Accounting History & Relevance: Key Concepts & Business Types

advertisement

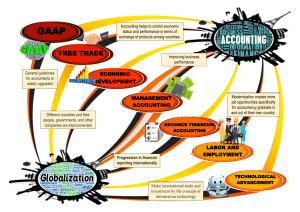

The Relevance and History of Accounting Accounting is part of your daily life. Individual Needs Accounting o Day to day activities o Budget of finances o Doing a better job (employee and/or entrepreneur) o Comply with government regulations For as long as civilizations have been engaging in trade or organized systems of government, methods of record keeping, accounting, and accounting tools have been in use. Benedetto Cotrugli o In 1458, he invented the doubleentry accounting system, which revolutionized accounting. Double-entry accounting o It is defined as any bookkeeping system that involves a debit and/or credit entry for transactions. Luca Bartolomes Pacioli o He is an Italian mathematician and Franciscan monk. o He invented a system of record keeping that used a memorandum, journal, and ledger, wrote many books on accounting. o Born in 1445 in Tuscany. o He is known today as the father of accounting and bookkeeping. o In 1494, he wrote “Summa de Arithmetica, Geometria, Proportioni et Proportionalita”. Summa de Arithmetica, Geometria, Proportioni et Proportionalita o It is translated as "The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality". o It included a 27-page treatise on bookkeeping and was the first known published work on the topic of double-entry bookkeeping. o It was one of the first published using the historical Gutenberg press. o One chapter of it is "Particularis de Computis et Scripturis". Particularis de Computis et Scripturis o It became the reference text and teaching tool on those subjects for the next several hundred years on the topic of record keeping and double-entry accounting. o It educated readers about the use of journals and ledgers; accounting for assets, receivables, inventories, liabilities, capital, income and expenses; and keeping a balance sheet and an income statement. History of Accounting 1. Simple accounting is mentioned in the Christian Bible in the book of Mathew in the parable of the Talents. 2. The Quran also mentions simple accounting for trade and credit arrangements. 3. Kautilya’s famous Arthashastra not only relates to Economics and Politics, but also explains the art of account keeping. 4. Luca Pacioli, wrote a book, “Summa de Arithmetica, Geometria, Proportioni et Proportionalita” in 1494. o The Importance of Accounting in Business Business o It is an entity that produce or sell goods and services for a profit. o Its major concern is to earn profit. Non-for-profit Organization o It is a business established for other reasons. o It operates to fulfill a charitable mission or further a social cause. o Common examples of it are Red Cross which is known for its blood donation activities and provides immediate relief and assistance during disasters, and Gawad Kalinga with its mission of ending the poverty of Filipino families. Roles that business plays in our society: o Service provider o Product provider o Job provider o Revenue source for the economy The taxes that these businesses pay to the government are being used to construct public schools, hospitals, roads and bridges which improves the lives of its citizen while creating more job opportunities. If the business system will stop, it will greatly harm the economy like what we are experiencing right now due to the effect of COVID 19 where most of nonessential operations suffered severe losses and others were forced to close. Accounting o It refers to the systematic and detailed recording of financial transactions of a business. o It is called the “language of business”. It is a means of communicating financial information about the business. Roles of accounting in a business o To enable the business maintain an organized financial records and reports. o Financial reports will provide information on: position of the business in terms of its assets, liabilities and capital; performance of the business if earning or losing (revenue and expenses); changes in equity if increasing or decreasing; and it provides the balance of your cash, its sources and uses. o It ensures statutory compliance. o It provides investors, management, and government with quantitative financial information. o It can alert the management if there is something wrong with the business. It is critical to keep the financial records organized and up to date to provide reliable financial information about the business. Forms of Business Organization Sole Proprietorship o It is a business owned by only one person. o It is easy to set-up and is the least costly among all forms of ownership. o The owner faces unlimited liability; meaning, the creditors of the business may go after the personal assets of the owner if the business cannot pay them. o It is usually adopted by small business entities. o Capital: From owner o o o o o o Management: By owner Decision: Quick – Only by owner Life of Business: Limited Extent of Liability: Owner’s liability is unlimited Registration: Department of Trade and Industry (DTI) Partnership o It is a business owned by two or more persons who contribute resources into the entity. o The partners divide the profits of the business among themselves. o In general partnerships, all partners have unlimited liability. o In limited partnerships, creditors cannot go after the personal assets of the limited partners. o Capital: From partners o Management: By managing partners o Decision: By all partners o Life of Business: Limited o Extent of Liability: General Partners – Unlimited o Registration: Securities and Exchange Commission (SEC) Corporation o It is a business organization that has a separate legal personality from its owners. o Ownership in a stock corporation is represented by shares of stock. o The owners (stockholders) enjoy limited liability but have limited involvement in the company's operations. o The board of directors, an elected group from the stockholders, controls the activities of the corporation. o Capital: From public Management: Board of Directors, President/CEO o Decision: Board of Directors, President/CEO o Life of Business: Unlimited o Extent of Liability: Limited – Only up to amount of investment o Registration: Securities and Exchange Commission (SEC) Limited Liability Company (LLCs) o It is a hybrid form of business that have characteristics of both a corporation and a partnership. o It is not incorporated; hence, it is not considered a corporation. But the owners enjoy limited liability like in a corporation. o It may elect to be taxed as a sole proprietorship, a partnership, or a corporation. Cooperative o It is a business organization owned by a group of individuals and is operated for their mutual benefit. o The persons making up the group are called members. o It may be incorporated or unincorporated. o Some examples of it are: water and electricity (utility) cooperatives, cooperative banking, credit unions, and housing cooperatives. Types of Business Operations A business earns profit depending on its type of operation. Service Business o It provides intangible products (products with no physical form). o It offers professional skills, expertise, advice, and other similar products. o Examples of it are: salons, repair shops, schools, banks, accounting firms, and law firms. Merchandising Business o It buys products at wholesale price and sells the same at retail price. o It is known as "buy and sell" business. o It makes profit by selling the products at prices higher than their purchase costs. o It sells a product without changing its form. o Examples are: grocery stores, convenience stores, distributors, and other resellers. Manufacturing Business o It buys products with the intention of using them as materials in making a new product. Thus, there is a transformation of the products purchased. o It combines raw materials, labor, and overhead costs in its production process. The manufactured goods will then be sold to customers. But how are you going to classify a fast food chain such as Jollibee or Mc Donald’s? Since they transform a dressed chicken legs into delicious chicken joy and potatoes to french fries, they are into manufacturing type or processing type of operation. There are several businesses that are engaged in different type of operations. Example is a hotel business that has a restaurant inside the hotel. The hotel's primary business is service for the rooms income, but for the hotel's restaurant it is a merchandising and manufacturing (processing) type of operations. This type of business that is engaged in more than one type of operations is called "hybrid" type of business. The Definition of Accounting, Types and Users of Financial Statements Immersive Reader Accounting o Make possible the periodic matching of cost (efforts) and revenue. o Art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events, which are in part at least of a financial character and interpreting the results thereof. o The purpose of accounting is to provide information which is potentially useful for making economic decisions and which if provided will enhance social welfare. o As the provision of information about the financial position, performance and financial adaptability of an enterprise that is useful to wide range of potential users in making economic decisions. o It comes from the word “account” which is synonymous to a record, narration, or journal. o The Merriam Webster dictionary define the word account as a description of facts, conditions, or events; and to furnish a justifying analysis or explanation. You could relate it to a typical job of an accountant who records the transactions of an entity and prepares its financial reports. But of course, the responsibilities of an accountant are beyond the recordkeeping task, there are enormous value-added function an accountant could offer. o “Accounting is a service activity. Its function is to provide quantitative information, primarily financial in nature, about economic entities that is intended to be useful in making economic decisions, in making reasoned choices among alternative courses of action.” – The American Institute of Certified Public Accountants (AICPA) o It is referred to as “the language of business” as financial information is a means to communicate the financial condition and performance of an entity to its users in making sound decisions. “Accounting is a service activity…” o Similar to other professions, accountants use its technical expertise to serve its clients. o The accountant could act as a bookkeeper who records all the transactions of the company. o He may also serve as an auditor who examines the company’s financial records. o He could also act as a consultant who assist the owners in coming up with important management decisions. “Its function is to provide quantitative information, primarily financial in nature about economic entities…” o The financial reports contain information about economic entities or business in terms of money. o It shows the net worth of the company by detailing out the amount of its resources (e.g. cash, inventories, building, equipment, etc.) and obligations (e.g. salaries payable, utilities payable, loans payable, etc.) at any given point of time and how much did the company earned by summarizing the income and expenditures for a specified period. “that is useful in making economic decisions, in making reasoned choices among alternative courses of action.” o Business owners and/or managers from time to time would need to make a decision about their business. o Should they open up another branch? Is it the right time to increase the selling price? Should they add more employees? These questions shouldn’t be answered through a wild guess. A decision must be based on a complete and relevant data. That is when financial reports will be very useful. Financial Statement o It shows you where a company’s money came from, where it went and where it is now. o It is a report that summarizes important financial information about the business. o It is the end product of the accounting process prepared the company’s management to present the financial performance and position in a o given period (monthly, semiannually or yearly) depending on the company’s practices and reporting period. Usually, companies observe the yearly reporting period. Users of Financial Information Basic Set of Financial Statement Statement of Financial Position (Balance Sheet) o It is a progress report showing a list of assets, liabilities and owner’s net worth. Statement of Comprehensive Income (Income Statement) o It is a performance report of revenues against costs and expenses. o It shows the net income or profit that the owner has generated during a period. Statement of Cash Flows o It is a cash report showing where we got and where we used the money. o Was it used in operation, investing or financing activities? Statement of Changes in Owner’s Equity (Net Worth) o This is a progress report that shows how the capital/ owner’s investment had increased or decreased for a given period as a result of additional investments, profit and any withdrawals the owner have made. Notes to the Financial Statements o They are explanatory notes supplemental to the four basic statements that provides additional information so that the users can understand what information it is trying to convey. Primary or Internal Users o Owner/s – the owners provide capital for the business. Owners are interested in knowing whether their capital is earning or losing. o Management – the management is interested in knowing the position and performance of the business. The financial statements serve as the initial source of information in planning the course of actions by the management. o Employees – the demand for salary increase, benefits, bonus and better working conditions of employees depend upon the profitability of the firm and to its financial position. For this reason, employees are interested in financial statements of the business. Secondary or External Users o Creditors and Financial Institutions – the Creditors are the persons who supply goods on credit, or bankers or lenders of money. The creditors are interested to know the financial soundness of the company before granting credit. o Investors – the prospective investors are interested to see the progress and prosperity of the firm by reviewing the financial statements. This is to safeguard the investment. o Government – the government is interested in the financial statements to know the earnings for the purpose of taxation. o o o o o Customers – in situations wherein customers are dependent on the product of the firm, they become interested in the financial statements. This is to ensure that the customer’s production will not be affected in the event that the firm closed its operations. Vendors and Suppliers - are users of accounting information as they need to decide whether to trade with the business, and in particular whether or not to provide credit terms. They are concerned with the ability of a business to make payment of invoices on the due dates. Employees - are stakeholders in the business and want to know their employer or potential employer is financially stable, and is able to continue to provide remuneration, employment opportunities, and retirement benefits. Competitors - Competitors will make use of publicly available accounting information in order to assess the level of competition they face. Public - The public use corporate financial information, particularly the annual financial statements, to gather information about a business and its activities during the year. Governing Authorities and Regulators Authorities and Standards that Govern the Practice of Accountancy Profession International Standard-Setting Boards o Setting high-quality international standards that o inspire confidence in economies. o The work of the international, independent standard-setting boards supports the global economy and financial markets by producing high-quality, global standards for audit and assurance, professional ethics, public sector financial reporting, and professional skills and competencies. The International Auditing and Assurance Standards Board (IAASB) o It sets high-quality international standards for auditing, assurance, and quality management that strengthen public confidence in the global profession. o Audit and Assurance. International Accounting Education Standards Board (IAESB) o It established standards for professional accountancy education that prescribe technical competence and professional skills, values, ethics, and attitudes. o It was the independent standard-setting body that established the International Education Standards (IES). o Professional skills and competencies. International Education Standards (IES) o These standards detail the principles professional accountancy organizations should follow to build a national accountancy profession that is fully capable of fulfilling the complex demands economies and societies place on it. o They are authoritative and are used by IFAC member bodies when setting education requirements for aspiring professional accountants International Ethics Standards Board for Accountants (IESBA) o It sets high-quality, internationally appropriate ethics standards for professional accountants, including auditor independence requirements. o Professional Ethics. International Public Sector Accounting Standards Board (IPSASB) o It develops standards, guidance, and resources, for use by public sector entities around the world for preparation of general purpose financial statement. o Public Sector Financial Reporting. International Accounting Standards Board (IASB) o It is established by International Financial Reporting Standards (IFRS) Foundation. o It is IFRS Foundation’s standard setting body, that develops a single set of high quality, understandable, enforceable and globally-accepted accounting standards – IFRS Standards – and promotes and facilitates adoption of the standards. o As of April 25, 2018, a total of 166 jurisdictions (nations) worldwide have made a public commitment to support a single set of high quality global accounting standards. o Private Sector Financial Reporting International Financial Reporting Standards (IFRS) Foundation o It is established and headquartered in London. Financial Accounting Standards Board (FASB) o It is established by Financial Accounting Foundation. o It establishes financial accounting and reporting standards for public and private companies and non-for-profit organizations that follow Generally Accepted Accounting Principles (GAAP). o Private Sector Financial Reporting IES 1 o Entry Requirements to Professional Accounting Education Programs IES 2 (Initial Professional Development) o Technical Competence IES 3 (Initial Professional Development) o Professional Skills IES 4 (Initial Professional Development) o Professional Values, Ethics and Attitudes IES 5 (Initial Professional Development) o Practical Experience IES 6 (Initial Professional Development) o Assessment of Professional Competence IES 7 o Continuing Professional Development IES 8 o Professional Competence for Engagement Partners Responsible for Audits of Financial Statements Commission on Higher Education (CHED) o It is a government regulatory unit that sets the minimum requirements for professional accounting education program in the Philippines. o IES 1, 2, 3, 4, 5 (through the Technical Committee on Accounting Education) Professional Regulatory Board of Accountancy (PRBOA) o It is government regulatory unit that supervises the registration, licensure, and practice of accountancy in the Philippines. o IES 1, 6, 7, 8 Philippine Institute of Certified Public Accountants (PICPA) o It is the Accredited Professional Organization (APO) of CPAs in the Philippines. o It is the IFAC Member Body for the Filipino CPAs. o IES 7, 8 Generally Accepted Accounting Principles (GAAP) o They are rules, conventions, procedures and standards that are accepted in a community, thus, generally accepted accounting standards could vary in different locations. o Practically, the rest of the world that had not yet adopted IFRS are still using GAAP, two of which are major economies of the world – U.S.A. and China. Financial Accounting Foundation (FAF) o It is established and headquartered in Norwalk, Connecticut, USA. International Federation of Accountants (IFAC) o It is the global organization for the accountancy profession, comprising more than 180 member and associate organizations in 135 countries and jurisdictions, representing more than 3 million professional accountants. o It is committed to a global standard-setting system that is credible, inclusive, legitimate, and produces international standards that are relevant, innovative, and responsive to meet the challenges of the future. o It facilitates the structures and processes that support the following independent standard-setting boards’ operations: IAASB, IAESB, IESBA, and IPSASB. o It also supports IASB with respect to setting international accounting standards. Philippine Institute of Certified Public Accountants (PICPA) o It is one of the more than 175 member organizations of IFAC, and officially represents the Filipino CPAs to this global organization. Other government regulatory units that affect the work of professional accountants, depending on the financial reporting industry: o Securities and Exchange Commission (SEC) o Bangko Sentral ng Pilipinas (BSP) o Bureau of Internal Revenue (BIR) Minimum Requirements o Curriculum Requirements o Retention policies o Licensure or Certification Exams o Continuing Professional Development requirements Fields of Professional Practice Section 4 of the Philippine Accountancy Act of 2004 enumerate the Scope of Practice of Accountancy, though not really limited to the following: Practice of Public Accountancy o A person, be it his/her individual capacity, is a partner or a staff member in an accounting or auditing firm. o A qualified person to render professional services as a certified public accountant, or offering or rendering, or both, to more than one client on a fee basis or otherwise, services such as: (1) the audit or verification of financial transactions and accounting records; (2) preparation of financial reports to be used by stockholders for publication or credit purposes, or to be filed with a court or government agency, or used for any other purpose; (3) the design, installation, review and revision of accounting systems and controls; (4) preparation and/or review of income tax return when related to accounting and auditing procedures; representing clients before government agencies on tax and other matters related to accounting; (5) and professional assistance in matters relating to accounting procedures and the presentation of financial information. Practice in Commerce and Industry o Persons involved in decision making requiring professional knowledge in the science of accounting, as well as the aspects of finance and taxation. o When he/she represents his/her employer before government agencies on tax and other matters related to accounting. o When such employment or position requires that the holder thereof must be a certified public accountant. Practice in the Government o A person who holds, or is appointed to, a position in an accounting professional group in government or in a governmentowned and/or controlled corporation, including those performing proprietary functions, where decision making required professional knowledge in the science of accounting, or where a civil service eligibility as a certified public accountant is a prerequisite. Practice in Education/Academe o Persons in an educational institution which involve teaching of accounting, auditing, management advisory services, accounting aspect of finance, business law, taxation and other technically related subjects; provided, that the position of either the dean or the department chairman or its equivalent that supervises the Bachelor of Science in Accountancy program of an educational institution is deemed to be in practice of accountancy in the academe/education and therefore must be occupied only by a duly registered CPA. Code of Ethics for Professional Accountants “A distinguishing mark of the accountancy profession is its acceptance of the responsibility to act in the public interest.” International Code of Ethics for Professional Accountants (“Code”) o It sets out fundamental principles of ethics, reflecting the profession’s recognition of its public interest responsibility. Fundamental Principles Integrity o To be straightforward and honest in all professional and business relationships. Objectivity o Not to compromise professional or business judgments because of bias, conflict of interest or undue influence of others. Professional Competence and Due Care o Attain and maintain professional knowledge and skill at the level required to ensure that a client or employing organization receives competent professional service, based on current technical and professional standards and relevant legislation. o Act diligently and in accordance with applicable technical and professional standards. Confidentiality o To respect the confidentiality of information acquired as a result of professional and business relationships. Professional Behavior o To comply with relevant laws and regulations and avoid any conduct that the professional accountant knows or should know might discredit the profession. A professional accountant shall comply with the Code. There might be circumstances where laws or regulations preclude an accountant from complying with certain parts of the Code. In such circumstances, those laws and regulations prevail, and the accountant shall comply with all other parts of the Code. A professional accountant might face a situation in which complying with one fundamental principle conflicts with complying with one or more other fundamental principles. In such a situation, the accountant might consider consulting, on an anonymous basis if necessary, with: (1) others within the firm or employing organization; (2) those charged with governance; (3) a professional body; (4) a regulatory body; (5) legal counsel. However, such consultation does not relieve the accountant from the responsibility to exercise professional judgment to resolve the conflict or, if necessary, and unless prohibited by law or regulation, disassociate from the matter creating the conflict.