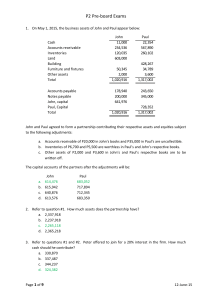

P2 Pre-board Exams 1. On May 1, 2015, the business assets of John and Paul appear below: Cash Accounts receivable Inventories Land Building Furniture and fixtures Other assets Total Accounts payable Notes payable John, capital Paul, Capital Total John 11,000 234,536 120,035 603,000 50,345 2,000 1,020,916 Paul 22,354 567,890 260,102 428,267 34,789 3,600 1,317,002 178,940 200,000 641,976 1,020,916 243,650 345,000 728,352 1,317,002 John and Paul agreed to form a partnership contributing their respective assets and equities subject to the following adjustments: a. Accounts receivable of P20,000 in John’s books and P35,000 in Paul’s are uncollectible. b. Inventories of P6,700 and P5,500 are worthless in Paul’s and John’s respective books. c. Other assets of P2,000 and P3,600 in John’s and Paul’s respective books are to be written off. The capital accounts of the partners after the adjustments will be: a. b. c. d. John 614,476 615,942 640,876 613,576 Paul 683,052 717,894 712,345 683,350 2. Refer to question #1. How much assets does the partnership have? a. 2,337,918 b. 2,237,918 c. 2,265,118 d. 2,365,218 3. Refer to questions #1 and #2. Peter offered to join for a 20% interest in the firm. How much cash should he contribute? a. 330,870 b. 337,487 c. 344,237 d. 324,382 Page 1 of 9 12-June-15 P2 Pre-board Exams 4. Refer to questions #1 to #3. After Peter’s admission, the profit and loss sharing ratio was agreed to be 40:40:20, based on capital credits. How much should the cash settlement be between John and Paul? a. 33,602 b. 32,930 c. 32,272 d. 34,288 5. Refer to questions #1 to #4. During the first year of their operations, the partnership earned P325,000. Profits were distributed in the agreed manner. Drawings were made in these amounts: John, P50,000; Paul P65,000; Peter, P28,000. How much are the capital balances after the first year? a. b. c. d. John 750,627 728,764 757,915 743,121 Paul 735,177 713,764 742,315 727,825 Peter 372,223 361,382 375,837 368,501 6. The Mia and Janna partnership agreement provides for Mia to receive a 20% bonus on profits before bonus. Remaining profits and losses are divided between Janna and Mia in the ratio of 3:2 respectively. Which partner has a greater advantage when the partnership has a profit or when it has a loss? a. b. c. d. Profit Mia Mia Janna Janna Loss Janna Mia Mia Janna 7. Partner Maa first contributed P50,000 of capital into existing partnership on March 1, 2015. On June 1, 2015, said partner contributed another P20,000. On September 1, 2015, he withdrew P15,000 from the partnership. Withdrawal in excess of P10,000 are charged to the partner’s capital accounts. What is the annual weighted average capital balance of Partner Maa? a. 32,500 b. 51,667 c. 60,000 d. 48,333 8. If a partnership has net income of P44,000 and Partner X is to be allowed bonus of 10% of net income after bonus. What is the amount of bonus Partner X will received? a. 3,000 b. 3,300 c. 4,000 d. 4,400 Page 2 of 9 12-June-15 P2 Pre-board Exams 9. Fox, Greg, and Hoe are partners with average capital balances during 2014 of P120,000, P60,000, and P40,000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P30,000 to Fox and P20,000 to Hoe, the residual profit and loss is divided equally. In 2014, the partnership sustained a P33,000 loss before interest and salaries to partners. By what amount should Fox’s capital account change? a. 7,000 increase b. 11,000 decrease c. 35,000 decrease d. 42,000 increase 10. Partners AA and BB have profit and loss agreement with the following provisions: salaries of P30,000 and P45,000 for AA and BB, respectively; a bonus to AA of 10% of net income after salaries and bonus; and interest of 10% on average capital balances of P20,000 and P35,000 for AA and BB, respectively. One-third off any remaining profits will be allocated to AA and the balance to BB. If the partnership had net income of P102,500, how much should be allocated to partner AA? a. 44,250 b. 47,500 c. 41,000 d. 41,167 11. Rando is trying to decide whether to accept a salary of P40,000 or salary of P25,000 plus a bonus of 10% of net income after salaries and bonus as a means of allocating profits among partners. Salaries traceable to the other partners are estimated to be P100,000. What amount of income would be necessary so that Rando would consider choices to be equal? a. 165,000 b. 290,000 c. 265,000 d. 305,000 12. A partnership has the following accounting amounts: Sales Cost of goods sold Operaing expenses Salary allocations to partners Interest paid to banks Partner's drawings 700,000 400,000 100,000 130,000 20,000 80,000 What is the partnership net income (loss)? a. b. c. d. Page 3 of 9 200,000 180,000 50,000 (30,000) 12-June-15 P2 Pre-board Exams 13. Citrine and Ruby are partners who share profits and losses in the ratio of 6:4, respectively. On May 1, 2014, their respective capital accounts were as follows: Citrine Ruby 60,000 50,000 On that date, Emerald was admitted to the partner with one-third interest in capital, and profits for an investment of P40,000. The new partnership began with total capital of P150,000. Immediately after the Emerald’s admission, Citrine’s capital should be: a. 50,000 b. 54,000 c. 56,667 d. 60,000 14. Digma purchases 50% of Dhaniel’s capital interest in the FD partnership for P22,000. If the capital balances of Ferdinand and Dhaniel are P40,000 and P30,000 respectively, Digma’s capital balance following the purchase is: a. 22,000 b. 35,000 c. 20,000 d. 15,000 15. The capital balances in CPA Partnership are: C, capital P60,000; P, capital P50,000; and A, capital P40,000 and income ratios are; 5:3:2, respectively. The CPAT Partnership is formed by admitting T to the firm with cash investment of P60,000 for a 25% interest in capital. What is the amount of bonus to be credited to A capital in admitting T? a. 10,000 b. 7,500 c. 3,750 d. 1,500 16. In May 2015, Virgilio, a partner of the accounting firm, decided to withdraw when the partners’ capital balances were: Rio, P600,000; Mohammad, P600,000, and Virgilio, P400,000. It was agreed that Virgilio is to take the partnership’s fully depreciated computer with a second hand value of P24,000 that cost the partnership P36,000. If profits and losses are shared equally, what would be the capital balances of the remaining partners after the retirement of Virgilio? Rio Mohammad a. 608,000 608,000 b. 596,000 596,000 c. 592,000 592,000 d. 612,000 612,000 17. On June 30, 2014 the balance sheet for the partnership of ALL, MEL, and ABU, together with their respective profit and loss ratios, were as follows: Page 4 of 9 12-June-15 P2 Pre-board Exams Assets, at cost ALL, loan ALL, capital (20%) MEL, capital (20%) ABU, capital (60%) 180,000 9,000 42,000 39,000 90,000 180,000 ALL decided to retire from the partnership. By mutual agreement, the assets are to be adjusted to their fair value of P216,000 at June 30, 2014. It was agreed that the partnership would pay ALL P61,200 cash for ALL’s partnership interest, including ALL’s loan which is to be paid in full. No goodwill is to be recorded. After ALL’s retirement, what is the balance of MEL’s capital account? a. b. c. d. 36,450 39,000 45,450 46,200 18. On October 31, 2014, Mickey, retired from the partnership of Mickey, Mouse, and Minnie. Mickey received P55,000 representing final settlement of his interest in the amount of P50,000. Under the bonus method, a. Credit P5,000 against the capital balances of Mouse and Minnie. b. P5,000 was recorded as expense. c. Charged P5,000 against the capital balances of Mouse and Minnie. d. P55,000 was recorded as bonus. 19. Cohen, Butler, and Davis are partners in a partnership and share profits and losses 50%, 30%, and 20%, respectively. The partners have agreed to liquidate the partnership and anticipate that liquidation expenses will total P14,000. Prior to the liquidation, the partnership balance sheet reflects the following book values: Cash Non-cash assets Notes payable to Davis Other liabilities Cohen, capital Butler, capital (deficit) Davis, capital 21,000 248,000 32,000 154,000 60,000 (10,000) 33,000 Assuming that the actual liquidation expenses are P14,000 and that non-cash assets are sold for P218,000, how would the assets be distributed to partners if Butler has net personal assets of P8,500? Page 5 of 9 12-June-15 P2 Pre-board Exams Cohen 15,500 21,500 30,650 27,500 a. b. c. d. Butler - Davis 49,571 53,260 52,000 20. The condensed balance sheet of Alex, Jay, and John as of March 31, XXXX as follows: Cash Other Assets 28,000 265,000 Total 293,000 Liabilities Alex, capital Jay, capital John, capital Total 48,000 95,000 80,000 70,000 293,000 The income and loss ratio is 50:25:25, respectively. The partners voted to dissolve their partnership and liquidate by selling other assets in installments. P70,000 was realized on the first cash sale of other assets with a book value of P150,000 After settlement with creditors, all cash available was distributed to partners. How much cash was received by John? a. 10,500 b. 20,000 c. 21,250 d. 32,500 21. As of December 31, the books of AME Partnership showed capital balances of A – P40,000; M – P25,000; and E – P5,000. The partners’ profit and loss ratio was 3:2:1, respectively. The partners decided to dissolve and liquidate. They sold all the non-cash assets for P37,000 cash. After settlement of all liabilities amounting to P12,000, they still have P28,000 cash left for distribution. The loss on the realization of non-cash assets was: a. 40,000 b. 42,000 c. 44,000 d. 45,000 22. Refer to question # 21. Assuming that any partners’ capital debit balance is uncollectible, the share of A in the P28,000 cash for distribution would be: a. 19,000 b. 18,000 c. 17,800 d. 40,000 23. The Palace Co., a construction company, has December 31 year end. It is to build a factory for a client and has scheduled its work as follows: Page 6 of 9 12-June-15 P2 Pre-board Exams March 20, 2014 April 25, 2014 November 27, 2014 December 30, 2014 Construction to be awarded and signed. Construction work to commence. Principal construction work to be completed. Final completion of contract. In accordance with IAS 11, Construction Contracts, the maximum expected period over which the cost attributable to the contract should be accumulated is: a. b. c. d. From March 20, 2014 to December 30, 2014 From April 25, 2014 to November 27, 2014 From April 25, 2014 to December 30, 2014 From March 20, 2014 to November 27, 2014 24. The company signed an P800,000 contract to build an environmentally friendly access trail to Calamba, Laguna. The project was expected to take approximately 3 years. The following information was collected for each year of the project – Year 1, Year 2, and Year 3: Year 1 Year 2 Year 3 Cost Expected Support Additional Trail feet Additional Expended additional timbers laid support constructed trail feet during cost to during timbers to during to be the year completion the year be laid the year constructed 100,000 450,000 150 850 3,000 15,200 150,000 280,000 300 520 7,500 8,200 250,000 500 8,000 - Compute the amount of revenue to be recognized in the year 2, assume that the company employs the efforts-expended method of estimating percentage of completion and the company measures its progress by the number of support timbers laid in the trail: a. 428,866 b. 371,134 c. 251,134 d. 120,000 25. Using the same information in #24. Compute the amount of revenue to be recognized in year 3, assume that the company employs the efforts-expended method of estimating percentage of completion and the company measures its progress by the number of support timbers laid in the trail: a. 371,134 c. 120,000 b. 428,866 d. 251,134 26. Using the same information in #24. Compute the amount of revenue to be recognized in year 3, assume that the company employs an output measure and the company measures its progress by the number of trail feet that have been completed: c. 129,730 c. 350,802 d. 319,730 d. 449,198 Page 7 of 9 12-June-15 P2 Pre-board Exams 27. If the value of the pledged property is lesser than the obligation, what is the treatment of the liability? a. Partially secured b. Fully secured c. Collateralized d. Unsecured 28. The trust for Dandan, Inc. prepares a statement of affairs which shows that unsecured creditors whose claims total P600,000 may expect to receive approximately P360,000 if assets are sold for the benefit of the creditors. Francis is an employee who is owed P7,500. Mercuria holds a note for P10,000 on which interest of P500 is accrued; nothing has been pledge on the note. William holds a note of P60,000 on which interest of P3,000 is accrued; securities with a book value of P65,000 and a present market value of P50,000 are pledge on the note. Flora holds a note for P25,000 on which interest of P1,500 is accrued properly with a book value of P20,000 and a present market value of P30,000 is pledged on the note. How much may each of the following creditors hope to receive? a. b. c. d. Francis 7,500 4,500 4,500 7,500 Mercuria 6,300 6,300 6,300 6,300 William 57,800 87,800 57,800 87,800 Flora 26,500 26,500 26,500 26,500 29. On December 31, 2014, the statement of affairs of Pasawwey company, which is in bankruptcy liquidation, included the following: Assets pledged for fully secured liabilities Assets pledged for partially secured liabilities Free assets Fully secured liabilities Partially secured liabilities Unsecured liabilities with priority Unsecured liabilities without priority Page 8 of 9 100,000 40,000 120,000 80,000 50,000 60,000 90,000 12-June-15 P2 Pre-board Exams Compute the estimated amount to be paid to: a. b. c. d. Fully Secured Liabilities 80,000 64,000 80,000 80,000 Unsecured Liabilities w/ Priority 60,000 60,000 48,000 60,000 Partially Secured Liabilities 50,000 48,000 60,000 48,000 Unsecured Liabilities w/o priority 70,000 88,000 72,000 72,000 30. In 2013, AIC Construction Co. started construction of a building with a contract price of P100,000,000 and estimated total cost of P80,000,000. For 2013, AIC incurred construction cost in the amount of P33,000,000. Using the zero profit method of accounting, what is the amount of revenue to be recognized in 2013? a. 6,600,000 b. 100,000,000 c. -0d. 33,000,000 “My God, please let me understand the topics that I am supposed to remember, and correctly apply them to get the right answers, and to enable me to pass the SPLBE CPA board exams this coming September 2015. Amen” Page 9 of 9 12-June-15