Management Accounting Test: True/False & Multiple Choice

advertisement

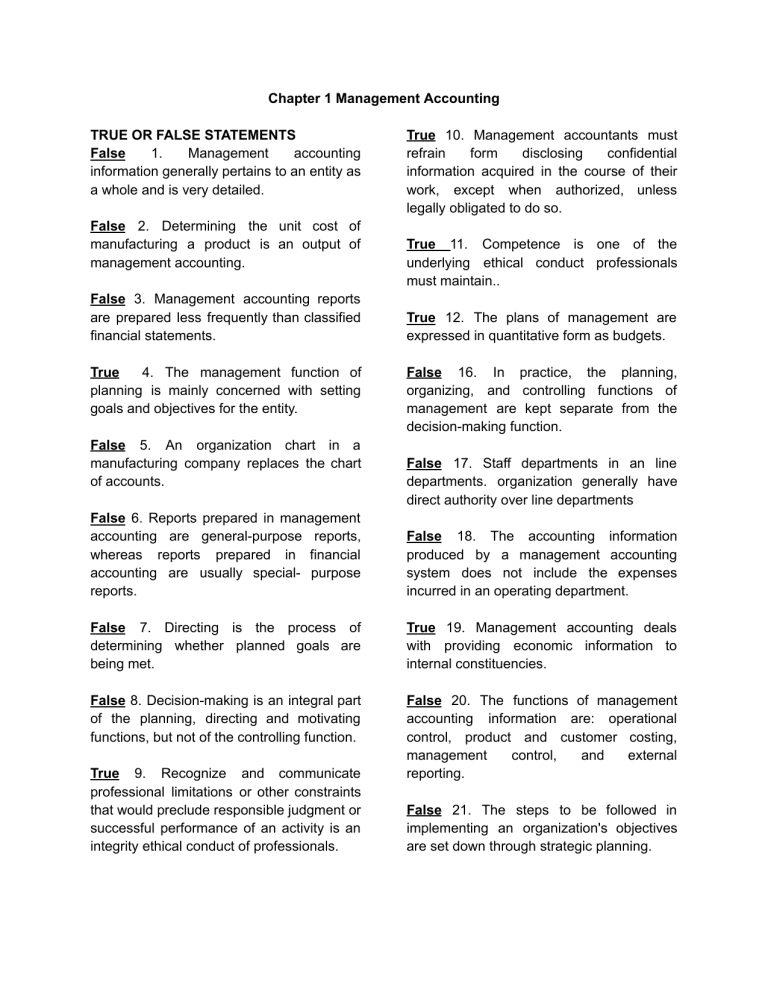

Chapter 1 Management Accounting TRUE OR FALSE STATEMENTS False 1. Management accounting information generally pertains to an entity as a whole and is very detailed. False 2. Determining the unit cost of manufacturing a product is an output of management accounting. False 3. Management accounting reports are prepared less frequently than classified financial statements. True 4. The management function of planning is mainly concerned with setting goals and objectives for the entity. False 5. An organization chart in a manufacturing company replaces the chart of accounts. True 10. Management accountants must refrain form disclosing confidential information acquired in the course of their work, except when authorized, unless legally obligated to do so. True 11. Competence is one of the underlying ethical conduct professionals must maintain.. True 12. The plans of management are expressed in quantitative form as budgets. False 16. In practice, the planning, organizing, and controlling functions of management are kept separate from the decision-making function. False 17. Staff departments in an line departments. organization generally have direct authority over line departments False 6. Reports prepared in management accounting are general-purpose reports, whereas reports prepared in financial accounting are usually special- purpose reports. False 18. The accounting information produced by a management accounting system does not include the expenses incurred in an operating department. False 7. Directing is the process of determining whether planned goals are being met. True 19. Management accounting deals with providing economic information to internal constituencies. False 8. Decision-making is an integral part of the planning, directing and motivating functions, but not of the controlling function. False 20. The functions of management accounting information are: operational control, product and customer costing, management control, and external reporting. True 9. Recognize and communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity is an integrity ethical conduct of professionals. False 21. The steps to be followed in implementing an organization's objectives are set down through strategic planning. True 22. Strategic planning is sometimes referred to as setting policy. True 23. Management accountant must understand and anticipate the reactions of individual to information and measurements. True 24. A balanced report is a measurement system for clarifying, communicating, and implementing business strategy. False 25. Management accounting produces information that helps workers, manager, and executives in organizations make better decisions and improve their processes and performance. False 26. Internal reporting is the preparation of financial reports based on generally accepted accounting principles 3. Which description identifies financial statements that are prepared for external users? a. External reports b. Special-purpose c. User-specific d. General-purpose 4. Which term describes management accounting reports? a. All purpose reports b. Special-purpose c. General-purpose d. Regulatory reports 5. Which one of the following involves coordinating a company's activities to produce a smooth-running operation? a. Auditing b. Controlling c. Planning d. Directing II. MULTIPLE CHOICE QUESTIONS 1. Management accounting information a. pertains to the entity as a whole and is highly aggregated. b. must be prepared according to generally accepted accounting principles. c. pertains to subunits of the entity and may be very detailed. d. ‘is prepared only once a year. 2. How often are internal management reports communicated? a. As frequently as needed b. Annually c. During every audit by the company's CPA d. Monthly 6. Which of the following statements about internal reports is true? a. Most internal reports are summarized rather than detailed. b. Internal reports focus on general purpose needs of users. c. The content of internal reports extends beyond the double-entry accounting system. d. Internal reports are often very general. 7. Management accounting a. is concerned with costing products. b. is governed by generally accepted accounting principles. c. pertains to the entity as a whole and is highly aggregated. d. places emphasis on special-purpose information. 8. What broad functions do the management of an organization perform? a. Directing, manufacturing, and controlling b. Planning, directing, and controlling c. Planning, directing, and selling d. Planning, manufacturing, and controlling 9. Management accounting information is generally prepared for a. stockholders. b. managers. c. regulatory agencies. d. investors. 10. Which one of the following describes internal reports? a. They are often audited by CPAs. b. They are highly regulated by the Securities & Exchange Commission. c. They are aggregated d. They are detailed. 11. Which one of the following does the planning function involve? a. Analyzing financial statements b. Setting goals and objectives for an entity c. Hiring the right people for a particular job d. Coordinating the accounting information system 12. Which one of the following is true concerning the managerial function of controlling? a. It includes performance evaluation by management. b. It is concerned mainly with operating a manufacturing segment. c. It is performed only by the controller of a company. d. It includes employees. hiring and training 13. Which of the following represents two management functions? a. Regulating and directing b. Controlling and directing. c. Controlling and auditing d. Auditing and planning 14. Which management function is a manager performing when objectives are being established? a. Regulating b. Planning c. Motivating d. Directing 15. Which one of the following shows the delegation of responsibility within a company? a. Authority Outline b. Organization chart c. Company's charter d. Sarbanes-Oxley Act 16. Management and financial accounting are used for which of the following purposes? Management Accounting Financial Accounting a. Internal External b. External Internal c. Internal Internal d, External External 17. Management accounting a. Is more concerned with the future than financial accounting. b. Is less concerned with segments of a company than financial accounting. c. Is more constrained by rules and regulations than financial accounting. d. all of the above are true. 22. The key link between managing resources and managing change in an organization is a. Responsibility accounting. b. Information c. Strategies. d. conversion activities. 18. Which of the following is not an internal user? a. Corporate officers b. Staff employees c. Stockholders d. Department manager 23. Management accounting differs from financial accounting in that management accounting: a. Is internal and future oriented, and governed by generally accepted accounting principles, whereas financial accounting is not b. Is future oriented and focuses on the organization as a whole, whereas financial accounting is not. c. Emphasizes relevant and flexible information whereas financial accounting does not. d. Emphasizes relevant historical information about the whole firm, whereas financial accounting does not. 19. Which of the following is not part of management a. Determining whether planned goals are being met b. Reporting financial information to the shareholders c. Calculating product costs d. Controlling costs 20. Which of the following uses management accounting? a. Manufacturing and service entities, but not merchandising b. Profit-oriented businesses only c. Service, manufacturing, and merchandising entities d. Only manufacturing entities 21. Which one of the following tasks would not be performed by a management accountant? a. Being concerned with the impact of cost and volume on profits b. Strategic cost management c. Assisting in budget planning d. Preparing reports primarily for external users 24. Which of the following is a false statement? a. Financial accounting is governed by generally accepted accounting principles whereas management accounting is not. b. Management accounting places more emphasis on the past than does financial accounting. c. Financial accounting tends to emphasize precision while management accounting emphasizes relevance and flexibility. d. Management accounting draws heavily from other disciplines. 25. Financial accounting a. is primarily concerned with internal reporting. b. is more concerned with verifiable, historical information than is cost accounting. c. focuses on the parts of the organization rather than the whole. d. is specifically directed at management decision-making needs. 26. The ethical standards established for management accountants are in the areas of a. competence, licensing, reporting, and education. b. budgeting, cost allocation, product costing, and insider trading. c. competence, confidentiality, integrity, and objectivity. d. disclosure, communication, decision making, and planning. 27. Management accounting a. must follow generally accepted accounting principles. b. information should be developed within the same general accounting system as financial accounting. c. deals primarily with the needs of parties external to the firm such as investors and creditors. d. is just another financial accounting term. 28. Financial accounting is concerned with: a. The company as a whole rather than with the segments of a company. b. The needs of stockholders and creditors, c. Meeting the requirements of internal users only. d. Recording the financial history of an organization. 29. The basic difference between management and financial accounting is that: a. Financial accounting is a division of accounting that is concerned with providing information to stockholders whereas management accounting is concerned with providing information to managers for their use in directing the activities of the organization. b. Financial accounting relies on information gathered from sources outside the business whereas management accounting relies on internally generated information. c. Financial accounting system relies on accounting information whereas management accounting does not. d. Management accounting relies upon the concept of responsibility accounting whereas financial accounting does not. 1. Enumerate the four areas covered by Standards of Ethical Conduct for Management Accountants and how these areas are defined? A. Competence - “Is defined as the capacity to respond to individual, or societal, demands in order to perform an activity or complete a given task.” - Maintain an appropriate level of professional competence by ongoing development of their knowledge and skills. - Perform their professional duties in accordance with laws, regulations and technical standards. B. Confidentiality - Refrain from disclosing confidential information acquired in the course of their work, except when authorized, unless legally obligated to do so. C. Integrity - Avoid actual or apparent conflicts of interest and advise all appropriate parties of any potential conflict. - Refrain from engaging in any activity that would prejudice their ability to carry out their duties ethically. D. Objectivity - Communicate information fairly and objectively 2. Consider the following short descriptions. Indicate whether each description more closely relates to a major feature of financial accounting (use FA) or management accounting (use MA) a. Behavioral impact is secondary - FA b. Is constrained by generally accepted accounting principles - FA c. Has a future orientation - MA d. Is characterized by detailed reports - MA e. Field is more sharply defined - MA f. Has less flexibility - FA 3. For each of the following, indicate whether the employee has line (L), or standard responsibility (S). a. Production superintendent - L b. Cost accountant - S c. Market research analyst - S d. District sales manager - L e. Head of the legal department - L f. President - L 4. Financial accounting information and management accounting information have a number of distinguishing characteristics. M 1. Reporting standard is relevant to the decision to be made. F 2. Classified financial statements. F 3. Reports generally pertain to the company as a whole. M 4. Reports generally pertain to subunits. M 5. Reports issued quarterly or annually. F 6. General purpose reports. M 7. Reports are used internally. F 8. Prepared in accordance with generally accepted accounting principles. M 9. Special purpose reports. F 10. Limited to historical cost data. Chapter 2: Management Accounting Information System TRUE OR FALSE STATEMENTS True 1. Designing a good accounting system is a specialized job requiring a high degree of skill. True 2. Accounting system must contain controls to achieve accuracy, reliability, and efficiency. True 3. Information system is a combination of hardware, software, people, and events to provide information for decision making. True 4. Data collection via an accounting system facilitates the best collective decision making True 5. A program is a series of steps planned to carry out a certain process, such as the preparation of payroll. False 6. Accounting machines is usually applied to mechanical or electronic equipment capable of performing arithmetic functions and not used to produce a variety of accounting records and reports. True 7. The input in a computer-based system corresponds to the journals in a manual system True 8. One of the first steps in the development of an accounting system is the preparation of a chart of accounts. True 9. Accounting system is often the principal means of gathering data to aid and coordinate the process of making the best collective operating or routine decisions in light of the overall goals or objectives of an organization. True 10. An effective accounting system provides information only to internal managers for use in planning and controlling routine operations and in strategic planning. True 11. Data processing includes the preparation of documents (such as checks and invoices), and the flow of the data contained in these documents through the major accounting steps of recording, classifying, and summarizing. True 12. Information generated or processed by computers is said to be free from any errors, thus, it possesses the quality of accuracy. False 13. Computers can make decisions in the sense of exercising judgment and can choose among alternatives by following the specific instructions contained in the program, False 14. Accounting system must contain controls to achieve accuracy, honesty, and efficiency, and speed. True 15. The accuracy quality of information refers to the degree to which information is free from error. True 16. The firm's organizational structure refers to how authority and responsibility for decision making are distributed. True 17. Costs-benefits trade-offs may be considered by managers in designing management information system. False 18. Information could be considered as complete only when all the necessary dara needed by the user is provided. False 19. In order to become effective, managers should always follow the order of information flow set by the organization. True 20. Information system can only function efficiently and effectively if the people involved in it will perform their duties carefully and accurately. False 21. Information is said to be complete if the user could accumulate as many information as possible. True 22. Information is said to be timely if it still useful to the decision makers before a decision has been made. True 23. Management control systems guides the organizations in designing and implementing strategies to achieve its objectives True 24. A detector is a measuring device that identifies what is actually happening in the process being controlled False 25. Communications network is a part of cost management system that identifies the cost of resources of the firms. Multiple Choice Questions: 1. A management accounting system should provide information to a. all functional areas of the organization b. only the accounting area of the organization c. only the production areas of the organization d. organizational managers, but not to staff personnel 2. Which of the following is not a primary goal of a cost management system? a. use cost drivers to develop product costs. b. improve understanding of activities c. develop organizational strategies d. measure performance 3. A cost management system will provide the means to develop a. the most accurate product or service costs b. a reasonably accurate product or service cost oven cost-benefit analysis c. a product or service cost that does not include any non-value-added overhead d. a costing mom that traces all costs directly to individual products or serving 4. The cost generated by the cost management system are used to a. Assess product/service profitability b. Establish prices for products with significant competition c. Determine underlying reasons for variations from standards d. All of the above 5. Information about the life-cycle performance of a product or service should provided in the Financial Accounting System a. b. c. d. Cost Management System Yes Yes No No Yes No Yes No 6. A management information should do which of the following? Collect Data Organize Data for Managers system Analyze data for management a Yes No Yes b Yes Yes No c No No Yes d Yes Yes Yes 7. A management information system should emphasize satisfying a. external demands for information. b. external and internal demands for information. c. internal demands for information. d. the Accounting Department's demands for information. 8. Who of the following are external users of data gathered by a management information system? a Creditors Regulatory Bodies Suppliers Yes No Yes b No No No c No Yes Yes d Yes Yes Yes 9. Which of the following considered a detector? a. computer program b. source document c. variance report d. all of the above would be 10. Feedback is reflected in which component of a management control system? a. Sensor b. Assessor c. Effector d. Detector 11. Reactions to information provided by the management control system are a. formulated in the organization's strategic plan. b. judgmental, and are based on interpretations and circumstances c. cassessed by the communications network of the MCS. d. determined as those activities that will be most efficient and effective given the organization's available technology. 12. An increase in the use of technology has caused a. fewer costs to be susceptible to short-run control b. companies to be more flexible in responding to changing short-term conditions c. managers to be less concerned about capacity utilization because of the increased ability to produce in large quantities. d. a decline in the amount of fixed costs in an organization 13. Which of the following is considered a "feeder system to the cost management system? Payroll Budgeting Inventory Valuation a Yes No Yes b Yes Yes Yes c No No No d Yes Yes No 14. Which of the following is a primary element of a cost management system? Informa tion Reporting Motiva tion Evalua tion a Yes Yes Yes Yes b No Yes Yes No c Yes No No Yes d Yes Yes Yes No 15. Organizational form directly affects which of the following? Decision-making Decision Making Authority Cost of Capital Taxation Mission a No Yes Yes Yes b Yes Yes Yes No c No Yes No Yes d Yes Yes No No 16. As an organization moves to decentralize its operations, an effective reporting system will have _________ when the organization was centralized. a. about the same importance as b. less importance than c. more importance than d. a level of importance that depends on organizational size as compared to 17. Performance reports are useful only to the extent that performance is measured against a. a meaningful benchmark b. the performance of all other units or managers c. the budget as adopted for the period. d. competitors achievements. 18. The reward system for subunit managers of mature businesses should emphasize a. Long-term competitive prospects. b. near-term profit and cash flow c. success in product design and development. d. exceeding last year's subunit profit. Chapter 3: Cost concepts, Classifications, and Cost Behavior TRUE OR FALSE STATEMENTS True 1. A cost object is the monetary measure of a resource used or foregone to achieve a specific purpose. True 2. The major purpose for using cost objects is to aid management planning and control. True 3. Cost accumulation, cost allocation, and cost objects are interrelated. True 4. An activity index is the activity that causes changes in the behavior of costs. True 12. A variable cost will change in total in proportion to changes in the level of activity. True 13. Cost function is an expression that mathematically links costs,, their behavior, and their cost driver. True 14. As volume decreases within the relevant range, variable cost per unit remains the - same and fixed cost per unit increases False 4. Fixed cost per unit remains constant at various levels of activity. False 15. When making predictions, variable costs and fixed costs should be thought of on a per unit basis. True 5. A variable cost remains constant per unit, though in total increases as activity levels increase. True 16. Within the relevant range, the amount of variable cost per unit remains constant at each volume level. False 6. If volume increases, both total variable and total fixed costs will increase. False 17. The relevant range of activity is the activity level at which the company the highest amount of profits. makes False 7. If the activity level decreases, fixed costs per unit will decrease. False 8. Decreases in the level of activity will cause total variable and total fixed costs to decrease. False 9. An assumption regarding cost behavior is that two cost drivers are used for a given cost. False 10. Manufacturing overhead combined with direct materials is known as conversion cost. True 11. Non-manufacturing costs consist of selling costs and administrative costs. True 18. Fixed costs per unit decline as the activity level increases within the relevant range of activity. False 19. A fixed cost is const int per unit of product. True 20. Manufacturing overhead is an indirect cost with respect to units of product. True 21. Cost behavior is the impact that a cost driver has on a cost True 29. Variable cost changes in total in direct proportion to changes in activity or output. True 22. When graphed, total variable costs and total fixed costs are both assumed to be linear within the relevant range. True 23. Fixed cost is constant in total amount regardless of changes in activity level within the relevant range. True 24. The variable cost element of a mixed cost is the amount that total costs increase for each additional unit of activity. True 25. A period cost is defined as the cost incurred when asset is used up or sold for the purpose of generating revenue. True 26. Average cost is the total cost to produce the products is divided by the number of units manufactured or produced. True 27.Opportunity costs could be defined as the revenue lost when one alternative is not taken in favor of another alternative II. MULTIPLE CHOICE QUESTIONS 1. The term "relevant range" in cost accounting means the range over which a. a. costs may fluctuate. b. cost relationships are valid. c. Production may vary. d. relevant costs are incurred. 2. Which of the following defines variable cost behavior? Total cost reaction to increase in activity Cost per unit rection to increase in activity a. remains constant remains constant b. remains constant increases c. increases increases d. increases remains constants 3. A cost that remains constant in total but varies on a per-unit basis with changes in activity is called a(n) a. expired cost. b. fixed cost. c. variable cost d. mixed cost. 4. When the number of units manufactured increases, the most significant change in unit cost will be reflected as a(n) a. increase in the fixed element. b. decrease in the variable element. c. increase in the mixed element. d. decrease in the fixed element. 5. Which of the following always has a direct cause-effect relationship to a cost? Predictor Cost driver a. yes yes b. yes no c. no yes d. no no 6. A cost driver a. causes fixed costs to rise because of production changes. b. has a direct cause-effect relationship to a cost. c. can predict the cost behavior of a variable, but not a fixed cost.