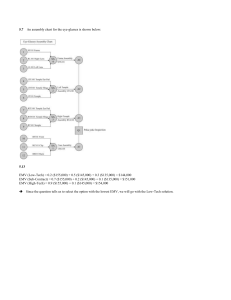

A house holder is currently considering insuring the contents of his house against theft for one year. He estimated the contents of his house would cost him £20,000 to replace. Local crime statistics indicates that there is a probability of 0.03 that his house will be broken into in the coming year. In that event his losses will be 10%, 20% or 40% of the contents with probabilities 0.5, 0.35 and 0.15 respectively. An insurance policy from Company A costs £150 a year but guarantees to replace any loss due to the theft. An insurance policy from Company B will be cheaper at £100 a year but the householder has to pay the first £x of any loss himself. An insurance policy from Company C is even more cheaper at £75 a year but only replaces a fraction of any loss (y%) suffered. Assume that there can be at most one theft a year. Draw a decision tree and give your advice to the house holder if x=50, y=40 and his objective is to maximize the expected monitory value(EMV)? 0.97 150 £ 11 3 0.5 0.03 7 12 0.35 13 0.15 14 A IF INSURED WHICH 2 COMPANY? B 0.97 100 £ C 4 0.5 0.03 FINAL 1 DECISION 0.35 8 0.5 9 0.35 0.15 21 22 B C NI 23 6 0.5 0.03 A 18 20 0.97 IF NOT INSURED 17 19 5 0.03 16 0.15 0.97 75 £ 15 10 0.35 0.15 24 25 26 T - NODE A B C NI CALCULATION 0F PROFIT PROFIT PROB T - EMV 11 COST OF INSURING = (-150) 0.97 (-145.5) 12 2,000 – 150 = 1,850 0.5 925 13 4,000 – 150 = 3,850 0.35 1,347.5 14 8,000 – 150 = 7,850 0.15 1,177.5 15 COST OF INSURING = (-100) 0.97 (-97) 16 2,000 – 100 – 50 = 1,850 0.5 925 17 4,000 – 100 – 50 = 3,850 0.35 1,347.5 18 8,000 – 100 – 50 = 7,850 0.15 1,177.5 19 COST OF INSURING = (-75) 0.97 (-72.75) 20 2,000 – [2,000 x (40/100)] – 75 = 1,125 0.5 562.5 21 4,000 – [4,000 x (40/100)] – 75 = 2,325 0.35 813.75 22 8,000 – [8,000 x (40/100)] – 75 = 4,725 0.15 708.75 23 NOT INSURED & NO THEFT = 0 0.97 0 24 20,000 x (10/100) = (-2,000) 0.5 (-1,000) 25 20,000 x (20/100) = (-4,000) 0.35 (-1,400) 26 20,000 x (40/100) = (-8,000) 0.15 (-1,200) C - NODE A B C NI CALCULATION C - EMV 7 925 + 1,347.5 + 1,177.5 = 3,450 8 925 + 1,347.5 + 1,177.5 = 3,450 9 562.5 + 813.75 + 708.75 = 2,085 10 (-1,000) + (-1,400) + (-1,200) = 3 (3,450 x .03) + (-145.5) = 4 (3,450 x .03) + (-97) = 5 (2,085 x .03) + (-72.75) = (-10.2) 6 (3,600 x .03) + 0 = (-108) (-3,600) (-42) 6.5 The best choice that the house holder can make is to insure the contents of the household with the company B, which gives him the highest EMV of 6.5. In such case if there happens to be a theft at his house he will be safe even though he has to bear an amount of £50 on his own. This insurance policy comes with a premium of £100.