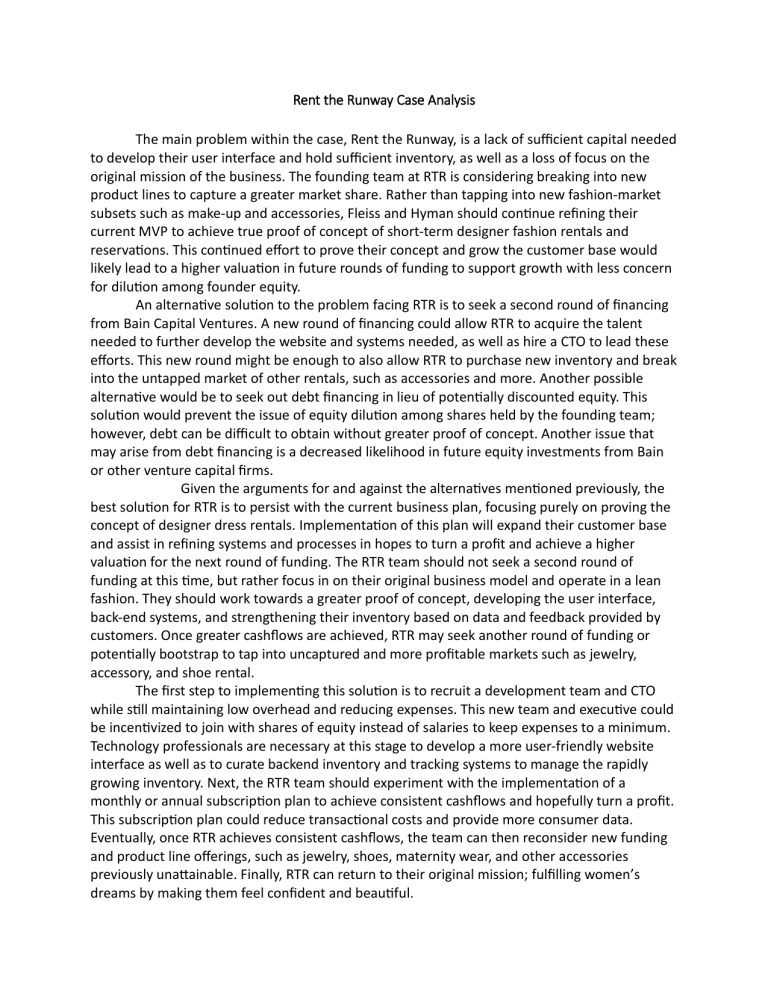

Rent the Runway Case Analysis The main problem within the case, Rent the Runway, is a lack of sufficient capital needed to develop their user interface and hold sufficient inventory, as well as a loss of focus on the original mission of the business. The founding team at RTR is considering breaking into new product lines to capture a greater market share. Rather than tapping into new fashion-market subsets such as make-up and accessories, Fleiss and Hyman should continue refining their current MVP to achieve true proof of concept of short-term designer fashion rentals and reservations. This continued effort to prove their concept and grow the customer base would likely lead to a higher valuation in future rounds of funding to support growth with less concern for dilution among founder equity. An alternative solution to the problem facing RTR is to seek a second round of financing from Bain Capital Ventures. A new round of financing could allow RTR to acquire the talent needed to further develop the website and systems needed, as well as hire a CTO to lead these efforts. This new round might be enough to also allow RTR to purchase new inventory and break into the untapped market of other rentals, such as accessories and more. Another possible alternative would be to seek out debt financing in lieu of potentially discounted equity. This solution would prevent the issue of equity dilution among shares held by the founding team; however, debt can be difficult to obtain without greater proof of concept. Another issue that may arise from debt financing is a decreased likelihood in future equity investments from Bain or other venture capital firms. Given the arguments for and against the alternatives mentioned previously, the best solution for RTR is to persist with the current business plan, focusing purely on proving the concept of designer dress rentals. Implementation of this plan will expand their customer base and assist in refining systems and processes in hopes to turn a profit and achieve a higher valuation for the next round of funding. The RTR team should not seek a second round of funding at this time, but rather focus in on their original business model and operate in a lean fashion. They should work towards a greater proof of concept, developing the user interface, back-end systems, and strengthening their inventory based on data and feedback provided by customers. Once greater cashflows are achieved, RTR may seek another round of funding or potentially bootstrap to tap into uncaptured and more profitable markets such as jewelry, accessory, and shoe rental. The first step to implementing this solution is to recruit a development team and CTO while still maintaining low overhead and reducing expenses. This new team and executive could be incentivized to join with shares of equity instead of salaries to keep expenses to a minimum. Technology professionals are necessary at this stage to develop a more user-friendly website interface as well as to curate backend inventory and tracking systems to manage the rapidly growing inventory. Next, the RTR team should experiment with the implementation of a monthly or annual subscription plan to achieve consistent cashflows and hopefully turn a profit. This subscription plan could reduce transactional costs and provide more consumer data. Eventually, once RTR achieves consistent cashflows, the team can then reconsider new funding and product line offerings, such as jewelry, shoes, maternity wear, and other accessories previously unattainable. Finally, RTR can return to their original mission; fulfilling women’s dreams by making them feel confident and beautiful.