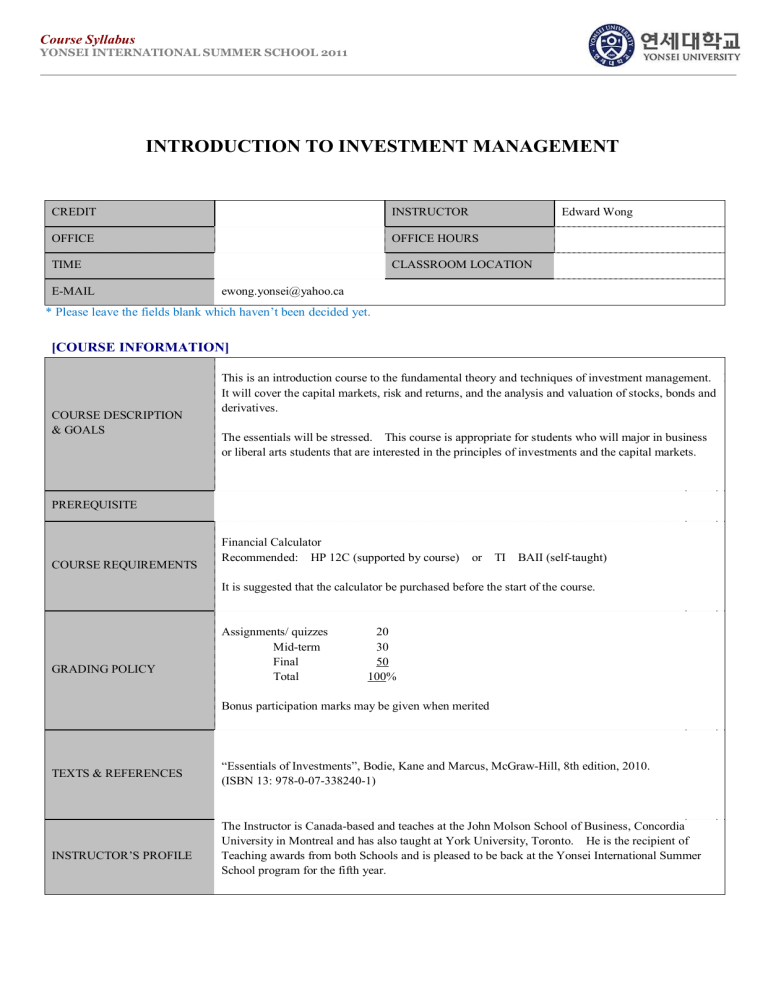

Course Syllabus YONSEI INTERNATIONAL SUMMER SCHOOL 2011 INTRODUCTION TO INVESTMENT MANAGEMENT CREDIT INSTRUCTOR OFFICE OFFICE HOURS TIME CLASSROOM LOCATION E-MAIL Edward Wong ewong.yonsei@yahoo.ca * Please leave the fields blank which haven’t been decided yet. [COURSE INFORMATION] COURSE DESCRIPTION & GOALS This is an introduction course to the fundamental theory and techniques of investment management. It will It will cover the capital markets, risk and returns, and the analysis and valuation of stocks, bonds and derivatives. The essentials will be stressed. This course is appropriate for students who will major in business or liberal arts students that are interested in the principles of investments and the capital markets. PREREQUISITE COURSE REQUIREMENTS Financial Calculator Recommended: HP 12C (supported by course) or TI BAII (self-taught) It is suggested that the calculator be purchased before the start of the course. GRADING POLICY Assignments/ quizzes Mid-term Final Total 20 30 50 100% Bonus participation marks may be given when merited TEXTS & REFERENCES INSTRUCTOR’S PROFILE “Essentials of Investments”, Bodie, Kane and Marcus, McGraw-Hill, 8th edition, 2010. (ISBN 13: 978-0-07-338240-1) The Instructor is Canada-based and teaches at the John Molson School of Business, Concordia University in Montreal and has also taught at York University, Toronto. He is the recipient of Teaching awards from both Schools and is pleased to be back at the Yonsei International Summer School program for the fifth year. Course Syllabus YONSEI INTERNATIONAL SUMMER SCHOOL 2011 [WEEKLY SCHEDULE] * Your detailed explanations would be very helpful for prospective students to get a pre-approval for credit-transfer from their home university in advance. WEEK (PERIOD) 1 (06.27 ~ 07.01) 2 (07.04 ~ 07.08) WEEKLY TOPIC & CONTENTS COURSE MATERIAL & ASSIGNMENTS Introduction • Welcome • course objectives • grading REFERENCE Class #1 Investments: Background and issues • real vs financial assets • financial markets • investment process • players • recent trends chapter 1 Class #2 Asset Classes and Financial Instruments • money markets • bond market • equities • market indices • derivatives chapter 2 Class #3 Securities Markets • how firms issue securities • trading • U.S. markets and Global markets • Trading costs • Margins and short sales chapter 3 Class #4 Mutual Funds • types • costs • exchange-traded funds • performance chapter 4 Class #5 Macroeconomic • global economy • domestic macroeconomy • interest rates • business cycles • industry analysis chapter 12 Class #6, #7 Equity Valuation • valuation by comparables • intrinsic • dividend discount model • price-earnings ratio • free cash flow chapter 13 Class #8 Course Syllabus YONSEI INTERNATIONAL SUMMER SCHOOL 2011 WEEK (PERIOD) WEEKLY TOPIC & CONTENTS 3 (07.11 ~ 07.15) COURSE MATERIAL & ASSIGNMENTS REFERENCE Quiz #1 Class #9 Class #10 continued: Equity Valuation • valuation by comparables • intrinsic • dividend discount model • price-earnings ratio • free cash flow Financial Statement Analysis • major statements • accounting vs economic earnings • ratio analysis • economic value added 4 (07.18 ~ 07.22) chapter 14 Class #11 Mid-Term exam Class #12 Class #13 Cont’d: Financial Statement Analysis • major statements • accounting vs economic earnings • ratio analysis • economic value added Bond Prices and Yields • bond characteristics • bond pricing • bond yields chapter 10 Class #14, #15 Globalization and International Investing • global markets • risk factors • international investing chapter 19 Class #16 Quiz #2 Class #17 5 (07.25 ~ 07.29) Cont’d: Globalization and International Investing • global markets • risk factors • international investing Class #18 Options Markets • option contract • value of option • option valuation Class #19, #20 Course Syllabus YONSEI INTERNATIONAL SUMMER SCHOOL 2011 WEEK (PERIOD) 6 (08.01 ~ 08.04) WEEKLY TOPIC & CONTENTS COURSE MATERIAL & ASSIGNMENTS REFERENCE Risk and Return • rates of return • risk premiums • historical record • asset allocation chapter 5 Class #21 Review Class #22 Final Examination Class #23 Commencement Class #24