Texture Company Investor Report: Financial Analysis & Strategy

advertisement

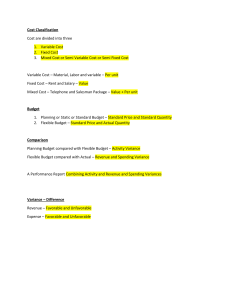

1 Investor Report for Texture Company [Your Name] Southern New Hampshire University 2 Table of Contents 1.0 Introduction ............................................................................................................................... 3 1.1 Purpose .................................................................................................................................. 4 1.2 Methods and Approach ......................................................................................................... 4 2.0 Financial Strategy ..................................................................................................................... 6 2.1 Costing System ...................................................................................................................... 6 2.2 Selling Prices ......................................................................................................................... 7 2.3 Contribution Margin .............................................................................................................. 7 2.4 Target Profits ......................................................................................................................... 8 3.0 Financial Statements ................................................................................................................. 9 3.1 Statement of Cost of Goods Sold .......................................................................................... 9 3.2 Income Statement .................................................................................................................. 9 3.3 Variances ............................................................................................................................. 10 3.4 Significance of Variances.................................................................................................... 11 Direct Labor Rate Variance ................................................................................................... 11 Direct Labor Efficiency Variance.......................................................................................... 11 Direct Materials Price ............................................................................................................ 11 Direct Material Quantity Variance ........................................................................................ 12 4.0 References ............................................................................................................................... 13 3 1.0 Introduction The organization is called Texture Clothing Company. Texture Company started as a clothing processing company. The business raises the process of distributing collars, leashes, and harnesses products to customers. The business's future vision is to be the most trusted brand in the clothing industry through its provision of quality and safe clothing products to customers on a global scale. The company strives to continue building on its legacy of offering nutritious and high-quality clothing products while widening to capture new markets and establishing innovative services and products that meet the dynamic customer demands. The organization strives to attain this goal by practicing sustainability, clothing safety, animal welfare, commitment, and innovation to offer the best clothing quality and beauty standards. Texture Company mainly focuses on establishing value for consumers, employees, stakeholders, and the business community. In the next five years, Texture Company will be the leading clothing market player. It will have a solid portfolio of clothing products that attract customers seeking more sustainable, quality clothing. Texture Company will also expand into international markets, especially Latin America and Europe, where demand for collars, leashes, and harnesses grows rapidly. In the coming ten years, Texture Company will fully integrate into a completely sustainable clothing company leading in innovation and environmental stewardship. The organization will remain at the top by prioritizing these values. It will continue offering consumers and customers the most required clothing, products, and services. 4 1.1 Purpose This report aims to inform Texture Clothing's financial performance over the past first month of its operations. It explains the costing strategies that were used to attain the performance. It reviews the original business strategies, shows the financial performance through financial statements, outlines the labor variance, and explains its significance to the investors. The information in this report is essential and needs close attention since it communicates facts and figures that can enable stakeholders and investors to examine the business performance against the budgets and projected costs. Similarly, it enables investors and stakeholders to understand different managerial accounting techniques implemented to make strategic decisions for Texture Clothing. Finally, the information in the report serves as a reference that investors and stakeholders can use to decide on the business plan and budgeting in the future. This report is critical for getting insight into Texture Clothing's financial health after its first month in operation. Therefore, investors can understand business prospects for future success and growth. 1.2 Methods and Approach Texture Company adheres to the AICPA code of ethics and industry standards when preparing financial statements to ensure that the business provides reliable, accurate, and consistent financial information (Frazer, 2020). The company used management accounting techniques such as job order costing, cost-volume-profit analysis, and variance analysis to generate and present the financial information in this report. This report uses the job order costing method, which is suitable for the company since it produces customized products. It also enables the organization to allocate costs to every product depending on its distinctive features and production requirements. The job order costing method allows Texture Company to accurately monitor costs for every product and job finished during 5 the first month of business operations. Secondly, cost-volume-profit (CVP) analysis is suitable for Texture Company since it determines the business selling prices and contribution margins for every product (Sorin & Carmen, 2010). The business uses the method to calculate its break-even point foreign. Texture Company uses Cost-volume-profit (CVP) method to know the contribution margins and selling prices of harnesses, leashes, and collars per unit. While using CVP, the business calculates the sales level required for the break-even point to obtain the desired profit. Therefore, the CVP method enables Texture Company to determine selling prices that cover the costs and contribute to the business profits. Lastly, this report implements variance analysis to identify and analyze differences between expected and actual costs. The business uses this method to examine the direct labor performance and performance of material costs to recognize the areas where it can reduce costs and improve efficiency. 6 2.0 Financial Strategy 2.1 Costing System Texture Company uses a job order costing system to assist in the business costing strategy. The job order costing method involves the allocation of costs to every individual job, order, and product depending on their distinctive features (Hansen et al., 2021). The job order costing method works well for Texture Company since the business produces different products with distinctive and varying production processes. Therefore, the system allows the business to assign costs to every product accurately. From the job order costing method, Texture Company can acquire more accurate cost information about each product for pricing decisions. Since Texture Company offers products that vary in production process and complexity, the job order costing technique allows the business to accurately assign costs to every job to ensure the correct pricing of products (Drury, 2013). The business team can easily monitor costs at every production stage and acquire valuable information to help reduce costs or improve processes. On the other hand, other costing methods such as activity-based and process costing are better suited for businesses that process similar products and encounter complex production processes with multiple activities. 7 2.2 Selling Prices The following are the established selling prices for the products: Leashes: $22 Collars: $20 Harnesses: $25 These are competitive prices in the market for similar products. These prices are suitable because they are high enough to cover the cost of production on each product and generate the desired profit. In the conducted cost-volume analysis, every product's minimum selling price should be at least $10 to cover the production cost. However, each product is supposed to sell for at least $15 to make a profit. For example, a selling price of $20 is suitable for collars since it is above the production cost and also competitive in the market. In comparison, the selling price of each leash goes for $22, which is a competitive price in the market. Lastly, harnesses have a selling price of $25 per unit to make a profit and remain competitive in the market. 2.3 Contribution Margin No Product Selling price Variable cost Contribution margin 1 Collars $ 20.00 $9.10 $10.90 2 Leashes $22.00 $12.10 $9.90 3 Harnesses $25.00 $14.60 $10.40 The contribution margin is calculated by subtracting the variable cost from the selling price. o Contribution margin = selling price – variable cost It represents the income available to cover the fixed costs and generate profit. 8 For instance, the contribution margin for collars is $10.90 because $20.00 - $9.10 = $10.90. It tells the amount of money the company makes on each product. This information helps in deciding on pricing, marketing, and production. 2.4 Target Profits The table below shows a breakeven-analysis of the products Break-Even Point = (fixed costs + target profit) / contribution margin No Product Fixed costs Target profit Break-Even Units 1 Collars $4,028 $300 397 2 Leashes $4,028 $400 447 3 Harnesses $4,202 $500 542 The break-even point is different for every product because the variable cost, sales prices, and fixed cost for each product are different due to the uniqueness of each product. The chosen target profits are achievable with the available marketing plan, and once achieved, these profits can make the company grow. For collars, the target profit of $300 is realistic and attainable when selling collars at $20 per unit. The same with leashes when selling them at $22 per unit to attain a target profit of $400. Furthermore, lastly, selling each unit of harnesses at $25 to make a target profit of $500. 9 3.0 Financial Statements 3.1 Statement of Cost of Goods Sold No Product Quantity Sold Unit Cost Total Cost 1 Collars 460 $9.10 $3,640 2 Leashes 500 $12.10 $6,050 3 Harnesses 400 $14.60 $5,840 Total $16,076 The actual cost of goods sold in the first month was $16,076, slightly higher than the budgeted cost of goods sold of $15,000. The difference was brought by the slight increase in the cost of raw materials over the originally expected price due to increased demand for the same raw materials. The overall business performance against the benchmarks is pleasing. The business can continue generating more profit while controlling costs by negotiating lower prices with suppliers, reducing waste during production, and increasing sales volumes. 3.2 Income Statement Revenue COGS Gross Profit Operating Expenses Net Income $24,000 $16,076 $8,470 $5,000 $2,924 The net profit for the first month is $2,924, which is higher than the budgeted $1,200. The difference in profit arises due to increased sales than the budgeted sales. The business performed well against the benchmark put in place. The business is confident to continue controlling its costs and generating profits. 10 3.3 Variances Direct Labor Rate Variance = (Actual rate – standard rate) x actual hours Direct labor efficiency variance = (actual hours – standard hours) x standard rate Direct materials price = (actual price – standard price) x actual quantity Direct material quantity variance = (actual quantity – standard quantity) x standard price Direct Labor Time Variance Direct Labor Efficiency Variance Direct Material Price Variance Direct material Quantity Variance Actual Hours Expected Hours 16.5 hours 16.0 hours Actual Hours Standard Hours 180 160 Actual price Standard Price $10.00 $9.10 Actual Quan. Standard Quan. 460 400 Standard Rate $180.00 Standard Rate $16.00 Actual Quantity 460 Standard Price $9.10 Variance $90 Variance $1,280 Variance $220 Variance $224 From the calculations above, the actual labor cost was above the standard cost, and the actual cost of materials was more than the standard cost. The direct labor time variance was higher than expected, while the direct labor efficiency variance was lower. Similarly, the direct material price variance and material direct material quantity variance were higher than expected. 11 3.4 Significance of Variances Here is the summary of the variance analysis: No Variance Significance Favorable or Unfavorable 1 Direct Labor Time Variance $90 Unfavorable 2 Direct Labor Efficiency Variance $1,280 Unfavorable 3 Direct Material Price Variance $220 Unfavorable 4 Direct material Quantity Variance $224 Favorable Direct Labor Rate Variance The unfavorable direct labor rate variance made the company pay more for labor than expected. The wage increase, fluctuating production process, or change in employee mix led to high labor costs. The company should standardize labor costs and wages by training employees and retaining an affordable workforce. The company should also avoid employee mix to ensure employees work effectively and efficiently toward producing collars. Direct Labor Efficiency Variance The Unfavorable direct labor efficiency shows that the company utilized more labor hours than budgeted to produce a similar quantity of products. Factors like an inexperienced workforce, fluctuating production processes, and variations in material qualities promoted the results. Therefore, the company should ensure that it recruits competent and skilled employees, design a standard production process for the collar products, and establish quality assurance standards to ensure that the quality of materials used in processing is expected. Direct Materials Price The unfavorable direct material price show that the company paid more for materials to make collars than budgeted. An increase in the cost of raw materials for collars, variations in material suppliers, and change in the purchased quantity of collars materials led to the higher 12 direct material price for collars. Therefore, the company should seek materials from suppliers offering the same quality at lower prices. It is difficult to avoid purchasing materials from different sellers in a dynamic market with changing prices, but the company should purchase materials from one stable supplier with sustainable prices for collar materials. Direct Material Quantity Variance The favorable direct material quantity variance show that the company utilized fewer materials than expected to manufacture a similar number of collars. Efficient utilization of materials, adoption of better production processes, and positive variation in material quality contributed to the lower direct material quality variance. The company must retain or improve its efficiency when using the material to create a better variance than this on collars. Unfavorable variances mean the company experienced higher actual costs than the budgeted ones (Helms & Weiss, 1986). Several factors, such as the increase in labor costs, material costs, and overhead costs, led to unfavorable variances. The company is establishing various means to correct these errors. These variances have small sizes, which reduces their significance in the business profitability and future survival. As of now, the variances do not cause the company any major problems since the company is still profitable. Therefore, the company's decision for the next month is to reduce the variances by reducing production costs to increase revenue. 13 4.0 References Drury, C. M. (2013). Management and cost accounting. Springer. Frazer, L. (2020). Does internal control improve the attestation function and, by extension, assurance services? A Practical Approach. Journal of Accounting and Finance, 20(1), 28–38. Hansen, D. R., Mowen, M. M., & Heitger, D. L. (2021). Cost management. Cengage Learning. Helms, G. L., & Weiss, I. R. (1986). The cost of internally developed applications: Analysis of problems and cost control methods. Journal of Management Information Systems, 3(2), 5-21. Sorin, B., & Carmen, S. (2010). Cost volume profit model, the break-even point, and the decision-making process in the hospitality industry. Annals of the University of Oradea, Economic Science Series, 19(2).