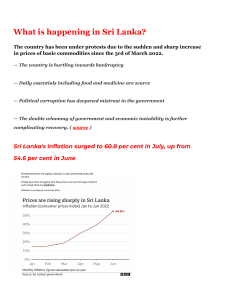

Inflation, economic development, and currency depreciation Economic Problems in Sri Lanka Cost-push inflation Most countries in the world are experiencing a continuing economic shock that has followed the Covid19 pandemic. If the pandemic was the earthquake, the world economy is currently experiencing a major after-shock. The surge in global costs, particularly in energy, is causing significant costs-push inflation in most of the world’s economies. Supply chain problems in many industrial markets along with higher energy and food prices caused by the conflict in Ukraine have driven world commodity prices higher and higher. This is a problem for all economies but for ELDCs its consequences may well be catastrophic. The situation in Sri Lanka is a particularly extreme example of what is happening in poorer nations. The economic situation that faces Sri Lanka’s population is frightening. In May the country’s inflation rate jumped from 18.7 per cent to 29.8 per cent which has taken the price of many basic goods out of the reach of many households. Impact on households There are extreme shortages of food, medicine, and fuel that force people to queue for hours in extreme heat while shops have been forced to close. "We don't have kerosene, we don't have petrol, we don't have diesel, we don't have cooking gas and we don't even have access to woodfired stoves," a 68-year-old woman in the Sri Lankan capital Colombo told AFP. "We are struggling every day to feed our children. Food prices have tripled in the past few days. How are we supposed to manage?" Government debt The problems facing Sri Lanka have been building gradually over time and many of them can be traced back to unsustainable levels of government borrowing over the last 20 years. In a dash for growth and development, the Sri Lankan government has embarked on expensive infrastructure projects that have not been fully financed by taxation and this has led to high levels of government debt. © Alex Smith InThinking www.thinkib.net/Economics 1 The Covid19 pandemic compounded the government’s debt problem as tax revenues fell. The pandemic had a catastrophic effect on the country’s tourist industry, which is a crucial source of tax revenue and driver of economic growth. There have also been significant political mistakes. In April 2021 the Sri Lankan government banned the import of chemical fertilizers which had a ruinous impact on Sri Lanka’s domestic food production and made it even more reliant on expensive imports. Now Sri Lanka has defaulted on its debts for the first time. The government has stopped repaying its international debts to conserve falling foreign currency reserves. Sri Lanka has postponed repayments on $7bn of international loans due this year, out of total foreign debt of $51bn. The default on its debt combined with growing financial uncertainty has caused Sri Lanka’s interest rate to rise to 14 per cent and the credit market has dried up. This makes the country’s business environment extremely challenging, and it is having a very negative impact on investment. The Sri Lankan currency has collapsed with the rupee falling from $1 = R200 to $1 = R355 since March. Whilst this might be good for the country’s tourist industry it is very bad for cost-push inflation. Corruption Sri Lanka struggles with corruption with a corruption perception index that puts it 102 out of 180 countries. Corruption amongst government officials hinders businesses and leads to inefficiency in the public sector. As one business leader said, 'getting an investment project approved takes considerable time, money and knowing the right official'. Questions a. Explain the causes of cost-push inflation in Sri Lanka. [10] b. Using a real-world example, evaluate the consequences of cost-push inflation on different stakeholders in Sri Lanka. [15] c. Explain how corruption and an increase in government debt might be a barrier to economic development in Sri Lanka. [10] d. Evaluate the view that the depreciation of the Sri Lankan rupee is a significant problem for the Sri Lankan economy. [15] © Alex Smith InThinking www.thinkib.net/Economics 2