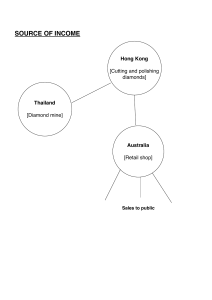

De Beers: Addressing the New Competitiveness Challenges Lama Zock|201502902 | Strategic Management |10/5/2022 Case Overview De Beers is a company dominating the Diamond industry. Diamond mining, diamond shops, diamond trade, and industrial diamond production are all part of De Beers' main operations. De Beers is involved in all types of industrial diamond mining, including open-pit, underground, large-scale alluvial, coastal, and deep-sea mining. The headquarters of the corporation are in Johannesburg, South Africa. De Beers controls the power of supply to its'sight holders' as a vertically integrated diamond producer. The company owns and runs mines in Canada and has a 26 percent stake in South African mines through its partners. It also has operations in over 20 countries on six continents. Botswana, Angola, India, Canada, and South Africa are among the countries targeted (South Africa). With significant activity in the value chain of discovery, mining, and distribution of rough stones, as well as major influence in processing, manufacturing, and marketing, the firm remained the world's biggest diamond producer and distributor until the year 2000. History timeline During the diamond boom in 1871, Cecil Rhodes, the company's founder, began by renting pumps to diggers. He took advantage of possibilities to buy and consolidate claims, then enter mines. Rhodes, who never married, was also the one who came up with the idea of diamonds as a symbol of committed love. He renamed the country 'Rhodesia' (Zimbabwe since 1980) and efficiently built trains, bridges, schools, and public buildings during his reign. In 1908, Ernest Oppenheimer arrived in South Africa as a diamond buyer, and in 1924, he established the Anglo-American Corporation. In the early 1920s, he purchased every known diamond mine and developed a distribution system independent of the dominating De Beers syndicate. He advocated for the establishment of modern native villages and social advancement for black Africans as a member of parliament. Unfortunately, when the Nationalist Party came to power in 1942, racial prejudice became established. From 1957 through 1984, Harry Oppenheimer was the CEO of De Beers, a diamond mining firm. He was born in Kimberly, South Africa's first diamond mining town, but spent the majority of his life in Johannesburg. Following the 1976 Soweto riots, Harry founded the Urban Foundation to help urban native Africans better their social and industrial environments. During his tenure as CEO, he coined the tagline "Diamond is Forever." In 1985, Harry's son Nicholas took over as Chairman of the Board of Directors from his father. De Beers geologists explored in Angola, Australia, Brazil, Bolivia, Canada, China, DRC, Namibia, Russia, Venezuela, and Zimbabwe in the 1980s and 1990s. During this time, De Beers also developed its global advertising program. De Beers made strategies in the mid-1990s to ensure that its African mines fulfilled 3rdparty certified environmental management requirements. In South Africa, Botswana, and Namibia, De Beers established nature parks surrounding mining areas and began efforts to safeguard unique biodiversity. Problem: South Africa's policies have changed significantly since the end of the apartheid era in 1994. The situation changed for the indigenous people, who were given greater importance than the Afrikaners. While acknowledging the economic benefits of diamond mining, a growing number of African officials say the diamond business does not contribute enough in terms of value-added processing. As a result, the South African Department of Minds and Energy (DME) created the Minerals Development Bill, which would become the country's new mining law by the year 2000, giving the state sole custody of all mineral rights. Then, in 2000, a new program known as "Black Economic Empowerment" (BEE) was introduced, with a goal of increasing black economic empowerment. Then, in 2000, a new program known as "Black Economic Empowerment" (BEE) was introduced with the purpose of providing chances for historically disadvantaged communities and individuals, such as black Africans, women, and persons with disabilities. A possible danger emerged in the gem market as evolving technology for synthetic manufacturing, in addition to policy changes as one of the most significant issues. De Beers needs a new strategy to deal with the fast-changing industry environment as well as increasing societal demands. SWOT ANALYSIS: SRENGTH: Allocated budget towards marketing and WEAKENESS: advertising Built good relations and reputation with the sorting and distribution government One of the biggest companies in the diamond industry High operating costs (exploration, mining, Strong competitors with other brands (limited market growth) Issue with mines that are offset with Strong brand equity Monopolistic. Control Good brand reputation for social intervention (education initiatives civilization areas Some people might prefer gold over diamond De Beers did not have retail stores (except including scholarships, academic bridging for one polished division), hence were not programs for black students, and close to the end-consumer supplementary lessons) HIV effected the work productivity and increased costs by 2% OPPORTUNITIES: Exploration expansion to tap the market areas Technology advancement Backed by government policies to THREATS: Apartheid issue Strong competitors from other brands. Racial issue could cause angry mobs to destroy the mining equipment (loss) support the health of the industry Market penetration globally Acquisition of smaller businesses Heavy investments Heavy investments in R&D as trends are quickly changing Business partnerships (e.g. BEE enterprise) Tourism projects (e.g., Big Hole tourism project) Economics fluctuations leading to people spending less as it’s not a “necessity” good Governmental polices changes Advancements in technology for synthetic production Clashes between the U.S and De beers prevented the company to operate in the U.S Possible contract termination with De Beers just like the Argyle Mine The collapse of the Soviet Union will effect the agreement with De Beers hence effecting the diamonds production there PESTEL ANALYSIS: Political factors: The most serious difficulties in the United States and internationally caused by political concerns Diamonds are beginning to flow from the conflict-torn fields of Serbia Leone and Angola, while mines in Russia are being controlled locally rather than in conjunction with De beers, due to violence in Western Africa. These factors alone offer a threat to De Beers' current position of dominance in the diamond business. Due to these difficulties, was centered in the United States, where the entire De Beers group was legally in violation of US antitrust law. This made it illegal for De Beers to sell directly in the United States. Economic factors: As new diamond sources are discovered, the historical price of diamonds has decreased and may perhaps be dropping. De Beers and the diamond industry may suffer as a result of the price drops. The other major economic issue is diamond price stability. Stockpiling in order to regulate diamond supplies and pricing is cutting into earnings, resulting in poor stock prices. Social factors: Socially, Diamonds are viewed as a beautiful and precious stone that is a symbol of romance and can be treasured for decades in society. The availability of diamonds surged in the nineteenth century, transforming the stones from a luxury item available solely to the wealthy to a commodity available to the general public. Despite this increase in production, diamonds are still seen as a rare and valuable item. Technological factors: South Africa had well-established transportation, financial, telecommunications, and legal infrastructure. Moreover, De Beers founded “The Diamond Development Company” to develop new uses for industrial diamonds and to allocated budget towards research. Advancing technologies for synthetic production were viewed by diamond producers as a potential threat to the gem market. Environmental factors: South Africa had large natural resources such as gold, iron ore, chrome, copper, etc. South Africa also had the highest reserves in the world of a variety of metals. Legal factors: South Africa’s market contained many labor unions. In 1910, the government implemented policies giving rights for the native African. De beers had a single channel distribution system. This is the reason the diamond industry has thrived over the past century , however this is one of the reason for the U.S conflicts. Porter’s 5 forces In general, the worldwide diamond industry continues to be very profitable and lucrative across the value chain. The industry's shrinking monopoly is allowing new competitors to compete in various chain segments. However, the restrictions remain considerable, particularly when it comes to profiting from diamond mining activities. With the discovery of new diamond mines in other nations, there is fierce competition among important businesses. The creation of specialty markets by other competitors, such as rare, pricey gems or colored diamonds, is another element that has increased rivalry. Barriers are also increasing in the diamond industry's value chain section. For example, while cutting and polishing diamonds has traditionally needed a lot of skill and personnel, the business now requires greater investments in new technology to cut and polish gems gracefully. Supplier bargaining power has weakened as a result of new diamond sources and new players. The market is oversupplied, and even the market leader, De Beers, has been demoted to a lower supplier power. Buyers' bargaining power has increased as a result of the global financial crisis. This is also due to an oversupply of diamonds and a decrease in demand, resulting in reduced pricing. According to industry analysts, the bargaining power will move from buyers to suppliers as demand rises and supplies fall. As a result, purchasers' bargaining power will be weakened once more. In general, the risk of substitution is modest. Diamonds have played an important cultural role in numerous civilizations around the world, and their worth has long related to status, aristocracy, and prestige, among other things. As a result, diamond demand has remained stable over time. This is bolstered even further by numerous advertising methods designed to increase the product's additional value and appeal. Technological advancements also offer a significant threat to the demand for actual diamonds, as synthetic diamonds may be produced to look just as beautiful as real diamonds. Synthetic diamonds pose a severe threat to the natural diamond business because they can lower the gem's perceived consumer value. It also addresses the environmental and mining concerns that exist with actual diamonds. The monopoly's demise has also posed a significant threat to diamond manufacturing and jewelry sales. For example, the Indian, Jewish, and Chinese markets have begun producing equally stunning diamond jewelry items that were previously controlled by European countries. Finally, the industry's level of competition is extremely high. The unorganized portion of the global diamond industry is extremely concentrated. There is a lot of separation in the various stages of production, such as cutting and polishing, retailing, and jewelry design. For competing diamond firms, this means lower profits. Rivalry will escalate if the industry has similarly large participants and the departure costs are higher due to the significant capital investments required to enter. To increase their margins, each company will look for a strategy to use all their resources and channels. With less demand, they'll do their hardest to outsmart one other. Because actual diamonds are in short supply, their quality can be polished. Diamon model Demand factors: In comparison to other luxury items, demand for diamonds has been steadily increasing, especially since De Beers committed a large budget to marketing diamonds and promoting them as gifts for love and special occasions, with the goal of further raising demand. De Beers also partnered with premium brands to expand its reach into the high-end market. Factor conditions: De Beers benefits from the fact that South Africa and Botswana are naturally rich in diamonds and other natural resources. The diamond industry relied heavily on labor. Not to mention the requirement for all of the necessary technology and large machinery. Furthermore, following norms and regulations to ensure that everything done is legitimate, ensuring proper labor rights and eradicating discrimination. Infrastructure, such as roads, housing, and hospitals, is also necessary to ensure that workers have access to all of their needs. Related and supporting industries: De Beers outfitted a cutting plant, and the South African government hired a Belgian cutting factory to establish a manufacturing company and train 500 cutters. De Beers has also collaborated with a number of organizations, including DTC. Newspapers such as the Diamon News, which chronicled developments in the diamond business in Maharashtra, played an essential role. De Beers also teamed up with BEE Enterprise to seek and find diamonds in northern South Africa. Firm Strategy and Rivalry Other than De Beets, there were other large vertically integrated producers. However, competition was not fierce because De Beers had nearly monopolized the market. Recommendation: De Beers should expand/ try to penetrate new projects of exploration areas despite owning ownership in the key mining area since the late 1920s. This is owing to the high demand for synthetic industrial diamonds, which are widely utilized in a variety of fields including medicine, oil and gas drilling instruments, the entertainment industry, particularly in acoustic devices, and others. Since De Beers has been the market leader for nearly half a century, I couldn't see any expansion concerns as an analyst. De Beers can enhance its labor policies in order to manage the societal issue by providing more perks such as insurance, incentives, and other associated compensation. Apart from that, the corporation should set a minimum salary for its employees and continue to protect workers' rights against child labor, which is a big concern on the African continent. De Beers should establish measures to give back to the community in order to maintain a good CSR. HIV/AIDS, poverty, and starvation prevention campaigns, which are quite popular in African countries, should be carried out effectively to ensure that De Beers is seen as a company that cares, for what it's worth to public perception. For the company to remain relevant in the industry, it is also necessary to maintain the efficiency of offering good diamonds to the world. To do so, De Beers must concentrate on its core business of producing pure diamonds, rather than focusing on synthetic quality. Lebanese Crisis: Lebanon's financial collapse since 2019 is a narrative of how mismanagement ruined an ambition for reconstructing a nation long renowned as the Middle East's Switzerland, as a sectarian elite borrowed with little restriction. Downtown Beirut was rebuilt after the civil war, with skyscrapers designed by international architects and posh shopping malls packed with designer boutiques accepting dollars or Lebanese pounds as payment. But Lebanon had nothing more to show for a debt mountain that amounted to 150 percent of national production at the time, making it one of the world's most severe debt burdens. Lebanon's electricity plants are unable to provide 24 hour power, and its sole reliable export is its human resources. After the civil war, tourism income, foreign aid, earnings from the financial sector, and the generosity of Gulf Arab powers, which financed the state by bolstering central bank reserves, helped Lebanon balance its books. Remittances from the millions of Lebanese who travelled overseas to find employment were one of its most consistent sources of funds. They sent money home even during the global financial crisis of 2008. However, remittances began to decline in 2011 as Lebanon's sectarian strife led to further political sclerosis and much of the Middle East, especially Syria, slid into anarchy. Because of Iran's growing influence in Lebanon, via Hezbollah, Gulf monarchies, previously staunch backers, began to move away. As transfers failed to match imports of everything from staple foods to showy vehicles, the budget deficit soared and the balance of payments plunged deeper into the red. That is, until 2016, when banks began providing incredible interest rates on new dollar deposits - the official currency in the dollarised economy - and even higher rates on Lebanese pound accounts. Lebanon's political system was still broken, and it had been without a president for the majority of 2016. However, since 1993, the central bank, Banque du Liban, directed by former Merrill Lynch banker Riad Salameh, has used "financial engineering," a set of measures that amounted to generous rewards for fresh dollars. It was a strategy that bankers say would have been suitable if reforms were implemented quickly. Before the 2018 election, when the state needed to cut spending, legislators splurged on a public sector wage raise. Foreign donors also withheld billions of dollars in funding due to the government's unwillingness to implement reforms. In October 2019, a plan to charge WhatsApp calls ignited the final spark of revolt. With a large diaspora and a tax system that favors the wealthy, imposing a levy on how many Lebanese communicated was devastating. Disgruntled youth demanded comprehensive change, and mass protests erupted against a political elite, including aging militia leaders who prospered as others struggled. Dollars left Lebanon as foreign exchange inflows dried up. Banks closed their doors because they ran out of money to pay depositors waiting outside. In addition, the government defaulted on its foreign obligations. An explosion at Beirut port in August 2020 added to the concerns by killing 215 people and causing billions of dollars in damage. Following a rapid economic downturn, government debt was estimated to be 495 percent of GDP in 2021, significantly higher than the levels that plagued certain European countries a decade ago.France has been at the forefront of international attempts to press Lebanon to combat corruption and execute donor-mandated reforms. In late 2021, a new administration was created, intending to restart negotiations with the International Monetary Fund. It has yet to put in place any major reform plans. Importantly, politicians and bankers must agree on the magnitude of the massive losses and what went wrong in order for Lebanon to change course and cease living beyond its means.