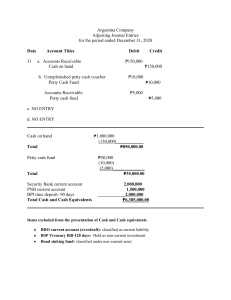

PROBLEMS AND THEORIES Theories 1. Among the following, which can’t be considered cash? a. Petty cash fund b. Money orders c. Coins and currency d. IOUs 2. A cash equivalent is a short-term, highly liquid investment that is readily convertible into known amount of cash and a. is acceptable as a means to pay current liabilities b. Has a current market value that is greater than the original cost c. Bears an interest rate that is at least equal to the prime interest rate at the date of liquidation d. Is so near maturity that it presents insignificant risk of change in interest rate 3. Which of the following is not considered as a cash equivalent? a. A three-year treasury notes maturing on January 31 of the next year purchased by the entity on December 1 of the current year. b. A three-year treasury notes maturing on January 31 of the next year purchased by the entity on October 1 of the current year c. A 90-day T-bill d. A 60-day money market placement 4. Petty cash fund is a. Separately classified as current asset b. Money kept on hand for making minor disbursements of coin and currency rather than by writing checks c. Set aside for the payment of payroll d. Restricted cash 5. On October 31, year 2, Dingo, Inc. had cash accounts at three different banks. One account balance is segregated solely for a November 15, year 2 payment into a bond sinking fund. A second account, used for branch operations, is overdrawn. The third account, used for regular corporate operations, has a positive balance. How should these accounts be reported in Dingo’s October 31, year 2 classified balance sheet? a. The segregated account should be reported as a noncurrent asset, the regular account should be reported as a current asset, and the overdraft should be reported as a current liability. b. The segregated and regular accounts should be reported as current assets, and the overdraft should be reported as a current liability. c. The segregated account should be reported as a noncurrent asset, and the regular account should be reported as a current asset net of the overdraft. d. The segregated and regular accounts should be reported as current assets net of the overdraft. 6. Which of the following items must be added to the cash balance per ledger in preparing a bank reconciliation which ends with adjusted cash balance? a. Note receivable collected by bank in favor of the depositor and credited to the account of the depositor b. NSF customer check c. Service charge d. Erroneous bank debit 7. In preparing a bank reconciliation, interest paid by the bank on the combined current and saving account is a. Added to the bank balance b. Subtracted from the bank balance c. Added to the book balance d. Subtracted from the book balance 8. Which of the following would be added to the balance per bank statement to arrive at the correct cash balance? a. Outstanding check b. Bank service charge c. Deposit in transit d. A customer’s note collected by the bank on behalf of the depositor 9. Bank statements provide information about all of the following, except a. Checks cleared during the period b. NSF checks c. Bank charges for the period d. Errors made by the depositor 10. These refer to all items credited to the account of the depositor a. Book debits b. Bank credits c. Book credits d. Bank debits Problems Problem #1 (Cash and Cash Equivalents) Pibikit Company provided the following information at year-end comprising the cash account: Bills and coins 400,000 Cash in bank – demand deposit 5,000,000 Cash in bank – savings deposit 1,000,000 Certificate of time deposit, 2 years 1,500,000 Postage stamps unused 5,000 Money order 50,000 Manager check 100,000 Traveler check 1,000,000 Bank Draft 60,000 Postdated customer check 500,000 Change Fund 22,000 Petty Cash Fund 50,000 Emergency Fund 175,000 Compute for the total amount of cash at year end. Answer: 7,682,000 Problem #2 (Cash and Cash Equivalents) Clay Solace Company had the following account balances on December 31, 2021: Cash in bank Cash on hand Cash restricted for addition to plant in 2022 2,500,000 125,000 1,600,000 Cash in bank included P600,000 of compensating balance against short-term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal. Compute for the total amount of cash at year end. Answer: 2,625,000 Problem #3 (Cash and Cash Equivalents) Dudas Company reported the following on its cash and cash equivalents accounts on December 31, 2021: Cash on hand Petty cash fund Good Bank current account Morning Bank current account No.1 Morning Bank current account No. 2 (overdraft) Afternoon Bank saving account Afternoon Bank time deposit, 90 days Cash on hand included the following items: 200,000 20,000 5,000,000 4,000,000 (100,000) 250,000 2,000,000 1. Customer check for 35,000 returned by bank December 21, 2021 due to insufficient fund but subsequently redeposited and cleared by the bank on January 10, 2022. 2. Customer check for P15,000 dated January 10,2022, received December 23, 2021. The petty cash fund consisted of the following items: Currency and coins IOUs from officers Unreplenished petty cash vouchers 5,000 2,000 12,000 Included among the checks drawn by Dudas Company against the Good Bank current account and recorded in December 2021 were the following: 1. Check written and dated December 23, 2021 and delivered to payee on January 31, 2022, P25,000. 2. Check written December 26, 2021, dated January 30, 2022, delivered to payee on December 28, 2021, P45,000. Compute the total cash and cash equivalents at year end. Answer: 11,375,000 Problem #4 (Cash and Cash Equivalents) Chelsea Company reported the following information at the end of the current year. Investment securities of P1,000,000. These securities are share investments in entities that are traded in the Philippine Stock Exchange. As a result, the shares are very actively traded in the market. Investment securities of P2,000,000. These securities are government treasury bills. The treasury bills have a 10- year term and purchased on November 30 at which time they had two months to go until they mature. Investment securities of P1,500,000. These securities are commercial papers or money market placements. The term of the commercial papers is three months and the instruments were purchased on December 31 at which time they had one and a half month to go until they mature. What total amount should be reported as cash equivalents at the end of current year? Answer: 3,500,000 Problem #5 (Petty Cash Fund) Gupit Company closed the accounts on June 30. The entity provided the following transactions: May 1 30 The entity established an imprest fund of P10,000. The fund is replenished. The petty cash items include: Currency and coin Postage Supplies Transportation Miscellaneous expense June 30 2,000 1,000 3,000 2,500 1,500 The fund was not replenished. The fund is composed of the following: Currency and coin Supplies Postage Transportation July 15 6,000 2,000 1,000 1,000 The fund is replenished and increased to P15,000. Currency and coin 3,000 Supplies 3,500 Postage 1,500 Transportation 1,500 Miscellaneous expense 500 Prepare journal entries to record the transactions under: Imprest fund system Fluctuating fund system. May 1 May 30 June 30 July 1 July 15 Imprest Fund System PCF 10,000 Cash in Bank 10,000 Postage 1,000 Supplies 3,000 Transportation 2,500 Misc. Expense 1,500 Cash in Bank 8,000 Supplies 2,000 Postage 1,000 Transportation 1,000 Petty Cash Fund 4,000 Petty Cash Fund 4,000 Supplies 2,000 Postage 1,000 Transportation 1,000 Petty Cash Fund 5,000 Cash in Bank 5,000 Supplies Postage Transportation Misc. Expense Cash in Bank 3,500 1,500 1,500 500 7,000 Fluctuating Fund System PCF 10,000 Cash in Bank 10,000 Postage 1,000 Supplies 3,000 Transportation 2,500 Misc. Expense 1,500 Petty Cash Fund 8,000 Petty Cash Fund 8,000 Cash in Bank 8,000 Supplies 2,000 Postage 1,000 Transportation 1,000 Petty Cash Fund 4,000 NO ENTRY Supplies 1,500 Postage 500 Transportation 500 Misc. Expense 500 Petty Cash Fund 3,000 Petty Cash Fund Cash in Bank 12,000 12,000 Problem #6 (Cash and Cash Equivalents) YG Company had the following account balances at December 31, year 2: Cash in banks 2,250,000 Cash on hand 125,000 Cash legally restricted for additions to plant (expected to be disbursed in year 3) 1,600,000 Cash in banks includes 600,000 of compensating balances against short-term borrowing arrangements. The compensating balances are not legally restricted as to withdrawal by YG. In the current assets section of YG’s December 31, year 2 balance sheet, total cash should be reported at: a. 1,775,000 b. 2,250,000 c. 2,375,000 d. 3,975,000 Problem #7 (Cash and Cash Equivalents) SM Corp.’s checkbook balance on December 31, year 2, was 5,000. In addition, SM held the following items in its safe on that date: Check payable to SM Corp., dated January 2, year 3, in payment of a sale made in December year 2, not included in December 31 checkbook balance 2,000 Check payable to SM Corp., deposited December 15 and included in December 31 checkbook balance, but returned by bank on December 30 stamped “NSF.” The check was redeposited on January 2, year 3, and cleared on January 9 500 Check drawn on SM Corp.’s account, payable to a vendor, dated and recorded in SM’s books on December 31 but not mailed until January 10, year 3 300 The proper amount to be shown as Cash on SM’s balance sheet at December 31, year 2, is a. 4,800 b. 5,300 c. 6,500 d. 6,800 Problem #8 (Cash and Cash Equivalents) HYBE Co. had the following balances at December 31, year 2: Cash in checking account 35,000 Cash in money market account 75,000 Treasury bill, purchased 11/1/year 2, maturing 350,000 1/31/year 3 Treasury bill, purchased 12/1/year 2, maturing 400,000 3/31/year 3 Trans’s policy is to treat as cash equivalents all highly liquid investments with a maturity of three months or less when purchased. What amount should Trans report as cash and cash equivalents in its December 31, year 2 balance sheet? a. 110,000 b. 385,000 c. 460,000 d. 860,000 Problem #9 (Cash and Cash Equivalents) You noted the following composition of PNation Company’s “cash account” as of December 31, 2020 in connection with your audit: Demand deposit account Time deposit – 30 days NSF check of customer Money market placement (due June 30, 2021) Savings deposit in a closed bank IOU from employee Pension fund Petty cash fund Customer’s check dated January 1, 2021 Customer’s check outstanding for 18 months Total Additional information follows: 2,000,000 1,000,000 40,000 1,500,000 100,000 20,000 3,000,000 10,000 50,000 40,000 7,760,000 a) Check of P200,000 in payment of accounts payable was recorded on December 31, 2020 but mailed to suppliers on January 5, 2021. b) Check of P100,000 dated January 15, 2021 in payment of accounts payable was recorded and mailed on December 31, 2020. c) The company uses the calendar year. The cash receipts journal was held open until January 15, 2021, during which time P400,000 was collected and recorded on December 31, 2020. The cash and cash equivalents to be shown on the December 31, 2020 balance sheet is a. P3,310,000 b. P1,910,000 c. P2,910,000 d. P4,410,000 Demand deposit account as adjusted: Demand deposit account per books Undelivered check Postdated check issued Window dressing of collection Time deposit - 30 days Petty cash fund Cash and cash equivalents P2,000,000 200,000 100,000 (400,000) P1,900,000 1,000,000 10,000 P2,910,000 Problem #10 (Petty Cash Fund) YGX Company reported an imprest petty cash fund of P50,000 with the following details: Currencies 20,000 Coins 2,000 Petty cash vouchers: Gasoline payments for delivery equipment 3,000 Medical supplies for employees 1,000 Repairs of office equipment 1,500 Loans to employees 3,500 A check drawn by the entity payable to the order of Grace de la Cruz, petty cash custodian, representing her salary 15,000 An employee’s check returned by the bank for insufficiency of funds 3,000 A sheet of paper with names of several employees together with contribution for a birthday gift of a co employee. Attached to the sheet of paper is a currency of 5,000 What amount of petty cash fund should be reported in the statement of financial position? a) 42,000 b) 27,000 c) 37,000 d) 22,000 Problem #10 (Cash and Cash Equivalents) The books of BP Service, Inc. disclosed a cash balance of P687,570 on December 31, 2020. The bank statement as of December 31 showed a balance of P547,800. Additional information that might be useful in reconciling the two balances follows: a) Check number 748 for P30,000 was originally recorded on the books as P45,000. b) A customer's note dated September 25 was discounted on October 12. The note was dishonored on December 29 (maturity date). The bank charged Manila's account for P142,650, including a protest fee of P2,650. c) The deposit of December 24 was recorded on the books as P28,950, but it was actually a deposit of P27,000. d) Outstanding checks totaled P98,850 as of December 31. e) There were bank service charges for December of P2,100 not yet recorded on the books. f) Manila's account had been charged on December 26 for a customer's NSF check for P12,960. g) Manila properly deposited P6,000 on December 3 that was not recorded by the bank. h) Receipts of December 31 for P134,250 were recorded by the bank on January 2. i) A bank memo stated that a customer's note for P45,000 and interest of P1,650 had been collected on December 27, and the bank charged a P360 collection fee. Questions: Based on the above and the result of your audit, determine the following: 1. Adjusted cash in bank balance a. P583,200 c. P589,200 b. P577,200 d. P512,400 2. Net adjustment to cash as of December 31, 2020 a. P104,370 c. P 98,370 b. P110,370 d. P175,170 Problem #11 (Cash and Cash Equivalents) Shown below is the bank reconciliation for BTS Company for November 2020: Balance per bank, Nov. 30, 2020 P150,000 Add: Deposits in transit 24,000 Total 174,000 Less: Outstanding checks P28,000 Bank credit recorded in error 10,000 38,000 Cash balance per books, Nov. 30, 2020 P136,000 The bank statement for December 2020 contains the following data: Total deposits P110,000 Total charges, including an NSF check of P8,000 and a service charge of P400 96,000 All outstanding checks on November 30, 2020, including the bank credit, were cleared in the bank in December 2020. There were outstanding checks of P30,000 and deposits in transit of P38,000 on December 31, 2020. Questions: Based on the above and the result of your audit, answer the following: 1. How much is the cash balance per bank on December 31, 2020? a. P154,000 c. P164,000 b. P150,000 d. P172,400 2. How much is the December receipts per books? a. P124,000 c. P110,000 b. P 96,000 d. P148,000 3. How much is the December disbursements per books? a. P96,000 b. P79,600 c. P89,600 d. P98,000 4. How much is the cash balance per books on December 31, 2020? a. P150,000 c. P180,400 b. P170,400 d. P162,000 5. The adjusted cash in bank balance as of December 31, 2020 is a. P141,600 c. P172,000 b. P162,000 d. P196,000 Problem #12 (Proof of Cash) The accountant for the Seventeen Company assembled the following data: June 30 July 31 Cash account balance P 15,822 P 39,745 Bank statement balance 107,082 137,817 Deposits in transit 8,201 12,880 Outstanding checks 27,718 30,112 Bank service charge 72 60 Customer's check deposited July 10, returned by bank on July 16 marked NSF, and redeposited immediately; no entry made on books for return or redeposit 8,250 Collection by bank of company's notes receivable 71,815 80,900 The bank statements and the company's cash records show these totals: Disbursements in July per bank statement P218,373 Cash receipts in July per Muntinlupa's books 236,452 QUESTIONS: Based on the application of the necessary audit procedures and appreciation of the above data, you are to provide the answers to the following: 1. How much is the adjusted bank receipts for July? a. P253,787 c. P245,537 b. P214,802 d. P232,881 2. How much is the adjusted book disbursements for July? a. P220,767 c. P181,782 b. P212,517 d. P206,673 3. How much is the adjusted cash balance as of July 31? a. P137,817 c. P22,513 b. P112,335 d. P120,585 Answer Key: Theories 1. D 2. D 3. B 4. B 5. A 6. A 7. C 8. C 9. D 10.B