SAP GRC For Dummies: Governance, Risk, Compliance Guide

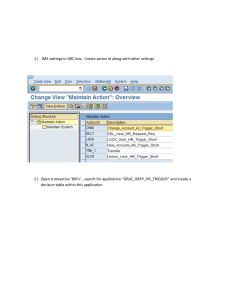

advertisement