solutions-to-mc-problems-froeb-mccann-5th-editionpdf

advertisement

Managerial Economics:

A Problem-Solving Approach

5th Edition

Interactive HW Questions

(solutions to end-of-chapter multiple choice questions)

Table of Contents

Chapter 1 ......................................................................................................................................... 3

Chapter 2 ......................................................................................................................................... 6

Chapter 3 ......................................................................................................................................... 9

Chapter 4 ........................................................................................................................................12

Chapter 5 ........................................................................................................................................15

Chapter 6 ........................................................................................................................................18

Chapter 7 ................................................................................................................................................................ 22

Chapter 8 ................................................................................................................................................................ 25

Chapter 9 ................................................................................................................................................................ 28

Chapter 10.............................................................................................................................................................. 30

Chapter 11 ......................................................................................................................................32

Chapter 12 ...................................................................................................................................... 36

Chapter 14 (and 13)........................................................................................................................38

Chapter 15 ...................................................................................................................................... 41

Chapter 16 ...................................................................................................................................... 44

Chapter 17 ...................................................................................................................................... 47

Chapter 18 ......................................................................................................................................50

Chapter 19.............................................................................................................................................................. 52

Chapter 20.............................................................................................................................................................. 55

Chapter 21.............................................................................................................................................................. 58

Chapter 22.............................................................................................................................................................. 61

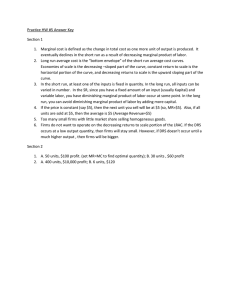

Chapter 1

1.

Why might performance compensation caps be bad?

a. Different pay rates promote dissent. [A compensation cap is a maximum salary limit, it does

not necessarily produce varied pay rates]

b. Compensation caps can discourage employees from being productive after the cap.

[correct; at least with regards to salary, the employee is not rewarded for further

productivity beyond the amount that produces the cap value]

c. Compensation caps can discourage employees from being productive before the cap.

[employees are incentivized to reach the value of the cap, encouraging productivity prior to

its achievement]

d. Both b and c

2.

What is a possible consequence of a performance compensation reward scheme?

a. It creates productive incentives. [As pay is tied directly to performance, such a policy may

motivate workers to improve their performance for the additional compensation]

b. It creates harmful incentives. [Such a policy may create incentives to manipulate the

performance indicators or outputs, or view that performance metric exclusive from the

overall interests of the firm]

c. Both a and b [correct; could produce productive or harmful incentives depending on the

situation and the character of the person being rewarded]

d. Neither a nor b [Performance compensation schemes will produce some kind of incentives]

3.

Which of the following is NOT one of the three problem solving principles laid out in Chapter 1?

a. Under whose jurisdiction is the problem? [correct; This is NOT one of the key problem

solving principles].

b. Who is making the bad decision? [This is one of the key problem solving principles]

c. Does the decision maker have enough information to make a good decision? [This is one of

the key problem solving principles]

d. Does the decision maker have the incentive to make a good decision? [This is one of the key

problem solving principles]

4.

Why might it be bad for hotels to not charge higher prices when rooms are in higher demand?

a. Arbitrageurs might establish a black market by reserving rooms and then selling the

reservations to customers. [This black market allows the arbitrageurs to capture the value of

the increased demand rather than the hotels who are providing the rooms as well as creating

a less reliable system for the consumer]

b. Rooms may be rationed. [If demand increases but prices do not, demand for rooms may

exceed supply, forcing the hotel to ration the rooms and turn customers who would have

been willing to pay higher rates away]

c. Without the profit from these high demand times, hotels would have less of an incentive to

build/expand, making the long run scarcity problem even worse. [Such a policy essentially

creates a performance cap on the hotels, limiting their profitability to the number of rooms

rather than overall demand]

d. All of the above. [correct; all of these are potential negative impacts of hotels not adjusting

prices to accommodate demand]

5.

The rational-actor paradigm assumes the people do NOT

a. Act rationally. [The rational actor paradigm does assume that people act rationally]

b. Use rules of thumb. [correct; the rational actor paradigm assumes people will act

rationally, optimally and self-interestedly. Rules of thumb will only be used if they meet

those three specific parameters]

c. Act optimally. [The rational actor paradigm does assume people will act optimally, selecting

or creating the outcome that provides them with the most benefit]

d. Act self-interestedly. [The rational actor paradigm does assume that people will act in their

own best interest]

6.

The problem-solving principles analyze firm problems,

a. from the organization’s point of view. [correct; considering a problem from the view of

the overall organization will help ensure all elements and impacts are considered.]

b. from the manager’s point of view. [Managers are also employees of the organization,

thinking of a problem from only their perspective may overlook its impact on the company

as a whole]

c. from the worker’s point of view. [Thinking about a problem only from the employee’s point

of view risks missing the fundamental problem of goal alignment with the overall

organization]

d. Both A and B [Think about problems from the perspective of the overall organization, not its

employees]

7.

Why might welfare for low income households reduce the propensity to work?

a. It will not. [It can if working can only provide similar benefits to those that can be received

from welfare without working]

b. It reduces the incentive to work. [correct; those receiving welfare may have less incentive

to work if the benefits of working are similar to or worse than those that are received

without it. Additionally, welfare may reduce the value of working for higher income workers

who have to support the system, also reducing their incentives]

c. It is unfair. [Perception of fairness alone will not alter the propensity to work unless it also

impacts the value of that work for the individual, which would impact his overall incentives]

d. It encourages jealousy. [Jealousy itself will not alter the propensity to work unless it also

impacts the perceived value of that work, which changes the incentives]

8.

Why might a “bonus cap” for executives be a bad policy for the company?

a. It isn’t. Executives shouldn’t make more than a certain amount. [Just like other types of

employees, setting a maximum value for executives eliminates the ability to separate,

reward and motivate them based on their performance]

b. It would sew discontent. [Even if discontented, the rational actor paradigm indicates

executives would still perform to reach the cap value in order to maximize their bonus]

c. It would encourage laziness after the executives reached the cap. [correct; limiting the

bonus may reduce the incentive of executives to continue improving or performing once it is

achieved]

d. The cap could be set too high, so execs may work too hard and not reach it. [This is a

problem not with the cap itself, but with the level, which can be adjusted as needed]

9.

What might happen if a car dealership is awarded a bonus by the manufacturer for selling a certain

number of its cars monthly, but the dealership is just short of that quota near the end of the month?

a. It may sell the remaining cars at huge discounts to hit the quota. [correct; the loss of

income from the reduced rate will be offset by the manufacturer’s bonus]

b. It creates an incentive to sell cars from different manufacturers. [the dealership is more

inclined to sell cars from the manufacturer providing the bonus]

c. It would ruin the relationship between dealer and manufacturer. [The dealer is working to

meet the requirements of the manufacturer to achieve the bonus]

10. Why might a supermarket advertise low prices on certain high profile items and sell them at a loss?

a. It is a way for companies to be charitable. [The rational actor paradigm tells us the firm will

act in its own self-interest]

b. The store will sell other groceries to the same customers, often at a markup. [correct;

by using the discounted items to bring consumers into the stores, the supermarket can profit

by increasing the prices on the other items they will purchase while they are there.]

c. They would not. [Actually, they do quite often. Can you think of why this may be?]

d. This reduces the incentives of trade. [Trade incentives do not apply in this case]

Chapter 2

Multiple Choice Solutions:

1.

An individual’s value for a good or service is

a. The amount of money he or she used to pay for a good. [Past payments do not necessarily

indicate the current value of a good or service to an individual]

b. The amount of money he or she is willing to pay for it. [correct; to “value” a good means

that you want it and can pay for it]

c. The amount of money he or she has to spend on goods. [Total individual wealth does not

reflect the value of a particular good or service]

d. None of the above [To “value” a good means that you want it and can pay for it]

2.

The biggest advantage of capitalism is

a. generates wealth with the help of government intervention [Not all government intervention

generates wealth, often it does the opposite. Rather, governments play a critical role in

facilitating wealth generating transactions, particularly by enforcing property rights and

contracts.]

b. that prices assists in moving assets from high valued to low value uses [Wealth is created

when assets move from lower to higher valued uses]

c. it forces involuntary exchanges [Voluntary transactions create wealth]

d. it creates wealth by letting a person follow his or her own self-interest [correct; a

buyer willingly buys if the price is above her value, and a seller sells when the price is above

her value, otherwise they would not transact]

3.

Wealth creating transactions are more likely to occur

a. with private property rights [private property rights facilitate voluntary transactions]

b. with contract enforcement [contract enforcement helps facilitate voluntary transactions]

c. with black markets [black markets are often created from a wealth-generating arbitrage

opportunity]

d. All of the above [correct; By making sure that buyers and sellers can keep the gains of

trade, legal mechanisms such as private property and contract rights that facilitate voluntary

transactions will help generate wealth; black markets also create wealth from seizing

arbitrage opportunities that exist from inefficiencies in the market]

4.

Government regulation

a. provides incentives to conduct business in an illegal black market [correct;

government regulation that impedes the movement of assets to higher valued uses destroys

wealth. Black markets arise in part because of the arbitrage opportunities created in these

situations]

b. plays no role in generating wealth [governments play a critical role in the wealth creating

process by enforcing property rights and contracts]

c. is the best way to eliminate poverty [There are other opportunities beyond government

regulation to address poverty, especially as often some regulations ultimately result in

wealth destroying transactions]

d. does not enforce property rights [One of governments most important roles is the

enforcement of private property rights]

5.

Which of the following are examples of a price floor?

a. Minimum wages [correct; by outlawing wages below a certain price, minimum wages are

an example of a price floor]

b. Rent controls in New York [this is an example of a price ceiling, in which the price of rent

cannot go above a specified value]

c. Both a and b [Of the two options, one is indeed an example of a price floor, while the other is

a price ceiling]

d. None of the above. [At least one of the answers above is an example of a price floor, which is

defined as a regulation that outlaws trade at prices below the specified “floor” value]

6.

A price ceiling

a. Is a government-set price above market equilibrium price. [A price ceiling is a regulation

that outlaws trade above a specified price; it does not have to be above market equilibrium]

b. Is the equivalent of an implicit tax on producers and an implicit subsidy to consumers.

[correct; Price ceilings prevent producers from selling at a higher price to consumers who

would be willing to pay more, while consumers have the opportunity to purchase something

they may not have been able to otherwise]

c. Will create a surplus. [Likely, both the consumer (buyer) and producer (seller) will value the

good at or above the specified ceiling. If the producer is forced to sell, any surplus for the

consumer is a loss for the producer, so no net surplus is created from the transaction]

d. Causes an increase in consumer and producer surplus. [Both the consumer (buyer) and

producer [seller] likely value the item at or above the specified ceiling, resulting in a benefit

for the consumer but a loss of potential wealth for the producers]

**NOTE of post-production change: the phrasing of answer a. should be changed to “is a government-set

price above market equilibrium price.”

7.

Taxes

a.

impede the movement of assets to higher valued uses. [This is the result of anything that

deters a wealth creating transaction]

b. reduce incentives to work. [By not allowing people to capture the full value of their labor and

production, taxes reduce the incentive to work]

c. decrease the number of wealth-creating transactions. [If a tax is larger than the total surplus

created by a transaction, the transaction will not take place]

d. All of the above. [correct; when taxes are larger than the surplus of a transaction, that

transaction will not take place, thus deterring a wealth creating transaction. Likewise, by not

allowing people to keep the gains from their own trade, taxes can diminish the incentive to

work].

8.

A consumer values a car at $30,000 and a producer values the same car at $20,000. If the transaction

is completed at $24,000, the transaction will generate

a. no surplus [A surplus is created from this transaction]

b. $4,000 worth of seller surplus and unknown amount of buyer surplus [Seller surplus is

$4000, (Final price less seller value); Similarly, buyer surplus can be calculated by looking at

the difference between the buyer value and the final price.

c. $6,000 worth of buyer surplus and $4,000 of seller surplus [correct; Buyer surplus is

calculated by looking at the difference between the buyer value and the final price ($30,000-

d.

9.

$24,000=$6,000), while the seller surplus is calculated by looking at the difference between

the final price and the seller’s value ($24,000-$20,000=$4,000)]

$6,000 worth of buyer surplus and unknown amount of seller surplus. [Buyer surplus is

$6000, (Buyer value less final price); similarly, seller surplus can be calculated by looking at

the difference between the final price and the seller value]

A consumer values a car at $525,000 and a producer values the same car at $485,000. If sales tax is

8% and is levied on the seller, then the seller’s bottom line price is (rounded to the nearest thousand)

a. $527,000 (correct; At a price of $527,000, the seller will receive $485,760 ($528,000*0.92)

which is above his bottom line (For the exact value, look at $485,000/0.92 = $527,173.93. As

the seller requires a number at or above this value, $528,000 is the best response)]

b. $524,000 [at a price of $524,000, the seller will only receive $482,080 ($524,000*0.92)

which is below his bottom line]

c. $525,000 [at a price of $525,000, the seller will only receive $483,000 ($525,000*0.92)

which is below his bottom line]

d. $500,000 [at a price of $500,000, the seller will only receive $460,000 ($500,000*0.92)

which is below his bottom line]

10. Efficiency implies opportunity

a. always [In an efficient market, all assets are already employed in their highest valued uses]

b. never [correct; by definition, wealth is generated from inefficiencies in the market, which

allow for assets to be moved from lower to high valued uses]

c. only if accompanied by secure property rights [Secure property rights assist in wealth

generating transactions, which occur from the movement of assets from lower to higher

valued uses]

d. None of the above [It is one of the above]

Chapter 3

Multiple Choice Solutions:

1.

A business owner makes 1000 items a day. Each day he or she contributes 8 hours to produce those

items. If hired, elsewhere he/she could have earned $250 an hour. The item sells for $15 each.

Production does not stop during weekends. If the explicit costs total $150,000 for 30 days, the firm’s

accounting profit for the month equals:

a. $300,000 [correct; Revenue equals 1000 items per day * $15/item*30days = $450,000.

Explicit costs are given as $150,000. Therefore, accounting profit = $450,000-$150,000 =

$300,000]

b. $60,000 [This number represents the opportunity cost of his labor; $250/hr*8hrs/day*30

days = $60,000]

c. $450,000 [This number represents the total revenue; 1000 items per day * $15/item*30days

= $450,000.]

d. $240,000 [For accounting profit, opportunity costs are not considered]

2.

A business owner makes 1000 items a day. Each day he/she contributes 8 hours to produce those

items. If hired, elsewhere he/she could have earned $250 an hour. The item sells for $15 each.

Production does not stop during weekends. If the explicit costs total $150,000 for 30 days, the

economic profit for the month equals:

a. $300,000 [This number represents the accounting profit. Revenue equals 1000 items per

day * $15/item*30days = $450,000. Explicit costs are given as $150,000. Therefore,

accounting profit = $450,000-$150,000 = $300,000]

b. $60,000 [This number represents the opportunity cost of his labor; $250/hr*8hrs/day*30

days = $60,000]

c. $450,000 [This number represents the total revenue; 1000 items per day * $15/item*30days

= $450,000.]

d. $240,000 [correct; When calculating economic profit, opportunity costs are considered.

Total Revenue is $450,000 (1000 item/day*$15/item*30days), Explicit costs are given at

$150,000 and the opportunity cost of labor is $60,000 ($250.hr*8hrs/day*30days).

Therefore, economic profit is $450,000-$150,000-$60,000 = $240,000]

3.

If a firm is earning negative economic profits, it implies

a. That the firm’s accounting profits are zero. [Not necessarily, it is impossible to determine the

relationship between economic and accounting profit without information on the economic

costs involved].

b. That the firm’s accounting profits are positive. [Not necessarily, it is impossible to determine

the relationship between economic and accounting profit without information on the

economic costs involved].

c. That the firm’s accounting profits are negative. [Not necessarily, it is impossible to

determine the relationship between economic and accounting profit without information on

the economic costs involved].

d. More information is needed to conclude about accounting profits [correct; it is

impossible to determine the relationship between economic and accounting profit without

information on the economic costs involved]

4.

Opportunity costs arise due to

a. Resource scarcity [correct; without scarce resources (time, labor, money, etc), the pursuit

of another alternative does not require one to give up anything in return.

b. Interest rates [interest is an economic cost that reflects what creditors charge for use of their

capital]

c. Limited wants [Limited wants would not generate opportunity costs]

d. Unlimited scarcity [Unlimited scarcity does not generate opportunity costs]

5.

After graduating from college, Jim had three choices, listed in order of preference: (1) Move to Florida

from Philadelphia, (2) work in a car dealership in Philadelphia, or (3) play soccer for a minor league

in Philadelphia. His opportunity cost of moving to Florida includes

a. The benefits he could have received from playing soccer [Opportunity cost represents the

value of only the best foregone alternative]

b. The income he could have earned at the car dealership [correct; opportunity cost

reflects the value of the best foregone alternative, in this case the car dealership salary]

c. Both a and b. [Opportunity costs represent the value of only the best foregone alternative]

d. Cannot be determined from the given information. [Opportunity costs reflect the value of the

best foregone alternative, what is that for Jim in this case?]

6.

Economic Value Added helps firms avoid the hidden-cost fallacy

a. by ignoring the opportunity costs of using capital [On the contrary, EVA makes the hidden

cost of equity visible to the firm]

b. by differentiating between sunk and fixed costs [EVA may help managers distinguish

between the two, but it does so by looking at the cost of capital associated with each]

c. by taking all capital costs into account, including the cost of equity [correct; By taking

all of the capital costs into account such as the cost of equity, firms can better gauge their

economic profit and the opportunity costs associated with some of their current assets]

d. None of the above. [It is one of the above]

7.

The fixed-cost fallacy occurs when

a. A firm considers irrelevant costs [The sunk or fixed cost fallacy occurs when you make

decisions using irrelevant costs or benefits. In other words, you consider costs and benefits

that do not vary with the consequences of your decision]

b. A firm ignores relevant costs [This is the definition of the hidden cost fallacy]

c. A firm considers overhead or depreciation costs to make short-run decisions [Overhead and

depreciation are example of irrelevant or suck costs that are not impacted by the outcome of

a short term decision]

d. Both a and c. [correct; The sunk or fixed cost fallacy occurs when costs (such as

depreciation and overhead) are considered even when they do not vary with the

consequences of the decision.

8.

Mr. D's Barbeque of Pickwick, TN, produces 10,000 dry-rubbed rib slabs per year. Annually Mr. D's

fixed costs are $50,000. The average variable cost per slab is a constant $2. The average total cost per

slab then is

a. $7. [correct; Total fixed costs are $5/lab ($50,000Total Fixed Cost/10,000 units), and

average variable cost is given as $2/slab. Therefore average total cost (Fixed + Variable) per

unit equal $5+$2=$7]

b.

c.

d.

9.

$2. [This represents the average variable cost per unit. Average total cost requires

consideration of the fixed component]

$5. [This represents the average fixed cost per unit, calculated as $50,000 Total Fixed

cost/10,000 units]

Iimpossible to determine. [Average total cost per unit can be determined by adding the

average variable and fixed costs per unit of the rib slabs]

All the following are examples of variable costs, except

a. Labor costs [varies by the number of employees as well as their hours worked, which

correlate with the total amount of output produced]

b. Cost of raw materials [Cost of raw materials with the total amount of output produced]

c. Accounting fees [correct; accounting fees are paid regardless of total output. They do not

vary with the amount that is produced]

d. Electricity costs [Electricity, like other utilities varies by usage]

10. The U.S. Government bought 112,000 acres of land in southeastern Colorado in 1968 for

$17,500,000. The cost of using this land today exclusively for the reintroduction of the black-tailed

prairie dog

a. is zero, because they already own the land. [The cost of the land includes the cost of the best

foregone option]

b. is zero, because the land represents a sunk cost. [A cost is sunk when it does not vary with

the outcome of the decision. In this case, there may be an opportunity cost associated with

using the land for prairie dogs that should be considered]

c. is equal to the market value of the land. [correct; the cost of a decision includes the cost

of the best foregone option. In this case, this is the amount the government could sell the

land for if they did not use if for prairie dog introduction]

d. is equal to the total dollar value the land would yield if used for farming and ranching. [This

may be hard to determine, and also requires additional resources and labor. In this case,

there may be a better alternative]

e. depends on the value to society of black-tailed prairie dogs. [Regardless of the prairie dog

value, the cost would include that of the best foregone option and should still be considered.

If that cost is deemed less than the value of the prairie dogs, the project will move forward]

Chapter 4

Multiple Choice Solutions:

1.

When economists speak of “marginal”, they mean

a. opportunity [The opportunity cost of an alternative is the profit you give up to pursue it]

b. scarcity [Scarcity refers to the limited availability of resources]

c. incremental [correct; marginal refers to additional cost or benefit created from producing

each additional unit]

d. unimportant [In economic terms, marginal does not imply unimportant. On the contrary,

marginal analysis is a critical component of a wide variety of economic decisions]

2.

Managers undertake an investment only if

a. Marginal benefits of the investment are greater than zero [when considering a decision, both

the marginal benefits and marginal costs should be compared]

b. Marginal costs of the investment are greater than marginal benefits of the investment [if the

marginal costs are greater than the marginal benefits of a decision, management will not

make the investment]

c. Marginal benefits are greater than marginal costs [correct; managers should undertake

an investment when the marginal benefits are greater than the marginal costs]

d. Investment decisions do not depend on marginal analysis [marginal analysis is critical in

investment decisions]

3.

A firm produces 500 units per week. It hires 20 full-time workers (40 hours/week) at an hourly wage

of $15. Raw materials are ordered weekly and they costs $10 for every unit produced. The weekly

cost of the rent payment for the factory is $2,250. How do the overall costs breakdown?

a. Total variable cost is $17,000; total fixed cost is $2,250; total cost is $19,250 [correct;

both the $12,000 of labor costs (20 workers*40hrs/week*$15/hr) and the $5000 raw

materials cost ($10/unit*500 units) are considered variable expenses. Factory rent is

considered a fixed cost]

b. Total variable cost is $12,000; total fixed cost is $7,250; total cost is $19,250 [Both labor and

raw materials are considered variable costs as they both change as output levels change]

c. Total variable cost is $5,000; total fixed cost is $14,250; total cost is $19.250 [Both labor and

raw materials are considered variable costs as they change as output levels change]

d. Total variable cost is $5,000; total fixed cost is $2,250; total cost is $7,250 [Both raw

materials and labor should be considered as variable costs, which when added to the fixed

rental cost will equal the total costs of production]

4.

Total costs increase from $1500 to $1800 when a firm increases output from 40 to 50 units. Which of

the following are true?

a. FC = $100 [We know that Total cost = FC + VC(Quantity). This means 1500 = FC+VC(40) and

1800=FC+VC(50). Using this information, we can solve for FC]

b. FC = $200 [We know that Total cost = FC + VC(Quantity). This means 1500 = FC+VC(40) and

1800=FC+VC(50). Using this information, we can solve for FC]

c. FC = $300 [We know that Total cost = FC + VC(Quantity). This means 1500 = FC+VC(40) and

1800=FC+VC(50). Using this information, we can solve for FC. For example, using the first

equation we see VC(40)=1500-FC, hence VC=(1500-FC)/40. Plugging this value for VC into

1800=FC+VC(50) will give you 1800=FC+50((1500-FC)/40), which lets us find FC=300]

d.

FC = $400 [We know that Total cost = FC + VC(Quantity). This means 1500 = FC+VC(40) and

1800=FC+VC(50). Using this information, we can solve for FC]

5.

A manager of a clothing firm is deciding whether to add another factory in addition to one already in

production. The manager would compare

a. the total benefits gained from the two factories to the total costs of running the two factories.

[By combining the total costs and benefits of the two factories, the manager would not be

able to determine the contribution of the second factory on its own]

b. the incremental benefit expected from the second factory to the total costs of running the

two factories. [The additional benefit of the second factory should only be compared to the

additional costs of that factory, as the costs from the first factory will be incurred regardless]

c. the incremental benefit expected from the second factory to the cost of the second

factory [correct; the manager will decide to add another factory when the incremental

benefits of that factory are greater than its incremental costs]

d. the total benefits gained from the two factories to the incremental costs of running the two

factories. [The incremental costs of having a second factory should be compared only to its

incremental benefit, as the benefits of the first factory will be produced regardless]

6.

A firm is thinking of hiring an additional worker to their organization who can increase total

productivity by 100 units a week. The cost of hiring him is $1,500 per week. If the price of each unit is

$12,

a. the MR of hiring the worker is $1,500 [The MR of hiring the worker is $1200 (100 additional

units produced*$12/unit)]

b. The MC of hiring the worker is $1,200 [The MC of hiring the worker is his salary of $1500]

c. The firm should not hire the worker since MB < MC [correct; The MR of hiring the

worker is $1200 (100 additional units*$12/unit), while his MC is his salary of $1500,

indicating the company will lose $300/week by hiring the additional worker]

d. All the above [Remember the marginal benefit is the additional revenue generated by the

worker, while the marginal costs will be any additional costs that occur from hiring him]

7.

A retailer has to pay $9 per hour to hire 13 workers. If the retailer only needs to hire twelve workers,

a wage rate of $7 per hour is sufficient. What is the marginal cost of the 13th worker?

a. $117. [This is the total cost of having 13 workers ($9*13)]

b. $9. [This represents the wage of the additional worker, but does not take into consideration

the additional costs of the wage increase for the rest of the employees associated with his

hiring]

c. $33. [correct; The total cost of having twelve workers is $84 (12workers*$7hr) while the

addition of the thirteenth worker brings the total cost up to $117 (13 workers*$9/hr).

Therefore, the marginal cost of the 13th worker is $33 ($117-$84)]

d. $84. [This is the total cost of having 12 workers (12*$7/hr)]

8.

If a firm’s average cost is rising then

a. marginal cost is less than average cost. [If marginal cost is less that average cost, then its

average cost will fall with each additional unit]

b. marginal cost is rising. [Average cost may still be falling even as marginal cost rises, provided

the marginal cost still falls below the average]

c.

d.

9.

marginal cost is greater than average cost [correct; when the marginal cost is above the

average, then the average will rise with output]

the firm is making an economic profit. [Average cost trends cannot be determined by looking

at average costs exclusively]

After the first week of his MBA Managerial Economics class, one of your pharmaceutical sales

representatives accuses you of committing the sunk cost fallacy by refusing to allow him to reduce

price to make what he considers to be a really tough sale. Which of the following suggest the sales

representative may be right?

a. Most of the costs of drug development are sunk, not fixed. [correct; in this case, he may

be correct. The costs of drug development have already been incurred, cannot be recovered,

and will not change with the outcome of the sale]

b. Sales representatives are paid a sales commission on revenue, so they don’t care about the

costs of drug development. [The fact that representatives are paid a commission on revenue

does not have anything to do with whether you are committing the sunk cost fallacy]

c. Sales representatives don’t worry that a low price today may make it more difficult for the

company’s other sales representatives to charge higher prices to their customers tomorrow.

[If true, this would be an example of a hidden cost]

d. Sales representatives think only about one thing, sales. [The fact that representatives think

only of sales does not have anything to do with whether you are committing the sunk cost

fallacy]

10. A company is producing 15,000 units. At this output level, marginal revenue is $22 and the marginal

cost is $18. The firm sells each unit for $48 and average total cost is $40. What can we conclude from

this information?

a. The company is making a loss. [The company is making a profit of $120000. Total revenues

equal $720000 ($48*15000units) while total costs are $600000 ($40*15000units)]

b. The company needs to cut production. [You need to cut production when MC>MR]

c. The company needs to increase production. [correct; When MR>MC, you need to sell

more. In this case MR=$22 is greater than MC=$18, therefore they should increase

production]

d. Not enough information is provided. [There is enough information provided to answer this

question]

Chapter 5

Multiple Choice Solutions

1.

Which of the following will increase the break-even quantity?

a. A decrease in overall fixed costs [Breakeven is calculated as Q=F/(P-MC), Therefore a

decrease in overall fixed costs would decrease the numerator and hence the Breakeven

Quantity]

b. A decrease in the marginal costs [Breakeven is calculated as Q = F/(P-MC). Therefore a

decrease in the marginal costs will increase the denominator, and subsequently decreases

the Breakeven Quantity]

c. A decrease in the price level [correct; Breakeven is calculated as Q= F/(P-MC). Therefore,

a decrease in the price level will decrease the denominator, which will increase the

Breakeven quantity]

d. An increase in price level [Breakeven is calculated as Q= F/(P-MC). Therefore, an increase in

the price level will increase the denominator, which will decrease the Breakeven Quantity.

2.

The higher the discount rates

a. the more value individuals place on future dollars [a higher discount rate means future

dollars are worth less relative to current dollars (present value of future dollars is lower)]

b. the more value individuals place on current dollars [correct; a higher discount rate

means dollars today are value comparatively more relative to future dollars]

c. the more investments will take place [the higher discount rate means the future value of

current dollars is lower, which may lead to an decrease in investment]

d. Does not affect the investment strategy [interest rates are an important consideration of any

investment strategy in terms of its impact on both the investing and borrowing rates]

3.

Assume a firm has the following cost and revenue characteristics at its current level of output:

price=$10.00, average variable cost=$8.00 and average fixed cost =$4.00. This firm is

a. incurring a loss of $2.00 per unit and should shut down. [In the short run, only variable costs

are avoidable and should be considered in a shut down decision]

b. realizing only a normal profit. [In this case, the firm is not making a profit]

c. realizing an economic profit of $2.00 per unit. [In this case, the firm is not making a profit]

d. incurring a loss per unit of $2.00 but should continue to operate in the short run.

[correct; In the short run, only variable costs are avoidable and should be considered in a

shutdown decision. As the current price ($10) is still higher than the variable costs ($8), the

company should continue to operate in the short run until the fixed costs become avoidable]

4.

Sarah’s Machinery Company is deciding to dump their current technology A for a new technology B

with smaller fixed costs but bigger marginal costs. The current technology has fixed costs of $500 and

marginal costs of $50 whereas the new technology has fixed costs of $250 and marginal costs of

$100. At what quantity is Sarah Machinery indifferent between two technologies?

a. 5 [correct; Total costs can be calculated as C=FC+VC(Q). Technology A has total costs of

C=500+50(Q), while Technology B has C=250+100(Q). Sarah is indifferent at the quantity at

which these two costs are the same. Therefore, setting these equations equal to each other

gives us 500+50(Q) = 250 +100(Q), which allows us to solve for Q = 5]

b. 6 [Total costs can be calculated as C=FC+VC(Q). Sarah will be indifferent between the two

technologies at the quantity where these two costs are the same]

c.

d.

7 [Total costs can be calculated as C=FC+VC(Q). Sarah will be indifferent between the two

technologies at the quantity where these two costs are the same]

8 [Total costs can be calculated as C=FC+VC(Q). Sarah will be indifferent between the two

technologies at the quantity where these two costs are the same]

5.

What is the net present value of a project that requires a $100 investment today and returns $50 at

the end of the first year and $80 at the end of the second year? Assume a discount rate of 10%.

a. $10.52 [To find Net Present Value, discount the future cash flows by the discount rate raised

to the period in which it was received (for example, year one means k=1, etc) and then

subtract the initial investment from the sum of those cash flows]

b. $11.57 [correct; Net present value is calculated by discounting the future cash flows from

the period they were received and subtracting the initial investment from the sum of those

cash flows. In this case, (50/1.1)+(80/1.12)=111.57. $111.57-$100 initial investment gives a

NPV of $11.57]

c. $18.18 [Remember that the cash inflows need to be discounted back to present value from

the time period in which they occur (50 at the end of year 1, 80 at the end of year 2)]

d. $30.00 [Don’t forget about the time value of money. To determine the net present value, the

future cash flows will need to be discounted and the initial investment will be subtracted

from the sum of those values]

6.

You expect to sell 500 cell phones a month, which have a marginal cost of $50. If your fixed costs are

$5,000 per month, what is the break-even price?

a. $10 [Breakeven Q= FC/(P-MC). This means (P-MC)Q=FC, so P-MC= (FC/Q) and finally P=

(FC/Q) – MC]

b. $50 [Breakeven Q= FC/(P-MC). This means (P-MC)Q=FC, so P-MC= (FC/Q) and finally P=

(FC/Q) – MC]

c. $60 [Breakeven Q= FC/(P-MC). This means (P-MC)Q=FC, so P-MC= (FC/Q) and finally P=

(FC/Q) – MC. This gives us P= (5000/500)+50 = 10+50 = $60]

d. $100[Breakeven Q= FC/(P-MC). This means (P-MC)Q=FC, so P-MC= (FC/Q) and finally P=

(FC/Q) – MC]

7.

You are considering opening a new business to sell dartboards. You estimate that your

manufacturing equipment will cost $100,000, facility updates will cost $250,000, and on average it

will cost you $80 (in labor and material) to produce a board. If you can sell dart boards for $100

each, what is your break-even quantity?

a. 1,000 [Breakeven Q=FC/(P-MC). In this case, the Fixed costs include both the equipment and

the updates, the price is given at $100, and the MC equals the average cost per board]

b. 3,500 [Breakeven Q= FC/(P-MC). Don’t forget to consider the marginal costs!]

c. 4,375 [Breakeven Q= FC/(P-MC). Don’t forget to consider the price!]

d. 17,500 [correct; Breakeven Q = FC/(P-MC). In this case, fixed costs are $350,000 ($100,000

equipment + $250,000 updates), the Price is given as $100 and the Marginal cost is the $80

cost per additional board. Putting these in the formula, we see that 350,000/(100-80) =

17,500]

8.

Which of the following is NOT true if a firm shuts down and produces zero output in the short run?

a. Variable costs will be zero. [This is true; variable costs relate directly to the amount of

output. With an output of zero, variable costs will also be zero]

b.

c.

d.

9.

Losses will be incurred. [This is true. Only variable costs are avoidable in the short run,

therefore the fixed costs will still be incurred even without any revenue produced which will

result in losses for the firm]

Fixed costs will be greater than zero. [This is true; only variable costs are avoidable in the

short run, which means the fixed costs will still be incurred]

Fixed costs will be less than zero. [correct; this is not true; fixed costs cannot be less than

zero]

What are some of the solutions for a hold-up problem?

a. Mergers [Mergers will help a hold-up problem by aligning the incentives of the two

organizations into one]

b. Contracts [When hold-up is anticipated, contracts can protect the potential victim]

c. Exchange of ‘hostages’ [The use of ‘hostages’ helps ensure both parties make appropriate

relationship specific investments, and provides either collateral or a means of escaping a

hold up situation]

d. All of the above [correct; all of these are potential solutions to hold up]

10. Which of the following is classified as a sunk cost?

a. Cost of the next best alternative [this is the definition of an opportunity cost]

b. Additional cost of producing an additional unit [this is the definition of a marginal cost]

c. Research costs to determine the implementation of a technology [correct; research is

often an example of a sunk cost as it is incurred before production and sale and cannot be

recovered regardless of what happens with the final product]

d. Total cost of producing a product [Production costs are more than likely not sunk, as they

tend to be impacted by output decisions]

Chapter 6

Multiple Choice Questions

1.

Jim has estimated elasticity of demand for gasoline to be -0.7 in the short-run and -1.8 in the long run.

A decrease in taxes on gasoline would:

a. lower tax revenue in both the short and long run. [Demand is inelastic in the short run, but

elastic in the long run, indicating different effects in the short and long run from the price

reduction that results from lower taxes]

b. raise tax revenue in both the short and long run. [Demand is inelastic in the short run, but

elastic in the long run, indicating different effects in the short and long run from the price

reduction that results from lower taxes]

c. raise tax revenue in the short run but lower tax revenue in the long run. [Inelastic demand in

the short run means people initially will not change their consumption habits, which will

lower tax run. What are the long term effects?]

d. lower tax revenue in the short run but raise tax revenue in the long run. [correct;

demand is inelastic in the short run, which means that initially the decrease in taxes will not

alter people’s demand or consumption for gas, which will result in a decrease in the potential

tax revenue as there is the same level of consumption at a lower price. However, in the long

tax revenue will increase as the demand for gasoline becomes elastic, and the consumption

of gasoline rises]

**NOTE of post-production change: the word “tax” should be removed from each of the multiplechoice answers

a.

lower revenue in both the short and long run. [Demand is inelastic in the short run, but

elastic in the long run, indicating different effects in the short and long run from the price

reduction that results from lower taxes]

b. raise revenue in both the short and long run. [Demand is inelastic in the short run, but elastic

in the long run, indicating different effects in the short and long run from the price reduction

that results from lower taxes]

c. raise revenue in the short run but lower revenue in the long run. [Inelastic demand in the

short run means people initially will not change their consumption habits much, so revenue

will decrease. What are the long term effects?]

d. lower revenue in the short run but raise revenue in the long run. [correct; demand is

inelastic in the short run, meaning a price decrease will decrease revenue. However, in the

long revenue, demand is elastic so revenue will increase due to the price decrease]

2.

Which one of the following is true?

a. Nike has a more inelastic demand curve than shoes [False; Demand for an individual brand is

more elastic than industry aggregate demand]

b. The demand curve for gas is more elastic in the short run than in the long run. [False; In the

long run, demand curves become more elastic]

c. Cigarettes have a more elastic demands than televisions [False; As price increases, demand

becomes more elastic].

d. Salt has a more inelastic demand than meat [correct; This is true, not only is salt less

expensive than meat (as price increases, price becomes more elastic), but salt also has many

complements (it is a staple in most households with every meal), which would indicate a less

elastic demand than meat]

3.

Jim recently graduated from college. His income increased tremendously from earning $5000 a year

to $60,000 a year. Jim decided that instead of renting he will buy a house. This implies that

a. houses are normal goods for Jim [correct; for normal goods, demand increases as income

increases]

b. houses are inferior goods for Jim [for inferior goods, demand decreases as income increases]

c. renting and owning are complementary for Jim [Jim’s decision to purchase a house was not

reflective of a change in rental rates. If anything, renting and owning are substitutes for one

another]

d. need information on the price of houses. [Not necessarily, Jim’s behavior and purchasing

decision here is more informative than the actual housing prices]

4.

Which of the following goods have a negative income elasticity of demand?

a. Cars [cars are a normal good; typically demand for cars increases with income]

b. Items from Dollar stores [correct; Dollar store items are typically considered inferior

goods, hence their demand will decrease as the income of the user increases]

c. Shoes [typically, shoes are considered a normal good, with demand increasing with the

income of the purchaser]

d. Bread [Bread, like most food is considered a normal good]

5.

An economist estimated the cross-price elasticity for peanut butter and jelly to be +1.5. Based on this

information, we know the goods are

a. inferior goods. [Cross price elasticity measures the change in the demand of one good with

regard to the price of another in order to determine complements and substitutes. It does

not reflect if a good is normal or inferior]

b. complements. [Complements have negative cross price elasticity]

c. inelastic. [With a cross price elasticity of 1.5>1, this relationship is elastic]

d. substitutes. [correct; Positive cross price elasticity means that Good A (Peanut Butter) is a

substitute for Good B (Jelly)]

6.

Christine has purchased five bananas and is considering the purchase of a sixth. It is likely she will

purchase the sixth banana if

a. the marginal value she gets from the sixth banana is lower than its price. [Christine will not

purchase an additional banana if the marginal value she receives is lower than her marginal

cost (the price of the additional banana)]

b. the marginal benefit of the sixth banana exceeds its price. [correct; Christine will only

purchase the banana when the marginal benefit she receives is greater than the marginal

cost (or price) of the additional banana]

c. the average value of the sixth bananas exceeds the price. [The marginal benefit, not the

average value/benefit of the sixth banana is what is important to consider for this decision]

d. the total personal value of six bananas exceeds the total expenditure to purchase six

bananas. [Total values should not impact the decision to purchase an additional banana.

Rather, the marginal benefit of the sixth banana relative to its cost should be considered]

7.

Buyers consider Marlboro cigarettes and Budweiser beer to be complements. If Marlboro just

increased its prices, what would you expect to occur in the Budweiser market?

a.

b.

c.

d.

Demand would rise, and Budweiser would reduce price. [If two goods are complements, an

increase in the price of one results in a decrease in demand for the other]

Demand would fall, and Budweiser would reduce price. [correct; when two goods are

complements, an increase in the price of one results in a decrease in the demand for the

other. To account for this decrease in demand, Budweiser would ultimately lower its prices

as well]

Demand would fall, and Budweiser would increase price. [As complements, demand for

Budweiser would fall as a result of the increase in Marlboro prices. An increase in prices

would only further decrease demand]

Demand would rise, and Budweiser would increase supply. [If two goods are complements,

and increase in the price of one results in a decrease in the demand for the other]

8.

Which of the following is the reason for the existence of consumer surplus?

a. Consumers can purchase goods that they “want” in addition to what they “need.” [Wants

and needs are both a reflection of how the consumer values an item, not necessarily an

indication of consumer surplus]

b. Consumers can occasionally purchase products for less than their production cost.

[Production cost is less relevant to creating consumer surplus than the amount of value a

consumer places on a final good (this could in fact be lower than the production cost as

well)]

c. Some consumers receive temporary discounts that result in below-market prices.

[Consumer surplus is a measure of the difference between the value a consumer places on an

item and the amount they ultimately pay for it. If a consumer only purchases an item because

of a discount, it indicates they likely value the item at the below-market price, so no surplus

is created]

d. Some consumers are willing to pay more than the market price. [correct; consumer

surplus exists when the Value to the consumer is greater than the final (or market) price. It

is when consumers pay market price for a good they place a higher value on that a consumer

surplus is created]

9.

A bakery currently sells chocolate chip cookies at a price of $16 per dozen. The marginal cost per

dozen is $8. The cookies are becoming more popular with customers and so the bakery owner is

considering raising the price to $20/dozen. What percentage of customers must be maintained to

ensure that the price increase is profitable?

a. 28.0% [if the store only maintained 28% of its current customers, it would need to increase

its prices to $36!]

b. 33.3% [this is the number of customers the bakery can lose and still remain profitable]

c. 66.6% [correct; as the margin has increased from 8 (16-8) to 12(20-8), the bakery must

maintain 66.6% (8/12) of its customers in order to get the same level of profitability]

d. 72.0% [if the store maintained 72% of its current customers, it would only need to increase

its prices to $19]

10. A firm adopts a technology that allows you to increase your output by 15%. If the elasticity of

demand in the US is -3, how should you adjust your price if you want to sell all of your output?

a.

5% lower. [correct; %ΔQ= e(%ΔP). Therefore, an 15% increase in Q = -3(%ΔP), hence

%ΔP = -5%]

b.

0.5% lower. [Remember, %ΔQ= e(%ΔP)]

c.

15% higher. [Remember, %ΔQ= e(%ΔP)]

d.

15% lower. [Remember, %ΔQ= e(%ΔP)]

Chapter 7

Multiple Choice Questions

1.

Microsoft found that instead of producing a DVD player and a gaming system separately, it is cheaper

to incorporate DVD playing capabilities in its new version of the gaming system. Microsoft is taking

advantage of

a. economies of scale [economies of scale mean average costs decline with output. There is no

indication here that this is happening.]

b. learning curve [learning curves mean that current production lowers future costs for the

same product; that does not apply here]

c. economies of scope [correct; the cost to produce the two products together is less than the

sum of the costs of producing them separately]

d. decreasing marginal costs [there is no indication that marginal costs are decreasing for

either individual product]

2.

As a golf club production company produces more clubs, the average total cost of each club produced

decreases. This is because:

a. total fixed costs are decreasing as more clubs are produced [fixed costs by definition do not

change with volume].

b. average variable cost is decreasing as more clubs are produced [there is no information to

indicate that variable costs are declining].

c. there are scale economies. [correct; declining average total costs are indicative of

economies of scale]

d. total variable cost is decreasing as more clubs are produced [because variable cost will not

be less than zero, total variable cost would not decrease as more units are produced]

3.

Average costs curves initially fall

a. due to declining average fixed costs [correct; as output increases and fixed costs are

distributed over more units, average fixed costs per unit fall]

b. due to rising average fixed costs [average costs curves would increase if average fixed cost is

increasing]

c. due to declining accounting costs [accounting costs are not relevant here]

d. due to rising marginal costs [rising marginal costs would cause the average costs curve to

rise, not fall]

4.

What might you reasonably expect of an industry in which firms tend to have economies of scale?

a. Exceptional competition among firms [economies of scale means average cost falls with

output; it does not necessarily imply a high level of competition]

b. A large number of firms [given the importance of volume in gaining economies of scale, we

would expect few firms, each with a large volume]

c. Highly diversified firms [given the importance of volume in gaining economies of scale, we

would expect a few firms that concentrate on building volume of individual products and

concentrate less on diversifying into other product areas]

d. A small number of firms [correct; a few firms with large volume could be expected to

capture the economies of scale]

5.

A security system company’s total production costs depend on the number of systems produced

according to the following equation: Total Costs = $20,000,000 + $4000*quantity produced. Given

these data, which of the following is a false statement?

a. There are economies of scale. [this statement is true; average costs fall with output]

b. There are fixed costs associated with this business. [this statement is true; the $20,000,000

is a fixed cost]

c.

d.

There are diseconomies of scale [correct; if average costs increased with output, there

would be diseconomies. That is not the case here]

A firm that produces a larger output has a cost advantage over a smaller firm. [this

statement is true; because average costs decrease with output(economies of scale), firms

producing more will have lower average costs]

6.

Following are the costs to produce Product A, Product B, and Products A and B together. Which of the

following exhibits economies of scope?

a. 100, 150, 240 [correct; the cost of producing both products together (240) is less than the

sum of the cost of producing them separately (250)]

b. 100, 150, 250 [the cost of producing both products together (250) is NOT less than the sum

of the cost of producing them separately (250)]

c. 100, 150, 260 [the cost to produce the two products together (260) is NOT less than the sum

of the costs of producing them separately(250)]

d. All of the above [only one of the choices exhibits economies of scope]

7.

According to the law of diminishing marginal returns, marginal returns:

a. diminish always prior to increasing. [marginal returns do not always diminish prior to

increasing]

b. diminish constantly. [there are cases where marginal returns increase]

c. diminish never. [the law of diminishing marginal returns suggests some cases where returns

will diminish]diminish eventually. [correct; The law of diminishing marginal returns states

that as you try to expand output, your marginal productivity (the extra output associated

with extra inputs) eventually declines.]

8.

It costs a firm $90 per unit to produce product A and $70 per unit to produce product B individually.

If the firm can produce both products together at $175 per unit of product A and B, this exhibits signs

of

a. economies of scale [economies of scale are not relevant here because the question refers to

the cost of producing two separate products, not more of the same product]

b. economies of scope [economies of scope indicate that the cost of producing the two products

together is less than the sum of the cost of producing them separately. This is not the case

here.]

c. diseconomies of scale [economies of scale are not relevant here because the question refers

to the cost of producing two separate products, not more of the same product]

d. diseconomies of scope [correct; the cost to produce the two products together (175) is more

than the sum of the costs of producing them separately(160)]

9.

A company faces the following costs at the respective production level in addition to its fixed costs of

$50,000:

Quantity

1

2

3

4

5

Marginal Cost

$10,000

$11,000

$12,000

$13,000

$14,000

Sale Price

$20,000

$20,000

$20,000

$20,000

$20,000

Marginal Return

$10,000

$9,000

$8,000

$7,000

$6,000

How would you describe the returns to scale for this company?

a. Increasing [correct; average total costs are falling with output]

b. Decreasing [average costs are falling with output, so returns are not decreasing]

c. Constant [average costs are falling with output, so returns are not constant]

d. Marginal [“marginal” returns to scale is not a meaningful phrase]

10. Once marginal cost rises above average cost,

a. Average costs will increase [correct; the cost to produce an additional unit of output will be

greater than the previous unit of output, which will increase average costs]

b. Average costs are unaffected [average costs will be affected]

c. Average costs will decrease [average costs will not decrease]

d. None of the above [one of the answers is correct because marginal and average costs are

related]

Chapter 8

1.

Changes in prices of a good causes

a. movement along the demand curve [yes but this is not the only effect]

b. movement along the supply curve [yes but this is not the only effect]

c. no movement along either curve [changes in prices will result in movement along one or

more of these curves

d. Both a and b [correct; it causes movement along both curves]

2.

If the market for a certain product experiences an increase in supply and a decrease in demand,

which of the following results is expected to occur?

a. Both the equilibrium price and the equilibrium quantity could rise or fall. [increase in supply

and decrease in demand both lead to a fall in price ]

b. The equilibrium price would rise, and the equilibrium quantity could rise or fall. [increase in

supply and decrease in demand both lead to a fall in price]

c. The equilibrium price would fall, and the equilibrium quantity could rise or fall. [correct;

increase in supply and decrease in demand both lead to lower price; net quantity change is

unknown because the increase in supply would lead to higher quantity while the decrease in

demand would lead to lower quantity]

d. The equilibrium price would fall, and the equilibrium quantity would fall. [net quantity

change is unknown because the increase in supply would lead to higher quantity while the

decrease in demand would lead to lower quantity]

3.

When demand for a product falls, which of the following events would you NOT necessarily expect to

occur?

a. A decrease in the quantity of the product supplied. [equilibrium quantity will fall with a

decrease in demand]

b. A decrease in its price. [equilibrium price will fall with a decrease in demand]

c. A decrease in the supply of the product. [correct; while a decrease in demand will be

associated with a decrease in the quantity supplied at equilibrium, it will not cause a shift in

the supply curve]

d. A leftward shift of the demand curve. [falling demand means the demand curve shifts

leftward]

4.

Suppose a recent and widely circulated medical article has reported new benefits of cycling for

exercise. Simultaneously, the price of the parts needed to make bikes falls. If the change in supply is

greater than the change in demand, the price will

and the quantity will

.

a. rise, rise [demand will increase because of the article while supply will also increase because

of lower costs; if the supply shift (leading to lower prices) is greater than the change in

demand (leading to higher prices), the net effect should not be a rise in both price and

quantity]

b. rise, fall [demand will increase because of the article while supply also increases because of

lower costs; if the supply shift (leading to lower prices) is greater than the change in demand

(leading to higher prices), the net effect should not be a fall in quantity.]

c. fall, rise [correct; demand will increase because of the article while supply will also increase

because of lower costs; if the supply shift (leading to lower prices) is greater than the change

in demand (leading to higher prices), the net effect should be a fall in price while both shifts

lead to a rise in quantity]

d. fall, fall [demand will increase because of the article while supply will also increase because

of lower costs; if the supply shift (leading to lower prices) is greater than the change in

demand (leading to higher prices), the net effect should be a fall in price while both shifts

lead to a rise in quantity]

5.

Suppose there are nine sellers and nine buyers in a competitive market, each willing to buy or sell

one unit of a good, with values {$10, $9, $8, $7, $6, $5, $4, $3, $2}. Assuming there are no transactions

costs, what is the equilibrium price in this market?

a. $5 [at a price of $5, four suppliers are willing to sell but six buyers are willing to buy]

b. $6 [correct; at a price of $6, five suppliers are willing to sell and five buyers are willing to

buy]

c. $7 [at a price of $7, six suppliers are willing to sell but four buyers are willing to buy]

d. $8 [at a price of $8, seven suppliers are willing to sell but three buyers are willing to buy]

6.

If the government imposes a price floor at $9 (i.e., price must be $9 or higher) in the above market,

how many goods will be traded?

a. Five [at a price of $9, eight suppliers are willing to sell but only two buyers have values of $9

or more]

b. Four [at a price of $9, eight suppliers are willing to sell but only two buyers have values of $9

or more]

c. Three [at a price of $9, eight suppliers are willing to sell but only two buyers have values of

$9 or more]

d. Two [correct; at a price of $9, eight suppliers are willing to sell but only two buyers are

willing to buy]

7.

Say the average price of a new home in Lampard City is $160,000. The local government has just

passed new licensing requirements for housing contractors. Based on possible shifts in demand or

supply and assuming that the licensing changes do not affect the quality of new houses, which of the

following is a reasonable prediction for the average price of a new home in the future?

a. $140,000 [the new licensing requirements lead to a reduction in supply, which will NOT lead

to a lower equilibrium price]

b. $150,000 [the new licensing requirements lead to a reduction in supply, which will NOT lead

to a lower equilibrium price]

c. $160,000 [the new licensing requirements lead to a reduction in supply, which will affect the

equilibrium price]

d. $170,000 [correct; the new licensing requirements lead to a reduction in supply, which will

lead to a higher equilibrium price]

8.

Suppose a new employer is also re-locating to Lampard City and will be attracting many new people

who will want to buy new houses. Assume that the change in licensing requirements mentioned

above occurs at the same time. What do you think will happen to the equilibrium quantity of new

homes bought and sold in Lampard City?

a. It will decrease substantially [while quantity will decrease from the reduction in supply, the

demand increase will cause quantity to rise]

b. It will decrease but not by much [while quantity will decrease from the reduction in supply,

the demand increase will cause quantity to rise]

c. It will increase [while quantity will increase from the increase in demand, the supply

decrease will cause quantity to fall]

d. Not enough information [correct; the decrease in supply from the prior question will be

associated with a lower quantity while the increase in demand mentioned here will be

associated with higher quantity. Without knowing the magnitude of the shifts, it’s not

possible to know the net effect (there is not enough information).]

9.

The price of peanuts increases. At the same time, we see the price of jelly rise. How does this affect

the market for peanut butter?

a. The demand curve will shift to the left; the supply curve will shift to the left [correct; the

price of peanuts leads to higher peanut butter production costs meaning supply will shift

left; a rise in the price of jelly, a complement to peanut butter, will cause peanut butter

demand to shift left]

b.

c.

d.

The demand curve will shift to the left; the supply curve will shift to the right [the price of

peanuts leads to higher peanut butter production costs meaning supply will shift left]

The demand curve will shift to the right; the supply curve will shift to the left [a rise in the

price of jelly, a complement to peanut butter, will cause peanut butter demand to shift left]

The demand curve will shift to the right; the supply curve will shift to the right [the price of

peanuts leads to higher peanut butter production costs meaning supply will shift left; a rise

in the price of jelly, a complement to peanut butter, will cause peanut butter demand to shift

left]

10. Holding other factors constant, a decrease in the tax for producing coffee causes

a. the supply curve to shift to the left, causing the prices of coffee to rise [a decrease in tax

lowers coffee production costs, leading to an increase (shift right) in supply]

b. the supply curve to shift to the right, causing the prices of coffee to rise [an shift right in

supply means price will fall]

c. the supply curve to shift to the left, causing the prices of coffee to fall [a decrease in tax

lowers coffee production costs, leading to an increase (shift right) in supply]

d. the supply curve to shift to the right, causing the prices of coffee to fall [correct; a decrease

in tax lowers coffee production costs, leading to an increase (shift right) in supply which

means price will fall]

Chapter 9

Multiple Choice Questions

1.

In the long-run, which of the following outcomes is most likely for a firm?

a. Zero accounting profits but positive economic profits [ firms do not earn positive economic

profit in the long-run]

b. Zero accounting profits [zero accounting profit implies negative economic profit, and firms

do not earn negative economic profit in the long-run]

c. Positive accounting profits and positive economic profits [ firms do not earn positive

economic profit in the long-run]

d. Zero economic profits but positive accounting profits [correct; in the long-run economic

profit is driven to zero]

2.

At the individual firm level, which of the following types of firms faces a downward-sloping demand

curve?

a. Both a perfectly competitive firm and a monopoly firm [the demand curve for the output of a

perfectly competitive firm is flat]

b. Neither a perfectly competitive firm nor a monopoly firm [one of the two types does face a

downward-sloping demand curve]

c. A perfectly competitive firm but not a monopoly firm [the demand curve for the output of a

perfectly competitive firm is flat]

d. A monopoly firm but not a perfectly competitive firm [correct; monopoly firms face a

downward-sloping demand curve]

3.

Which of the following types of firms are guaranteed to make positive economic profit?

a. Both a perfectly competitive firm and a monopoly [in the long-run, economic profit for both

types of firms will be zero]

b. Neither a perfectly competitive firm nor a monopoly [correct; no firm is guaranteed to make

positive economic profit]

c. A perfectly competitive firm but not a monopoly [in the long-run, economic profit for

competitive firms will be zero]

d. A monopoly but not a perfectly competitive firm [in the long-run, economic profit for

monopoly firms will be zero]

4.

What is the main difference between a competitive firm and a monopoly firm?

a. The number of customers served by the firm [competitive firms and monopoly firms may or

may not have similar numbers of customers]

b. Monopoly firms are more efficient and therefore have lower costs. [monopoly firms may or

may not have lower costs]

c. Monopoly firms can generally earn positive profits over a longer period of time. [correct;

this profit is a reward for doing something unique, innovative, or creative—something that

gives the firm less elastic demand.]

d. Monopoly firms enjoy government protection from competition. [not necessarily; other

factors can contribute to the lack of rivals]

5.

Which of the products below is closest to operating in a perfectly competitive industry?

a. Nike shoes [branding of the shoes reduces the “closeness” of substitute products]

b. Cotton [correct; agricultural commodities are close to perfectly competitive industries]

c. Perdue Chicken [branding of the chicken reduces the “closeness” of substitute products]

d. Restaurants [branding and other differentiation efforts reduce the “closeness” of substitute

restaurants]

10.

6.

A firm in a perfectly competitive market (a price taker) faces what type of demand curve?

a. Unit elastic [a unit elastic demand curve is downward sloping; firms in perfectly competitive

markets do not face unit elastic or downward sloping demand curves]

b. Perfectly inelastic [demand is not inelastic for competitive firms]

c. Perfectly elastic [correct; the demand curve for the output of a perfectly competitive firm is

perfectly elastic (flat)]

d. None of the above [one of the answers is correct]

7.

A competitive firm’s profit maximizing price is $15. At MC=MR, the output is 100 units. At this level of

production, average total costs are $12. The firm’s profits are

a. $300 in the short run and long run [long-run profit will be driven down to zero]

b. $300 in the short-run and zero in the long run [correct; (15-12)*100. Long run profit is

always driven to zero.]

c. $500 in the short-run and long-run [short-run profit will be price minus average cost times

quantity; long-run profit will be driven down to zero]

d. $500 in the short-run and zero in the long run [short-run profit will be price minus average

cost times quantity]

8.

What would happen to revenues if a firm in a perfectly competitive industry raised prices?

a. They would increase [a competitive firm can only sell at the industry price]