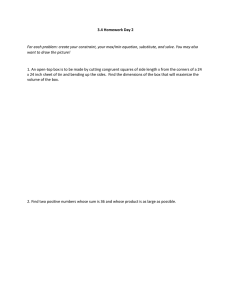

DAILY INSIGHTS EQUITY RESEARCH Thursday, 31 August 2006 MINING /1H06 RESULTS SELL Timah Unchange Price Rp1,740 Target Price Very poor performance Rp1,200 Downgrade Reuters Code Bloomberg Code No. of shares (mn) Market cap (Rp bn) (US$ mn) Weight in JCI (%) 3mo Avg. daily T/O (US$ mn) TINS.JK TIN SIJ 503.3 875.7 96 0.1 0.4 Price 12 mos Hi/Lo (Rp) 2,525/1,480 PER - 2006F 12 mos Hi/Lo (x) 47.3/24.5 EV/EBITDA - 2006F 12 mos Hi/Lo (x) 9.8/6.2 Key Financial Net Gearing, % ROAA, % ROAE, % 06F/07F 10.1/3.8 1.0/0.8 1.8/1.3 (%) -5.2 -14.0 -32.0 -27.2 USD/IDR - YE 2005 2006F (Rp) 9,830 9,997 (%) 65 35 · Performance of the tin business, despite flat sales volume and prices, was slightly worse than expected, driven by higher unit costs dragging down the unit margin by 35%. As inland production was down and offshore production was up in an environment of firmer tin prices, we suspect the main driver for the increase in costs was higher fuel costs. As such, the net profit was down by 75% to Rp24bn. · We will upgrade our forecasts to reflect higher tin prices and the higher contribution from the coal business, but we maintain our SELL call with a YE06 target price of Rp1,200 due to the unclear future business prospects. 1H05 1H06 yoy % 2006F A/F % 1Q06 2Q06 qoq % Average exchange rate, Rp/US$ Tin ore production, Ton Sn Inland Offshore Total 9,392 9,228 -1.7 9,475 97.4 9,329 9,098 -2.5 19,549 3,749 23,298 15,154 5,382 20,536 -22.5 43.6 -11.9 28,000 12,000 40,000 54.1 44.9 51.3 6,717 2,738 9,455 8,437 2,644 11,081 25.6 -3.4 17.2 Tin metal sales, M tons Average tin price, US$/Mton Tin COGS, US$/Mton Margin, US$/Mton 19,364 8,221 6,814 1,407 19,083 8,120 7,201 919 -1.5 -1.2 5.7 -34.7 40,000 8,000 7,132 868 47.7 101.5 101.0 105.9 9,614 7,629 6,351 1,278 9,469 8,614 7,973 641 -1.5 12.9 25.5 -49.8 Sales, Rp bn Gross profit, Rp bn Operating profit, Rp bn Net profit, Rp bn 1,607 269 147 97 1,729 200 68 24 7.7 -25.6 -53.8 -75.2 3,274 315 39 27 52.8 63.4 175.7 88.9 810 107 47 12 920 94 21 12 13.6 -12.2 -55.7 7.8 9.6 5.2 3.4 5.9 2.0 0.7 10.7 4.7 1.2 11.8 2.6 1.6 Source: Danareksa Sekuritas & Company 1,000 -30 Year end to Dec, Rp bn 2004 2005 2006F 2007F 2008F Revenue, Rp bn Net profit, Rp bn Core profit, Rp bn EPS, Rp EPS growth, % Core EPS, Rp Core EPS growth, % PER, x Core PER, x PBV, x EV/EBITDA, x Yield, % 2,812 178 238 353 387.5 472 93.7 4.9 3.7 0.6 2.1 7.3 3,396 107 145 214 (39.6) 289 (38.8) 8.1 6.0 0.6 3.2 9.3 3,274 27 30 53 (75.0) 60 (79.1) 32.6 28.9 0.6 7.1 4.9 3,442 20 23 40 (24.3) 46 (24.5) 43.1 38.2 0.6 7.0 1.2 3,571 6 13 13 (68.9) 25 (44.7) 138.3 69.1 0.6 8.1 0.9 11/9/2005 10/5/2005 8/31/2005 Isnaputra Iskandar, CFA (62-21) 350 9888 ext. 3504 isnaputra@danareksa.com Danareksa research reports are also available at Reuters Multex, First Call Direct and Bloomberg. www.danareksa.com 8/16/2006 -20 6/7/2006 1,500 7/12/2006 -10 5/3/2006 2,000 Margins, % Gross margin Operating margin Net margin 3/29/2006 0 2/22/2006 2,500 1/18/2006 (%) 10 Rp Relative to JCI (RHS) TINS posted sales of Rp1,729bn (+8% yoy) in 1H06 driven by the stronger-than-expected performance of its coal business. The coal business posted Rp287bn in sales which almost reached out FY06 target of Rp295.1bn. 3,000 12/14/2005 TINS (LHS) · Exhibit 1. 1H06 results Price Relative to JCI 1 mo 3 mos 6 mos 12 mos Major shareholders Govt. of Indonesia Est. free float News & comments: 10.1 1.2 0.9 31 August 2006 DAILY INSIGHTS Shareprice and Recommendation Date Rec Price Target, Rp 3-Apr-06 SELL 1,500 30-May-06 SELL 1,500 31-Aug-06 SELL 1,200 3,500 3,000 2,500 S 2,000 S S 1,500 1,000 500 8/28/2006 5/29/2006 2/27/2006 11/28/2005 8/29/2005 5/30/2005 2/28/2005 11/29/2004 8/30/2004 5/31/2004 3/1/2004 12/1/2003 9/1/2003 - DISCLAIMER The information contained in this report has been taken from sources which we deem reliable. However, none of P.T. Danareksa Sekuritas and/or its affiliated companies and/or their respective employees and/or agents makes any representation or warranty (express or implied) or accepts any responsibility or liability as to, or in relation to, the accuracy or completeness of the information and opinions contained in this report or as to any information contained in this report or any other such information or opinions remaining unchanged after the issue thereof. We expressly disclaim any responsibility or liability (express or implied) of P.T. Danareksa Sekuritas, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action , suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither P.T. Danareksa Sekuritas, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or mis-statements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. The information contained in this report is not be taken as any recommendation made by P.T. Danareksa Sekuritas or any other person to enter into any agreement with regard to any investment mentioned in this document. This report is prepared for general circulation. It does not have regards to the specific person who may receive this report. In considering any investments you should make your own independent assessment and seek your own professional financial and legal advice. 2