed.UriN. Maltsev.Auburn,AL:LudwigvonMisesInstitute. Novak,Michael.1991.WillItLiberate?QuestionsAboutLiberationTheology.New York:MadisonBooks. Padover,SaulK.1978.KarlMarx:AnIntimateBiography.NewYork:McGraw-Hill. Patinkin,Don.1956.Money,InterestandPrice.NewYork:Harper&Row. Payne,Robert.1968.Marx.NewYork:Simon&Schuster. ______.1971.TheUnknownMarx.NewYork:NewYorkUniversityPress. Pearlstine,Norman.1998.“BigWheelsTurning.”Time,December7,70–73. Phillips,A.W.1958.“TheRelationshipBetweenUnemploymentandtheRateof ChangeinMoneyWageRatesintheUnitedKingdom,1861–1957.”Economica 25(November):283–99. Pigou,ArthurC.,ed.1925.MemorialsofAlfredMarshall.London:Macmillian. Pigou,Arthur C. 1943. “The Classical Stationary State.” Economic Journal 53 (December):343–51. ______.1947.“EconomicProgressinaStableEnvironment.”Economica14(August):180–88. Plaut,EricA.,andKevinAnderson.1999.MarxonSuicide.Evanston,IL:NorthwesternUniversityPress. Popper,Karl.1972.ConjecturesandRefutations.4thed.London:Routledgeand KeganPaul. Powell,Jim.2000.TheTriumphofLiberty.NewYork:TheFreePress. Raddatz,FritzJ.1978.KarlMarx:APoliticalBiography.Boston:Little,Brown. Rae,John.1895.LifeofAdamSmith.London:Macmillan. Rand,Ayn.1964.TheVirtueofSelfishness.NewYork:Signet. Rashid,Salim.1998.TheMythofAdamSmith.Cheltenham,UK:EdwardElgar. Read,LeonardE.1999.“I,Pencil.”Irvington,NY:FoundationforEconomicEducation.(OriginallypublishedinFreeman,December1958.) Ricardo,David.1951.OnthePrinciplesofPoliticalEconomyandTaxation,ed. PieroSraffa.Cambridge,UK:CambridgeUniversityPress. Robinson,Joan.1933.EconomicsofImperfectCompetition.London:Macmillan. Roemer,JohnE.1988.FreetoLose.Cambridge,MA:HarvardUniversityPress. Rogge, BenjaminA., ed. 1976. TheWisdom of Adam Smith. Indianapolis, IN: LibertyPress. Ross,IanSimpson.1995.TheLifeofAdamSmith.Oxford:Clarendon. Rostow, W.W. 1960. The Stages of Economic Growth. Cambridge: Cambridge UniversityPress. ______.1990.TheoristsofEconomicGrowthfromDavidHumetothePresent.New York:OxfordUniversityPress. Rothbard,MurrayN.1980.“TheEssentialVonMises.”InPlanningforFreedom,by LudwigvonMises,234–70.4thed.SpringMills,PA:LibertarianPress. BIBLIOGRAPHY 227 ______.1983[1963].America’sGreatDepression.4thed.NewYork:Richardson andSnyder. ______.1995a.EconomicThoughtBeforeAdamSmith.Hants,UK:EdwardElgar. ______.1995b.ClassicalEconomics.Hants,UK:EdwardElgar. Rothschild,Emma.2001.EconomicSentiments:AdamSmith,Condorcet,andthe Enlightenment.Cambridge,MA:HarvardUniversityPress. St.Clair,Oswald.1965.AKeytoRicardo.NewYork:AugustusM.Kelley. Samuelson,Paul.1947.FoundationsofEconomicAnalysis.Cambridge,MA:HarvardUniversityPress. ______.1948.Economics.NewYork:McGraw-Hill. ______.1957.“WagesandInterest:AModernDissectionofMarxianEconomic Models.”AmericanEconomicReview47,6(May):884–910. ———.1960.“AmericanEconomics.”InPostwarEconomicTrendsintheU.S.,ed. RalphE.Freeman.NewYork:Harper. ______.1961.Economics.5thed.NewYork:McGraw-Hill. ______.1962.“EconomistsandtheHistoryofIdeas.”AmericanEconomicReview 52,1(March):1–18. ———.1964.Economics.6thed.NewYork:McGraw-Hill. ———.1966.CollectedScientificPapersofPaulA.Samuelson.Vol.2.Cambridge, MA:MITPress. ———.1967a.Economics.7thed.NewYork:McGraw-Hill. ———.1967b.“MarxianEconomicsasEconomics.”AmericanEconomicReview 57,2(May):616–23. ———.1968.“WhatClassicalandNeoclassicalMonetaryTheoryReallyWas.” CanadianJournalofEconomics1(February):1–15 ———.1970.Economics.8thed.NewYork:McGraw-Hill. ———.1976.Economics.10thed.NewYork:McGraw-Hill. ———.1977.TheCollectedScientificPapersofPaulA.Samuelson.Vol.4.Cambridge,MA:MITPress. ———.1990.“Foreword.”InThePrinciplesofEconomicsCourse,ed.Phillips SaundersandWilliamB.Walstad.NewYork:McGraw-Hill. ———.1997.“CredoofaLuckyTextbookAuthor.”JournalofEconomicPerspectives11,2(spring):153–60. Samuelson,PaulA.,andWilliamD.Nordhaus.1985.Economics.12thed.New York:McGraw-Hill. ———.1989.Economics.13thed.NewYork:McGraw-Hill. ______.1998.Economics.16thed.NewYork:Irwin-McGraw-Hill. Say,Jean-Baptiste.1971[1880].ATreatiseonPoliticalEconomy,transC.R.Prinsep. 4thed.NewYork:AugustusM.Kelley. Schor,JulietB.1991.TheOverworkedAmerican.NewYork:BasicBooks. Schumacher,E.F.1973.SmallIsBeautiful.London:Penguin. Schumpeter, Joseph. 1950 [1942]. Capitalism, Socialism and Democracy. New York:Harper. ______. 1954. History of Economic Analysis. NewYork: Oxford University Press. Schwartzchild,Leopold.1947.KarlMarx,theRedPrussian.NewYork:Grosset andDunlap. Schweickart,David.2002.AfterCapitalism.London:RowmanandLittlefield. 228 BIBLIOGRAPHY Seymour-Smith,Martin.1998.The100MostInfluentialBooksEverWritten.Toronto:Citadel. Shaw,G.K.1988.KeynesianEconomics:ThePermanentRevolution.Hants,UK: EdwardElgar. Shiller,RobertJ.2005.IrrationalExuberance.2nded.Princeton:PrincetonUniversityPress. Shleifer,Andrei,andRobertW.Vishny.1998.TheGrabbingHand:Government PathologiesandTheirCures.Cambridge,MA:HarvardUniversityPress. Siegel,JeremyJ.2005.TheFutureforInvestors.NewYork:Crown/Business. Simon,JulianL.,ed.1995.TheStateofHumanity.Cambridge,UK:Blackwell. ______.1996.TheUltimateResource2.Princeton,NJ:PrincetonUniversityPress. Skidelsky,Robert.1992.JohnMaynardKeynes:TheEconomistasSaviour,1920– 1937.London:Macmillan. ______. 2003. John Maynard Keynes: Economist, Philosopher, Statesman. New York:PenguinBooks. Skousen,Mark.1990.TheStructureofProduction.NewYork:NewYorkUniversity Press. ______,ed.1992.DissentonKeynes:ACriticalAppraisalofKeynesianEconomics. NewYork:Praeger. ______.2001.TheMakingofModernEconomics.Armonk,NY:M.E.Sharpe. ______. 2005. Vienna and Chicago, Friends or Foes? Washington, DC: Capital Press. Smith,Adam.1947.“LetterfromAdamSmithtoWilliamStrahan.”InSupplement toDavidHume,DialoguesConcerningNaturalReligion,ed.NormanKemp Smith.Indianapolis,IN:Bobbs-Merrill,248. ———.1965[1776].AnInquiryintotheNatureandCausesoftheWealthofNations.NewYork:ModernLibrary. ———.1982[1759].TheTheoryofMoralSentiments,ed.D.D.RaphaelandA.L. Macfie.Indianapolis,IN:LibertyFund. ———.1982[1763].LecturesonJurisprudence,ed.R.L.Meek,D.D.Raphael,and P.G.Stein.Indianapolis,IN:LibertyFund. ______.1982.EssaysonPhilosophicalSubjects,ed.W.P.D.Wightman.Indianapolis, IN:LibertyFund. ———.1987.CorrespondenceofAdamSmith,ed.E.G.MossnerandI.S.Ross. Indianapolis,IN:LibertyFund. Snooks,GraemeDonald.1993.EconomicsWithoutTime.AnnArbor:University ofMichiganPress. Sobel,Robert.1980.TheWorldlyEconomists.NewYork:TheFreePress. Solomou,S.N.1987.“NikolaiKondratieff.”InTheNewPalgrave:ADictionaryof Economics.Vol.3,60.London:Macmillan. Solow,RobertW.1965.“EconomicGrowthandResidentialHousing.”InReadings inFinancialInstitutions,ed.M.E.KetchumandL.T.Kendall,142–64.Boston: HoughtonMifflin. Somary,Felix.1986[1960].TheRavenofZurich.London:C.Hurst. Soto,Hernandode.2002.TheOtherPath.2ded.NewYork:PerseusBooks. ______.2003.TheMysteryofCapital.NewYork:BasicBooks. Sraffa,Piero.1960.ProductionofCommoditiesbyMeansofCommodities.Cambridge,UK:CambridgeUniversityPress. BIBLIOGRAPHY 229 Stafford,William.1998.JohnStuartMill.London:Macmillan. Stigler, George J. 1941. Production and Distribution Theories. NewYork: Macmillan. ______.1966.TheTheoryofPrice.3ded.NewYork:Macmillan. ———.1976.“TheSuccessesandFailuresofProfessorSmith.”JournalofPolitical Economy84,6(December):1199–213. Stiglitz,JosephE.2001.“InformationandtheChangeintheParadigminEconomics.”2001NobelPrizeLectures(December8),472–525.Sweden:NobelPrize Committee. Sweezy,PaulM.1942.TheTheoryofCapitalistDevelopment.NewYork:Modern Reader. Sweezy,PaulM.,andPaulBaran.1966.MonopolyCapitalism.NewYork:Monthly Review. Sweezy, Paul M., and Harry Magdoff. 1977. The End of Prosperity. NewYork: MonthlyReview. Tarshis,Lorie.1947.TheElementsofEconomics.Boston:HoughtonMifflin. Terborgh, George. 1945. The Bogey of Economic Maturity. Chicago: Machinery andAlliedProductsInstitute. Thaler, Richard and Shlomo Benartzi. 2004. “Saving More Tomorrow: Using BehavioralEconomicstoIncreaseEmploymentSavings.”JournalofPolitical Economy112:S1(February),164–187. Tobin,James.1965.“TheMonetaryInterpretationofHistory:AReviewArticle.” AmericanEconomicReview55(June):466–85. ______.1992.“TheInvisibleHandinModernMacroeconomics.”InAdamSmith’s Legacy,ed.MichaelFry,117–29.London:Routledge. Tvede,Lars.1997.BusinessCycles:FromJohnLawtoChaosTheory.Amsterdam: Harwood. U.S.DepartmentofCommerce.2000.“GrossOutputbyIndustry,1987–98.”Survey ofCurrentBusiness.Washington,DC:U.S.DepartmentofCommerce.June. Veblen,Thorstein.1994[1899].TheTheoryoftheLeisureClass.NewYork:Penguin. Viner,Jacob.1965.“GuidetoJohnRae’sLifeofAdamSmith.”InLifeofAdam Smith,byJohnRae.NewYork:AugustusM.Kelley. ______.1972.TheRoleofProvidenceintheSocialOrder.Princeton,NJ:Princeton UniversityPress. Vivo,G.de.1987.“DavidRicardo.”InTheNewPalgrave:ADictionaryofEconomics.Vol.4,183–98.London:Macmillan. Wallich,HenryC.1960.TheCostofFreedom.NewYork:Collier. Walras,Leon.1954[1874,1877].ElementsofPureEconomics.Homewood,IL: RichardD.Irwin. Weber,Max.1930[1904–05].TheProtestantEthicandtheSpiritofCapitalism. NewYork:HarperCollins. Wesson,RobertG.1976.WhyMarxism?TheContinuingSuccessofaFailedTheory. NewYork:BasicBooks. West, Edwin G. 1976. Adam Smith, The Man and HisWorks. Indianapolis, IN: LibertyPress. ———.1990.“AdamSmith’sHypothesesonReligion:SomeNewEmpiricalTests.” InAdamSmithandModernEconomics,151–64.Hants,UK:EdwardElgar. 230 BIBLIOGRAPHY Wicksell,Knut.1958.SelectedPapersonEconomicTheory.London:AllenandUnwin. Wicksteed, Philip H. 1933. The Common Sense of Political Economy. Rev. ed. London:RoutledgeandKeganPaul. Wilson,Edmund.1940.TotheFinlandStation.NewYork:Harcourt,Brace. Wolff,Jonathan.2002.WhyReadMarxToday?Oxford:OxfordUniversityPress. WorldBank.1993.TheEastAsianMiracle.NewYork:WorldBank. Yergin,Daniel,andJosephStanislaw.1998.TheCommandingHeights.NewYork: Simon&Schuster. Ylikoski, Petri. 1995. “The Invisible Hand and Science.” Science Studies 8: 32–43. Yunus,Muhammad.1999.BankertothePoor.NewYork:PublicAffairs. Zarnowitz,Victor.1992.BusinessCycles.Chicago:UniversityofChicagoPress. Index Abstinencetheoryofinterest,110 Aggregatedemand,153,154f,188–189 Aggregatedemandmanagement,136, 137,150 Aggregateeffectivedemand,158–159 Aggregatesupply,153,154f,188–189 Agriculture,42,43,49 Alienation,97 AllianceforProgress,201 Alm,Richard,33–34 Anti-Americanattitudes,86 Anti-Samuelson,170 Anti-Semitism,Marxand,68–69 Antisavingproponents,157–158 Apostles,139 Aristotle,38–39 Arrow,KennethJ.,20 AS-ADdiagram,188–189 Associations,establishmentof,113 Austrianeconomists,128–132 Balancedbudgetmultiplier,172,176 BankertothePoor(Yunus),204 Banking,free,36 Bastiat,Frederic,47,74,151,216 Bauer,P.T.,202,204 Behavioraleconomics,214n1 Berman,Marshall,67 Birthrate,52–53 Black,Joseph,17 Blackboardeconomics,55 Blaug,Mark,55,105q,125,167 Blinder,Alan,20,188–189 Block,Walter,31 Böhm-Bawerk,Eugen,93,110–112, 180 Boulding,KennethE.,208 Bourgeoisie,76 BrettonWoodsagreement,152 Brown,WilliamMontgomery,67 Buchanan,James,209–210 Buckle,HenryThomas,12 Burningincidents,Smith’s,16,17 Callaghan,James,198 Cambridgeschool,115 Cannan,Edwin,15 Cantillon,Richard,42–43 Capital accumulationandfallingprofits,85–86 formsof,84–85 marginalproductivitytheory,120 CapitalandInterest(Böhm-Bawerk),110 Capitaldevelopment,positivetheoryof, 112 Capitalinvestment,11 Capital(Marx),68,80–81 money,99–100 transformationproblem,92–93 Capitalism benefits,32–34,98 collapsepredictions,90–91,101,102 crisisof,86 degreesoffaithin,26–27 evolutionaryroleof,99–100 Friedman’sviewof,196 Heilbroner’sviewof,202 Keynes’viewof,135–136,149,153 Marxistviewof,83,85–87 modernday,97–98 Protestantismand,123–124 threatsto,135,138 unstabilityof,153,172,196 Veblen’sviewof,121–123 Weber’sviewof,123 SeealsoEconomicfreedom CapitalismandFreedom(Friedman),192, 197 Capitalist-entrepreneur,111 Capitalists Böhm-Bawerk’sviewof,110–111 Marxistviewof,93 risktaker,111 workersand,93–94,111–112 Carlyle,Thomas,63 Carnegie,Andrew,33 Catchings,Waddill,157–158,183 231 232 INDEX Catholics,39,103 Chamberlin,EdwardH.,134,215 Chirognomy,141n3 Churchattendance,24n9 Churchill,Winston,142 Clark,JohnBates,109–110,117–120 Classconflict Marx,85,96 Ricardo,55,57 Veblen,121–122 Classconsciousness,96 Classicalmodel,7 abandonmentof,106 dismalscience,50–52,63 imperfections,134–135 Keynesand,149–150 macroeconomics,48–49 principles,18,36–37 recessions,185–186 recurrence,206–209,216 SeealsoNaturalliberty Coase,Ronald,30,55 Colander,David,56 CollectivistEconomicPlanning(Hayek), 200 Colonialism,8,86 Commerce,Montesquieuon,40–41 CommerceandGovernment(Condillac),43 Communism Marxand,65–66,87–89,95 SeealsoSocialism CommunismandtheBible,103 CommunistManifesto(Marx&Engels), 75–76,86 revolutionarysocialism,88–89 youthfulfanaticismand,66–67 Comparativeadvantage,54 Compensatoryfiscalpolicy,172 Competition,18 imperfect,134–135,215 Montesquieuon,39 Smithon,30–31 Condillac,EtienneBonnotde,43 ConditionoftheWorkingClassinEngland (Engels),75 Constantcapital,84–85 Consumerdemand.SeeDemand Consumption economicindicators,182 Keynesianviewof,150,175,181 leaks,180 productionand,48–49,184 productiveandunproductive,186 Contradictioninnature,87 Cornmodel,57,59 Cost.SeePrice Cost,opportunity,109 CostofFreedom(Wallich),201 Costtheory,59 Cox,Michael,32–34 Credit,Keynes’viewof,152 CritiqueofCriticalCritique(Marx& Engels),75 Darwin,Charles,80 DasKapital(Marx).SeeCapital Debt,national,176–177 Demand,48–49 aggregate.SeeAggregatedemand consumer,106,107–109,185 createssupply,159 effective,158–159 pricesdeterminedby,109 Demuth,Helene,78 Denby,David,97,98 Depressionmodel,162 Desai,Meghnad,102 Determinism,80,87,96 Dialecticalmaterialism,71 Diamond-waterparadox,50–51, 108n1–109n1 DigressiononSilver(Smith),36 Diminishingreturns,53 Dismalscience,50–52,63 Dissent,101 Distribution,106 fundamentaltheoremof,58 lawofcompetitive,118 linkedtoproduction,109 DistributionofWealth(Clark),118,119 Distributionproblem,117–118 Divisionoflabor.SeeLabor Douglas,C.H.,157 D’Souza,Dinesh,29 Easy-moneypolicy,128,130,213 Eaton,John,148n7 EconomicandPhilosophicalManuscripts of1844(Marx),67,74 Economicclasses,disintegrationof, 93–94 EconomicConsequencesofMr.Churchill (Keynes),142 EconomicConsequencesofthePeace (Keynes),140–141,156 Economicdeterminism,80,87,96 INDEX 233 Economicfreedom,10–11,18 economicgrowthand,31–32,203–204 effectsof,31–32,34 SeealsoCapitalism Economicgrowth Böhm-Bawerkon,112 economicfreedomand,31–32,203–204 keysto,11 Protestantismand,124 savingsand,179 Economicindicators,182 EconomicPossibilitiesforOur Grandchildren(Keynes),152,217 Economictheories pendulumapproachto,ix–x totempoleapproachto,x–xi Economics blackboard,55 classical.SeeClassicalmodel expandingroleof,209 theimperialscience,209 mathematicsand,55,56 moralbehaviorand,30 neoclassical,106,192–193,199,205 asasocialscience,113 stagnationof,106 Economics(Samuelson),165–166,169, 170 EconomicsofImperfectCompetition (Robinson),134–135 Edgeworth,Francis,115–116 Education,89 Effectivedemand,158–159 Egoism,27,29 Ekinsdiagram,180,181f Ekins,Paul,180,181f ElementsofPureEconomics(Walras),107, 116 Employment Keynes’theoryof,153,154,160–162,172 SeealsoUnemployment EndofLaissez-Faire(Keynes),149 EndofProsperity(Sweezy),91 Engels,Friedrich deathof,83 onFeuerbach,71 friendshipwithMarx,74–75 Marx’sillegitimateson,78–79 revisedviews,95–96 Enlightenedself-interest.SeeInvisible hand Enlightenment,4,6 Entrepreneurs,48,93,111 Environmentalism,214 Equationofexchange,126–127,196 EssayonPopulation(Malthus),51 EssayontheNatureofCommercein General(Cantillon),42–43 EssenceofChristianity(Feuerbach),71 EverydayStalinism(Fitzpatrick),203 Exchange classicalviewof,106 equationof,126–127,196 keytowealth,9 Marxistviewof,99–100 Experimentaleconomics,215 Exploitation,worker,85,86 FableoftheBees,39–40 Fallingprofits,85–86 Faust,72 FederalReserve,127–128,160, 194–195 Feuerbach,Ludwig,71 Fiscalpolicy,172,208 Fisher,Irving,125–128,129 Fitzpatrick,Sheila,203 Foster,WilliamT.,157–158,183 FoundationsofEconomicAnalysis (Samuelson),55 Franklin,Benjamin,44–45,174 Freebanking,36 Freemarkets degreesoffaithin,26–27 postSovietUnion,199,204 wealthandprosperitythrough,18 Freetrade.SeeTrade Freedom,economic.SeeEconomic freedom Friedman,Milton,3q,191q onGreatDepression,128,193–196 honorsandawards,192 on“invisiblehand,”19–20,192 Keynesianopponent,137,192–193 monetaryrules,198–199 Phillipscurve,197–198 quantityofmoney,194,196–197 Frugality.SeeThrift Fukuyama,Francis,204 Galbraith,JohnKenneth,136 Garrison,Roger,109n1 Generalequilibriumtheory,116 GeneralTheoryofEmployment,Interest andMoney(Keynes),144–146 capitalinstability,135,153–154 234 INDEX GeneralTheoryofEmployment,Interest andMoney(Keynes)(continued) Germanedition,163 monetarypolicy,196–197 Say’slawofmarkets,184–186 George,Henry,119,120n2 Gibbon,Edward,5 God invisiblehandand,25–26 Smith’sreferencesto,23,24,25,44 SeealsoReligiousbeliefs Goethe,72 Gold GreatDepression,194–195 Keynes’viewof,150,152 mercantilismand,8 Mises’viewof,131 removingfrommonetarysystem,152 Smith’sviewof,9,36 SeealsoMoney Government Friedman’sviewof,196 GreatDepressionand,211 Keynes’viewsof,136,150,159 sizeandgrowth,212–213 Smith’sviewof,34–36 GreatContraction,194,211 GreatDepression,128,132,134,163 Friedmanon,193–196 goldstandard,194–195 Higgson,210–211 moneysupply,194,195f GreatDuration,211 GreatEscape,211 Greed,27,29,97,124 Grossdomesticexpenditures(GDE),182 Grossdomesticproduct(GDP),158–159, 182,212 Gutiérrez,Gustavo,103 Gwartney,James,31–32,34,205–206 Hahn,Frank,20,26 Hands,readingof,141n3 Hansen,Alvin,165,167–168 Harmonyofinterests,57 Harrington,Michael,90,94 Harris,SeymourE.,164–165 Harrod,Roy,139 Harrod-Domarmodel,201 Hayek,Friedrich onclassicalmodel,106 onFableoftheBees,40 oninvestment,183 onKeynes,192 Hayek,Friedrich(continued) onMill,62 monetarycrisispredictions,128,132 onsavings,158 onsocialismandeconomics,200 stagesofproduction,131 Hayekiantriangles,131 Hazlitt,Henry,192 Hegel,GeorgeWilhem,71,87 Heilbroner,Robert,25,202–203 Hicks,John,153 Higgs,Robert,210–211 Historicalmaterialism,87,96 HistoryofAstronomy(Smith),21 HistoryoftheDeclineandFallofthe RomanEmpire(Gibbon),5 Hobson,J.A.,86 HumanAction(Mises),192 Hume,David,6,17,24–25,44 Hutt,W.H.,163q Hutton,James,17 HydraulicKeynesianism,174,175f,180 I,Pencil(Read),10n2,26 Illiad(Homer),78 Imperfectcompetition,134–135,215 Imperfectmarket,214–215 Imperialscience,209 Imperialism,86 “Inthelongrunwearealldead”(Keynes), 150–152 Income earned,109 national,171–172,182,197 SeealsoDistribution Income-expenditurediagram,171–172,186 Inflation,unemploymentand,187,198 Inflationarybooms,130–131 Inflationarycrisis,186–189 Interest abstinencetheoryof,110 marginalproductivitytheory,120 marketrateof,130 naturalrateof,130 SeealsoSavings Internationaldevelopmentorganizations, 201 Investment Böhm-Bawerk’sviewof,112,120 Hayekon,183 Keynes’viewof,155–157,162 Samuelson’sviewof,171–172,174–175 transfertax,162 SeealsoSavings INDEX 235 Investors,Keynes’viewof,153–155 InvisibleGod,25 Invisiblehand benefits,19–20 FableoftheBees,39 Friedmanon,19–20,192 Godand,25–26 interpretations,22–23 Keynes’critiqueof,149 mathematicalmodels,115 Smith’sreferencesto,21–22,23 Stiglitzon,214 Ironlawofwages,58 IS-LMdiagram,153 Jevons,WilliamStanley,46q,107–108, 114–115 Jews,Marx’santi-Semitism,68–69 Joint-inputproblem,118 Journals,101,113 Jouvenel,Bertrandde,7–8,11 Justprice,39 Justice,18,206 Kahn,Richard,160 Kates,Steven,49,184–186 Keynes,FlorenceAda,138 Keynes,JohnMaynard oncapitalism,135–136,149,153 chirognomy,141n3 darkside,137–138 deathof,147 disdainforMarx,147–148 onFableoftheBees,40 GeneralTheory.SeeGeneralTheoryof Employment,InterestandMoney ongovernment,136,150,159 homosexuality,139–140 honorsandawards,191 “Inthelongrunwearealldead,” 150–152 onJevons,114–115 lifeof,138–147 Marxistdisdainfor,148n7 misogynistictendencies,140,156n9 onMontesquieu,41 publicworks,160–162 recessionsolutions,159–160 onRicardo,56–57,60 onSmith,149 spending,158–162 stockmarketactivities,142–144,155 totempoleposition,x,xif onuninvestedsavings,155–157 Keynes,JohnNeville,138 Keynesiancross,171–172,186 Keynesianeconomics comeback,186–189,213 critics,177–186 revoltagainst,192 Samuelsonand,170–177 Keynesianrevolution,136–137,163 Keynesiantopics,171 Klamer,Arjo,56 Kolakowski,Leszek,89 Kondratieff,Nikolai,91 Krugman,Paul,133q onKeynes’GeneralTheory,146 onKeynsianeconomics,138,189 Kuznets,Simon,158 Labor divisionof,10 marginalproductivityof,109 valuein,59–60,83 Labortheoryofvalue,54,59–60,83–84,92 Laborunions,119 Laissez-fairepolicy Bastiat,47 Keynes,149 Malthus,53 Montesquieu,41 Quesnay,42 Say,47 Walras,116 Land,marginalproductivityand,119–120 Landlords Marxand,84,85 Ricardoand,57–59 Lassalle,Ferdinand,77 LatinAmerica AdamSmithsolution,104 Marxist-drivenideology,102–104 Law,The(Bastiat),47 Lawofcomparativeadvantage,54 Lawofcompetitivedistribution,118 Lawofdiminishingreturns,53,58 Lawofmarkets.SeeSay’slaw Lawofnature,Malthus,’52–54 Lawofthefallingrateofprofit,85–86 Lawson,RobertA.,31–32,34 Lebergott,Stanley,32–33 Leisureclass,121,122 Lenin,VladimirIlich,81,86 Leontief,Wassily,89 Liberationtheology,102–104 Liebknecht,Wilhelm,77 Liquiditytrap,160,177–178 236 INDEX Livingstandards.SeeStandardofliving LondonSchoolofEconomics,113 Lopokova,Lydia,140 Loss,price-costmarginsand,109 Lucas,RobertJr.,198 Macbeth,22–23 Machinery labor-saving,11 Marxistviewof,85,86,94 Macroeconomics classicalmodel,48–49 Keynesand,137,153 microeconomicslinkedto,129,137n2 neoclassical,205 Samuelsonand,166 Macroeconomics(Mankiw),206–207 Malthus,ThomasRobert dismalscience,50–52,63 populationstudies,51–52 sinsofomission,53–54 Mandel,Ernest,90 Mandeville,Bernard,39–40 Mankiw,N.Gregory,191q,206–207 Mantoux,Etiennede,141n4 Marginalproductivitytheory,118–120 Marginalutility,108,114 Marginalistrevolution,107–110 Marginalityprinciple,117 Marketeconomy,invisiblehand,19 Marketimperfection,214–215 Marketrateofinterest,130 Markets,Say’slawof.SeeSay’sLaw Marshall,Alfred,112–113,115,133q MarshallPlan,201 Marx,Eleanor,83 Marx,Karl anantieconomist,94–95 beardandZeus,78 collegeradical,70–71 communism,65–66,87–89,95 CommunistManifesto.SeeCommunist Manifesto criticismsof,92–94,110 darksideof,72–73 DasKapital.SeeCapital deathof,82 andeconomics,67–68 andEngels,74–75 falsepredictions,89–90 illegitimateson,78–79,83 influenceson,71–72 Keynes’disdainfor,147–148 Marx,Karl(continued) lifeof,68–82 marriage,73–74 phrenology,77–78 poemabout,71 poemsby,72–73 policereporton,76–77 povertyandwealthof,79–80 quotes,64q recantation,95 religiousbeliefs,69–70,71,89 revolutionarysocialism,88–89 Ricardo’sinfluenceon,54 Smithcontrastedto,64–65 surplusvalue,84–85 totempoleposition,xi,xif transformationproblem,92–93 youthfulfanaticismand,66–67 Marx,Laura,83 Marxism&Marxists collapseof,199–200 Keynes’disdainfor,147–148 modern-day,90–91,96–98,100–104, 213 1930’s,135 Materialism,97 Mathematics,55,56,115–116,168 McConnell,Campbell,179 Meltzer,AllanH.,154 Menger,Carl,107–108 Mercantilism,7–9,22,44 Micro-creditrevolution,204 Microeconomics imperfectcompetition,134–135 macroeconomicslinkedto,129,137n2 neoclassical,205 Mill,JohnStuart,50,61–63,106,122 Minsky,HymanP.,153,175 Mises,Ludwigvon,94,128–132 onKeynes,151,164,192 onsocialismandeconomics,200 vindicationof,203 Modigliani,Franco,179 Monetarycrisispredictions,128 MonetaryHistoryoftheUnitedStates (Friedman),193 Monetarymodelsandpolicy Fisher’s,125–128,129 Friedman’s,193–194,197–199 governmentand,213 Keyneson,196–197 Mises’s,129–130 Monetarysystem,Smith’sviewof,36 INDEX 237 Money asacommodity,129 eliminationof,89 Marxistviewof,99–100 roleof,125 SeealsoExchange;Gold;Monetary modelsandpolicy;Money,quantity theoryof Money,InterestandPrices(Patinkin),178 Money,quantitytheoryof Fisher’s,126–127 Friedmanvs.Keynes,196–197 Hume’sviewsof,44 Smith’sviewof,36 Monopoly,30–31,86 Montesquieu,CharlesdeSecondat,39, 40–41 MonthlyReview,101 Moralbehavior,30 Multiplier balancedbudget,172,176 Friedmanon,197 fullemployment,160–162 savings,180 Musgrave,Richard,209–210 Nationaldebt,176–177 Nationalincome,171–172,182,197 Naturalliberty,7,10–11 Keynes’critiqueof,149 principlesof,11,18 standardoflivingand,31–32 SeealsoClassicalmodel Naturalrate interest,130 unemployment,197 Neoclassicaleconomics.SeeEconomics, neoclassical NewLeftReview,101 Newcomb,Simon,126 Nordhaus,Bill,208 Novak,Michael,103–104 OnLiberty(Mill),61 OnPrinciplesofPoliticalEconomyand Taxation(Ricardo),54,56,60 OntheJewishQuestion(Marx),68–69 Opportunitycost,109 Optimality,116–117 Optimism eraof,46 Smithand,37–38 turnsdismal,50–52,63 OrbisBooks,103,104 Oulanem(Marx),72–73 OverworkedAmerican(Schor),97–98 Padover,SaulK.,64q,69 Paradoxofthrift,173–174,179,208 Paradoxes diamond-water,50–51,108n1–109n1 thrift,173–174,179,208 value,108 Pareto,Vilfredo,115–116 Paretooptimality,116–117 Patinkin,Don,178 Pendulum,ix–x Peuchet,Jacques,73 Phillips,A.W.,187 Phillipscurve,187,197–198 Phrenology,77–78 Pigou,ArthurC.,178 Pinfactory,10 Plato,38–39 Player,The(Marx),72 Poetry aboutMarx,71 Marx’s,72–73 Pollutionfees,214 Poorpeople benefitfromcapitalism,32–34 Yunusand,204–205 Popper,Karl,96–97 Populationstudies,51–52 PositiveTheoryofCapital(Böhm-Bawerk), 112 PovertyofPhilosophy(Marx),96 Price determinedbydemands,109 determinedbyscarcity,108n1 determinedbysupply,59 stability,127,130 PriceandProduction(Hayek),131 Price-costmargins,109 PrinciplesofEconomics(Mankiw),207 PrinciplesofEconomics(Marshall),113 PrinciplesofEconomics(Menger),107 PrinciplesofPoliticalEconomy(Mill),61, 106,122 Privateproperty Marxistviewof,89 Veblen’sviewof,121 Privatization,35 Production consumptionand,48–49,184 errorsof,185 238 INDEX Production(continued) factorsof,118 keytowealth,9 linkedtodistribution,109 forprofitsanduse,106 roundabout,112,131 stagesof,10,131 ProductionofCommoditiesbyMeansof Commodities(Sraffa),55 Profitrateandvalueproblem,92–93 Profits falling,85–86 price-costmarginsand,109 productionfor,106 useand,109 Property,private.SeePrivateproperty Prosperity economicfreedomand,31 keysto,10–11,18 ProtestantEthicandtheSpiritof Capitalism(Weber),123 ProtestantReformation,123,124 Protestants,39 Public-choicetheory,209–210 PublicFinanceinTheoryandPractice (Musgrave),209 Publicworks,160–162 PurchasingPowerofMoney(Fisher),126 QuantityTheoryofMoney,126–127 Quantitytheoryofmoney.SeeMoney, quantitytheoryof Quesnay,François,41–42 Radicaljournalsandorganizations,101–102 Rationalexpectations,198 Read,Leonard,10n2,26 Realbalanceeffect,178 Recession 1970s,186–189,198 Keynesiansolutionsto,159–160,172–173 Say’sexplanationfor,185–186 ReflectionsontheFormationand DistributionofWealth(Turgot),43 Religiousbeliefs Hume,24–25,44 Marx,69–70,71,89 Smith,24–25,44 Weber,123,124 SeealsoGod Religiousfreedom,churchattendanceand, 24n9 Revolutionarysocialism.SeeSocialism Ricardianvice,54,55 Ricardo,David,54–56 dismalscience,50,51,63 distribution,57–59 Marxand,83–84 Sayon,48 valueinlabor,59–60 Risklevel,111 Robinson,Joan,135,215 Rostow,W.W.,201,204 Rothbard,Murray,42,192 Rothschild,Emma,22–23 Roundaboutness,112,131 Samuelson,PaulA.,164 AS-ADdiagram,188 onCapital,93 criticismof,169–170 Economics,165–166,169,170 goalsof,171 honorsandawards,166,168,169 onKeynes’GeneralTheory,146,153 Keynesiancross,171–172,186 lifeof,166–167 macropolicydilemma,187 onMarx,69 onMarxisteconomics,94 mathematicalequations,55,168 onnationaldebt,176–177 onnewglobaleconomy,208 paradoxofthrift,173–174,208 postwarpredictions,168 revisedtheories,208 onSmith,12,174 onsocialism,201 SavingAmericanCapitalism(Harris),164 Savings antisavingproponents,157–158 Böhm-Bawerk’sviewof,112,180 economicgrowthand,179 Hayekon,158 Keynes’viewof,155–157 Mankiw’sviewof,207 multiplier,180 positivesideof,180 Protestantismand,124 Samuelson’sviewof,171–175,208 Say’sviewof,49 SeealsoInterest;Investment;Thrift Say,Jean-Baptiste,47–48 Say’sLaw,48–49,86,92 inverseof,159 Keynesand,184–186 INDEX 239 Say’sLawandtheKeynesianRevolution (Kates),184–185 Schor,Juliet,97–98 Schumpeter,Joseph,60,101,200 Schwartz,AnnaJ.,193 Schweickart,David,102 Self-interest meaningof,27 sympathyvs.,29–30 wealthandprosperitythrough,18,19 SeealsoInvisiblehand Self-restraint,28 Selfishness,29 Senior,NassauWilliam,28n10 Shakespeare,22–23 Sham-lecture,13–14 Shaw,G.K.,189 Silver,8,9,36 Skulls,readingof,77–78 Smith,Adam advocateforthecommonman,6–7 burningofmanuscripts&papers,17 burnsclothes,16 customsagent,16–17 deathof,18 economicfreedom,10–11 onFableoftheBees,40 famousremark,38 ongovernment,34–36 hypotheses,31–32 invisiblehand.SeeInvisiblehand Keynes’critiqueof,149 lifeof,12–18 Marxcontrastedto,64–65 naturalliberty,7,10–11 optimist,37–38 religiousbeliefs,24–25,44 sham-lecture,13–14 shiftbackto,205–206,216 sympathyvs.self-interest,29–30 totempoleposition,x,xif universalopulence,6,7,10–11,32 viewofgreedandselfishness,29 viewoftrade,8 WealthofNations.SeeWealthofNations Smith,VernonL.,215 Smugglers,16 SocialJusticeWithoutSocialism(Clark),119 SocialSecurity,207 Socialism,60–61,200 criticsof,203 Heilbroneron,202–203 Marxand,88–89,95 Socialism(continued) Milland,62–63 postWWII,200–202 Sweezyand,101 Solowgrowthmodel,207 Somary,Felix,142 SovietUnion,collapseof,199,202 Spanishscholastics,39,124 Specie-flowmechanism,44,131 Spending,Keynes’on,158–161 SpiritoftheLaws(Montesquieu),40 Sraffa,Piero,54,55 Stabilizationpolicy,208 StagesofEconomicGrowth(Rostow),201 Stages-of-production,10 Stagflation,198 Stagnationthesis,167–168 Standardofliving capitalismand,32–34 economicfreedomand,31–32 Stigler,George,14n4,20 Stiglitz,Joseph,214–215 Stockmarket crashof1929,127 Keynesand,142–144,155 transfertax,162 Suicide ofMarx’sdaughters,83 Marx’sfascinationwith,73 Supply,48–49 aggregate,153,154f,188–189 demandcreates,159 pricedeterminedby,59 Surplusvalue,84–85,110 Sweezy,PaulM.,91,100–101,135 Sympathy,self-interestvs.,29–30 Systemofnaturalliberty.SeeNatural liberty Tableauéconomique,41–42 Tariffs,Smith’sviewof,8 Tarshis,Lorie,175 Taxcuts,Keynesianviewof,172 Taxation land,119–120 Samuelson’sviewof,176 Smith’sviewof,35 TeachingofMarxforGirlsandBoys (Brown),67 Theology,liberation,102–104 TheologyofLiberation(Gutiérrez),103 TheoryofMoneyandCredit(Mises), 129–130 240 INDEX TheoryofMonopolisticCompetition (Chamberlin),134 TheoryofMoralSentiments(Smith) God,23,25,44 government,35–36 invisiblehand,21–22,23 sympathy,29–30 yearpublished,14 TheoryofPoliticalEconomy(Jevons),107 Theoryofsurplusvalue,84–85,110 TheoryoftheLeisureClass(Veblen),121,122 Thrift,11,36 anti-thriftproponents,157–158 Böhm-Bawerk’sviewof,112 Keynes’viewof,156–157 paradoxof,173–174,179,208 Protestantismand,124 Say’sviewof,49 SeealsoSavings Tobin,James,26,162n11,193 Tocqueville,Alexisde,47 Totempole,x–xi Townsend,Charles,15 TractonMonetaryReform(Keynes),142 Trade Bastiat’sviewof,47 Hume’sviewof,44 mercantilistrestraintof,8 Smith’sviewof,8–9,16 Transfertax,162 Transformationproblem,92–93 Travelingabroad,youth,14n4 TreatiseonMoney(Keynes),143,156 TreatiseonPoliticalEconomy(Say),47,48 Tullock,Gordon,210 Turgot,Jacques,43 TwilightofCapitalism(Harrington),90 Underconsumptionists,157–158 Unemployment inflationand,187,198 involuntary,185,215 Mankiw’sviewof,207 naturalrateof,197 wagecutsand,178 warand,163–164 Unemploymentequilibrium,153 UnionofRadicalPoliticalEconomics, 101–102 Unions.SeeLaborunions UnitedKingdom,riseinincome,5f UnitedStates standardofliving,33,33f UnitedStates(continued) stockmarketcrashof1929,127 Universalopulence,6,7,10–11,32 Universities,economicsdepartments,113 URPE.SeeUnionofRadicalPolitical Economics Utility,marginal.SeeMarginalutility Value cost-of-productiontheory,59,106, 108 labortheory,54,59–60,83–84,92 marginalprincipleof,108–109 paradoxof,108 surplus,84–85,110 in“use”vs.in“exchange,”108 Variablecapital,84–85 Veblen,Thorstein,121–123 Viner,Jacob,23 Voltaire,15 Wages Böhm-Bawerk’sviewof,111 Clark’sviewof,118–119 cutsandunemployment,178 Malthus’viewof,54 Mankiw’sviewof,207 marginalproductivityoflaborand, 109 naturallibertyand,11 Ricardo’sviewof,57–59 Waitingargument,110 Wallich,HenryC.,201 Walrus,Leon,107–108,115–116 War employmentand,163–164 Keynes’viewof,163 Smith’sviewof,35 Watershedyears 1776,4–6 1848,60–61 1948,164–165 1970s,186–189 Wealth earned,109 keysto,9–10,18 measurementof,9 Ricardo’sdistributionof,57–59 Wealth,Distributionof(Clark),118,119 WealthofNations(Smith) editions,15 greedandegoism,27–28 invisiblehandreference,22 INDEX 241 WealthofNations(Smith)(continued) objectivesofwriting,7 sympathyvs.self-interest,29–30 universalacclaim,12 writingandpublicationof,4–5,15 SeealsoSmith,Adam Webb,Beatrice,135,200 Webb,Sidney,135,200 Weber,Max,123–125 Welfareeconomics,20–21,115–116 Westphalen,Jennyvon,72,73–74,79 deathof,82 Wicksell,Knut,107,130 “Woolencoat”example(Smith),10, 19 Wordsworth,William,46,168 Worker-capitalistphenomenon,93–94 SeealsoCapitalists Workerexploitation,85,86 Workerrevolts,76 WorldBank,199,201,204 WorldWarII,163,211 socialismafter,200–203 WorldlyPhilosophers(Heilbroner),202 Yeager,Leland,189 Youth education,89 travelingabroad,14n4 Yunus,Muhammad,204–205 Zeus,78 AbouttheAuthor Mark Skousen is a professional economist, investment expert, university professor, and author of over twenty books. Currently heholdstheBenjaminFranklinChairofManagementatGrantham University.In2004–05,hetaughteconomicsandfinanceatColumbia BusinessSchoolandColumbiaUniversity,andfrom1986to2003, atRollinsCollegeinFlorida.Since1980,Skousenhasbeeneditorin chiefofForecasts&Strategies,apopularaward-winninginvestment newsletter.HeisalsochairmanofInvestmentU,oneofthelargest investmente-lettersinthecountry,with300,000subscribers.Heis aformeranalystfortheCIA,acolumnisttoForbesmagazine,and pastpresidentoftheFoundationforEconomicEducation(FEE)in NewYork.HehaswrittenfortheWallStreetJournal,Forbes,and Reasonmagazine,andhasappearedonCNBC,CNN,ABCNews, FoxNews,andC-SPANBookTV.HisbestsellersincludeTheMakingofModernEconomicsandThePowerofEconomicThinking.In 2006, he compiled and edited The CompleatedAutobiography, by BenjaminFranklin.Inhonorofhisworkineconomics,financeand management,GranthamUniversityrenameditsbusinessschool“The MarkSkousenSchoolofBusiness.” Websites:www.markskousen.com;www.mskousen.com Emailaddress:editors@markskousen.com 243