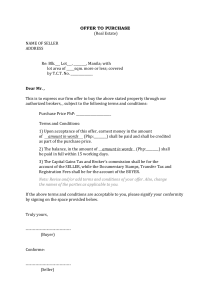

Letter of Credit herin referred to as LC can be defined as a written instrument used when a person (the applicant) has a payment obligation towards another (the beneficiary) under a given transaction (usually the sale of goods) and this obligation is vested on an appointed bank by the applicant on promise of reimbursement. (Megrah, Risks Aspects of the Irrevocable Letter of Credit, 1982). A LC is generally defined as a document from a bank guaranteeing that a seller will receive payment in full as long as certain delivery conditions have been met. These conditions entail producing correct documentation that relates to the underlying contract between the buyer and the seller. In the text, I will discuss the history of the LC and the doctrines of strict compliance and autonomy as used thereunder, their growth and current usage. I will also aim at pointing out how different courts have interpreted these concepts. History of development The term LC comes from the French word accreditif (the power of doing something), which in turn derives from the Latin word accreditivus (trust). LC have been used since time memorial as a mechanism of financing trade; they have been used by the Phoenicians, Babylonians, Assyrians, the Greek and other merchants to help their own credit. The LC originated from the bill of exchange and were a useful device for travellers who did not want to carry hard cash while travelling for obvious security reasons, they would instead give this money in trust to their bankers in exchange for a “LC” which could later be cashed at another bank at their destination. LC were prominently used after the Second World War, following the General Agreement on Tariff and Trade. Since then, banks have overtime assumed the role of facilitating international transactions and communication between traders in different countries. The LC were later to be embodied in provisions of the Uniform Customs and Practice for Documentary Credits herein after referred to as“UCP” Doctrine of strict compliance The doctrine of strict compliance can be defined as the legal principle that entitles the bank to reject documents which do not strictly comply with the terms of LC. (Davidson, 2001). The earliest support for the doctrine of strict compliance can be traced from a decision by Viscount Sumner (Equitable Trust Company of New York v Dawson Partners ltd, 1926) wherein his Lordship stated at page 52: “It is both common ground and common sense that in such a transaction the accepting bank can only claim indemnity if the conditions on which it is authorized to accept are in the matter of the accompanying documents is strictly observed. There is no room for documents which are almost the same, or which will do just as well. Business could not proceed securely on any other lines. The bank which knows nothing officially of the details of the transactions financed cannot take upon itself to decide what will do well enough and what will not”. From this decision, one can clearly identify the role of strict LC in protecting the customer. The possibility of fraud on the part of the seller is limited by restricting the discretion of banks to review the documents. The banks role is to ensure that the shipment strictly complies with the underlying transactions as set out in the LC. (TECK, 1990). The rationale for this requirement is that banks cannot be imputed with knowledge of trade practices; its trade is a trade of documents and not with goods. (Carr, 2009). In addition to that, a buyer has the documents as the only security since he has no opportunity to supervise loading and later examine the goods physically. At the same time, the principle of strict compliance also benefits the seller by providing fast payment. The seller does not have to wait until the goods shipped safely reach the buyer before claiming payment. The seller can claim payment for the goods sold by presenting to the bank the documents required by the buyer once the goods have been shipped to the buyer. (HASHIM, 2013) Apart from the buyer and seller, the bank also benefits from the application of the principle of strict compliance in LC. The bank will be protected against any legal repercussion as long as the payment to the seller was made upon strict compliance of seller’s documents. Application of doctrine of strict compliance by courts Courts have approached the doctrine of strict compliance with a literal rule approach; the banker is not expected to act beyond what the wording of the LC requires of him. The role of the banker therefore is to reach a comparison by mere examination of the documents against the LC. It follows then that the purpose for which the beneficiary is to open the credit is irrelevant a factor to consider for payment to be made, it is an extraneous factor as there is no judicial support for it. (Pringle-Associated Mortgage Corp v. Southern National Bank Hattiesburg, Mississippi, 1978). In another case, Goddard LJ put it more clearly that; “It does not matter whether the terms imposed by the person who requires them to open the credit are reasonable, or seem to be reasonable, or unreasonable. Of course, they may be terms which, as between themselves and the beneficiary, they would not be entitled to impose. The bank is not concerned with that. The bank, if it accepts the mandate to open the credit, must do exactly what its customer requires it to do.” (Rayner & Co v. Hambros Bank Ltd, 1943) In the United States of America, courts seem to have approached the doctrine of strict compliance with a lot of equity and justice notions as opposed to certainty in observance of the doctrine. In some cases, the courts have attempted a purposive approach to the doctrine; they have considered the aspect of substantial compliance as opposed to strict compliance. (First National Bank of Atlanta v Wynne, 1979) In that case, the LC required that the beneficiary provide a draft to prove that it was drawn under the credit, it was also required to identify the credit number, when the beneficiary failed to furnish such proof, court held that no error can be said to be significant if it does not mislead the issuer. It consequently held that such a defect did not require dishonour by the issuer. This position was however criticised since it requires the bank to do more than examine the documents. It can also be criticised because it seems to place too much discretion to the courts in deciding what content of the documents should be complied with, a discretion that is against the spirit of the doctrine of strict compliance. It should be noted at this point that the doctrine of strict compliance should not so rigidly be interpreted as to deny the documents on mere minor variations. It is to be noted that the strictness referred does not extend to the dotting of the i’s and the crossing of the t’s (Megrah). Minor variations like singulars instead of plurals, numbers in sets instead of totals and any superfluous adjectives should be ignored. Discrepancies between the descriptions of the goods Any discrepancies between the description of goods shipped and the goods described in the letters will result into a rejection of the documents. A banker who risks in applying the substantial compliance approach as opposed to the strict compliance approach in terms of comparing the goods shipped and the description of those in the letters will not be indemnified. In (Bank Melli Iran v Barclays (Dominion Colonial and Overseas), 1951) McNair J held that documents evidencing a shipment of ‘100 new, good, Chevrolet trucks’, were not a good tender under a credit calling for ‘100 new Chevrolet trucks. Discrepancies in documents tendered Discrepancies in documents tendered can also lead to rejection. The requirements for good documents are that, firstly, the document must be effective and legal, e.g Bill of lading, secondly, the document must be one of current usage in the trade and lastly, the document has to be and labelled original (although this position was lessened by A20 (b) of UCP 500) If the LC require the beneficiary to tender 5 documents and they tender 2 instead, they are to be rejected. (Donald H Scott & Co Ltd v. Barclays Bank Ltd, 1923). It therefore follows that the buyer should give extremely clear instructions in order to avoid any ambiguity that might result into the bank interpreting them its way which is normally “a reasonable manner” interpretation. (Chuah, 2009) It should be noted that under the International Chamber of Commerce Uniform Customs and Practice for Documentary Credits rules, there are irregularities of documents which are permissible. These provisions may be invoked by the beneficiary. For example, the credit may require the shipment of 100 tons of a particular commodity but the beneficiary ships only 97 tons and the latter figure appears in the invoice and the bill of lading. In the absence of any stipulation that the quantity of goods specified must not be reduced, this under shipment is within the tolerance admitted by Article 43(b) of the UCP. As a result, the bank should accept the documents but reduce the amount payable under the credit correspondingly. (TECK, 1990). This position however is to be compared with (Moralice (London) ltd v ED and F Man, 1954), in that case, the credit stipulated a bill of lading with 5000 bags, the bank’s rejection of a bill indicating 4997 bags was allowed. By practice, however, bankers who chose to receive documents with irregularities use a tripartite protective mechanism; they seek indemnity from the beneficiary, make payments under reserve or make arrangements for collection under protection of credit. Under the UCP rules, the banker is expected to notify the beneficiary of any defects in the documents tendered in order for them to make appropriate corrections before either of the two suffer losses. This was demonstrated in Philadelphia Gear Corp v. Central Bank(5th Cir 1983) 717 F 2d 230 where court held that one of the important aspects of the doctrine of strict compliance is to provide the beneficiary with an opportunity to make corrections on the draft by returning the documents to him and giving him notice of the defects. As a matter of fact, it is although still yet to be decided upon argued that the bank owes the beneficiary a duty to inform and guide on any defects. Limitations of doctrine of strict compliance The doctrine of strict compliance is limited by estoppels, waiver. In (W J Alan&Co Ltd v. El Nasr Export and Import Co, 1972), the arrangement required payment to be in Kenyan shillings while the LC indicated Sterling, court held that the seller’s failure to object to the LC and their actual acting on the LC in sterling constituted a waiver and as such, they could not claim payment by means of a LC in Kenyan shillings. However, if the confirming bank does not reject the documents or adopt a protective mechanism like seeking indemnity, and accepts the document, it will be liable for damages to the beneficiary if it fails to meet its obligation under the LC. AUTONOMY PRINCIPLE This principle is to the effect that the obligation of the banks to pay to the beneficiary does not depend on what the buyer and seller agreed or disagreed upon while they were forming their contract, it rather depends on the documents, if the documents are okay, the bank is not to look at the agreement and whether or not all the terms were met by either parties. (Carr, 2009). The rationale is to be found in (Hamzeh Malas and Sons V British Imex Industries Ltd, 1958) where Jenkins LJ asserted that “The system of financing these operations as I see it, would breakdown completely if the dispute between the vendor and the purchaser was to have the effect of ‘freezing’, if I may use that expression, the sum in respect of which the LC was opened” The seller who needs his payment cannot be restricted to only suing the buyer for his money. It is argued that sellers had for overtime grown to understand that they will receive payment on presentation of the correct documents to the issuing or confirming bank, to have that belief subjected to an underlying contract would be disrupting the known course of international transactions, it would be taking away the certainty with which international traders enter into these kind of transactions which would consequently ruin their enthusiasm to engage in the same, as such, banks must not be seen to take on considerations beyond the obligation of payment to the correct documents presented. It follows then that a seller who needs financing for goods he received from the manufacturer should be accorded that chance to access it through the doctrine of autonomy in the LC. (Chuah, 2009). The right of the seller under the LC are to be taken as cash at hand. The other rationale is to be found in Article 4 and 5 of the UCP rules. These articles are to the effect that a LC by its nature is an independent and different transaction from the sale or any other contract on which it may be based and that an issuing bank should discourage the attempt of including terms of the underlying contract into the LC, banks are expected to deal with documents as opposed to goods and services. If the documents are correct, the courts will not be restrained from effecting payment. In (Discount Records Ltd V Barclays Bnak Ltd, 1975), an injunction to block the bank from paying the seller on grounds that the goods that had been ordered for had not been delivered was denied by the court. In that case, the buyer had ordered for records to be shipped, however, upon examination of the packaging boxes, the records were missing and some boxes contained cassettes instead. In a later case (Power Curber Internatinal LTD V National Bank of Kuwait, 1981) lord Denning clearly put it that; “.....The bank is in no way concerned with any dispute that the buyer may have with the seller. The buyer may say that the goods are not up to contract, nevertheless the bank must honour its obligation....no set-off or counterclaim is allowed to detract from it....a LC is given by a bank to the seller with the very intention of avoiding anything in the nature of a set-off or counterclaim.” There is no such an obligation to the bank that the goods should correspond to the contract description, the only obligation the bank has is to make sure it is paying on accurate documents. The buyer carries with him the risk of paying and yet the wrong goods are delivered, he cannot visit that on the bank. Although in some cases, few banks might expressly agree with the buyer to get involved in the underlying contract. A confirming bank is not to be held negligent if upon failing to notice discrepancies in the documents, the issuing bank captures them. This is not to be used as an excuse under contributory negligence to deny the confirming bank an opportunity to recover from the beneficiary. This was held i (Standard Chartered Bank v Pakistan National Shipping Corp, 2002) . The concept of autonomy makes it illogical that actually, court can uphold payment of a beneficiary when there is underlying evidence that he is not actually entitled to it. Exceptions to the autonomy principle The only exceptions to the autonomy rule are in cases of fraud and illegality. In case of illegality, the bank is expected on grounds of public policy to refrain from enforcing payment under an illegal contract. In (Mahonia Ltd V JP Morgan Bank and Another, 2003), a LC was based on Swaps transactions as the underlying contract, SWAPS were prohibited by the law. Colman J held that; It would be wrong in principle to invest LC with a rigid inflexibility in the face of strong countervailing public policy considerations. If a beneficially should as a matter of public policy be precluded from utilising a LC to benefit his own fraud, it is hard to see why he should be permitted to use the courts to enforce part of those underlying transactions. Although in this case, the LC were enforced because court could not establish fraud, this assertion illustrates the reluctance of courts to enforce an illegality. Indeed, court rightly held in Cardnimal Wamala Nsubuga v Makula international HCB 1982 11 that court cannot sanction an illegality, the same can be said in terms of a LC based on a contract marred with illegality. The other exception is fraud, in (Unitted City Merchants (Investments) Ltd V Royal Bank of Canada, 1983), The carrier’s agent forged a bill of lading showing shipment to be in the shipment period, this was unknown to the sellers. Upon presenting the document, the bank refused payment on the ground that it had information that the goods were not shipped on the time indicated in the bill. Court held to the effect that where a seller presents documents that contain representations that are known to him to be untrue, the presentations should not be honoured. It should be noted however that this case does not perfectly fit in the fraud exception since the sellers were not aware of the fraud. The fraud could either be in relation to the document; the credit itself or the underlying contractual transaction, but it should be perpetuated by the seller or his agent. (Chuah, 2009) However, for a bank to rely on the exception of fraud, actual fraud must be proved. In (Bolivinter Oil SA V Manhattan Bank, 1984), Sir John Donaldson said; “But the evidence must be clear, both as to fraud and as to the bank’s knowledge. It would certainly not normally be sufficient that this rests upon the uncorroborated statement of the customer (buyer), for irreparable damage can be done to a bank’s credit in the relatively brief time involved...” It is therefore evident from this decision that courts are careful to apply the exception of fraud, extra proof of the act that constituted the fraud is required and the buyer is given an opportunity to counter the allegations as to fraud. In case of fraud, the buyer can also apply for a pre-trial injunction in order to prevent the seller from getting paid under the LC or to prevent other banks from making payment. For an injunction of this nature to be attained, there are conditions that have to be met. These conditions were set up in the case of RD Harbottle (Mercantile) Ltd V National Westminster Bank Ltd [1978] QB 146. They include; a) If there is an imminent payment about to be made by the issuing bank in breach of the contract with the applicant. b) If the balance of convenience is in favour of the applicant c) That the beneficiary is accountable for the wrongdoing. Having looked at the exceptions of fraud and illegality, one is left to wonder why the issuing bank would not in the first place be permitted to be critical on the underlying contract in order to avoid the absurdities of the presence of fraud. It has been argued that the little regard accorded to the underlying contract has facilitated false calls, abuse and fraud. (Stewart, 2002) After all, it plays a significant role in the existence of the LC, if there was no underlying contract, there would be no LC and the bank would be left to enforce nothing. There ought to be a clear distinction on the seller’s right to certainty of payment and his factual right to payment under the underlying contract, the former is only possible if the latter is existing. It is my considered opinion therefore that it is not possible to conceive the underlying transaction as separate from the LC. Conclusion Letter of Credit contain a unilateral payment system of considerable complexity, the documentary arrangement has the required capacity to protect the banks under the doctrine of strict compliance and the buyers under the autonomous principle, it therefore does matter which mode you chose, the choice will certainly depend on whether one is buyer or a seller, for any of these, it only seems logical that the appropriate mode will be strict compliance and autonomous principles respectively. BIBLIOGRAPHY Bank Melli Iran v Barclays (Dominion Colonial and Overseas), 1057 (1951). Bolivinter Oil SA V Manhattan Bank, 251 (1984). Carr, I. (2009). International Trade Law. Abingdon: Routledge-Cavendish. Chuah, J. C. (2009). Law of International trade; Cross border Commercial Transaction. Sweet & Maxwell. Davidson, A. (2001). Commercial Laws in Conflict - An application of the Autonomy Principle in Letter of Credit. Discount Records Ltd V Barclays Bnak Ltd, 444 (1975). Donald H Scott & Co Ltd v. Barclays Bank Ltd, 1 (1923). Equitable Trust Company of New York v Dawson Partners ltd, 49 (1926). First National Bank of Atlanta v Wynne, 1273 (1979). Hamzeh Malas and Sons V British Imex Industries Ltd, 127 (House of Lords 1958). HASHIM, D. R. (2013). PRINCIPLE OF STRICT COMPLIANCE IN LETTER OF CREDIT; TOWARDS A PROPER STANDARD OF COMPLIANCE. LEGAL NETWORK SERIES . Mahonia Ltd V JP Morgan Bank and Another (2003). Megrah, M. (1982). Risks Aspects of the Irrevocable Letter of Credit. Ariz Law Review , 260. Megrah, M. The Law of Banker's Commercial Credit. Gutteridge and Megrah. Moralice (London) ltd v ED and F Man, 526 (Lloyd's Rep 1954). Old Colony Trust Co v. Lawyers’ Title & Trust Co, 152 (1924). Power Curber Internatinal LTD V National Bank of Kuwait (House of Lords 1981). Pringle-Associated Mortgage Corp v. Southern National Bank Hattiesburg, Mississippi, 874 (Unitted States Court of Appeal 1978). Rayner & Co v. Hambros Bank Ltd, 37 (Court of Appeal 1943). Standard Chartered Bank v Pakistan National Shipping Corp, 43 (2002). Stewart, H. (2002). It is Insufficient to Rely on Documents. Journal of Money Laudering Control . TECK, W. C. (1990). Strict Compliance in Letters of Credit; the Banker's protection or Bane? Singapore Academy of Law Journal , 70-89. Unitted City Merchants (Investments) Ltd V Royal Bank of Canada (1983). W J Alan&Co Ltd v. El Nasr Export and Import Co, 189 (House of Lords 1972). UGANDA CHRISTIAN UNIVERSITY NAME: NAMARA KEITH REG NO: S11B11/529 FACULTY: LAW COURSE UNIT: INTERNATIONAL TRADE LAW LECTURER: KIZZA ROBERT TUTOR: BULUNGU JOHN TOPIC OF DISCUSSION: Discuss the doctrines of autonomy and strict compliance as used in the letters of credit