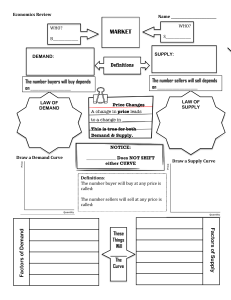

C.1: TEN PRINCIPLES OF ECONOMICS -Resources are scarce. -Economics: study of how society manages its scarce resources. -Economists study: How people make decisions How people interact with one another Forces and trends that affect the economy as a whole How people make decisions 1. People face trade-offs 2. The cost of something is what you give up to get it Opportunity cost = Explicit cost + Implicit cost 3. Rational people think at the margin 4. People respond to incentives How people interact 5. Trade can make everyone better off 6. Markets are usually a good way to organize economic activity 7. Governments can sometimes improve market outcomes How the economy as a whole works 8. A country’s standard of living depends on its ability to produce goods and services 9. Prices rise when the government prints too much money 10. Society faces a short-run trade-off between inflation and unemployment Recession→Unemployment↑ →Total income↓ →Total spending↓ →Prices↓ →Inflation↓ C.2: THINKING LIKE AN ECONOMIST Economic models Circular-flow diagram 1 -Firms: Produce goods and services Use factors of production -Households: Own factors of production (labor, land, capital) Consume goods and services Markets for goods and services: Households are buyers, firms are sellers. Markets for factors of production: Households are sellers, firms are buyers. The Production of Possibilities Frontier (PPF) -A, B, E, F: highest production efficiency, there is no way to produce more of one good without producing less of the other. -D: inefficient outcome, the economy has not fully exploited its resources. -C: Not feasible, the economy does not have enough of the factors of production to support that level of output. *A shift in the Production of Possibilities Frontier (PPF) -Additional resources or an improvement in technological advance, the economy can produce more of both goods, or any combinations. → The PPF shifts outward →More goods produced →Society can move production from a point on the old frontier to a point on the new frontier. The production possibilities frontier simplifies a complex economy to highlight some basic but powerful ideas: scarcity, efficiency, trade-offs, opportunity cost, and economic growth. Positive vs. Normative analysis -Positive statements (Objective): Describe the event in accordance with what is happening. -Normative statements (Subjective): Personal opinions about an event. 2 C.4: THE MARKET FORCES OF SUPPLY AND DEMAND Markets and competition -Competitive market: A market in which there are so many buyers and so many sellers that each has a negligible impact on the market price. -Perfectly competitive market: Must have 2 characteristics: The goods offered for sale are all exactly the same The buyers and sellers are so numerous that no single buyer or seller has any influence over the market price. Demand -Quantity demanded: The amount of a good that buyers are willing and able to purchase. -Law of demand: When the price of a good rises, the quantity demanded of the good falls, and vice versa, other things equal. -Demand schedule: A table that shows the relationship between the price of a good and the quantity demanded. Price increases and quantity demanded decreases steadily, vice versa → Demand curve is a straight line. (D): QD = b + aP a: slope of demand curve. a<0: negative relationship between price and quantity demanded. -Demand curve: a graph of the relationship between the price of a good and the quantity demanded. The demand curve slopes downward because, other things being equal, a lower price means a greater quantity demanded. 3 SHIFTS IN THE DEMAND CURVE -Increase in demand: Any change that increases the quantity demanded at every price, shifts the demand curve to the right. -Decrease in demand: …decreases…left. Variables that can shift the demand curve 1. Income -Normal goods: Other things being equal, an increase in income leads to an increase in demand. -Inferior goods: Other things being equal, an increase in income leads to a decrease in demand. 2. Prices of related goods -Substitutes: Pairs of goods that are used in place of each other, an increase in the price of one leads to an increase in the demand for the other. -Complements: Pairs of goods that are used together, an increase in the price of one leads to a decrease in the demand for the other. 3. Tastes 4. Expectations 5. Number of buyers Supply -Seller’s goal: Maximize the total profit. (π.Q) Price per unit = Cost of production + Tax(es) + Profit P = Z + tx + π →Total revenue = Total cost + Total taxes + Total profit Q.P = Q. (Z + tx + π) -Quantity supplied: Amount of a good that sellers are willing and able to sell at each price. -Law of supply: When the price of a good rises, the quantity supplied of the good also rises, and vice versa, other things equal. -Supply schedule: A table that shows the relationship between the price of a good and the quantity supplied. 4 Price increases and quantity supplied increases steadily, vice versa → The supply curve is a straight line. (S): QS = b + aP a: slope of the supply curve a <0: shows the positive relationship between price and quantity supplied -Supply curve: A graph of the relationship between the price of a good and the quantity supplied. The supply curve slopes upward because, other things being equal, a higher price means a greater quantity supplied. SHIFTS IN THE SUPPLY CURVE -Increase in supply: Any change that raises quantity supplied at every price, shifts the supply curve to the right. -Decrease in supply: …reduces…left. Variables that can shift the supply curve 1. Input prices 2. Technology 3. Expectations 4. Number of sellers 5 Supply and Demand together -Equilibrium: A situation in which various forces are in balance. The point at which the supply and demand curves intersect. At the equilibrium price, the quantity of the good that buyers are willing and able to buy exactly balances the quantity that sellers are willing and able to sell. -Equilibrium price (Market-clearing price): Price at the intersection. -Equilibrium quantity: Quantity at the intersection. -Surplus (Excess supply): Suppliers are unable to sell all they want at the going price. (Quantity supplied > Quantity demanded) -Sellers respond to the surplus by cutting their prices. -Gaining back equilibrium (Downward pressure): Falling prices, in turn, increase the quantity demanded and decrease the quantity supplied. Prices continue to fall until the market reaches the equilibrium. Movements only along the demand and supply curves. -Shortage (Excess demand): Demanders are unable to buy all they want at the going price. (Quantity demanded > Quantity supplied) 6 -Gaining back equilibrium (Upward pressure): Price increases cause the quantity demanded to fall and the quantity supplied to rise. Prices continue to rise until the market reaches equilibrium. Movements only along the demand and supply curves. -In most free markets, surpluses and shortages are only temporary because prices eventually move toward their equilibrium levels. - Law of supply and demand: The price of any good adjusts to bring the quantity supplied and quantity demanded for that good into balance. C.5: ELASTICITY AND ITS APPLICATION Elasticity of demand -Elasticity: A measure of the responsiveness of quantity demanded or quantity supplied to a change in one of its determinants. -Price elasticity of demand (PED): Measures how much the quantity demanded responds to a change in price. (How willing consumers are to buy less of the good as its price rises) -Computing: Price elasticity of demand = 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑸𝑫 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑷 *MIDPOINT METHOD: Price elasticity of demand = (𝑸𝟐− 𝑸𝟏 )/[(𝑸𝟏 + 𝑸𝟐 )/𝟐] (𝑷𝟐− 𝑷𝟏 )/[(𝑷𝟏 + 𝑷𝟐 )/𝟐] -Elastic demand (PED > 1): The quantity demanded responds substantially to changes in the price. -Inelastic demand (PED <1): The quantity demanded responds only slightly to changes in the price. -Unit elasticity (PED =1): The percentage change in quantity equals the percentage change in price. Influences of the price elasticity of demand 1. Availability of close substitutes Goods with close substitutes tend to have more elastic demand because it is easier for consumers to switch from that good to others. 2. Necessities vs Luxuries Necessities tend to have inelastic demands, whereas luxuries have elastic demands. 3. Definition of the market 7 Narrowly defined markets tend to have more elastic demand than broadly defined markets because it is easier to find close substitutes for narrowly defined goods. 4. Time horizon Goods tend to have more elastic demand over longer time horizons. Variety of demand curves -The flatter the demand curve that passes through a given point, the greater the price elasticity of demand. The steeper the demand curve that passes through a given point, the smaller the price elasticity of demand. Total revenue & the PED 1. Inelastic demand -An increase in the price causes an increase in total revenue. (The fall in Q is proportionately smaller than the rise in P) →PRICE AND TOTAL REVENUE MOVE IN THE SAME DIRECTION. 2. Elastic demand -An increase in the price causes a decrease in total revenue. (The reduction in the quantity demanded is so great that it more than offsets the increase in the price) 8 →PRICE AND TOTAL REVENUE MOVE IN OPPOSITE DIRECTIONS. 3. On a linear demand curve -At points with a low price and high quantity, the demand curve is inelastic. At points with a high price and low quantity, the demand curve is elastic. (When the price is low and consumers are buying a lot, a $1 price increase and 2-unit reduction in quantity demanded constitute a large percentage increase in the price and a small percentage decrease in quantity demanded, resulting in a small elasticity. When the price is high and consumers are not buying much, the same $1 price increase and 2-unit reduction in quantity demanded constitute a small percentage increase in the price and a large percentage decrease in quantity demanded, resulting in a large elasticity.) Income elasticity of demand -How much the quantity demanded of a good responds to a change in consumers’ income. -Computing: Income elasticity of demand = 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝒒𝒖𝒂𝒏𝒕𝒊𝒕𝒚 𝒅𝒆𝒎𝒂𝒏𝒅𝒆𝒅 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝒊𝒏𝒄𝒐𝒎𝒆 -Normal goods have positive income elasticities (Quantity demanded and income move in the same direction). -Inferior goods have negative income elasticities (Quantity demanded and income move in opposite directions). Cross-price elasticity of demand -How the quantity demanded of one good responds to a change in the price of another good. -Computing: Cross-price elasticity of demand = 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑸𝑫 𝒐𝒇 𝒈𝒐𝒐𝒅 𝑿 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑷 𝒐𝒇 𝒈𝒐𝒐𝒅 𝒀 -Substitutes: Positive cross-price elasticity. -Complements: Negative cross-price elasticity. 9 Elasticity of supply -Price elasticity of supply (PES): How much the quantity supplied of a good responds to a change in the price of that good. - The PES depends on the flexibility of sellers to change the amount of the good they produce. -Computing: Price elasticity of supply = 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑸𝑫 𝑷𝒆𝒓𝒄𝒆𝒏𝒕𝒂𝒈𝒆 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑷 *MIDPOINT METHOD: Price elasticity of supply = (𝑸𝟐− 𝑸𝟏 )/[(𝑸𝟏 + 𝑸𝟐 )/𝟐] (𝑷𝟐− 𝑷𝟏 )/[(𝑷𝟏 + 𝑷𝟐 )/𝟐] -Elastic supply (PES > 1): The quantity supplied responds substantially to changes in the price. -Inelastic supply (PES <1): The quantity supplied responds only slightly to changes in the price. Determinants of Price elasticity of supply 1. Ease to change the quantity produced -The more easily sellers can change the quantity they produce, the greater the price elasticity of supply. 2. Time horizon Supply is usually more elastic in the long run than in the short run. (In the short run, the quantity supplied is not very responsive to the price. In the long run, the quantity supplied can respond substantially to price changes.) Variety of supply curves -The flatter the supply curve that passes through a given point, the greater the price elasticity of supply. The steeper the supply curve that passes through a given point, the smaller the price elasticity of supply. *Supply curve with different price elasticities 1. Points with low price, low quantity Elastic supply (Firms begin to use idle capacity for production). 2. Points with high price and high quantity 10 Inelastic supply (Capacity for production is fully used, firms start to construct new plants, which incur extra expense, forcing the price to rise substantially). C.6: SUPPLY, DEMAND, AND GOVERNMENT POLICIES Controls on prices Price ceiling -A legal maximum on the price at which a good can be sold. 1. Price ceiling that is not binding -Above the equilibrium price. -Market forces naturally move the economy to the equilibrium, and the price ceiling has no effect on the price or the quantity sold. 2. Price ceiling that is binding (Binding constraint) -Below the equilibrium price. -The forces of supply and demand move the price toward the equilibrium price, but when the market price hits the ceiling, it cannot rise any further. →Market price = Price ceiling →Quantity demanded exceeds quantity supplied → SHORTAGE 11 →When the government imposes a binding price ceiling on a competitive market, a shortage of the good arises, and sellers must ration the scarce goods among the large number of potential buyers. Price floor -A legal minimum on the price at which a good can be sold. 1. Price floor that is not binding -Below the equilibrium price. -Market forces naturally move the economy to the equilibrium, and the price floor has no effect. 2. Price floor that is binding (Binding constraint) -Above the equilibrium price. -The forces of supply and demand move the price toward the equilibrium price, but when the market price hits the floor, it can fall no further. →Market price = Price floor →Quantity supplied exceeds quantity demanded → SURPLUS 12 Taxes -All governments use taxes to raise revenue for public projects, such as roads, schools, and national defense. -Tax incidence: How the burden of a tax is distributed among the various people who make up the economy. Taxes on sellers -The quantity of ice cream demanded at any given price is the same → The demand curve does not change. -Tax on sellers raises the cost of producing, reduces the quantity supplied at every price. →The supply curve shifts to the left (upward) -To induce sellers to supply any given quantity, the market price must be higher by the amount of the tax to compensate for the effect of it. →THE TAX REDUCES THE SIZE OF THE MARKET *Lessons: -Taxes discourage market activity, buyers and sellers share the burden of taxes. -When a good is taxed, the quantity of the good sold is smaller in the new equilibrium. -In the new equilibrium, buyers pay more for the good, and sellers receive less. Taxes on buyers -For any given price of ice cream, sellers have the same incentive to provide ice cream to the market → The supply curve is not affected. -The tax on buyers makes buying less attractive, buyers demand a smaller quantity at every price → The demand curve shifts to the left (downward). -To induce buyers to demand any given quantity, the market price must be lower by the amount of the tax to make up for the effect of the it. 13 -Sellers: Get a lower price for their product. -Buyers: Pay a lower market price to sellers than they did previously, but the effective price (including the tax buyers have to pay) rises. →THE TAX REDUCES THE SIZE OF THE MARKET. Elasticity and tax incidence -A TAX BURDEN FALLS MORE HEAVILY ON THE SIDE OF THE MARKET THAT IS LESS ELASTIC. (+The elasticity measures the willingness of buyers or sellers to leave the market when conditions become unfavorable. +When the good is taxed, the side of the market with fewer good alternatives is less willing to leave the market and, therefore, bears more of the burden of the tax). C.7: CONSUMERS, PRODUCERS AND THE EFFICIENCY OF MARKETS -Welfare economics: How the allocation of resources affects economic well-being. Consumer surplus -Willingness to pay (WTP): The maximum amount that a buyer will pay for a good. Measures how much that buyer values the good. -Consumer surplus: Measures the benefit buyers receive from participating in a market. -Computing: Consumer surplus = Willingness to Pay – Price Demand schedule and Demand curve -Demand schedule: Derived from willingness to pay of possible buyers. 14 -Demand curve: Shows the demand curve that corresponds to the demand schedule. -Marginal buyer: The buyer who would leave the market first if the price were any higher. -At any quantity, the price given by the demand curve (the height of the curve) shows the willingness to pay of the marginal buyer. *Measuring consumer surplus: →The area below the demand curve and above the price measures the consumer surplus in a market. -Market consumer surplus: Total consumer surplus of all individuals participating in a market. Lower Price Raises Consumer Surplus -This curve gradually slopes downward instead of taking discrete steps because the resulting steps from each buyer dropping out are so small that they form a smooth curve. -When the price falls: Increase in consumer surplus (ABC → ADF) Increase in quantity demanded (Q1 → Q2) What consumer surplus measures -Measures the benefit that buyers receive from a good as the buyers themselves perceive it. -A good measure of economic well-being if policymakers want to satisfy the preferences of buyers. 15 -Exception: Drug addicts (From the standpoint of society, willingness to pay in this instance is not a good measure of the buyers’ benefit, because addicts are not looking after their own best interests). Producer surplus -Cost: The value of everything a seller must give up to produce a good. (Explicit + Implicit) -Willingness to sell: The minimum amount/price that a seller will accept for a good/service. -Producer surplus: the amount a seller is paid for a good minus the seller’s cost of providing it. -Computing: Producer surplus = Price – Willingness to sell Supply schedule and Supply curve -Supply schedule: Derived from the costs of the suppliers. -Supply curve: Shows the supply curve that corresponds to this supply schedule. -Marginal seller: The seller who would leave the market first if the price were any lower. -At any quantity, the price given by the supply curve (the height of the curve) shows the cost of the marginal seller. *Measuring producer surplus: 16 →The area below the price and above the supply curve measures the producer surplus in a market. -Market producer surplus: Total producer surplus of all sellers participating in a market. Higher price raises producer surplus - Typical upward-sloping supply curve that would arise in a market with many sellers. -When the price rises: Increase in producer surplus (ABC → ADF), increase of the area of BCED for existing sellers, CEF for new users. Increase in quantity supplied (Q1 → Q2) Market efficiency -Benevolent social planner: An all-knowing, all-powerful, well-intentioned dictator that wants to maximize the economic well-being of everyone in society. -Measuring the economic well-being of a society: Total surplus = Consumer surplus + Producer surplus Total surplus = (Value to buyers – Amount paid by buyers) + (Amount received by sellers – Cost to sellers) →Total surplus = Value to buyers – Cost to sellers (WTP – WTS) -Efficiency: An allocation of resources that maximizes total surplus received by all members of society. (If an allocation is not efficient, then some of the potential gains from trade among buyers and sellers are not being realized) -Equality: Distributing economic prosperity uniformly among the members of society. Evaluating market equilibrium 17 -Market outcomes: 1. Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. 2. Free markets allocate the demand for goods to the sellers who can produce them at the lowest cost. 3. Free markets produce the quantity of goods that maximizes the sum of consumer and producer surplus. →To maximize total surplus, the social planner would choose the quantity where the supply and demand curves intersect. →The equilibrium outcome is an efficient allocation of resources (market outcome makes the sum of consumer and producer surplus as large as it can be). C.13: THE COSTS OF PRODUCTION Costs Total Revenue, Total Cost, and Profit - Economists normally assume that the goal of a firm is to maximize profit, and they find that this assumption works well in most cases. -Total revenue: The amount a firm receives for the sale of its output. -Total cost: the market value of the inputs a firm uses in production. -Total profit: Total revenue – Total cost Opportunity costs -Explicit costs: Input costs that require an outlay of money by the firm. -Implicit costs: Input costs that do not require an outlay of money by the firm. (Ignored by accountants because no money flows out of the business) →Total costs = Explicit costs + Implicit costs Economic Profit & Accounting Profit -Economic profit: Total revenue - Total cost (Explicit costs + Implicit costs) -Accounting profit: Total revenue – Explicit costs 18 →Accounting profit – Implicit costs = Economic profit →A firm making positive economic profit will stay in business. When economic profits are negative, business owners are failing to earn enough revenue to cover all the costs of production → Close down the business and exit the industry. Production and costs -Production function: the relationship between the quantity of inputs used to make a good and the quantity of output of that good. +Depends on the quantity of inputs: machines, equipments, labor, materials, etc. →Quantity of output = f (Quantity of inputs) →Q = f (X1, X2, X3…) (X1, X2, X3: quantity of each input) +Factors of production can be divided into 2 groups: capital (K) and labor (L) →Q = f (K, L) -Marginal product: The increase in output that arises from an additional unit of input. ∆𝑸 +Marginal product of labor: MPL = ∆𝑳 ∆𝑸 +Marginal product of capital: MPK = ∆𝑲 -Slope of the production function. -Diminishing marginal product: The marginal product of an input declines as the quantity of the input increases. (As more workers are hired, each additional worker contributes fewer additional products to total production) +As the number of workers increases, the marginal product declines, and the production function becomes flatter, reflecting diminishing marginal product. 19 -Total-cost curve: Relationship between quantity produced and total costs. - When the quantity produced is large, the total-cost curve is relatively steep: Each additional worker adds less to production (diminishing marginal product). → Producing an additional product requires a lot of additional labor and is thus very costly. Measures of costs -Fixed costs: Costs that do not vary with the quantity of output produced. (They are incurred even if the firm produces nothing at all) +Fixed cost curve is horizontal at any quantity of output. -Variable costs: Costs that vary with the quantity of output produced. +Variable cost curve slopes upward. →Total cost = Fixed costs + Variable costs +Total cost curve slopes upward. +Slope of (TC) = Slope of (VC) Average and Marginal cost 𝑻𝒐𝒕𝒂𝒍 𝒄𝒐𝒔𝒕 -Average total cost: 𝑸𝒖𝒂𝒏𝒕𝒊𝒕𝒚 𝒐𝒇 𝒐𝒖𝒕𝒑𝒖𝒕 -Average fixed cost: 𝑭𝒊𝒙𝒆𝒅 𝒄𝒐𝒔𝒕 𝑸𝒖𝒂𝒏𝒕𝒊𝒕𝒚 𝒐𝒇 𝒐𝒖𝒕𝒑𝒖𝒕 -Average variable cost: 𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝒄𝒐𝒔𝒕 𝑸𝒖𝒂𝒏𝒕𝒊𝒕𝒚 𝒐𝒇 𝒐𝒖𝒕𝒑𝒖𝒕 → Average total cost = Average fixed cost + Average variable cost -Marginal cost: The increase in total cost that arises from an extra unit of production. ∆𝑻𝒐𝒕𝒂𝒍 𝒄𝒐𝒔𝒕 +Marginal cost = ∆𝑸𝒖𝒂𝒏𝒕𝒊𝒕𝒚 20 Cost curves 1. AFC: always declines as output rises because the fixed cost is getting spread over a larger number of units. 2. AVC: Usually rises as output increases because of diminishing marginal product. 3. ATC: -Phase 1 (1-5): Average variable cost is low, average fixed cost declines rapidly at first and then more slowly → Average total cost also declines -Phase 2 (6-10): The increase in average variable cost becomes the dominant force → Average total cost starts rising -Efficient scale: The quantity of output that minimizes average total cost. (Bottom of the U-shape) +At the efficient scale, fixed cost and variable cost are balanced to yield the lowest average total cost. Marginal Cost and Average Total Cost -MC < ATC: ATC is falling. -MC > ATC: ATC is rising. -The marginal-cost curve crosses the average-total-cost curve at its minimum. Costs in the Short run and long run -Short run: +Many decisions are fixed in the short run. +The only way a firm can produce additional cars is to hire more workers at the factories it already has. +A firm has to use whatever short-run curve it has, based on decisions it has made in the past. +All the short-run curves lie on or above the long-run curve. →The cost of these factories is a fixed cost in the short run. -Long run: +Firms have greater flexibility in the long run. +Firm gets to choose which short-run curve it wants to use. →All inputs are variable over time. 21 Economies and Diseconomies of scale -Economies of scale: Long-run average total cost falls as the quantity of output increases. -Diseconomies of scale: Long-run average total cost rises as the quantity of output increases. -Constant returns to scale: Long-run average total cost stays the same as the quantity of output changes. C.14: FIRMS IN COMPETITIVE MARKETS -Competitive market: A market with many buyers and sellers trading identical products so that each buyer and seller is a price taker. -Characteristics: There are many buyers and many sellers in the market. The goods offered by the various sellers are largely the same. Firms can freely enter or exit the market. Revenue of competitive firms -Average revenue: 𝑻𝒐𝒕𝒂𝒍 𝒓𝒆𝒗𝒆𝒏𝒖𝒆 𝑸𝒖𝒂𝒏𝒕𝒊𝒕𝒚 𝒔𝒐𝒍𝒅 →For all types of firms, average revenue equals the price of the good. -Marginal revenue: The change in total revenue from an additional unit sold. →For competitive firms, marginal revenue equals the price of the good. *For a competitive firm, the price equals both the firm’s average revenue (AR) and its marginal revenue (MR). Profit Maximization -General rules: If marginal revenue is greater than marginal cost, the firm should increase its output. If marginal cost is greater than marginal revenue, the firm should decrease its output. At the profit-maximizing level of output, marginal revenue and marginal cost are exactly equal. 22 The Firm’s Short-Run Decision to Shut Down -Shutdown: Refers to a short-run decision not to produce anything during a specific period of time because of current market conditions. If a firm shuts down, it loses all revenue from the sale of its product. At the same time, it saves the variable costs of making its product (but must still pay the fixed costs). →The firm shuts down if the revenue that it would earn from producing is less than its variable costs of production. Shut down if: TR < VC →TR /Q < VC /Q →P < AVC -Exit: Refers to a long-run decision to leave the market. -The short-run and long-run decisions differ because most firms cannot avoid their fixed costs in the short run but can do so in the long run. →THE COMPETITIVE FIRM’S SHORT-RUN SUPPLY CURVE IS THE PORTION OF ITS MARGINAL-COST CURVE THAT LIES ABOVE AVERAGE VARIABLE COST. The Firm’s Long-Run Decision to Exit or Enter a Market →The firm exits the market if the revenue it would get from producing is less than its total cost. Exit if: TR < TC → TR /Q < TC /Q → P < ATC → A firm chooses to exit if the price of its good is less than the average total cost of production. Enter if: P > ATC → THE COMPETITIVE FIRM’S LONG-RUN SUPPLY CURVE IS THE PORTION OF ITS MARGINAL-COST CURVE THAT LIES ABOVE AVERAGE TOTAL COST. 23 Contents C.1: TEN PRINCIPLES OF ECONOMICS ........................................................................................ 1 How people make decisions ............................................................................................................. 1 How people interact ......................................................................................................................... 1 How the economy as a whole works ................................................................................................ 1 C.2: THINKING LIKE AN ECONOMIST ......................................................................................... 1 Economic models ............................................................................................................................. 1 Circular-flow diagram .................................................................................................................. 1 The Production of Possibilities Frontier (PPF) ............................................................................ 2 Positive vs. Normative analysis ....................................................................................................... 2 C.4: THE MARKET FORCES OF SUPPLY AND DEMAND ........................................................... 3 Markets and competition .................................................................................................................. 3 Demand ............................................................................................................................................ 3 SHIFTS IN THE DEMAND CURVE.......................................................................................... 4 Variables that can shift the demand curve .................................................................................... 4 Supply .............................................................................................................................................. 4 SHIFTS IN THE SUPPLY CURVE ............................................................................................. 5 Variables that can shift the supply curve ...................................................................................... 5 Supply and Demand together ........................................................................................................... 6 C.5: ELASTICITY AND ITS APPLICATION .................................................................................... 7 Elasticity of demand......................................................................................................................... 7 Influences of the price elasticity of demand ................................................................................ 7 Variety of demand curves ............................................................................................................. 8 Total revenue & the PED ............................................................................................................. 8 Income elasticity of demand ........................................................................................................ 9 Cross-price elasticity of demand .................................................................................................. 9 Elasticity of supply......................................................................................................................... 10 24 Determinants of Price elasticity of supply ................................................................................. 10 Variety of supply curves ............................................................................................................. 10 C.6: SUPPLY, DEMAND, AND GOVERNMENT POLICIES ........................................................ 11 Controls on prices .......................................................................................................................... 11 Price ceiling................................................................................................................................ 11 Price floor ................................................................................................................................... 12 Taxes .............................................................................................................................................. 13 Taxes on sellers .......................................................................................................................... 13 Taxes on buyers .......................................................................................................................... 13 Elasticity and tax incidence........................................................................................................ 14 C.7: CONSUMERS, PRODUCERS AND THE EFFICIENCY OF MARKETS ............................. 14 Consumer surplus ........................................................................................................................... 14 Demand schedule and Demand curve ........................................................................................ 14 Lower Price Raises Consumer Surplus ...................................................................................... 15 What consumer surplus measures .............................................................................................. 15 Producer surplus ............................................................................................................................. 16 Supply schedule and Supply curve ............................................................................................ 16 Higher price raises producer surplus .......................................................................................... 17 Market efficiency ........................................................................................................................... 17 Evaluating market equilibrium................................................................................................... 17 C.13: THE COSTS OF PRODUCTION ............................................................................................ 18 Costs ............................................................................................................................................... 18 Total Revenue, Total Cost, and Profit ........................................................................................ 18 Opportunity costs ....................................................................................................................... 18 Economic Profit & Accounting Profit ........................................................................................ 18 Production and costs ...................................................................................................................... 19 Measures of costs ........................................................................................................................... 20 Average and Marginal cost......................................................................................................... 20 Cost curves ................................................................................................................................. 21 Marginal Cost and Average Total Cost ...................................................................................... 21 Costs in the Short run and long run............................................................................................ 21 Economies and Diseconomies of scale ...................................................................................... 22 C.14: FIRMS IN COMPETITIVE MARKETS ................................................................................. 22 Revenue of competitive firms ........................................................................................................ 22 Profit Maximization ....................................................................................................................... 22 The Firm’s Short-Run Decision to Shut Down .......................................................................... 23 The Firm’s Long-Run Decision to Exit or Enter a Market ........................................................ 23 25 26