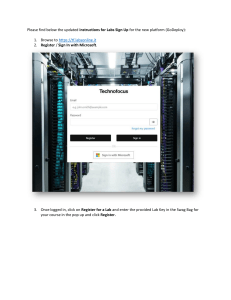

FINOLOGY MUTUAL 2023 FUNDS Nov’22 HDFC Index S&P BSE Sensex Fund Large Cap | Direct Growth Plan About the Fund An open-ended scheme replicating/tracking S&P BSE SENSEX Index. The Scheme is managed passively with investments in stocks in a proportion that is as close as possible to the weightages of these stocks in the S&P BSE SENSEX Index. The investment strategy revolves around reducing the tracking error to the least possible through regular rebalancing of the portfolio, taking into account the change in weights of stocks in the Index as well as the incremental collections/redemptions. Rolling Returns HDFC Index S&P BSE Sensex Fund Category Average 1 year 3 years 5 years 2.62% 15.24% 13.59% 0.41% 15.16% 11.09% Details of the Fund AUM (as of Nov 2022) 4100 Cr Launch Date 1st Jan 2013 Returns since launch 13.39% Trailing Returns (1 Yr) 1.48% Expense Ratio 0.20% Risk Moderately High Minimum Investment Rs 100 Why we like this fund? The fund has a low expense ratio and provides exposure to the broader market. Nov’22 Parag Parikh Tax Saver Fund ELSS | Direct Growth Plan About the Fund The Scheme was launched in July 2019. Indian investors who invest in this Scheme are eligible for Income Tax deduction u/s 80C up to a sum of Rs. 1.50 lakhs. Considering their well-built portfolio, one can invest for atleast 3 years and get additional benefits of income tax savings apart from good returns. Rolling Returns Parag Parikh tax Saver fund Category Average 1 year 3 years 5 years 9.17% 23.44% - 1.55% 17.86% - Details of the Fund AUM (as of Nov 2022) 848 Cr Launch Date 24th July 2019 Returns since launch 25.68% Trailing Returns (1Yr) 8.73% Expense Ratio 0.84% Risk Moderate Minimum Investment Rs 500 Why we like this fund? Unlike other fund houses, Parag Parikh has almost the same set of domestic stocks in its tax saver fund and Flexi cap fund (except international stocks). This is an indication of the fact that the fund manager is pretty confident about his bets and provides you not only tax saving benefits but also growth in ELSS. However, if you already have its Flexi cap fund, consider the overlap before investing in this ELSS. Nov’22 Mirae Asset Tax Saver Fund ELSS | Direct Growth Plan About the Fund Mirae Asset tax saver fund was launched on 28th Dec 2015.The investment strategy is open to invest across market capitalisation. Rolling Returns Mirae Asset tax Saver fund Category Average 1 year 3 years 5 years -2.33% 18.91% 14.2% 1.55% 17.86% 9.5% Details of the Fund AUM (as of Nov 2022) 13546 Cr Launch Date 28th Dec 2015 Returns since launch 19.85% Trailing Returns (1 Yr) -2.98% Expense Ratio 0.50% Risk Moderate Minimum Investment Rs 500 Why we like this fund? The expense ratio of this fund is very low. Being an ELSS fund, it serves the dual purpose of tax saving and long-term wealth creation. Nov’22 Axis Long-Term Equity Fund ELSS | Direct Growth Plan About the Fund Axis long-term fund seems to be a growth-oriented follower. It focuses essentially on quality stocks that can be held in the portfolio for a longer horizon (at least 8-10 years). Mr Jinesh Gopani is the fund manager. He has managed nine funds until now in his 17 Years of experience in the Mutual fund industry. Rolling Returns Axis Long Term Equity fund Category Average 1 year 3 years 5 years -11.34% 10.93% 11.01% 1.55% 17.86% 9.5% Details of the Fund AUM (as of Nov 2022) 31268.51 Cr Launch Date 1st Jan 2013 Returns since launch 17.62% Trailing Returns (1Yr) -13.41% Expense Ratio 0.77% Risk Moderate Minimum Investment Rs 500 Why we like this fund? The fund invests in companies with minimum debt, a good return on capital, some degree of the economic moat and good prospects. The fund manager looks for a sustainable business and a sound balance sheet, and thus he makes sure that the fund delivers stable performance with minimum volatility. Nov’22 Kotak Equity Opportunities Fund Large And Midcap | Direct Growth Plan About the Fund The fund is well-diversified compared to its peers in the same category. It focuses essentially on quality stocks that can be held in the portfolio for a longer horizon (at least 8-10 years). The fund manager looks for a sustainable business and a sound balance sheet and thereby ensures stable performance with minimum volatility. Rolling Returns Kotak Equity Opportunities fund Category Average 1 year 3 years 5 years 6.18% 19.29% 12.7% 0.12% 16.62% 8.87% Details of the Fund AUM (as of Nov 2022) 11370 Cr Launch Date 1st Jan 2013 Returns since launch 16.75% Trailing returns (1 yr) 5.20% Expense Ratio 0.59% Risk Moderate Minimum Investment Rs 5000 Why we like this fund? Investments in mid-cap companies possess moderate to high risk, but the Kotak Equity Opportunities fund has shown lesser volatility than its peers in the same category. Hence it’s a good investment avenue for investors who wish to invest in a lesser volatile scheme. Nov’22 Axis Small Cap fund Small Cap | Direct Growth Plan About the Fund The scheme follows a bottom-up approach in identifying long-term businesses that have a sustainable competitive advantage and multi-year growth potential. Mr Anupam Tiwari has been managing Axis small-cap fund since 2016. Rolling Returns 1 year 3 years 5 years Axis Small Cap fund 6.41% 26.5% 18.53% Category Average 2.75% 28.8% 11.37% Details of the Fund AUM (as of Nov 2022) 10992 Cr Launch Date 29th Nov 2013 Returns since launch 24.63% Trailing returns (1yr) 5.20% Expense Ratio 0.52% Risk Very High Minimum Investment Rs 500 Why we like this fund? The fund manager looks for stability, scalability and quality. He prefers companies with strong promoter pedigree and sound balance sheets during stock selection. The fund has been successful at reducing downsides due to its quality-oriented approach. Nov’22 SBI Small Cap Fund Small Cap | Direct Growth Plan About the Fund SBI Small Cap Fund follows a growth-oriented strategy. It has been managed by R Srinivasan since 2013. The scheme has outperformed its benchmark most of the time since its inception. It has a high allocation to consumer discretionary stocks and capital goods. These calls are contrary to the average allocation of the small-cap category. It has also cut its allocation to technology sector stocks vis-a-vis the category average. Rolling Returns 1 year 3 years 5 years SBI Small Cap Fund 10.03% 29.18% 16.18% Category Average 2.75% 28.8% 11.37% Details of the Fund AUM (as of Nov 2022) 14869 Cr Launch Date 1st Jan 2013 Returns since launch 26.36% Trailing Returns (1 Yr) 8.33% Expense Ratio 0.71% Risk Very High Minimum Investment Rs 5000 Why we like this fund? Fund has managed the downside better than the average small-cap category. The fund's portfolio turnover ratio has been very low, which indicates its stock picks, conviction, analysis, and buy & hold strategy has played out very well. Nov’22 Parag Parikh Flexi Cap Fund Flexi Cap | Direct Growth Plan About the Fund The fund follows a value investing strategy and picks stock across market cap and Geography. The scheme believes in buying quality stocks at a discounted price and holds them for a longer-term horizon. In order to hedge the portfolio from country-specific risk, the scheme also takes exposure to international stocks with a maximum cap of 35% of the overall portfolio. the fund manager also ensures a reasonable price tag before investing. The core equity portfolio consists of high conviction stocks which are not churned frequently and thus it has one of the lowest portfolio turnover rates. Rolling Returns Parag Parikh Flexi Cap Fund Category Average 1 year 3 years 5 years -5.15% 22% 16.3% -0.89% 14.99% 8.96% Details of the Fund AUM (as of Nov 2022) 27712 Cr Launch Date 28th May 2013 Returns since launch 18.92% Trailing Returns (1 Yr) -6.77% Expense Ratio 0.78% Risk Moderately High Minimum Investment Rs 1000 Why we like this fund? Parag Parikh, Flexi Cap Fund follows a value investing strategy and picks stocks across market cap and geography. Even with a conservative investment approach, the fund has delivered superior returns and is one of the best-performing funds in its category. Note- The fund was popular due to its international exposure but now has taken a hit due to the global slowdown. Besides, due to the limit set by the SEBI on overseas exposure, the fund has not been able to take advantage of the fall in prices of global stocks and resultantly, has taken a beat. Nov’22 Mirae Asset NYSE Fang+ ETF International | Direct Growth Plan About the Fund The fund offers an option to take exposure in the 10 high-growth innovative technology companies which are at the forefront of several megatrends. With a small investment, one can get exposure to global tech leaders such as Facebook, Amazon, Apple, Netflix, Alphabet (Google), Tesla, Twitter, among others. These companies contemplate long term megatrends that have the power to transform. business, society and economies and are leaders in their respective domains. Rolling Returns Mirae asset NYSE Fang+ ETF Category Average 1 year 3 years 5 years -18.18% _ _ _ _ _ Details of the Fund AUM (as of Nov 2022) 995 Cr Launch Date 6th May 2021 Returns since launch -18% Trailing return (1 Yr) -36.32% Expense Ratio 0.69% Risk Very high Minimum Investment Rs 5000 Why we like this fund? This fund has exposure to the top tech firms in the world, which are poised to exhibit significant growth over the years. This fund can be your chance to ride this massive tech wave. All overseas funds have taken a hit due to global shocks, which we expected to rebound gradually and hence, this doesn’t change our view on the fund. The secret to complete and holistic financial planning is not in picking the best of a single asset class but in having the best combination of various asset classes that suits ‘you’, your goals and your ability to take risks. Get to know how much you should invest in which asset class by entering just a few details about yourself in Recipe’s ‘Financial Appetite’ . Visit : recipe.finology.in