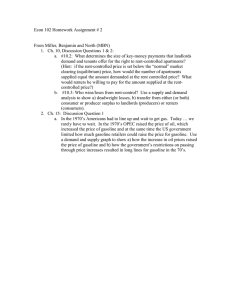

Gasoline Price Expectations: Consumer Beliefs & Forecasting

advertisement