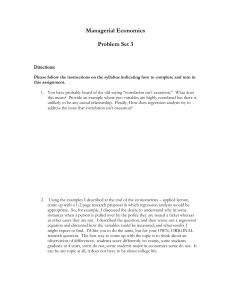

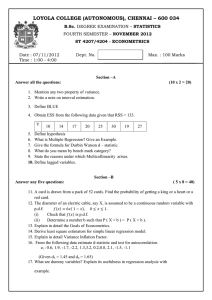

Essential Statistics, Regression, and Econometrics Textbook

advertisement