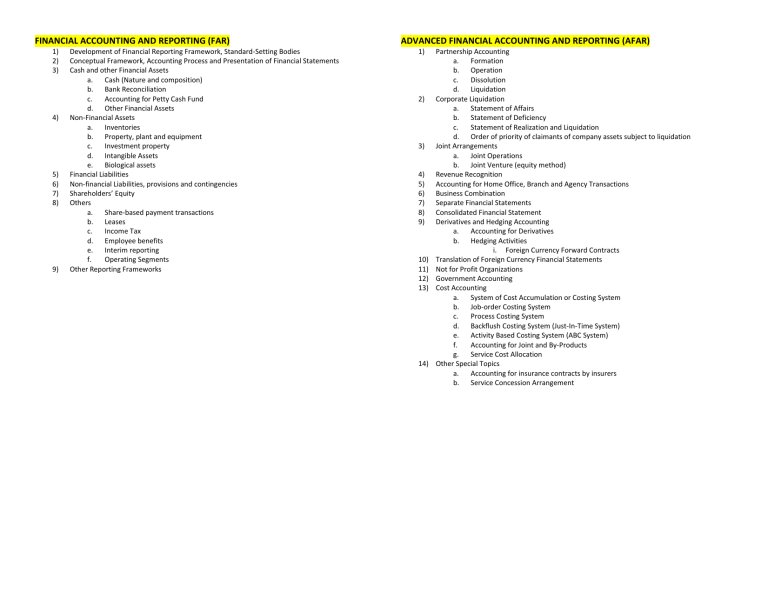

FINANCIAL ACCOUNTING AND REPORTING (FAR) 1) 2) 3) 4) 5) 6) 7) 8) 9) Development of Financial Reporting Framework, Standard-Setting Bodies Conceptual Framework, Accounting Process and Presentation of Financial Statements Cash and other Financial Assets a. Cash (Nature and composition) b. Bank Reconciliation c. Accounting for Petty Cash Fund d. Other Financial Assets Non-Financial Assets a. Inventories b. Property, plant and equipment c. Investment property d. Intangible Assets e. Biological assets Financial Liabilities Non-financial Liabilities, provisions and contingencies Shareholders’ Equity Others a. Share-based payment transactions b. Leases c. Income Tax d. Employee benefits e. Interim reporting f. Operating Segments Other Reporting Frameworks ADVANCED FINANCIAL ACCOUNTING AND REPORTING (AFAR) 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) Partnership Accounting a. Formation b. Operation c. Dissolution d. Liquidation Corporate Liquidation a. Statement of Affairs b. Statement of Deficiency c. Statement of Realization and Liquidation d. Order of priority of claimants of company assets subject to liquidation Joint Arrangements a. Joint Operations b. Joint Venture (equity method) Revenue Recognition Accounting for Home Office, Branch and Agency Transactions Business Combination Separate Financial Statements Consolidated Financial Statement Derivatives and Hedging Accounting a. Accounting for Derivatives b. Hedging Activities i. Foreign Currency Forward Contracts Translation of Foreign Currency Financial Statements Not for Profit Organizations Government Accounting Cost Accounting a. System of Cost Accumulation or Costing System b. Job-order Costing System c. Process Costing System d. Backflush Costing System (Just-In-Time System) e. Activity Based Costing System (ABC System) f. Accounting for Joint and By-Products g. Service Cost Allocation Other Special Topics a. Accounting for insurance contracts by insurers b. Service Concession Arrangement AUDITING 1) Theory on Auditing and Attestation Services 2) Auditing Practice MANAGEMENT SERVICES 1) Management Accounting a. Objectives, role and scope of management accounting b. Management accounting concepts and techniques for planning and control i. Cost terms, concepts and behavior ii. Cost-volume profit (CVP) analysis iii. Standard costing and variance analysis iv. Variable vs. Absorption Costing v. Financial planning and budgets c. Management accounting concepts and techniques for performance measurement i. Responsibility accounting and transfer pricing ii. Balanced scorecard d. Management accounting concepts and techniques for decision making i. Relevant costing and differential analysis 2) Financial Management a. Objectives and scope of financial management b. Financial management Concepts and Techniques for planning, control and decision making i. Financial statement analysis ii. Working capital management iii. Capital Budgeting iv. Risks and leverage v. Capital structure and long-term financing decision vi. Financial markets 3) Economic Concepts essential to obtaining an understanding of entity’s business and industry a. Macroeconomics b. Microeconomics REGULATORY FRAMEWORK AND BUSINESS TRANSACTIONS (RFBT) 1) 2) 3) 4) 5) 6) 7) 8) Law on Business Transactions a. Obligations b. Contracts c. Sales d. Credit Transactions Bouncing checks Consumer Protection Financial Rehabilitation and Insolvency Philippine Competition Act Government Procurement Law Law on Business Organization a. Partnerships b. Corporations c. Insurance d. Cooperatives Law on Other Business Transactions a. PDIC LAW b. Secrecy of Bank Deposits c. Truth in Lending Act d. AMLA Law e. Intellectual Property Law f. Data Privacy Act g. Electronic Commerce Act h. Ease of Doing Business and Efficient Delivery of Government Service Delivery Act i. Labor Law j. Social Security Law TAXATION 1) 2) 3) 4) 5) 6) 7) 8) 9) Principles of Taxation Tax Remedies Income Taxation Transfer Taxes a. Estate Tax b. Donor’s Tax Business Taxes a. Value-added tax b. Percentage Tax c. Specific provisions of other special laws relating to business taxation i. Senior Citizen’s Law ii. Magna Carta for Disabled Persons Documentary Stamp Tax Excise Tax Taxation Under Local Government Code Preferential Taxation a. Special Economic Zone Act b. Bases Conversion and Development Act c. Omnibus Investment Code d. Basic Principles of tax treaty and specific provisions of Double Taxation Agreement models e. Tax implications of transactions applying the tax rules and regulations, and sound tax planning strategies within legal and ethical bounds to efficiently manage tax liabilities