Uploaded by

zubairrafiqueofficial007

ACCA F2 Management Accounting Mock Exam Questions

advertisement

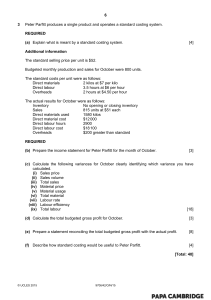

ACCA F2 (MA/FMA) Management Accounting QUESTIONS Mock A We're not sure whether it is Becker's mock exam or Kaplan's, or someone else's. Whomever it is, we are grateful to them. MO CK QUESTIONS SECTION A – ALL 35 QUESTIONS ARE COMPULSORY AND MUST BE ATTEMPTED Each question is worth 2 marks 1 2 Which TWO of the following are direct expenses? A The cost of special designs, drawings or layouts for a specific job. B The hire of tools or equipment for a particular job. C Salesmen’s wages. D Rent, wages and insurance of a factory. Storm plc has just developed a new product to be called the Rain and is now considering putting it into production. Which of the following costs/revenues would be relevant to an NPV calculation (tick in the box)? Relevant? Costs incurred in the development of Rain amounting to $480,000 Purchase of new machinery at a cost of $2,400,000 payable immediately Depreciation charge for the new machinery of $600,000 per annum Sales price of $80 per Rain 3 What is the weighted price index, using 20X1 as the base year, based on the following data? Product Quantity 20X1 Price 20X2 Price Towel 250 $2.50 $2.00 Bucket 300 $1.50 $3.00 A 101.5 B 145.5 C 84.1 D 108.4 3 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 4 A company wants to calculate the economic order quantity (EOQ) for an item of inventory. The following data is available in a spreadsheet. A B 1 Monthly demand 1,000 units 2 Cost of placing an order 3 Cost of holding one unit of inventory $2.50 per annum 4 Economic order quantity $25 ?? What formula is required to calculate the EOQ? 5 A B4 = SQRT((2*B3*B1*12)/B2) B B4 = SQRT(2*B3*B1*12)/B2 C B4 = SQRT((2*B2*B1*12)/B3) D B4 = SQRT(2*B2*B1)/B3 Kiveton Cleaning Services supplies its employees with protective clothing. One such item is protective gloves. Records from the stores department for January showed: 1 Jan Opening inventory 150 pairs @ $2 each 7 Jan Purchases 40 pairs @ $1.90 15 Jan Issues 30 pairs 29 Jan Issues 35 pairs What is the value of the issues and the closing inventory if the FIFO method is used? 6 Issues Closing inventory A $130 $246 B $129 $247 C $246 $130 D $247 $129 The following data is available for Tallus Co in period 2. Actual overheads $225,900 Actual machine hours 7,530 Budgeted overheads $216,000 The budgeted overhead absorption rate was $32 per hour What were the budgeted machine hours? hours 4 MO CK QUESTIONS 7 Binsey Co uses regression analysis to forecast monthly costs. The accountant has produced the following equation: TC = 4Q + 600 Where Q is the number of units produced each month and TC is the total cost in a month. Which of the following statements is correct? 8 A Variable costs = $600 per unit, Fixed costs = $4 per month B Annual fixed costs = $28,800 C Annual fixed costs = $7,200 D Variable costs = $4 per unit, Fixed costs = $7,200 per month Burgess operates a continuous process into which 3,000 units of material costing $9,000 was input in a period. Conversion costs for this period were $11,970 and losses, which have a scrap value of $1.50 per unit, are expected at a rate of 10% of input. There was no opening or closing inventory and output for the period was 2,900 units. What was the cost per unit of output? 9 A $6.84 B $6.99 C $7.76 D $7.60 When opening inventory was 10,000 litres and closing inventory was 12,000 litres, a company had a profit of $72,000 using absorption costing. The fixed overhead absorption rate was $5 per litre. What would be the profit under marginal costing? $ 10 Mountain Venture has net assets of $540,000 and made profits of $280,000 for the year. The cost of capital is 8% per annum. What are the ROI and RI for Mountain Venture? ROI RI A 4% $43,200 B 15% $22,400 C 48% $517,600 D 52% $236,800 5 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 11 12 If a company compares its procedures with another company that is does not compete with. What is this form of benchmarking is known as? A Strategic B Competitive C Functional D Internal A retailer has mean sales of 75 per day and a standard deviation of 15 sales. What is the coefficient of variation as a % (to the nearest whole number)? % 13 A company had a budgeted fixed production overhead of $7,500 with budgeted output of 1,000 units. The company absorbs overheads using labour hours and had budgeted to work 10,000 hours. Actual output was 790 units, 8,848 hours were worked and the actual overhead was $6,800. What were the fixed overhead capacity and efficiency variances for the period? 14 15 6 Capacity $ Efficiency $ A 864 (A) 1,575 (F) B 864 (A) 711 (A) C 1,575 (A) 711 (F) D 864 (F) 711 (F) If a population is very large but opinions need to be sourced in the most efficient way from the entirety of a couple of groups, which method of sampling would be the most appropriate? A Random B Multi‐stage C Cluster D Quota Which of the following is a building firm who constructs extensions to private houses most likely to use? A Service Costing B Batch Costing C Job Costing D Process Costing MO CK QUESTIONS 16 The value for money concept used in assessing performance in a not for profit organisation revolves around the 3Es. What are the 3Es? 17 1 Efficiency 2 Effectiveness 3 Ecology 4 Economy A 1, 2 and 3 only B 1, 3 and 4 only C 2, 3 and 4 only D 1, 2 and 4 only A company sells a product with the following unit standard cost card: $ Selling price Variable cost Fixed production overhead Profit 50 20 5 __ 25 __ This card is based on budgeted sales of 1,700 units. Actual selling price was $48, unit variable costs were $22 and unit fixed cost $4. Actual sales were 1,800 and 1,950 units were made. The company currently uses marginal costing. What was the sales volume variance? 18 A $4,500 (F) B $3,000 (F) C $5,000 (F) D $6,000 (F) Identify whether each of the following statements about big data analytics in organisations is true or false? True False It can improve forecasting to aid decision making It can help to provide more detailed, relevant and up to date performance measurement. 7 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 19 A veterinarian should take on average 20 minutes to stitch a dog’s wound. In one day the veterinarian stitched 5 dogs taking 1 hour in total. What is the efficiency ratio for the veterinarian? 20 A 100% B 83% C 167% D 60% The numbers below have been calculated to use in a linear regression analysis, in order to estimate the total cost line for a company. x = number of units y = total costs (in $000) x = 25 y = 271 xy = 550 x2 = 65 y2 = 30,275 n = 15 What is the variable cost per unit using regression analysis (to two decimal places)? $ 21 Over the last two months the following production costs were incurred by Department Z: Level of activity 2,180 units 3,200 units May June Production cost $13,405 $15,700 In July budgeted production was 2,560 units, what would the budgeted production cost be? 8 A $14,260 B $15,740 C $12,560 D $14,552.50 MO CK QUESTIONS 22 The production machinery of Grape Co is nearing the end of its useful life and it needs to be replaced. Estimates have been made for the initial capital cost, proportional sales income and operating costs of the replacement machine, which is expected to have a useful life of three years: Initial investment $500,000 Cash flows Year 1 2 3 Sales income $280,000 $330,000 $390,000 Operating costs $100,000 $120,000 $130,000 The company appraises capital investment projects using a cost of capital of 10% per annum. What is the NPV of this machine? 23 A $32,340 B $150,000 C $1,032,340 D $850,000 A company uses marginal costing. The following variances occurred in the last period when the actual net profit was $80,000. Materials $1,800 adverse Labour $2,000 favourable Overheads $1,400 adverse Sales price $1,000 favourable Sales volume contribution $1,800 favourable What was the budgeted net profit for the last period? A $83,000 B $81,600 C $77,000 D $78,400 9 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 24 Field is considering a new project. Details of the proposed project are as follows: Life of project: 6 years Initial cost: $85,000 Annual savings: $24,000 NPV at 5%: £36,824 What is the internal rate of return for this project to the nearest 1%? 25 26 27 A 16% B 18% C 20% D 22% Which of the following are features of Activity Based Costing? 1 Cost pools 2 Cost drivers 3 Low levels of overhead costs A 1 only B 1 and 2 only C 3 only D 1, 2 and 3 Which of the following would NOT be classified as a production overhead in a food processing company? A The cost of renting the factory building B The salary of the factory manager C The depreciation of equipment located in the materials store D The cost of ingredients A company produces two types of tables, the farmhouse and the cottage which require 10 and 16 labour hours respectively. The budgeted data for the next period is as follows: Sales Opening inventory of finished goods Farmhouse 7,500 units 1,800 units Cottage 12,000 units 2,400 units Inventory of finished goods is budgeted to be reduced by 50% by the end of the next period. What are the total budgeted labour hours for the next period? 10 A 295,200 hours B 267,000 hours C 238,800 hours D 210,600 hours MO CK QUESTIONS 28 The instruction to a market researcher is to ‘stop 50 men and 70 women to do the questionnaire’. What type of sampling is being used? 29 A Stratified sampling B Quota sampling C Cluster sampling D Random sampling ABC Co sells to both cash and credit customers. It expects that 40% of its sales will be paid for in cash and of the remainder, 50% will be paid the month after sale, 40% two months after sale and the rest will remain unpaid. Jan $000s 100 Feb $000s 120 Mar $000s 140 Apr $000s 150 May $000s 160 Jun $000s 180 What is the value of cash receipts forecast in the month of April? 30 A $182,000 B $130,800 C $116,000 D $212,000 The results of a customer survey are normally distributed with a mean score of 75 and a standard deviation of 15. What is the percentage probability that a customer scored more than 90 (to 2 decimal places)? % 31 Which TWO of the following are advantages of using the Balanced Scorecard approach to appraising performance? A Performance is appraised from a much wider view point B Managers can easily distort measures to their advantage C Comparison with different organisations is made easier D It should lead to long term success rather than short term improvements 11 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 32 Bag Inc manufactures a popular suitcase. They produce the suitcases in batches. The following information is available for Bag Inc: Fixed costs = $100 per month Annual demand for suitcases = 100,000 per year Cost of setting up a batch = $500 Holding cost = $8 per suitcase Replenishment rate = 200,000 per year How many suitcases should be produced in a batch? 33 A 2,000 B 3,000 C 4,000 D 5,000 A company that operates a standard costing system reported favourable labour rate variances though the labour efficiency variance was adverse. Which of the following could explain both of these variances? 34 1 The use of inexperienced staff 2 A machine breakdown 3 Higher quality of material being purchased than expected 4 A lower than expected sales demand A 1 only B 1 and 2 only C 1 and 3 only D 1 and 4 only Puffle plc wants to produce a pie chart to represent the sales levels in its 6 regions. The sales are as follows: Region Sales value $000s 1 352 2 410 3 248 4 178 5 578 6 368 What would be the angle on the pie chart for region 5? ° 12 MO CK QUESTIONS 35 Which of the following costs has a variable cost behaviour? 1,840 units 4,700 units 1 Materials $9,200 $23,500 2 Labour $12,880 $42,300 3 Rent $2,000 $4,000 A 1 only B 1 and 2 only C 2 and 3 only D All of them 13 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G SECTION B – ALL THREE QUESTIONS ARE COMPULSORY AND MUST BE ATTEMPTED 36 Damage Ltd will be replacing some machines in the next year and needs to decide whether to purchase or lease the machines. The company uses 10% as its cost of capital and has the following information: Purchase price of $600,000. Annual running costs of $45,000 for the next five years, paid annually in arrears. A residual value of $220,000 at the end of the five years. The machine could be leased for five years based upon total annual costs of $135,000 paid annually in advance. (a) What is the NPV of purchasing the machine? $ (2 marks) (b) What is the NPV of leasing the machine? $ (2 marks) Lease (c) Buy Should Damage Ltd lease or buy the machine? (tick appropriate box) (2 marks) (d) (e) What does the statement ‘the level of sales is the principal budget factor’ mean? A The level of sales will determine the level of cash at the end of the period. B The level of sales will determine the level of profit at the end of the period. C The company’s activities are limited by the level of sales it can achieve. D Only sales budgets are required for management accounts. (2 marks) Which of the following statements are true about IRRs? 1 IRR ignores the time value of money 2 if the IRR exceeds the companies cost of capital the NPV at the company’s cost of capital should be positive 3 it is not possible for one investment to have 2 IRRs A 1 only B 2 only C 2 and 3 only D 1, 2 and 3 (2 marks) (Total: 10 marks) 14 MO CK QUESTIONS 37 GW Co manufactures and sells a single product and has a standard costing system in which: purchases of materials are recorded at standard cost direct material costs and direct labour costs are variable production overheads are fixed and absorbed using direct labour hours. The budgeted and actual results for the month of November 20X6 are as follows: Budget Actual 200,000 190,000 Production units Direct materials purchased and used 10,000 kgs $4,500,000 9,595 kgs $3,838,000 Direct labour 20,000 hrs $200,000 20,000 hrs $240,000 Fixed overheads $1,250,000 $1,375,000 Your colleague has calculated the following variances: material price variance of $479,750 favourable material usage variance of $42,750 adverse. Required (a) (b) (c) Calculate the following information for November: (i) standard rate per hour for labour (1 mark) (ii) standard hours of labour for actual production (1 mark) (iii) the total standard cost for actual production. (1 mark) Calculate the following: (i) Budgeted cost for 190,000 units (0.5 marks) (ii) Labour rate variance (1 mark) (iii) Labour efficiency variance (1 mark) (iv) Fixed overhead expenditure variance (1 mark) (v) Fixed overhead volume variance (1 mark) (vi) Actual cost for 190,000 units (0.5 marks) Which of the following variances would not be shown in an operating statement produced under a marginal costing system? A Direct material price variance B Labour efficiency variance C Fixed overhead expenditure variance D Fixed overhead capacity variance (2 marks) (Total: 10 marks) 15 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 38 LRC is a multi‐divisional company. One of the divisions has net assets of $420,000. The profit statement for the division for the latest period is as follows: $ 630,000 390,000 ––––––– 240,000 180,000 25,000 ––––––– 35,000 ––––––– Revenue Variable costs Contribution Attributable fixed costs Allocated central costs Divisional profit The divisional manager is considering investing in a machine costing $50,000. The machine would earn annual profits, after depreciation, of $5,500. The company’s cost of capital is 10%. Required: (a) What is the division’s controllable return on investment, without the new machine (to 1 decimal place)? % (1 mark) (b) What is the division’s controllable return on investment, with the new machine (to 1 decimal place)? % (2 marks) (c) What is the controllable residual income for the division without the new machine (to the nearest whole $)? $ (1 mark) (d) What is the controllable residual income for the division with the new machine (to the nearest whole $)? $ (2 marks) 16 MO CK QUESTIONS (e) (f) Which TWO of the following are strengths of using Return on Investment as a performance measure for Investment appraisal? 1 It is an absolute measure of increase in shareholder wealth 2 It is commonly used and understood 3 It uses objective profits instead of subjective cash flows 4 It leads to goal congruent decisions 5 It cannot be manipulated 6 It can be used to compare projects of different sizes (2 marks) Which TWO of the following are strengths of using Residual Income as a performance measure for a large organisation/group? 1 It ensures divisional managers consider the cost of financing 2 It is commonly used and understood 3 It uses objective profits instead of subjective cash flows 4 It often leads to goal congruent decisions 5 It cannot be manipulated 6 It can be used to compare divisions of different sizes within the company (2 marks) (Total 10 marks) 17 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G FORMULAE AND TABLES Regression analysis y = a + bx a= b= r= n ∑x ∑y n b ∑x n n ∑xy ∑x ∑y n ∑x 2 (∑x)2 n ∑xy ∑x ∑y 2 (∑x) 2 ) (n ∑y 2 (∑y)2 Economic order quantity 2C 0 D Ch = Economic batch quantity = 2C 0 D D C h 1 R Arithmetic mean x x n x fx (frequency distribution) f Standard deviation ( x x ) 2 n 2 fx 2 fx (frequency distribution) f f Variance 2 Co‐efficient of variation CV x Expected value EV = ∑px 18 MO CK QUESTIONS PRESENT VALUE TABLE Present value of 1, i.e. (1 + r)–n Where r = interest rate n = number of periods until payment. Periods (n) Discount rate (r) 5% 6% 0.952 0.943 0.907 0.890 0.864 0.840 0.823 0.792 0.784 0.747 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0.942 0.924 0.906 3% 0.971 0.943 0.915 0.888 0.863 4% 0.962 0.925 0.889 0.855 0.822 6 7 8 9 10 0.942 0.933 0.923 0.914 0.905 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 0.746 0.711 0.677 0.645 0.614 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.642 0.650 0.625 0.601 0.577 0.555 1 2 3 4 5 11% 0.901 0.812 0.731 0.659 0.593 12% 0.893 0.797 0.712 0.636 0.567 13% 0.885 0.783 0.693 0.613 0.543 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.452 0.404 0.361 0.322 11 12 13 14 15 0.317 0.286 0.258 0.232 0.209 0.287 0.257 0.229 0.205 0.183 (n) 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 9% 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0.683 0.621 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.547 0.502 0.460 0.422 0.564 0.513 0.467 0.424 0.386 0.585 0.557 0.530 0.505 0.481 0.527 0.497 0.469 0.442 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 14% 0.877 0.769 0.675 0.592 0.519 15% 0.870 0.756 0.658 0.572 0.497 16% 0.862 0.743 0.641 0.552 0.476 17% 0.855 0.731 0.624 0.534 0.456 18% 0.847 0.718 0.609 0.516 0.437 19% 0.840 0.706 0.593 0.499 0.419 20% 0.833 0.694 0.579 0.482 0.402 0.480 0.425 0.376 0.333 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.390 0.333 0.285 0.243 0.208 0.370 0.314 0.266 0.225 0.191 0.352 0.296 0.249 0.209 0.176 0.335 0.279 0.233 0.194 0.162 0.261 0.231 0.204 0.181 0.160 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.178 0.152 0.130 0.111 0.095 0.162 0.137 0.116 0.099 0.084 0.148 0.124 0.104 0.088 0.079 0.135 0.112 0.093 0.078 0.065 19 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G ANNUITY TABLE Present value of an annuity of 1 i.e. Where 1 (1 r) n r r = interest rate n = number of periods. Periods (n) 1 2 3 4 5 1% 0.990 1.970 2.941 3.902 4.853 2% 0.980 1.942 2.884 3.808 4.713 3% 0.971 1.913 2.829 3.717 4.580 4% 0.962 1.886 2.775 3.630 4.452 6 7 8 9 10 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 11 12 13 14 15 10.368 11.255 12.134 13.004 13.865 Discount rate (r) 5% 6% 0.952 0.943 1.859 1.833 2.723 2.673 3.546 3.465 4.329 4.212 7% 0.935 1.808 2.624 3.387 4.100 8% 0.926 1.783 2.577 3.312 3.993 9% 0.917 1.759 2.531 3.240 3.890 10% 0.909 1.736 2.487 3.170 3.791 5.076 5.786 6.463 7.108 7.722 4.917 5.582 6.210 6.802 7.360 4.767 5.389 5.971 6.515 7.024 4.623 5.206 5.747 6.247 6.710 4.486 5.033 5.535 5.995 6.418 4.355 4.868 5.335 5.759 6.145 9.787 9.253 8.760 8.306 10.575 9.954 9.385 8.863 11.348 10.635 9.986 9.394 12.106 11.296 10.563 9.899 12.849 11.938 11.118 10.380 7.887 8.384 8.853 9.295 9.712 7.499 7.943 8.358 8.745 9.108 7.139 7.536 7.904 8.244 8.559 6.805 7.161 7.487 7.786 8.061 6.495 6.814 7.103 7.367 7.606 1 2 3 4 5 11% 0.901 1.713 2.444 3.102 3.696 12% 0.893 1.690 2.402 3.037 3.605 13% 0.885 1.668 2.361 2.974 3.517 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2.798 3.274 17% 0.855 1.585 2.210 2.743 3.199 18% 0.847 1.566 2.174 2.690 3.127 19% 0.840 1.547 2.140 2.639 3.058 20% 0.833 1.528 2.106 2.589 2.991 6 7 8 9 10 4.231 4.712 5.146 5.537 5.889 4.111 4.564 4.968 5.328 5.650 3.998 4.423 4.799 5.132 5.426 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.589 3.922 4.207 4.451 4.659 3.498 3.812 4.078 4.303 4.494 3.410 3.706 3.954 4.163 4.339 3.326 3.605 3.837 4.031 4.192 11 12 13 14 15 6.207 6.492 6.750 6.982 7.191 5.938 6.194 6.424 6.628 6.811 5.687 5.918 6.122 6.302 6.462 5.453 5.660 5.842 6.002 6.142 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.836 4.988 5.118 5.229 5.324 4.656 7.793 4.910 5.008 5.092 4.486 4.611 4.715 4.802 4.876 4.327 4.439 4.533 4.611 4.675 (n) 20 MO CK QUESTIONS To find the area under the normal curve between the mean and a point Z standard deviations above the mean, use the table below. The corresponding area for a point Z standard deviations below the mean can be found through using symmetry. z= x –μ σ STANDARD NORMAL DISTRIBUTION TABLE 0.0 0.1 0.2 0.3 0.4 0.00 0.0000 0.0398 0.0793 0.1179 0.1554 0.01 0.0040 0.0438 0.0832 0.1217 0.1591 0.02 0.0080 0.0478 0.0871 0.1255 0.1628 0.03 0.0120 0.0517 0.0910 0.1293 0.1664 0.04 0.0160 0.0557 0.0948 0.1331 0.1700 0.05 0.0199 0.0596 0.0987 0.1368 0.1736 0.06 0.0239 0.0636 0.1026 0.1406 0.1772 0.07 0.0279 0.0675 0.1064 0.1443 0.1808 0.08 0.0319 0.0714 0.1103 0.1480 0.1844 0.09 0.0359 0.0753 0.1141 0.1517 0.1879 0.5 0.6 0.7 0.8 0.9 0.1915 0.2257 0.2580 0.2881 0.3159 0.1950 0.2291 0.2611 0.2910 0.3186 0.1985 0.2324 0.2642 0.2939 0.3212 0.2019 0.2357 0.2673 0.2967 0.3238 0.2054 0.2389 0.2704 0.2995 0.3264 0.2088 0.2422 0.2734 0.3023 0.3289 0.2123 0.2454 0.2764 0.3051 0.3315 0.2157 0.2486 0.2794 0.3078 0.3340 0.2190 0.2517 0.2823 0.3106 0.3365 0.2224 0.2549 0.2852 0.3133 0.3389 1.0 1.1 1.2 1.3 1.4 0.3413 0.3643 0.3849 0.4032 0.4192 0.3438 0.3665 0.3869 0.4049 0.4207 0.3461 0.3686 0.3888 0.4066 0.4222 0.3485 0.3708 0.3907 0.4082 0.4236 0.3508 0.3729 0.3925 0.4099 0.4251 0.3531 0.3749 0.3944 0.4115 0.4265 0.3554 0.3770 0.3962 0.4131 0.4279 0.3577 0.3790 0.3980 0.4147 0.4292 0.3599 0.3810 0.3997 0.4162 0.4306 0.3621 0.3830 0.4015 0.4177 0.4319 1.5 1.6 1.7 1.8 1.9 0.4332 0.4452 0.4554 0.4641 0.4713 0.4345 0.4463 0.4564 0.4649 0.4719 0.4357 0.4474 0.4573 0.4656 0.4726 0.4370 0.4484 0.4582 0.4664 0.4732 0.4382 0.4495 0.4591 0.4671 0.4738 0.4394 0.4505 0.4599 0.4678 0.4744 0.4406 0.4515 0.4608 0.4686 0.4750 0.4418 0.4525 0.4616 0.4693 0.4756 0.4429 0.4535 0.4625 0.4699 0.4761 0.4441 0.4545 0.4633 0.4706 0.4767 2.0 2.1 2.2 2.3 2.4 0.4772 0.4821 0.4861 0.4893 0.4918 0.4778 0.4826 0.4864 0.4896 0.4920 0.4783 0.4830 0.4868 0.4898 0.4922 0.4788 0.4834 0.4871 0.4901 0.4925 0.4793 0.4838 0.4875 0.4904 0.4927 0.4798 0.4842 0.4878 0.4906 0.4929 0.4803 0.4846 0.4881 0.4909 0.4931 0.4808 0.4850 0.4884 0.4911 0.4932 0.4812 0.4854 0.4887 0.4913 0.4934 0.4817 0.4857 0.4890 0.4916 0.4936 2.5 2.6 2.7 2.8 2.9 0.4938 0.4953 0.4965 0.4974 0.4981 0.4940 0.4955 0.4966 0.4975 0.4982 0.4941 0.4956 0.4967 0.4976 0.4982 0.4943 0.4957 0.4968 0.4977 0.4983 0.4945 0.4959 0.4969 0.4977 0.4984 0.4946 0.4960 0.4970 0.4978 0.4984 0.4948 0.4961 0.4971 0.4979 0.4985 0.4949 0.4962 0.4972 0.4979 0.4985 0.4951 0.4963 0.4973 0.4980 0.4986 0.4952 0.4964 0.4974 0.4981 0.4986 3.0 0.4987 0.4987 0.4987 0.4988 0.4988 0.4989 0.4989 0.4989 0.4990 0.4990 21 AC C A MA AN D FMA: MANA GEME NT A CCO UN TIN G 22