Happy Money The Japanese Art of Making Peace with Your Money By Ken Honda

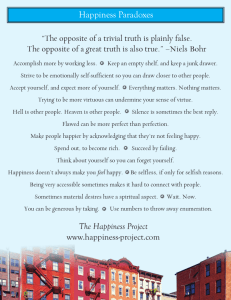

advertisement