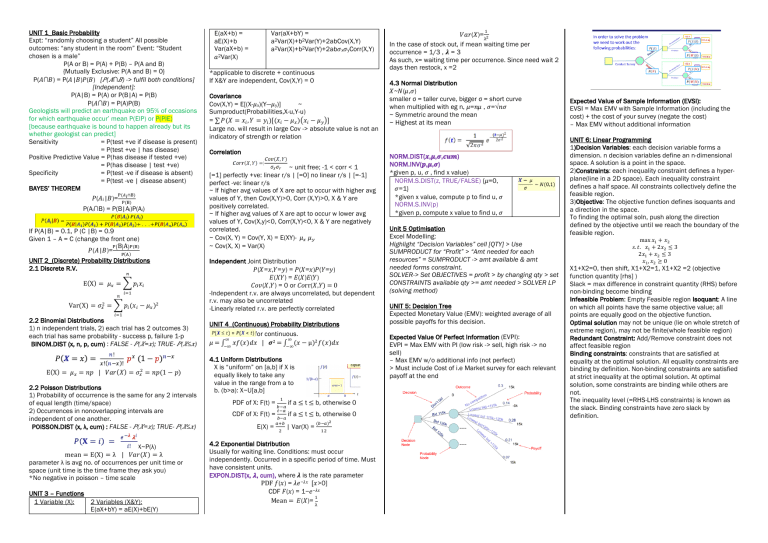

UNIT 1_Basic Probability

Expt: “randomly choosing a student” All possible

outcomes: “any student in the room” Event: “Student

chosen is a male”

P(A or B) = P(A) + P(B) – P(A and B)

{Mutually Exclusive: P(A and B) = 0}

P(𝐴∩𝐵) = P(𝐴|𝐵)𝑃(𝐵) [𝑃(𝐴∩𝐵) -> fulfil both conditions]

[Independent]:

P(A|B) = P(A) or P(B|A) = P(B)

P(𝐴∩𝐵) = P(A)P(B)

Geologists will predict an earthquake on 95% of occasions

for which earthquake occur’ mean P(ElP) or P(PlE)

[because earthquake is bound to happen already but its

whether geologist can predict]

Sensitivity

= P(test +ve if disease is present)

= P(test +ve | has disease)

Positive Predictive Value = P(has disease if tested +ve)

= P(has disease | test +ve)

Specificity

= P(test -ve if disease is absent)

= P(test -ve | disease absent)

BAYES’ THEOREM

𝑃(𝐴𝑖|𝐵)=

"($! ∩&)

"(&)

P(Ai∩B) = P(B|Ai)P(Ai)

If P(A|B) = 0.1, P (C |B) = 0.9

Given 1 – A = C (change the front one)

"(B)A*"(&)

𝑃(𝐴|𝐵)=

"(+)

UNIT 2_(Discrete) Probability Distributions

2.1 Discrete R.V.

.

E(X) = 𝜇, = - 𝑝- 𝑥.

Var(X) =

𝜎,1

-/0

= - 𝑝- (𝑥- − 𝜇, )1

-/0

2.2 Binomial Distributions

1) n independent trials, 2) each trial has 2 outcomes 3)

each trial has same probability - success p, failure 1-p

BINOM.DIST (x, n, p, cum) : FALSE - 𝑃(𝑋=𝑥); TRUE- 𝑃(𝑋≤𝑥)

E(X) = 𝜇, = 𝑛𝑝 | 𝑉𝑎𝑟(𝑋) = 𝜎,1 = 𝑛𝑝(1 − 𝑝)

2.2 Poisson Distributions

1) Probability of occurrence is the same for any 2 intervals

of equal length (time/space)

2) Occurrences in nonoverlapping intervals are

independent of one another.

POISSON.DIST (x, λ, cum) : FALSE - 𝑃(𝑋=𝑥); TRUE- 𝑃(𝑋≤𝑥)

X~P(λ)

mean = E(X) = λ | 𝑉𝑎𝑟(𝑋) = λ

parameter λ is avg no. of occurrences per unit time or

space (unit time is the time frame they ask you)

*No negative in poisson – time scale

UNIT 3 – Functions

1 Variable (X):

2 Variables (X&Y):

E(aX+bY) = aE(X)+bE(Y)

E(aX+b) =

aE(X)+b

Var(aX+b) =

𝑎2Var(X)

Var(aX+bY) =

a2Var(X)+b2Var(Y)+2abCov(X,Y)

a2Var(X)+b2Var(Y)+2ab𝜎x𝜎yCorr(X,Y)

*applicable to discrete + continuous

If X&Y are independent, Cov(X,Y) = 0

Covariance

Cov(X,Y) = E[(X-𝜇 x)(Y—𝜇 y)]

~

Sumproduct(Probabilities,X-u,Y-u)

= ∑ 𝑃(𝑋 = 𝑥- , 𝑌 = 𝑦- )[(𝑥- − 𝜇, )E𝑥- − 𝜇2 F]

Large no. will result in large Cov -> absolute value is not an

indicatory of strength or relation

Correlation

~ unit free; -1 < corr < 1

[=1] perfectly +ve: linear r/s | [=0] no linear r/s | [=-1]

perfect -ve: linear r/s

~ If higher avg values of X are apt to occur with higher avg

values of Y, then Cov(X,Y)>0, Corr (X,Y)>0, X & Y are

positively correlated.

~ If higher avg values of X are apt to occur w lower avg

values of Y, Cov(X,y)<0, Corr(X,Y)<0, X & Y are negatively

correlated.

~ Cov(X, Y) = Cov(Y, X) = E(XY)- 𝜇, 𝜇2

~ Cov(X, X) = Var(X)

Independent Joint Distribution

𝑃(𝑋=𝑥,𝑌=𝑦) = 𝑃(𝑋=𝑥)𝑃(𝑌=𝑦)

𝐸(𝑋𝑌) = 𝐸(𝑋)𝐸(𝑌)

𝐶𝑜𝑣(𝑋,𝑌) = 0 or 𝐶𝑜rr(𝑋,𝑌) = 0

-Independent r.v. are always uncorrelated, but dependent

r.v. may also be uncorrelated

-Linearly related r.v. are perfectly correlated

UNIT 4_(Continuous) Probability Distributions

for continuous.

3

3

𝜇 = ∫43 𝑥𝑓(𝑥)𝑑𝑥 | 𝝈2 = ∫43(𝑥 − µ)1 𝑓(𝑥)𝑑𝑥

4.1 Uniform Distributions

X is “uniform” on [a,b] if X is

equally likely to take any

value in the range from a to

b. (b>a): X~U[a,b]

PDF of X: F(t) =

CDF of X: F(t) =

E(X) =

0

647

847

647

796

1

if a ≤ t ≤ b, otherwise 0

if a ≤ t ≤ b, otherwise 0

| Var(X) =

(647)"

01

4.2 Exponential Distribution

Usually for waiting line. Conditions: must occur

independently. Occurred in a specific period of time. Must

have consistent units.

EXPON.DIST(x, 𝝀, cum), where 𝝀 is the rate parameter

PDF 𝑓(𝑥) = 𝜆𝑒−𝜆𝑥 [𝑥>0]

CDF 𝐹(𝑥) = 1−𝑒−𝜆𝑥

0

Mean = 𝐸(𝑋)=

<

0

𝑉𝑎𝑟(𝑋)= "

<

In the case of stock out, if mean waiting time per

occurrence = 1/3 , 𝝀 = 3

As such, x= waiting time per occurrence. Since need wait 2

days then restock, x =2

4.3 Normal Distribution

𝑋~𝑁(𝜇,𝜎)

smaller σ = taller curve, bigger σ = short curve

when multiplied with eg n, 𝜇=𝑛𝜇 , 𝜎=√𝑛𝜎

~ Symmetric around the mean

~ Highest at its mean

NORM.DIST(𝒙,𝝁,𝝈,𝒄𝒖𝒎)

NORM.INV(𝒑,𝝁,𝝈)

*given p, u, 𝜎 , find x value)

NORM.S.DIST(z, TRUE/FALSE) {𝜇=0,

𝜎=1}

*given x value, compute p to find u, 𝜎

NORM.S.INV(p)

*given p, compute x value to find u, 𝜎

Unit 5 Optimisation

Excel Modelling:

Highlight “Decision Variables” cell [QTY] > Use

SUMPRODUCT for “Profit” > “Amt needed for each

resources” = SUMPRODUCT -> amt available & amt

needed forms constraint.

SOLVER-> Set OBJECTIVES = profit > by changing qty > set

CONSTRAINTS available qty >= amt needed > SOLVER LP

(solving method)

UNIT 5: Decision Tree

Expected Monetary Value (EMV): weighted average of all

possible payoffs for this decision.

Expected Value Of Perfect Information (EVPI):

EVPI = Max EMV with PI (low risk -> sell, high risk -> no

sell)

– Max EMV w/o additional info (not perfect)

> Must include Cost of i.e Market survey for each relevant

payoff at the end

Expected Value of Sample Information (EVSI):

EVSI = Max EMV with Sample Information (including the

cost) + the cost of your survey (negate the cost)

– Max EMV without additional information

UNIT 6: Linear Programming

1)Decision Variables: each decision variable forms a

dimension. n decision variables define an n-dimensional

space. A solution is a point in the space.

2)Constraints: each inequality constraint defines a hyperplane(line in a 2D space). Each inequality constraint

defines a half space. All constraints collectively define the

feasible region.

3)Objective: The objective function defines isoquants and

a direction in the space.

To finding the optimal soln, push along the direction

defined by the objective until we reach the boundary of the

feasible region.

max 𝑥# + 𝑥$

𝑠. 𝑡. 𝑥# + 2𝑥$ ≤ 3

2𝑥# + 𝑥$ ≤ 3

𝑥# , 𝑥$ ≥ 0

X1+X2=0, then shift, X1+X2=1, X1+X2 =2 (objective

function quantity [rhs] )

Slack = max difference in constraint quantity (RHS) before

non-binding become binding

Infeasible Problem: Empty Feasible region Isoquant: A line

on which all points have the same objective value; all

points are equally good on the objective function.

Optimal solution may not be unique (lie on whole stretch of

extreme region), may not be finite(whole feasible region)

Redundant Constraint: Add/Remove constraint does not

affect feasible region

Binding constraints: constraints that are satisfied at

equality at the optimal solution. All equality constraints are

binding by definition. Non-binding constraints are satisfied

at strict inequality at the optimal solution. At optimal

solution, some constraints are binding while others are

not.

The inequality level (=RHS-LHS constraints) is known as

the slack. Binding constraints have zero slack by

definition.

3

#

𝐷

! 𝑥!" = 𝑑" 𝑓𝑜𝑟 𝑗 = 𝐴, 𝐵, 𝐶, 𝐷 <=> 𝑚𝑖𝑛 ! ! 𝑐𝑖𝑗 𝑥𝑖𝑗

𝑖=1 𝑗=𝐴

!$%

UNIT 9: DISCRETE OPTIMIZATION

9.1 Common Uses of Binary Variables

All or Nothing can occur

𝑥1 = 𝑥0

𝑥0 , 𝑥1 𝑏𝑖𝑛𝑎𝑟𝑦

For 3 events: 𝑥0 = 𝑥1 =

𝑥=

𝑍≤𝑋

UNIT 7: SENSITIVITY ANALYSIS

If X is not selected, then Z

cannot be selected

If X and Y are selected,

𝑋+𝑌−1≤𝑍

then Z must be selected

If neither X nor Y is

1−𝑋−𝑌 ≤𝑍

selected, then Z must be

selected

At most two of the three

𝑋+𝑌+𝑍 ≤2

projects can be selected

If either X or Y or both is

(2 − 𝑋 − 𝑌)/2 ≥ 𝑍

selected, then Z cannot be

selected

X is selected only if both Y

𝑋 ≤ (𝑌 + 𝑍)/2

and Z are selected

Introduce 1/M (Binary P1 will never exceed 1)

P1 >= {X11+X12+X13}/M

Remember that binary only has 0/1 so if we have

inequality value of ½ → 1

B. Change in constraint

Changing 𝒃𝒊 (constraint quantity) shifts the corresponding

constraint. The optimal solution change when constraint is

binding. Binding constraints will NOT change if within the

sensitivity range (range whereby binding constraint

remains as binding constraint). Use the shadow price to

estimate the impact on the objective value. Non-binding

constraint -> Shadow price 0

Changing 𝒂𝒊𝒋 (constraint coefficients) rotates the

corresponding constraint. Optimal solution, objective

value, binding constraint will be affected. No sensitivity

range here.

Shadow Price: the marginal change of the objective value

bcos of an additional unit of resource or requirement. Only

valid in the sensitivity range.

UNIT 8: OPTIMIZATION

Include assumptions, if need be.

key components:

Decision Variables –[variables can be grouped if there are

any complementing patterns]

Constraints – Linear, Non-negativity Constraint, Capacity,

Resource Constraint, Binary Constraint (Only for Integer

Programming).

* Simplify expression to just LHS

Inequality Sign

Fulfilled → >= Max Sold → <=

Know the difference between optimal decision/solution

(Deliver 800 from plant1 to shop2, 900 to shop4) and

optimal objective/value i.e (27200)

Standard formation of optimization models

Writing out standardization

*Always link decision variable with binary variable

&

i=1,2..5,

where M is a large

enough number i.e.

1000

OTHER EXCEL FORMULAS

SUMPRODUCT(A2:D69,F2:J69)

RAND( ), AVERAGE(b11:b41), STDEV.P(b11:b41),

VLOOKUP(lookup_value, table array(a2:d66), col

no(column from table array), [true/false[exact]),

COUNTIF(range, “criteria”), MAX(number 1, number 2…),

ROUND(number, 1/2/-1/-2)

-1 -> 10th Place -10 -> 100TH place 1 -> 1 dp

Lock Excel Formulas $B$4