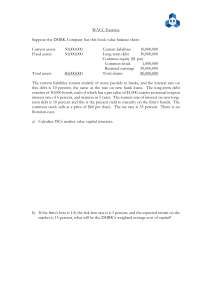

NAME: Question 1: On January 1, 2020, a company issues ten-year bonds with a total face value of $800,000. A $19,000 contracted payment is made to bondholders each June 30 and December 31st (semiannual payments) beginning in June 30, 2020. These bonds were issued for $836,166. Complete the financial statement presentation which reflects and summarizes all of the bond transactions during 2020. For the income statement, present the information for the year ended December 31, 2020 (and indicate whether the items are operating or nonoperating. For the statement of cash flows, present the information for the year ended December 31, 2020. Use the normal classifications. Assume the direct method. For the balance sheet, present the information as of December 31, 2019. Use the normal balance sheet categories. HINT: you have the information required to determine the issue rate of interest. Use this space to show your calculations: Question 2 Following is the stockholders’ equity section of the 2020 balance sheet for Waitsburg Company: STOCKHOLDERS' EQUITY June 30, 2020 Common stock: $0.45 par value, authorized 500,000 shares; 225,000 shares issued $ 101,250 Additional paid‐in capital Retained earnings Treasury stock: 30,000 shares Total stockholders' equity 932,000 79,500 210,000 ???? a) What is Total stockholders’ equity at June 30, 2020? b) How many share are outstanding at June 30, 2020? c) How many more shares can Waitsburg issue before it must seek approval from shareholders? d)What is the average price Waitsburg paid to repurchase its shares? e) Provide one possible reason why Waitsburg is repurchasing its own stock. Question 3: On January 1, Year One, Reed Corp. sells $700,000 of bonds to private investors. The bonds are due in seven years, have a 6% coupon rate and interest is paid semiannually. The bonds were sold to yield 4%. Reed Corp. makes both interest payments on June 30 and December 31st Year One. a) How much cash will the Reed Corp. receive for the issuance of these bonds? b) How much cash payments will the Reed Corp make during Year One? c) If the market rate of interest is 3.5% at December 31, Year One, what is the fair value of the bond issue on December 31, Year One (assuming all contracted payments have been made). d) If Reed Corp. retires the bonds on December 31, Year One. The company pays the amount you calculated (c) above as this is the fair value of the debt at December 31, Year One. Show the impact on the accounting equation below of the retirement of this bond. Include both the direction and the amount of the changes.: HINT: You will need to determine the carrying value of the bond on the retirement date. Calculation space: Question 4: The following amortization table was lifted from a company’s books and records. The column headings were missing when you were asked to discuss the terms of the bond issue. a. Was the bond issued at a Discount or a Premium? b. What is the Issue Rate of Interest? c. Is the stated rate of interest Higher or Lower than the Issue rate of interest? d. Complete the following information: Cash paid for interest in 2021: Interest Expense in 2021: Question 5: The following information excerpts were taken from the 2018 financial statements of The Walt Disney Company (amounts in $millions): (Assume the debt pays interest semiannually.) Note 8: Borrowings The Company’s borrowings at September 29, 2018 and September 30, 2017 are as follows. Capital Cities / ABC debt 2018 2017 Stated Interest Rate Effective Interest Rate 103 106 8.75% 5.99% Capital Cities/ABC Debt In connection with the Capital Cities/ABC, Inc. acquisition in 1996, the Company assumed debt previously issued by Capital Cities/ABC, Inc. The $100 million par value debt matures in 2021 and has a stated interest rate of 8.75%. Questions continue on following page. a. This bond was initially issued in 1996. Does the change in interest rates since the issuance of these bonds affect the amount of interest expense that Disney reports in its income statement? Explain. b. Approximately, how much Interest Expense did Disney record for its Capital Cities / ABC Debt during the fiscal year 2018? c. Is the fiscal year 2018 Interest Expense higher or lower than the Interest Expense reported in fiscal 2017? d. Approximately, how much cash did Disney pay during fiscal year 2018 on this debt? e. If the fair value of this debt was $107.5 at September 29, 2018 and there are five payments remaining, what was estimated market yield of the Capital Cities/ABC Debt issue on September 29, 2018?