Basic Accounting Test: Fundamentals & Financial Statements

advertisement

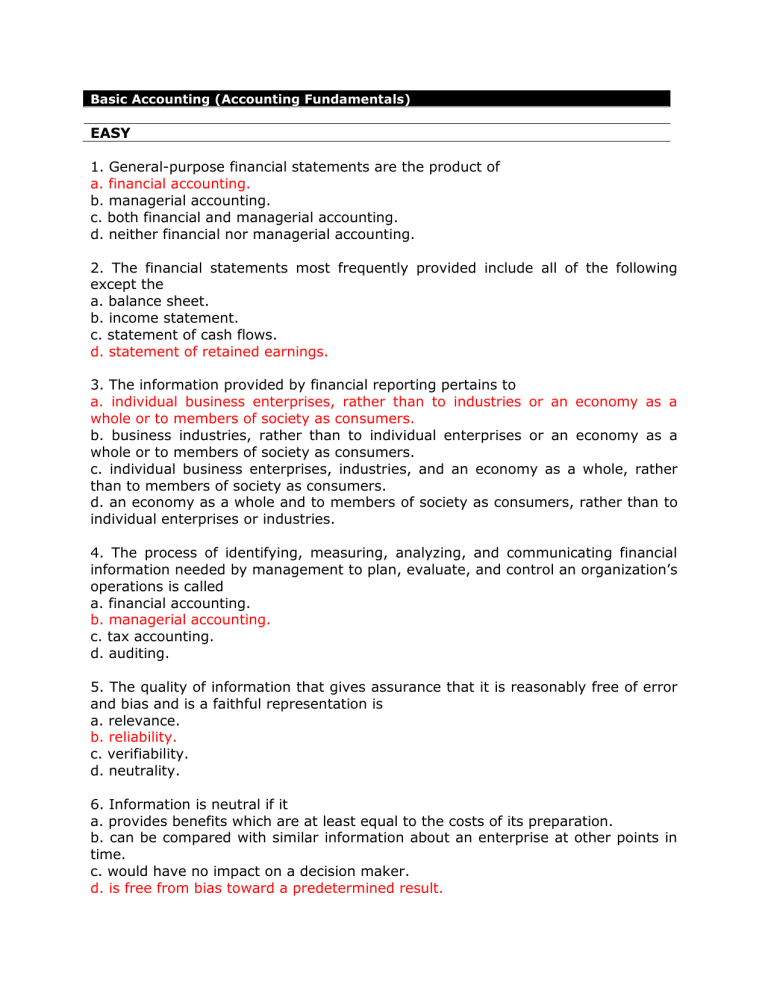

Basic Accounting (Accounting Fundamentals) EASY 1. General-purpose financial statements are the product of a. financial accounting. b. managerial accounting. c. both financial and managerial accounting. d. neither financial nor managerial accounting. 2. The financial statements most frequently provided include all of the following except the a. balance sheet. b. income statement. c. statement of cash flows. d. statement of retained earnings. 3. The information provided by financial reporting pertains to a. individual business enterprises, rather than to industries or an economy as a whole or to members of society as consumers. b. business industries, rather than to individual enterprises or an economy as a whole or to members of society as consumers. c. individual business enterprises, industries, and an economy as a whole, rather than to members of society as consumers. d. an economy as a whole and to members of society as consumers, rather than to individual enterprises or industries. 4. The process of identifying, measuring, analyzing, and communicating financial information needed by management to plan, evaluate, and control an organization’s operations is called a. financial accounting. b. managerial accounting. c. tax accounting. d. auditing. 5. The quality of information that gives assurance that it is reasonably free of error and bias and is a faithful representation is a. relevance. b. reliability. c. verifiability. d. neutrality. 6. Information is neutral if it a. provides benefits which are at least equal to the costs of its preparation. b. can be compared with similar information about an enterprise at other points in time. c. would have no impact on a decision maker. d. is free from bias toward a predetermined result. Accounting Fundamentals | BASIC 7. Financial information does not demonstrate consistency when a. firms in the same industry use different accounting methods to account for the same type of transaction. b. a company changes its estimate of the salvage value of a fixed asset. c. a company fails to adjust its financial statements for changes in the value of the measuring unit. d. none of these. 8. "When products (goods or services), merchandise, or other assets are exchanged for cash or claims to cash" is a definition of a. allocated. b. realized. c. realizable. d. earned. 9. Trade-offs between the characteristics that make information useful may be necessary or beneficial. Issuance of interim financial statements is an example of a trade-off between a. relevance and reliability. b. reliability and periodicity. c. timeliness and materiality. d. understandability and timeliness. 10. Which of the following is not an enhancing quality of the Financial Statements? a. Verifiability b. Faithful Representation c. Comparability d. Timeliness 11. Which of the following is true regarding Treasury shares? a. It is an increase equity b. It is included in the computation of outstanding shares c. It has no effect in the financial position d. It has no right to receive dividend 12. Chen Company's account balances at December 31, 2017 for Accounts Receivable and the Allowance for Doubtful Accounts are P320,000 debit and P600 credit. Sales during 2017 were P900,000. The entity employs the income statement approach and uses an arbitrary percentage of 1% for bad debts. The adjusting entry would include a credit to the allowance account for a. P9,600. b. P9,000. c. P8,400. d. P3,200. 13. Pappy Corporation received cash of P13,500 on September 1, 2017 for one year’s rent in advance and recorded a liability for the transaction. The December 31, 2017 adjusting entry is Page 2 of 15 Accounting Fundamentals | BASIC a. debit Rent Revenue and credit Unearned Rent, P4,500. b. debit Rent Revenue and credit Unearned Rent, P9,000. c. debit Unearned Rent and credit Rent Revenue, P4,500. d. debit Cash and credit Unearned Rent, P9,000. 13,500 x 4/12 = 4,500. 14. Tate Company purchased equipment on November 1, 2017 and gave a 3month, 9% note with a face value of P20,000. The December 31, 2017 adjusting entry is a. debit Interest Expense and credit Interest Payable, P1,800. b. debit Interest Expense and credit Interest Payable, P450. c. debit Interest Expense and credit Cash, P300. d. debit Interest Expense and credit Interest Payable, P300. 2/12 x 9% x 20,000 = 300. 15. The making and collecting loans of a universal bank shall be classified as what activity under the statement of cash flows? a. operating activities. b. investing activities. c. financing activities. d. liquidating activities. 16. An example of an item which is not an element of working capital is a. accrued interest on notes receivable. b. goodwill. c. goods in process. d. temporary investments. 17. Which financial statement uses the expanded accounting equation? a. Income statement b. Cash flow statement c. Balance Sheet d. Statement of Changes in Owner’s Equity 18. Lovingyouwasred Company purchased a depreciable asset for P200,000. The estimated salvage value is P20,000, and the estimated useful life is 10 years. The straight-line method will be used for depreciation. What is the depreciation base of this asset? a. P18,000 b. P20,000 c. P180,000 d. P200,000 (200,000 – 20,000) = 180,000 Page 3 of 15 Accounting Fundamentals | BASIC 19. A corporation pays its annual property tax bill of approximately P12,000 in one payment each December 28. During the year, the corporation's monthly income statements report Property Tax Expense of P1,000. This is an example of which accounting principle/guideline? a. Conservatism b. Matching c. Monetary Unit d. Cost 20. The creative chief executive of a corporation who is personally responsible for numerous inventions and innovations is not reported as an asset on the corporation's balance sheet. The accounting principle/guideline that prevents the corporation for reporting this person as an asset is a. Cost b. Conservatism c. Going Concern d. Industry Practices AVERAGE 1. Which of the following statements is not an objective of financial reporting? a. Provide information that is useful in investment and credit decisions. b. Provide information about enterprise resources, claims to those resources, and changes to them. c. Provide information on the liquidation value of an enterprise. d. Provide information that is useful in assessing cash flow prospects. 2. Accounting principles are "generally accepted" only when a. an authoritative accounting rule-making body has established it in an official pronouncement. b. it has been accepted as appropriate because of its universal application. c. both a and b. d. neither a nor b. 3. A decrease in net assets arising from peripheral or incidental transactions is called a(n) a. capital expenditure. b. cost. c. loss. d. expense. 4. The economic entity assumption a. is inapplicable to unincorporated businesses. b. recognizes the legal aspects of business organizations. c. requires periodic income measurement. d. is applicable to all forms of business organizations Page 4 of 15 Accounting Fundamentals | BASIC 5. Factors that shape an accounting information system include the a. nature of the business. b. size of the firm. c. volume of data to be handled. d. all of these. 6. To compute interest expense for an adjusting entry, the formula is principal X rate X a fraction. The numerator and denominator of the fraction are: Numerator Denominator a. Length of time note has been outstanding 12 months b. Length of note 12 months c. Length of time until note matures Length of note d. Length of time note has been outstanding Length of note 7. Bae and Bee formed a partnership and agreed to have profit sharing of 60:40 respectively. Additionally, Bee will receive a salary of P2,000 per month and Bae will receive a salary of P10,000 per year. Bae will receive a 5% bonus of net income before tax but after bonus and salaries. How much bonus will Bae receive if the partnership has a profit of P169,000? a. P7,476 b. P1,762 c. P6,429 d. P2,238 Solution: [5%(169,000-34,000)]/1.05 8. Maso Company recorded journal entries for the issuance of common stock for P40,000, the payment of P13,000 on accounts payable, and the payment of salaries expense of P21,000. What net effect do these entries have on owners’ equity? a. Increase of P40,000. b. Increase of P27,000. c. Increase of P19,000. d. Increase of P6,000. 40,000 - 21,000 = 19,000. 9. In November and December 2017, Lane Co., a newly organized magazine publisher, received P90,000 for 1,000 three-year subscriptions at P30 per year, starting with the January 2018 issue. Lane included the entire P90,000 in its 2017 income tax return. What amount should Lane report in its 2017 income statement for subscriptions revenue? a. P0. b. P5,000. c. P30,000. d. P90,000. 0, none of the 90,000 is earned. Page 5 of 15 Accounting Fundamentals | BASIC 10. Bacolaw Co. pays all salaried employees on a biweekly basis. Overtime pay, however, is paid in the next biweekly period. Bacolaw accrues salaries expense only at its December 31 year end. Data relating to salaries earned in December 2017 are as follows: Last payroll was paid on 12/26/17, for the 2-week period ended 12/26/17. Overtime pay earned in the 2-week period ended 12/26/17 was P10,000. Remaining work days in 2017 were December 29, 30, 31, on which days there was no overtime. The recurring biweekly salaries total P180,000. Assuming a five-day work week, Colaw should record a liability at December 31, 2017 for accrued salaries of a. P54,000. b. P64,000. c. P108,000. d. P118,000. 10,000 + (180,000 ÷ 10 × 3) = 64,000. 11. Shank Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in the calculation of depreciation. The error caused the net income to be reported at almost double the proper amount. Correction of the error when discovered in the next year should be treated as a. an increase in depreciation expense for the year in which the error is discovered. b. a component of income for the year in which the error is discovered, but separately listed on the income statement and fully explained in a note to the financial statements. c. an extraordinary item for the year in which the error was made. d. a prior period adjustment. 12. Bowen Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 2017 included the following expense and loss accounts: Accounting and legal fees P140,000 Advertising 180,000 Freight-out 80,000 Interest 70,000 Loss on sale of long-term investment 30,000 Officers' salaries 225,000 Rent for office space 220,000 Sales salaries and commissions 170,000 One-half of the rented premises is occupied by the sales department. Bowen's total selling expenses for 2017 are a. 540,000. b. 460,000. c. 430,000. d. 370,000. 180,000 + 80,000 + 110,000 + 170,000 = 540,000. Page 6 of 15 Accounting Fundamentals | BASIC 13. Briggs Corporation uses the perpetual inventory method. On March 1, it purchased P10,000 of inventory, terms 2/10, n/30. On March 3, Briggs returned goods that cost P1,000. On March 9, Briggs paid the supplier. On March 9, Briggs should credit a. purchase discounts for P200. b. inventory for P200. c. purchase discounts for P180. d. inventory for P180. 14. On December 1, 2017, Michael Hess Company sold some machinery to Shawn Keling Company. The two companies entered into an installment sales contract at a predetermined interest rate. The contract required four equal annual payments with the first payment due on December 1, 2017, the date of the sale. What present value concept is appropriate for this situation? a. Future amount of an annuity of 1 for four periods b. Future amount of 1 for four periods c. Present value of an ordinary annuity of 1 for four periods d. Present value of an annuity due of 1 for four periods. 15. At the close of its first year of operations, December 31, 2017, Linn Company had accounts receivable of P540,000, after deducting the related allowance for doubtful accounts. During 2017, the company had charges to bad debt expense of P90,000 and wrote off, as uncollectible, accounts receivable of P40,000. What should the company report on its balance sheet at December 31, 2017, as accounts receivable before the allowance for doubtful accounts? a. P670,000 b. P590,000 c. P490,000 d. P440,000 540,000 + (90,000 – 40,000) = 590,000. 16. During 2017 Foley Corporation transferred inventory to Kline Corporation and agreed to repurchase the merchandise early in 2018. Kline then used the inventory as collateral to borrow from Norwalk Bank, remitting the proceeds to Foley. In 2018 when Foley repurchased the inventory, Kline used the proceeds to repay its bank loan. This transaction is known as a(n) a. consignment. b. installment sale. c. assignment for the benefit of creditors. d. product financing arrangement. 17. The following information is available for Kerr Company for 2007: Freight-in P 30,000 Purchase returns 75,000 Selling expenses 150,000 Page 7 of 15 Accounting Fundamentals | BASIC Ending inventory 260,000 The cost of goods sold is equal to 400% of selling expenses. What is the cost of goods available for sale? a. P600,000. b. P890,000. c. P815,000. d. P860,000. 260,000 + (4 × 150,000) = 860,000. 18. Richey Co. records purchases at net amounts. On May 5 Richey purchased merchandise on account, P16,000, terms 2/10, n/30. Richey returned P1,200 of the May 5 purchase and received credit on account. At May 31 the balance had not been paid. By how much should the account payable be adjusted on May 31? a. 0. b. 344. c. 320. d. 296. (16,000 – 1,200) × .02 = 296. 19. Tysen Retailers purchased merchandise with a list price of P50,000, subject to trade discounts of 20% and 10%, with no cash discounts allowable. Tysen should record the cost of this merchandise as a. P35,000. b. P36,000. c. P39,000. d. P50,000. 50,000 × .8 × .9 = 36,000. 20. Each year a company has been investing an increasingly greater amount in machinery. Since there is a large number of small items with relatively similar useful lives, the company has been applying straight-line depreciation at a uniform rate to the machinery as a group. The ratio of this group's total accumulated depreciation to the total cost of the machinery has been steadily increasing and now stands at .75 to 1.00. The most likely explanation for this increasing ratio is the a. company should have been using one of the accelerated methods of depreciation. b. estimated average life of the machinery is less than the actual average useful life. c. estimated average life of the machinery is greater than the actual average useful life. d. company has been retiring fully depreciated machinery that should have remained in service. Page 8 of 15 Accounting Fundamentals | BASIC DIFFICULT 1. Preparation of consolidated financial statements when a parent-subsidiary relationship exists is an example of the a. economic entity assumption. b. relevance characteristic. c. comparability characteristic. d. neutrality characteristic. 2. The debit and credit analysis of a transaction normally takes place a. before an entry is recorded in a journal. b. when the entry is posted to the ledger. c. when the trial balance is prepared. d. at some other point in the accounting cycle. 3. Which of the following is a correction of error? a. A change in the estimated service life of machinery b. A change from LIFO to FIFO c. A change from straight-line to double-declining-balance d. A change from FIFO to LIFO and a change from straight-line to double-declining balance 4. A business has the following items in its Statement of Financial Position: Land ? Vehicles 600,000 Cash 30,000 Equity 1,000,000 Loan 500,000 Creditors 50,000 Debtors P20,000 What is the value of the land? a. 1,000,000 b. 1,550,000 c. 900,000 d. 750,000 5. A plant asset has a cost of P24,000 and a salvage value of P6,000. The asset has a three-year life. If depreciation in the third year amounted to P3,000, which depreciation method was used? a. Straight-line b. Declining-balance c. Sum-of-the-years'-digits d. Composite method 6. King Co.'s allowance for uncollectible accounts was P95,000 at the end of 2017 and P90,000 at the end of 2016. For the year ended December 31, 2017, King reported bad debt expense of P13,000 in its income statement. What amount did King debit to the appropriate account in 2017 to write off actual bad debts? Page 9 of 15 Accounting Fundamentals | BASIC a. P5,000 b. P8,000 c. P13,000 d. P18,000 90,000 + 13,000 – 95,000 = 8,000. 7. The body of rules and principles which govern accounting practices is referred to as a. Accounting practice b. Accounting concepts c. Accounting principles d. Accounting theory 8. The normative attitudes or ideas of the accounting profession as to what ought to represent good accounting practice and which modify the application of accounting principles are known as a. accounting postulates b. accounting procedures c. accounting conventions d. accounting principles 9. The specific methods used by accountants in carrying out t5he general guidelines provided by GAAP, including the numerous rules specifying how financial data should be recorded, classified, summarized and reported are referred to as a. accounting postulates b. accounting procedures c. accounting conventions d. accounting principles 10. In January 2017, Castro Corporation, a newly formed company, issued 10,000 shares of its P10 par common stock for P15 per share. On July 1, 2017, Castro Corporation reacquired 1,000 shares of its outstanding stock for P12 per share. The acquisition of these treasury shares a. decreased total stockholders' equity. b. increased total stockholders' equity. c. did not change total stockholders' equity. d. decreased the number of issued shares. 11. Farmer Corporation owns 4,000,000 shares of stock in Baha Corporation. On December 31, 2007, Farmer distributed these shares of stock as a dividend to its stockholders. This is an example of a a. property dividend. b. stock dividend. c. liquidating dividend. d. cash dividend. Page 10 of 15 Accounting Fundamentals | BASIC 12. Bleeker Company issued 10,000 shares of its P5 par value common stock having a market value of P25 per share and 15,000 shares of its P15 par value preferred stock having a market value of P20 per share for a lump sum of P480,000. How much of the proceeds would be allocated to the common stock? a. P50,000 b. P218,182 c. P250,000 d. P255,000 (10,000 × P25) + (15,000 × P20) = P550,000 (250,000 ÷ P550,000) × 480,000 = 218,182. 13. On September 1, 2018, Zelner Company reacquired 12,000 shares of its P10 par value common stock for P15 per share. Zelner uses the cost method to account for treasury stock. The journal entry to record the reacquisition of the stock should debit a. Treasury Stock for P120,000. b. Common Stock for P120,000. c. Common Stock for P120,000 and Paid-in Capital in Excess of Par for $60,000 d. Treasury Stock for P180,000. 12,000 × P15 = P180,000. 14. Trent Corporation was organized on January 1, 2017, with an authorization of 1,200,000 shares of common stock with a par value of P6 per share. During 2017, the corporation had the following capital transactions: January 5 issued 675,000 shares @ P10 per share July 28 purchased 90,000 shares @ P1 per share December 31 sold the 90,000 shares held in treasury @ P18 per share Trent used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of additional paid-in capital as of December 31, 2017? a. P-0-. b. P2,070,000. c. P2,700,000. d. P3,330,000. (675,000 × P4) + (90,000 × P7) = P3,330,000. 15. Baden Corporation owned 20,000 shares of Terney Corporation’s P5 par value common stock. These shares were purchased in 2014 for P180,000. On September 15, 2018, Baden declared a property dividend of one share of Terney for every ten shares of Baden held by a stockholder. On that date, when the market price of Terney was P14 per share, there were 180,000 shares of Baden outstanding. What NET reduction in retained earnings would result from this property dividend? a. P90,000 b. P252,000 c. P72,000 d. P162,000 Page 11 of 15 Accounting Fundamentals | BASIC (180,000 ÷ 10) × P14 = P252,000 P252,000 – [P252,000 – (180,000 × 18/20)] = P162,000 16. On January 1, 2017, Golden Corporation had 110,000 shares of its P5 par value common stock outstanding. On June 1, the corporation acquired 10,000 shares of stock to be held in the treasury. On December 1, when the market price of the stock was P8, the corporation declared a 10% stock dividend to be issued to stockholders of record on December 16, 2017. What was the impact of the 10% stock dividend on the balance of the retained earnings account? a. P50,000 decrease b. P80,000 decrease c. P88,000 decrease d. No effect 100,000 × .10 × P8 = P80,000. 17. On July 1, 2017, Cole Co. issued 2,500 shares of its P10 par common stock and 5,000 shares of its P10 par convertible preferred stock for a lump sum of P125,000. At this date Cole's common stock was selling for P24 per share and the convertible preferred stock for P18 per share. The amount of the proceeds allocated to Cole's preferred stock should be a. P62,500. b. P75,000. c. P90,000. d. P68,750. (24 × 2,500) + (18 × 5,000) = 150,000. (90,000/150,00) × 125,000 = 75,000 18. On January 1, year 4, Jambon purchased equipment for use in developing a new product. Jambon uses the straight-line depreciation method. The equipment could provide benefits over a ten-year period. However, the new product development is expected to take five years, and the equipment can be used only for this project. Jambon’s year 4 expense equals a. The total cost of the equipment. b. One-fi fth of the cost of the equipment. c. One-tenth of the cost of the equipment. d. Zero. 19. Able Co. provides an incentive compensation plan under which its president receives a bonus equal to 10% of the corporation’s income before income tax but after deduction of the bonus. If the tax rate is 40% and net income after bonus and income tax was P360,000, what was the amount of the bonus? a. P36,000 b. P60,000 c. P66,000 d. P90,000 Page 12 of 15 Accounting Fundamentals | BASIC 360,000/0.6 = P600,000 x 10% = P 60,000 20. Tod Corp. wrote off P100,000 of obsolete inventory at December 31, year 2. The effect of this write-off was to decrease a. Both the current and acid-test ratios. b. Only the current ratio. c. Only the acid-test ratio. d. Neither the current nor the acid-test ratios. CLINCHER 1. The role of the Securities and Exchange Commission in the formulation of accounting principles can be best described as a. consistently primary. b. consistently secondary. c. sometimes primary and sometimes secondary. d. non-existent. 2. Proponents of historical cost ordinarily maintain that in comparison with all other valuation alternatives for general purpose financial reporting, statements prepared using historical costs are more a. reliable. b. relevant. c. indicative of the entity's purchasing power. d. conservative. 3. Reversing entries are 1. normally prepared for prepaid, accrued, and estimated items. 2. necessary to achieve a proper matching of revenue and expense. 3. desirable to exercise consistency and establish standardized procedures. a. 1 b. 2 c. 3 d. 1 and 2 4. Gordman Corporation reports: Cash provided by operating activities Cash used by investing activities Cash provided by financing activities Beginning cash balance What is Gordman’s ending cash balance? a. P230,000. b. P300,000. c. P450,000. d. P520,000. P200,000 110,000 140,000 70,000 Page 13 of 15 Accounting Fundamentals | BASIC 70,000 + 200,000 – 110,000 + 140,000 = 300,000. 5. In a period of rising prices, the inventory method which tends to give the highest reported net income is a. base stock. b. first-in, first-out. c. last-in, first-out. d. weighted-average. 6. Sears Corporation, which has a calendar year accounting period, purchased a new machine for P40,000 on April 1, 2012. At that time Sears expected to use the machine for nine years and then sell it for P4,000. The machine was sold for P22,000 on Sept. 30, 2017. Assuming straight-line depreciation, no depreciation in the year of acquisition, and a full year of depreciation in the year of retirement, the gain to be recognized at the time of sale would be a. P4,000. b. P3,000. c. P2,000. d. P0 40,000 – [(40,000 – 4,000) ÷ 9 × 5] = 20,000 (BV) 22,000 – 20,000 = 2,000 (gain). 7. Which of the following statements is/are true? I. Accounting is a service activity intended to fulfill a useful function in society II. Accounting involves the art of recording, classifying and summarizing transaction and events, and interpreting the results thereof. III. Accounting is an art but not a science IV. Accounting provides quantitative financial information intended to be useful in making economic decisions a. I, II, III, IV b. I, II, IV c. I, II, III d. II, III, IV 8. The general guidelines used in accounting practice that are based on substantial authoritative support are called a. Accounting postulates b. accounting procedures c. accounting conventions d. accounting principles 9. “The life of a business firm can be segmented into short run time periods in order to provide timely financial information to aid in financial decision making; hence, periodic reporting implies the use of accrual accounting and use of estimates ( approximations) and informed judgment by accountants.” This postulate is referred to as Page 14 of 15 Accounting Fundamentals | BASIC a. Historical cost b. Money measuring unit c. Revenue recognition d. Fiscal period 10. Cash, short-term investments, and net receivables are the numerator for Acid-Test Ratio Current Ratio a. Yes No b. Yes Yes c. No No d. No Yes Page 15 of 15