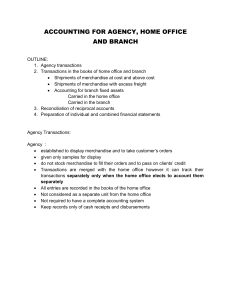

Contabilidad Financiera Manual Fase 1: Financial Accouting 1 Financial Accounting Manual 2 Index The accounting process Actividad 2.2 Practice 1 ……………. 3 Evidencia 2 Practice 2 …………....... 7 Evidencia 2 Practice 3 ……………… 17 Evidencia 2 Practice 4 ………………. 26 Financial statements Actividad 3.1 Practice 1……………… 35 Actividad 3.2 Practice 2 ……………… 37 Evidencia 3 Practice 3………………... 39 Evidencia 3 Practice 4………………. 42 Evidencia 3 Practice 5………………. 45 Financial Ratios Actividad 4.1 Practice 1……………… 48 Actividad 4.2 Practice 2 ……………… 51 Evidencia 4 Practice 3………………... 53 Evidencia 4 Practice 4………………. 54 3 Evidencia 4 Practice 5………………. Final Project PIA Final Project …………..……… 55 54 Actividad 2.2 Práctica contable de IVA I. For the following practices, prepare: ⬧ ⬧ Journal entries Plus VAT Practice 1. The following are MX Company´s beginning balances in May 2021: Assets Cash Banks Merchandise Inventory Computer Equipment $ Liabilities and Owners´ equity Accounts payable $ 300,000 Paid-in Capital 458,000 20,000 200,000 438,000 100,000 $ 758,000 $ 758,000 Transactions of MX Company in May 2021: 1. May 1st – MX Company sold merchandise for $290,000, plus VAT, and the customer guaranteed the payment with a note, including a 10% interest. The cost of goods sold was $93,000. 2. May 3rd – Purchase of equipment for $40,000, plus VAT,50% was paid with a check and the rest on account. 3. May 4th – Purchase of merchandise for $100,000, plus VAT, 50% was paid with checks and for the rest the company issued a note, including a 10% interest. 4. May 5th – Sale of merchandise in cash for $480,000, plus VAT. The cost of this merchandise was the 30% of the sale. 5. May 5th – From the previous sale, the company paid with a check for shipping costs a total of $20,000, plus VAT. 6. May 6th – Sale of merchandise on credit for $300,400, plus VAT. The cost of goods sold was $100,000. 7. May 8th - The company purchased merchandise for inventory on credit. The total was $40,000, plus VAT. 4 8. May 8th – From the previous purchase, the company paid in cash shipping costs for $2,000 plus VAT. th 9. May 10 – The company made a deposit in its bank account for $400,000. 10. May 12th – From the purchase on May 8th, we returned merchandise for $4,200. 11. May 18th –The company purchased merchandise for inventory for $200,000, plus VAT, and paid with a check. The supplier gave a discount of 10% 12. May 22nd – The company sold merchandise on credit for $30,890, plus VAT and gave a 10% discount. The cost of this merchandise was $10,293. 13. May 31st - The general expenses accrued in the month were: In the administrative department $197,000, plus VAT and in the sales department $200,800, plus VAT. 14. May 31st - Depreciation of fixed assets in the month: $3,000. 15. May 31st - Income taxes accrued 30% 5 Entry no. Date Account title and Description 6 Debit Credit Evidencia 2 Reporte de prácticas contables del análisis de operaciones, bajo el método de inventarios perpetuos. I. For the following practices 2,3,4, prepare: ⬧ ⬧ ⬧ ⬧ Journal entries Plus VAT T Accounts Trial Balance 7 Practice 2. The following are the beginning balances of Leading Technology Company in March 2021: Assets Cash Banks Merchandise Inventory Computer Equipment $ Liabilities and Owners´ equity Accounts payable $ 260,000 Sundry Creditors 80,000 Paid-in Capital 214,000 4,000 100,000 370,000 80,000 $ 554,000 $ 554,000 Events in the month: 1. March 3rd - Leading Technology Company sold merchandise on credit for $122,100, plus VAT. The cost of this merchandise was $40,000. 2. March 4th – The company purchased furniture on credit for $2,000, plus VAT. 3. March 5th – Purchase of merchandise on account for $15,000, plus VAT. 4. March 6th – Purchase of equipment for $20,000, plus VAT, paid with a check. 5. March 7th – From the purchase of merchandise on March 5th the company returned $3,000. 6. March 10th – The company sold merchandise in cash for $300,000, plus VAT. The cost was the 35% of the sale. 7. March 11th – From the previous sale, the customer returned merchandise for $10,000 and our company paid the refund with a check. The cost of goods sold was the 35% of the sale. 8. March 11th – From the previous sale, the company paid shipping costs with a check for $15,000, plus VAT. 9. March 15th – The company sold merchandise for $100,000, plus VAT; the customer guaranteed the payment with a note. The cost of this merchandise was $30,500. 10. March 18th – Sale of merchandise for $100,170, plus VAT. The customer promised to pay with a note, including a 10% interest. The cost of this merchandise was $30,380. 11. March 20th – Salaries accrued in the month: For the administrative personnel $180,000 and for the sales manager $40,000. 12. March 22nd – Administrative expenses accrued $20,000, plus VAT. 13. March 25th – The company made a deposit in its bank account for $295,000. 14. March 27th – The company sold merchandise in cash for $20,000, plus VAT and gave a 10% discount. The cost of goods sold was $5,000. 15. March 28th – The company purchased merchandise for $208,000, plus VAT and paid 50% with a check and for the rest we issued a note, including a 10% interest. 16. March 28th – The company purchased merchandise for $50,000, plus VAT. We guaranteed the payment with a note. 17. March 29th – Purchase of merchandise for $30,000, plus VAT, paid with a check. 18. March 30th – Purchase of a computer for $20,000, plus VAT. The payment was made with a check. 8 19. March 31st – Depreciation of fixed assets in the month: $1,500. st 20. March 31 – Income taxes accrued 30% 9 General Journal 10 Entry no. Date Account title and Description 11 Debit Credit Entry no. Date Account title and Description 12 Debit Credit Entry no. Date Account title and Description 13 Debit Credit Entry no. Date Account title and Description 14 Debit Credit T accounts 15 16 17 Trial Balance Account activity Debit Credit Account title 18 Ending balances Debit Credit Equal amounts General Manager Accountant Practice 3. X Mart Company has the following beginning balances in November 2021: Assets Cash Banks Merchandise Inventory Equipment Computer Equipment $ 20,830 220,687 400,200 200,000 40,000 Liabilities and Owners´ equity Accounts payable $ 220,000 Notes payable 100,000 Paid-in Capital 561,717 $ 881,717 $ 881,717 Events in the month: 1. November 1st – X Mart Company purchased merchandise on credit for $10,000, plus VAT. 2. November 2nd – From the previous purchase, we returned merchandise for $1,000. 3. November 3rd – The company purchased merchandise for $8,000, plus VAT which was paid with a check. This merchandise had a 10% discount. 4. November 5th – Sale of merchandise for $246,000, plus VAT which was guaranteed with a note, including a 10% interest. The cost of the merchandise was $98,400. 5. November 6th – The company sold merchandise in cash for $400,000, plus VAT and gave a 10% discount. The cost of the merchandise was $100,800. 6. November 7th – Sale of merchandise in cash for $220,000, plus VAT. The cost of goods sold was the 30% of the sale. 19 7. November 10th – Deposit in the bank account for $550,000. th 8. November 13 – From the sale on November 7th, the customer returned merchandise for $40,000. The refund was paid with a check. The cost of this merchandise was the 30% of the sale. 9. November 18th – The company purchased merchandise for $500,000, plus VAT and paid the 50% with a check and the rest on account. 10. November 21st – From the sale on November 7th, the company paid shipping costs with a check, for a total of $10,000, plus VAT. 11. November 23rd – Purchase of equipment for $10,000, plus VAT and furniture for $20,000 plus VAT, both purchases were on credit. 12. November 24th – Expenses of the administrative department accrued in the month: $30,000, plus VAT. 13. November 25th – Salaried accrued for the sales personnel: $100,000. 14. November 30th – Depreciation expense in the month: $1,500. 15. November 30th – Income tax expense accrued 30% General Journal 20 Entry no. Date Account title and Description 21 Debit Credit Entry no. Date Account title and Description 22 Debit Credit Entry no. Date Account title and Description 23 Debit Credit Entry no. Date Account title and Description 24 Debit Credit T accounts 25 26 27 Trial Balance Account activity Debit Credit Account title 28 Ending balances Debit Credit Equal amounts General Manager Accountant Practice 4. ABC Electronics Company has the following beginning balances in September 2021: Assets Cash Banks Merchandise Inventory Equipment Computer Equipment $ 6,000 500,000 90,000 100,000 120,000 Liabilities and Owners´ equity Accounts payable $ 80,000 Notes payable 10,000 Sundry Creditors 110,000 Paid-in Capital 616,000 $816,000 $ 816,000 Events in the month: 1. September 1st. Purchase of merchandise on credit for $200,000, plus VAT. 2. September 2nd. The company sold merchandise for $300,000, plus VAT; 50% of the sale was made on credit and the rest in cash. The cost of goods sold was the 30% of the sale. 3. September 3rd. From the previous sale, the customer returned merchandise for $10,000. The company paid the refund with a check. The cost of the products was the 30% of the sale. 4. September 6th. From the purchase of merchandise on September 1st, we returned $20,000 to the supplier. 5. September 10th. The company purchased merchandise inventory for $220,000, plus VAT; 60% was paid with a check and 40% was guaranteed with a note. 29 6. September 12th. From the sale on September 2nd, we paid shipping costs with a check for $15,000, plus VAT. 7. September 15th. The company sold merchandise for $390,000, plus VAT. The customer guaranteed the payment with a note, including a 10% interest. The cost of goods sold was $120,000. 8. September 20th. The company purchased new equipment for $60,000, plus VAT and computer equipment for $40,000. Both purchases were made on account (credit) 9. September 25th. We made a deposit in our bank account for $135,000. 10. September 28th. The total of expenses accrued for the electricity and telephone bill in the administrative department was $40,000, plus VAT, and the total of salaries accrued in the sales department was $73,800. 11. September 30th. Depreciation of fixed assets in the month: $2,600. 12. September 30th. Income taxes accrued 30% General Journal 30 Entry no. Date Account title and Description 31 Debit Credit Entry no. Date Account title and Description 32 Debit Credit Entry no. Date Account title and Description 33 Debit Credit Entry no. Date Account title and Description 34 Debit Credit T accounts 35 36 37 Trial Balance Account activity Debit Credit Account title 38 Ending balances Debit Credit Equal amounts General Manager Accountant Actividad 3.1 Ejercicio práctico de Balance general With Trial balance prepare Balance sheet 39 Account Cash Banks Accounts receivable Notes receivable Merchandise Inventory Equipment Computer equipment Furniture Office Supplies Inventory Prepaid Rent Accounts payable Sundry creditors Notes payable Expenses payable Salaries payable Interest payable Long-term debt Paid-in Capital Cost of goods sold Administrative expenses Selling expenses Interest expense Sales revenue Interest income Accumulated depreciation Equal amounts Garry Company Trial balance For the month of March 2021 Account Activity Debit Credit $247,420 $201,000 1,200,000 151,200 377,220 322,300 605,400 310,008 50,000 30,400 18,000 1,000 80,000 20,000 3,000 192,600 38,000 131,000 27,000 143,400 50,000 500,000 780,000 306,388 4,200 131,000 60,400 61,000 20,000 914,020 29,300 21,800 $3,513,528 $3,513,528 40 Ending balances Debit Credit $46,420 1,048,800 377,220 322,300 295,392 50,000 30,400 18,000 1,000 60,000 $189,600 38,000 131,000 27,000 143,400 50,000 500,000 780,000 302,188 131,000 60,400 61,000 894,020 29,300 21,800 $2,804,120 $2,804,120 41 General Manager Accountant Actividad 3.2 Ejercicio práctico de Estado de resultado With trial balance prepare Income Satement Account Cash Banks Accounts receivable Notes receivable Merchandise Inventory Equipment Computer equipment Furniture Office Supplies Inventory Prepaid Rent Accounts payable Sundry creditors Notes payable Expenses payable Salaries payable Interest payable Long-term debt Paid-in Capital Cost of goods sold Administrative expenses Selling expenses Interest expense Sales revenue Interest income Accumulated depreciation Equal amounts Garry Company Trial balance For the month of March 2021 Account Activity Debit Credit $247,420 $201,000 1,200,000 151,200 377,220 322,300 605,400 310,008 50,000 30,400 18,000 1,000 80,000 20,000 3,000 192,600 38,000 131,000 27,000 143,400 50,000 500,000 780,000 306,388 4,200 131,000 60,400 61,000 20,000 914,020 29,300 21,800 $3,513,528 $3,513,528 42 Ending balances Debit Credit $46,420 1,048,800 377,220 322,300 295,392 50,000 30,400 18,000 1,000 60,000 $189,600 38,000 131,000 27,000 143,400 50,000 500,000 780,000 302,188 131,000 60,400 61,000 894,020 29,300 21,800 $2,804,120 $2,804,120 Income Statement General Manager Accountant 43 Evidencia 3 Reporte de Estados financieros: Balance General y Estado de Resultados I. With the Trial Balance 1,2,3, prepare practice 3, 4, 5. ⬧ ⬧ Income Statement Balance Sheet Practice 3 1. Trial Balance Account Cash Banks Accounts receivable Notes receivable Merchandise Inventory Equipment Computer Equipment Accounts payable Notes payable Sundry creditors Expenses payable Paid-in Capital Cost of goods sold Administrative expenses Selling expenses Interest expense Sales revenue Interest income Accumulated depreciation Equal amounts MX Company Trial balance For the month of May 2021 Account Activity Debit Credit $500,000 $402,000 600,000 270,000 328,201 319,000 780,000 371,493 40,000 100,000 4,200 340,000 55,000 20,000 397,800 458,000 347,293 200,000 220,800 5,000 3,089 1,101,290 29,000 3,000 $3,447,583 $3,447,583 44 Ending balances Debit Credit $98,000 330,000 328,201 319,000 408,507 40,000 100,000 335,800 55,000 20,000 397,800 458,000 347,293 200,000 220,800 5,000 1,098,201 29,000 3,000 $2,396,801 $2,396,801 Income Statement General Manager Accountant 45 46 General Manager Accountant Evidencia 3 Practice 4 2. Trial Balance Prepare ⬧ ⬧ Income Statement Balance Sheet Account Cash Banks Accounts receivable Notes receivable Merchandise Inventory Equipment Computer Equipment Accounts payable Notes payable Sundry creditors Expenses payable Salaries payable Paid-in Capital Cost of goods sold Administrative expenses Selling expenses Sales revenue Interest income Accumulated depreciation Equal amounts ABC Electronics Company Trial balance For the month of September 2021 Account Activity Ending balances Debit Credit Debit Credit $156,000 $135,000 $21,000 635,000 157,000 478,000 150,000 150,000 429,000 429,000 513,000 230,000 283,000 160,000 160,000 160,000 160,000 20,000 280,000 260,000 98,000 98,000 210,000 210,000 40,000 40,000 73,800 73,800 616,000 616,000 210,000 3,000 207,000 42,600 42,600 88,800 88,800 10,000 690,000 680,000 39,000 39,000 2,600 2,600 $2,574,400 $2,574,400 $2,019,400 $2,019,400 47 Income Statement General Manager Accountant 48 49 General Manager Accountant Evidencia 3 Practice 5 3. Trial Balance Prepare ⬧ ⬧ Income Statement Balance Sheet Account Cash Banks Accounts Receivable Merchandise Inventory Notes Receivable Equipment Computer Equipment Furniture Accounts Payable Notes Payable Salaries Payable Sundry Creditors Expenses Payable Paid-in Capital Cost of goods sold Administrative expenses Selling expenses Interest Expense Sales Revenue Interest Income Accumulated depreciation Equal amounts Leading Technology Company Trial balance For the month of March 2021 Account Activity Debit Credit $322,000 $295,000 395,000 199,000 122,100 676,500 213,880 210,187 20,000 100,000 2,000 3,000 275,000 164,400 220,000 82,000 20,000 214,000 210,880 3,500 201,500 55,000 10,400 12,000 642,270 10,017 1,500 $2,340,567 $2,340,567 50 Ending balances Debit Credit $27,000 196,000 122,100 462,620 210,187 20,000 100,000 2,000 $272,000 164,400 220,000 82,000 20,000 214,000 207,380 201,500 55,000 10,400 630,270 10,017 1,500 $1,614,187 $1,614,187 Income Statement General Manager Accountant 51 52 General Manager Accountant Actividad 4.1 Reporte práctico de razones financieras Practice 1 Calculate the financial ratios of profitability, liquidity and leverage for ABQ Company; Financial ratios required: ⬧ ⬧ ⬧ ⬧ ⬧ ⬧ ⬧ Return on Investment Return on Equity Working Capital Current Ratio Acid-test Ratio Debt Ratio Debt/Equity Ratio 53 ABQ Company Comparative Balance Sheets At April 30th. and March 31st. 2021 April 30th. March 31st. Assets Current Assets Cash Accounts receivable Notes receivable Merchandise Inventory Total of current assets Fixed Assets Equipment Furniture Computer equipment Less: Accumulated depreciation Total of fixed assets Deferred charges Office supplies Prepaid Rent Total of deferred charges Total of Assets Liabilities Current Liabilities Accounts payable Bank loan Salaries payable Expenses payable Interest payable Taxes payable Total of current liabilities Long-term debt Total of Liabilities Owners´equity Common stock Retained Earnings Total of Owners´equity Total of Liabilities plus Owners´equity $ $ 20,000 100,800 40,000 300,000 460,800 $ 16,000 120,000 30,000 200,000 366,000 $ 80,000 20,000 90,000 80,000 110,000 $ 60,000 30,000 84,000 74,000 100,000 $ $ $ $ 3,200 226,000 229,200 800,000 $ $ $ $ 2,000 200,000 202,000 668,000 $ 20,000 100,000 26,000 3,000 2,000 23,000 174,000 300,000 474,000 $ 4,000 80,000 96,000 2,000 10,000 26,000 218,000 200,000 418,000 236,000 90,000 326,000 800,000 $ $ $ $ $ $ $ Manager´s signature $ $ $ $ $ $ 180,000 70,000 250,000 668,000 Accountant´s signature Income Statement Information Net Income $ 54 200,000 55 4.2 Práctica de análisis de razones Practice 2 Hartford, Inc. Comparative Balance Sheets At December 31st, 2021 and 2020 2021 2020 Assets Current Assets Cash Accounts receivable Merchandise Inventory Total of current assets Fixed Assets Land Buildings Equipment Less: Accumulated depreciation Total of fixed assets Total of Assets Liabilities Current Liabilities Accounts payable Bank loan Notes payable Total of current liabilities Long-term debt Total of Liabilities Owners´equity Common stock Retained Earnings Total of Owners´equity Total of Liabilities plus Owners´equity $ $ $ $ $ $ $ $ $ $ $ $ 53,000 50,000 56,000 159,000 $ 88,000 73,000 49,000 $ 210,000 40,000 $ 40,000 200,000 140,000 60,000 22,000 168,000 123,000 132,000 $ 79,000 291,000 $ 289,000 23,000 32,000 48,000 103,000 85,000 188,000 $ 40,000 63,000 103,000 291,000 $ Manager´s signature 29,000 27,000 36,000 $ 92,000 $ 110,000 $ 202,000 30,000 57,000 $ 87,000 $ 289,000 Accountant´s signature Income statement information Net Income $ 56 9,000 Evidencia 4 Evidencia 4 Reporte escrito de razones financieras Practice 3,4,5 With Comparative Balance Sheet Calculate the financial ratios of profitability, liquidity and leverage for Hoeman, Inc; Millco, Inc; Harris, Inc. Write down the formula, calculation and answer for each ratio. Financial ratios required: ⬧ ⬧ ⬧ ⬧ ⬧ ⬧ ⬧ Return on Investment Return on Equity Working Capital Current Ratio Acid-test Ratio Debt Ratio Debt/Equity Ratio 57 Practice 3 Hoeman, Inc. Comparative Balance Sheets At December 31st, 2014 and 2021 2021 2020 Assets Current Assets Cash Accounts receivable Merchandise Inventory Total of current assets Fixed Assets Land Buildings Less: Accumulated depreciation Total of fixed assets Total of Assets Liabilities Current Liabilities Accounts payable Notes payable Total of current liabilities Long-term debt Total of Liabilities Owners´equity Common stock Retained Earnings Total of Owners´equity Total of Liabilities plus Owners´equity $ $ $ $ $ $ $ $ $ $ $ $ 52,000 124,000 156,000 332,000 $ 46,000 134,000 176,000 $ 356,000 140,000 $ 140,000 415,000 290,000 120,000 105,000 435,000 $ 325,000 767,000 $ 681,000 167,000 155,000 322,000 192,000 514,000 $ 197,000 124,000 $ 321,000 $ 139,000 $ 460,000 50,000 203,000 253,000 767,000 $ Manager´s signature 45,000 176,000 $ 221,000 $ 681,000 Accountant´s signature Income statement information Net Income $ 58 94,000 Practice 4 59 Millco, Inc. Comparative Balance Sheets At February 28th and January 31st. 2021 February 28th January 31st. Assets Current Assets Cash Accounts receivable Notes receivable Merchandise Inventory Total of current assets Fixed Assets Machinery Less: Accumulated depreciation Total of fixed assets Deferred charges Office supplies Prepaid Rent Total of deferred charges Total of Assets Liabilities Current Liabilities Accounts payable Short-term debt Salaries payable Expenses payable Interest payable Taxes payable Total of current liabilities Long-term debt Total of Liabilities Owners´equity Common stock Retained Earnings: Beginning balance Net Income for the month Dividends Ending balance Total of Owners´equity Total of Liabilities plus Owners´equity $ $ 42,000 64,000 30,000 81,000 217,000 $ 37,000 53,000 32,000 98,000 220,000 $ 166,000 24,000 142,000 $ 152,000 21,000 131,000 $ $ $ $ 1,000 20,000 21,000 380,000 $ $ $ $ 800 10,000 10,800 361,800 $ $ $ $ $ 37,000 44,000 21,000 38,000 4,000 9,000 153,000 33,000 186,000 $ $ $ 41,000 44,000 26,000 40,000 8,000 5,200 164,200 46,000 210,200 $ 104,000 $ 87,600 $ $ $ 64,000 36,000 10,000 90,000 194,000 380,000 $ $ $ 43,000 29,000 8,000 64,000 151,600 361,800 Manager´s signature $ Accountant´s signature Income statement information Net Income $ 60 36,000 Practice 5 Harris, Inc. Comparative Balance Sheet At December 31st, 2021 and 2020 2021 2020 Assets Current Assets Cash Accounts receivable Merchandise Inventory Total of current assets Fixed Assets Land Buildings Less: Accumulated depreciation Total of fixed assets Total of Assets Liabilities Current Liabilities Accounts payable Short-term debt Notes payable Total of current liabilities Long-term debt Total of Liabilities Owners´equity Common stock Retained Earnings Total of Owners´equity Total of Liabilities plus Owners´equity $ $ $ $ $ $ $ $ $ $ $ $ 6,000 67,000 46,000 119,000 $ 27,000 208,000 101,000 134,000 253,000 $ 61,000 12,000 24,000 97,000 65,000 162,000 $ 28,000 63,000 91,000 253,000 $ Manager´s signature 15,000 61,000 76,000 $ 152,000 34,000 118,000 72,000 $ 80,000 $ 232,000 58,000 16,000 33,000 $ 107,000 $ 50,000 $ 157,000 20,000 55,000 $ 75,000 $ 232,000 Accountant´s signature Income statement information Net Income $ 61 13,000 Accounting Final Project 62 FINAL PROJECT Requirement Value Some of the transactions have missing amounts. Write down an amount of 1 your choice for each of them, based on the list that will be provided by the - professor. 2 Write down the journal entries for each of the 58 transactions. 5 points 3 Prepare the T Accounts for each of the accounts used in the journal entries. 3 points 4 Prepare the Trial Balance for April 2021. 3 points 5 Prepare the Income Statement for the month. 3 points 6 Prepare a Balance Sheet at April 30th 2021. 3 points 7 Calculate the following financial ratios: Return on Investment, Return on 3 points Equity, Working Capital, Current Ratio, Acid-test Ratio, Debt Ratio and Debt/Equity Ratio 8 Write down, in 1 page, your interpretation of the financial ratios and a 3 points report of the financial situation of the company. Prepare Word, Pdf of Word, Excel 5 points 9 Prepare Presentation Power Point 10 2 points 63 Total 30 points Information to fill in the spaces in the list of transactions for a Merchandising Company: 64 Transaction number Range of amounts 1 $30,800 - $40,800 $30,000 - $40,000 2 $85,000 - $90,000 3 $40,000 - $42,100 5 $200,000 - $215,000 6 $350,000 - $380,000 7 $38,000 - $40,000 9 $450,000 - $480,000 10 $28,000 - $30,000 12 $295,000 - $300,000 22 $430,000 – 450,000 34 $800 - $1,000 40 $930,000 – $950,000 50 $200,000 - $210,000 53 Merchandising $300,000 - $320,000 54 Company Name of the Company: _____________________________________________ 65 Beginning balances in April 2021: Assets Cash Banks Merchandise Inventory Equipment $ 50,000 300,000 800,000 200,000 $ 1,350,000 Liabilities and Owners´ equity Accounts payable $ 500,000 Paid-in Capital 850,000 $ 1,350,000 1. April 1st – The company sold merchandise in cash for $__________, plus VAT. The cost was $10,000. 2. April 2nd - The company purchased new equipment for $__________; plus VAT, the payment was made with a check. 3. April 2nd - The company purchased merchandise for $__________, plus VAT, and paid with a check. 4. April 2nd. From the previous purchase, the company paid for shipping costs with a check a total of $5,000, plus VAT. 5. April 3rd - The company bought 2 new computers for a total of $__________, plus VAT, the payment was made with a check. 6. April 3rd – Sale of merchandise in cash for a total of $__________, plus VAT The cost of the products was $60,000. 7. April 4th – Sale of merchandise on credit for a total of $__________, plus VAT. The cost was $180,000. 8. April 5th - The company purchase8d new furniture on credit for $10,000, plus VAT. 9. April 6th - Purchase of merchandise for inventory on credit for a total of $__________, plus VAT. 10. April 7th - The company sold merchandise on credit for a total of $__________, plus VAT. The cost of the products was $210,000. 11. April 8th – From the sale on April 1st, the customer returned merchandise for $3,000. The amount was refunded with a check. The cost of this merchandise was $900. 12. April 9th - The company purchased equipment on account and the total was $__________, plus VAT. 13. April 10th - Purchase of office supplies for inventory, paid with a check. The total was $3,500, plus VAT. April 10th – Sale of merchandise in cash for $100,000, plus VAT. The cost of goods sold was $30,000. 14. April 11th - Purchase of equipment for a total of $10,000, the payment was made with a check, plus VAT. 15. April 12th – The company made a deposit in its bank account for $200,000. 66 16. April 13th - The company purchased merchandise for inventory for a total of $51,340 plus VAT, and paid with checks. 17. April 13th - Sale of merchandise for a total of $388,000, plus VAT. The sale was made 50% in cash and 50% on account =credit. Cost of goods sold $160,000. 18. April 14th - Sale of merchandise in cash for a total of $300,500, plus VAT. The cost of this merchandise was $100,000. 19. April 14th - Sale of merchandise on credit for a total of $200,350, plus VAT. Cost of goods sold $100,800. 20. April 15th – The company sold products in cash for $100,610, plus VAT, and gave a 10% discount. The cost of those products was $30,600. 21. April 16th - Purchase of merchandise for $__________, 50% was paid in cash and 50% of the purchase was on account =credit, plus VAT. 22. April 16th - Administrative expenses accrued in the month (Electricity and water): $90,000, plus VAT. 23. April 16th - The company must pay the wages of 4 employees who work in the administrative department. The total is $120,000. Salaries 24. April 16th – The total amount of wages accrued of the sales department is $40,000. Salaries 25. April 16th – Total amount of commissions that must be paid to sales personnel: $100,000. Salaries 26. April 17th – The company purchased merchandise for $20,200 and paid with a check, plus VAT. The supplier gave a 10% discount. 27. April 17th - Payment in advance of the rent of a warehouse for $60,000 in cash, plus VAT 28. April 17th – From the sale on April 10th, the customer returned merchandise for a total of $20,000. The cost of this merchandise was $6,000. 29. April 17th – Purchase of merchandise for $40,000, plus VAT, guaranteed with notes. 30. April 17th – From the previous purchase, the company paid for shipping costs a total of $2,600 plus VAT, in cash. 31. April 18th – The company made a deposit in its bank account for $400,000. 32. April 18th - The company lent $3,000 to an employee. loan 33. April 18th - Sale of merchandise for $__________. plus VAT. The customer guaranteed the payment with notes. The cost of goods sold was$200,700. 34. April 19th – The company borrowed $40,000 from the bank and has to pay back in 8 months. 35. April 19th – Purchases of merchandise for inventory on credit for a total of $20,800. plus VAT. 36. April 19th - The company sold merchandise for $234,000, plus VAT, and the customer issued notes for this amount, including a 12% interest. The cost of the merchandise was $95,800. 67 37. April 20th – From the purchase on credit yesterday, we returned merchandise for $3,500. th 38. April 20 – Purchase of merchandise for $200,000, plus VAT. The 50% of this amount was paid with a check and for the other 50% we issued a note, including a 10% interest. 39. April 20th - Telephone service expense accrued in the administrative department for a total of $__________, plus VAT and in the sales department $2,000, plus VAT. 40. April 20th – Sale of merchandise for $88,000, 80% in cash and 20% on account, plus VAT. The cost of goods sold was the 40% of the sale. 41. April 21st – Purchase of computer equipment for $40,300, plus VAT. which was paid with a check. 42. April 21st – Purchase of furniture for $180,300, plus VAT. The payment was made with a check. 43. April 21st – The company returned merchandise to the supplier for $20,000 and for this amount we received a check. 44. April 22nd - The company borrowed $800,000 from a bank, which was deposited in the company´s bank account. The debt matures in 2 years. Interest payable $80,000. 45. April 23rd – Equipment was purchased for $300,450; plus VAT, 50% was paid with a check, and for the rest we issued a note. 46. April 24th – Equipment was purchased on credit for a total of $50,000, plus VAT. 47. April 24th – The company sold merchandise in cash for a total of $900,000, plus VAT. The cost of this merchandise was the 30% of the sale. 48. April 24th – The company paid shipping costs from the previous sale. The amount was $40,000 plus VAT, and was paid with a check. 49. April 25th – The company collected accounts receivable for $__________. This amount was deposited in the company´s bank account. 50. April 25th – The company made a deposit in its bank account for $940,000. 51. April 26th – Purchase of equipment for $1,000,000 and furniture for $290,000; plus VAT, the company paid with checks. 52. April 27th – Advertising expense for $__________ plus VAT, was paid with a check. 53. April 27th – From the sale on April 24th, the customer returned $__________; this amount was refunded with a check. 54. April 28th – Purchases of merchandise for inventory for $700,000; plus VAT, 30% was paid with a check and the rest on account. =credit 55. April 29th – Payment of accounts payable for $320,890; $120,890 in cash and the rest with a check. 56. April 30th - Depreciation of fixed assets in the month: $133,596. 57. April 30th - Income taxes accrued 30% General Journal 68 Entry no. Date Account title and Description 69 Debit Credit Entry no. Date Account title and Description 70 Debit Credit Entry no. Date Account title and Description 71 Debit Credit Entry no. Date Account title and Description 72 Debit Credit Entry no. Date Account title and Description 73 Debit Credit Entry no. Date Account title and Description 74 Debit Credit Entry no. Date Account title and Description 75 Debit Credit Entry no. Date Account title and Description 76 Debit Credit Entry no. Date Account title and Description 77 Debit Credit Entry no. Date Account title and Description 78 Debit Credit Entry no. Date Account title and Description 79 Debit Credit Entry no. Date Account title and Description 80 Debit Credit T accounts 81 82 83 84 85 86 87 88 89 90 91 Account title Trial Balance Account activity 92 Ending balances Debit Credit Debit Equal amounts General Manager Accountant 93 Credit Income Statement General Manager Accountant 94 95 Financial Ratios 96 Financial Report of ________________________________ 97 98