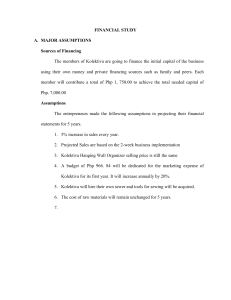

Fundamentals of Accountancy, Business and Management 1 Quarter 3 – Module 3: Accounting Equation Fundamentals of Accountancy, Business and Management 1 – Grade 11 Alternative Delivery Mode Quarter 3 – Module 3: Accounting Equation First Edition, 2020 Republic Act 8293, section 176 states that: No copyright shall subsist in any work of the Government of the Philippines. However, prior approval of the government agency or office wherein the work is created shall be necessary for exploitation of such work for profit. Such agency or office may, among other things, impose as a condition the payment of royalties. Borrowed materials (i.e., songs, stories, poems, pictures, photos, brand names, trademarks, etc.) included in this module are owned by their respective copyright holders. Every effort has been exerted to locate and seek permission to use these materials from their respective copyright owners. The publisher and authors do not represent nor claim ownership over them. Published by the Department of Education Secretary: Leonor Magtolis Briones Undersecretary: Diosdado M. San Antonio SENIOR HS MODULE DEVELOPMENT TEAM Printed in the Philippines by Department of Education – Schools Division of Bataan Author : Judith S. Balanga Tabugan City, Bataan Office Address: Provincial Capitol Compound, Editor : Janelle Paola V. Arceo Telefax: Co-Author – Language (047) 237-2102 Co-Author – Content Evaluator E-mail Address: bataan@deped.gov.ph: Rose Darren G. Buenaventura Co-Author – Illustrator Co-Author – Layout Artist Team Leaders: School Head LRMDS Coordinator : Marvin B. Hernandez : Lawrence O. Munar : Marijoy B. Mendoza, EdD : Karl Angelo R. Tabernero SDO-BATAAN MANAGEMENT TEAM: Schools Division Superintendent OIC- Asst. Schools Division Superintendent Chief Education Supervisor, CID Education Program Supervisor, LRMDS Education Program Supervisor, AP/ADM Education Program Supervisor, Senior HS Project Development Officer II, LRMDS Division Librarian II, LRMDS : Romeo M. Alip, PhD, CESO V : William Roderick R. Fallorin, CESE : Milagros M. Peñaflor, PhD : Edgar E. Garcia, MITE : Romeo M. Layug : Danilo S. Caysido : Joan T. Briz : Rosita P. Serrano REGIONAL OFFICE 3 MANAGEMENT TEAM: Regional Director Chief Education Supervisor, CLMD Education Program Supervisor, LRMS Education Program Supervisor, ADM : May B. Eclar, PhD, CESO III : Librada M. Rubio, PhD : Ma. Editha R. Caparas, EdD : Nestor P. Nuesca, EdD Printed in the Philippines by the Department of Education – Schools Division of Bataan Office Address: Provincial Capitol Compound, Balanga City, Bataan Telefax: (047) 237-2102 E-mail Address: bataan@deped.gov.ph Fundamentals of Accountancy, Business and Management 1 Quarter 3 – Module 3: Accounting Equation Introductory Message This Self-Learning Module (SLM) is prepared so that you, our dear learners, can continue your studies and learn while at home. Activities, questions, directions, exercises, and discussions are carefully stated for you to understand each lesson. Each SLM is composed of different parts. Each part shall guide you step-bystep as you discover and understand the lesson prepared for you. Pre-tests are provided to measure your prior knowledge on lessons in each SLM. This will tell you if you need to proceed on completing this module or if you need to ask your facilitator or your teacher’s assistance for better understanding of the lesson. At the end of each module, you need to answer the post-test to self-check your learning. Answer keys are provided for each activity and test. We trust that you will be honest in using these. In addition to the material in the main text, Notes to the Teacher are also provided to our facilitators and parents for strategies and reminders on how they can best help you on your home-based learning. Please use this module with care. Do not put unnecessary marks on any part of this SLM. Use a separate sheet of paper in answering the exercises and tests. And read the instructions carefully before performing each task. If you have any questions in using this SLM or any difficulty in answering the tasks in this module, do not hesitate to consult your teacher or facilitator. Thank you. What I Need to Know This module was designed and written so that you will learn the basic tool of accounting equation. It will also help you learn to solve problems by applying the basic accounting equation (ABM_FABM11-IIIc-17-18). At the end of this module, you are expected to: a. illustrate the accounting equation and b. perform operations involving simple cases with the use of accounting equation. 1 What I Know Directions: Read the statement carefully and write TRUE if the statement is correct and FALSE if not. Write your answers on a separate sheet of paper. ____________ 1. Accounting equation has two (2) sides. ____________ 2. Asset is equal to the total of liabilities and owner's equity. ____________ 3. Assets, liabilities, and owner’s equity are the components of the accounting equation. ____________ 4. Assets are the resources borrowed by the owner. ____________ 5. If the business has liabilities it has obligations. ____________ 6. There are three (3) elements that affect equity account. ____________ 7. Investments affect the owner's equity account. ____________ 8.Assets and liabilities increase when the business purchases supplies on account. ____________9. There is an increase in liability when you buy equipment on account. ___________10. If there is Php 500,000.00 worth of assets and Php 200,000.00 worth of liabilities, then there is Php 300,000.00 worth of owner's equity. 2 Lesson 1 Accounting Equation Formulas and equations are important to solve a certain mathematical problem not only in the fields of Mathematics and Science but also in Accounting. Its equation has two sides - the left and the right side. The left side of the equation is the company’s assets and the liabilities and equity are shown on the right side. The accounting equation is composed of asset, liabilities, and owner's equity. The asset is the sum of liabilities and owner's equity, while liability is the difference after the owner’s equity is deducted to asset. Equity is the money that is bought by owners of the company for running the business . There is also an extended accounting equation where revenue and expenses are added. Accounting equation is the foundation of other accounting formulas. This helps one avoid confusions on computing assets, liabilities, or owner's equity. What’s In Directions: Analyze the problem carefully and answer the questions that follow. Write your answers on a separate sheet of paper. Hannah Mae Vista graduated as summa cum laude with the degree of B.S. Accountancy and got her job through her brother’s recommendation. She has served as an accountant on Vista Accounting Firm for three years. She has been very passionate about her work since it was her dream to be an accountant. One day, when she was doing the financial reports of the company, she noticed that the debit and the credit sides were not balanced. She kept finding the errors but found none. Unexpectedly, Hannah’s boss approached and told her that he got cash amounting to Php 100,000.00 for personal use but he refused to record it as drawings or withdrawals. Her boss wanted to record the Php 100,000.00 as expenses even though it was used for his personal obligations. 3 Questions: 1. What is/are the principle/s being violated in the problem presented? 2. Is it a right decision for Hannah to record the supposed to be drawings as expenses? Justify your answer. Notes to the Teacher This module prepares students to solve problems by using the accounting equation. Rubrics Exemplary Good Poor 5pts. 3pts. 1pt. Quality of Information Information clearly relates to the main topic and add new concepts. Information somehow clearly relates to the main topic. Information has little or nothing to do with the main topic. Critical Thinking It enhances the critical thinking process consistently through reflection. Some critical thinking and reflection is demonstrated. It does not answer the question/s. 4 What’s New Directions: Compute the missing amount in the equation. Write your answers on a separate sheet of paper. Assets 1. ? Liabilities Php 100,000.00 2. Php 230,000.00 ? 3. Php 109,000.00 Php 4. Php 650,000.00 ? 5. ? Php 7. Php 2,716,217.00 8. Php 9. 10. 456,000.00 729,879.00 ? Php Php 50,000.00 Php 200,000.00 9,000.00 Php 90,000.00 6. Owner's equity ? Php 500,000.00 Php 700,000.00 Php 67,000.00 ? ? Php 1,729,000.00 Php 167,000.00 Php 123,456.00 15,676.00 ? ? Php 789,100.00 Php 13,780.00 What Is It Remember that accounting equation must be balanced for each transaction. It means that the asset should be equal to the total of liabilities and owner's equity. The formula below shows that the asset is the sum of liabilities and owner's equity. A = L + OE The accounting equation consists of three (3) major accounts: 1. Assets are the items that a company owns that can provide future economic benefit. Assets are valuable resources controlled by the company. Examples of assets are cash, supplies, accounts receivable, and more. 5 2. Liabilities are the financial obligation of a company that results in the company’s future sacrifices of economic benefits to other businesses. Some of its examples are loans and accounts payable. 3. Equity is the money that is bought by owners of the company for running the business. It is the residual interest of the owners which means any asset left after paying liabilities is the right of the owner of the business. Four elements that affect equity: a. Investment is an asset or item acquired with the goal of generating income or appreciation. b. Withdrawal occurs when funds are removed from an account for personal use. c. Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations. d. Expenses is the cost of operations that a company incurs to generate revenue. To maintain this equation, transactions affecting financial position accounts may have the following effects: • Increase in Assets = Increase in Owner’s Equity Example: Calma started his new business by depositing Php 350,000.00 in a bank account in the name of Calma Graphics Design at Masa Bank. • Increase in Assets = Increase in Liabilities Example: Calma acquired computer equipment by issuing a Php 40,000.00 note payable to Microsoft Office Systems. The note is due in six months. • Increase in one Asset = Decrease in another Asset Example: Calma paid Php 10,000.00 to El Grande Suites for rent on the office studio for the months of June, July, and August. • Decrease in Assets = Decrease in Liabilities Example: Calma partially paid Php 15,000.00 for the purchase of computer supplies on account. • Decrease in Assets = Decrease in Owner’s Equity Example: Calma paid Php 5,000.00 to Bills Express for the semi-monthly utilities. • Increase in Liabilities = Decrease in Owner’s Equity Example: Yola Company billed Calma for Php 25,000.00 for the ads. Calma will pay next month. 6 Here are the examples where you will see the effects of every transaction to the major accounts. Assets invested by the owner July 1 – Sandy Dela Cruz started a catering service on July 1, 2020. She invested Php 800,000.00 cash and car amounting to Php 200,000.00 which both happened in the month of July. Assets Cash Php 800,000.00 + Car Php 200,000.00 + Liabilities Owner's Equity Dela Cruz, Capital Php 1,000,000.00 + Borrowings from the bank July 2 – Sandy Dela Cruz borrowed Php 100,000.00 cash from Matagumpay Bank for her business. Assets Cash Php 100,000.00 + Liabilities Loans Payable Php 100,000.00 + Owner's Equity The asset purchased for cash July 7 – Sandy bought tables and chairs from Matibay Furnitures and paid Php 45,000.00 cash. Assets Liabilities Owner's Equity Cash Php 45,000.00 (-) Furniture Php 45,000.00 + Assets purchased on account July 15 – Various equipment were purchased on account from Masigasig Trucking Services for Php 55,000.00. Assets Equipment Php 55,000.00 + Liabilities Accounts Payable Php 55,000.00 + 7 Owner's Equity Cash withdrawal by the owner July 18 – Sandy Dela Cruz made a withdrawal of Php 5,000 for her personal use. Assets Cash Php 5,000.00 (-) Liabilities Owner's Equity Dela Cruz, Drawings Php (5,000.00) (-) Payment of liability July 20 – The account due to Masigasig Trucking Services was paid in cash. Assets Cash Php 55,000.00 (-) Liabilities Accounts Payable Php 55,000.00 (-) Owner's Equity The table summarizes the effects of these transactions on the accounting equation: Date Assets July Cash Car 1 Php 800,000.00 Php 200,000.00 2 Php 100,000.00 7 Php (45,000.00) Furniture Php 45,000.00 15 Php 55,000.00 18 Php (5,000.00) 20 Php (55,000) Balances Php 795,000.00 Php 200,000.00 Php 45,000.00 Total Balance Date July Php 55,000.00 Php 1,095,000.00 Liabilities Payable Loans Owner’s Equity Accounts Payable 1 2 Equipment Dela Cruz Capital Other Account Title Php 1,000,000.00 Php 100,000.00 7 15 Php 55,000.00 18 (Php5,000.00) 20 Balances Dela Cruz Drawings (Php 55,000.00) Php 100,000.00 Php 0.00 Total Balance Php 995,000.00 Php 1,095,000.00 8 Received cash for revenue earned July 21 – Sandy Dela Cruz’s catering service was hired and Php 15,000.00 cash was received from the customers. Assets Cash Php 15,000.00 + Liabilities Owner's Equity Service Revenue Php 15,000.00 + Paid cash for expenses incurred July 22 – Gas and oil worth Php 500.00, and car repairs worth Php 1,000.00 were paid in a cash transaction. Assets Cash Php (1,500.00) (-) Liabilities Owner's Equity Gas & Oil Php (500.00) Repair Exp. Php (1,000.00) (-) Revenue rendered on account July 24 – Dela Cruz’s catering service was hired again by a customer but this time, the customer was not able to pay Dela Cruz on that day. Instead, she made a promise to pay Php 16,000.00 on July 31 and August 15. Assets Liabilities Accounts Receivable Php 16,000.00 + Owner's Equity Service Revenue Php 16,000.00 + Paid for expenses incurred July 25 – Dela Cruz paid Php 500.00 for the telephone bill. Assets Liabilities Cash Php (500.00) (-) 9 Owner's Equity Telephone expense Php (500.00) (-) Revenue earned with a down payment, balance on the account July 27 – Another customer hired the catering service of Dela Cruz and received a bill amounting to Php 20,000.00 and 50% of it was collected. Assets Cash Php 10,000.00 + Accounts Receivable Php 10,000.00 + Liabilities Owner's Equity Service Revenue Php 20,000.00 + Customer’s account collected in cash July 30 – The customer on July 24 paid 50% of his account in cash. Assets Cash Php 8,000.00 + Accounts Receivable Php (8,000.00) (-) Liabilities Owner's Equity Paid cash for expenses incurred July 31 – Sandy Dela Cruz paid Php 10,000.00 for rental of office space, and salaries of Php 9,000.00. Assets Cash Php (19,000.00) (-) Liabilities Owner's Equity Salaries Expense Php (9,000.00) (-) Rent Expense Php (10,000.00) (-) 10 The table summarizes the effects of these transactions on the accounting equation, (increase or decrease in each account). Sandy Dela Cruz’s Catering Service Financial Transaction Worksheet Month of July, 2020 Assets Date July Cash Car 1 2 7 15 18 P 800,000.00 P 200,000.00 20 P (55,000.00) 21 22 Furnitures Equipment Loans Payable ( in Php ) Accounts Payable Owner’s Equity Aguinaldo, Capital Other Account Title P 1,000,000.00 P 100,000.00 P (45,000.00) P 45,000.00 P 55,000.00 P 55,000.00 P (5,000.00) Dela Cruz, Drawings P 15,000.00 P 15,000.00 Service Revenue P (500.00) P (500.00) P (1,000.00) P (1,000.00) Repair Expense P 16,000.00 Service Revenue P (5,000.00) P (55,000.00) P 16,000.00 25 P (500.00) 27 P 10,000.00 Bal. Accounts Receivable P 100,000.00 24 30 31 Liabilities ( in Php ) P (500.00) P 10,000.00 P 20,000.00 P (10,000.00) P (10,000.00) P (9,000.00) P (9,000.00) P 807,000.00 Telephone Expense Service Revenue (8,000.00) P 8,000.00 TOTAL BALANCES Gas and Oil P 200,000.00 P 45,000.00 P 55,000.00 P 18,000.00 P 100,000.00 P 1,125,000.00 P 1,125,000.00 11 P 0.00 P 1,025,000.00 Rent Expense Salaries Expense What’s More Directions: For each transaction, tell whether the assets, liabilities, and equity will increase, decrease, or have no effect. Write + for increase, (-) for decrease, and NE for no effect. Write your answers on a separate sheet of paper. Assets Liabilities 1. The owner invested cash in the business. 2. The owner withdrew cash for personal use. 3. The company received cash from a bank loan. 4. The company paid the bank loan. 5. The company purchased supplies on a cash basis. 6. The owner contributed her personal computer to the business. 7. The company purchased equipment on account. 8. The company purchased a piece of land with a down payment and signed note. 9. The owner bought furniture for the business on account. 10. The company repaid its suppliers. 12 Owner's Equity What I Have Learned Directions: Compute the amount of the missing element of financial position (A= L+OE). Write your answers on a separate sheet of paper. 1. Del Mundo Corporation has assets of Php 500,000.00 and an owner’s equity of Php 340,000.00. 2. Hernandez Cooperative has liabilities of Php 400,000.00 and an owner’s equity of Php 320,000.00. 3. Valdez Plumbing Services has assets of Php 234,000.00 and liabilities of Php 100,000.00. 4. Marta’s First Eatery has liabilities of Php 180,000.00 and an owner’s equity of Php 230,300.00. 5. Paway Hub has assets of Php 892,000.00 and liabilities of Php 190,000.00. 6. Golden Corporation has assets of Php 120,000.00 and liabilities of Php 20,000.00. 7. Tessie’s Store has liabilities of Php 8,000.00 and an owner’s equity of Php 12,000.00. 8. De Guzman Merchandise has assets of Php 500,000.00 and an owner’s equity of Php 390,500.00. 9. Marziano Cooperative has liabilities of Php 90,000.00 and an owner’s equity of Php 240,000.00. 10. Pearl Trading Enterprise has assets of Php 800,500.00 and liabilities of Php 450,000.00. 13 What I Can Do Directions: Analyze the transactions of Kim as the owner of Chinita Girl Spa Services. Record the transactions using a financial transaction worksheet indicated on the next page. Write your answers on a separate sheet of paper. June 1 Kim invested Php 500,000.00 cash and equipment amounting to Php100,000.00 to open Chinita Girl Spa. 2 She borrowed Php 50,000.00 cash from Bamba Bank to be used for her business. 7 She bought tables and chairs from Maginhawa Furnitures and paid Php 20,000.00 cash. 15 Various equipment were purchased on account from Beauty Shoppy for Php 50,000.00. 18 She made a withdrawal of Php 10,000.00 for her personal use. 20 The account due to Beauty Shoppy was paid in cash. 21 Chinita Girl Spa Services was hired. The cash of Php 10,000.00 was received from the customer. 22 Gas and oil worth Php 1,000.00 and equipment repairs worth Php 1,000.00 were paid in a cash transaction. 24 Service was hired again by a customer for Php 15,000.00 but this time the customer was only able to pay Kim 50% on that day and she made a promise to pay the other 50% on June 30. 25 She paid Php 1,000.00 for the telephone bill. 27 Another customer hired the services of Chinita Girl Spa Services. A bill was issued to them for Php 30,000.00 and 50% of it was collected. 30 The remaining balance on the transaction last June 24 was paid in cash. 30 She paid Php 5,000.00 for the office rental space and Php 4,000.00 for employees’ salaries. 14 Chinita Girl Spa Services Financial Transaction Worksheet Month of June, 2020 Date June ASSETS Cash Furnitures Equipment LIABILITIES Accounts Receivable 1 2 7 15 18 20 21 22 24 25 27 30 30 Bal. Total Balances 15 Loans Payable Accounts Payable OWNER’S EQUITY Kim, Capital Other Account Title Assessment Directions: Answer the questions that follow. Write the letter of your answers on a separate sheet of paper. 1. Which is the accounting equation? A. assets= liabilities + owner’s equity B. liabilities = assets + owner’s equity C. owner’s equity = assets + liabilities D. assets = revenue - expenses 2. What are the resources owned by the owners? A. expenses B. liabilities C. revenues D. assets 3. Which term refers to the obligations of the business? A. liabilities B. assets C. revenues D. owner’s equity 4. Which refers to the remaining amount of the assets after paying all the company’s liabilities? A. revenues B. owner’s equity C. expenses D. net profits 5. What does an extended accounting equation include? A. revenues and expenses B. revenues and assets C. expenses and liabilities D. none of the above 6. When the owner invested cash on the business, what account/s increase/s? A. assets and owner's equity B. assets only C. liabilities and assets D. owner's equity only 16 7. Is there an effect on the assets account when the owner withdraws cash for personal use? A. B. C. D. Yes, it decreases. Yes, it increases. Yes, it increases and decreases. None of the above 8. What would be the effect to the liabilities of the business after availing loan from Panata Bank? A. It remains the same. B. It decreases. C. It increases. D. None of the above 9. Mr. Kim has assets of Php1,000,000.00 and liabilities of Php 300,000.00 What is his equity? A. Php 700,000 B. Php 1,300,000 C. Php 800,000 D. 0 10. The liabilities of Senshin’s Shop are Php 450,000 and his equity is Php 780,000. What is the business' total assets? A. Php 1,032,000 B. Php 1,320,000 C. Php 1,023,000 D. Php 1,230,000 17 Additional Activities Directions: Analyze the transactions of Ronald Cabiling Housekeeping Services during the month of August 2020. Record the transactions using the financial transaction worksheet. Write your answers on a separate sheet of paper. August1 – Mr. Cabiling invested Php 1, 000,000.00 cash for his business. 2– Various equipment were purchased for the business amounting to Php 100,000.00 4– Cabiling Housekeeping Services was hired by a customer and they received a payment of Php 5, 000.00. 5– Cabiling paid Php 3,000.00 for the salary of the employees. 7– Another customer hired the service of Cabiling Housekeeping. A bill was issued to them for Php 10,000.00 of which 90% was collected. 13 – Cabiling paid Php 2,000.00 for the telephone bill. 21 – Cabiling invested again the amount of Php 50,000 in the business. 25 – The account on August 7 was finally collected in full. 28 – The De Guzman family hired Cabiling Housekeeping Services to clean their mansion amounting to Php 20,000.00. The family paid the amount of Php 5,000.00 and the balance will be paid on August 30. 30 – Cabiling collected the balance from De Guzman family. 18 Date August 1 2 4 5 7 13 21 25 28 30 Bal. Cash 1. 2. 3. 4. 5. 19 Assessment A D A B A 6. A 7. A 8. C 9. A 10. D Additional Activities Ronald Cabiling Housekeeping Service Financial Transaction Worksheet Month of August, 2020 ASSETS LIABILITIES Accounts Receivable Equipment OWNER’S EQUITY Cabiling, Capital P 1,000,000 (100,000) Other Account Title P 1,000,000 P 100,000 5,000 (3,000) P 1,000 9,000 (2,000) Service Revenue 10,000 Salaries Expense (3,000) Service Revenue 5,000 (2,000) 50,000 Telephone Expense 50,000 (1,000) 1,000 15,000 5,000 20,000 Service Revenue (15,000) 15,000 P 980,000 0 P 100,000 0 P 1,080,000 TOTAL BALANCES P 1,080,000 P 1,080,000 Answer Key Date June 1 2 7 15 18 Cash 20 What I Have Learned 1. L= Php 160,000 6. OE = Php 100,000 2. A= Php 720,000 7. A= Php 20,000 3. OE= Php 134,000 8. L= Php 109,500 4. A = Php 410,300 9. A= Php 330,000 5. OE = Php 702,000 10. OE= Php 350,500 What Can I Do Chinita Girl Spa Services Financial Transaction Worksheet Month of June, 2020 ASSETS Furnitures P 500,000 LIABILITIES Accounts Receivable Equipment Loans Payable Accoun ts Payable (50,000) 20 24 Other Account Title P 600,000 P 50,000 P 20,000 P 50,000 10,000 21 7,500 P 50,000 (10,000) Kim, Drawings (50,000) 10,000 (1,000) (1,000) P 7,500 15,000 (1,000) 15,000 15,000 30,000 Service Revenue Gas and Oil Repair Expense Service Revenue Telephone Expense Service Revenue (7,500) 7,500 (5,000) P 498,000 OWNER’S EQUITY Kim, Capital P 100,000 50,000 (20,000) (10,000) (1,000) 22 (1,000) (1,000) 25 27 30 31 (5,000) (4,000) Bal. (4,000) P 20,000 P 150,000 P 15,000 TOTAL BALANCES P 683,000 P 50,000 0 Rent Expense Salaries Expense P 633,000 P 683,000 ASSETS 21 What’s New (In Php ) LIABILITIES OWNER'S EQUITY 1. 150,000 2. 30,000 3. 100,000 4. 150,000 5. 790,000 6. 389,000 7. 987,217 8. 562,879 9. 912,556 10. 1,896 What’s More NE - NE + NE + NE + + NE NE NE NE - NE + - NE + NE + LIABILITIES ASSETS - 10. The company repaid its suppliers. + 9. The owner bought furniture for the business on account. +- 8. The company purchased a piece of land with a down payment and signed note. + 7. The company purchased equipment on account. + 6. The owner contributed her personal computer to the business. -+ 5. The company purchased supplies on a cash basis. - 4. The company paid the bank loan. + 3. The company received cash from a bank loan. - 2. The owner withdrew cash for personal use. 1. The owner invested cash in the business. OWNER'S EQUITY 2. 22 What I Know 8. True 6. False 7. 3. True True 1. True True 4. False 9. True 5. True 10. True What’s In 1. Business Entity Principle 2. Yes, Answer may vary References Anastacio, Ma. Flordeliza. 2011. Fundamentals Of Financial Management (With Industry Based Perspective). Manila: Rex Book Store. Gilbertson, Claudia. 2010. Fundamentals Of Accounting. 8th ed. Australia: Cengage Learning. Padillo, Nicanor Jr. 2011. Financial Statements Preparation, Analysis And Interpretation. Manila: GIC Enterprises. Pefianco, Erlinda C. 1996. The Accounting Process: Principles And Problems. Makati: GoodWill Trading. Young, Felina C. 2008. Principles Of Marketing. Manila: Rex BookStore. Teaching Guide For Senior High School, Fundamentals Of Accountancy, Business And Management 1.. 2016. Quezon City: Commission on Higher Education. 23 For inquiries or feedback, please write or call: Department of Education – Region III, Schools Division of Bataan - Curriculum Implementation Division Learning Resources Management and Development Section (LRMDS) Provincial Capitol Compound, Balanga City, Bataan Telefax: (047) 237-2102 Email Address: bataan@deped.gov.ph