Inflation: Definition, Measurement, Effects, and Policies

advertisement

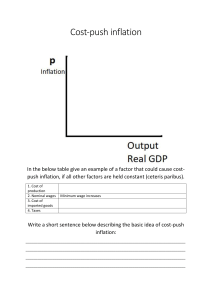

lOMoARcPSD|28787953 Chapter 20 Inflation - Economics module level 1 Internal Auditing (Walter Sisulu University) Studocu is not sponsored or endorsed by any college or university Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 CHAPTER 20: INFLATION LEARNING OUTCOMES Define inflation Distinguish between different measures of inflation CPI PPI Explain the effects of inflation Distinguish between two approaches to explaining what causes inflation: Demand pull vs. Cost push inflation Mention policies that can be used to combat inflation 20.1 DEFINITION OF INFLATION Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. This does not necessarily mean that all prices increase. There are some goods, like computers, which have actually dropped in price, THE INFLATION RATE is the percentage change in the price level from the previous period. 20.2 THE MEASUREMENT OF INFLATION The consumer price index (CPI) The producer price index (PPI) THE CONSUMER PRICE INDEX CPI = an index which reflects the cost of a representative basket of consumer goods and services How to calculate CPI Two methods can be used to calculate inflation rate Month on the same month during the previous year Annual average on annual average 1 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 MONTH ON THE SAME MONTH DURING THE PREVIOUS YEAR Example: we compare the index value for December 2013 (i.e. 105.4) with that of December 2012 (100. 0) an inflation rate of 5.4 per cent is obtained. The calculation is as follows: Problems with this method change in prices of oil, repo rates, vat can happen any time of the year and therefore may suddenly raise or lower the inflation rate in a particular month Another problem with this method is that not all prices are measured every month. Some prices (like the prices of motorcars) are collected only every three months while other prices (like the cost of education) are collected only annually. ANNUAL AVERAGE ON ANNUAL AVERAGE When the inflation rate has to be calculated for a calendar year, The usual procedure is to compare the average of all the monthly indices in a particular year with the corresponding average for the previous year Current year = 103.4 Previous year = 97.8 103, 4 – 97, 8 ––––––––––– × 100 = 5, 7% 97, 8 Note that this figure differs from month to month calculation Advantage of this method Short-term fluctuations in the index figures for particular months are eliminated This measure therefore gives a better indication of the inflation process over a longer period THE PRODUCER PRICE INDEX (PPI) Producer Price Index is a family of indexes that measures the average change over time in the selling prices received by domestic producers of goods and services 2 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 The PPI measures prices at the level of the first significant commercial transaction For example, manufactured goods are priced when they leave the factory, not when they are sold to consumers. Another important feature of the PPI is that it includes capital and intermediate goods, but excludes services (which account for half of the CPI basket) The PPI, which is also estimated and published on a monthly basis by Statistics South Africa, measures the cost of production rather than the cost of living MAIN DIFFERENCES BETWEEN CPI AND PPI 20.3 THE EFFECTS OF INFLATION Distribution effects: inflation tends to redistribute income and wealth from creditors to debtors. In other words, debtors (borrowers) tend to gain, while creditors (lenders) tend to lose. When prices rise, the value of money falls. Interest on savings is lower than inflation If you borrow say R100 and repay it a year later, the R100 that you repay is worth much less than the R100 you borrowed. You will have to pay interest, of course, but the interest is simply the price you have to pay to have access to the funds for the period concerned. If the interest rate is lower than the inflation rate, the debtor (borrower) gains in this respect as well. The distribution effects benefit certain participants at the expense of others 3 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 Economic effects: decision makers in the private sector tend to become more concerned with anticipating inflation than with seeking out profitable new production opportunities. Inflation may also discourage saving in traditional forms such as fixed deposits and pension fund contributions Income not rising with the same percentage as inflation Fixed income (pensioners) Social and political effect: Price increases make people unhappy and different groups in society start blaming one another for increases in the cost of living. When rents, service charges, bus fares or taxi fares are raised, the frustration often causes social and political unrest. Inflation tends to create a climate of conflict and tension which is not conducive to economic progress. Expected inflation: For example, unions may base their wage claims on the expected higher inflation. If these claims are granted, production costs and prices will rise more rapidly than during the previous period. Similarly, firms may raise the prices of their products in anticipation of expected cost increases. When the rate of inflation is expected to increase, consumers may also rush to buy things now instead of later. This will put further upward pressure on prices. If unchecked, such a process may eventually result in very high inflation or hyperinflation 20.4 THE CAUSES OF INFLATION DEMAND-PULL AND COST-PUSH INFLATION DEMAND-PULL INFLATION Demand-pull inflation occurs when the aggregate demand for goods and services increases while aggregate supply remains unchanged described as a case of “too much money chasing too few goods The excess demand pulls up the prices of goods and services Causes of demand-pull inflation Increased consumption spending by households (C), for example as a result of a greater availability of consumer credit or the availability of cheaper credit as a result of a drop in interest rates Increased investment spending by firms (I), for example as a result of lower interest rates or an improvement in business sentiment and profit expectations 4 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 Increased government spending (G), for example to combat unemployment or to provide more or better services to the population at large Increased export earnings (X), for example as a result of improved economic conditions in the rest of the world or because of increases in the prices of important export products (such as minerals, in the case of South Africa) All these causes of demand-pull inflation tend to be accompanied by increases in the money stock Demand-pull inflation graph (AD-AS MODEL) An increase in aggregate demand leads to an increase in the price level (P) and an increase in production and income (Y) Demand-pull inflation thus has a positive impact on production, income and employment, provided that there are still some unemployed resources When the economy is at full employment (all resources are used up), further increases in aggregate demand simply lead to price increases Policies to combat demand-pull inflation Restrictive monetary policy entails raising interest rates and limiting the increase in the money stock. Restrictive fiscal policy entails a reduction in government spending and/or increased taxation This will result in leftward shift of the AD curve and a fall in prices, but it may have costly sideeffects since production, income and employment will also tend to fall COST-PUSH INFLATION 5 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 As the term indicates, cost-push inflation is triggered by increases in the cost of production. Increases in production costs push up the price level Five main sources of cost-push inflation The first source is increases in wages and salaries. Increase in cost of imported capital and intermediate goods e.g. oil, machinery and equipment Increases in profit margins, result in increase in the cost of production, prices of goods and services Decreased productivity Natural disasters, such as droughts or floods, or earthquake which occur periodically Cost-push inflation graph (AD-AS MODEL) Cost-push is reflected in an upward (or leftward) shift of the AS curve An increase in the cost of production results in an increase in the price level (P) and a decrease in production and income (Y). Cost-push inflation thus has a negative impact on production, income and employment In Chapter 19 we called this phenomenon stagflation, since price increases (inflation) are accompanied by increased unemployment (stagnation). 20.5 ANTI-INFLATION POLICY In principle, anti-inflationary policy can have one or more of three objectives The first is to reduce the inflation bias of the economy: This can be achieved, for example, by increasing the degree of competition in the goods markets, increasing the flexibility of the labour market and establishing fiscal discipline 6 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com) lOMoARcPSD|28787953 A second possible objective is to avoid or limit possible triggers of inflation, that is, to aim policy at the initiating factors: Certain triggers, however, such as the impact of drought on food prices or an increase in the oil price, cannot be avoided A third objective: The focus of anti-inflation policy should therefore be on trying to influence the propagating factors in a way that prevents the initiating factors giving rise to accelerated inflation, or limits the extent to which it occurs. Possible policies: Monetarists want the central bank to control inflation by controlling the rate of increase in the money stock. But the problem is that money stock is not controlled by central bank In the case of demand-pull inflation: the appropriate response would be to apply contractionary (or restrictive) monetary and fiscal policies, raising the interest rate and tax rates and reducing the rate of increase in government spending In the case of cost-push inflation: the appropriate response would be to increase aggregate supply, illustrated by a rightward (or downward) shift of the AS curve. One of the options is to apply an incomes policy, while another option is to apply the policy recommendations of the supply-side economists 7 Downloaded by lungelo chutshela Kulu (chutshela.kulu@gmail.com)