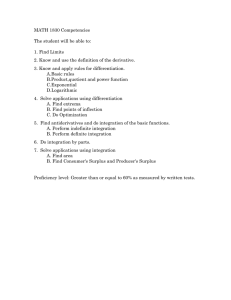

Positioning 2/16/22 Strategy & Positioning • • • • Positioning – the choice of where to compete in a market Who comprises the market segment? o Demographics, preferences, geography What are the products offered? o The key difference in price or other attributes that customers may care about Firms in the same industry may position themselves differently o Not all positions will be equally profitable o Not all firms will be able to have the resources to take all profitable positions What is positioning? • • Some industries may only have one viable strategic position Other industries may have multiple valuable positions Why is positioning difficult? • External factors may make the profitability of positions on the landscape change In Practice? • • Industries like grocery, these firms offer different trade-offs with price and product attributes o There are multiple valuable positions as different customer segments have different preferences In industries where customers’ preferences are more similar, one position may be dominant o Only small niches of consumers care about other attributes What informs positioning? • • The use of PESTEL, industry analysis, and value curves can identify a viable position The use of internal analysis of key activities, resources/capabilities, and business model to ensure the firm is aiming for what they want o Does the position fit with a feasible business model? Choosing a position? • Two generic strategies o Differentiation/Benefit Leadership ▪ Increase customers’ Willingness to Pay o Cost leadership ▪ Drive down costs without losing too much WTP Trade-offs in positioning • • • • Choices between a cost or benefit position, focusing on whole market or a narrow segment Tension between value creation and pressure to keep cost in check Different set of value chain activities Inconsistencies in image and reputation Understanding benefit creation • • A maximum WTP is the price at which the consumer is indifferent between buying the product and not buying/ switching to a substitute Consumer Surplus – the difference between the maximum the consumer is willing to pay and the market price o Consumer surplus needs to be positive for the purchase to occur o Choice between two or more products, consumers will choose the one with the largest consumer surplus o A firm can increase consumer surplus by increasing perceived benefit or lowering the price Value creation • • Value created = B – C = (B – P) + (P – C) = Consumer surplus + Producer Surplus o B = Maximum willingness to pay o P = Price of the product o C = Cost of making the product Consumers will choose the product that maximizes their consumer surplus (B – P) Value Capture – Firms’ must create more total value than competitors to have an advantage Achieving benefit leadership – unique features that increases value, so that consumers pay a higher price Achieving cost leadership – have lower costs than competitors while maintaining acceptable quality in customers’ eyes Achieving the position • • Cost leadership – How to reduce costs? o Cost of input factors – Raw materials, capital, labor o Economies of Scale – decreases in cost per unit as output increases o Learning-curve effects – improvements to technology and production processes Benefit Leadership – How to increase benefits? o Unique or quality product features o Customer service o New product launches o Reputation through marketing and promotion o Complements for product/service that enhance value Key questions—How to choose where to focus? 1. What resources/capabilities can the firm develop/exploit to add value/cut costs? 2. Do these apply to all customers/product varieties or only specific niches? Key Takeaways • • • Different positions have different strategic logics o Differentiation/Benefit Leadership: Increase customers’ WTP through a more valuable product, get ΔB > ΔC Cost Leadership: Drive down costs without losing too much WTP, get ΔC > ΔB o Can do this for the whole market or segments: customer-specific, productspecific, or location-specific Demand conditions are important for choosing between benefit and cost leadership and whether to price for profit or market share Strategy and Positioning - Positioning is the choice of where to compete in a market - Who comprises the market segments? - What are the products offered? - Firms within the same industry can position themselves in different ways - Not all position equally profitable - Not all firms equally have acquired resources to take all positions What is Positioning - Some industries may have only one viable position - Others have multiple valuable positions Why Positioning Difficult - External factors may make profitability on different position on landscape change Positioning in Practice - Grocery firms - Offer different trade off with respect to price and product attributes - many successful - Multiple valuable position is b/c different customers segments and preferences - Customers preferences similar - One type of position may be dominant - Only small niches of consumers care about others attributes What Informs Positioning - PESTEL industry analysis value curve is to identify viable position - Find most valuable position given external environment - Use internal analysis of key activities to ensure firm is at peak it is aiming for Choosing Position - Acting strategically attempts to take position in market in terms of a who and a what - Goal - max the gap between customers willingness to pay and firms’ costs - Two generic strategies - differentiation/benefit leadership - Increase customers WTP through more valuable product - Cost leadership - Drive down costs as low as possible without losing too much WTP - Can do that with broad competitive scope or narrow forums on segment of customers - Trade-Offs in Positioning - Positioning involves trade offs - Choices btwn cost or benefit position - Choices btwn focusing on whole market tor narrow segment - Tension between value creation and pressure to keep cost in check - Different set tof value chain activities - Inconsistencies in image or reputation - Need strategy that makes clear choice on dimensions Understanding Benefit Creation - Consumer's max willingness to pay is the price at which the consumer is indifferent btwn buying the product and not buying or switching to a substitute product - Consumer surplus - difference btwn the max consumer is willing to pay and the prevailing market price - Needs to be positive for purchase to occur - If choice btwn 2 or more products consumer will choose one with largest surplus - Firms can increase consumer surplus by increasing perceived benefit or by lowering price Value Creation - B = max willingness to pay - P = price of product - C - cost of making iproduct - Value created = B - C = (B - P) + (P - C) = Consumer surplus + producer surplus - Value creation occurs with respect to particular customer - Consumer will choose product that max consumer surplus → (B - P) Value Capture Firms must offer consumer more consumer surplus and create more total value than competitors to have advantage - Benefit leadership - B is greater than rivals - Cost leadership - C is lower than rivals Benefit Strategies - Higher benefits at their price - Vertical differentiation - Different benefits at sam epice - Horizontal differentiation Strategic Logic of Benefit Leadership Benefit leadership create more value than rivals - higher B - With larger B-C benefit leaders can create more value Achieving Benefit Leadership - Unique features that increase value so that consumers pay higher price - Firms focused competitive efforts on - Unique higher quality product features - Customer service - New product launches - Reputation - Compliments that enhance value - Likely to increase cost - Investment in R&D - Investment in human capital - Investment in marketing and advertising Cost Strategies - Same benefits at lower price - Lower benefits at lower price Achieving Cost Leadership - Have lower costs than competitors while maintaining acceptable quality - Reduce cost below competitors - Offer adequate value - Reduce prices for customers - Optimize value chain for low cost - Key considerations - Cost of input factors - Economies of scale - Learning curve effects Strategic Logic of Cost Leadership - Cost leader creates more value than rivals - lower C - With larger B-C cost leader can create more value than competitors by offering - Same benefits - Slightly lower benefit but with greater decrease in price - Qualitatively different products with lower cost but sufficient value - Cost leader can - Price its product below rivals and have greater market share - Match rivals price and achieve better price cost margins Economies of Scale - Economies of scale - Spreads fixed costs over larger output - Employee specialized systems - Take advantage of physical properties - Diseconomies of scale - Firms too big - Coordination challenges to complex - Inflexible or slow process Learning Curves - Moving down learning curve - Lower costs with additional knowledge how to run process Achieving the Position - Cost leadership - how to reduce costs - Cost input factors - Economies of scale - Learning curve effects - Benefit leadership - how to increase benefits - Unique or higher quality product - Customer service - New product launches - Reputation - Complement Which Type of Position is More Valuable - Benefit advantage when - Consumers willing to pay premium for benefit enhancements - Econ of scale and learning have already been exploited - Product has more experiential attributes - Cost advantage sought when - Nature of product does not allow benefit enhancement - Consumers relatively more sensitive tt price - Products’ attributes clearly observable Exploiting Advantage Through Price - Optimal pricing strategy depends on homogeneity of industry customers' preferences - If product differential is weak firm - market share strategy - Cost advantage - underprice rivals and building shar - Benefit advantage - maintain price parity and let benefit build shar - If product different is strong - profit margin strategy - Cost advantage - maintain price with rivals and enjoy higher margins - Benefit advantage - share price premium How to Choose Where to Focus - Industry represented in two dimensions - Product varieties - What - Customer groups - Who - Potential segment intersection of particular product groups with particular customer group Customer Specialization Focus - Offer array of product varieties to limited class of customers - Focus on catering to particular needs of that group - Customer specific knowledge more important Product Specialization Focus - Offer limited set of products to array of customer groups - Focus on being excellent at providing best in class product - Product specific knowledge more important Geographic Specialization Focus - Offer variety of products and or sell to customer group with narrow geography - Focus on exploiting local knowledge - Location specific knowledge more important February 16, 2022 - Positioning Strategy and Positioning ● Positioning is the choice of where to compete in a market ○ WHO comprises the market segment? Demographics, preferences, geography, etc. ○ WHAT are the products offered? Defined by key differences in price or other relevant attributes ● Firms within the same industry can position themselves in different ways - not positions equally profitable, different firms will have different capabilities ○ Ex. cost leader like WalMart, specific like Trader Joe’s, high quality w higher price like Whole Foods, bulk buying like CostCo What is Positioning? ● Some industries may have only one viable strategic position ○ ● Ex. industry where price is the only relevant concern Others may have multiple valuable positions in which firms can make profits ○ Diff customer segments with different preferences What does this mean in practice? ● In industries like grocery, firms offer different trade-offs with respect to price and product attributes and many can be successful - diff customer segments ● In industries where customers’ preferences are much more similar, one type of position may be dominant - Ex. Amazon as a bookseller; only small niches of consumers care about other attributes What informs positioning? ● Use PESTEL, industry analysis, value curves to identify a broadly viable position in the industry landscape ○ *find the most valuable position in the industry or a profitable niche given the external environment ● Use internal analysis of key activities, resources/capabilities, business model to ensure the firm is at the peak it is aiming for Choosing a Position ● A firm acting strategically attempts to take a position in the market in terms of a set of customers and a value proposition - a Who and a What ○ ● Goal - maximize the gap between the customers’ willingness to pay and firms’ costs Two “generic strategies” ○ differentiation/benefit leadership: increase customers’ WTP through a more valuable product - this typically comes with higher costs ○ Cost leadership: drive down costs as low as possible without losing too much WTP since the trade-off lower costs is typically a less (or at least not more) valuable product ■ Broad competitive scope or narrow focus ■ Cost leadership, differentiation, focused cost leadership, focused differentiation Trade-Offs in Positioning ● Positioning involves trade-offs ○ Cost vs benefit position ○ Focusing on whole market vs narrow segment ○ Tension between value creation and pressure to keep cost in check (even within a position) ● ○ Different set of value chain activities are optimal for different positions ○ Inconsistencies in image or reputation from taking up diff positions *need a strategy that makes clear choices on these dimensions - can’t be trying to walk the line Understanding Benefit Creation ● A consumer’s maximum willingness to pay is the price at which the consumer is indifferent between buying the product and not buying/switching to a substitute product ● Consumer surplus is the difference between the maximum the consumer is willing to pay and the prevailing market price ○ Needs to be positive for purchase to occur ○ When there are options, consumers choose option w largest consumer surplus ○ Increase consumer surplus by increasing perceived benefit or lowering price Value Creation ● Value created = B-C=(B-P)+(P-C) ○ B = max willingness to pay ○ P = price of the product ○ C = cost of making the product ● Value created = consumer surplus + producer surplus ● Value creation occurs with respect to particular customers Value Capture ● Firms must offer some consumers more (or at least as much) consumer surplus and create more total value than competitors to have an advantage ● Benefit leadership: B is greater than rivals ● Cost leadership: C is lower than rivals Benefit Strategies ● Higher (perceived) benefits at a higher price ○ ● Vertical differentiation; ex. Apple vs Huawei Different benefits at the same price ○ Horizontal differentiation; ex. Competing on varieties in soft drinks Strategic Logic of Benefit Leadership ● A benefit leader creates more value than its rivals (larger B-C) by achieving a higher B than its rivals with change in B being greater than change in C ● With larger B-C, the benefit leader firm can create more value by offering cost parity, cost proximity but with greater increased benefit, substantially higher benefit and higher cost ● Benefit leader can price product the same as rivals and have greater market share, change a premium over rivals’ price and achieve better price-cost margins Achieving Benefit Leadership - Ex. Apple ● Unique features that increase value, so that consumers pay a higher price ● Firm focuses on competitive efforts on higher quality/unique product, customer service, new product launches, reputation through marketing and promotion, and complements for product/service that enhance value ● Likely to increase costs - R&D, human capital, marketing and advertising Cost Strategies ● Same benefits at a lower price - Ex. Vanguard, Amazon ● Lower benefits at lower price - Ex. Ikea vs high end furniture Achieving Cost Leadership ● Have lower costs than competitors while maintaining acceptable quality - reduce cost below competitors, offer adequate value, optimize value chain for low cost ● Key considerations - cost of input factors, economies of scale, learning-curve effects Strategic Logic of Cost Leadership ● A cost leader creates more value than its rivals (larger B-C) by achieving a lower C than its rival, such that the change in C is greater than the change in B ● With a larger B-C, a cost leader can create more value than its competitors by offering same benefits as the competitors do (benefit parity), slightly lower benefit (benefit proximity) but with greater decrease in price, qualitatively different products to competitors with lower cost but sufficient value ● Cost leader can price its product below the rivals and have a greater market share, match rivals’ price and achieve better price-cost margins (Dis)Economies of Scale ● Economies of scale - spreads fixed costs over larger output, employs specialized systems/equipment, takes advantage of physical properties ● Diseconomies of scale - firms too big, coordination challenges too complex, inflexible/slow process Learning Curves ● Moving down learning curve ○ Lower costs with additional knowledge of how to run processes ○ Ex. tesla model S was sold at a loss for the first 4,000 units Achieving the Position ● Cost leadership - how to reduce costs? - Ex. Walmart, Vanguard ○ ● Cost of input factors, economies of scale, learning-curve effects Benefit leadership - how to increase benefits? - Ex. Apple, Whole Foods ○ unique/higher quality features, customer service, new products, reputation, complements Which Type of Position is More Valuable? ● Benefit advantage should be sought when ○ Consumers are willing to pay a premium for benefit enhancements ○ Economies of scale and learning have been already exploited and differentiation is the best route to value creation ○ The product has more experiential attributes (ie greater buyer uncertainty so establishing reputation and quality are important and can lower customers’ willingness to switch) think cell phones ● Cost advantage should be sought when ○ The nature of the product does not allow benefit enhancement - ex. Sugar ○ Consumers are relatively more sensitive to price than product characteristics ○ The product’s attributes are clearly observable (ie any additional benefits could be more easily copied and customers then switch to the lowest price product/service) Exploiting Advantage through Pricing ● Optimal pricing strategy depends on homogeneity of industry customers’ preferences - two basic routes: ● If product differentiation is weak, the firm should follow a market share strategy ○ Cost advantage - underprice rivals and build share ○ ● Benefit advantage - maintain price parity and let the benefit build the share If product differentiation is strong, the firm should follow a profit margin strategy (since more costly to incentivize customers to switch between diff products) ○ Cost advantage - maintain price parity with rivals and enjoy higher margins ○ Benefit advantage - charge a price premium over the competitors How to Choose Where to Focus? ● An industry can be represented by product varieties (What) and customer groups (Who) ● A potential segment in the intersection of a particular product group with a particular customer group ● Key questions: ○ What resources/capabilities can the firm develop/exploit to add value/cut costs? ○ Do these apply to all customers/product varieties or only specific niches? Customer Specialization Focus ● Offer an array of product varieties to limited class of customers ○ Focus on catering to the particular needs of that customer group served ○ customer -specific knowledge/resources are more important to value create and capture Product Specialization Focus ● Offer a limited set of products to an array of customer groups ○ Focus on being excellent at providing best in class product valued by all customer groups ○ Product-specific knowledge/resources are more important to value creation and capture Geographic Specialization Focus ● Offer a variety of products and/or sell to a variety of customer groups within a narrow geography ○ Focus on exploiting local knowledge/resources to be better at satisfying the needs of the customers in that location ○ Location-specific knowledge/resources are more important to value creation and capture ○ Ex. regional breweries Key Takeaways ● Different positions have different strategic logics ○ differentiation/benefit leadership vs cost leadership ○ Demand conditions are important for choosing between benefit and cost leadership and whether to price for profit or market share MGMT 301; Wednesday, 2/16 Lecture: Positioning ● ● ● ● ● Positioning: choice of where to compete in a market ○ Who (demographics, preferences, geography, etc) and What (key product differences in price/other attributes customers may care about) ○ Many firms in the same industry make good profits, so there are multiple good positions to take (Walmart, Trader Joe’s, Whole Foods) ○ Not all positions will be equally profitable, and not all firms are able to acquire the resources/capabilities to take all profitable positions Some industries may have only one viable strategic position (ex. books) ○ Customers only care about one product attribute (benefit or price); only small niches care about other attributes Some industries may have multiple valuable positions (ex. grocery) ○ Different customer segments have different preferences over product attributes or price/quality trade-offs External Analysis (PESTEL, industry analysis, value curves, etc.) to identify a broadly viable position in the industry landscape ○ Find most valuable position in the industry or a profitable niche given the external environment; external factors may make the profitability of different positions change Internal Analysis of key activities, resources/capabilities, and business model to ensure the firm is at the peak it is aiming for ○ Position fits with a feasible business model and firm effectively delivers value and keeps its operations efficient ● Choosing a position: take a market position in terms of a set of customers and a value proposition (Who and What) with the goal to maximize the gap between the Customers’ Willingness-To-Pay and Firms’ Costs ○ Differentiation/Benefit Leadership: increase customers’ WTP through a more valuable product; typically comes with higher costs (ex. Full service airline carriers) ○ Cost Leadership: drive down costs without losing too much WTP; trade-off of lower costs is typically a less (or at least not more) valuable product (ex. Southwest) ○ Can do this with a broad competitive scope or narrow focus on a segment of customers for which this is a profitable trade-off ● Trade-Offs (can’t make high and low quality cars; release different iPhones at different prices, but they are all iPhones and have that brand value) ○ Cost or benefit position, focusing on whole market or a narrow segment, tension between value creation and pressure to keep cost in check, different set of value chain activities are optimal for different positions, inconsistencies in image or reputation from taking up different positions ● ● ● ● ● ● ● ● ● ● ● ● ● Willingness To Pay: maximum price at which the consumer is indifferent between buying the product and not buying/switching to a substitute product Consumer Surplus: the difference between the maximum the consumer is willing to pay (monetary value of the perceived benefit) and the prevailing market price ○ Needs to be positive for the purchase to occur ○ Consumers want largest consumer surplus ○ Firm can increase consumer surplus by increasing perceived benefit or lowering price Value created = B – C = (B – P) + (P – C) = Consumer surplus + Producer surplus Firms’ must offer some consumers more (or at least as much) consumer surplus and create more total value than competitors to have an advantage Benefit Strategies Higher (perceived) benefits at a higher price ○ Vertical Differentiation, e.g. Apple vs. Huawei Different benefits at the same price ○ Horizontal Differentiation, e.g. competing on varieties in soft drinks Benefit leader creates more value by achieving a higher B with ΔB > ΔC ○ Capture value from higher margins (from higher B) by increasing P or increase market share at similar P ○ Cost parity, cost proximity but with greater increased benefit, and substantially higher benefit and higher cost (but not so much higher so as to offset additional benefit) ○ Can price its product the same as rivals and have a greater market share and charge a premium over rivals and achieve better price-cost margins Achieving Benefit Leadership: unique features increase value so consumers pay more ○ APPLE: unique or higher quality product features, customer service, new product launches, reputation through marketing and promotion, complements for product/service that enhance value ○ Increase costs with investment in R&D to facilitate innovation, investment in human capital to improve service and product, and investment in marketing and advertising Cost Strategies Same benefits at a lower price (e.g. Vanguard, Amazon) Lower benefits at a lower price (e.g. Ikea) Achieving Cost Leadership ○ Have lower costs than competitors while maintaining acceptable quality in customers’ eyes: reduce cost below competitors, offer adequate value, reduce prices for customer, optimize the value chain for low cost ○ Key considerations: cost of inputs, economies of scale, and ● ● ● ● ● ● ● ● ● learning-curve effects ○ Often big firms - not sustainable to be a cost leader in a small segment of a market Cost leader creates more value by achieving a lower C than its rival, such that ΔC > ΔB ○ Capture value from higher margins (from lower C) with similar P or increase market share with lower P ○ Create more value than its competitors by offering same benefits as the competitors do (benefit parity), slightly lower benefit (benefit proximity) but with greater decrease in price, and qualitatively different products to competitors with lower cost but sufficient value ○ Cost leader can price its product below the rivals and have a greater market share and match rivals’ price and achieve better price-cost margins Economies of Scale ○ Spreads fixed costs over larger output ○ Employs specialized systems/equipment ○ Takes advantage of physical properties Diseconomies of Scale ○ Firms too big ○ Coordination challenges to complex ○ Inflexible/slow processes Moving down learning curve: lower costs with additional knowledge of how to run processes Benefit advantage should be sought when: ○ Consumers are willing to pay a premium for benefit enhancements ○ Economies of scale and learning have been already exploited and differentiation is the best route to value creation ○ The product has more experiential attributes (i.e. greater buyer uncertainty so establishing reputation and quality are important and can lower customers’ willingness to switch) Cost advantage should be sought when: ○ The nature of the product does not allow benefit enhancement ○ Consumers are relatively more sensitive to price than product characteristics ○ The products’ attributes are clearly observable (i.e. any additional benefits could be more easily copied and customers then switch to the lowest price product/service Exploiting Advantage through Pricing Product differentiation is weak - market share strategy ○ Cost Advantage: underprice rivals and build share ○ Benefit Advantage: maintain price parity and let the benefit build the share Product differentiation is strong - profit margin strategy ○ Cost Advantage: maintain price parity with rivals and enjoy higher margins ○ Benefit Advantage: charge a price premium over the competitor ● ● ● ● ● ● ● ● How to Choose Where to Focus An industry can be represented in two dimensions: Who (consumers) and What (products) ○ Potential segment is the intersection of a particular who with a particular what Customer Specialization Focus: offer an array of product varieties to limited class of customers; focus on catering to the particular needs of that customer group served, customer-specific knowledge/resources are more important to value creation and capture Product Specialization Focus: offer a limited set of products to an array of customer groups; focus on being excellent at providing best in class product valued by all customer groups, product-specific knowledge/resources are more important to value creation and capture Geographic Specialization Focus: offer a variety of products and/or sell to a variety of customer groups within a narrow geography; focus on exploiting local knowledge/resources to be better at satisfying the needs of the customers in that location, location-specific knowledge/resources are more important to value creation and capture Key Takeaways Different positions have different strategic logics ○ Differentiation/Benefit Leadership: increase WTP through a more valuable product (typically comes with higher costs), get ΔB > ΔC ○ Cost Leadership: drive down costs without losing too much WTP, get ΔC > ΔB ○ For the whole market or segments: customer, product, or location-specific Demand conditions are important for choosing between benefit and cost leadership and whether to price for profit or market share February 16, 2022 Note Taking Assignment Strategy & Positioning ● Positioning: the choice of where to compete in a market ○ Who comprises the market segment? ■ Demographics, preferences, geography ○ What are the products offered? ■ Difference in price or; ■ Other attributes consumers might care about ● Firms can position themselves in different ways ○ Not all positions are equally profitable ○ Not all firms will equally have the ability to acquire resources/ capabilities to take all profitable positions What is positioning? ● When a firm has one strategic positioning ○ Customers only care about one product attribute and need to be the leader on this (benefit or prive) ● When a firm has multiple positions to make profit ○ Different customer segments have different preferences over product attributes or price/quality trade-offs But why is Strategic Positioning Difficult? ● There are external factors may make the profitability of different positions on the landscape change ○ ex// Grocery store offers trade-offs with respect to price and product attributes. The grocery store has multiple valuable positions because it has different customers ○ ex// Amazon has customers whose preferences are much more similar, so one type of position may be dominant. Only small niches of consumers care about other attributes What Informs Positioning? ● Use PESTEL ○ Given the external environment, what are the most valuable position in the industry or a profitable niche? ● Use internal analysis of key activities. resources/capabilities, business model to ensure the firm is at the peak it is aiming for ○ Does the position fit with a feasible business model? ○ Is the firm effectively delivering value and keeping its operations efficient Choosing a position ● A firm acting strategically attempts to take a position in the market in terms of a set of customers and a value proposition – a Who and a What ○ Goal: Maximize the gap between the Customers’ Willingness-To-Pay and Firms’ Costs Two ‘generic strategies’ ● ● ● Differentiation/Benefit Leadership: Increase customers’ WTP through a more valuable product – but this typically comes with higher costs Cost Leadership: Drive down costs as low as possible without losing too much WTP – since the trade-off of lower costs is typically a less (or at least not more) valuable product Can do this with a broad competitive scope or narrow focus on a segment of customers for which this is a profitable trade-off Tradeoffs in Positioning ● ● Positioning involves trade-offs ○ Choices between a cost or benefit position ○ Choices between focusing on whole market or a narrow segment ○ Tension between value creation and pressure to keep cost in check (even within a position) ○ Different set of value chain activities are optimal for different positions ○ Inconsistencies in image or reputation from taking up different positions Need a strategy that makes clear choices on these dimensions Understating Benefit Creation ● A consumers’ maximum Willingness To Pay is the price at which the consumer is indifferent between buying the product and not buying/switching to a substitute product ● Consumer Surplus is the difference between the maximum the consumer is willing to pay (monetary value of the perceived benefit) and the prevailing market price ○ Consumer surplus needs to be positive for the purchase to occur ○ If there is a choice between two or more products consumer will choose the one with the largest consumer surplus ○ A firm can increase consumer surplus by increasing the perceived benefit or by lowering the price External Environment and Value Value Creation ● ● ● ● B = Maximum willingness to pay P = Price of the product C = Cost of making the product Value created = B – C = (B – P) + (P – C) = Consumer surplus + Producer surplus ○ Value creation occurs with respect to particular customers (i.e. there may be heterogeneous preferences across market segments) ○ One firm may be successful in creating positive B – C in one segment while it takes another firm to do the same in another segment ○ Consumers will choose the product that maximizes their consumer surplus (B – P) Value Capture ● Firms’ must offer some consumers more (or at least as much) consumer surplus and create more total value than competitors to have an advantage ○ Value created = B – C ○ ● ● ● ● If B – P is at least equal to rivals, P – C must be greater than rivals for a firm to have an advantage Benefit Leadership: B is greater than rivals and ΔB > ΔC to achieve this higher B Capture value from higher margins (from higher B) by increasing P or increase market share at similar P Cost Leadership: C is lower than rivals and ΔC > ΔB to achieve this lower C Capture value from higher margins (from lower C) with similar P or increase market share with lower P Benefit Strategies ● Higher (perceived) benefits at a higher price ○ Vertical Differentiation ■ e.g. Apple vs. Huawei ● Different benefits at the same price ○ Horizontal Differentiation ■ e.g. Competing on Varieties in Soft Drinks Strategic Logic of Benefit Leadership ● ● ● A benefit leader creates more value than its rivals (i.e. larger B-C) by achieving a higher B than its rivals with ΔB > ΔC With a larger B-C, the benefit leader firm can create more value by offering ○ Cost parity ○ Cost proximity but with greater increased benefit ○ Substantially higher benefit and higher cost (but not so much higher so as to offset additional benefit) The benefit leader can ○ Price its product the same as rivals and have a greater market share ○ Charge a premium over rivals’ price and achieve better price-cost margins Achieving Benefit Leadership ● ● ● Unique features that increase value, so that consumers pay a higher price The firms focuses competitive efforts on ○ Unique or higher quality product features ○ Customer service ○ New product launches ○ Reputation through marketing and promotion ○ Complements for product/service that enhance value Likely to increase costs ○ Investment in R&D to facilitate innovation ○ Investment in human capital to improve service and product ○ Investment in marketing and advertising Cost Strategies ● Same benefits at a lower price ○ e.g. Vanguard, Amazon ● Lower benefits at lower price ○ (with Pc- Pf > Bc - Bf or equivalently Bf - Pf > Bc – Pc) ○ e.g. Ikea Achieving Cost Leadership ● ● Have lower costs than competitors while maintaining acceptable quality in customers’ eyes: ○ Reduce cost below competitors ○ Offer adequate value ○ Reduce prices for customers ○ Optimize the value chain for low cost What are the key considerations? ○ Cost of Input Factors – Raw materials, capital, labor, and IT services ○ Economies of scale – Decreases in cost per unit as output increases ○ Learning-curve effects – Improvements to technology and production processes Strategic Logic of Cost Leadership ● ● ● A cost leader creates more value than its rivals (i.e. a larger B-C) by achieving a lower C than its rival, such that ΔC > ΔB With a larger B-C, a cost leader can create more value than its competitors by offering ○ Same benefits as the competitors do (benefit parity) ○ Slightly lower benefit (benefit proximity) but with greater decrease in price ○ Qualitatively different products to competitors with lower cost but sufficient value The cost leader can ○ Price its product below the rivals and have a greater market share ○ Match rivals’ price and achieve better price-cost margins (DIS) Economies of Scale ● ● ● ● Economies of scale ○ Spreads fixed costs over larger output ○ Employs specialized systems/equipment ○ Takes advantage of physical properties Diseconomies of Scale Firms too big Coordination challenges to complex ● Inflexible/slow processes Learning Curves ● Moving down learning curve ○ Lower costs with additional knowledge of how to run processes ■ For example, Tesla Model S was sold at a loss for the first 4,000 units Cost Leadership – How to reduce costs? (e.g. Walmart, Vanguard) Cost of Input Factors – Raw materials, capital, labor, and IT services. Economies of scale – Decreases in cost per unit as output increases. Learning-curve effects – Improvements to technology and production processes Benefit Leadership – How to increase benefits? (e.g. Apple, Whole Foods) Generic Strategies Achieving The Position ● ● Cost Leadership – How to reduce costs? (e.g. Walmart, Vanguard) ○ Cost of Input Factors – Raw materials, capital, labor, and IT services. ○ Economies of scale – Decreases in cost per unit as output increases. ○ Learning-curve effects – Improvements to technology and production processes Benefit Leadership – How to increase benefits? (e.g. Apple, Whole Foods) ● Unique or higher quality product features ● Customer service ● New product launches ● Reputation through marketing and promotion ● Compliments for product/service that enhance value Which type of position is more valuable? ● ● Benefit advantage should be sought when ○ Consumers are willing to pay a premium for benefit enhancements ○ Economies of scale and learning have been already exploited and differentiation is the best route to value creation ○ The product has more experiential attributes (i.e. greater buyer uncertainty so establishing reputation and quality are important and can lower customers’ willingness to switch) Cost advantage should be sought when ○ The nature of the product does not allow benefit enhancement ○ Consumers are relatively more sensitive to price than product characteristics ○ The products’ attributes are clearly observable (i.e. any additional benefits could be more easily copied and customers then switch to the lowest price product/service) Exploiting Advantage Through Pricing ● Optimal pricing strategy depends on homogeneity of industry customers’ preferences ○ ○ If product differentiation is weak the firm should follow a market share strategy ■ Cost Advantage – underprice rivals and build share ■ Benefit Advantage – maintain price parity and let the benefit build the share If product differentiation is strong the firm should follow a profit margin strategy (since more costly to incentivize customers to switch between different products) ○ Cost Advantage – maintain price parity with rivals and enjoy higher margins ○ Benefit Advantage – charge a price premium over the competitors How to Choose Where to Focus? ● ● ● An industry can be represented in two dimensions ○ Product varieties – i.e. What ○ Customer groups – i.e. Who A potential segment is the intersection of a particular product group with a particular customer group ○ Some segments may be more attractive due to e.g. segment size, buyer power, supply conditions ○ Segments may also vary by geography Key questions 1. What resources/capabilities can the firm develop/exploit to add value/cut costs? 2. Do these apply to all customers/product varieties or only specific niches? Customer Specialization Focus ● Offer an array of product varieties to limited class of customers ○ Focus on catering to the particular needs of that customer group served ○ Customer-specific knowledge/resources are more important to value creation and capture Product Specialization Focus ● Offer a limited set of products to an array of customer groups ○ Focus on being excellent at providing best in class product valued by all customer groups ○ Product-specific knowledge/resources are more important to value creation and capture Graphic Specialization Focus ● Offer a variety of products and/or sell to a variety of customer groups within a narrow geography ○ Focus on exploiting local knowledge/resources to be better at satisfying the needs of the customers in that location ○ Location-specific knowledge/resources are more important to value creation and capture ● ● ● ● ● ● ● What is Positioning? Definition ○ The choice of where to compete in a market ■ Who comprises the market segment? ● Defined by demographics, preferences, geography, etc ■ What products are offered? ● Defined by the key points of difference in price or other attributes customers may care about ○ Firms within same industry can position themselves in different ways ■ Not all positions will be equally profitable ■ Not all firms will equally have/be able to acquire the resources/capabilities to take all profitable positions ○ Some industries may only have 1 viable strategic position ■ Customers only care about one product attribute to be the leader on this (benefit or price) ○ Others may have multiple viable positions in which firms can make profits ■ Different customer segments have different preferences over product attributes or price/quality trade offs Why is it Difficult? ○ External factors may make the profitability of different positions on the landscape change Positioning in Practice ○ In industries like grocery, firms offer different trade offs w/ respect to price and product attributes ■ Many can be successful ■ Multiple valuable positions because different customer segments have different preferences ○ In industries where customer preferences are much more similar, one type of position may be dominant ■ Only small niches of customers care about other attributes What Informs Positioning? ○ PESTEL, industry analysis, value curves ■ Find the most valuable position in the industry or a profitable niche given the external environment ○ Internal analysis of key activities, resources, business model ■ Does the position fit w/ a feasible business model ■ Is the firm effectively delivering value and keeping its operations efficient Choosing A Position How to Choose ○ A firm acting strategically attempts to take a position in the market in terms of a set of customers and a value prop ■ Who and what ■ Goal: Maximize the gap between customer willingness to pay and girls costs ○ ● ● ● ● 2 generic strategies ■ Differentiation/ benefit leadership ● Increase customers WTP through a more valuable product, typically comes w/ higher costs ■ Cost leadership ● Drive down costs as low as possible w/ out losing too much WTP ○ Can do this w/ broad competitive scope or narrow focus Trade-offs ○ Between… ■ Cost or benefit ■ Focusing on whole market or narrow segment ■ Value creation and pressure to keep cost in check ○ Different set of value chain activities are optimal for different positions ○ Incositienes in image or reputation from taking up different position ○ Need a strategy that makes clear choices on these dimensions! Benefit Creation ○ A consumers maximum willingness to pay is the price where consumer is indifferent between buying the product and not buying/switching to a substitute ○ Consumer surplus is the difference between the max consumer is willing to pay and the prevailing market price ■ Needs to be positive for purchase to occur ■ If there is a choice between 2 products, consumer will choose one w/ largest consumer surplus ■ A firm can inc. consumer surplus by inc. perceived benefit or by lowering the price Value Creation ○ B = Maximum consumer willingness to pay ○ P = Price of product ○ C = Cost of making the product ○ Value created = B - C = (B - P) + (P - C) = Consumer Surplus + Producer Surplus ○ Value creation occurs w/ respect to particular customer ■ 1 firm may be successful in creating positive B - C in 1 segment while it takes another firm to do the same in another segment ○ Consumers will choose the product that ,maximizes their consumer surplus Value Capture ○ Firms must offer some consumers more (or at least as much) consumer surplus and create more total value than competitors to have advantage ■ Value Created = B - C ■ If B-P is at least equal to rivals, P-C must be greater for advantage ○ Benefit leadership ■ B is greater than rivals ● Capture value from higher margins by inc. P or increase market share at similar P ○ Cost Leadership ■ ● ● ● ● C is lower than rivals ● Capture value from higher margins w/ similar P or inc. market share w/ lower P Benefit Strategies ○ Definition ■ Higher benefits at higher price ● Vertical Differentiation ■ Different benefits at same price ● Horizontal Differentiation ○ Strategic Logic ■ Creates more value from having higher B than its rivals ■ W/ larger B-C, benefit leader firm can create more valuable from… ● Cost parity ● Cost proximity w/ increased benefit] ■ Benefit eader can ● Price its product the same as rivals and have greater market share Achieving Benefit Leadership ○ Unique features that inc. value ○ Firm focus efforts on ■ Unique or higher quality product features ■ Customer service ■ New product launches ■ Reputation through marketing and promotion ○ Likely to increase costs ■ Inc. RE&D ■ Inc. human capital ■ Marketing and advertising Cost Strategies ○ Definition ■ Same benefits at lower price ■ Lower benefits at lower price ○ Strategic Logic ■ Creates more value than rivals by achieving a lower C than its rival ■ W/ a larger B-C, create more value than rivals by offering… ● Same benefits as competitors do (benefit parity) ● Slightly lower benefit (benefit proximity) but w/ greater dec. in price ● QUalitatively diff. Products to competitors w/ lower cost and sufficient value ■ Then cost leader can ● Price product below rivals and have greater market share ● Mach rivals [price and achieve best price cost margins Achieving Cost Leadership ○ Have lower costs than competitors while maintaining acceptable quality in customers eyes ● ● ● ● ● ● ■ Reduce cost below competitors ■ Offer adequate value ■ Reduce prices for customer ■ Optimize value chain for low cost ○ Key considerations ■ Cost of input factors ■ Economies of scale ■ Learning curve effects Economies of Scale ○ Spreads fixed costs over larger output ○ Employs specializes systems ○ Takes advantage of physical prop. Diseconomies of Scale ○ Firms too big ○ Coordination challenges too complex ○ Inflexible/slow process Learning Curves ○ Moving down learning curves ○ Lower costs w/ addition; knowledge of how to run process Achieving the Position ○ Cost leadership: How to reduce costs? ■ Cost of input factors: Raw materials, capital, labor, IT services ■ Economies of scale: dec. in cost per unit as output inc. ■ Learning curve effects: improvements to technology and production processes ○ Benefit leadership: how to increase benefits? ■ Unique or higher quality product features ■ Customer service ■ New product launches ■ Reputation through marketing and promotion ■ Compliments for product/service that enhance value Which Position is More Valuable? ○ Benefit adv. When… ■ Consumers are willing to pay a premium for benefit enhancements ■ Economies of scale and learning curves have already exploited and differentiation is best route to value creation ■ Product has more experimental attributes ○ Cost adv. When…. ■ Nature of product does not allow benefit enhancements ■ Consumers are relatively more sensitive to price than product characteristics ■ Products attributes are clearly observable Exploiting Advantage Through Pricing ○ ● Optimal pricing strategy depends on homogeneity of industry customers preferences ○ If product differentiation is weak firm should follow market share strat ■ Cost adv: underprice rivals and build share ■ Benefit adv: maintain price parity and let the benefit build the share ○ If product differentiation is strong firm should follow a profit margin strat ■ Cost adv: maintain price parity w/ rivals and enjoy higher margins ■ Benefit adv: charge a price premium over the competitors Choosing Where to Focus ○ How? ■ Industry in 2 dimensions ● Product varieties (WHAT) ● Customer groups (WHO) ■ Potential segment is the intersection of a particular product group w/ particular customer group ● Some segments more attractives ● Segments also vary by geography ■ Key ?s ● What resources/capabilities can the firm develop/exploit to add value/cut costs? ● Do these apply to customers/product varieties or only specific niches? ○ Customer Specialization ■ Offer an array of product varieties to limited class of customers ● Focus on catering to particular needs of that customer group ● Customer specific knowledge are more important to value creation/capture ○ Product Specialization ■ Offer a limited set of producers to an array of customer groups ● Focus on being excellent at providing best in class product valued by all customer groups ● Product specific knowledge/resources are more important to value creation and capture ○ Geographic Specialization ■ Offer a variety of products and/or sell to a variety of customer groups w/ in a narrow geography ● Focus on exploiting local knowledge/resources to be better at satisfying the needs of the customers in that location ● Location specific knowledge are more important to value creation and capture